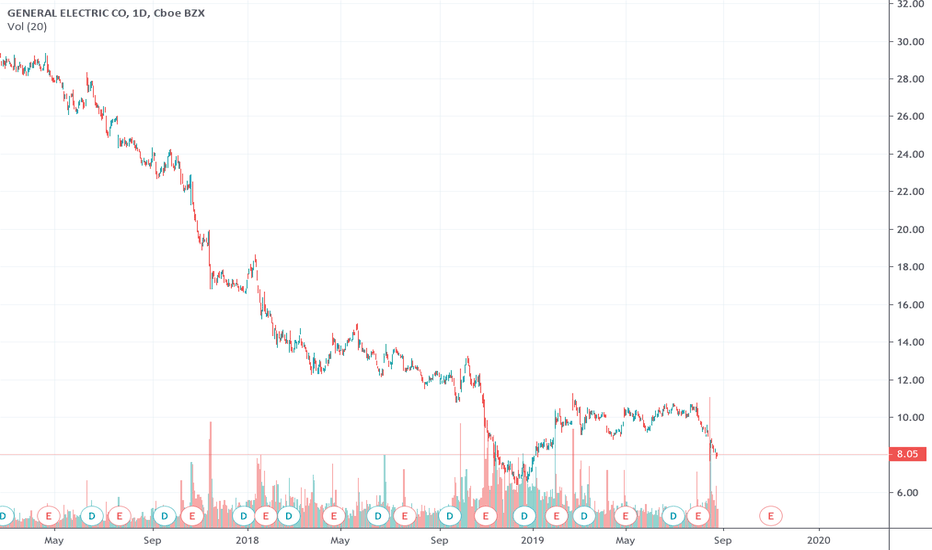

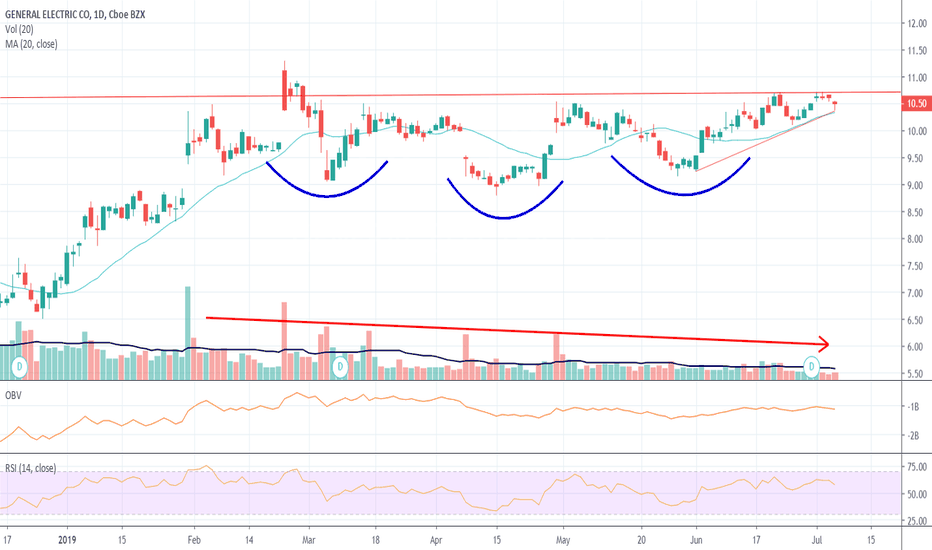

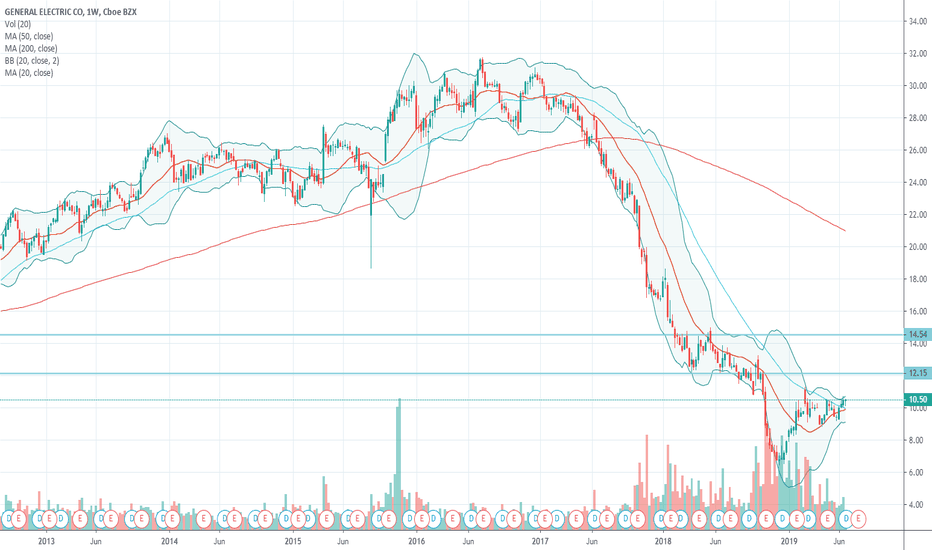

$GE Looking Better Technically and Fundamentally$GE is now trading above its 200-day moving average and has made a series of higher lows. After a solid quarterly earnings report and improved Free Cash Flow, $GE looks much better from a fundamental and technical perspective. If $GE closes above the 200- day moving average, we believe institutions will start coming back into the stock. We think new 52 week highs could be come sooner rather than later considering many had written $GE off.

As always, trade with caution and use protective stops.

Good luck to all!

GE

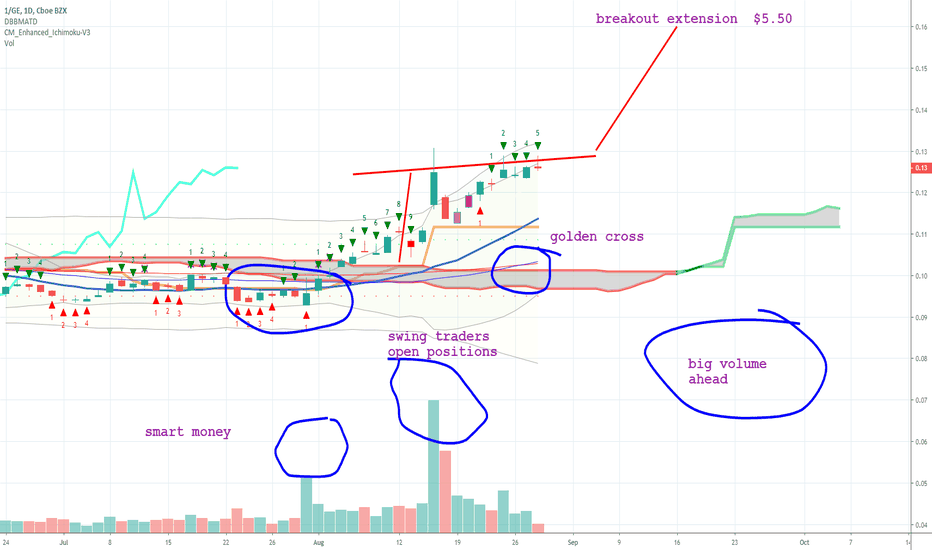

$BHGE Is A Buy On $GE SellingThe worst looks to be over for $BHGE. The debt problems at its majority shareholder $GE have been an overhang on the stock for the past year. With $GE now selling, it's time to buy $BHGE.

According to investment bank Tudor Pickering, Baker Hughes (BHGE -7.6%) share weakness presents a buying opportunity following news that GE will give up its majority stake in the oil services company.

Tudor's desk says it would buy BHGE shares at sub-$22.50 and become more aggressive sub-$22, although the firm rates BHGE as a Hold.

$GE received $2.7 billion from selling shares in $BHGE. We believe smart money is buying with $GE forced to sell.

Baker Hughes, a GE company provides integrated oilfield products, services, and digital solutions worldwide. Its Oilfield Services segment offers drilling, wireline, evaluation, completion, production, and intervention services; and drilling and completions fluids, completions tools and systems, wellbore intervention tools and services, artificial lift systems, pressure pumping systems, and oilfield and industrial chemicals for integrated oil and natural gas, and oilfield service companies. The company’s Oilfield Equipment segment designs and manufactures products and services, including pressure control equipment and services, subsea production systems and services, drilling equipment, and flexible pipeline systems; and onshore and offshore drilling and production systems, and equipment for floating production platforms, as well as provides a range of services related to onshore and offshore drilling activities. Its Turbomachinery & Process Solutions segment provides equipment and related services for mechanical-drive, compression, and power-generation applications across the oil and gas industry, as well as products and services to serve the downstream segments of industry. Its product portfolio includes drivers, compressors, and turnkey solutions; and pumps, valves, and compressed natural gas and small-scale liquefied natural gas solutions. This segment serves upstream, midstream, onshore and offshore, industrial, engineering, procurement, and construction companies. The company’s Digital Solutions segment provides sensor-based measurement, non-destructive testing and inspection, turbine, generator and plant controls, and condition monitoring, as well as pipeline integrity solutions for a range of industries, including oil and gas, power generation, aerospace, metals, and transportation. It serves through direct and indirect channels. The company is based in Houston, Texas. Baker Hughes, a GE company operates as a subsidiary of General Electric Company.

