2024-11-14 - priceactiontds - daily update - daxGood Evening and I hope you are well.

tl;dr

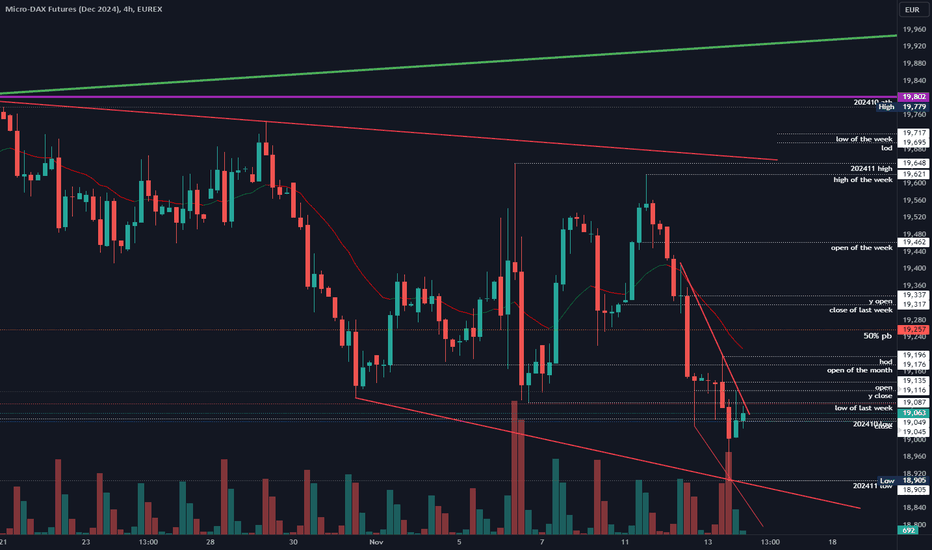

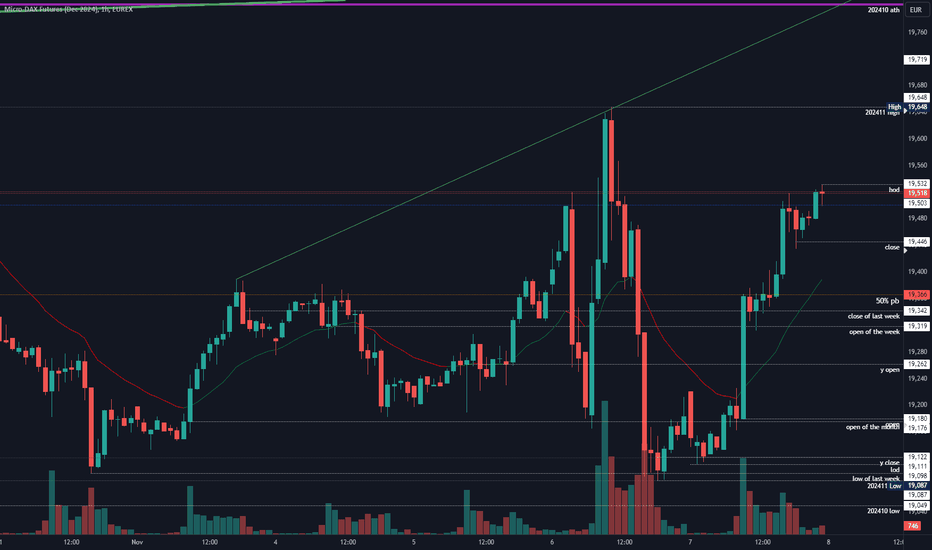

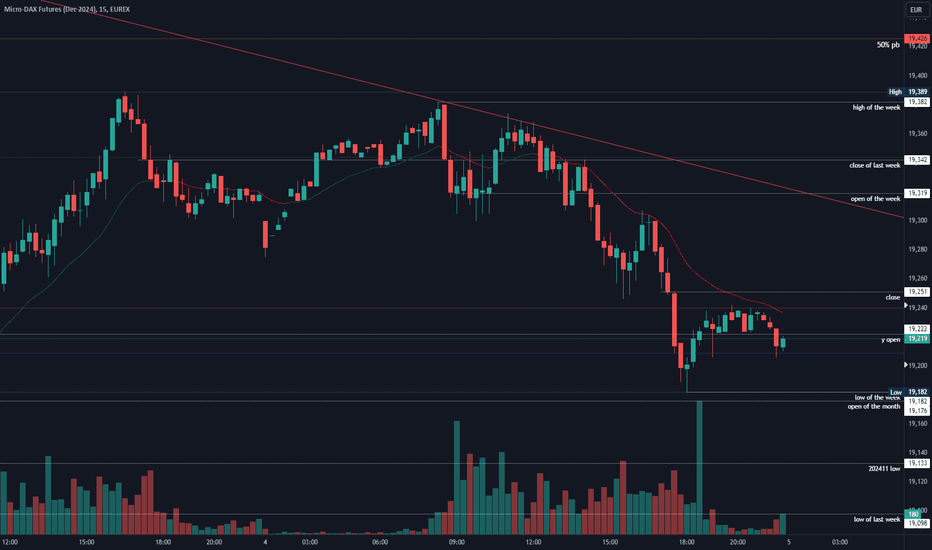

dax futures - 19300 was the first target and bulls could not get above, since overall markets were very weak today. 19600 is still my target for tomorrow, if we stay above 19200. If US bulls do not want to reverse hard tomorrow and we have an overall weak market again, dax will likely close the week around 19100 or below.

comment : Bulls listened and we got the huge reversal up. Measured move up target is 19600 and then there is no reason why we can’t make a new ath. Tomorrow is Friday and Opex, so we will likely see a huge move. Bias is still full bull, 1h 20ema should be support. Below 19200 bears will likely take control again and we can close the week below 19100 or around 19000, which would be bearish going into next week.

current market cycle: trading range

key levels: 18900 - 19700

bull case: Said the most in my comment. Watch if market holds it above the 1h ema and 19250ish. Also keep an eye on the other big indexes, if they are all weak again tomorrow, dax will likely not close the week above 19300.

Invalidation is below 19200.

bear case: Bears gave up early today, which was expected after today’s strong reversal from 18905. Will bears fight this at 19300? I can only see this happening if most markets are weak tomorrow. The leg up was very strong to expect a second one and the measured move up is 19600. Bears can not hold short if this goes above 19400 and the buying will accelerate then.

Invalidation is above 19400.

short term: Bull if we stay above 19200/19250 or 1h 20ema - target 19600 or higher. If all markets are weak, we could close the week below 19000 but I can’t see this for now.

medium-long term - Update from 2024-10-19: 20000 is the goal for 2024, if bulls do not get it until year end, it will probably not happen for the next 5-10 years. This market is beyond overvalued and will drop 30-50% in the next 5 years. I have no doubts about that. That fact should not be relevant to your trading at all.

current swing trade: None

trade of the day: I gave the long yesterday and it was good for 200+ points. Hope you made some.

Ger40

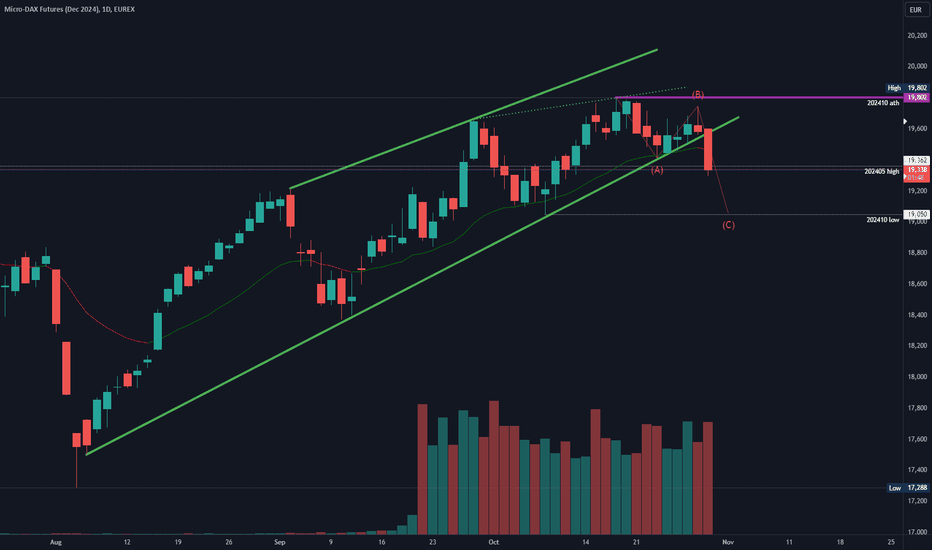

2024-11-13 - priceactiontds - daily update - daxGood Evening and I hope you are well.

