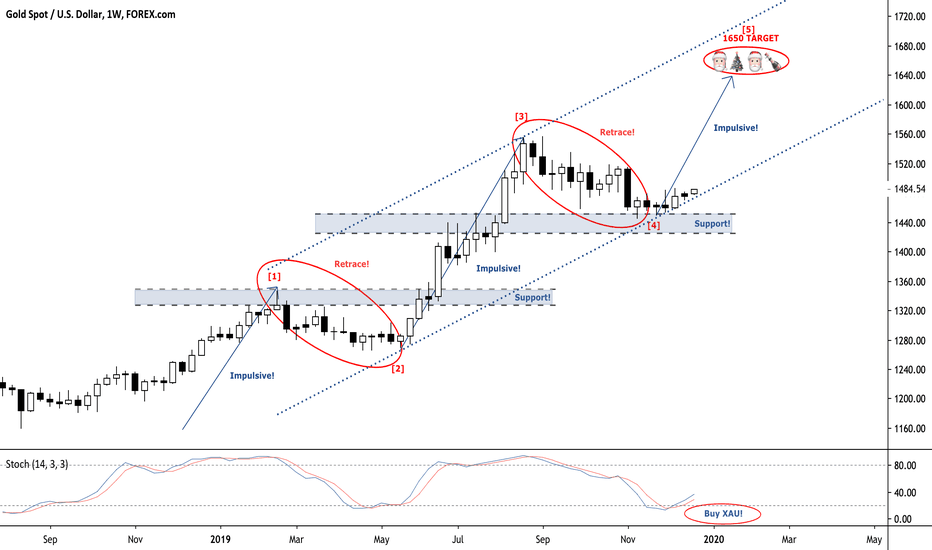

ridethepig | Gold & the "Santa Rally"Uncertainty around reflationary fears will add upside risks to prices in Gold for 1H20. Gold remains bid since the start of November, despite risky assets continuing to gain ground. CB's have been buying 20% of the Gold supplies, the same rate circa Nixon era, all whilst mainstream media paints the geopolitical landscape with a more constructive backdrop, any signs of complacency or gusts of wind from risk will likely drive more flows on the demand side in Gold from retail.

We are finally getting the breakout:

As widely covered here before, the physical Gold market remains incredibly resilient and first targets come into play at 1595:

Expecting another relative breakout versus S&P in 1H20:

On the mining side :

Yields:

For those tracking the end of year positioning flows for 2020 Q1, reflationary risks are around the corner!! After months of choppy waters , finally bulls are emerging from beneath the woodwork as we begin the flows towards 1650. I stick to my average forecast of $1650 and expect Gold to hit $1595, $1650 and $1800 on a 6, 12 and 24m basis. This is my final target in the 5 wave swing, afterwards I will expect Gold to enter in consolidation via profit taking.

Thanks for keeping the support coming with likes, comments, charts and etc. And as usual the comments are open for all.

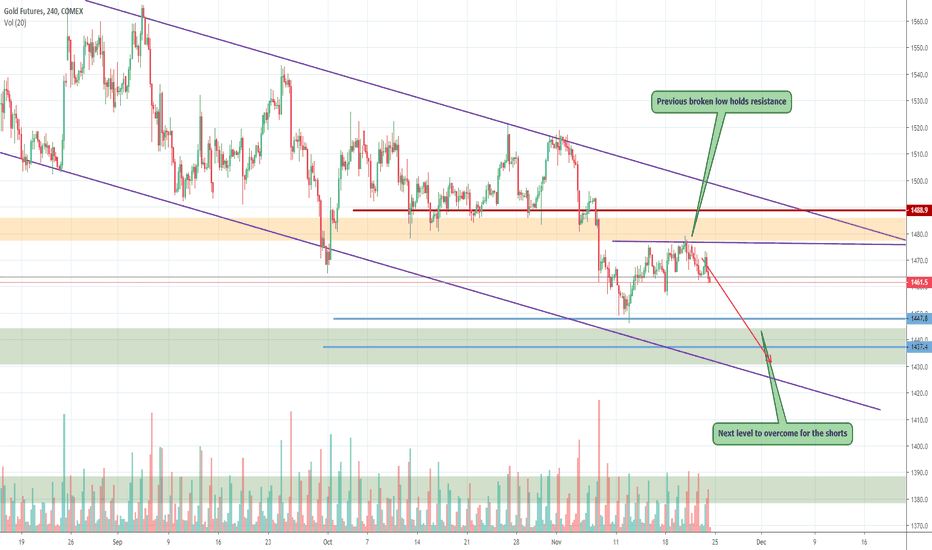

Gc1!short

Gold: Technical & Fundamental SHORT to $1420Gold recently held the broken support as resistance at $1475 and moved lower well. There is an indication that it could slide through the support structure immediately at $1457 and then $1445.

