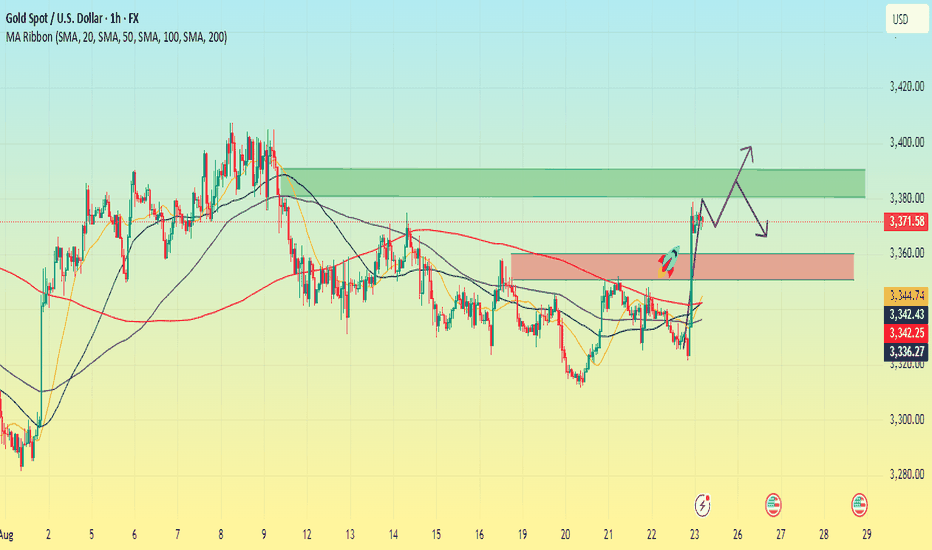

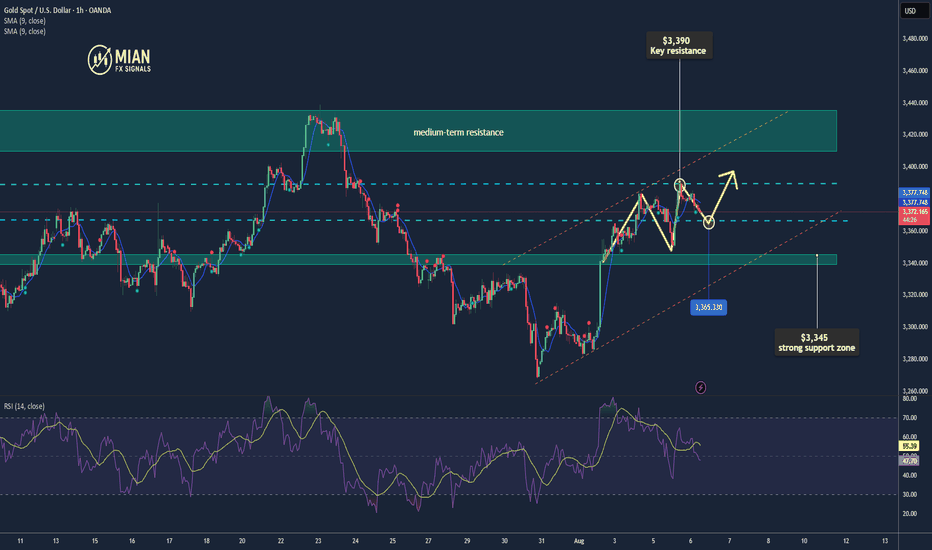

Trend reversal? Continued upward movement next week?On Friday, gold fluctuated weakly downward, hitting a low of 3321. However, during Powell's speech, prices surged, breaking through the previous resistance level of 3350-3360. The price reached a high of around 3378 before retreating to around 3371, a gain of 57 points. This strong breakout has given the market a clearer trend, transforming all previous resistance levels into support levels, further allowing bulls to exert their remaining momentum. The trend has also broken through the resistance of the short-term moving average, which overall suggests significant positive news for bulls.

However, Powell's speech did not reveal any interest rate cuts, and most traders believe that the lack of a clear indication of no rate cuts suggests a possibility. This view has yet to be confirmed. I believe a short-term wait-and-see approach is recommended for the Asian market opening next week to see how the market digests the impact of the speech.

Currently, support is focused around 3350-3360, while resistance is focused around 3380-3390.

Next Monday, we will focus on the continued strength of the upward trend. If gold retreats but fails to rebound, especially if it fails to maintain its upward momentum during the European and American trading sessions, a potential weakening trend cannot be ruled out. The specific situation will depend on how the market processes this event.

The weekend is here, I wish you all a happy weekend. See you next week.

