$GE earnings analysis *This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management*

My team has been digging into global tech company $GE for the past few days in anticipation of their upcoming earnings report. $GE continues to be a dominate power in air travel (aerospace engines), precision public health (medical diagnostic equipment), and energy transition (steam and wind turbines). This company is a triple threat and certainly not a force to be reckoned with.

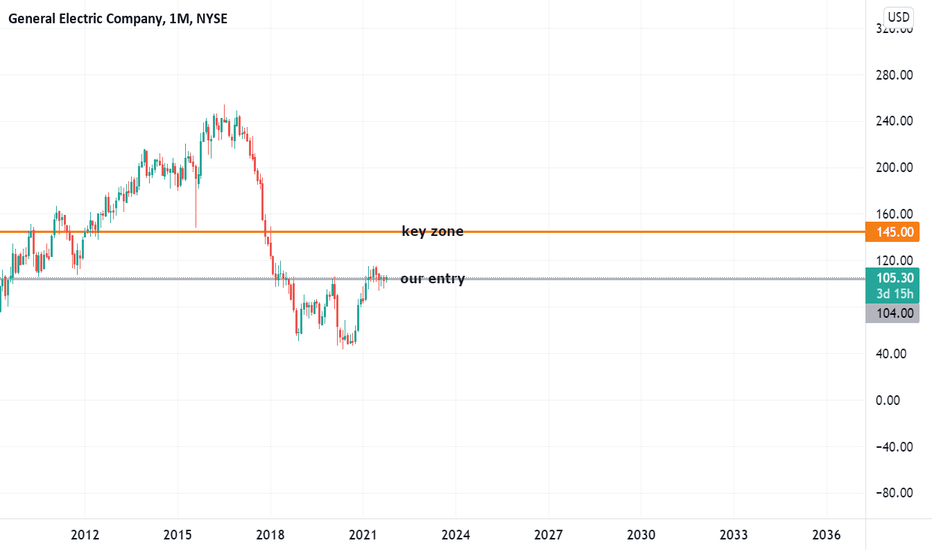

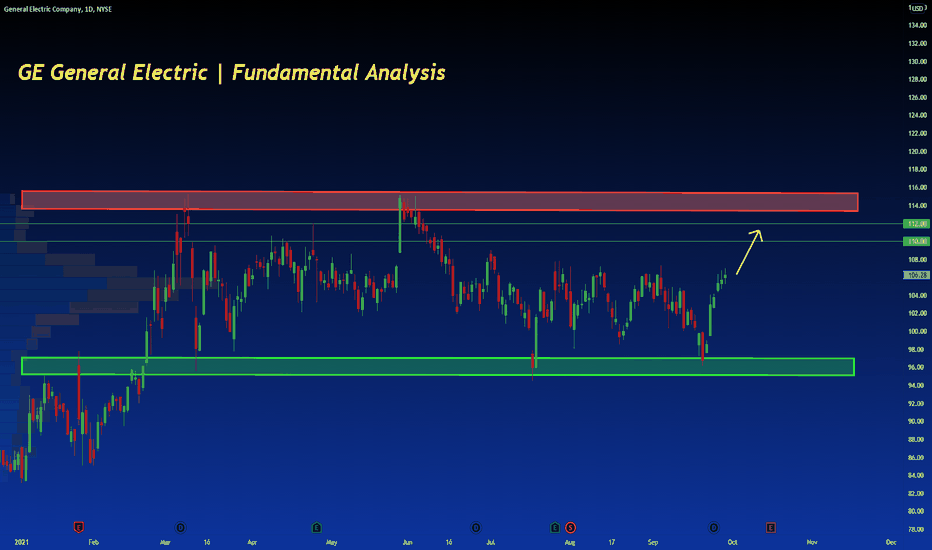

$GE has a great technical set-up right now on the charts as well. If $GE has an earnings beat pre-market expect current resistance at $115-116 to be broken sometime during the day. My team still has yet determined a good take profit on $GE due to a lack of uncertainty in the companies potential. However we believe that $145 is a key zone to look at if an uptrend does emerge.

My team entered $GE on 10/25/21 at $104 per share. This is a long term trade.

Earnings are expected to be announced premarket on 10/26/21.

If you want to see more, please like and follow us @SimplyShowMeTheMoney

GE

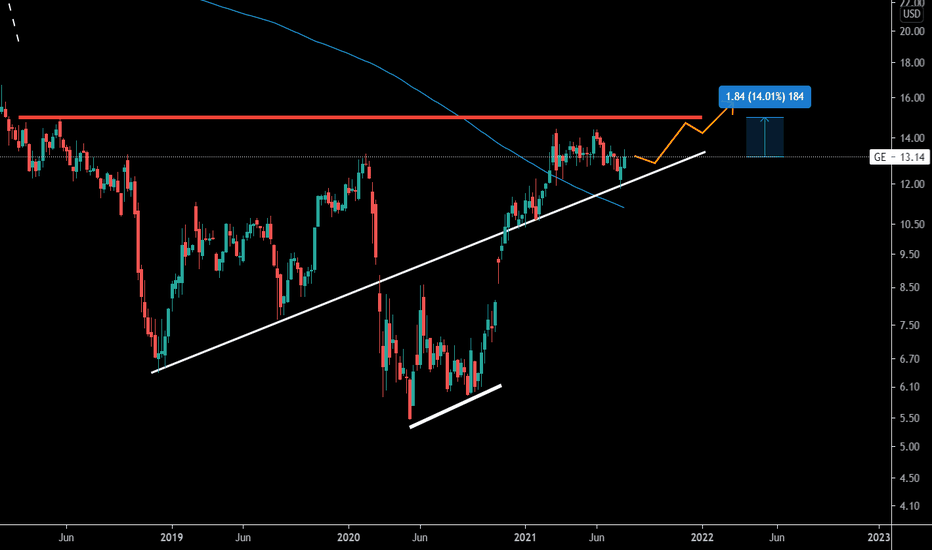

Beautiful Channel!Money Makers!

