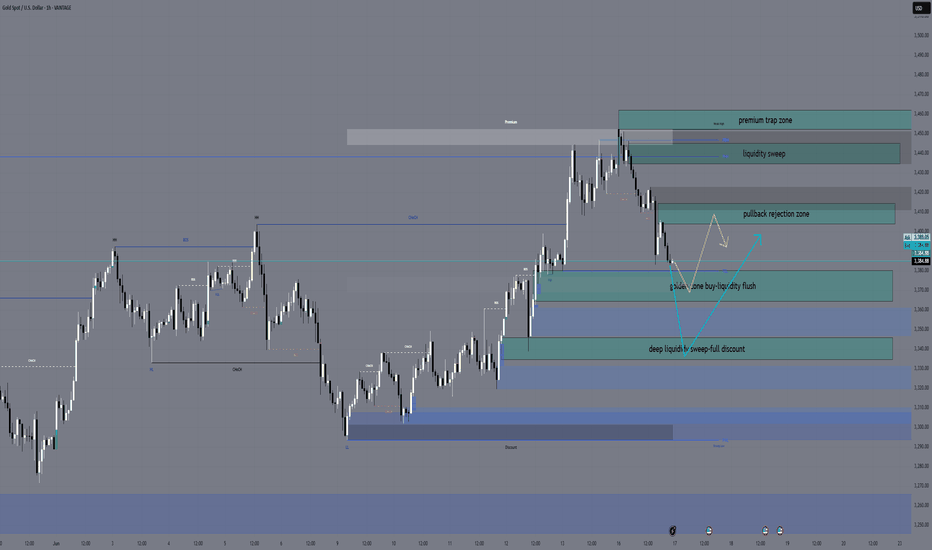

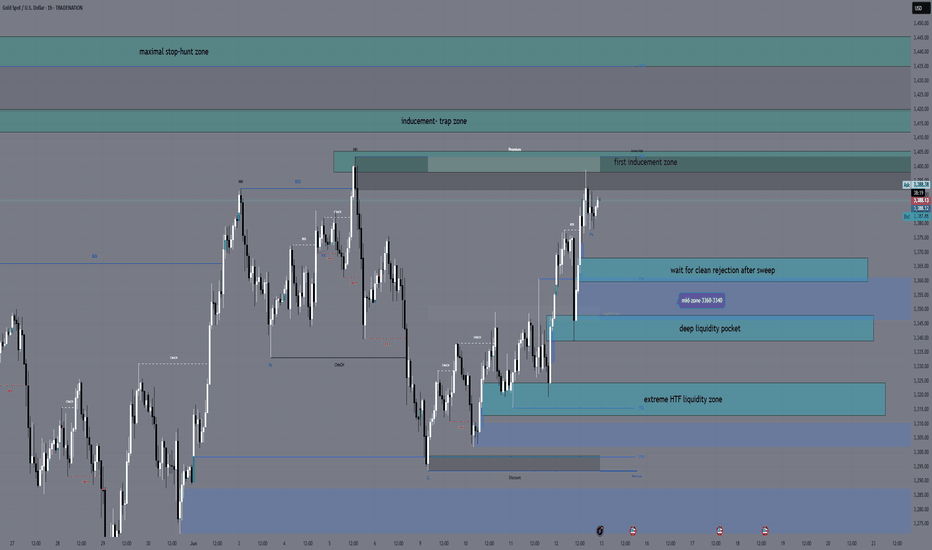

XAUUSD Daily Sniper Plan – June 27, 2025Hey traders! Today’s a trader’s dream: high-impact US news, gold trapped in a tight coil between supply and demand, and price flirting with the decision zone. The first breakout will be explosive — but only one side survives the trap. Let’s lock in the real structure, real bias, and sniper-level execution.

🔸 HTF Bias Breakdown

Daily Bias: Neutral → Price trapped between major supply (3359) and HTF demand (3282). Expect breakout after news.

H4 Bias: Bearish → Lower highs holding below 3359, structure weak below 3340.

H1 Bias: Mixed → Bullish momentum building off 3310–3282, but compression under EMAs warns of a fake rally.

🔹 Key Levels Above Price

3385 – Final top-side liquidity zone (last week’s spike high)

3359–3344 – HTF supply & OB (main short zone)

3340–3330 – The pivot zone (battle for control)

🔸 Key Levels Below Price

3317–3310 – Primary demand zone (where buyers stepped in yesterday)

3297–3282 – Deep liquidity pocket & HTF OB (last chance for bulls)

3260 – Breakdown zone if everything fails below

🔥 Sniper Zones & Execution Logic

🔴 3385–3375 – Extreme Supply

Only trade this zone if NY news launches price up and rejection is instant. Needs M5/M15 bearish reversal (engulfing, CHoCH, FVG fill). No news spike = no trade.

🔴 3359–3344 – Main Supply Zone

This is your first real short setup. Sweep into this area + rejection = clean short trigger. Confluence: HTF OB, FVG, EMA 100 rejection, bearish CHoCH.

⚔️ 3340–3330 – Pivot Decision Zone

This is where direction flips.

Break and hold above 3340 = bullish → targets 3359 / 3375

Rejection under 3330 = bearish → back toward 3310 or 3282

Plan: Use for break/retest entries only with M5/M15 confirmation. No blind trades.

🟢 3317–3310 – Primary Demand Zone

Watch for news-induced sweep, then M15 bullish PA (CHoCH, engulfing, RSI bounce). First safe buy zone if structure holds.

🟢 3297–3282 – Deep Demand Zone

Only used if NY session nukes the market. Enter only on textbook SMC/ICT reversal + RSI sub-30. This is the last stand for bulls.

🧠 Execution Strategy

Wait for NY news and first liquidity sweep. Don’t guess.

Sell 3359–3344 or 3375+ only on strong rejection

Buy 3310 or 3282 only on bullish reversal confirmation

Pivot 3340–3330 is the heart of today — use for break/retest or trap reversal

If you love clear logic, tap like, follow, and share your bias in the comments! 🚀👇

Disclosure: I am part of TradeNation's Influencer program and I'm using their TradingView charts in my analyses and educational articles.

