NFP continues to ferment, short-term trend dominated by bears📰 News information:

1. 90-day tariffs are about to expire

2. New unilateral tariffs

3. Geopolitical situation

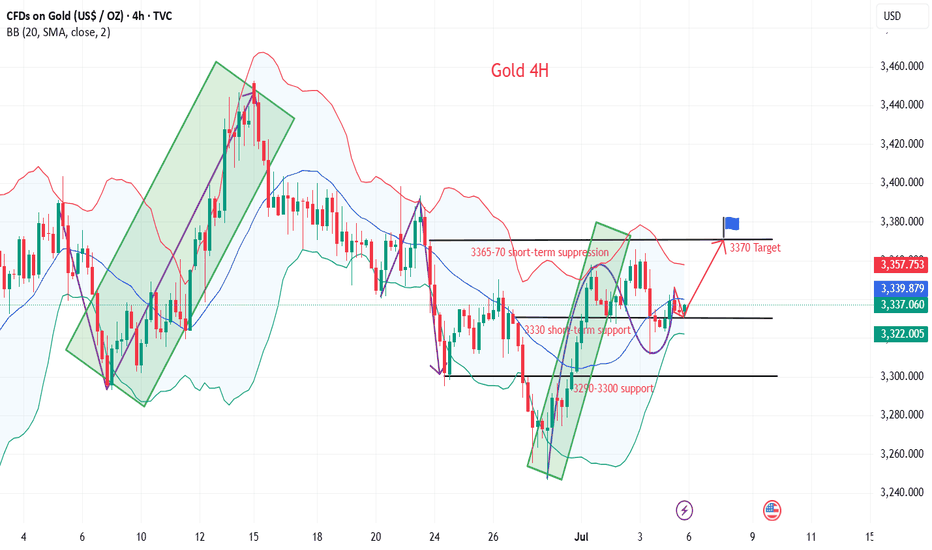

📈 Technical Analysis:

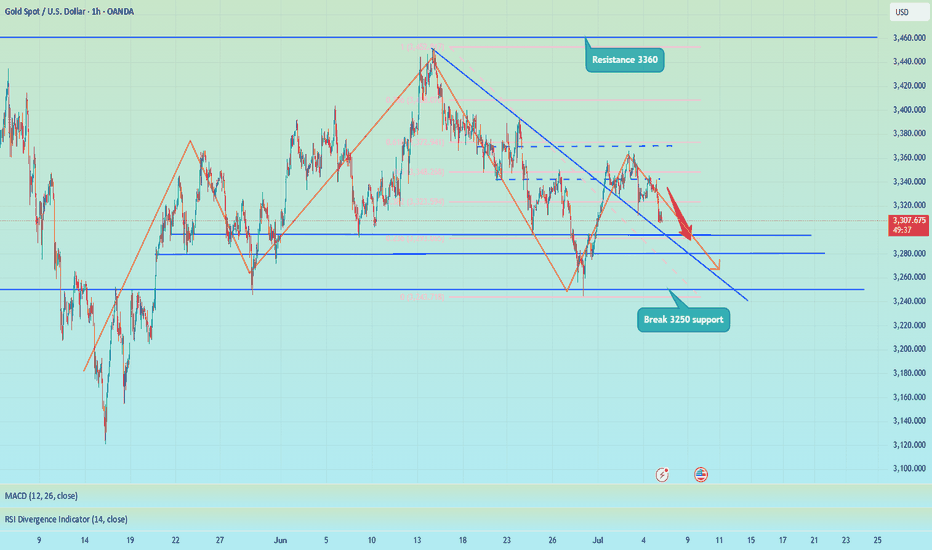

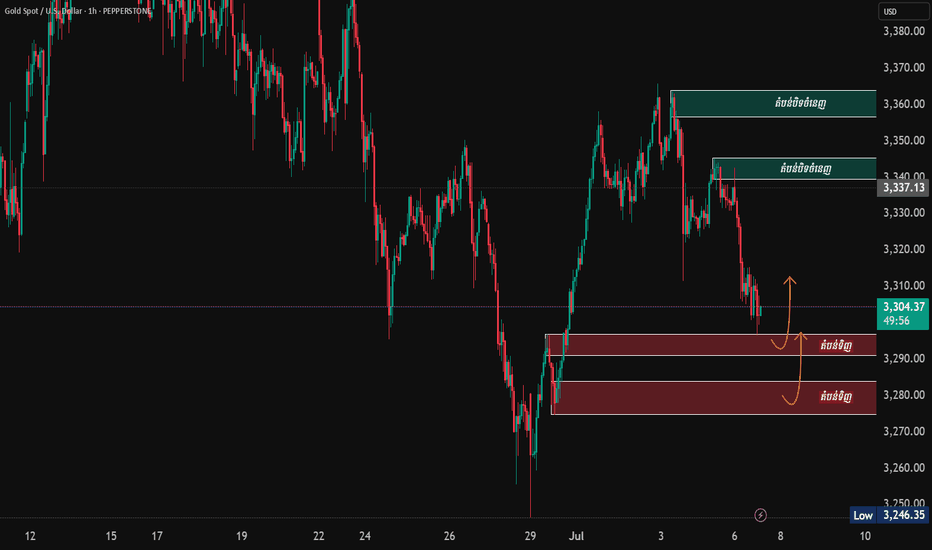

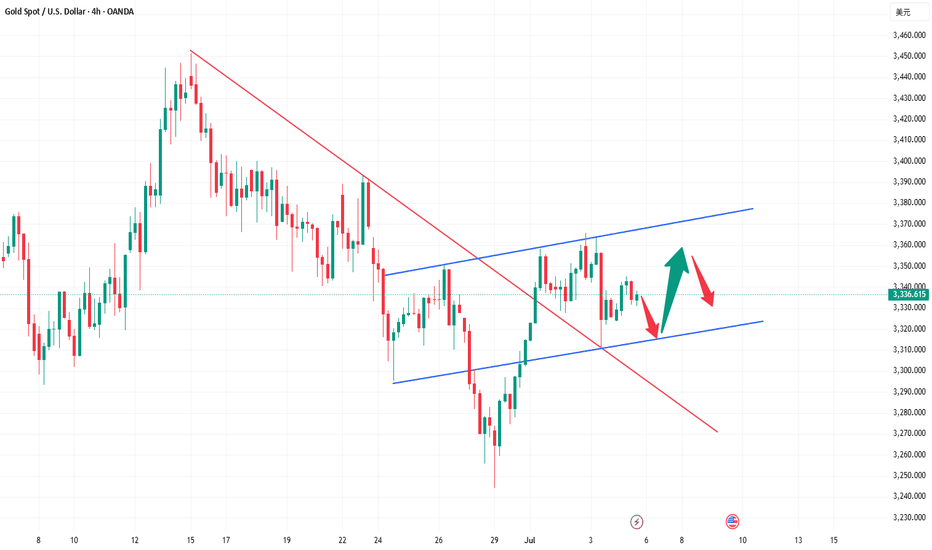

Good morning, bros. From a technical point of view, the overall trend of the daily line is a head and shoulders top. If the bulls do not recover 3360, the bears will still be the medium-term trend. The 4H MACD indicator is dead cross running. The best position for the day to deploy the short position again is 3330-3335, and the 1H chart keeps testing the 3305 first-line support, which may be broken in the short term. At present, 3295-3285 below is a relatively important short-term support. Once it falls below, it is expected to reach 3250, which is also the point I repeatedly emphasized in the morning. The intraday operation suggestion is to rebound shorting as the main, and to go long at lows as the auxiliary. Pay attention to the 3325-3335 support area on the upper side and the 3295-3285 support on the lower side.

