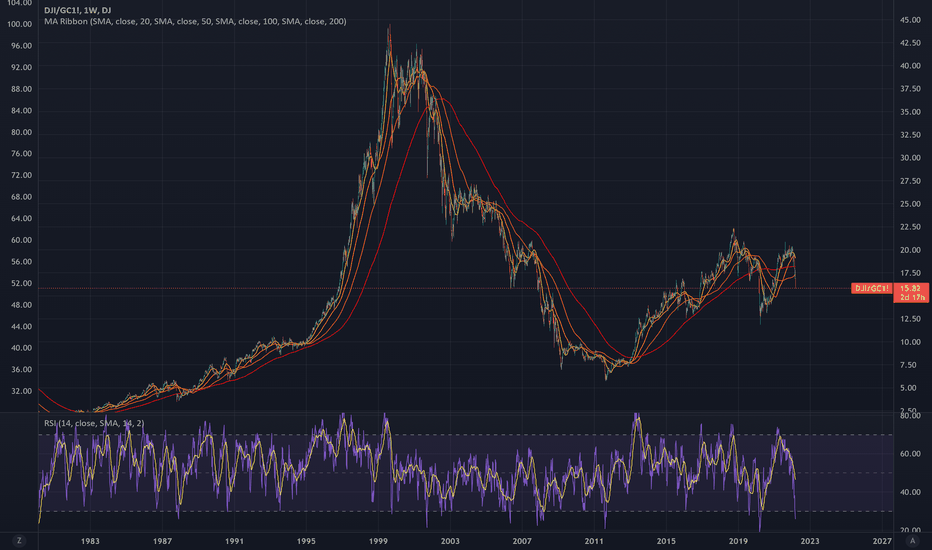

GOLD-SILVER

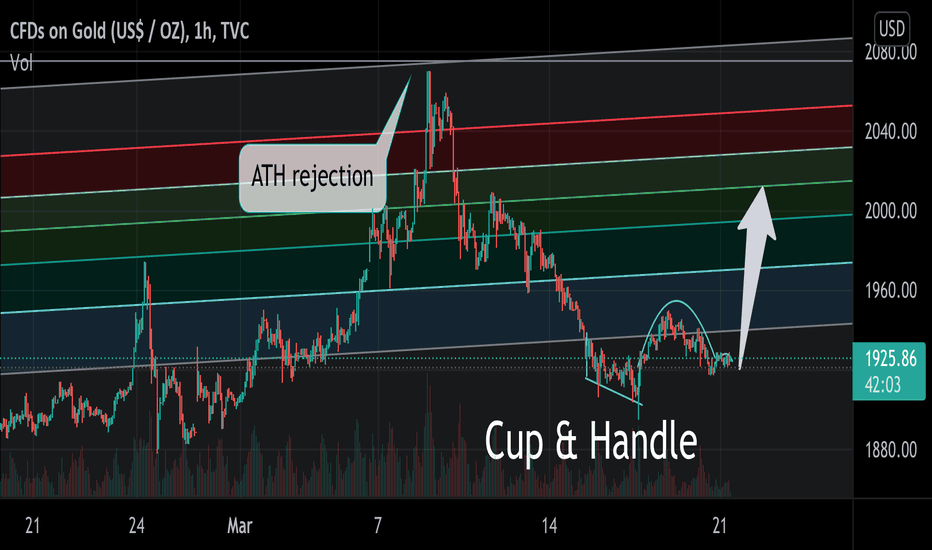

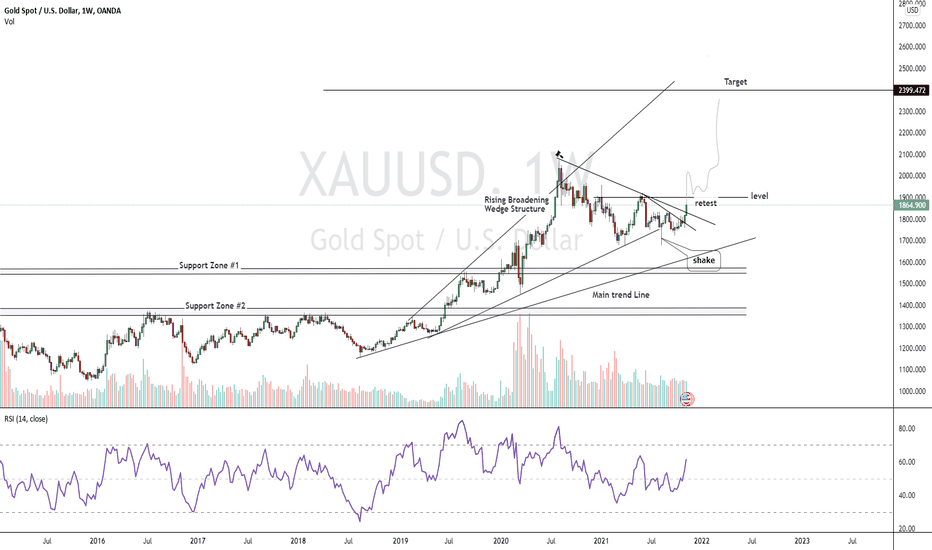

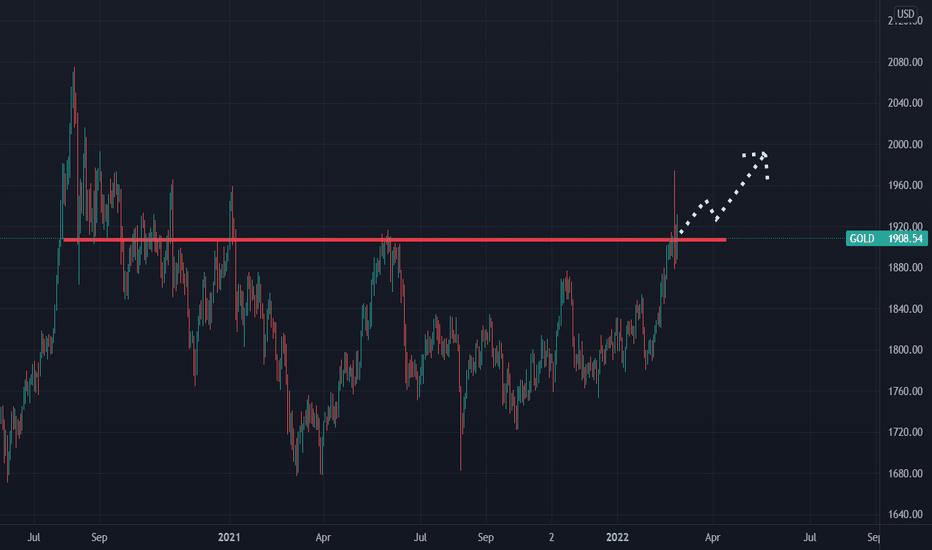

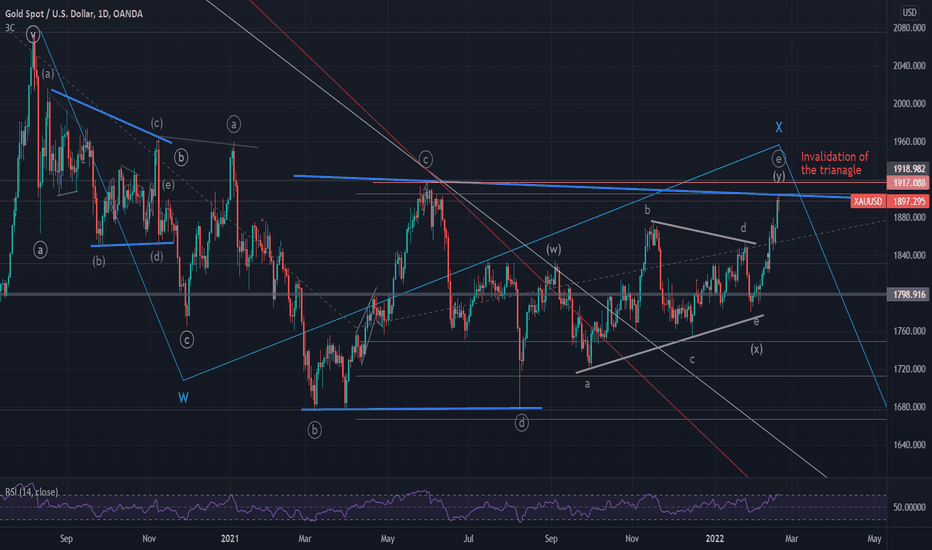

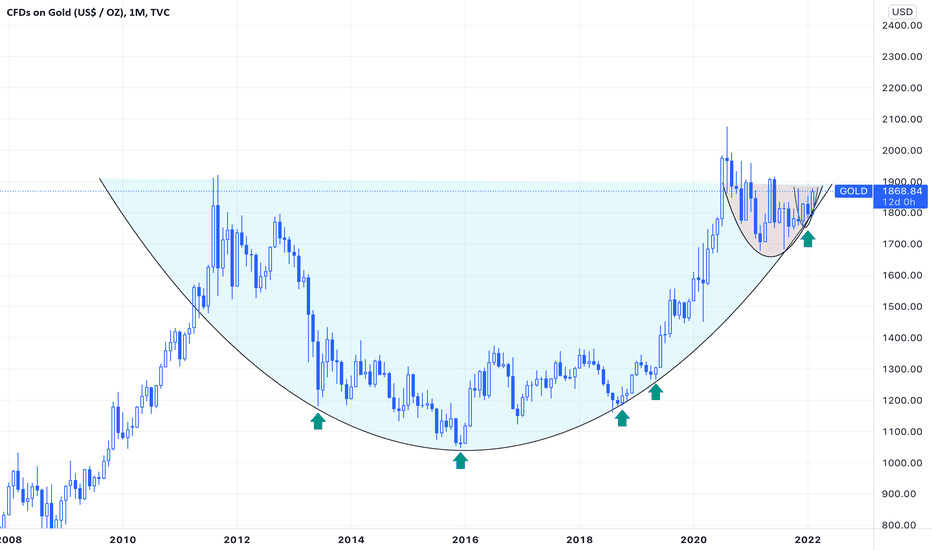

CUP & HANDE on GOLD This year has been quite the sell off this year and what’s happening over seas is making a very uncertain market. With news on inflation and stock market getting near very negative territory the flock to gold has been strong. It made a rejection at ATH and made a head and shoulder sell of which made a breather and let interest rates settle in. Now