GE

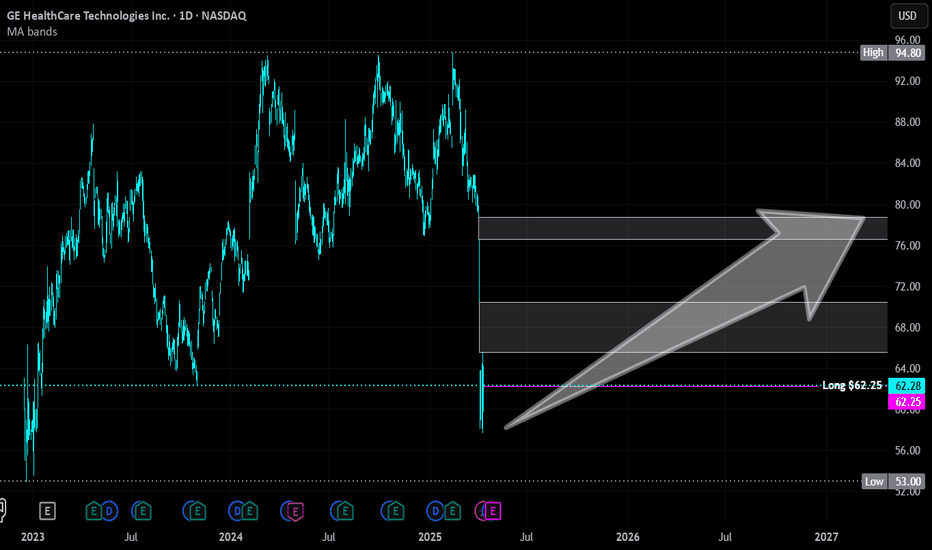

GE Healthcare Technology | GEHC | Long at $62.25GE Healthcare Technology $NASDAQ:GEHC. An aging and unhealthy population will only create an increased need for healthcare imaging services. Add AI to the diagnostic mix, and imaging will be imperative for routine health maintenance and screening. With a P/E of 15x, debt-to equity of 1x, earnings forecast growth of 8.36% per year, and bullish analyst ratings, this could be a good value play for the patient.

Thus, at $62.25, NASDAQ:GEHC is in a personal buy zone. Further drops are possible if trade wars make imaging materials/technology difficult to obtain, but that general statement applies to the whole market at this time...

Targets:

$70.00

$78.00

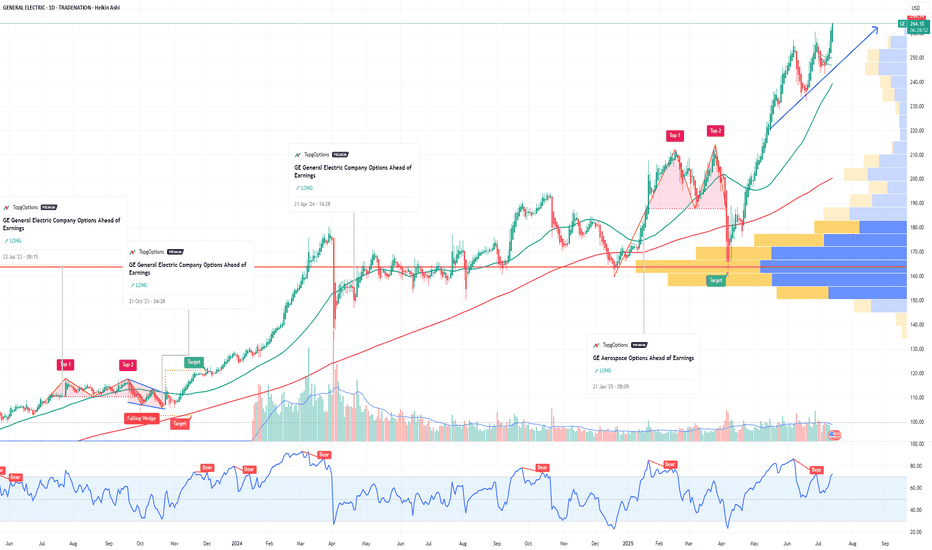

GE Aerospace Options Ahead of EarningsIf you haven`t bought GE before the rally:

Now analyzing the options chain and the chart patterns of GE Aerospace prior to the earnings report this week,

I would consider purchasing the 270usd strike price Calls with

an expiration date of 2025-8-15,

for a premium of approximately $8.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

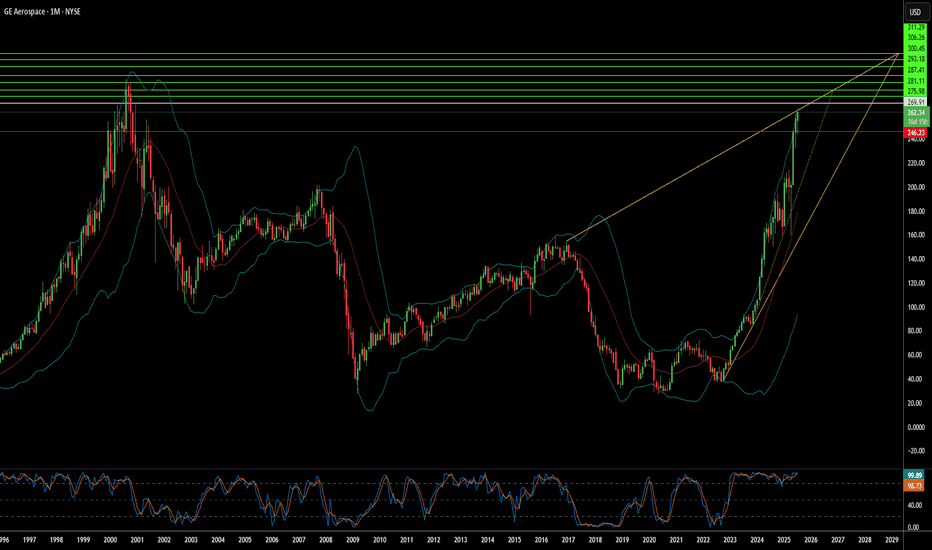

Soaring High: What Fuels GE Aerospace's Ascent?GE Aerospace's remarkable rise reflects a confluence of strategic maneuvers and favorable market dynamics. The company maintains a dominant position in the commercial and military aircraft engine markets, powering over 60% of the global narrowbody fleet through its CFM International joint venture and proprietary platforms. This market leadership, coupled with formidable barriers to entry and significant switching costs in the aircraft engine industry, secures a robust competitive advantage. Furthermore, a highly profitable aftermarket business, driven by long-term maintenance contracts and an expanding installed engine base, provides a resilient, recurring revenue stream. This lucrative segment buffers the company against cyclicality and ensures consistent earnings visibility.