🎯 Trading Points:

SELL 3325-3335

TP 3315-3305-3295

BUY 3295-3285

TP 3305-3315-3325

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

FXOPEN:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD TVC:GOLD

Goldprediction

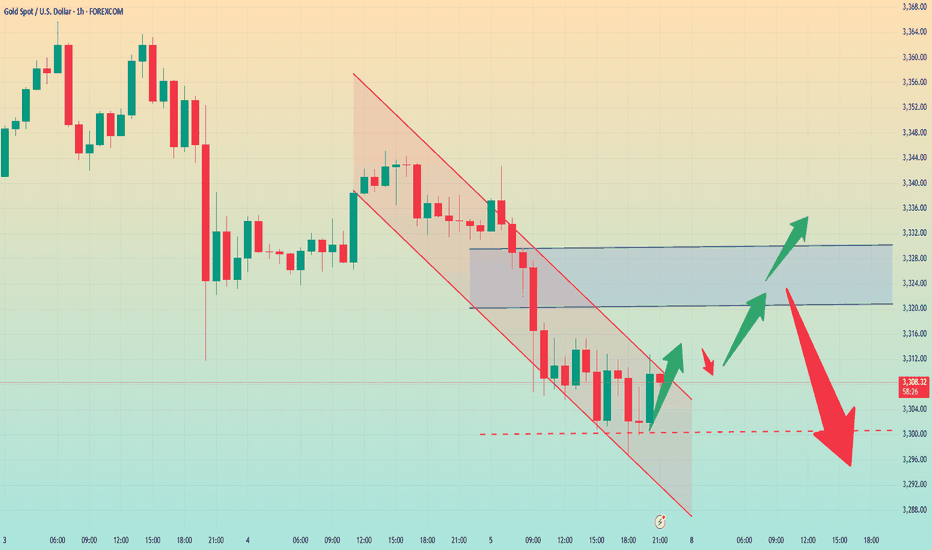

Gold fluctuates downward. Do not short blindly.Today, gold is in a consolidation downward trend, with the lowest point reaching around 3296; it has rebounded slightly to around 3310. From the overall market, gold is indeed in a short trend. However, do not continue to short, which is very dangerous.

Because from the hourly chart, although the low point of gold is constantly refreshing, the key hourly chart support range position has not yet broken.

So, here I may think that gold may still be tempting to short in the short term. There is still a possibility of a pullback here on the hourly chart. From the current point of view, there is still a probability of a pullback to 3320-30 before the range is broken. In terms of the next operation, I suggest that you can pay attention to 3320-30.

However, if it really pulls up again, as long as it does not stand above 3330 again. Then, we can short here at 3320-30. On the contrary, if the rebound directly breaks above 3340, then be careful. The rebound may turn into a trend reversal, and it is very likely to replicate the rhythm at the beginning of last week.

