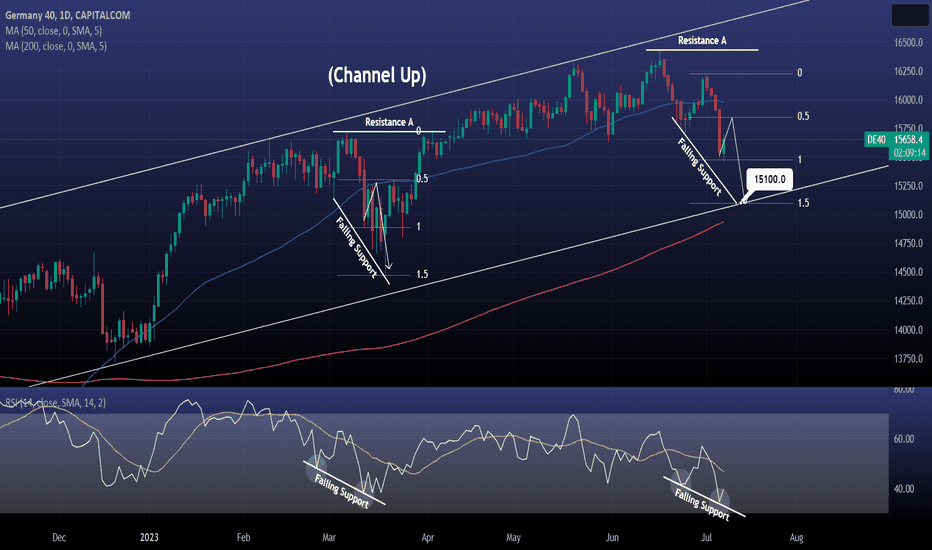

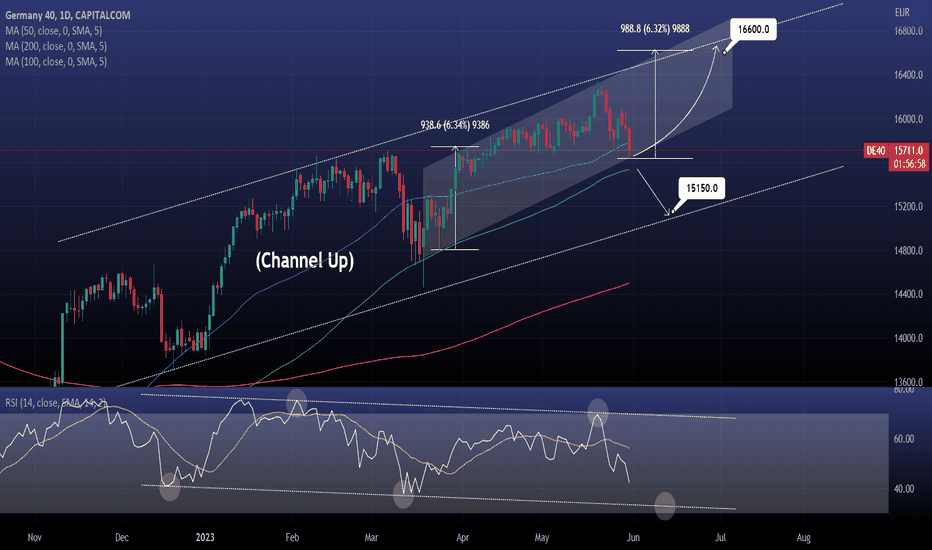

DAX Lower Low to come after this quick rebound. Sell.DAX is recovering today from yesterday's brutal break down but this should be a short lived reaction.

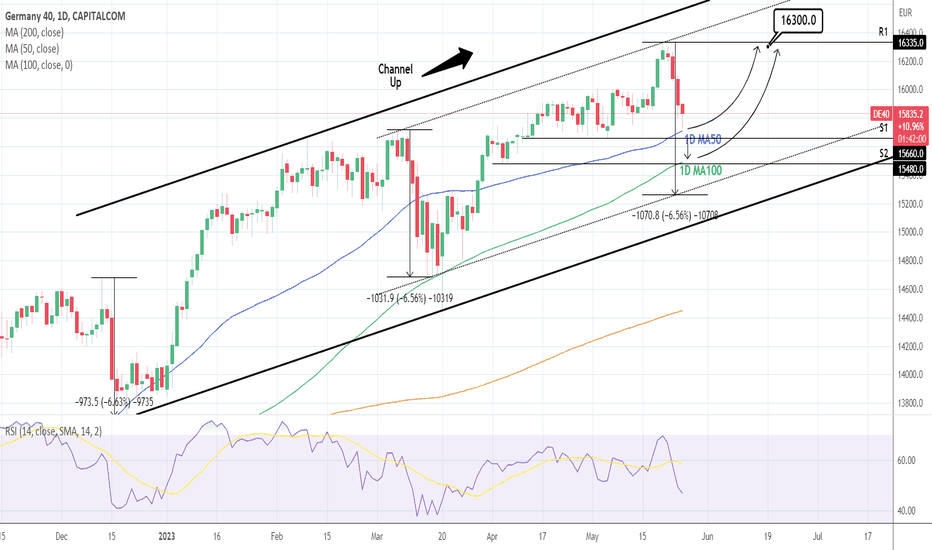

The 1day RSI made a Double Bounce on a Falling Support, much like the one on March 13th.

On that price action, after a short lived rebound that got rejected on the 1day MA50 and the 0.5 Fibonacci, the price resumed the downtrend and bottomed on the 1.5 Fibonacci level.

Take advantage of this quick rebound for a better sell entry and target 15100, which happens to be also at the bottom of the long term Channel Up and the 1day MA200 (which is intact since November 10th).

Previous chart:

Follow us, like the idea and leave a comment below!!

