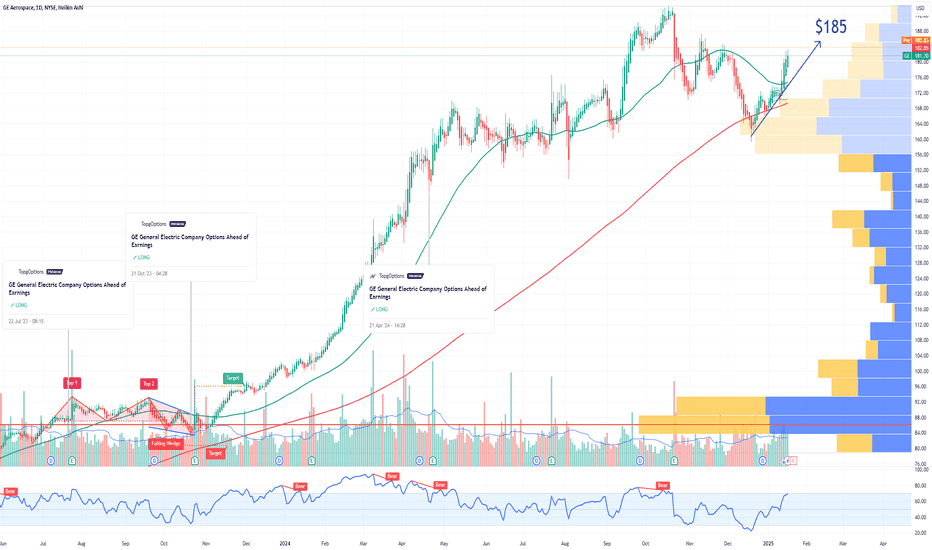

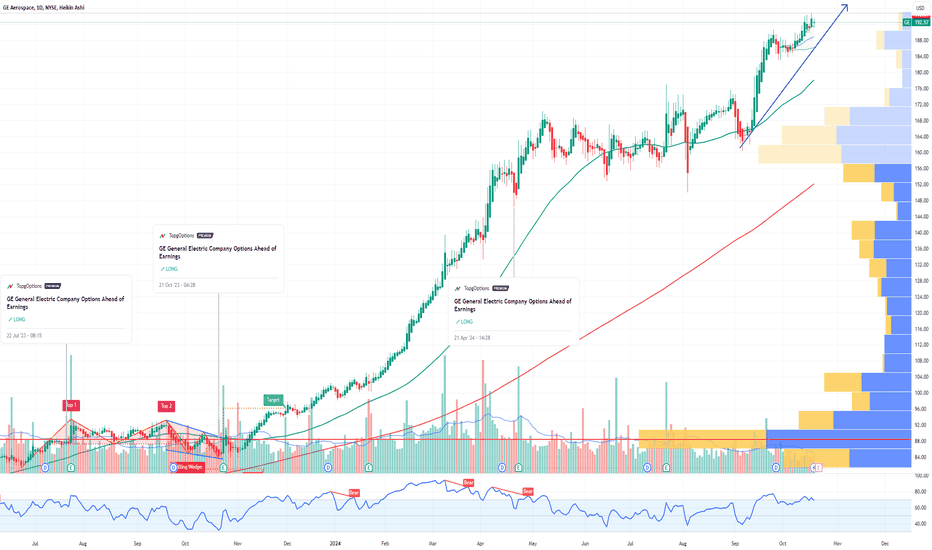

GE Aerospace Options Ahead of EarningsIf you haven`t bought GE before the rally:

Now analyzing the options chain and the chart patterns of GE Aerospace prior to the earnings report this week,

I would consider purchasing the 270usd strike price Calls with

an expiration date of 2025-8-15,

for a premium of approximately $8.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Geaerospace

Soaring High: What Fuels GE Aerospace's Ascent?GE Aerospace's remarkable rise reflects a confluence of strategic maneuvers and favorable market dynamics. The company maintains a dominant position in the commercial and military aircraft engine markets, powering over 60% of the global narrowbody fleet through its CFM International joint venture and proprietary platforms. This market leadership, coupled with formidable barriers to entry and significant switching costs in the aircraft engine industry, secures a robust competitive advantage. Furthermore, a highly profitable aftermarket business, driven by long-term maintenance contracts and an expanding installed engine base, provides a resilient, recurring revenue stream. This lucrative segment buffers the company against cyclicality and ensures consistent earnings visibility.

