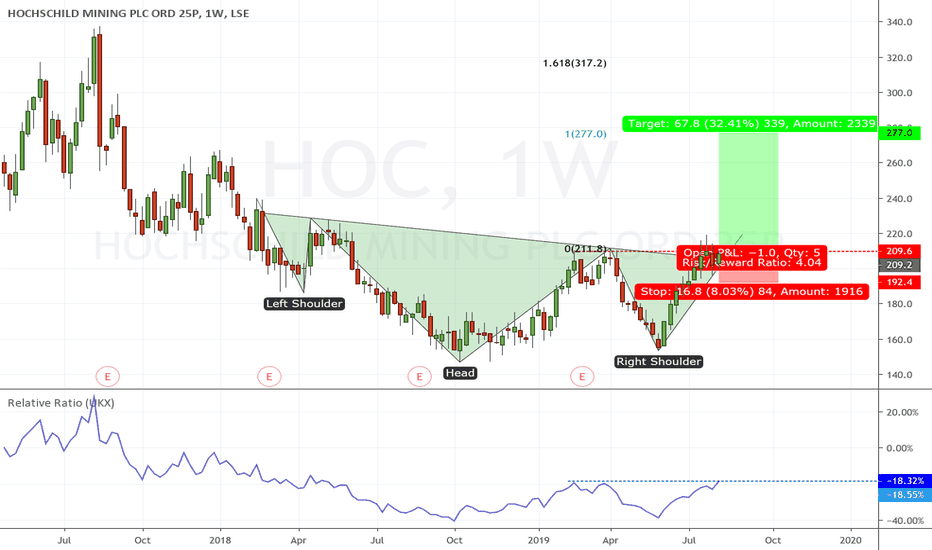

Hochschild Mining - Gold miners in demand amid uncertainty.Technical Analysis

Hochschild Mining was a higher yesterday against a backdrop of red in UK markets. The shares appear to have been in the process of bottoming out over the past few months and have now completed an inverse head and shoulders bottom. This is a powerful reversal pattern and suggest there will be more upside over the medium term.

Fundamentals

Hochschild Mining currently ranks above average in our fundamental model with exceptional scores on value and momentum metrics. The shares have significantly outperformed the market over the past 1 to 3 months and we expect this to continue.

Pros

The company recent produced its 2nd best production performance in its history.

RBC Capital Markets reiterated their ‘Outperform’ rating on the 5th July 2019 with a 260p price target.

Global markets are in decline which could prompt even more demand for safe haven assets like gold.

Cons

The overall market is very volatile. This could impact the performance of all assets in the short term.

Berenberg bank issued a sell rating on the 17th July 2019 with a 165p price target.

Recent market declines have been short lived, if this occurs again investors may seek risker assets.

Entry At Market (208p)