Ger40

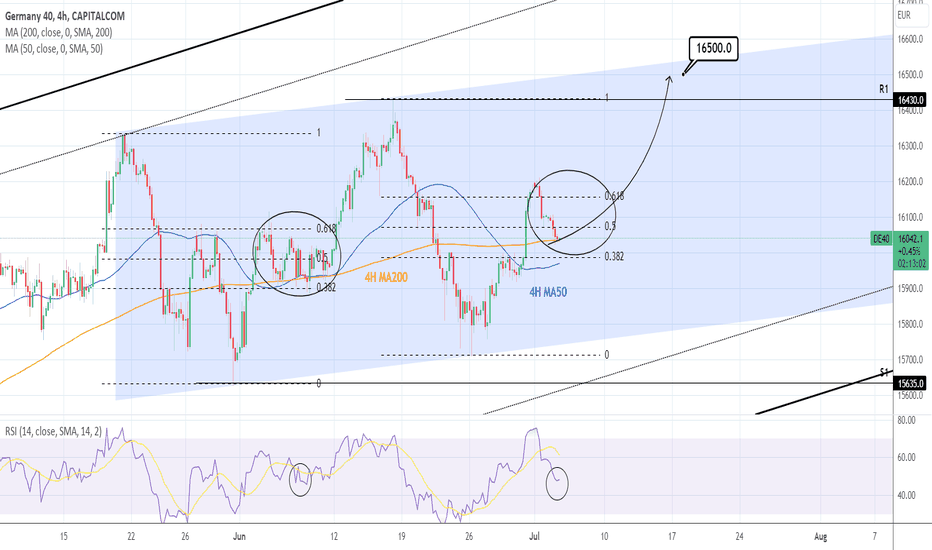

DAX: Entered a short term accumulation phase ahead of the next rDAX hit the 4H MA200 again after a much needed technical pull back that helped at correcting last week's overbought technicals on the 4H time frame (RSI = 48.684, MACD = 21.500, ADX = 34.751). This is a similar structure as early June, when the 4H MA200 (and 0.382 Fibonacci) offered support to a 4 day accumulation phase before the bullish leg made a Higher High on the Channel Up pattern.

We are entering a new buy on the current market price, targeting the top of the Channel Up (TP = 16,500).

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

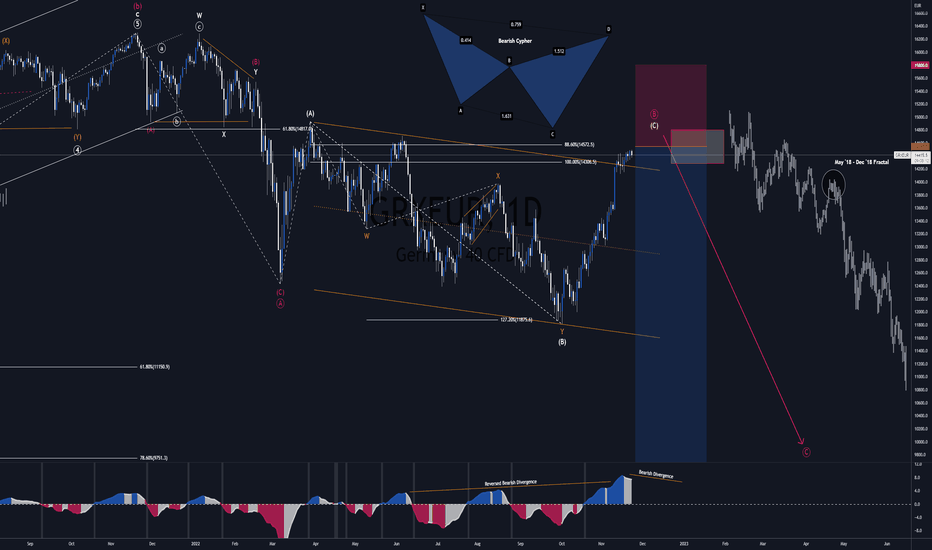

DAX40 Crash - Short Signal - Swing TradingDAX40 is about to crash. A BIG short trade is pending its turn.

Germany40 Index (GER40, GRXEUR, GER30) is trapped in a Bearish stance.

Fundamentally, many things are against a Bull-Market at these times, but I mentioned that in my VIX spike idea.

From a Technical Analysis standpoint, well, the picture is much clearer.

Technicals:

* A-B-C Elliott Wave Sequence

* Running Flat Pattern

* Bearish Harmonic: Cypher Pattern

* Fractal Pattern: May-Dec '18 Sequence

* Reversed Bearish Divergence

* Bearish Divergence

* Descending Channel

* 61.8% Fibonacci Retracements of Primary A (red)

* 88.6% Fibonacci Retracements of Intermediate (B) (white)

* 100% Fibonacci Extensions of Intermediates (A) & (B) (white)

Expected Outcome:

* Powerful Bearish Impulse in Primary C (red).

Trading Signal:

* Entry @ 14550

* SL @ 15800

* TP1 @ 11200

* TP2 @ 9750

* TP1 @ 9000

Safety Measures:

* When in the green, moving stop-loss at break-even.