GoldFxMinds

Goldfxminds

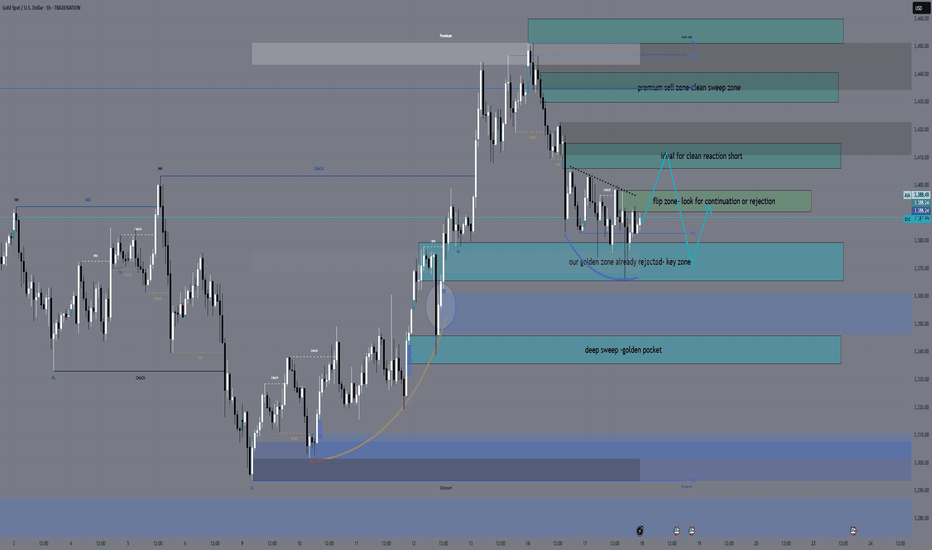

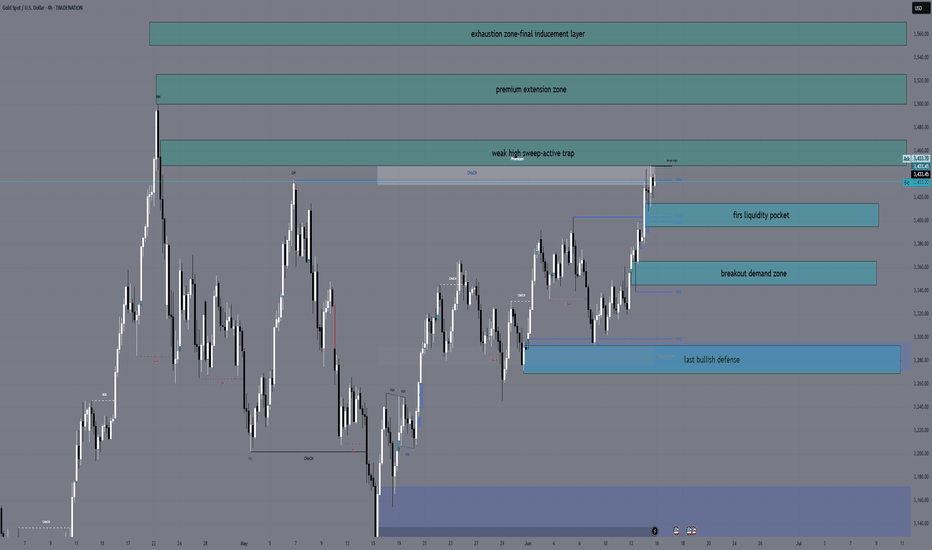

XAUUSD – Sniper Entry Plan June 26, 2025👋 Hello traders,

Gold is currently consolidating after recent downside liquidity sweeps, and Thursday brings high-impact USD catalysts. Let’s break it down and build a precise plan for sniper entries around these volatile zones. We’re trading structure, not noise — eyes on the prize. 🎯

🔸 HTF Outlook (D1 → H4 → H1)

🌐 Macro & Geopolitical Context

Markets are bracing for:

USD Unemployment Claims (Forecast: 244K, previous: 245K)

Final GDP q/q and Durable Goods Orders

Fed speakers (Barkin, Barr, Harker)

Stronger-than-expected data could reinforce USD bullish sentiment, sending gold down. Weaker reports + dovish Fed = bullish pressure on gold.

🗺️ Daily Bias: Neutral to Bullish

Price is ranging above a key CHoCH low + Daily OB (3272–3288)

Strong bullish continuation only confirmed with a break above 3370–3384

FIBO: 50% retracement of the last swing is near 3310, giving structure to Buy Zone 1

Bias: Bullish as long as 3272 holds — PA supports HL structure above imbalance

🕓 H4 Bias: Bearish Pullback

CHoCH at 3384 → clean Lower High + price failed to close above premium FVG

Pullback testing EMA 50/100 + FVG at 3345

FIBO extension zone at 161.8% aligns near 3288 = reactive downside target

Bias: Reactive bearish under 3352. If 3370 breaks cleanly → short invalid.

🕐 H1 Bias: Bullish Short-Term

CHoCH → HL printed at 3310 → higher lows forming toward supply

EMA 21/50 crossed to the upside, RSI mid-range (50–60)

PA structure showing ascending triangle under resistance

Bias: Bullish continuation valid toward 3352–3370, unless breakdown under 3308

🔸 LTF Precision (M30 → M15)

🔹 Sell Zone 1 – 3352–3345

H1 OB + M15 FVG + upper range sweep

RSI expected to peak near 70 → potential divergence

FIBO: 78.6% retracement of previous bearish leg

PA: Watch for M15 liquidity sweep + bearish engulfing

🔸 Entry: Wait for break/retest → confirmation on M5–M15 BOS

🔹 Sell Zone 2 – 3370–3384

HTF premium imbalance zone + weak high above

RSI likely in exhaustion zone

FIBO extension 1.272–1.618 completes inside this supply

PA: Only enter after stop hunt wick + clear CHoCH (M5)

🔸 Entry: Reactive fade after liquidity trap

🔸 Buy Zone 1 – 3308–3313

H1 CHoCH + OB + EQ zone

RSI bounce zone (30–40)

FIBO 50–61.8% retracement of bullish swing

PA: Watch for M15 bullish engulfing or double bottom formation

🔸 Entry: Only on structure break + retest confirmation

🔸 Buy Zone 2 – 3288–3272

Daily OB + HTF FVG + massive imbalance

RSI expected to overshoot under 30

FIBO: 1.618 extension from previous M15 bullish leg

PA: High-RR reversal zone if flushed by NY open

🔸 Entry: Enter only after M5 CHoCH or strong engulfing near the OB

⚖️ Decision Zone – 3333–3336

Previous supply turned EQ zone

PA shows indecision — do not enter here

Useful for monitoring if price holds support or rejects

🔸 Trade Scenarios

🟢 Bullish Scenario

If USD data is weak:

Flush to 3308 or 3288

Confirm HL formation → sniper buy from OB → aim 3345+, possibly 3370 sweep

🔴 Bearish Scenario

If USD prints strong:

Price spikes into 3352 or 3370 zones → rejection + BOS

Sniper short entry → targets 3310 → 3288

🔸 Final Plan & Action Points

✅ Patience is key during news. Let structure confirm.

