Goldmining

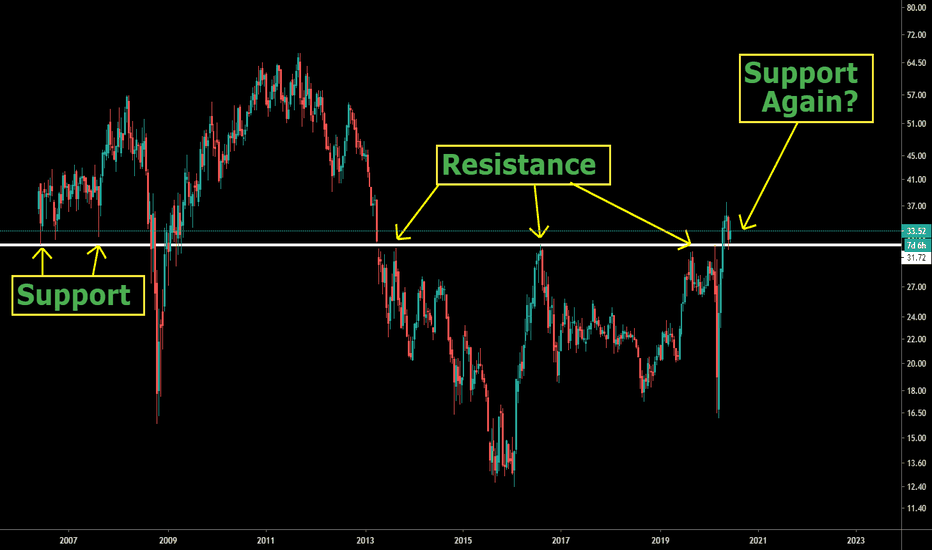

GDX, is this a forgotten treasure?Hello everyone,

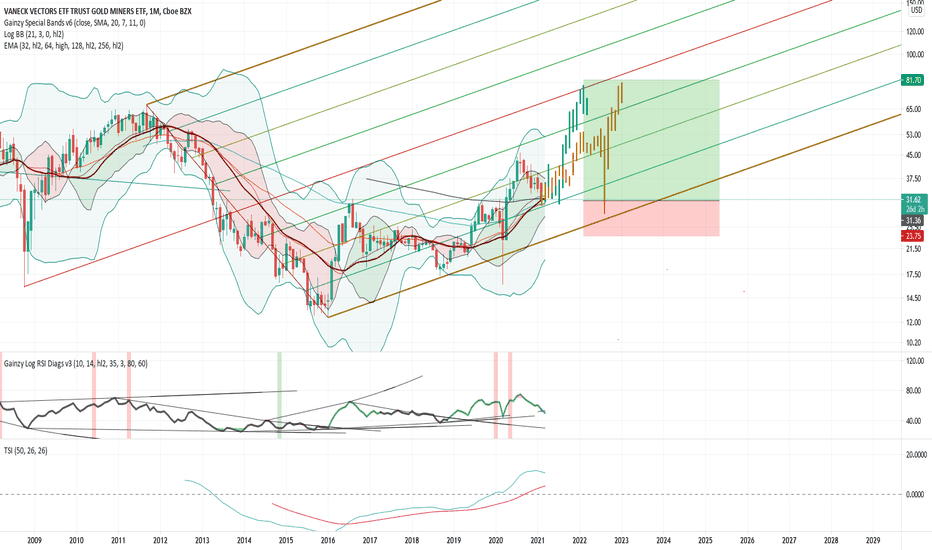

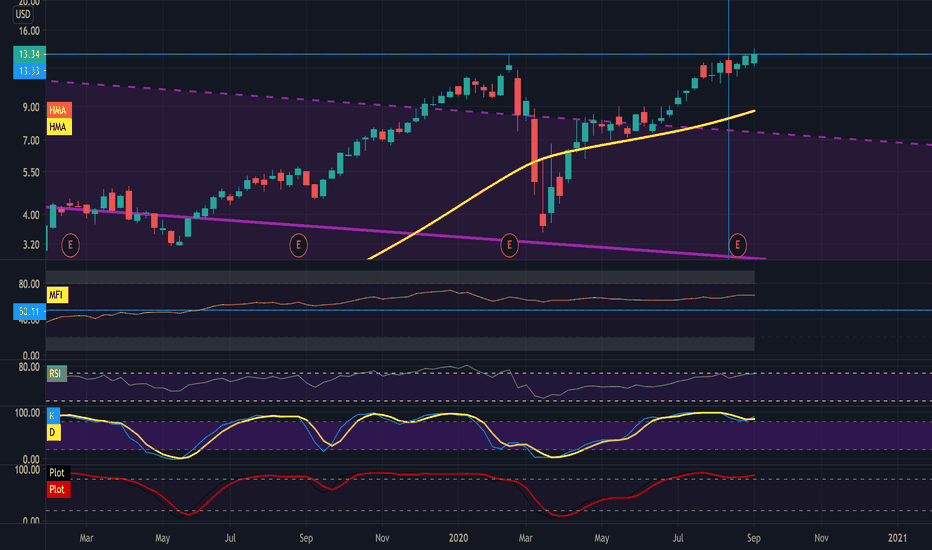

So Gold is finally back in a buy/accumulation zone, even though DXY may have more room to run I doubt this will translate in to heavy downside for gold. 1650 maybe? However, the stars look alligned once again to buy gold, or in this case GDX (Gold miners ETF). You can see the trade parameters in the chart. But this is definetely an opportunity like no other, whilst everyone is still lookin at Bitcoin, or Stocks, nobody is expecting a resurgence from gold at this point. However as we see volatility is not dead and gold does like volatile times. Even though this trade will take patience, and most likely won't payoff like crypto. The optimal upside is around a 150%, and in a mania case 400-600%. And the risk is -25%, I mean, it's a casual day in crypto or even stocks these days... Buying now is like buying BTC at 10k. Which BTW i've also advised in doing heavily. It's the same mantra as always - Buy low, sell high. However, most will do it the other way around.

Also check out my other ideas, even though I don't post often. When I do it's usually when things are CHEAP or EXPENSIVE.

As always, stay safe and stay liquid.