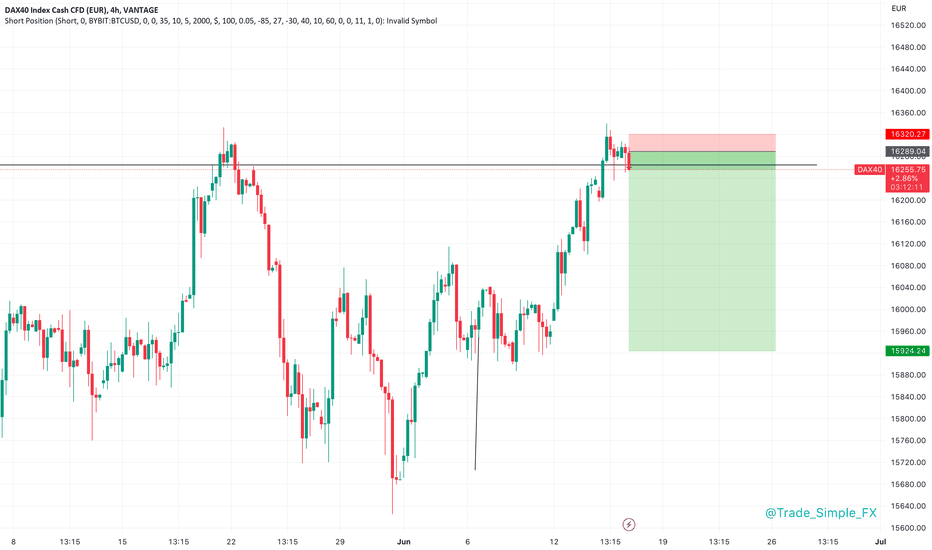

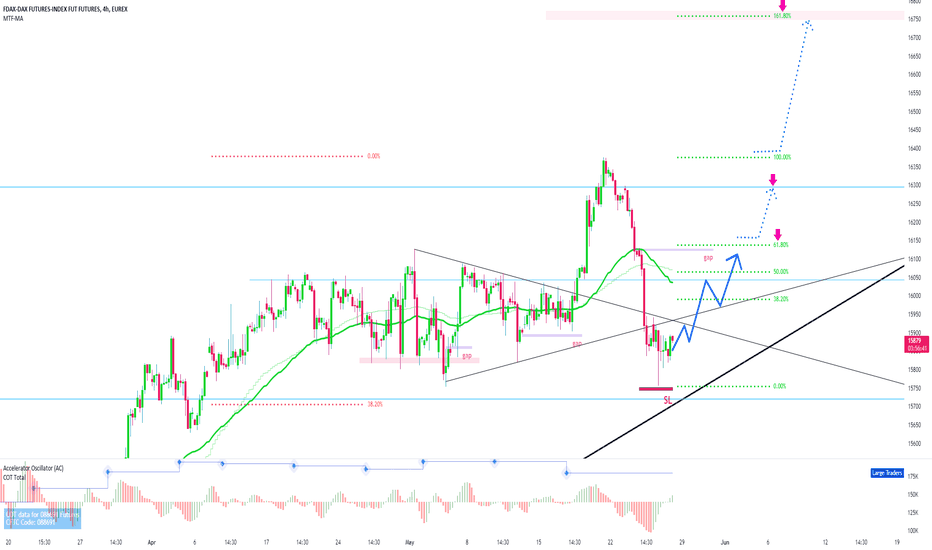

DAX H8 - Long Signal (Update)DAX H8

We pushed almost as high at 16000 before seeing a slight rejection, corrections possible, infact another test of 15700 isn't out of the question. Simple longs from this support zone again if this is the case.

16000 being quite a prominent psychological resistance price. We have a void of 285 pips to take us up to our major resistance and ultimate TP.

DAX40 H8 - Long SignalDAX40 8H

Finding a range on the German indices at the moment, after aggressive highs of 16440 ish... We have now started correcting back into a previous play of S/R. Which is good for us as it now means we have previous highs to target, and previous support to buy from.

Ideally looking for longs (in line with alerts) from 15700 price, in aim to trade back up beyond 16000 again.

