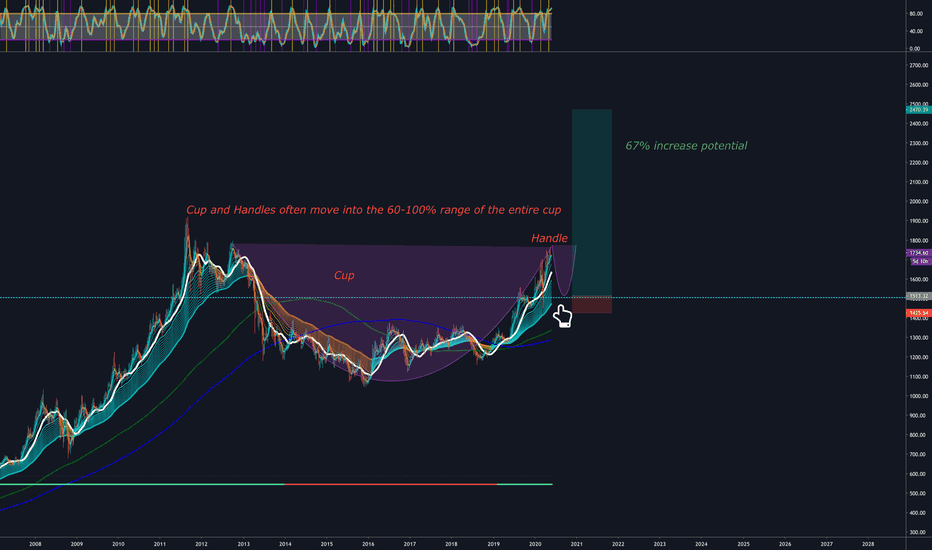

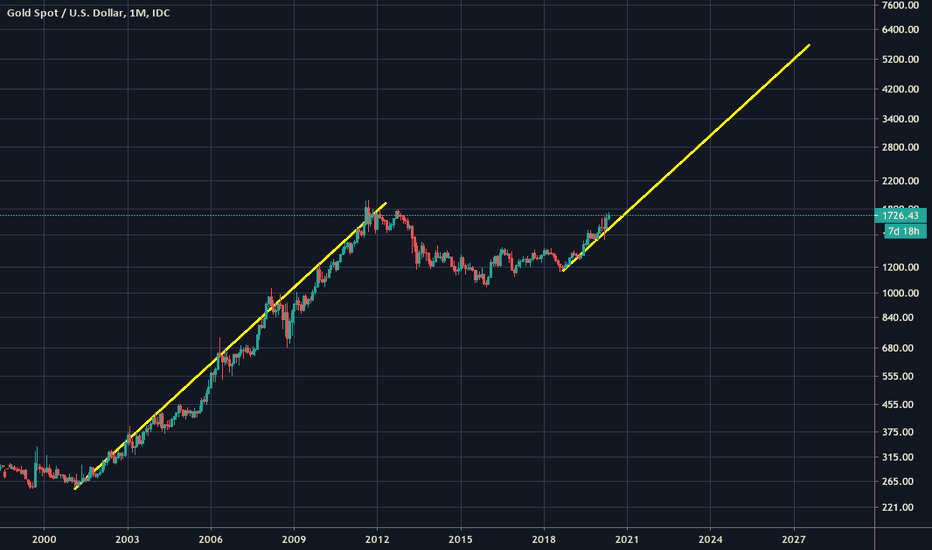

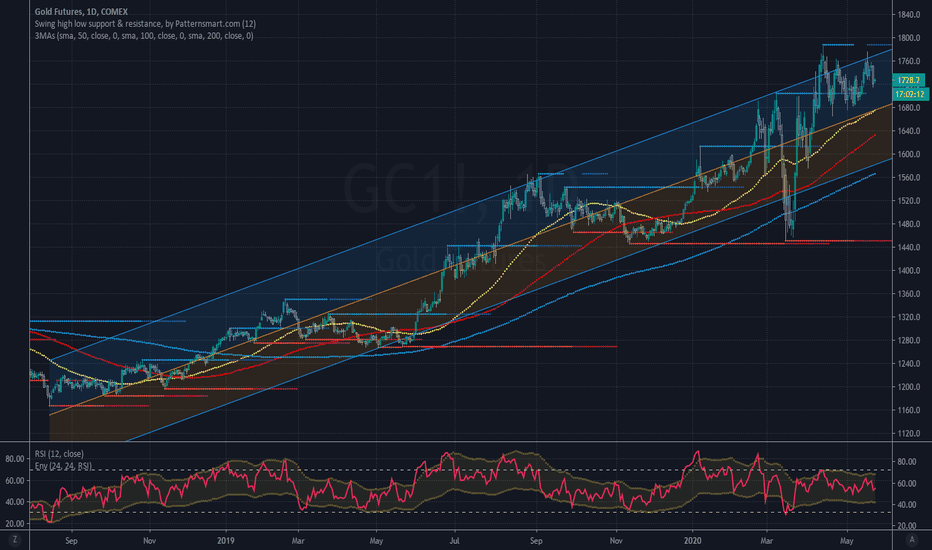

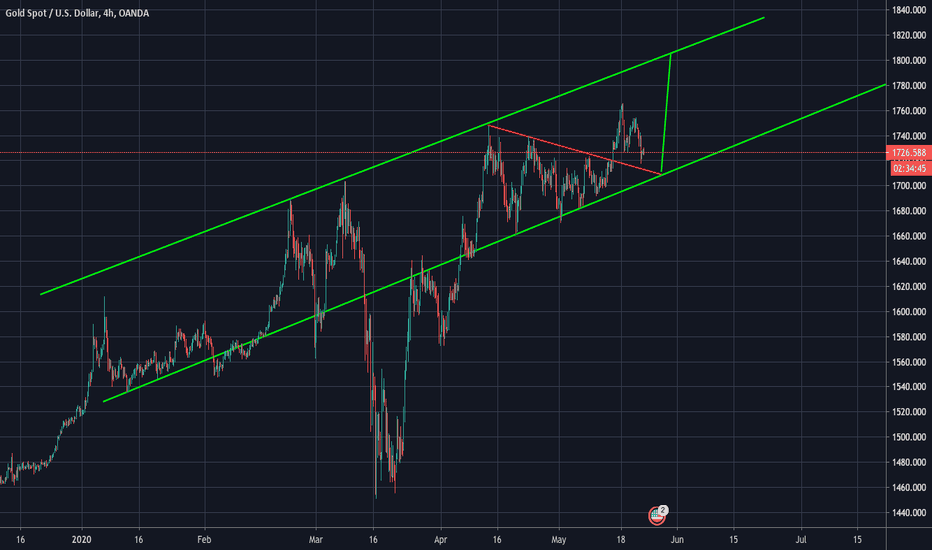

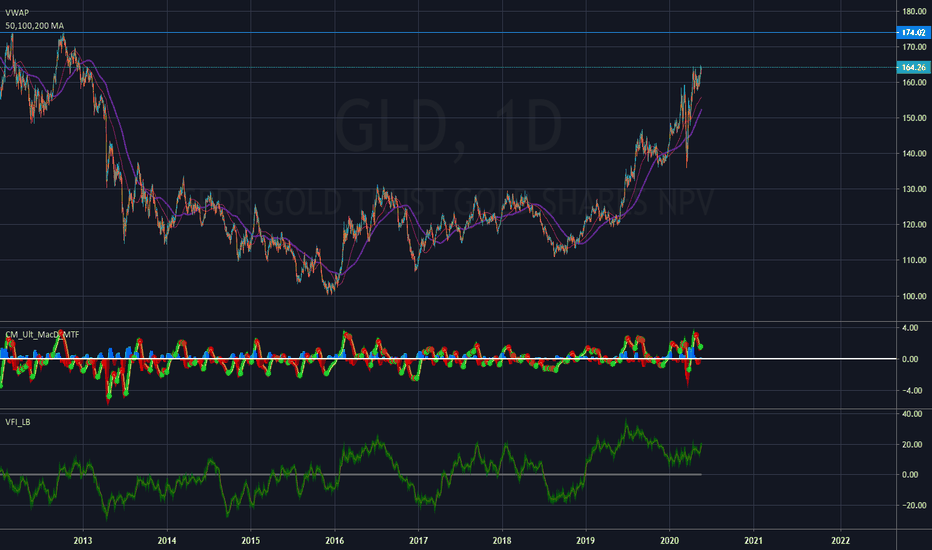

Gold 100% Potential - Cup and HandleThe cup and handle is a fairly reliable trading pattern, especially when we see it continue here on the long term time frames. Gold has been building this position for quite some time.

