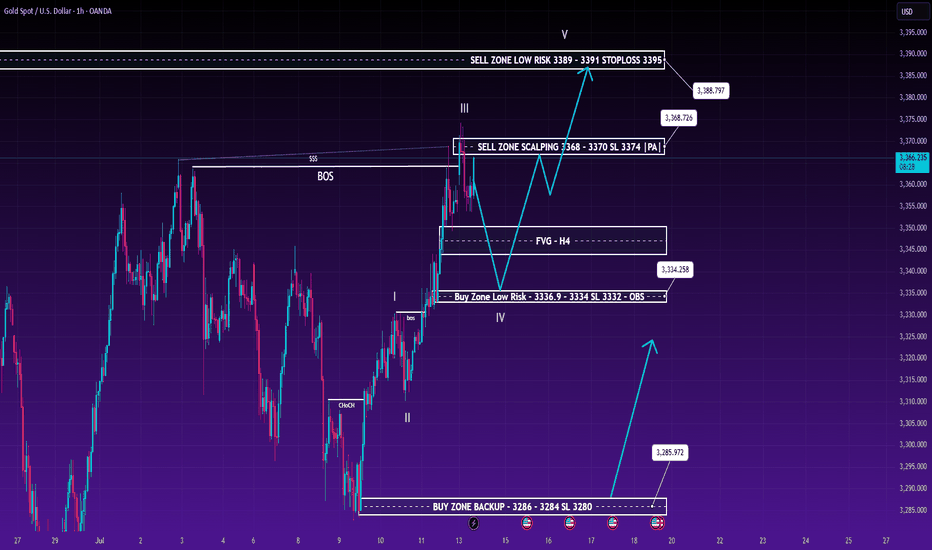

GOLD PLAN 14/07 – NOT ENOUGH LIQUIDITY TO FLY YET📰 MARKET OVERVIEW & MACRO CONTEXT

Gold begins the new week with a sharp correction after filling a major Fair Value Gap (FVG) formed two weeks ago. The early drop reflects investor caution as several key macroeconomic events loom this week:

US CPI & PPI

Unemployment Claims

Retail Sales Data

Volatility is expected to stay high from the beginning to midweek, before the market forms a clearer direction based on incoming data.

🔍 TECHNICAL ANALYSIS – FOCUS ON LIQUIDITY & SMART MONEY CONCEPTS (SMC)

🧠 Core Logic:

Gold has swept liquidity at the recent short-term high around 3368–3370.

Price is now pulling back to hunt deeper liquidity below, particularly near:

H4 FVG zone: 3340–3334

Primary Buy Zone: 3336.9 – 3334 (aligned with intraday VPOC)

🔎 SMC Setup:

A clear Break of Structure (BOS) on H1 confirms a bullish continuation.

Price is currently retesting a confluence zone of Order Block and FVG — typical Smart Money behaviour.

If price sweeps below 3334, a sharp move to the upside is expected, targeting:

3388 – 3391 (distribution / sell zone)

🌊 Elliott Wave:

Wave III likely completed around 3388.

Market is now in corrective Wave IV.

If the structure holds, Wave V could launch with significant bullish momentum.

📌 TRADE SCENARIOS

✅ PRIMARY BUY SETUP (PREFERRED)

Entry: 3336.9 – 3334

Stop Loss: 3332

Targets:

TP1: 3368 (M15 Supply Zone)

TP2: 3388 (Previous Swing High)

TP3: 3391 (Major Distribution Zone)

🔁 BACKUP BUY SETUP

Entry: 3286 – 3284 (if deeper flush occurs)

Stop Loss: 3280

Targets: 3291 – 3299 – 3310 – Open

❌ SHORT-TERM SELL SCALP (Advanced Only)

Entry: 3368 – 3370

Stop Loss: 3374

Targets: 3363 – 3355 – 3341 – Open

🧭 OUTLOOK

Current price action suggests gold is not ready to rally just yet. Deeper liquidity must be tapped, especially around the FVG and lower OB zone, before a sustained move upward.

Priority remains on buying from liquidity zones aligned with Smart Money logic.

Scalp sells are optional but carry higher risk — trend bias remains bullish.