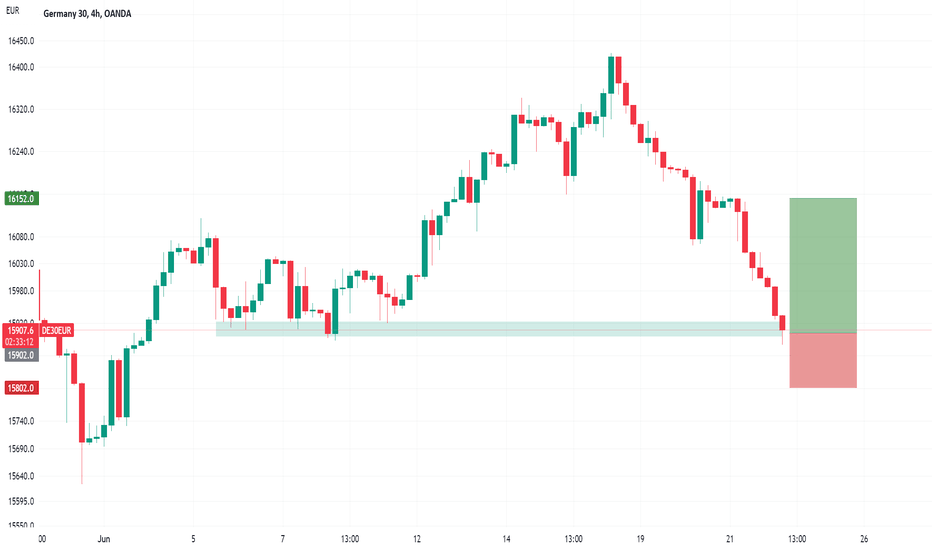

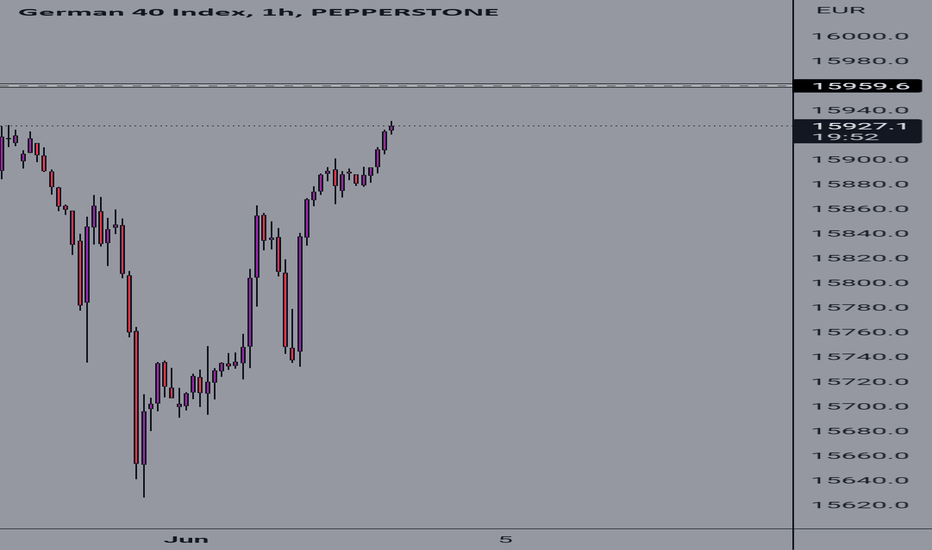

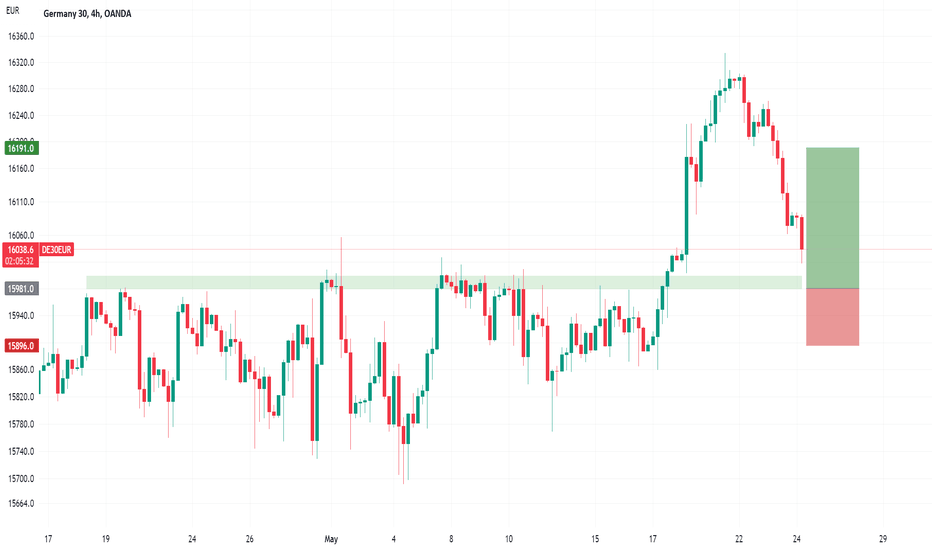

Will DAX find buyers at market?GER40 - 24h expiry

Offers ample risk/reward to buy at the market.

The primary trend remains bullish.

The 1 day moving average should provide support at 15923.

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible.

Bespoke support is located at 15900.

We look to Buy at 15902 (stop at 15802)

Our profit targets will be 16152 and 16192

Resistance: 15950 / 16000 / 16050

Support: 15912 / 15860 / 15800

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

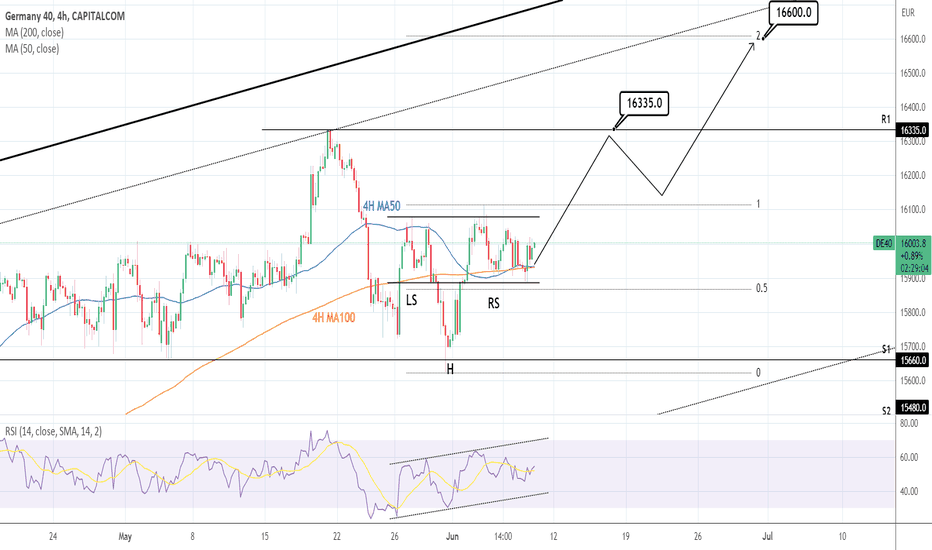

DAX to reach a new all-time high today?GER40 - Intraday

Price action continues to trade around the all-time highs.

There is no clear indication that the upward move is coming to an end.

The bullish engulfing candle on the 4 hour chart the positive for sentiment.

The bias is to break to the upside.

The primary trend remains bullish.

We look to Buy a break of 16351 (stop at 16251)