As always, trade with caution and use protective stops.

Good luck to all!

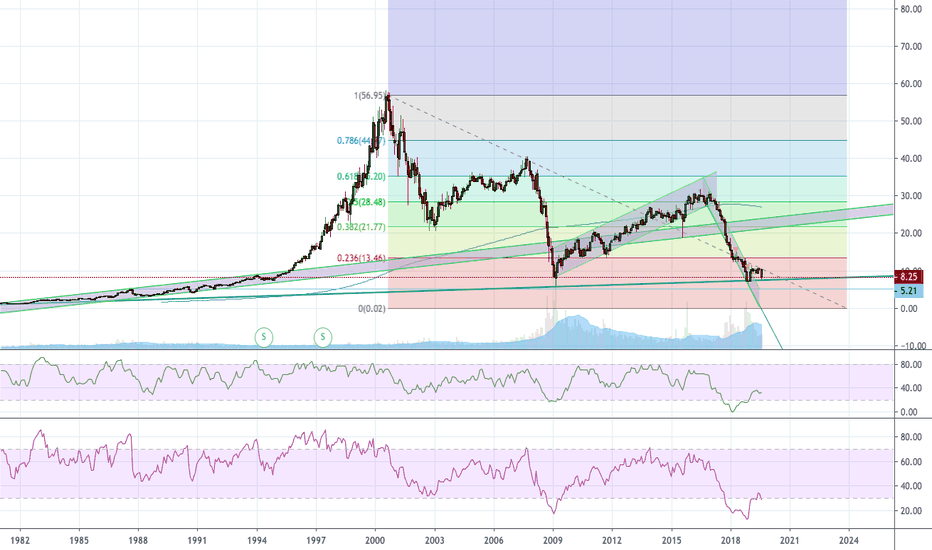

Lifetime opportunity, soon Bankruptcy, short with PUT options!!It's time to talk about the story of a decade!

It is now clear, that General Electric has been cooking it's books for years now!

Says Harry Markopolos, a legendary whislteblower, who runs a finical fraud detection company, famous with him exposing Bernie Madoff and his Wall Street firm Bernard L. Madoff Investment Securities LLC, a hedge fund that turned out to be a giant Ponzi Scheme!

The company is allegedly lacking 39 billion in cash, that being a conservative estimation, covering up it's losses with sophisticated accounting and it's organizational structure!

I am long PUT options on the 2.00-1.5 level with 4-6 moths expiration, and will be adding to the portfolio each month!

When the company announces it's bankruptcy the stock price will go below the mentioned levels, ideally to a couple of cents per share!

A MASSIVE opportunity with 1:100/ 1:300 returns, as the put options on these levels are currently worth almost nothing!

even if the odds of it going bankrupt is 1:2, the risk return ratio is just mind blowing!

It is important to note, that I am taking 4-6 months as an average for the previous cases of such fraud detection, like Enron and WorldCom, which both went bankrupt within 4 moths after the exposure!

S NYSE:GE o I am just being on the safe side here, being up put options with further expiration each month!

It does not matter how the stock's price behaves during these 4 months.If it goes up, take it as the opportunity to double down on your PUTS position.

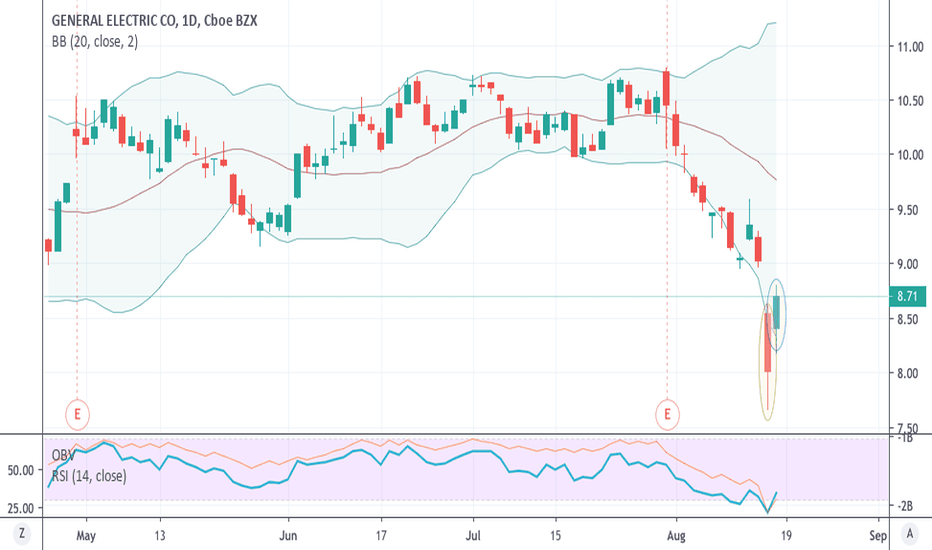

General Electric - Expect volatilityGE, America's sweetheart has been accused of fraud allegations before. This time though, it's by the same person who did it on the Madoff Scheme (Harry Markopolos)