Macroeconomic tailwinds also play a crucial role in GE Aerospace's sustained growth. Global air travel is steadily increasing, driving higher aircraft utilization rates. This directly translates to greater demand for new engines and, more importantly, consistent aftermarket servicing, which is a core profit driver for GE Aerospace. Management, under CEO Larry Culp, has also strategically navigated external challenges. They localized supply chains, secured alternate component sources, and optimized logistics costs. These actions proved critical in mitigating the impact of new tariff regimes and broader trade war tensions.

Geopolitical developments have significantly shaped GE Aerospace's trajectory. Notably, the U.S. government's decision to lift restrictions on exporting aircraft engines, including LEAP-1C and GE CF34 engines, to China's Commercial Aircraft Corporation of China (COMAC) reopened a vital market channel. This move, occurring amidst a complex U.S.-China trade environment, underscores the strategic importance of GE Aerospace's technology on the global stage. The company's robust financial performance further solidifies its position, with strong earnings beats, a healthy return on equity, and positive outlooks from a majority of Wall Street analysts. Institutional investors are actively increasing their stakes, signaling strong market confidence in GE Aerospace's continued growth potential.

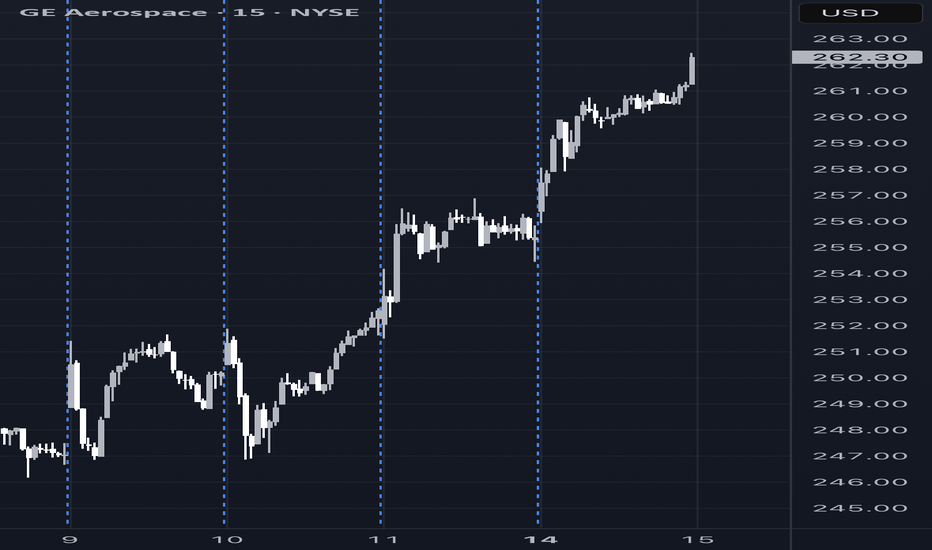

GE Weekly Options Trade Setup – 07/14/2025 $290C | Exp. July 18

📈 GE Weekly Options Trade Setup – 07/14/2025

$290C | Exp. July 18 | Bullish Catalyst In Play

⸻

🔥 BULLISH MOMENTUM CONFIRMED

✅ All 5 major AI models (Grok, Claude, Gemini, Llama, DeepSeek) agree:

GE just broke out — strong momentum, price above MAs, MACD bullish.

📰 Catalyst: Citigroup Upgrade 💥

Low implied volatility + analyst boost = ideal environment for calls.

⚠️ Caution: RSI is overbought, signaling possible short-term pullback. This is a fast trade, not a swing.

⸻

🎯 Trade Plan – High Conviction Setup

Entry at open, ride breakout continuation 🚀

{

"ticker": "GE",

"type": "CALL",

"strike": 290,

"exp": "2025-07-18",

"entry": 0.89,

"target": 1.78,

"stop": 0.45,

"size": 1,

"confidence": "70%",

"entry_timing": "market open"

}

🔹 Entry: $0.89

🎯 Target: $1.78 (+100%)

🛑 Stop: $0.45 (-50%)

📅 Expiry: 07/18/25

📈 Confidence: 70%

💼 Strategy: Naked Call

⸻

📌 Why $290C?

High strike = low cost, great R/R. High OI, and supported by breakout levels from DeepSeek & Grok models.

🧠 Model Sentiment:

“Moderately Bullish” – All point to upside, but suggest smart risk management due to hot RSI.

⸻

💡 Quick Notes

⚠️ Overbought ≠ reversal — just be quick.

📊 Citigroup news is driving flows — but don’t hold into chop.

💬 Tag someone who’s been sleeping on GE 👇

#GE #OptionsTrading #BreakoutPlay #CallOption #AITrading #WeeklySetup #FlowWatch #0DTE #tradingview

