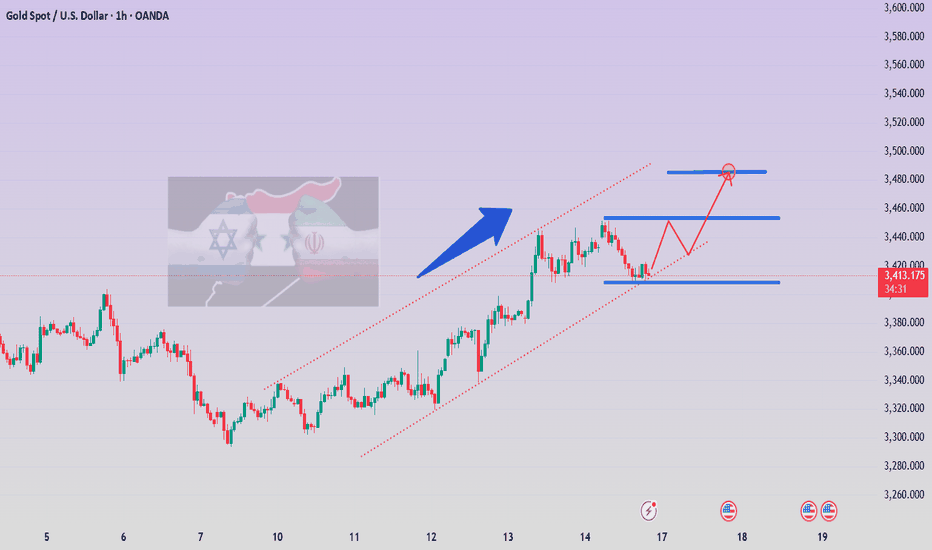

Gold long-short strategy US trading range operation

Gold prices (XAU/USD) recovered some of their losses during Monday's Asian trading session, driven by expectations that the Federal Reserve may cut interest rates further this year (and perhaps earlier than previously expected). This prospect weighed on the dollar, making dollar-denominated gold more attractive to overseas buyers.

However, the recent improvement in global risk sentiment (driven by the US-China trade agreement and the Israeli-Iranian ceasefire agreement) may reduce the safe-haven demand for gold. Investors will now turn their attention to upcoming comments from Federal Reserve officials, with Atlanta Fed President Rafael Bostic and Chicago Fed President Austan Goolsbee expected to speak later in the day.

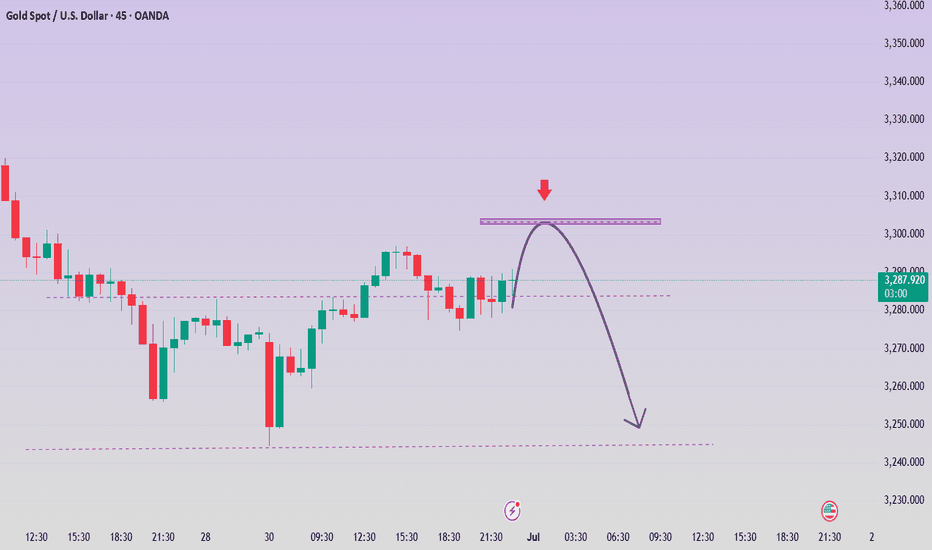

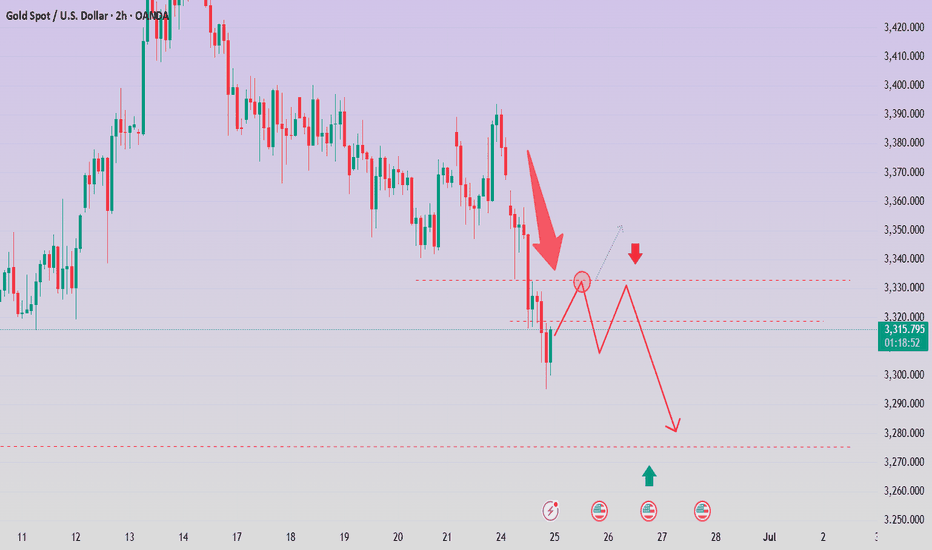

Gold prices recovered, accumulating around the 3,300 price range at the beginning of the new week. Still in a major downtrend.

⭐️Set Gold Price:

🔥Sell Gold Area: 3316-3318 SL 3323

TP1: $3305

TP2: $3290

TP3: $3277

🔥Buy Gold Area: $3248-$3246 SL $3241

TP1: $3258

TP2: $3270

TP3: $3286

⭐️Technical Analysis:

Set reasonable buy orders based on technical indicators EMA 34, EMA89 and support and resistance areas.

Goldinvestment

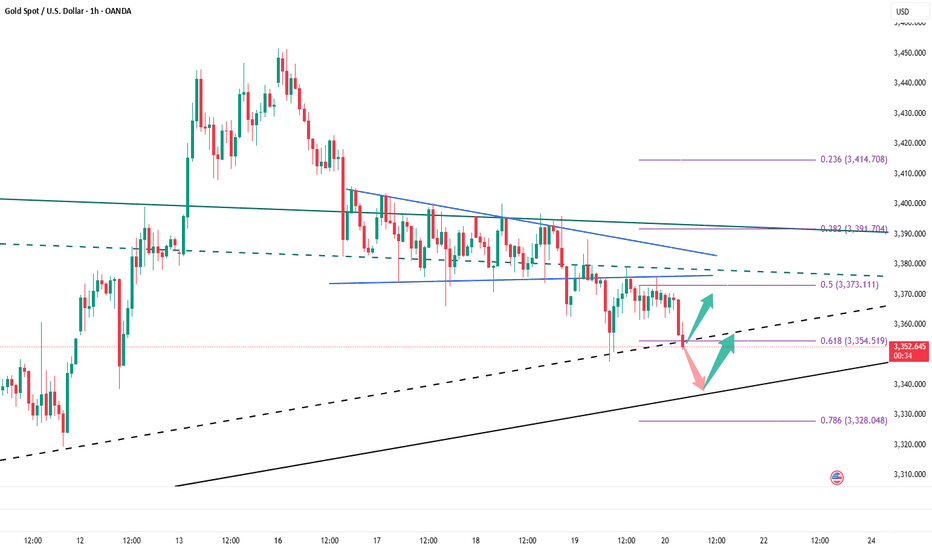

Gold's rally has not reversed yet? The consolidation pattern hasTechnicals:

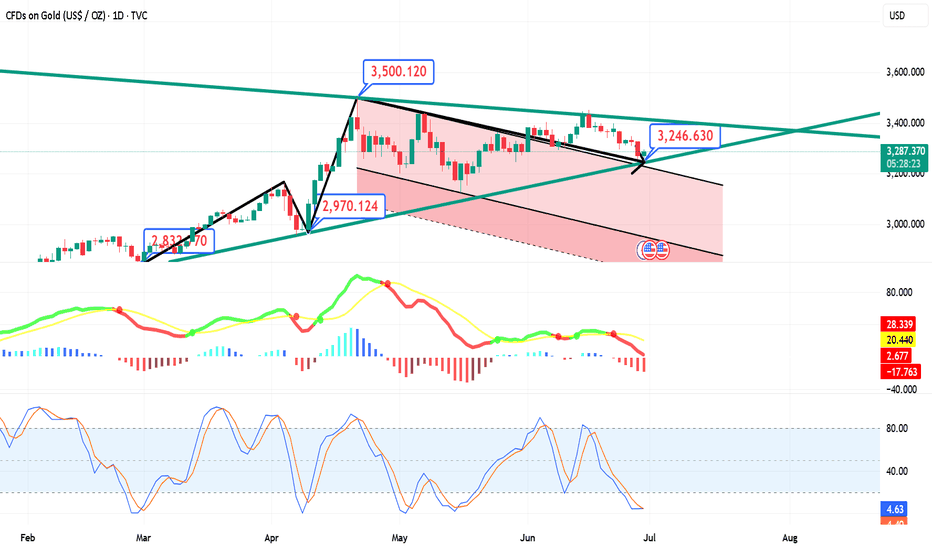

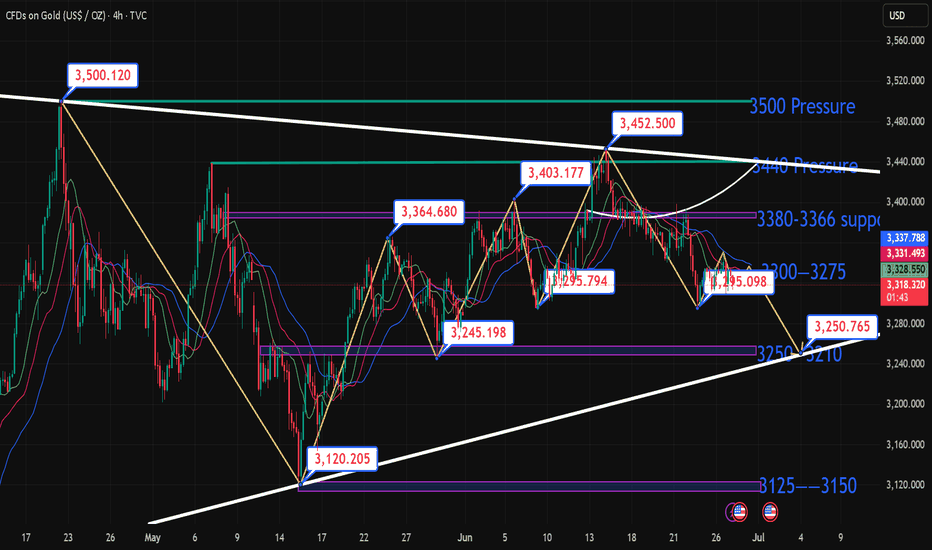

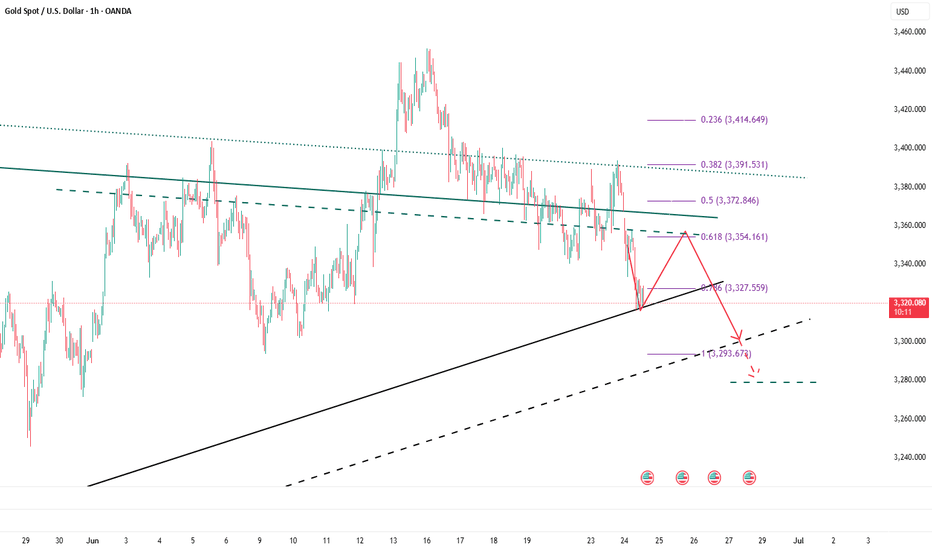

Short-term risks remain skewed to the downside as the momentum of the relative strength index (RSI) and the moving average convergence divergence indicator (MACD) weakens. The RSI hit a new low below the neutral 50 mark. If short pressure intensifies in the next few trading days, gold prices may retest the upper track of the previous falling channel at 3215, followed by the rising support line from October 2024 at 3150. If it falls below this level, the decline may accelerate towards the psychological level of 3000, or even lower to 2970.

On the upside, if a strong catalyst pushes gold to rebound above the 20-day and 50-day moving averages (currently 3320-3350), the next resistance level may appear in the 3400-3435 range. A decisive close above this boundary may pave the way for gold prices to move towards 3500, or test resistance near 3530, and then may target the 3600 level.

Overall, despite the weakening technical indicators, gold has not completely lost its bullish reversal potential. As long as the price remains within the sideways structure above 3150, the downward pressure may still give rise to a "buy on dips" strategy.

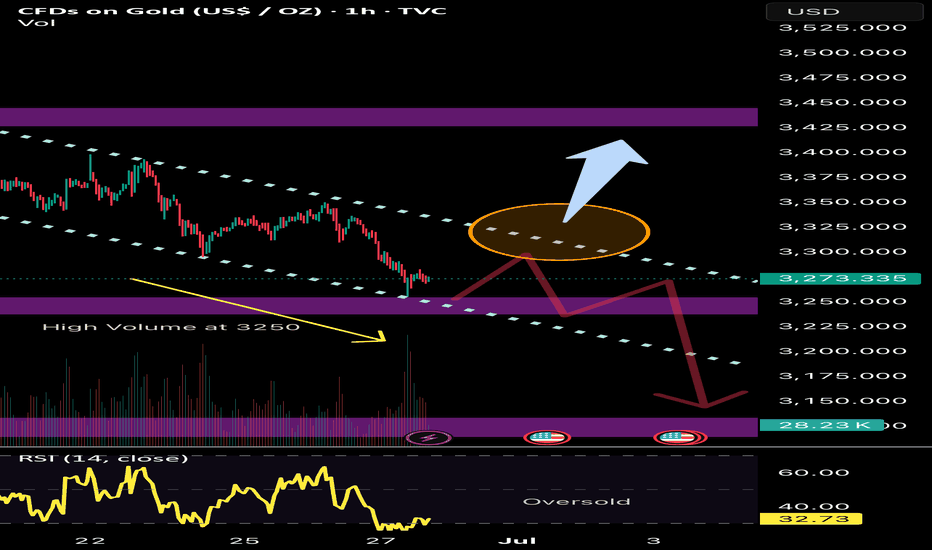

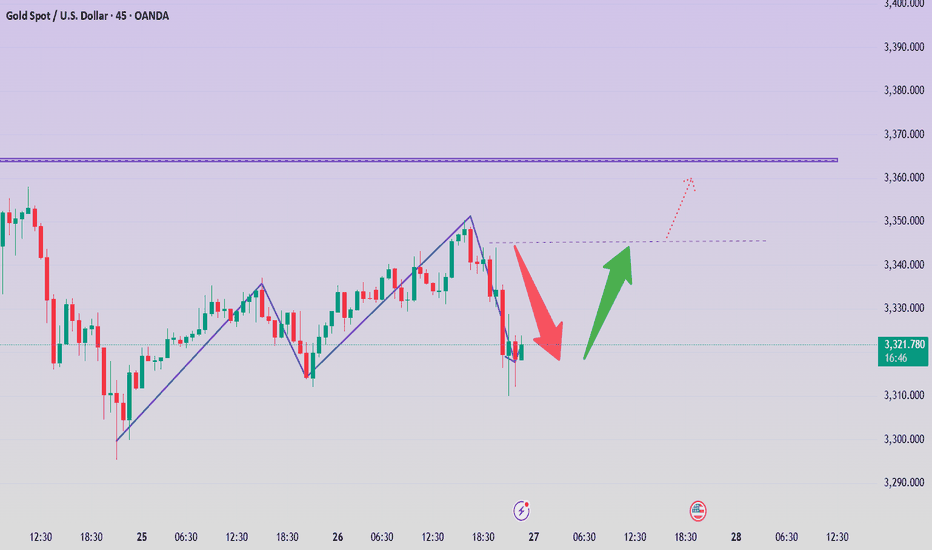

Will the FALL continues?Last trade idea was fulfilled and went into the downside. Targeted 3250. If this 3250 major support area breaks down, we can expect a bigger downside move.