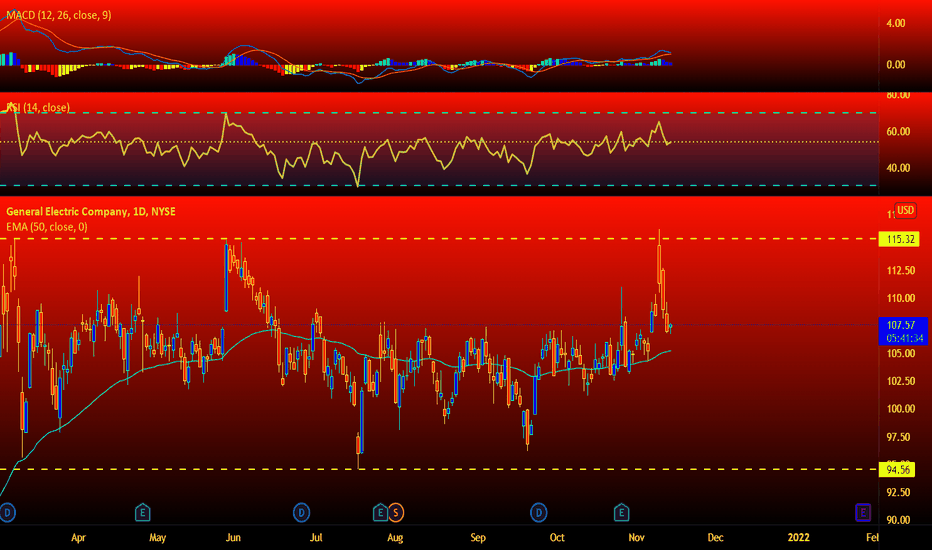

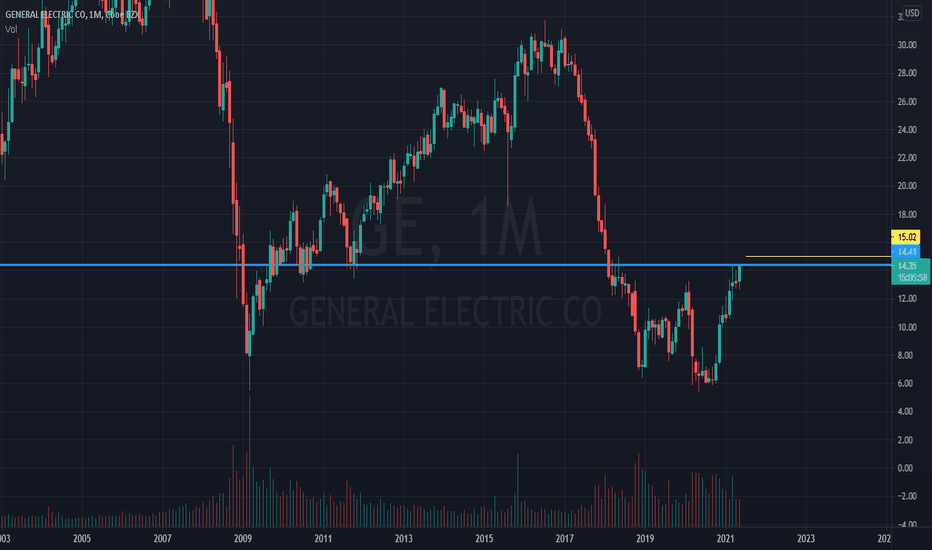

GE has been trading in a horizontal channel for a very long time. It recently was rejected from moving higher and is currently attempting to bounce off the 50 EMA. If the 50 EMA fails we can expect it to move lower to retest the bottom of the channel again.

Love it or hate it, hit that thumbs up and share your thoughts!

It's all about Market structure, Area of value, and Entry Trigger.

Don't trade with what you're not willing to lose. Safe Trading Calculate Your Risk/Reward & Collect!

This is not financial advice.