tl;dr

dax futures - Bullish. 95 points below huge support is something. I banged my head against that wall today. Still think the bullish read is good, since market reversed for 200 points from the lows. Bear trend line needs to be broken and then we will likely see 19600 tomorrow or Friday. Below 18900 we flush down to 18500. There is no more support for the bulls and they either get a huge reversal day tomorrow or we will crash down and likely won’t trade above 19000 for a long time.

comment: Market had it’s spike below 19000 and is now free to squeeze late bears. First target is 19300 and I think we can print 19600 this week. If it drops below 18980 again, I am wrong and we are most likely on our way to 18500, followed by 18300. Tomorrow is bulls last chance to keep it at the highs or the head & shoulders triggers and measured move down is 18300ish.

current market cycle: trading range

key levels: 18900 - 19700

bull case: Bulls need a break above the bear trend line and are then free to melt up and squeeze late bears. I don’t think they can let the market dip below 19000 again or they risk a flush down. Confirmation for the bulls is above 19200.

Invalidation is below 18900.

bear case: Bears outdid themselves with a 95 dip below huge support. They want to stay inside the nested bear wedges and continue down. They should keep it below 19130 or the market turns neutral again.

Invalidation is above 19200.

short term: Last try to be a bull. Stop is 18900 but I will only go long if I see big buying pressure tomorrow. Below 18900 this bull show is over.

medium-long term - Update from 2024-10-19: 20000 is the goal for 2024, if bulls do not get it until year end, it will probably not happen for the next 5-10 years. This market is beyond overvalued and will drop 30-50% in the next 5 years. I have no doubts about that. That fact should not be relevant to your trading at all.

current swing trade: None

trade of the day: Selling anywhere near the 1h 20ema was amazing. Again.

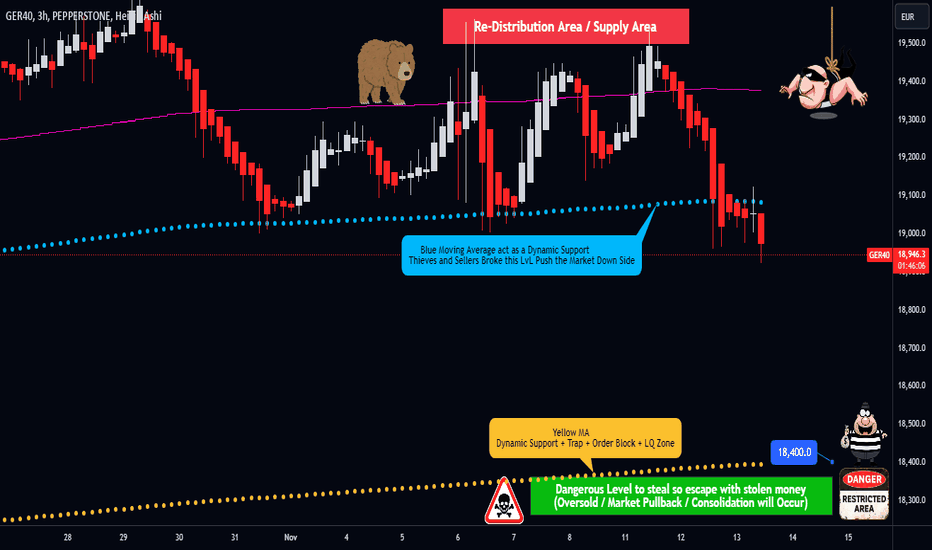

GER40/DE40 "Germany 40 Index" Money Heist Plan on Bearish Side.Ola! Ola! My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist GER40/DE40 "Germany 40 Index" Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry 👇 📉: Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe, Recent / Nearest High Point.

Stop Loss 🛑: Recent Swing High using 3h timeframe

Attention for Scalpers : Focus to scalp only on Short side, If you've got a money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

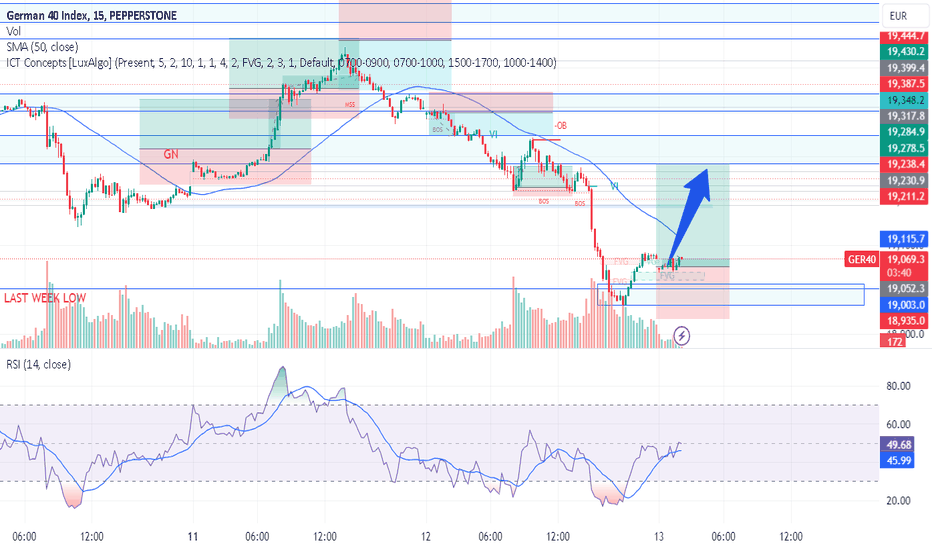

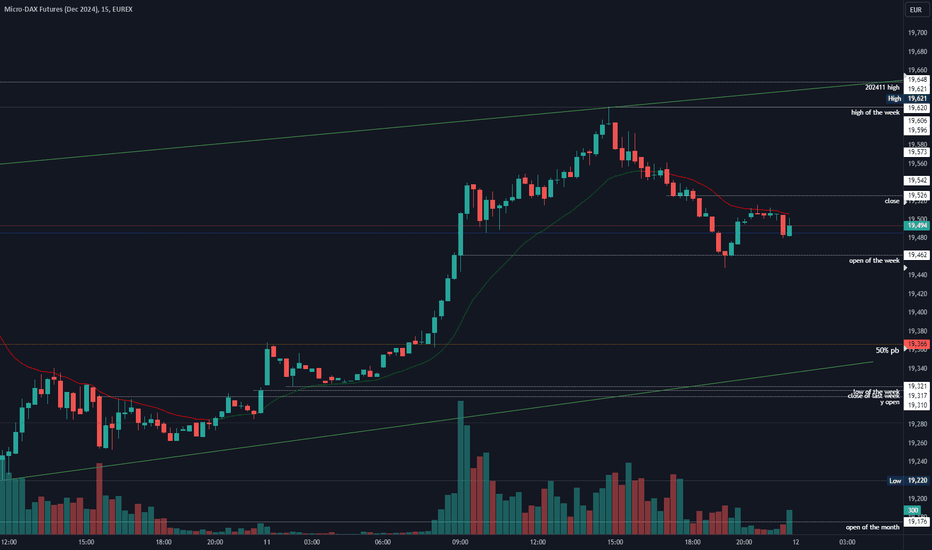

DAX/GER30-40 - ALL THE WAY FOR RECOVERYTeam,

it has been a while since we are trading this.

Yesterday we did not post, we tried, but hit stop loss

then later I got all the money back as I expect the target hit. but we were using very tight stop loss, no room for movement

Today we are entering between 19050-19060 with STOP LOSS at 19035

Target 1 - 19086-95

Target 2 - 19126-335

Target 3 - 19211-19230

Please NOTE: once the price hit the 1st target, bring STOP LOSS TO BE. REMEMBER to take partial profit.