with a cup and handle on the board it could be trying to make its way to all time high again and maybe possibly break through it around 5-15%

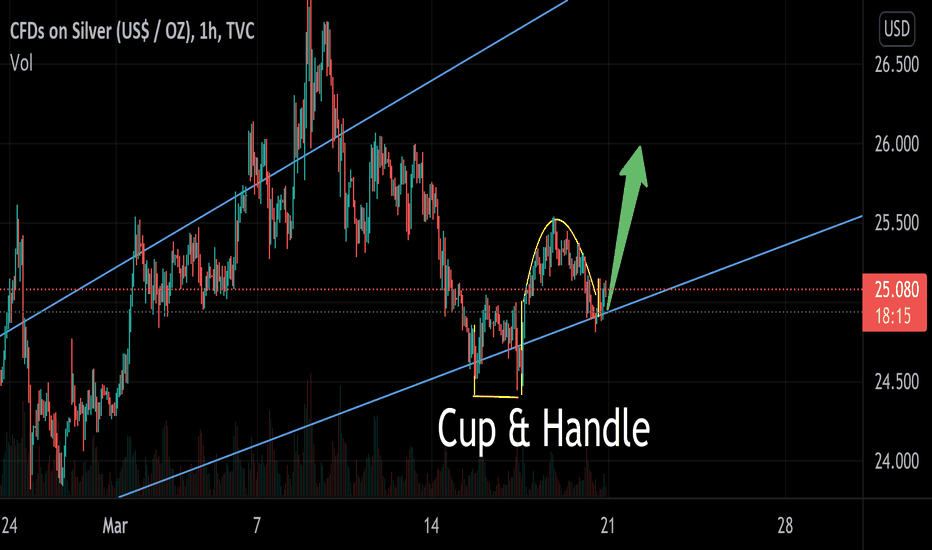

Silver cup and handle Silver over all has followed with general respect to and upward trend lately. With people buying gold and silver because house prices going down. Stocks going down. Uncertainty over the next 6-18 months. People do know gold and silver should go up in value. So a lot of eyes has been into those metals.

With that and what looks to be a very nice cup and handle formation. This very well could be an upward moment still for silver.

