GE

GE / W1 : Weekly chart signals. Trade Validated.NOTE : first, be aware that the signal is a double Taking Profit pattern, which is the weakest possible one ! But regarding the way this asset got sold in a bullish market kind of makes me wonder how deep this could go if this was just for a retracement.

Hope this idea will inspire some of you !

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

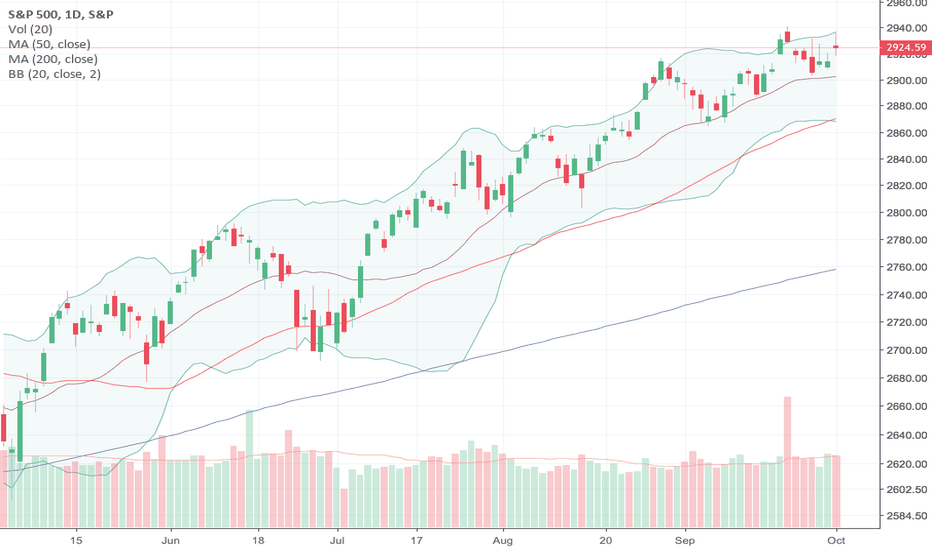

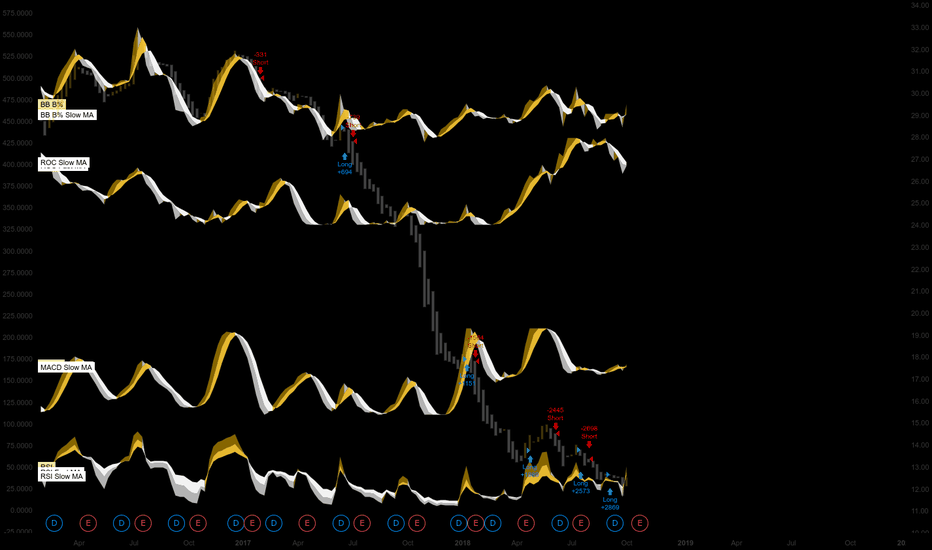

The Stock Market's Anchors Ignore Over-Stretched Conditions AT40 = 38.9% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 51.6% of stocks are trading above their respective 200DMAs

VIX = 12.1

Short-term Trading Call: neutral

Commentary

Looks like I had good reason to give a tepid endorsement to the upside potential for the stock market off the over-stretched conditions on display in AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs). The S&P 500 (SPY) had every reason to rally robustly in the wake of a trade deal among the U.S., Canada, and Mexico. Instead, the index only gained as much as 0.5% or so before reversing almost the entire gain. Only a desperate bounce in the last 15 minutes of trading took the index to a 0.4% close.

The S&P 500 sustained a hollow victory with AT40 sinking on the day to close below 40% again. AT40 has not looked this bad since April. Now I think the risk of going even lower is somewhere higher than 50%.

The anchor from small caps weighed quite heavily on AT40. The iShares Russell 2000 ETF (IWM) opened up and promptly faded from resistance at its 50DMA. IWM closed with a 1.3% loss and a 6-week low. A downtrend continues from IWM’s last all-time high.

The market did not worry about the broad, underlying weakness betraying the small gains on the S&P 500. The volatility index, the VIX, closed LOWER by about 1%. I went ahead and bought a small amount of SPY call options expiring October 8th that I plan to sell on the very next bounce or a fill of Monday’s gap up, whichever comes first. Beyond that trade, I am even more wary about the market than I was in the last Above the 40. I am still keeping the short-term trading call at neutral just out of deference for the relatively low level of AT40 while the S&P 500 remains above important support at its uptrending 20DMA.

