GER30 CFD

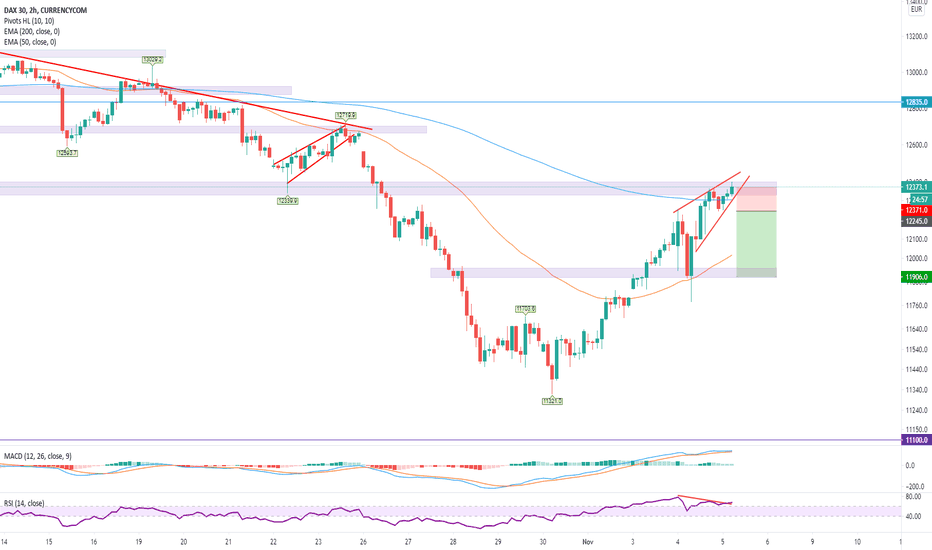

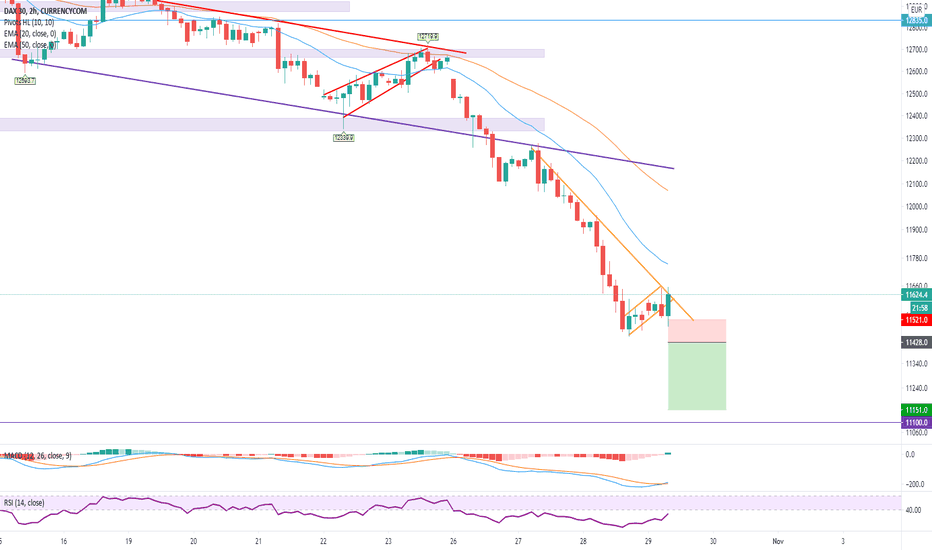

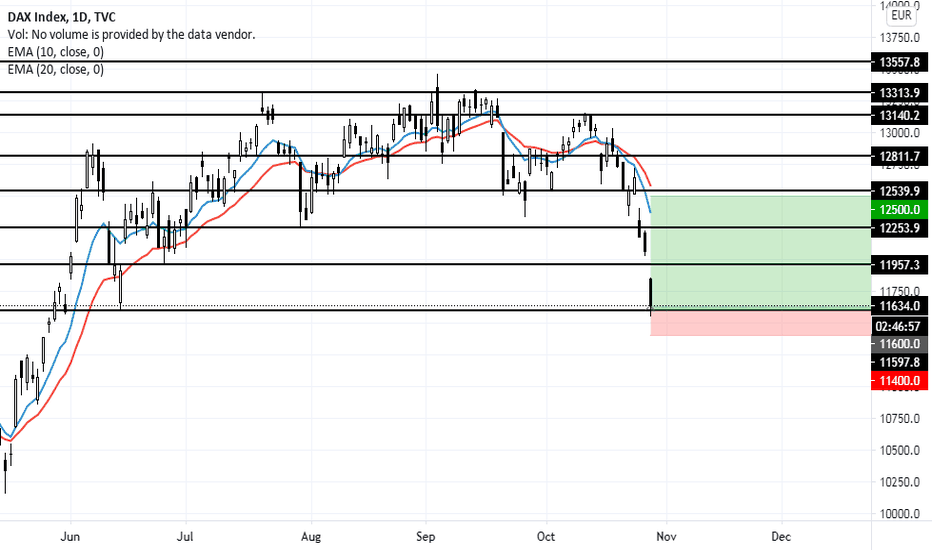

DE30 Intraday Setup.GER30 - Intraday - We look to Sell a break of 12245 (stop at 12371)

Early optimism is likely to lead to gains although extended attempts higher are expected to fail.

We expect an initial move higher to fail and look to set shorts on a break back through 12250.

Our outlook is bearish.

Trades at the lowest level in 21 weeks.

Bearish divergence is expected to cap gains.

The price is in a bearish wedge formation.

Short term MACD is moving lower.

The bias is to break to the downside.

Our profit targets will be 11906 and 11806

Resistance: 12400 / 12500 / 12600

Support: 12300 / 12200 / 12050

Dax30- time to sell?After reaching my 11500 target, the German index had a false break under support and reversed.

Now is trading exactly in resistance (12500) which is also the neck-line support of H&S.

A new leg down is probable from this point and also we can have a great R:R if the index is retesting 11500 zone

