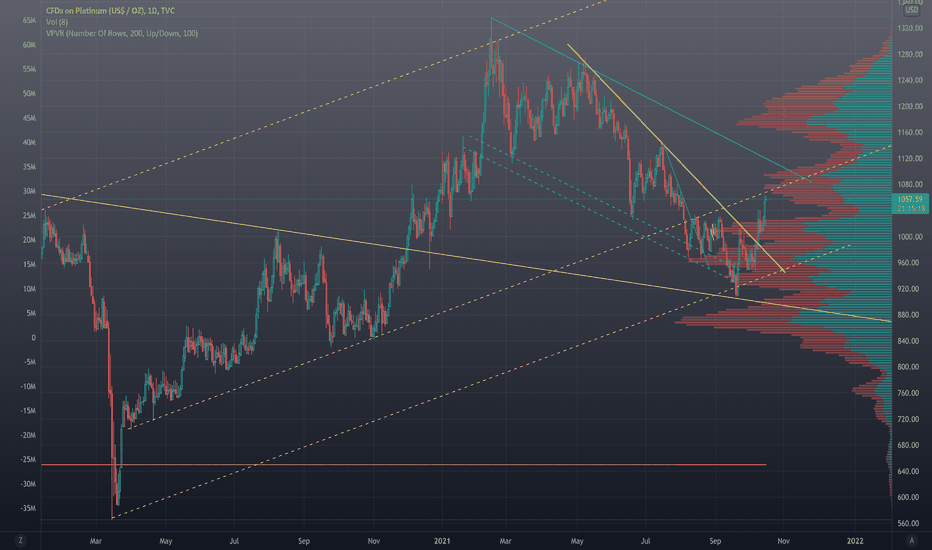

GOLD-SILVER

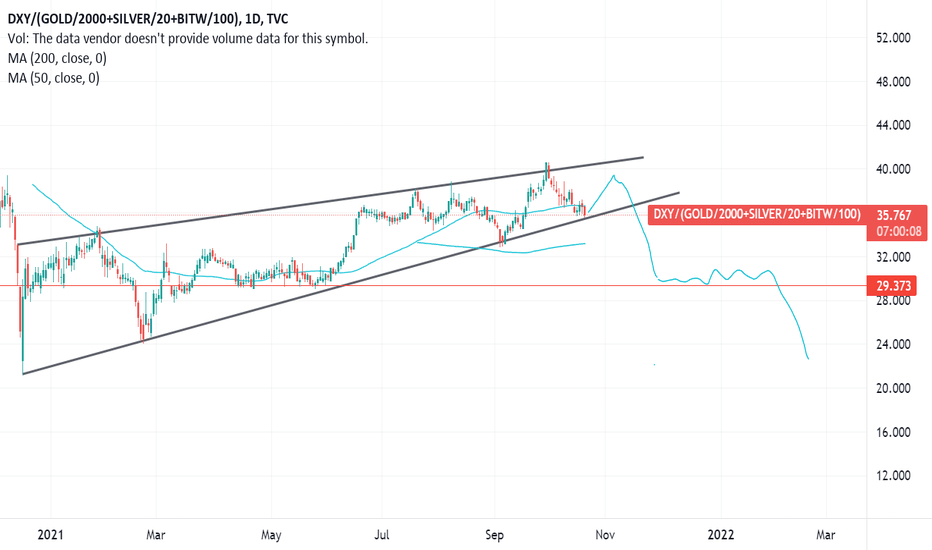

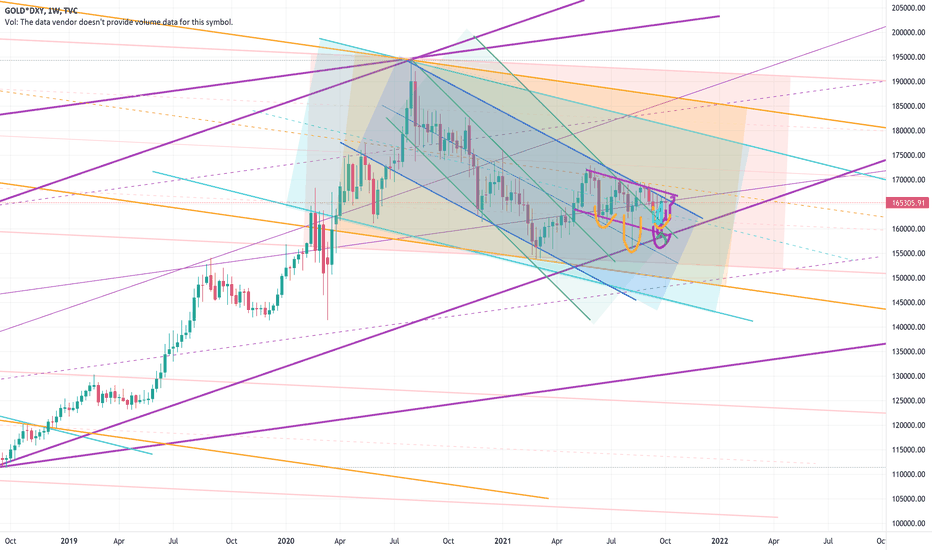

The Dollar's last hoorahThis chart shows DXY over an equal weighting of gold + silver + crypto. The idea is that these asset classes could potentially replace the dollar in global reserves, thus weakening the dollar. During a downtrend in the dollar starting in March 2020, we see a channel up in the dollar while alternative assets even sell off during the same period. In this ratio chart, a rising wedge is near it's pinnacle, revealing a continuation in the downward trend for DXY and bullishness for metals and crypto. I expect this chart to fall to around 30 before end of 2022. That is, January levels on DXY around 90.

This chart also shows a bullish case for those alternative assets. Gold and silver just completed an inverted head and shoulders pattern and look ready to start a new bull run. Bitcoin just reached a new ATH.

