Make sure to focus on improving in every aspectNote I am using GBPJPY, a favorite of high leverage day gamblers as it has the biggest range of the 30 leverage pairs.

I am not "spreading FUD", if day gamblers want to lose their money I do not care. Actually I like it.

Finding success is satisfying but additionally watching others fail has an added sweetness that is irresistible.

This is simply a reminder to be logical, and since we try to always better ourselves we have to make sure to better ourselves on all aspects.

It sounds simple like this but I assure you it is simple when you are told it, like hindsight.

People think they are supermen that think of everything, never miss anything, and are going to buy at bottoms and sell at tops.

Well to people that think that: good for you. I am no superman. And believe me I'm not being humble I hold myself to high standards and have a big pride.

Warren Buffett is no superman either. Neither is George Soros. Nor Jim Simons, he made real money decades after buying his first future contract and needed to hire someone to help him out with stocks which he did not know that well.

You may ask "But MrRenev how do I improve on myself and my trading? I do not even know where to start, I do not even know what to improve in".

Well you force yourself to have a rational organised mind, write it down; and you take your chart screen, sit in front of it, and stay there for the next 50 years.

==> Read, read, read. Watch videos, read articles like this one or (I'm not sure if I can mention potential competitors), go on forums, read books if you want.

I would call this part the "fun" part, or the leisure part. Watch videos you find interesting, even read memeposts on the internet, as long as you can tell what is bs what is not, even absolute trash will teach you how others think or will make you think or will show you others mistakes.

==> The second part, the laborious one (it's okay when you get into it you won't see the hours). You open excel, you open tradingview, you get a tool to save screenshots automatically, you open the calculator, you open a CME window, you open notepad/sublimetext. And you grind. You take in vast amounts of data, process it, look at the stats, and you learn. You ask questions such as "what are other participants doing? What are their holding periods" and so on.

So here is the secret holy grail:

R.D. Wyckoff started as a stock runner for a New York brokerage at 15 years old. He started speculating at least 10 years later, after having learned much from the charts and his clients mistakes.

W.D. Gann is the son of a cotton farmer and started hearing and learning about markets at a young age. He then went to a business school (useless) and worked for a broker, like Wyckoff he learned from his clients mistakes and then started proprietary trading.

George Soros started in 1954 as a clerk, then arbitrage trader, in 1959 he was an analyst for euro stocks, until 1963 when he became a VP.

He started a fund in 1966 with his employer money (correct me if I am wrong) to try out his trading strategies - developed during his 12 years in the business.

Don't just "try to make money", improve on everything and it will come with time. Remember, the most toxic tryhards are the best players in sports and video games. Same thing here.

If your goal is not to be "the best I can" and just "make money", McDonald's has job offers available, good luck as a burger flipper, and I'm not sure I'd want to eat those.

Gitgud

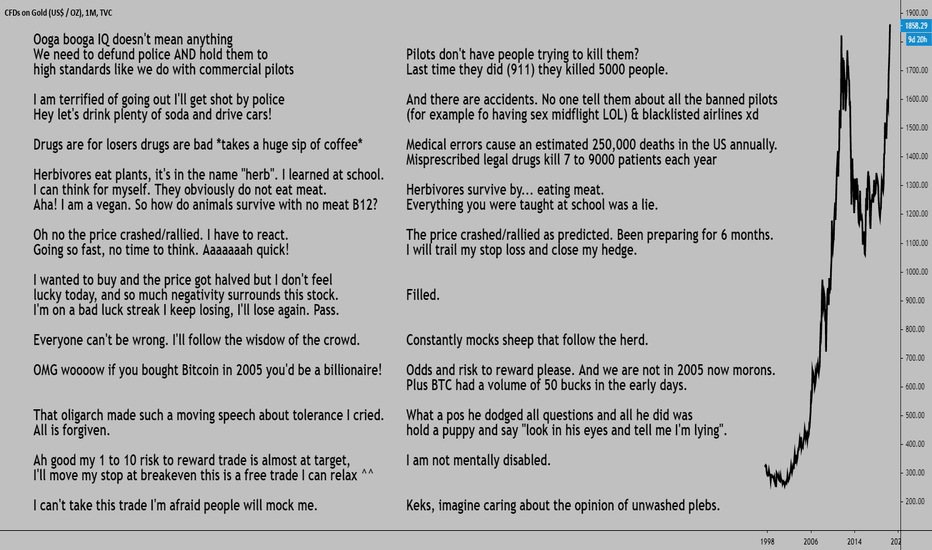

Emotional losers versus rational mastersRidiculous people think they have to act like robots to be good at this. I yell at my screen celebrate and chant I'm the best when I win and shout Bitcoin is a ponzi to friends all the time for fun.

