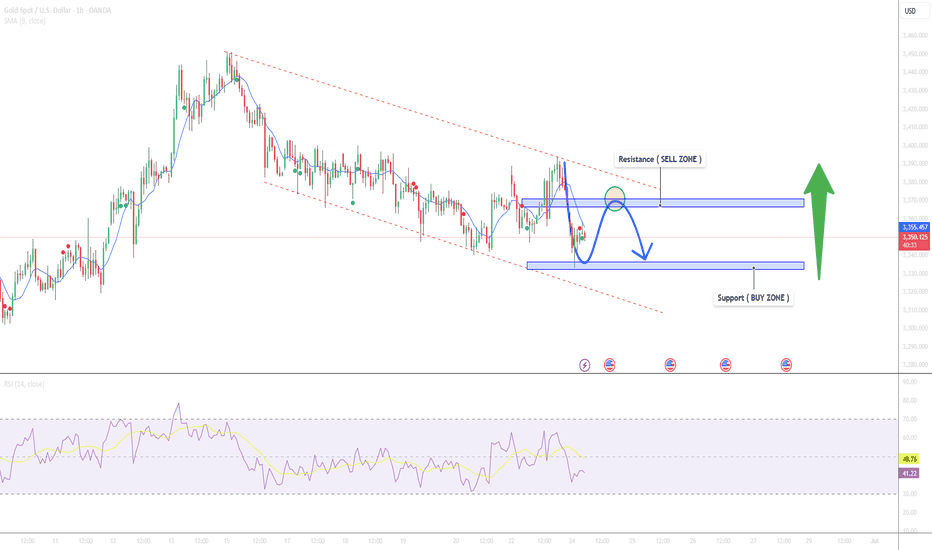

Gold Pulls Back to 3332 Before Mild Rebound📊 Market Overview:

This morning, gold dropped sharply to $3,332/oz, marking the lowest level in recent sessions, due to profit-taking after the early-week rally and a slight recovery in the USD.

However, dip-buying interest returned near key support, pushing the price back up to around $3,350/oz.

The market remains sensitive to Middle East geopolitical headlines and comments from Fed officials scheduled throughout the week.

📉 Technical Analysis:

• Resistance: $3,360 – $3,370

• Support: $3,332 – $3,340 (tested this morning)

• EMA 09: Price is currently below EMA09 ($3,355) → short-term trend remains slightly bearish

• Momentum / Volume / Candlesticks:

o H1 candle shows a bullish hammer formation at $3,332 → signal of potential short-term rebound.

o RSI recovered from oversold (<30) to ~42 → mildly positive signal.

o StochRSI indicates short-term buying pressure, but a break above $3,355 is needed to confirm a reversal.

📌 Outlook:

Gold may see a mild recovery toward the $3,360–3,370 area if buying interest holds near the $3,330 support. However, failure to break above $3,370 could lead to a pullback during the US session.

💡 Suggested Trading Plan:

🔻 SELL XAU/USD at: $3,365–3,370

🎯 TP: $3,345 (~20)

❌ SL: $3,375

🔺 BUY XAU/USD at: $3,332–3,340

🎯 TP: $3,355 (~20)

