GE

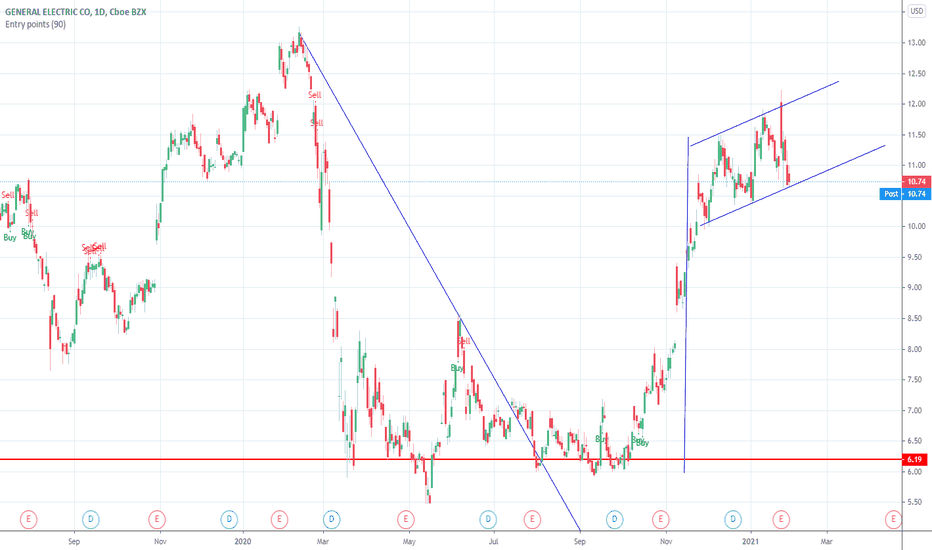

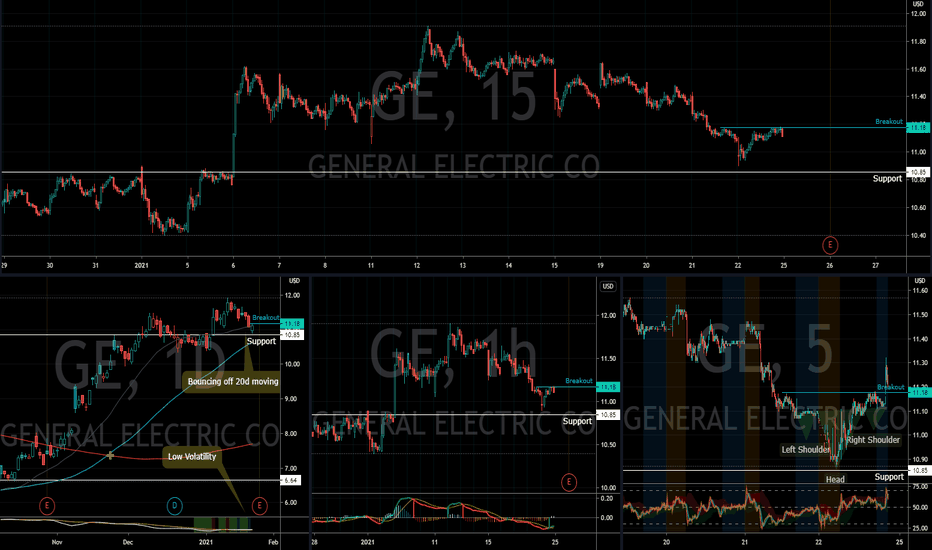

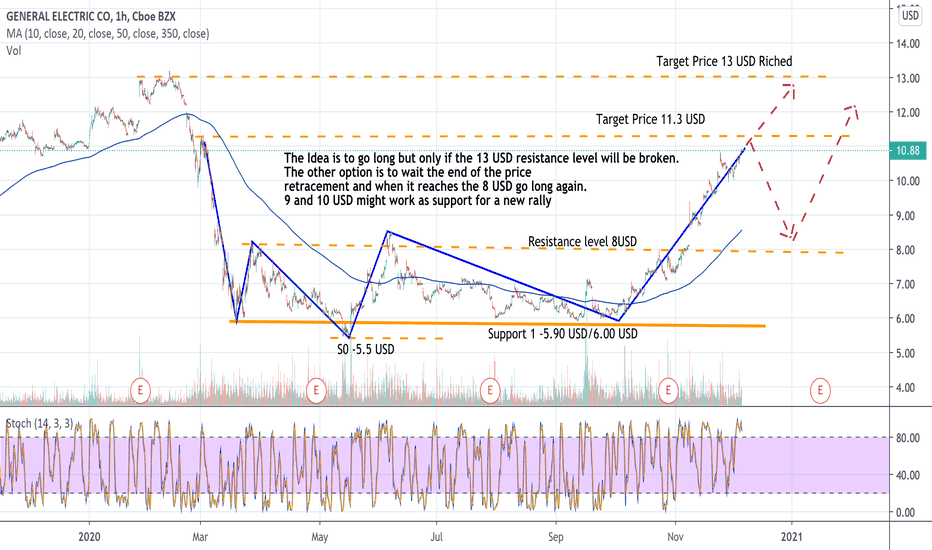

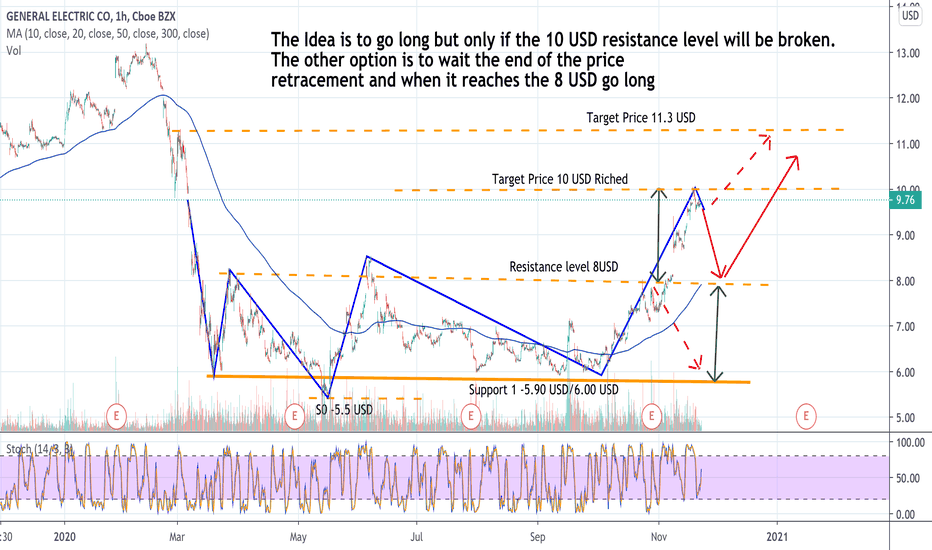

GE Short before LongI have price testing the resistance zone which is going on now. I can see price dipping down $10.63 - $10.99 which is a support zone to then testing $11.60 and up. For this company, it seems as if price always tests a resistance before dipping. We might be on pattern. I dont expect nothing crazy like Gamestop but get in where you fit in! Two opportunities coming up at market entry!

Let me know what you think!