Goldinvestment

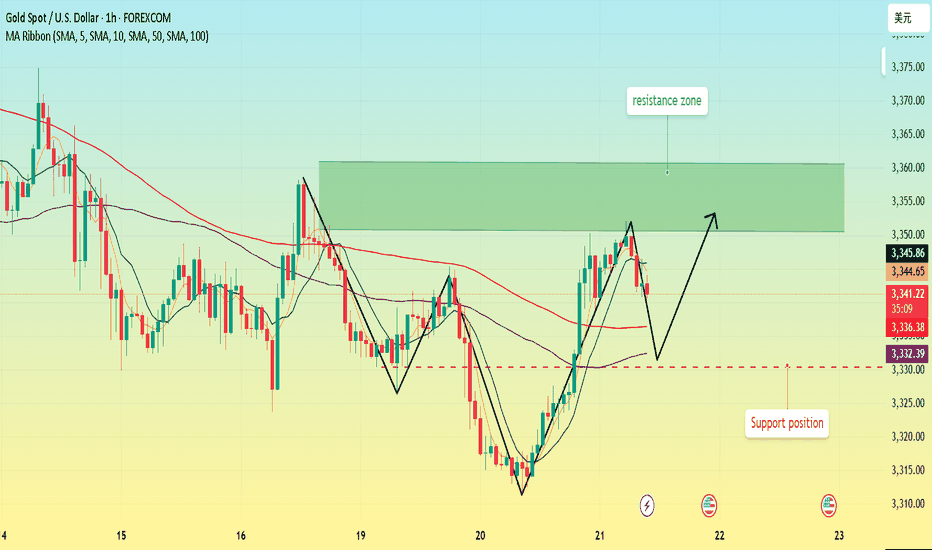

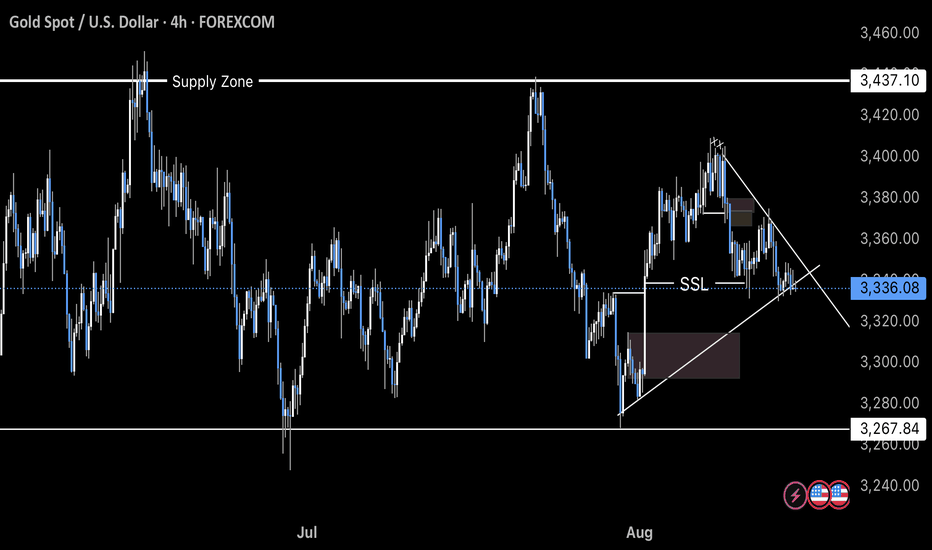

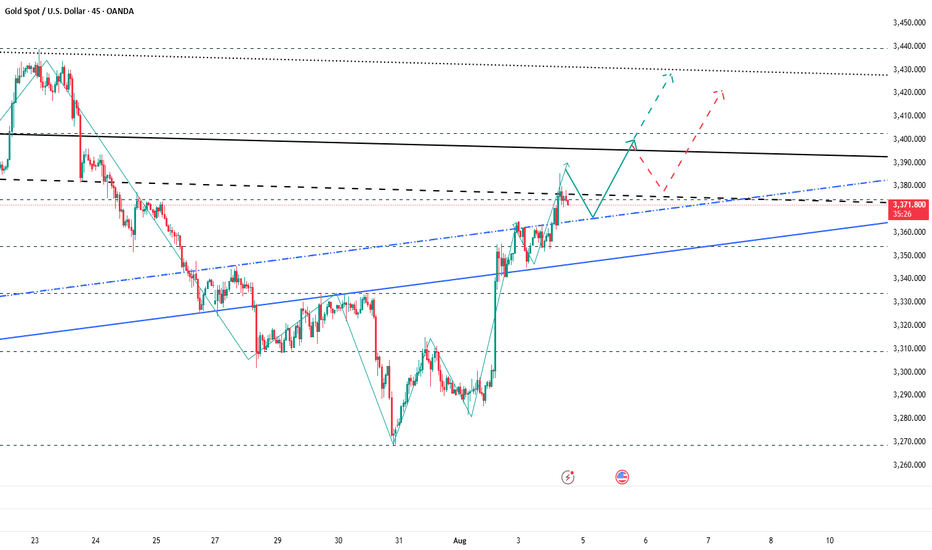

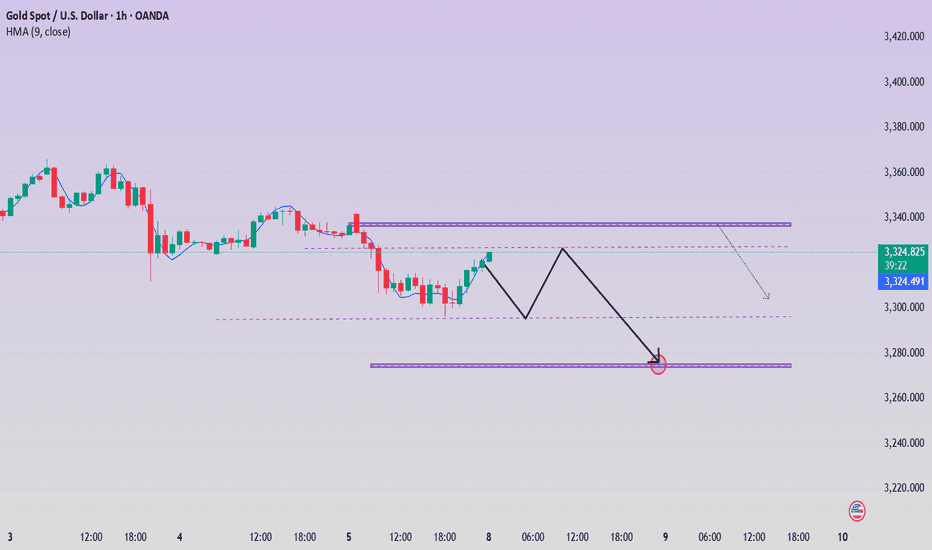

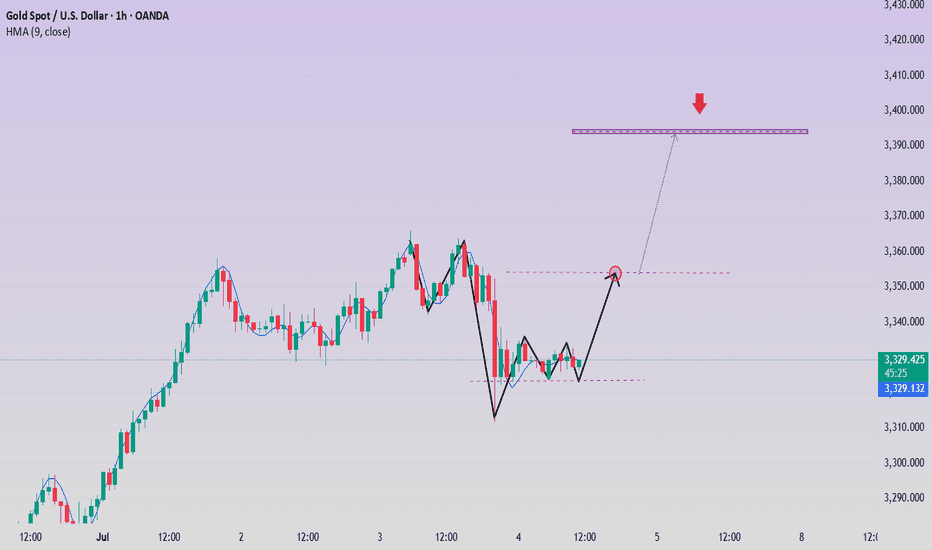

Gold is rising slowly. Should we trade within a range?Gold hit the strong resistance of 3350 on Wednesday and then fluctuated at a high level. The slow rise on Wednesday broke the fixed trend of the previous few days, that is, the trend of rising first and then falling. So under the current trend, will there be any different changes today? A surge and then a fall cannot be ruled out on the hourly chart, but for now, the overall trend remains within a range, with upper resistance remaining within the 3350-3360 range seen at the beginning of the week.

Gold's short-term support remains near 3330, the second rally point on Wednesday. With no new events impacting gold's trend in the short term, trading within this range is recommended. Market fluctuations have been irregular these past few days, and aggressive trading can easily lead to losses. Most of the time, it's best to adapt to market conditions.

Trading strategy:

Go long near 3330, stop loss at 3320, profit range 3350-3360.

Short sell near 3355, stop loss at 3365, profit range is 3340-3330.

