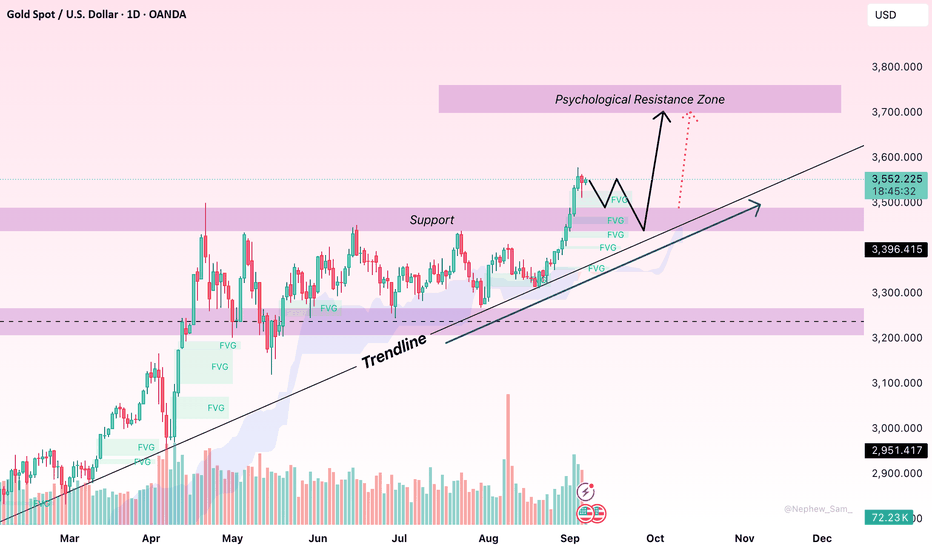

Gold: Profit-Taking Ahead of NFP, Main Trend Still BullishHello everyone, after a strong rally, gold has seen a short-term pullback. On the daily chart, this looks more like profit-taking near all-time highs rather than a genuine reversal. The broader structure remains intact: price is holding above the Ichimoku cloud, the Kijun is sloping upward, and stacked demand FVGs just beneath price signal a healthy uptrend.

In terms of levels, nearby resistance is at 3,555–3,565. A daily close above could naturally open the path toward 3,600–3,620. On the downside, the key buffer lies at 3,525–3,510 (cluster of FVGs + upper cloud edge). Only if a daily close breaks decisively below 3,510 would a deeper correction toward 3,480–3,450 become significant.

News flow also contributes to the pause: ETF outflows and caution ahead of NFP have capped momentum. Still, with safe-haven demand intact (as labour and PMI data hint at economic risks), I see this more as a “lock profit” phase than a trend change.

NFP Scenarios: If data comes strong (USD/yields ↑), gold may retreat toward 3,525–3,510; losing this zone could extend to 3,480–3,450. Conversely, if data is weak (USD/yields ↓), the chance of breaking 3,565 is high, opening the door to 3,600+.

In short, the major trend remains bullish as long as 3,525–3,510 holds. After NFP, a daily close above 3,565 would confirm trend continuation.

What do you think – will gold break 3,565 straight after NFP, or first retest support before heading higher?

Gold-trading

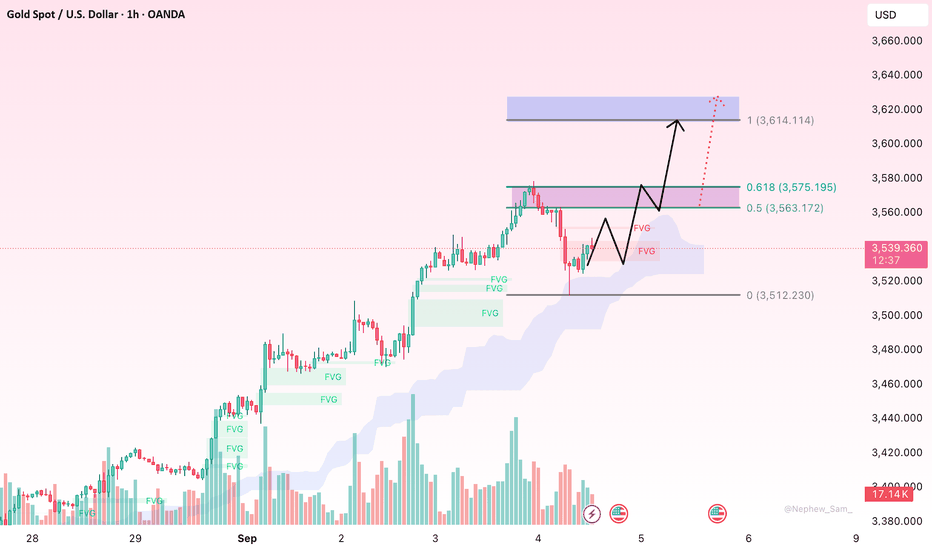

Gold Uptrend – 3,563–3,575 Key to 3,600+Hello everyone, last week gold staged a strong rally, consistently building new steps upward, gaining around 50–60 USD from the 3,520 zone. On the H1 chart, the structure remains very clean: price is holding above the upward-sloping Ichimoku cloud, with layered FVG blocks beneath – clear signs that buying flow is still maintaining momentum. The recent dip only tested the edge of the cloud before bouncing back, leaving the trend intact.

The immediate key lies in the 3,563–3,575 cluster (a confluence of the 0.5–0.618 Fib and recent highs). A decisive H1 close above this area could open the path to 3,595–3,600, and further to 3,610–3,620. On the downside, nearby supports sit at 3,538–3,532, followed by 3,520–3,525. Structure would only turn weaker if price closes below 3,512 – in which case risks shift towards a broader consolidation phase.

In short, I still favour the scenario of a shallow pullback before continuation, as long as price holds above the cloud and the FVG floors.

What do you think – will 3,563–3,575 have the strength to unlock 3,600+? Feel free to share your view.

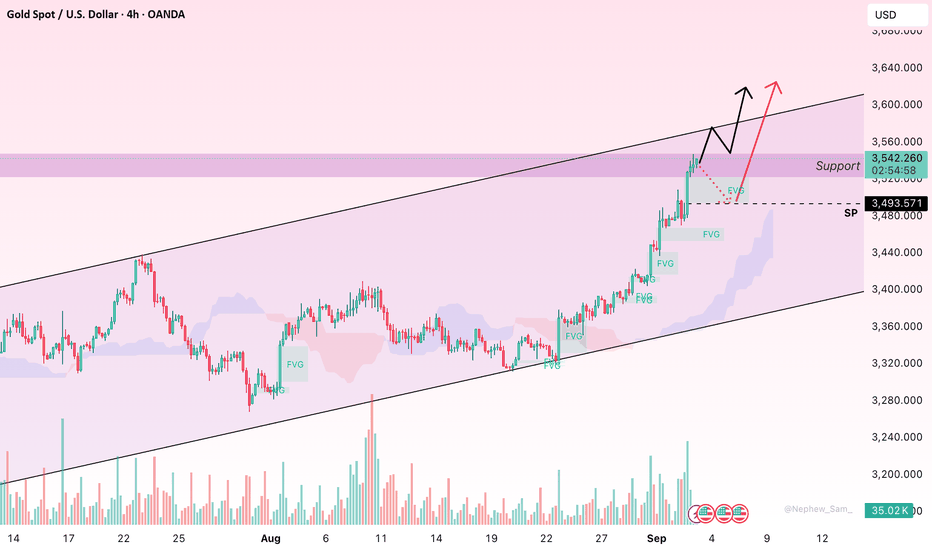

Gold Breaks New Highs, Momentum Still Favouring BullsHello friends, the past week has been quite rewarding for gold as it surged through major resistance levels and printed fresh highs. On the H4 chart, the trend looks very clear: price action is holding firmly above the Ichimoku cloud, with Tenkan sitting comfortably above Kijun, and the cloud slope widening further. Multiple Fair Value Gaps (FVGs) remain unfilled below, showing that buying momentum is powerful and liquidity is being left behind — a signature of a strong rally, not just a short-term move.