Markopolos’ main points of contention are:

1) GE’s insurance obligations are woefully under-reserved and it has been lying to the Kansas Insurance Department

2) GE shouldn’t have consolidated BHGE’s financial statements, which are a source of confusion

3) GE’s evolving presentation makes it very difficult to evaluate GE’s operating performance.

-------

In response to the whole ordeal, General Electric's CEO bought $2million in shares.

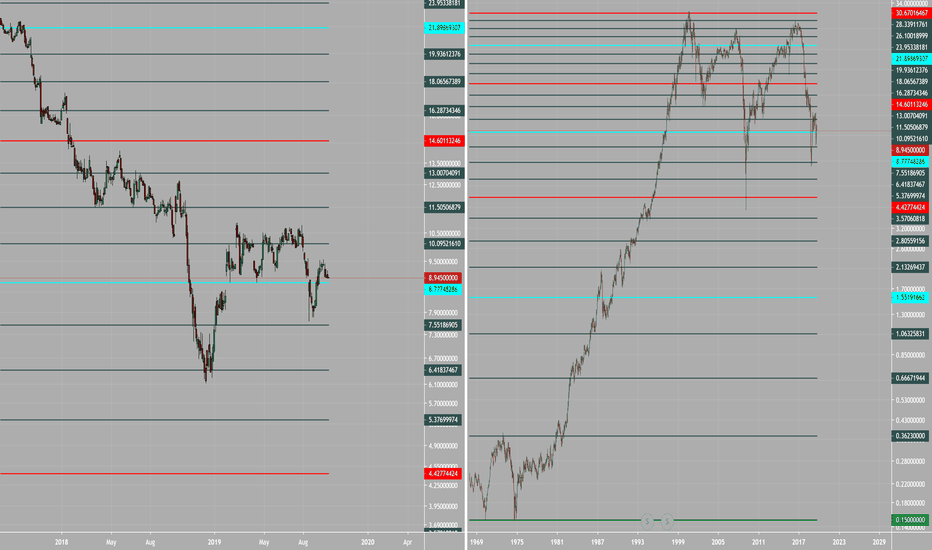

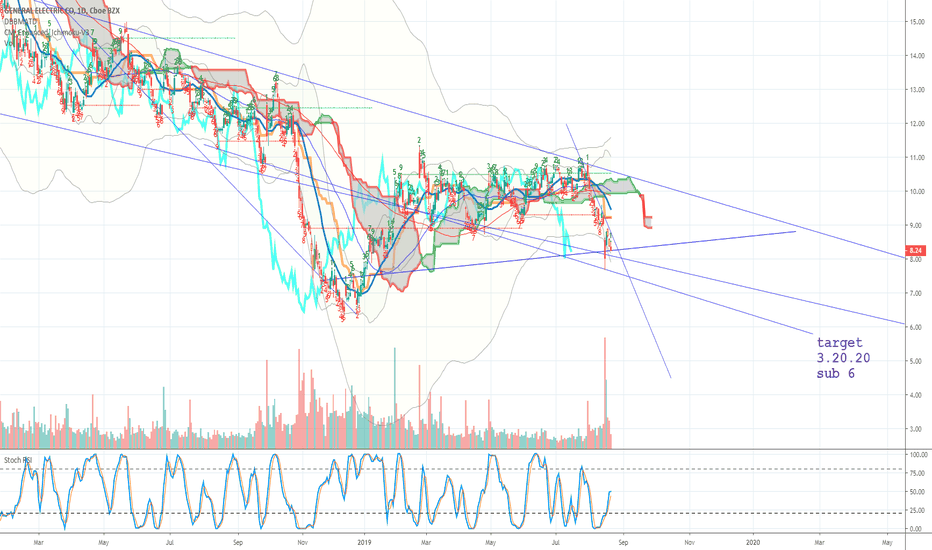

GE - Reminder of The TrendReminding viewers of what we posted 17 months ago! Lots of research being published today. The simple version is to remember Basel III agreement TCE ratios. That being addressed, GE will need capital.

How that does it remains to be seen.

GE needs a minimum of $32.25 billion adding non controlling equity back to the balance sheet. A maximum of $52.56 billion taking out non controlling equity.

This equates to a negative $5-$10 per share currently.

