GOLD | Interesting facts about GoldOANDA:XAUUSD

1.Gold is a 'noble' metal, meaning that it does not rust or lose its shine. Other noble metals include ruthenium, rhodium, palladium, silver, osmium, iridium, platinum, mercury, rhenium and copper.

2.Gold is the only yellow metal. All other metals darken or turn a yellowish colour after they have oxidised or reacted with other chemicals.

3.Gold is one of the heaviest and densest of all metals in the Periodic Chart; a cubic foot would weigh more than half a ton.

4.Pure gold will melt at 1064.43° and boils at 2856.1°. Even at normal temperatures gold is extremely soft. One gram of gold can be flattened down to a square meter sheet, which is so thin that light passes through, and because of this it has been used as a protective film on visors in space suits

5.Odourless and tasteless, gold is not toxic - and flakes may be eaten in foods or drinks.

6.Gold is far rarer than diamonds but is only the 58th rarest earth element.

7.It is estimated about 160,000 tons of gold have been mined throughout history.

8.In 2018, China was the world leader in gold mining production. Second was Australia, Russia third, US fourth and Canada fifth.

9.The largest gold nugget is the 'Welcome Stranger' mined in Australia in 1869, weighing in at a colossal 173 pounds (that is nearly 78.5 kilos).

10.The first gold coins were produced in Lydia between 700 - 650 BC. They were made from electrum, which is a naturally occurring alloy of gold.

11.The Swiss Franc was the last remaining country to peg its currency to a value in gold. It became a fiat currency in 1999.

12.The Perth Mint in Western Australia cast the largest ever coin - weighing one tonne and measuring 80 centimetres (31.4 inches) in diameter.

13.New York’s US Federal Reserve Bank is reported to hold 25% of the world's gold reserves.

14.Gold is frequently used as a safe haven asset in times of economic turmoil or geopolitical uncertainty.

15.Gold has historically had a weak correlation to movements in the financial markets and is frequently used as a hedge against inflation.

Goldmining

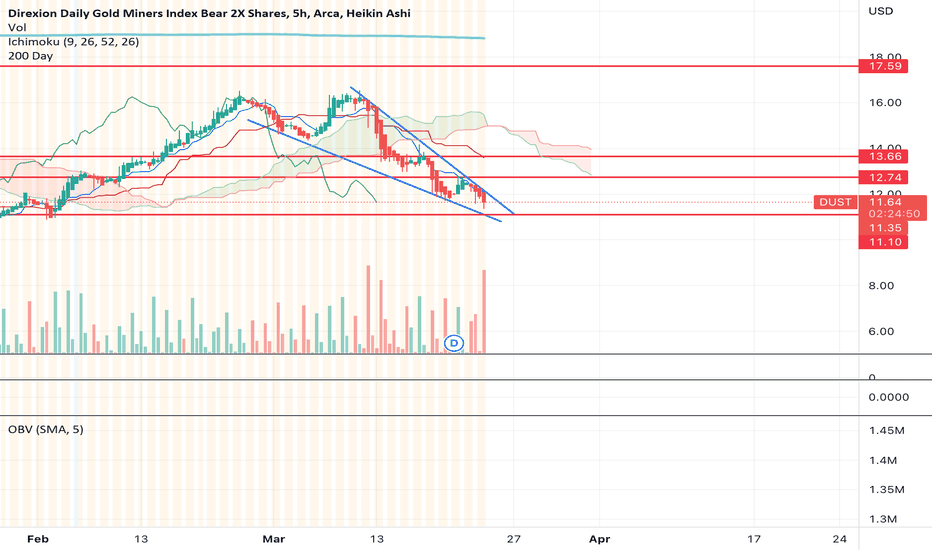

Are miners about to crash? Looks like it to meDust looks like it's putting in a bottom to me. Also, there's a big falling wedge forming.

If we see a breakout of this pattern (which I think will materialize over the next week or so), I think we'll see a sharp move higher in $DUST and miners should fall quickly.

I'd be targeting the $17 resistance level as the target. Let's see what happens over the next few weeks.

Non-agricultural data will be released soon, long or short?