Our profit targets will be 16601 and 16651

Resistance: 16340 / 16400 / 16500

Support: 16300 / 16200 / 16100

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

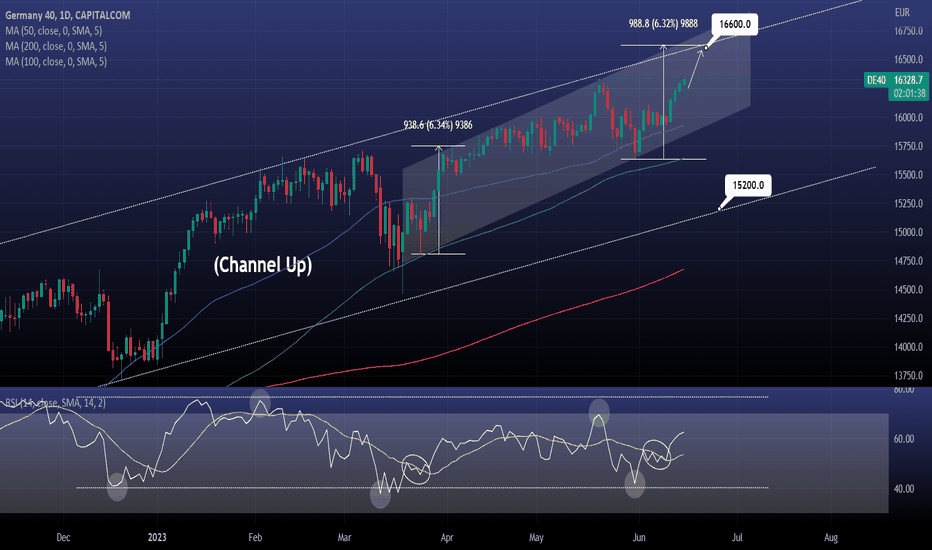

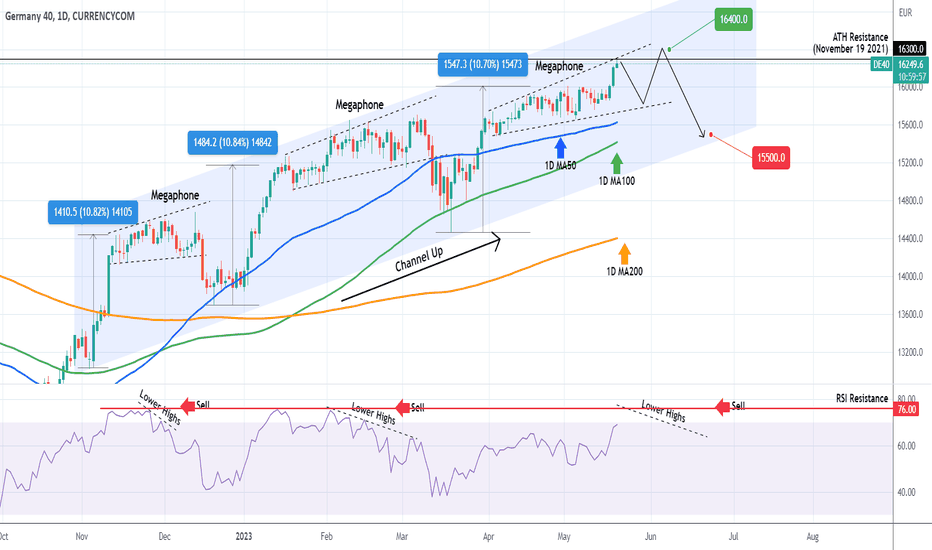

DAX One last pump to 16600.DAX is on the 4th green 1day candle in a row, extending the spot on buy entry we gave 2 weeks ago exactly at the bottom.

The 1day RSI is on balance bullish levels (62.31) and shows still upside potential while there is still room left before the Channel Up makes a Higher High.

That will be at a +6.30% rise from the Low, as previously taken place.

Target remains at 16600.

Previous chart:

Follow us, like the idea and leave a comment below!!

DAX H4 & D1 - Sell SignalDAX40 H4 & D1

Starting to see rejections from this 16300/350 price, I would like to see us pull down towards that 16000 whole number price in the short term before then maybe seeing something even deeper on a higher timeframe basis.

We have indicated an entry (albeit a little late, apologies) for the H4 entry, and also marked the D1 timeframe for reference and significance. Stock indices are massively overpriced at the moment, corrections I feel are certainly over-due!

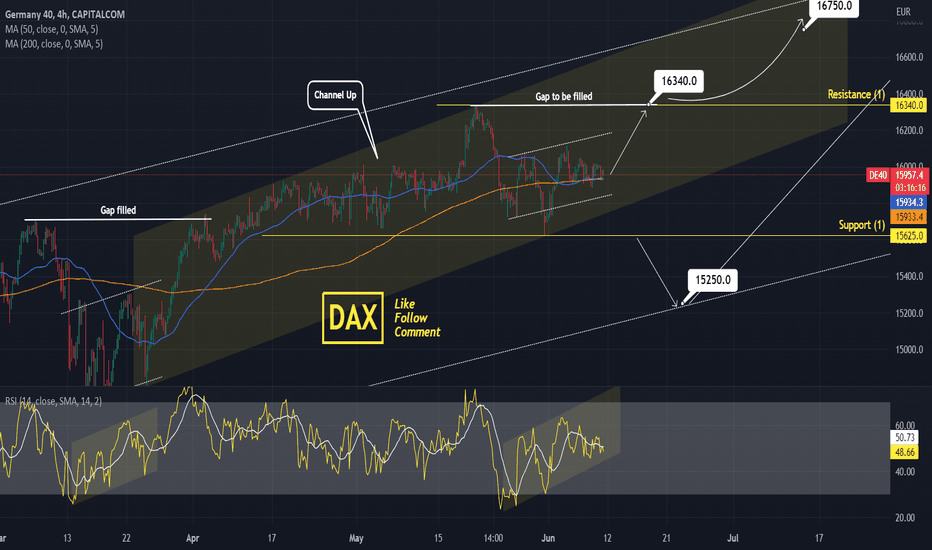

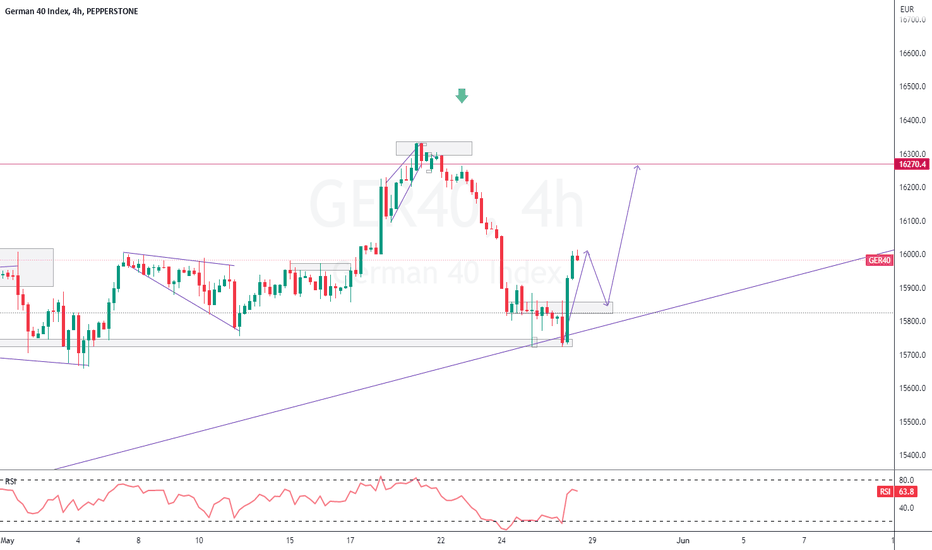

DAX Channel Up and Inverse Head & Shoulders pushing for Gap fillDAX rebounded at the bottom of the Channel Up, forming Support (1) at 15625.

By doing so it completed the formation of an Inverse Head and Shoulders.

This is a twin bullish signal same with the March bottom.

Trading Plan:

1. Buy on the current market price.

2. Sell if it crosses Support 1 (15625).

Targets:

1. 16340 (Resistance 1 and Gap fill as per the March fractal).

2. 15250 (bottom of long term Channel Up).

Tips:

1. The RSI (4h) is also forming a Channel Up like March indicating that we might be exactly before the breakout to the gap fill.

Please like, follow and comment!!

Notes:

Past trading plan:

DAX: Inverse Head and Shoulders aiming for a new All Time High.DAX is trading around the 4H MA50 and 4H MA200 with technicals naturally neutral (RSI = 52.802, MACD = 10.300, ADX = 21.396) as on any consolidation. The pattern that was completed (inside the long term Channel Up) is an Inverse Head and Shoulders. Technically such formations target the 2.0 Fibonacci. Our plan is to traget the R1 initially (TP1 = 16,335) and then buy any pull back given and aim at Fibonacci 2.0 (TP2 = 16,600).

