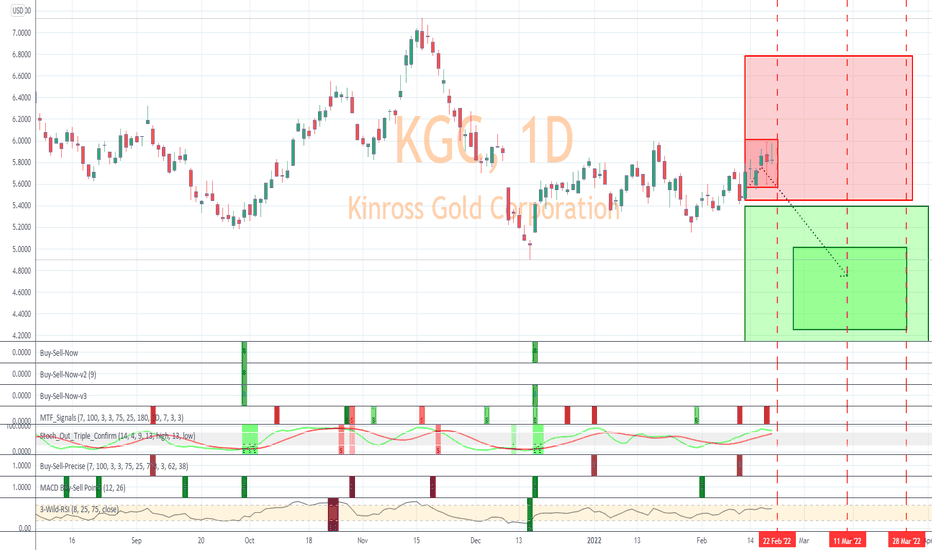

KGC, The Barometer For Easing Tensions?Based on historical movement, the peak could occur anywhere in the larger red box. The final targets are in the green boxes. The pending bottom should occur within the larger green box as has been the historical case. Half of all movement has ended in the smaller green box. In this instance, the signal indicated SELL on February 10, 2022 with a closing price of 5.45.

If this instance is successful, that means the stock should decline to at least 5.39 which is the top of the larger green box. Three-quarters of all successful signals have the stock decline 8.029% from the signal closing price. This percentage is the top of the smaller green box. Half of all successful signals have the stock decline 12.591% which is the end point of the black dotted arrow. One-quarter of all successful signals have the stock decline 21.953% from the signal closing price which is the bottom of the smaller green box. The maximum decline on record would see a move to the bottom of the larger green box. These are the same concepts for the levels in the red boxes as well.

The ends/vertical sides of the boxes are determined in a similar fashion. The trough of the decline can occur as soon as the next trading bar after signal close, while the max decline occurs within the limit of study at 35 trading bars after the signal. A 1% decline must occur over the next 35 trading bars in order to be considered a success. Three-quarters of successful movement occur after at least 10 trading bars; half occur within 20 trading bars, and one-quarter require at least 31 trading bars.

The black dotted arrow represents median historical movement. Medians are a good metric, but they are just one of many I use when forecasting future movement.

As always, the stock could decline the very next bar after the signal without looking back (therefore the red boxes would not come into play) or the stock may never decline (and the green boxes may never come into play).

