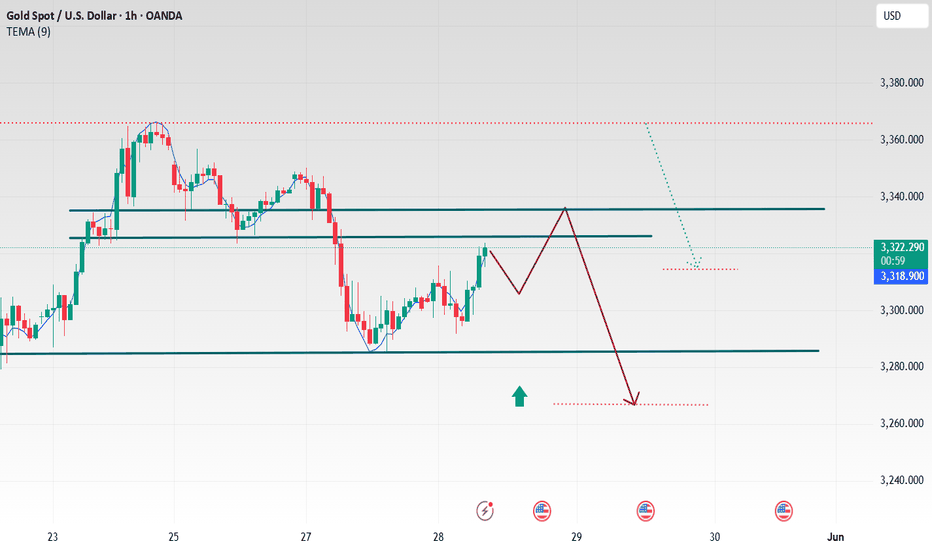

Gold is under pressure and bearish outlook remains unchanged

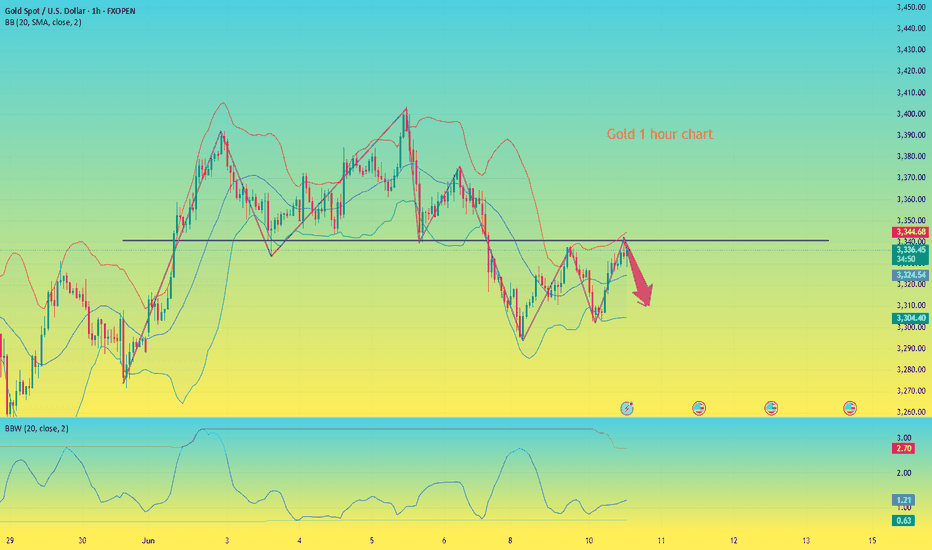

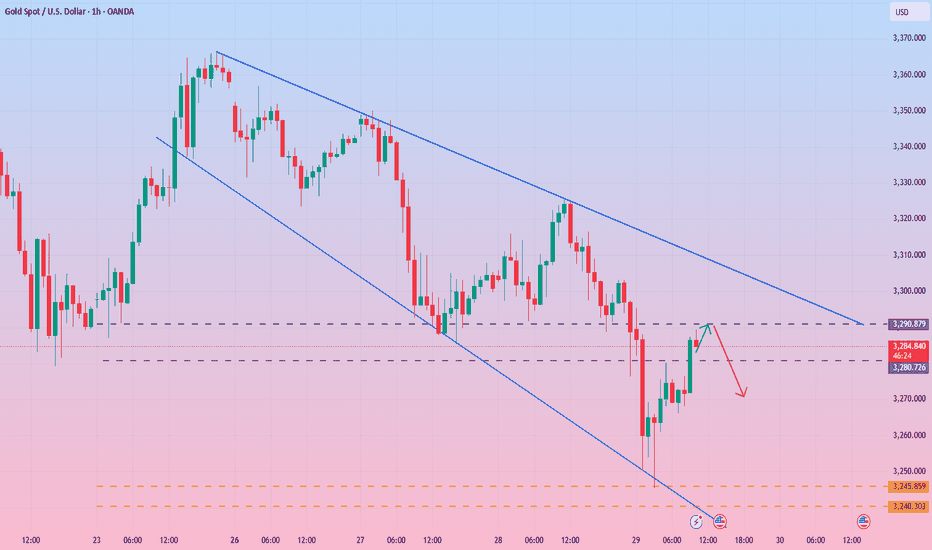

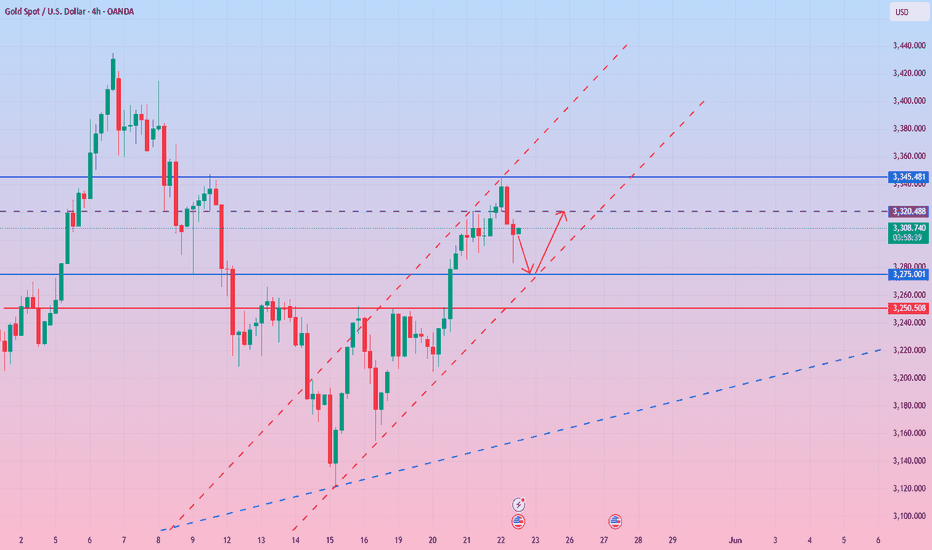

Gold has been rebounding during the day, but the strength of the rebound has weakened significantly. Although the one-hour trend broke through the upper pressure of 3340, it did not stand on 3340. The one-hour trend closed with a negative line, which means that the short-term rebound has come to an end. For this, we will continue to maintain a bearish view.

The pressure level of the one-hour market is at 3340. Before the gold price stands firm at 3340, it means that the rebound is an opportunity for us to short. The idea of our analysis just now is correct. Our internal strategy is also short at 3335. At present, the market has begun to fall back. Our positions are profitable. The target below will gradually look to around 3270, and our defense only needs to bring a little break loss.