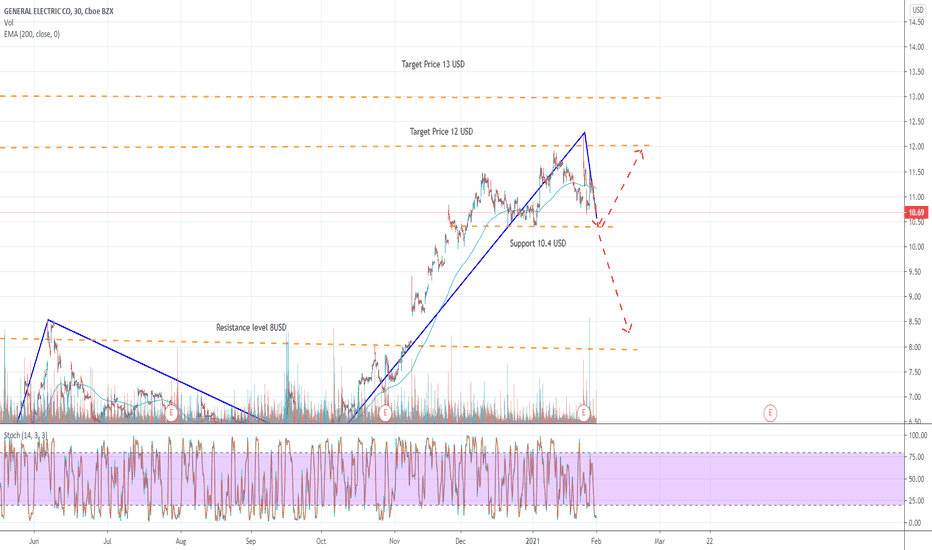

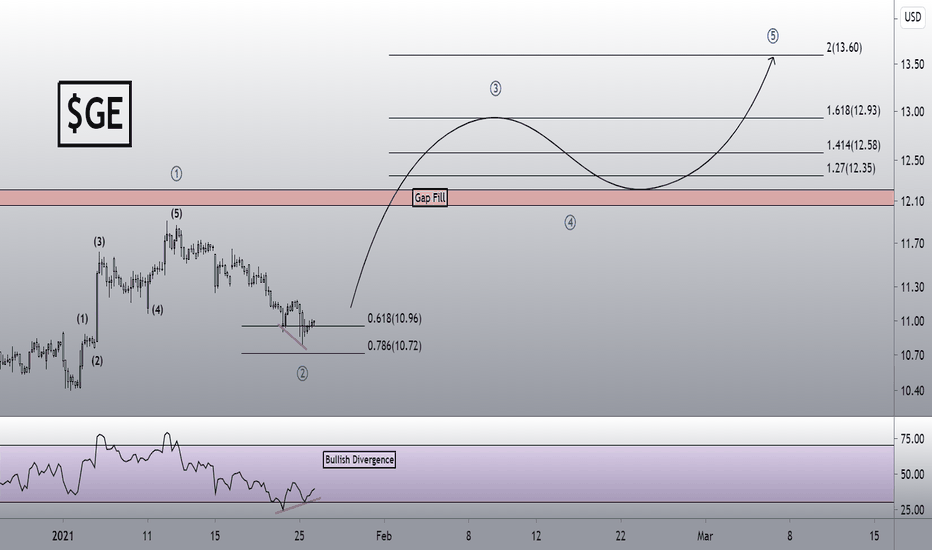

GE Gap FillAfter retracement to the golden zone between 0.618-0.65, GE looks to head for a gap fill for wave 3. There is bullish divergence on the RSI on the hourly and with a solid hammer candle on the daily. A break above $11.15-11.20 would confirm a breakout. Break below $10.70 would invalidate wave count