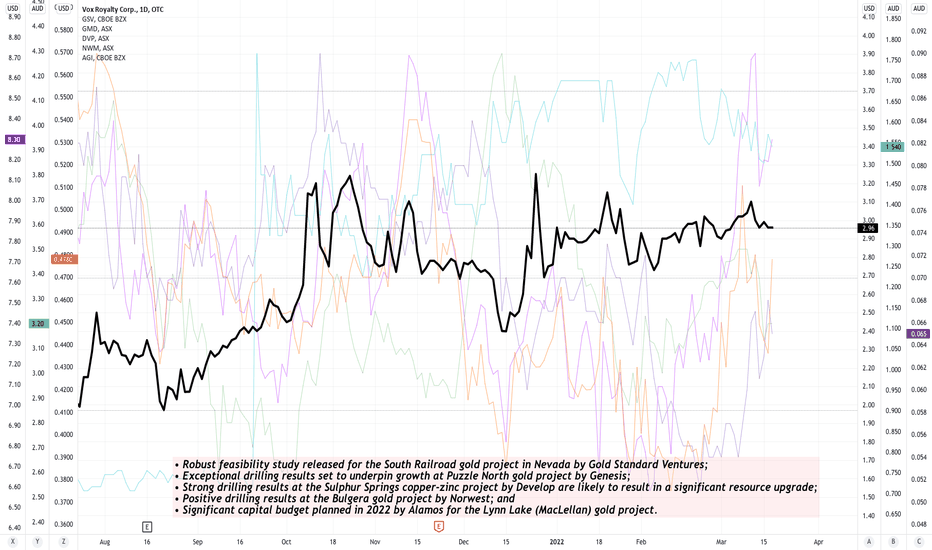

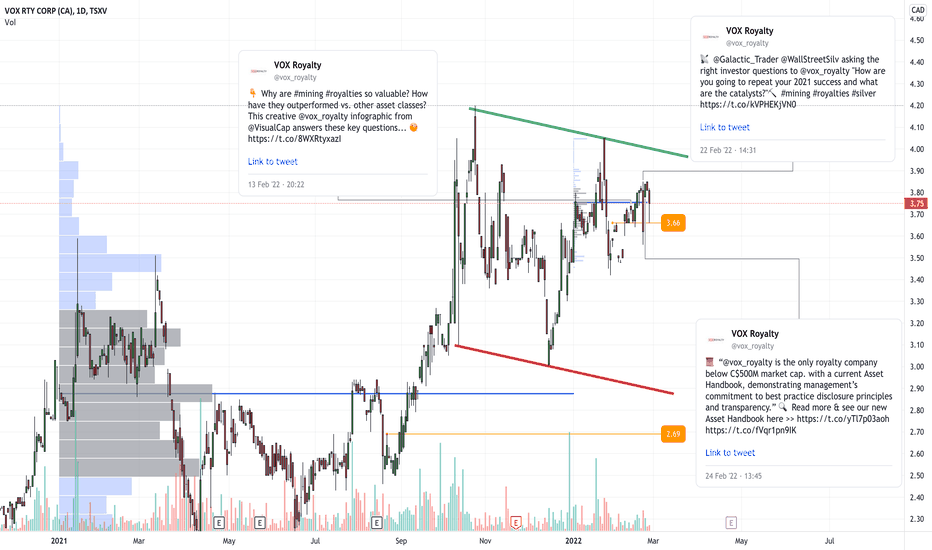

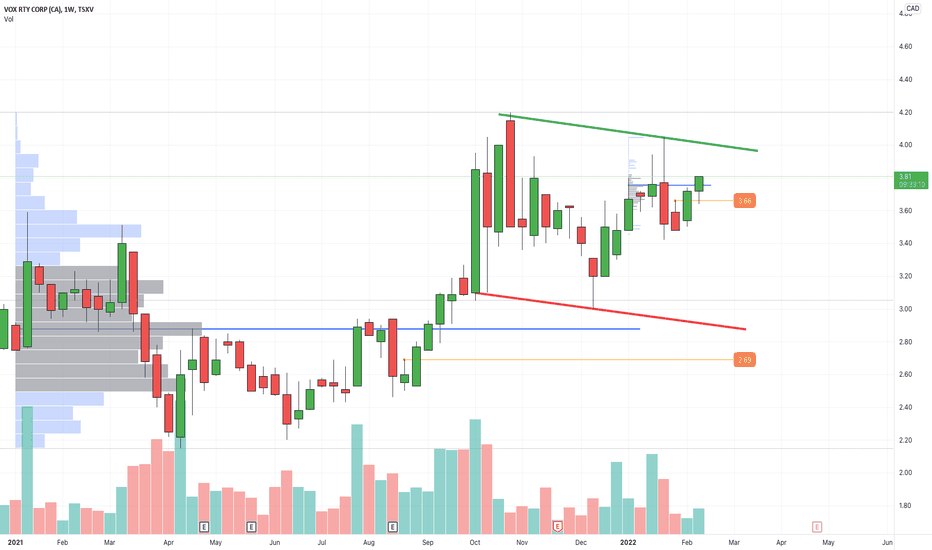

Vox Royalty Smoothes Out VolatilityHaving multiple royalties within a portfolio means Vox Royalty has enough diversification to clearly smooth out the volatility.

High inflationary environments are great for commodities and equities, but for miners, there is an increase in costs and CapEx. Not so with the royalty company.

Their expenditure doesn't change but they have access to the widening profit margins when each of the producers realise their gains.

TORONTO, ON / ACCESSWIRE / March 8, 2022 / Vox Royalty Corp. (TSX.V:VOX)(VOTCQX:VOX) ("Vox" or the "Company"), a high growth precious metals focused royalty company, is pleased to provide recent development and exploration updates from royalty operating partners Gold Standard Ventures Corp. (TSX:GSV) ("Gold Standard Ventures"), Genesis Minerals Limited (ASX:GMD) ("Genesis"), Develop Global Limited (ASX:DVP) ("Develop"), Norwest Minerals Limited (ASX:NWM) ("Norwest"), and Alamos Gold Inc. (TSX:AGI) ("Alamos").

Spencer Cole, Chief Investment Officer stated: "The past month of royalty operator newsflow includes the exciting release of the South Railroad feasibility study, ongoing exploration success at Sulphur Springs, Puzzle North and Bulgera, capped off by consistent development guidance for Lynn Lake. Each of these projects are being aggressively progressed by well-capitalized operators towards near-term resource updates and development decisions. 2022 continues to be shaping up as a record year for the Vox royalty portfolio based on these developments."

Key Development Updates

Robust feasibility study released for the South Railroad gold project in Nevada by Gold Standard Ventures;

Exceptional drilling results set to underpin growth at Puzzle North gold project by Genesis;

Strong drilling results at the Sulphur Springs copper-zinc project by Develop are likely to result in a significant resource upgrade;

Positive drilling results at the Bulgera gold project by Norwest; and

Significant capital budget planned in 2022 by Alamos for the Lynn Lake (MacLellan) gold project.

South Railroad (Pre-Feasibility) - Robust Feasibility Study Released(1)

Vox holds a 0.633% net smelter return royalty with advance minimum royalty payments over key portions of the South Railroad gold project, which is located in the prolific Carlin Trend of Nevada;

Vox has been receiving advance minimum royalty payments from Gold Standard Ventures since October 2021;

On February 23, 2022, Gold Standard Ventures announced the following feasibility study results:

After-tax IRR of 62% and NPV5 of US$487M at Spot Gold Price (US$1,899.20 per ounce) and after-tax IRR of 44% and NPV5 of US$315M at US$1,650 per ounce gold ("Base Case Gold Price");

Payback of 1.6 years at Spot Gold Price and 1.9 years at Base Case Gold Price;

29% increase in Mineral Reserves to 1.6 million gold ounces;

10.5-year operating life with total gold production of over 1 million ounces, with an average gold production of 152,000 ounces over the first four years;

Launch of construction financing process, targeting 75% from non-equity sources, to be completed this year in advance of final construction permits; and

Orion Mine Finance to provide Gold Standard Ventures with a term sheet of up to $200 million to support the construction of the South Railroad Project.

Vox Management Summary: These compelling feasibility study results closely match Vox management's estimates formed during due diligence for the South Railroad rancher royalty. This high-return project is being fast-tracked towards a first production target in 2024, based on Gold Standard Ventures management guidance.

Kookynie (Pre-Feasibility) - Exceptional Drilling Results at Puzzle North Discovery

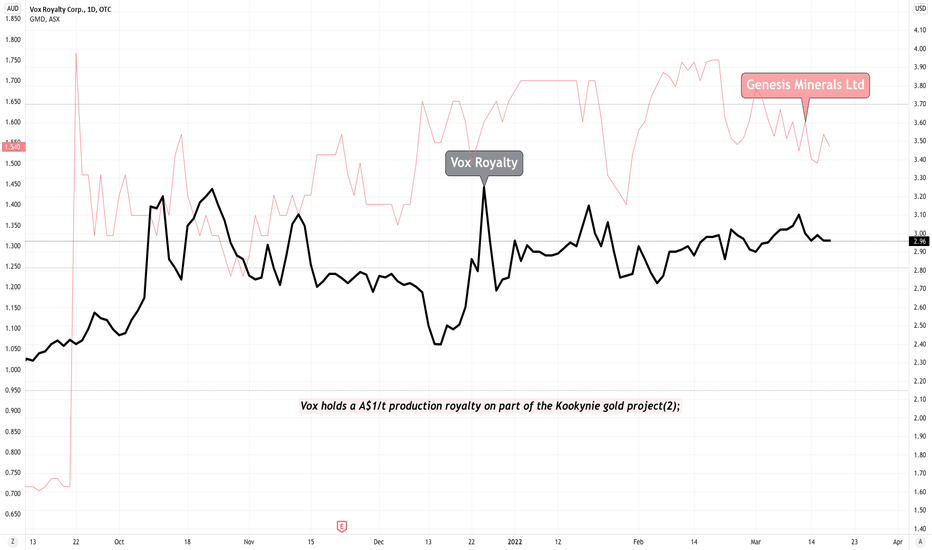

Vox holds a A$1/t production royalty on part of the Kookynie gold project(2);

On February 3, 2022, Genesis announced:

Outstanding new results from reverse circulation ("RC") drilling across multiple areas, confirming potential to expand the mineral resource at the Ulysses Gold Project near Leonora in Western Australia;

Broad, high-grade zones of gold mineralisation intersected from shallow depths in RC drilling at the Puzzle North Discovery, including:

21USRC1186: 27m @ 8.18g/t Au from 30m;

21USRC1190: 34m @ 13.36 Au from 42m, including 1m @ 382.6g/t Au from 68m; and

21USRC1192: 29m @ 2.91g/t Au from 52m;

Drilling at Puzzle North has now defined mineralisation over 600m of strike and up to 100m width, with the mineralisation remaining open both at depth and along strike;

Mineralisation at the southern end of the Puzzle pit extended over 200m south with results including:

21USRC1114: 11m @ 2.20g/t Au from 82m;

21USRC1119: 4m @ 9.07g/t Au from 92m;

21USRC1123: 5m @ 5.98g/t Au from 79m; and

21USRC1127: 47m @ 1.07g/t Au from 95m;

A large drilling program is currently being planned for the Puzzle North to Puzzle corridor.

Vox Management Summary: This exciting gold exploration royalty that Vox acquired for less than A$150k in 2020 is being rapidly drilled to include the royalty-linked Puzzle North discovery in an expanded feasibility study at the Ulysses gold project. The potential development timeline for this project from exploration to development continues to exceed Vox management expectations.