Specific strategy

Gold 3335 short, stop loss 3345, target 3310

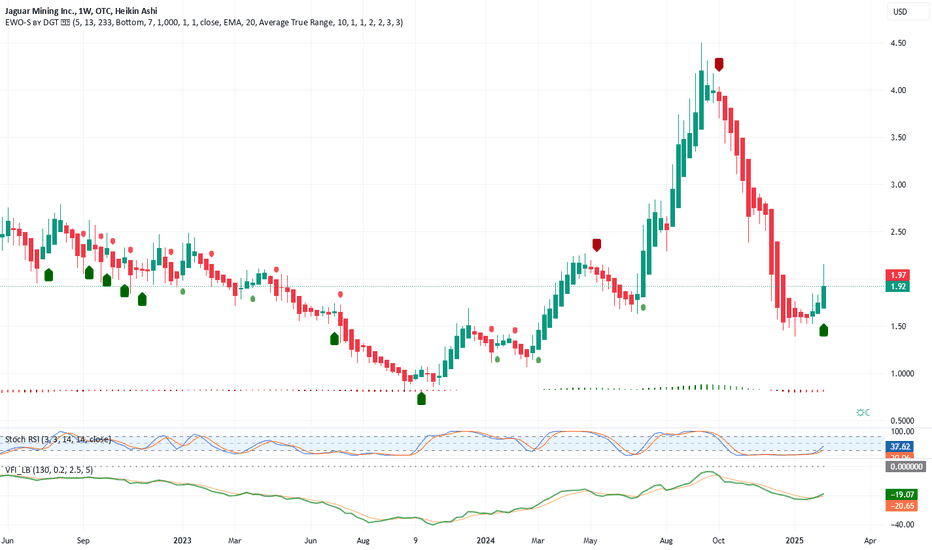

Goldminers

How will gold perform in the future?Market news:

In the early Asian session on Monday (June 9), spot gold opened high and fell, currently trading around $3,305/ounce. The large-scale riots in Los Angeles, the United States, attracted some safe-haven buying to support the London gold price. The stronger-than-expected US employment report hit the Federal Reserve's hopes of cutting interest rates this year, and silver once surged to its highest level since 2012. Data from the US Department of Labor showed that employers added 139,000 jobs in May, less than 147,000 in April, but more than the 130,000 increase predicted by a survey of economists. After the data was released, the financial market bet that the Federal Reserve would not cut interest rates until September, and the probability of a rate cut in September dropped from 88% to 60%. There will be two rate cuts in 2025, reducing bets on a possible third rate cut.In the next week, the market will usher in major trade negotiations and heavyweight US CPI data, which investors need to pay close attention to. In addition, US federal law enforcement officers continued to search for illegal immigrants in many places in Los Angeles County on the 7th, and had serious conflicts with local community residents for the second consecutive day. Investors also need to pay attention to the impact of market sentiment.

Technical Review:

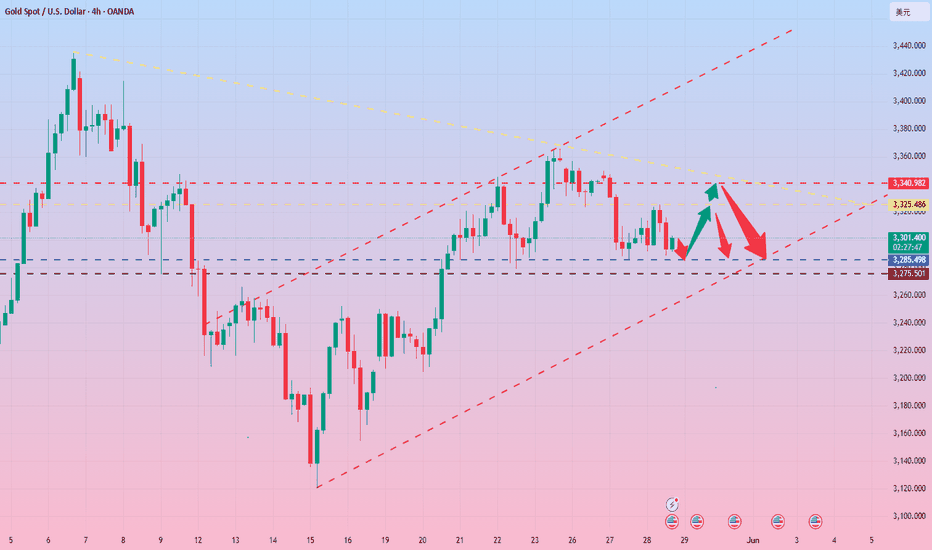

Technically, gold plunged sharply after midnight on Friday, and the weekly line closed with a long upper shadow line and a small positive. The 3400 mark encountered resistance and fell sharply and fell into another adjustment cycle. The daily line closed with a continuous negative structure, and the New York closing price once again lost the MA10-day moving average of 3330. The price returned to the middle track of the Bollinger band at 3310, and the RSI indicator's central axis 50 value flattened! The short-term four-hour chart MA10/7-day moving average opened downward, the RSI indicator's central axis 50 value ran below, and the Bollinger band opened downward and the price ran along the middle and lower tracks. At the beginning of the week, trading focused on the rebound strength after the oversold. The main idea was to sell at a high price on the rebound, and to buy at a low price as an auxiliary.

Today's analysis:

At the daily level, the price of gold has maintained a volatile pattern in recent times. The Bollinger band opening narrowed, indicating that the buying and selling forces were stalemate. MACD fast and slow lines are above the zero axis, the spacing is narrowing and there is a golden cross trend, the red kinetic energy column is beginning to appear, the buying power is slowly gathering, the RSI indicator is around 55, and the buying and selling game is fierce! From the hourly line, the Bollinger Bands open downward, and selling is temporarily dominant.MACD dead cross operation, the green kinetic energy column continues to increase, the 5-day moving average crosses the 10-day moving average, and the short-term downward trend is obvious. However, the current support near 3300 is strong, and it rebounded after multiple dips. In the future, we need to pay attention to the breakthrough of key positions to grasp the trading opportunity.

Operation ideas:

Short-term gold 3283-3286 buy, stop loss 3275, target 3310-3330;

Short-term gold 3330-3333 sell, stop loss 3342, target 3290-3270;

Key points:

First support level: 3293, second support level: 3271, third support level: 3253

First resistance level: 3330, second resistance level: 3356, third resistance level: 3378

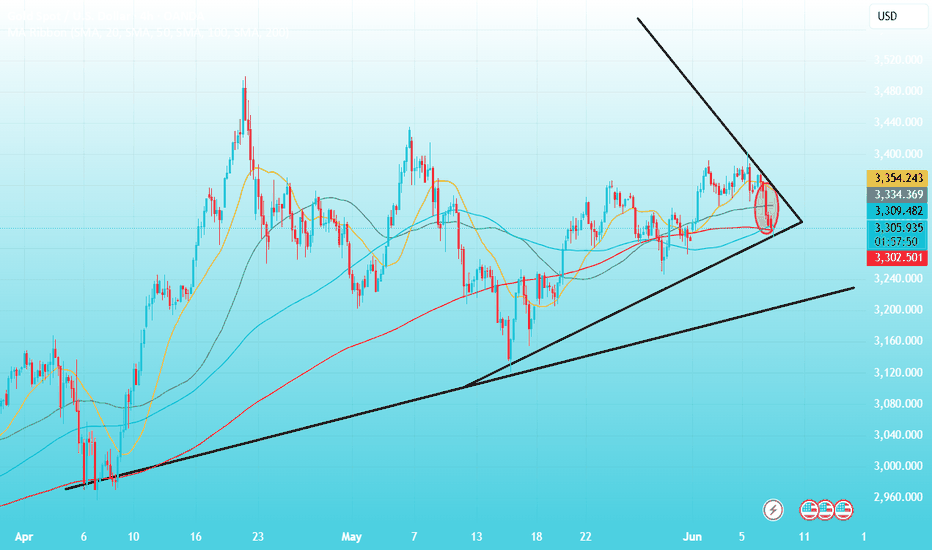

Ivanhoe Mines - a 50% discount opportunity !The share price of this mining monster has suffered a 50% price decline in the last 6 months.

One of the main reasons for the share price decline is the suspension of underground operations at the Kakula mine due to seismic activity. This suspension has led to a withdrawal of production and cost guidance for 2025, causing investor uncertainty and a subsequent drop in share price 1,2,3 Additionally, the company has faced challenges with its smelter, including a fire that damaged onsite generators and caused a three-month delay in commissioning. These issues, combined with power constraints and grid instability in the Democratic Republic of Congo (DRC), have contributed to a more conservative production outlook.

However there are lots of positive catalysts for Ivanhoe Mines: the upcoming rise in precious metal prices, especially the wake up of the severely undervalued PLATINUM prices.