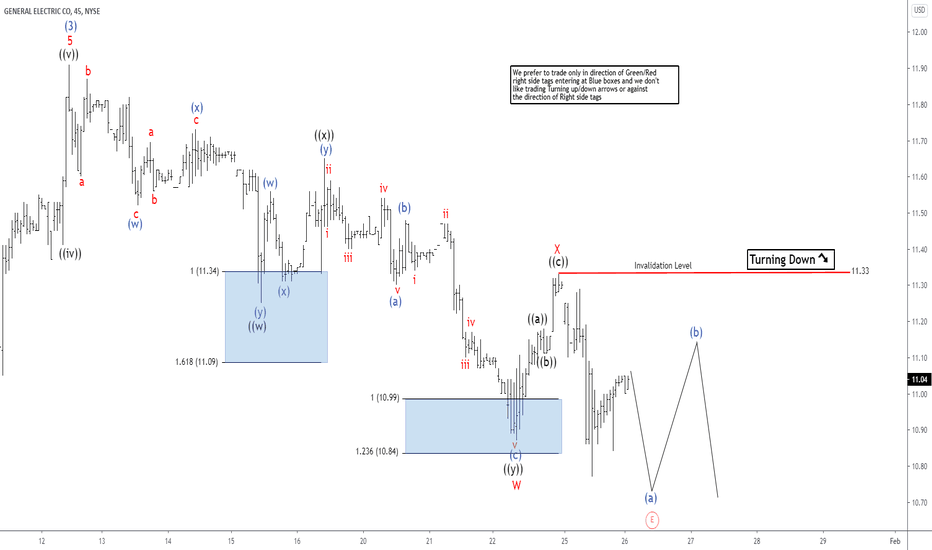

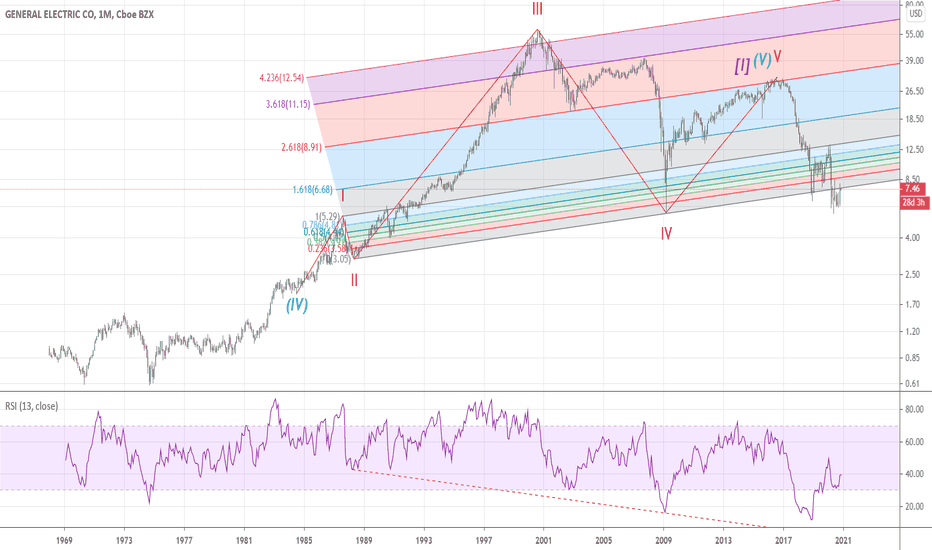

Elliott Wave View: General Electric (GE) Has Further Downside inShort Term Elliott Wave view in General Electric (ticker: GE) suggests the rally to January 13 high at $11.91 ended wave (3). The stock is now in wave (4) pullback and the internal is unfolding as a double three Elliott Wave structure. Down from wave (3) peak, wave ((w)) ended at $11.25, bounce in wave ((x)) ended at $11.65, and wave ((y)) lower ended at $10.87. This completed wave W in higher degree.

Stock then bounced in wave X which ended at $11.33 as a zigzag Elliott Wave structure. Up from wave W at $10.87, Wave ((a)) ended at $11.18, and wave ((b)) pullback ended at $11.11. Wave ((c)) higher ended at $11.33, which completed wave X. GE then turned lower and broke below wave W at $10.87, suggesting the next leg lower has started. Near term, while rally fails against $11.33 in the first degree, expect further downside in the stock. Potential target lower in wave (4) is 100% – 161.8% Fibonacci extension from January 13 peak which comes at $9.65 – $10.29. Once the stock completes wave (4) pullback, it can then resume higher again in wave (5) to a new high above wave (3) at $11.91.

