Gold surged and then fell back to fluctuate, pay attention to 33

The first goal of trading is survival, and the second is profit.

📌 Driving events

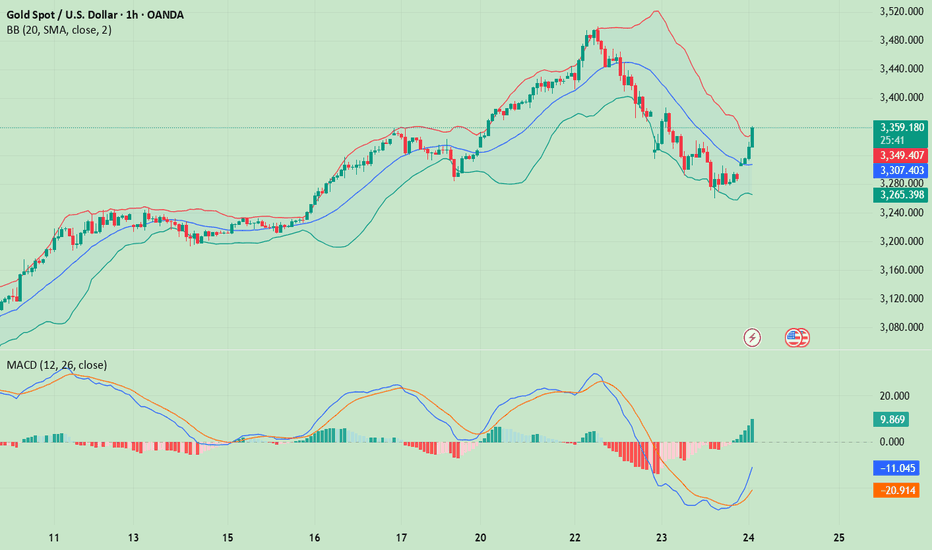

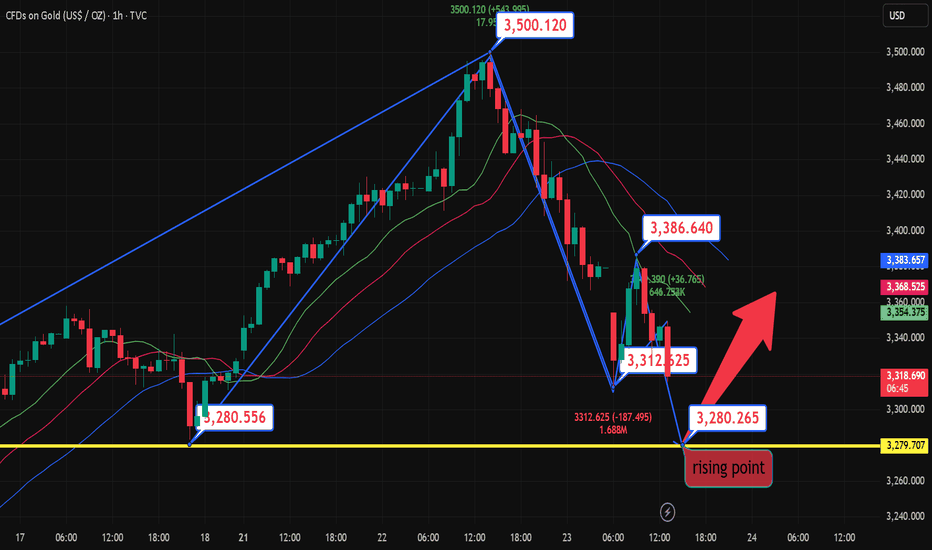

After experiencing the biggest drop in five months, gold prices rose on Thursday (April 24) and returned to above the 3300 mark.

After US President Trump hinted that tariffs on China might be reduced and expressed no intention to remove Federal Reserve Chairman Powell, the market's risk aversion has cooled down. Gold hit a high of $3,367 during the Asian trading session, which can be regarded as ice and fire!

📊Comment analysis

For participants in the gold market, the impact of this price plunge is self-evident. The stock prices of gold mining companies have fallen accordingly, and the production capacity that expanded in the early stage due to the rise in gold prices may face the risk of shrinking profits.

At present, gold is under obvious pressure from above, and what needs to be paid attention to now is that the current round of gold adjustments is likely to continue, which means that it is not time to buy the bottom yet!