Platreef PGM project in South Africa contains 7 million ounces of gold (0.25 gpt) and 50 million ounces of AuEq. About 90% of annual production (1 million ounces) will consist of PGMs (platinum group metals), making it the largest PGM mine in the world ! Platreef is expected to have low all-in production costs, though more precise figures will become available after the ramp-up phase, scheduled for the second half of 2025.

Platreef PGM, Kakula-Kamoa (massive copper mine, the largest high grade mine globally) and Kipushi (a high-grade zinc operation); With all three of their mines expected to be in production, 2025 could be a pivotal year for them.

Chart wise, the price is still rising in a long term rising wedge. Price just found support on the lower resistance and is bouncing strongly. OBV on balance volume is still on a steady rise. I own Ivanhoe Mines since I got in at sub 1$ (thanks to Rick Rule's reccomandation - God may bless him). and I am not willing to let go before we reach 50$, which is my long term target.

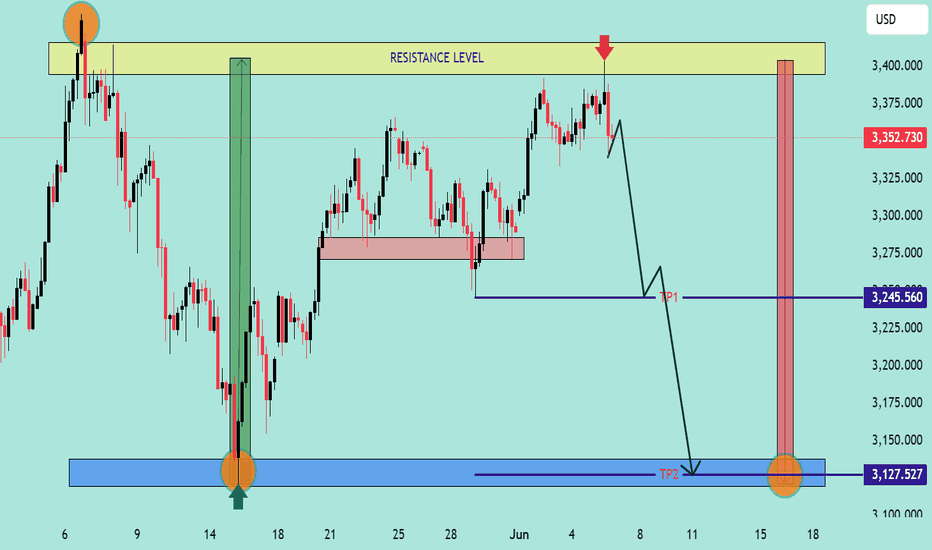

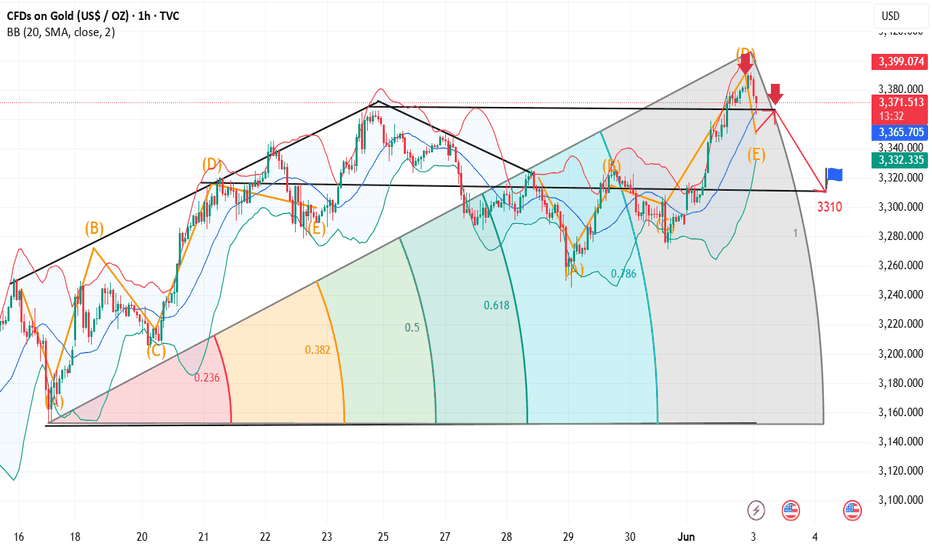

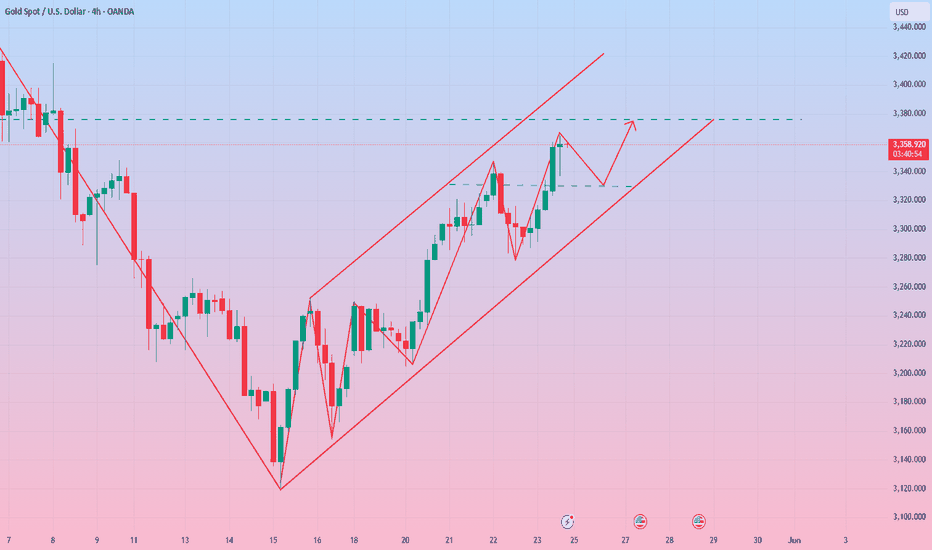

Gold is getting ready for another uptrend!Market news:

In the early Asian session on Friday (June 6), spot gold fluctuated slightly higher and is currently trading near the 3360 mark. London gold prices rose and fell on Thursday. Earlier in the session, silver broke through the $35 mark, hitting a 13-year high, driving the international gold price to break through the 3400 mark, hitting a nearly four-week high of around $3403/ounce, but then due to the signal of easing trade tensions released by the leaders of China and the United States!At the same time, data showed that the number of initial jobless claims in the United States increased for the second consecutive week. Now all eyes turn to Friday's non-farm payrolls report. Trump again called on Federal Reserve Chairman Jerome Powell to cut interest rates on Wednesday. And the easing of trade tensions directly affected the performance of safe-haven assets. The decline in gold prices reflects the market's optimistic expectations for the progress of Sino-US trade negotiations, weakening the attractiveness of gold as a safe-haven asset!The market is closely watching the upcoming non-farm payrolls data and the Fed's meeting resolution on June 17-18 to judge the short-term direction of gold prices. On the whole, international gold still has long-term investment value under the current global economic and geopolitical uncertainties. In the short term, it may fluctuate in a relatively high range, waiting for more guidance from economic data and policy signals.

