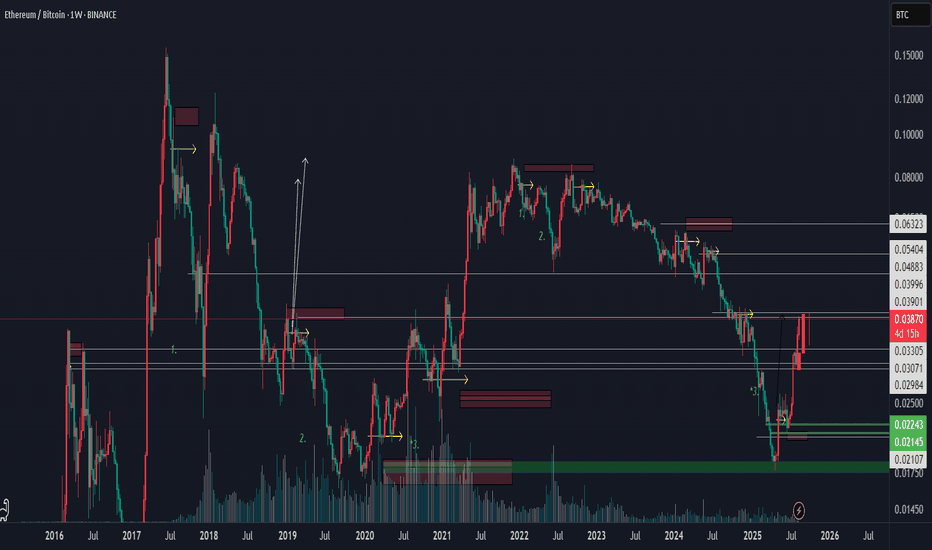

ethbtc [W] - 2019 shelf retest & long exit (April to Aug 25)So we've had a pretty eventful 2025 so far for eth . For most wanting to know why eth moves have been so aggressive and to quote an old mentor "Gung-Ho", all we need to do really is take a look at ETHBTC.

Historically alts have had their moments in relation to their strength (or weakness) against bitcoin. this time is no different.

To key my chart, the yellow lines show the point of control or gain/failure for any given local spot. the red and green bands are by extension a couple of points above or below that mark. These bands represent 'slippage' or liquidity points provided by either algo (standard deviations), stop losses and failure of trend.

To be fair the size of the band is relative to the volatility of the underlining pair. In this example i believe it should fall within the 3.2-->13.6% range. enough to liquidate or margin call all positions from 20x to 5x. This represents the majority of open interest in any given point.

My goal is always to observe the point of control and look to rebound from these initial liquidity hunts. April 2025 gave us this opportunity and cleared the bench. For those late to the party the market offered us a juicy little v-bottom setup. from there on you had exits all the way up to the liquidity band sitting just above the support shelf created all the way back in 2019.

By no means am I claiming the move is 100% done, but if you check volume, I'd say 80%+ has exited, and so am I.

NEXT: rotate back into BTC primarily and watch.

Sentiments not all that great in the real world, but at least this move has some definitive-ness to it. Peace out

#btc #eth #ethbtc #2025 #alt #mstr #goingup-goingup