✅ Track price behavior near 14:30 CEST, avoid instant spikes.

✅ Best sniper RR zones:

🔹 Sell from 3352 or 3370

🔸 Buy from 3308 or 3288

📊 Precision matters. Structure wins.

👍 Like this if it helped you map the move, and 🔔 follow for tomorrow’s sniper entry.

— GoldFxMinds

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

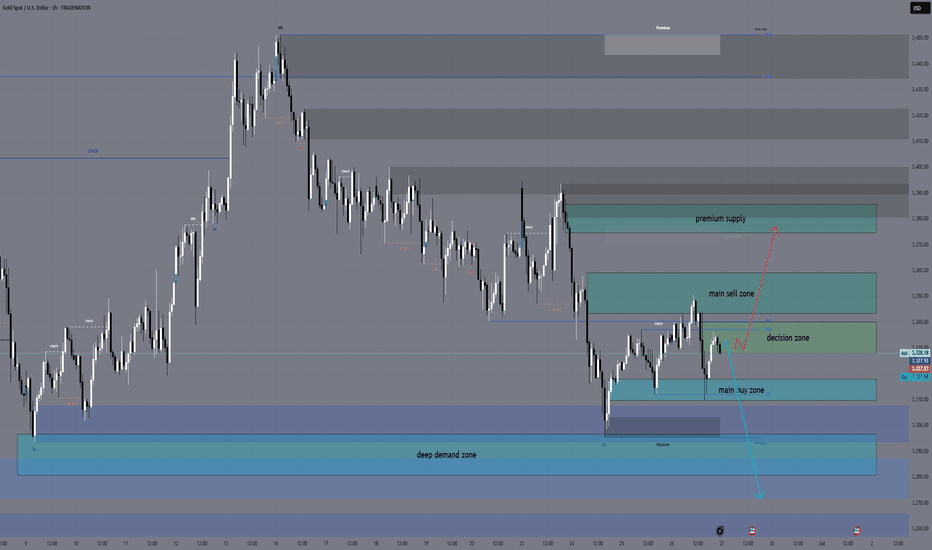

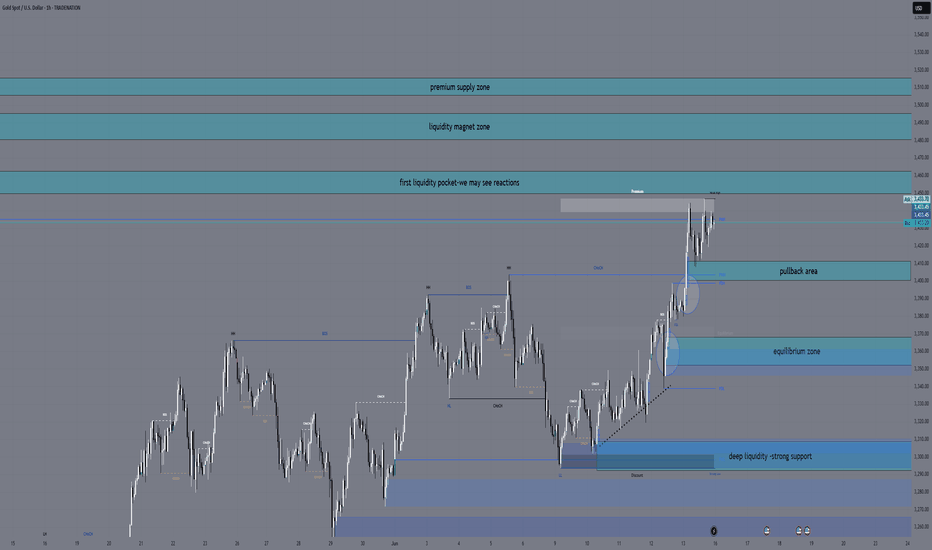

XAUUSD Daily Sniper Plan – June 24, 2025“Snipers wait. Structure tells the story.”

Hello traders! The market is stuck between the FOMC high at 3452 and the confirmed low at 3340. Price is compressing under H1 supply and above a key liquidity pocket. Here's your full plan with all sniper zones — now including a decision zone for intraday confirmation.

📰 Macro + Fundamental Context

Powell Testimony + multiple FOMC speeches today → high potential for dollar-driven volatility.

Inflation concerns and hawkish tone expected → short-term gold bearish pressure unless structure reclaims 3415+.

Smart money likely hunting liquidity both below 3340 and above 3400.

🔸 HTF Structure Summary (D1 → H4 → H1)

D1: Consolidation between 3452 and 3340. No new BOS.

H4: LL formed at 3340. LH not confirmed. Market is compressing under resistance.

H1: CHoCH + BOS confirmed. Current price sits in mid-range.

🔍 Sniper Entry Zones

🟥 Sell Zone 1: 3382–3395

H1 supply zone with previous rejection.

Includes order block + FVG.

Valid for new short entries if price returns and rejects.

🟥 Sell Zone 2: 3406–3420

High-risk spike zone from FOMC.

Only valid during fast, news-driven price movement.

Not a default entry unless confirmed rejection.

🟨 Decision Zone (Flip Area): 3360–3372

This is the key intraday flip level.

If price stays below, sell zones remain valid.

If price closes above, short bias is invalid and market may aim higher.

Use this zone to confirm bias before entering from either side.

🟩 Buy Zone 1: 3335–3345

Strong demand under equal lows.

OB + small imbalance on M15.

Valid for intraday long setups if confirmed with bullish price action.

🟦 Buy Zone 2: 3305–3285

H4 demand zone with major liquidity below.

Deep reversal area — only valid if price breaks 3340.

Smart money may be waiting here.

📌 Key Levels Summary

Zone Type Price Range Explanation

🔺 Premium OB 3450–3480 Daily supply zone

🟥 Sell Zone 1 3382–3395 Active H1 supply

🟥 Sell Zone 2 3406–3420 FOMC wick inducement

🟨 Flip Zone 3360–3372 Decision area — confirm bias

🟩 Buy Zone 1 3335–3345 Demand under equal lows

🟦 Buy Zone 2 3305–3285 H4 demand + deep liquidity

📣 Final Notes

📌 The market is at a critical moment. The flip zone (3360–3372) will decide tomorrow’s control: bear continuation or deeper retracement.

