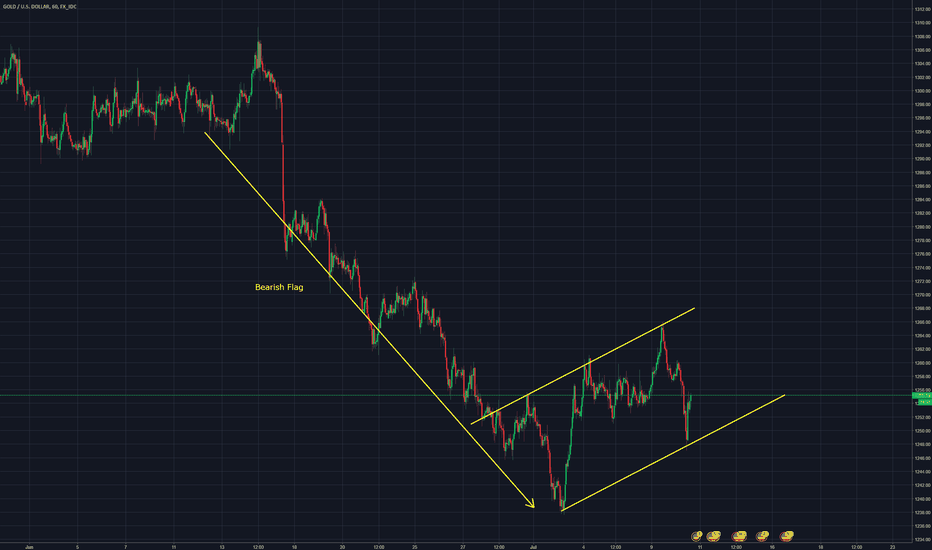

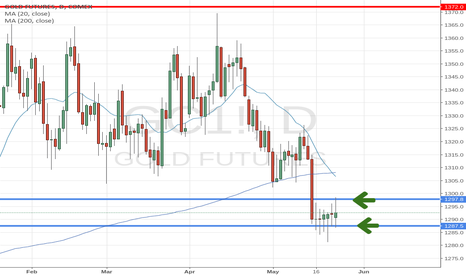

Gold / GC / XAUUSD - Bearish flag forming on the intra-day chartFor those of you already short or looking for a short entry, there is a new, bearish flag pattern forming. I think we could still see price pop from here considering the strong bullish move from the bottom of the flag, but as long as price stays contained within the flag we could see selling pressure re-enter and a break down of the flag setting up a price target of about 1205-1210. Price target is calculated using the length of the flagpole, and then measuring down from the last swing high before a break of the flag channel.

Gc!

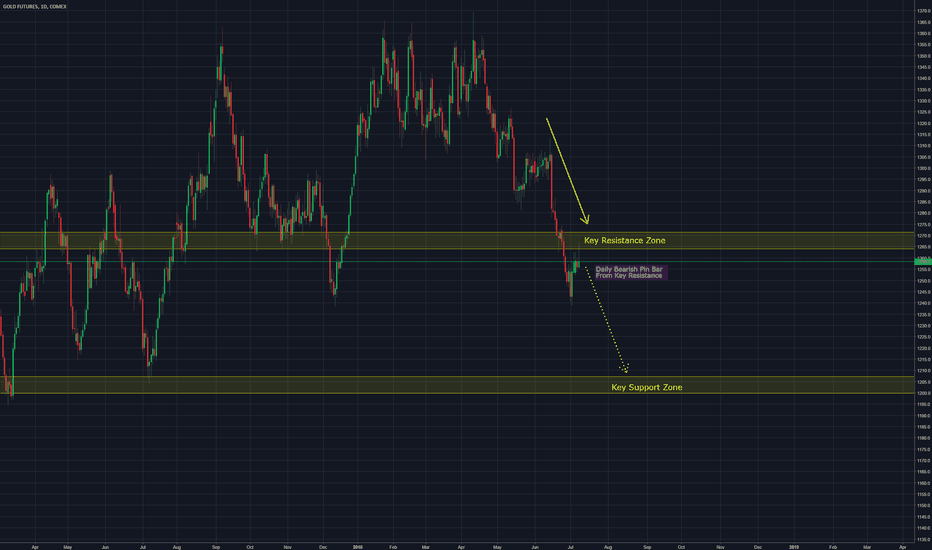

GOLD / GC / XAUUSD - Bearish inside bar fake-out patternIn this video I talk about the bearish inside bar fake-out pattern that has formed on the daily charts in the gold futures market. I cover a short educational lesson on the important of market key support and resistance levels ahead of time. Finally I cover some potential entry / stop loss / profit taking levels for short sellers.