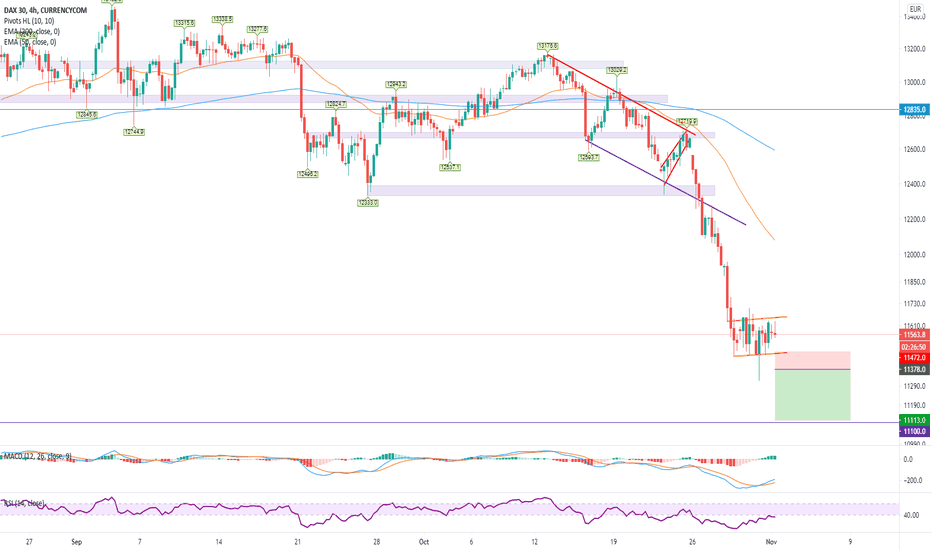

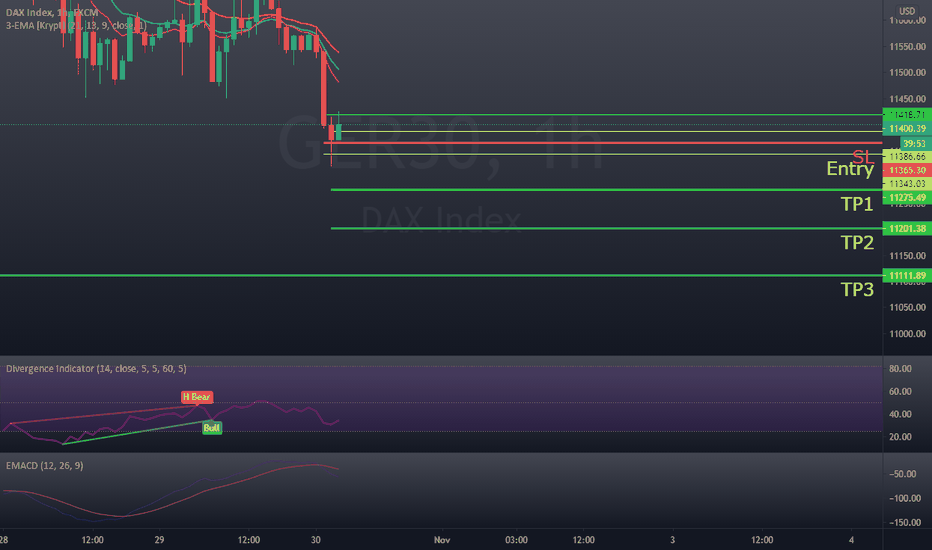

DE30 Intraday Setup. GER30 - Intraday - We look to Sell a break of 11378 (stop at 11472)

Prices are extending lower from the bearish flag/pennant formation.

We can see no technical reason for a change of trend.

Our outlook is bearish.

Trades at the lowest level in 21 weeks.

We look for losses to be extended today.

Price action is forming a bearish flag which has a bias to break to the downside.