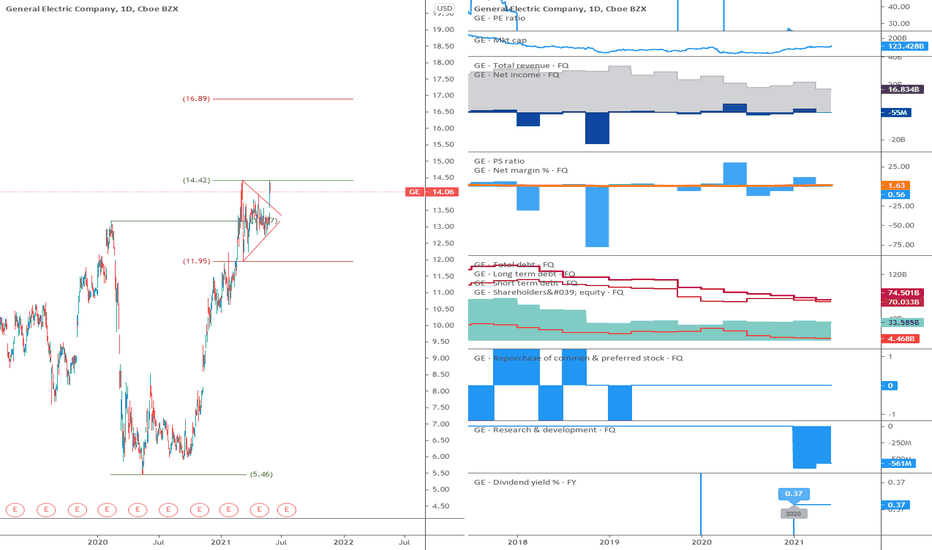

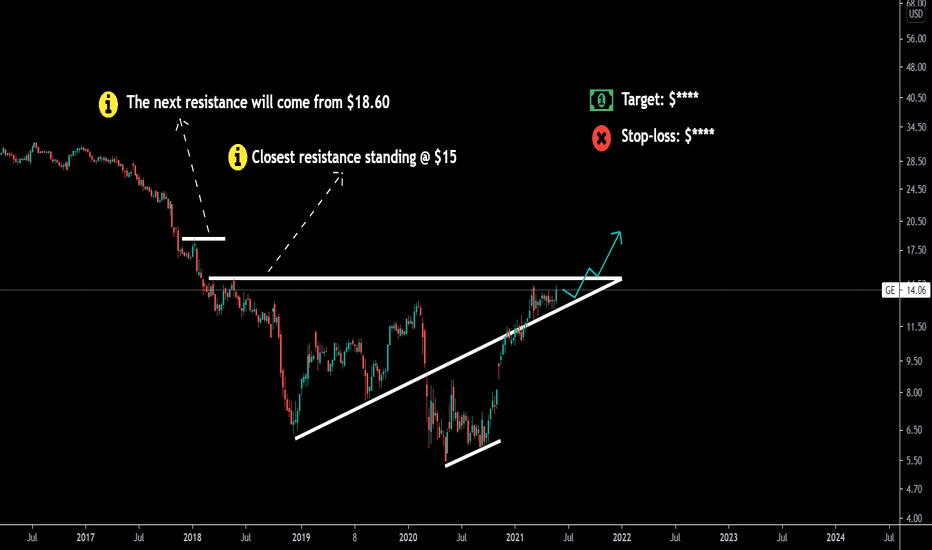

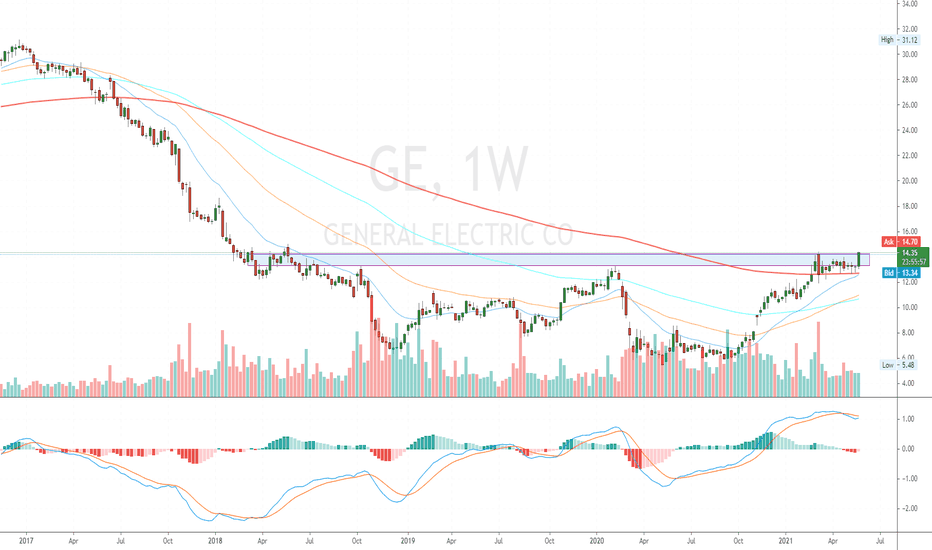

A perfect technical scenario on General Electric Today we will speak about GE. Why? because it's on a situation that from a technical perspective is BEAUTIFUL.

Let's check those items:

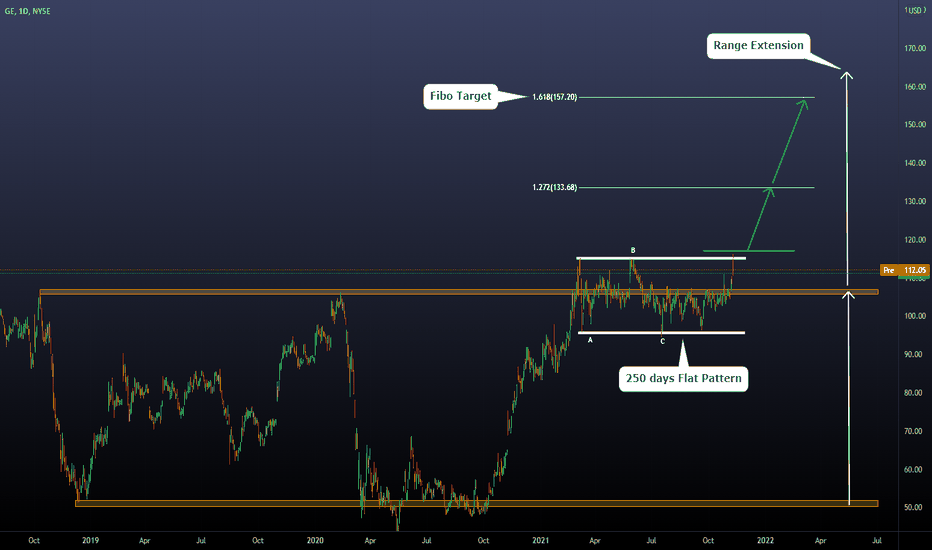

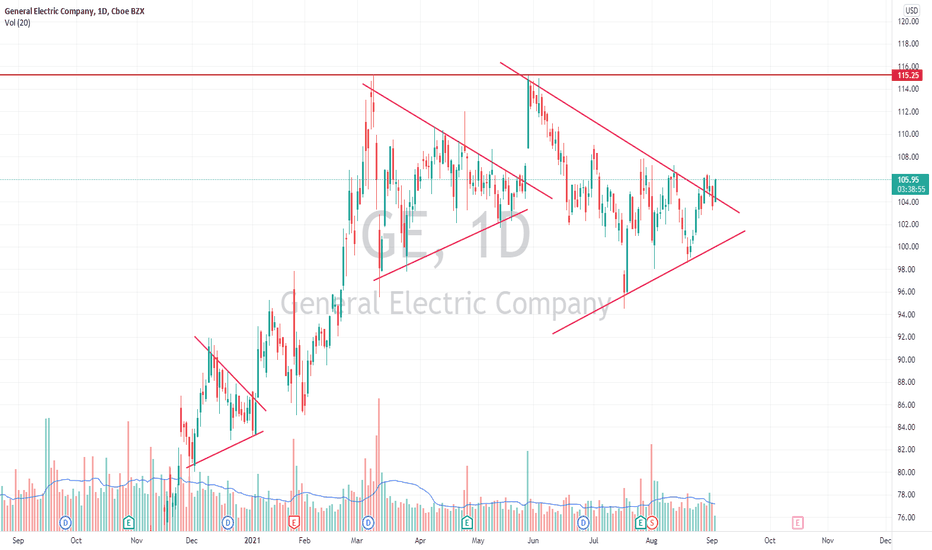

1) Massive range that started in 2019 and was broken on March 2021. Remember that classical chart patterns tell us that when we have a range, we can calculate the minimum target extending the size of it above or below the breakout.

2) After the March 2021 breakout, the price started a consolidation on the edge of the previous major structure. From an Elliott Wave theory perspective, this is a Flat Pattern (composed by an ABC movement, which means that is 100% finished).