What matters is obviously the way they think and the buy/sell actions they take, with how it makes them feel or with logic? You don't get good by being Michael Myers lol what an idea really.

"Emotional people" are those that do not think rationally, and this is decided even before birth. For them there is no hope.

No amount of £4500 trading courses will change that. Those in the middle on the spectrum can maybe work on it.

Probably a waste of time, you really need a pure clean mind not a naturally foggy mind that on top of that has to work double to control itself and remember all kinds of rules.

Oh and also as an added handicap all those days spent on "emotions in trading" are days not spent on looking at trends, backtesting, reading about central banks...

People care about a handicapped deformed kid that becomes a boxing champion against all odds, no one cares if an emotional becomes good at trading.

There is really no point wasting time, but the thing is... do the emotionally "thinking" know that they are emotional?

You don't have to be absolutely perfect but all those people that make absolutely no sense and consistently find themselves in those examples (get pissed at police for no reason, follow the herd, notice their opinions get changed easilly by whoever was speaking the more loud, try being right in a probability thing etc) should quit.

In an experiment (Kahnemann and Tversky) asked people questions no one knows the answer to, with the answer being a percentage, and they spinned a wheel all random. They found that the people they asked were complete sheep that picked numbers close to the number shown by the wheel because reasons.

Peasants have what is called hindsight bias. With no proof they randomly go ahead and claimed they knew something (sort of like after mocking "climate deniers" EVERY ONE will claim - AND ACTUALLY BELIEVE - they knew it was a hoax/exageration all along).

They don't really think logically making it even harder for them to remember what they thought, and become persuaded of being "masters". And then take mind bogglingly stupid trades and are so persuaded they are right they hold and hold and hold. And then get rekt.

"Ooga booga I KNEW it would go up and it did. I'd better use that visionary brain to make money now, next time I'll kill it!"

The crazy thing is the actually believe this xd

They didn't buy because they "knew price would go down". I can guarentee that if the price goes down they say "Bah. I was right. Knew it all along that's why I didn't buy.". If it goes up 100/100 times they'll say they knew it too. Maybe you can try it with people around you. Talk about some stock, then a while later tell them the price went down "I knew it" should come. Wait a while for them to forget and say the price went up. Maybe picking a few ones will work better because just 1 they might remember.

MadCuzBad Noobs follow 5 steps =>

Step 1: Make trash calls.

Step 2: Be so delusional you think you predicted correctly price direction.

Step 3: Get into investing because you think you're good.

Step 4: Fail because bad.

Step 5: "It's impossible to make money trading". Warn others.

The tender feelings community has 6 psychological states:

Regret: 99% of crypto investors rofl. "It went up I missed up oh no now I better make up for it and throw all my lifesavings in a ponzi"

Mad (cuz bad): IT KEEPS DOING THE OPPOSITE OF WHAT I DO AND WHEN I AVOID IT I MISS OUT. IT'S OUT TO GET ME. I AM DONE. ALL IN REVENGE TRADING HAHAHA.

Greed: PonziCoin is going to 1 million! If it gets 10% of gold market cap I'll be a billionaire! I am up 100% I'm taking family money and using leverage now!

Fear: It's all red it won't stop going down OMG ANOTHER DUMP 😱 SELL SELL SELL.

Hope: It's not going very strongly against me, just drifting, I'll hold to it a while longer it's going to reverse eventually.

Loser: It keeps doing the opposite of what I do and when I avoid it I miss out :( There is no hope I give up.

Meanwile, the non emotional chad doesn't care about any of this he has his journal and know what to do what not to do all he has to focus on is his stats.

We should segregate the world because the emotionals that get jobs as actors, singers, toilet cleaners... And the rational masters that take all the decisions.