Our profit targets will be 11113 and 11015

Resistance: 11700 / 11950 / 12050

Support: 11500 / 11400 / 11100

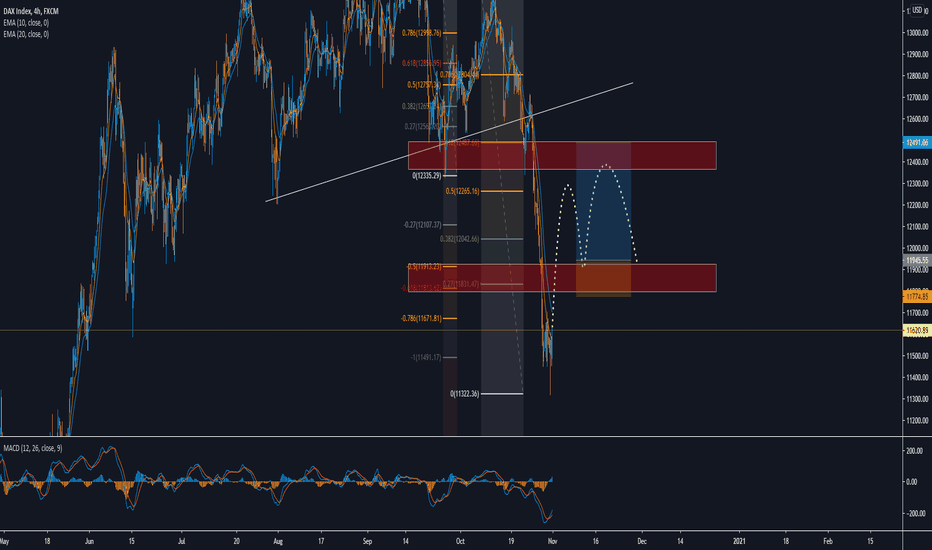

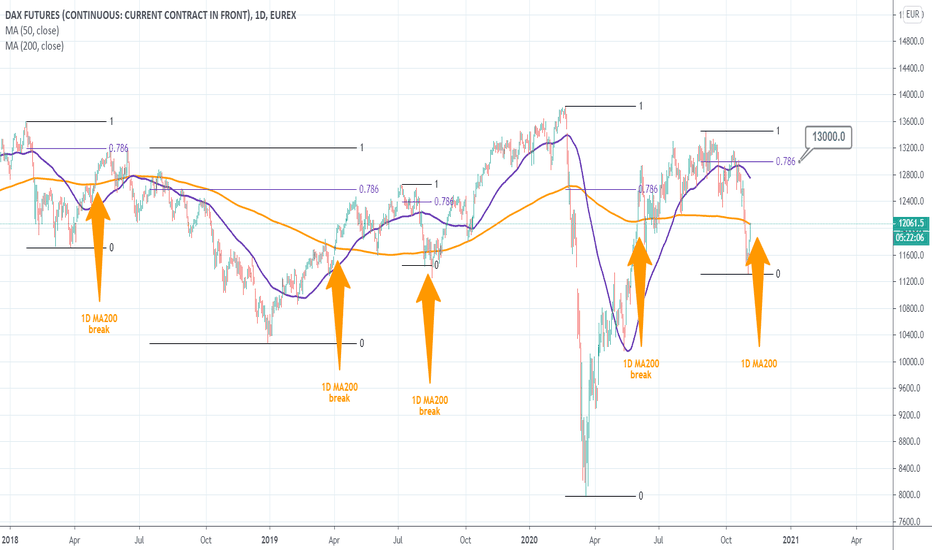

DAX targeting 13000 if the 1D MA200 breaks (3 year pattern)This is an interesting 3 year pattern for DAX. Since 2018, every time the 1D MA200 breaks as a Resistance (index closes one 1D candle above it), DAX rallies to at least the 0.786 Fibonacci retracement level of the previous Top.

Right now we are testing the 1D MA200 and the 0.786 is at 13000. Will history repeat?

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

🎉 👍 Shout-out to TradingShot's 💰 top TradingView Coin donor 💰 this week ==> didogetsov

--------------------------------------------------------------------------------------------------------

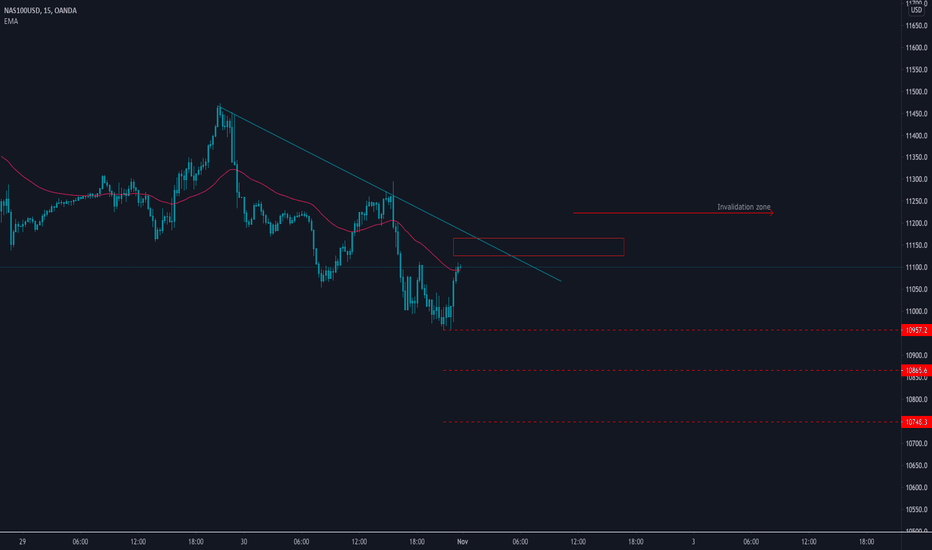

NASDAQ Potential sell setupHello traders,

Nasdaq is currently in a downtrend and we are looking for potential short positions. Price is respecting the downwards trend line and we will be looking for price to reach our sell zone and touch the trend line before looking for sell signals.

Our trading plan goes as follows;

TP1: Close 50% of position and move SL to Breakeven. Remaining position is 50% and risk free.

TP2: Close 25% of remaining position and move stop loss to TP1. Remaining position is 25% and profit is secured.

TP3: Full take profit is realised.

Good luck and Happy Trading!!

Dax30- Where to short it?My 11500 target was hit and now the German index is consolidating just above this support.

A correction from this point is not out of the question but with EU imminent lockdown I expect this to be short-lived and a new leg down is just around the corner.

12k zone is a great place to sell Dax30 and a target of 10k for swing traders is very probable

DE30 Sell a Break setup.GER30 - Intraday - We look to Sell a break of 11428 (stop at 11521)

Posted a bearish Flag formation.