Golddailytrading

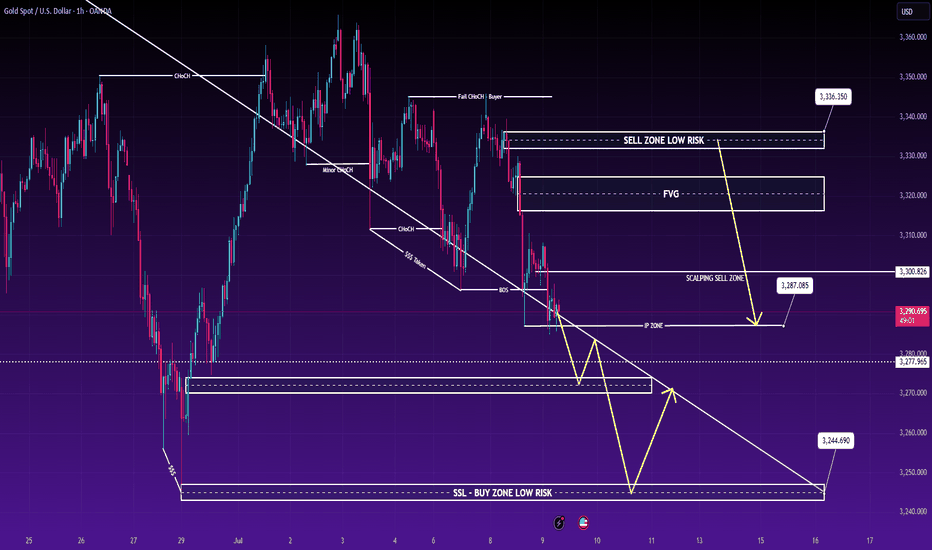

Gold Market Outlook: Testing Key Liquidity Zones🔹 Gold Faces Liquidity Pressure at 3300 - Can It Hold or Will a Deeper Pullback Occur?

Gold has been under pressure after rejecting key resistance levels, with the market now entering a crucial phase where liquidity zones are key to determining the next move. As global trade developments unfold and the latest economic data trickles in, traders are eyeing whether the gold market will continue its bullish momentum or face a deeper pullback.

🔹 Market Context – US Dollar Gains Strength Amid Positive Trade Sentiment

The US dollar is showing a notable rebound, driven by positive trade negotiations and agreements between the US and other major nations. As a result, the greenback is receiving short-term support, which is creating downward pressure on gold as traders rotate into a more risk-on environment. Additionally, lower-than-expected inflation data out of the US suggests the Fed may hold off on rate hikes, further boosting the dollar.

🔹 Geopolitical Factors Easing

Geopolitical tensions have somewhat eased, reducing the need for safe-haven assets like gold. This has contributed to a calm in the market, but it’s crucial to watch for any new developments that might trigger renewed interest in gold as a hedge.

🔹 Technical Outlook – Gold in Range-Bound Consolidation

On the H1 chart, gold is trending within a well-defined downward channel, ranging from 3360 to 3290. This range is currently acting as a resistance and support zone. If gold remains in this range, it could pull back further to the 3250 liquidity area. The market is effectively testing lower liquidity zones, and the reaction at these levels will be vital for determining the short-term direction.

🔹 Strategic View – Monitoring for Breakout or Continuation

Given the current price structure, we are likely to see the market retest key liquidity zones around 3320-3325. If the price holds above this zone, we might see buying pressure that leads to a bounce. However, traders should remain cautious as false breakouts are common, particularly when the market is moving fast and without confirmation from higher timeframes.

🔹TRADING STRATEGY:

BUY ZONE: 3346 – 3344 | Stop Loss: 3340 | TP 3350 - 3361 - 3372 - OPEN

SCALPING SELL ZONE: 3305 – 3307 | Stop Loss: 3310 | TP 3300 - 3395 - 3387 - OPEN

LIMIT SELL ZONE: 3334 – 3336 | Stop Loss: 3340 | TP 3327 - 3310 - 3300

As always, patience is key. Ensure you wait for solid confirmation signals, especially at these critical liquidity zones. False breakouts are frequent, and it's important to trade with a structured risk management plan.

🔹 Conclusion

The market is at a crucial inflection point. While we may see some upside pressure if buyers gain momentum, the risk of a further correction is present, especially if liquidity demand shifts. Watch how price behaves around the 3300 level, and be prepared to adapt to market conditions as they unfold.