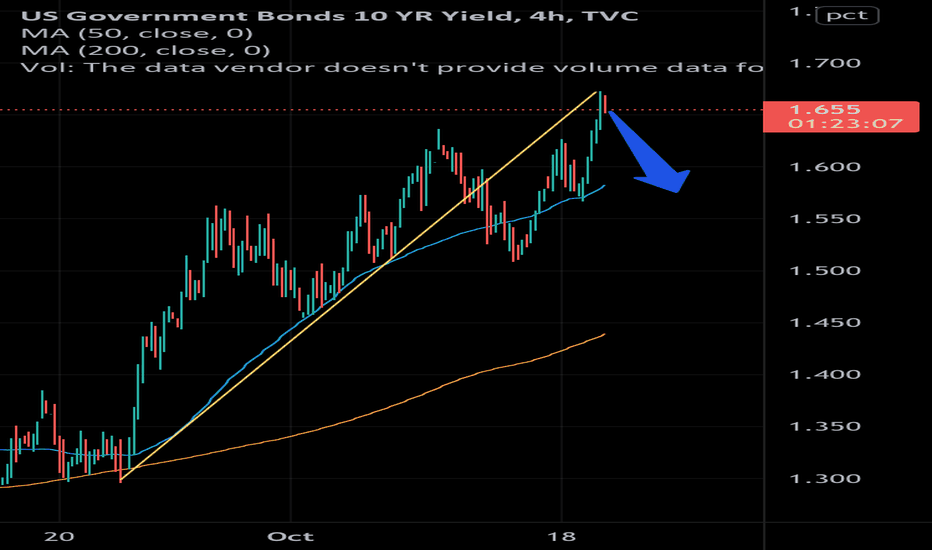

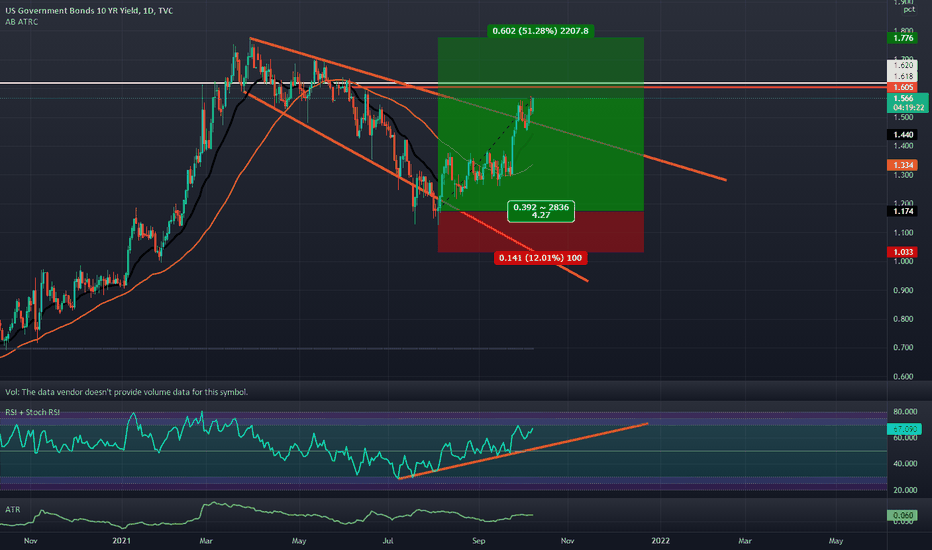

Gold Under Pressure from Bonds?It appears the US 10 yr is temporarily topped out. With Gold and Silver holding up despite very bearish outlook sentiment, this catalyst could be the final barrier in the way for further upside of PMs. DXY also seems to be breaking down from weekly chart bearish ascending triangle.

*first shared idea… please forgive the lack of technical viewpoint. Just my opinion. Do your own DD, and good luck.