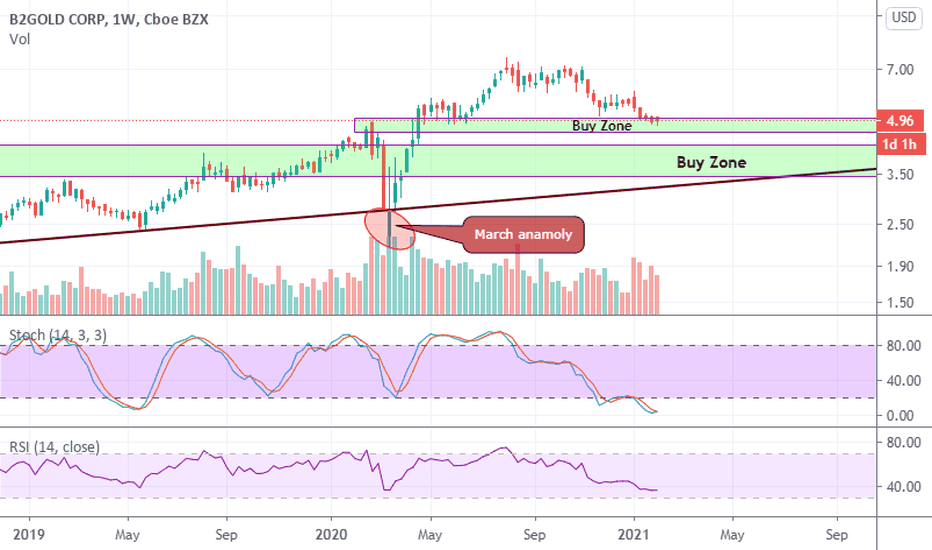

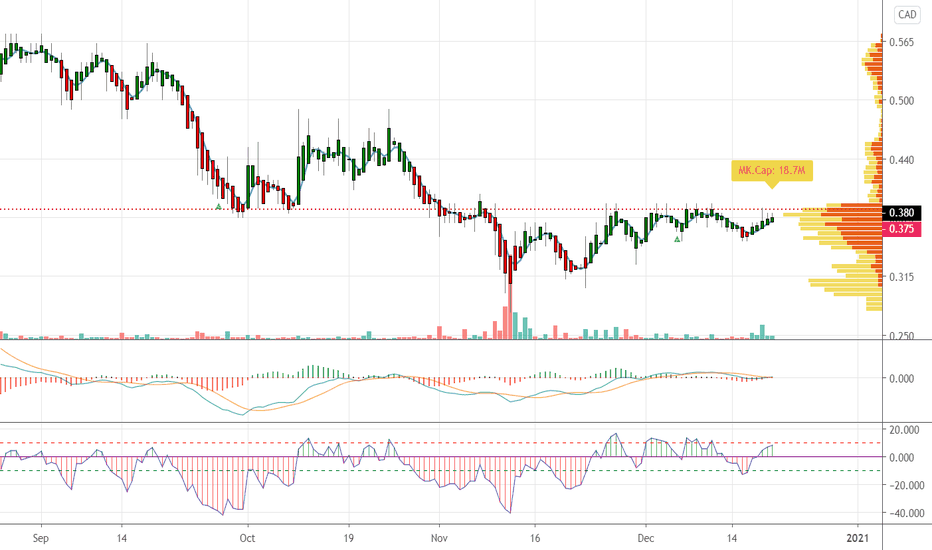

BTG - Currently in the Buy Zone!AMEX:BTG currently offers one of the most compelling chart-based entries of any top-tier gold mining company. BTG offers tremendous value and can easily be considered a core holding within any long-term portfolio. We are currently within our first of two buy zone targets, both of which offer extremely undervalued buying opportunities. We will be adding a half position at these levels.

Everything shared here is my own opinion and no results are guaranteed. Good luck!

