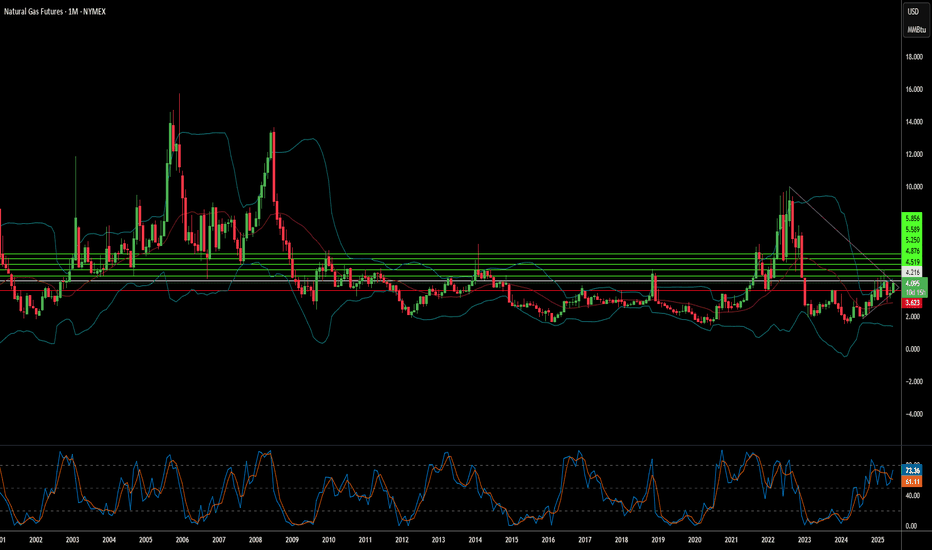

Will Middle East Flames Ignite Winter Gas Prices?The global natural gas market is currently navigating a period of profound volatility, with prices surging and defying typical seasonal trends. This significant upward movement is primarily driven by escalating geopolitical tensions in the Middle East, specifically the intensifying conflict between Iran and Israel, coupled with the looming potential for direct US military intervention. This complex interplay of factors is fundamentally reshaping perceptions of global energy supply and influencing investor sentiment, pushing natural gas prices towards critical psychological and technical thresholds.

Direct military strikes on Iran's energy infrastructure, including the world's largest gas field, the South Pars, have introduced a tangible threat to supply at the source. This is compounded by the strategic vulnerability of the Strait of Hormuz, a vital maritime chokepoint through which a significant portion of the world's liquefied natural gas (LNG) transits. Despite Iran possessing the world's second-largest natural gas reserves and being the third-largest producer, international sanctions and high domestic consumption severely limit its export capabilities, making its existing, albeit modest, export volumes disproportionately sensitive to disruption.

Europe, having strategically pivoted to LNG imports following the reduction of Russian pipeline gas, finds its energy security increasingly tied to the stability of Middle Eastern supply routes. A prolonged conflict, especially one extending into the crucial winter months, would necessitate substantial LNG volumes to meet storage targets, intensifying competition and potentially driving European gas prices higher. This environment of heightened risk and volatility also attracts speculative trading, which can amplify price movements beyond fundamental supply-demand dynamics, embedding a significant geopolitical risk premium into current market valuations.

This confluence of direct infrastructure threats, critical chokepoint risks, and Europe's structural reliance on global LNG flows creates a highly sensitive market. The trajectory of natural gas prices remains inextricably linked to geopolitical developments, with potential for further substantial increases in an escalation scenario, or sharp reversals should de-escalation occur. Navigating this landscape requires a keen understanding of both energy fundamentals and the intricate, often unpredictable, currents of international relations.

Globaltrends

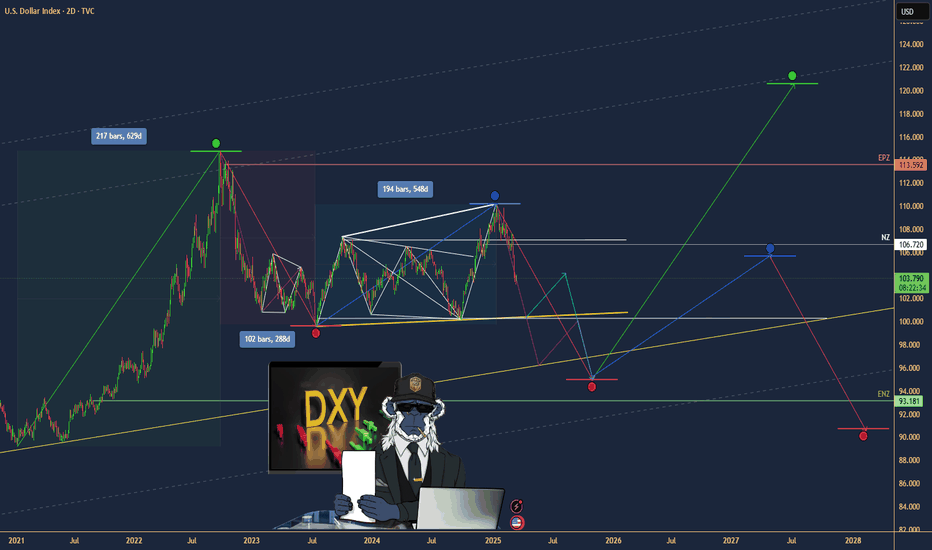

$DXY: Dollar Strength or Dollar Dip?(1/9)

Good afternoon, everyone! 🌞 DXY: Dollar Strength or Dollar Dip?

With the DXY at 103.732, is the dollar flexing its muscles or ready to stumble? Let’s break it down! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: 103.732 as of Mar 14, 2025 💰

• Recent Move: Near recent levels, down from 110.18 peak (web data) 📏

• Sector Trend: Forex markets volatile, with trade and policy shifts 🌟

It’s a wild ride—dollar’s dancing on the edge! ⚙️

(3/9) – MARKET POSITION 📈

• Role: Measures USD vs. euro, yen, pound, and more 🏆

• Influence: Drives forex and commodity prices globally ⏰

• Trend: Balancing U.S. policy and global demand, per data 🎯

King of currencies, but not without challengers! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Trade Tensions: U.S.-China tariff talks ongoing, per data 🌍

• Rate Cut Bets: Markets eyeing Fed moves, per posts on X 📋

• Market Reaction: Holding steady at 103.732 amid mixed signals 💡

Navigating a storm of global pressures! 🛳️

(5/9) – RISKS IN FOCUS ⚡

• Rate Cuts: Could weaken dollar if Fed acts, per X sentiment 🔍

• Trade Wars: Tariffs disrupting supply chains, per data 📉

• Global Growth: Slowdowns hitting demand for USD ❄️

It’s a tightrope—risks aplenty! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Reserve Status: USD’s global dominance holds firm 🥇

• U.S. Economy: Still a powerhouse, supporting dollar value 📊

• Safe Haven: Attracts flows in uncertain times, per trends 🔧

Got muscle to flex when it counts! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Vulnerable to rate cuts, trade spats 📉

• Opportunities: Strong U.S. data could lift it higher, per outlook 📈

Can it hold the line or break out? 🤔

(8/9) – POLL TIME! 📢

DXY at 103.732—your take? 🗳️

• Bullish: 105+ soon, dollar rallies 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: 100 looms, dollar dips 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

The DXY’s 103.732 shows it’s steady but tested 📈. Trade wars and Fed moves could swing it either way—dips are our DCA gold 💰. Buy low, ride high—time’s the key! Gem or bust?