CHART REVIEWS

General Electric (GE)

Last week I made the case for waiting on GE before making a fresh trade on a bottom. Then out of nowhere, GE replaced its CEO with former Danaher (DHR) CEO and current GE board member Larry Culp. The market’s initial reaction was extremely positive and easily cleared the thresholds for more safely playing a bottom. However, the stock failed to hold the best levels at the close and thus shut the down the buy trigger. GE even closed under its downtrending 20DMA; GE went from breakout to fakeout. This sharp fade makes a more aggressive trade even more risky than it looked on Friday.

CNBC Fast Money’s Karen Finerman made a case for a GE bottom from a fundamentals perspective. Like me, she likes the January 2020 call options. She is targeting the $13 strike while I have $15 strikes from an earlier dip.

iShares 20+ Year Treasury Bond ETF (TLT)

Speaking of bottoms, TLT violated the bottom that I thought was secured with last week’s Federal Reserve announcement on monetary policy. Still, I doubled down on my TLT call options as they have suddenly become a very cheap hedge on bullishness. I fully expect TLT to soar again if the market sells off at some point this month.

Tesla (TSLA)

TSLA delivered major relief in line with CEO Elon Musk coming to his senses and settling fraud charges from the SEC. In keeping with the tantalizing theme, TSLA nearly perfectly filled Friday’s gap down. As is its habit, the stock even closed at an obvious technical level which in this case was 50DMA resistance.

United States Oil (USO)

I suddenly see an elephant in the room: oil. Oil prices soared today perhaps in sympathy with Canada and the U.S making nice on a trade deal that includes Mexico. Whatever the reason, oil sitting around 3-year highs is NOT good news for consumers. Moreover, inflation watchers are likely starting to worry about inflation expectations creeping higher along with oil prices. I am now watching oil a lot more closely.

— – —

FOLLOW more of Dr. Duru’s commentary on financial markets via email, StockTwits, Twitter, and even Instagram!