However, there’s a huge buying that happened at that level. It may first have a pullback upwards before it continues its decline. RSI is also at oversold level.

Bullish reversal can be confirmed if 3350 gets broken.

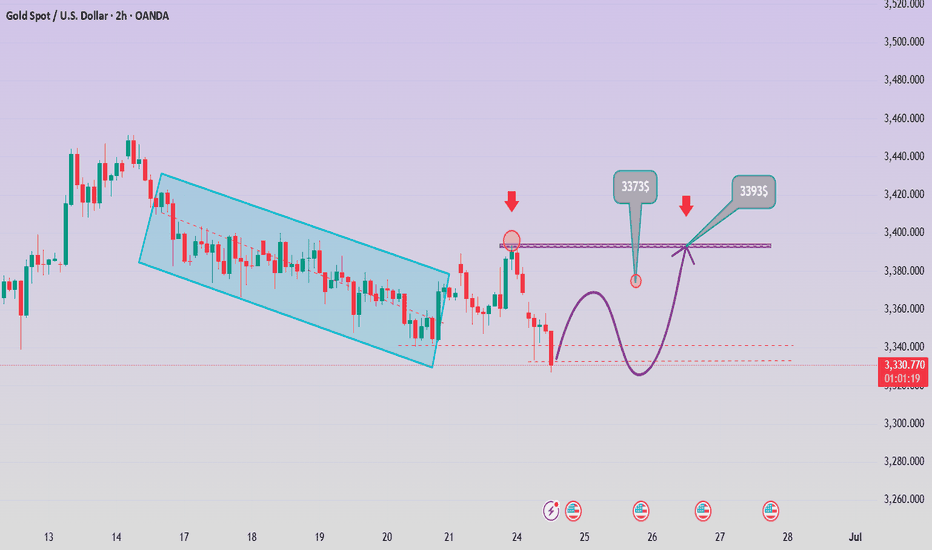

Gold fluctuated and fell, and the rebound was directly short

📣Gold News

Due to the easing of the situation in the Middle East, gold has fallen in the past few days, and the market has been eagerly looking forward to the interest rate cut, because the tariffs in the Trump era may push up inflation, but it has not come yet. "

On Thursday, the U.S. Department of Labor and Commerce issued key economic data, including initial jobless claims and the final value of real GDP in the first quarter. The number of initial jobless claims was 236,000, a decrease of 9,000 from 245,000 in the previous week, better than the market expectation of 245,000. At the same time, as of June 14, the number of continued unemployment claims in the week increased by 37,000 to 1.974 million, a new high since November 2021. Gold stopped below the moving average today. Gold did not continue the small positive line rise, and the decline continued during the U.S. trading period.

Today, focus on the continuation of short positions, comprehensive Labaron believes that gold is bearish today. For today's operation, consider rebound shorting as the main, and low long as the auxiliary.

📣 Pay attention to the resistance of 3330-3345 US dollars above

📣 Pay attention to the support of 3300-3280 US dollars below

💰 Go long near 3295-3285, target 3310-3320

💰 Go short near 3330-3340, target 3000-3290

If you have just entered the market, you are confused about the market of gold, oil and silver, and you always do the opposite operation direction and the entry price is unstable. I hope Labaron's article will help you.

6.27 Risk aversion dissipates and gold prices adjust! The range As the Middle East war came to an end, the risk aversion sentiment in the global financial market subsided, the risk aversion funds dissipated, and the three major bullish markets of gold, crude oil, and silver all fell downward; at the same time, the US dollar index broke a new low !

Fundamentals:

1: The Middle East war has been temporarily paused, and both sides have entered the adjustment phase; however, irreconcilable contradictions may become the starting point of the next war at any time; although it has ended for now, we must not slack off. Once the two sides are on the verge of a war again, risk aversion will sweep the world again; this is not impossible;

This Middle East war came suddenly and ended suddenly; it was like a child's play washing the global financial market; therefore, the possibility of a resumption of war cannot be ruled out in the future;

At present, in the overall market:

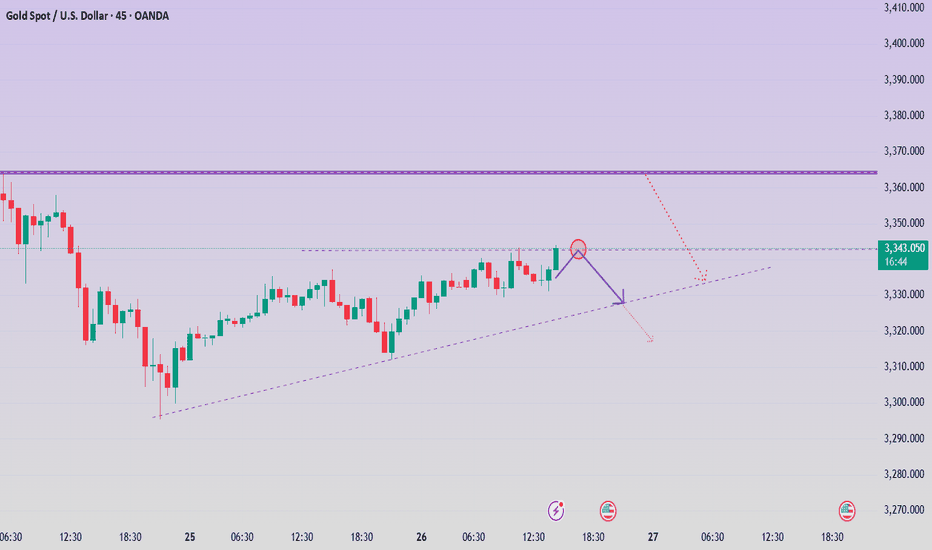

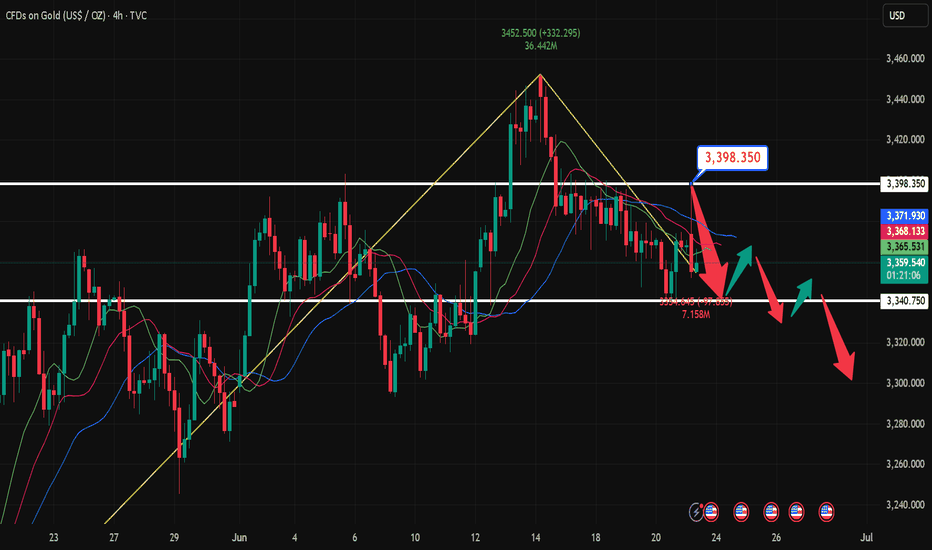

1: In the short cycle, the gold price fluctuates downward, so in the short term, the short-term decline is seen, and the fluctuation is downward;

2: In terms of trend, the range is temporarily contracted, the BOLL of the daily K is contracted, the speed slows down, and the overall range is back to the range of fluctuations; there is no obvious long and short trend, and it returns to the range of fluctuations;