In terms of price action, the immediate resistance lies between $3,535–3,560. A clean H4 close above this area may unlock the next natural expansion towards $3,580–3,600. On the downside, layered supports are found at $3,520–3,505, then $3,485–3,470, and deeper at $3,440–3,420, coinciding with the upper edge of the cloud, often tested during medium-term uptrends.

Fundamentally, the environment still favours buyers: safe-haven demand is rising, the Fed is expected to ease policy sooner, and the USD is weakening, all adding fuel to the bullish case. Unless gold closes back into the cloud and loses the $3,440–3,420 zone, the probability of trend continuation remains high.

Do you think gold can stretch further from here? Share your thoughts below!

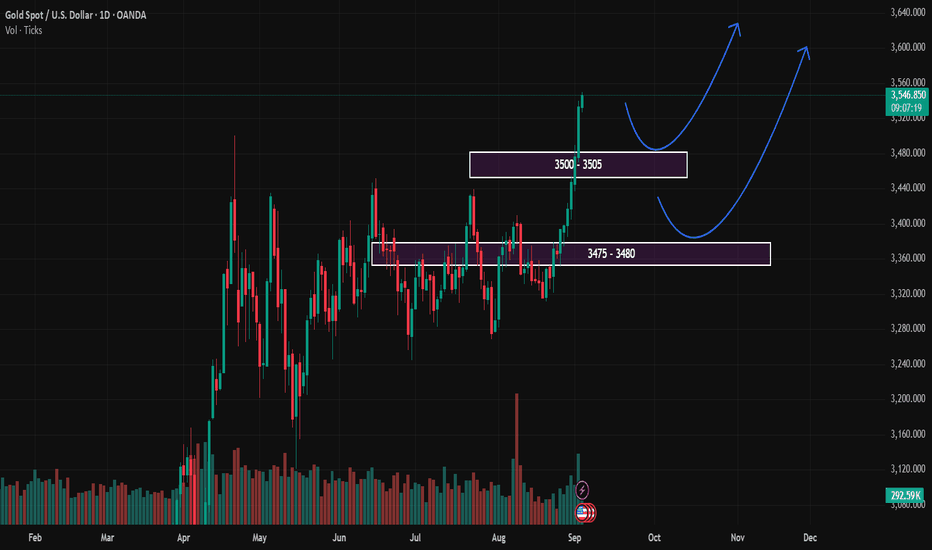

XAUUSD Gold Trading Strategy September 3, 2025XAUUSD Gold Trading Strategy September 3, 2025: Gold prices are stable, heading towards the $3,550 mark with ETF capital flows boosting and the market is also waiting for employment data and developments from the FED.

Basic news: Spot gold prices remained stable in today's Asian trading session, after rising sharply in the previous session. The current international gold price is around $3,531/ounce, according to CMC Group's FedWatch Tool, the market is pricing in nearly 92% of the possibility that the Fed will cut 25 basis points at the meeting on September 17.

Technical analysis: Spot gold prices continue to increase strongly. The rising price channel remains. Currently, the MA lines and the Fib frame are still very good support areas for prices, however, the RSI is in the overbought area; we should be careful that prices will have a correction first and then increase again. We limit FOMO, continue to wait at support zones combined between MA, Fib and FVG zone.

Important price zones today: 3500 - 3505 and 3475 - 3480.

Today's trading trend: BUY.

Recommended orders:

Plan 1: BUY XAUUSD zone 3500 - 3502

SL 3497

TP 3505 - 3515 - 3530 - 3550.

Plan 2: BUY XAUUSD zone 3475 - 3477

SL 3472

TP 3480 - 3490 - 3500 - 3530.

Wish you a safe, effective and profitable trading day.💯💯💯💯💯

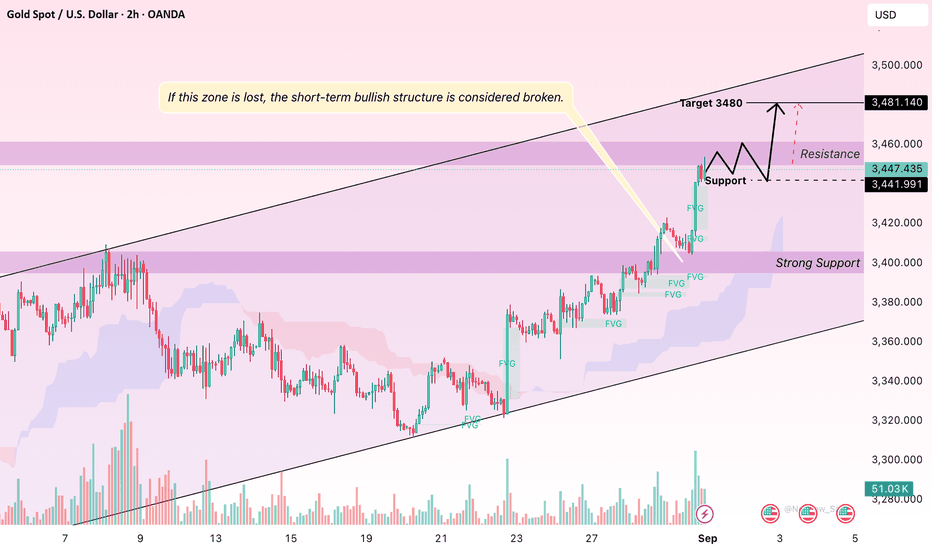

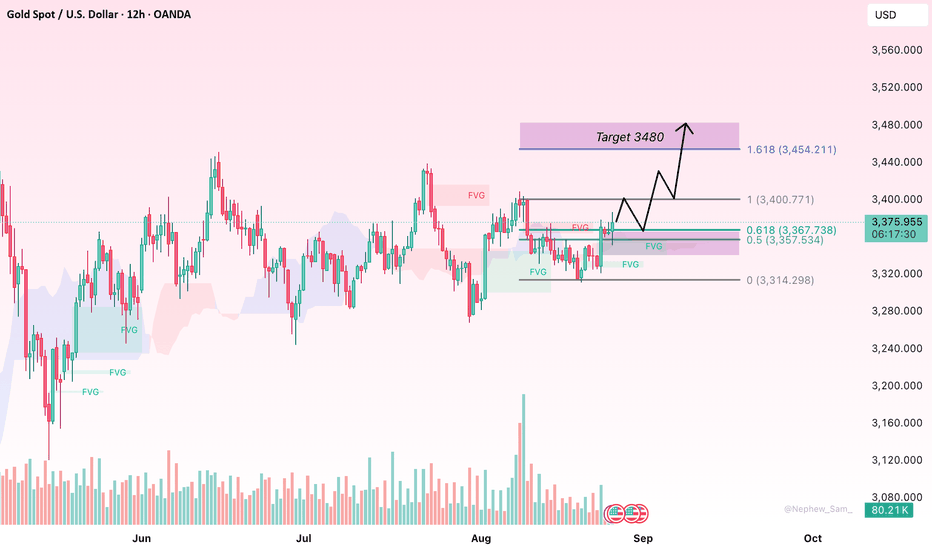

XAU/USD – Gold Pushes Toward 3,480 ResistanceHello everyone, last week gold had quite an impressive rally, recording a gain of around +2%, equivalent to more than $70, as the price climbed from the 3,380 area to nearly 3,450. This indicates that buying pressure continues to dominate the market.

Looking at the H2 timeframe, the uptrend remains intact as the price maintains a higher high – higher low structure, combined with trading volume favoring the bulls. The 3,455–3,463 zone is acting as short-term resistance; if broken decisively, gold could extend its rally toward 3,478–3,480. On the other hand, the 3,405 area will serve as a key support; only if an H2 candle closes below this level will the bullish structure face the risk of being invalidated.

The main short-term trend still leans bullish, although some technical pullbacks may occur when approaching strong resistance.

What do you think about this move? Does gold have enough momentum to break resistance and extend its rally? Share your thoughts below!