Watch price at the zone. Let the structure speak. Trade only where the logic is clean.

👁 Good luck in the market tomorrow, traders!

— GoldFxMinds

🟨 Disclosure: I am part of TradeNation’s Influencer Program and receive a monthly fee for using their TradingView charts in educational work.

Luxury, War, and Clarity – This Is the Golden Reset.🟨 The Real Gold Era: Clarity While the World Burns 🟨

"While some bleed in the streets, others sip cocktails in the Bahamas. This is not a coincidence. This is the new world."

Right now, we live in a time like no other.

People are dying in wars they never chose.

Currencies collapse. Nations threaten each other.

And yet — capital flows, gold climbs, and the rich get richer.

🕰️ A war started long ago — and most never saw it:

2020–2022: They printed trillions. COVID shut down the world. Fiat was silently devalued.

2022–2023: Russia was cut off from SWIFT. BRICS started buying gold. The dollar was no longer untouchable.

2023–2024: Gold broke $2100… then $2400… now $3400+. Even high interest rates can't stop it.

2025: U.S. and Israel strike Iran. BRICS discuss a gold-backed currency. Trust in fiat? Gone.

The Gold Era is no longer just metaphor. It’s the new battlefield.

💣 "War is loud. Wealth is silent."

While bombs fall in the East,

✨ capital quietly moves to safe havens.

While families flee,

✨ smart money finds gold, data, and sovereign positioning.

While headlines scream chaos,

✨ traders make decisions in silence.

🌍 But here's the paradox:

We also live in a world of unmatched abundance:

You can build a brand from a phone.

You can trade gold from a beach.

You can learn SMC, AI, geopolitics — and use it to build freedom.

You can escape the system, if you understand the structure.

In this gold era, the true asset isn't just metal.

It's mental clarity. Information. Sovereignty.

The gold is you.

📉 This isn’t just about trading.

It’s about knowing where we are in the timeline of collapse and rebirth.

The markets don’t lie — they expose what’s really coming.

And those who read them… can rise while others fall.

🧠 Final note:

Not everyone survives a reset.

But those who think in structure, who lead with clarity — they don’t just survive.

They reposition.

They build.

They lead.

🟡 Welcome to the Real Gold Era.

Where charts speak louder than news.

Where truth is a position.

Where you don’t wait for safety — you create it.

—

✍️ GoldFxMinds – where structure meets truth.

📢 Disclosure: This analysis was created using TradingView charts through my Trade Nation broker integration. As part of Trade Nation’s partner program, I may receive compensation for educational content shared using their tools.

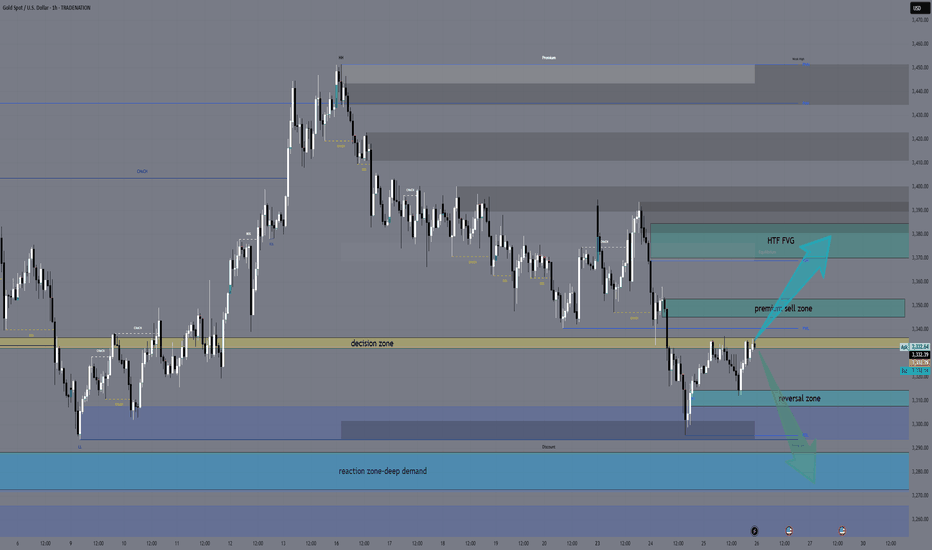

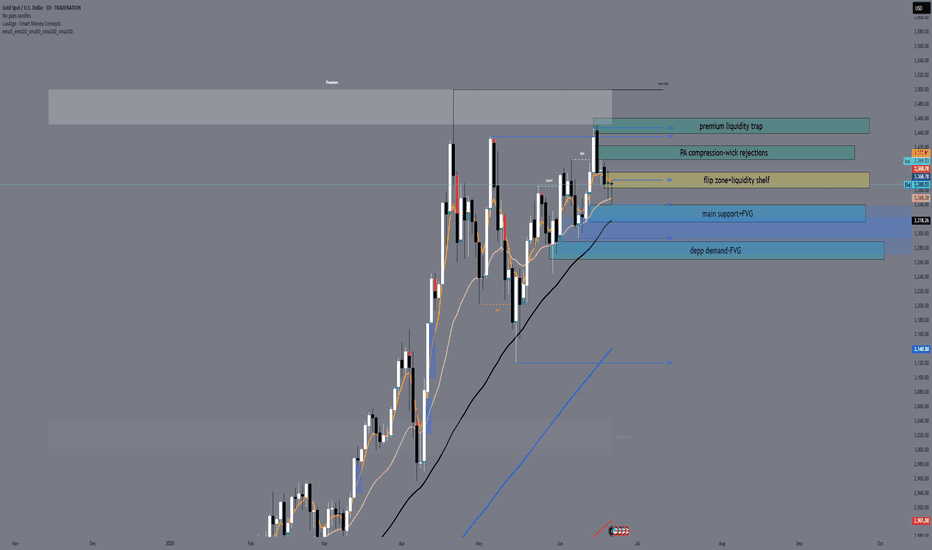

H4 Outlook – Between Flip and Trap👋 Hey Gold minds, welcome to another sniper-level breakdown. We're mid-range between major sweep zones and watching carefully how price reacts around the current compression under key EMAs and FVG. Let’s break it down:

🔸 MACRO + FUNDAMENTAL CONTEXT

USD drivers this week:

🔹 Monday–Tuesday: Multiple FOMC Members speaking

🔹 Wednesday: Powell Testimony

🔹 Thursday: Final GDP + Unemployment Claims

🔹 Friday: Core PCE and UoM Inflation Expectations

Macro sentiment:

FOMC speakers remain hawkish while inflation is sticky. Gold reacts defensively as markets price in Powell’s tone. Liquidity traps on both sides still active. Gold consolidates below key liquidity at 3405, potentially setting up for either expansion or sweep rejection.