Stop: 192.40p

Target: 277p

Goldminers

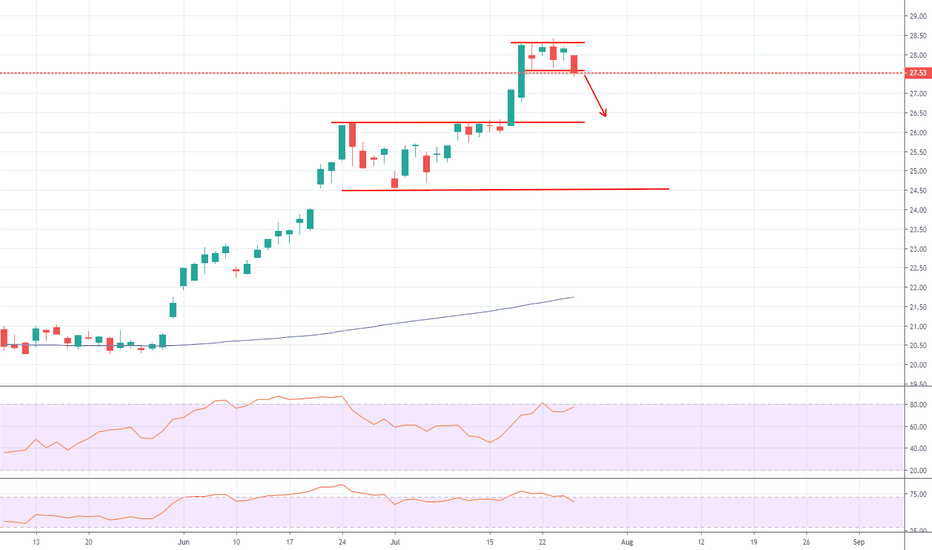

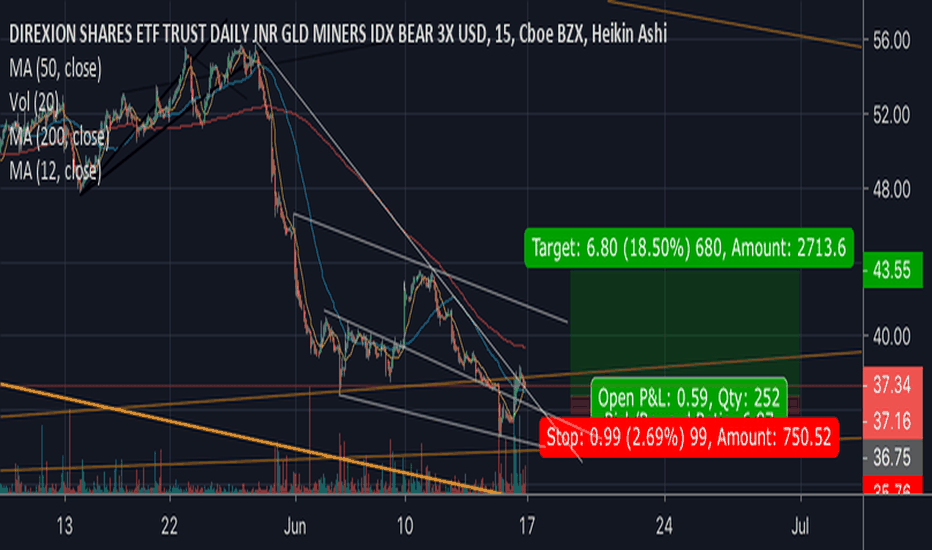

GDX - Possible breakout downwardsGDX broke out of the recent range to the downside. Could be a potential sustained downtrend in the short term.

Entered half position in $DUST so far, however have stop loss tight and waiting for further confirmation of the breakout strength before entering remaining position.

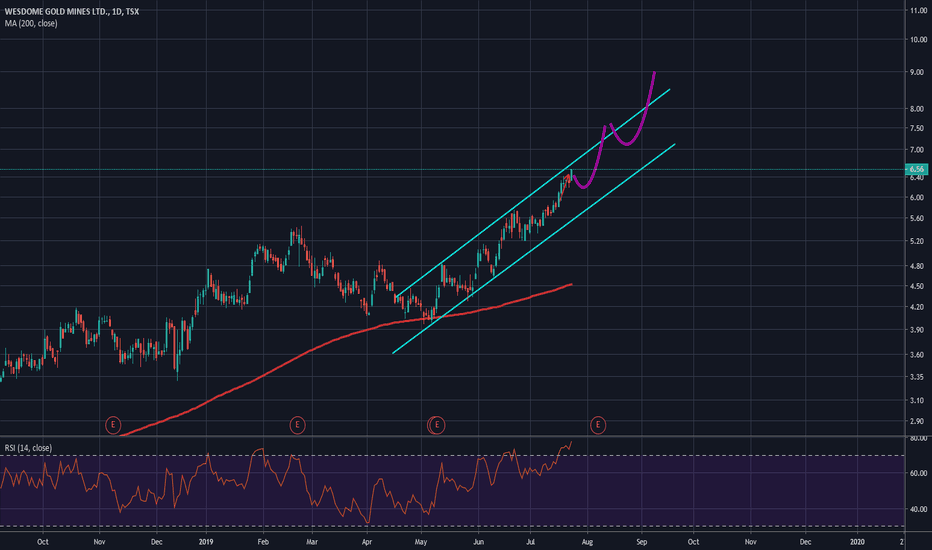

Wesdome Gold MinesIn the precious metals mining industry a large part of equity prices reflect the price of gold and silver. But in this herd of mismanaged elephants and lottery tickets, there exists a few properly managed nuggets that are hidden in the piles of wasted ore.