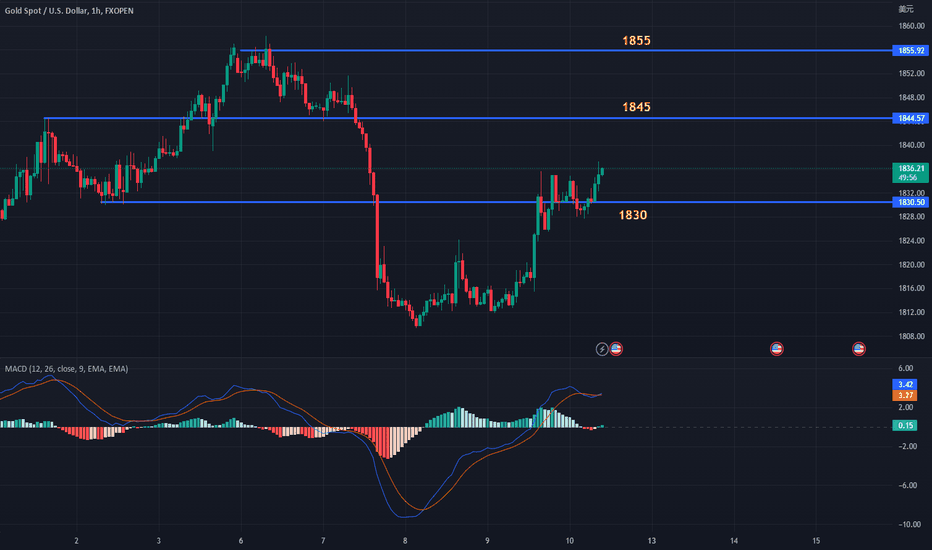

The non-farm payroll data in January was unexpectedly weak, largely due to statistical adjustments and labor hoarding causing abnormal data. The addition of over 500,000 jobs to the non-farm sector is unsustainable, and inflation is likely to continue to trend downward in the first half of this year due to base effects. Therefore, I personally believe that the Federal Reserve does not need to be excessively hawkish during a period of sustained inflation decline, and market sentiment will not remain pessimistic indefinitely. The comments from Powell on Tuesday and Wednesday were also ambiguous, indicating that acceleration in interest rate hikes would only occur when necessary, and not definitively. Therefore, whether or not it is necessary will depend entirely on how the data performs. Based on yesterday's initial jobless claims data, I believe the probability of non-farm payrolls being bullish for gold is relatively high.

Furthermore, this week's sell-off did not continue, and after two consecutive days of low-level volatility, prices rose sharply during the US session, reaching a high of around 1835. This has changed the weak trend, and from a technical perspective, there has been no break below new lows. Instead, bearish momentum has stalled after falling to 1809, and gold has rebounded again. The expected bearish momentum for gold breaking new lows no longer exists, and from a technical standpoint, yesterday's rebound has stopped the downward trend. Gold is likely to continue to rise, particularly given the weak performance of US employment data, which has boosted the long-term expectations for gold. It is not ruled out that gold will continue to oscillate upwards with 1809 as the bottom, fluctuating in a broad range between 1809 and 1855. Based on the weekly chart, signals suggest that the current upward trend will continue next week.

If both the news and technical aspects indicate a bullish outlook for gold, then the rise in gold prices is inevitable, and prices are highly likely to test the previous highs. Conversely, if the bearish factors do not break through the 1809 level, then the rebound in gold prices will not be small either.

Therefore, my short-term trading strategy will focus on going long. As long as the watershed of 1830 is not broken, I will gradually go long at this line, with a target of 1845-1855.

I will provide specific trading strategies during market hours and recommend subscribing. The recent market volatility has been significant, with opportunities and risks coexisting. Control risks while pursuing gains.

OANDA:XAUUSD FXOPEN:XAUUSD

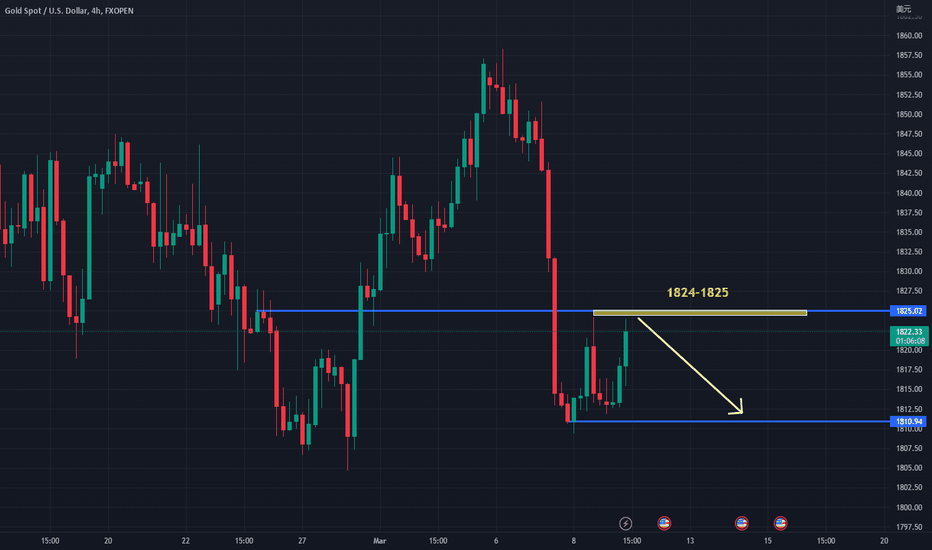

Continue to short gold.

Gold received a boost from the positive impact of initial jobless claims data, resulting in a short-term rally. The resistance level above is at 1225, and those holding short positions at 1819 can continue to do so, waiting for the market to return to the technical aspect and continue to decline. Additionally, it is possible to add short positions again around 1824-1825 and short directly at that level. The stop-loss can be set at 1830, with the target at 1810. During the profitable process, investors can choose their own take-profit points according to their risk tolerance.