Sulphur Springs (Pre-Construction) - Strong Drilling Results Point to Significant Resource Upgrade

Vox holds a A$2/tonne production royalty (capped at A$3.7M) on the Sulphur Springs copper-zinc deposit and an uncapped A$0.80/tonne production royalty on the Kangaroo Caves deposit, which is part of the combined Sulphur Springs project;

On February 10, 2022, Develop announced:

It has now received ~60% of the assays from the A$10M resource infill and exploration drilling program at Sulphur Springs;

The drilling has been highly successful, with numerous high-grade mineralisation intersections of more than 50m, significantly thicker than anticipated and with two of the intercepts being the thickest intersections achieved in the project's history;

The results point to a substantial conversion of Inferred Resources to the higher confidence Indicated Resource classification;

The upgrade in Indicated Resource classification will pave the way for Develop to update reserves, mine development plans, project costings and to finalise funding options;

Exploration drilling has also returned outstanding results, paving the way for an increase to the total resource;

A resource update is scheduled for mid-2022; and

Preparations for construction of the exploration decline are proceeding rapidly with the approval request submitted. This will be pivotal because it will enable drilling to be conducted faster, and cheaper and brings forward capital/access to the underground deposit.

Vox Management Summary: Under the new leadership of Northern Star Resources founder Bill Beament, the Sulphur Springs project is on track to be expanded in resource size and fast-tracked into underground decline development within the next 12 months. This drilling success indicates that the potential economics of this high-grade copper project are improving month to month.

Bulgera (Exploration) - New High-Grade Drilling Results

Vox holds a 1% net smelter return royalty over the Bulgera gold project;

On February 3, 2022, Norwest announced:

The first three of seven diamond drill holes extend new high-grade gold lode to beyond 400m down dip of the shallow Bulgera open pit;

Drill results included:

BDD21003: 11.3m @ 3.25g/t gold from 260m (downhole), including 4m @ 4.5g/t Au from 260m and 3.3m @ 5.3g/t Au from 268m;

BDD21001: 16.5m @ 1.20g/t gold from 128m and 3m @ 4.10g/t gold from 166m;

BDD21002: 6m @ 2.07g/t gold from 195m;

It is sourcing a drill rig to undertake the Phase 2 diamond drill program (targeting March/April 2022) which will test mineralisation to ~700m down-dip of the Bulgera open-pit; and

Norwest's CEO, Mr. Charles Schaus commented: "Assay results from the first 3 diamond holes confirms that strong gold mineralisation extends beyond 400 metres down dip of the shallow Bulgera open pit. Once the gold assays from the remaining 4 diamond holes are received (over the coming weeks), the Company will commence re-modelling the Bulgera gold resources which should add considerably to the current, 94,000-ounce, gold resource reported in April 2020".

Vox Management Summary: Norwest management are now guiding towards a remodelled and expanded resource estimate for the past-producing Bulgera gold project which would increase the value of Vox's royalty. Oxide ore from Bulgera was last processed at the nearby Plutonic gold mine in 2004 and given the haul road remains in place, credible near-term development options are available for Bulgera.

Lynn Lake (MacLellan, Feasibility) - 2022 Capital Budget

Vox holds a 2% gross revenue royalty (post initial capital recovery) on part of the MacLellan deposit at the Lynn Lake gold project;

On February 23, 2022, Alamos announced:

the total capital budget for Lynn Lake in 2022 is US$14M, including US$11M for development activities and US$3M for exploration;

Development activities will be focused on environmental work in support for permitting detailed engineering and other site access upgrades; and

The approval of the Environmental Impact Statement for the project is expected in the second half of 2022, following which Alamos expects to make a construction decision.

Vox Management Summary: Alamos management has been very consistent in guiding towards a 2022 construction decision at Lynn Lake and is currently guiding investors towards 2025 first production in its corporate presentation. Alamos' 2022 capital budget further supports its consistent project development guidance.

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a "Qualified Person" under National Instrument 43-101 - Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a high growth precious metals royalty and streaming company with a portfolio of over 50 royalties and streams spanning eight jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to become the fastest growing company in the royalty sector. Since the beginning of 2019, Vox has announced over 20 separate transactions to acquire over 45 royalties.

Vox Royalty - Genesis Minerals LtdKookynie (Pre-Feasibility) - Exceptional Drilling Results at Puzzle North Discovery

Vox holds a A$1/t production royalty on part of the Kookynie gold project(2);

On February 3, 2022, Genesis announced:

Outstanding new results from reverse circulation ("RC") drilling across multiple areas, confirming potential to expand the mineral resource at the Ulysses Gold Project near Leonora in Western Australia;

Broad, high-grade zones of gold mineralisation intersected from shallow depths in RC drilling at the Puzzle North Discovery, including:

21USRC1186: 27m @ 8.18g/t Au from 30m;

21USRC1190: 34m @ 13.36 Au from 42m, including 1m @ 382.6g/t Au from 68m; and

21USRC1192: 29m @ 2.91g/t Au from 52m;

Drilling at Puzzle North has now defined mineralisation over 600m of strike and up to 100m width, with the mineralisation remaining open both at depth and along strike;

Mineralisation at the southern end of the Puzzle pit extended over 200m south with results including:

21USRC1114: 11m @ 2.20g/t Au from 82m;

21USRC1119: 4m @ 9.07g/t Au from 92m;

21USRC1123: 5m @ 5.98g/t Au from 79m; and

21USRC1127: 47m @ 1.07g/t Au from 95m;

A large drilling program is currently being planned for the Puzzle North to Puzzle corridor.

Vox Management Summary: This exciting gold exploration royalty that Vox acquired for less than A$150k in 2020 is being rapidly drilled to include the royalty-linked Puzzle North discovery in an expanded feasibility study at the Ulysses gold project. The potential development timeline for this project from exploration to development continues to exceed Vox management expectations.

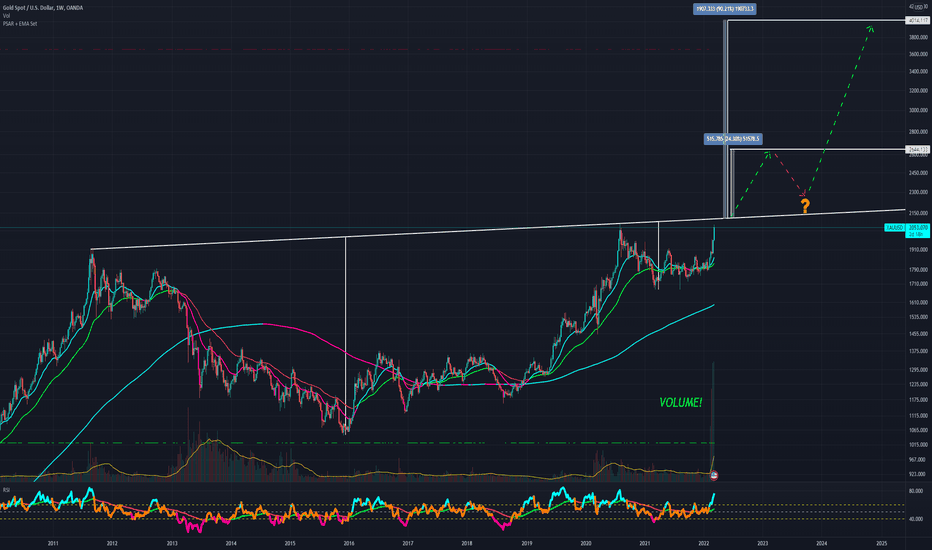

Relation between price of gold and FED's balance sheet.Seems to exists a relation between those two. In the long run, gold price seems to follow the expansion movements of the FED. In 08, prior to the GFC, the size of the BS was 800 times bigger than the price of a gold ounce. In 2012, it was 1,800 times bigger than the ounce of gold.

In both cases, the FED's BS was bigger than the ounce of gold by a factor that equals the price of that ounce.

After a growth in the BS size, it seems that it takes some time for gold to reach the value that matches the relation described above. It seems to require some time of keeping a steady not growing BS to reach it. In 2019, the FED failed in its attempt to reduce the BS, so gold wouldn't reach the desired value.

Would the FED be able to taper now? Would we see the ounce of gold at $3,600?

+1PALLADIUM@2412 - OPEN LONG - Target: $3,600 (+50%)Might be a good entry.. looking for at least $3,600 before the current diversion is exhausted

The only reason I prefer silver & gold over palladium and other exclusive metals is that it's one step more difficult to assay and physically trade in general.