Wesdome is one of those companies. When the gold market really takes off investors will eventually realize this (many already have), and as hot money rolls into mining companies, outfits like Wesdome can be easily overlooked against the larger cap majors. But eventually the smart money finds the well managed companies.

This is a long-term hold. Much like Kirkland Lake was a couple of years ago. Watch it shine with Gold and expect a healthy return in the medium term. (assuming banksters don't smash gold).

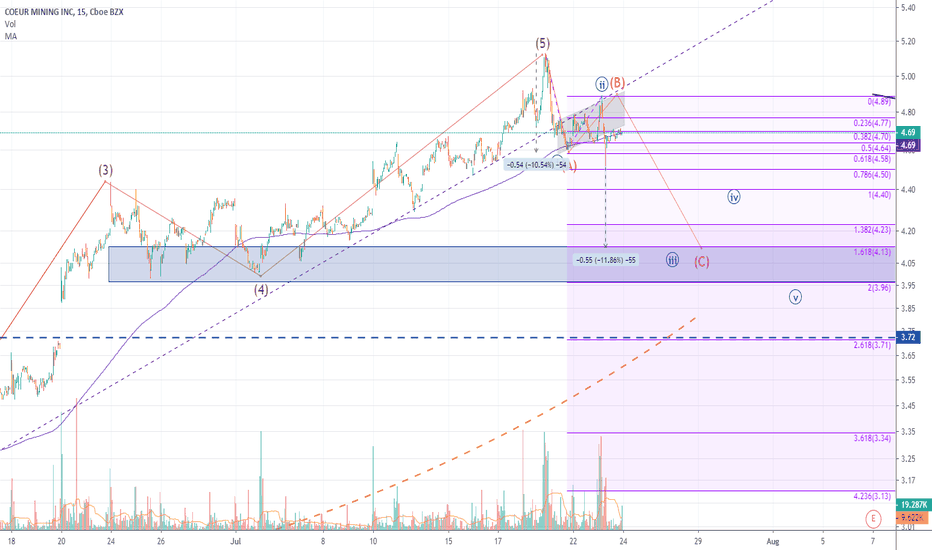

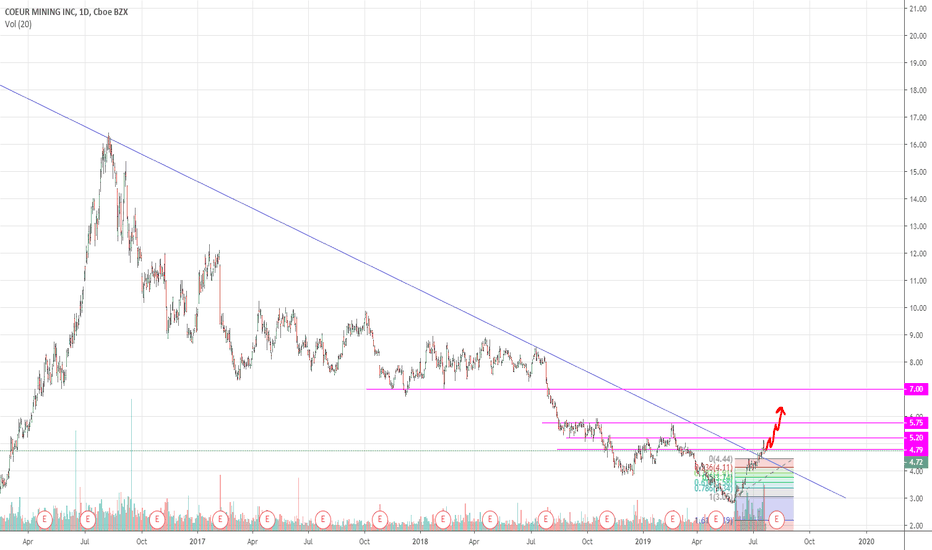

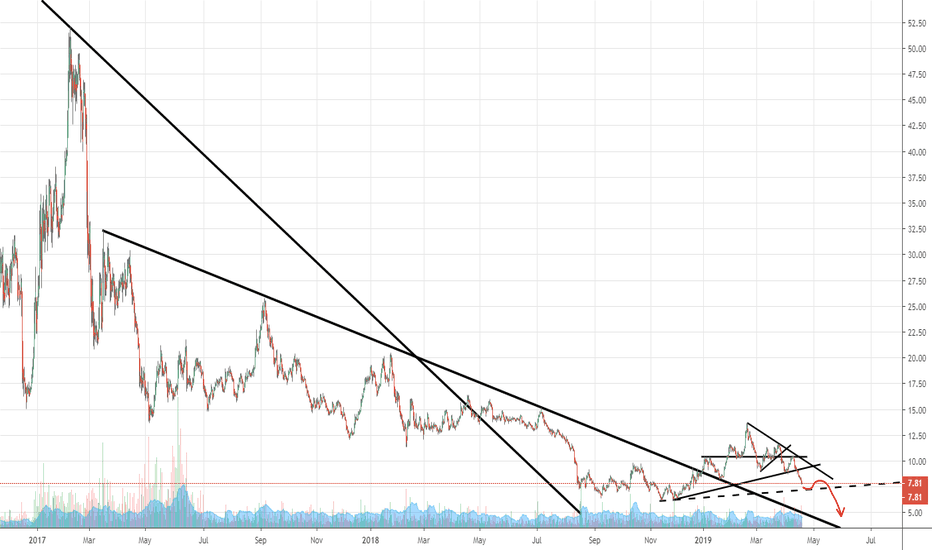

CDE - move to 4$ in playYesterday NYSE:CDE broke through bearish flag and is now targeting region at around 4$, based on the symmetry and current chart structure. There it should find strong support, for the move higher.

Potrential trade: Sell short @ 4.60-4.70 region

Target: 4-4.15

S top-loss: 4.90

Risk/reward: 2 to 1 or 3 to 1 based on the entries, which is reasonable.

LONG CDE - Company just broke out of a 8 year down trendCDE is a great buy here as the stock has broken out of a 8 year down trend starting in 2011. CDE has lagged other silver miners slightly during these recent silver breakout ().

They are optimizing recovery and costs at current claims and have a great deal of exploration and potential for new claims in the works. They have suffered from aggressive short selling as of late - see: fintel.io , but this should just fuel a spike in the stock as Silver moves to its next resistance point of $17.30. Technically resistance at $5.20, then $5.75.

Gold Analysis, via Daily ChartGold recently broke out of February's bullish flag pattern and broke pass that area of supply that is now demand (1350's area). Price is now floating in the Weekly Resistance area of 1428.30 and is creating an ascending broadening wedge pattern. There is also bearish divergence on the RSI indicator. These confluences are letting me know that this pair wants to reject resistance and push down, possibly to an area of demand.