Gold Trading Scenario – Start of the WeekGold Trading Scenario – Start of the Week

Hello traders,

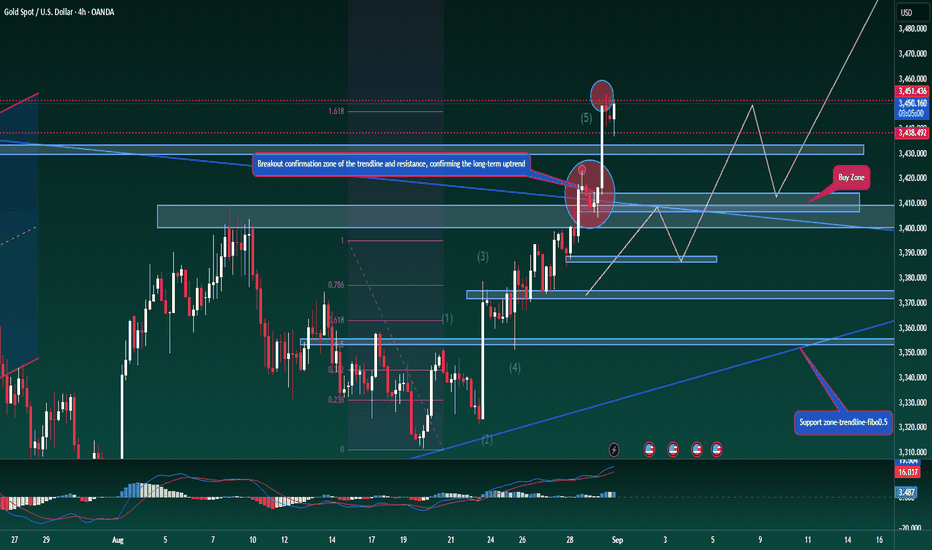

A new week begins with gold holding steady above the 34xx zone, establishing a fresh value area. The current structure has already broken through key resistance levels on the higher timeframe – including the daily trendline and H4 barriers – confirming strong bullish momentum.

The rally played out exactly as expected, reaching the target around 3450 (with a high of 3454). Price is now showing a slight pullback. This will only be seen as a trend reversal if price breaks below 3404. Otherwise, it’s simply a secondary correction in line with Dow Theory.

Wave 5 may have already completed, but the ABC structure is not yet clear. For that reason, I continue to favour buying in line with the trend to maintain higher probability setups.

Buy zone for today: 3408–3412. This area previously acted as resistance, but was broken on Friday and now serves as a solid support region.

This is my medium-term outlook for gold at the start of the week. Take it as reference, and feel free to share your thoughts in the comments so we can discuss further.

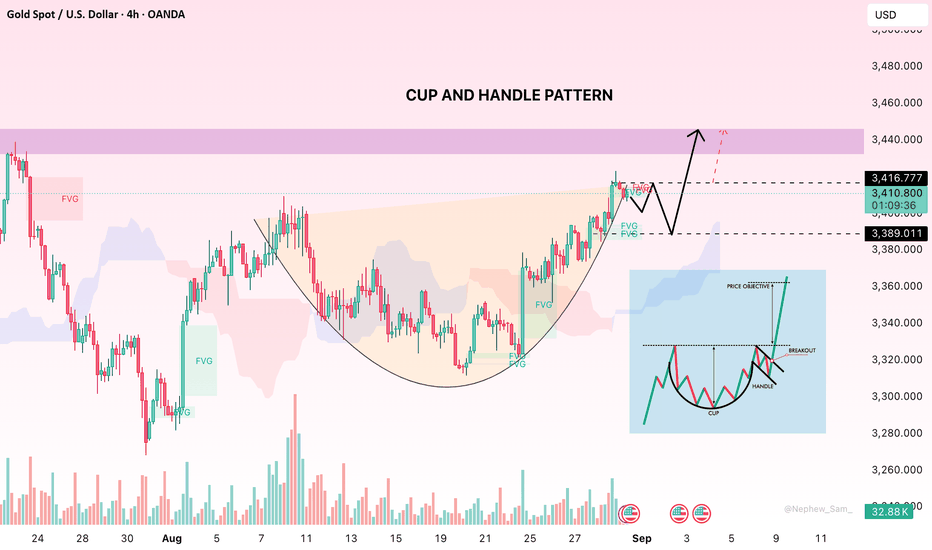

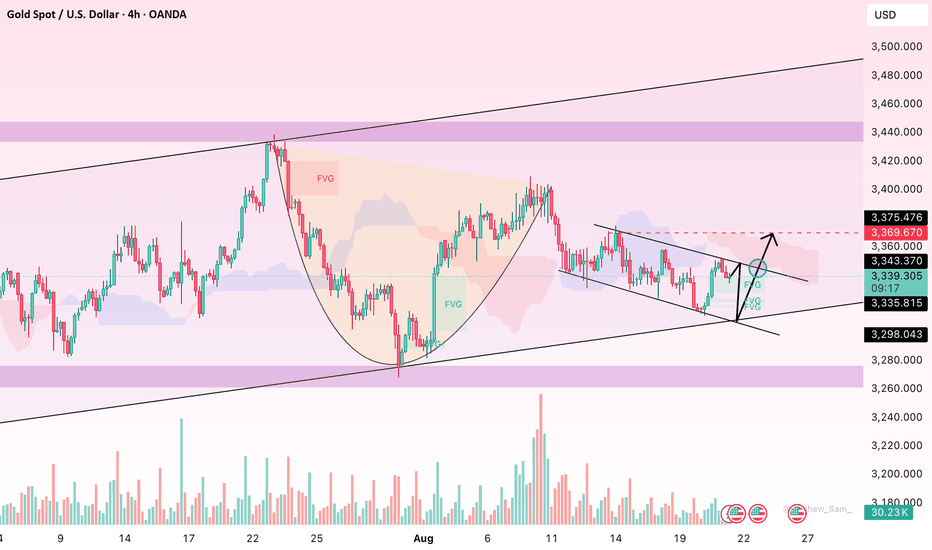

Strong Bullish Momentum, Eyeing a Break Above $3,420Hello everyone,

Gold is currently maintaining a clear bullish structure as the Cup and Handle pattern nears completion, signalling the potential for a breakout should the $3,420 resistance be breached. The Fair Value Gap (FVG) zones at $3,375 – $3,400 have repeatedly acted as solid support for the ongoing uptrend, while trading volumes during upward sessions highlight that buying pressure remains dominant. Should the price break above $3,420, the next target could extend to $3,440, or even higher, as the bullish momentum strengthens further.

Do you think gold has the strength to push through $3,420 this time? Share your thoughts in the comments!

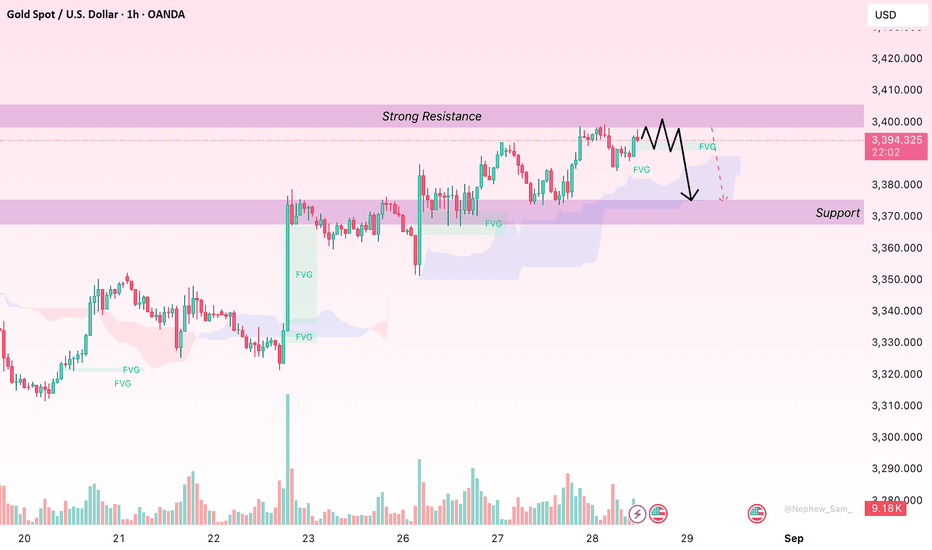

XAU/USD – Rise to 3,400 Followed by a PullbackHello everyone, on the H1 chart, gold has resumed its upward movement after bouncing from the 3,375–3,380 USD support zone. However, the 3,400 USD area is acting as a strong resistance level and is unlikely to be broken immediately. It is highly probable that the price will test 3,400 before facing selling pressure, leading to a correction back towards the 3,375 USD zone to retest demand strength.