💰Strategy Package

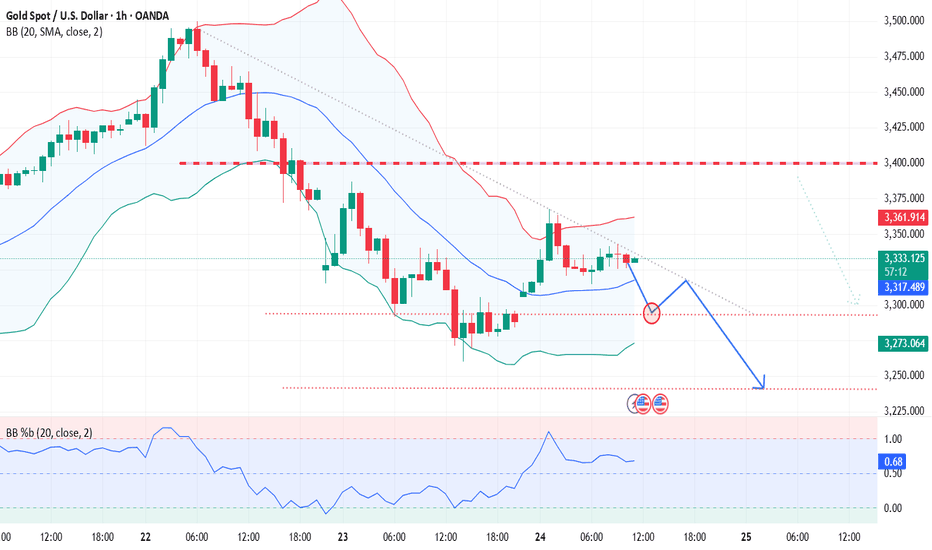

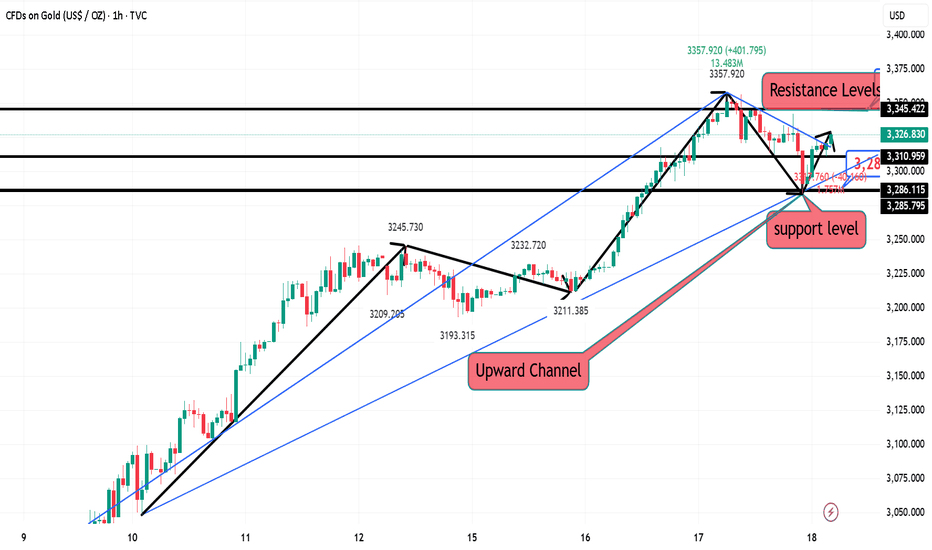

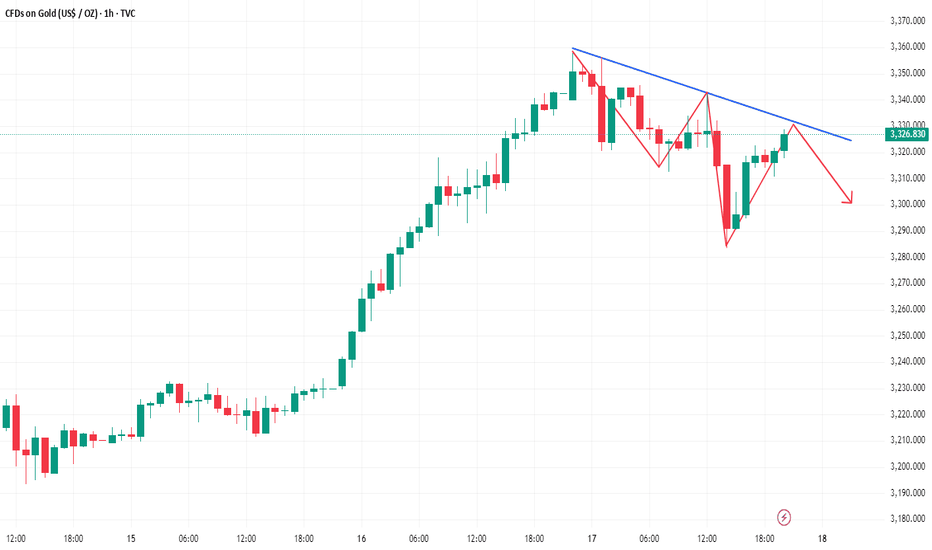

Except for the early morning wave, the strength of the hourly line rebound is actually somewhat weak. As for the European session, Labaron is more inclined to continue to be bearish, and the current first round of rebound pressure is around 3350! If the rebound is in place, you can continue to try short orders!

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

- Profit is 4-7% of the fund account

- Stop loss is 1-3% of the fund account

Goldinvesting

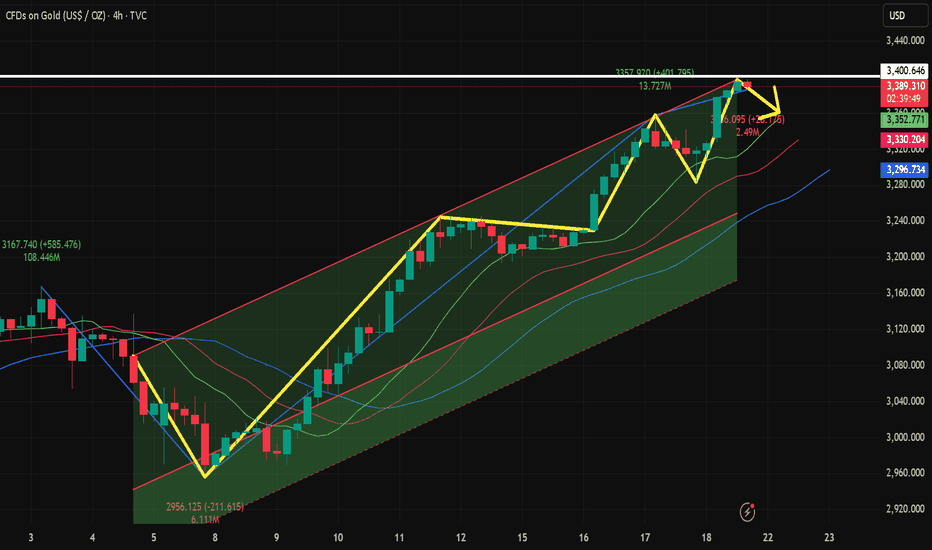

Gold fluctuates in a wide range, and the short-term trend is upwGold fell by $240 in two trading days, but the rebound was also very fierce, from yesterday's low of 3260 to 3367 in the early trading. The current volatility is still very large. The high and low points of $100 often appear, and it is normal to fluctuate by dozens of dollars. So pay attention to the market. There is no shortage of opportunities. Just grab what you can grasp.

The daily cycle has stepped back to the MA10 position. It has entered a critical stage. If the bulls recover, the strong rhythm is still there. It is too early to say that the peak has been reached. Pay attention to follow the market and don't be stubborn. The short-term resistance is 3386 and the 618 position of the decline and rebound is 3408. It is recommended to wait and see in the European session and look at the trend. Intervene in the US session.

Gold profit taking continuesThe gold market opened at 3337.5 yesterday due to the profit-taking of the previous day. After the market fell back to 3315.6, the market rose strongly to fill the gap. The daily line reached a high of 3386.7 and then fell strongly. The daily line reached a low of 3259.6 and then the market consolidated at the end of the day. The daily line finally closed at 3287.9 and the market closed with a long upper shadow line. After this pattern ended, today's market continued to be empty. In terms of points, the short positions at 3496, 3468 and 3442 the day before were reduced and the stop loss was followed up at 3400.

SELL:3340 45 50 Stop loss: 55

TP1:3330

TP2:3320

TP3:3300

XAU/USD(20250424) Today's AnalysisMarket News:

The United States hit a 16-month low in April. The total number of new home sales in the United States in March was an annualized to a new high since September 2024.

Technical analysis:

Today's buying and selling boundaries:

3311

Support and resistance levels:

3436

3389

3359

3263

3233

3186

Trading strategy:

If the price breaks through 3311, consider buying, the first target price is 3359

If the price breaks through 3263, consider selling, the first target price is 3233

Gold once fell below the 3,300 mark, can it rise again?

📌 Driving Event

Spot gold (XAU/USD) once fell below the 3,300 US dollar mark, a significant correction from the previous historical high of nearly 3,500 US dollars. The market's risk appetite has increased, making the attractiveness of safe-haven assets weakened in the short term. However, repeated news about the direction of US policy and the Fed Chairman's movements may still affect the market in the medium and long term.