You can assay gold or silver using only fire and bone ash, but it gets a bit more cumbersome to test palladium, which eventually makes it a bad apocalypse coin.

Also, the margin for the physical market is really huge, at least from my experience in Egypt's market. No matter how far you refine your palladium it's going to be sold maximum at only 40-50% of the screen value.

However, the demand for palladium doesn't seem to be ending soon, although a very small number of people deal it, you can see them sniffing all around the gold alley in Khan el Khalili sneaking outside dealerships looking for any traces of palladium in cast silver bars being sold.

It can have all sorts of chemical, medical, and industrial applications but locally I've seen workshops use it frequently as a supplement for rhodium which became a nonexistent ATM..

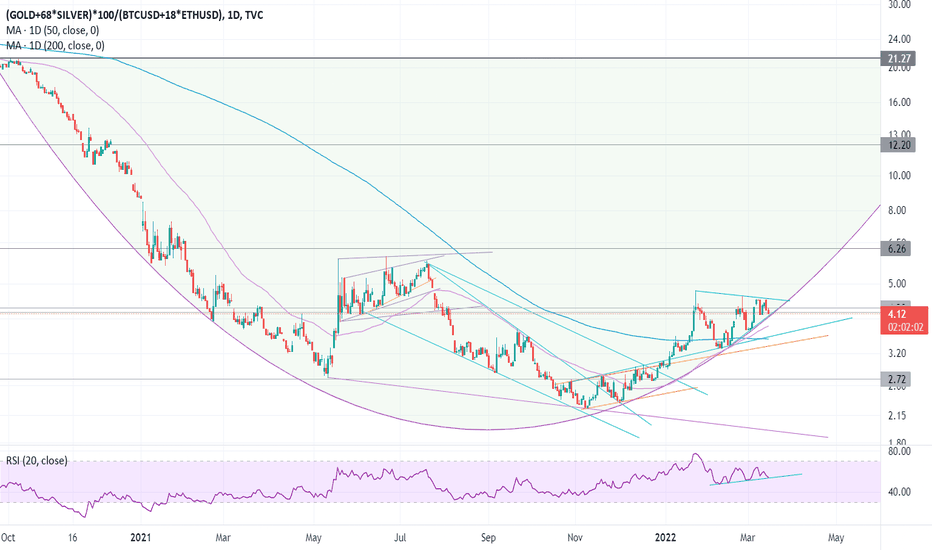

Update on PMs vs Cryptos right now. Gold, Silver, BTC, ETHI designed this custom chart to monitor the relative strength of top precious metals gold and silver versus top cryptos bitcoin and ethereum, to their respective ratios.

As you can see, there is a compression triangle of sorts that has formed and looking to determine which way it will break out.

The bottom is supported also by this arc spanning a much larger time horizon.

The fundamentals favor PMs.

All this together leads me to believe we are headed UP in gold/silver relative to cryptos.

None of this is financial advice.

If you're seeking a platform to trade between cryptos and precious metals (and fiat if you like), check out Kinesis. Their gold and silver on blockhchain are real, allocated, audited, and deliverable (at a very reasonable price I might add). Really the best of the best. Check out their informational videos to learn more:

kms.kinesis.money

Gold Cup and Handle target estimatesEveryone is talking about gold and silver making massive Cup and Handles but I haven't seen many measured move estimates.

We are just about to touch the brim resistance with a possible consolidation before the break out and major moves up being.

Trying to estimate measured move targets give me an estimate move to $26k (+24%)before a pull back. Maybe a retest but I have doubts.

Then measuring the bowl to break out gives an estimate of $40k (+90%)

Gold RIPPING higher. New Record Coming! Buy Discounted!Gold is exploding higher on fears in the market. When the "you know what" hits the fan, real stuff matters. Countries and hedge funds are piling into gold and treasuries as a safety net as the market continues to implode. In this video, I talk about physically-backed trusts that allow a paper-type holding via stocks but real gold, silver, palladium, and platinum behind it. And get this, at a discount! If you were looking for a place to get out of your overpriced NASDAQ stocks, this might be a place to hang out as the dust settles. Here I talk about Sprott's Trusts on physical metals as I see them as a very trustworthy company that knows what they're doing and with the clarity on how many assets they have in these metals so you know what you're actually getting into.

Don't be a chump. If you found this video helpful, insightful, or educational, make sure you like it and drop a quick comment below. If you have questions, POST! many people on here answer these questions and have other insights to charts and videos to help continue educating each other. Also, if you're watching this somewhere else on the internet that may have an advertisement, watch a quick ad to support this free content. Only costs you a moment.

Stocks PSLV, PHYS, CEF, SPPP GLD, SLV, FUTURES, DJI

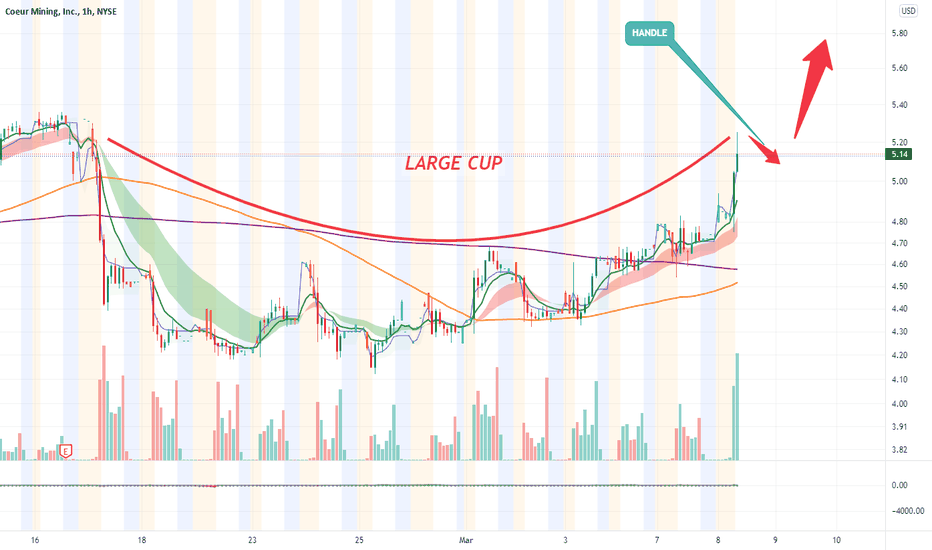

$CDE - MINING PLAY BREAKOUTCDE is yet another example of a mining name that hasn't been found yet but is working on a major breakout.

Coeur Mining, Inc. explores for precious metals in the United States, Canada, and Mexico. The company primarily explores for gold, silver, zinc, and lead properties. It holds 100% interests in the Palmarejo gold and silver mine covering an area of approximately 67,296 net acres located in the State of Chihuahua in Northern Mexico; the Rochester silver and gold mine that covers an area of approximately 43,441net acres situated in northwestern Nevada; the Kensington gold mine comprising 3,972 net acres located to the north of Juneau, Alaska; the Wharf gold mine covering an area of approximately 3,243 net acres situated in the northern Black Hills of western South Dakota; and the Silvertip silver-zinc-lead mine comprising 97,298 net acres located in northern British Columbia, Canada. In addition, the company owns interests in the Crown and Sterling projects located in southern Nevada; and the La Preciosa project located in Mexico. Further, it markets and sells its concentrates to third-party customers, smelters, under off-take agreements. The company was formerly known as Coeur d'Alene Mines Corporation and changed its name to Coeur Mining, Inc. in May 2013.Coeur Mining, Inc. was incorporated in 1928 and is headquartered in Chicago, Illinois.