2019 Cash Flow is estimated to be ~$8.812 billion. At no growth this produces an intrinsic value of $6.14 - $14.13 per share.

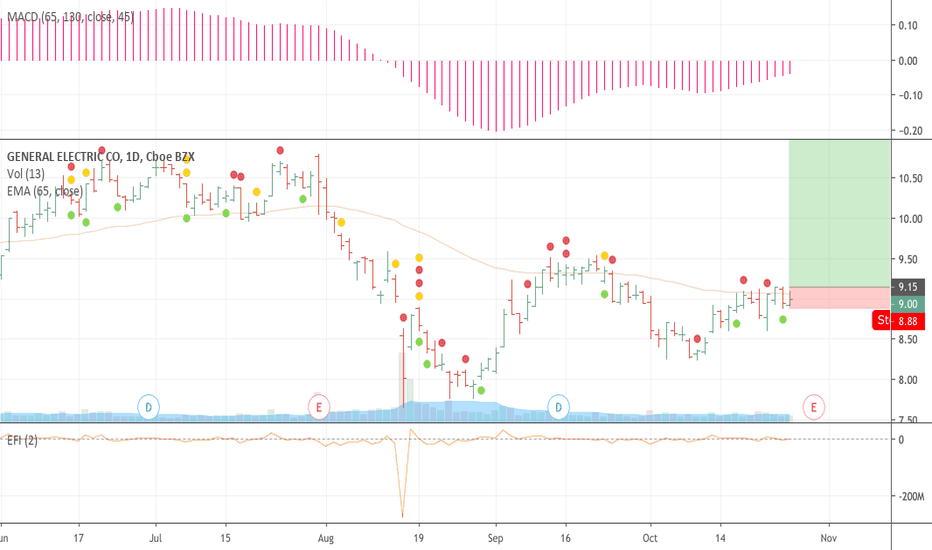

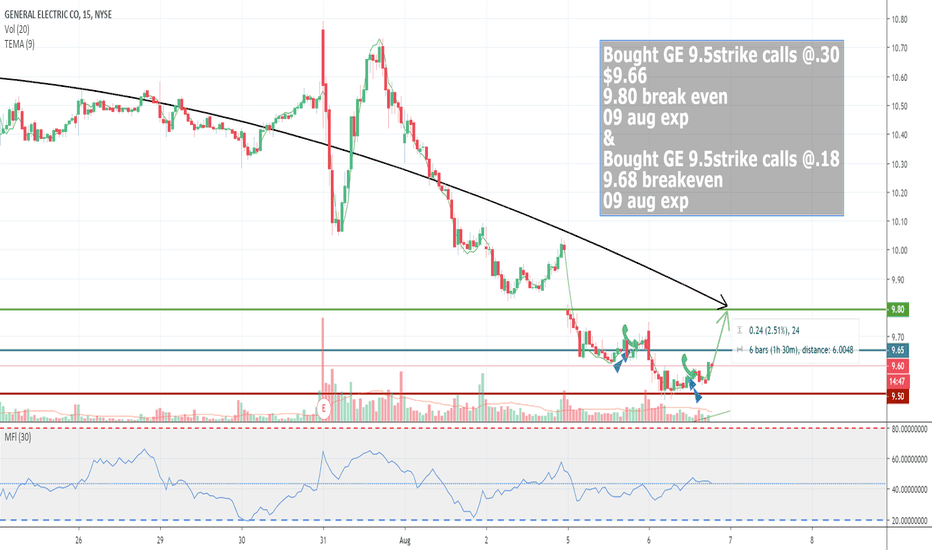

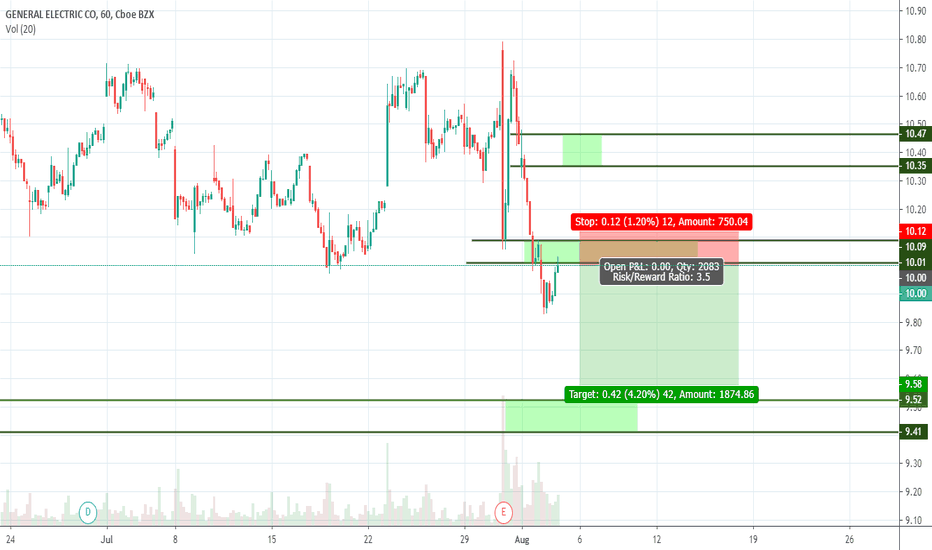

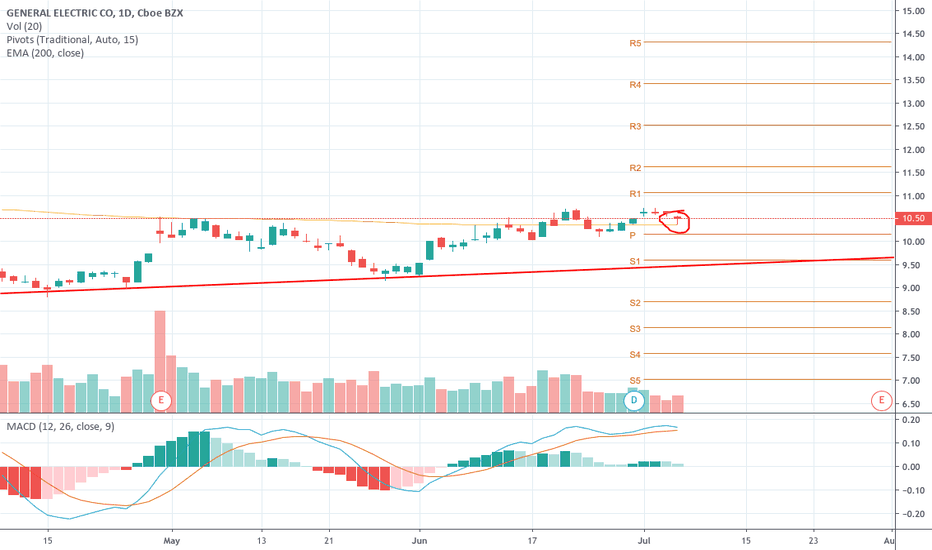