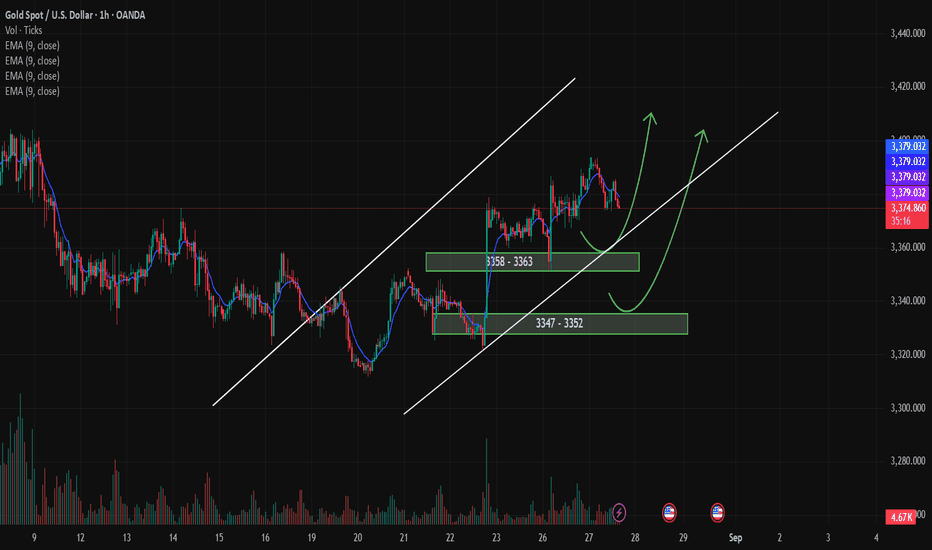

XAUUSD Gold Trading Strategy August 27, 2025XAUUSD Gold Trading Strategy August 27, 2025: Gold prices remain in the rising price channel, trading opportunities for investors.

Basic news: CB Consumer Confidence Report (August) is 97.4, higher than the forecast of 96.4 but lower than last month's 98.7. News that President Trump decided to remove Federal Reserve Governor Lisa Cook still has a strong impact on the US Dollar, creating upward momentum for gold.

Technical analysis: Gold prices continue to fluctuate in the rising price channel, however, after approaching the 3395 area, gold prices are currently adjusting. MA lines, liquidity zones combined with Fib frames and price channels are still supporting the upward momentum for gold prices. We continue to wait for transactions in these support areas. There is a high possibility that spot gold prices will approach the 3410 - 3420 area and continue to be held.

Important price zones today: 3358 - 3363 and 3347 - 3352.

Today's trading trend: BUY.

Recommended orders:

Plan 1: BUY XAUUSD zone 3358 - 3360

SL 3355

TP 3363 - 3373 - 3393 - 3410.

Plan 2: BUY XAUUSD zone 3347 - 3349

SL 3344

TP 3352 - 3362 - 3382 - 3400.

Plan 3: SELL XAUUSD zone 3418 - 3420

SL 3423

TP 3415 - 3405 - 3395 - 3380 (small volume).

Wish you a safe, effective and profitable trading day.🥰🥰🥰🥰🥰

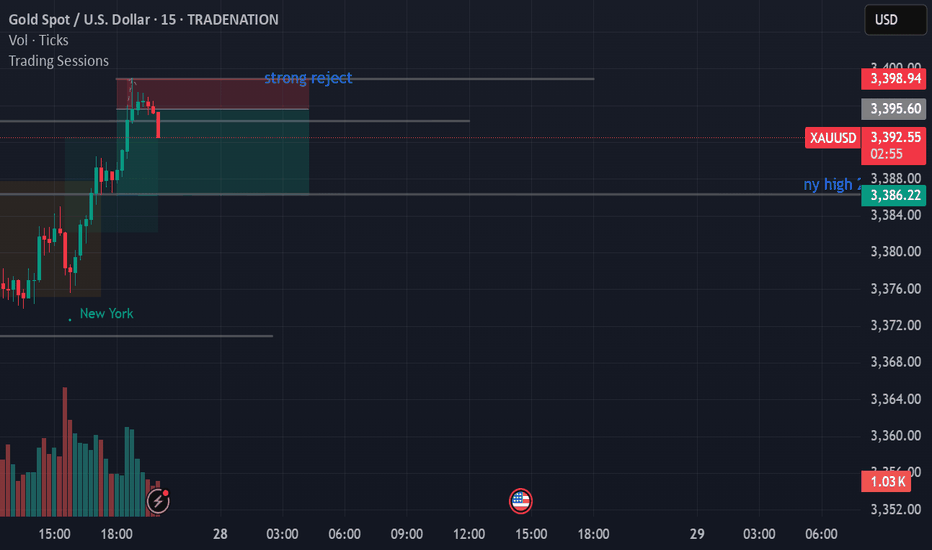

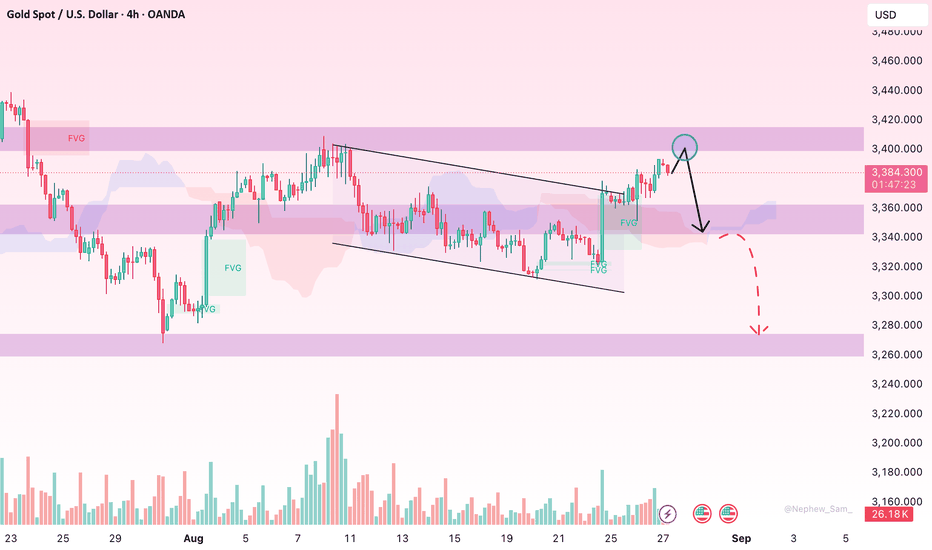

Gold Faces Resistance at 3,380–3,385: Downside Move PreferredHello everyone,

Looking at the H4 chart of OANDA:XAUUSD , gold is struggling to clear the heavy resistance zone between $3,380 and $3,385, which coincides with both a supply-based Fair Value Gap and the upper edge of the Kumo cloud. Price action here shows strong selling pressure, with short-bodied candles, long wicks, and muted volume, all of which suggest that buyers lack the conviction to push higher. Unless this zone is decisively broken, momentum points towards a short-term pullback, potentially dragging prices back to $3,355 and then $3,345.

From a macro perspective, today’s release of the US PCE inflation index will be critical. A stronger-than-expected print could reinforce expectations of tighter Fed policy, weighing on gold. Political uncertainty following President Trump’s move against a Fed governor adds another layer of volatility. Traders are now faced with a key question: does gold lose steam and retreat, or is a breakout towards $3,400–$3,425 still on the cards?

What do you think about this setup? Share your thoughts below!

Gold Supported by Ichimoku Cloud, Upside Bias in PlayHello everyone, looking at the 12H XAU/USD chart, I see gold is consolidating right at the upper edge of the sideways range. Price has held firmly above the Kumo (Ichimoku cloud) and left behind two clear demand FVG zones: 3,345–3,355 and deeper at 3,330–3,345. These often act as a “cushion” for price to rebalance before continuing higher. On the upside, a supply FVG is still hanging around 3.38x and further at 3.40x — making 3,380 the key “wall” that gold needs to break.