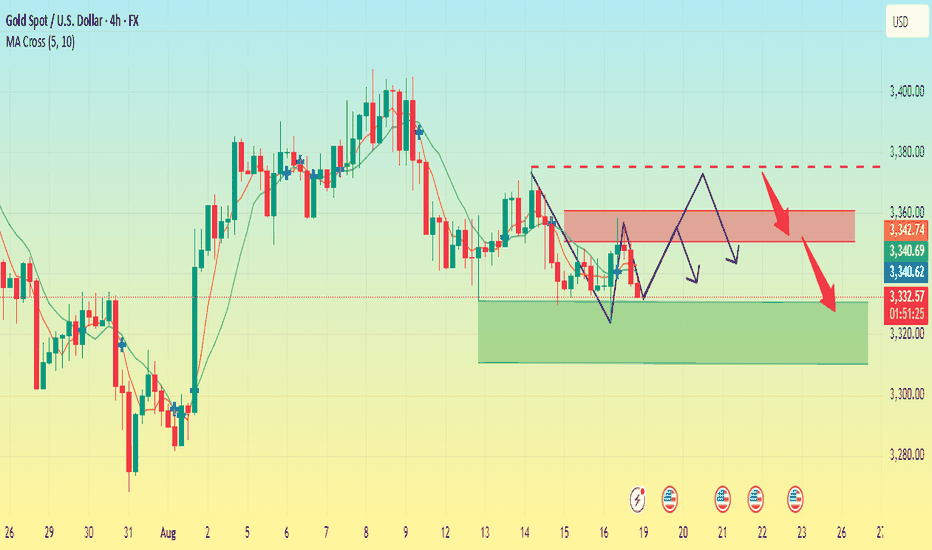

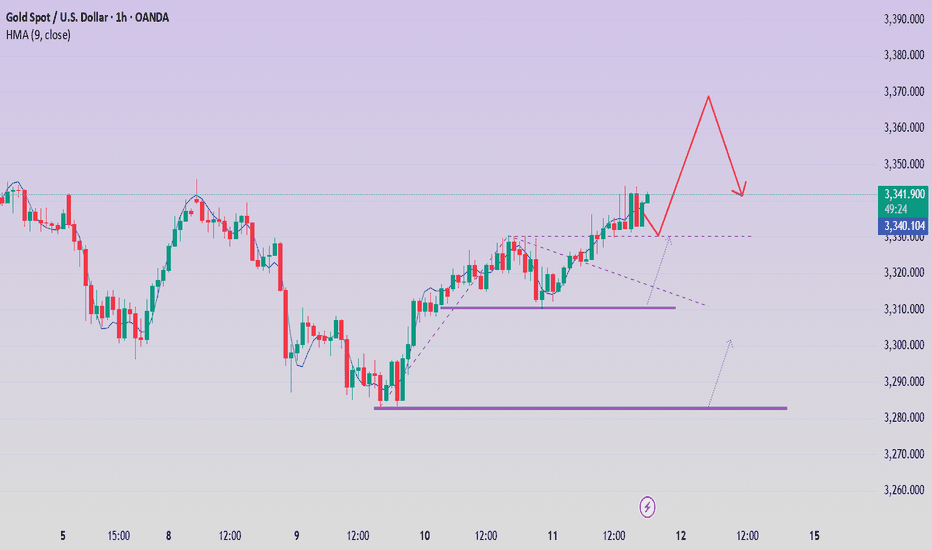

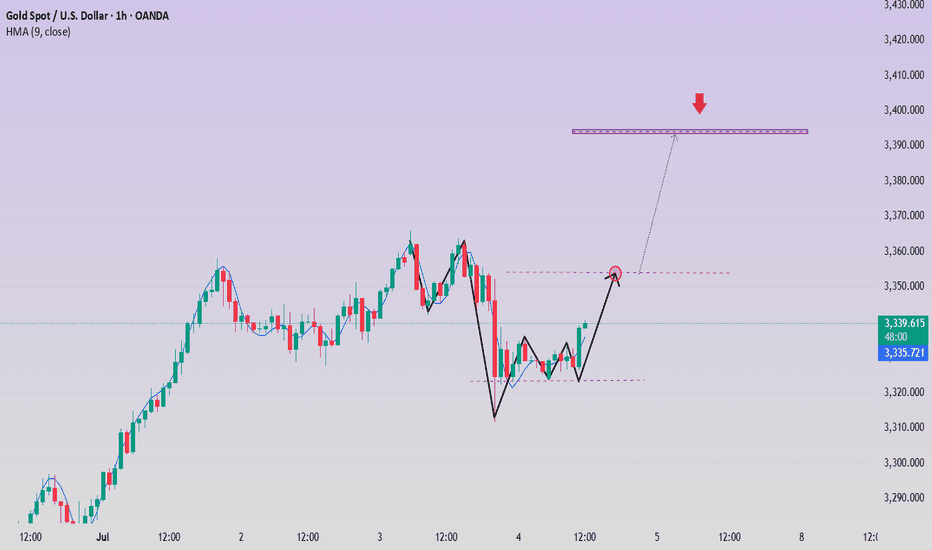

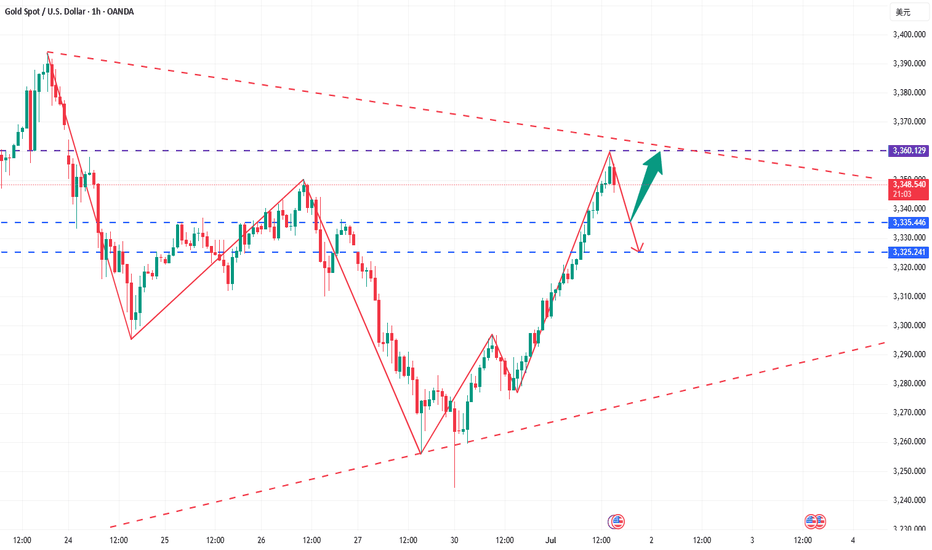

Gold is under pressure. Bearish theme?Gold experienced a sharp drop in the early Asian session on Monday, hitting a low of 3323 before rebounding slightly. It reached a high of around 3358 in the European session and began to retreat under pressure. I also gave a short-selling strategy based on the views of the early Asian session. Currently, gold continues to fluctuate around the 3330 support level, and a breakout of 3330 is only a matter of time.

Judging from the 1-hour chart, the first upper pressure position is still at 3350-3360. The price has failed to break through this position despite repeated shocks and is under downward pressure at this position. The current support is still focused on the neckline near 3330. The overall main tone of high-altitude participation remains unchanged. In the middle position, please be cautious and wait patiently for key points to enter the market.

Trading strategy:

Short around 3355, and cover shorts on a rebound to 3365-3375. Stop-loss at 3385. Profit range: 3330-3320-3310.