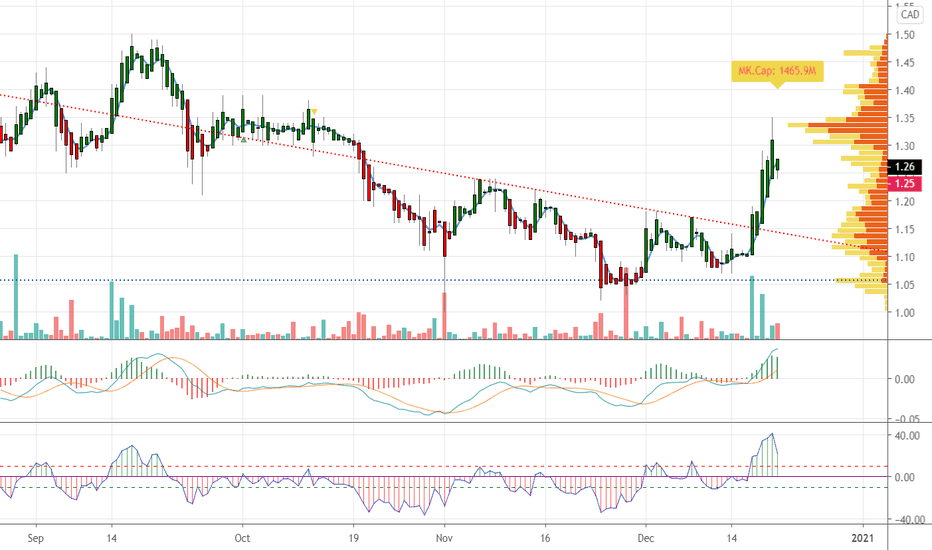

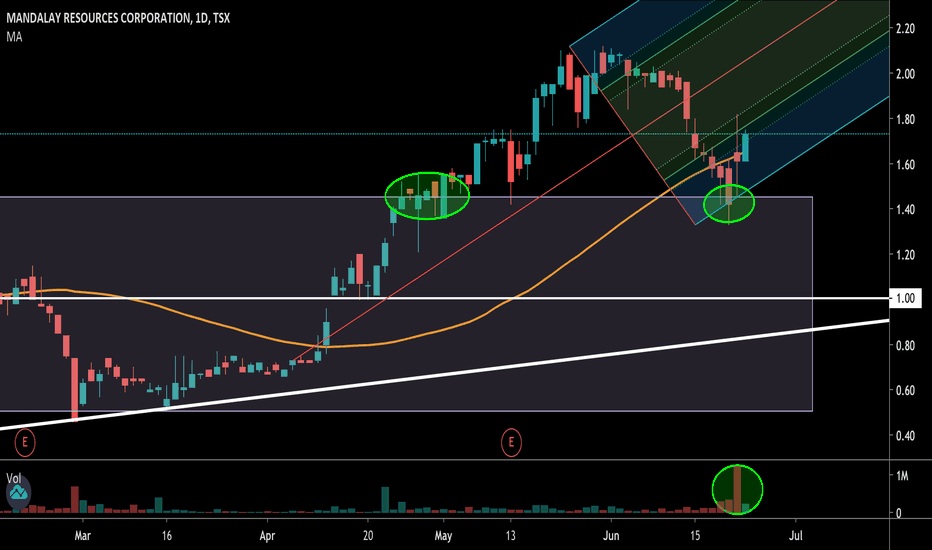

GOLDMINING INC (GOLD) Ready for Next Rally? (+34% Potential)Hello fellow traders,