Technical Review:

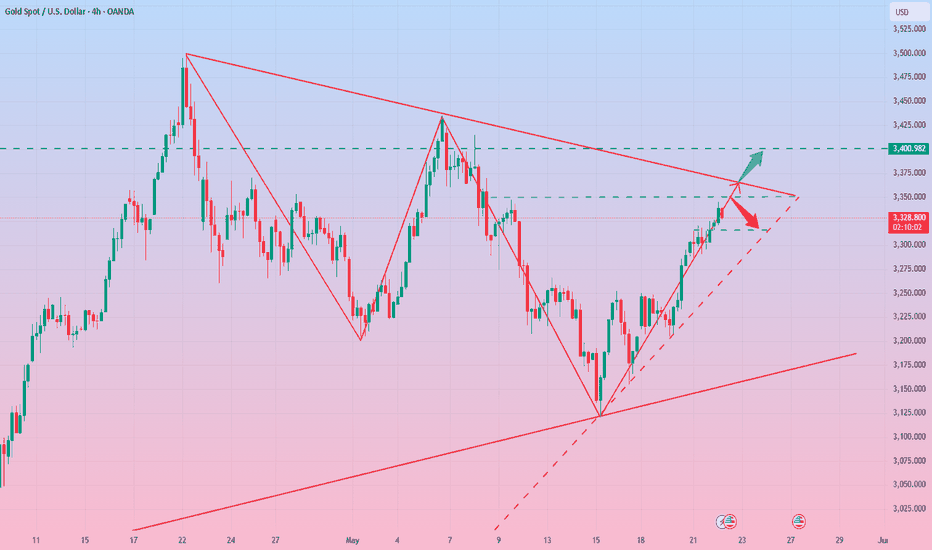

Gold closed alternately in the first four trading days of this week. Yesterday, gold rose sharply in the Asian and European sessions, and fell back in the US session. The roller coaster at the end of the session gave up all the gains during the day and fell below the 3350 mark to touch the 3339 line. The daily line pattern turned from a big positive to a big negative K and closed above 3350. Technically, the daily chart has alternated between positive and negative for four consecutive trading days. The US session fell sharply and tested the MA7-day moving average, but the price is still running above the MA10/7-day moving average. The Bollinger band of the short-term four-hour chart closed, the RSI indicator's middle axis flattened, and the hourly chart's four-hour moving average was glued. The technical side of gold intraday trading is arranged with a shock idea, and the intraday range refers to the 3328/3388 layout. Fundamentals today focus on the non-agricultural data released at 20:30 in the evening. The previous value was 177,000, and the market estimated value was only 130,000. According to the estimated value, it is bullish for gold and silver.

Today's analysis:

This year, it has been emphasized that 2025 is a strong year for gold. Gold may enter an accelerated buying structure this year. Tariff trade policies, geopolitical tensions, the Federal Reserve's interest rate decision, the decline in confidence in US bonds, and the increase in global central bank purchases have affected gold as a strong hedging tool. There will be room for growth. Therefore, as long as the overall environment remains unchanged, gold is still an absolute buying trend. Therefore, no matter how it is adjusted, it is an opportunity to buy into the warehouse. This week, gold remained in the range of 3332-3392 for the first three days. During this period, we sold at a high price and bought at a low price, which was also considered to have completed the expectations. Then, on Thursday and Friday, gold will remain in this range and look up. If the rise breaks through and stabilizes at 3400, the upper side will look at 3500. If it breaks through 3330, the lower side will look at 3280. Look for fluctuations before non-agricultural data, and then look at the impact of non-agricultural data.

Operation ideas:

Short-term gold 3340-3360 buy, stop loss 3330, target 3380-3400;

Short-term gold 3387-3390 short, stop loss 3400, target 3350-3330;

Key points:

First support level: 3342, second support level: 3328, third support level: 3303

First resistance level: 3376, second resistance level: 3388, third resistance level: 3410

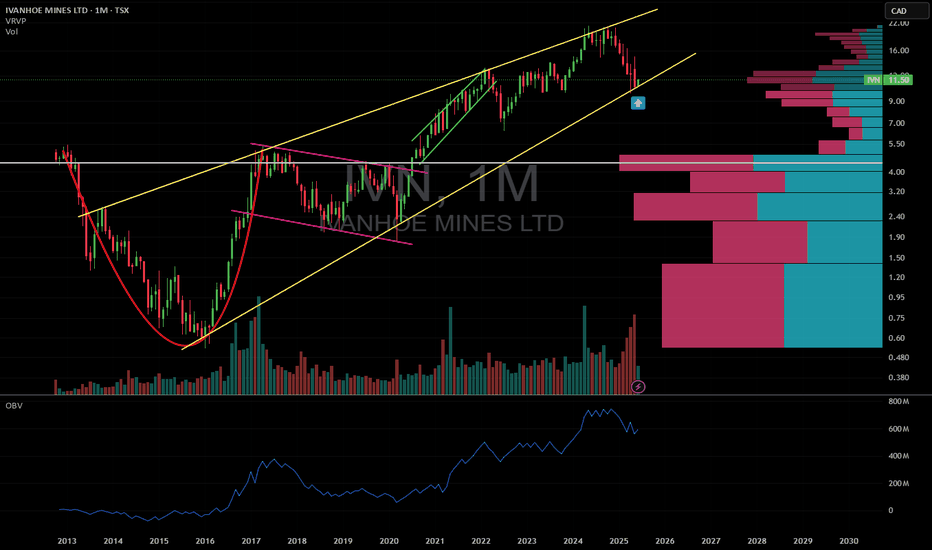

XAUUSD – Bearish Outlook from Resistance Zone📊 XAUUSD – Bearish Outlook from Resistance Zone

🕒 Date: June 5, 2025

💰 Instrument: Gold (XAUUSD)

📍 Current Price: 3,352.730 USD

🟨 Key Resistance Level

🔴 Price has sharply reacted from the 3,375–3,400 USD zone, highlighted as a strong resistance area.

📉 This zone has previously triggered significant sell-offs, confirmed again by the current bearish rejection (red arrow 🔻).

📉 Bearish Market Structure

The price structure suggests a classic lower high rejection scenario with potential for further downside:

🔻 Immediate Drop Expected

After rejection from resistance, the price shows early signs of breakdown. A minor pullback is expected before continuation.

🧭 TP1 – First Target Zone:

📍 3,245.560 USD

This level aligns with a previous demand area (light red box), likely to act as temporary support or reaction point.

🎯 TP2 – Final Bearish Target:

📍 3,127.527 USD

This blue demand zone is a major support level, previously a strong rally base (green arrow 🟢). Expect buyers to step in here again.

🔄 Trade Idea Summary

💼 Setup Type: Resistance Rejection

🛑 Bias: Bearish

📍 Entry Zone: ~3,350–3,360 USD (confirmed rejection)

🎯 Take Profit 1: 3,245.560 USD

🎯 Take Profit 2: 3,127.527 USD

🔒 Stop Loss: Above 3,400 USD (outside resistance zone)

📌 Observations:

🔁 The market repeated its previous pattern: bouncing from the blue demand zone and rejecting at the yellow resistance zone.

🧱 A solid breakdown below TP1 could accelerate movement toward TP2.

🔍 Watch for any bullish reaction around TP2 for potential reversal setups.

📉 Bias: Bearish

📆 Outlook: Short-term to mid-term swing

Can gold prices continue to rebound?Market news:

Spot gold rose slightly in early Asian trading on Thursday (June 5), currently trading around $3,382/oz. Supported by a weaker dollar and weaker U.S. data, investors are struggling to cope with growing economic and political uncertainty. Against the backdrop of rising risk aversion demand and weak economic data, gold prices rose slightly. At the same time, tensions between major powers, progress in EU-U.S. trade negotiations, and rising market expectations for a Fed rate cut have further ignited enthusiasm in the gold market, and the possibility of London gold prices rising above the 3,400 mark has increased.

The job market is sluggish, some industries are laying off employees, and wage growth is offset by the cost of living. Inflationary pressures continue, and companies plan to raise prices to pass on tariff costs. The Fed said the economic outlook is unclear and it will continue to monitor data to adjust its policies. As a safe-haven asset in times of political and economic uncertainty, gold tends to perform strongly in a low-interest rate environment.

Investors are closely watching the U.S. non-farm payrolls report to be released on Friday, June 6, for clues to the Fed's next move. In addition, we also need to pay attention to the ECB interest rate decision and the changes in the number of initial jobless claims in the United States on this trading day. The market expects the ECB to cut interest rates by 25 basis points. In the medium and long term, it tends to support the international gold price. In addition, continue to pay attention to the international trade situation and speeches by Fed officials.

Technical Review:

Gold successfully bottomed out yesterday, with the lowest point of the day at 3344, which is not much different from the point of 3345 that we disclosed in the morning. The market point is basically in place. The small non-agricultural positives in the evening helped the gold price to rise further. The high point of gold is gradually approaching the pressure level of 3392. In the short term, the gold price is expected to break through the pressure and continue the upward trend!