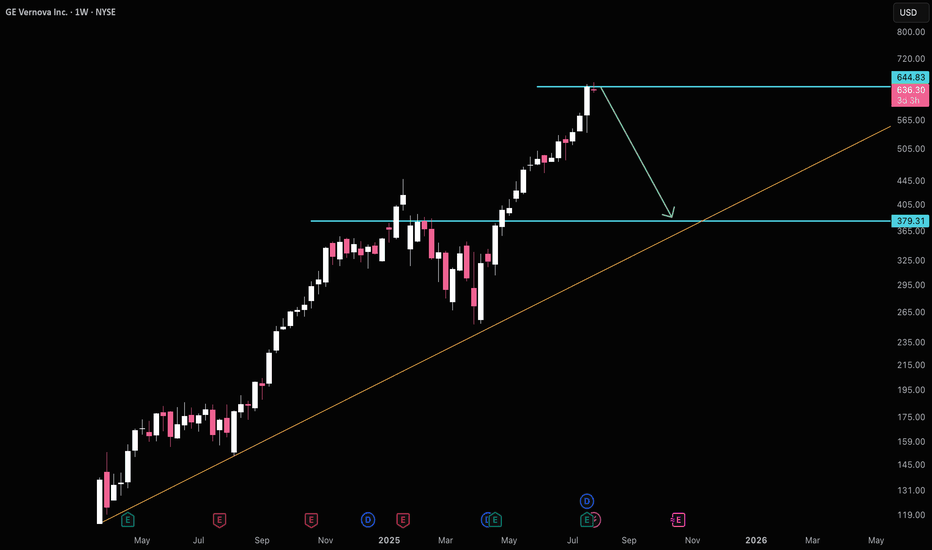

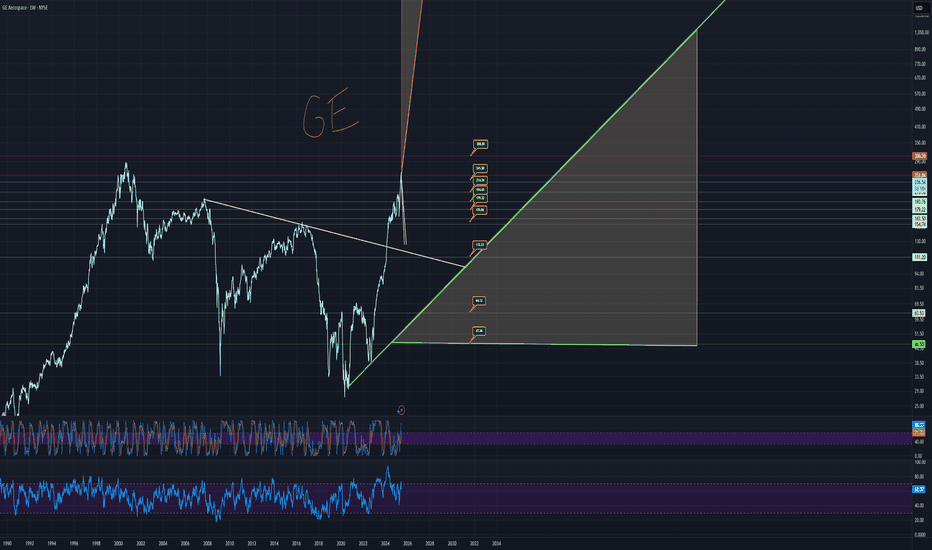

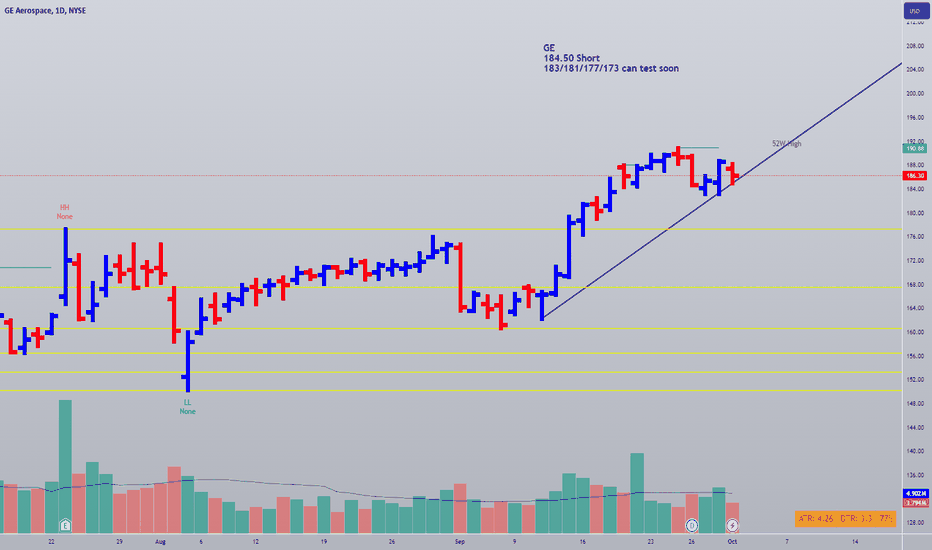

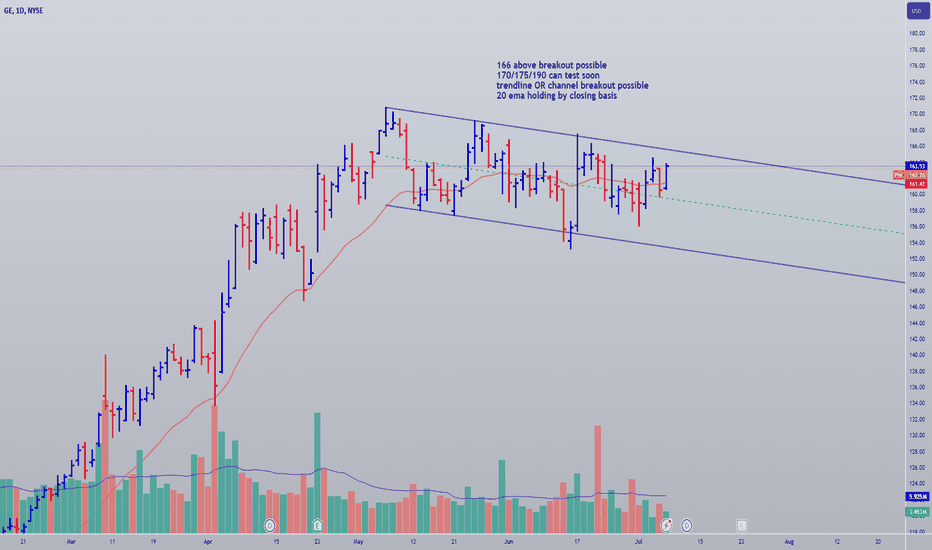

GE AERO WHERE WILL THE PRICE GOTRENDS and Price targets marked.

Price appears to be in "danger zone" or high side with not many price targets left.

There are both support and rejection trends trading down in the short term.

These both lead to a support trend.

Good luck.

Follow for more charts like this.

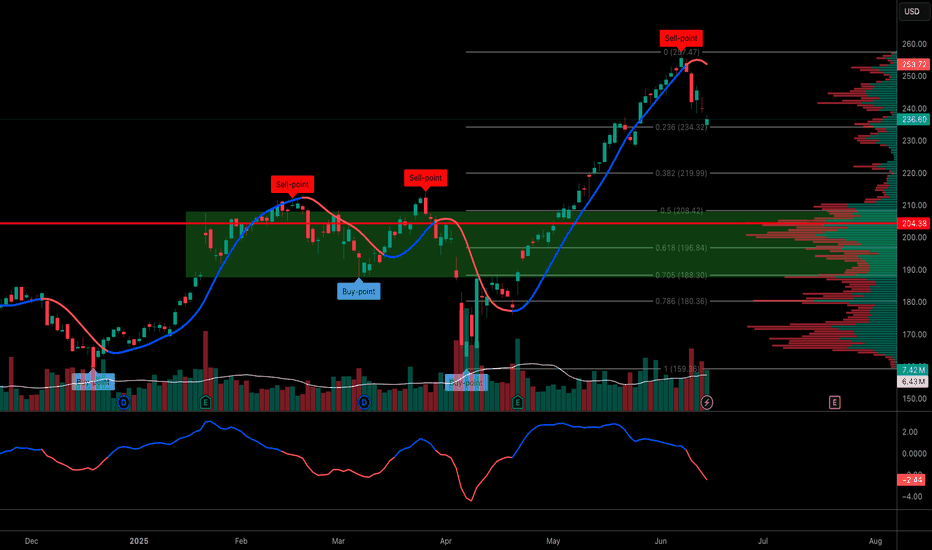

Taking profit on GE Aerospace stock to buy in lower after summerIt's clear NYSE:GE has hit overbought, it's the perfect time to take profits now. Less stress managing stocks over the summer too lol...