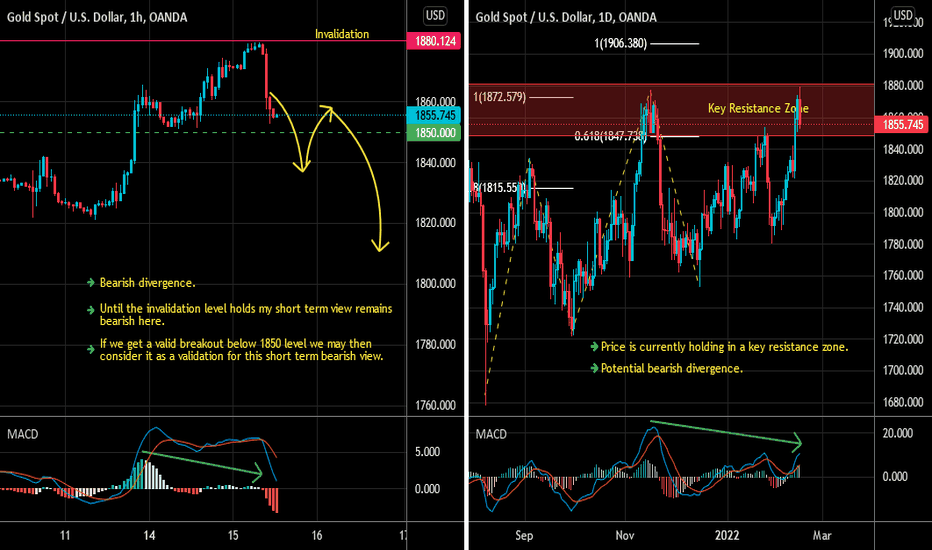

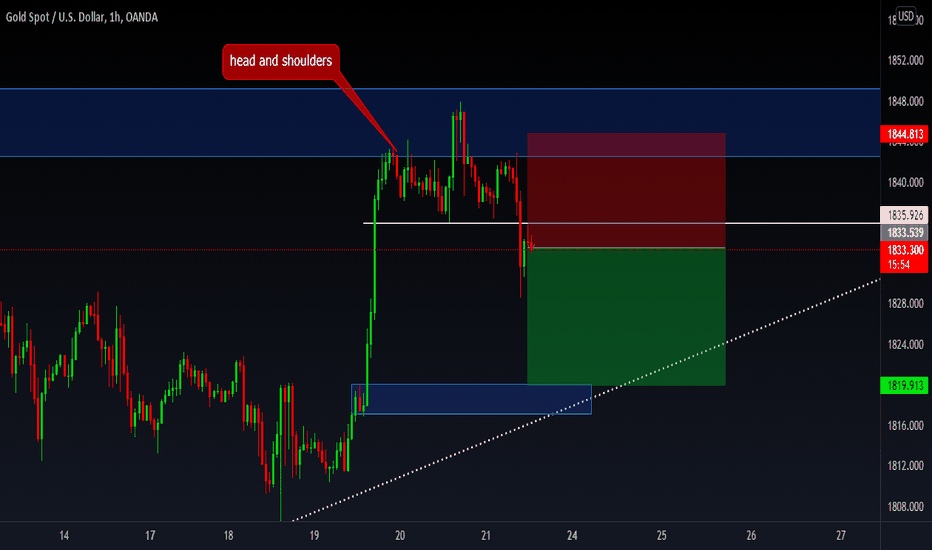

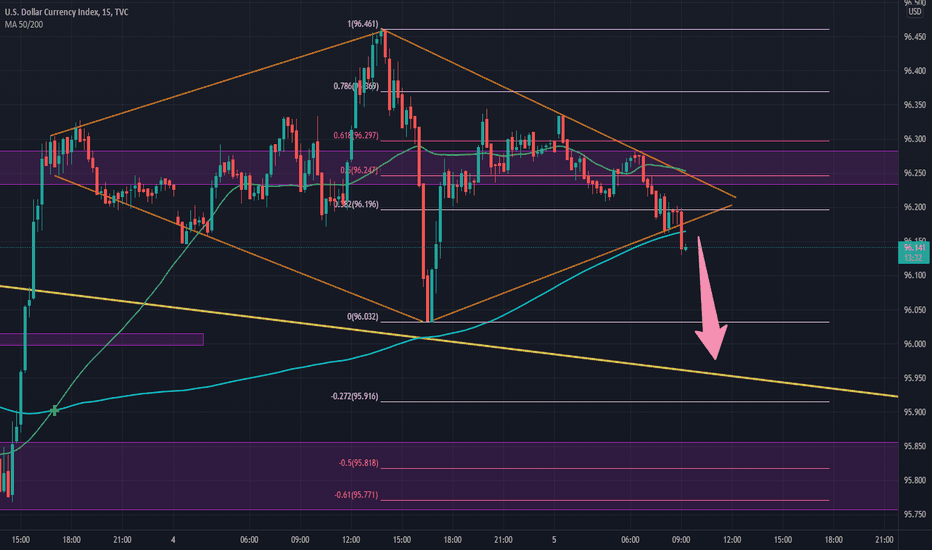

Gold-sell

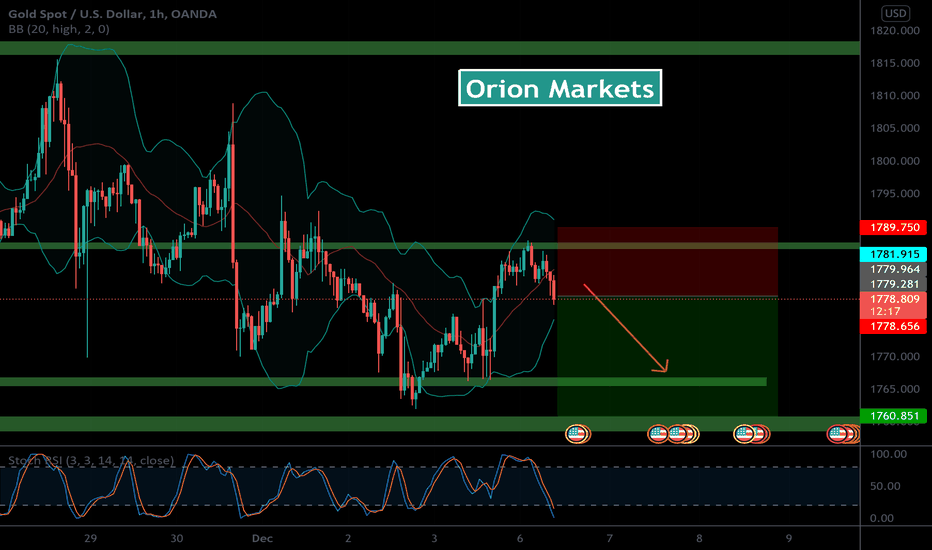

Gold Short Term Sell IdeaD1 - Price is currently holding in a key resistance zone.

Potential bearish divergence.

H1 - Bearish divergence.

Until the invalidation level holds my short term view remains bearish here.

If we get a valid breakout below 1850 level we may then consider it as a validation for this short term bearish view.