The technical side of gold maintains the bullish low-multiple thinking. The daily chart price extends the MA5/10/7-day moving average high point upward, and the RSI indicator is hooked upward above the middle axis. The short-term four-hour chart and hourly chart moving average open upward, the Bollinger band opens upward, and the price is running on the upper and middle track of the Bollinger band. The main idea is to buy at a low price and sell at a high price.

Today's analysis:

Recently, the market, tariff trade policies, and geopolitical tensions have been affecting the strength of the US dollar and gold. Although it seems that gold is fluctuating upward for the time being and has not gone out of the space for a unilateral surge, it can be seen from this week's slow rise that gold is still an absolute buying trend. Therefore, no matter how it adjusts, falls back, or fluctuates, it is an opportunity to buy into the warehouse.

How to plan for the future market? I believe everyone has a clear direction in mind. Buying is very strong, just go with the trend. The important thing is the point. The low point below is moving up, which means that if the gold price drops again, the low point will not fall below 3344. Yesterday, the gold Asian and European sessions were in a volatile adjustment trend. After the release of the US session data, the gold price rose from 3350 to the current price of 3385 and then fell back. In terms of short-term operations, since the high point of the Asian session broke, it is still recommended to buy at a low price and focus on bullish operations.

Operation ideas:

Short-term gold 3350-3360 buy, stop loss 3340, target 3380-3400;

Short-term gold 3397-3400 short, stop loss 3408, target 3360-3340;

Key points:

First support level: 3363, second support level: 3350, third support level: 3333

First resistance level: 3388, second resistance level: 3396, third resistance level: 341

XAU/USD) Technical analysis Read The captionSMC trading point update

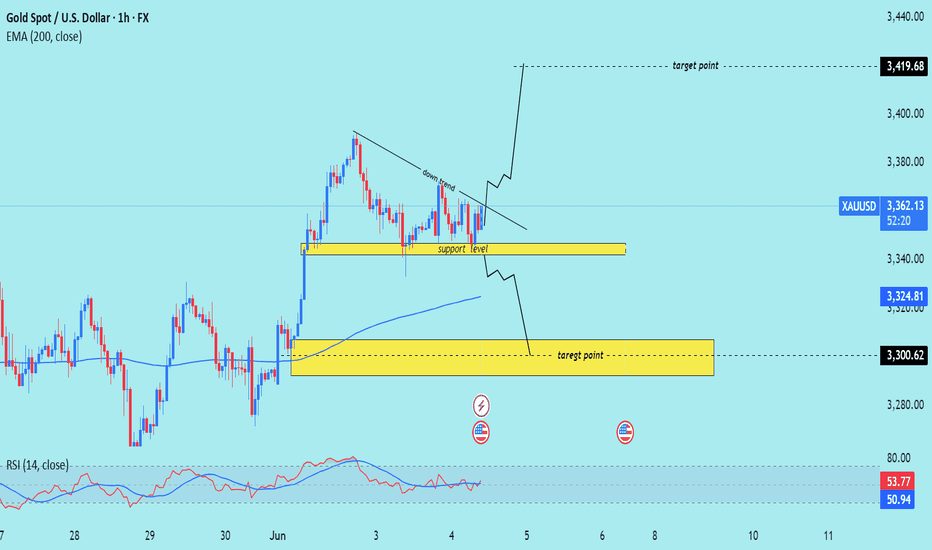

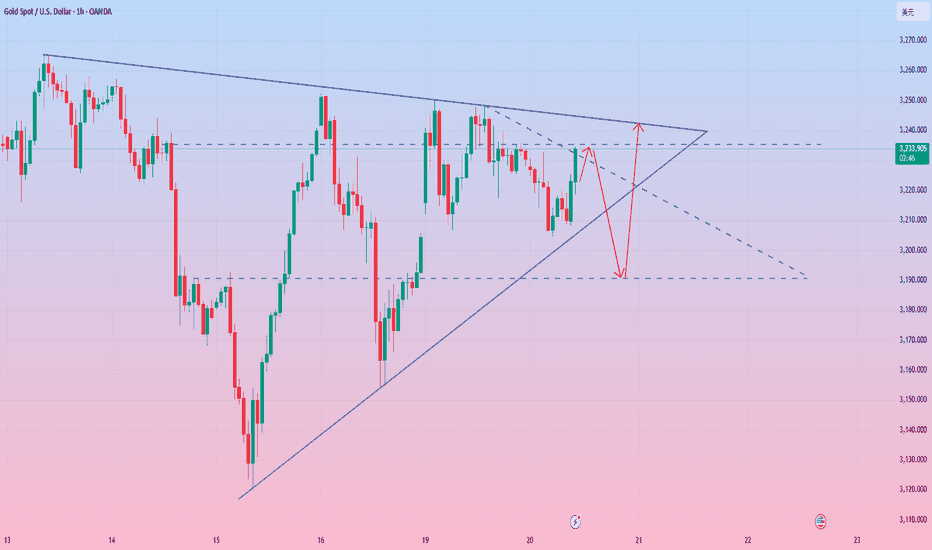

Technical analysis of Gold (XAUUSD) on the 1-hour timeframe. Here's a breakdown of the key ideas in the analysis:

---

Chart Elements:

Support Level (Yellow Zone at ~3,340–3,350):

This area has been highlighted as a key support zone where price has bounced previously.

Price is currently hovering just above this level.

Downtrend Line:

A descending trendline is drawn, indicating a short-term bearish trend.

A breakout above this line could trigger bullish momentum.

Two Scenarios Outlined:

Bullish Scenario:

If price breaks the downtrend and holds above support, it may rally towards the upper target point at 3,419.68.

Bearish Scenario:

If price breaks below the support, the next target point is marked lower around 3,300.62, a previous consolidation area and close to the 200 EMA (blue line).

200 EMA (~3,324.72):

Acts as dynamic support. If price moves below it, bearish sentiment may increase.

RSI (Relative Strength Index):

RSI is neutral (~50.54), not showing overbought or oversold signals, leaving room for movement in either direction.

---

Key Takeaways:

Neutral-Biased Setup: The price is consolidating between a clear support level and downtrend resistance.

Confirmation Needed: A breakout from either direction is necessary to confirm the next move.

Bullish Breakout: May lead to a retest of highs at 3,419.68.

Bearish Breakdown: Could push the price toward 3,300.62, aligned with past support and the 200 EMA.

Mr SMC Trading point

---

Trading Ideas (based on this analysis):

Long Entry: On breakout above the downtrend line + confirmation above 3,360.

Short Entry: On breakdown below 3,340 with strong volume.

Stop-Loss: Just outside the consolidation zone depending on trade direction.

Risk Management: Be cautious around economic news (calendar icons shown suggest upcoming events).

Please support boost this analysis )