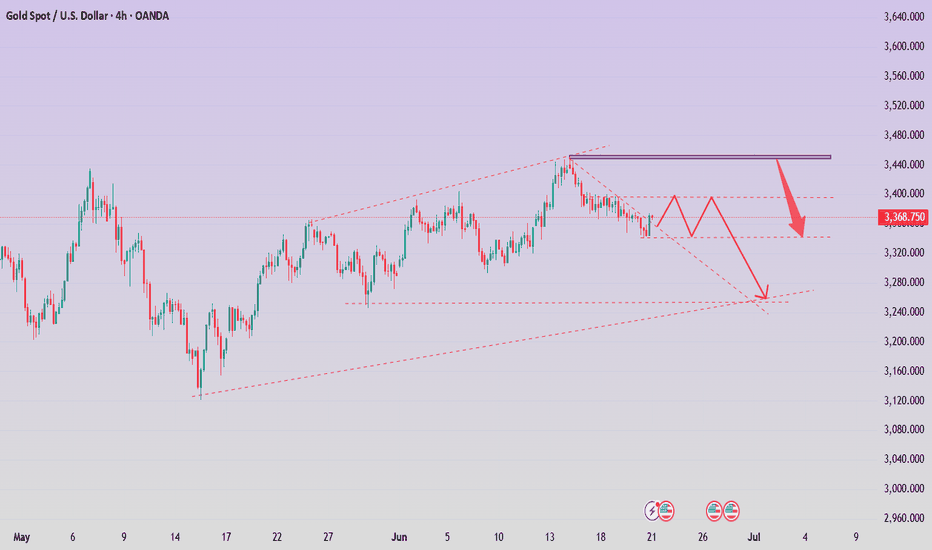

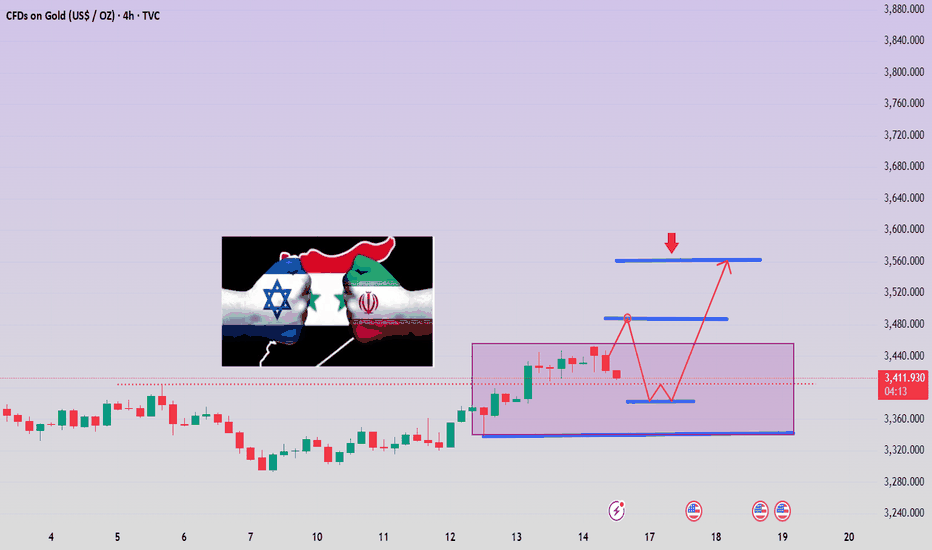

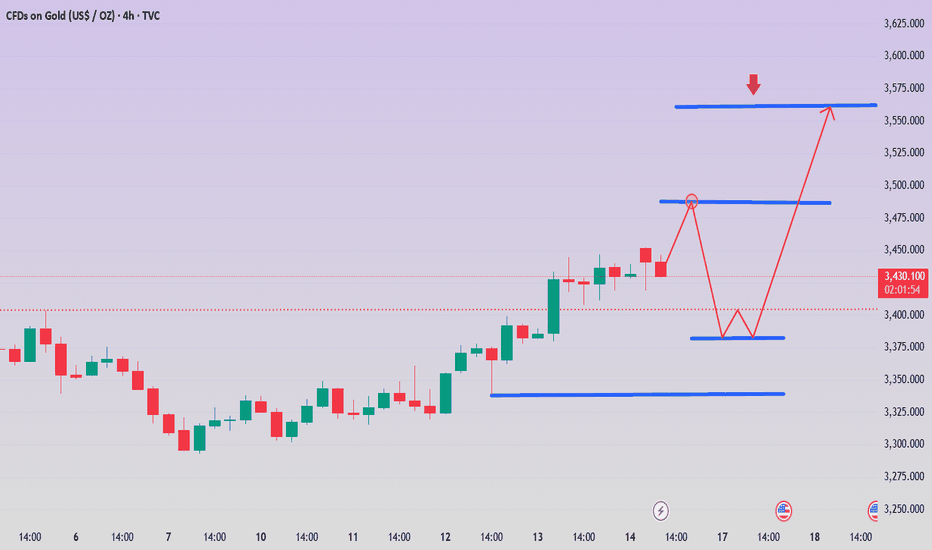

Today's technical trend chart:

1: In 4 hours, the stochastic indicator crosses downward, which is a main empty signal; in terms of form, it is temporarily under pressure from the central axis track of the 4-hour BOLL, and the empty trend continues downward, and the form tends to continue to oscillate downward; therefore, it is recommended to choose the high-altitude approach for 4 hours;

2: In the daily K, the stochastic indicator continues to cross downward, which is a empty signal; in terms of form, it is temporarily a broken Yin and Yang pattern, with no obvious trend; BOLL forms a contraction, the range of 3417-3277, the range is mainly in an oscillating trend, and the strong and weak dividing point is near 3347;

Comprehensive: The daily K is mainly in an oscillating trend, so it is recommended to deal with it according to the oscillating trend, choose to buy low and sell high; the reference pressure position is near 3347, the support position is near 3295 and 3278; the second pressure position is 3390-3400 pressure position; continue to choose the oscillating approach, and play a oscillating treatment of buying low and selling high;

Can we still go long if the decline of gold intensifies?

📊Comment Analysis

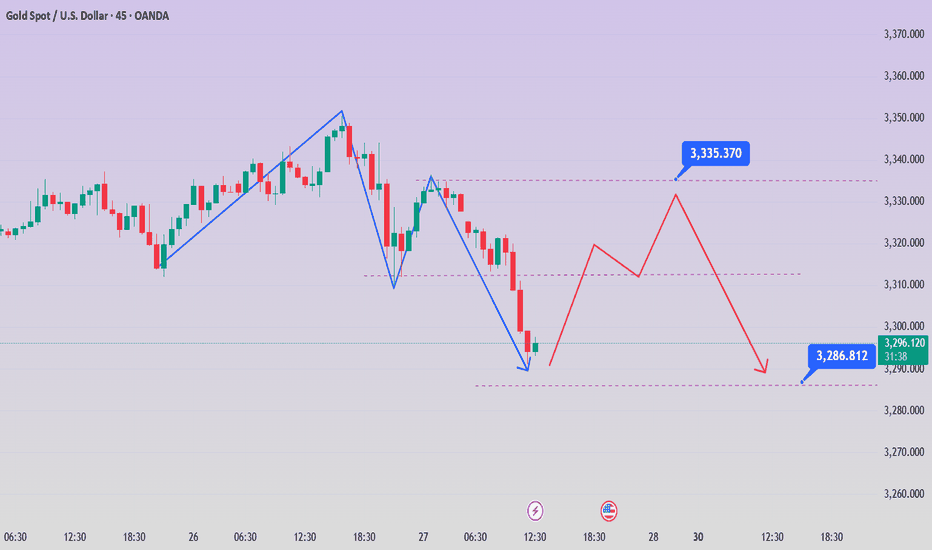

Looking back at today's trend, it rose to a high of 3350, and then continued to retreat. The current low is 3310. At present, due to the upward trend line broken by the hourly line, many orders can only be short. The trend is still biased to the short side, and the current market risk aversion does not facilitate the longs. But first of all, one thing can be confirmed that this round of gold decline lasted for a long time, which also enhanced the execution of gold to go long near 3310-3320 in the future.

Since gold has fluctuated greatly in the past two days, it means that the end point of emotions will not disappear so easily for the time being. In the short-term K-line pattern, continuous short-side artillery should not be constantly changed and increased. It is necessary to stop and see appropriately. The early trading is relatively difficult to grasp, but at least the current market has given some signals, so I hope that when the market is in place, your execution will be strong enough, and then you can look at gold according to the trading signals I gave. The rehearsal is definitely exciting enough, but the actual operation is not that simple!

💰Strategy Package

Gold: Pay attention to the low-long opportunities of 3310-3220 in the US market, and defend at the 3300 line. If the retracement continues, go long directly. Otherwise, the upper resistance will be around 3345!