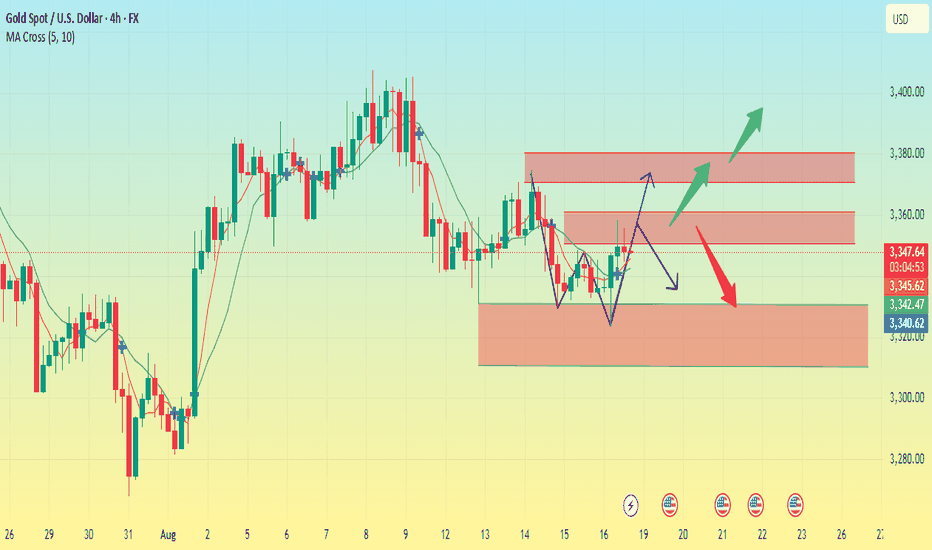

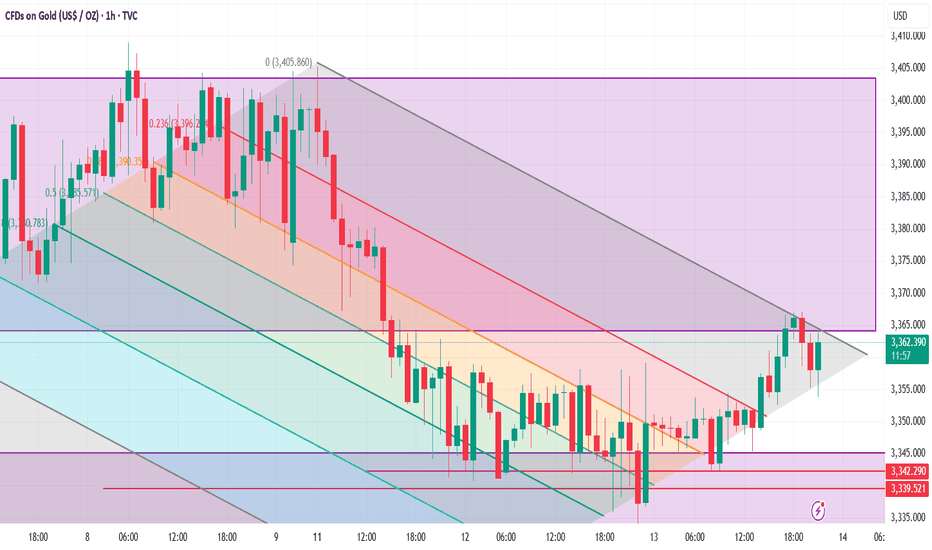

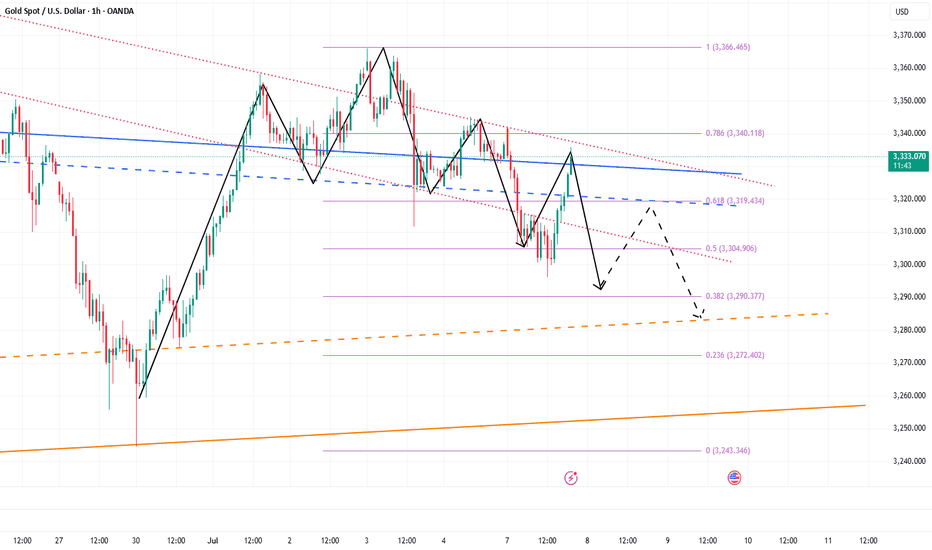

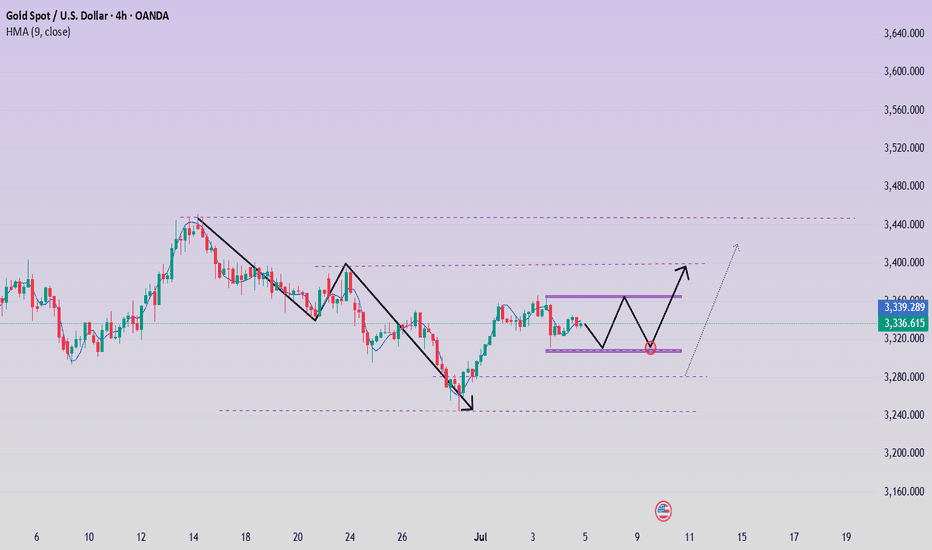

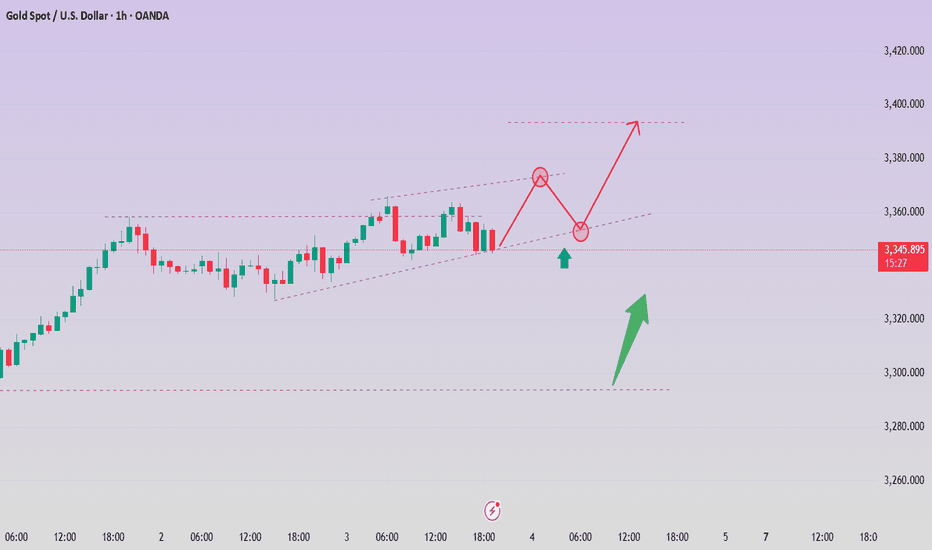

Gold Corrects. Targeting an Upward Move?Gold opened Monday with a dip before rising, breaking below last Friday's low, continuing its downward trend. However, the market did not continue its downward trend after the break, instead undergoing a rapid rebound, reaching a high near 3358, but remaining below the resistance level of 3375.