📊Comment Analysis

From the perspective of market sentiment, the strong rise in gold prices in the early stage mainly relied on safe-haven demand and speculation about subsequent monetary easing. However, the short-term trend has led to some profit-taking in safe-haven assets due to the recovery of the equity market. This change in sentiment reflects the current market's optimism and caution about the US macroeconomic environment: once risk appetite weakens again, gold may be supported again; if risk appetite continues to rise, gold prices may continue to retreat.

Overall, the market is in a state of repeated game, and sudden news can easily lead to large fluctuations in gold prices, and we need to continue to pay attention to the evolution of risk sentiment.

✅ Outlook for the future

Short-term outlook: In the case of short-term technical continuation signals, gold prices may remain weak, and the support around $3,300 and $3,230.00 is worth paying attention to. If volatility further increases, it is not ruled out that prices will rebound quickly or bottom out rapidly.

Medium- and long-term outlook: The upward structure at the daily level has not been completely destroyed. If the uncertainty of US policies increases or economic data is weak in the future, it will once again drive the recovery of safe-haven demand. Gold prices may still regain their upward momentum and hit $3,500 or even higher. On the contrary, if the equity market continues to strengthen, gold prices will face deeper correction pressure.

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose a lot size that matches your funds

- Profit is 4-7% of the fund account

- Stop loss is 1-3% of the fund account

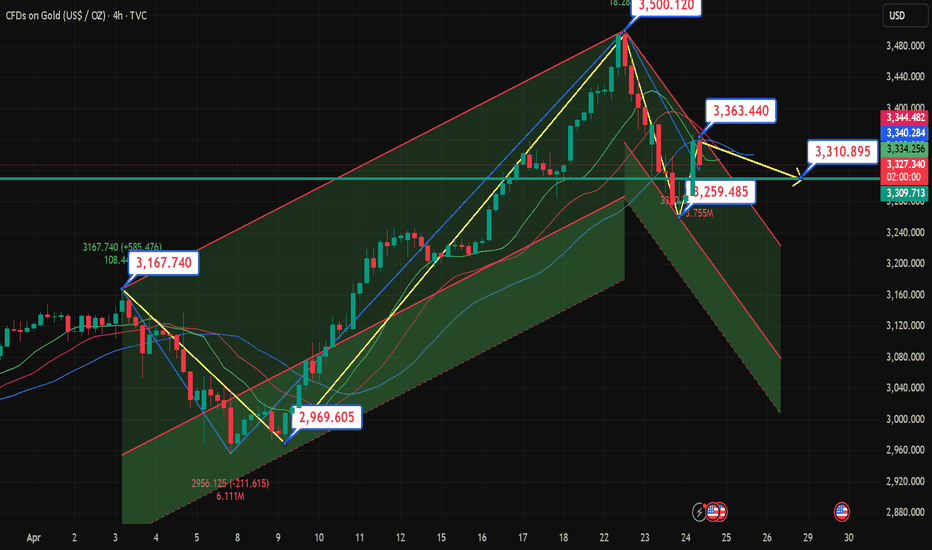

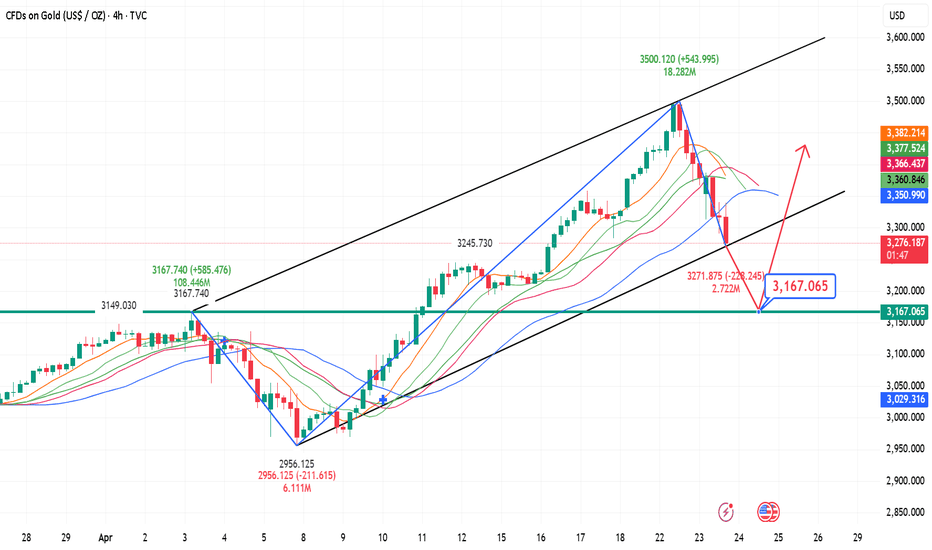

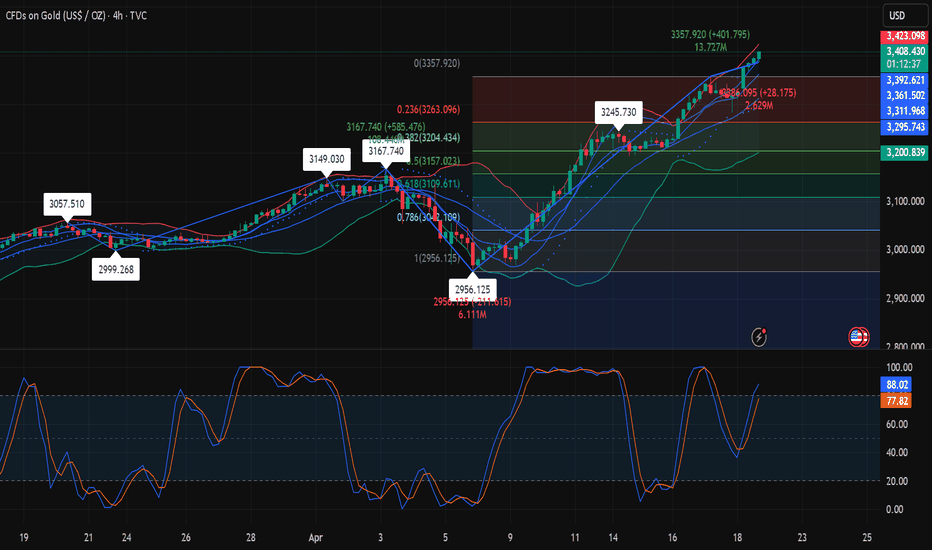

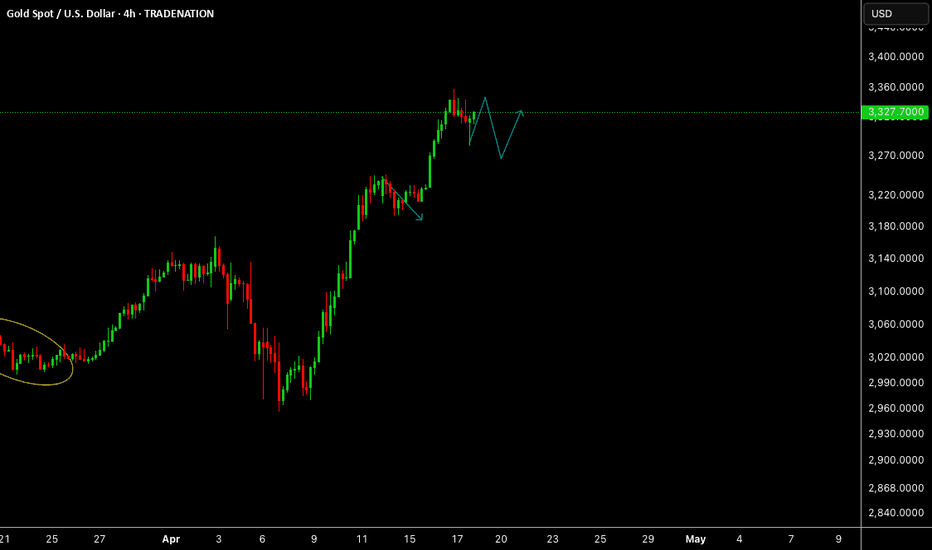

Gold continues to pull back to the turning point!!!In the 4-hour chart, the price found support near the 3284 area (the recent swing low) and rebounded. Buyers stepped in at this position and set risk below this support level in an attempt to push prices higher again. Sellers hope that the price will fall below this level to push the price further down to the 3167 area.

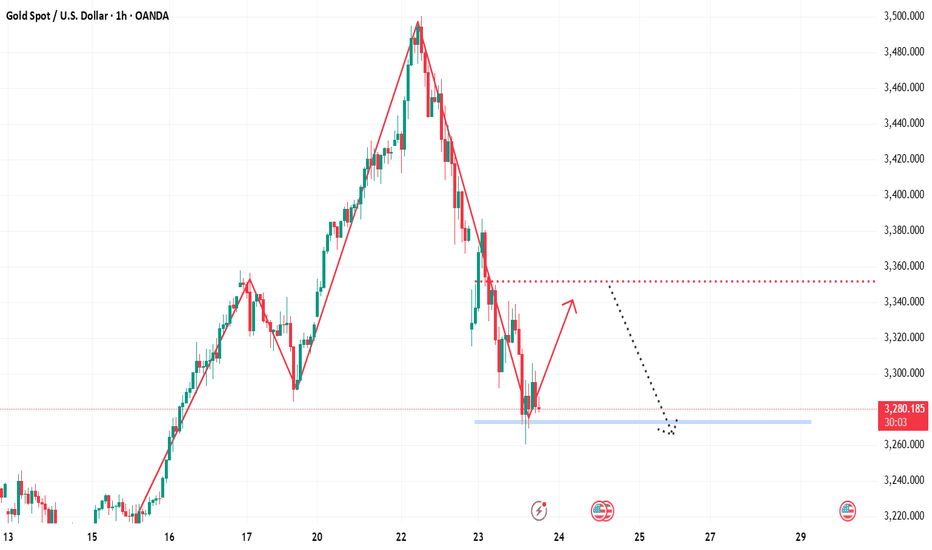

1-hour chart

On the 1-hour chart, a short-term downward trend line can be seen, which is currently limiting the market's bullish sentiment. Sellers may establish positions near this trend line and set stops above the trend line with a target of 3167.

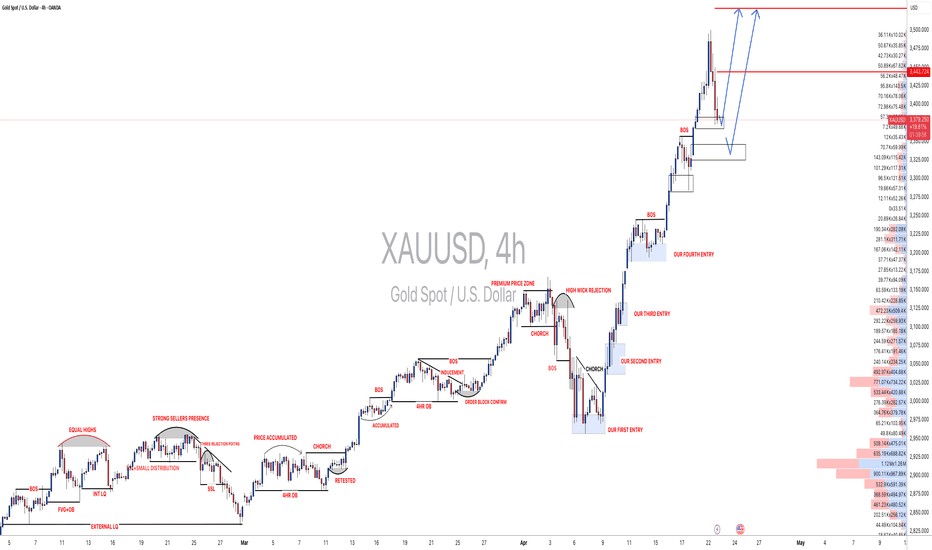

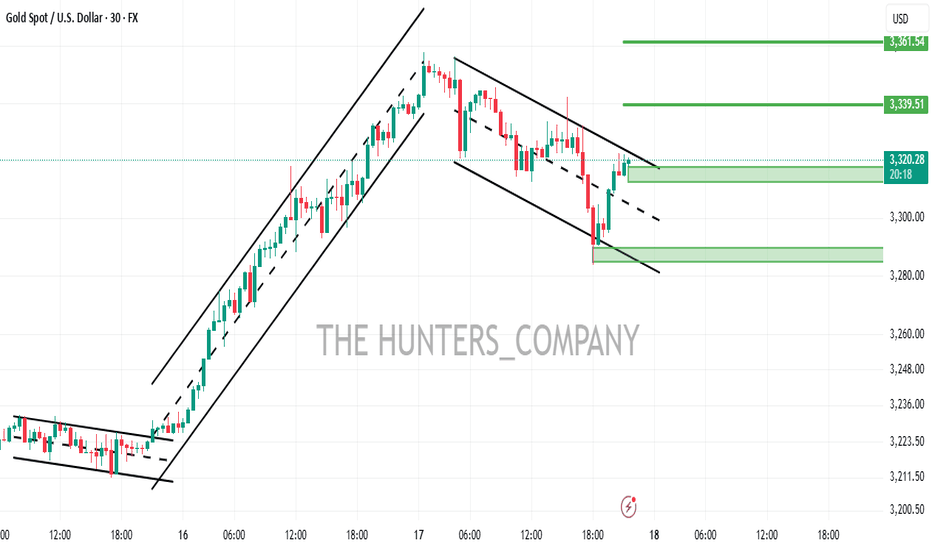

GOLD: Two Prominent Buying Areas to buy Gold From!Hey there! So, gold took a dip after hitting the $3500 mark, and it’s now at $3370. But here’s the thing, we think it might bounce back soon because it’s filled the liquidity gap. There are two possible points where it could turn around: right now or at $3330. Keep an eye on it and trade safely! Good luck!