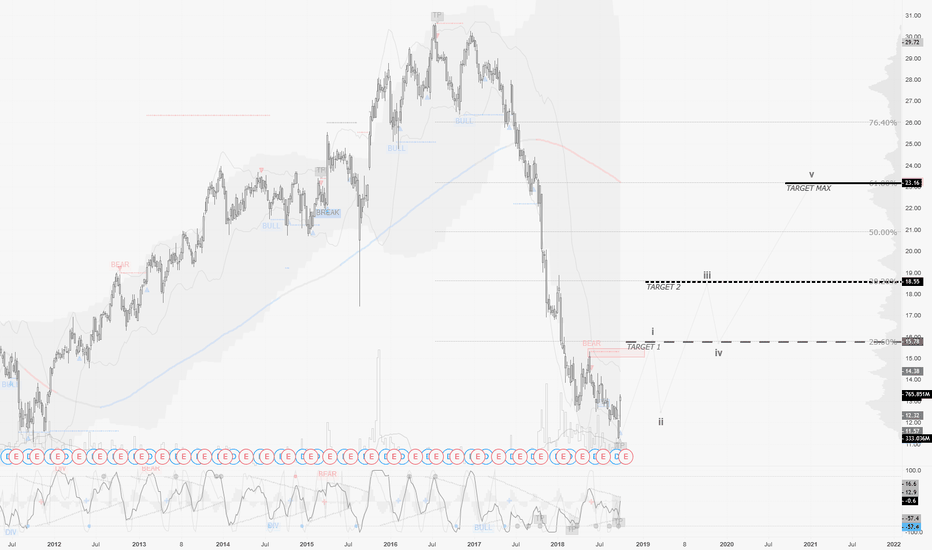

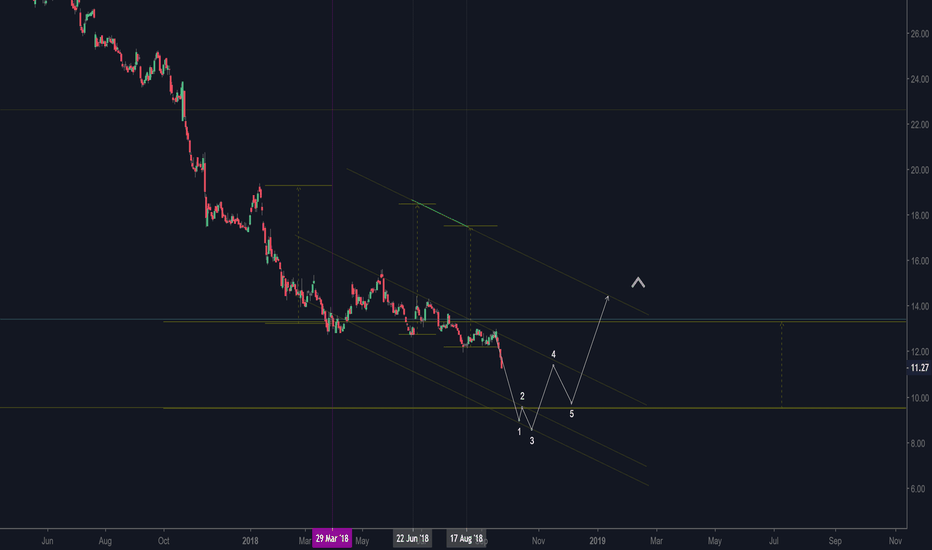

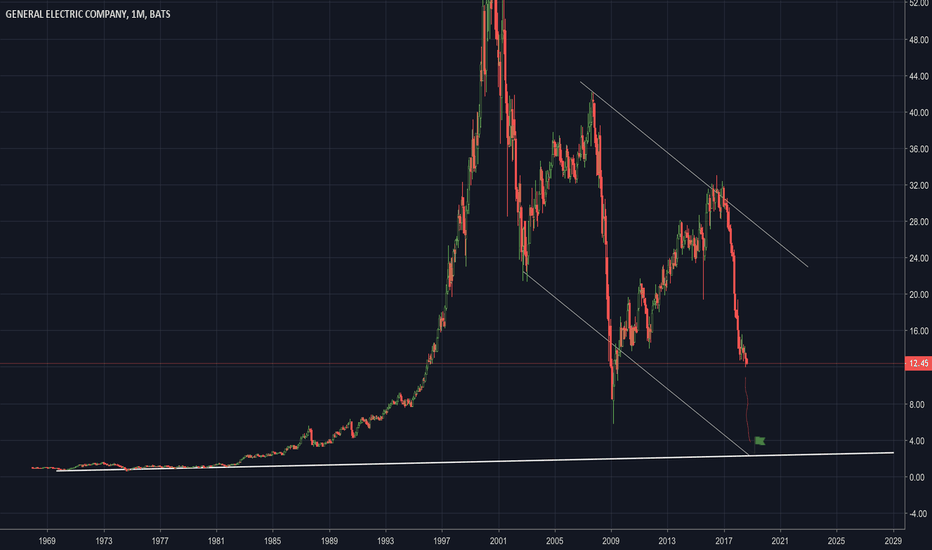

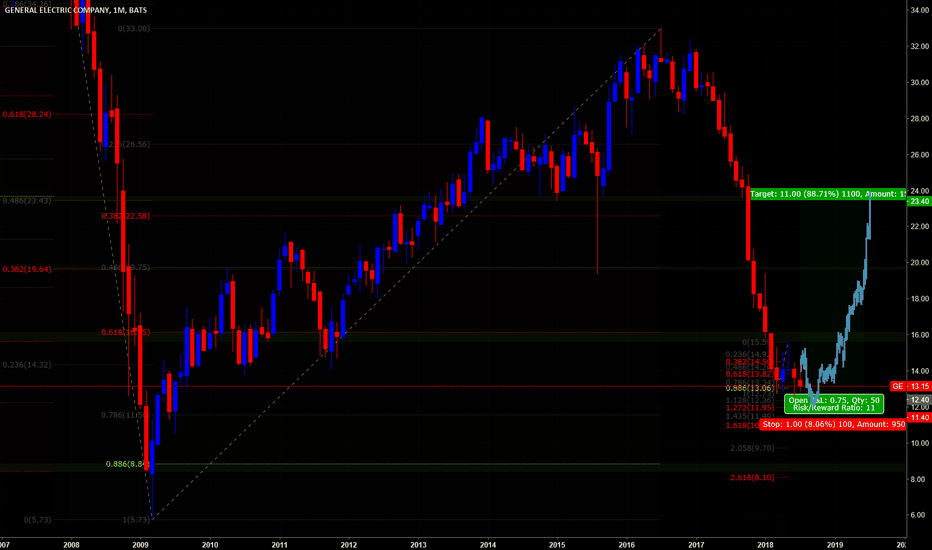

GE slowly reaches the end...Nearly two years of decline can be completed. In the exchange rate, it is possible to identify a so-called 2 and a half wave sequence that follows the exchange rate steadily during its two-year course. Therefore, there is no reason to deviate from this. This means that the wave structures in motion (regardless of the direction) consist of 2 whole and half wave structures. Of course, this is the distance of the ATR of that particular motion side. If we start from this mathematical model, it can be seen that GE's rate is based on the last decreasing wave structure. The target price may end somewhere between 8 to 10 usd. We are expecting a rising structure from there. GE's more distant target is 25 usd. Therefore, in this hope, you need to enter trading.