GE long in to earningsGE typically trades with air lines and BA as the main provider of turbines etc. but this year I believe GE will be an epic turn around story.

I like GE for MANY reasons but as the new administration comes in with a focus on clean energy we know GE will be a huge player when it comes to wind energy. I don't believe this is factored in to the stock. Internally, there's also major turn around going on and the new leadership's changes are just now starting to gain traction. This entry point should be good for both long term holds and short term trades.

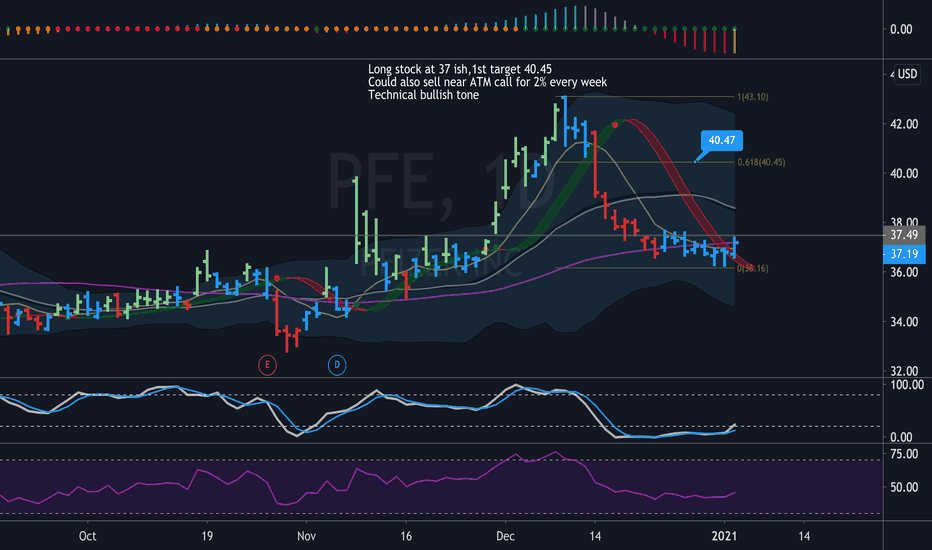

PFE 37: Boring but good Risk/Reward in a dangerous market PFE is an enormously profitable company that is not in fashion with the momo crowd or the new kids chasing sexy names. It is however an A+ company with staying power and good dividend yield, a better alternative to bonds in today's near-zero interest rate. As SPY correction is highly likely, it is perhaps a place to park some cash.

Also, the market has shown some interest in routing into real economy stocks (with real revenue and profit). TGT, WMT, GE for instance.

Technically it has turned upwards, after a sharp and quick sell-off from 43, after all the covid vaccine news. 1st Target is 40.50

To be long around 37 or sell PCS of 37/33. If needed lunch money, one could also sell ATM weekly calls that give out a 2% weekly premium.

This is a plan, obviously not any sort of advice.

