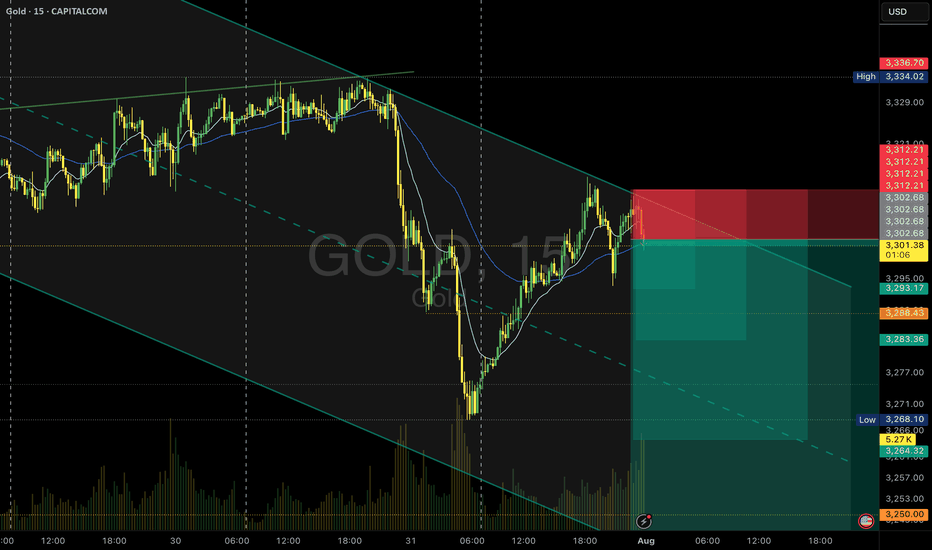

Gold Sell Setup - M15PEPPERSTONE:XAUUSD

Timeframe: m15

Risk Level: Medium

🔹 Setup:

Price is testing the upper boundary of the descending channel.

📈 Entry:

Current price zone: 3302.5

🎯 Targets (TP):

TP1: 3393

TP2: 3283

TP4: 3264

TP6: 3244

⛔ Stop Loss (SL):

3312.2

#XAUUSD #GOLD #SELL #Signal #MJTrading

Psychology Always Matters:

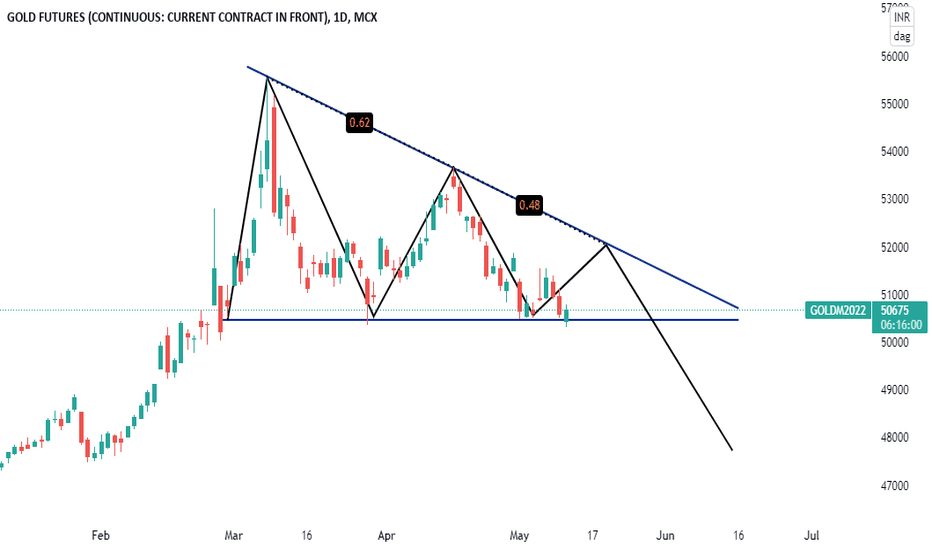

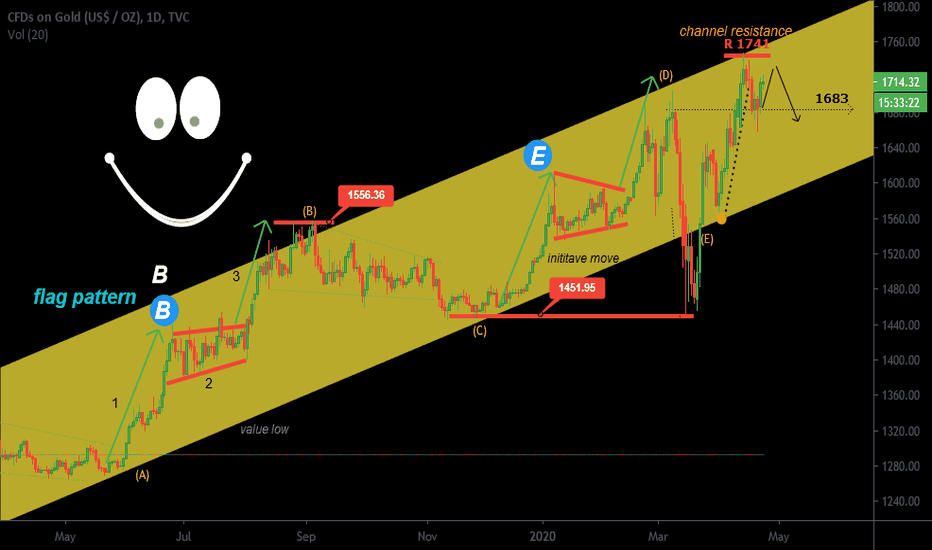

Gold-chart

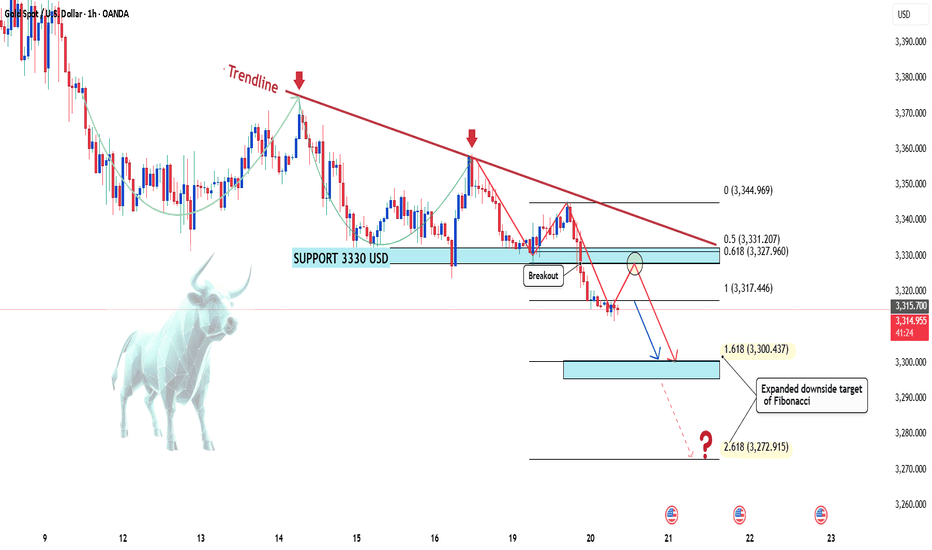

Latest Gold Price Update – Will the Downtrend Continue?Hello everyone, what do you think about OANDA:XAUUSD ? Will it go up or down?

As per our strategy from yesterday , gold has dropped sharply, currently trading around 3,315 USD, and down more than 300 pips from the previous session.

Gold continues to trade within a narrow range as traders await the next catalyst to drive price action, with the upcoming speech by Fed Chairman Jerome Powell being seen as a potential factor. Additionally, the recent recovery of the TVC:DXY index has also put some pressure on the strength of this precious metal.

From a technical perspective, gold has lost the 3,330 USD support level and remains capped below the descending trendline. The price is moving downward following the Dow Theory wave pattern. If favorable, the first profit-taking target (at the 1.618 level) at the round 3,300 USD mark may be pushed lower by the bears.

What do you think? How will gold move? Keep a close eye on the market to spot opportunities, and remember that trading with the trend is always a good strategy.

Good luck!

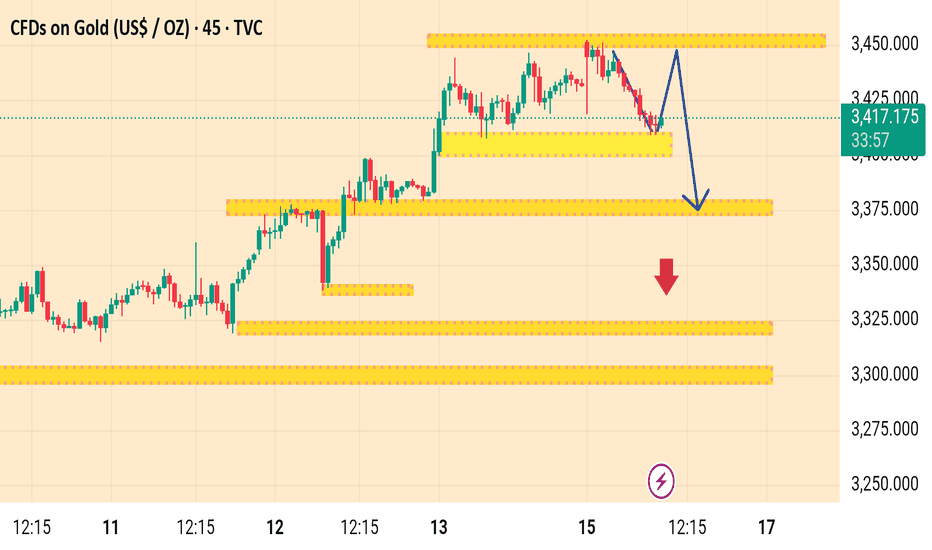

XAUUAD UPDATE 16- 6 +2025The chart you provided is a 45-minute time frame analysis for Gold CFDs (US$/OZ). Here's a breakdown of the key elements and what they suggest:

---

Current Price

$3,414.93, down -18.42 (-0.54%)

---

Analysis Summary

Price Action

The price has recently rejected from a resistance zone (around $3,445–$3,450).

It is currently pulling back, heading downward from this resistance.

Support Zones Highlighted

Multiple horizontal yellow zones mark previous support/resistance levels.

The key immediate support level lies near $3,400–$3,405.

A deeper support area is visible around $3,360–$3,365, and further below near $3,320.

---

Forecast Indication (Based on Markings)

A short-term pullback (blue arrow up) may retest the breakdown level (~$3,430).

Then, a potential drop toward the next support at $3,360 is expected (blue arrow down).

A bearish continuation scenario is emphasized with a red downward arrow, suggesting price may head further down to the $3,320 area if $3,360 fails to hold.

---

Implications for Traders

Bearish Bias: Suggested by the forecast arrows and recent resistance rejection.

Potential Setup:

Short on pullback near $3,430 (if price fails to reclaim this zone).

Target: $3,360 and possibly $3,320.

Stop-loss: Above $3,450 resistance.

---

Would you like a trading plan or signal based on this analysis?