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

Gold fluctuated slightly, retreating to low-multiple operations

📌 Gold news

During the North American trading session on Wednesday, gold prices remained stable, rising by more than 0.30% as easing tensions between Israel and Iran boosted risk sentiment. Meanwhile, disappointing US housing data may prompt the Federal Reserve (Fed) to take action in the future. However, Fed Chairman Jerome Powell's continued tough stance has limited further upside for gold.

📊Comment analysis

Gold fluctuated in a small range yesterday, and the daily line closed with a positive cross star.

Daily support is around 3327-3324, and you can go long if you touch it.

Daily resistance is around 3368, and you can go short if you touch it.

If the market goes down to yesterday's low, the bottom continues to look near this week's low, and I am more inclined to be bullish

💰Gold operation strategy

If gold is close to 3327, you can go long, with a target of 3345.

Look for opportunities to short around 3350-3360, with a target around 3330.

I hope Labaron's article can help you with your investment. If you don't understand something, you can find me. I am not only a mentor, but also a friend worth making in your life.

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

Gold today high-altitude low-multiple operation

📌 Gold news

On Tuesday, the spot gold price plummeted, hitting a two-week low. The main reason was that Iran and Israel announced a ceasefire, which suppressed the demand for safe-haven gold. In addition, Fed Chairman Powell made hawkish remarks, which also hit the gold price trend. Short-term long-short game will focus on the PCE inflation data to be released by the United States. If the economic data performs poorly or inflation continues to fall, it may still provide a medium-term rebound opportunity for gold.

📊Comment analysis

Yesterday, gold was weak overall, and the decline and rebound were limited. It fell directly from around 3357 to 3295, and then rebounded according to the news. It ran around 3326 in the morning. From a technical point of view, the daily low trend line support is around 3290, the 4-hour long lower shadow line bottomed out, and three consecutive positive rebounds, the daily line supports the lower track of the Bollinger band, and the Bollinger band tends to be parallel. There is no sign of opening downward, so the short-term decline of gold prices is limited. Consider paying attention to the support of 3294 during the day, and mainly use this position for defense and low long. Pay attention to the important suppression of the middle track 3363 above, and mainly short.

💰Strategy Package

Focus on the support near 3316-3317 in the short term, rely on this position to go long, stop loss 3307, take profit near 3345, and break 3363. If it falls strongly below 3294, then don't consider going long during the day.

Gold operation strategy: long near 3316, stop loss 3307. Take profit 3345

⭐️ Note: Labaron is not 100% correct here, only a steady operation idea, large warehouse for trend, small warehouse for wave, control the proportion by yourself, there is no unprofitable investment, only unsuccessful orders, whether to make money depends on the timing of buying up and buying down, making money depends on opportunities, investment depends on wisdom, and financial management depends on professionalism.

Gold prices rose as dollar data was not good

📌 Gold information:

Gold prices plunged on Tuesday as a ceasefire was declared in the 12-day war between Iran and Israel, market risk appetite rebounded, and demand for safe-haven assets declined. The ceasefire news pushed global stocks higher, while oil prices fell to a two-week low as concerns about supply disruptions eased. The plunge in crude oil prices also further suppressed gold's inflation hedging appeal. As an interest-free asset, gold prices are under pressure against the backdrop of waning risk aversion, but there is still buying support at low levels.

Investors are currently focusing on Federal Reserve Chairman Jerome Powell's appearance at a House Financial Services Committee hearing. Powell has been cautious on whether to cut interest rates in the near future.

📊Comment Analysis

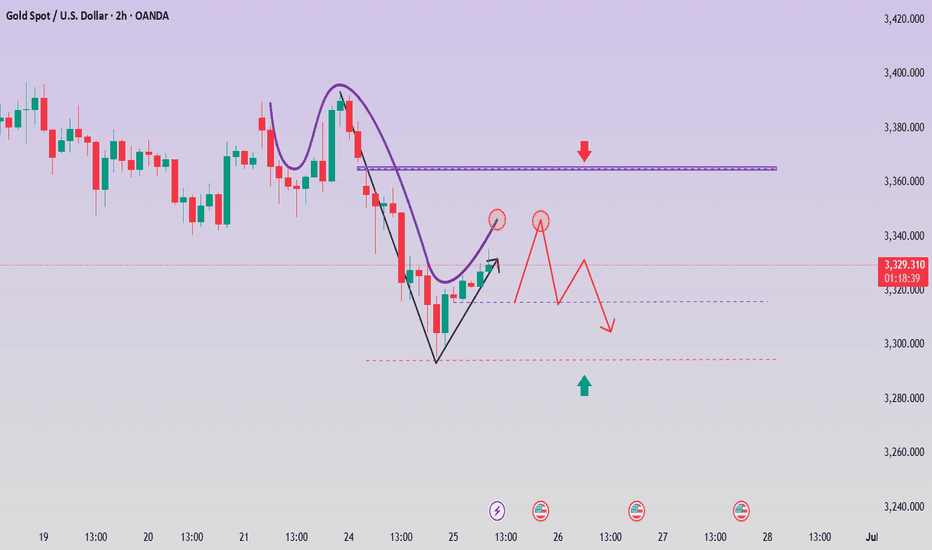

The current market selling sentiment has increased significantly, and for gold, falling seems to be the only way to go. Today, whether you look at rebound short or low long, basically you will not have a chance, that is, falling, it seems that the market has lost hope in gold, and the current gold has fallen to 3295, and the break of 3300 declares that gold has further room to fall. From the trend point of view, it is likely to fall now!

The further strong support on the current trend line is around 3274, and it is not ruled out that it will fall directly to the current position. At present, the Federal Reserve is still speaking, and whether it will cause drastic fluctuations in gold in the future is still unpredictable, but from today's trend, shorting is already the best solution at present, and the upper resistance can first look at 3330!

💰Strategy Package

Gold: Rebound 3325-3335 short, stop loss 3345, target 3290-3300!

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the lot size that matches your funds

Buy gold, there may be a rebound in the short termAt present, gold has touched the area of 3325-3315 mentioned in my previous article, and the lowest price is around 3316. At present, due to the current important support area of 3310-3300 below, gold still has a rebound demand in the short term; although gold has not rebounded sharply at present, the downward momentum has indeed slowed down, and gold may rebound after the short force is consumed. Moreover, the ceasefire between Iran and Israel has not yet been settled. Moreover, the ceasefire between Iran and Israel has not yet been settled. With the fluctuating situation in the Middle East, bulls may have opportunities to counterattack.

However, the current performance of gold is indeed relatively weak, so there is no need to expect gold to rebound and fill the upper gap area of 3360-3370 in the short term; in trading, the rebound expectation can be appropriately lowered, and long positions can continue to be held and look up to the 3340-3350 area.

Iran and Israel ceasefire? Gold price falls and adjusts

📌 Gold information:

Gold prices continued to be well supported during the North American trading session following the breaking news of Iran's retaliatory attack on the US military base in Qatar. The escalation was a response to Washington's weekend attack on Iran's nuclear facilities. As geopolitical tensions in the Middle East dominated the headlines, investors largely ignored US economic data

Macroeconomic indicators have taken a back seat as the intensification of the conflict has affected market sentiment. Arab TV cited Israeli media reports that Iran used missiles to attack US bases in Qatar, Kuwait and Iraq. In further escalation, Tehran approved the closure of the strategic Strait of Hormuz and launched more missiles at Israeli targets, which amplified the safe-haven demand for gold.

The situation in the Middle East has mixed signals. Trump announced a "stop" to the Iran-Israel conflict, while the exchange of fire between the two sides continued, and the proportion of gold longs fell back

📊Commentary Analysis

Gold prices responded to the reduction of positive news on peace in the Middle East and continued to rise.

💰Strategy Package

Short when the price rebounds to around 3370, stop loss at 3480, target at 3350-3388 points

Long around 3310-3320, stop loss at 3300, target at 3360-3368 points

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

6.23 Gold Short-term Technical AnalysisStimulated by geopolitical conflicts such as the US airstrike on Iran's nuclear facilities on Monday, gold opened $24 higher at 3398 in the early trading. However, it failed to continue the upward trend and quickly fell back to the 3360-65 area. Retrieve all the gains!

Technical analysis: 4-hour head and shoulders top pattern: right shoulder 3373 neckline 3340 MACD dead cross diverges downward Bollinger band opening expansion and price running near the lower track, short-term trend is bearish, and the daily line is still in the rising channel!

