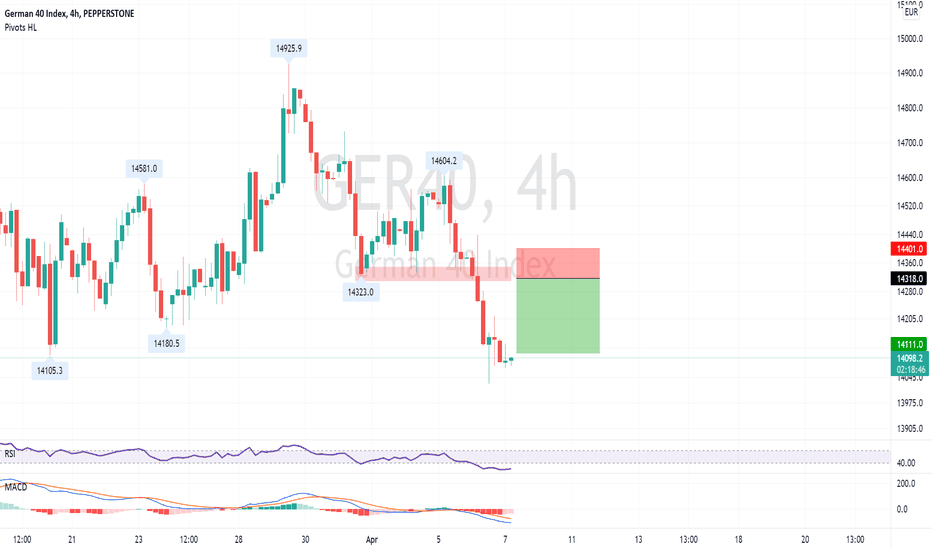

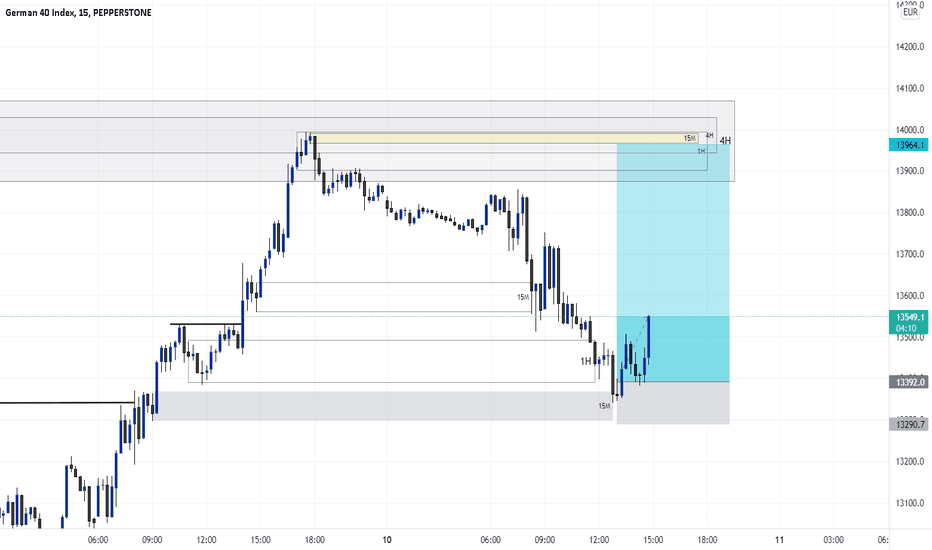

GER40 Sell the previous support.GER40 - Intraday - We look to Sell at 14318 (stop at 14401)

Short term bias has turned negative.

Previous support at 14300 now becomes resistance.

We look for a temporary move higher.

20 1day EMA is at 14316.