3) My conclusion is that this scenario is about to define a new direction when we observe the breakout of the flat pattern.

Directions:

Currently, the price is in the higher zone of the flat pattern, and I like the idea of thinking about bullish breakouts (I'm not interested in bearish setups). So let's explore this idea better:

If we have a clear breakout and the price reaches our horizontal green line, we will consider that as a confirmation of this new movement, and the targets we expect are either the 2nd level of the Fibo extension or the Range extension. Both are valid situations.

What if the price reaches the green line and then we have a bearish movement? This is impossible to happen because all our analysis goes in the right direction (100% win rate)... Just joking. You must think on levels where you will say "This is not going as expected fellas, abort mission". That level for us is below the flat pattern. So, if the price reaches our green horizontal line, we will consider that our view is wrong if the price goes below C.

Feel free to add any idea, or view about this situation, in the comments! Thanks for reading.

General Electric | Fundamental AnalysisGeneral Electric's $1.45 billion cash acquisition of advanced surgical imaging company BK Medical announced last week would have been something out of the ordinary for GE a decade ago. These days, however, it's much more important. This deal is CEO Larry Culp's biggest acquisition, a leader noted for his ability to acquire businesses, and it should give shareholders certainty in the company's future. And here's why.

First, the deal will support growth. BK Medical makes imaging and surgical navigation technology used in surgery and ultrasound urology. Thus, it greatly complements GE's ultrasound business. That is important because ultrasonography is one of GE Healthcare's fastest-growing businesses. For instance, management has drafted a mid-single-digit growth rate for its ultrasound business, compared to a low- to mid-single-digit growth rate for the entire healthcare business.

Moreover, GE Healthcare is probably the industry that would get the highest rating if traded as an independent company. For example, GE's closest competitor, Germany's Siemens Healthineers, trades at a higher valuation (Wall Street analyst consensus) of enterprise value (market value plus net debt) to earnings before interest, taxes, depreciation, and amortization, or EBITDA.

In short, GE is accelerating growth in one of the fastest-growing divisions and the highest-rated business.

For Culp, taking the helm in October 2018 must have been like playing a game of closed position chess with former world champion Anatoly Karpov. Heavily mired in debt and with limited scope for movement, the open option was to start a series of asset sales to reduce debt while gradually improving the position by repositioning the business.

As a result, GE sold its biopharmaceutical business to Danaher (formerly Culp`s company) for a net price of about $20 billion; its aircraft leasing business, GECAS, for $24 billion; and several others.

It's been a long time since GE has been in a position to make meaningful acquisitions. It worries the industrial conglomerate because investors are relying on management to invest in parts of the diversified business that will grow -- one of the advantages of diversification. That is also a concern because GE tends to produce large products that require a significant upfront investment, such as aircraft engines, gas turbines, wind turbines, and imaging equipment.

Thus, the deal with BK Medical gives investors confidence that GE's financial position is now sound and management can invest in growth. That is especially important given that Culp has built its reputation at Danaher by making some successful acquisitions and applying several continuous improvement and lean management practices to improve the efficiency of these businesses. Investors will hope that he can do the same for GE.

The investment also suggests that GE is unlikely to sell its health care business anytime soon. Former CEO John Flannery (who previously ran GE Healthcare) had planned to spin off the company into a separate company to raise money to pay down debt, but those plans were abandoned in favor of selling the biopharmaceutical business.

In addition, this deal would lower expectations for the sale of the rest of GE Healthcare (imaging, ultrasound, health systems, pharmaceutical diagnostics, software, and solutions).

This makes sense, given that GE will need the profits and cash flow from GE Healthcare to support GE Aviation, which is recovering from the impact of the COVID-19 pandemic on commercial flights, and GE Renewable Energy, which is building its offshore wind turbine business virtually from scratch in 2021.

To be sure, GE Healthcare will face some near-term headwinds due to ongoing supply chain issues, which will likely extend into the first half of 2022. Nevertheless, as Culp noted recently at the Morgan Stanley Laguna Conference, there are no end-market demand issues.

Thus, once GE overcomes the difficulties associated with restarting production, we can expect BK Medical to start helping GE accelerate the growth rate of the healthcare segment to mid-single-digit rather than low-single-digit levels. Given how highly valued healthcare companies are, this could have a significant impact on the stock price for years to come.

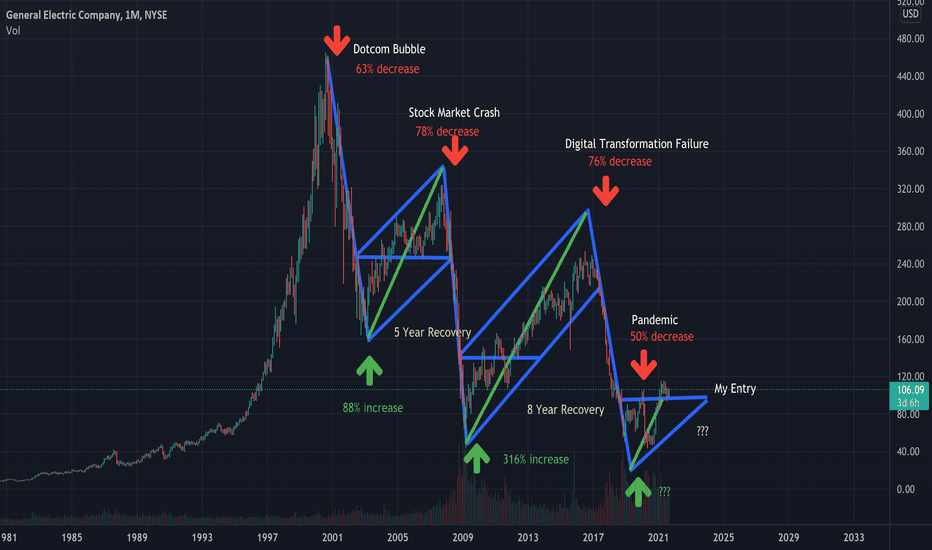

General Electric (GE) Bearish FlagsIn this technical analysis, I give you an explanation for GE's price movement. After every major market correction, GE forms a bearish flag. It is my hope that after the pandemic we see another flag. The market corrections are labeled. The percent increase/decrease is measured left to right from the arrows. If you notice in the last two flags, the price hit the top resistance line so I expect this flag to hover around the price of $96. I can't estimate how long the recovery period will take or the percent increase.