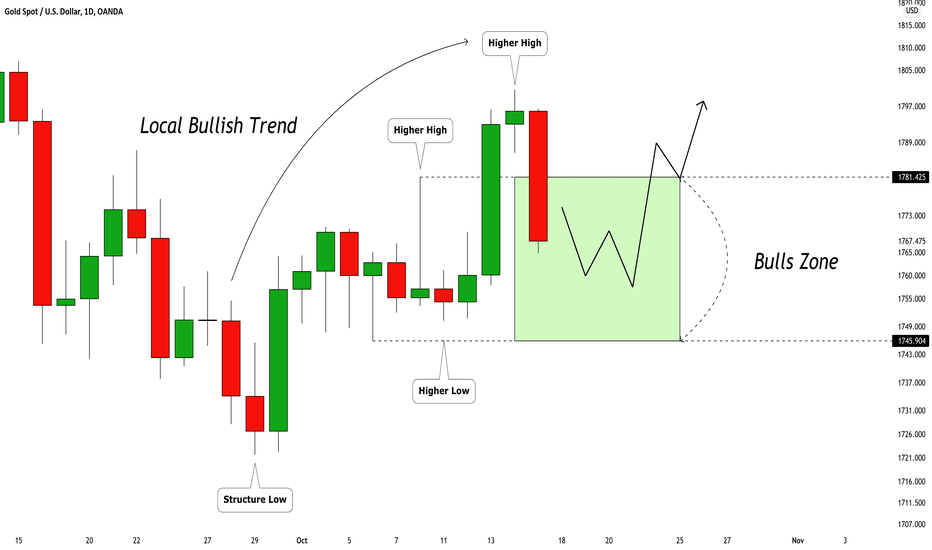

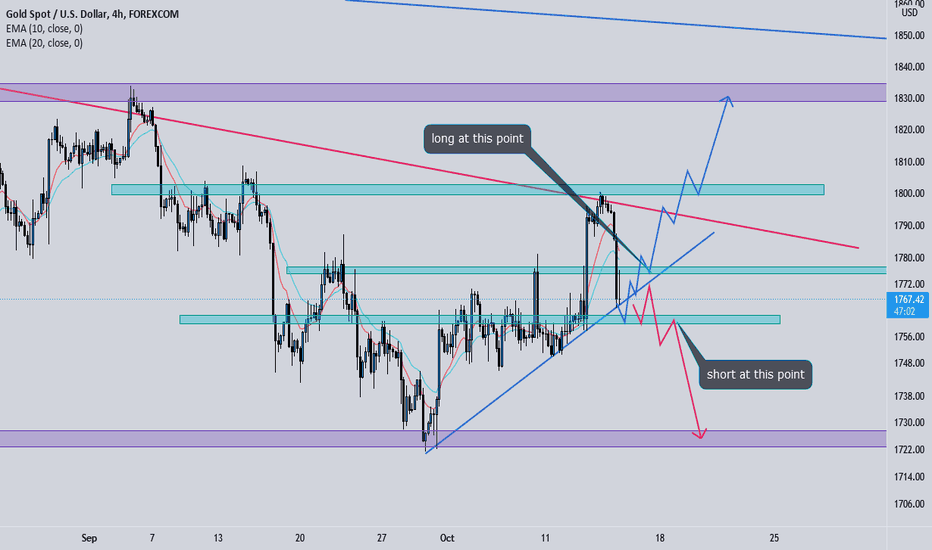

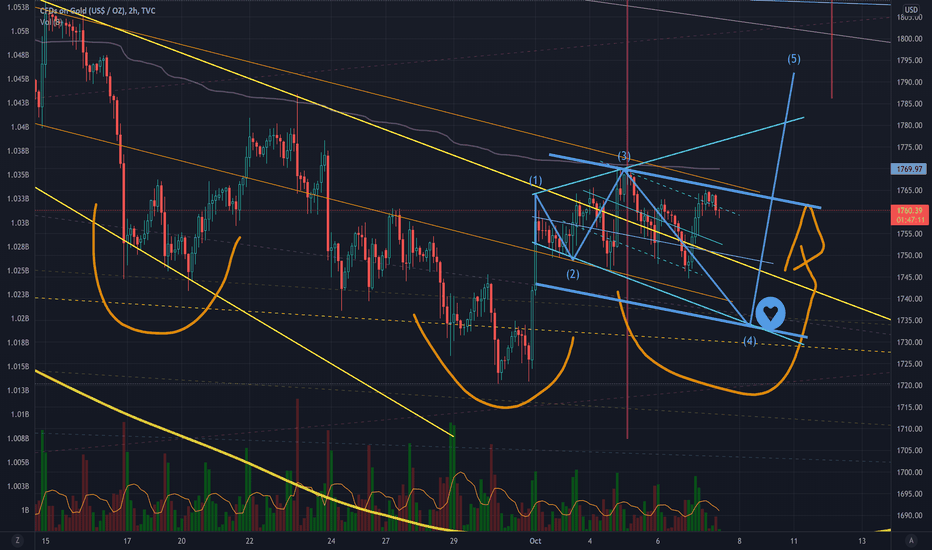

GOLD (XAUUSD) Price Action Analysis & Technical Outlook 🥇

Hey traders,

A lot of questions about Gold.