The fundamental backdrop looks quite supportive:

After Jackson Hole, Mr. Powell signalled that the Fed could cut rates in September. The probability of a cut via FedWatch has risen sharply, dragging yields lower and cooling the USD.

At the start of the week, the USD staged a technical rebound as the market “reset” risk ahead of a heavy data calendar, causing choppy intraday swings in gold but without breaking the structure above the cloud.

This week’s US calendar is packed: Consumer Confidence, Durable Goods Orders, preliminary GDP, Jobless Claims, and especially core PCE at the end of the week. If data comes in weak, rate cut expectations will be further reinforced.

The PBOC continues to inject large liquidity to support the CNY, easing global cash stress and creating a more favourable environment for gold.

Gold ETF (GLD) holdings remain elevated, showing that investor positions have not weakened significantly. At the same time, US consumer confidence is softening, adding another reason for the Fed to “soften its tone.”

As long as price stays above the Kumo and with the demand FVG 3,345–3,355 right below, I favour the upside scenario. If 3,350 holds, my near-term target is 3,390, with extension to 3,405 (overlapping with the higher supply FVG). This view only weakens if a 12H candle closes below 3,335 — in which case the risk of a deeper pullback to retest the lower FVG increases.

What do you think about the scenario of gold being “backed by the Ichimoku cloud” and heading towards the 3,390–3,405 zone?

Gold Faces Short-Term Cooling: Watch the Gap at 3,355–3,345Hello everyone, looking at this H2 chart, what do you see in XAU/USD?

Technically, gold has just spiked sharply and is now trading narrowly just below 3,372–3,375 USD. The spike left a very clear bullish Fair Value Gap (FVG) at 3,355–3,345 USD. On the Ichimoku cloud, the price has just slightly exceeded the cloud’s edge, but the forward kumo is fairly flat – a setup that often “pulls” price back to test the gap before any further breakout.

Above, the old supply FVG around 3,372–3,375 USD still shows where price was restrained, with a series of short-bodied candles and long upper wicks. Below, the green FVG at 3,355–3,345 lies near the cloud’s edge – a new equilibrium formed after the spike.

What stands out is how price is “holding its breath” just below 3,372 while the flat kumo stretches ahead and the FVG sits right beneath: this trio often signals a technical retracement to fill the gap at 3,355–3,345 before the market decides the next move.

Watch price action around 3,372 closely: if rejected at the old supply FVG, the likelihood of a pullback to 3,355 → 3,345 is high. Only a firm H2 close above 3,372 would brighten the chance of continuing to 3,380.

What do you think about this gap-fill scenario? Leave your thoughts in the comments below!

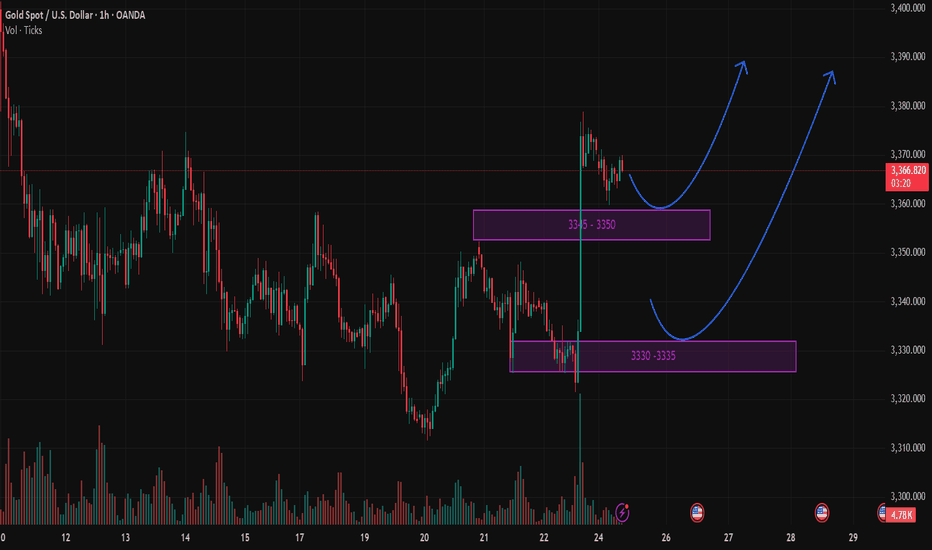

XAUUSD Gold Trading Strategy August 25, 2025XAUUSD Gold Trading Strategy August 25, 2025:

The market revolved around the FED and Trump, gold rose at the end of last week and was limited by the 0.236% Fib level.

Fundamental news: Mr. Powell's unexpectedly dovish remarks reinforced the market's hopes for a rate cut in September. As a result, the US Dollar Index fell sharply on Friday, reversing the upward trend of the first 4 trading days of the week. Moreover, the strong increase on Friday also pushed the gold price to skyrocket nearly 36 USD during the week.

Technical analysis: After a strong increase when it had compressed enough force in the bullish pattern and broke the downtrend channel on the H1 frame, the gold price at the beginning of this week's trading session is having a correction phase. The uptrend of gold is still maintained. The liquidity zones combined with FIB support and MA lines will now be our trading area. The gold price is very likely to return to the old ATH zone of 3500 this week.

Important price zones today: 3345 - 3350 and 3330 - 3335.

Today's trading trend: BUY.

Recommended orders:

Plan 1: BUY XAUUSD zone 3345 - 3347

SL 3342

TP 3350 - 3360 - 3370 - 3390.

Plan 2: BUY XAUUSD zone 3330 - 3332

SL 3327

TP 3335 - 3345 - 3355 - 3390.

Wish you a safe, successful and profitable trading week.🌟🌟🌟🌟🌟

Gold: Will the Bullish Momentum Resume Above $3,350?Hello everyone,

Gold is currently trading around $3,345, with the critical level at $3,350 acting as a decisive resistance. If this barrier is broken, I believe the bullish momentum will continue. From a technical perspective, gold is testing the Fair Value Gap (FVG) between $3,340 and $3,350 – an area that, once filled, could strengthen the case for long positions. Notably, trading volume has been rising in recent candles, indicating that buyers are gradually regaining control.

On the macro side, the backdrop also favours gold. Growing expectations of a Federal Reserve rate cut have weakened the US dollar, making gold more attractive as a safe-haven asset. If Jerome Powell’s upcoming speech at Jackson Hole reinforces the likelihood of lower interest rates, this will provide additional tailwinds for gold.

In conclusion, if gold can break above $3,350 with conviction, I expect the uptrend to extend towards $3,370. This presents a strong opportunity for buyers, as long as the breakout is confirmed.

See you in the next update – let me know your thoughts in the comments below.

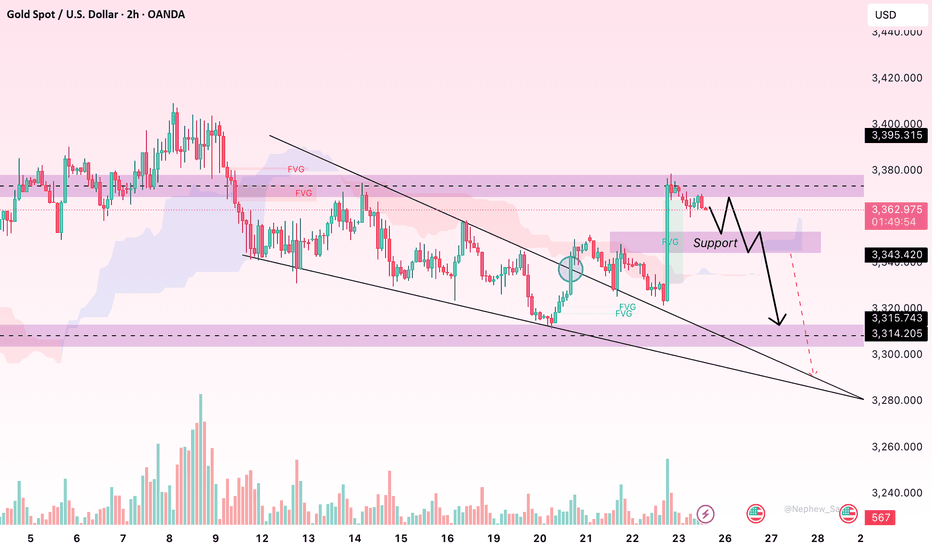

Gold: Bearish Channel Persists Amid DXY ConsolidationHello everyone,

On the H1 timeframe, gold continues to trade within a clear descending channel. After a short rebound from the 3,312 USD area, the price faced resistance around 3,325 – 3,328 USD, which coincides with the 0.5 – 0.618 Fibonacci retracement and an unfilled FVG zone. Sellers have been using this region to reinforce downward pressure.