FXOPEN:XAUUSD OANDA:XAUUSD

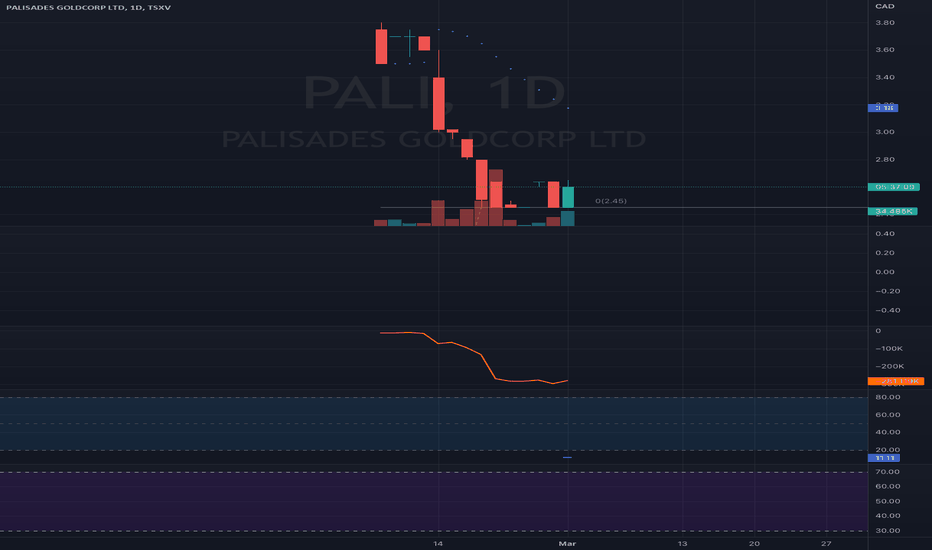

Assets are worth 2x the market cap (holds 46.7M shares of NFG)PALI market cap is $125M. Holds 46.7M shares of NFG, currently worth $230M + other assets.

-----------------------------------------------------------------------------------------------

PALISADES ANNOUNCES HIGH-GRADE GOLD ZONE DISCOVERY BY NEW FOUND GOLD, INTERCEPTING 72.2 G/T AU OVER 9.65M

VANCOUVER, BC, March 1, 2023 /CNW/ - Palisades Goldcorp Ltd. (TSXV: PALI) ("Palisades" or the "Company") today announced that New Found Gold Corp. ("New Found"), a significant equity investee of Palisades within the meaning of applicable Canadian securities legislation, has announced the discovery of Iceberg, a high-grade zone located 300m northeast of Keats Main along the highly prospective Appleton Fault Zone ("AFZ"). New Found's 100%-owned Queensway project comprises a 1,650km2 area, accessible via the Trans-Canada Highway, 15km west of Gander, Newfoundland and Labrador.

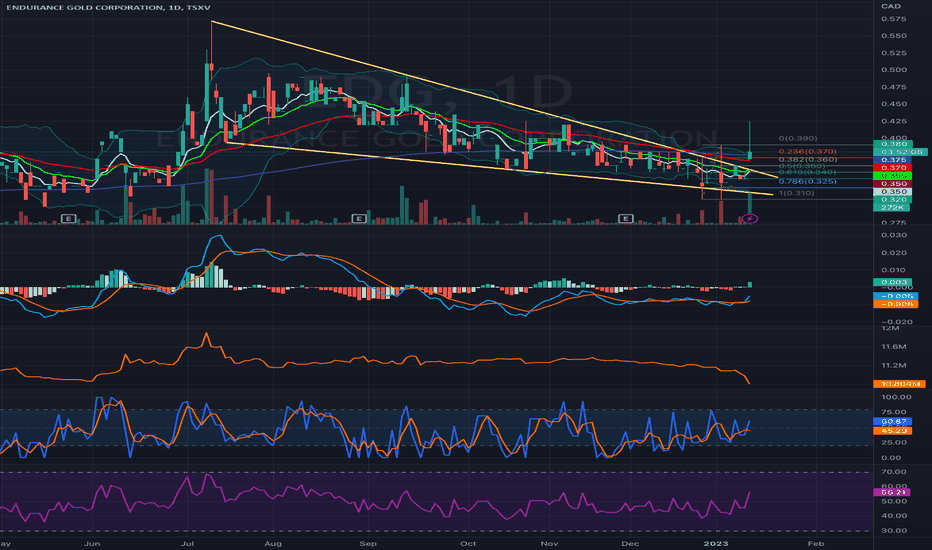

Strong assays; Falling Wedge breakout; bullish GoldEndurance Reports Results at Southeast Eagle - 139.9m of 3.05gpt Au including 12.9m of 12.85gpt Au & 11.8m of 6.21gpt Au

Vancouver, British Columbia--(Newsfile Corp. - January 12, 2023) - Endurance Gold Corporation (TSXV: EDG) (OTC Pink: ENDGF) (FSE: 3EG) (the "Company") is pleased to report assay results from the 2022 diamond drilling program at its Reliance Gold Property (the "Property") in southern British Columbia. The road accessible property is located 4 kilometres ("km") east of the village of Gold Bridge, and 10 km north of the historic Bralorne-Pioneer Gold Mining Camp which has produced over 4 million ounces of gold. During the 2022 field season, the Company completed thirty-eight (38) diamond drill holes for 8,274 metres ("m") and thirty-three (33) reverse-circulation drill holes for 2,455 m.