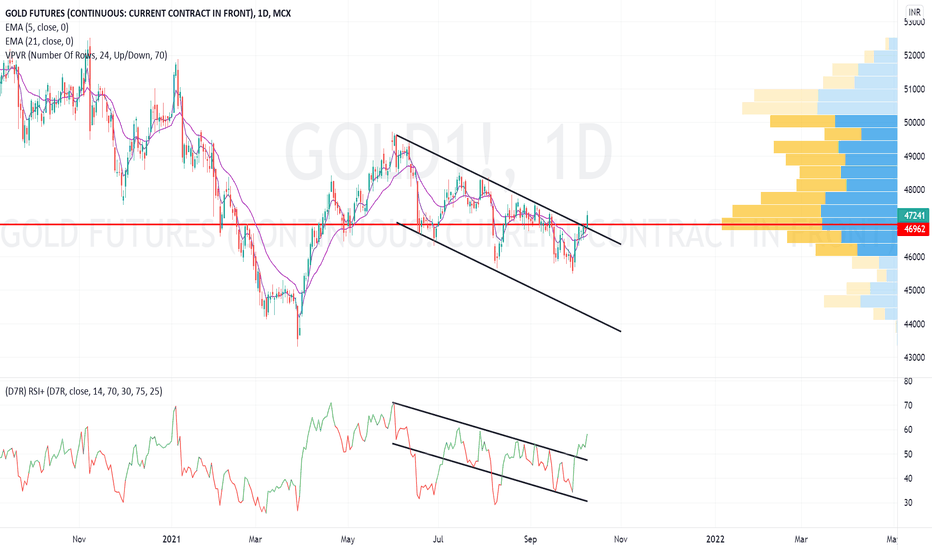

Analyzing a price action on a daily and following the impulse legs from 1721 September's low

we can derive that the market is trading in a local bullish trend.