It is important to mention that the 4H RSI has been trading inside a Channel Up during the formation of the Inverse Head and Shoulders, giving an early bullish signal.

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

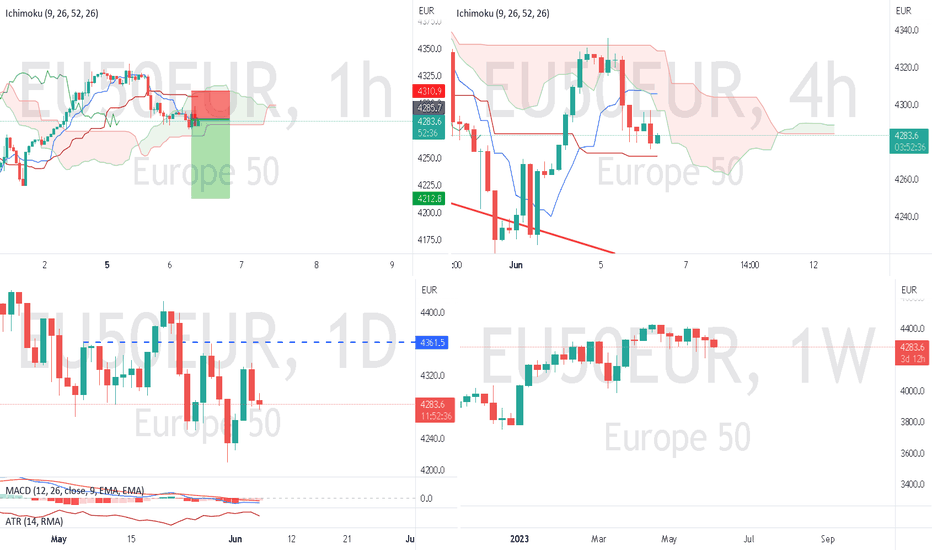

Dark cloud cover in EU50EURTrade Idea: Selling EU50EUR

Reasoning:

• Weekly – Consecutive hanging man candles (Bearish)

• Daily – Bearish dark cloud cover after Fridays break higher (Bearish)

• 4hr – Bearish outside candle at Ichimoku Cloud resistance

• 1hr – Testing Ichimoku cloud support (Neutral/Bullish)

Entry Level: 4285.7

Take Profit Level: 4212.8

Stop Loss: 4310.9

Risk/Reward: 2.89:1

Disclaimer – Signal Centre. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis, as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

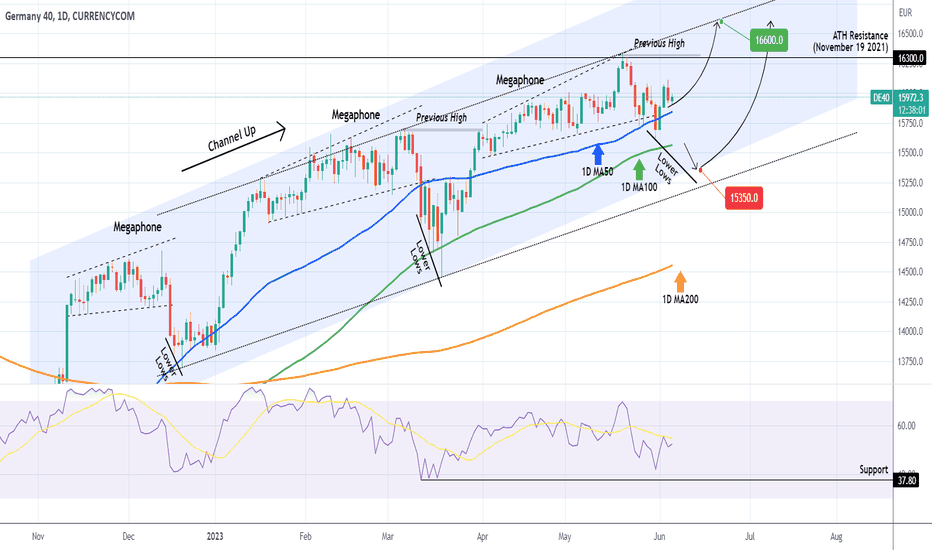

DAX potential pull-back.DAX had an excellent run since our buy signal (see chart below) more than two months ago (March 21) but after it broke above the former All Time High (ATH) on May 19, it has formed a top and is pulling back:

As long as the price is closing the 1D candle above the 1D MA50 (blue trend-line), it will be a buy opportunity targeting the top of the (dotted) Channel Up at 16600. If however it breaks below the 1D MA100 (green trend-line) we will quick sell towards the Channel's bottom at 15350 and add a new buy there. In either case, the target remains intact at 16600.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

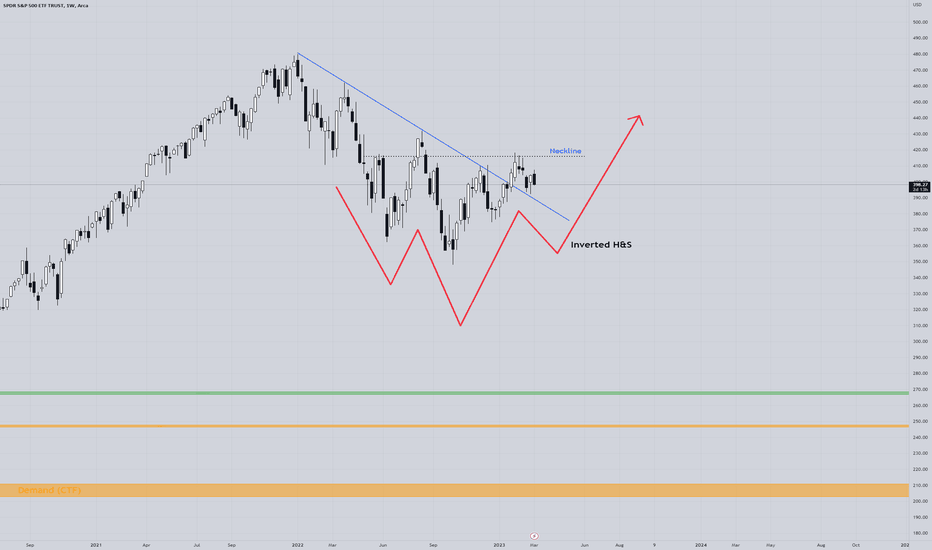

GER40 possible LongIt looks like Ger40 might be forming an inverted Head & Shoulders pattern on the weekly chart, which could potentially indicate a rise in price.