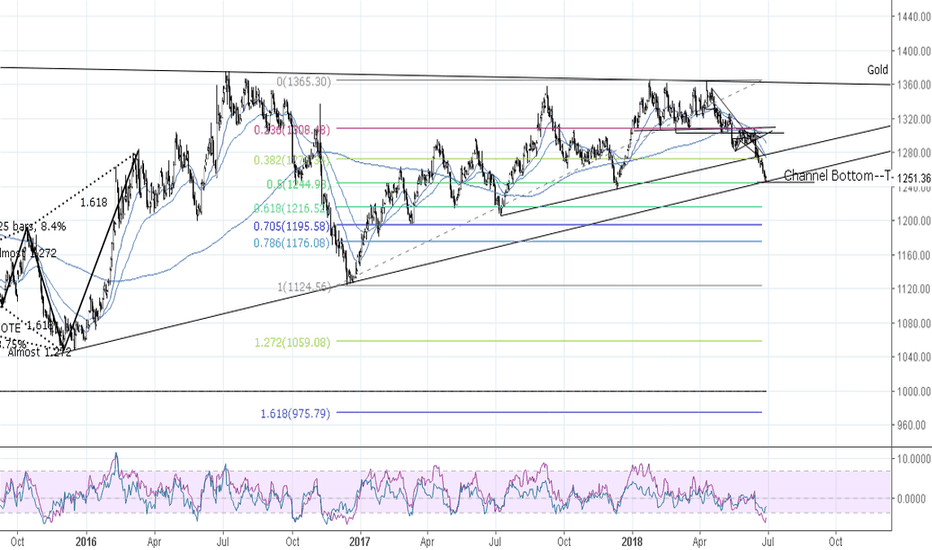

Expecting Gold Rebound 6-29-18Hello friends, gold has been hit very hard recently. RSI Shows an extreme oversold reading on the daily, at the same level at which price has reversed twice before. the Gold price is also at the boundary of an ascending triangle, and furthermore at the 0.5 retrace level. In addition, it does appear the dollar may be topping out for the time being--at least it's a good possibility we'll see some steeper declines.

For these reasons, it seems a no-brainier to go for the long on the next opportunity.

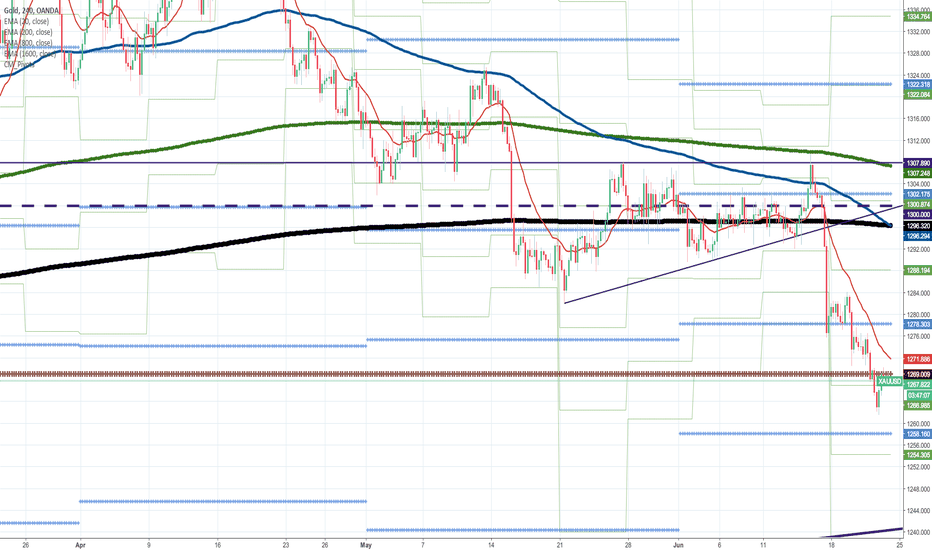

Would gold decide to Downtrend?It is gold down since last Friday, but it is currently staying under YPP 1269.009.

If YPP functions as resistance as it is, if the trend line of the weekly feet below (currently around 1242.000) also goes down, I think that it is the aspect of the downtrend.

weekly chart

As the most recent trade.

1) Judge that YPP 1269.009 functions as a resistance.

Short and set limit above MPP 1258.160.

2) Pull out YPP 1269.009

MPP 1278.303 is above YPP1269.009, I think that the immediate long is difficult.