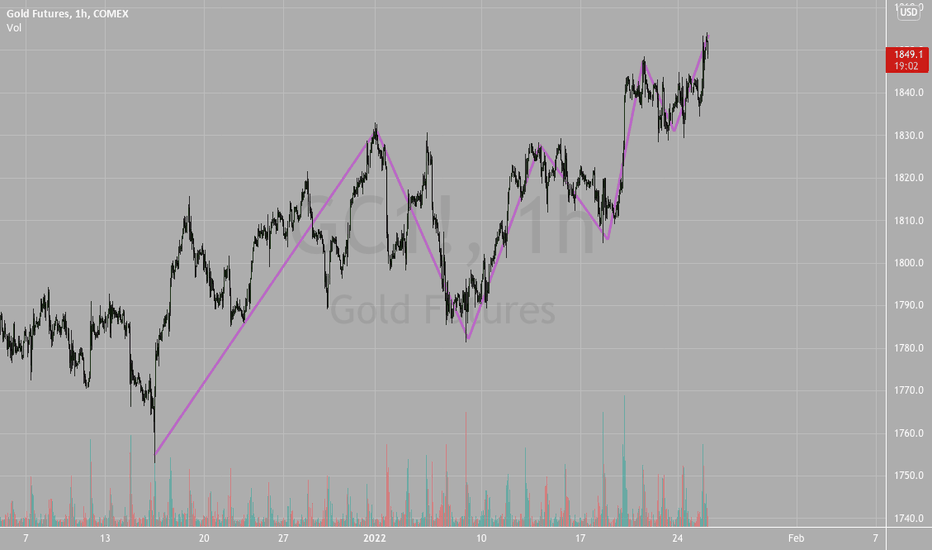

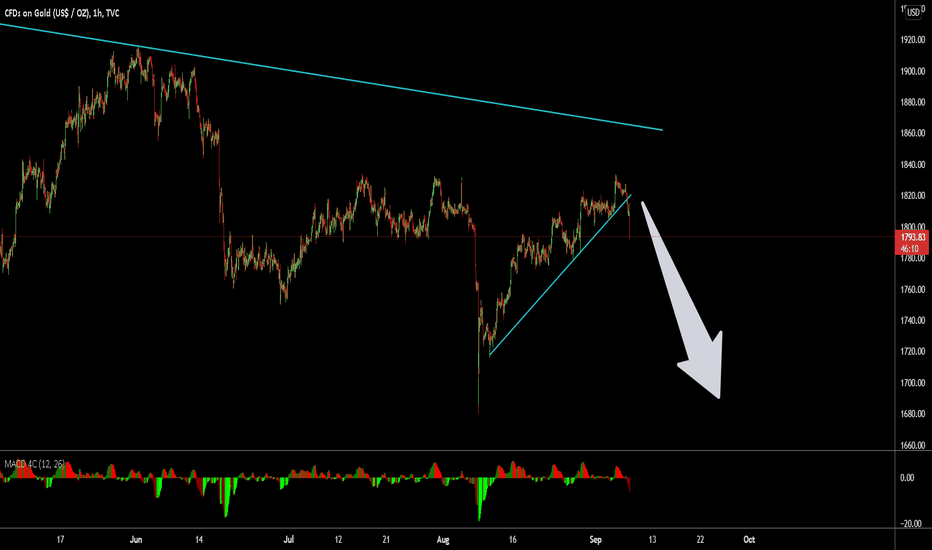

Corrective Price Action In GoldGold similar to oil conitnues to drag its feet and move in an ascending (bearish) pattern by

making higher highs and then correct strongly downward. This zigzagging price action OFTEN

indicates WEAKNESS. Gold is ALWAYS mistaken to be a safe haven when times are tough for the

general markets. Well this is NOT the case and has not been for most of its modern history.

I believe this misrepresentation of gold comes from the price action of the 1929 crash where gold

I believe did move contrary to stocks at times. BUT it does not concern us what happend 90 years ago!

Gold prices I believe were fixed back then and so its outcome had to have been different. What does

concern us is what happened in 2008 where gold fell just like any other asset. And this continues to

inspire confidence that this will NOT BE THE DEFENSIVE ASSET EVERYONE ELSE THINKS GOLD IS!

It is an asset just like oil or stocks. And in hard times it too will fall. The price action here reminds

us that this will likely be the case and sooner than later. For now we remain neutral and wait for further

confirmation before well sell gold.

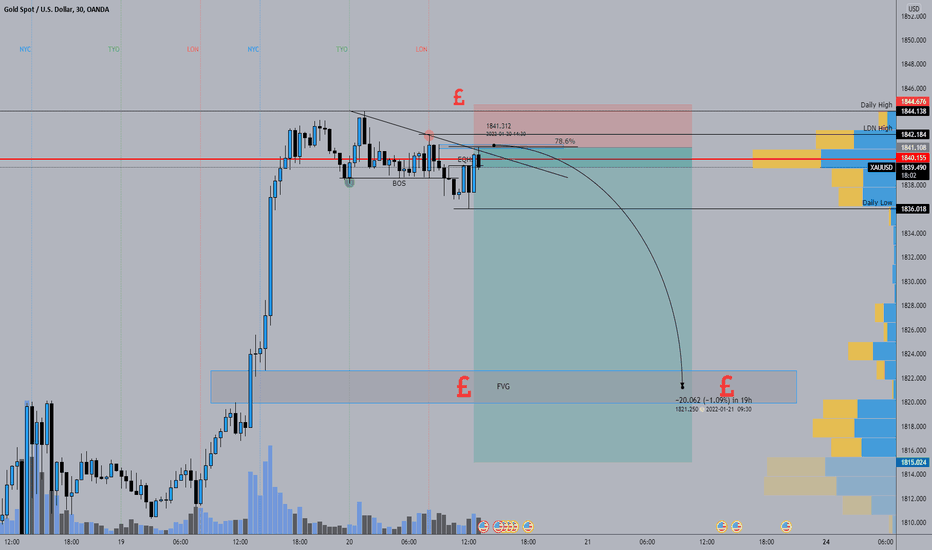

XAU/USD SellsGold sells into the FVG. Entry is a on a wick rejection from the 78.6% retracement after the BOS to the downside. Another confluence was that our entry was inline with the current OB in the market for the last downside push and we just broke the daily low which has invalidated the current range and presents a bearish outlook to me.