A break of 11450 is needed to confirm the outlook.

This has resulted in signals for sentiment being at oversold extremes and we look for a move to the upside.

Our outlook is bearish.

Trades at the lowest level in 18 weeks.

We look for losses to be extended today.

Trend line resistance is located at 11640.

We can see no technical reason for a change of trend.

Our profit targets will be 11151 and 11081

Resistance: 11700 / 11800 / 11950

Support: 11550 / 11450 / 11300

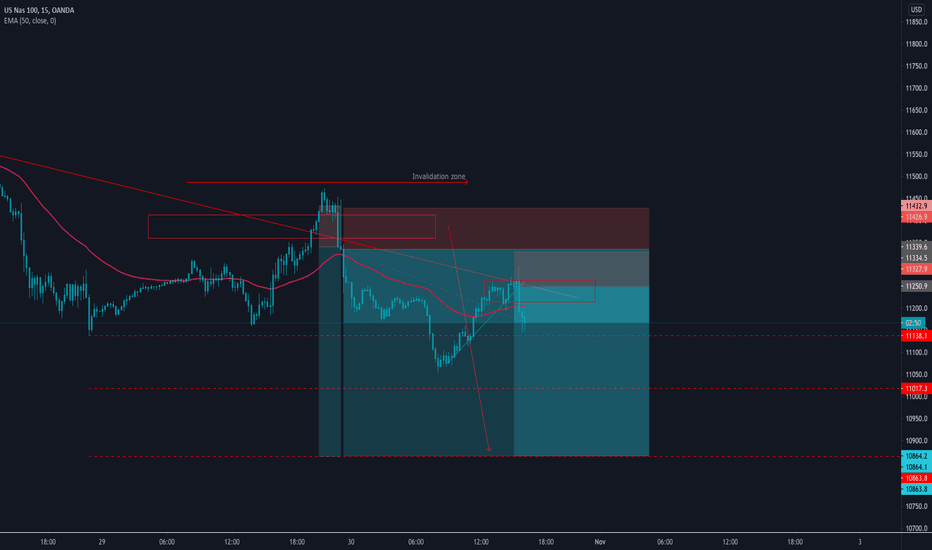

Update: Nasdaq Potential ShortHello Traders,

This is the update to our previous analysis on Nasdaq. The first position hit stop loss but we managed to get another entry on the next candle due to the rejection signifying selling pressure.

We have closed 50%of the position and are currently risk free.

We took a second entry as price approached the trend line again.

Good luck and Happy Trading!

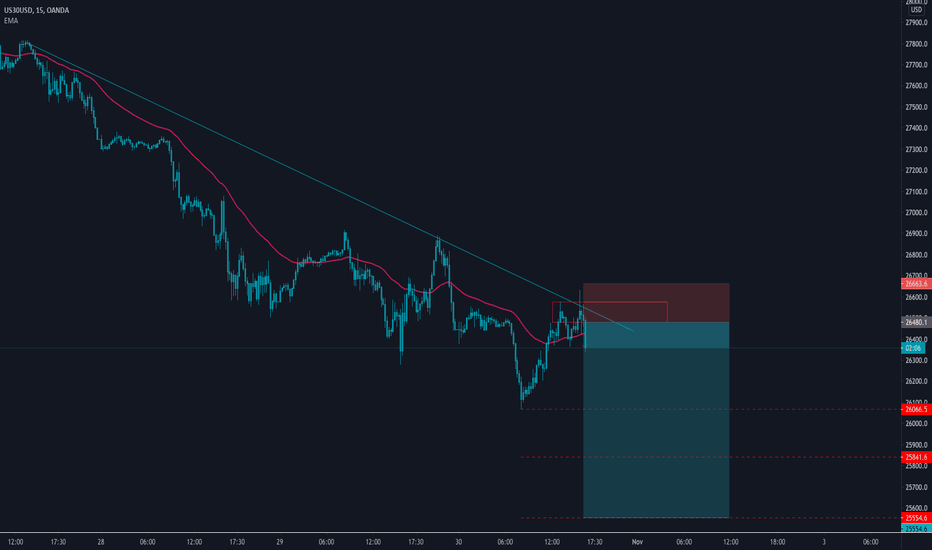

US30 Potential shortHello Traders,

Today we've been presented with a potential short position that we have currently executed.