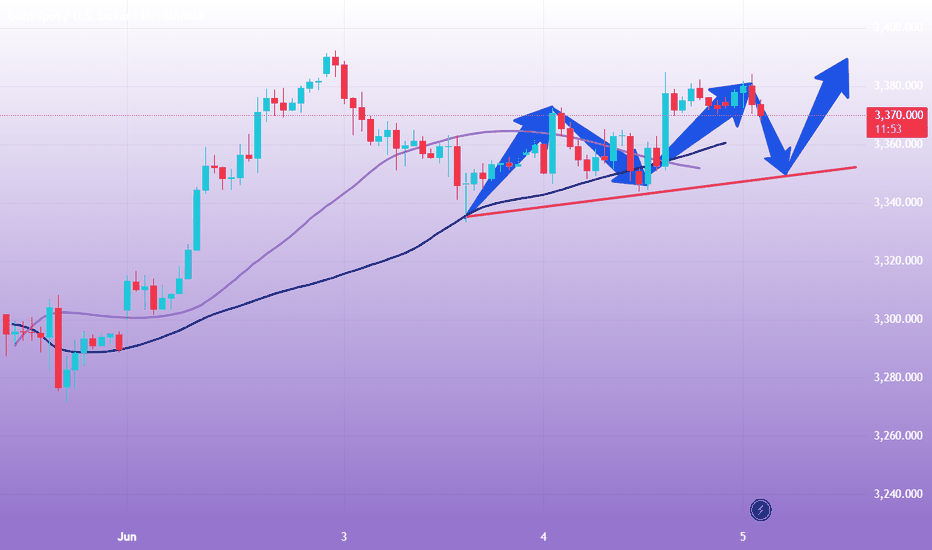

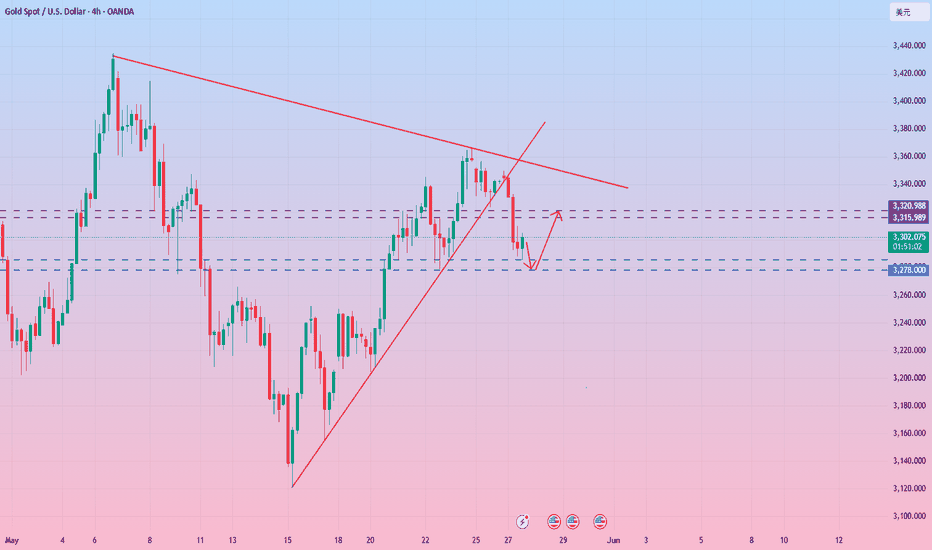

If the direction is unclear, don’t panic, respond flexibly!Gold has been showing a daily yin-yang alternating pattern since last Wednesday, but the overall rising rhythm has not been broken. The MA5-day moving average and the MA10-day moving average formed a golden cross and continued to extend upward. The arrangement of this moving average system provides a certain support momentum for the gold price. During the day, we need to focus on the support effect of the moving average. The current 5-day moving average is near 3340, and the 10-day moving average is near 3325. These two positions constitute an important support area for the short-term gold price correction. In terms of upper resistance, first pay attention to yesterday's high of 3392. If the gold price can break through this resistance level, it means that the upward momentum is strong, and it is expected to continue to be strong to 3400-3420, further opening up the upward space.

From the 4-hour chart, as long as the short-term gold market is above 3330, then gold is still in a strong bullish trend. On the contrary, if it falls below the closing line near 3330, then it is a broken trend line, and the subsequent market is likely to form a weak shock pattern again, so the current operation is actually very simple. As long as the 3330 position is not broken, you can rely on 3330 to enter the market and do more. Focus on the support near yesterday's low of 3333 below, and focus on the resistance near 3375-3380 above.

Gold operation suggestions: It is recommended to short gold near 3365-3375, with a target of 3350. Go long gold when it falls back to 3335-3345, with a target of 3360-3370.

The secret behind the surge in gold prices

💡Message Strategy

(June 2) Gold prices soared nearly 3% as U.S. President Trump's tariff threats intensified trade tensions, stimulating investors' demand for safe-haven assets, and the U.S. dollar plummeted.

The dollar index fell nearly 0.8% on Monday. The sharp drop in the dollar makes dollar-denominated gold cheaper for holders of other currencies.

US President Trump said last Friday that from June 4, the tariff on US imported steel and aluminum will be raised from the current 25% to 50%. British Reuters said that this has once again disrupted international trade.

A spokesman for the European Commission expressed strong regret over the US announcement that it would increase tariffs and said that the EU is ready to implement countermeasures. The Canadian industry also expressed strong opposition, emphasizing that disrupting the cross-border supply chain of steel and aluminum will cause huge losses to both Canada and the United States.

📊Technical aspects

On the daily chart, gold rebounded from a two-week low and hit a four-week high this week, with a strong short-term trend.

For gold's lower support, focus on the breakout position of $3,350 in the U.S. session on Monday, which is also near the high point of gold last week, and the low point of $3,345 after the gold price rose in the European session on Monday;

For gold's upper pressure, focus on the integer position of $3,400 and the upper track of the daily Bollinger band near $3,410. For further strength, focus on the high of gold in May at $3,438.

The 5-day moving average and the MACD indicator re-formed a golden cross, and the KDJ and RSI indicators formed a golden cross downward. The short-term technical aspect shows that after the adjustment of gold, the bears began to gain an advantage.

💰 Strategy Package

Short Position:3385-3375,3395-3410

Gold's rebound is weak and the bearish trend is dominant.The 1-hour gold chart shows that the Bollinger Bands open downward, and the gold price is running near the lower track, with a weak short-term trend. If it fails to rebound effectively and break through the 3290 line, the support below will focus on the 3240-3230 area. Overall, the gold price fluctuates downward, the moving average system is in a short position, and the downward pressure is further revealed. It is currently recommended to continue to maintain a high-altitude thinking and focus on short-selling opportunities after the rebound.

In the short-term operation of gold during the day, rebound short-selling is the main focus. Pay attention to the pressure level of the 3290-3280 area above, and the support level of the 3240-3230 area below. In terms of operation strategy, it is recommended to arrange short orders when the gold price rebounds to the 3280-3290 range. This is a key pressure area, and it is necessary to pay attention to the market reaction in this range.

The golden range strategy continues to workGold bottomed out and rebounded as expected today. Friends who follow me should be able to clearly feel that I have been insisting on analyzing the trend of "bottoming out and rebounding" recently. Today, gold opened at 3300, and rebounded after the lowest price fell to around 3291. So far, the highest price has reached 3325. Overall, the support below gold is still strong, but the suppression above cannot be ignored. Therefore, the market performance yesterday and today was relatively stable, with small fluctuations as the main trend.

In terms of operation ideas, continue to pay attention to the support level of 3290-3295. If it falls back and does not break, maintain a bullish mindset. At present, the long orders in the 3290-3295 range have been notified to enter the market as planned, and are currently in the profit stage. If you encounter difficulties in the current gold market operation, I hope my analysis can help you. Welcome to communicate at any time.

From the 4-hour cycle chart, the support below gold is around 3290-3295, and the pressure above is concentrated in the 3330-3340 range. In the short term, the watershed between long and short is around 3275-3283. Before the daily level effectively falls below the watershed, it is still in a long-short shock pattern, maintaining the main theme of "high-altitude and low-multiple" cycle participation.

Gold operation strategy: If gold falls back to the 3290-3295 line, you can try to go long. If it further falls back to the 3280-3285 line, you can consider covering long orders, and the target is around 3316-3320.