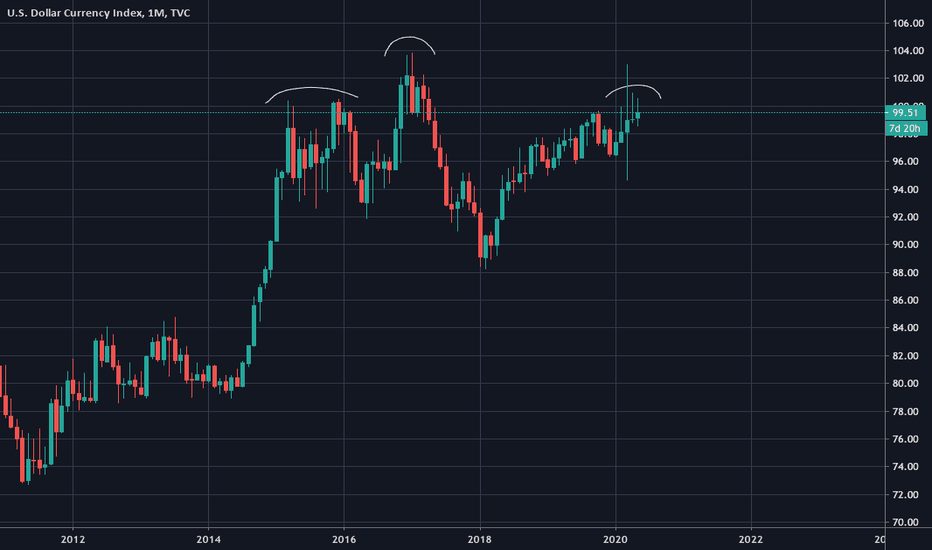

For those that are huge fans of this stable asset, the massive amount of money printing that can be seen coming from the FED is a shot in the dark for those who like to hold scarce assets. In a world where supply can be stimulated simply through printing, how do we retain some type of reality in the markets. They physical assets here will maintain a value sentiment as dollars are increasingly printed. They will inflate the prices of all the other asset classes, or at least, that is my current conjecture, Keep a close eye on your GLD trades here, or do as I do and ....

ALWAYS KEEP INVESTING!

