Will Ethereum lead next Altseason? ETF & Fusaka update in focus!Ethereum ETFs have recently seen significant inflows, outpacing Bitcoin ETFs, just ahead of the upcoming Fusaka upgrade in November.

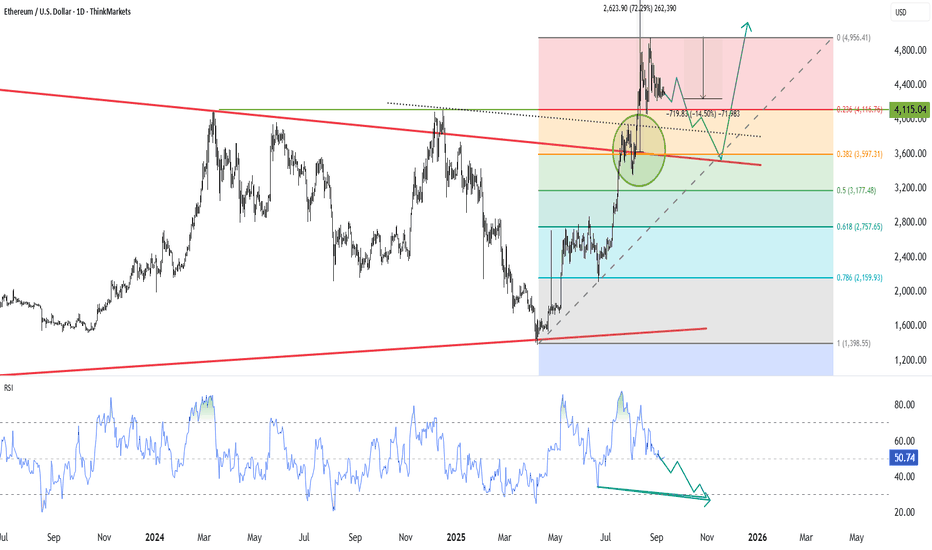

Ethereum recently broke above its previous record high, a move that was anticipated in earlier analysis, and is pulling back before shooting higher. For a sustained move higher, a strong breakout with increased volume and momentum is needed. There are signs of momentum exhaustion, so traders should watch for confirmation before expecting further upside.

A classic cup and handle formation opens the door to $6,200 if resistance is cleared, with key support at $4,115 (previous resistance now acting as support) and a deeper pullback exposing $3,500. But this would not necessarily change the long-term bullish outlook.

Indicators to Watch

Bitcoin Dominance:

Bitcoin’s market dominance is currently around 55%, suggesting the market is still Bitcoin-led, and a true “altseason” may be at its early stage.

Total Crypto Market Cap:

Watch for breakouts in the total crypto market cap (TOTAL3 - excluding Bitcoin and Ethereum) and the formation of bullish patterns for confirmation of a broader market uptrend.

Altcoin Season Index:

The index remains below the threshold for a full altseason but is rising, indicating that Ethereum and other altcoins are not broadly outperforming Bitcoin but are nearing breakout.

Short/Medium-Term Outlook:

Expect continued consolidation or a possible pullback before any sustained move higher if support above $4,115 holds firm.

Long-Term Outlook:

As long as Ethereum holds above the 50% retracement level, the long-term trend remains positive. A confirmed breakout above resistance could signal the next major upward phase.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Geniusact

ETH might just be setting up for a monster move!Something BIG is brewing with #Ethereum...

👀 And it’s being quietly triggered by a law almost no one was talking about, till today.

A new rally could be closer than you think. Here's the full story 🧵👇

Last month, the U.S. Senate passed the Genius Act — the first serious law aimed at regulating stablecoins.

Sounds boring? It's not.

Because this act could light a fire under ETH... and hardly anyone sees it coming.

Stablecoins like CRYPTOCAP:USDC will soon have clear rules to follow.

That opens the doors for banks, funds, and institutions to use them legally — and massively.

And who benefits most from that? You guessed it: Ethereum.

Ethereum hosts nearly 50% of ALL stablecoin supply.

It's the core infrastructure of the stablecoin economy.

That means:

More stablecoin adoption → More activity on ETH → More gas fees → More ETH burned.

And it doesn’t stop there.

Right now, Ethereum handles about 60% of all stablecoin transactions.

Tron is in second place… with just 15%.

This is ETH's game to lose.

Here’s where it gets juicy:

ETH gas fees = ETH getting burned.

Rising stablecoin usage doesn’t just mean more revenue for the network…

It means less ETH in circulation.

And you know what that does to price.

Oh — and the smart money knows.

Since mid-2024, ETH whales have been quietly accumulating.

Whale holdings just hit their highest level since 2021.

Last time that happened?

Right before a massive rally.

Also… Ethereum activity is already spiking on-chain.

Transaction volume is rising, fast.

The last two times we saw this setup?

🔹 2016–2017

🔹 2020–2021

ETH went on to crush ATHs both times.

Circle — the company behind USDC — just IPO’d in June.

Their stock? Skyrocketed!

The stablecoin dominoes are falling fast...

And Ethereum is sitting at the center of it all.

To sum it up:

✅ Regulatory clarity (Genius Act)

✅ Institutional greenlight for stablecoins

✅ ETH is the foundation

✅ Whales accumulating

✅ On-chain activity heating up

✅ Supply burn kicking in

The House just rejected a key vote on the GENIUS Act.

🚨 Regulatory momentum just hit a speed bump — but the charts will tell you the real story.

Pass or fail... ETH might just be setting up for a monster move.

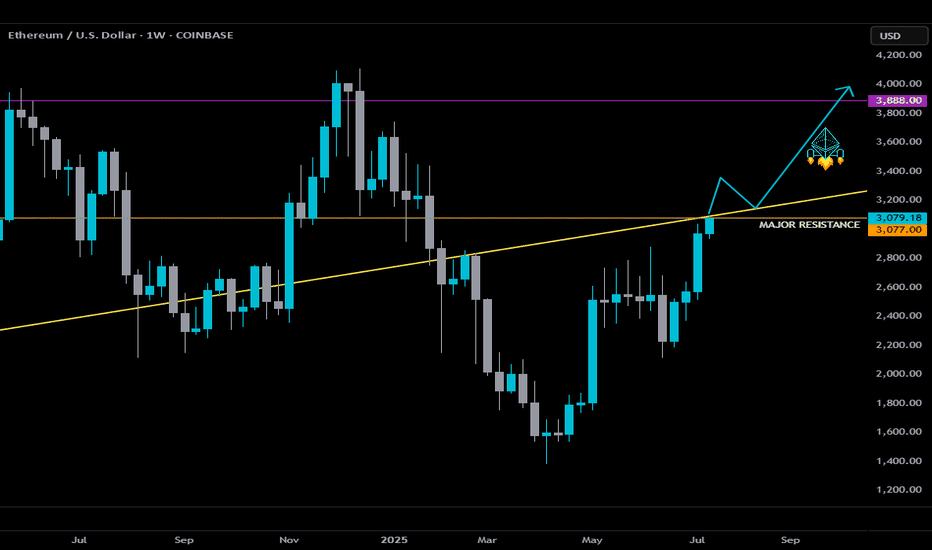

Here’s the set up…

If ETH can secure a Weekly close above the orange major resistance and confirm a breakout above the yellow ascending trendline, we could experience LIFTOFF. 🚀

NFA... For edutainment purposes only!