------------------------- --------------------------

Brown thick line: Yearly Pivot Points (YPP in the text)

Light blue thick line: Monthly Pivot Points (MPP in the text)

Green thin line: Weekly Pivot Points (WePP in the text)

Indigo thickLine: Horizontal line or Trend line seen by weekly or monthly

Indigo thin line: Horizontal line or Trend line seen by 4hourly or daily

Indigo dotted line: outstanding double zero

Red curve: EMA 20 close

Indigo curve: EMA 200 close

Green curve: EMA 800 close

Black curve: EMA 1600 close

x mark: Line which may not function

------------------------- --------------------------

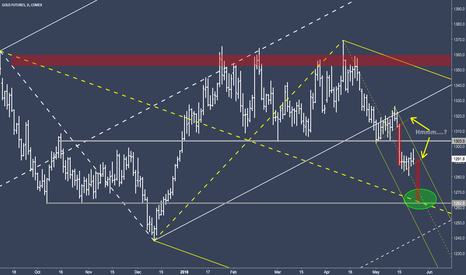

GC - Gold is trying hard but...The down-sloping Fork reveilles the most probable path of price. And we see how price reacts to the Forks balance line, the Centerline (CL).

It's just wonderful, watching the ebb & flow of this market eve on this lower timeframe.

I would not immediately short it but wait for a better tell.

Reaching the orange zone would not surprise me, since this is where real structure is sitting, just to bump Gold on it's head §8-)

So let's put our hunting Hat on and hide in the bush...

P!

GC - Gold...hmmmm...?!?Right side of the chart:

See how it broke the last time?

There was a retesting at the L-MLH (white) going on. Then in the middle it pierced the upsloping orange, dotted Pressure-Line.

Now, compare it to the actual situation...

One of my coaches in the earlier days always told me: "Before you cut meat, you must sharpen your knife".

In Trading the Grindstone is called "observation". Let's learn to earn...

P!

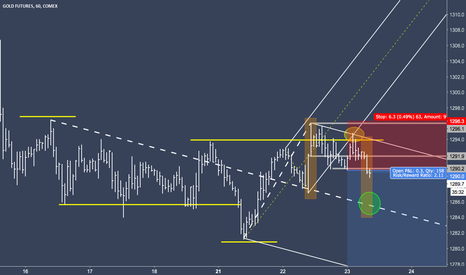

XAUUSD - Bullish reversal flag pattern playing outThe reversal flag that I identified yesterday has broken to the upside as predicted. Price was being pinched between the descending channel (flag) and the major support trend line and finally broke out of the flag with a strong upside move. In this video I perform analysis on the pattern and the type of further price action I will need to see before I become a buyer of gold. We are not there yet but the bullish case is strengthening!

GC - No Chance For Gold Anymore.Sounds dramatic?

...I think it is.

Every commodity has it's price. But only the one that Humans are giving it.

Why has Gold failed so many times to make new highs? Why did the Bank of Canada sold (most or now all?) its Gold in 2016?

Yes, I know, we don't trade on fundamentals, but pure price and Action/Reaction. However, sometimes fundamental facts have their merit.

Away from the fundamentals and on to the real "meat":

The white up sloping Fork projects the most probable path of price. Even the Centerline was hit a couple times, without any clear indication to close or even stay above the balance.

Instead price dropped, gone sideways and then it happened...the L-MLH (Lower-Medianline-Parallel) was broken.

A simple break by itself is no intention to proceed the journey to the South. But when the L-MLH was tested a couple times, then the time is ripe to bring the wounded booty down to the ground.

Like a predator is hunting as economically as possible, saving energy and looking for signs for high probability success, we as Forkers are sitting patient...until the time has come, which is now.

Real Forkers are now short this market and stalk the booty until it's out of energy and ready for the final hit...

Let's have a feast at the Centerline...

§8-)

P!

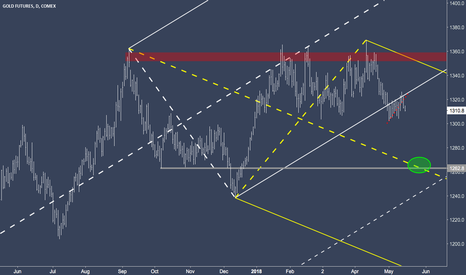

GOLD likely to breakout before June! Target $1520 (GC1! GLD)Hey,

We've long been waiting for this inverse head & shoulders to come to fruition. As we can see, we broke out of the downtrend in 2016 but the 1360-1365 neckline has been tested multiple times. Finally it seems like we're ready to break out, how do we know?

1. The last low has not hit the ascending support of the latest move up. This means it's likely getting closer for a parabolic move.

2. GLD 130 & 131 May Calls are starting to get bought pretty heavily.

3. Consistent new short term highs and lows.

I went ahead and started building a GLD call position into the end of today. I distributed them at $128-130 from May-July.

Potential ETP-4 PatternToo early to tell about this trade until i see the sonar results but the setup is a potential for the week ahead. I like the risk vs reward and the range bound with the pattern so this is good. Need to check news, price action when we enter the reversal but over all the setup is one to watch. Thumbs up if you agree!