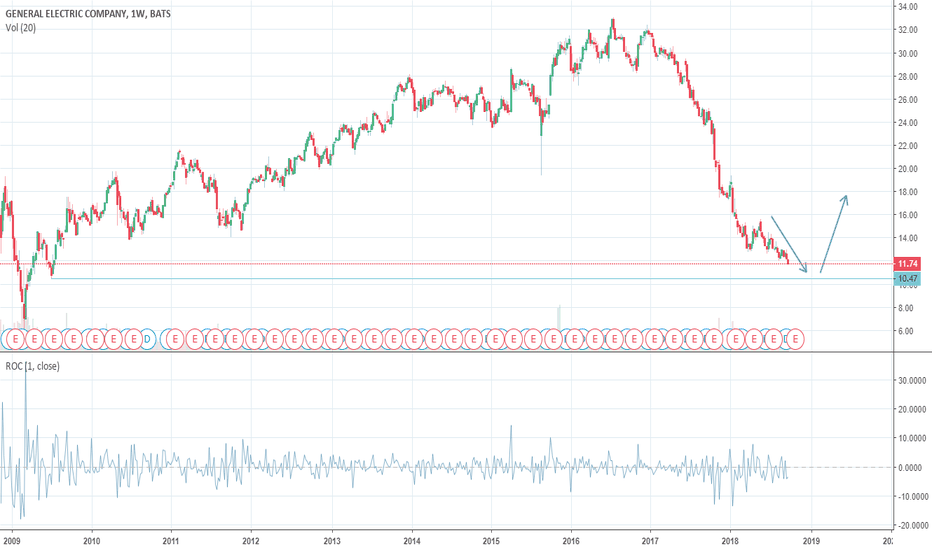

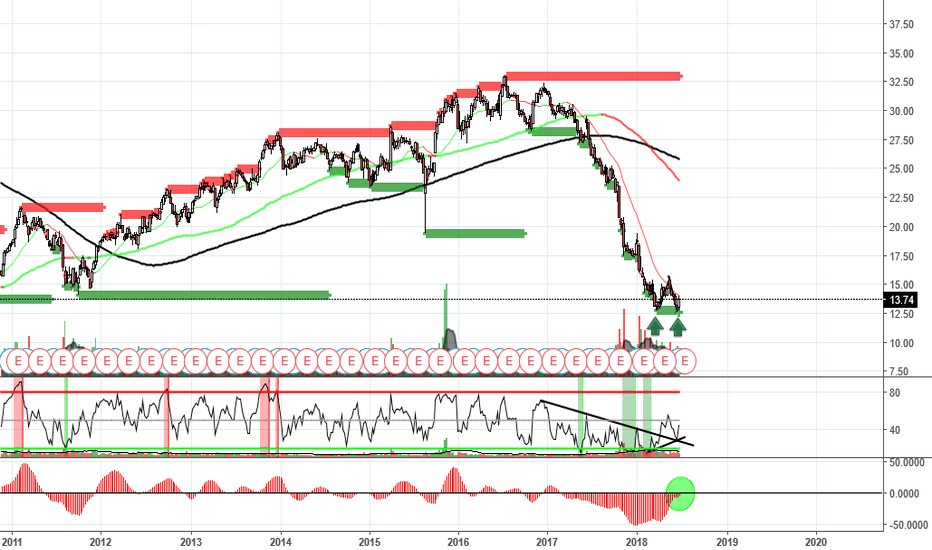

Do Not Argue With Sellers – Celebrate With Buyers: GE EditionGeneral Electric (GE) dropped 4.0% for a fourth straight day of high volume selling. At $11.27/share GE sits at a stomach-churning 9-year low.

GE’s early June expulsion from the Dow Jones Industrial Index seemed like such natural ignition for a bottom that even CNBC’s Jim Cramer got off the fence to declare the stock a buy. At the time I proposed a lower risk method of playing a potential bottom using call options. The call option configuration certainly helped ease the pain of the recent 9-year lows. Still, with selling accelerating, the temptation to consider the conditions for a bottom is too great to resist. Sure enough, Guy Adami on Fast Money offered his keys for determining whether GE (or any stock) has indeed finally reached bottom:

A new 52-week low on heavy volume: this action can indicate a wash-out of sellers.

Management is up-front and addressing the problems with the business: hope remains the company figure things out.

The company remains in a viable industry: the business and economic environment still gives the company time to turn things around.

I like Adami’s points. However, the title “how to catch a falling knife” is telling. Traders and investors should not actually reach out to catch a falling knife. Instead, they should step in when the risk of catching a knife is sufficiently low to make the risk worthwhile. In other words, I prefer to wait for “confirmation” that the falling knife has finished falling; I want the ground to catch the knife, not me.

Two years ago, I described this confirmation process in a piece titled “Do Not Argue With Sellers – Celebrate With Buyers.” When sellers have firm control of a stock, I want to wait for a some sign of buying like a trading day with a gain. A stronger confirmation occurs after buyers manage to establish control of the trading with a complete reversal of the most concentrated part of the sell-off. My only rare exception to the confirmation rule occurs when I have a strong conviction from some data or analysis that puts me in accumulation mode.

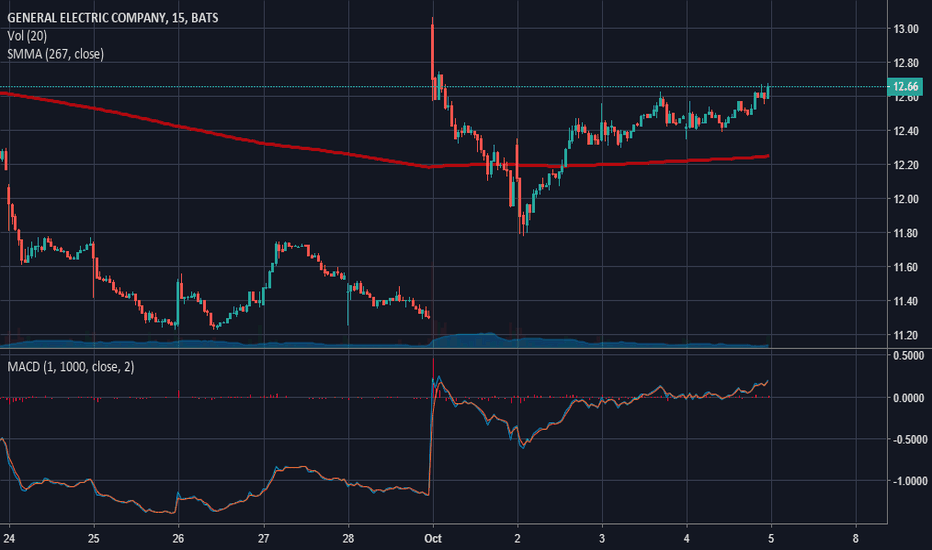

In the case of GE above, a close above $11.80 would be the first potential sign of a washout and exhaustion of sellers. A close above $12.71 would signal high odds of a complete washout. Since I already have a position in play, I am content to wait for this more definitive confirmation. Shorter-term traders should stop out of their long positions if GE manages to close below the latest low of $11.27. If GE closes at fresh lows, then the first signal of seller’s exhaustion adjusts downward to whatever closing price clears the intraday high of the last day of high-volume selling.