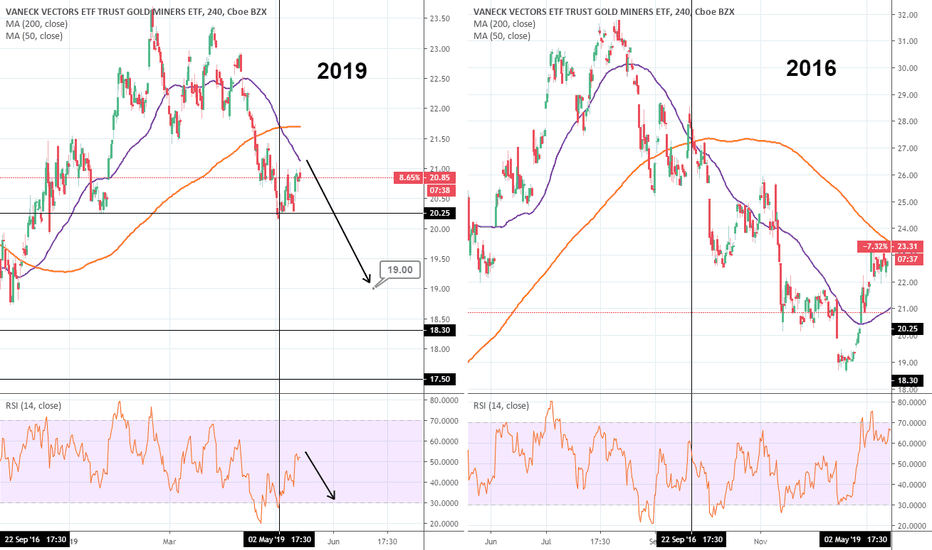

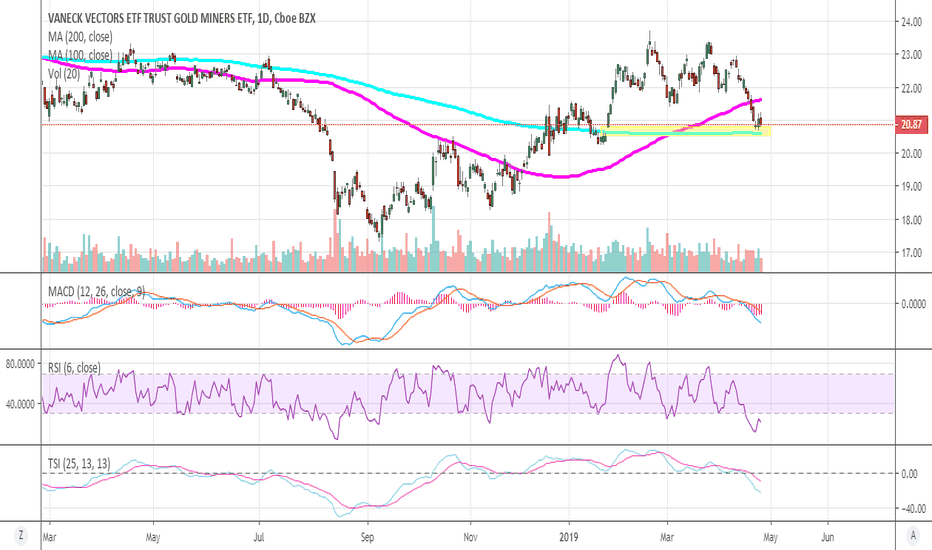

Vaneck Vectors ETF: Medium term sell opportunity.GDX has printed a Death Cross (MA50 crossing below the MA200) on a similar trading pattern as in 2016. The RSI price sequence is also identical, indicating that at least one more bearish sequence is due. With MACD turning at -0.277, it is an optimal opportunity to short. Our TP is 19.00.

** If you like our free content follow our profile (tradingview.sweetlogin.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

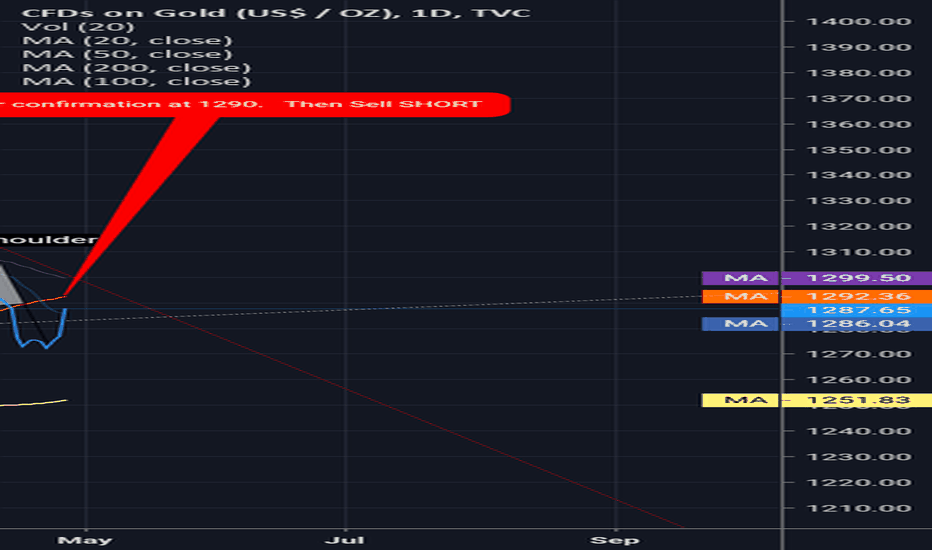

Head, Shoulders, Knees, and Toes. With confirmation We experienced heavy selling pressure on gold today once the head and shoulders pattern was confirmed at 1292 neckline .