Currently, gold prices are fluctuating around 3350, indicating a lack of upward momentum. The characteristic of volatile markets is that they tend not to sustain. Breaking through key points often leads to a rapid rebound, while approaching key resistance levels above, the market enters a period of stagnation and could experience a correction at any time. In the short term, focus on the first resistance level of 3350-3360, and the second resistance level of 3370-3380.

If the price continues to withstand pressure at the first resistance level and fails to break through, it will likely undergo a correction, accumulating upward momentum before retesting the upward resistance level. If the first resistance level is broken, we will focus on the second resistance level, which will be the watershed between bulls and bears this week. If it breaks through and stabilizes above this position, gold will usher in an upward trend. Support levels to watch are 3330-3310.

Analysis for the next weekHello traders.

The market is going to open tonight, are you ready for the next week??

The gold is falling like a crazy from the last week. Gold can fly from 3327 - 3301. Next week will be bullish. Gold can touch 3413 next week.

Kindly share your thoughts, where will be the next move for gold according to your analysis??

Gold is range-bound, enter a short position at the resistance leThe gold buy strategy outlined earlier has already yielded profits. During a range-bound market, buying short at resistance levels and buying long at support levels can easily yield profits. Until the price breaks out of the range, the short-term strategy of shorting near resistance levels and buying at support levels remains unchanged.

Gold is currently range-bound. Currently, focus on resistance near 3360 and 3370, both of which are suitable for shorting. The bearish target is near 3345.

Rebound is still a good opportunity to shortGold was trading sideways at a low level yesterday, with bulls and bears oscillating back and forth. After the data was released, it broke the bottom slightly, touching the lowest point of 3331, and then quickly recovered to the range. The overnight daily line closed with a bullish cross star, indicating that bulls and bears are temporarily balanced. Today, we will maintain the idea of oscillation. Before the range is effectively broken, short-term long and short operations will be the main focus. The Bollinger Bands in the 4H cycle are closing. After oversold, the decline has temporarily stopped and stabilized. There is a need for a rebound and repair in the short term, but the strength is expected to be limited. Pay attention to the pressure in the 3357-3370 area on the top. In terms of operation, the rebound is mainly under pressure at high altitude. The lower targets are 3340-3331 in turn. If it breaks, it will further look to the 3320 line.

Gold operation suggestion: short gold around 3357-3370, target 3340-3331-3320. If the support area of 3335-3320 stabilizes, you can consider going long.

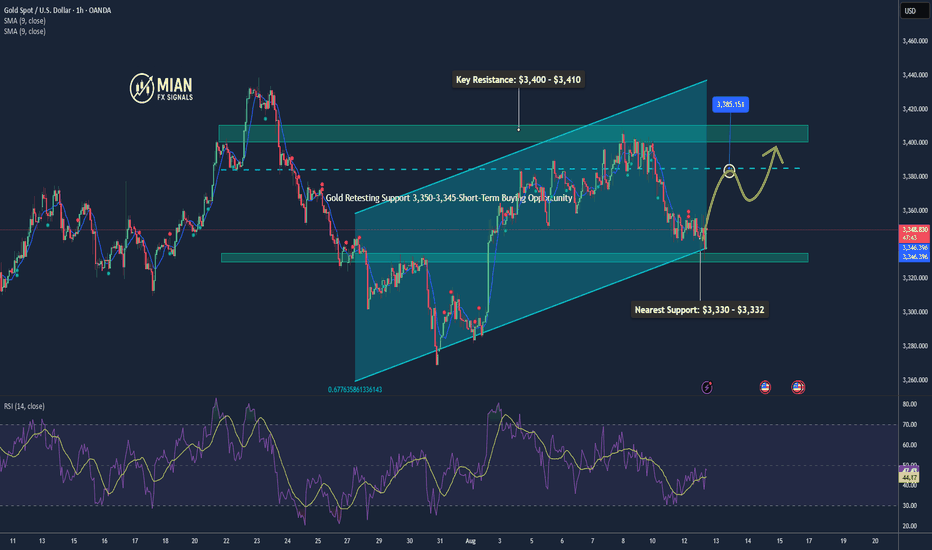

Gold Poised for Mild Rebound amid Tariff Relief📊 Market Movement:

Gold eased after President Trump announced tariff exclusions on imported gold bars, easing prior market uncertainty. Safe-haven demand stays supported by macroeconomic and Fed policy concerns.

📉 Technical Analysis:

• Key Resistance: $3,385 – $3,410 – $3,460

• Nearest Support: $3,330 – $3,332

• EMA: Price fluctuates around medium-term EMA.

• Candlestick / Momentum: Ascending triangle, neutral RSI, rising volume → mild accumulation signs.

📌 Outlook:

Gold may see a mild rebound in the short term if trade policy remains stable and the Fed keeps rates unchanged. Strong US economic data could pressure prices downward.

________________________________________

💡 Suggested Trading Plan

🔻 SELL XAU/USD: $3,410–$3,413

🎯 TP: 40/80/200 pips

❌ SL: $3,416

🔺 BUY XAU/USD: $3,330–$3,333

🎯 TP: 40/80/200 pips

❌ SL: $3,327

Gold Slightly Pulls Back – Awaiting Fed & Dollar Direction📊 Market Drivers:

Spot gold slipped ~0.1% to $3,376/oz, pressured by a firmer USD and caution ahead of Trump’s Fed chair and governor appointments

📉 Technical Analysis

• Key resistance levels:

o $3,390: previous session high – near-term ceiling

o $3,410: weekly high – stronger upside barrier

o $3,435: medium-term resistance – break above confirms strong bullish continuation

• Nearest support levels:

o $3,365: current Asian session low

o $3,345: strong support zone – EMA50 on H4 chart

o $3,305: last week's low – breakdown here may trigger deeper pullback

• EMA: Price remains above EMA09 and EMA50, suggesting a short-term bullish bias, though momentum is slowing.

• Candlestick / Volume / Momentum: Low volume in Asian session; H1 candles show indecision (doji with long wicks), signaling a tug-of-war between buyers and sellers.

📌 Outlook:

Gold may consolidate or dip slightly short-term unless it decisively breaks above $3,395 to confirm a new bullish leg.

________________________________________

💡 Suggested Trading Strategy:

SELL XAU/USD: ~3,392– 3,395

🎯 TP: 40/80/200 pips

❌ SL: ~3,398

BUY XAU/USD : ~3,366 - 3363

🎯 TP: 40/80/200 pips

❌ SL: ~3,360

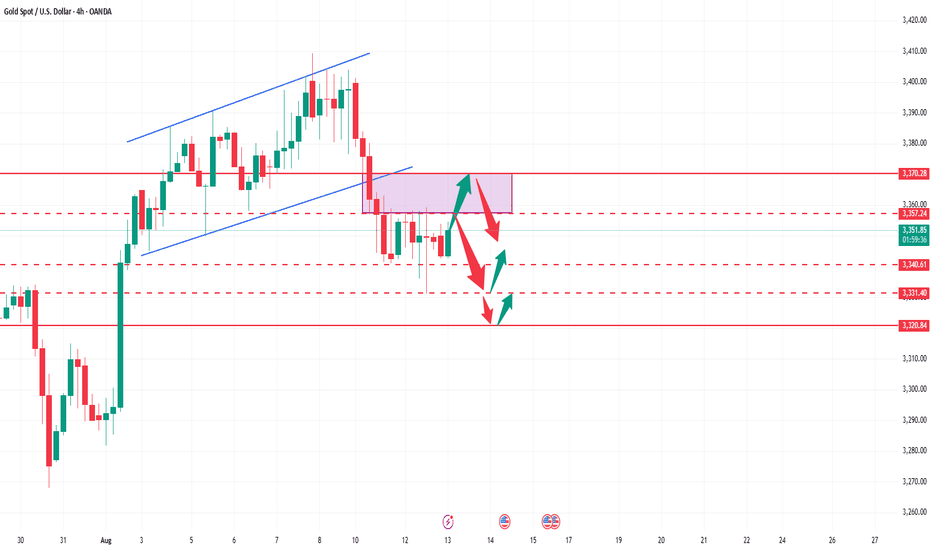

Next Stop 3420? Gold Bulls Push the LimitBecause the U.S. non-farm payroll report performed worse than expected, gold rebounded strongly last Friday and recovered half of its losses in one fell swoop. The bulls returned strongly. Today, after consolidating at a high level, gold continued to choose to break upward, reaching a high of around 3385.