🔸 H4 STRUCTURE + BIAS

Market structure:

Price formed a Lower High (3452) and confirmed bearish intent with a break of structure to the downside (CHoCH & BOS).

Currently compressing under H4 Fair Value Gap and retesting an internal OB + EQ zone around 3360–3370, showing signs of rejection.

EMA Cluster:

Price is compressing between EMA 21 / 50 / 100, failing to reclaim EMA100.

EMA5 is crossing under EMA21 – short-term bearish bias holds.

Bias: 🔻 Bearish to neutral

As long as price stays under 3380, supply remains in control. Only a break and close above 3405–3415 would flip bias bullish short term.

🧭 Sniper Zones – H4 Precision Map

🔷 Type 📍 Price Zone 📌 Justification

🔵 Buy Zone #1 3315 – 3340 Valid OB , previous HL structure, FVG reaction support

🔵 Buy Zone #2 3280 – 3302 Deeper demand pocket, untapped imbalance

🟠 Flip Zone 3360 – 3380 FVG + internal OB + EMA compression = key battle zone

🔴 Sell Zone #1 3405 – 3415 Internal OB + unmitigated premium zone under LH

🔴 Sell Trap Zone 3440 – 3460 Extreme rejection zone — 3452 HH sweep logic + OB

🔸 Price Action Expectations (PA)

If price rejects 3360–3380, expect a clean push back to 3320, with possible deeper draw to 3300–3285.

A clean break and close above 3380 (not just a wick) may open the door for a sweep of 3405, where sellers are expected.

Only an aggressive news-driven breakout above 3415 would unlock the final trap zone toward 3450+ – lower probability unless Powell surprises.

✅ Conclusion & Execution Plan

🎯 Watch how price behaves around the Flip Zone — this is the decision point.

📉 Main bearish confirmation = strong rejection at Flip Zone or 3405.

📈 Bullish continuation only above 3415 with volume and closing strength.

💎 Best RR zones:

Sell 3405–3420 → targeting 3360 / 3340

Buy 3315–3340 → targeting 3360 / 3380

🔥 If this breakdown helped sharpen your edge, drop a 🚀 in the comments and like the post!

🔔 Follow GoldFxMinds for more real-time, structure-based sniper plans.

🧠 Precision isn't optional. It's the edge.

🔹 Disclosure: As part of Trade Nation’s Influencer Program, we receive monthly compensation for using their charts.

GoldFxMinds

XAUUSD Daily Outlook | June 23, 2025👋 Hello Gold traders!

We’re entering a new week with structure sharpening around key zones. Price is now hovering just below the decision shelf at 3385, and all eyes are on whether bulls defend structure — or bears trigger the first real trap. Let’s zoom in with pure Daily focus and zero noise.

🔸 DAILY STRUCTURE OUTLOOK

Gold remains in a clear bullish trend on the Daily timeframe, with the last confirmed Higher High at 3452. However, current price is in a retracement phase, testing the area just below the BOS and reacting to recent liquidity sweeps.

Despite rising USD pressure, the bullish structure remains intact unless a daily close breaks below 3315.

📌 Daily Bias: Bullish (retracement phase active)

🧭 Macro Context:

Heavy Fed week: Powell testifies Tue & Wed, Core PCE and Consumer Sentiment hit Fri.

USD may remain supported short-term, but gold still benefits from long-term inflation hedge + geopolitical risk flows.

🔹 STRUCTURAL KEY ZONES (D1)

Type Zone Confluences

🟢 Buy Zone #1 3320 – 3340 Daily OB, FVG base, EMA50 , structure HL defense

🔵 Buy Zone #2 3265 – 3285 Untapped OB + imbalance, deeper fib retrace

🟠 Flip Zone 3363 – 3385 Former BOS, FVG retest, minor liquidity shelf

🔴 Sell Zone #1 3405 – 3425 First sweep of equal highs, premium OB, FVG pocket

🔴 Sell Zone #2 3440 – 3460 Extreme bull trap: clean OB top, imbalance cluster

🎯 EXECUTION PLAN

🔍 Flip Zone is your battlefield — if bulls reclaim this zone cleanly, we may revisit 3405.

📉 3405–3425 offers the first sniper short opportunity: liquidity sweep + OB + FVG = prime short trigger.

📈 3320–3340 is the cleanest high-RR long zone — only enter if price reacts with strength and forms a rejection candle or bullish engulfing.

🧊 If 3320 fails, standby at 3265–3285 for a deeper correction entry backed by clean OB/FVG logic.

✅ SUMMARY & ACTION PLAN

Wait for confirmation at the Flip Zone — do not force direction.

Most precise sniper trades expected:

🔻 Sell from 3405–3425 → target Flip Zone

🔺 Buy from 3320–3340 → target 3385–3400

Only engage with clear OB reactions and strong PA confirmation — no bounce chasing.

💬 If this outlook gave you clarity, drop a 🚀 and a like to support the work — it helps more traders find it.

💡 Got feedback or want to ask something? Comment below — we read everything.

📌 Follow GoldFxMinds for high-precision sniper plans, every single day.

📌 Disclaimer: I'm part of Trade Nation's Influencer Program and receive compensation for using their charts on TradingView. This content is for educational purposes only.