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️

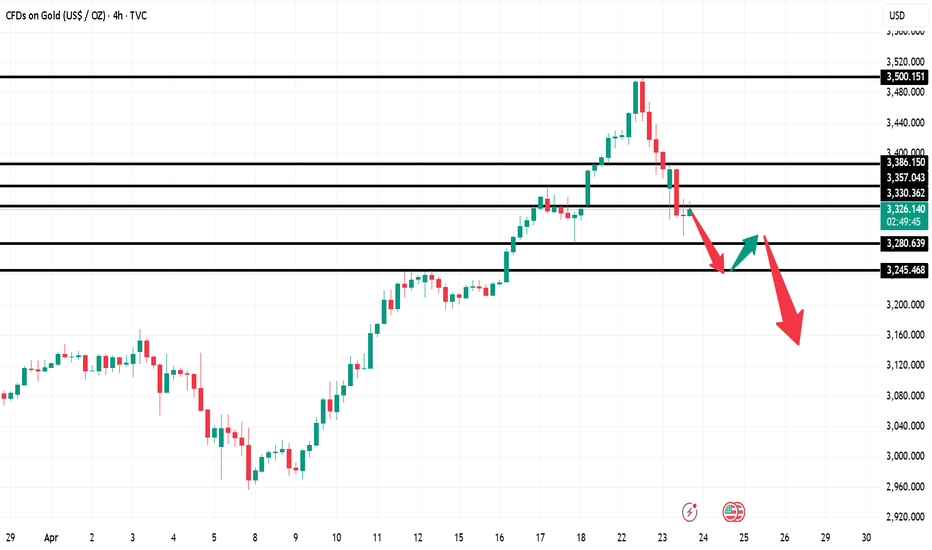

Analysis of gold short-term operation ideasGold price is currently trading below 3330. The downward trend in Asian session broke through the 3315 position in the morning. Our short position also successfully harvested a wave of big profits. Gold price showed signs of rebound in early European session. Now the upper pressure level can be moved down. The short-term pressure level is 3318, followed by the second highest point on the way up at 3357. The lower support level focuses on 3285. After effectively breaking through, we can focus on 3245. Now gold price is trading near the early low of 3315. The prudent operation idea is to go short at 3320 for protection at 3331 and wait for the gold price to reach 3285. After the break, wait for the rebound to 3300 and go short again to see the position of 3245. Long positions are not recommended.

Interpretation of gold short-term operation ideasThe gold market opened at 3423.4 in the morning yesterday, and then the market fell back to 3411.6, and then the market rose strongly. The daily line reached a high of 3500.4, and then the market fell under technical pressure. Subsequently, the market took profits and went down. The daily line gave a low of 3365.8 and then the market consolidated. The daily line finally closed at 3381.2, and the market closed in an inverted hammer pattern with a very long upper shadow. After the end of this pattern, the market continued to be short after opening low today. In terms of points, yesterday's short positions at 3496, 3468 and 3442 were reduced, and the stop loss was followed up at 3445. If it opens low today and falls directly, give 3292 long stop loss 3285. The target is 3336, 3350, 3365 and 3374. Exit the market and continue the short stop loss at 3381. The target is not released and the loss is held in stages.

Tariffs ease, risk aversion drops, gold continues to be bearishAfter hitting the integer mark of 3500 yesterday, gold fell back by nearly 200 US dollars. Today's early trading opened lower and directly swallowed up the overall rise of yesterday. Will gold continue to correct or turn around?

From the current decline, the range from the high point of 3500 to the current low point of 3315 is close to 200 US dollars. Considering this round of decline, it has exceeded the range of short-term correction. Therefore, traders should guard against the probability that the gold price will enter a turning point in the short term!

After the current decline is too large, the main area is to go sideways to correct the main force. The overall rebound will not be too large.

Main area: around 3380-3400

Defensive support below: double bottom around 3280

Operation suggestion: Do not carry orders, heavy positions, lock positions in sudden change cycles, and bring stop losses! "Specific operations are subject to actual trading"

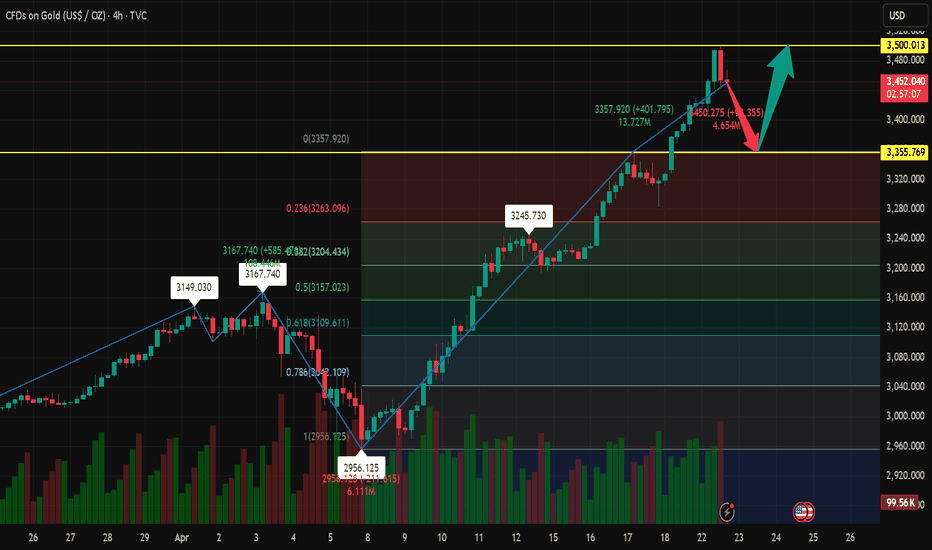

Gold hits 3500 retracement adjustmentGold Technical Forecast:

From a technical perspective, gold is confidently moving along a bullish trajectory. There is no doubt about that. But the signals now sent by the Relative Strength Index (RSI) and other momentum indicators are worth paying attention to. The daily RSI reading is close to 80, which has entered the severely overbought area. However, this does not necessarily indicate impending doom. It just confirms what we already know: buyers are in control.