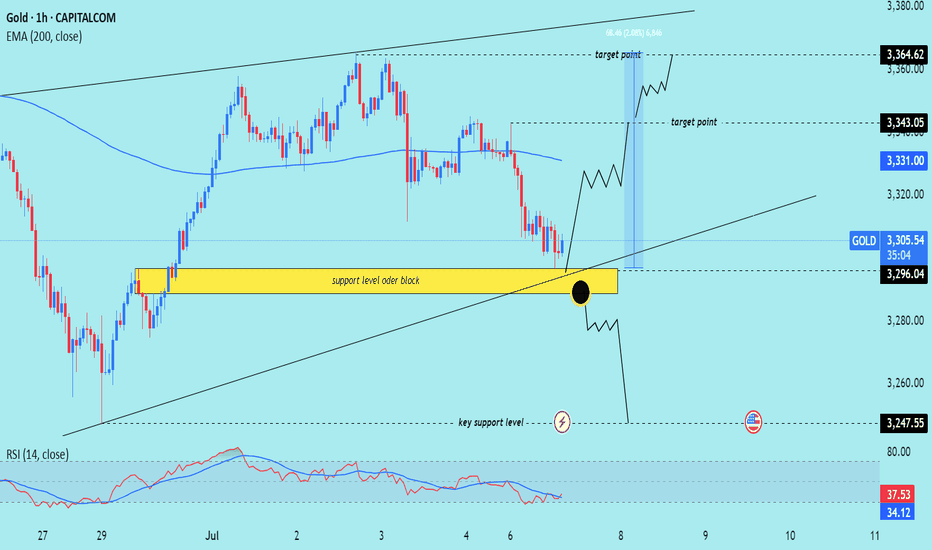

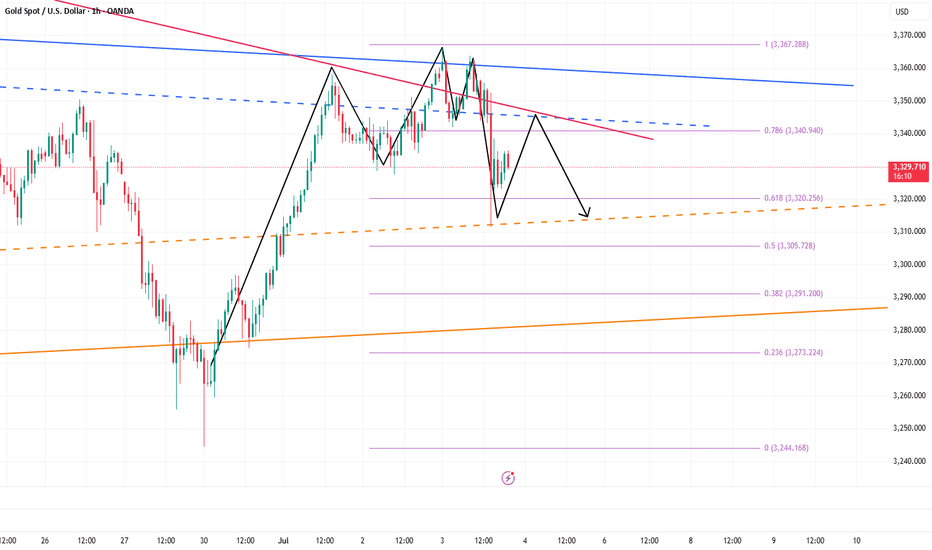

XAU/USD) order block back up trand Read The captionSMC trading point update

Technical analysis of Gold (XAU/USD) on the 1-hour timeframe, focusing on a potential reversal from a key support/order block zone. Here's a full breakdown

---

Chart Analysis – XAU/USD (1H)

1. Key Zone: Support Level / Order Block (Yellow Box)

The price is currently testing a strong support zone that previously acted as a bullish order block (demand area).

This zone is also near a diagonal trendline and a prior breakout level, adding confluence to the setup.

2. Reversal Anticipation (Black Zigzag Path)

The chart suggests two possible scenarios from the support area:

A bullish bounce leading price up toward:

Target 1: 3,343.05 (near 200 EMA)

Target 2: 3,364.62 (upper resistance)

A break below the yellow support zone, triggering a deeper move toward:

Key support: 3,247.55

3. RSI Oversold Signal

RSI (14) is at 32.66, which is near oversold territory, signaling potential for a bullish reversal if buying pressure steps in.

4. EMA (200 - Blue Line)

EMA at 3,330.95 currently acts as dynamic resistance.

If price bounces from the order block, this EMA may serve as the first reaction level before further upside.

Mr SMC Trading point

---

Summary

Bias: Bullish bounce if price holds above 3,296.04 (order block support).

Entry Zone: Current price near 3,301 or confirmation bounce candle.

Targets:

TP1: 3,343.05

TP2: 3,364.62

Invalidation: Strong break and close below 3,296.04 may open the path to 3,247.55.

RSI: Favoring reversal conditions (near oversold).

---

Please support boost 🚀 this analysis)

XAU/USD) support level back bullish trend Read The captionSMC trading point update