— GoldFxMinds

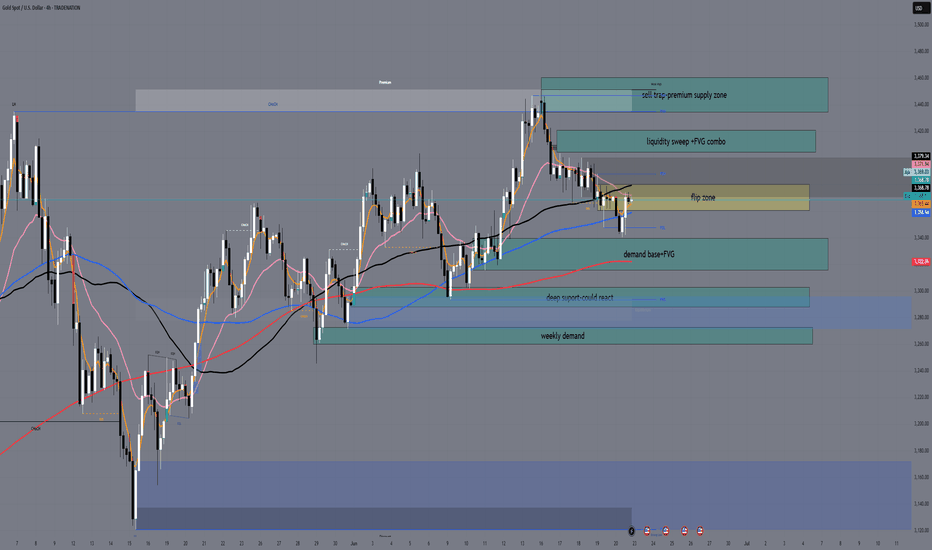

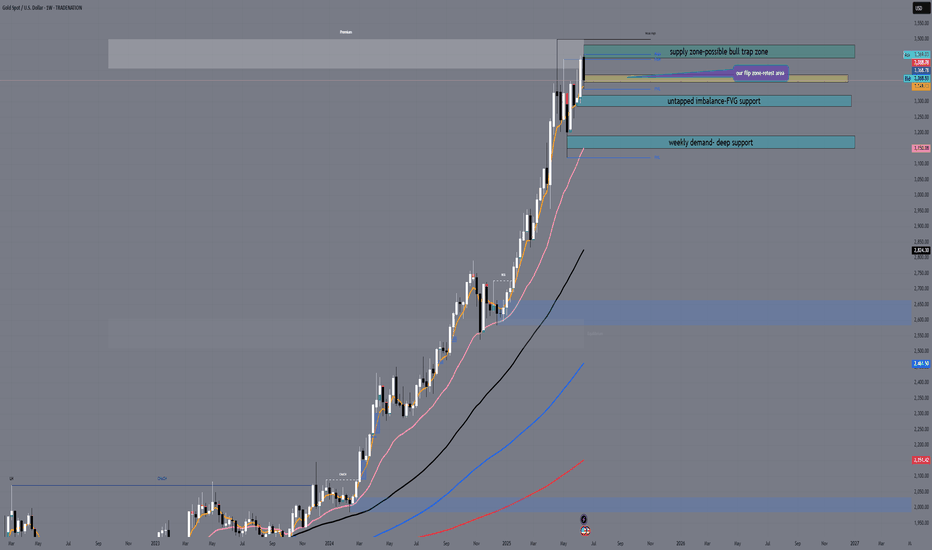

XAUUSD Weekly Outlook | June 23–27, 2025👋 Hey gold traders! As we close out the FOMC week and head into the final stretch of June, gold continues to hold bullish structure — but this week's candle is entering a very sensitive premium area. Let's break it all down in full top-down clarity:

🔍 Weekly Structure Update

✅ Weekly BOS confirmed since November 2023

✅ Price holding above EMA 5/21/50 — bullish lock intact

🔼 Current HH printed at 3452

📍Price is now entering a weekly FVG + supply trap zone around 3440–3460

🟣 RSI divergence starting to appear — caution in premium

🗺 Key Weekly Zones

Type Price Range Context

🔵 Demand Zone 3150 – 3190 Weekly OB + EMA50 confluence

🟣 FVG Support 3284 – 3320 Fresh imbalance post BOS

🟠 Flip Zone 3363 – 3385 Retest of BOS + FVG bottom

🔴 Sell Trap Zone 3440 – 3460 Weekly OB + liquidity sweep area

🧠 Bias This Week

📌 Bullish, but extended.

We expect a reaction from 3440–3460, not blind continuation.

The next healthy buy opportunity is only valid on a retrace toward 3320–3280, aligned with imbalance + structure.

🧭 GoldFxMinds Game Plan

Above 3440–3460 = overextension — wait for trap/sweep confirmation 🧨

Below 3363 = bearish flip zone — risk of revisiting 3280

Ideal buy = 3284–3320 → only on bullish PA or reversal confirmation

📰 Upcoming Economic Events (June 23–27)

🗣 FOMC Speakers flood the week (Waller, Powell, Williams, Goolsbee, Hammack, etc.)

🏠 Existing & New Home Sales, Consumer Confidence, Pending Home Sales

🛢 Crude Oil & Natural Gas Inventory reports

📊 Final GDP q/q, Core PCE, Personal Spending/Income

📉 Durable Goods, Unemployment Claims

🧪 Bank Stress Test Results (Friday)

⚠️ This is a dense news week — stay alert for surprise volatility, especially around Powell’s testimonies (Tue & Wed).

⚠️ Summary:

We are no longer in discount — we are inside the premium trap. Gold remains bullish, but 3440–3460 is a red flag zone. If this becomes the top, watch the flip at 3363–3385. Only re-enter long if structure confirms.

💬 If you found this helpful, drop a comment, give it a like, and make sure to follow GoldFxMinds for more sniper-level updates every week!

📣 This post was made using the Trade Nation chart feed. As a partner in their influencer program, I receive compensation for using and sharing their tools.

XAUUSD Sniper Plan – June 18, 2025Hey GoldMinds! 💛

After a messy reaction to today's Retail Sales miss, Gold continues to coil inside a premium range. With FOMC projections, rate statement, Powell’s press conference, and Unemployment Claims lined up next — volatility is far from over. Here’s our refined tactical plan 👇

🌍 Macro & Geopolitical Context

• US Retail Sales disappointed — signaling cracks in consumer demand, potentially weighing on the USD.

• Unemployment Claims up next — job market weakness could add pressure on USD if claims increase.

• FOMC day: Expect massive liquidity sweeps during economic projections, rate decision, and Powell’s press conference.

• Geopolitical tensions persist — no ceasefire in Middle East conflicts (Israel–Iran), and Russia–Ukraine remains unstable. Safe haven bids may still support gold on dips.