GE will continue to capture the imagination given its iconic status as a symbol of America’s industrial past. Now we wonder whether the future is waiting for GE as it sinks in stark contrast to the strength of the American economy and the near relentless up-trend of the S&P 500 (SPY).

Be careful out there!

Full disclosure: long GE call options

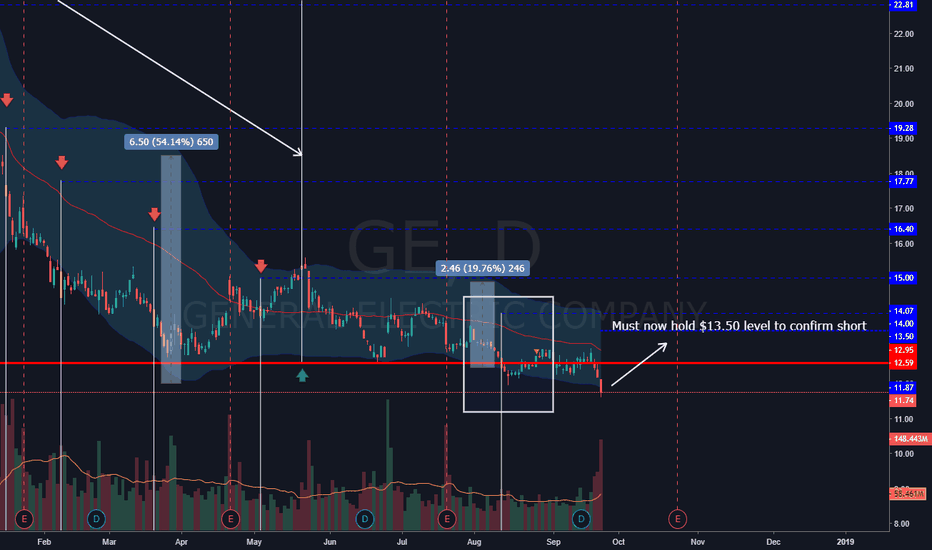

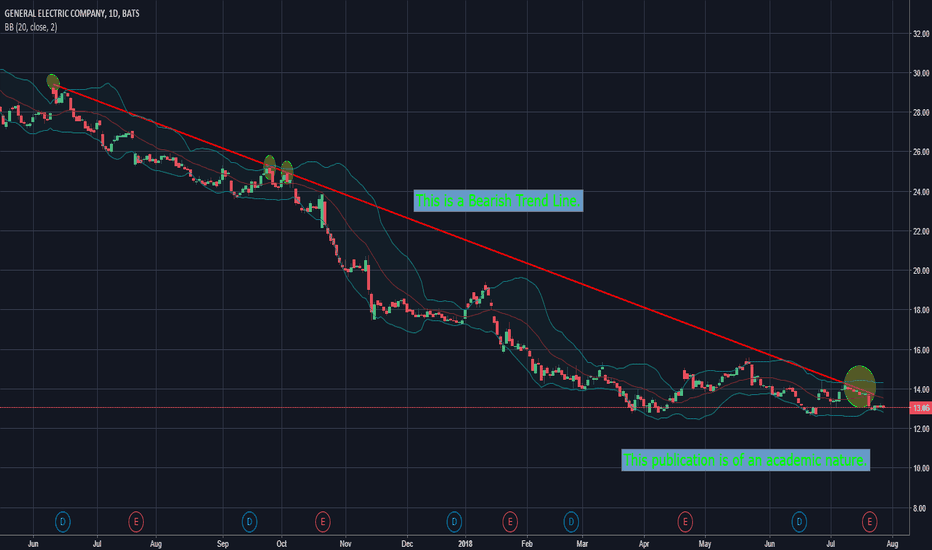

GE - Another Short Teaser?This a follow-up to the GE idea about the downtrend it started on May '17 through May '18. GE just broke down another support level at $12.60 after failing to even test the $14 mark. Right now the support break tells us that the stock is still weak, but it is still a little early to call it a bankruptcy confirmation. The stock is weak and would not be a great idea to buy now, whether to trade or to invest, but even though it looks short the downtrend has been stretched out for a long time.

Single digit numbers (below $10) would be really interesting but sad if it happens. Just like before, if GE holds below its $13.50 level and makes a correction to the downside, it would confirm my bias about poor performance based on the price action. As short as I am on this stock, it is still only a waiting game until a further sign of weakness appears.

Again, let's keep watching GE till about December to see if it makes up its mind. We will see how this plays out.