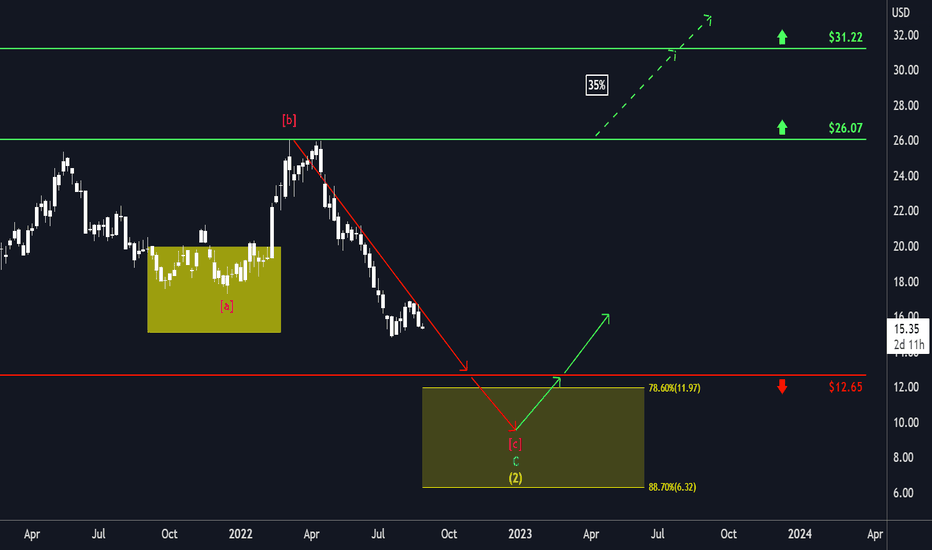

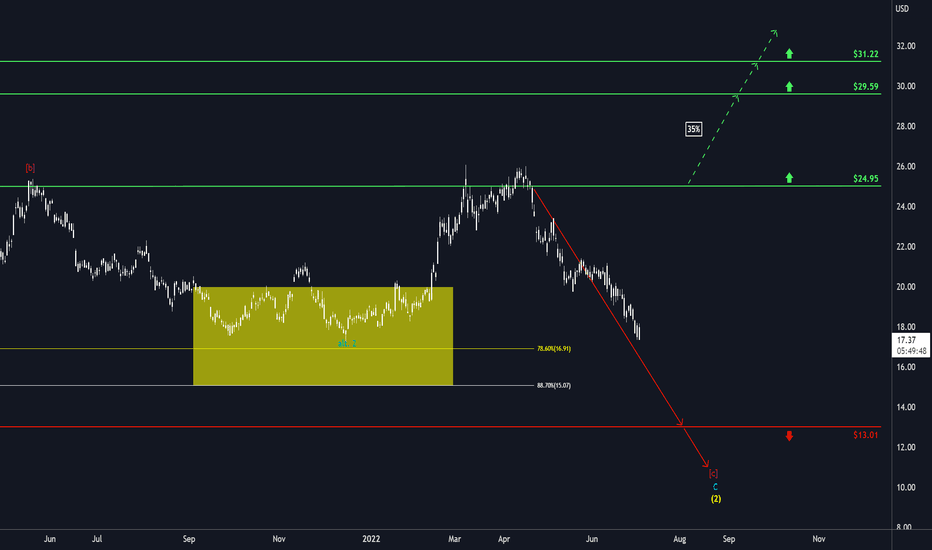

Barrick: To the Beach ⛱The bears have grabbed Barrick and are dragging it along southwards to the warm and sandy beach strip between $11.97 and $6.32, which is seated picturesquely below the support at $12.65. Once there, though, there’s not too much time to relax but also work to be done: Barrick should finish the long-term corrective movement in the form of wave (2) in yellow. Afterwards, the bulls should take over so enthusiastically that the beach sand is swirled up and push Barrick northwards. However, there is a 35% chance that the bulls could intervene earlier already and shove Barrick above the resistance at $26.07, thus eliciting further ascent above the next mark at $31.22.

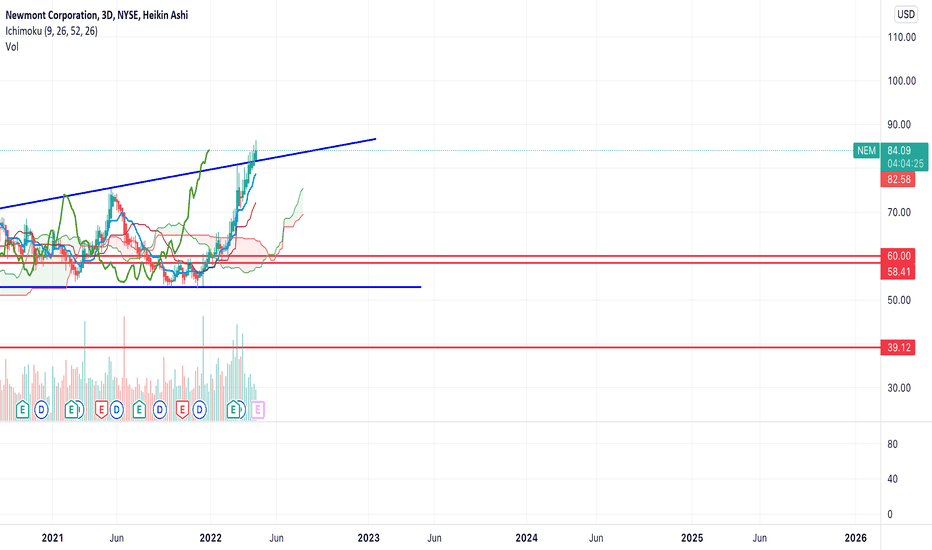

Short Newmont mining? Price to fall below $65.Just like many of the other commodities, Newmont mining looks overextended and is starting to turn over.