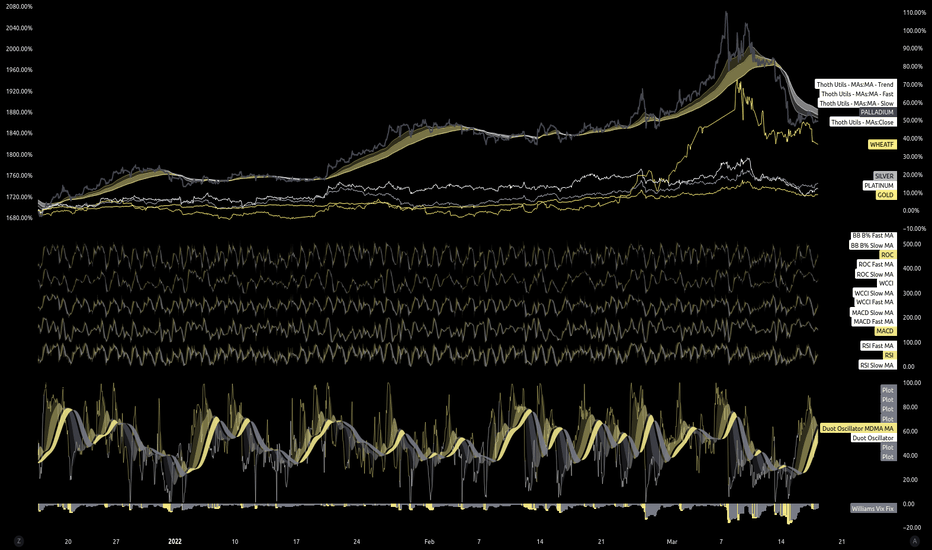

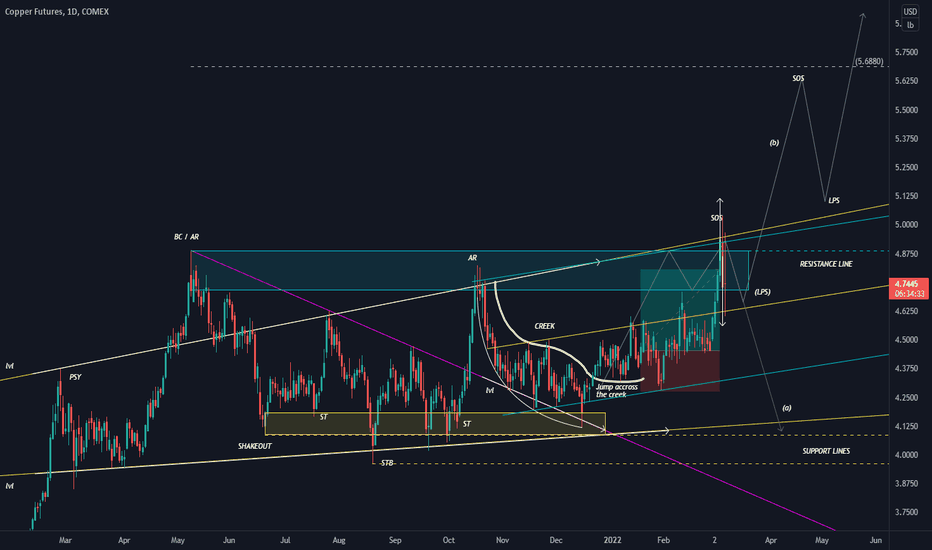

THREAD #2 : Commodities Update ‼️How it works ?

Ask me in comment my chart analysis of the asset you want if it didn't have already done under. If I find something intersting to say and show, I will update the idea with it. A comment of each asset expose will be post under, come react about it or debate.

Before to start I want to remind that we are in a period of conflict and news can emerge at any moment with strong effect and reaction on market. So invest carefully on this hard times and reduce your loss exposition on market when you can. Don't forget to take profit too.

"Making money in trading is math and respect of strategy, so never let your emotions guide you in uncomfortable positions"

As I've already done ideas on copper last months, let's start with it.

COPPER ✅

First of all, if you follow my ideas you can see it's the same chart than the 29th of December when I posted it and the 20th of January for the trade. It is attached under and I invit you to see it because it will be the continuation of these analysis.

So we are always in the Wyckoff Accumulation which have been developped, pullback on creek is done, and SOS too. Unfortunetly SOS failed so for me it's an end of the pattern. By consequence major part of my position have been closed and I will explain next why I keep a little which I not do usually. Why SOS is a fail ? Simply because we have selling volume, on the resistance area, on a primary resistance (yellow line) and because we have also selling pressure in it. The work have been done for the pattern, we took profit but can't project anymore in a term of "Wyckoff accumulation" of a bull continuation. So what to expect now from it ? The standard expectation after a failed SOS is to go back on the support area, usely rapidly and strongly, and invert the pattern in a way that we will now test the buying strenght on support. So we can expect a retest of support with an SOS to see, if it succeed, a bear continuation. That my scenario (a), and technically the most probable for me. BUT we have to live with our time and with the macroeconomic dynamic that we deal with. I will not hide that if the conflict between Russia-Ukraine continu and maybe gets worse, this will be a boost for every metals assets. That why I closed only 80% of my position, I can't advise to take long position anymore but it's could be wise to take profit and keep a part of your position if you are already in it. We can handle the technics evolutions but we can't handle the macroeconomic evolutions. If it this scenario (b) happen, we will see the construction of an LPS around $4.60 before to break up to the target around $5.70 in a first time. Take care of volatility, it will swing.

GOLD ✅

Like for the copper, the chart don't have change since the commodities update of the 20th of January. We are coming to the end of the bull scenario. I invit to take profits on the conjoncture of the resistance area and the (2c) resistance. There is no interest to sell a refuge asset like gold, even more in this time of conflict. So if there is selling signals take it like an opportunity to buy it lower. Especially here, we will wait for buying signals on the (1b) or (1a) support and the best case would be the support area of $1,700 - $1,675 but far from now. For peoples already exposed on it, if it continu is bull movement and breakout the resistance area, we will be in price discovery so it's always hard to find targets in it because of volatility, but I don't expect it to go higher than $2,500 - $2,600 where we will probably find a big selling pressure.

SILVER ✅

Like targeted in the last commodities update we are now on resistances of the downward channel. I don't expect a breakout of (1b) and the resistance area, so for me we will see the construction of a range between them around $27 and $29. The biggest probability for me is a bull outcome of the range to target the (1c) resistance (scenario A) and probably more after. If we reject the resistance strongly after lateralization I expect price to go deeply retest the (1a) support around $20 (scenario B). And finally if we see a reject of (2a) / (1b) soon, we could expect a short consolidation to (2b) before to go back again to the resistance area (scenario C). Like every metals, It would be dumb to expose yourself on the bear side in a period of conflict. More wise to wait consolidation and signals around the orange circles areas.

PALLADIUM ✅

Palladium is another successfull prediction we had in the last commodities update. In term of evolution now it is very close from the copper analysis because we made an SOS which has also failed. So technically, the biggest probability is to see it go down on the (2b) line in a first time (scenario A) maybe more with (1a) before to retest the resistance (1b). If the macroeconomic dynamic bring it higher we could see an interesting area to enter on a buying signal on the pullback on (1b) (scenario B). Else we could go straight to (1c) around $4,500 - $4,600 before to see a strong selling pressure on price discovery.

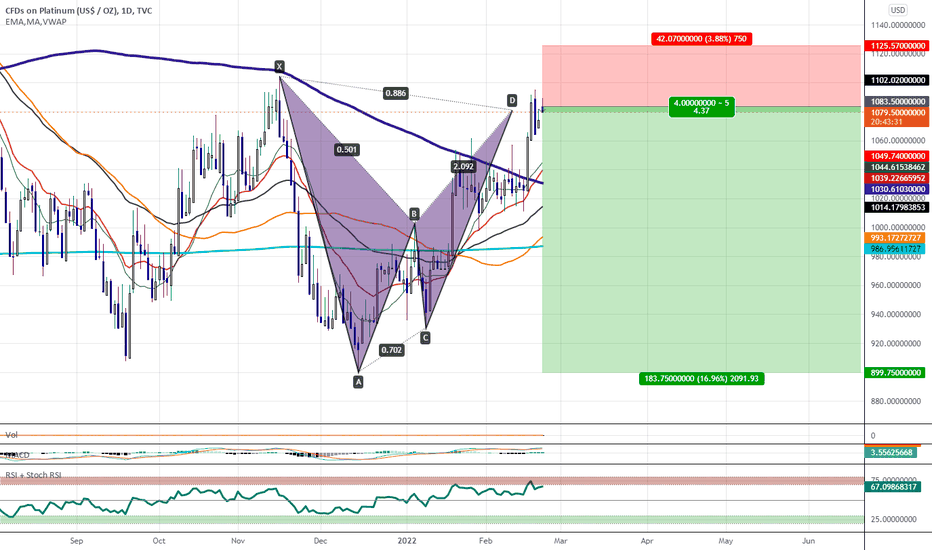

PLATINUM ✅

Platinum is also targeting the prediction of the last update. In term of perspective now it's more blurry for it. The most interesting pattern that we could see is for me a reject of (2a) to go down to (2b) which could be a nice entry on signal around $950. Else, probabilities to see it continu on the bull side are strong but I'm not confident on any areas, except the support of $860, to target entries once we will reach the resistance area of $1,340 - $1,270.