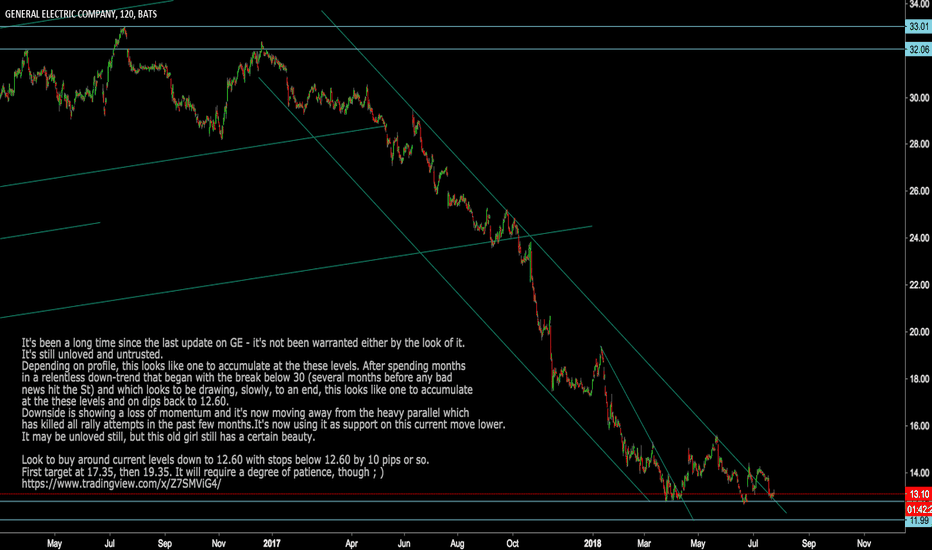

GE General Electric Speculative Buyondip with Stops below 12.50GE General Electric Not Dead Yet

It's been a long time since the last update on GE - it's not been warranted either by the look of it.

It's still unloved and untrusted.

Depending on profile, this looks like one to accumulate at the these levels. After spending months

in a relentless down-trend that began with the break below 30 (several months before any bad

news hit the St) and which looks to be drawing, slowly, to an end, this looks like one to accumulate

at the these levels and on dips back to 12.60.

Downside is showing a loss of momentum and it's now moving away from the heavy parallel which

has killed all rally attempts in the past few months.It's now using it as support on this current move lower.

It may be unloved still, but this old girl still has a certain beauty.

Look to buy around current levels down to 12.60 with stops below 12.60 by 10 pips or so.

First target at 17.35, then 19.35. It will require a degree of patience, though ; )

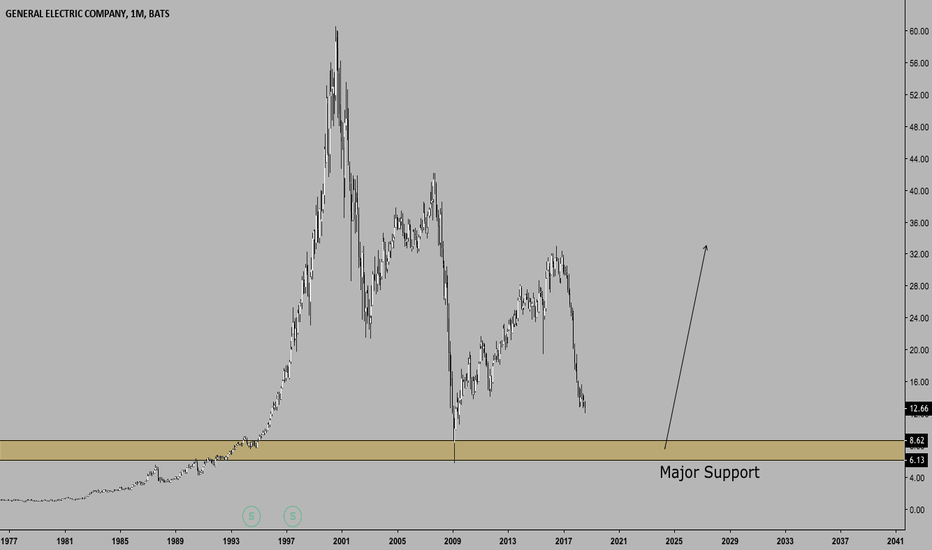

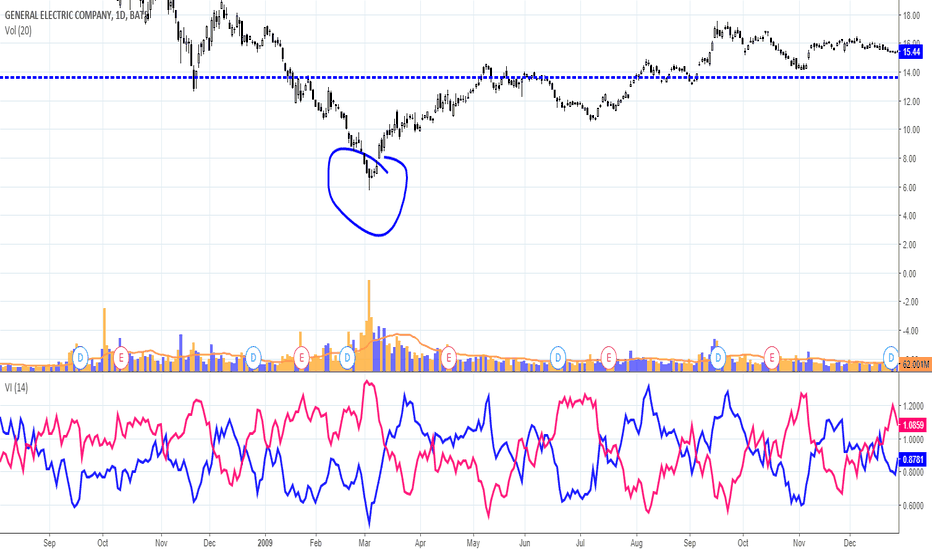

Very long very bearish GE market might be endingLooks like general electric is bottoming.