The latest green candle shows some recovery but is not strong enough to break the channel, suggesting that buying momentum remains weak. Unless gold can decisively push above 3,328 USD, the dominant scenario points to another decline toward 3,312 USD, with an extended target near 3,292 USD (aligned with the 1.618 Fibonacci extension and the lower boundary of the channel).

Looking at the DXY, the U.S. dollar index is currently moving sideways without a clear breakout, providing no major pressure on gold but also limiting its upside potential as investors remain cautious.

In terms of news flow, the market is waiting for key U.S. data this week, especially the FOMC minutes and labor figures. A stronger dollar could drive gold to fresh lows, while any signs of a more dovish stance from the Fed on interest rates may help gold stabilize at support and attempt a rebound.

What do you think—will gold hold its ground or break lower? Share your view in the comments below!

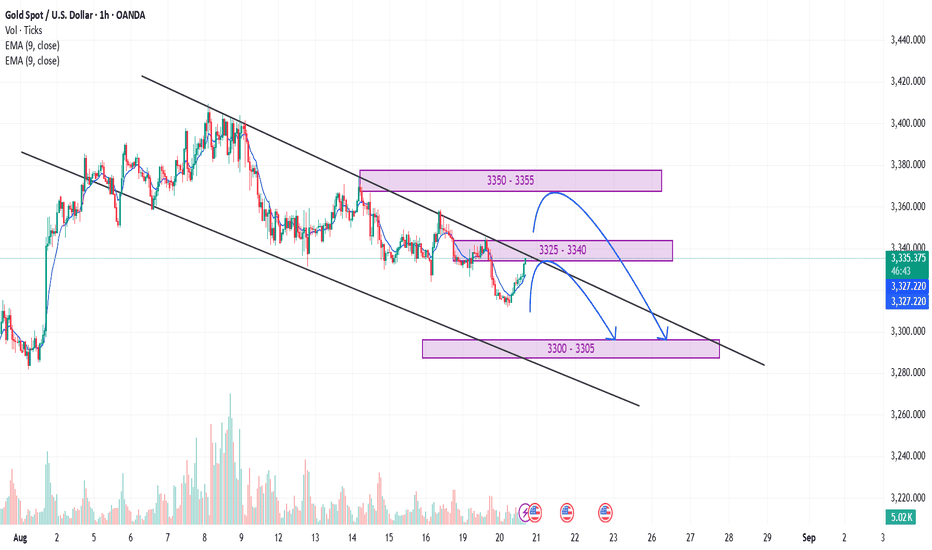

Gold Trading Strategy XAUUSD 20/8/2025Gold Trading Strategy XAUUSD 20/8/2025: Gold falls to lowest level since early this month, continues to be under pressure from potential talks, watching the FED minutes.

Fundamental news: Spot gold prices fell sharply, hitting their lowest intraday level since August 1. Gold prices fell as US President Donald Trump, Ukrainian President Zelensky and European leaders discussed potential talks with Russia. Safe-haven demand eased as security speculation in Kiev sparked optimism that the war could end.

Technical analysis: Gold prices broke out of a bullish pattern and formed a bearish channel on the H1 timeframe. Currently, the MA lines combined with the liquidity zone are the resistance zones of gold prices. However, gold prices can recover strongly when approaching the support area of 3300, the fluctuation range of gold prices today will be 3300 - 3350.

Important price zones today: 3335 - 3340, 3350 - 3355 and 3300 - 3305.

Today's trading trend: SELL.

Recommended orders:

Plan 1: SELL XAUUSD zone 3338 - 3340

SL 3343

TP 3335 - 3325 - 3315 - 3300.

Plan 2: SELL XAUUSD zone 3350 - 3352

SL 3355

TP 3347 - 3337 - 3327 - 3300.

Plan 3: BUY XAUUSD zone 3300 - 3302

SL 3297

TP 3305 - 3315 - 3335 - 3350.

Wish you a safe, successful and profitable trading day.🥰🥰🥰🥰🥰

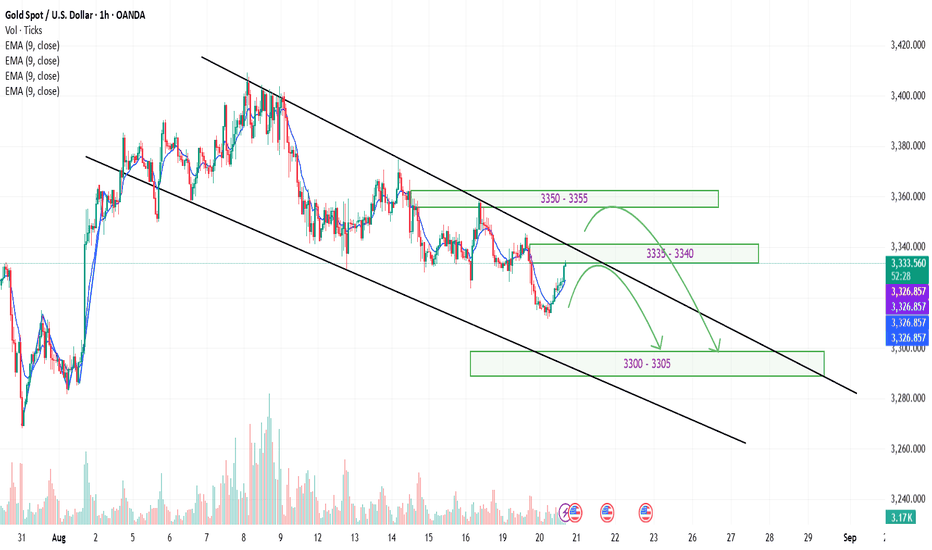

Gold Trading Strategy XAUUSD 20/8/2025Gold Trading Strategy XAUUSD 20/8/2025: Gold falls to lowest level since early this month, continues to be under pressure from potential talks, watching the FED minutes.

Fundamental news: Spot gold prices fell sharply, hitting their lowest intraday level since August 1. Gold prices fell as US President Donald Trump, Ukrainian President Zelensky and European leaders discussed potential talks with Russia. Safe-haven demand eased as security speculation in Kiev sparked optimism that the war could end.

Technical analysis: Gold prices broke out of a bullish pattern and formed a bearish channel on the H1 timeframe. Currently, the MA lines combined with the liquidity zone are the resistance zones of gold prices. However, gold prices can recover strongly when approaching the support area of 3300, the fluctuation range of gold prices today will be 3300 - 3350.

Important price zones today: 3335 - 3340, 3350 - 3355 and 3300 - 3305.

Today's trading trend: SELL.

Recommended orders:

Plan 1: SELL XAUUSD zone 3338 - 3340

SL 3343

TP 3335 - 3325 - 3315 - 3300.

Plan 2: SELL XAUUSD zone 3350 - 3352

SL 3355

TP 3347 - 3337 - 3327 - 3300.

Plan 3: BUY XAUUSD zone 3300 - 3302

SL 3297

TP 3305 - 3315 - 3335 - 3350.