❌ SL: $3,325

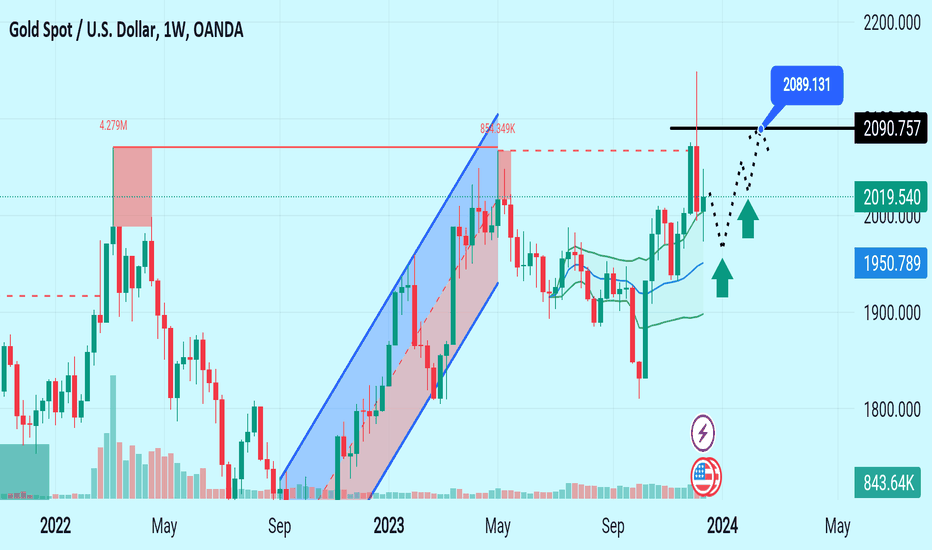

Goldllong

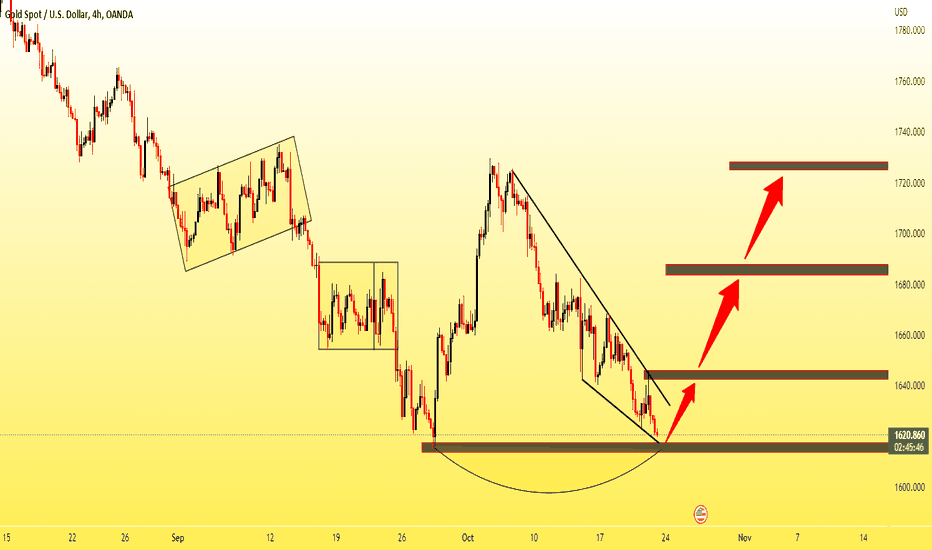

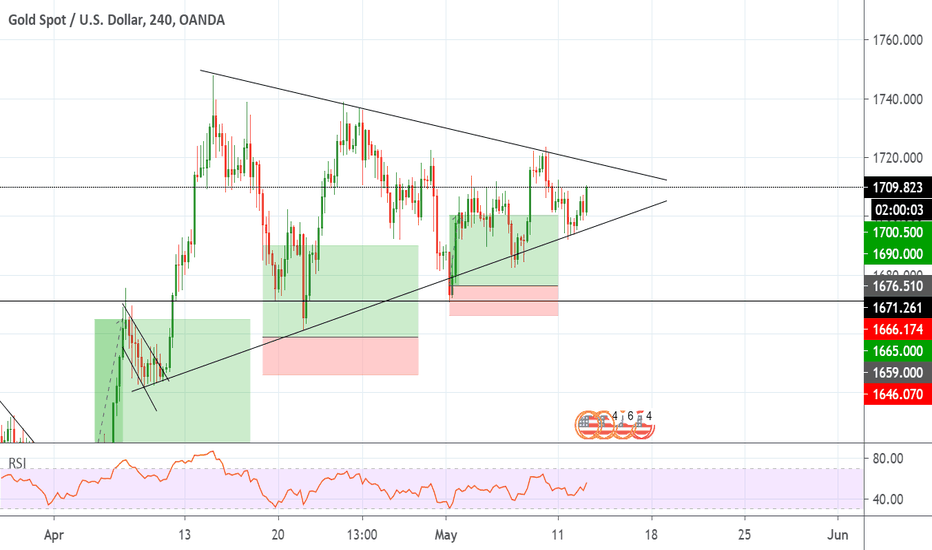

Gold Potential Rising Wedge/Pennant - $1800 or $1660 next move?As we can see, from this Gold chart we have a clear ascending Wedge/Pennant pattern. What is the next move for Gold?

Using the past few weeks of data and news from the FED my personal Bias is LONG on XAUUSD. I believe that Gold will break to the upside out of this pattern and hit $1800 before this pandemic is over. I am adding positions to Gold (as you can see by the chart) and I will continue to do so. However, we must consider the risk of a downside move in light of the FED bailing out the stock market in the form of buying Corporate & Junk Bonds, this money will be directly invested back into the stock market to stabilise it (which in my opinion will be short term) but we must consider this for Gold downside risk, Gold has been uptrending for quite some time and is due a break, however, this does not change my Bias.

Please follow at your own risk and also add comments as to what you currently think on Gold.