It's visiting a level that has been reactive in the past, the monthly RSI is at it's ath on the monthly (very slightly higher)

If that support gets reached with bullish divergence again (daily & weekly chart too), I think it won't be a bad idea to go long.

I am prepared.

It could also spike too fast and/or during pre-market so we all miss it rip.

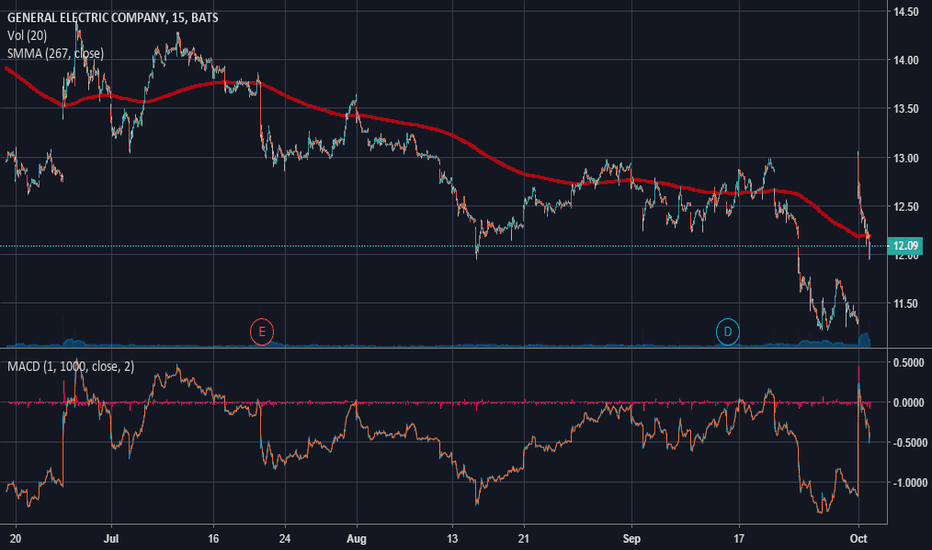

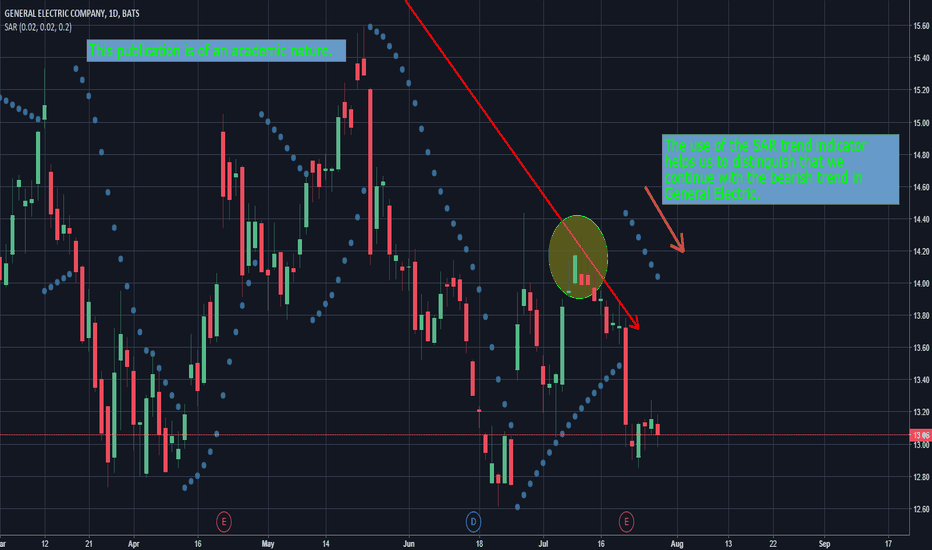

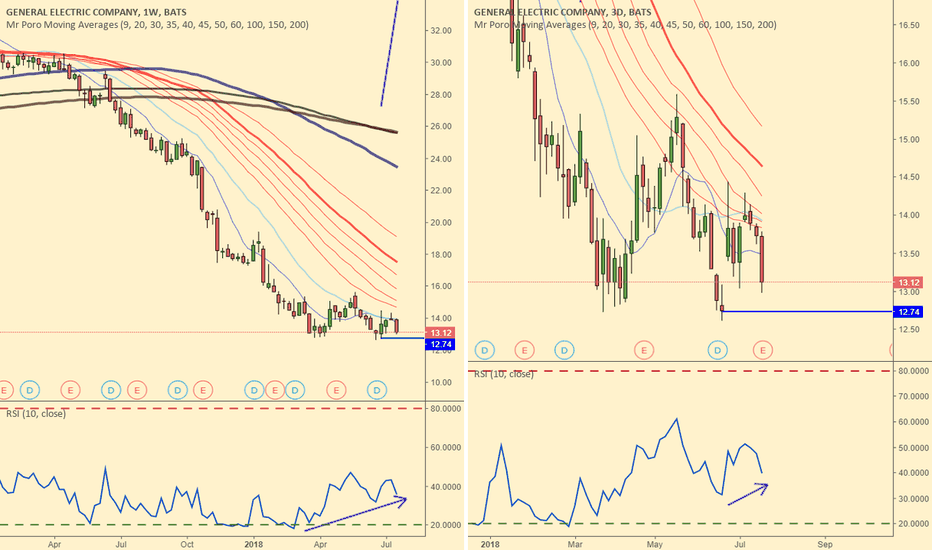

GE - Ready to star an uptrend?GE has been in a downtrend path for all the 2017 and 2018, most of the time even under the moving average 50 days (blue line), and the price just once tested the 100 days trend line (orange moving average).