Because of how quickly it ran, I think we're likely to see a violent snap back in price back to the February lows.

I can see price going to the $60 range before continuing up and/or retesting these highs as resistance.

Barrick Gold: Keep It Up, Bears! 🐻Down it goes! Just as we expected, the bears are in high gear and have proceeded to carry Barrick downwards. Soon, they should reach the support at $13.01 and lead the price below this mark. However, there still remains a 35% chance that Barrick could escape the bears’ paws and rise above the resistance at $24.95, thus activating further ascent above the next ones at $29.59 and $31.22.

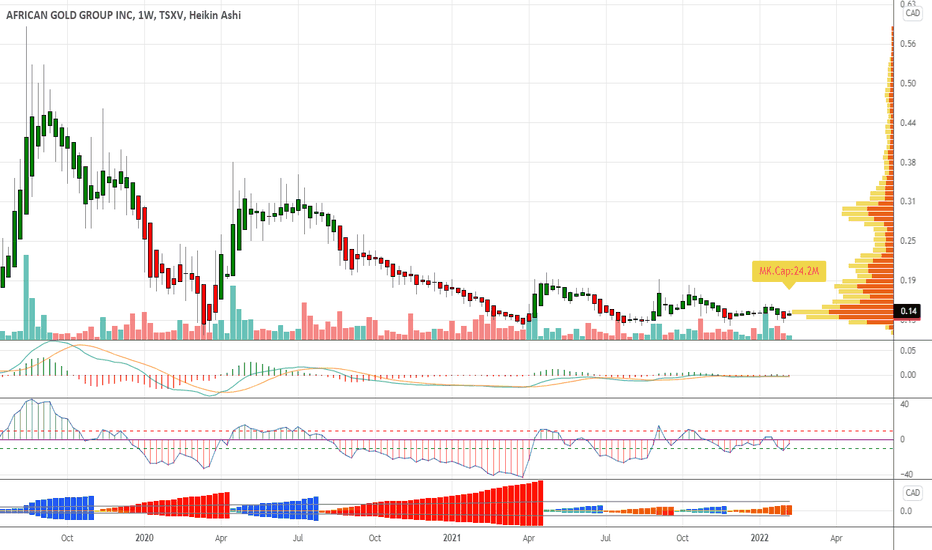

AFRICAN GOLD AAG- W1 - Feb 2022last news : Definitive Feasibility Study

The majority of 2021 has been largely focused on the delivery of an updated definitive feasibility study for the Kobada Gold Project (the “Project” or “Kobada”), which was delivered in October 2021. Over the past two years we have worked tirelessly on the technical elements of the project to demonstrate that the Kobada project has the potential to be one of the largest new gold projects in West Africa. Since new management took over in August 2019, and with new drilling campaigns totaling more than 18,000 metres, we have managed to increase our reserve base by 144% (66% increase over the 2020 DFS) and our measured and indicated resource more than 40%.

With our updated 2021 DFS we have shown that Kobada has the potential to produce over 1.2 mln oz of gold over a 16-year mine life

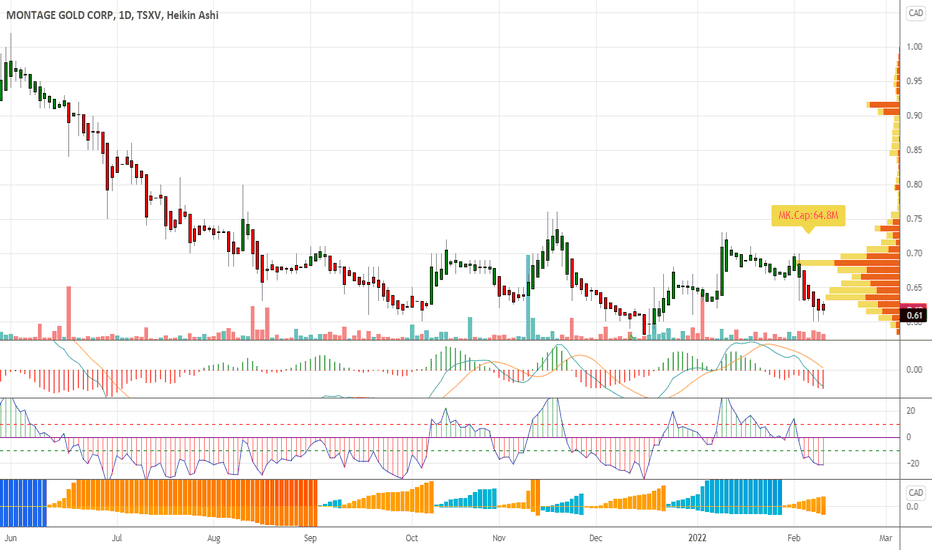

Montage Gold - D1 - Feb 2022last news: Hugh Stuart, Montage CEO commented, "With most aspects of the DFS nearing completion the Company expects to release the results to the market in early February.