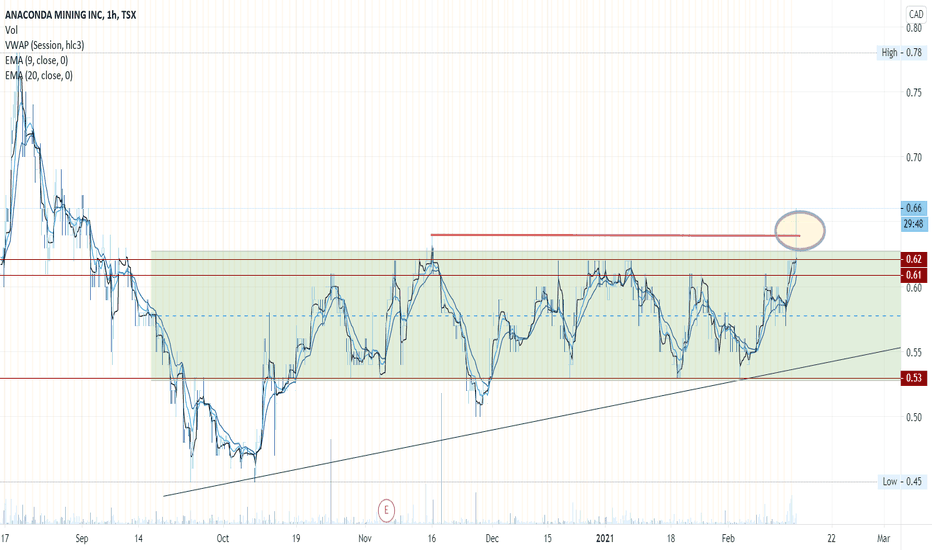

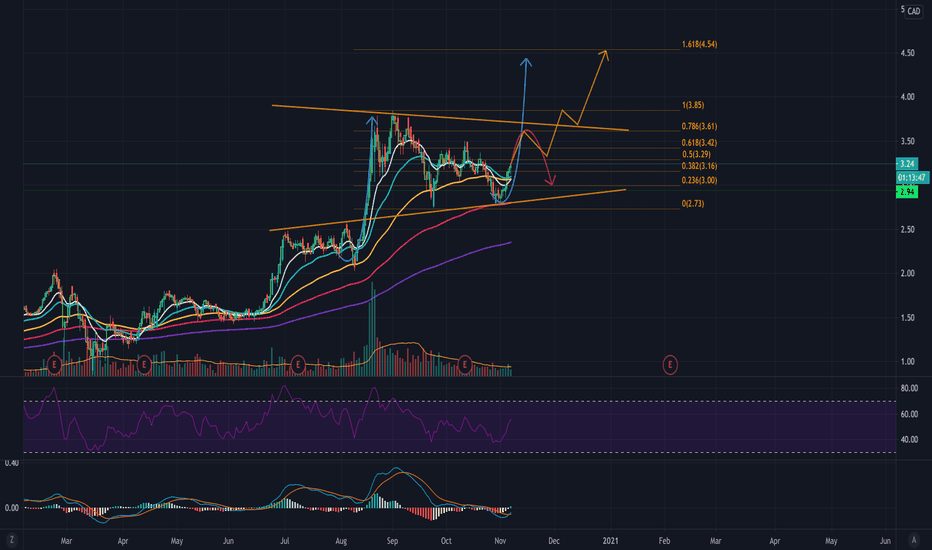

Today we are looking at the daily timeframe for GOLDMINING INC (GOLD) on the TSX. As we can see, GOLD peaked around $3.85. It has since corrected, printing a double bottom at previous resistance, in between the 50/100 EMAs (yellow/pink).

Prices have broken and are now trading above all EMAs. The RSI has increasing fast, and the MACD has just given off a bullish cross. Additionally, we have increased volume coming in with prices moving up. All of these signals are bullish. The key levels to watch here around $3.40 and $3.60, past which, prices can easily jump. On the chart, I have marked the three likely paths using arrows that prices should approximately follow. Depending on the level of resistance ahead, primarily at the $3.60 level, prices may either jump or correct back down and continue trading in this wedge.

A potential entry zone now would be $3.10-$3.35, with a second entry around $2.75-$3.00 if prices break down to the next support level. An immediate target would be at them most recent highs, around $3.80 (+14%). A breakout past the most recent high could launch prices up to the 1.618 Fibonacci level, at around $4.50 (+34%) in the short-to-mid term. A stop loss could be placed in the $2.50-$2.60 range to be safe, however I am not using one as of yet because my entry was at $2.94. Keep your eyes on this one!

Let me know your own thoughts and comments down below. Remember to leave a like if you enjoyed, and check out my profile for more stock and cryptocurrency trading ideas. Thanks for reading!