Today, the stock is closing almost with a +8%, after the company announced his plans to spin off its health-care business and sell its participation in the oil-services company Baker Hughes.

Maybe is too early to say the downtrend is finished, and the company still faces some risks in the short term, as some expected downgrades in his credit rating, and his recent reality after it was removed from the Dow Jones.

From the technical analysis view, there are some key elements: A) possible double bottom formation, around the $12.75 area, and B) a possible MACD bullish cross in the daily graph (left).

Before to go long, I will wait for some confirmation signals for the next days, such as: 1) keep price action over today GAP ($13.5); 2) price action over the moving average 8 days (green line); 3) golden cross between 20 and 50 days moving average; and lastly, but not least important 4) stay above the long-term trend, the 200 days moving average!

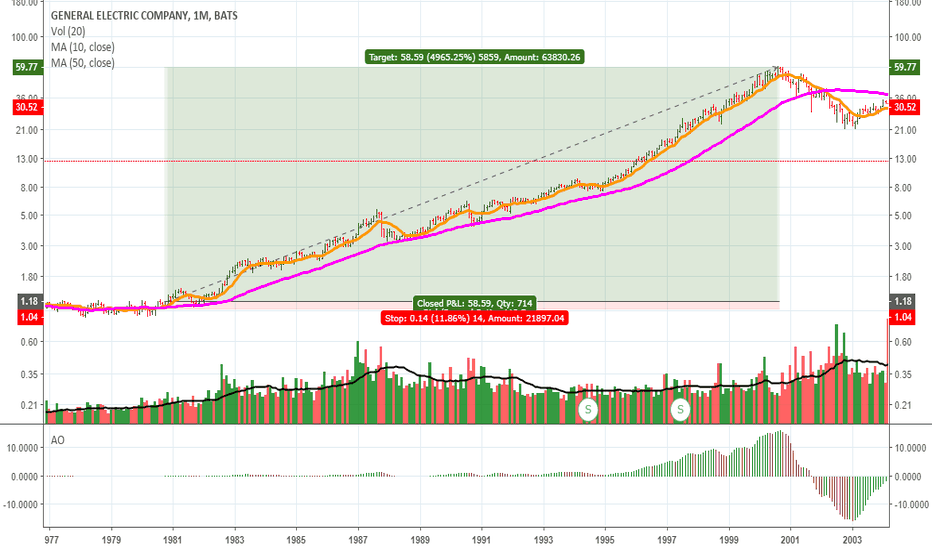

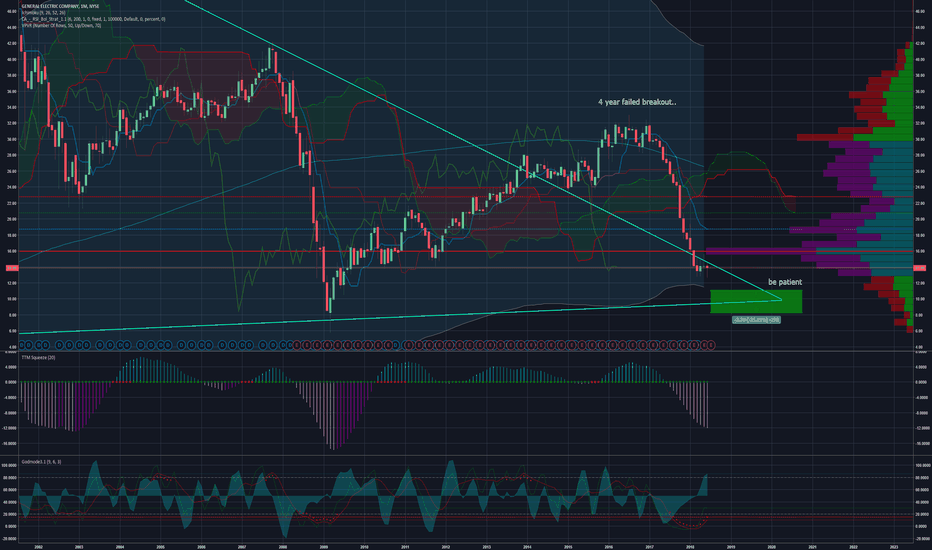

GE General Electric Company. Don't be scared!Keep it simple.

So this one is fun to chart. I've found a 20 year wedge that has fallen back into play.

You can see we broke back into the wedge after a 4 year false breakout.. that's rough.

I'm seeing a ton of buy signals on the MONTHLY, but momentum is still bearish, peaking out though soon to be bullish. Ichimoku is still in the bearish zone, turning though.

Another note is on the WEEKLY, we have a 4 week squeeze, which has never happened, well, back in 1994 before it went from 7 to its ATH high...

I can see it reaching the bottom of the 20 year wedge, well 24 year wedge, because why not? Its done all that work to selloff to stop right above where it NEEDS to go?

I've placed my buy zones, and this could be an amazing grab considering the beauty of DIVIDENDS.

BE PATIENT, you have already waited 24 years, don't mess up the last year of decent!

Happy Trading, Debating and speculating! I want everyone to win!