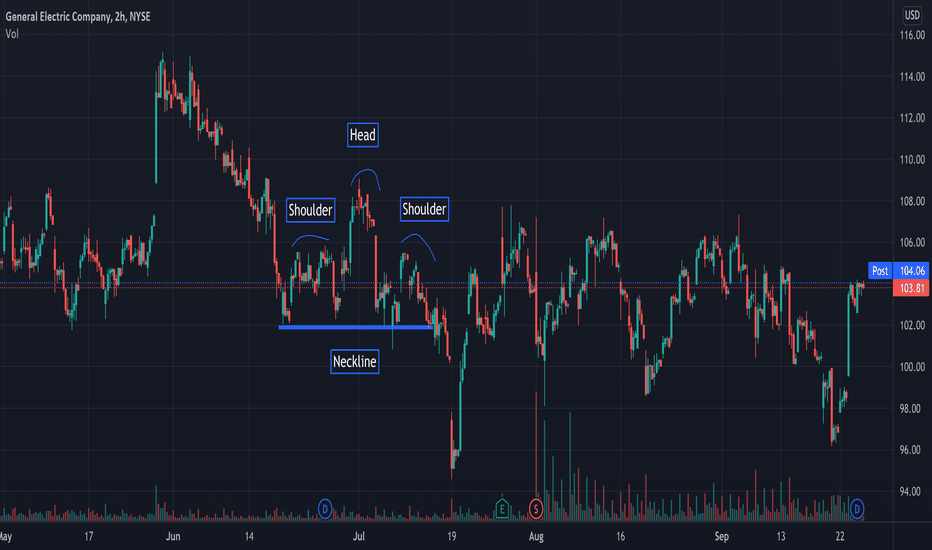

General Electric (GE) TAGeneral Electric formed a Head and Shoulders pattern starting on June 17, 2021, and ended on July 15, 2021. This pattern was soon followed by a breakdown. Since then, the stock has been operating in a horizontal channel with resistance at $107 and $98. Look to enter the market around the lower resistance mark.

GENERAL ELECTRIC:DETAILED FUNDAMENTAL ANALISYS-LONG SCENARIO 🔔General Electric was once a massive power producer. Back in 2017, turbine manufacturing was the company's biggest business. Then it all went downhill.

A turbine design defect (now fixed) forced potential power producers to put their purchase plans on hold. And then clean natural gas power began to lose its popularity as alternatives to solar power became more affordable. GE's energy turbine revenues are now down to about half of their peak levels. This decline in sales has further trimmed the company's bottom line of profits.

Investors should pay attention to the fact that the company is changing. This could be an indicator that GE's once-great energy business is slowly recovering.

Of course, it's hard to distinguish between organic growth driven by increased demand and growth that is merely the mathematical result of last year's COVID-19-induced outages. For most companies, it's probably a mixture of both.

For General Electric's power turbine business, however, it will likely be organic growth. Utility companies plan million-dollar investments years in advance and then maintain the purchased turbines for 20 years or more. The difficulties associated with time constraints designed to keep consumers at home are not a major hindrance to the power generation industry.

Knowing this fact helps put the chart below in the right perspective. Last year's modest orders and revenues for GE's power division are not the result of the spread of the coronavirus.

Rather, business began to decline in 2018 when several turbine blade failures took out too many GE-made gas turbines. General Electric quickly began responding, but its institutional customers were reluctant to do so until it became clear that the company's turbines would not fail for a long time.

It's also naive to ignore the fact that around the same time that GE turbine blades began to fail, alternative energy sources were undergoing a real revolution, leading to a shift away from old technology and toward investment in cleaner, greener technologies. According to IHS Markit, the rate of annual photovoltaic panel installations more than doubled from 2015 to 2019, more than doubling global solar power capacity, according to the International Energy Agency. It would be surprising if General Electric's energy business didn't face obstacles.

But take a closer look at the chart above. Specifically, note the fact that, at least, energy business revenues and orders stabilized in 2020 - despite the turbulence - during the recently ended quarter. Equipment orders also improved significantly in two of the last three quarters. That's a subtle hint that things are changing for the better, even if most investors don't see it yet.

Of course, not losing ground is not necessarily the same as growing, and frankly, it could be years before GE's energy division approaches its glory days, when revenues of $8 billion and quarterly profits of a few hundred million dollars were the norm.

But don't be too quick to dismiss the potential of this part of the company's business for several reasons.

Foremost among them is that, as reliable as solar power is, it still faces the problem of a lack of overnight power generation. This problem is solved quite effectively with battery-based energy storage. However, this solution still lacks the "instant-on" capability that most power producers need, especially in the extreme heat of summer and the bitter cold of winter. A multifaceted power generation portfolio using all available options seems like the most plausible future.

The second reason to expect demand for natural gas turbines in the foreseeable future is that the world is simply not ready for such a leap. In a long-term market forecast released last year, the U.S. Energy Information Administration predicts that by 2050, 36% of the nation's electricity will be generated by natural gas, just 1 percentage point less than 37% currently.

That's despite the fact that renewables will likely double their current share of the nation's electricity production from 19% to 38% over the same 30-year period.

And to the extent that there will be pressure for clean energy, GE's gas turbines can be made to run on hydrogen, which can be produced with minimal impact on the environment and - ultimately - produced economically. The company believes that all of its turbines can run on pure hydrogen within a few years, making the issue of natural gas's environmental impact moot.

The fact of the matter is that it all shows up in numbers that the company tacitly discloses. As of the end of June, GE's backlog of energy equipment and services totaled $71.8 billion.

That's more than four years ahead, not counting the new contracts signed during that time.

Investors expecting GE's energy business to blossom overnight will be disappointed. The company's customers are not fast-moving consumers. Rather, they are corporations that can take months to decide to shell out millions for new equipment.