"The DFS has gone well with the bulk of the test work and studies (geotechnical, mining, metallurgical) largely confirming the assumptions from the May 2021 Preliminary Economic Assessment ("PEA") which outlined average annual gold production of >200,000 ounces per year over a 15-year project life. We are expecting the maiden Mineral Reserves Estimate to be in-line with in-pit material reported from the PEA.

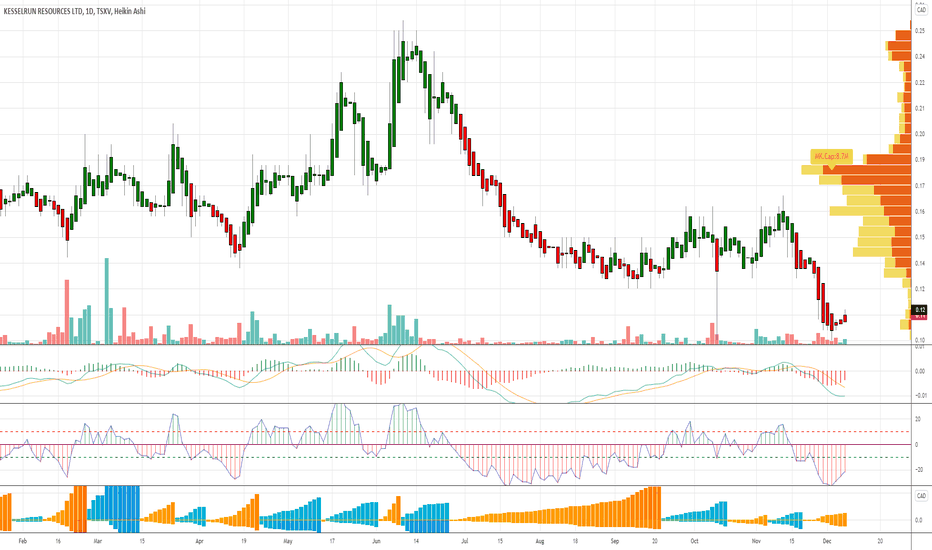

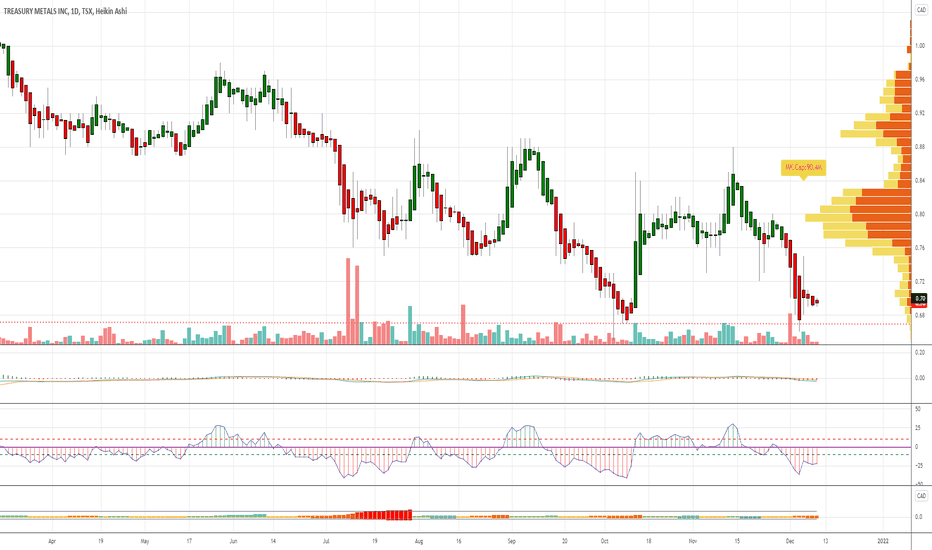

Treasury Metals - D1 - 2021Treasury Metals - D1 - 2021

last news : Treasury Metals Announces Closing of Private Placement Financing

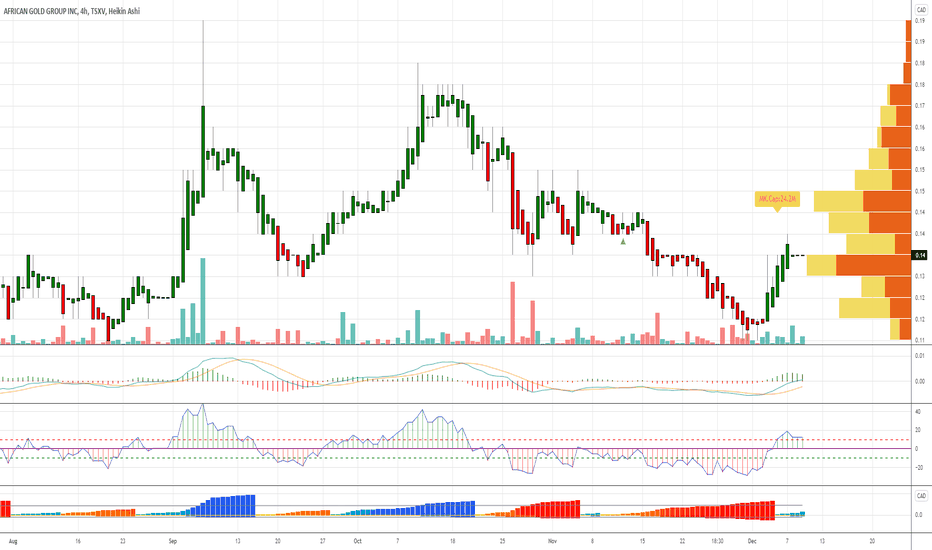