🧭 Bias: Tactical Neutral → Bearish

• Price remains capped under 3415–3445 supply

• EMAs are showing indecision: H1 trapped between EMA 5–21, H4 leaning weakly bullish

• RSI on most TFs is neutral → market waiting for event catalyst

• Structure suggests bull trap risk if 3415 holds

🔑 Key Sniper Zones

🔻 Sell Zones

1️⃣ 3405 – 3415

→ H1-H4 OB + FVG + sweep confluence

→ Premium liquidity pocket — ideal trap for reactive sellers

→ Watch M15 for rejection confirmation

2️⃣ 3430 – 3445

→ Upper inducement + clean OB + imbalance

→ Only valid if price spikes irrationally post-FOMC

→ Stronger reversal setup likely here

🟡 Pullback Monitor Zone

3390 – 3398

→ No trade zone — watch for signs of rejection or continuation

→ Could act as short-term resistance before deeper moves

🟢 Buy Zones

1️⃣ 3365 – 3380

→ Bounce zone with clean confluence: FVG, OB, previous HL

→ Best used for reactive entries after wick flushes

→ Key pivot zone with HL structure

→ OB + FVG combo, ideal for tactical long bounces with M15/M30 confirmation

2️⃣ 3335 – 3345

→ Deeper structure retracement zone

→ Contains H4 OB, imbalance + golden Fibo pocket

→ Most reactive buy zone post-event volatility

🧠 Battle Plan Recap

• If price fails to break 3415, we prepare for further bearish continuation

• Bounces expected at 3365–3380 — confirmation needed

• Final long setup lives at 3335–3345 — cleanest buy zone if FOMC triggers selloff

• 3390–3398 is not for entries — only reaction monitoring

• FOMC + Claims = high risk day → trade only sniper zones

✨ Final Notes

Volatility creates traps. Structure gives clarity.

We don’t predict — we react to the third move.

👇 Found this valuable? Hit the 🚀, follow for more sniper plans, and comment your bias!

Let’s trade like pros, not guessers — GoldFxMinds 🧠✨

GoldFxMinds Sniper Plan — June 17, 2025 🚀 GoldMinds Battle Plan Loaded — June 17, 2025

Good morning GoldMinds 👋

The market is again building perfect traps after CPI & PPI whipped both sides last week. Liquidity is stacking and volatility is hiding behind a quiet news calendar — exactly when the market loves to attack both sides. We stay patient, sniper-style.

🌎 Macro & Sentiment:

No major data today, but liquidity still reacts after last week’s CPI & FOMC tone.

DXY remains stable — gold remains capped inside premium supply zones.

The real game now is liquidity manipulation — we focus on clean execution.

🔬 Structure & Bias:

✅ D1: Liquidity sweep above 3450 — sellers protecting premium.

✅ H4: Lower high distribution forming.

✅ H1: Bearish order flow starting to control.

✅ EMAs 5/21/50: compressed bearish.

✅ RSI: showing divergence on intraday.

Bias: Tactical Bearish — under 3460 we remain sellers on sweeps. Liquidity hunts both ways but premium remains the trap zone.

🎯 Sniper Zones

🔻 SELL ZONES:

3405 – 3410 → early pullback rejection zone

3435 – 3445 → main OB liquidity sweep

3452 – 3460 → extreme premium trap zone

🔻 BUY ZONES:

3365 – 3380 → golden zone buy (perfect fibo confluence)

3335 – 3345 → deep flush exhaustion buy

🔄 Tactical Scenarios

Sell spikes into premium → M15 rejection → target 3380 first.

If flushed into golden zone → watch M15 confirmation → target 3405.

If deep flush into 3335 → exhaustion buy setups only.

💡 Tactical Notes

No chasing — liquidity first, reaction second.

News absence = perfect condition for engineered liquidity sweeps.

Stay sniper. Only act when structure confirms.

🔥 If this sniper battle plan helps you prepare, smash the 🚀, drop your bias in comments & hit FOLLOW to support real structure-based trading. Let’s bring back real value content to TradingView.

GoldFxMinds 🧠✨

XAUUSD BATTLE PLAN — 16 JUNE 2025GoldFxMinds — Sniper Liquidity Execution

👋 Hello traders — we’re entering a highly tactical week where liquidity rotation dominates both sides of the board. This is no longer trend-following — this is liquidity chess.

🔎 Market Narrative

Gold remains structurally bullish after a clean sequence of higher lows: 3120 → 3246 → 3448.

Last week’s sweep above 3447 cleared weak hands, activated premium liquidity traps, and left price fully positioned inside extended premium expansion. Smart money continues rotating liquidity aggressively as markets prepare for this week’s heavy catalysts.

With FOMC, Powell’s press conference, Fed projections, and Middle East tensions all unfolding, institutional positioning is building quietly beneath surface price moves.

For us, this is not a moment to guess or force trades — this is the phase where patience and structure offer the only real edge.

🎯 GoldFxMinds Bias for 16 June 2025

🔼 Short-term:

Price remains inside premium expansion, with open liquidity layers above 3450 → 3480 → 3505 still uncollected. We allow price to finish hunting late buyers before considering any premium exhaustion reactions. No blind shorting inside premium unless exhaustion signals confirm.

🔽 Medium-term positioning:

Controlled pullbacks into 3368 and deeper recalibration zones offer the cleanest tactical long opportunities, aligned with higher timeframe bullish structure for potential future premium expansions.

❌ No aggressive directional conviction intraday:

The current structure demands discipline, patience, and reactive execution — not early bias.

🔼 Premium Supply Zones (Sniper Calibrated)

Price Zone Explanation

3450 – 3462 🔸 Premium inducement zone — early liquidity pocket where price may react mildly before sweeping deeper premium levels.

3480 – 3495 🔸 Liquidity collection extension — gap zone drawing in late buyers and liquidity build-up above recent highs.

3505 – 3515 🔸 Premium exhaustion — final sweep level for late liquidity grabs before potential higher timeframe recalibrations.

🔽 Demand Defense Zones (Sniper Calibrated)

Price Zone Explanation

3410 – 3400 🔸 Micro pullback — short-term liquidity refill zone valid for scalps, not for strong swing positioning.

3368 – 3352 🔸 Tactical bullish recalibration — strong HTF OB + FVG combo, valid for tactical swing positioning with structure confirmation.

3308 – 3292 🔸 Institutional re-accumulation base — deeper liquidity recalibration where larger players likely step in for new expansions.

🎯 Execution Flow & Tactical Outlook

We let liquidity fully expose itself before positioning:

Above 3450: Expect continued liquidity sweeps. Monitor sharp reactions above 3480 for exhaustion setups — only trade short-side if clear rejection signals emerge.

Into pullbacks: Minor dips toward 3410 offer quick reactive scalps only. The real positioning opportunities open inside 3368 and deeper zones, where recalibration offers cleaner entries aligned with HTF bullish structure.

Discipline is key: No chasing. No prediction. Only reaction to clean liquidity behavior.

🧠 Trader’s Mindset for This Week

We're facing one of the heaviest institutional risk weeks:

🏛 FOMC Interest Rate Decision → Major market-moving catalyst.