2024-11-12 - priceactiontds - daily update - daxGood Evening and I hope you are well.

tl;dr

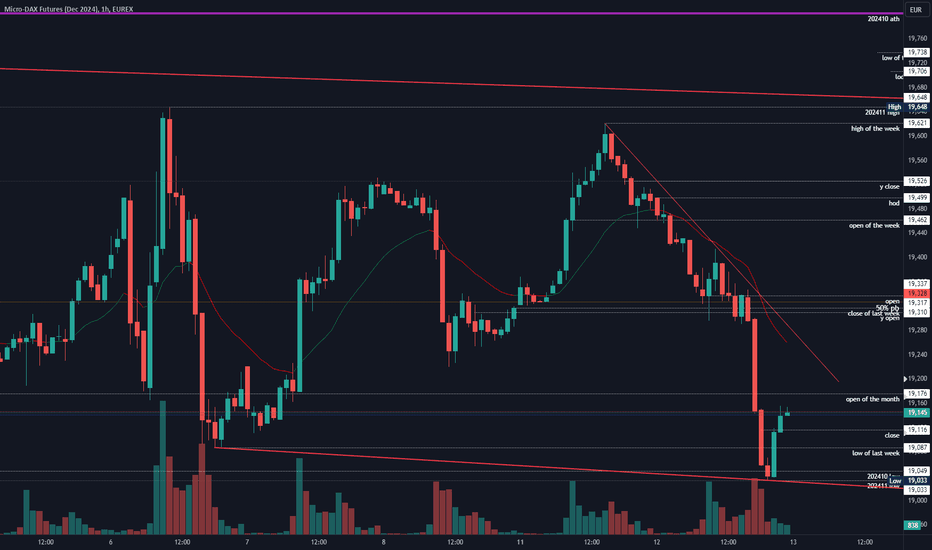

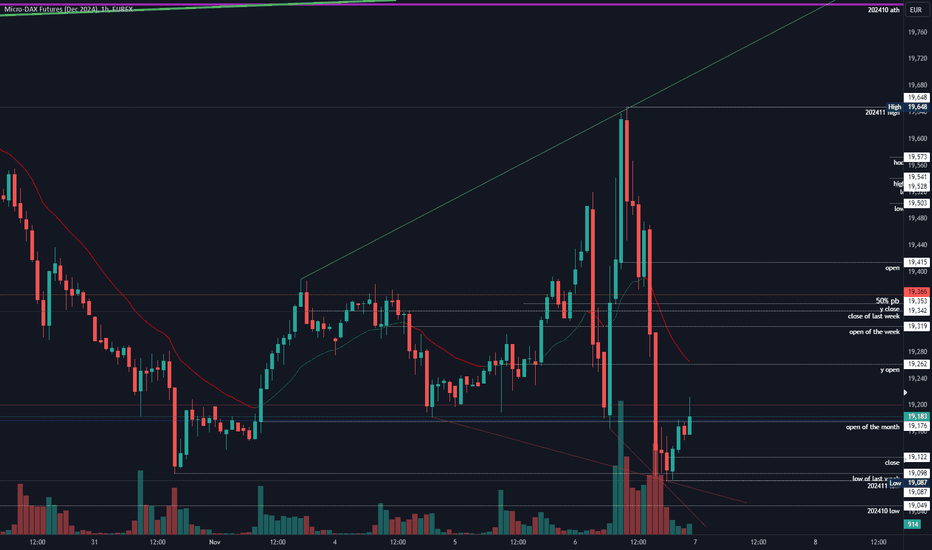

dax futures - Bullish. Any long near 19000 is a very good trade until we clearly break below 19000. Market is in a clear trading range 19000 - 19648. Maybe bears will retest 19000 tomorrow but it could also just continue to move up from US close. Only a daily close below 19000 would change things. BTFD.

comment: Daily chart continues to show alternating bull/bear bars and getting bearish around 19000 can only go wrong. If bears manage to continue below 19000 and close there, that would certainly change things big time but for now it’s a clear range, so play it.

current market cycle: trading range

key levels: 19000 - 19700

bull case: Bulls need to trap late bears and a bull trend during the asian session would help big time. Targets above are 1h 20ema at 19240 and then trying to break above the bear trend line. 50% retracement is around 19300 and this is the magnet we are oscillating around. Any long near 19000 is reasonable. Weekly 20ema for futures is 19100 and market could not close below it. Weekly on xetra is 18850, can we get there? Possible but for now I don’t think it’s more likely than a reversal up.

Invalidation is below 19000 (maybe give it 30-50 points of room).

bear case: Bears have going for them that they keep it below 19600 and the rejections are strong. On the weekly chart we now have made lower lows for 4 consecutive weeks but what do the bears accomplish? Bulls buy every dip and despite 4 bear weeks, we have gone nowhere. Until bears trap bulls with big selling below 19000, this will not change and we continue sideways. Bears need to keep this below 19250 to keep the momentum going. Above 19250 I heavily favor the bulls for 19300 and ignore the bear trend line and just move higher again.

Invalidation is above 19300.

short term: Bullish as long as we stay above 19000. Target above is 19600 and 20000 if bulls get freaky again.

medium-long term - Update from 2024-10-19: 20000 is the goal for 2024, if bulls do not get it until year end, it will probably not happen for the next 5-10 years. This market is beyond overvalued and will drop 30-50% in the next 5 years. I have no doubts about that. That fact should not be relevant to your trading at all.

current swing trade: None

trade of the day: Selling anywhere near the 1h 20ema was amazing.

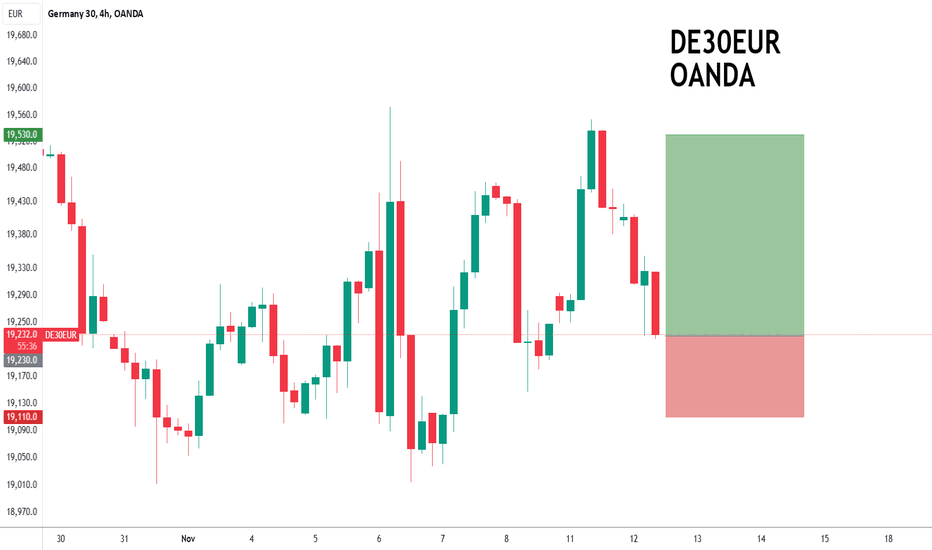

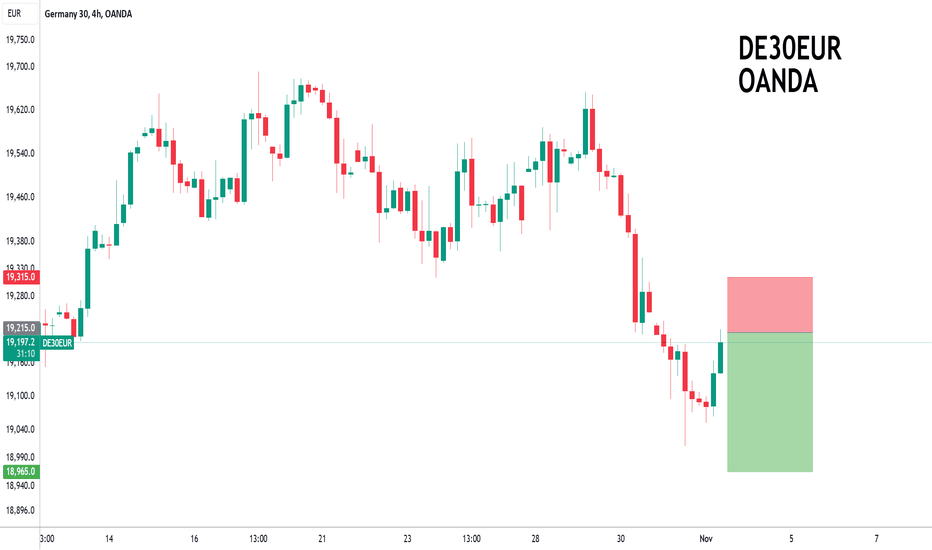

DAX to find buyers at current market price?GER40 - 24h expiry

Offers ample risk/reward to buy at the market.