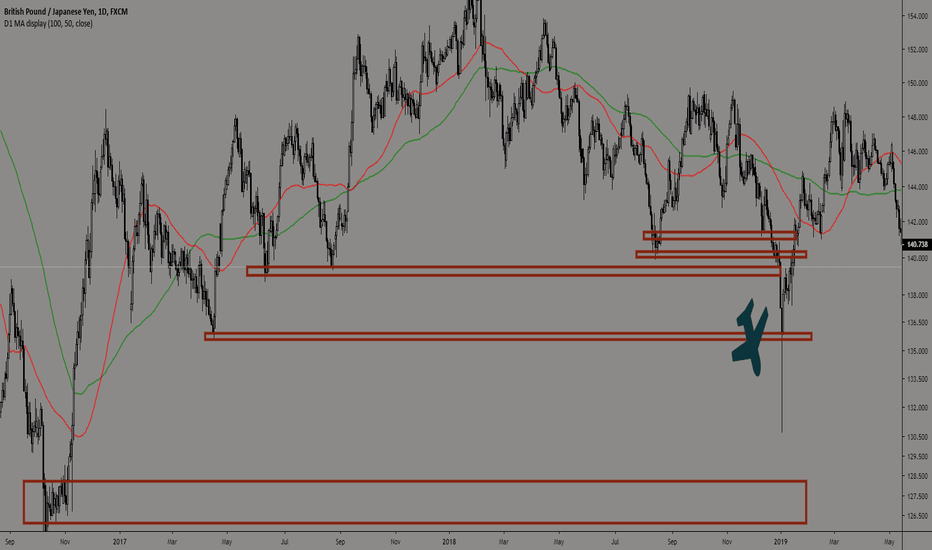

GBPJPY: Case study. From start to finish. [Trading System]I am glad I (re-) found out retail traders have a losing edge, now I don't have to pretend I care about news / fundamentals moving the market like there is a secret :D

Only really important thing is getting the trend right and looking on the economic calendar at the days with a red circle next to them (unless you want a 3 ATR slippage).

Trading is cool (not really), it's like you are a detective analysing cases, and then you land on the mission area and you become a sniper carefully preparing his execution, and then bam take the shot. A detective with a snipar. Grrr!

In this case, first here are the support areas (every strategy expect maybe super short term and long term) need support at its core, well at least when it comes to currencies & hard commodities.

Requirements:

- Being aware of the high TF trend and patterns (weekly)

- Knowing what the daily trend is

- Having drawn the support areas via daily chart

- Having checked technicals, such as EW counts, fibs, trendlines, MA's etc...

- Noticing all the resistance above (low risk and buying probably gets absorbed)

- Having a plan in advance (what do I expect to happen what will I look at / look for)

- Being aware of events for the week (central bank decisions...)

- Noticing how the price is rejecting resistance ==> High probability

- Noting how far the next area of support is ==> Big reward / low risk

- Preparing your evacuation plan (targets, approximate SL mostly)

- Zooming in (look for a specific reaction to take the shot)

- Taking the shot like a boss

- Preparing for extraction (trail stop set a limit order etc)

- Running away with the tears of those that went opposite, and their money.

- Logging it all and analysing it...

Ok the list is long actually. But it's simple. When you know it all and have a few months of correct practice under your belt.

If you do not have a "strategy" / system already, note the list down, draw it if you like, add some steps / details if necessary, and follow all steps until it becomes second nature.

Every week (if you trade short term like me) review your charts and note your plan/expectations, then every day every few hours look at what the price is doing, etc.

Gets natural with time. Becomes a habit.

Having a system like this is not an option by the way.

I saw some people I think it was in prop firms they did this: they have a little paper every day where they write their expectations and plan for the day, and once the day is over (they do intraday) they note on the paper in a rectangle what happened what they did etc.

This is actually awesome.

Maybe I should do something pretty like this via trading view. Right now I use excel and screenshots.

I watch > 20 charts thought so noting my plan for each on this site might get boring, not sure how useful it would be...

I should do something more than just a few notes in excel and a post trade screenshot.

I did spend an awful amount of time on my past trades thought, the only thing I really missed was what I expected before the trade setup my general bias.