$196 is the 0.618 level I'm aiming to re-enter, there's also decent support near that level $190 to $200

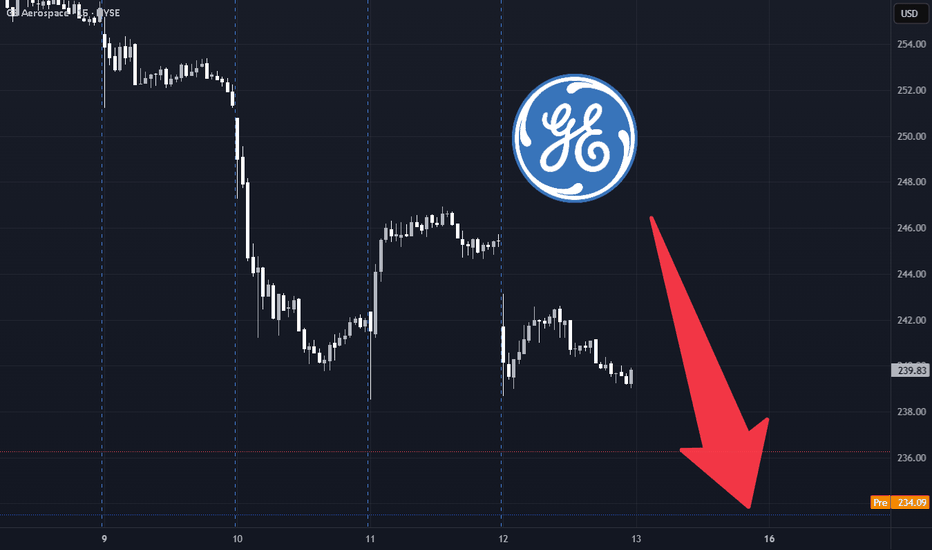

GE Weekly Options Trade – Bearish Setup After Breakdown (2025-0📉 GE Weekly Options Trade – Bearish Setup After Breakdown (2025-06-12)

Ticker: NYSE:GE | Strategy: 🔻 Naked PUT (Short Bias)

Bias: Moderately to Strongly Bearish

Confidence: 75% | Entry Timing: Market Open

Expiry: June 13, 2025 (Weekly)

🔍 Technical & Options Snapshot

• Trend:

– Daily: Bearish (below 10-EMA and Bollinger midline)

– 5-Min: Short-term bounce, but still under key EMAs

• MACD (Daily): Bearish

• Sector Catalyst: Negative headlines related to Boeing engine issues

• Max Pain: $242.50 → could slow full downside but not reverse bias

• OI Hotspot: $237.50 PUTs — strong volume + liquidity

🧠 Model Agreement Summary

✅ All 4 AI Models (Grok, Llama, Gemini, DeepSeek):

• Agree on bearish direction

• All favor puts at or around the $237.50 strike

• Daily breakdown confirmed; news pressure adds downside weight

⚠️ Gemini suggests: more aggressive $235 PUT → but $237.50 strike has better liquidity and balance of risk/reward

✅ Recommended Trade Setup

🎯 Direction: PUT

📍 Strike: $237.50

📅 Expiry: 2025-06-13

💵 Entry Price: $0.83 (ask)

🎯 Profit Target: $1.25 (+50–65%)

🛑 Stop Loss: $0.42 (–50%)

📈 Confidence: 75%

📏 Size: 1 contract

⏰ Entry Timing: Market Open

⚠️ Risks to Watch

• 🔁 Bounce risk: Short-term rally may challenge entry

• 📰 Unexpected good news could reverse momentum

• 💸 Bid/ask spreads may widen at open — use limit orders when possible

• 🎯 Max pain magnet at $242.50 could suppress full downside extension

📉 GE downside continuation or oversold bounce incoming?

💬 What’s your take — buying puts, calls, or staying flat? Drop your thoughts ⬇

📲 Follow for daily AI-backed trade signals and market breakdowns.

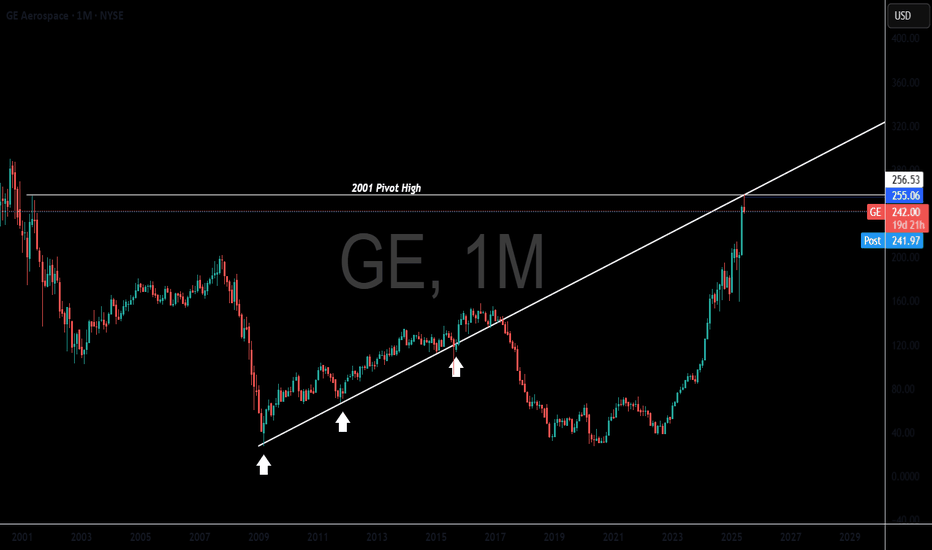

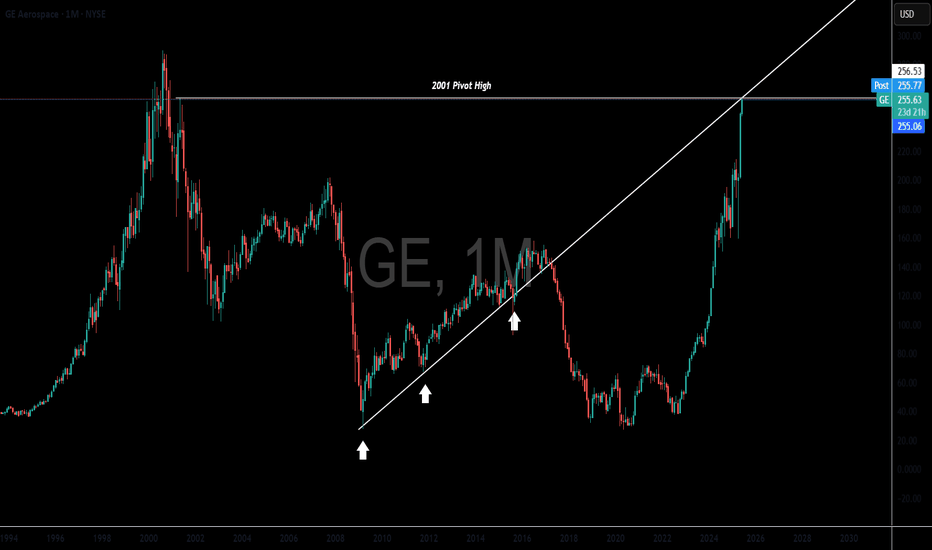

These 2 Signals Made Members 80% Profit!NYSE:GE has had a massive rejection off of Monthly chart rejection.