So, is the price close to a top? Possibly. But I would not sound the alarm bells just yet. These high indicators are more of a warning than a battle cry. It is more of a "stay alert" than a "get out of here".

Spot Gold Technical Levels to Watch

Gold's climb to a record $3,500 was impressive, but as expected, it has begun to retreat slightly from this psychological high, most likely due to some conventional profit-taking. There is no natural resistance above this level; all we have are round numbers. However, on the way down, the situation is different.

Technical Analysis

Initial support includes Monday's high of $3,430 and the round number mark of $3,400 on the daily chart. Looking further down, $3,357 is last week's breakout level, followed by reliable support at $3,300. If a more meaningful pullback occurs, $3,245 and $3,167 will be worth watching, both of which were previous resistance ranges and are now likely to become support levels.

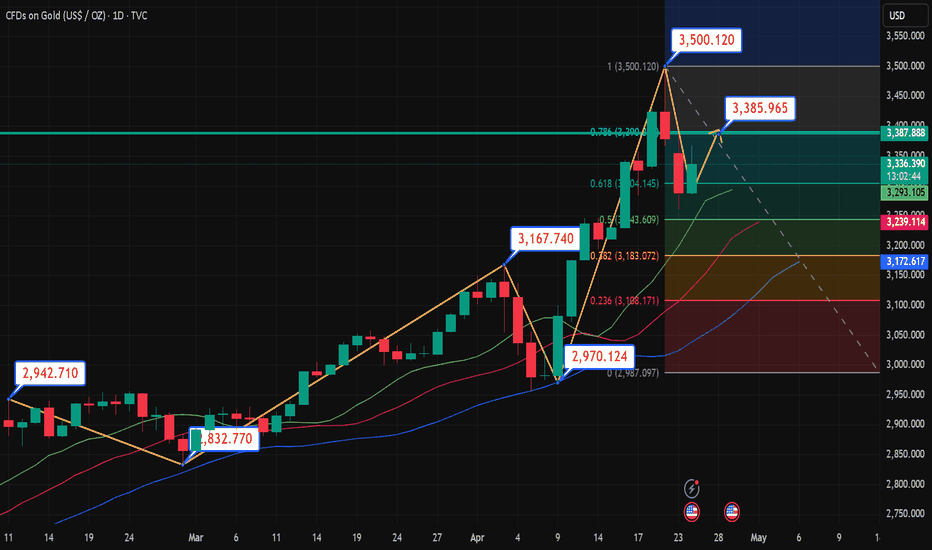

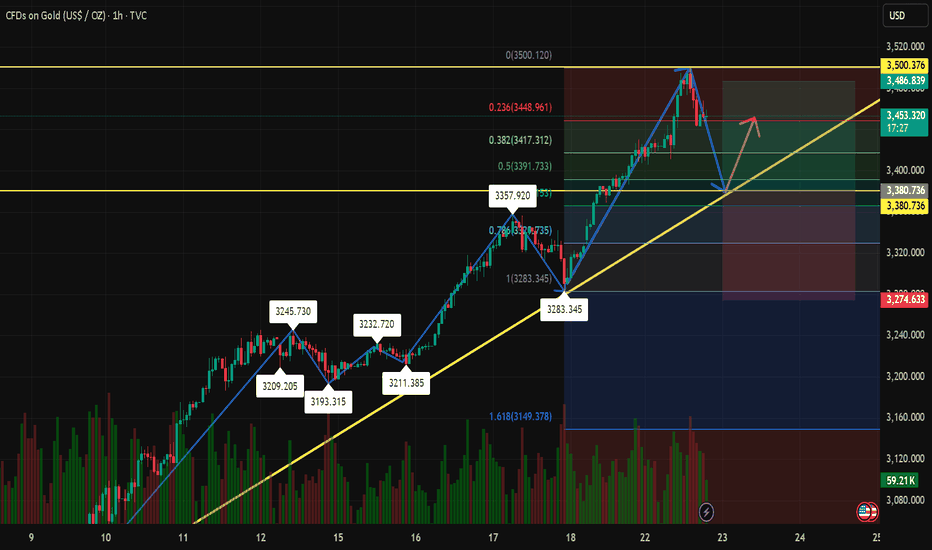

Gold price breaks through a new high of 3500 and enters the key Gold price hit a new record high of 3500. After reaching this point, it showed obvious pressure and went down to find the 3461 area. This is the largest correction since the rise of 3284 last Thursday.

Today's early trading price also continued to rise and break through the new high, but there was an episode, that is, it first broke through the high of 3444, then fell sharply to 3412, and finally confirmed the strong rise at 3418 to break through the new high, and continued to break through the sprint

Until noon, it sprinted to 3495 and suppressed the decline to find 3473 support, and then pulled up again to sprint to break the high of 3500. This time the decline was relatively strong, falling to the 3461 area

So far, the rising process can be slightly slowed down and enter a wave of adjustment

Accumulate momentum to provide power for the next round of start-up

During the adjustment process, pay attention to the golden section line

This wave from Since the rise from 2970, the largest adjustment squat is 0.382, and now this position is 3417, which is close to the Asian market acceleration starting point 3418. The two together become the stabilizer of the bullish trend: 0.382 position 3417 area

This is the first focus of today. During the adjustment process, pay attention to the position of the golden section line

0.382 position is 3417, close to the acceleration starting point

0.500 position is 3391, close to the 3384 area along the channel line

0.618 position is 3366, close to the four-hour lifeline

The current price space is large and the speed is fast. Articles and analysis are only auxiliary, and are more temporary reminders. Plans cannot keep up with changes. The three key points mentioned above can be kept in mind. If there are price variables during the process, they can also be adjusted accordingly.

Gold 3500 mark is about to openThe gold market opened at 3331.4 yesterday morning, then fell back slightly to 3328.6, then strongly fluctuated and pulled up, breaking through the previous week's high of 3358 and the pressure of 3387 and the 3400 integer mark, and then reached the highest position of 3430.8, and then the market consolidated. The weekly line finally closed at 3424.8, and the market closed with a basically saturated big positive line. After this pattern ended, today's market still has bullish demand driven by risk aversion and bullish sentiment, with the target at 3465, and the break at 3480 and 3500

#XAUUSD: Bullish Rally To Continue $3550 Area! Gold’s been on a steady upward climb, and it seems like it might keep going up. The only thing that’s really driving it up is the fundamentals. Right now, the price is super high, and selling it could be risky.