Price at writing: $3.24

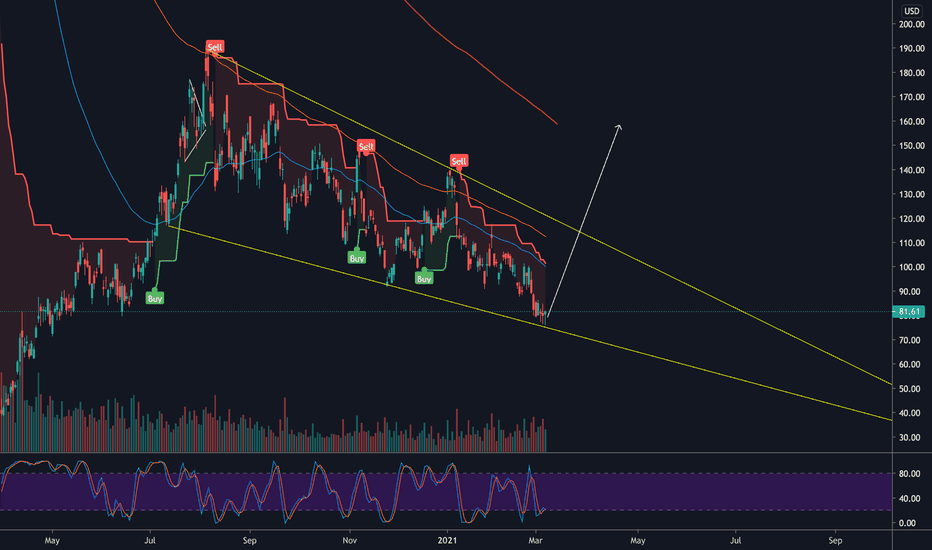

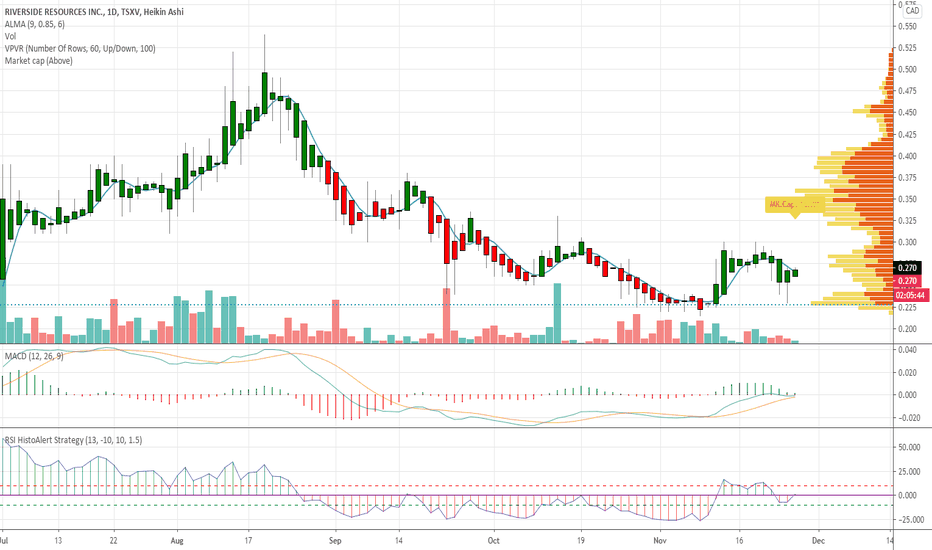

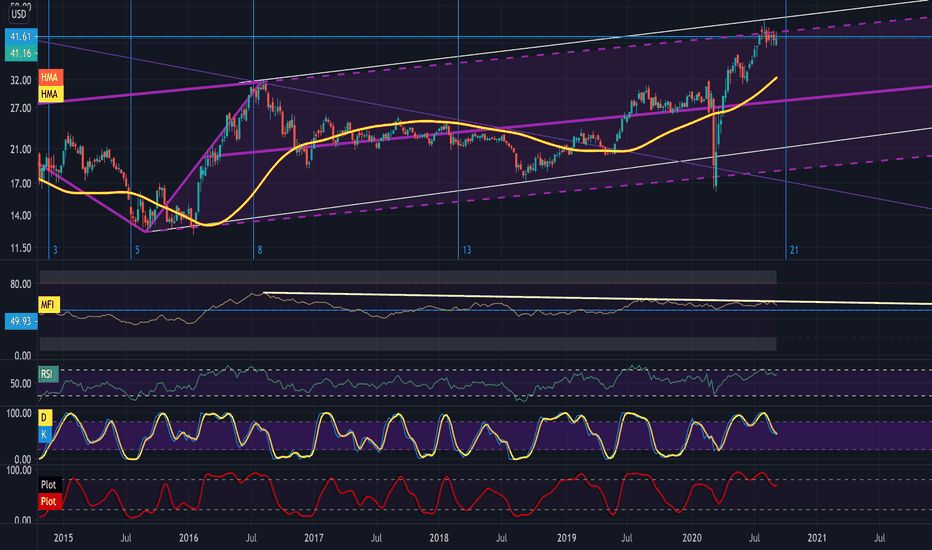

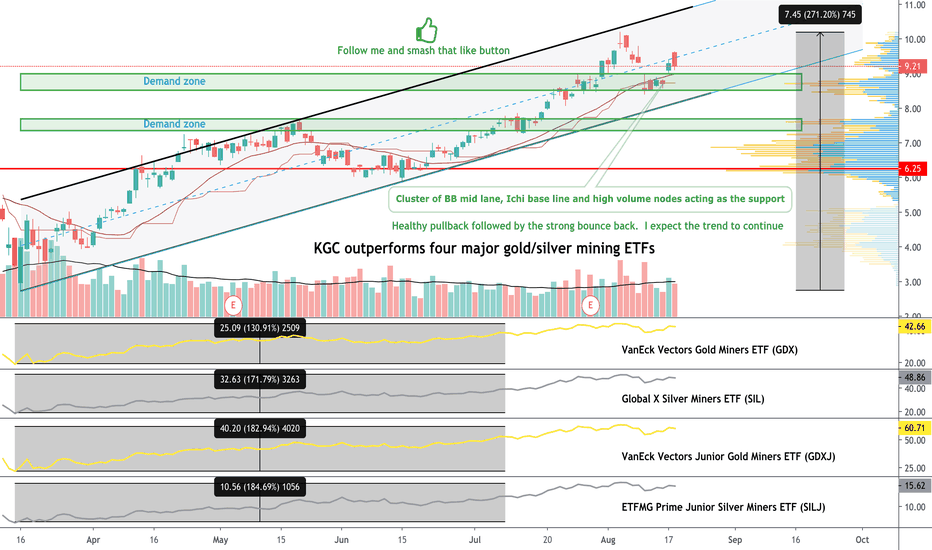

KGC- Gold/Silver mining play (Industry)As usual, demand for Gold mining stocks has risen with the ore rally. Mining stock such as KGC has outperformed major gold/silver mining ETFs and completely obliterated gold/silver ETFS since March.

It is a higher risk and higher reward play for investors who want to ride the gold/silver trend.

EV/EBITDA TTM, Price/cash flow TTM and many other valuation ratio indicate that KGC are undervalued compared to its peers.