We issued an alert to members om June 6th 2025. We entered a 245 Put (July 3) $5 con

We closed out our contracts today at $9 and roughly 80% gain.

This chart demonstrates the power of multiyear monthly chart resistance. Trades like these don't come around often but when they do you have to execute and forget about the noise!

This chart proves that technical trendlines do have power!

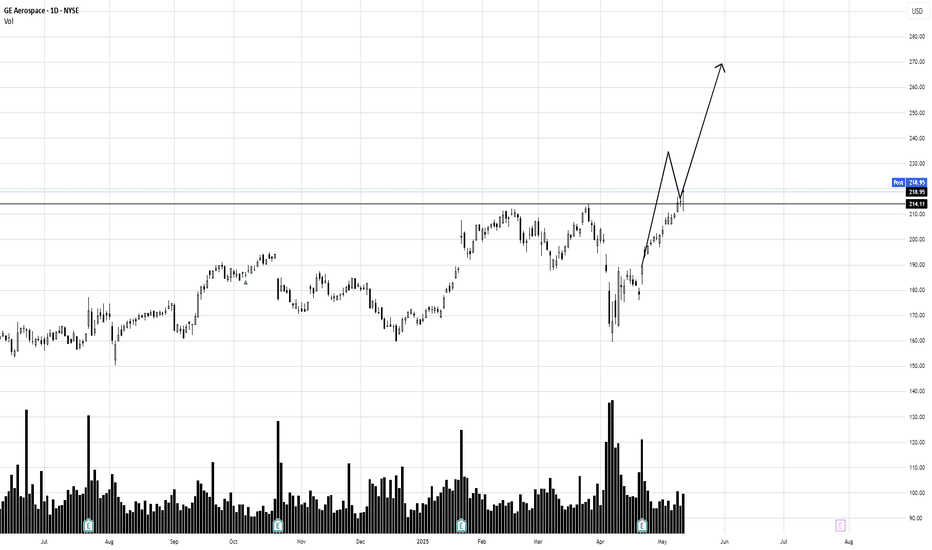

GE Aerospace: How to go to the moon!GE's stock is soaring due to strong earnings and optimistic future guidance from its aerospace division.

1. Blowout Earnings: GE Aerospace reported earnings per share of $1.75, far exceeding analysts' expectations of $1.10.

2. Surging Orders: The company saw a 46% increase in orders last quarter, signaling strong demand for its products.

3. Revenue Growth: GE generated $10.8 billion in revenue, beating forecasts of $10 billion.

4. Wall Street Optimism: Analysts are raising price targets, with some predicting the stock could climb even higher.

5. Industry Momentum: The aerospace sector is experiencing a boom, with GE positioned as a key player.

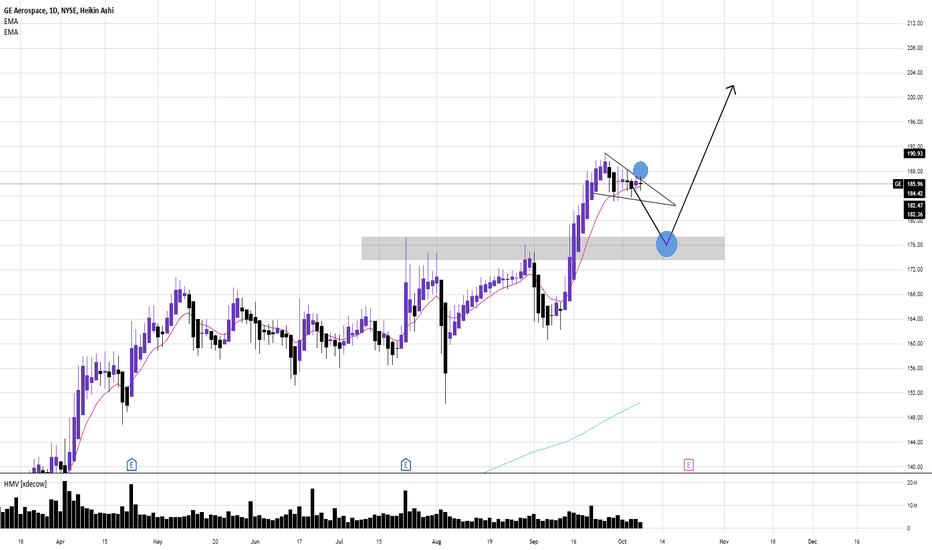

I'm betting we are close to a pullback and then catapult to New ATH!

OptionsMastery: Break and Retest on GE.🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

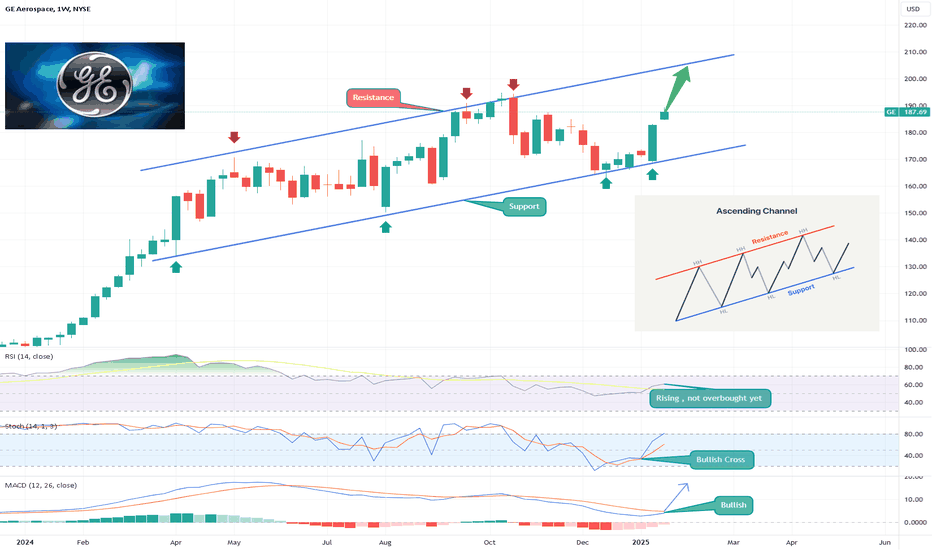

GE on the Rise: Bullish Momentum in an Ascending Channel!Current Price: $187.31

Stop Loss: $166 (below key support).

TP1: $195 (near-term resistance).

TP2: $210 (channel resistance).

TP3: $230 (analyst high target).

🚀Why GE is a Bullish Opportunity

1️⃣ Strong Earnings Potential (Jan 23, 2025)

Analysts expect: EPS: $1.03 and Revenue: around $9.85 billion, showcasing year-over-year growth.