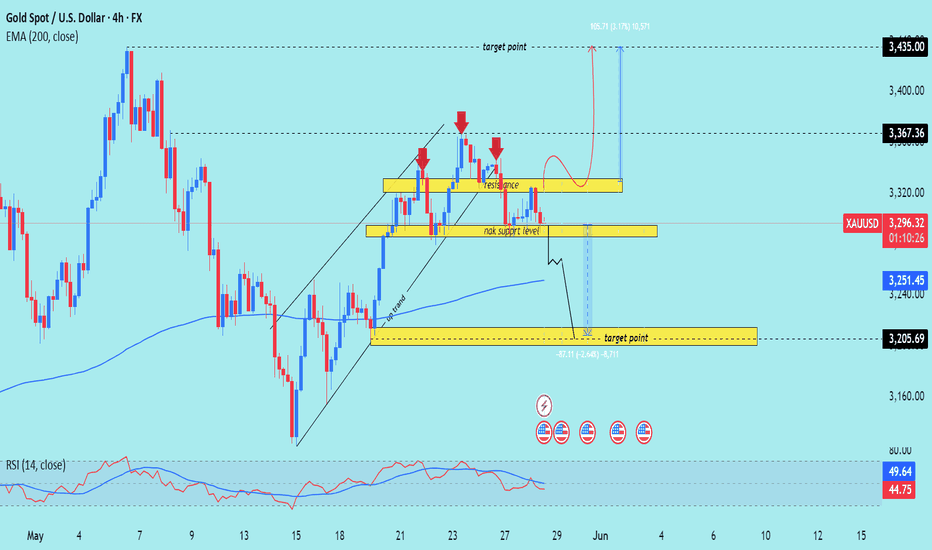

XAU/USD) 3 top technical analysis Read The ChaptianSMC trading point update

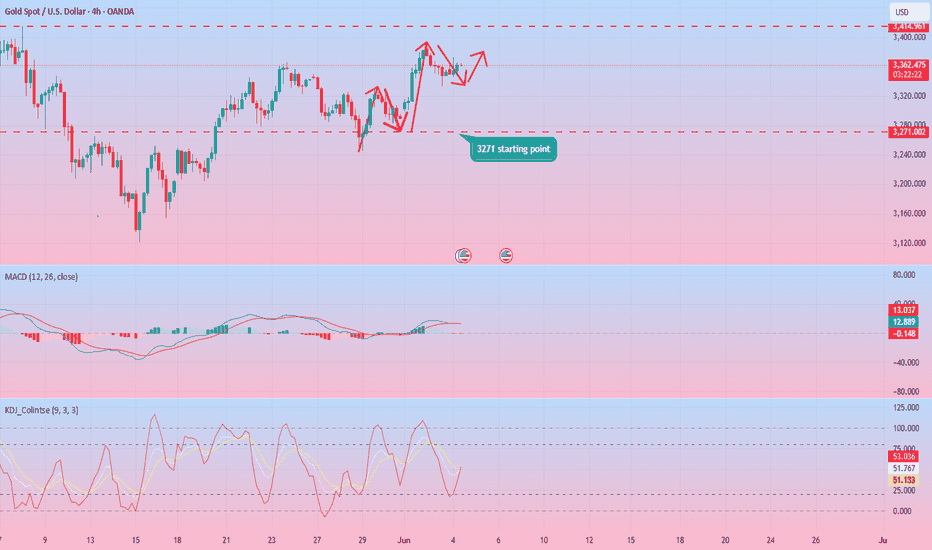

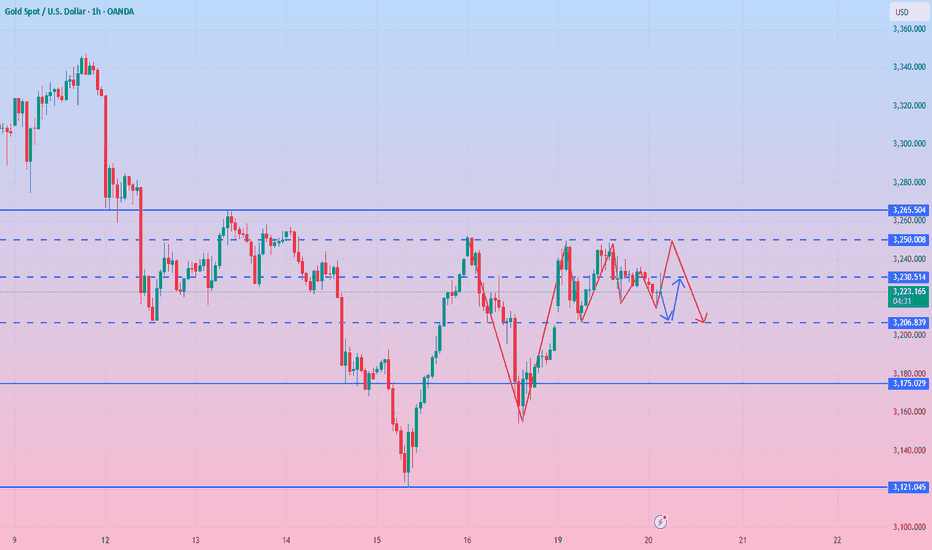

Technical analysis (XAU/USD) on a 4-hour timeframe, with key elements and potential price scenarios illustrated. Here's a breakdown of the idea behind this analysis:

---

1. Key Levels and Zones

Resistance Zone (~3,320–3,330):

Marked with red arrows indicating multiple rejections.

A crucial supply zone that the price failed to break several times.

Support Zone (~3,280–3,290):

Labeled as “nak support level” (likely means "neckline" support in a possible head-and-shoulders structure or just a key level).

Important for bullish structure continuation.

Lower Target Zone (~3,205):

A demand zone if the support fails.

Labeled as another “target point” indicating a bearish projection.

---

2. Trend Context

The price was in an upward channel (highlighted as "up trend"), which has now been broken.

EMA 200 (~3,251) is acting as a dynamic support.

---

3. Potential Scenarios

Bullish Scenario (Red/Blue Arrows Up):

If the price holds the “nak support level” and breaks back above resistance (~3,320):

A bullish move toward 3,367 and even 3,435 is expected.

The blue arrow shows a projected upside target of ~105 points.

Bearish Scenario (Black Arrow Down):

If the price breaks below the neckline/support and EMA 200:

A drop toward the 3,205 area is anticipated.

Target aligns with previous structure lows and a clean demand zone.

---

4. RSI Indicator (Bottom Panel)

RSI is hovering around neutral (~45–50), offering no strong momentum bias.

Could support either a bounce or a breakdown, depending on upcoming moves.

Mr SMC Trading point

---

Conclusion / Idea Summary

This chart presents a conditional trade setup:

Above 3,320: Long toward 3,367–3,435.

Below 3,280–3,250 (and EMA 200): Short toward 3,205.

The market is currently at a decision point, and traders should wait for confirmation (breakout or breakdown) before entering a trade.

Pales support boost 🚀 analysis follow)

Gold fluctuates repeatedly, and the opportunity has come

Gold hit 3325 in the European session, and fell under pressure in the US session. It can be seen that the market still has no continuity, and the recent volatility is narrowing compared to the previous period. The whole month of May was a wide range of roller coaster fluctuations.

The oscillating market is to operate at the point of card. Wait for a one-sided trend and then follow the trend. Short-term US market rebounds to 3315 to short, and use the intraday high as defense. The 1H cycle support below 3280/3290 is long in batches, and other positions are not involved.

How to seize this golden short-term opportunity!Yesterday, gold continued to fall from its highs, and the short-term trend was in line with our expectations. The lowest price of gold yesterday hit around 3285, which was also the long area given in yesterday's analysis. In addition, the secondary layout of long orders in yesterday's analysis brought us good returns.

At present, gold is in a rebound stage as a whole. Although the momentum and amplitude of the rebound have not increased significantly, this trend has shown signs of a gradual recovery in the market. In terms of short-term operations, it is recommended to follow the trend and wait for the price to fall back before choosing an opportunity to go long. Yesterday, the gold price fell again to around the 3285 mark and received effective support. Today, we still need to focus on the support performance of this area.

From the perspective of the 4-hour cycle, today's gold price relies on this area as a short-term strength and weakness dividing line for long and short layout. The lower support focuses on the 3275-3283 range, and the upper pressure is around 3316-3320. The short-term key watershed is around 3275-3280. As long as the daily level does not effectively fall below this area, the overall judgment of the long and short shock range is still maintained. In terms of operation, the "high-altitude and low-multiple" rotation idea will continue to be the main focus. If the market situation or rhythm changes, the strategy will be adjusted in time according to the actual market situation and will be notified separately.