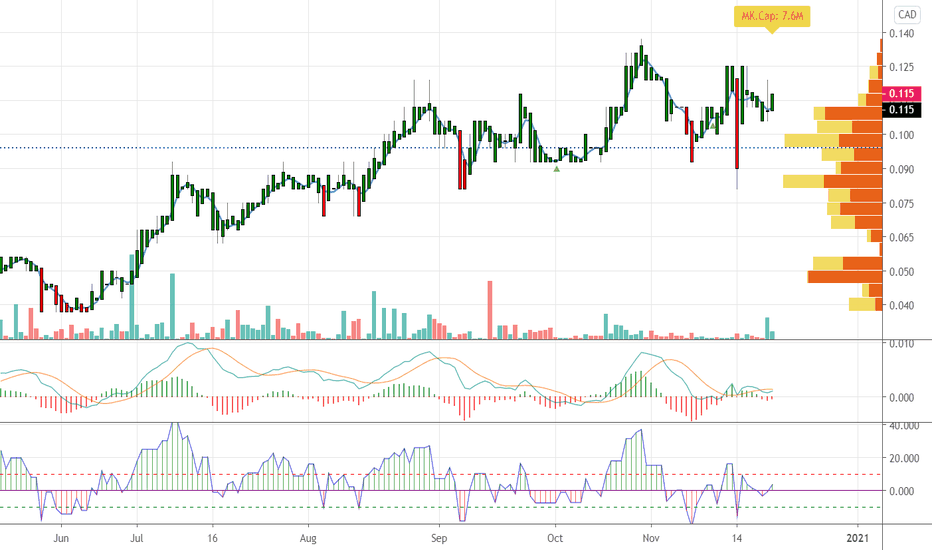

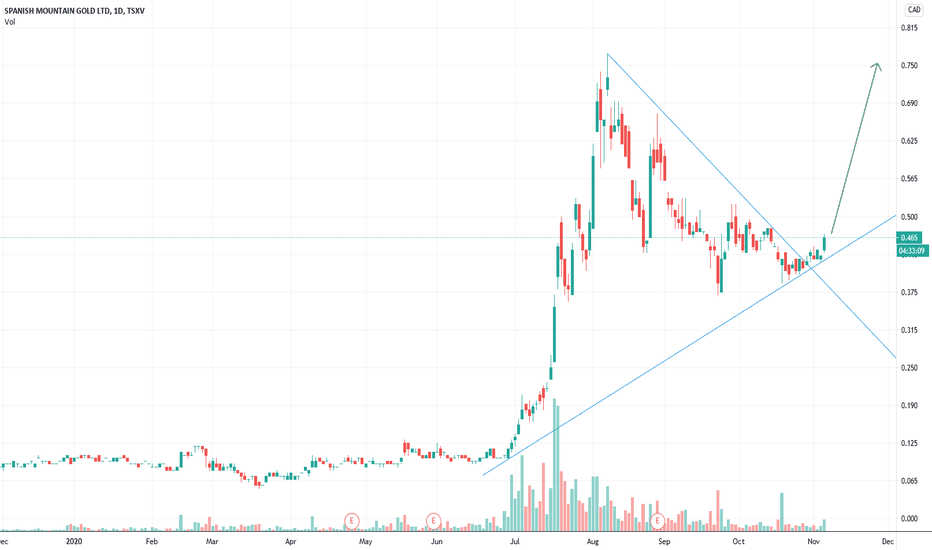

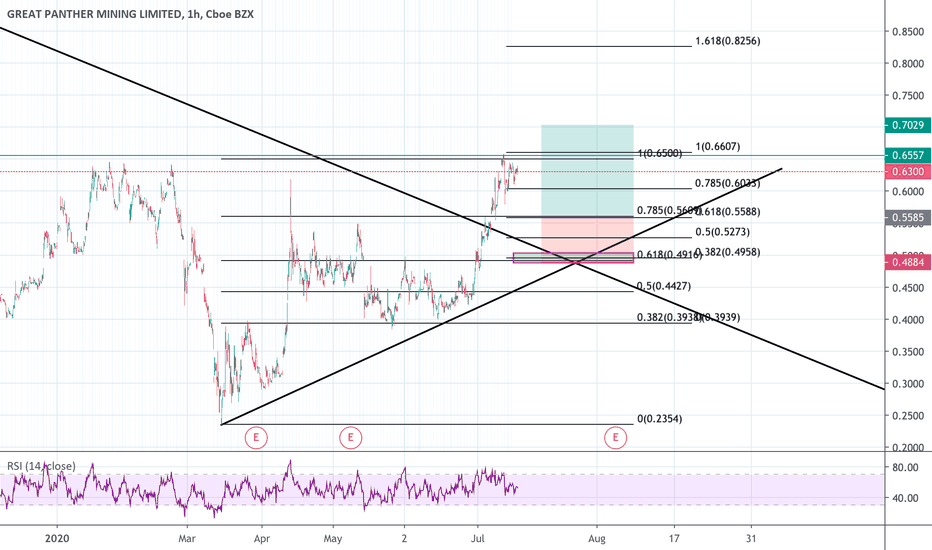

Mining on The Run - GPL Looks Good AgainI invested in GPL as it was an essential mining company for precious metals. Considering the price of precious metals are skyrocketing, so are the mining companies stocks. Great Panther silver has recently turned from a down trend to an uptrend. Just waiting on a retest of a trendline or a fib level before I sell some indecisive stocks and place them on GPL.