2️⃣ Aerospace Momentum

Projection: GE Aerospace is on track to achieve an operating profit of $6.7 billion to $6.9 billion for 2024, benefiting from robust demand in both commercial and defense sectors.

3️⃣ Bullish Technicals

Technical Indicators: GE stock is trading within a strong upward channel. Indicators like Stochastic (potentially showing bullish crossover), RSI (at a balanced level of 51, suggesting room for growth), and MACD (indicative of bullish momentum) support this view.

4️⃣ Analyst Sentiment

Consensus Price Target: Analysts have set an average target of $209.78, with some forecasts reaching up to $230, offering an upside potential of 15% to 23% from the current price of $187.31.

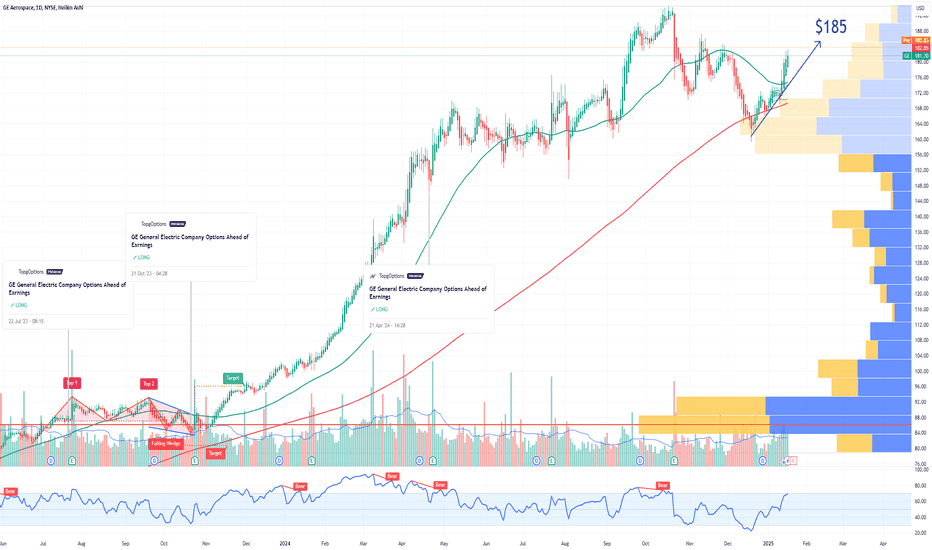

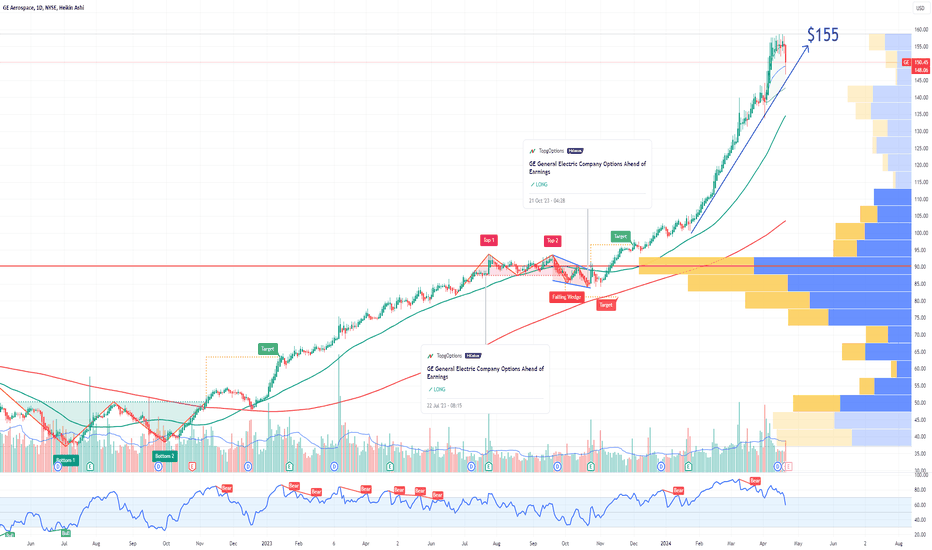

GE Aerospace Options Ahead of EarningsIf you haven`t bought GE before the breakout:

Now analyzing the options chain and the chart patterns of GE Aerospace prior to the earnings report this week,

I would consider purchasing the 185usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $8.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

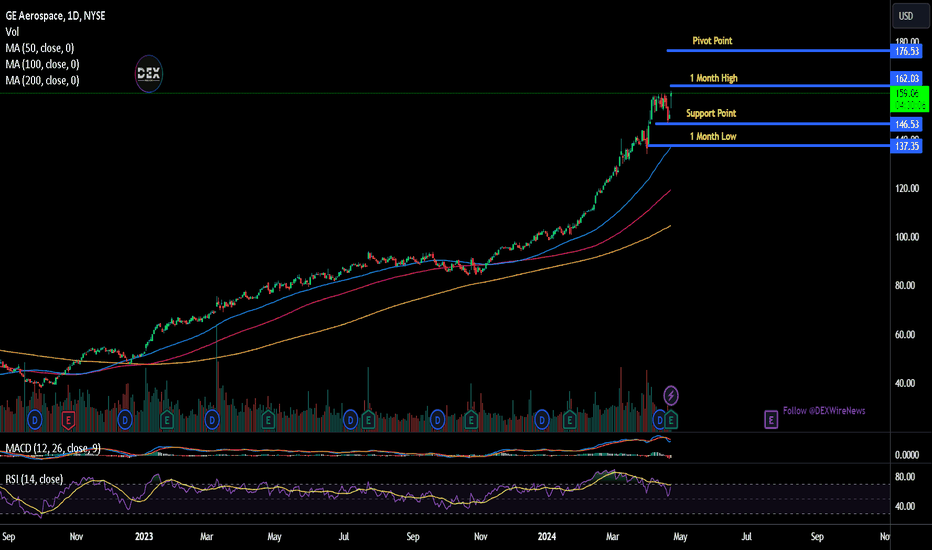

GE Aerospace Options Ahead of EarningsIf you haven`t bought the dip on GE:

Now analyzing the options chain and the chart patterns of GE Aerospace prior to the earnings report this week,

I would consider purchasing the 195usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approximately $8.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CAT blue chip industrial LONGCAT on the daily chart has trended down more or less since the last earnings beat 6-7 weeks ago.

It has now found support at the 0.5 and 0.612 Fibonacci levels confluent with the mean VWAP

anchored back 6 months. The Bollinger Band Trend shows a narrow band with for the first time

this year. The Relative Trend Index is negative but about to go neutral. I see this as opportunity

to take a long trade well ahead of the next earnings. I assume CAT may have solid earnings

in the current quarter as its equipment production is purchased by those in the construction

industry making expenditures for residential as well as road construction and repair.

The Chris Moody RSI indicator shows both lines inflecting in bullish divergence which supports

a long trade.