Posted a Double Bottom formation.

Our short term bias remains positive.

Intraday dips continue to attract buyers and there is no clear indication that this sequence for trading is coming to an end.

The sequence for trading is higher highs and lows.

The trend of higher lows is located at 19280.

We look to Buy at 19230 (stop at 19110)

Our profit targets will be 19530 and 19610

Resistance: 19350 / 19420 / 19567

Support: 19200 / 19100 / 19003

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

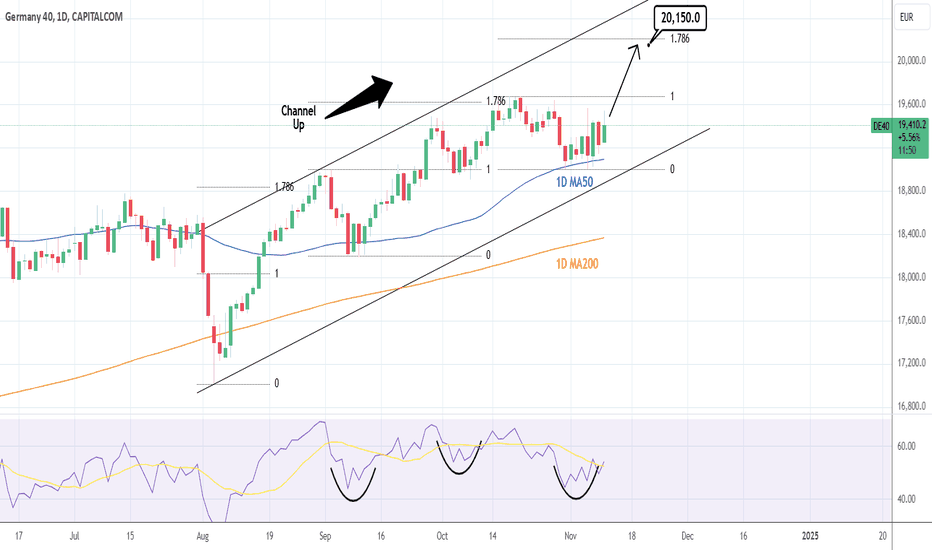

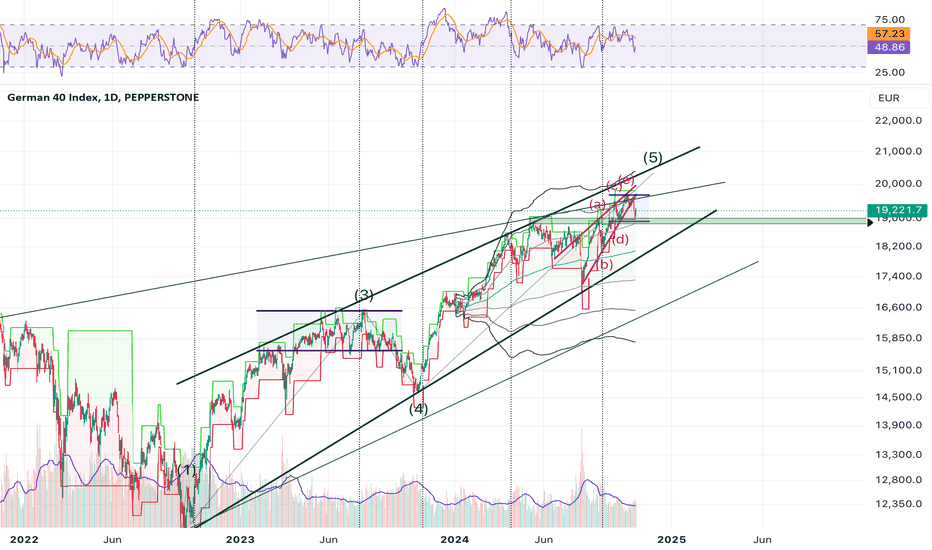

DAX: The 1D MA50 is holding. Expect rally.DAX is neutral on its 1D technical outlook (RSI = 53.908, MACD = 41.600, ADX = 23.126) as the price has been basically ranging since November 6th. The dominant pattern is still a Channel Up and it has held the 1D MA50 as support on multiple attempts since October 31st, which is a clear technical signal of an upcoming rebound. The last two HH tops were priced on the 1.786 Fibonacci extension and that is our target for this month (TP = 20,150)

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

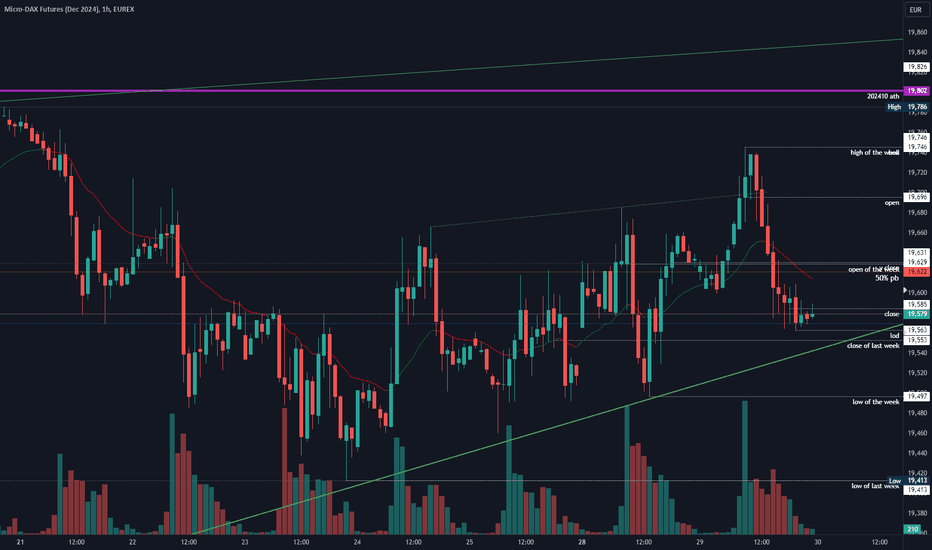

2024-11-11 - priceactiontds - daily update - daxGood Evening and I hope you are well.

tl;dr

dax futures - Neutral. Bulls need a strong move above 19600 for higher prices and bears a 1h bar close below 19500. Leaning very slightly bullish because overall market environment. On the daily chart the market is printing alternating bull/bear bars so your guess is as good as mine when this will end. For now it’s best to scalp and fade the extremes.

dax futures

comment : Slightly bullish bias was right and market just want higher since Globex open. 19600 was rejected as it was last week but at least bulls made higher lows and higher highs again. 19500 is a tough spot for a trade as of now. If bulls can keep it above that price, that would bring much higher prices in play. If we close a 1h bar below, we likely test down to 19350 or lower.

current market cycle: trading range

key levels: 19000 - 19700

bull case: Bulls had a decent day but inside prior range and they got rejected at previous resistance. Buying above 19500 was not profitable so far and that did not change today. Best for bulls would be to make 19500 support and poke 19620 enough times until bears give up. It’s currently in a week channel upwards or a trending trading range or whatever you want to call it, it does not matter because you trade them the same.

Invalidation is below 19000.

bear case: Bears need a 1h bar close below 19500 or more bulls will join the buying above 19500. The rejection from 19600 was reasonable strong but in an overall maximum bullish environment, this market will have a hard time going down. If we look at the last 3 bears legs down, they get weaker and I do think many bears will give up, if bulls try to push through 19600 with force. Another way to look at this from the daily tf is that bears prevented the bulls from a daily close above 19500 for 2 weeks now. This can only continue so much until bulls give up. Both sides have reasonable arguments and this is almost always the case in trading ranges.

Invalidation is above 19800.

short term: Neutral. Bulls need a strong move above 19600 for higher prices and bears a 1h bar close below 19500. Leaning very slightly bullish because overall market environment.

medium-long term - Update from 2024-10-19: 20000 is the goal for 2024, if bulls do not get it until year end, it will probably not happen for the next 5-10 years. This market is beyond overvalued and will drop 30-50% in the next 5 years. I have no doubts about that. That fact should not be relevant to your trading at all.

current swing trade: None

trade of the day: Any long before EU open with stop 19250 was reasonable and then after the move above 19500 it was tough. At that point 19600 was very likely but stop was very far away for a limited upside. The sell off from 19620 down to 19450 was much stronger than I expected.