The idea behind this is that price is in a downtrend and we have been presented with price pulling back to the trend line. Price has rejected the trend line and the 50.0% to 61.8% Fibonacci retracement zone.

Our trading plan goes as follows;

TP1: Close 50% of position and move SL to Breakeven. Remaining position is 50% and risk free.

TP2: Close 25% of remaining position and move stop loss to TP1. Remaining position is 25% and profit is secured.

TP3: Full take profit is realised.

Good luck and Happy Trading!!

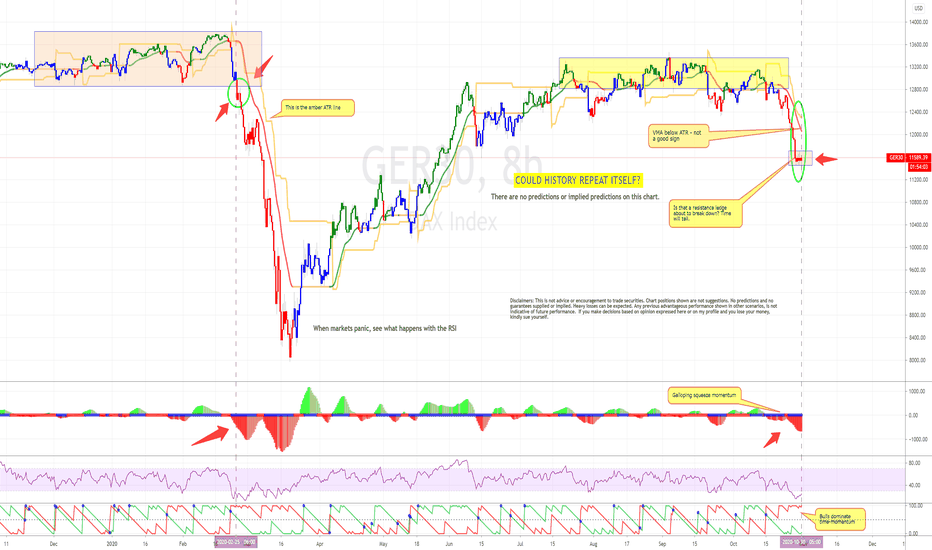

DAX COLLAPSE POSSIBLE: Does history repeat itself?This is an analysis of trend formation.

The DAX (Ger30) appears to be in a precarious position. Several features are shown on the charts.

No one knows what the future will bring. Some may have ideas but no one can know the future. Sound traders take positions with an acceptable, affordable loss.

Looking back to 25th February 2020, no one knew with near certainty that the DAX would fall further from around 12600. Then it happened. This does not mean that in the current situation, I'm saying that the DAX will fall in the same way from 11600. It's a strange coincidence though that '600' appears in the numbers. Please do not attach significance to that.

Some have been disappointed that I do not do predictions. I've explained my position on predictions before. Trend following requires no predictions. Why? Because one is just following the markets rather blindly! I've also explained how my unique methodology works in other posts.

On a related note you can see that one thing the markets are deathly afraid of is the effects of COVID-19. Well, around now the world is facing second and third waves of the virus heading at speed for Winter in the Northern hemisphere.

I have evidence for both second and third waves. Due to house rules this is not posted here.

Disclaimers : This is not advice or encouragement to trade securities. Chart positions shown are not suggestions. No predictions and no guarantees supplied or implied. Heavy losses can be expected. Any previous advantageous performance shown in other scenarios, is not indicative of future performance. If you make decisions based on opinion expressed here or on my profile and you lose your money, kindly sue yourself.