CRUDE OIL ✅

I said in last update : "If I had an advice to give : stay away or be on short timeframe on this asset. Too much risk to see price manipulated by news on this public interest asset." and so after +30% in a week we have to look back on montly timeframe to search resistances. I believe in the fact that it will fall as rapidly as it surged and I also believe in the fact that we will not stay a long time at this level. Oh .... wait ! Just don't take care of what I just said, like the last commodities update it's just a manipulated asset and price will go where OPEP want to see it. So stay away of it.

For those who really want my technical analysis it is : I think we can do an ATH just to say : "It's all time high !" but we will find a strong selling pressure because of (1b) and fall down rapidly.

WHEAT ✅

Similar to oil technically, boosted by the macroeconomic context we did a new ATH and seen a strong selling pressure. However I don't think it's wise to sell it. We totally outbreak the range we was looking to in the last update, now if we break the resistance it could go really high but you will be attached to macroeconomic news so I advise to also stay away of it in both side.Take profits if you are exposed on it.

SUGAR ✅

Rectification from the last update : we are always in the Wyckoff reaccumulation. I thought it failed because of the candle of the 10th of January but it seems to be an anomaly of market and the structure around the 28th of February confort me in the fact that it is a spring. Now we have jumped over the creek so the best area to target entry is, like for the copper pattern, the pullback on the creek. It's exactly the same pattern that we had on copper now, so just wait signals. If it go straight without pullback just let it go and don't buy in the resistance area before a breakout, there is a lot of resistances which will bring many pressure I think for the SOS.

🛑 Like, follow or comment if you like, it give me some strength to continue! 🛑

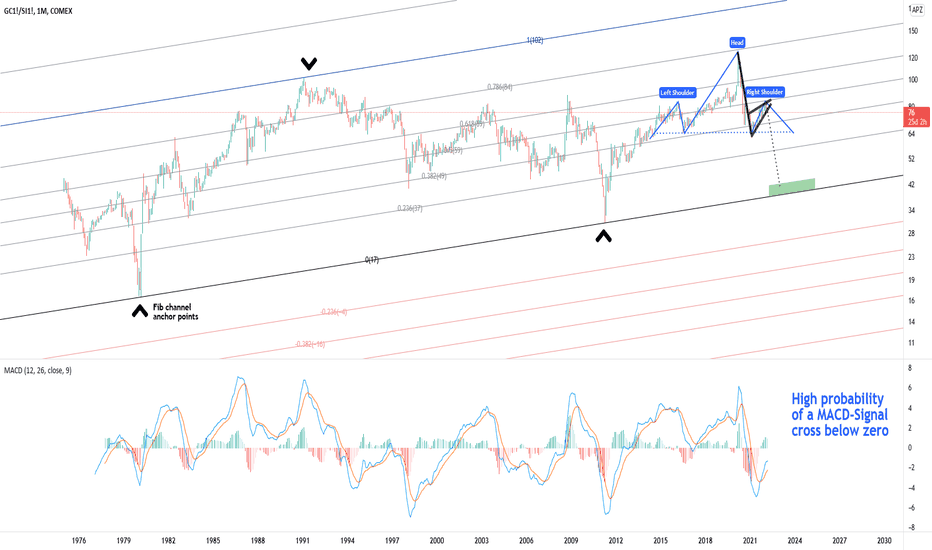

The GoldSilver head and shoulders and bearish wedgeThis is tagged as short due to the bearish patterns on the chart but it is kinda confusing because I am writing this to long silver

A zoom out has help me get a more detailed look at the goldsilver ratio. What appeared to be random chop and a blow off top now appears to be a left shoulder and head. The C19 dump created a new all time high for the goldsilver ratio and ever since then it has been bearishness. The ratio dropped almost in half from 120 to 64 and then created a classic bearish rising wedge pattern. Given the quick downside we have a flagpole and a bearish continuation structure that combined with the previous chop looks like a head and shoulders. The chart also shows a Fibonacci channel with the carats showing the anchor points. With the bearish chart pattern I see a high probability that the monthly MACD sees a bearish cross of the signal line as we see performance on the flag pole/head and shoulders.

Here is a draw on the channel drawn to monthly candle bodies as opposed to wicks. One reason I think the fib channel is valid for trading is there are lots of strong reversals at key levels.

Now this is a important point: I don't foresee this move happening in the next year or so. Price has spent a lot of time bounding around between the 62-66 range and since it has bounced there so many time as both support and resistance there is a fair chance that the ratio will be testing the range as resistance in the next couple of years if it fails as support here. A initial sell off then a return to the neckline of the head and shoulders pattern would be very typical price action. The chart below shows a fib draw and just the bottom of the fib channel. There is a confluence between the 1.618 target and the trend line support so some stall or bounce there is concurrent with the flag pole portion of the head and shoulders.

Below is my favorite example of a chart pattern hitting target off all time. It is a head and shoulders draw on Ford with quite the cant to the neckline, but it predicted a massive sell off and the technical traders stepped in right where we would expect them at that key ratio. Sure, price went down another 10% but if you were the mad man buying long term out of the money calls down there you would look like a genius. The targeting shows that we can't expect much below that 1.618 level with a high level of confidence. I have heard some technical analysts with a lot more experience than me say a flat neckline gets you better performance but I think I will be happy rotating out of silver into something else between 39 and 41.

Some Silver Nasdaq Stuff

Below is a comparison between the NDX, Silver, and Silver/NDX. It is still a bit to early to tell if Silver/NDX is in a ascending triangle with the purple as resistance or a symmetrical triangle shown by the black. But the case for NDX and Silver moving in opposite directions seems clear.

This could be its own post, and maybe I will make it one. The high beta index is NDX, and silver is high beta compared to gold. Just by simply looking at the SilverNDX pair it looks like equities broadly isn't a good decision. But if it looks like SilverNDX and GoldSilver are reversing at the same time it will be time to broadly be looking at equities and tech stocks and not precious metals and mines.

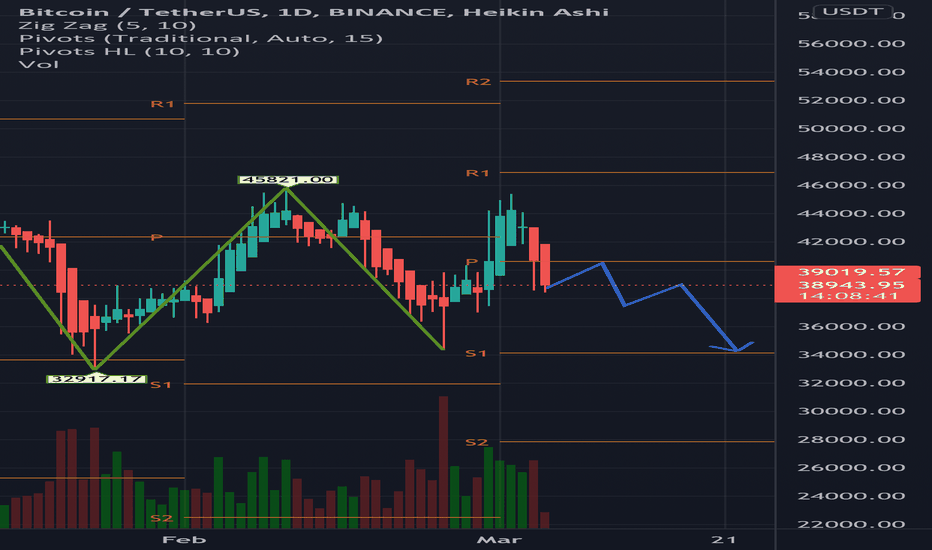

Updated perspective for Mar 3, 2022The chart is now set up for a possible bottom (I emphasize the word "possible").