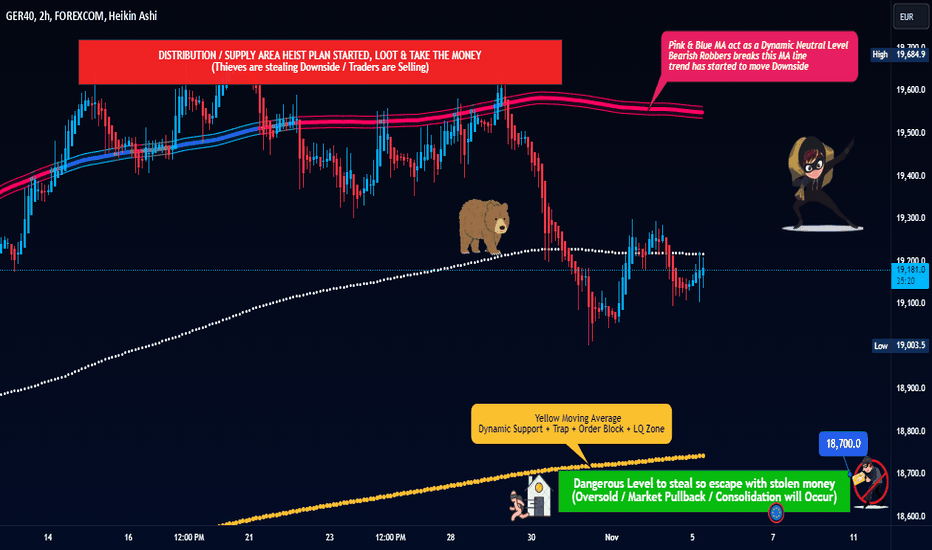

GER40 "Germany 40 Index" Money Heist Plan on Bearish Side.Ola! Ola! My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist GER40 "Germany 40 Index" Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry : Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe Recent / Nearest Swing High

Stop Loss 🛑: Recent Swing High using 2h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

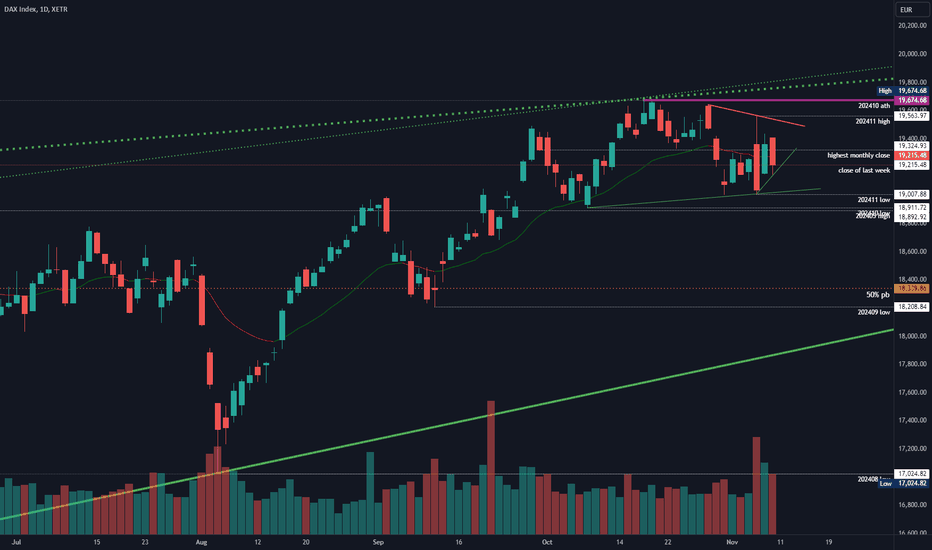

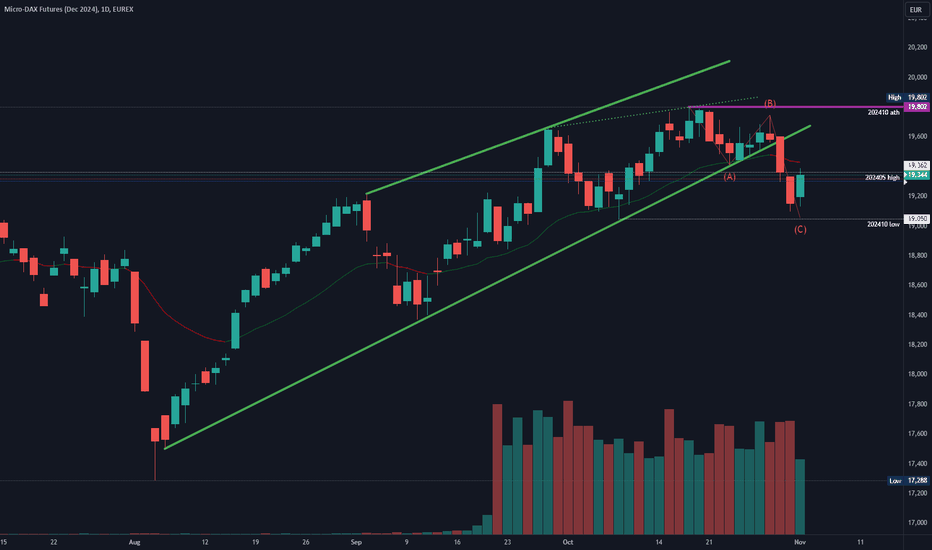

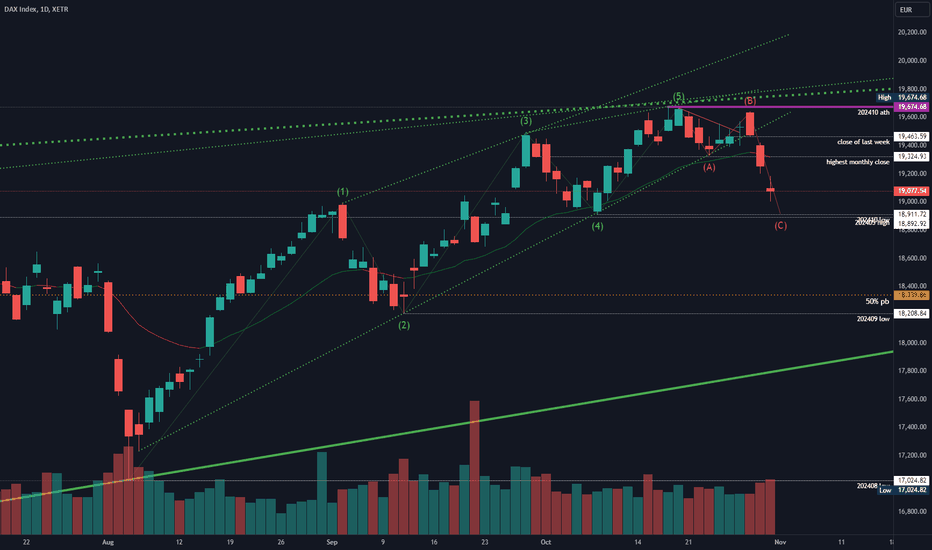

#202445 - priceactiontds - weekly update - daxGood Evening and I hope you are well.

tl;dr

dax xetra: Neutral. Choppy week with going nowhere. Market was moving sideways while other markets melted higher. Can’t be anything but neutral, since market is contracting in a tighter range. If I had to guess, I’d say bulls have a slightly higher chance of printing a new ath than bears breaking below 19000, just due to overall market euphoria. If bears break below 19000, measured move down is 18000. Bullish break above 19700 and we go for 20000. Buying below 19200 has been profitable for 2 months and I don’t expect it to fail next week.

Quote from last week:

comment: Big week for the bears since they broke the bull rally and most recent trend line, which turned the market neutral at previous support. Now comes the most important price action for the coming weeks. If bears get their strong second leg down, we will see 18200 in November, if we go sideways from here, odds drop for the bears and market is probably ranging more at the highs. It would also keep the possibility alive to print 20000 this year. The timing of the selling was in between very good earnings and mediocre outlooks. If we continue down, this would probably mean funds want to secure profits in this year and the selling could accelerate.

comment : Bears failed at 19000 which keeps 20000 alive and it’s more likely that we continue sideways than a break to the downside. Above 19600 I would favor the bulls to get it to a new ath and potentially to 20000. Wednesday was the most important day last week and I would join either side above or below that bar. Otherwise there is currently no deeper meaning of this trading range near the ath.

current market cycle: trading range

key levels: 18900 - 20000

bull case: Bulls failed on Wednesday where they were rejected big time from 19560 for 500 points down. They have been printing higher lows since and now they need a break above 19600 for 19700 and then potentially 20000. As of now the market is in balance around 19300 and the triangle will play out some more. Any long below 19200 has been profitable for a month, so look for longs in that area, until it’s clearly broken.