Both Fundamentals and Technicals show a weaker gold market.

The wicks that formed at the $1475 resistance mean that the sellers are strong and not to mention the volume on the swings lower was strong than any rally. The market has recently formed a month-long downward channel that we expect to hold and break to the downside. The bottom end of the channel and target is $1420, below that a slip through could bring gold down to $1380.

From a fundamental standpoint, the gold price is correlated inversely to the USD. The USD price movement is based on the Federal Reserves Monetary Policy.

The Fed no longer has a mega dovish stance, and just because of that in the short term we can see a stronger USD into the new year. This puts downside pressure on the gold market. Helping the bears come in on strong volume.

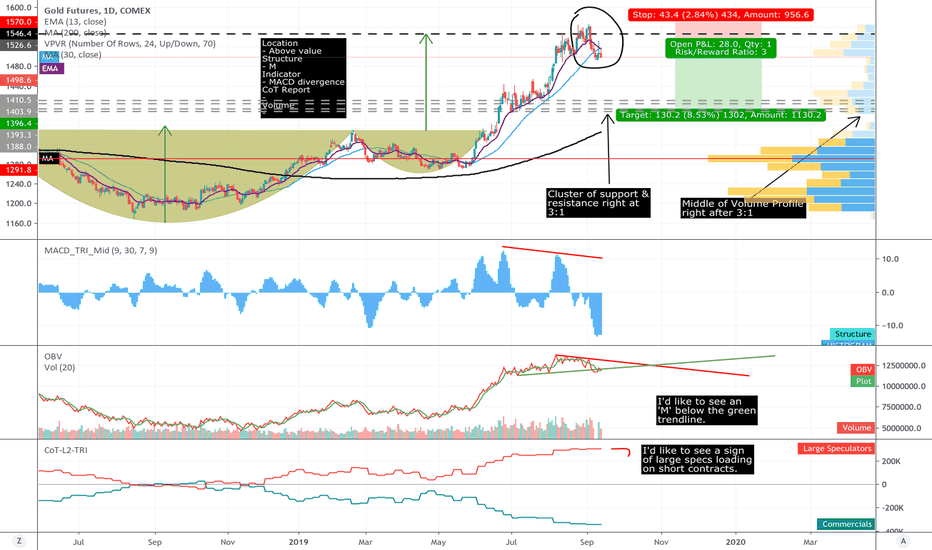

Short Gold (GC1!): My 5 Reasons to Take a TradeHere's my idea to go short on gold (GC1!). This is a daily chart.

First, I always need 4 independent reasons to take a trade. They are as follows ...

1. Location

- Is the price in the correct location? In general, I price must be in the bottom of a range for a long, and at the top of a range for a short.

2. Market Structure

- Is there a double top with a breakout? I need to see a 'M' like structure in price.

3. Momentum

- Is there a divergence in MACD? This is one sign that a reversal in trend is around the corner.

4. Volume

- This is paramount. I need to see a bullish trend in volume if I am going long, and vice versa for short positions.

And when I am trading commodities, I need a 5th reason - the CoT (Commitment of Traders) report. In short, I need to see signs that institutions (large speculators) are going long when I am thinking long and going short when I am thinking short.

So, do we have our 5 reasons for GC1!? Let see ...

We have ...

1. Location: We are above value in the Volume Profile. In other words, we are near the top of a range, right after the Cup and Handle target.

2. Market Structure: We see a double top with a breakout

3. Momentum: We have MACD divergence.

That's it. What are we missing in?

Volume: Let's wait until the volume make an 'M' under the green trendline.

CoT Report: Let's wait until we see a sign of large speculators (red line) loading up on short contracts. For this, I'd like to see further downward stair action.

Now, I only take trades where the minimum reward-to-risk ratio is 2:1. The 'M' gives us a nice framework for when to exit (stop loss) our trade. I am risking to the lower leg of the 'M'.

Here, we can even have a 3:1 reward/risk. Why? For our target profit, I just extend the R/R tool so 3:1 and see if that is a reasonable area to expect the price to go.

Is it reasonable, in this case?

3:1 profit takes us to:

- A cluster of support and resistance

- Middle of the Volume Profile

These are two areas are where price often settles too ... so we're good for our target :)

That's it. We have 3 of our 5 reasons. Let's wait for the other 2 to come in, and then it'd make sense to go short on gold.