Short-term operation:

SELL: 3375\3385 Stop loss: 3390

$1:3360 $2:3340

BUY: 3338\3345 Stop loss: 3353

$1:3380 $2:3400

Operation suggestion: High-altitude is the main, low-multiple is the radiation

Middle East war, gold breaks through 3400 early next week

Hello everyone:

Let's analyze the gold price next week (June 23, 2025 to June 27, 2025)

📌Gold information:

Gold prices held steady on Friday, hovering around $3,369, and are expected to fall nearly 1.90% this week as the market digests U.S. President Donald Trump's decision to abandon immediate military action against Iran and turn to diplomacy. As of writing, XAU/USD fell 0.11%.

While easing geopolitical tensions helped boost risk sentiment, concerns that the United States may restrict allies operating semiconductor factories in China put additional pressure on gold, according to Bloomberg. Trump's restraint on Iran encouraged risk appetite and suppressed the appeal of this safe-haven metal.

What has President Trump been busy with in the past 24 hours? (2025-06-22)

1. Announced the successful airstrike on Iran's three nuclear facilities - Trump issued a message saying that he had successfully launched attacks on Iran's three nuclear facilities, including Fordow, Natanz and Isfahan. The main target Fordow nuclear facility was bombed with a full load of bombs. All fighter jets are returning safely. Iran's Fordow (nuclear facility) no longer exists.

2. Was willing to go to Turkey to negotiate with Iran in person - According to the AXIOS website, sources said that when Trump attended the G7 summit last Monday, Erdogan called and proposed to hold talks between US and Iranian officials in Istanbul the next day to explore diplomatic solutions to the war. Trump agreed, and he was willing to send Vice President Vance and White House envoy Vitkov, and even if necessary, he was willing to go in person. But it was later cancelled because Khamenei could not be contacted.

3. Threatening to strike Iran again if the conflict does not stop - According to Reuters, US President Trump said in a telephone interview that tonight was a stunning success and Iran should immediately achieve peace and stop the war, otherwise they will be hit again.

4. Saying that Iran will either usher in peace or fall into tragedy - Trump said that the US goal is to destroy Iran's nuclear enrichment capabilities and stop Iran's nuclear threat. Iran's facilities have been completely destroyed. Iran will either usher in peace or fall into tragedy. Many goals have not yet been achieved. Tonight's strike is the "toughest target". If peace is not achieved in the future, other targets will be accurately struck.

5. Warning Iran not to retaliate - Trump posted on social media: "Any retaliatory action by Iran against the United States will lead to a military response 'far beyond what we saw tonight.'"

6. US Democratic lawmakers call for Trump's impeachment - On the evening of June 21, local time, according to NBC, New York Democratic Congresswoman Alexandria Ocasio-Cortez said that President Trump's decision to attack Iran without the authorization of Congress "absolutely and clearly constitutes grounds for impeachment." She said that the US President's disastrous decision to bomb Iran without authorization was a serious violation of the Constitution and Congress' war powers.

📣Personal analysis:

Tensions in the Middle East escalate, and gold prices will continue to rise above 3400 at the beginning of next week

🔥 Technical:

Based on the resistance and support levels of gold prices on the 4-hour chart, Labaron identified the important key areas as follows:

Resistance: $3395, $3448

Support: $3302, $3255

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

A glimmer of hope for bullish lovers!Gold is currently dominated by bears, but thanks to the support of risk aversion caused by geopolitical conflicts, gold has shown a certain degree of resistance to decline while falling. Therefore, the current market direction is very clear, with weak and volatile downward movement. But under this market situation, we cannot short gold excessively. We can only wait for it to rebound to the pressure level and then short gold, or try to go long on gold with strong support.

At present, gold has touched the 3350 area again, which has a certain support effect. If gold cannot effectively fall below 3350, then gold may still rebound to the 3370-3380 area again; but once gold effectively breaks the support near 3350, gold is expected to continue to fall to the 3340-3330 area.

In terms of short-term trading, I think it is possible to consider starting to try to go long on gold in batches in the 3350-3330 area, TP: 3365-3375

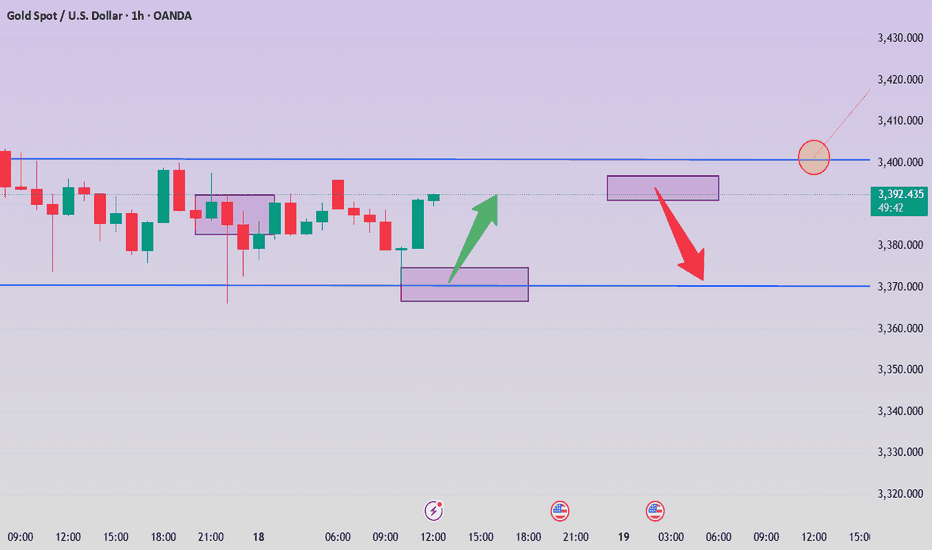

Gold fluctuates in the short term, pay attention to 3344 and go 📌 Driving Events

After the Fed’s interest rate decision, as expected, the Fed kept the interest rate unchanged in terms of gold, which was in line with market expectations. The price of gold continued to fluctuate and fall in the short term, and the bullish momentum was not obvious. Even if regional conflicts triggered risk aversion, it is likely to show a trend of rising first and then falling. As the price of gold is under pressure at 3,400 points, the intraday rebound will still fall back briefly under the pressure of 3,400 points.

📊Comment Analysis

Short sellers continue to exert selling pressure on gold prices. Accumulate to below 3400

💰Strategy Package

🔥Sell Gold Zone: 3390-3400 SL 3410

TP1: $3385

TP2: $3375

TP3: $3365

🔥Buy Gold Zone: $3360-$3370 SL $3355

TP1: $3380

TP2: $3390

TP3: $3400

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

Gold may usher in new opportunities

Key fundamental drivers

- Middle East tensions and nuclear negotiations Despite the ongoing tensions, Iran's signal of restarting nuclear talks has reduced risk aversion, triggering an intraday sell-off in gold, and the market has digested the reduced possibility of escalation of the conflict. The turbulent situation in the Middle East remains a trigger for market volatility, and any downgrade/escalation signals may trigger sharp fluctuations in gold prices.

- Fed policy and rate cut bets The Fed kept interest rates unchanged this week, but Powell's "data-dependent" stance has raised market expectations for a September rate cut to 60%. A dovish meeting statement could push gold prices above $3,400, while a delayed rate cut signal could drag gold prices to $3,350.

Short-term outlook

In the short term, gold prices may fluctuate between $3,350 and $3,450, and a breakthrough depends on:

- Upside catalyst: Escalating tensions in the Middle East + weak retail sales data may push gold prices to $3,450.

- Downside risks: Fed hawkish signals + fading geopolitical risks could push prices to $3,300.

Key event risks

- June 19: Fed policy meeting (expected to be dovish)

- June 21: US CPI data (inflation indicator to measure the timing of rate cuts)

- Middle East situation: progress in nuclear negotiations and conflict dynamics

💰Strategy Package

Set gold price:

🔥Sell gold area: 3390-33396 SL 3400

TP1: 3380 US dollars

TP2: 3375 US dollars

🔥Buy gold area: $3374-$3366 SL $3360

TP1: 3390 US dollars

TP2: 3400 US dollars

Gold is under pressure! What is the key to breaking the deadlock

📌 Core driving events

The conflict between Iran and Israel has entered the fifth day. Air raid alerts in Tel Aviv are frequent. The fire on a cruise ship in the Strait of Hormuz has exacerbated the panic of energy transportation. Safe-haven buying supports gold prices;

Trump's contradictory statement of "peace talks + tough" (may send executives to meet but demand "unconditional surrender") has exacerbated the market's disagreement on the direction of the conflict, and risk aversion has fluctuated repeatedly.

The Federal Reserve will announce its interest rate decision today. The market expects it to remain unchanged at 4.25%-4.50%, but Powell's statement on rate cuts will affect the trend of the US dollar (Trump continues to pressure for a 1 percentage point rate cut).