The resistance Trendline was recently broken and retested, and we're now waiting for the neckline to be broken to gain momentum towards the upside.

It's important to keep in mind that we'll want to see the candle close above the neckline for confirmation.

To avoid any potential losses, it's best to wait until the candles have closed before making any moves.

Additionally, there's a small gap to fill between $420 and $421 that could be worth keeping an eye on.

DAX Critical junction on the 1day MA100.DAX hit today the bottom of the short term Channel Up. This is inside a larger Channel Up pattern that started during last year's market bottom.

As long as it holds, especially the 1day MA100, buy and target 16600 on a +6.34% repetition of the first short term Channel Up rally.

If the price closes under the 1day MA100, sell and target the bottom of the long term Channel Up at 15150.

The 1day RSI, trading inside a Channel Down, gives a clear indication as to when that low may be achieved.

Previous chart:

Follow us, like the idea and leave a comment below!!

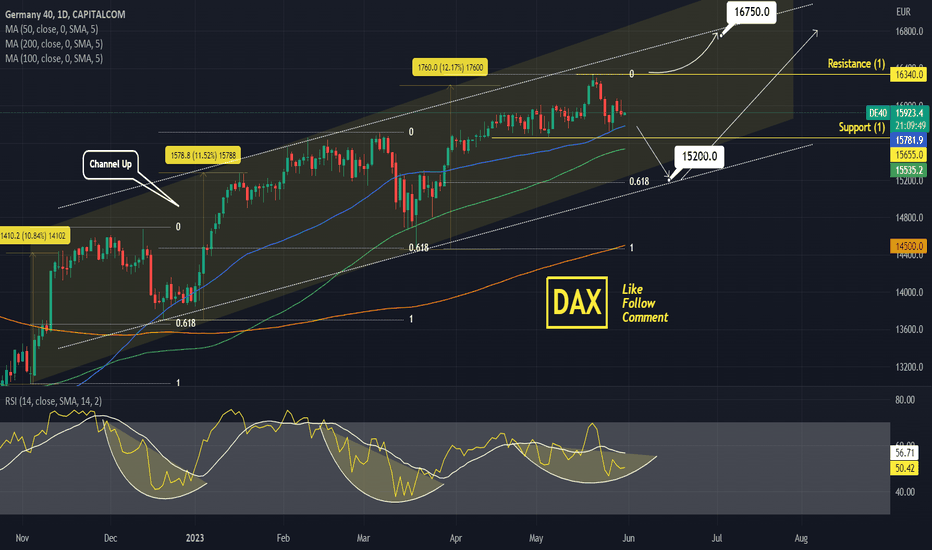

DAX Trade break outs only. Neutral at the moment.DAX has turned neutral after the 16340 top and the subsequent test of the MA50 (1d).

As long as those two levels hold, it will remain sideways with no action to take.

The long term pattern is a double Channel Up.

Trading Plan:

1. Buy if the price closes over Resistance (1).

2. Sell if the price closes under the MA50 (1d).

Targets:

1. 16750 (top of Channel Up).

2. 15200 (Fibonacci 0.618 level).

Tips:

1. The RSI (1d) is trading under the MA trend line, consistent with the previous two bottoms of the Channel Up.

Please like, follow and comment!!

Notes:

Past trading plan:

DAX: reached the 1D MA50 but can drop more if it breaksDAX has almost hit today the 1D MA50 (last time it had contact was March 29th) and reacted with a rebound. The 1D technicals are neutral (RSI = 45.355, MACD = 76.400, ADX = 25.34&) indicating that this is a first Support level but if we close a 1D candle under it, can drop more until they turn red.

Consequently, as long as the 1D MA50 holds, we will keep our first buy open, targeting the R1 (TP = 16,300). If a 1D candle closes under it, we will buy again on the 1D MA100, which is waiting on S2 and keep it for the long term even though a max technical drawdown extendes as low as -6.60%. Those where the % declines on the previous two corrective legs inside the Channel Up since December.

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

DAX primary trend still remains positive.GER40 - 24h expiry

Daily signals are bullish.

We are trading at overbought extremes.

Short-term momentum is bearish.

A lower correction is expected.

The 1-day moving average should provide support at 15980.

The sequence for trading is higher highs and lows.

We look to Buy at 15981 (stop at 15896)

Our profit targets will be 16191 and 16241

Resistance: 16090 / 16150 / 16230

Support: 16059 / 16000 / 15930

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

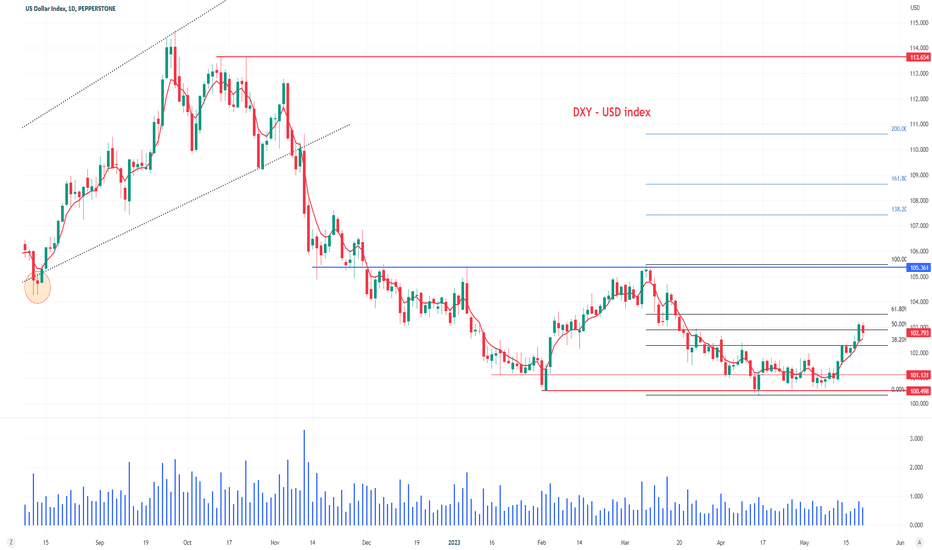

A Traders’ Playbook - A defining Week for Financial Markets After an eventful week for the NAS100, US500, JPN225, GER40 and the USD, traders should be open-minded for further twists in the market script this week.