But for long-term investors, the electric power industry offers an undervalued growth opportunity that is on par with GE's renewable energy and aviation businesses. This reinforces an already bullish position based on consistent cash flow growth, even if the company is slightly riskier than the average blue chip

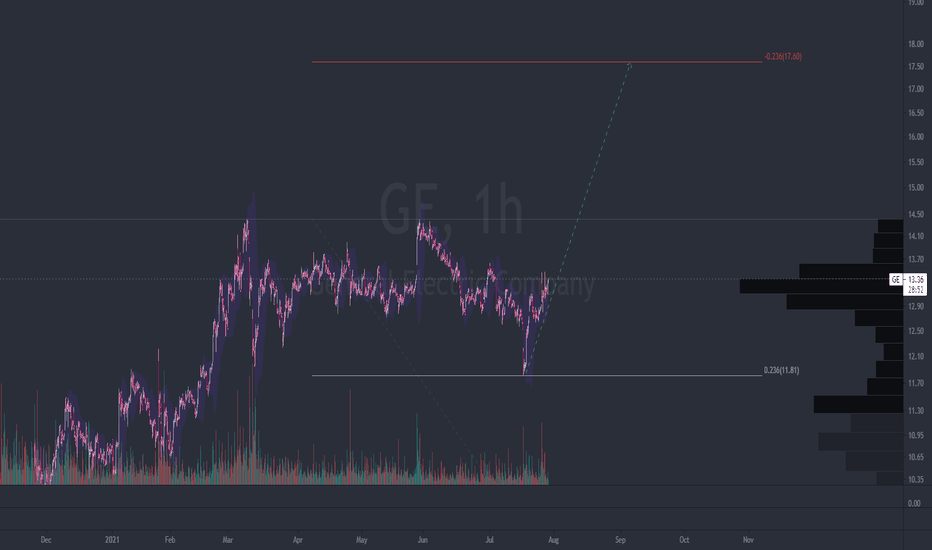

General Electric - Lets rise and shine!-Potential 14% rise!

-Following the trend-line perfectly

-Shares of General Electric Co. GE, +1.74% shot up 4.0% in premarket trading Tuesday, after the industrial conglomerate reported second-quarter profit and revenue that beat expectations, and surprisingly generated positive free cash flow.

-On a net basis, the loss per shares narrowed to 14 cents from 26 cents, while excluding nonrecurring items, GE swung to adjusted earnings per share of 5 cents from a loss of 14 cents to beat the FactSet EPS consensus of 3 cents.

-Revenue rose 9% to $18.28 billion, above the FactSet consensus of $18.14 billion. Industrial free cash flow was about positive $400 million, compared with the FactSet consensus of negative $338.3 million, and the company raised the 2021 FCF guidance range to $3.5 billion to $5.0 billion from $2.5 billion to $4.5 billion. Among GE's business segments, revenue for Aviation rose 10% to $4.84 billion, but was below the FactSet consensus of $5.16 billion;

-Healthcare revenue grew 14% to $4.85 billion, well above expectations of $4.30 billion; Power revenue rose 3% to $4.30 billion to top versus expectations of $4.09 billion and Renewable Energy revenue jumped 16% to $4.05 billion to exceed expectations of $3.87 billion.

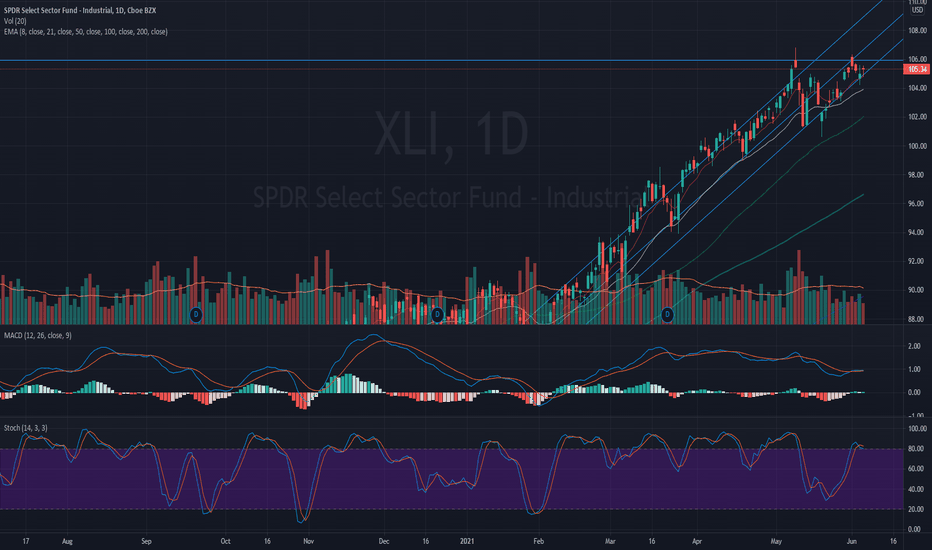

-"Momentum is building across our businesses, driven by Healthcare and services overall, with Aviation showing early signs of recovery," said Chief Executive Lawrence Culp. GE's stock has run up 19.6% year to date through Monday, while the SPDR Industrial Select Sector ETF XLI, -0.57% has gained 17.0% and the S&P 500 SPX, -0.61% has advanced 17.7%.