AFRICAN GOLD - H4 - Dec 2021AFRICAN GOLD - H4 - Dec 2021

last news : African Gold Group Closes Oversubscribed C$5 Million Private Placement

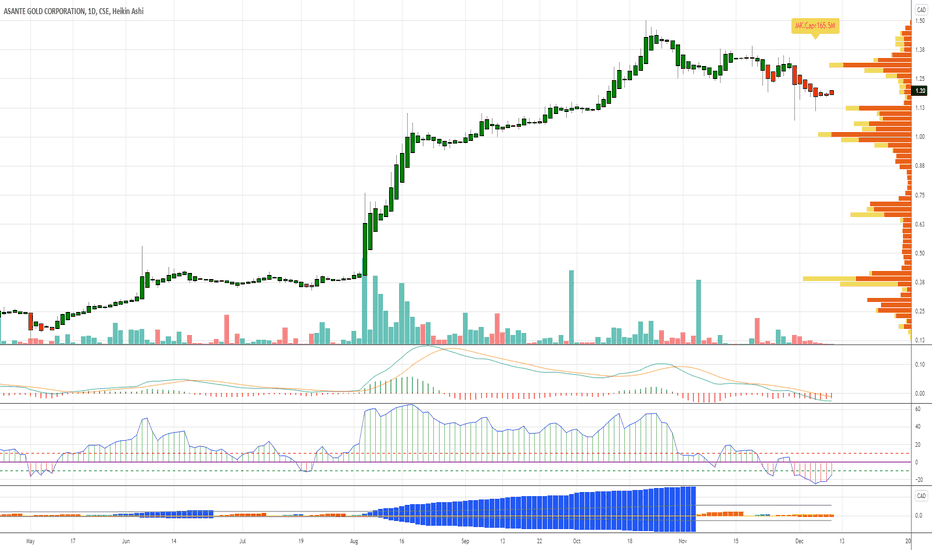

Asante Gold Corporation - D1 - Dec 2021Asante Gold Corporation - D1 - Dec 2021

Bibiani Gold Mine Operations Update

Asante is preparing a plan to deliver a mine that can produce approximately 190,000 ounces of gold at Bibiani in its first 12 months of operation and circa 240,000 ounces every year thereafter for a minimum of 6 years. Tenders have been invited for the selection of a Mining Contractor. We anticipate mobilization of the Mining Contractor to proceed in Q1 2022.