Macroeconomic tailwinds also play a crucial role in GE Aerospace's sustained growth. Global air travel is steadily increasing, driving higher aircraft utilization rates. This directly translates to greater demand for new engines and, more importantly, consistent aftermarket servicing, which is a core profit driver for GE Aerospace. Management, under CEO Larry Culp, has also strategically navigated external challenges. They localized supply chains, secured alternate component sources, and optimized logistics costs. These actions proved critical in mitigating the impact of new tariff regimes and broader trade war tensions.

Geopolitical developments have significantly shaped GE Aerospace's trajectory. Notably, the U.S. government's decision to lift restrictions on exporting aircraft engines, including LEAP-1C and GE CF34 engines, to China's Commercial Aircraft Corporation of China (COMAC) reopened a vital market channel. This move, occurring amidst a complex U.S.-China trade environment, underscores the strategic importance of GE Aerospace's technology on the global stage. The company's robust financial performance further solidifies its position, with strong earnings beats, a healthy return on equity, and positive outlooks from a majority of Wall Street analysts. Institutional investors are actively increasing their stakes, signaling strong market confidence in GE Aerospace's continued growth potential.

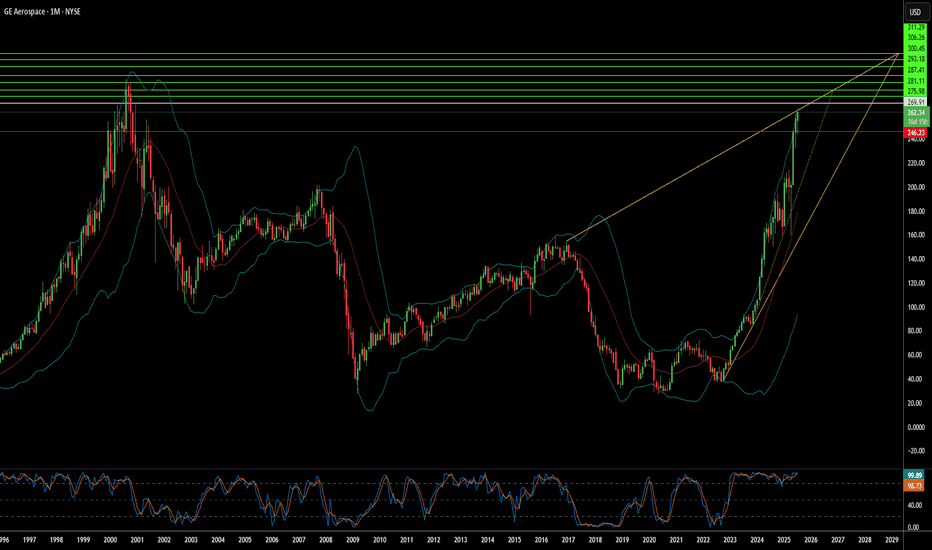

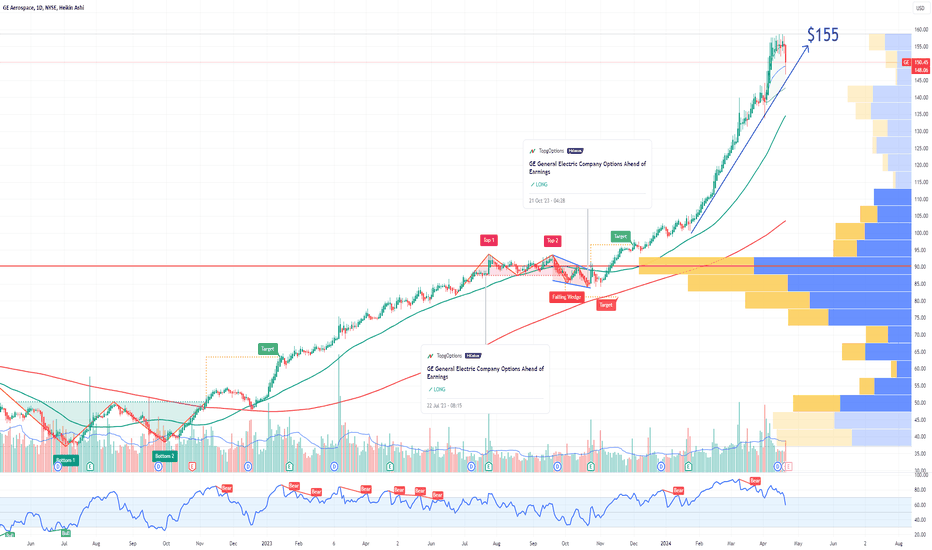