With an initial bullish impulse to 1781 and a retracement to 1745

the price managed to set a new higher high higher close then.

Now the area between a current October's high - 1800 & the last higher low - 1745

is a so-called bulls' zone.

Within that entire area, we expect a bullish accumulation & continuation.

Next week look for confirmation within the underlined zone and look for buying opportunities there.

Your initial target will be the retest of the current high.

❤️Please, support this idea with like and comment!❤️

Stonk-Crypto Update (#41) : Big Rotation Coming IMOHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

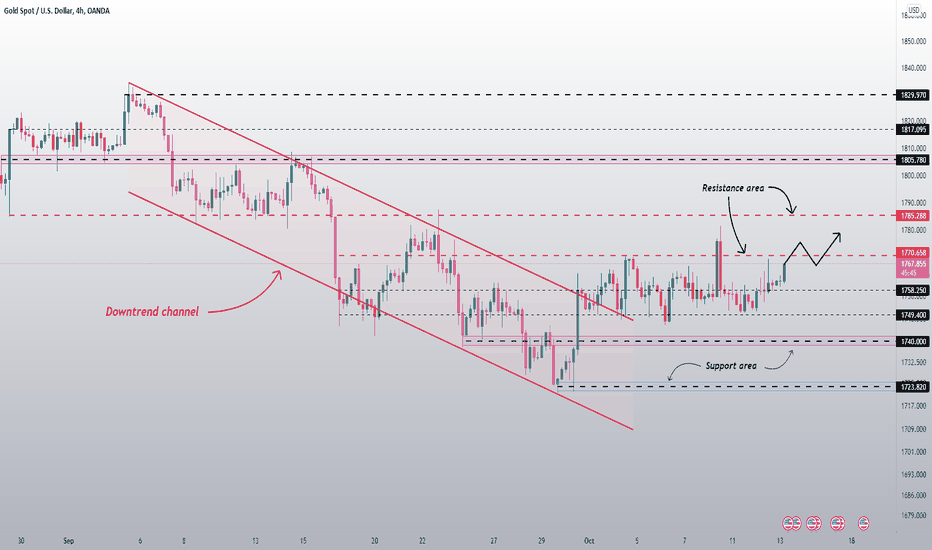

GOLD: small stopAnd so, GOLD in the near future would maintain a neutral position, it would be in consolidation. The resistance area 1770.658 - 1785.288 would keep the price from going up. It will not be so easy for buyers to punch it.

Remember, there is no place for luck in trading - only strategy!

Thanks for the likes and comments.