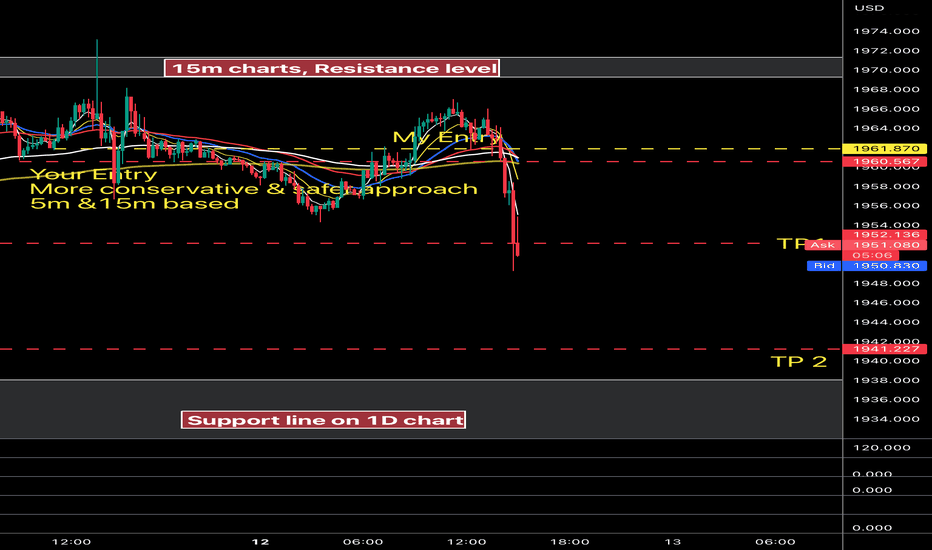

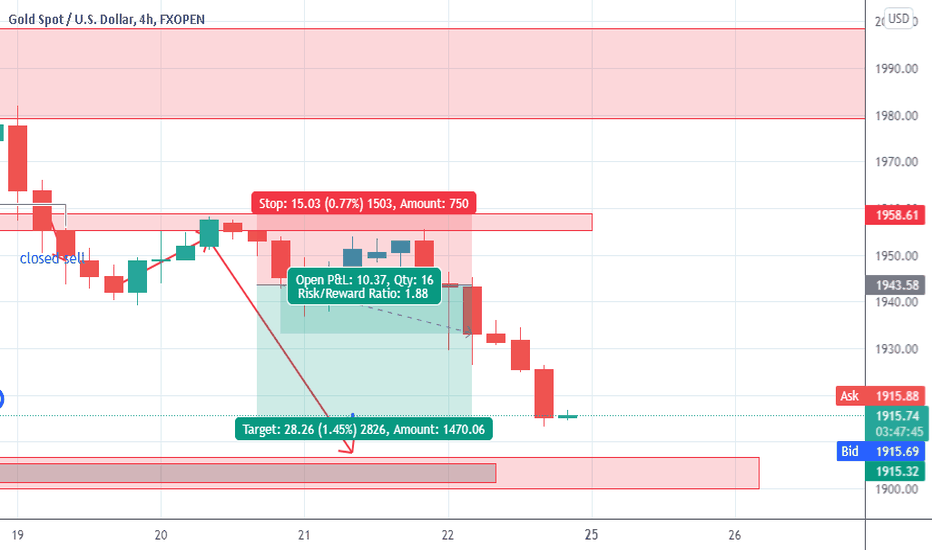

Gold Update 4- MON 12 JuneHi all,

New week started & update on the charts. Like as was predicted TP1 cleared up already with 8431 pips on micro account.

Congratulations all with a profitable day.

TP2 @1941.227 still valid , fingers crossed ;)

PS: never ignore SL, you never know for granted what is next coming….

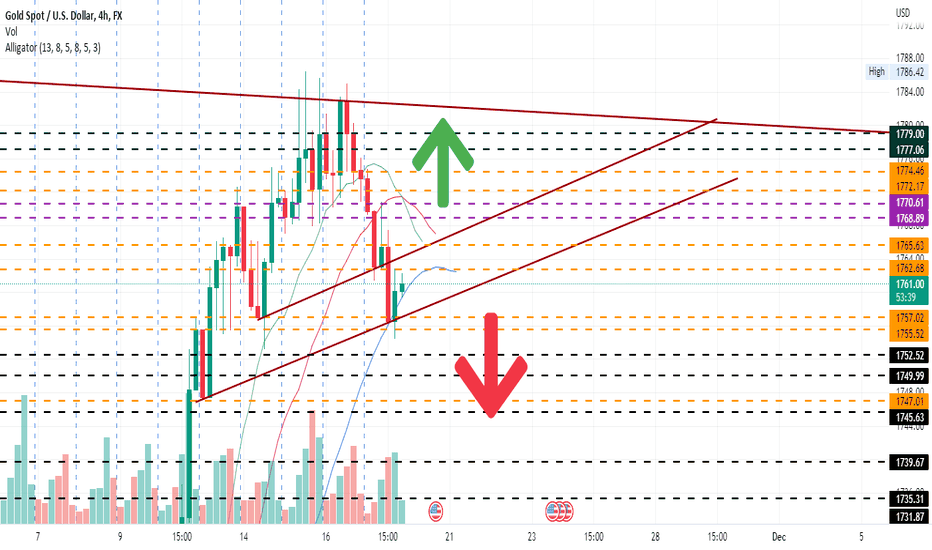

Gold 4 hour chart decide tomorrow go up or down Gold closed with a loss on Thursday, dropping for a third-straight session as the US dollar and bond yields are on the rise.

Gold for December delivery closed down US$12.80 to settle at US$1,763.00 per ounce.

The drop comes as the dollar continues to recover from a sell-off earlier this month after the US reported inflation rose less than expected in October, raising hopes the Federal Reserve could reconsider the pace of its interest-rate hikes, though an unexpectedly strong rise in retail sales last month reported on Wednesday showed the central bank may not have yet slowed the economy sufficiently to suppress demand.