There is no doubt that bullish forces still hold the upper hand. From a fundamental perspective, the Federal Reserve is currently facing greater pressure to cut interest rates; and it can also be clearly seen from the candlestick chart that a significant "W"-shaped double bottom structure has been constructed near 3268 and 3280, which has limited the gold's retracement space while also playing a key structural support role in the rise of gold. With the combined effects of news and technical factors, gold still has the potential to continue its upward trend. And I think there is still a great possibility that gold will test the 3400 mark again. Once gold stabilizes at 3400, it will definitely hit the 3420-3430 area.

As the center of gravity of gold gradually shifts upward, the lower support area also moves up. The current short-term support is obviously in the 3365-3355 area, while the relatively strong support is in the 3345-3335 area. According to the current pattern structure, the bulls may not allow gold to retreat to the 3345-3335 area. So in terms of short-term trading, we first consider the opportunity to enter long positions in the 3365-3355 area!

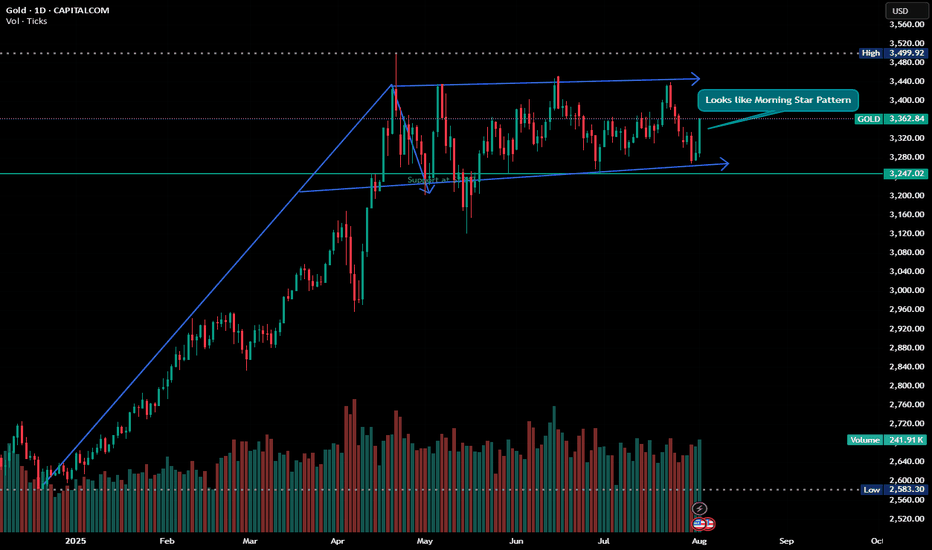

Glitters of Gold - Looks like Morning Star and Bullish Flag Disclaimer : Do your own research before investing. This is just a chart analysis. No recommendation to buy and sell.

With the up and down of stock market, there is always a safe investment place and its shine increase as the time passes with the increase in price, yes its GOLD. Everyone love it. if you look at gold from last couple of years, there is continuous growth in this metal.

while doing my chart analysis i found gold charts are quite interesting.

Gold is currently trading in range and formation of 2 patterns can be seen in the daily chart with my support and resistance level marked in CHART.

For some its investment and for some its trading however my recommendation is always do some SIP in GOLD.

Happy Investing.

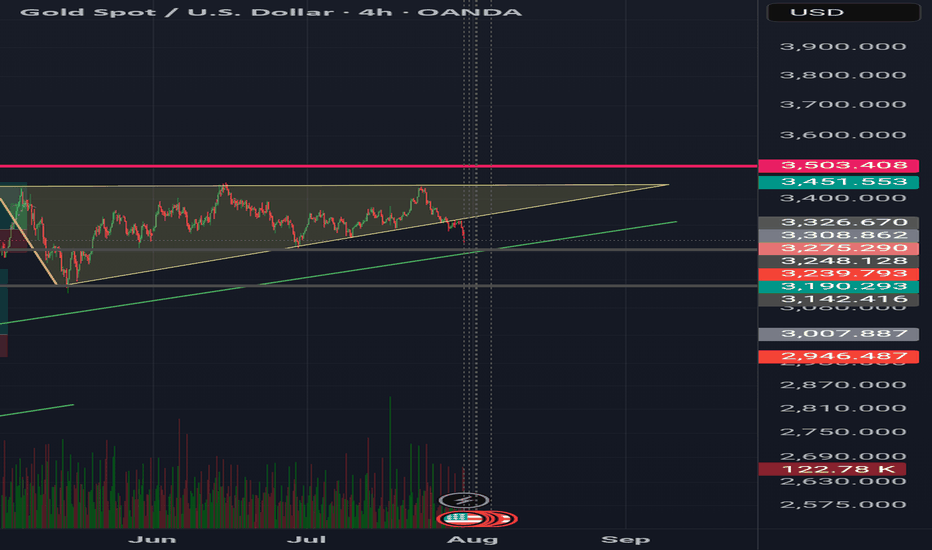

Gold rises after brief recovery

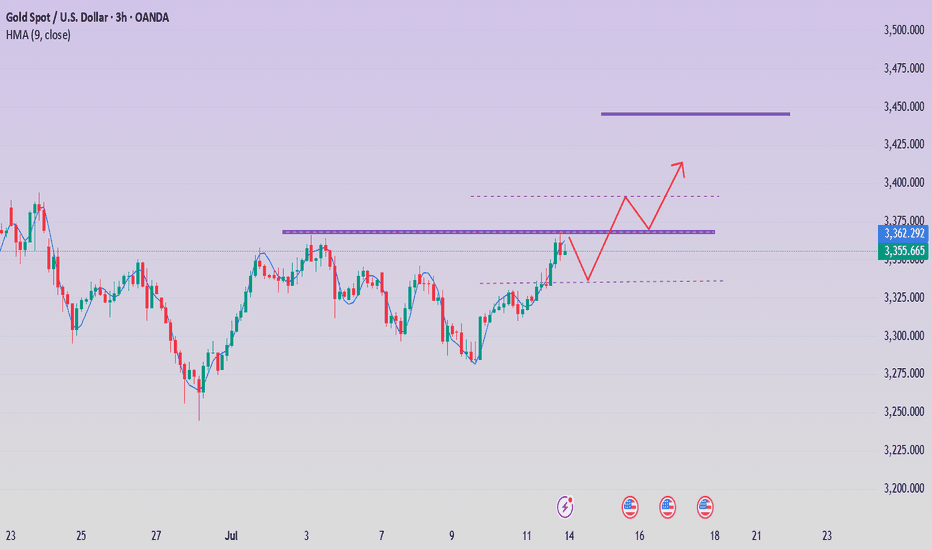

Let’s review the gold price for next week from July 14, 2025 to July 18, 2025

⭐️Gold Information:

Gold prices surged nearly 1% on Friday as sentiment soured over U.S. President Donald Trump’s controversial trade policy targeting Canada, while hinting at broader tariffs on other countries and copper. At the time of writing, XAU/USD was trading at $3,354, rebounding from an intraday low of $3,322.