The Factor Daily Trend Model turned Neutral on Mar 1 and will turn UP with a wide-bodied advancing candlestick that closes above 46,000.

While it is not the most ideal chart construction, I can argue that a decisive close above 46,000 will completed a double bottom pattern, turning the Factor Daily Chart Model into an UP status.

GOLD - To the Moon?-With Russian banks getting banned and sanctioned everywhere, what will happen to the market? Well if you freeze a country's dollar reserves, you decrease the liquidity within the market. With the decreased liquidity central banks such as FED would normally have to print more money or open more Swap Lines for other banks so that these banks have money to lend. This whole swift ban and sanctions on Russia have such a dramatic effect on the economy which we can't even imagine how will come out in the end. Definitely has a bearish effect tho!

-Another issue is the rising Gas prices. Well, why do they rise tho? Maybe because Russia is a major supplier of Gas internationally? That might be the issue, right? Of course, it is! One thing that Putin has, and that's his Ego. With so many sanctions applied to him from his western friends, he definitely plans about a pay-back in terms of Gas. Germany is a major economy in the European Union and Germany greatly depends on Russia for Gas. Guess what happens in inflation goes up in Germany due to rising oil prices? Union goes down as a whole.

-Third and last issue is the March Fed interest rate hike. Initially, it was clear that Powell wants to start easy with some small rise, but what about now? With the whole war and its effects on additional inflation, will we have a bigger rise? Or will FED ignore inflation for a while and save the market from a crash by easing the economy for a little more? Well, that's the question that keeps the market away from the crash, for now, it all depends on FED. Honestly, in this hell, we see no light, super bearish. But who are we when there is FED and their decision in March? Let's see how it goes!

Vox support holds, assets will support through 2022C$3.66 is a weekly support level that has been tested and proven to be a solid base to build on. Looking left along the chart there is very little imbalance within the price action to backfill unless of course, we go lower. With their focus on acquiring third-party royalties mainly within the precious metals (80%), they are delivering growth and returns on the invested capital and have executed 25 separate transactions since 2019. Invested capital so far is C$32M and now they have around C$140M total equity value.

In 2021 they had 5 producing assets in the next year or so we should be seeing that number more than double. There are currently 17 royalties in the development stage and 33 in exploration.

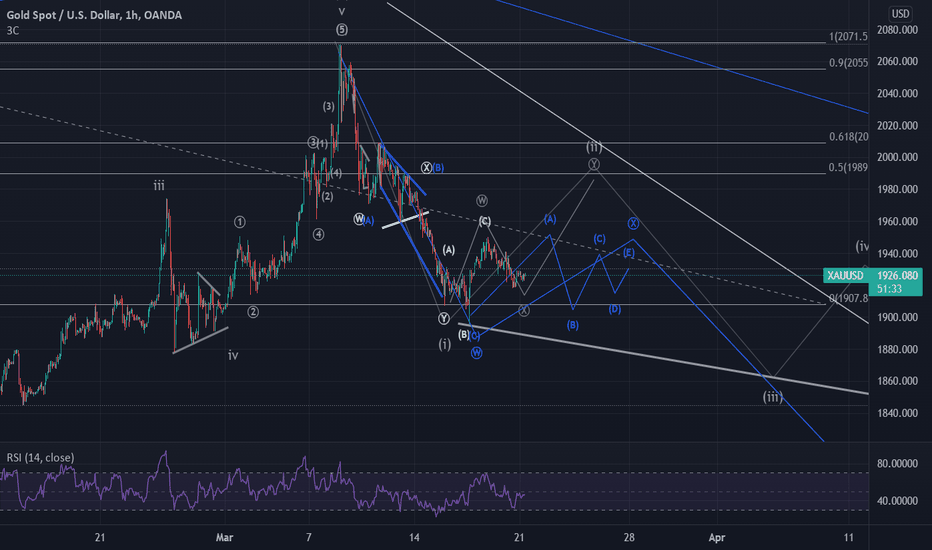

XAUUSD UpdateAnother week another post that the gold is short despite it is melting up on a Russian-Ukraine war hype.

Yes, the triangle scenario is getting extremely challenged. I even allow a scenario where the triangle is broken and I have to relabel it in some other bearish way. Tradingwise, I am very close to the point where I give up with my shorts to step outside and watch whatever happens next be it a melt up or forming the local top which will allow me to re-enter. If it melts up - perhaps I will miss that move.

I will elaborate more using my blog / website referring to Silver charts for confirmation.

Vox Royalty finds weekly supportI am going to assume that the price of gold is supported around the $1800 for the rest of 2022. If that level were to break, and a bear market ensued, precious metals miners, #GDX, etc. would come under pressure and the current rising tide that is lifting all boats would recede and companies like Vox Royalty Corp may come under pressure becue of sentiment.

Fundamentally, the Vox Royalty story goes from strength to strength and this coming earnings report should highlight the accretive nature of the current producing royalties which will form a base for what happens in the rest of 2022 and then beyond. With all that said, I don't think we get back down to C$2.69, which is the previous support, imbalance. This week's low dipped into C$3.66 and was rejected, which to me shows that the support level is currently there with the volume confirming the price action.

Looking left across the chart, there is no level of market structure to worry about, which means liquidity runs above C$4.00 is the path of least resistance.

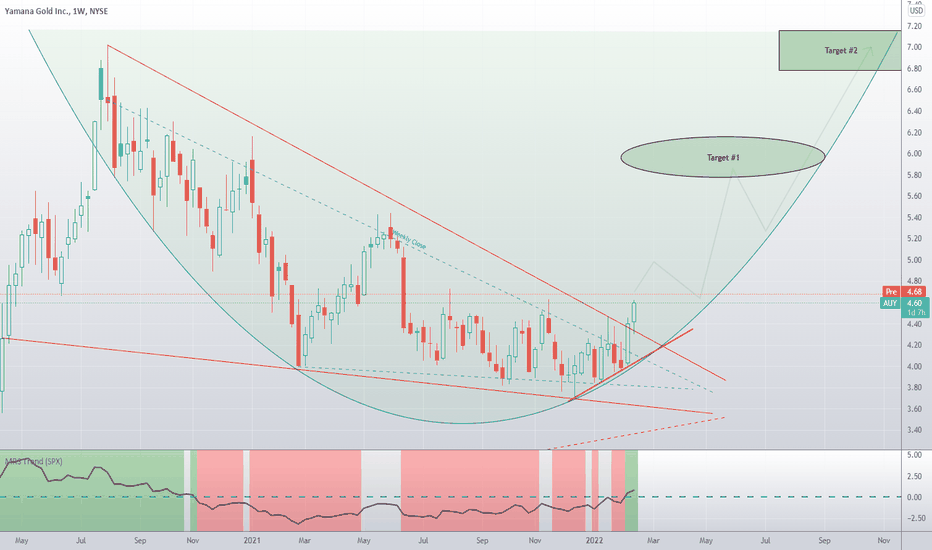

AUY's Inevitable Path to $7Is it finally time to be bullish on gold and silver mining stocks? A lot of indicators are pointing to YES. There will certainly be pullbacks along the way, but with interest rates rising and war tensions overseas, precious metal stocks are beginning to gain a lot of interest. NYSE:AUY will be the perfect example of that.

The featured content is intended to be used for informational purposes only. Everything shared here is my own opinion. It is very important to do your own analysis before making any investment based on your own personal circumstances. Please subscribe to our channel if you like what you are seeing!

There will be ,,golden‘‘ times coming From a chart technical perspective we are nearly at the highest point of the cyclicality. It’s unbelievable if you recognize how many years it’s costs to stay there where we are.

Anyway, if we see at the fundamentals right now, it doesn’t seems that bad for gold:

- inflation isn’t peaking

- Russia Ukraine could getting more worse (I don’t hope so)

- Gold is hitting 1870$ for several times &

- (If we should gonna get more worse economic datas than gold will more rise)

We are at a level of 1870$ right now. We could nearly hit 1900/1920 (or even more) in middle of march. If the FED will hike the interest rates we are gonna see big pullback to much bigger lower levels like 1720 or 1640. For now…