"The metal is currently dealing with mixed signals as elevated recession worries, highlighted by the most inverted yield curve in almost four decades, are being offset by the biggest increase in US retail sales in eight months, indicating Fed tightening has further to run to bring inflation under control," Saxo Bank noted.

The ICE dollar index was last seen up 0.42 points to 106.69, making gold more expensive for international buyers.

The yield on the US 10-year note was last seen up 8.9 basis points to 3.782%, bearish for gold since it offers no interest

gold 4 hour chart The dollar was supported by stronger-than-expected U.S. retail sales data on Wednesday as investors also looked for clues from Federal Reserve speakers on the path for interest rates.

The euro

EURUSD

was last up 0.33% at $1.0388 but still below the four-and-a-half month peak of $1.0481 it touched Tuesday when U.S. producer price inflation data was below expectations. While it was well off its session high of the day, the euro more than erased Tuesday's losses against the yen

EURJPY

. It was last up 0.46% against the Japanese currency.

Tuesday's U.S. data had suggested last week's cooler-than-expected consumer price inflation was not a one-off, fueling hopes that the U.S. Federal Reserve can slow aggressive rate hikes that had sent the dollar soaring against the pound, euro and yen this year.

Meanwhile, two key policy doves argued on Wednesday that while the European Central Bank must continue to raise interest rates, there is a growing case for in policy tightening after a string of aggressive moves.

"A lot of people are fixated on what we're going to see regarding what the Fed and the ECB will do," said Edward Moya senior market analyst at Oanda in New York.

Also, Fed Governor Christopher Waller, an early and outspoken "hawk," said the Fed has a on rates and will still need increases into next year although he added that data made him "more comfortable" with the idea of slowing to a 50-basis point hike in December.

"There's a lot of noise in the FX market. You could say Waller and Daley's comments today were somewhat hawkish," said Moya. "The retail sales figures showing there's more resilience in the economy could make the argument the Fed could be justified in maintaining its aggressive stance against inflation."

After rising earlier, Sterling

GBPUSD

was last up 0.31% at $1.1906.

Britain is set to announce a new budget on Thursday with expectations for tax hikes and spending cuts. The pound fell to a record low of $1.0327 in September after finance minister Jeremy Hunt's predecessor Kwasi Kwarteng announced a package of unfunded tax cuts.

The dollar was up 0.07% against the Japanese yen

USDJPY

at 139.3950, compared with Tuesday's two-and-a-half-month low of 137.67.

The dollar index

DXY

, which tracks the greenback against six main peers, was recently 0.06% lower at 106.342 after earlier hitting a low of 105.859.

$GOLD Safe Haven? or Pipe Dream?GOLD as valued as it is may not be the safe haven asset people would have you believe. While it has been a runner in the past due to economic downturn, There are rare market events that come around swiftly and without warning that drag all assets down. The wealth transfer/changing of the guard. One such even was the great depression. Considering the deepening economic crisis and the ongoing devaluation of the dollar, GOLD will likely collapse to lows it hasn't seen in many decades as America has one of the worst Deflationary periods in it's history. As people seek to possess gold and refuse to exchange it for worthless dollars, they will turn to physical commodities of all sorts for barter and trade such as coffee, weed, and other priceless goods.

My analysis of goldmy dear friends

I hope you enjoy the benefits of your business

I'm glad the previous analysis was correct.

We are shutting down our sales and awaiting a new diagnostic analysis

I will notify you as soon as new money and new analysis arrive

Please introduce me to your friends and ........

Do not forget to like

be successful and victorious

Hooray ..............