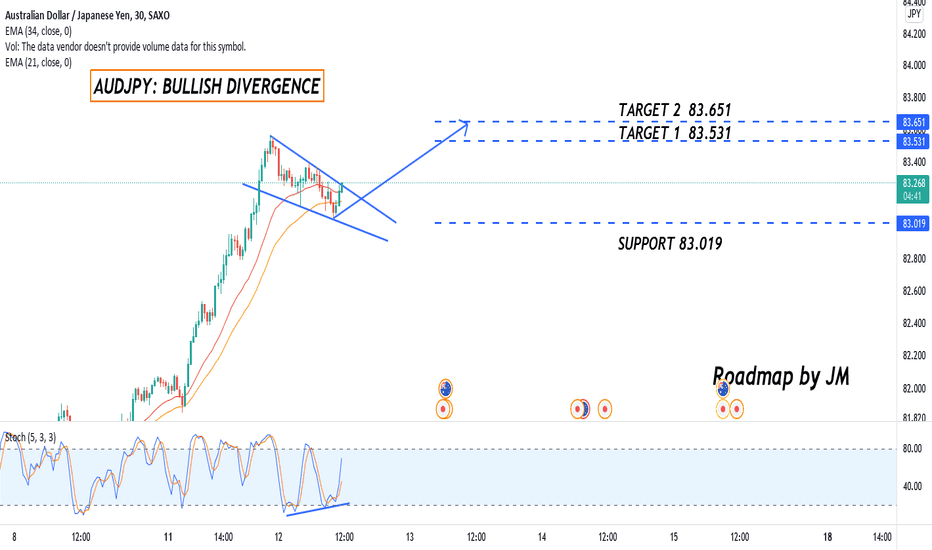

AUDJPY: BULLSIH DIVERGENCE, WILL IT BE BULLISH/FALSE BREAK?Hello Enthusiast Forex Traders! Here's short-term outlook for AUDJPY , Please give us the thumbs up and support the channel by Smashing the FOLLOW button :)

AUDJPY is breaking out of the Falling Wedge Pattern. Breakout of Falling Wedge could indicates the possibility of bullish movement ahead. The momentum indicator creates a bullish divergence, it signify the potential upward movement to the target area.

The roadmap will be invalid after exceeding the support/target area.

DISCLAIMER:

This is only an outlook, not a recommedation to buy or sell the forex pairs.

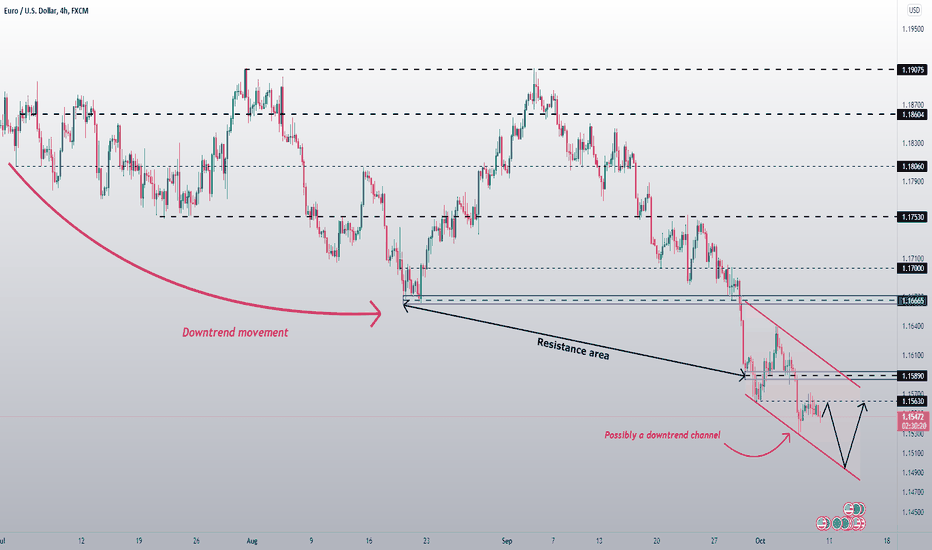

EURUSD: 1.15000 after NFPAnd so, the Euro is trading at 1.15630 ahead of the NFP. Analysts predict a positive NFP for the US dollar. Also, the currency pair remains bearish mood. A scenario is quite possible in which immediately after the release of news data, the price would sharply fall to 1.15000 and, most likely, rebound up again. The price range today is the price area 1.15000 - 1.15890.

Remember, there is no place for luck in trading - only strategy!

Thanks for the likes and comments.