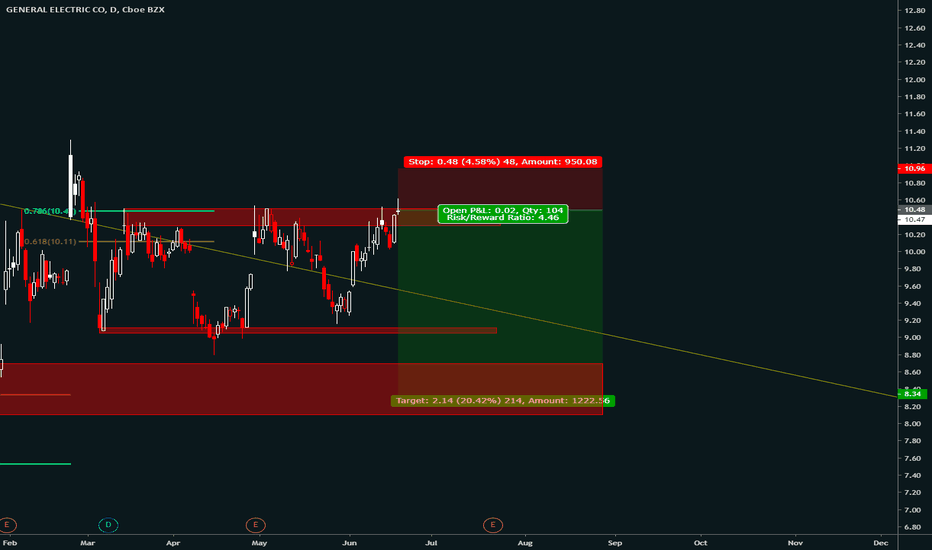

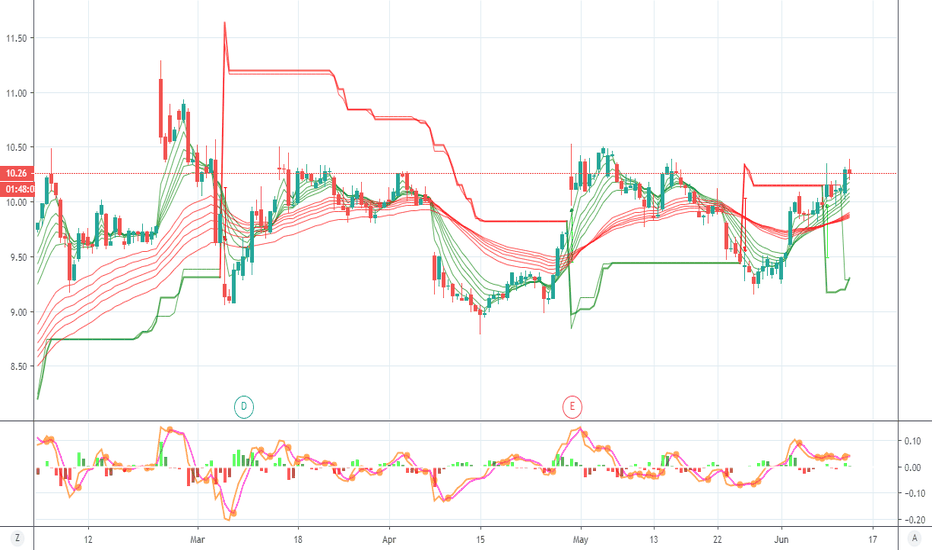

pin bar daily candle @ 200 day EMA pretty simple set up ill be looking for a break above 10.57 to go long, if the scenario ends up a bearish one ill look for a break of that