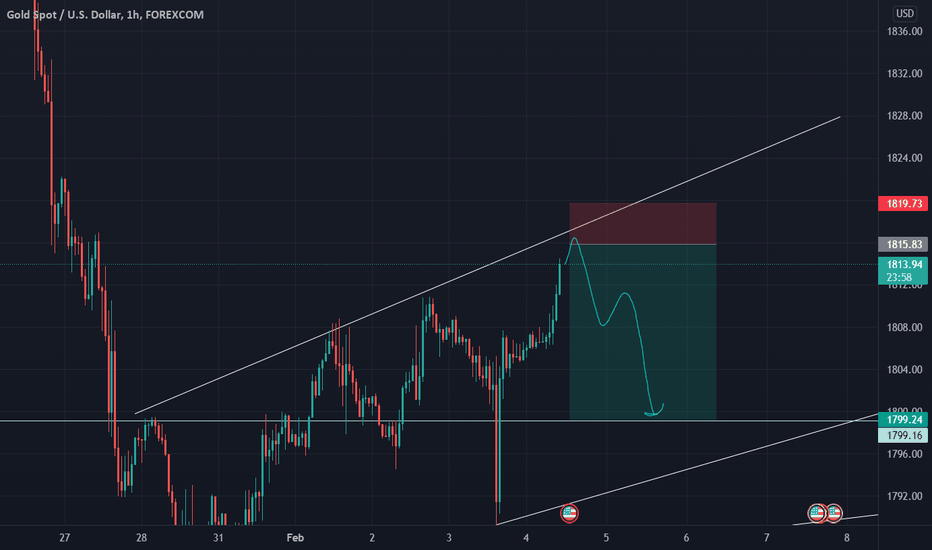

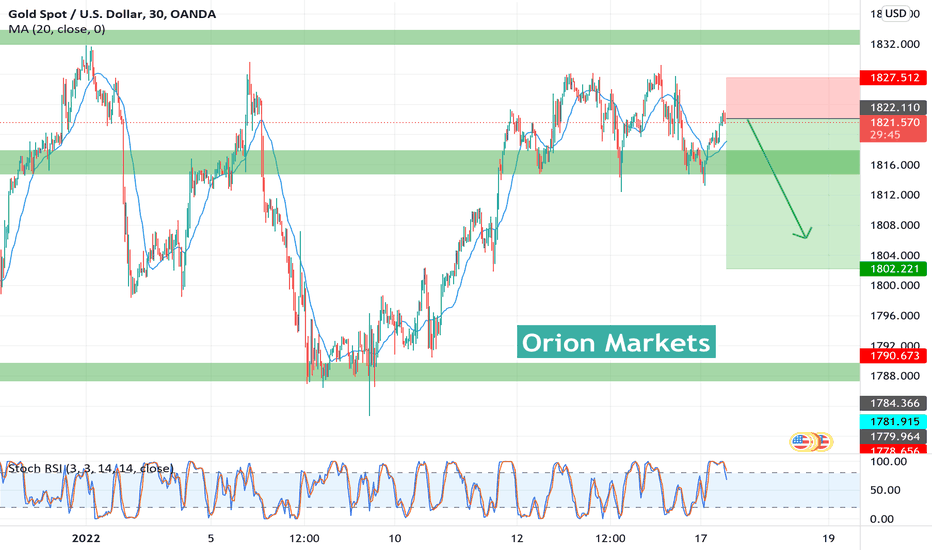

Gold (XAU) Sell idea Last week most USD pairs and indices fell in price drastically which resulted in Gold rising past the key 1820 level. However, it appears that the momentum has slowed down for Gold as there has been a failure to reclaim the 1830 level. Because of this and the fact many USD pairs and Indicies have seen some buying activity at their low levels, it might mean that Gold will fall in price as the USD starts to strengthen again. The target of this trade is at the recent resistance level of 1814, proceeding this, 1804 and 1796 are final targets. The stop loss area for this trade is located in the 1827 region.