GE Aerospace: How to go to the moon!GE's stock is soaring due to strong earnings and optimistic future guidance from its aerospace division.

1. Blowout Earnings: GE Aerospace reported earnings per share of $1.75, far exceeding analysts' expectations of $1.10.

2. Surging Orders: The company saw a 46% increase in orders last quarter, signaling strong demand for its products.

3. Revenue Growth: GE generated $10.8 billion in revenue, beating forecasts of $10 billion.

4. Wall Street Optimism: Analysts are raising price targets, with some predicting the stock could climb even higher.

5. Industry Momentum: The aerospace sector is experiencing a boom, with GE positioned as a key player.

I'm betting we are close to a pullback and then catapult to New ATH!

GE Aerospace Options Ahead of EarningsIf you haven`t bought GE before the breakout:

Now analyzing the options chain and the chart patterns of GE Aerospace prior to the earnings report this week,

I would consider purchasing the 185usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $8.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

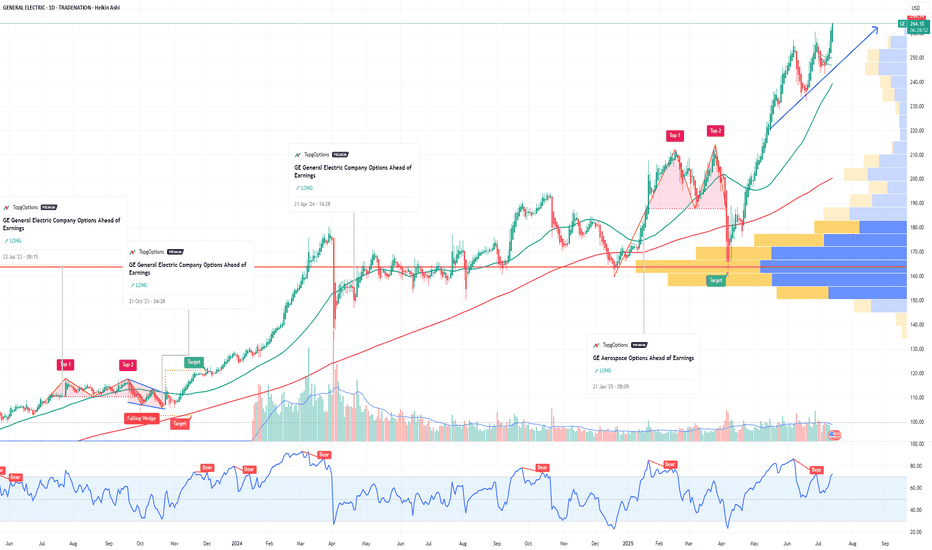

GE Aerospace Options Ahead of EarningsIf you haven`t bought the dip on GE:

Now analyzing the options chain and the chart patterns of GE Aerospace prior to the earnings report this week,

I would consider purchasing the 195usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approximately $8.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