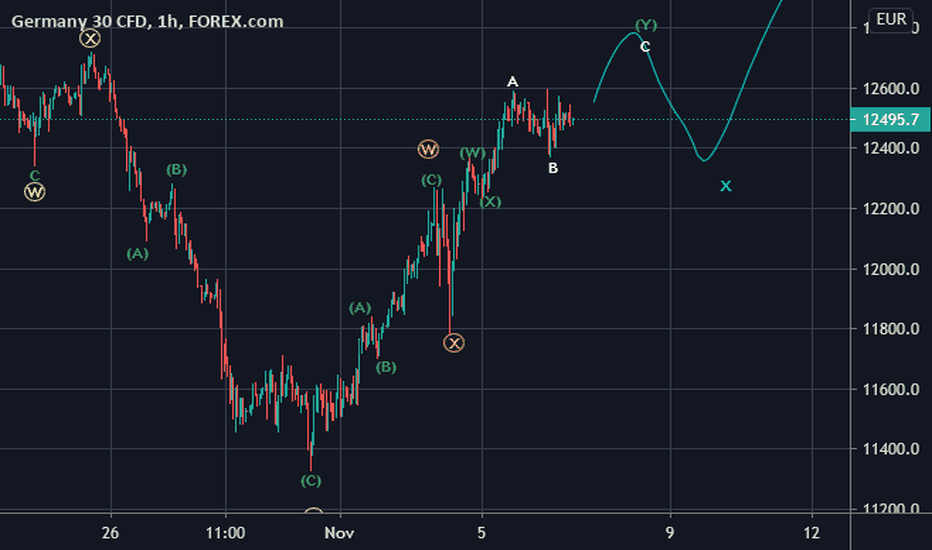

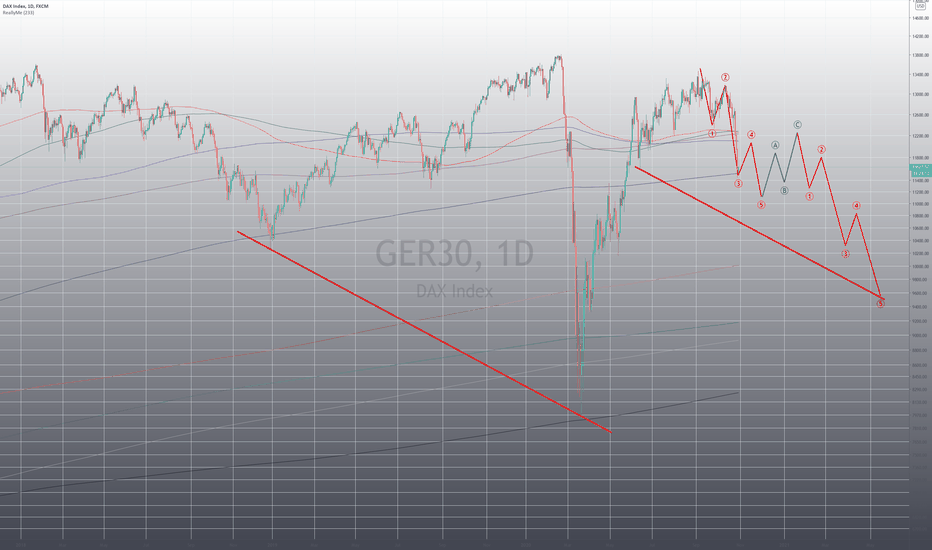

Germany DAX 30 - if things unfold slowly...Germany DAX 30 - if things unfold slowly...

I could imagine that it would develop like this.

The temporal extension of the pattern is uncertain.

Market time is relative. It can happen faster or slower.

Just an idea to share and to check later.

No investment advice. Use your own judgment to trade.

Stay safe, everyone.

ReallyMe

Dax30- Target hit, now what?IN my previous analysis on Dax30 I said that although "timid", we can see an H&S reversal pattern for the German Index.

A break occurred and the price dropped quickly to reach the 11500 target.

In my opinion, we are at the beginning of a medium-term downtrend, and 12k should be very well defended by bears.

Sell rallies around this price could be a good strategy with a great R:R

DAX / DEU30, daily tf, buy on support at oversold conditionHello my friends,

Today i spotted a good setup on DAX / GER30 indicies.

After marking all the potential support and resistance, i found that price currently on support level.

Price go down aggresively since 12600 to 11600. It goes down 1000 pips in just 3 days.

We could see price retrace back up to close the gap before continue south.

Buy DAX / GER30 at 11600

Stop loss at 11400

Take profit 1 at 12000 (2R)

Take profit 2 at 12500 (4.5R)

Use only 1-2% risk

Good luck