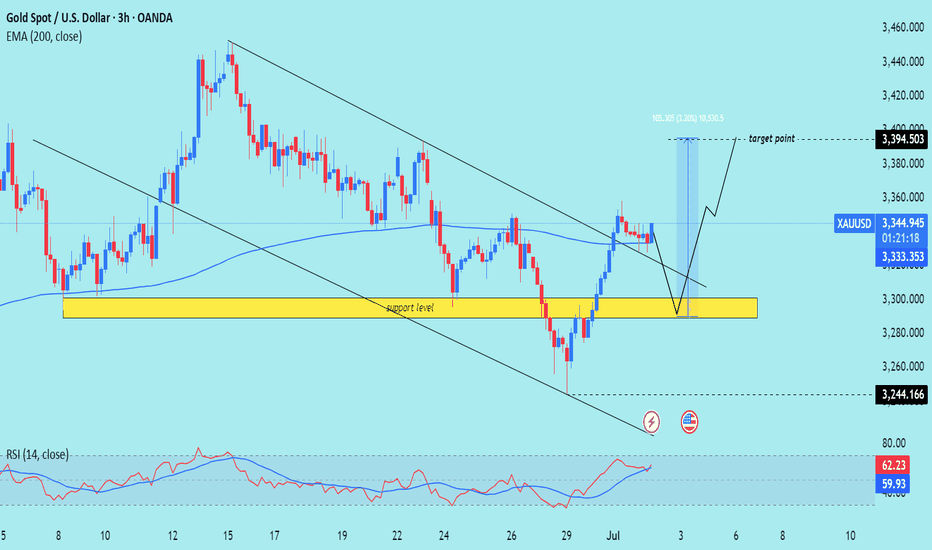

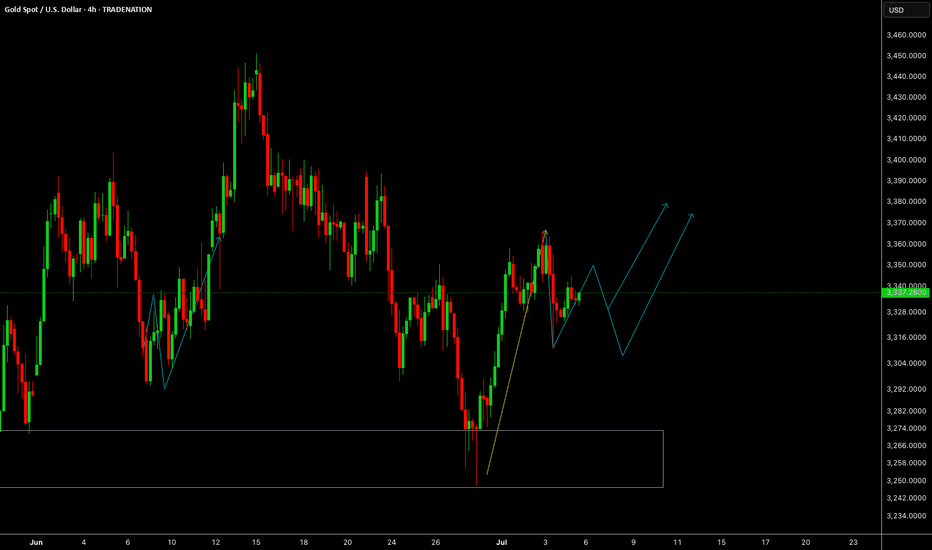

Technical analysis of Gold (XAU/USD) on the 3-hour timeframe, suggesting a long trade idea with a clearly defined support zone and target projection. Here's the detailed breakdown:

---

Chart Breakdown (3H - XAU/USD)

1. Support Zone (Yellow Box):

Price reacted strongly to the 3,244–3,300 area, which is identified as a key support level.

This area has historically seen demand and is now acting as a base for potential bullish continuation.

2. Falling Wedge Breakout:

A falling wedge pattern has been broken to the upside, which is typically a bullish reversal signal.

The breakout indicates a shift from the previous bearish momentum into bullish strength.

3. EMA 200 Confirmation:

Price is now above the 200 EMA (3,333.347), supporting a bullish bias.

This can act as dynamic support going forward.

4. RSI Momentum:

RSI at 62.00, indicating growing bullish momentum without being overbought.

The RSI has also broken above a previous local high, confirming strength.

5. Target Projection:

The projected move (blue arrowed box) suggests a potential rally of +105.305 points (3.20%), targeting the 3,394.503 level.

This level aligns with previous price structure and acts as the next major resistance.