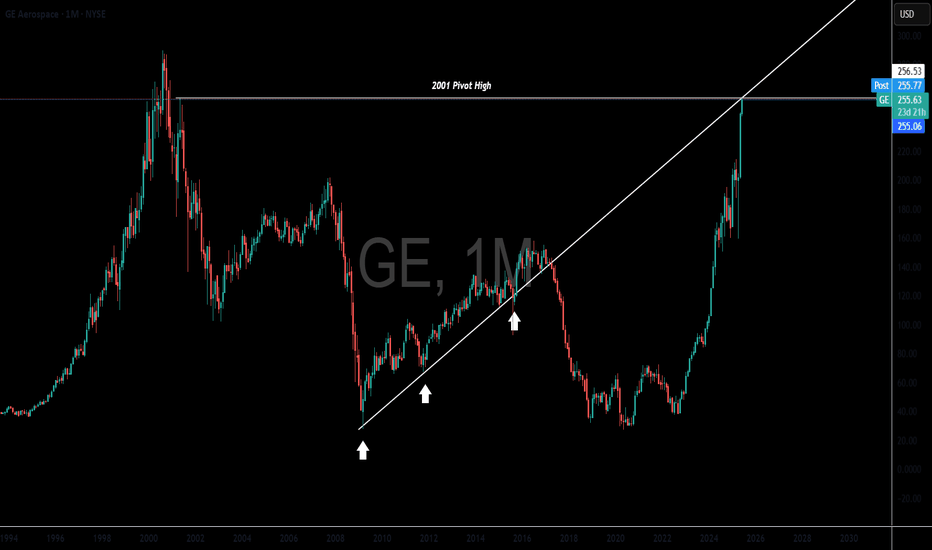

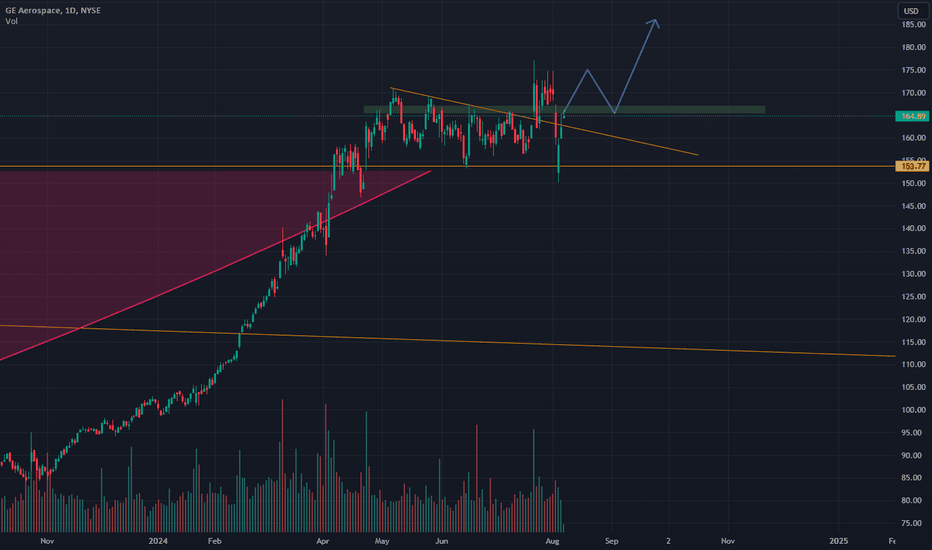

GE breaking above!! Uptrend to unfold

Looking at the weekly chart which shows the breakout above rounded bottom.

There are multiple trend breakouts we see.

1. Double bottom

2. Downtrend Line breakout

3. Rounded bottom (Neckline is at 153 level which in the past has acted as support and resistance both as shown in the chart with red circles)

After all this we are seeing some kind of consolidation above the neckline (Above 153 price). And that also shows the break of a triangular pattern

So I would like to see the break of the structure and retest the 165 levels. Boosting the confidence towards uptrend.

T1: 200

T2: 254

Technical Patterns of Reinvention: GENYSE:GE reported earnings yesterday and had a minor gap up to the high of the sideways range with some selling for profit toward the end of the day. This company is reinventing. Momentum Runs have developed out of Dark Pool Buy zones for swing trading since the last time it was mentioned.

GE General Electric Company Options Ahead of EarningsIf you haven`t bought GE before the previous earnings:

Then analyzing the options chain and the chart patterns of GE General Electric Company prior to the earnings report this week,

I would consider purchasing the 155usd strike price Calls with

an expiration date of 2024-8-16,

for a premium of approximately $8.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