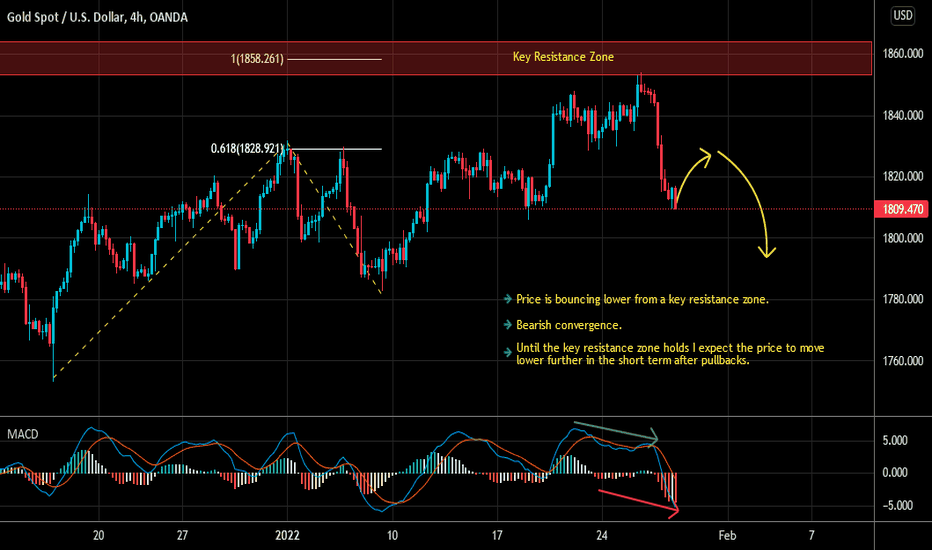

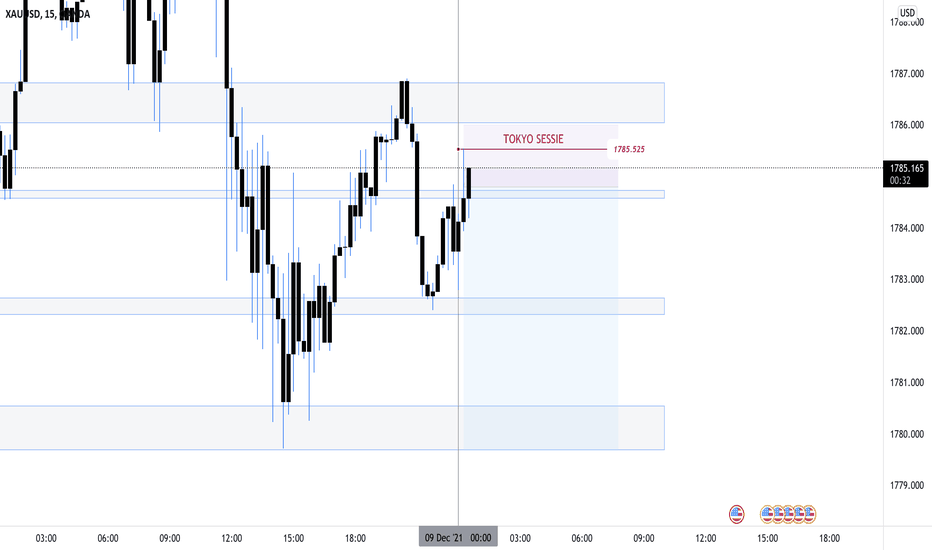

Gold Short Idea Gold has been no stranger to volatility in the last few weeks. There was a sell-off towards the levels of $1762, but now the price has rebounded towards the $1787 resistance zone. Gold's rally failed to surpass the $1800, in the short term I believe the trend is bearish. The RSI levels on the 4hr chart are overbought at 94.82. The target is the previous support level of $1770-67. The stop-loss area for this trade is located just above the recent high at $1788.