Invalidation is below 19000.

bear case: Even with the big reversal on Wednesday, bears do not have much right now. Support is holding and market is spiking up, rather than below. As long as bears can’t print a daily close below 19000, it is useless to look at this from a bearish point of view. Even if bears get below 19000, the weekly 20ema is around 18800, so the downside is probably very limited, while bulls have the big target 800 points higher.

Invalidation is above 19700.

outlook last week:

short term: Bearish for a second leg down, as long as we stay below 19400.

→ Last Sunday we traded 19254 and now we are at 19215. Monday and Tuesday were nothingburger and Wednesday crossed my invalidation line pretty fast. Wrong outlook anyway.

short term: Neutral 19000 - 19700, bullish above for 20000. I do think the triangle could play out some more and I am currently more willing to buy below 19200 than to short 19600.

medium-long term - Update from 2024-10-19: 20000 is the goal for 2024, if bulls do not get it until year end, it will probably not happen for the next 5-10 years. This market is beyond overvalued and will drop 30-50% in the next 5 years. I have no doubts about that. That fact should not be relevant to your trading at all.

current swing trade: None

chart update: Changed two legged correction into 3 legs down, target is the same for now.

2024-11-07 - priceactiontds - daily update - daxGood Evening and I hope you are well.

tl;dr

dax futures - Neutral. Bullish read was perfect and good for 300+ points. Now the air gets thinner again. Above 19500 longs are probably not a good trade since the downside is sub 19100 and upside probably limited to 19700 max. If market holds above the 1h 20ema tomorrow, I’ll try longs but if now, we could see some profit taking again.

comment : Hope you took the amazing longs today. Now it’s very tough to be a bull above 19500. We have big rejections from 19500 and 19600 on Wednesday and we have to assume that these prices continue to be resistance. If you want to buy this you would have to risk down to 19080 to make maybe 100 points. Not a good trade. I would rather try to scalp for 10-20 points than coming up with good trades from 19500. I will look for longs near the 30m or 1h 20ema, if they show to be support. No shorts until US starts the selling too.

current market cycle: trading range

key levels: 18900 - 19700

bull case: Bulls want to retest 19650 and then also the ath at 19802. No reason to not get there because we have multiple measured move targets or patterns that lead there or higher. 20000 is still possible, if we get follow through buying tomorrow. If you are thinking “this can’t go higher, the german economy is a dumpster fire and all news are beyond bad blablabla” I got bad news for you. This has nothing to do with any logical reason to trade near the ath. Everyone who wanted to short this because of logical reasons already has and market is moving where the least resistance is. Call it a pain trade if you will. We have 2 years of negative GDP print and dax is going for 20000. Stop looking for reasons why markets are doing stuff. Senseless waste of time and energy.

Invalidation is below 19000.

bear case: Bears want to keep 19500-19650 resistance to prevent more bulls to join for 19800 or 20000. I would not look for shorts to be honest. US markets are unstoppable and you would try to short during a euphoric wave. I do think below 19400 more bulls would cover again and we can trade to 19100 again but I would only join them on strong momentum but I still favor the bulls to print 20000 rather than bears selling this down below 19200 again.

Invalidation is above 19700.

short term: Neutral. Leaning slightly bullish if we just continue higher and we have a clear support with the 30m or 1h 20ema.

medium-long term - Update from 2024-10-19: 20000 is the goal for 2024, if bulls do not get it until year end, it will probably not happen for the next 5-10 years. This market is beyond overvalued and will drop 30-50% in the next 5 years. I have no doubts about that. That fact should not be relevant to your trading at all.

current swing trade: Took most off on 19500, leaving runner for 20000.

trade of the day: I called the long and long it was.

2024-11-06 - priceactiontds - daily update - daxGood Evening and I hope you are well.

tl;dr

dax futures - 1 daily bar to almost engulf 2 months of price action. The rejection above 19600 was strong enough to expect that the highs are in but I am not convinced. I highly doubt dax will be flat or lower while wallstreet is doing an early Santa rally on coke. I am much more bullish and expect 19000 to hold. Decent 1h bear bar that closes below 19000 can convince me to turn bear.

comment: Tough to ponder what to make of big up on US markets while dax sold off hard to get below 19100 again. I do think 19000 is huge support and bulls are favored but 6 consecutive daily bar closes below the ema is pretty bearish. Will continue to look for longs around 19100 until 19000 is clearly broken and we go down.

current market cycle: trading range

key levels: 18900 - 19700

bull case: Bulls got above 19600 which was an amazingly fast up move but the sell off was even better. Bulls have still no reason not to buy this around 19100. It has been profitable for a month now and given price action on the other markets, I am having a very hard time to be bearish. Bulls need to get above 19300 for more bears to cover and then they can try to go 19500 or higher again. Most outrageous target of 20000 is still on the table.

Invalidation is below 19000.

bear case : Bears see the perfect head & shoulders pattern on the daily chart. Also the huge rejection above 19600 and the 6 consecutive closes below the daily ema. Bears have all the arguments on their side to try and break below 19000. Is the current market environment good for them? I don’t know. It’s not that often that major western indices converge that much but let’s see tomorrow. Measured move down brings us to 18300. Make no mistake, I absolutely, 100% expect that price to be hit again this year. This rally is nothing but coke fueled euphoria based on hopes and dreams the next US government will wave a magic wand and fulfill wallstreet’s dreams.

Invalidation is above 19700.

short term: Bullish as long as 19000 holds. I think we can print 20000 before this corrects big time. Below 19000 I am wrong.

medium-long term - Update from 2024-10-19 : 20000 is the goal for 2024, if bulls do not get it until year end, it will probably not happen for the next 5-10 years. This market is beyond overvalued and will drop 30-50% in the next 5 years. I have no doubts about that. That fact should not be relevant to your trading at all.

current swing trade: If 19000 holds tomorrow, will do a swing long and hope for a homerun to 20000.

trade of the day: Wild swings in both directions. Globex was obviously as bullish as it gets but changing to full bear mode on EU open and hold to 19100 was tough.

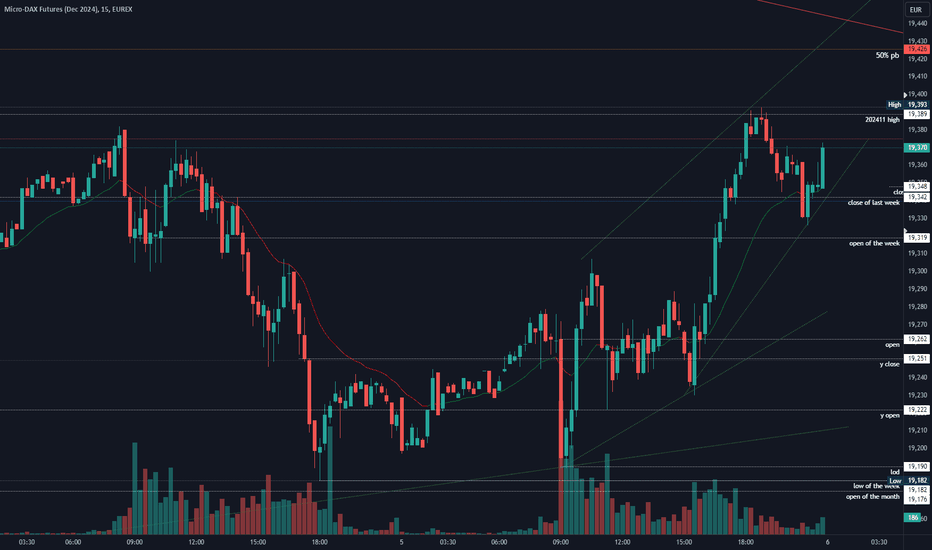

2024-11-05 - priceactiontds - daily update - daxGood Evening and I hope you are well.

tl;dr

Indexes - Who wants to be long into election day? That question pondered my mind couple of times today but here we are. Surprising bull strength. I said it was too soon for the bigger second bear leg down but today was also too strong for bulls at this point. No bigger opinion on today’s price action. Most markets traded back up to the 50% retracement and near their daily 20ema and that spot is as neutral as it gets. Still leaning more bearish than bullish and I would not be surprised if the Globex session sell this hard.

dax futures

comment: Clear trading range 19100 - 19400. I expect bears to come around soon and reverse it down. If we print above 19450, I am most likely wrong about this. Friday’s high was not broken and we are right under the 20 ema and 50% retracement. Many reasons for bear to short again. Above 19450 bears will probably give up and we test 19600 or higher. Market is neutral around 19250.

current market cycle: trading range

key levels: 18900 - 19400

bull case: My line in the sand for bulls continues to be 19400-19450. If they break above that, bears will likely give up. Other than that I don’t have many arguments for them. We are below the 50% and daily ema, if bears come around here, bulls just have to cover because it could easily go back down to 19250 or lower.