At one stage last week better-than-feared US data and some modestly hawkish Fed chatter saw US interest rate futures price a 40% chance of a hike at the June FOMC meeting - the USD naturally benefited from this pricing. Yet after Jay Powell’s speech on Friday market pricing is firmly back to thinking the Fed will pause. I look at the data flow due in the week ahead and question how the outcome could affect market pricing for Fed action in June (and further rout the rates curve) and what that means for the USD, equities, and gold.

However, it still feels like the US debt ceiling, and the price action in US banks, are going to dominate the narrative.

In the art of brinkmanship, it feels that to get a deal we must see greater market volatility and so far, we’ve not really seen really any stress outside of US Treasury bills. That could change this week and while for much of last week the headlines were that a deal is within reach, the breakdown in talks from Republican negotiators on Friday has many thinking that we could be pushed right to the June deadline before we see an agreement – where in the spirit of political negotiations politicians simply have to take this to the wire to make it seem like they’ve truly fought for the best deal.

Volatility markets are calm as they come, but don’t be surprised if that changes this week.

Marquee event risks for the week ahead

US core PCE (Friday 22:30 AEST) – The market expects core PCE at 4.6% YoY, with economists’ range of estimates set between 4.7% to 4.2%. A number below 4.4% could weigh on the USD, while above 4.7% and the USD should find buyers. Much obviously depends on the news flow at that time around the US debt ceiling.

FOMC May meeting minutes (Thurs 04:00 AEST) – while the minutes are backwards-looking in nature it could give us some understanding as to the appetite within the Fed ranks to pause in the 14 June FOMC meeting.

S&P Global US manufacturing and services PMI (Tues 23:45 AEST) – the market has moved on this data release before, and above consensus numbers could push the USD higher. With US growth data points under the spotlight, we look to see if manufacturing grows or contracts (month-on-month) and how it stacks up vs UK and EU PMIs – the consensus is for manufacturing to print 50 (from 50.2) and for services at 52.5 (53.6).

*Above 50 shows expansion vs the prior month, below 50 shows contraction.

UK CPI (Wed 16:00 AEST) – the market expects headline inflation to fall rapidly to 8.2% (from 10.1%), while core inflation is expected to be steady at 6.2% (6.2%). The form guide suggests a modest risk of an above consensus outcome and could have meaning on the 22 June BoE meeting, where the market ascribes an 80% chance of a hike. GBPUSD support is seen at 1.2355 and a weak print could see this tested.

UK Global manufacturing and services PMI (Tues 18:00 AEST) – the market sees the manufacturing index coming in at 48.0 and services at 55.5 (55.9). Unlikely this data series materially impacts interest rate expectations for the June BoE meeting - so in turn, I’m not expecting this to influence the GBP in any great capacity, but that depends on the outcome of course.

EU Global manufacturing and services PMI (Tues 18:00 AEST) – the market sees a modest improvement in the pace of contraction in manufacturing, with the diffusion index eyed at 46.0 (45.8). Services PMI is eyed at 55.5 (56.2), which would be a healthy pace of growth. EURUSD is likely sold into rallies this week, although higher volatility driven by a worsening in the debt ceiling talks could see the USD offered.

RBNZ meeting (Wed 12:00 AEST) – the market prices 33bp of hikes (a 32% chance of a 50bp hike), with 16/17 economists calling for a 25bp hike. With the economist community of the view we get a 25bp hike, there are risks of a quick drop in the NZD (given the small premium for a 50bp hike). We’ve seen traders covering NZD shorts into the meeting, with the NZD the best performer in G10 FX last week. Are we close to the end in the hiking cycle? The market prices a 25bp hike at this meeting and at least one more by October.

Tokyo CPI (Fri 09:50 AEST) – the market sees headline inflation at 3.4% and core inflation at 3.9% (from 3.8%) – last week the JPY attracted good selling flow as the carry trade kicked in in earnest. Again, much depends on the feel towards the US debt ceiling as the JPY is probably the best trade to be long if we do see higher volatility as we roll towards 1 June.

Stock of the week:

NVIDIA (report Thursday at 06:20 AEST) – it’s been an incredible hold throughout all of 2023 and a momentum juggernaut, driven largely by a constant wave of short-dated call (options) buyers. Into Q1 24 earnings, we find the stock +113% YTD with valuations at sky-high levels. Investors can buy NVDA for a hefty 68x earnings, well above the long-term average - the idea of buying growth at any price rings true here. Nvidia is the poster child of the AI revolution, with many now using the word “bubble” more liberally towards AI equities.

The implied move on the day of earnings is 3.3% and given the incredible run through 2023 this level of expected movement seems rather conservatively priced by options market makers. With the street expecting the company to report 91c of EPS, on $6.503b in sales, one questions if earnings and guidance truly matter - or do management just need to offer inspiration on the future of AI and Nvidia’s leadership in the AI/ML space to keep the bull run intact.

Central bank speakers in the week ahead:

Fed speakers – Bullard, Bostic, Barkin, Daly, Logan, Waller, Collins

ECB speakers – There are 19 speakers due this week I won’t list them all

RBA speakers – David Jacobs (Head of Domestic markets) speaks (Wed 17:10 AEST)

BoE speakers – Haskel, Bailey

DAX Testing its All Time High but upside may be limited!DAX had an excellent run since our previous buy signal on March 21 (see chart below) that hit its target yesterday:

The index is right now moments away from hitting the 16300 Resistance, which is the All Time High (ATH) of November 19 2021. The long-term pattern since the end of October 2022 has been a Channel Up and within it, three Megaphone patterns have guided the price to each Higher High before an eventual correction back towards its bottom. The symmetry is evident even on the +10.80% rallies that it has done three times.

The 1D RSI usually hits the 76.00 Resistance and then after a series of Lower Highs, we get the top confirmation to sell. Right now the RSI has just hit the 70.00 overbought barrier. In our opinion the upside is limited to around 16400 but as mentioned, we will only sell after we see Lower Highs forming. On the first Channel Up pull-back, it was the 1D MA50 (blue trend-line) that supported, on the second it was the 1D MA100 (green trend-line) and this time it should be lower. Our early projection is 15500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