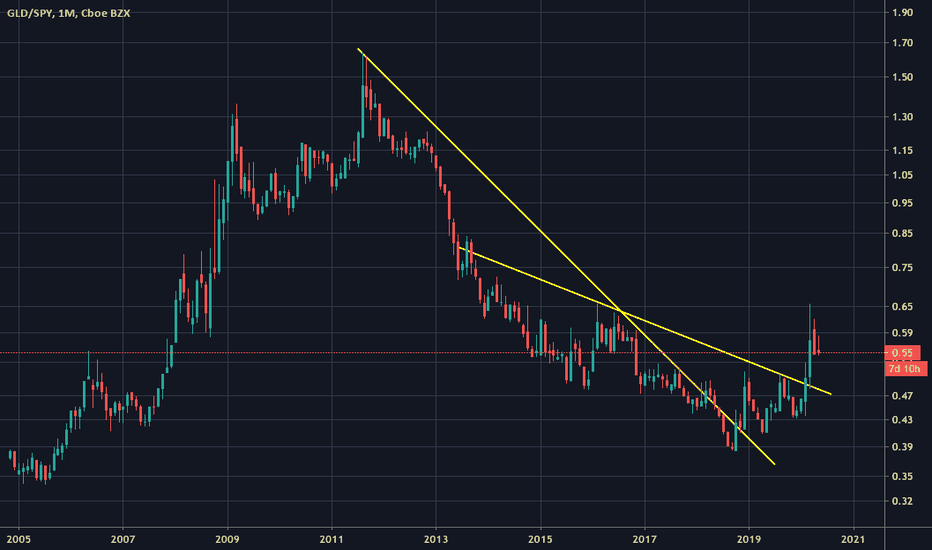

GLD

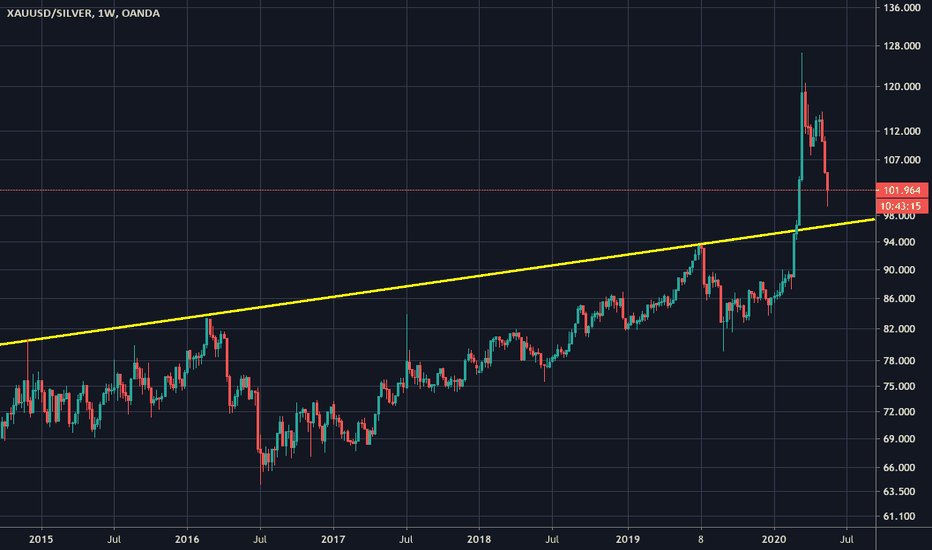

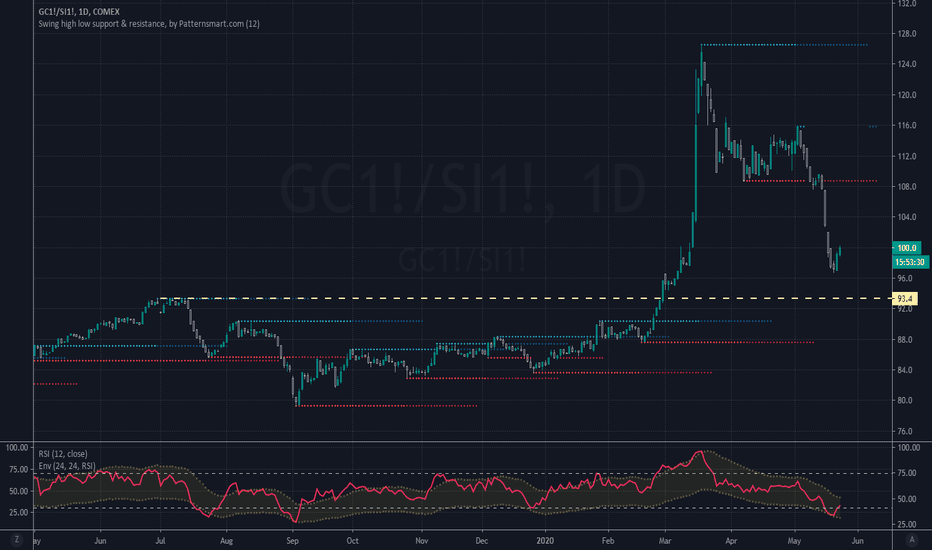

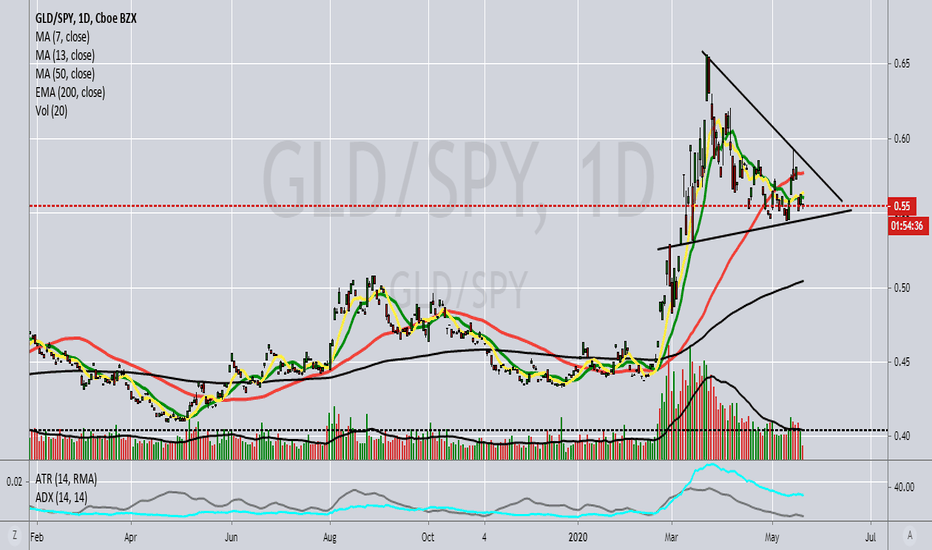

Risk-Off Would Equal a Big Bounce for Gold/Silver RatioWhile we have a $50 target for silver by the end of 2021, we fully expect it to get smacked in risk-off environments given its importance to industrial activity. When investors are optimistic, silver trades like copper; when they're scared, it trades more like gold. It's had a great run here and while we fully expect to see the ratio get back below 80 in time, gold should outperform silver in the very short term.