Invalidation is below 19000.

bear case: Bears need to keep this below 19400. If they can manage, next target is test of the open price 19260 and then we could get a big second leg down. We have a decent two legged pullback now on the 4h chart and today’s high could fit a proper channel.

Invalidation is above 19400.

short term: Bearish if we stay below 19420ish (max 19450). I think the odds of a reverse are much better than more upside.

medium-long term - Update from 2024-10-19: 20000 is the goal for 2024, if bulls do not get it until year end, it will probably not happen for the next 5-10 years. This market is beyond overvalued and will drop 30-50% in the next 5 years. I have no doubts about that. That fact should not be relevant to your trading at all.

current swing trade: None

trade of the day: Buying the EU opening reversal was an amazing trade. Perfect double bottom with Monday’s low.

2024-11-04 - priceactiontds - daily update - daxGood Evening and I hope you are well.

tl;dr

Indexes - Most went sideways today and we got some marginally lower lows. That was decent enough to disappoint bulls who were used to BTFD for a long long time now. I do think some expansion of the current range is possible but I doubt we get a bigger breakout tomorrow due to US elections. Will the election effect the market big time? No idea but my guess is less than many expect. Can either side end the party for the 0.1% and make them sell their overvalued stonkz? Probably not but I am open to surprises. My guess is we will chop wildy back and forth, like today’s US open. Bears will likely get their second leg down, but it’s too soon.

dax xetra

comment: 50% pullback of the current range from Thursday’s low to Friday’s high is around 19260 and we closed 19260. Market is in balance at that price and I expect more sideways before we get another impulse down. To guess if we hit 19000 before 19350, is impossible and you should not trade based on those questions. Middle of the range is the worst place for trades, so wait.

current market cycle: trading range

key levels: 18900 - 19400

bull case: My line in the sand for bulls continues to be 19400 and until they break that price, bears are in full control. For tomorrow I expect more buyers around 19000-19100 and I will continue to look for longs in that area, until it’s clearly broken.

Invalidation is below 19000.

bear case: Bears prevented bulls from printing 19400, which showed strength and bulls finally gave up around 2 p.m. cet where we broke below 19300. The selling was much weaker than Friday’s rally and already had 3 legs down. Maybe bears can push this down to 19000-19090 but I don’t think the odds are good to take that trade. Shorts above 19300 can work. Most important for now is to not get trapped into bad trades like shorting below 19200 or buying above 19350.

Invalidation is above 19400.

short term : Neutral. Market needs to move more sideways before we get another impulse, which will probably be down for a second leg. Will look for shorts above 19300.

medium-long term - Update from 2024-10-19: 20000 is the goal for 2024, if bulls do not get it until year end, it will probably not happen for the next 5-10 years. This market is beyond overvalued and will drop 30-50% in the next 5 years. I have no doubts about that. That fact should not be relevant to your trading at all.

current swing trade: None

trade of the day: Shorting 19350 since it was bigger resistance and market tried 3 times to get above and failed.

Heading into 50% Fibonacci resistance?GER40 is rising towards the resistance which is a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 19,326.61

Why we like it:

There is a pullback resistance level that aligns with the 50% Fibonacci retracement.

Stop loss: 19,557.03

Why we like it:

There is a pullback resistance level.

Take profit: 19,073.13

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

#202444 - priceactiontds - weekly update - daxGood Evening and I hope you are well.

tl;dr

dax xetra: Bearish. Bears finally got some follow through lower and got near 19000. Next they want to keep the pullback shallow and get a second leg down to weekly 20ema around 18800 which is also where the next bull trend line is on my chart. There we will see if it was low enough for bulls to buy or if we have to get even lower to 18000. Bulls need to get above 19400 and bears below 19000.

Quote from last week:

Market closed 200 points lower than last week but was mostly range bound. Bull trend line and the daily 20ema are still intact and we did not get the expected breakout. Market has absolutely no more room to inside the pattern. End of September market was at 19470 so we have a month of going nowhere behind us. Was it bulls scaling into longs for 20000 or bears scaling into shorts because the upside potential is probably very limited? Very likely both. Going into next week I can’t be anything but neutral until we see one side clearly giving up. The one thing that's clear on the weekly chart for the past 12 weeks is that bears only managed to print 1 bear in between bull bars. So 3 out of 13. That is really something and we should not expect it to end until it very clearly does. Don’t try to be the first.

comment: Big week for the bears since they broke the bull rally and most recent trend line, which turned the market neutral at previous support. Now comes the most important price action for the coming weeks. If bears get their strong second leg down, we will see 18200 in November, if we go sideways from here, odds drop for the bears and market is probably ranging more at the highs. It would also keep the possibility alive to print 20000 this year. The timing of the selling was in between very good earnings and mediocre outlooks. If we continue down, this would probably mean funds want to secure profits in this year and the selling could accelerate.

current market cycle: trading range

key levels: 18200 - 19700

bull case: Bulls did a decent job at keeping the market above 19000, which was important to disappoint eager bears from Thursday. If they now can trade above the daily 20ema and 19300, it would further weaken the bear case and we would likely continue inside the current trading range. 20000 is still the target for the bulls this year.

Invalidation is below 19000.

bear case: Bears showed some signs of life and we are now at the big decision spot 19000. Bears need to get better momentum going if they want to print below 18500. Above 19500 I can’t imagine many bears holding onto shorts because the risk of trading above 19700 are too great then. A measured move target down would lead to 18300 and that aligns with a 50% retracement and the September low. That is my preferred path forward over the next 1-2 weeks.

Invalidation is above 19400.

outlook last week:

short term: Neutral. Clear levels to break for both sides.

→ Last Sunday we traded 19463 and now we are at 19254. Ok’ish outlook.

short term: Bearish for a second leg down, as long as we stay below 19400.

medium-long term - Update from 2024-10-19: 20000 is the goal for 2024, if bulls do not get it until year end, it will probably not happen for the next 5-10 years. This market is beyond overvalued and will drop 30-50% in the next 5 years. I have no doubts about that. That fact should not be relevant to your trading at all.

current swing trade : None

chart update: Changed two legged correction into 3 legs down, target is the same for now.

DAX to attract sellers at market price?GER40 - Intraday

4 negative daily performances in succession.

Short term bias has turned negative.

Preferred trade is to sell into rallies.

Yesterday's Marabuzo is located at 19161.

Expect trading to remain mixed and volatile.

20 4hour EMA is at 19235.

We look to Sell at 19215 (stop at 19315)

Our profit targets will be 18965 and 18905

Resistance: 19100 / 19200 / 19300

Support: 19003 / 18900 / 18800

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

2024-10-31 - priceactiontds - daily update - daxGood Evening and I hope you are well.

tl;dr

Indexes - October is behind us and markets closed at the monthly lows. Clear sell signal going into November, since this is an amazing bear breakout. Markets are now in search for a intermediate bottom to form a proper channel. Most markets are also at bigger support and we can expect some more sideways to up movement before we get another impulse. That does not mean we can’t print another huge down day on Friday and have the pullback next week.

dax xetra

comment: Monthly chart shows a rejection at the top of multiple patterns and odds favor more downside over the next 1-2 months to have something of a pullback in this bubble. Weekly 20ema is around 18800, so only 200 points lower, which is reasonable to hit over the next days but we can’t expect that ema to be broken too easily. My rough target for November is 18000-18500. Daily chart shows huge bear gap bars and market needs some sideways to up movement soon.

current market cycle: trading range - bull trend is over.

key levels: 18900 - 19400

bull case: Bulls running for the exits and want to take profits before they are gone. 19000 is a decent target for market to take a breather and move sideways to up. Targets for bulls are gap close to 19270, which is also the daily 20ema. 19400 is far but could happend. I can’t imagine anything above that for now. 18900 has to hold, otherwise we see a flush down to ~18340, which is the 50% pullback.