On Thursday, Trump announced a 35% tariff on Canadian imports, but goods eligible under the 2020 USMCA trade agreement remain duty-free. He also expressed his intention to extend tariffs to most trading partners, proposing a basket of rates ranging from 15% to 20%.

With a light U.S. economic calendar, attention turns to comments from the Federal Reserve. Chicago Fed President Austan Goolsbee dismissed calls for rate cuts aimed at reducing government borrowing costs, stressing that the central bank's focus remains firmly on employment and price stability.

⭐️Personal Comment:

Growth with the trend, maintaining the accumulation price zone above 3300

🔥 Technical:

Based on the resistance and support levels of gold prices on the 4-hour chart, NOVA has identified the following important key areas:

Resistance: $3392, $3447

Support: $3330, $3308, $3246

The weekend closed higher to around 3360

📌 Driving Events

Gold prices (XAU/USD) were on track to rise for the third consecutive day on Friday, climbing to the upper limit of this week's trading range as escalating trade tensions fueled safe-haven demand. Amid a significant intensification of global trade disputes, U.S. President Donald Trump this week sent formal notices to multiple trading partners detailing individual tariff rates that will take effect on August 1 if no agreement is reached. This has disrupted investor sentiment, weighed on risk assets, and provided solid support for gold.

Meanwhile, expectations of an imminent rate cut by the Federal Reserve (Fed) have cooled after last week's strong U.S. jobs data. As a result, the U.S. dollar (USD) remained firm, holding near more than two-week highs set on Thursday. A stronger dollar could limit upside for the non-yielding gold in the short term. Therefore, traders could look for a sustained breakout before going further bullish on the XAU/USD pair.

📊Personal comments:

Gold price broke through 3330, maintained good buying pressure, and rebounded over the weekend

⭐️Set gold price:

🔥Sell gold area: 3367-3369 SL 3374

TP1: $3355

TP2: $3342

TP3: $3325

🔥Buy gold area: $3306-$3308 SL $3301

TP1: $3315

TP2: $3325

TP3: $3338

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose a lot size that matches your funds

The short position is losing money. What should we do?Gold hit the intraday low of around 3296 and then began to rebound. We can see that the rebound of gold is not strong, but it is relatively sustained, so gold has rebounded to around 3335. To be honest, I did short gold according to my plan and still hold a short position.

Although gold has rebounded to around 3330, I don’t think my short gold trade has failed. As I said in the previous point of view, gold is facing technical suppression of the head and shoulders in the short term, which will suppress the rebound limit within the 3335-3340 area. So before gold stabilizes at 3340, I think the gold shorts still have the upper hand. So as long as gold stays below 3340, I think the gold rebound is a good opportunity to short gold.

At present, gold is facing the resistance area of 3335-3340 and begins to show signs of stagflation. After consuming a certain amount of bullish momentum, the gold shorts may counterattack strongly again and stimulate gold to fall rapidly. Therefore, before gold breaks upward through the 3335-3345 area, we can still consider shorting gold, or continue to hold a short position in gold!

Bearish pressure below 3,300 at the start of the week

📌 Driving Events

Gold prices (XAU/USD) faced renewed selling pressure in early Asian trading on Monday, falling to the $3,320 level. Gold's pullback came as stronger-than-expected U.S. nonfarm payrolls data for June reshaped market expectations for the Federal Reserve's (Fed) policy path. Investors are now turning their attention to the Federal Open Market Committee minutes, which will be released on Wednesday, for further guidance.

The U.S. added 147,000 jobs in June, better than expected and slightly higher than the revised 144,000 in May. Meanwhile, the unemployment rate remained stable at 4.1%. These data reinforce the view that the labor market remains resilient, reducing the likelihood of an imminent rate cut by the Federal Reserve. As a result, the U.S. dollar strengthened, weighing on non-yielding assets such as gold.

📊Comment Analysis

The decline at the beginning of the week, gold prices give up accumulation below 3300

💰Strategy Package

⭐️Set gold price:

🔥Sell gold area: 3337-3339 SL 3344

TP1: $3328

TP2: $3312

TP3: $3300

🔥Buy gold area: $3297-$3295 SL $3290

TP1: $3308

TP2: $3320

TP3: $3330

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

- Profit is 4-7% of the fund account

- Stop loss is 1-3% of the fund account

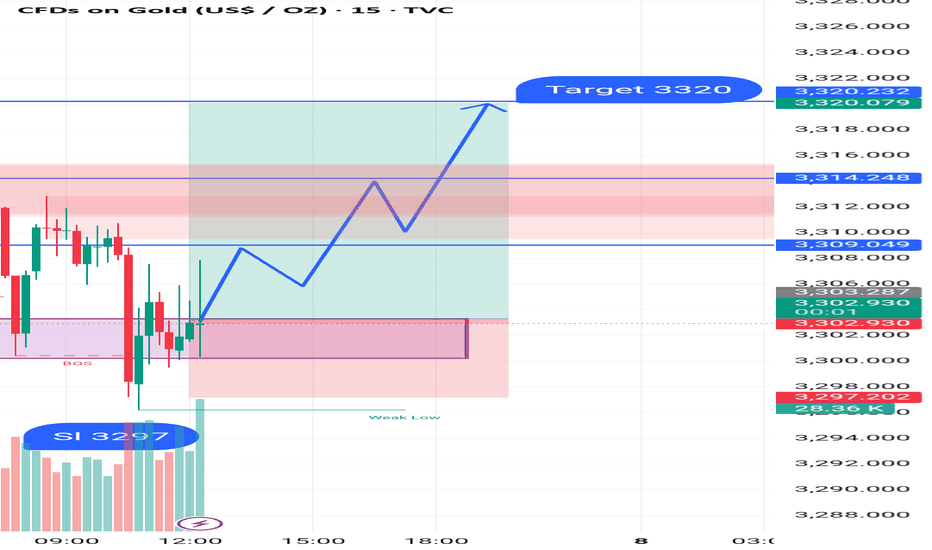

GOLD BUY M15 Gold (XAU/USD) Analysis – 15-Minute Chart

The price is currently showing signs of bullish momentum after forming a Break of Structure (BOS) around the 3297 level, which is also marked as the Stop Loss (SL) area.

After retesting the demand zone (highlighted in purple), the price has started to push upwards, suggesting a potential reversal. A bullish price path is projected, with expectations of higher highs.

Key Levels:

Entry Zone (Support): Around 3297 (SL zone)

Resistance Zones:

First Resistance: 3309

Second Resistance: 3314

Final Target: 3320

If the bullish momentum continues, the price is expected to break above the minor resistance levels and reach the target of 3320.

Trump's new tariffs are coming, will gold soar?

✏Hello everyone, let's comment on the gold price next week (July 7, 2025-July 11, 2025)

. ⭐️Gold Information:

This week, the spot gold price showed a trend of rising first and then falling. From Monday to Wednesday, driven by safe-haven demand and the weakness of the US dollar, the gold price recorded three consecutive increases, climbing rapidly from US$3,271/ounce to the intraday high of US$3,365/ounce on Wednesday afternoon, showing strong upward momentum. However, on Thursday, before the release of the June non-farm payrolls data, market sentiment turned, and the gold price plummeted to US$3,312/ounce, the largest single-day drop in the week. On Friday, affected by the light trading during the US Independence Day holiday, the gold price fluctuated between US$3,330 and US$3,355/ounce, closing at around US$3,337/ounce, up about 1.91% for the week.