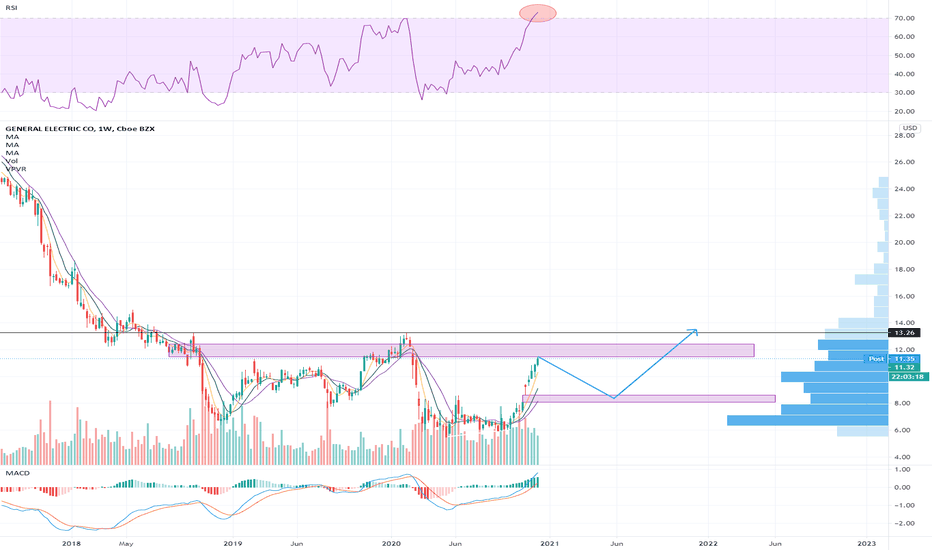

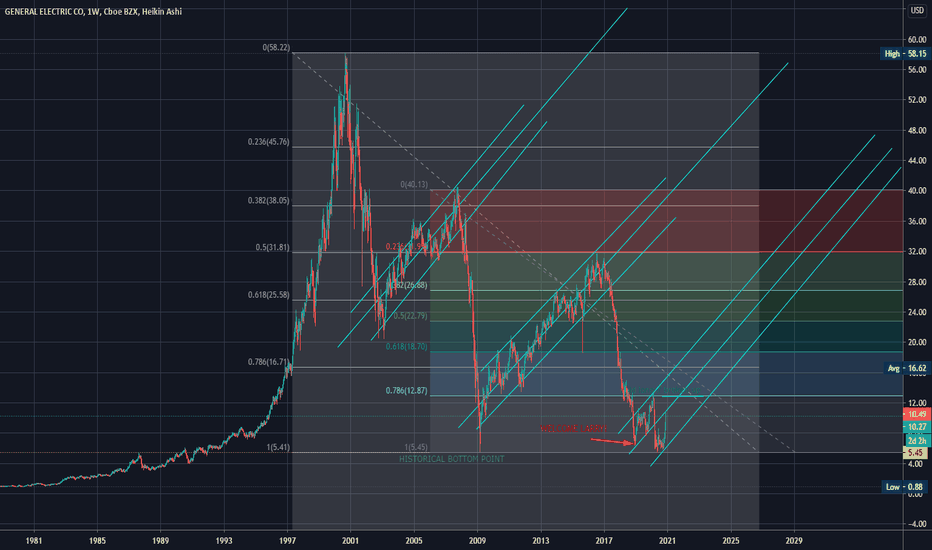

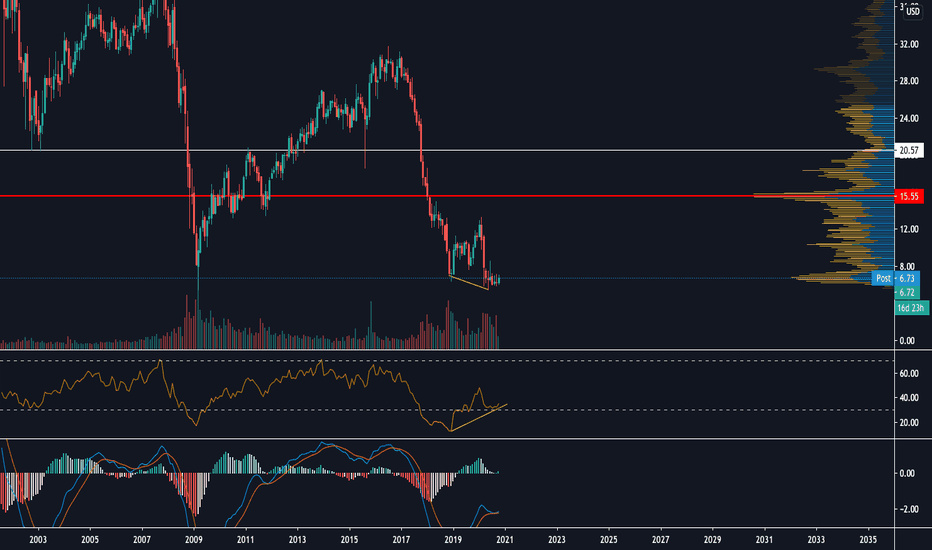

Long GE Through 2022 In The ChannelGE is potentially working on it's third bull channel here thanks to their CEO; Henry Lawrence "Larry" Culp, Jr.

Larry had a fantastic history at Danaher corporation before moving into his current role.

Larry is highly incentivized to raise GE's stock price... He will net $47m for a 50% increase in price, and $300m for a 150% increase. I would expect him to figure it out...

Things get interesting past ~2022. If Larry is incentivized to hit ~$18, then what happens after he does so? I wouldn't expect a test of the last peak at ~$31.75. Will GE keep making lower lows?

New Century Resources Ltd price target $0.38Stock Analysis Based on Fundamentals and Price Action.

With Risk Management You will never loss.