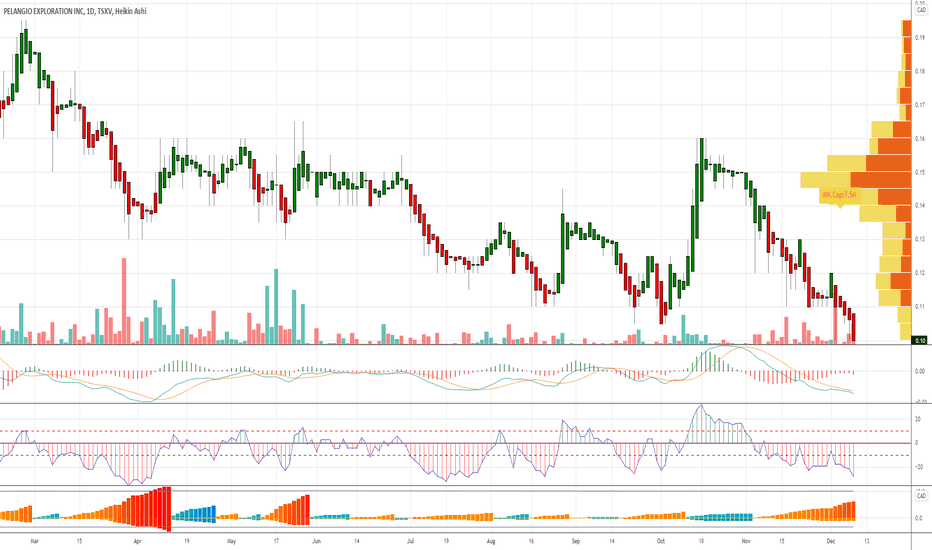

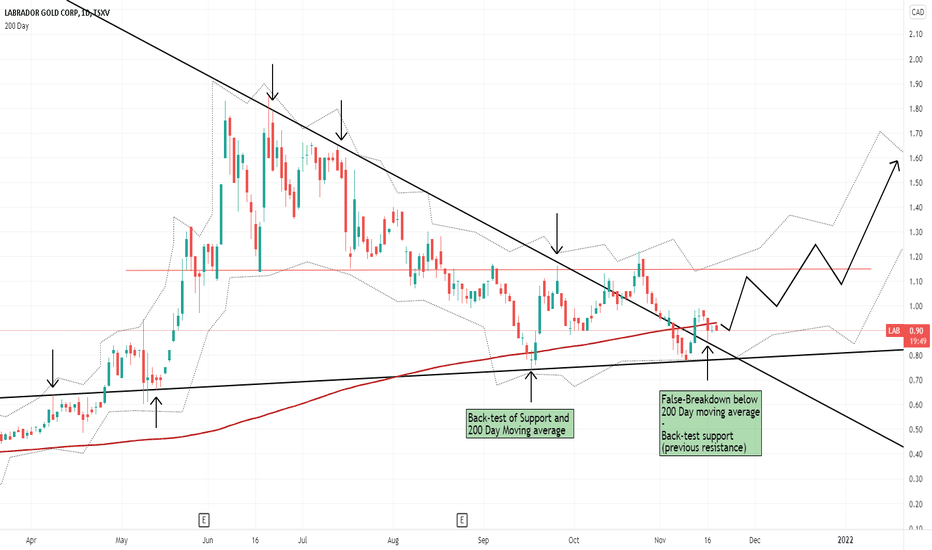

Bullish Fundamentals and Technicals !!before saying anything I would like to mention the upcoming Drill results which could be a serious catalyst for the price of Labrador Gold corp. So in term of due diligence I do not just speak to Technical chart but also to extensive research such as Grades ,jurisdiction, financials and more.

with that in mind, looking at TSXV:LAB one cant not notice the following Indicators:

-Bullish diversion in Momentum in the MACD : ✔

-Bullish diversion in Momentum in the RSI : ✔

(which are both signalling upside in the near term)

-also the STH Daily Bollinger bands are signalling a contraction to the upside : ✔

With regards to further TA :

-Double bottom Formation : ✔

-possible Resumption of 200 Simple moving average : ✔

-Breakout from diagonal resistance and back test : ✔

The Chart is screaming BUY BUY BUY BUY !!!!!!!!!!

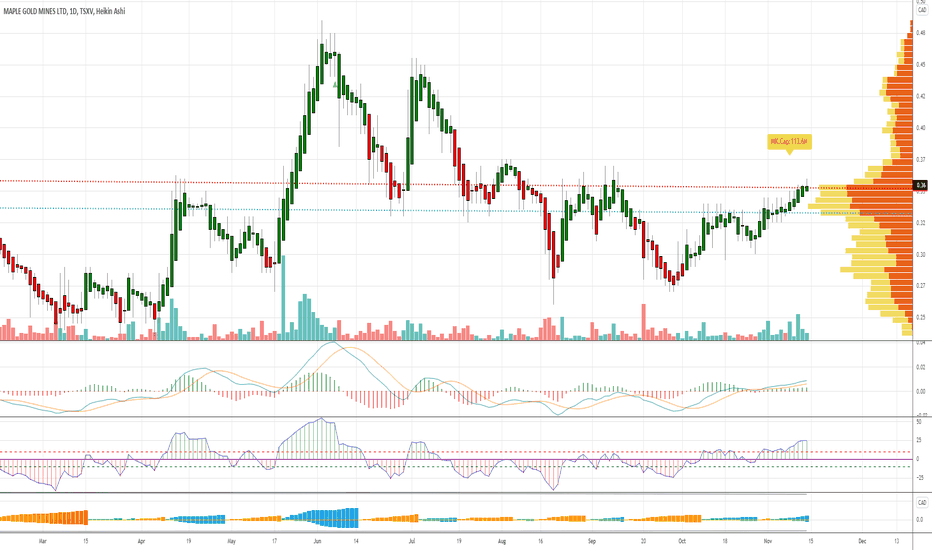

Maple Gold Mines - 2021 - Daily - 14NovMaple Gold Mines - 2021 - Daily - 14Nov

last news : Geotech Ltd. has been contracted to complete a regional high-resolution airborne magnetic and electromagnetic ("Mag-EM") survey to support exploration drill targeting across 266 km² of JV-controlled ground. The Company has also appointed Wilma Lee to the position of Vice President, Compliance & Corporate Secretary, effective immediately.

Newcore GOLD LTD - Ghana explorer - H4Newcore Gold is advancing its Enchi Gold Project located in Ghana, Africa’s largest gold producer (1). The Project currently hosts an Inferred Mineral Resource of 1.41 million ounces of gold at 0.62 g/t (2). Newcore Gold offers investors a unique combination of top-tier leadership, who are aligned with shareholders through their 27% equity ownership, and prime district scale exploration opportunities. Enchi’s 216 km2 land package covers 40 kilometres of Ghana’s prolific Bibiani Shear Zone, a gold belt which hosts several 5 million-ounce gold deposits, including Kinross’ Chirano mine 50 kilometers to the north. Newcore’s vision is to build a responsive, creative and powerful gold enterprise that maximizes returns for shareholders.