U.S. President Donald Trump announced that the U.S. will begin sending formal letters to trading partners on Friday, ahead of a July 9 deadline, outlining new tariffs ranging from 10% to 70%, which will take effect on August 1. Treasury Secretary Scott Bessant added that a series of trade agreements are expected before the deadline, with an estimated 100 countries facing reciprocal tariffs of at least 10%. He also hinted that some agreements will be announced soon.

⭐️Labaron personal comment:

Gold prices continue to consolidate sideways, fluctuating in the 3242-3450 range

The following important key areas have been identified:

Resistance: $3362, $3393, $3446

Support: $3312, $3279, $3241

Gold accumulates and breaks through 3350 points

⭐️Personal comments:

Gold price rebounded around 3350. There was no important news and bank holidays in the US session on Friday, so it rebounded in the short term

⭐️Set gold price:

🔥Sell gold area: 3365-3367 SL 3372

TP1: $3355

TP2: $3342

TP3: $3330

🔥Buy gold area: $3311-$3313 SL $3306

TP1: $3325

TP2: $3338

TP3: $3350

Gold fluctuates during the day, short-term profits will be left

📌Main driving events of gold

The big non-agricultural data in the United States caused the gold price to fall by almost 40 US dollars in one breath, but after a short emotional storm, the market returned to calm. Today's market began to bottom out and rise. As of now, the non-agricultural market has been backed by 50%, and the energy of the shorts has been basically digested. Next, the bulls will start to exert their strength! Today's direction is still the same and continue to be bullish!

📊Comment analysis

In the US market, the gold price rebounded after the decline and the bottom of the second retracement appeared. The support level is 3322. After a night of fluctuations, gold has begun to rise, and the low point has begun to rise. The key point of the day is still 3323. In the morning, we wait for the gold price to fall back to around 3323 and we will buy the bottom and go long. We don’t expect to surpass yesterday’s high point during the day, but at least it will go to 3350!

💰Strategy Package

Long position:

Gold long at 3322-3327, stop loss 3315, target 3350-3360

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

Gold non-agricultural layout strategy

💡Message Strategy

Small non-farm data "big surprise"

The ADP employment report released on Wednesday showed that the number of private employment in the United States decreased by 33,000 in June, the first decline since March 2023. Economists surveyed previously expected the number to increase by 100,000 on average.

The ADP employment report showed that the number of private employment in the United States fell for the first time in more than two years in June, indicating that the Federal Reserve may cut interest rates as early as September.

Spot gold closed up $18.20 on Wednesday at $3,356.90 per ounce.

Bednarik pointed out that gold has gained upward momentum recently, with a gold price target of $3,373.50 per ounce. The "big surprise" of the ADP data suggests a weak non-farm payrolls report in June.

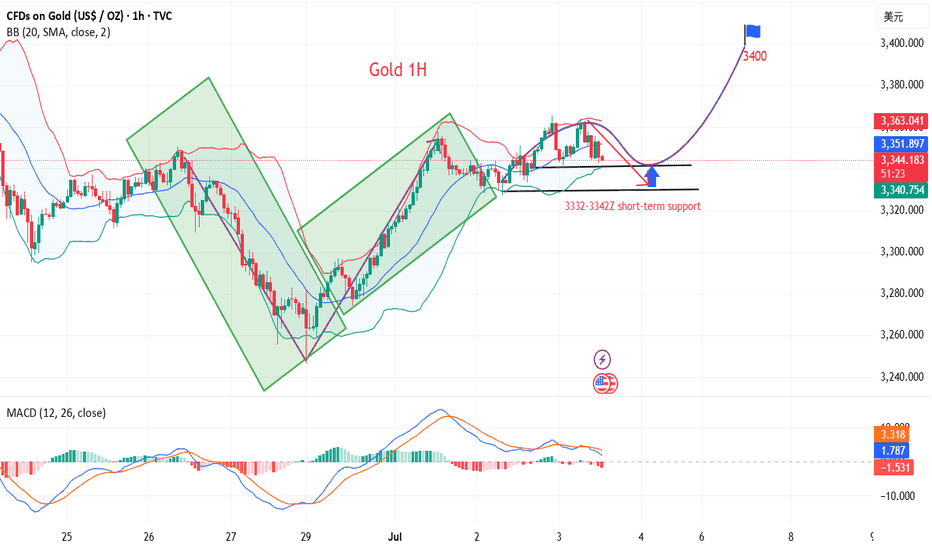

📊Technical aspects

1. The daily line was the support line for the rise in the previous month. It fell back very hard last week and turned into suppression. It was tested repeatedly and finally a big Yin hit the lower track of the pattern. However, it started at a low point this week and rose steadily. Now it has returned to the top of the lifeline again. At this point, the space will consider switching again.

2. The four-hour pattern opens slightly upward, with the lifeline 3330 as the dividing line between strength and weakness. Hold here and climb upward step by step.

3. The double lines on the hourly chart formed a dead cross after breaking through and turning into pressure last week, which helped to further increase the volume and fall by more than 100 US dollars. After breaking through and standing on it this time, it turned into support. The double line range is 3332-3342. This area is used as the boundary to switch between the upper and lower spaces. The support line for the bulls to dominate is the upper rail position of 3332, and the support line for the bulls to sweep is the lower rail position of 3316

💰Strategy Package

Long Position:3332-3340,SL:3316,Target: 3400

Gold grows, recovers near 3390

📣Gold News

Gold prices edged higher during the North American trading session as investors turned their attention to the upcoming U.S. non-farm payrolls report (NFP), which could influence the Fed's next policy move.

The latest labor data showed that companies are pausing hiring rather than laying off employees, reflecting caution in an uncertain economic environment. Meanwhile, Microsoft's decision to lay off 9,000 employees has heightened concerns about a weak labor market.

Traders are currently awaiting the official employment report from the U.S. Bureau of Labor Statistics on Thursday, which is expected to show 110,000 new jobs in June, down from 139,000 in May. The unemployment rate is expected to rise slightly to 4.3%, still within the 4.4% range of its forecast according to the Fed's latest summary of economic projections.

📣 Technical Analysis

NF is worth buying before the news release, holding. The dollar continues to be under selling pressure from investors worried about the Trump administration's erratic tariff policy.

💰Set Gold Price:

💰Sell Gold Zone: 3390-3398 SL 3405

TP1: 3380 USD

TP2: 3363 USD

TP3: 3350 USD

💰Buy Gold Zone: 3296-3294 USD SL 3289 USD

TP1: 3308 USD

TP2: 3318 USD

TP3: 3330 USD

⭐️Technical Analysis:

Set reasonable buy orders based on technical indicators EMA 34, EMA89 and support and resistance areas.

Short-term opportunities are imminent.Gold prices have continued to rebound recently and have reached around 3358, but there is a lack of effective retracement during the rise, and the risk of short-term chasing has increased significantly. From a technical perspective, the US dollar index has a demand for a corrective rebound after a rapid decline, and it is expected to form a significant suppression on gold in the short term, limiting the rebound space of gold prices. From a capital perspective, the previous high-level long chips have gradually been untied and started to leave the market with profits, and selling pressure has gradually emerged; short positions may be re-arranged after completing concentrated stop losses, and the market structure is quietly changing.

Based on the above factors, it is recommended that traders remain patient and continue to hold short positions, focusing on the support of the 3335-3325 area. Be sure to control your position during the operation, strictly set stop losses, and avoid the high risks brought by chasing the rise. The core of trading is to follow the trend, respect the market rhythm, and wait for the adjustment to be confirmed before intervening.

Steady trading can only make long-term profits. Welcome everyone to share and communicate to improve the operation level together.