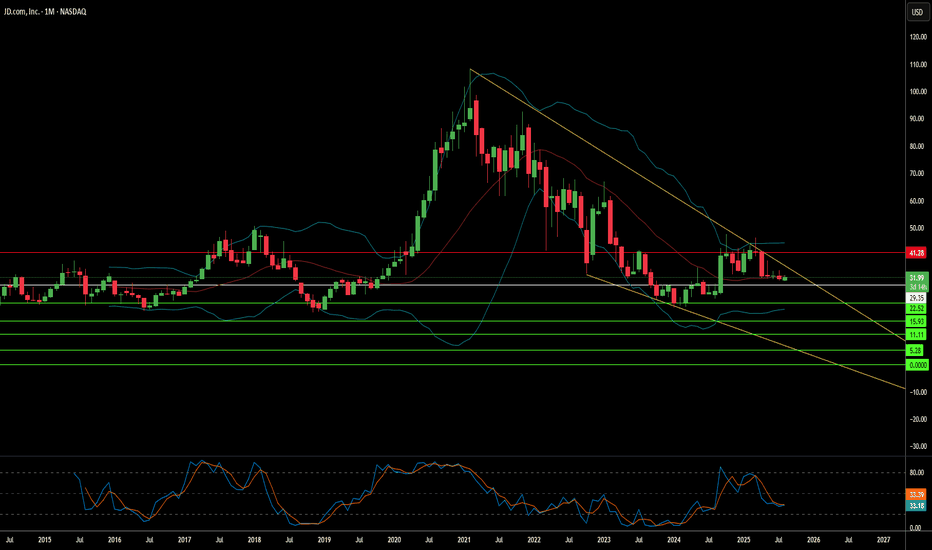

Can Strong Fundamentals Survive Geopolitical Storms?JD.com presents a compelling paradox in modern investing: a company demonstrating robust operational performance while its stock remains volatile due to factors entirely beyond its control. Despite market speculation about decline, JD.com has shown impressive financial resilience with consistent revenue growth—15.8% in Q1 2025 and 22.4% in Q2 2025 - alongside improving operating margins that reached 4.5% for JD Retail in Q2 2025. The company has strategically invested over RMB 75 billion in R&D since 2017, building a sophisticated logistics network spanning over 3,600 warehouses and developing cutting-edge technologies that have reduced fulfillment costs to a world-leading 6.5%.

However, JD.com's strong fundamentals exist within a challenging ecosystem of domestic and international pressures. China's deflationary environment, with CPI rising only 0.2% in 2024, has created subdued consumer demand, while intensifying competition from disruptors like Pinduoduo has reshaped the e-commerce landscape. Rather than engaging in destructive price wars, JD.com has pivoted toward sustainable profitability, leveraging its premium brand reputation and proprietary logistics network as key differentiators in an increasingly crowded market.

The most significant risk facing JD.com - and all US-listed Chinese companies- is geopolitical uncertainty rather than operational weakness. US-China trade tensions, regulatory crackdowns in both countries, and the specter of potential Taiwan conflict scenarios create unprecedented risks for investors. A hypothetical Taiwan invasion could trigger catastrophic sanctions, including SWIFT banking exclusions and forced delistings, potentially rendering these stocks worthless regardless of their underlying business strength. This analysis reveals that Bloomberg Economics estimates such a conflict would cost the global economy $10 trillion, with Chinese companies facing existential threats to their international operations.

The JD.com case study ultimately illustrates a new reality in global investing: traditional financial analysis focusing on revenue growth and operational efficiency may be insufficient when evaluating companies operating across geopolitical fault lines. While JD.com remains operationally strong with clear competitive advantages, investors must recognize they are essentially placing bets on US-China diplomatic stability rather than just corporate performance. This political risk premium fundamentally changes the investment equation.

Geopoliticalrisk

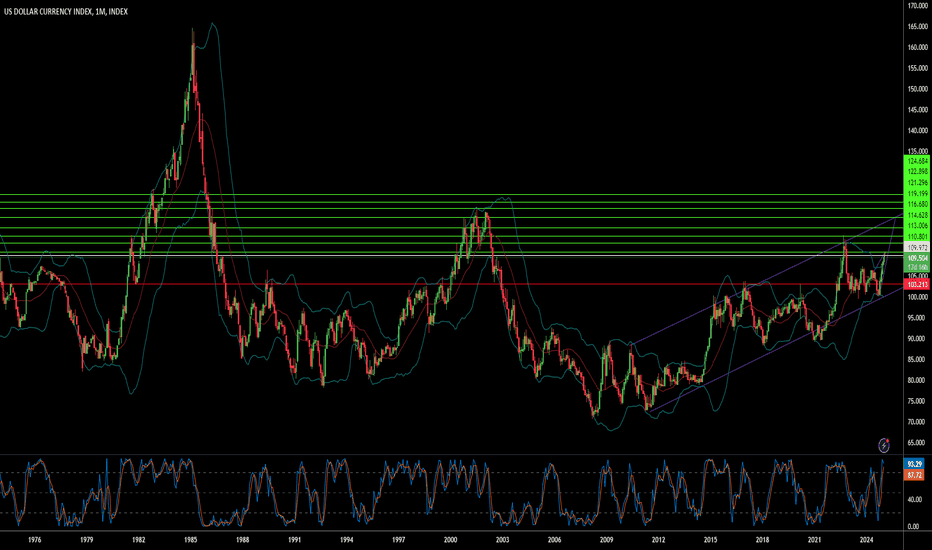

Can the Dollar Index Predict Global Chaos?In the intricate dance of global finance, the U.S. Dollar Index has emerged as a pivotal player, reaching heights unseen in over two years. This surge, coinciding with Donald Trump's anticipated return to the White House, underscores a market bracing for significant policy shifts. The index's climb is not just a number; it's a beacon reflecting the resilience of the U.S. economy amidst high interest rates and a low unemployment rate, painting a picture of optimism where investors envision a 'goldilocks' scenario under new economic policies.

However, this rise is shadowed by tariff threats, hinting at potential global trade disruptions. The depreciation of European currencies against the dollar signals a market in flux, with investors recalibrating their strategies in light of possible protectionist measures. This scenario challenges us to ponder the broader implications: How will these tariffs reshape international trade dynamics, and what does this mean for the global economic order that has favored open trade for decades?

The Dollar Index's ascent also prompts a deeper reflection on currency as a barometer of geopolitical stability. With the U.S. potentially stepping into a new era of economic policy, the world watches closely. This moment invites investors and policymakers alike to consider global economic relations' immediate impacts and long-term trajectory. Will this lead to a reevaluation of the dollar's role as the world's reserve currency, or will it strengthen its position amidst global uncertainties? This question is not just about economics; it's about understanding the undercurrents of power and influence in a world at a crossroads.