6. Anticipated Price Path (Black Zigzag Line):

Price is expected to pull back slightly, retesting the wedge breakout or support zone.

After this retest, a bullish continuation toward the target point is projected.

Mr SMC Trading point

---

Summary:

Bias: Bullish

Pattern: Falling wedge breakout + support retest

Entry Zone: Around 3,300–3,320 on a retest

Target: 3,394.503

Invalidation: Strong break and close below 3,244.166

Confirmation: Bullish price action near support + sustained RSI strength

Please support boost 🚀 this analysis)

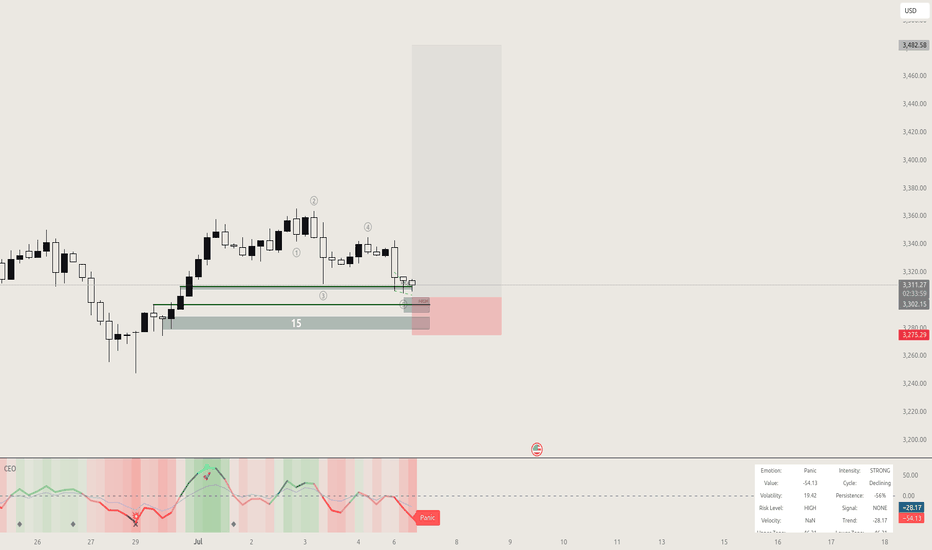

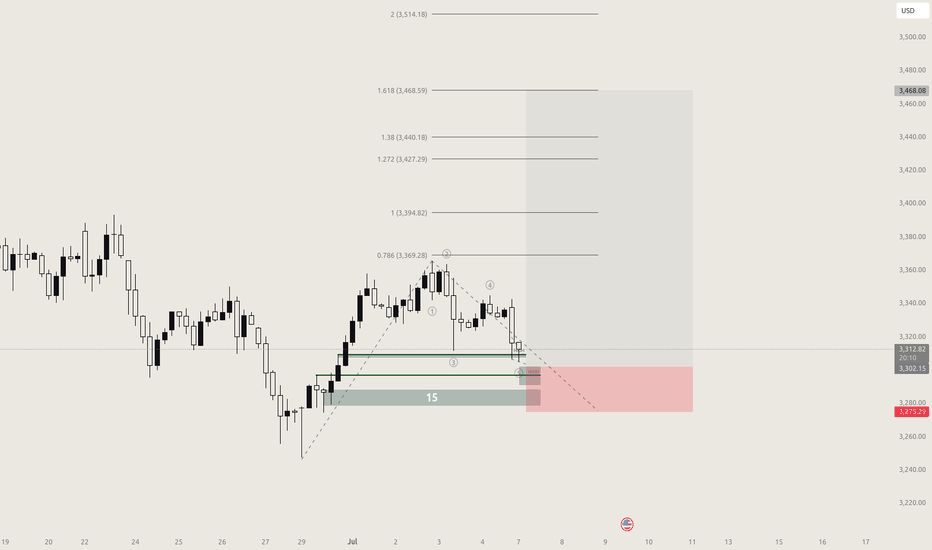

Trade Breakdown: XAUUSD 15-Min | Liquidity Grab + Reversal PlayOANDA:XAUUSD

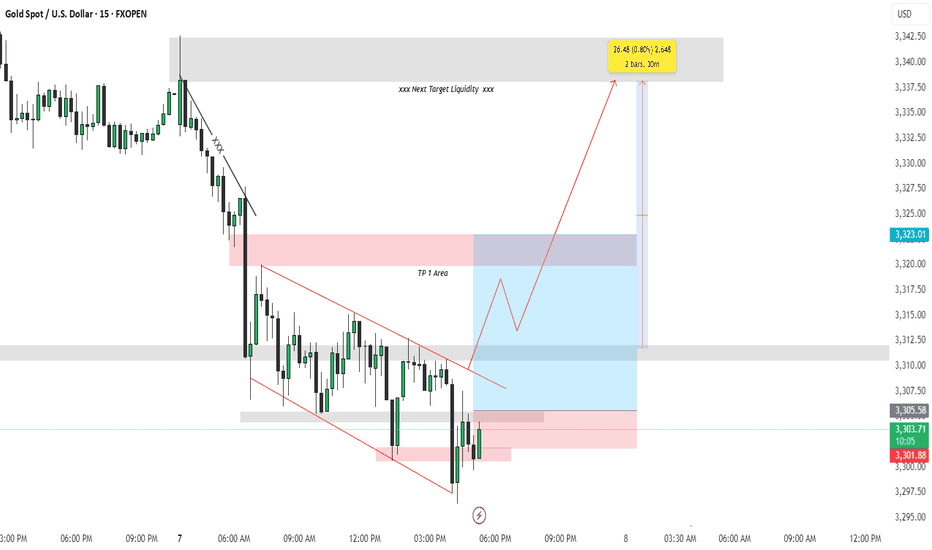

Psychological Setup

This trade is rooted in the psychology of smart money and retail behavior. After a sharp drop in price, most retail traders expect continuation (trend-following). However, institutions often manipulate liquidity zones — hunting for stop-losses before a true reversal. This trade capitalizes on that behavior.

🔍 Technical Explanation:

🔻 1. Market Structure:

Price was previously in a downtrend, forming lower highs and lower lows.

A falling wedge pattern (red lines) formed after a strong bearish move, signaling potential bullish reversal.

Price broke the wedge to the upside — a classic reversal signal.

🔁 2. Liquidity Concept:

Below the wedge: The market grabbed liquidity by taking out stop losses of buyers who entered too early.

Above the wedge (TP Areas):