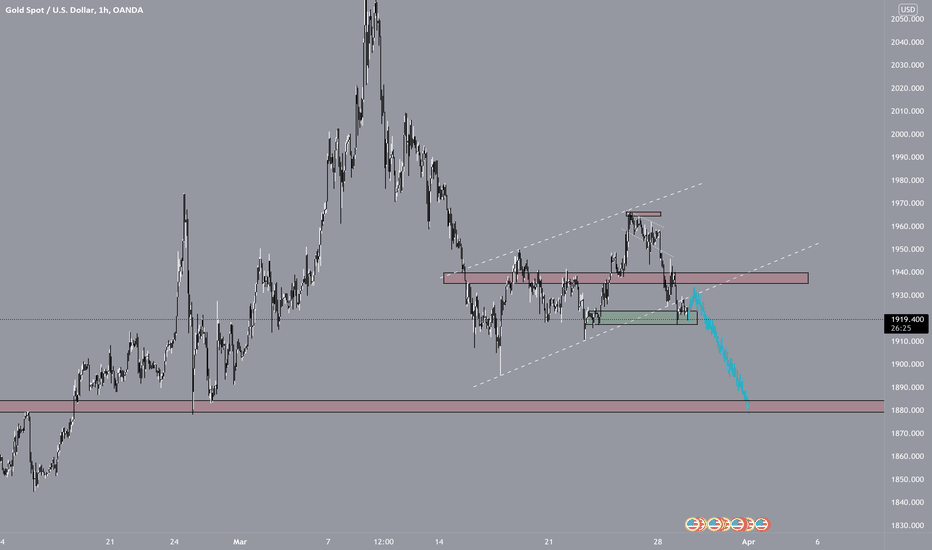

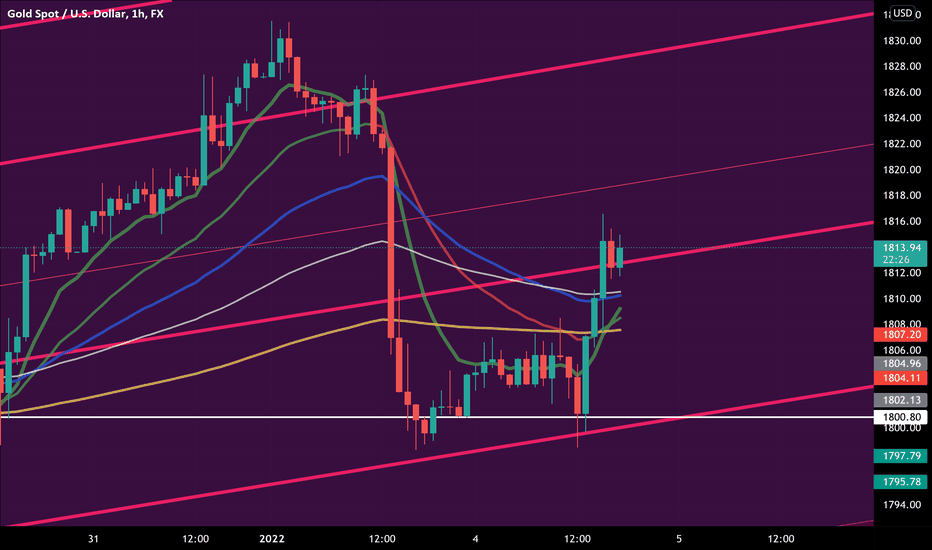

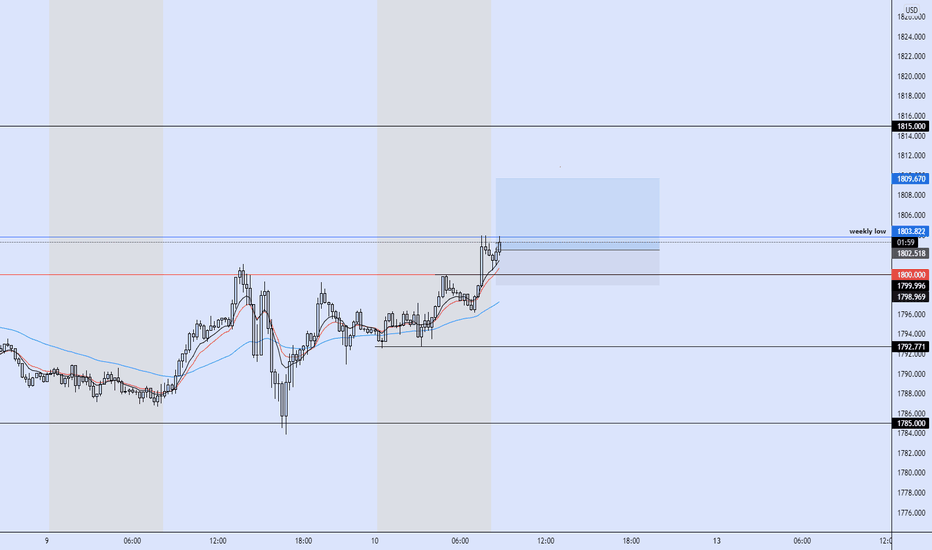

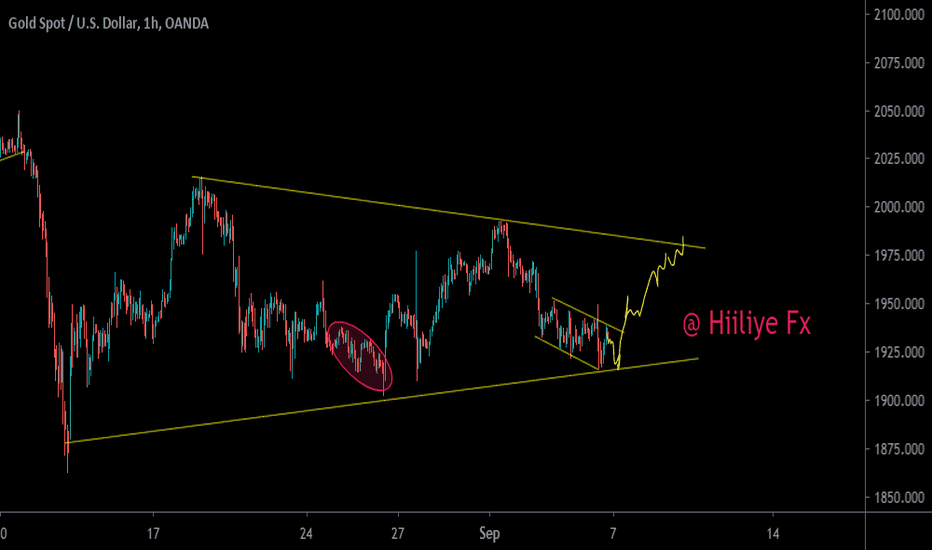

Gold - 04 / Jan review. What happened today?Sadly for all of us Gold today never managed to break through 1800.80 support level or through the channel ever. So, no selling orders today…

My fundamental analysis whisper to my ear that so aggressive drop in the price yesterday has been caused partially by Bank Holiday in the UK (London). Forex trades got affected badly as well ( almost all trades went to reversal direction ) Well, all trades start returning to the normal way today and in another day or two this all mess going to be cleared up.