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

Cheers,

Team Setupsfx_

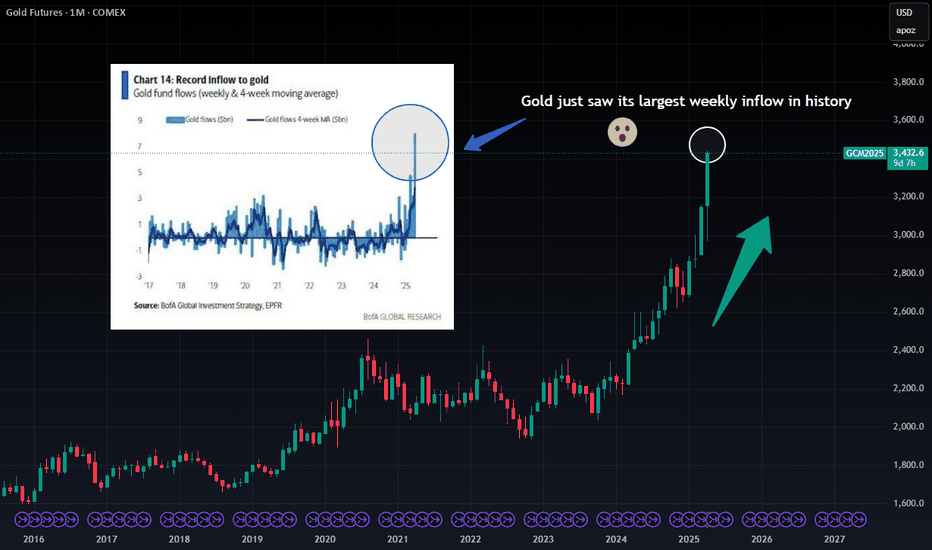

Gold's Surge: Flight to Safety or Foreshadowing Fear?🚨 Gold just saw its largest weekly inflow in history as shown in the chart by BofA Global Research. The metal is soaring above $3,400/oz while most other assets are crashing hard.

This isn't just bullish momentum — it's panic capital. When fear dominates markets, investors rush to safety. And historically, that safety has always been gold.

But here’s the catch: when fear becomes too crowded, even safe havens can become dangerous. If gold fails to hold these levels and begins to correct, it won’t be a slow bleed — it’ll be a free fall, and a lot of people will get caught.

💬 What do you think? Is this just the beginning of gold’s golden age, or are we seeing the early stages of a bubble?

Interpretation of gold US market operation ideas! ! !Gold continued to be bullish in the morning, and the 3400 mark has been broken. How will it evolve next?

The US dollar index directly fell on Monday morning, and the US Y index fell by more than 8% this year, causing gold to rise in a variable. The rise in gold caused by this situation will be greatly adjusted due to the recovery of the US dollar! The key to winning or losing tonight lies between 20 and 22 o'clock.

If the US stock market opens, it will fall below the 98 mark due to the southward movement of the US dollar, creating a new low since April 2022! The market's trust in the US dollar as a global reserve currency has declined! The possibility of turning to other safe-haven assets has increased, thereby increasing the variable of gold rising.

If based on this logic, tonight's 20-23 o'clock cycle is the main winning or losing day of this week!

Hypothetical principle: If it is postponed to the north during the day, everyone should pay attention to the selling pressure near 3415. As the price changes, the selling pressure is more likely to occur! And the defense line will rise in each round of corrective retracement!

Short-term defense line: 3355-3370-3383-3392

Pressure level above: 3430-3458

Risk notice: 1. When everyone is paying attention, long positions may fall at any time, and the range will not be less than 50-80 points!

2. The decline of the US dollar index will lead to a collapse in futures, which will trigger a chain reaction. Traders will face the possibility of gold settlement to fill the gap in other markets!

Gold is hard to break through 4000, short sellers are coming

Gold prices rose strongly in the Asian session on Monday, approaching the historical high of $3,400 per ounce, as concerns about the global trade situation intensified and the dollar fell to a two-year low due to concerns about economic recession. Despite the overbought signal on the technical side, the market's expectations of the Fed's rate cut and trade concerns continue to attract safe-haven funds to flow into the gold market.

Technical side:

Gold opened higher on Monday and has now risen from 3330 to 3394, with a range of $65. At present, gold indicators are expected to be severely overbought and a large correction may be needed at any time. In addition, the main force continues to push up gold to prevent the main force from fleeing. Gold is mainly shorted at highs below the 3400 mark!

SELL: 3394 Stop loss 3405

TP1: 3375

TP2: 3360

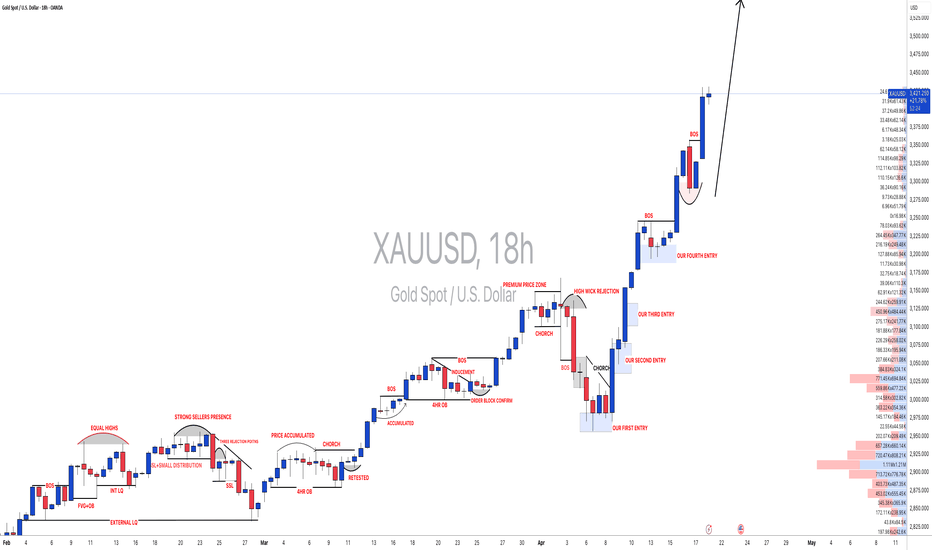

Interpretation of technical analysis of gold market opening operDue to the influence of Easter, the market was closed on Friday this week. After hitting a high of 3357, gold also ushered in a short-term adjustment! In the previous interpretation, we also emphasized to everyone that after hitting a new high, we should guard against the pullback caused by profit-taking. Especially at the critical time point when the market is about to close, but this does not mean the end of the bullish trend. After the sharp rise in gold, although there is selling pressure, gold still rose by 2.5% this week and closed above 3300.

So how should we trade gold next week?

The biggest driving factor for the rise in gold prices this time is Trump’s repeated tariff policy, coupled with the recent tense geopolitical situation, and the pace of global central banks buying gold. In the medium and long term, it is still a driving force for gold to rise.

Short-term operation: Pay attention to the first support level, which is 3310, which has been touched many times.

Short-term key support below: 3285-90

Short-term focus on high points above: 3340-45

If the breakthrough accelerates to the historical high point, everyone should be cautious in chasing more!