📊Comment Analysis

1-hour chart: 3396 becomes the intraday strength and weakness watershed

The Asian morning session hit a high of 3396 US dollars and fell back. This point is the previous high pressure point. If the intraday rebound does not break through this position, the bearish thinking will be maintained;

💰Strategy Package

Set gold price:

🔥Sell gold area: 3390-33396 SL 3402

TP1: 3380 US dollars

TP2: 3375 US dollars

🔥Buy gold area: $3374-$3368 SL $3362

TP1: 3390 US dollars

TP2: 3400 US dollars

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

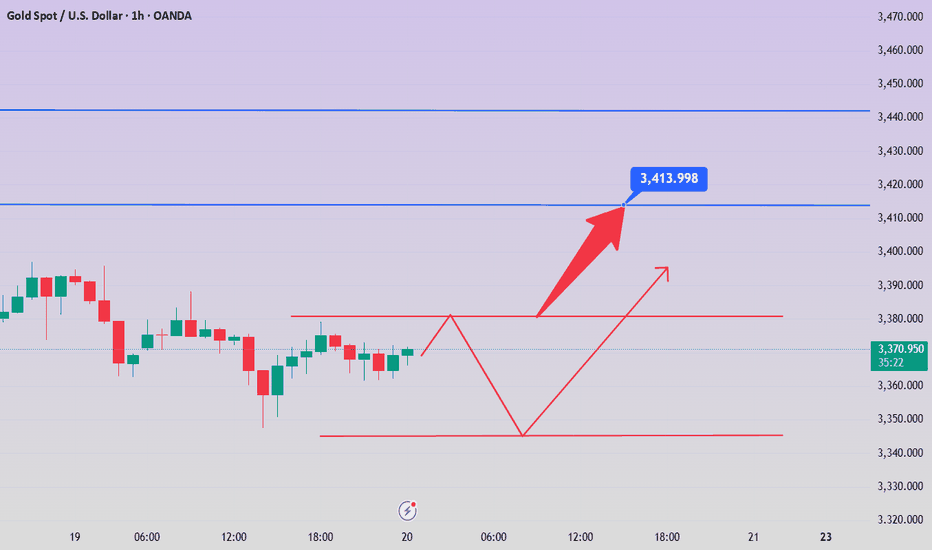

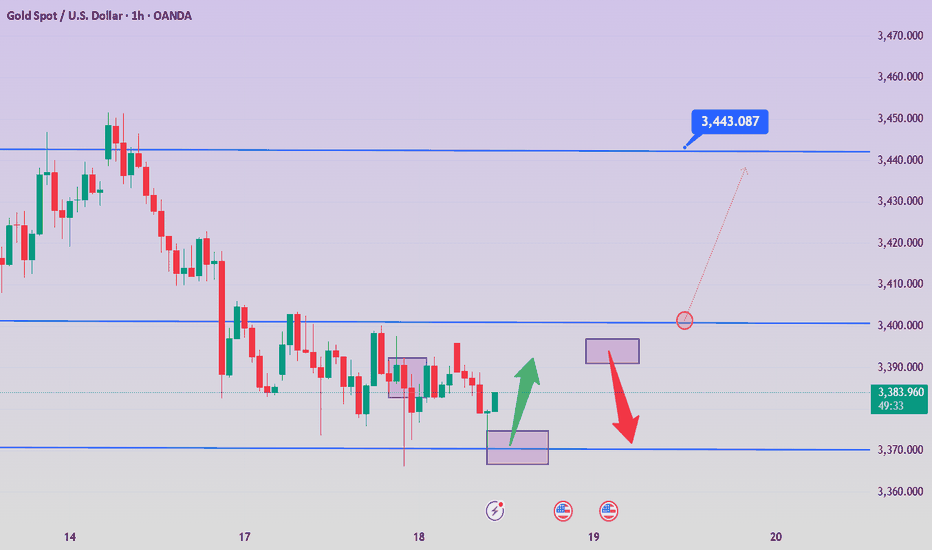

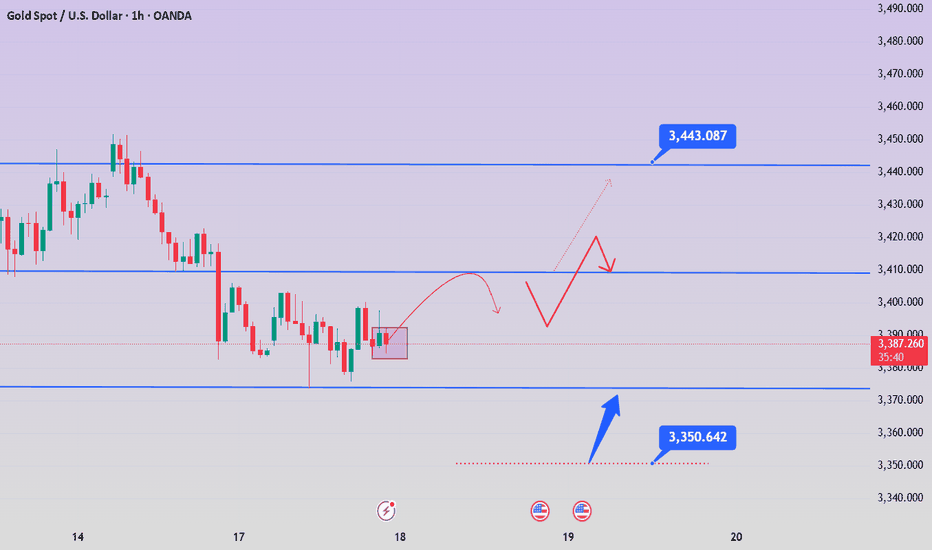

Continue the rally, get ready for gold to return to 3443

⭐️Gold News:

Gold prices (XAU/USD) fell for the second consecutive trading day on Tuesday, retreating from the gains in the early Asian trading hours, which had briefly pushed above $3,400. A slight rebound in the US dollar (USD) continued to put pressure on the precious metal, acting as a major resistance. However, the downside for gold seems limited due to escalating geopolitical tensions in the Middle East and growing market expectations that the Federal Reserve (Fed) will further cut interest rates in 2025.

Meanwhile, the ongoing air conflict between Israel and Iran has entered its fifth day, exacerbating concerns about further escalation in the region. This ongoing geopolitical uncertainty supports demand for safe-haven assets such as gold. Investors also remained cautious ahead of the Federal Open Market Committee (FOMC)'s two-day policy meeting, the outcome of which could affect the next move of non-yielding gold.

⭐️Technical analysis:

Gold price gets liquidity from the support level below: 3385, 3373 completed, short-term downward trend breaks, gold price will soon return to above 3400.

Set gold price:

🔥Sell gold area: 3443-3453 SL 3458

TP1: $3435

TP2: $3422

TP3: $3407

🔥Buy gold area: $3358-$3350 SL $3345

TP1: $3368

TP2: $3376

TP3: $3390

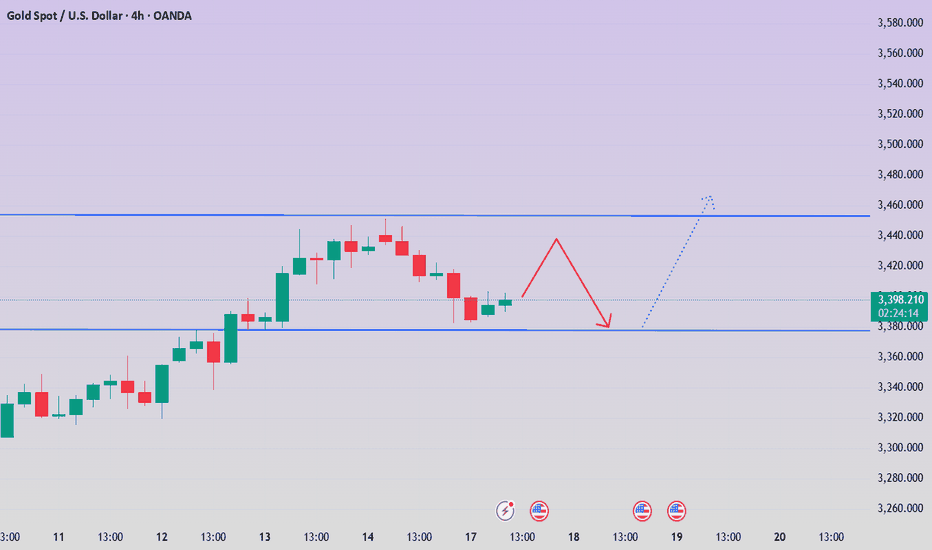

Geopolitics and Fed policies dominate the trend of gold prices

📌 Gold news

On Monday, boosted by the risk aversion of the Iran-Israel war, the gold price hit a high of 3452, but the continuity was not strong, and a series of other adjustments appeared; let's briefly sort it out:

1: Adjustment: Adjustment is normal. If the market rises, if the risk aversion does not continue to exert force, then the gold price can only return to technical adjustments. Therefore, Monday's adjustment trend and the decline trend are normal!