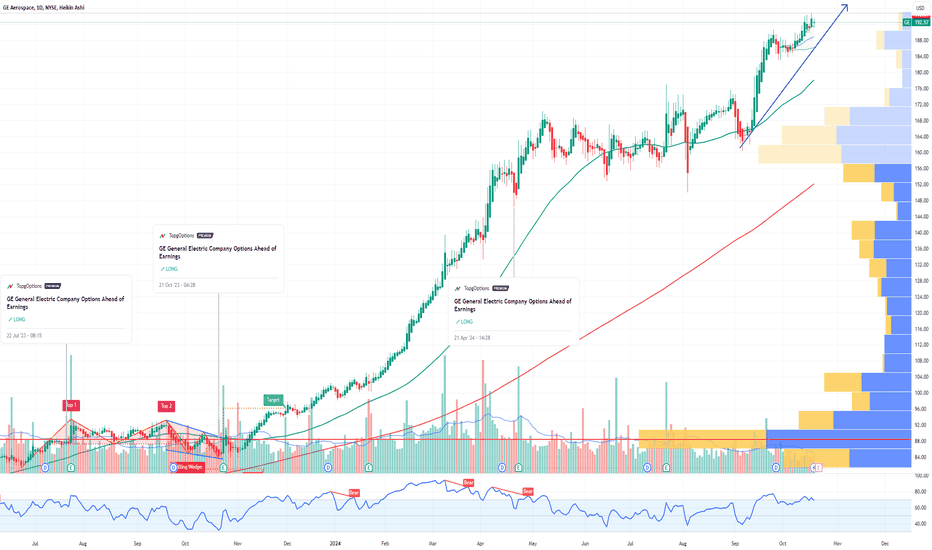

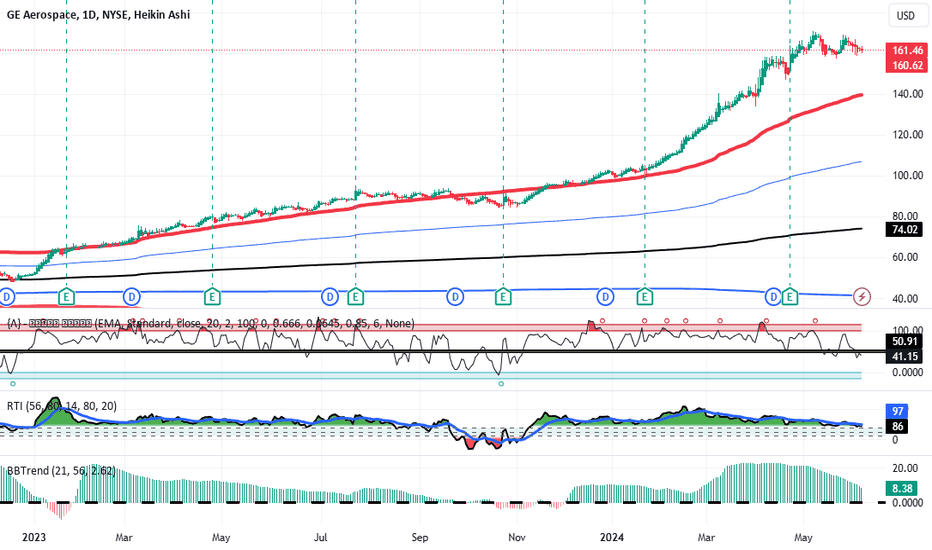

GE is GEAerospace a buy 5% below its ATH? - LONGGE is now priced at 5% below its recent ATH. The daily chart shows it to be on a VWAP breakout

over two standard deviations above the mean anchored VWAP originating in 2 and a half years

ago. Price has dipped and pulled back to the midline of the Bollinger Bands and buying volatility

is fading as can be seen on the indicators. I see this as a safe point to add to my GE long

positions of shares and call options. Having trimmed some of those positions 4 weeks ago, I

will add the same amount back in along with 20% extra. When earnings are upcoming in

August I will again look for a pivot high from which to trim again.

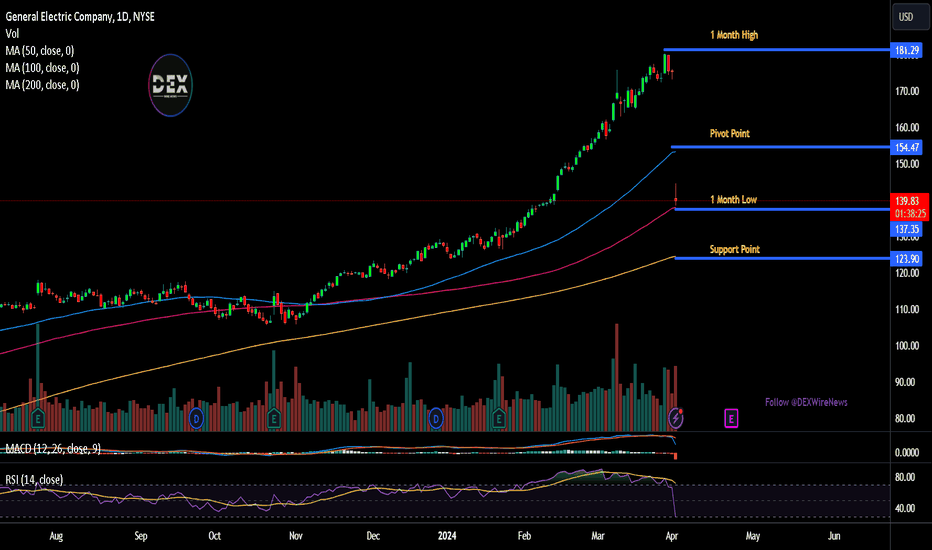

GE General Electric Company Options Ahead of EarningsIf you haven`t bought GE before the previous earnings:

Then analyzing the options chain and the chart patterns of GE General Electric Company prior to the earnings report this week,

I would consider purchasing the 155usd strike price Calls with

an expiration date of 2024-8-16,

for a premium of approximately $8.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

GE Aerospace Surges 6.37% On Earnings ReportGeneral Electric ( NYSE:GE ), a prominent global conglomerate, experienced a 6.37% surge in its stock prices following the release of its Q1 report. GE Aerospace, a subsidiary of General Electric, exceeded Q1 expectations, which included results for GE Vernova before the spinoff.

GE Aerospace reported standalone adjusted earnings of 92 cents per share for the quarter. Solo adjusted revenue saw a 15% increase to $8.1 billion. On a consolidated basis, adjusted earnings for both GE Aerospace and GE Vernova were 82 cents per share, with consolidated GAAP earnings amounting to $1.38 per share. Total consolidated revenue increased by 11% to $16.1 billion, surpassing FactSet analysts' expectations of 65 cents per share on $15.25 billion in revenue.