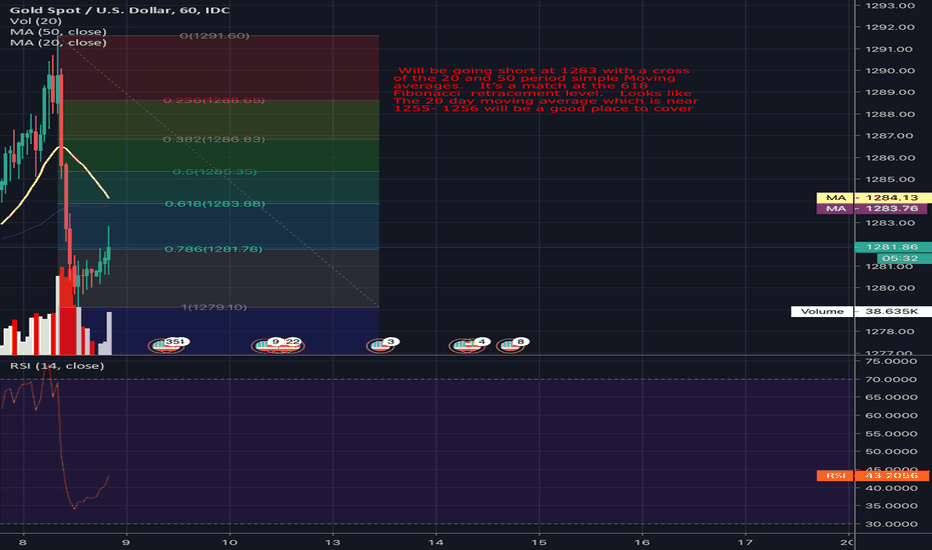

Will be going short at 1283 with a cross of the 20 and 50 period simple Moving averages. It’s also a match at the 618 Fibonacci retracement level. Looks like The 20 day moving average which is near 1255- 1256 will be a good place to cover

Gold Related: Strong Sell Head and shoulders reversal pattern formation complete on gold . Wait for confirmation with bounce off the 1290 neckline.

Suggest using a short position on futures options or mining etfs (JNUG, JDST) watch gold closely and cover to stop loss should price rise above the pattern's neckline.

Watch for breach of trendlines as indicated in chart to invalidate the trade.

Price Target 1: 200 day moving average currently at $1251

Price Target 2: $1215 as i dicated by measuring destance from top of head to the neckline.

FOREXCOM:XAUUSD

TVC:GOLD

AMEX:JNUG

AMEX:JDST

AMEX:DUST

AMEX:NUGT

AMEX:GDXJ

AMEX:GDX

AMEX:GLD

GDX - Metals Trading | Elliott Wave Structures I Q2 2019*If you like this idea please support it with a like so I can publish more. Thanks!

More details about me in my signature.

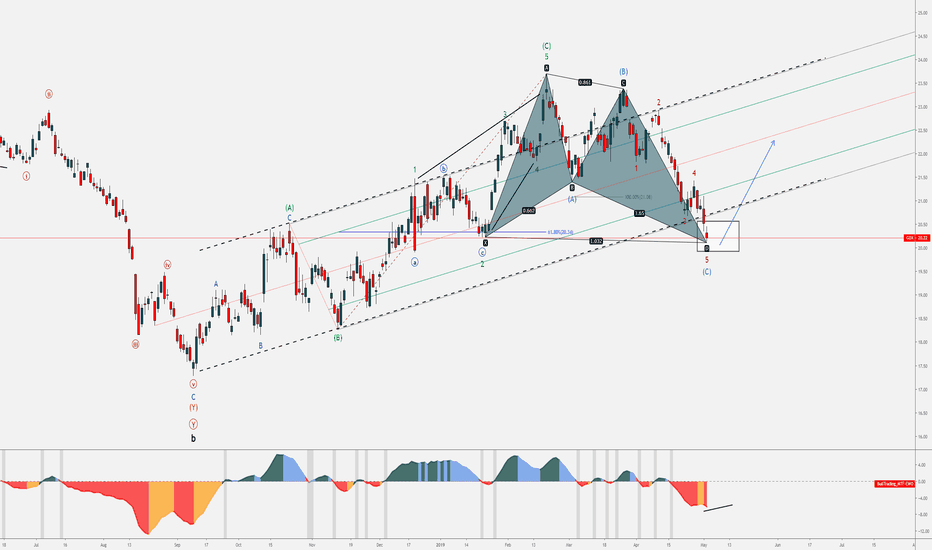

GDX - Elliott Wave Outlook

Bullish Swings - Patterns:

ABC swing in Intermediate (A) (green

Simple Correction in Intermediate (B) (green)

Ending Diagonal in Intermediate (C) (green)

Bearish Swings - Patterns

Sharp Bearish Impulse in Intermediate (A) (light blue)

Simple Correction in Intermediate (B) (light blue)

Ending Diagonal in Intermediate (C) (light blue)

Bullish Harmonic Pattern

Next expected swing:

Bullish leg in an attempt to reenter the Channel.

Structure change:

A breach on the down-side in an impulsive manner could lead towards a down-trend confirmation for Precious Metals.

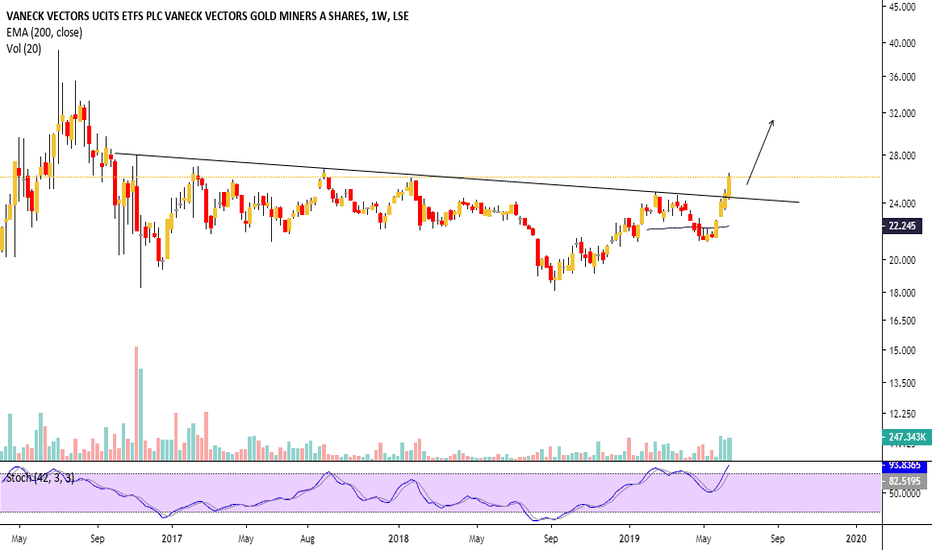

GDX -Waiting for a buy setupWe are getting closer and closer to an important buying opportunity in gold miners.

Though yesterday we almost tagged the 200 SMA and bounced I still don't see that buying opportunity what i like to see at the gold miners bottom.

At the beginning of today's trading we broke above yesterday's high which is usually a buy signal but after a few hours of trading we gave back all the gains and closed in the red.

I think we are quite close to the bottom in days - 4-5 days only - but these last few days can be extremely scary as we print the cycle lows.

First of all I dont see the volume spike what usually occurs at these intermediate bottoms:

The other thing that we stiill have a gap between 20.5 and 20.8 which pulling down price like a magnet:

Today was the 5th day since we broke below an important level at 21.41 and usually these breakdowns lasting for 7-8 trading days:

Today was day 5 of the breakdown.

So I would wait with the buying till next week in the miners as we might have 3-4 red days ahead in the upcomong trading sessions.

Gold Miners - Take Profits SoonThis is a continuation of my previous post on gold miners. I would recommend checking out that post and the updates to get up to speed on the current trade.

Profits so far should be at least 15% if you’re trading leveraged ETF ($DUST). Personally at around 20% gain so far in the trade.

I plan to take profits on the entire DUST position soon since GDX is getting close to oversold levels. Probably has a few more days of selling to go based on today’s heavy downward momentum.

Maintain overall bearish view of gold miners as long as there is a lack of negative macro news flow to boost gold prices. I’ll be updating this post daily in case general market sentiment start reversing from positive to negative, check this post regularly if you want to get a head start on trading the reversal!

You can try to scalp the bounce off the support once GDX is oversold, but don’t over-commit because it’s hard to precisely say how much it’ll bounce.