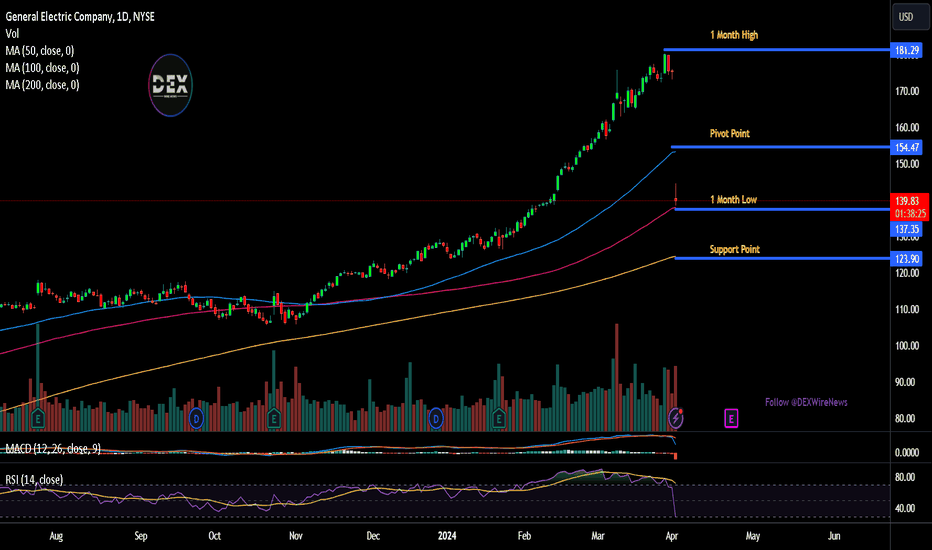

GE Completes Historic $191.9 Bil Breakup, Launches GE AerospaceIn a groundbreaking move that has sent ripples through the financial world, General Electric ( NYSE:GE ) has completed its long-anticipated $191.9 billion breakup, marking a pivotal moment in its storied history. With bullish investors eagerly eyeing the horizon.

The journey towards this momentous milestone has been nothing short of extraordinary. Despite facing headwinds and challenges along the way, NYSE:GE has demonstrated resilience and unwavering determination under the leadership of CEO Larry Culp. Today, as the dust settles and the applause reverberates across Wall Street, GE Aerospace stands tall as a testament to the power of strategic vision and bold execution.

The spinoff of GE Aerospace ( NYSE:GE ) marks the final chapter in GE's ambitious restructuring plan, which saw the conglomerate splitting into three distinct entities focused on aerospace, healthcare, and energy. This strategic realignment not only unlocks value but also provides investors with greater transparency and clarity in capital allocation—a crucial step towards revitalizing shareholder confidence.

Under the seasoned stewardship of H. Lawrence Culp Jr., GE Aerospace embarks on its maiden flight with unwavering resolve and a clear sense of purpose. With a strong balance sheet and a relentless focus on innovation, the company is primed to chart new territories and shape the future of aviation.

At the heart of GE Aerospace's strategy lies FLIGHT DECK, a proprietary lean operating model that epitomizes efficiency and agility. Armed with this powerful tool, the company is well-positioned to navigate the complexities of the aerospace industry and deliver unparalleled value to its customers, employees, and shareholders alike.

With an impressive portfolio boasting approximately 44,000 commercial engines and 26,000 military and defense engines worldwide, GE Aerospace ( NYSE:GE ) commands a dominant position in propulsion, services, and systems. The company's robust financial performance, with adjusted revenue of approximately $32 billion in 2023, underscores its resilience and market leadership.

Looking ahead, GE Aerospace ( NYSE:GE ) has set ambitious targets, reaffirming its 2024 guidance and presenting a compelling long-term financial outlook. With a steadfast commitment to delivering operating profit of around $10 billion by 2028, the company is charting a course towards sustained growth and value creation.

The launch of GE Aerospace ( NYSE:GE ) not only marks the culmination of GE's multi-year transformation journey but also signifies a new chapter in the company's illustrious history. Through prudent capital allocation and a relentless pursuit of excellence, GE has laid the groundwork for a brighter future—one defined by innovation, resilience, and unwavering commitment to success.

As shareholders eagerly await GE Aerospace's first-quarter earnings announcement on April 23, 2024, the stage is set for a new era of prosperity and growth. With a stellar lineup of advisors including Paul, Weiss, Rifkind, Wharton & Garrison LLP, Evercore, Morgan Stanley, and PJT Partners, GE Aerospace is well-equipped to navigate the complexities of the financial landscape and emerge victorious.