thank you

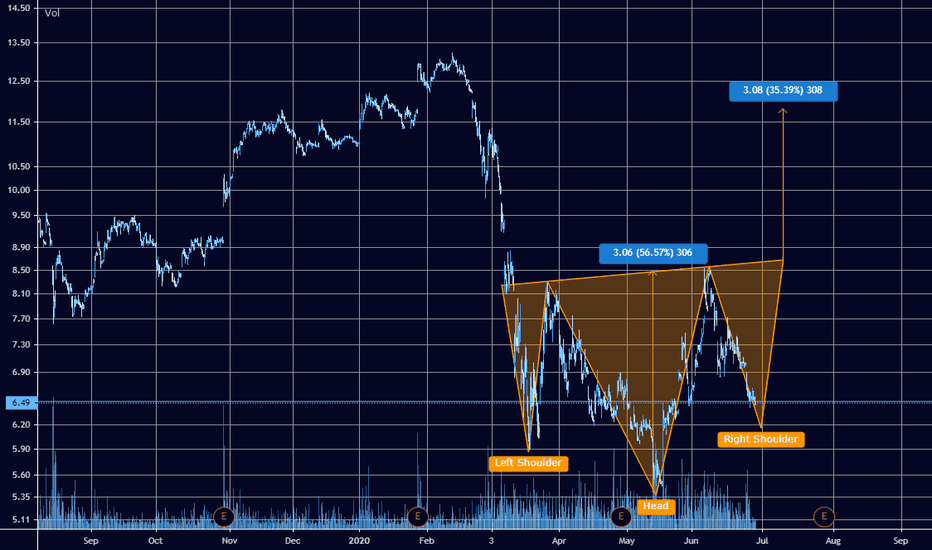

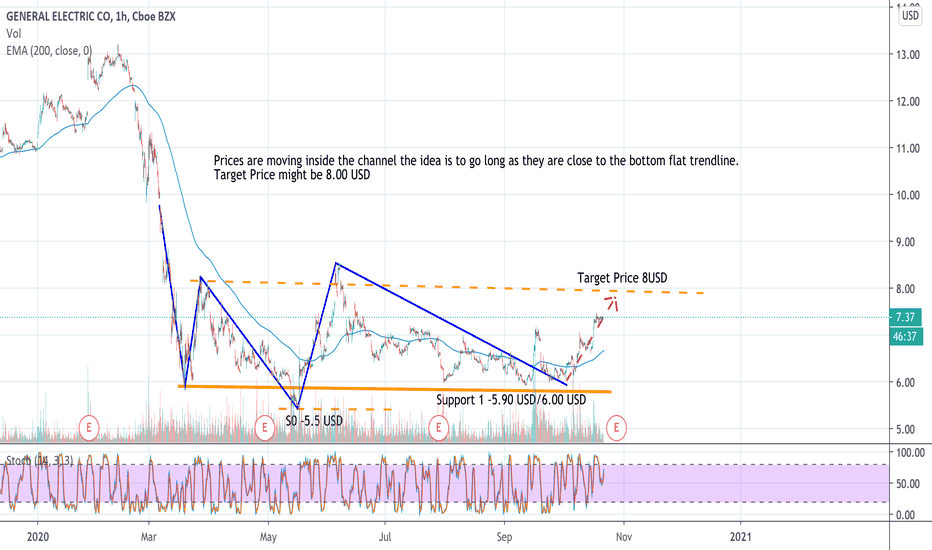

General Electric Stock Analysis + Ready for recovery !📌 General Electric Stock Analysis. For Financials Analysis Sheet kindly message us through Trading View.

📍 Stock info

Market Cap 54.62B

Revenue (ttm) 77.37B

Net Income (ttm) -4.48B

Shares Out 8.75B

EPS (ttm) -0.58

PE Ratio n/a

Forward PE 16.00

Dividend $0.04

Dividend Yield 0.64%

📍 Stock Quote

Trading Day Oct 2, 2020

Last Price $6.24

Previous Close $6.23

Change ($) 0.01

Change (%) 0.16%

Day's Open 6.28

Day's Range 6.11 - 6.29

Day's Volume 96,781,556

52-Week Range 5.48 - 13.26

📍 Market Cap 54.62B

Enterprise Value 95.07B

Earnings Date (est) Oct 28, 2020

Ex-Dividend Date Sep 25, 2020

Shares Outstanding 8.75B

Float 8.70B

EPS (basic) -0.58

EPS (diluted) -0.58

FCF / Share 0.69

📍 Dividend $0.04

Dividend Yield 0.64%

Earnings Yield n/a

FCF Yield 10.97%

Payout Ratio n/a

Shares Short 103.57M

Short Ratio 1.28

Short % of Float 1.19%

Beta 0.92

📍 PE Ratio n/a

Forward PE 16.00

P/FCF Ratio 9.11

PS Ratio 0.71

PB Ratio 1.58

Revenue 77.37B

Operating Income 819.00M

Net Income -4.48B

Free Cash Flow 5.99B

📍 Description

General Electric Company operates as a high-tech industrial company in the United States, Europe, Asia, the Americas, the Middle East, and Africa. It operates through Power, Renewable Energy, Aviation, Healthcare, and Capital segments. The Power segment offers technologies, solutions, and services related to energy production, including gas and steam turbines, generators, and power generation services. The Renewable Energy segment provides wind turbine platforms, and hardware and software; offshore wind turbines; solutions, products, and services to hydropower industry; blades for onshore and offshore wind turbines; and high voltage equipment. The Aviation segment provides jet engines and turboprops for commercial and military airframes; maintenance, component repair, and overhaul services, as well as replacement parts; integrated digital components; and additive machines and materials, and engineering services. The Healthcare segment provides healthcare technologies in medical imaging, digital solutions, patient monitoring, and diagnostics; drug discovery; biopharmaceutical manufacturing technologies; and performance enhancement solutions to hospitals, medical facilities, pharmaceutical and biotechnology companies, and life science research markets. The Capital segment leases and finances aircraft, aircraft engines, and helicopters; provides financial and underwriting solutions; and manages its run-off insurance operations which provides life and health insurance and reinsurance products. The company was founded in 1892 and is headquartered in Boston, Massachusetts.

💡 Is GE a good idea after all?

With its focus on renewable energy and its decision to stop catering to the shrinking coal industry -- in addition to its stronger financial position -- it's understandable why investors have grown so interested in GE's stock lately. For investors with a higher tolerance for risk and a willingness to weather near-term volatility, GE seems worth considering to Hold for better returns an portfolio Building.

Thank You.