Analysis of gold price trend next week!Market news:

April 14 to April 18, 2025, due to the Good Friday holiday, the market was closed on April 18. There were only four trading days this week, and the spot gold market performed strongly, with a weekly increase of 2.76%. Prior to this, some investors chose to take profits after the international gold price hit a new high of more than $3,357 on Thursday. Although the current technical side shows that gold is overbought, the overall market is still in a steady upward trend.The rise in London gold prices was driven by the safe-haven demand caused by the weakening of the US dollar, trade policy uncertainty, and hawkish remarks by Federal Reserve Chairman Jerome Powell on the risk of stagflation. The economic data released this week showed differentiation, with a solid labor market but weak housing data, coupled with geopolitical risks such as the European Central Bank's interest rate cut and the Russia-Ukraine conflict, further enhancing the attractiveness of gold.Looking ahead, the bullish trend of gold remains solid, and investors should pay close attention to the Fed's subsequent policy statements and trade policy dynamics, which will have an important impact on market sentiment and gold price trends in the coming weeks.

Technical Review:

Gold daily level still maintains a strong unilateral bullish trend in the short term. There is no highest, only higher. Before the top pressure K appears, it will continue to step back and be bullish. The support position confirmed by the step back is about 3300-3290. As long as this position is stabilized, there is hope for further efforts in the future to set a new historical high.The 4-hour level is now in high-level fluctuations. The key MA10-day support moves up to 3313. As long as this moving average can be held, this cycle will still maintain a strong squeeze and pull up. At the hourly level, there will be a certain decline and correction in the short-term Asian session on Thursday, and it will be trapped in a shock consolidation. The next step is to wait patiently for the consolidation to end. The short-term pressure point middle track is also the 10-day moving average 3332-33 line. There may be multiple attempts here, but before breaking through, don't chase the rise! Pay attention to the lower track support 3313 below, and the upper track of the previous channel step back to confirm the range of 3300-3290, because the upward channel is uncertain whether there will be a false piercing. Therefore, it is recommended to wait for 3313, 3300-3290 to stabilize and rise next week, or break through 3332-33 and then step back to confirm stability, which is also bullish. After a sharp rise, it is just a small adjustment at a high level or sideways, which is to prepare for the next round of rise.

Next week's analysis:

Gold fell all the way in the US market on Friday, falling to 3283 at the lowest, but gold rose again in the second half of the night for risk aversion. Will gold return to a large range of fluctuations or end the adjustment? Then the trend of gold after the opening next week is very critical. If gold continues to rise strongly at the opening next week, then gold may be adjusted to the end, and gold bulls may continue to exert their strength. This will be seen after the opening of Monday.The gold 1-hour moving average is now continuing to diverge upward with a golden cross. If the gold 1-hour moving average turns in the short term, then the gold 1-hour will begin to adjust. So if the short-term opening is weak next week, then the gold 1-hour moving average may begin to turn, and if it is strong, it will continue to extend upward. Gold is suppressed by the downward trend line in the 1-hour short term. The short-term pressure of gold moves down to the 3332 line. If gold is still under pressure at 3332 after opening next week, then gold may continue to fluctuate downward in the short term, thereby driving the moving average to turn around. If it directly breaks through 3332 after opening, then gold will start to fluctuate in a large range.

Operation ideas:

Buy short-term gold at 3300-3303, stop loss at 3292, target at 3340-3350;

Sell short-term gold at 3350-3353, stop loss at 3362, target at 3310-3300;

Key points:

First support level: 3313, second support level: 3300, third support level: 3285

First resistance level: 3332, second resistance level: 3357, third resistance level: 3373

Gold fluctuates and adjusts, will next week be the key?Gold fell all the way in the US market on Friday, with the lowest falling to the 3283 line. However, gold once again rose as a risk aversion. Will gold return to a large range of shocks, or will the adjustment end? The trend of gold after the opening next week will be critical. If gold continues to rise strongly at the opening next week, then gold may end its adjustment, and gold bulls may continue to exert their strength

If gold is still under pressure at 3332 after the opening next week, then gold may continue to fluctuate downward in the short term, thereby driving the moving average to turn. If it directly breaks through 3332 strongly after the opening, then gold will start to fluctuate in a large range.

The current market is very volatile due to the impact of news, and the next trend of gold will become clear on Monday. I will continue to bring analysis to my friends on Monday

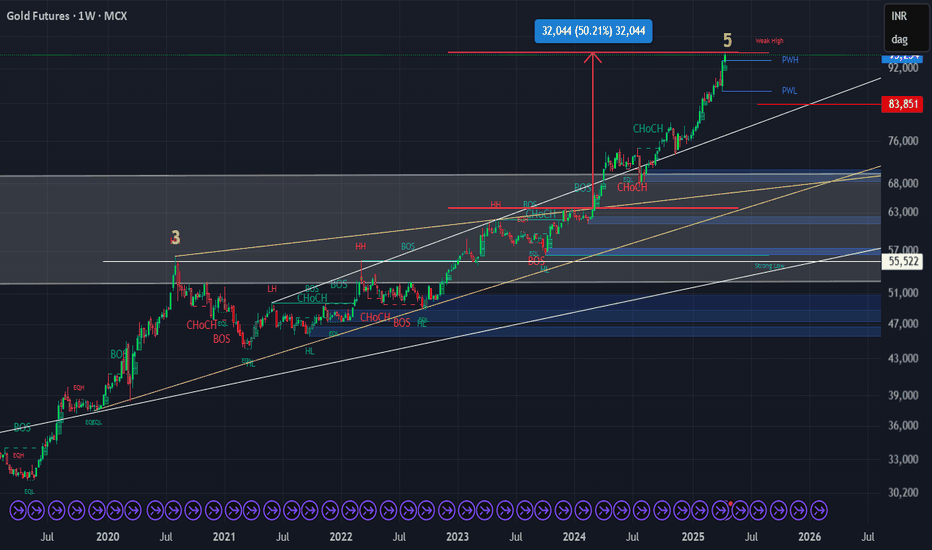

GOLD, Is it 5th Wave?1. Sharp Movement, Steep Trade Angle

2. Length of 3rd Wave is equal to 5th Wave

3. Ascending Channel TGT is completed

4. Divergence in the Price Movement

5. Nifty Price Movement - It is at a breakout point. The Correlation between 2 asset classes is approximately Negative 0.30 to 0.35 post Covid

If this is the case, then price may not move beyond 1 Lakh

This will be a great opportunity to book the profit in gold; it may correct to 70000 or below in the next few months.

GOLD: What happened?Hello friends

The trend is very bullish and given the recent events in the world, the possibility of a decline is decreasing, so we can buy in pullbacks that the price is making in steps and with capital management and risk, price targets have also been specified.

*Trade safely with us*