🏛 Powell’s Press Conference → Immediate tone-shifting potential.

📊 Fed Projections → Will influence short-term USD positioning.

📊 Retail Sales & Housing Data → Potential intraday volatility triggers.

🌍 Middle East Tensions → Underlying risk bid remains supportive for gold.

Each event is fuel for liquidity displacement. We don't react emotionally — we position where liquidity delivers.

🚀 If this battle plan helps you stay fully locked — drop a 🚀, share your views, and follow GoldFxMinds for sniper liquidity updates throughout the week.

Stay sharp — liquidity always moves first.

— GoldFxMinds

XAUUSD H4 Outlook — 16 June 2025👋 Hello team, here’s where we stand before the upcoming key week:

🔎 The Narrative

Gold remains in bullish control after weeks of controlled expansion.

The clean breakout above previous major highs triggered liquidity resets that cleared significant weak-handed positions.

Last week’s sweep into 3447 activated premium liquidity, trapping late buyers at the edge of impulsive highs. But the game is far from over — smart money continues to rotate liquidity at these extreme levels, using premium expansion to build further trap pockets both above and below.

Behind this technical expansion, macro tensions continue to fuel underlying gold demand. Geopolitical uncertainties remain elevated with the Middle East escalation risk growing, while recent Fed positioning keeps rate path expectations flexible.

The upcoming FOMC decision later this week will likely act as the true liquidity catalyst — until then, gold remains positioned for further inducement cycles as both buyers and sellers continue to get baited into traps.

🔼 Premium Supply Zones

Price Zone Description

3447 – 3470 Weak high sweep — premium liquidity trap fully active

3500 – 3525 Main extension liquidity pocket — Fibonacci cluster (1.272 & 1.414 extensions)

3550 – 3570 Exhaustion inducement — full 1.618 premium extension stack

🔽 Demand Defense Zones

Price Zone Description

3415 – 3395 Minor imbalance recalibration — short-term liquidity refill zone

3365 – 3345 Core breakout OB + FVG overlap — main recalibration zone if pullbacks extend

3285 – 3265 HTF bullish structure base — BOS origin + deep recalibration defense level

🎯 Where We Stand Right Now

✅ Smart money holds full control inside premium expansion.

✅ Inducement layers remain open both above and below current price.

✅ We expect short-term liquidity sweeps before any major expansion unfolds.

✅ No change in bias — bullish structure remains valid while 3285 holds.

🔐 The Mindset

👉 This is not the place for aggressive chasing.

👉 Liquidity will continue to hunt both sides into key events ahead.

👉 Our job is not to predict, but to position with discipline once liquidity confirms displacement inside the calibrated zones.

🚀 If this breakdown helps you stay locked:

💬 Drop a 🚀, leave your thoughts & follow for full sniper-level updates as we approach a volatile week ahead.

Stay sharp — the trap is already in play.

— GoldFxMinds

XAUUSD Daily Plan — June 13, 2025 By GoldFxMinds👋 Hello traders, and welcome to your full preparation for tomorrow’s gold session.

Gold continues to respect its structural map while liquidity traps remain active on both sides of the range. We’ve seen clean sweeps and fast reactions this week, but tomorrow brings a new catalyst: key U.S. data combined with fresh geopolitical tensions that may fuel additional volatility before the weekly close.

🌐 MACRO & GEOPOLITICAL OUTLOOK:

📊 Prelim UoM Consumer Sentiment & Inflation Expectations are scheduled tomorrow:

Consumer Sentiment ➔ 52.2

Inflation Expectations ➔ 6.6%

These data points often trigger sharp USD moves and liquidity grabs.

🌍 Geopolitical tension has increased as President Trump authorized the evacuation of U.S. personnel from several Middle East locations due to rising threats in the region, particularly concerning the Iran nuclear situation.

This development triggered sharp moves across commodities, with oil rallying strongly.

Gold remains well-supported in this environment as global risk sentiment deteriorates.

Traders should expect elevated intraday volatility and potential liquidity sweeps on both sides as markets digest these developments.

🔎 The combination of macro data and geopolitical risk creates highly reactive conditions where liquidity hunts may precede any clear directional moves.

🔎 STRUCTURE OVERVIEW:

Price remains inside premium territory after recent bullish expansions.

Liquidity has already been taken above and below earlier this week, but additional traps may unfold before Friday’s close.

Larger structure remains bullish while short-term supply zones may attract quick inducements.

Tomorrow's flow will likely begin with manipulation during or after news, before real momentum develops.

🎯 BIAS

Main bias: Controlled bullish, but highly reactive inside premium.

As long as price holds above 3340, bulls remain in control on higher timeframe.

However, premium zones above 3395 may act as liquidity traps, inviting fast selloffs after inducements.

Best opportunities likely to come from either:

Controlled retracement into buy zones for continuation higher.

Fast spikes into premium traps for short-term sell opportunities.

Patience will be critical as both news and geopolitical headlines may trigger manipulations before real trend unfolds.

🔑 KEY ZONES TO WATCH:

BUY ZONES

🔵 3368 - 3360

Intraday pullback zone.

Look for minor liquidity dips followed by bullish rejection.

Targets: 3390 → 3405.

🔵 3348 - 3340

Deeper liquidity pocket into H4 imbalance and OB.

Engage only after strong downside sweep with sharp bullish reaction.

Targets: 3380 → 3396.

🔵 3325 - 3312

Extreme HTF liquidity zone.

Valid only if aggressive liquidation occurs into deeper discount.

Targets: 3360 → 3380.

SELL ZONES

🔴 3398 - 3405

First premium inducement area.

Look for fast spikes with M15 bearish rejection candles.

Targets: 3370 → 3348.

🔴 3412 - 3420

Secondary premium trap zone.

Valid only after upside wick rejection.

Targets: 3385 → 3355.

🔴 3435 - 3445

Maximum stop-hunt exhaustion zone.

Only valid if price aggressively squeezes into final liquidity.

Targets: 3390 → 3360.

⚠ TRADING REMINDER:

Friday’s session will likely be driven by both news and geopolitical headlines. Let liquidity play out inside the zones, wait for clear rejection signals, and execute with full confirmation. No chasing — sniper discipline only. 🎯

💎 Hit that 🚀 if you found this plan helpful.

👉 Feel free to follow for daily gold plans and share your thoughts in the comments.

We remain disciplined. We trade structure.

🌙 Rest well tonight — tomorrow we execute with precision and control.

— GoldFxMinds