Our profit targets will be 14111 and 14061

Resistance: 14150 / 14200 / 14300

Support: 14000 / 13900 / 13800

Ger40signals

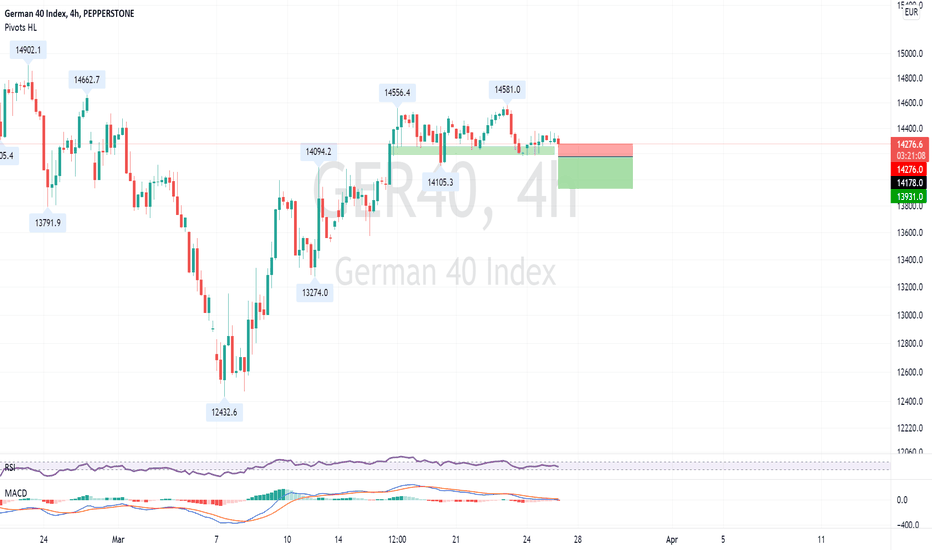

GER40 Sell a break setup.GER40 - Intraday - We look to Sell a break of 14178 (stop at 14276)

Daily signals are bearish.

A break of yesterdays low would confirm bearish momentum.

50 4hour EMA is at 14230.

The bearish engulfing candle on the daily chart is negative for sentiment.

Our profit targets will be 13931 and 13841

Resistance: 14380 / 14500 / 14580

Support: 14180 / 14100 / 14000

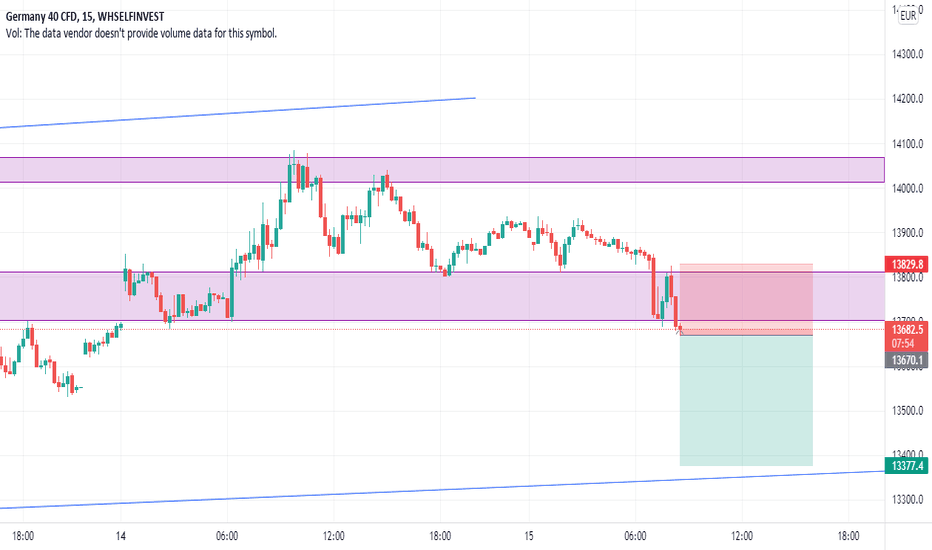

GER40 Buy a break setup.GER40 - Intraday - We look to Buy a break of 14561 (stop at 14469)

Short term bias is bullish.

14556 has been pivotal.

A break of the recent high at 14556 should result in a further move higher.

There is no clear indication that the upward move is coming to an end.