2: Risk aversion trend: The risk aversion trend will not be reversed for the time being! Once the war starts, it will not end easily; unless the interests of both sides are not damaged, the two sides agree to a ceasefire, but at present, the hope and probability are relatively small, so the risk aversion trend is the mainstream of the current global market;

3: The direction of the Iran-Israel war is nothing more than a few possibilities:

A: The war expands, the surrounding countries stand in line, and the US and Western imperialism join the battlefield; the war expands rapidly! At the same time, Iran is forced to block the Strait of Hormuz! This is a manifestation of escalating war;

B: Both sides, as well as the forces behind them, have calculated their interests, reached an agreement, and agreed to end the war conflict; this mainly depends on Iran's attitude; is it "powerful and unyielding", continuing to oppose the United States and imperialism; or is it pro-American, completely changing its identity, or changing its identity to submit to Israel and the United States;

To sum up: risk aversion eased slightly on Monday, but the overall global market is still risk-averse; technical adjustments are normal trends; but don't completely ignore the importance of risk aversion and risk aversion control because of technical adjustments; in addition, the subsequent results of the Middle East war are nothing more than the above two; what determines all this is the attitude of both sides;

📊Comment Analysis

Although the gold price fell below 3400 and the short-term trend changed, the general direction still remains bullish. In the future, it is still expected to hit the high point of 3500, but it is necessary to wait patiently for the bottom to stabilize before choosing the opportunity to buy the bottom. The current market is changing rapidly, and investors should adhere to the principle of following the trend and flexibly adjust their trading strategies.

💰Strategy Package

Short-term gold 3383-3393 long, stop loss 3372, target 3420-3440;

Short-term gold 3420-3430 short, stop loss 3435, target 3390-3370;

⭐️ Note: Labaron hopes that traders can properly manage their funds

Iran releases easing signals, gold is still bullish

📣Golden News

1. Iran sends a signal of easing. U.S. media reported that under the pressure of Israeli air strikes, Iran has used Arab intermediaries to send a peace signal to the United States and Israel - asking the United States not to carry out air strikes as a prerequisite for restarting nuclear negotiations, and emphasizing to Israel that controlling violence is in the common interest.

2. Israel's firm stance. Israeli warplanes fly freely over the Iranian capital, and Iran's counterattack is ineffective. Israel is still focused on dismantling Iran's nuclear facilities and weakening its theocratic regime, and there is no motivation to cease fire in the short term.

3. Gold's reaction and strategy. Iran's peace proposal caused the price of gold to plummet to as low as $3,382. However, since the situation in the Middle East has not eased significantly, it is recommended to buy on dips and pay attention to the support level of $3,400. ⭐️Set gold price:

🔥Sell gold area: 3465-3475 SL 3485

TP1: 3450 USD

TP2: 3440 USD

TP3: 3430 USD

🔥Buy gold area: 3390-3388 USD SL 3383 USD

TP1: 3400 USD

TP2: 3410 USD

TP3: 3422 USD

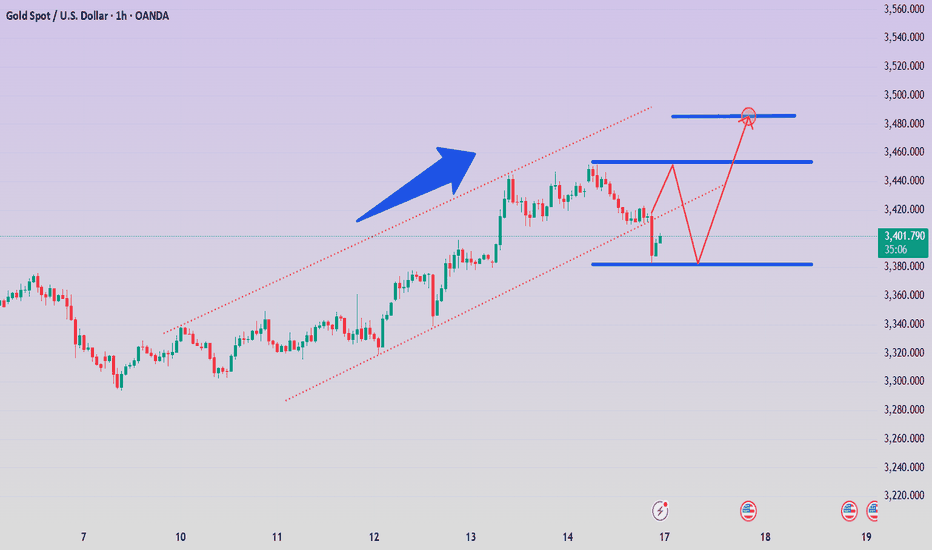

Gold, continued to rise after a pullback

📌 Driving events

Israel and Iran launched a new round of attacks on each other on Sunday (June 15), exacerbating market concerns that the escalation of the war could trigger a wider regional conflict, and gold continued to receive support from safe-haven buying. (The author believes that according to media reports, Iranian leaders have shown a tougher attitude, and Iran cannot be ruled out to give Israel a strong counterattack, so the geopolitical situation in the Middle East may escalate in the next few days, and gold as a safe-haven asset will shine even brighter.

Kremlin: (On Putin's possible mediation of the Israeli-Iranian conflict) Russia is ready to intervene at any time if necessary. (The author hopes that the two countries will be reconciled as soon as possible)

📊Comment Analysis

1-hour chart: The rising channel breaks down, and short-term shorting is at 3442.

💰Strategy Package

Today's US market plans to sell high and buy low in the 3408-3452 range. If the range breaks, follow the trend, strictly lighten the position and set a good stop loss.

⭐️ Note: I hope traders can properly manage their funds

- Choose the number of lots that matches your funds

I hope everyone will set rules, control emotions, and take a long-term view, and slowly get rid of the control of desire, be at ease in the trading market, find their own way to make money, and truly enjoy the fun and rewards brought by trading.

Analysis of gold trend on June 16!

📣Gold information:

Gold prices (XAU/USD) climbed to $3,445 in early Asian trading on Monday, the highest level in more than a month, as rising tensions in the Middle East and expectations of a rate cut by the Federal Reserve boosted demand for safe-haven assets.

Investors remain focused on geopolitical risks despite stronger-than-expected U.S. economic data on Friday. The University of Michigan's consumer confidence index jumped to 60.5 in June, well above market expectations of 53.5 and 52.2 in May. However, the market largely shrugged off the data. Instead, attention turned to the escalating conflict in the Middle East, with Israel's recent attack on Iran fueling concerns about instability in the wider region. In response, Iranian authorities warned that they would "respond firmly to any adventurism," which boosted gold's appeal amid global uncertainty.

⭐️Technical review and analysis: For the current short-term operation of gold, it is recommended to rebound high and go long, with the upward resistance level of 3450-3500 and the downward support level of 3385-3335.

⭐️Set gold price:

🔥Sell gold area: 3465-3475 SL 3485

TP1: $3450

TP2: $3430

🔥Buy gold area: $3390-$3388 SL $3383

TP1: $3400

TP2: $3422

Is this week a chance for gold to break through 3,500?

⭐️Gold Information:

Gold prices surged for the third consecutive trading day on Friday as geopolitical tensions intensified after Israel launched a military strike on Iranian targets, including nuclear facilities and key leaders. The escalation of the situation triggered widespread risk aversion in global markets, stimulating demand for safe-haven assets. As of the time of writing, XAU/USD was trading at $3,431.

Gold surged to a five-week high of $3,446 before giving up gains as traders took profits before the weekend. Geopolitical turmoil, coupled with dovish signals released by recent US inflation data, reinforced expectations that the Federal Reserve may begin to cut interest rates later this year - despite improved consumer confidence. These factors together support the bullish momentum of gold.

⭐️Personal Comment:

Continued military tensions next week are a big driving force for gold prices to continue to break through 3,500

. 🔥 Technical aspects:

Based on the resistance and support levels of gold prices in the H4 framework, the following important key areas can be identified:

Resistance: $3488, $3502, $3562

Support: $3382, $3342