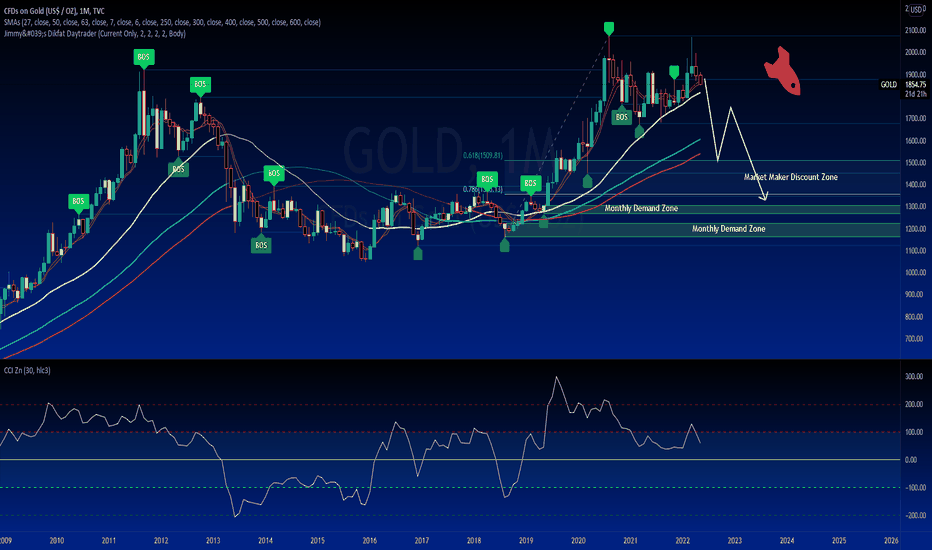

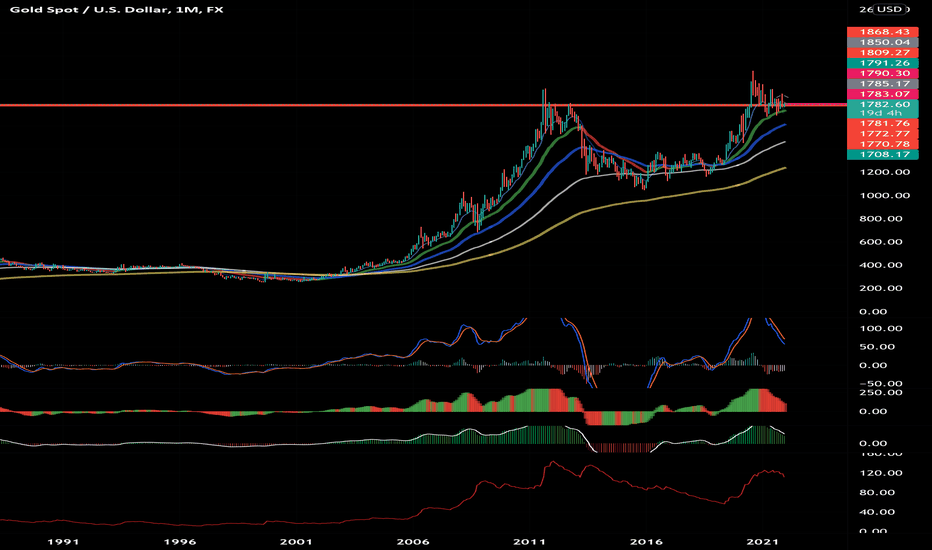

Diving to deep for Gold - TA on the 1M chartsIt seams that gold “hung up” on same level as in 2011. Briefly looking, it is going to drop, at least in the near future. 1M charts pointing for the moving down and for a bit. Look to the rest charts with a TA on a different timeframes with a thought in the back of your head about sell on the 1M charts