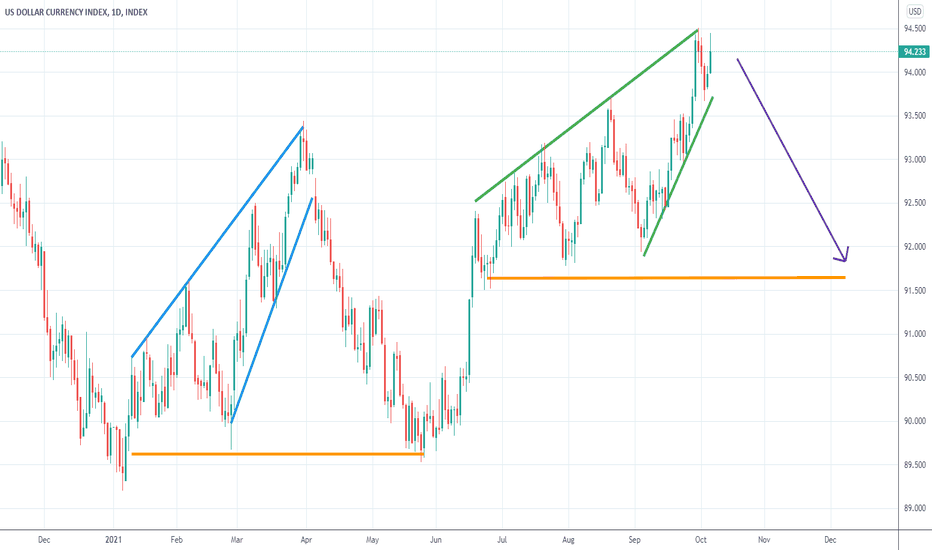

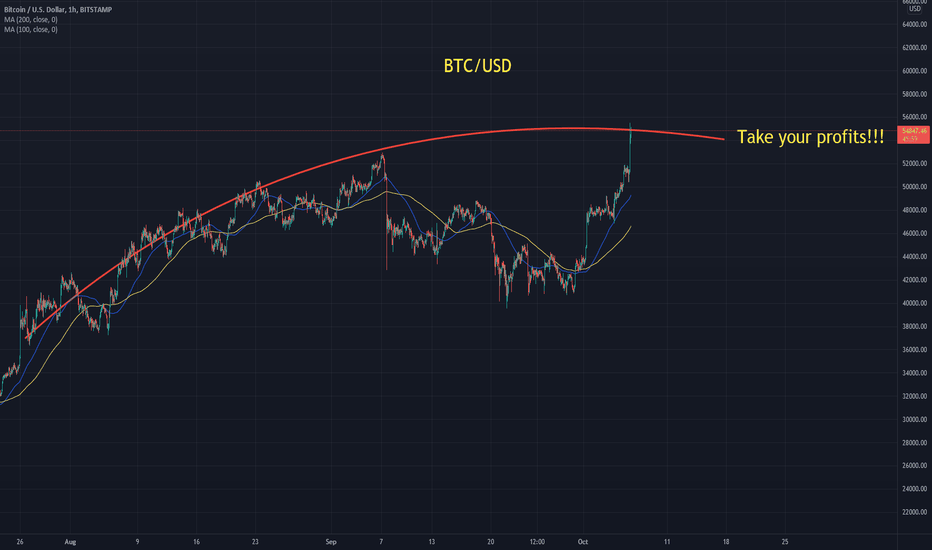

US Dollar - Should fall soon - Good for BTC and stocksUS Dollar index (DXY) shows the USD is close to the end of a bearish wedge (green lines). This is similar to the last bearish wedge (blue lines). USD should fall soon, possible with further news of infrastructure bill, debt ceiling solved, etc.

When USD falls, everything priced in USD goes up, including BTC, stocks, and commodities like gold and silver. Should be a strong Q4 for everything. Analyst Tom Lee from Fundstrat calls it "the everything rally".

10 Year Treasury Yields on track to reaching a minimum of 1.77Back in August I posted a Descending Broadening Wedge setup where we were at a potential bottom and today it would seem that we have successfully broken out of said wedge and back tested as support and are looking to finish the measure move that will take us to a minimum target of 1.77.

If you look on a timeframe like the weekly we have potential to go all the way up to 2.5 if we break above 1.77 but i wont go into charting that yet until we begin to.

To see the original idea check the related ideas tab below.

GOLD: course to support zoneAnd so, as predicted, Gold is feeling the strongest pressure from the US dollar. There is no need to wait for indulgences from the American yet. The instrument will clearly return to the support area 1723 - 1740.

Remember, there is no place for luck in trading - only strategy!

Thanks for the likes and comments.