Gold operation strategy reference:

1. If gold falls back to the 3275-3285 area, you can consider placing long orders, with the target at 3316-3320.

2. If gold rebounds to the 3316-3321 area, you can try to short with a light position, with the target at 3288-3290.

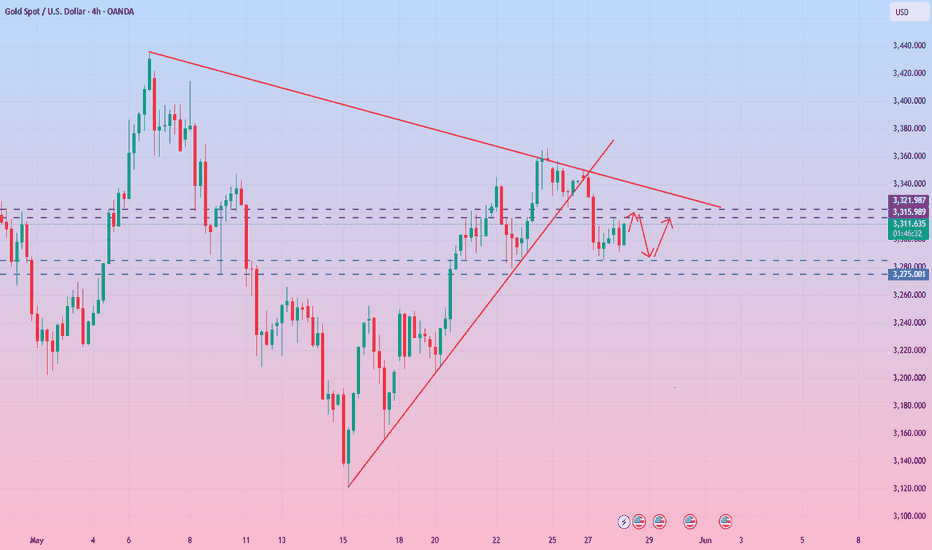

Gold is about to reach the shorting zone

The tariff policy against Europe and Apple was temporarily shelved last Friday due to the decline in the credibility of the Trump administration, which failed to push gold prices up this week. Instead, gold prices continue to fluctuate within the downward channel. Currently, the focus is on the resistance level of $3,325-3,335, and shorting can be attempted near this level.

Pay close attention to whether the support level of $3,280 and the resistance level of $3,365 are broken.

3278-3320 key position is mainly high sell low buyAt present, gold rebounded after falling back to 3287, and fluctuated around 3300 in the short term. Pay attention to the support area of 3278-3283 below. If it does not break this area, you can still try to go long in the short term. After all, from a technical point of view, the decline during the day is a correction and adjustment to the previous rise.

From the 4-hour chart, the upper short-term focus is on the suppression of the 3316-3320 area, and the lower focus is on the support of 3278-3283. In terms of operation ideas, continue to maintain the interval strategy of "high-altitude and low-multiple", rely on key positions to sell high and buy low, and wait patiently for effective signals before entering the market. If the structure or rhythm of the market changes, the strategy will be adjusted in time and notified separately.

Jaguar Mining starting to ExplodeA brief pause in the gold run may be a good time to pick up some of these cheap miners I'm coming across. For those less risk tolerant (is that possible in the mining sector?), AEM , GDX, WPM and others are breaking to new highs. I see WPM at 75 within the next year or two and big moves from NEM from current levels. If you have nothing in gold/silver/miners sector, a 5% spec position in your portfolio will add to your 2025 gains!

XAUUSD[GOLD]: 1 Hour View Show Extreme Seller Volume Gold in a shorter time frame shows extreme bearish volume kicking in the market, where bulls are failing to push prices higher. Additionally, if you’re someone who analyses patterns, a HEAD AND SHOULDERS pattern has also formed. There are three targets you can aim for.

We extend our best wishes and good luck in your trading endeavours. Your unwavering support is greatly appreciated.

If you’d like to contribute, here are a few ways you can assist us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_🚀❤️

Buying on pullbacks remains the main theme!Tariff turmoil resurfaces, gold price jumps!

The Trump administration once again wields the tariff stick, threatening to impose a 50% tariff on the EU from June 1, and saying that there has been no progress in the negotiations between the US and the EU. Because the timing of this threat is quite subtle. Just earlier this week, the EU just submitted a new framework proposal to the US to restart bilateral trade negotiations. This directly led to a jump in gold price tonight!

Faced with the tough stance of the US, the EU is not sitting still. It is reported that the EU has formulated a contingency plan. If the negotiations fail, it will impose additional tariffs on US exports worth 95 billion euros in response to Trump's "reciprocal" taxation and 25% tariffs on cars and some parts, which will inevitably cause further impact on the market!

The bulls are in control and are unwilling to give the bears too many opportunities to cover their losses. Therefore, the strategy of following the trend needs to be more active - strong markets usually do not experience a deep retracement, and the correction phase will not break the previous low for the second time. After the current gold price surged to 3365, the intraday bull defense position should be set at 3340. The previous low of 3320 has been effectively supported, and the bulls have taken the absolute initiative, and there will be no short-selling opportunities in the short term. Based on the current strong bullish performance, continuing to maintain a bullish mindset is the core of the transaction.

Operation strategy:

1. Gold recommends going long in the 3340-3330 area, with a target of 3350-3360.

2. Gold recommends going short in the 3365-3375 area, with a target of 3350-3340.

Seize the opportunity in the gold marketGold fell after reaching a high point during the day, reaching a high of 3345 before going out of the big drop space, and the evening star appeared in the 4H cycle. Combined with the correction of the top divergence of the indicator, the short-term will enter the adjustment stage. Pay attention to the middle track support around 3280-75 in the future market. If it does not break, you can consider going long. Pay attention to the upper pressure of 3320 and 3335. Keep the idea of shock in operation!

Operation suggestion: Go long on gold around 3280-3275, and look at 3300 and 3320. Go short if the rebound pressure of 3320 is not broken.

The unilateral offensive is fierce: the bulls have clear goalsGold is performing strongly sideways. We are in the same rhythm as yesterday and continue to maintain bullishness. Gold broke through the key resistance of 3280 on Tuesday and then rose strongly. It is currently above the area near 3330. The technical side shows that the bullish trend continues. The next target may point to the high of 3400. After rising continuously on Monday and Tuesday, it slightly adjusted back to around 3285 on Wednesday and stabilized before rising again. The daily line closed positive and stood firmly on the middle track. The Bollinger band opened upward, and the upper track pressure was at 3400, suggesting that the medium-term upward space is open. The Bollinger band opened significantly, the moving average was arranged in a bullish pattern, and the upward momentum was strong. Short-term support focuses on the moving average at 3315. If the correction does not break this position, the trend long order can follow up. If the key resistance of 3350 is effectively broken, it will further open up the upward space.

Gold operation suggestions: continue to go long after stepping back to 3320-3315, with a target of 3350. If it rises to around 3350 without breaking, you can arrange short-term short orders, with a target of 3330.

Rebound firmly short-sellingThe US dollar index continued to fall yesterday, breaking through the 100 integer mark, but the gold price did not break through the key resistance level. In the short term, we need to be alert to the risk of gold price correction. In addition, the three major US stock indexes have continued to rise recently, but the market risk appetite has decreased. We need to be alert to the market panic and liquidity tightening that may be caused by the stagnation of the US stock market's rise, which will put pressure on the gold market. Technically, the gold price was blocked at the important pressure level of 3250 yesterday, and the support below was at the 3200 mark. In the short term, it is still mainly range-bound. At present, the upper resistance is 3226-3233, and the lower support is 3189-3184. In terms of operation, it is recommended to rebound short and supplemented by callback long.

Operation strategy 1: It is recommended to rebound short at 3228-3235, and the target is 3210-3193.

Operation strategy 2: It is recommended to pull back to 3189-3185 and go long, and the target is 3215-3235.

Gold Trends and Trading StrategiesThe gold market continued to fluctuate yesterday, and the price was repeatedly under pressure at the key position of 3250. At the weekly level, gold prices tried to rebound after bottoming out on Friday, but the upper short-term moving average formed technical suppression, and the daily line closed with a cross star with long upper and lower shadows, and the long-short game was fierce. From a technical perspective, the 4-hour chart shows a descending channel pattern. The price rebounded after testing the lower track of the channel many times, but it has never effectively broken through the 3250 central axis suppression. The hourly chart shows that the market maintains a rhythm of shock correction. The current daily line has two Yins and one Yang, but it has not effectively broken the previous low. It is expected that the bottoming and rebounding mode may continue today. In terms of operation, it is recommended to pay attention to the 3260-3200 range, and rely on the upper and lower edges of the channel to implement a high-altitude low-multiple strategy.

Gold operation suggestions:

1. Short near the rebound of 3247-3252, target 3230-3220.

2. Go long near the retracement of 3206-3215, target 3230-3245.