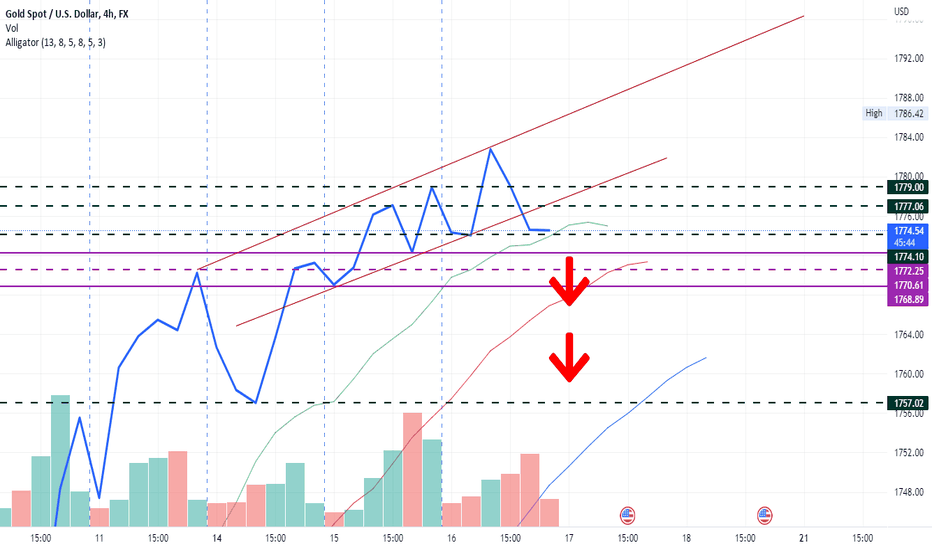

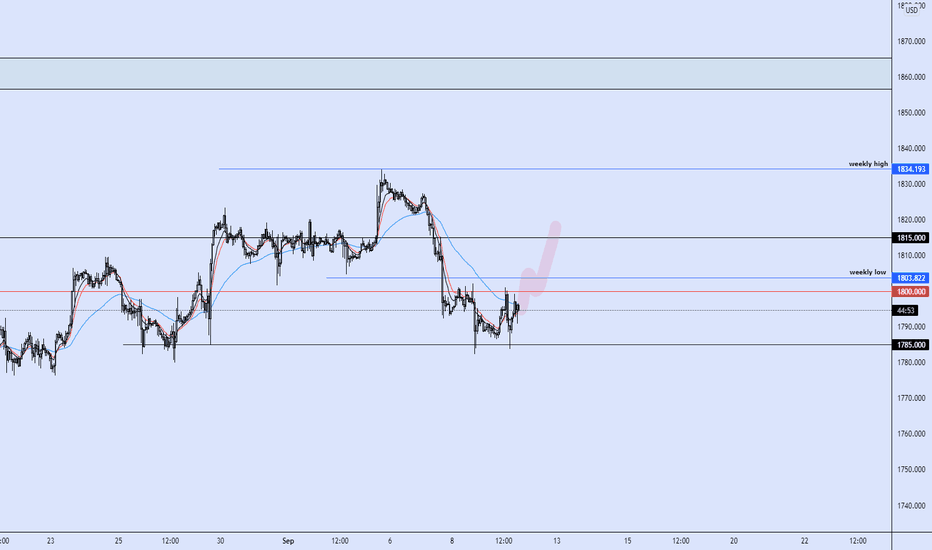

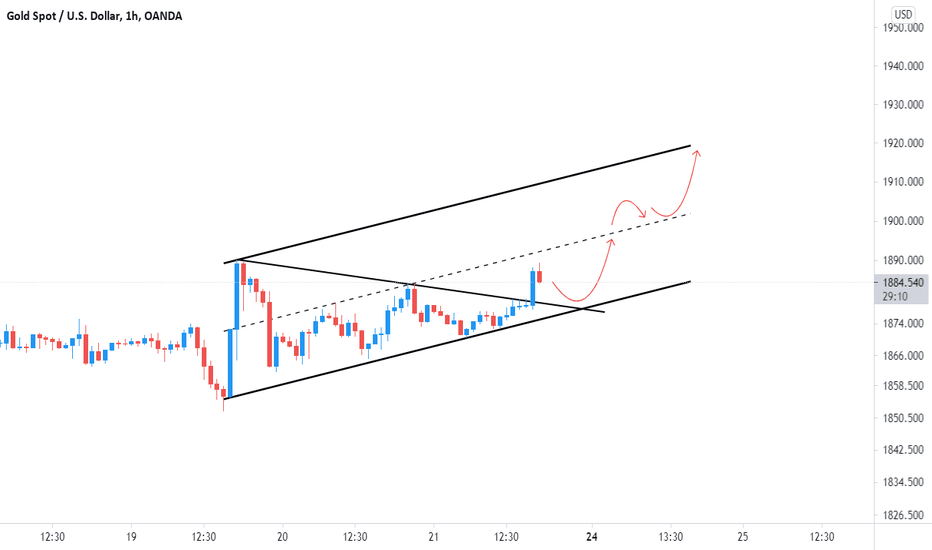

Gold ready to head higher again after small correction We had the first half of the week, a small correction at the gold chart. Wich is healthy ofcourse. If you you zome out where are still in a bulltrend.

Just need to patience to enter longs again

What I want to see is a close and retest above the $1800 level. Wich is highly respected in history.