Our profit targets will be 14788 and 14848

Resistance: 14400 / 14550 / 14800

Support: 14250 / 14100 / 14000

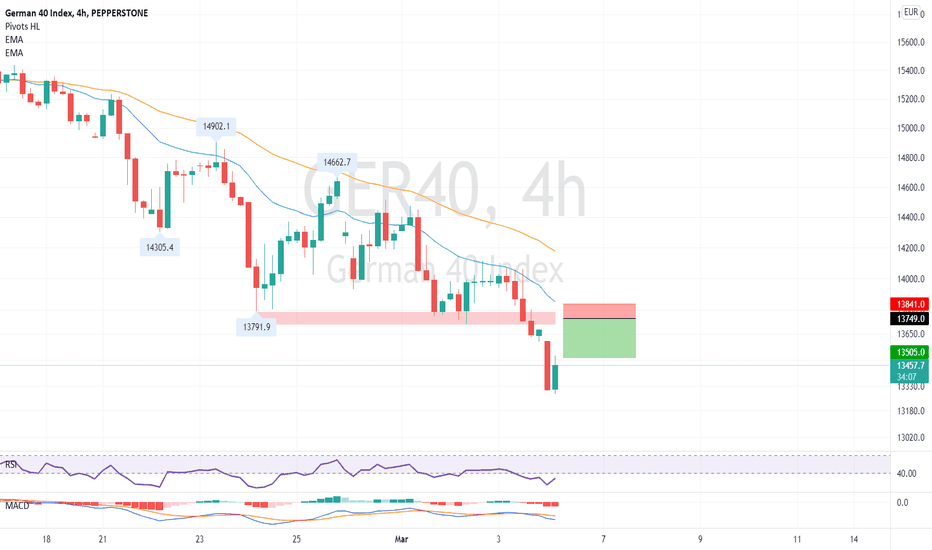

GER40 Sell the previous support.GER40 - Intraday - We look to Sell at 13749 (stop at 13841)

Our bespoke support of 13800 has been clearly broken.

Previous support at 13800 now becomes resistance.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

Daily signals are bearish.

Our profit targets will be 13505 and 13455

Resistance: 13500 / 13600 / 13800

Support: 13300 / 13150 / 13000

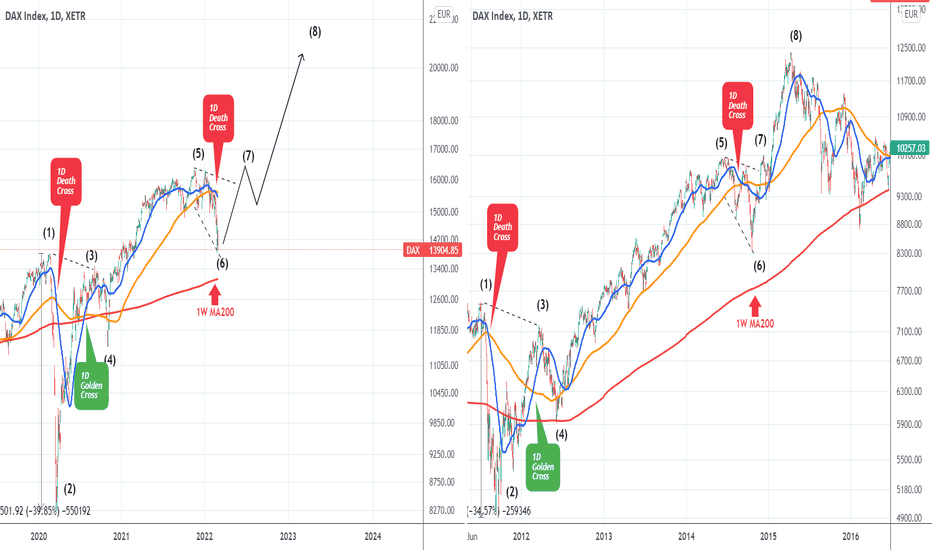

DAX is pricing the long-term bottom for the 20k waveThis is a fractal from the past. DAX's current Bearish Megaphone pattern resembles that of June - October 2014. In fact the whole price action from the February 2020 collapse due to the COVID outbreak, is similar to the July 2011 - October 2014 sequence.

See how all major formations align almost perfectly between the two: Death and Golden Crosses on the 1D time-frame, the 1W MA50 (red trend-line) and all legs from (1) to (6) so far. Right now, DAX is at the bottom of the Bearish Megaphone on leg (6). If that holds, then we may see a continuation of the 2014 pattern to a leg (7) which should be near the All Time High (ATH) and if the fractal continues to play out, possibly a hyper rise to (8) around 20000.

*Interesting fact: 2014 was the year when Russia annexed Crimea and threatened the rest of Ukraine. Is this Déjà vu?

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------