Invalidation is below 19000.

bear case: Bears are in full control of the market after 3 huge selling days. Volume is increasing and xetra has not touched the 1h 20ema since Tuesday. Bears can view this leg down as w1, which already had 3 nested legs down (1 per last 3 days). Some pullback and sideways movement is expected. If bears can keep this below 19300, that would show strength and w3 would accelerate down in that case, since bulls had no better relief. Next target is 18900 and below that is 18800 (weekly 20ema), below that is nothing until 18400.

Invalidation is above 19300.

short term: Bearish but more cautious and only selling pullbacks again. 18900/19000 should be bigger support. Expecting two more legs down in November, rough target is 18000.

medium-long term: Will update this over the weekend.

current swing trade: None

trade of the day: ~19170 was rejected many times and bears had enough chances to get on the short train. 19000 was obvious support and one should have covered there.

2024-10-30 - priceactiontds - daily update - daxGood Evening and I hope you are well.

tl;dr

Indexes - Many bull trend lines are gone for good. Bears closed at the lows and they desperately need follow through tomorrow. If nq won’t keep the markets afloat tomorrow and drops below 20400, we will likely see a big sell off with 20200 or lower. Dax looks done, clear break of the trend line, swing shorts are juicy here.

dax futures

comment: Daily chart now looks really bad. Next support is around 19000-19100. If bears fail to generate follow through tomorrow, we could retest the bull trend line even up to 19600 again but as of now I heavily favor the bears to go deep red into the weekend.

current market cycle: trading range more likely than start of a bear trend but we only know once we reach 19000 and see if it’s support or not

key levels: 19000 - 19800

bull case: Bulls gave up today after the market failed to print a better close yesterday. Since they have been trying to go above 19800 for so long now, I do think many will wait for a deeper pull back to at least 19000 before buying again. They could try to retest the bull trend line up to 19600 but as of now, it’s a stretch. Got not much for the bulls here.

Invalidation is below 19000.

bear case: Bears now have the best setup in a long time. Clear trend line break and market has tested the highs more than enough. Bears next target is 19000 where we could expect bigger support. 19000 is the previous October low and an exact measured move from the current range down. I will watch futures open in an hour and will likely get on some swing shorts.

Invalidation is above 19620.

short term: Bearish for 19000 if we stay below 19620. My bullish targets are met with this lower high and trend line break. Expecting a deeper pull back before a year end rally.

medium-long term - Update from 2024-10-19: 20000 is the goal for 2024, if bulls do not get it until year end, it will probably not happen for the next 5-10 years. This market is beyond overvalued and will drop 30-50% in the next 5 years. I have no doubts about that. That fact should not be relevant to your trading at all. Right now there is no selling pressure. I am confident that we will hit 17000 in 2025 but timing is more important than price, so let’s not waste brain capital on being bearish for now.

current swing trade: None

trade of the day: Globex marked the high of the day and market just sold off. 19300 was expected to be bigger support and market showed a decent reaction where one should have covered shorts.

2024-10-29 - priceactiontds - daily update - daxGood Evening and I hope you are well.

tl;dr

Indexes - Mixed and still undecided. Not one broke out of their patterns today and I expected the breakout last Friday. Dax faked to the upside to sell off to the bull trend line again while nasdaq printed a strong bullish outside bar and is now near the top of the bull wedge. All patterns are still valid and the only constant is that bears are not able to generate follow through selling, so naturally market tries the opposite.

dax futures

comment : Daily chart says it all. Bulls not strong enough to close a day at the highs but bears even weaker and not able to print lower lows. 19600 is the middle of the range and mean reversion pays. I still lean more bullish than bearish for another run at the ath.

current market cycle: late bull trend

key levels: 19400 - 20000

bull case: Bulls broke above the minor bull channel but it was a trap and market sold off to near the bull trend line. As long as this line holds and market makes higher lows, I favor the bulls to retest the ath or go higher for 20000. The current trading range is fairly tight, so there is no deeper meaning to what the market is doing. No side has an advantage and we are waiting for the next impulse. Play the range until it clearly stops working.

Invalidation is below 19490.

bear case: Bears had a decent sell off today but market closed only 40 points lower. Bears need to start printing lower lows but most bears use the lows to cover and scalp out of positions.

Invalidation is above 19750.

short term: Bullish below 19600 for at least 19700. Stop is 19490

medium-long term - Update from 2024-10-19: 20000 is the goal for 2024, if bulls do not get it until year end, it will probably not happen for the next 5-10 years. This market is beyond overvalued and will drop 30-50% in the next 5 years. I have no doubts about that. That fact should not be relevant to your trading at all. Right now there is no selling pressure. I am confident that we will hit 17000 in 2025 but timing is more important than price, so let’s not waste brain capital on being bearish for now.

current swing trade: None

trade of the day: Buying before EU open was good if you were awake. The selling after the open surprised me big time and I absolutely did not expect bears to be able to get all the way down to below 19600. Good for you if you took it. Best trade was obviously selling 19700 and just holding. Was tough to take if you were long before, because the breakout look good enough.

#202443 - priceactiontds - weekly update - dax Good Evening and I hope you are well.

tl;dr

dax xetra : 4h chart shows a triangle if you adjust the bull trend line from August. It will break out on Monday and I clearly favor the bears to break below and go for 19000. Above 19650 I am wrong and we could see the leg up to 20000. Bear confirmation is only below 19300. Until the breakout, you can either wait or play the tight range.

Quote from last week:

comment: Bullish was good but the rally is losing steam. We are in the final leg before we probably transition into a trading range before we go down. 20000 is the target for bulls and I expect them to get it one way or the other. Preferred path is a spike followed by huge profit taking. Nothing about the chart is good for bears and I would not even think about shorts, before we see some decent selling again. You never want to be early in a trade as a retail trader.

comment: Market closed 200 points lower than last week but was mostly range bound. Bull trend line and the daily 20ema are still intact and we did not get the expected breakout. Market has absolutely no more room to inside the pattern. End of September market was at 19470 so we have a month of going nowhere behind us. Was it bulls scaling into longs for 20000 or bears scaling into shorts because the upside potential is probably very limited? Very likely both. Going into next week I can’t be anything but neutral until we see one side clearly giving up. The one thing that's clear on the weekly chart for the past 12 weeks is that bears only managed to print 1 bear in between bull bars. So 3 out of 13. That is really something and we should not expect it to end until it very clearly does. Don’t try to be the first.

current market cycle: Late bull trend. Has likely ended already and we are now in a trading range.

key levels: 19000 - 20000

bull case: We learned nothing last week, other that market is in balance at 19500. Bulls need to stay above 19320 to keep the trend alive and their target is 20000. How likely is follow through buying above 20000 and another bull break above for much higher prices? I can’t think of anything less likely tbh. That obviously does not mean it can not happen. I was wrong about the top a couple of times in the past 3 years.

Invalidation is below 19300.

bear case: If you look at this chart and go “I really want to short this right now”, dm me and let’s do a remote counselling session. You are so out of touch with the market, that there has to be deeper stuff going on inside you, causing that. Nothing about this is bearish and until we see actual selling pressure, we should not waste brain capacity on bearish thoughts. 19300 is the clear target for a daily close below. Once bears have that, we will likely test down to 19000 and there we have a big decision. Market can either find new buyers there in hopes of 20000 or most bulls are done for the year and let it go. Below 19000, nothing can save this until 18000. That is the lowest I can see this go this year and even that price is very unlikely.

Invalidation is above 19400.

outlook last week:

short term: Bullish for 20000. Can see a pullback first or not. We are in the middle of the channel, which is always a bad spot. Trade momentum or long a decent pullback.

→ Last Sunday we traded 19779 and now we are at 19463. Wrong outlook. Thesis still stands. If we keep above 19300, market wants 20000.

short term: Neutral. Clear levels to break for both sides.

medium-long term - Update from 2024-10-19: 20000 is the goal for 2024, if bulls do not get it until year end, it will probably not happen for the next 5-10 years. This market is beyond overvalued and will drop 30-50% in the next 5 years. I have no doubts about that. That fact should not be relevant to your trading at all. Right now there is no selling pressure. I am confident that we will hit 17000 in 2025 but timing is more important than price, so let’s not waste brain capital on being bearish for now.

current swing trade: None

chart update: Adjusted the potential two legged correction