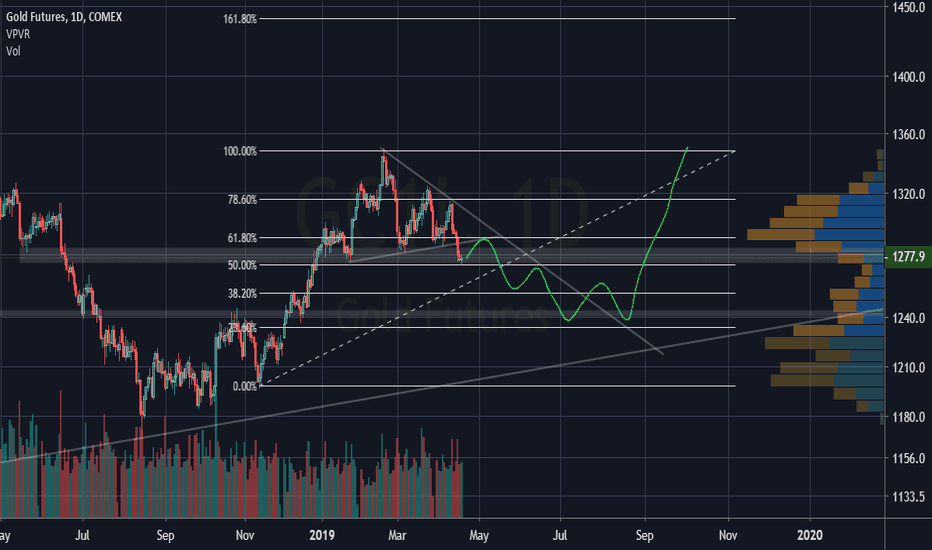

GC1! Gold futures. Who's ready to short?Good morning traders.

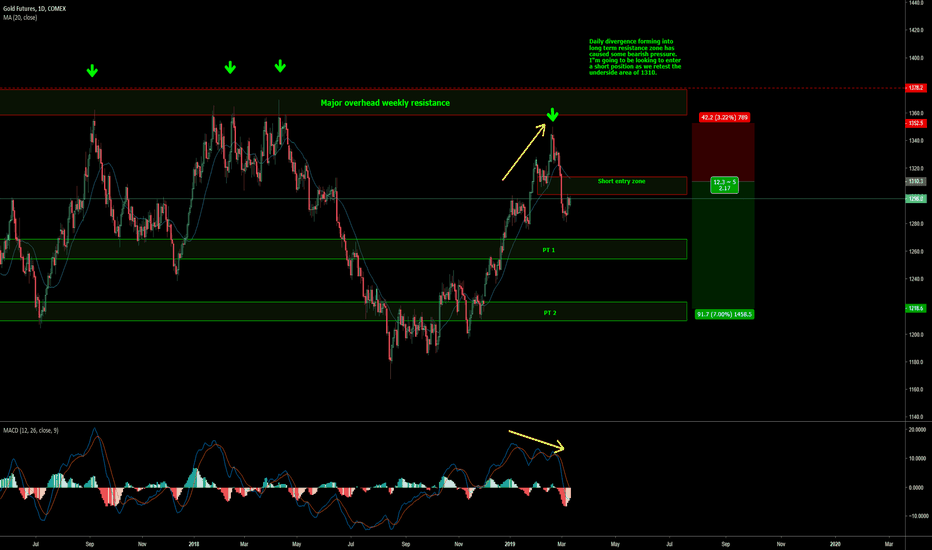

I'm quite interested in a short swing trade on gold futures quite soon. It appears we have some divergence happening coming into major weekly resistance zone. This divergence/resistance combined has created some bearish pressure enough to impulse past the first valley of 1320 area. I believe with all these signals together we could form a decent short position taking profits as we retest zones 1250's and 1220's using the current swing high of 1350 as my stop.

Remember to always manage personal risk and follow through with your trade plans!

*Will update trade idea as we go if people are interested.

Please leave a comment or a thumbs up if you agree.

Enjoy and good luck traders!

AUD - GOLDFrom my analysis (not listed here) i suppose that gold is on top for now. Because of corellation with AUD (analysis is primary the same as for gold) i was entered short AUD/USD at price 0.7540 - 3.5.2016. best day to enter was 27.4.2016 at price 0.7650.

If you are trading GOLD you can enter SHORT NOW, best enter for me was 9.5.2016 at price 1275.

EXIT is trialing stop.

I don't wish you good luck, i preffer probability and statistic, luck is important especially in casino :)

* ARROW is not profit target.