Total orders for GE Aerospace rose 34% to $11 billion, primarily driven by orders for commercial engines and services. The company registered free cash flow of $1.7 billion for the quarter.

For fiscal 2024, GE Aerospace projects an adjusted earnings range of $3.80 to $4.05 per share, with free cash flow exceeding $5 billion. GE Aerospace raised its total operating profit outlook from $6 billion to $6.5 billion to $6.2 billion to $6.6 billion. GE anticipates mid-to-high teens growth in commercial engines and services revenue. It lifted its operating profit outlook for the business segment by $0.1 billion to $6.1 billion to $6.4 billion. GE Aerospace expects defense and propulsion technologies revenue to rise in the mid-to-high-single-digits, with its defense operating profit ranging from $1 billion to $1.3 billion.

In early March, GE Aerospace adjusted its 2025 revenue outlook to low double-digit growth. It also forecasts an operating profit of roughly $7.3 billion as the midpoint for the year, to reach an operating profit of $10 billion in 2028.

GE Aerospace plans to deliver approximately 70% to 75% of cash to shareholders through dividends and share buybacks, including an initial dividend payout at 30% of net income, subject to board approval, and $15 billion in share buybacks.

TD Cowen upgraded GE stock to buy from hold on April 9, citing GE Aerospace's commercial aftermarket prospects in light of Boeing production issues. Over 50% of GE Aerospace sales and 75% of its profits come from the commercial aerospace aftermarket following the spinoff. The firm raised its price target on GE shares to $180 from $175.

NYSE:GE stock has rallied 4.6% early Tuesday. Shares rose 1.4% Monday, bouncing off their 21-day exponential moving average. NYSE:GE stock jumped 37% in 2024 leading up to the April 2 spinout. GE Aerospace stock saw a nearly 54% increase so far this year and is trading at its highest level since July 2016.

GE Completes Historic $191.9 Bil Breakup, Launches GE AerospaceIn a groundbreaking move that has sent ripples through the financial world, General Electric ( NYSE:GE ) has completed its long-anticipated $191.9 billion breakup, marking a pivotal moment in its storied history. With bullish investors eagerly eyeing the horizon.

The journey towards this momentous milestone has been nothing short of extraordinary. Despite facing headwinds and challenges along the way, NYSE:GE has demonstrated resilience and unwavering determination under the leadership of CEO Larry Culp. Today, as the dust settles and the applause reverberates across Wall Street, GE Aerospace stands tall as a testament to the power of strategic vision and bold execution.

The spinoff of GE Aerospace ( NYSE:GE ) marks the final chapter in GE's ambitious restructuring plan, which saw the conglomerate splitting into three distinct entities focused on aerospace, healthcare, and energy. This strategic realignment not only unlocks value but also provides investors with greater transparency and clarity in capital allocation—a crucial step towards revitalizing shareholder confidence.

Under the seasoned stewardship of H. Lawrence Culp Jr., GE Aerospace embarks on its maiden flight with unwavering resolve and a clear sense of purpose. With a strong balance sheet and a relentless focus on innovation, the company is primed to chart new territories and shape the future of aviation.

At the heart of GE Aerospace's strategy lies FLIGHT DECK, a proprietary lean operating model that epitomizes efficiency and agility. Armed with this powerful tool, the company is well-positioned to navigate the complexities of the aerospace industry and deliver unparalleled value to its customers, employees, and shareholders alike.

With an impressive portfolio boasting approximately 44,000 commercial engines and 26,000 military and defense engines worldwide, GE Aerospace ( NYSE:GE ) commands a dominant position in propulsion, services, and systems. The company's robust financial performance, with adjusted revenue of approximately $32 billion in 2023, underscores its resilience and market leadership.

Looking ahead, GE Aerospace ( NYSE:GE ) has set ambitious targets, reaffirming its 2024 guidance and presenting a compelling long-term financial outlook. With a steadfast commitment to delivering operating profit of around $10 billion by 2028, the company is charting a course towards sustained growth and value creation.

The launch of GE Aerospace ( NYSE:GE ) not only marks the culmination of GE's multi-year transformation journey but also signifies a new chapter in the company's illustrious history. Through prudent capital allocation and a relentless pursuit of excellence, GE has laid the groundwork for a brighter future—one defined by innovation, resilience, and unwavering commitment to success.

As shareholders eagerly await GE Aerospace's first-quarter earnings announcement on April 23, 2024, the stage is set for a new era of prosperity and growth. With a stellar lineup of advisors including Paul, Weiss, Rifkind, Wharton & Garrison LLP, Evercore, Morgan Stanley, and PJT Partners, GE Aerospace is well-equipped to navigate the complexities of the financial landscape and emerge victorious.

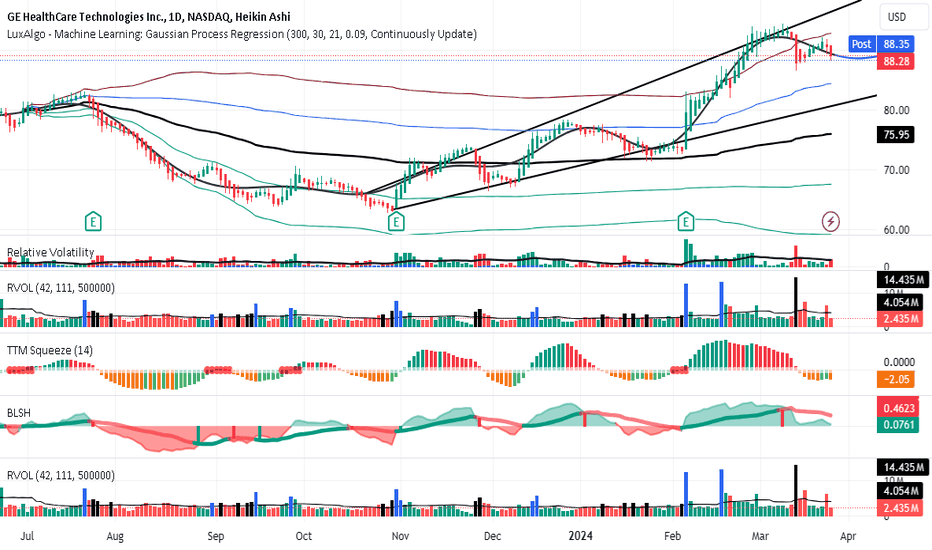

GEHC topped out in an ascending channel SHORTGEHC is a new spinoff from General Electric. It has great success thus far with good earnings

reports and no dependency on debt and interest rates. It has been on an uptrend since

the November earnings. At present it is correcting. I will play this going short on shares while

hedging with a long term call options. I am in GE calls out into 2026. A long term call option

will yield a lower capital gains tax if closed beyond 12 months. Accordingly, I will go out 15-16

months as I typically want to close early to avoid the effects of time decay. I have high

expectations for GEHC. I do not think it will disappoint. When price reaches the running mean

anchored VWAP I will close the shares and run only the options.