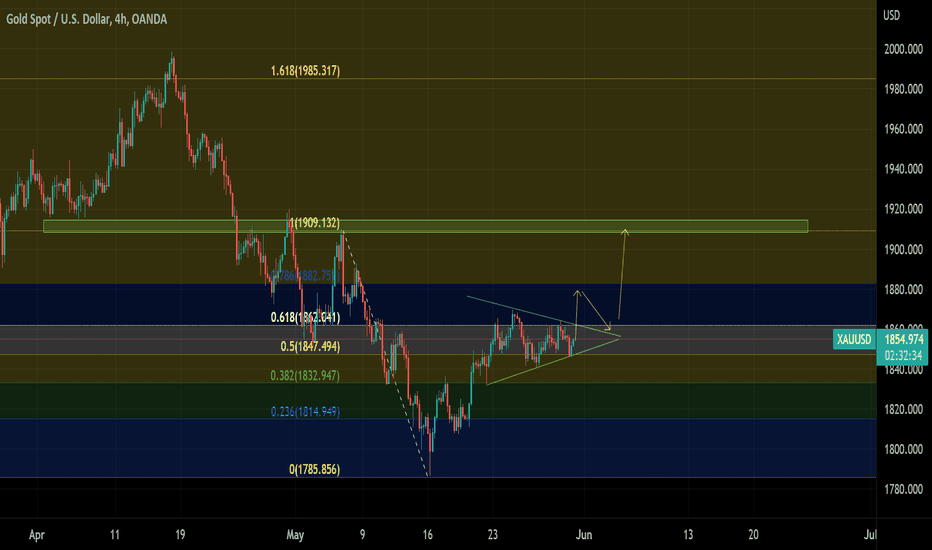

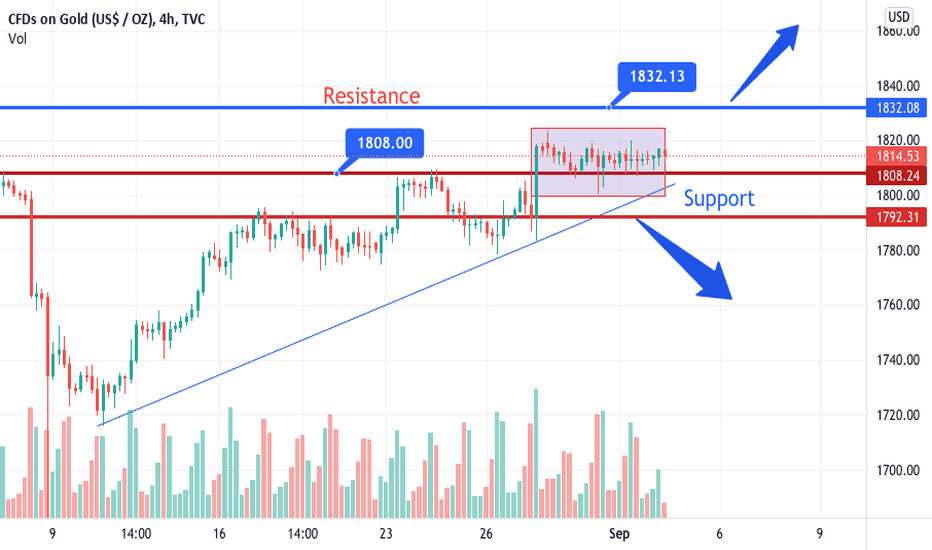

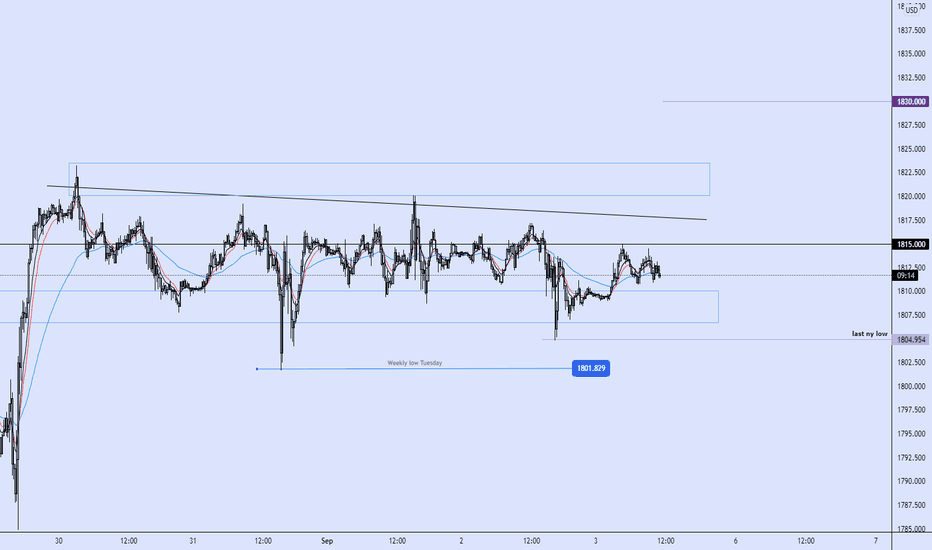

Gold sep ideaWith NFP numbers, gold found its breakout to upside with low job numbers and it literally exploded in few minutes before the numbers.

But it reached to all-time resistance 1833 area and have significant resistance and need to have a clear breakout to confirm moving upside towards 1900.

It might come back to the area of `1810 to take support with an extension to 1801 to find its support before moving up and can have a significant pullback.

Anyways all in all final gold starts moving .....

DYOR and play safe

Gold 2nd sep Now gold is waiting for the NFP news to decide its direction to either move up /down.

A breakout above 1830 would trigger a bullish run and upwards to 1900.

But there seems to be a lot of support in the region 1792-1808 and 1808 is acting strong support with 1820 a resistance to seeing a further upside to 1830.

Overall it's not clear and gold is gearing up to have big movement after the consolidation area comes to an end.

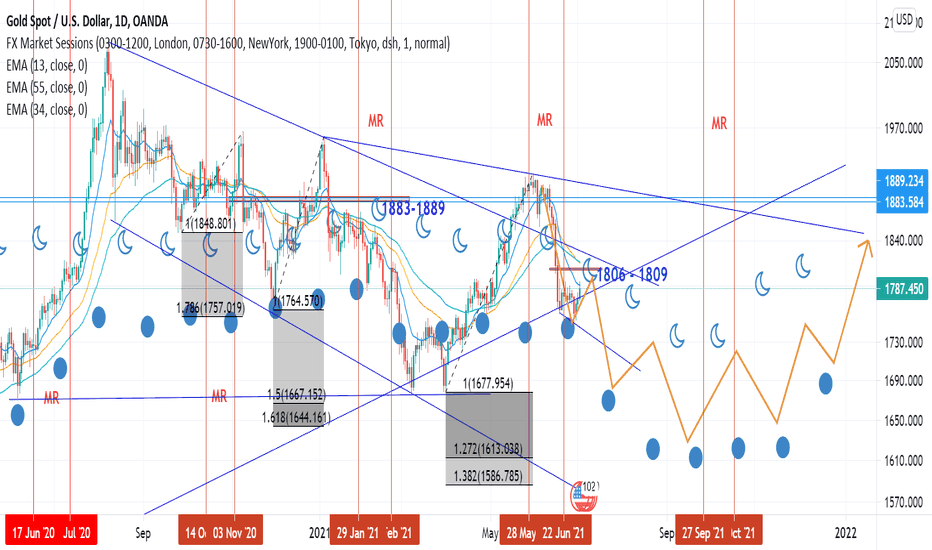

XAUUSD - Despite The Downturn, It Is Remain A Great Asset ClassThis is what I'm thinking about OANDA:XAUUSD movements until 2021 end, despite the bear is taking over for the overall movement in this year, but either sell or buy, your chance is still there.

For those who loves the gold bar, might be a moment of truth to bargain its price :).

I'm still here, thinking, trading and try to away from COVID.

Have a great weekend to all of you.

-AJ-

XAUUSD CLEAR UP MOVEMENTXAUUSD ITS IN THE ZONE I MEAN THE GOLDEN ZONE I WOULD LOVE TO MOVE TO THE DOWN SIDE ONE IMPULSIVE MOVE AND IM READY TO TAKE THE RISK ENTRY OR TO BREAK THE TRENDLINE GONNA TAKE REDUCED RISK ENTRY.

BOYS AND GIRLS IM NOT THE BEST ANALYST BUT IM TRYING TO BE HHHH JUST KIDDING.

FOLLOW ME FOR MORE NAKED CHARTS !