pivot level to take us down to S1 or that red support for a 3rd test 9.50-9.60 area, would be a great spot to get bullish again if we test and hold that 9.50-9.60 area

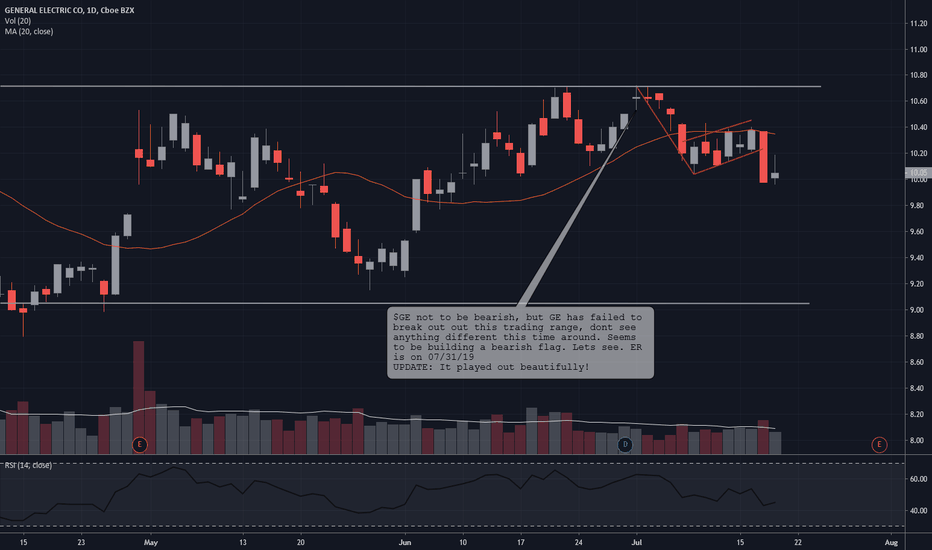

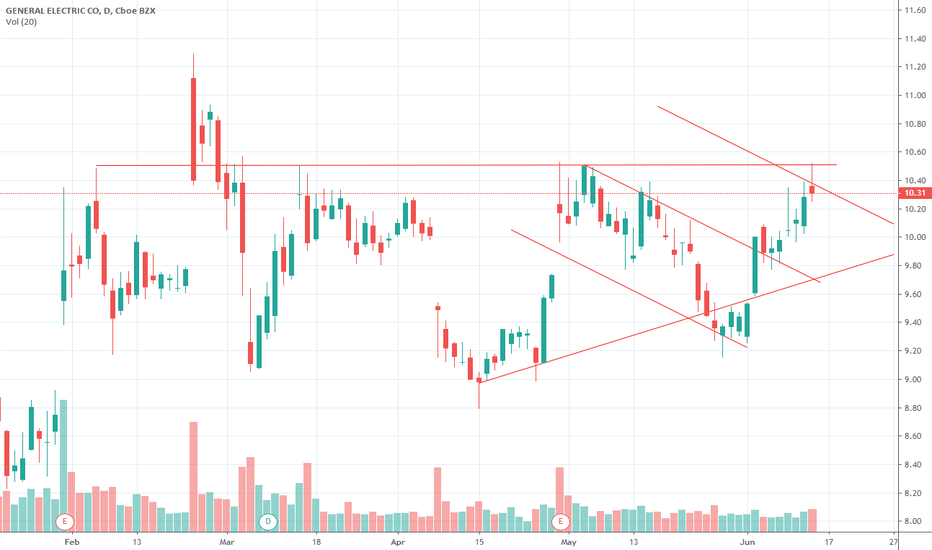

GE - Daily 7-7-19Upside:

- Ascending triangle forming over the past month

- The bottom of the ascending triangle is closely in-line with the 20-day SMA, providing additional support

- Inverse head and shoulders set-up forming since early February

Downside:

- Stock price has failed to break above $10.71-$10.72 on three separate days, potentially leading to a double-top set-up

- Volume has slowly been trending down

Notable Prices:

- Top of ascending triangle (also potential double top level) is $10.72

- Bottom of triangle and 2-day SMA is $10.35

I am watching to see which way out of this narrow range the stock price breaks and the volume that is associated with it.

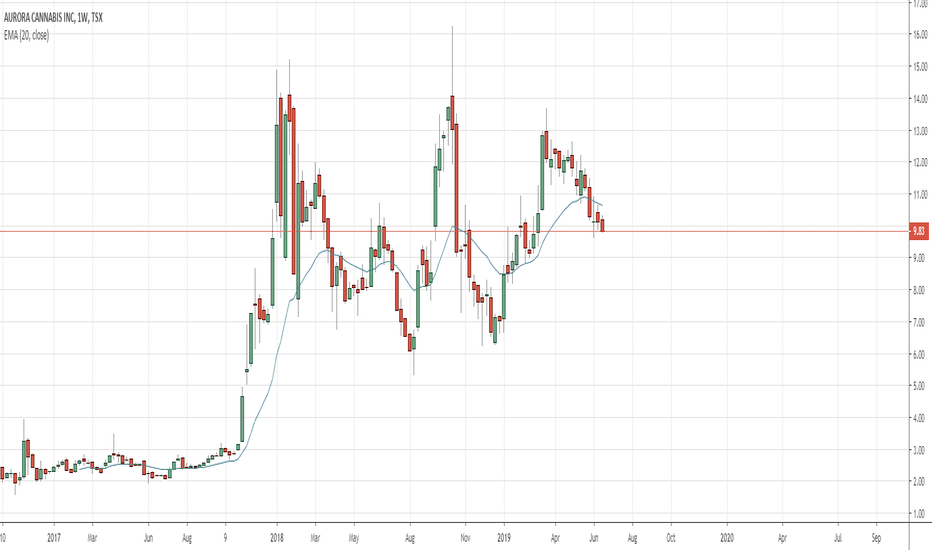

ACB 50/50 Bull Flag Trading Range - Breakout ModeACB is currently in the dead center of the bull flag trading range, and a converging triangle. This is where the directional probability is very close to 50/50. However the bulls have a slight advantage because it is a bull flag trading range, and there are bull gaps below. Prices are currently stalling at the failed bear reversal, where trapped bears may soon buy and contribute to a rally. However there is no valid but setup yet this week. The Bears want a test of the 7 low, and to fill the bull breakout gap. If this gap is filled, it will decrease the bull strength and prices will likely remain range bound for the next 20-40 bars. If instead the bulls keep the breakout gap open and form a higher low in the coming weeks, it will increase the probability of a test of the all time high and possibly bull trend continuation. But since prices are in a trading range, there will probably be some profit taking and short selling at a new all time high, unless the bull rally and breakout is exceptional.

If you found this helpful, please like and share. Feel free to comment or ask questions.

GE stock price forecast timing analysis. 13-Jun

Investing position about Supply-Demand(S&D) strength: Rising section of high profit & low risk

Supply-Demand(S&D) strength linkage Trend Analysis: In the midst of an adjustment trend of downward direction box pattern stock price flow marked by limited rises and downward fluctuations.

Today's Supply-Demand(S&D) strength Flow: Supply-Demand strength has changed from a weak selling flow to a suddenly strengthening selling flow.

Possibility of change in forecast timing: Forecast timing has become high variability conditions. because the flow of supply - demand has changed, and the supply - demand linkage is unstable.

D+1 Candlestick Color forecast: RED Candlestick

%D+1 Range forecast: 0.4% (HIGH) ~ -3.1% (LOW), -1.9%(CLOSE)

%AVG in case of rising: 3.2% (HIGH) ~ -0.8% (LOW), 2.4% (CLOSE)

%AVG in case of falling: 1.2% (HIGH) ~ -2.2% (LOW), -0.9%(CLOSE)

Stock Price Forecast Timing Criteria: Stock price forecast timing is analyzed based on pretiming algorithm of Supply-Demand(S&D) strength.

Read more a detailed Forecast Analysis Reports that candlestick shape and %change, S&D strength flow in the future 7 days.

www.pretiming.com