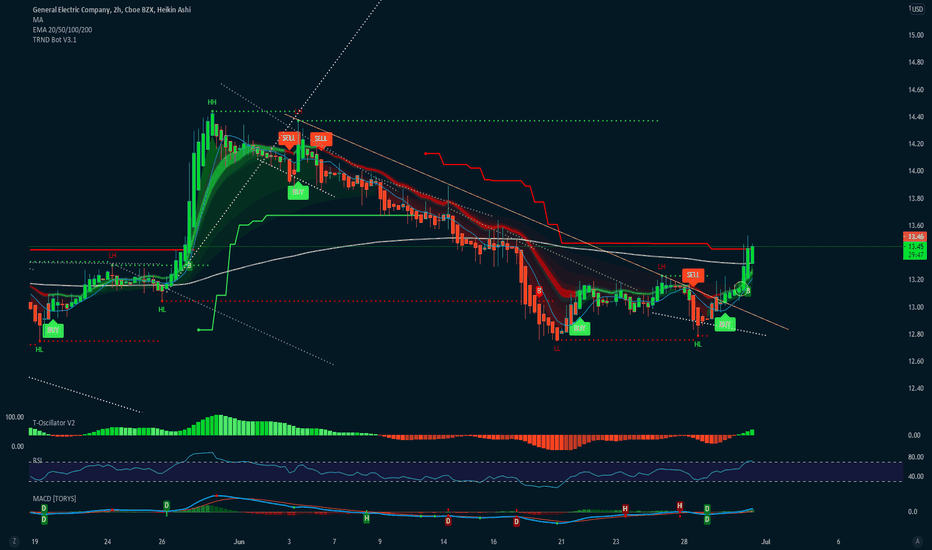

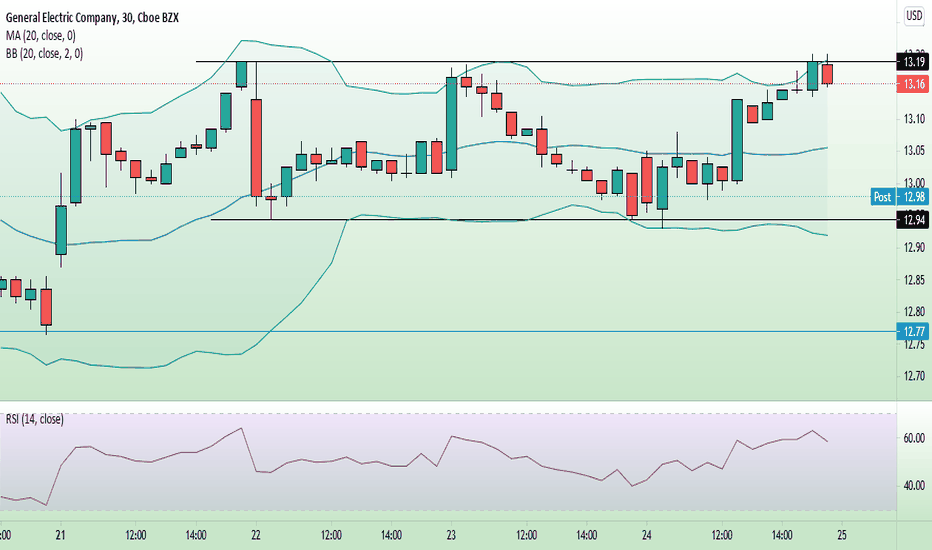

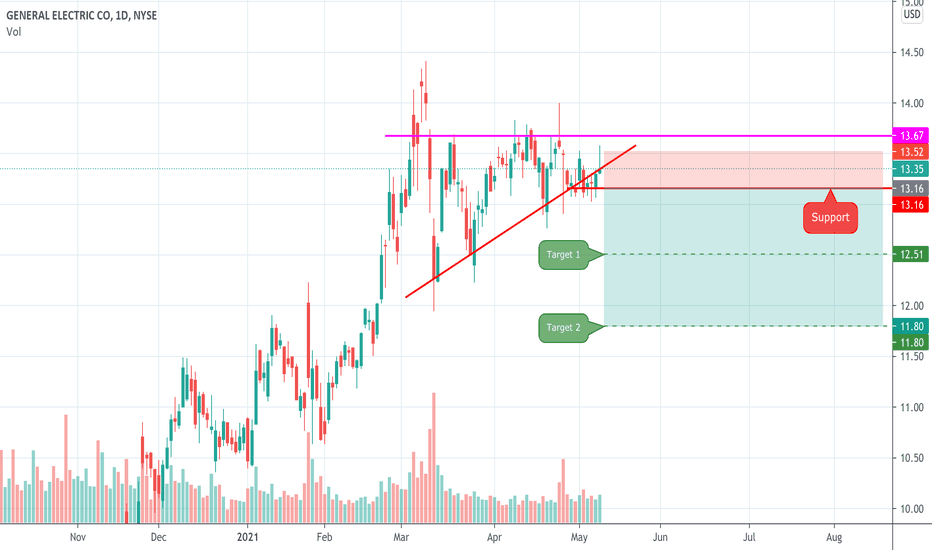

These patterns can make GE fly to the $13.90! 👀We are in a consolidation, and the 13.19 is a ceiling for GE, while the 12.94 is a floor. According to Al Brooks, 80% of the breakouts are going to be false, so we must be careful.

The time to buy is near the support, but there’s a chance we’ll see a breakout from the 13.19.

We have a possible advanced breakout in the 4h chart, and if confirmed, this can make GE fly and close the gap around 13.90.

This is something that favor the buyers, but again, let’s wait for the confirmation on the price action! Also, the 20ma is right there above us, so, we must see a good breakout as soon as possible.

If you liked this trading idea, remember to click on the “Follow” button to get more trading ideas like this, and if you agree with me, click on the “Agree” button 😉.

See you soon,

Melissa.