Wish you a safe, successful and profitable trading day.🥰🥰🥰🥰🥰

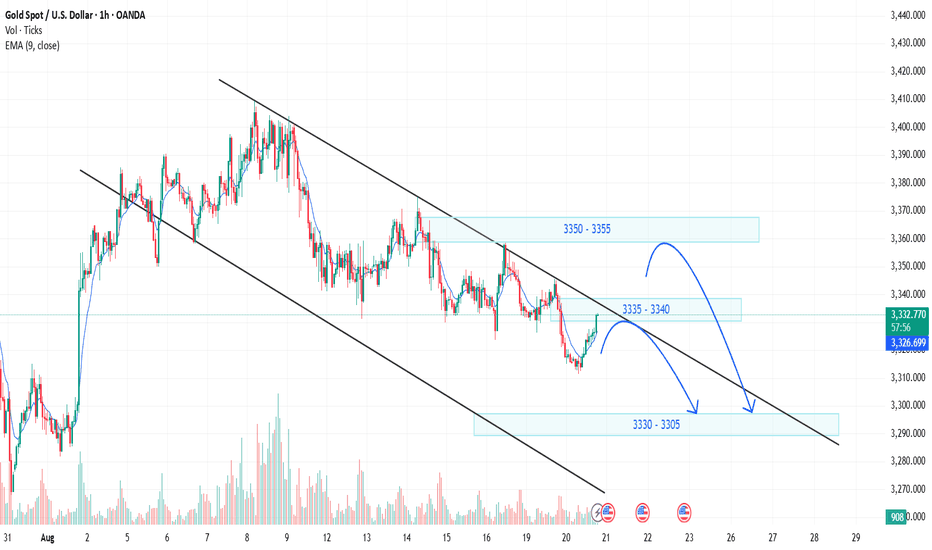

Gold Trading Strategy XAUUSD 20/8/2025Gold Trading Strategy XAUUSD 20/8/2025:

Gold falls to lowest level since early this month, continues to be under pressure from potential talks, watching the FED minutes.

Fundamental news: Spot gold prices fell sharply, hitting their lowest intraday level since August 1. Gold prices fell as US President Donald Trump, Ukrainian President Zelensky and European leaders discussed potential talks with Russia. Safe-haven demand eased as security speculation in Kiev sparked optimism that the war could end.

Technical analysis: Gold prices broke out of a bullish pattern and formed a bearish channel on the H1 timeframe. Currently, the MA lines combined with the liquidity zone are the resistance zones of gold prices. However, gold prices can recover strongly when approaching the support area of 3300, the fluctuation range of gold prices today will be 3300 - 3350.

Important price zones today: 3335 - 3340, 3350 - 3355 and 3300 - 3305.

Today's trading trend: SELL.

Recommended orders:

Plan 1: SELL XAUUSD zone 3338 - 3340

SL 3343

TP 3335 - 3325 - 3315 - 3300.

Plan 2: SELL XAUUSD zone 3350 - 3352

SL 3355

TP 3347 - 3337 - 3327 - 3300.

Plan 3: BUY XAUUSD zone 3300 - 3302

SL 3297

TP 3305 - 3315 - 3335 - 3350.

Wish you a safe, successful and profitable trading day.🥰🥰🥰🥰🥰

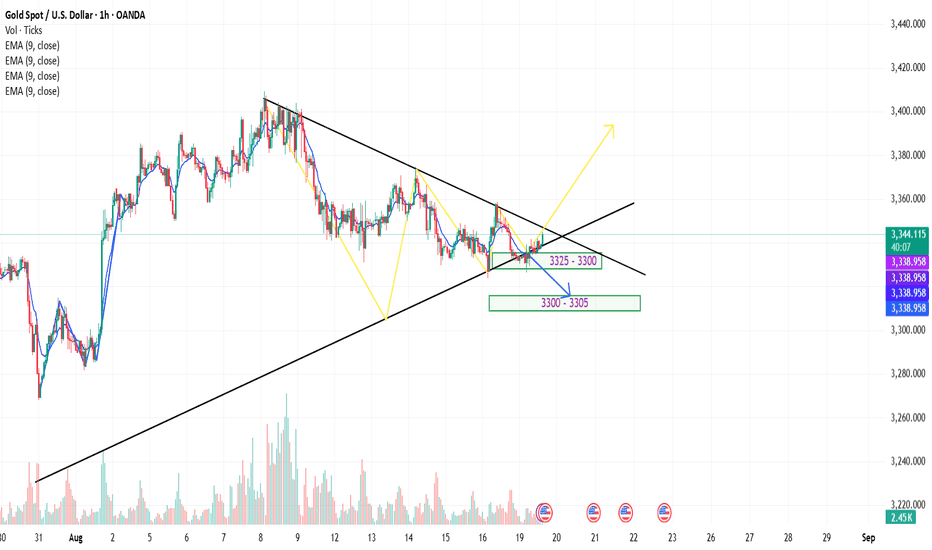

XAUUSD Gold Trading Strategy August 19, 2025XAUUSD Gold Trading Strategy August 19, 2025:

Gold's range remains narrow, closely monitoring the progress of ceasefire negotiations in Ukraine.

Basic news: Yesterday, August 18, according to Rueter, US President Donald Trump told Ukrainian President Zelenskiy that the United States will support Ukraine's security in any agreement to end Russia's war in Ukraine. Gold reacted quite mildly when no message of real weight was released, and market sentiment was still very hesitant, currently spot gold is trading around $3,335/oz, equivalent to an increase of about $2 on the day.

Technical analysis: Yesterday's bullish pattern of gold is still maintained when gold prices approach our Plan 1 area and increase again. However, the increase is not strong, it is very likely that today the gold price will still maintain a slight fluctuation in the area of 3325 - 3350. When the gold price breaks the pattern, it will fluctuate very strongly, we will continue to wait to buy mainly in the area around 3300.

Important price zones today: 3325 - 3330, 3300 - 3305 and 3345 - 3350.

Today's trading trend: BUY.

Recommended orders:

Plan 1: BUY XAUUSD zone 3328 - 3330

SL 3325

TP 3333 - 3340 - 3360 - 3390.

Plan 2: BUY XAUUSD zone 3300 - 3302

SL 3297

TP 3305 - 3315 - 3335 - 3370.

Plan 3: SELL STOP XAUUSD zone 3320 - 3322

SL 3325

TP 3317 - 3307 - 3300.

Wish you a safe, successful and profitable trading day.🌟🌟🌟🌟🌟

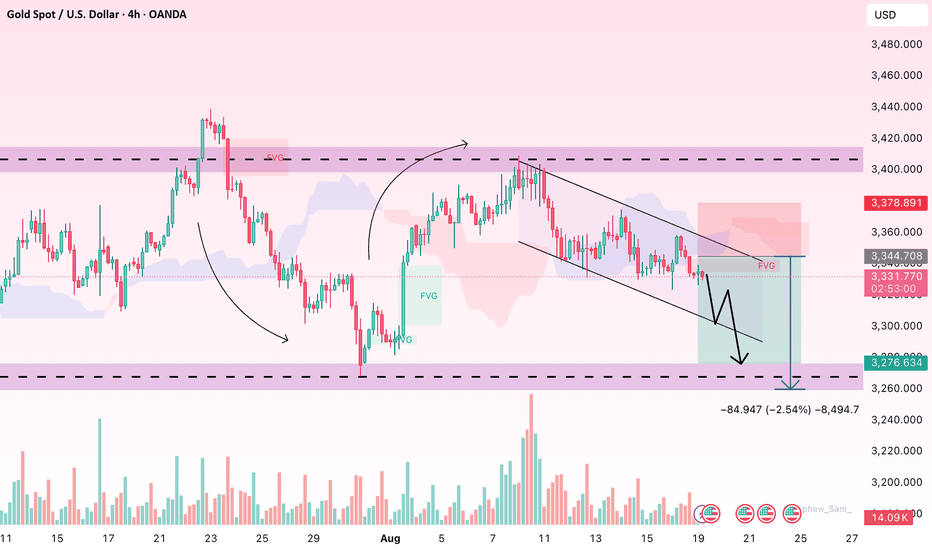

Gold: Selling Pressure Intensifies Ahead of FOMC MinutesHello everyone,

On the 4H timeframe, gold is showing clear signs of weakness. After multiple failed attempts at the 3,360 – 3,378 USD resistance zone, the price slipped below 3,340 USD and is now hovering around 3,330 USD. This indicates that selling pressure remains dominant, while the buyers’ defensive efforts are increasingly fragile. If the 3,326 USD level is breached, the market is likely to extend its decline toward 3,276 USD – the lower boundary of the sideways range that has lasted for nearly a month.