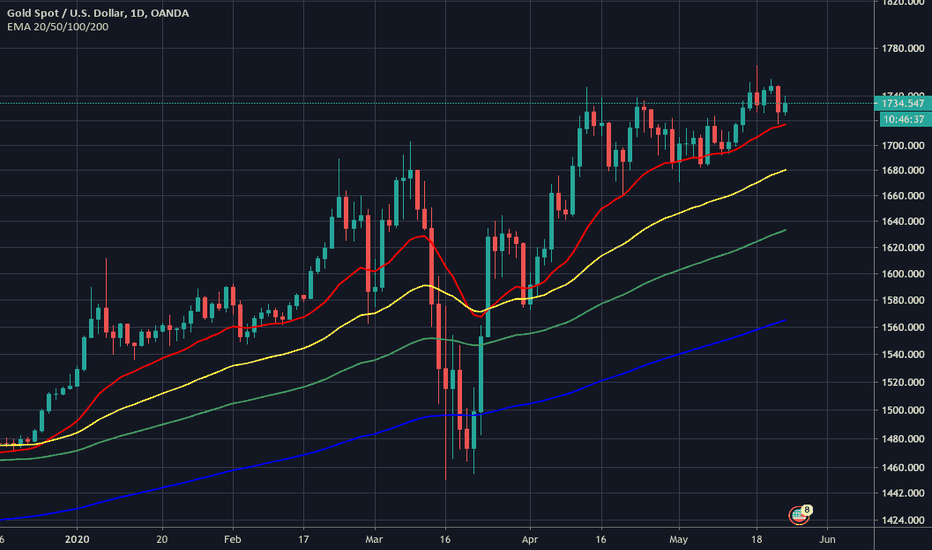

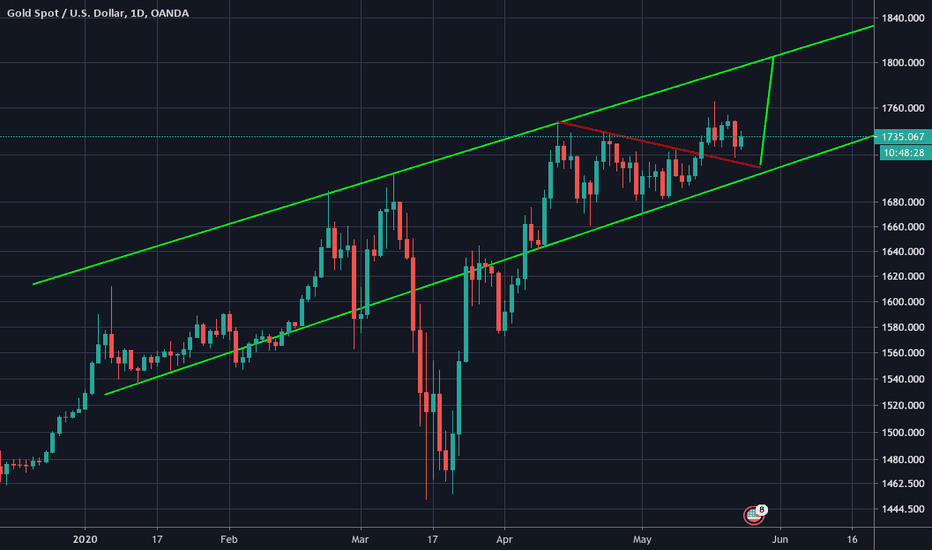

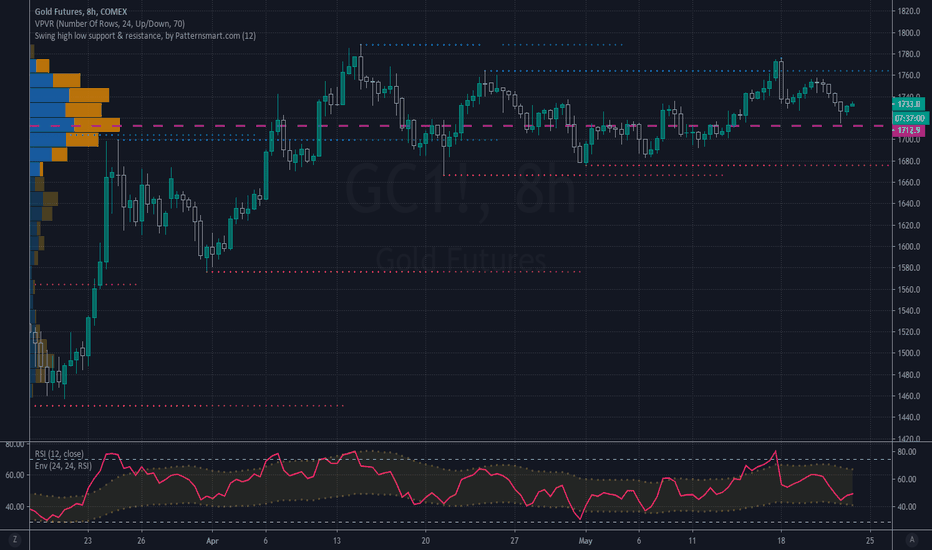

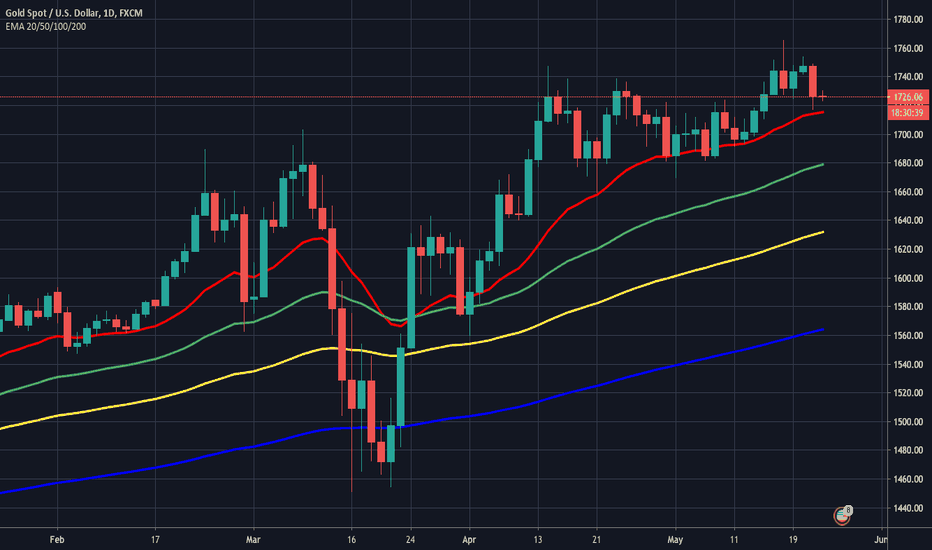

China Tensions to Push Gold Over the Top?Technically, gold has been more or less bulletproof since March, finding strong demand on every minor pullback. If the "China Trade War" period is any guide, we are very close to a breakout topside. As long as GC1! stays in the upper half of that regression channel, you're supposed to get long and/or stay long. Bulls may need to wait for the 50-day to catch up so be willing to be a little patient. Our target remains $2,000 by Labor Day and $3,000 by the end of 2021.