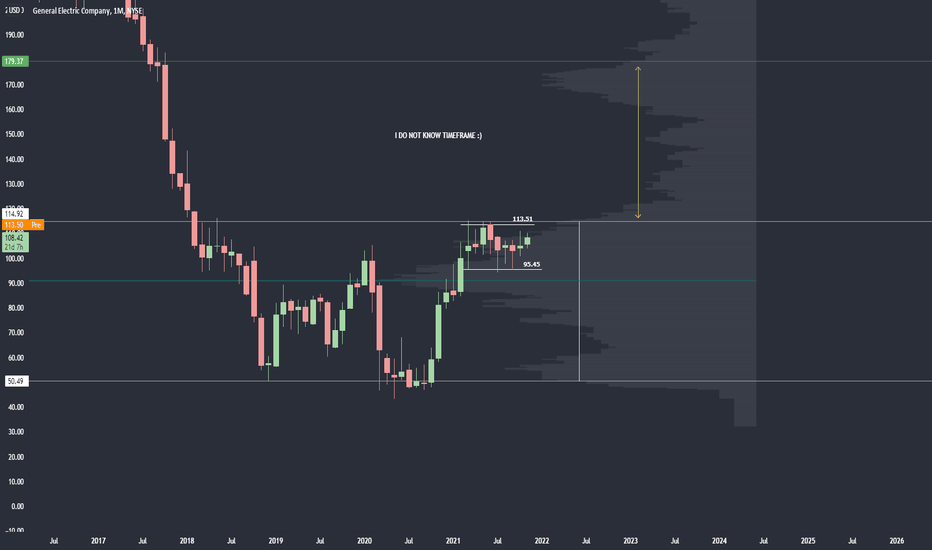

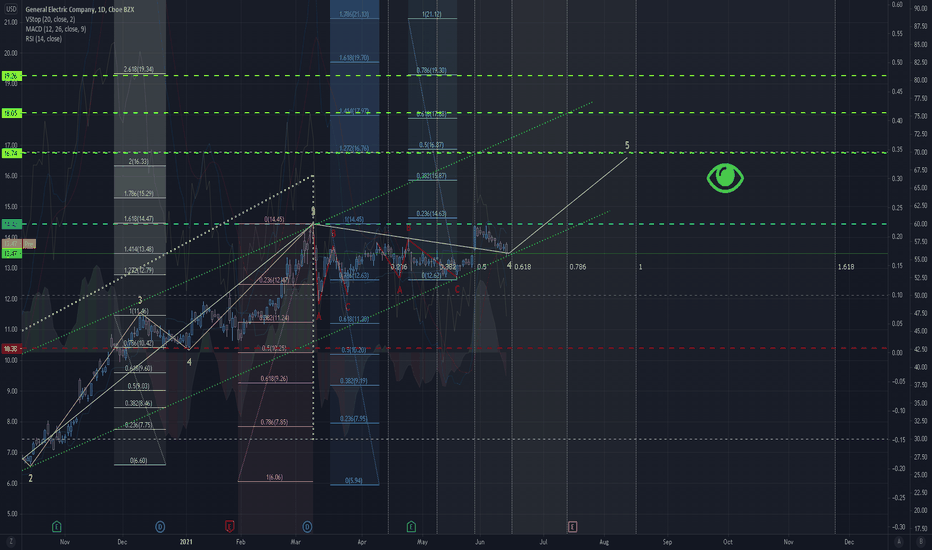

Bullish on General electric. GELatest set of zigzags seem like a whole bunch of flats taking up quite a bit of fibtime. This is classical of a Wave 4. A careful count confirms this at an eagle eye view. If that assessment proves to be true, then we have one more move up, and given the moves already made, it might be quite a big one comparatively.

Fibonacci goals are in green, reversal or invalidation is in red. This post is not financial advice, make your own financial advice or pay a certified professional ( you are to statistically faire better at blindly longing SnP500 incase of the latter). Playing on the market whether you are an investor or a trader is risky. No good thing is ever without. Good luck out there.

Industrials needs a breatherXLI, the Sultan, was the ultimate DOW mover. He ruled over everyone including hedge fund managers. Tuesdays action to the upside was great but gave it up at the end of the day. Wed and Thursday continued to the downside. On Friday, the Sultan tapped the 8 day EMA and came back up but closed below previous day high. The issue with XLI is the channels are small. If this low channel is to break, look out below cause I'm thinking of a 3 point move down to 102 as support. Based on HON, FDX, and UPS, Sultan's rule might be done for this coming two weeks.

GE - Great Week for GE ⚡-GE Stock Is Having a Great Week. Thank Airbus.

-An improving commercial aerospace business appears to be the reason for recent gains. On Thursday, Airbus (AIR.France) announced plans to increase output of its A320 family of jets. The European airframe assembler says it will build 45 jets a month by the end of 2021, up from about 40 jets a month now.

-The big news for GE though is Airbus’s target of building 64 jets a month by 2023. That is a big increase, and signals that Airbus believes commercial air traffic will continue to recover. Air traffic in the U.S., over the past week, is still down about 30% from prepandemic 2019 levels. But that actually is an improvement from recent months, and traffic is up about 480% year over year.

-GE makes engines for both the A320 and Boeing ‘s (BA) 737 families of jets through its CFM joint venture with Safran (SAF.France). Safran stock is also seeing gains, rising about 3% for the week and trading just below a 52-week high.

-Boeing is also looking to boost 737 MAX production rates in coming months, while also delivering some of the MAX inventories that were built while that plane was grounded worldwide between March 2019 and December 2020.

-The increased output from Airbus—and Boeing—helps more than just GE and Safran; all aerospace suppliers benefit. Shares of Raytheon Technologies (RTX), Honeywell International (HON), and Woodward (WWD), for instance, all rose roughly 3% to 4% this week. The S&P 500 is up about 1.4%.

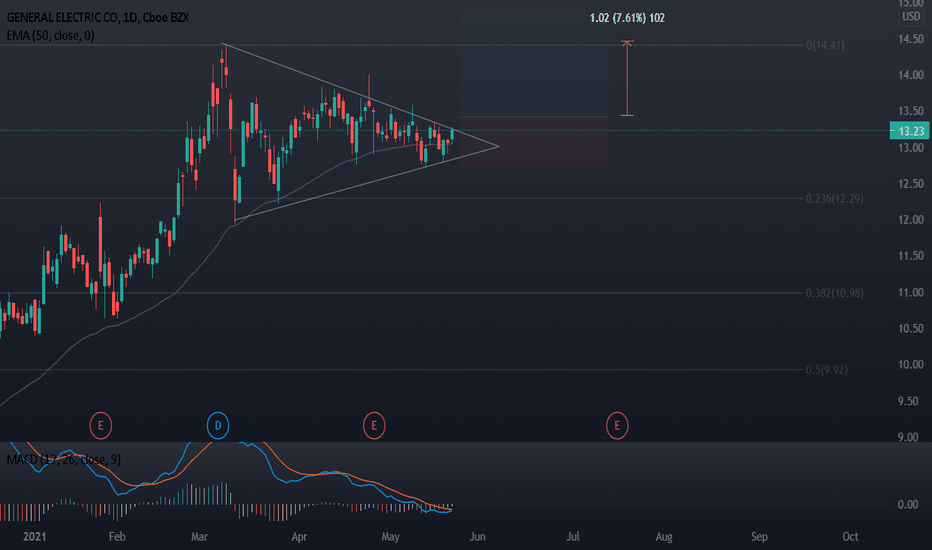

#GE - 1D - LOOKING GREATAfter a massive uptrend ride, GE took a break during the past two months leaving a clear bullish pennant.

MACD its looking gorgeous right now.

- OPPENING POSITION: 13.5

- STOP LOSS: 12.75

- TAKE PROFIT: If we are thinking on a swing trade, 14.40 (+7.6%) would be a decent profit. But, I believe that its a great position for a long term. Lets check once we reach our first target if technical indicators validate this idea.