From a macro perspective, the market’s focus is on the FOMC minutes to be released tonight. Following a streak of disappointing labor market data along with higher July PPI inflation, investors are eagerly awaiting clearer signals from the Fed. While expectations for a rate cut in September remain dominant, this alone is not enough to ease short-term downside pressure on gold. Moreover, news of the meeting between President Zelensky and U.S. President Donald Trump suggests that the door to peace talks in Ukraine is opening wider, potentially reducing safe-haven demand.

Considering these factors, the main scenario remains that gold continues to face downward pressure, with the next target at 3,276 USD, unless the price reclaims the 3,340 USD zone.

Thank you for following this analysis. See you again in the next updates!

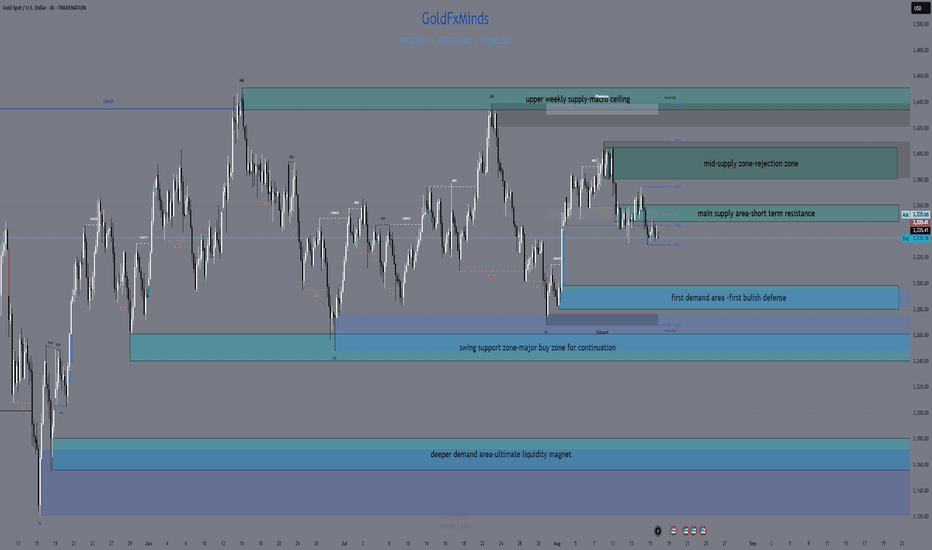

XAUUSD – H4 Structural OutlookHello traders 👋,

We’re navigating a tight structure on H4, with gold trading around the 3335 pivot area. Let’s map the main institutional footprints shaping the market.

🔸 Macro Context

Markets remain highly reactive to USD strength, yields, and Fed policy expectations. Gold has been caught between safe-haven demand and a resilient dollar. With FOMC minutes and inflation data ahead, volatility and decisive breakouts are likely.

🔸 Bias

The current H4 structure leaves no fixed bias.

Holding above 3348–3360 supply opens room toward deeper premium zones (3380–3405).

Slipping under 3300–3280 demand exposes broader discount territory.

Patience is key here: let structure confirm before leaning bullish or bearish.

📌 Structural Supply Zones (Premium Side)

“Upper Weekly Supply” – 3439 → 3350

Large untouched weekly OB, origin of the last bearish drive.

Holds liquidity above recent highs.

Role: macro ceiling, where bears could reinforce.

“Mid-Supply Trap” – 3405 → 3380

Defined H4 OB in premium.

Fresh, partially tapped.

Role: intermediate rejection zone, where sellers may step in early.

“Immediate Supply Cap” – 3360 → 3348

Nearest clean OB above price.

Backed by imbalance + inducement.

Role: short-term resistance lid – could cap retracements.

📌 Structural Demand Zones (Discount Side)

“Protective Demand Floor” – 3300 → 3280

Fresh untested OB right below spot.

Confluence with gap fill + early discount.

Role: first defensive layer for bulls.

“Swing Demand Base” – 3260 → 3240

Clean H4 OB, fully intact.

Supported by liquidity beneath.

Role: major buy zone for continuation.

“Deep Weekly Demand” – 3180 → 3160

Untouched weekly OB, extreme discount.

Role: ultimate liquidity magnet for long-term positioning.

🔸 Extended Context (secondary footprints)

3328–3312 → Micro demand (reactive but weak).

3295 → Minor continuation demand (aligned with EMA50).

3275–3240 → Historical demand block (already partially mitigated).

3235–3210 → Discount FVG (liquidity cluster).

3200–3150 → Wick-driven liquidity pool.

3135–3120 → Weekly higher-low demand.

These remain relevant as broader roadmap markers but are not as dominant as the six primary structural zones listed above.

🔸 Conclusion & Action Plan

Gold is currently boxed between Immediate Supply Cap (3360–3348) and Protective Demand Floor (3300–3280).

A clean break above 3360 reopens 3380–3405.

A slip under 3280 sharpens the path toward 3240 and potentially 3180 in deeper discount.

Sniper entries will need confirmation from lower timeframes (M30–M15) inside these macro footprints.

If this breakdown helps you map the field clearly, don’t forget to 🚀🚀🚀this post & follow GoldFxMinds for more sniper-precision updates 🔔✨

📌 Disclosure:

Outlook is based on Trade Nation data feed. Educational only – not financial advice.

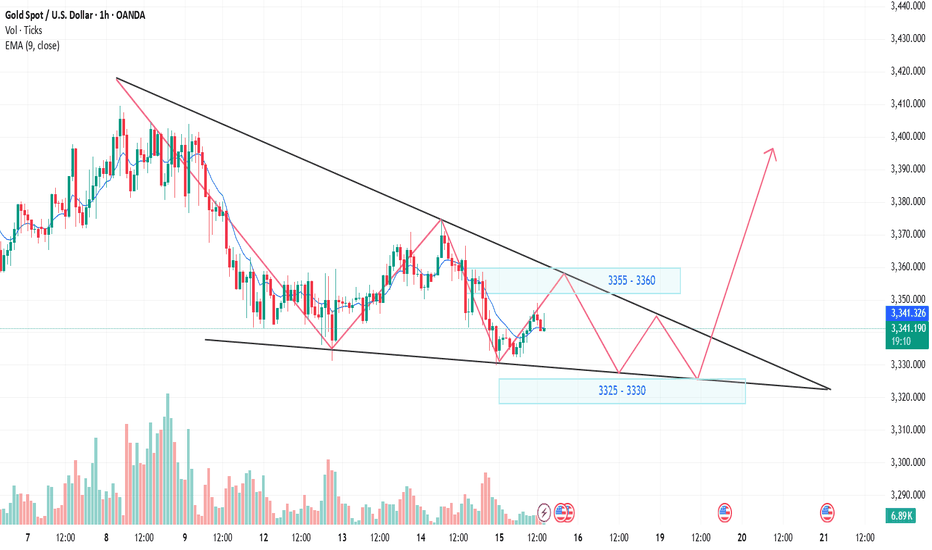

XAUUSD Gold Trading Strategy August 15, 2025XAUUSD Gold Trading Strategy August 15, 2025:

Spot gold prices edged down from intraday highs in Asia on August 14, 2025, approaching the $3,330/ounce area. Earlier, the US Dollar Index weakened to a two-week low of 97.839, along with falling US Treasury yields, pushing gold prices back up.

Fundamental news: The market is now pricing in a 97% chance of the US Federal Reserve cutting interest rates in September, with an increasing likelihood of one or even two more rate cuts before the end of the year. Lower borrowing costs and falling yields tend to support gold as the metal does not pay interest.

Technical analysis: After breaking out of the rising channel yesterday, gold prices have approached the old bottom of $3,330, and there is a high possibility of forming a bullish flag pattern on the H1 chart. However, this model needs a lot of time to create enough strength. We will mainly trade in the current bullish flag model.

Important price zones today: 3325 - 3330 and 3355 - 3360.

Today's trading trend: BUY hold.

Recommended orders:

Plan 1: BUY XAUUSD zone 3325 - 3327

SL 3322

TP 3330 - 3340 - 3350 - 3360 - OPEN.

Plan 2: SELL XAUUSD zone 3358 - 3360

SL 3363

TP 3355 - 3345 - 3335 - 3325.

Wish you a safe, successful and profitable weekend trading day.🌟🌟🌟🌟🌟