TP 1 Area (red box): This is the first logical resistance where previous supply sits — many sellers will enter here, providing buy-side liquidity.

Next Target Liquidity (grey box above): This is a major imbalance zone and likely where stop-losses of early short sellers are stacked.

Price is expected to grab liquidity from that area (marked by the red arrow).

✅ Entry & Trade Logic:

Entry Zone: After liquidity was swept at the bottom of the wedge, a bullish engulfing candle formed near demand — signaling institutional interest.

Risk-Reward Setup:

Targeting 0.80% move (approx. 26.48 points).

Trade is based on reversal from demand zone + wedge breakout + liquidity grab confirmation.

🎯 Target Projections:

TP1 Area: Conservative target, just above recent structure.

Final Target: High-probability liquidity zone where market is drawn to clean up resting orders (grey zone).

🧠 Why This Trade Matters (Trading Psychology Insight):

Most retail traders get trapped in emotional entries — entering shorts after a drop or longs too early in a wedge.

Smart money waits for liquidity sweeps before moving price in the desired direction.

This setup shows the importance of patience, structure, and understanding market psychology rather than reacting emotionally to price action.

📌 Key Takeaways:

📉 Trap: Falling wedge builds false bearish confidence.

🧠 Psychology: Stop hunts create fuel for reversal.

📈 Reaction: Smart money absorbs liquidity, moves price toward next inefficiency.

Hashtags:

#XAUUSD #SmartMoney #LiquidityHunt #TradingPsychology #GoldTrade #PriceAction #WedgeBreakout #FXOpen #TechnicalAnalysis #SupplyDemand

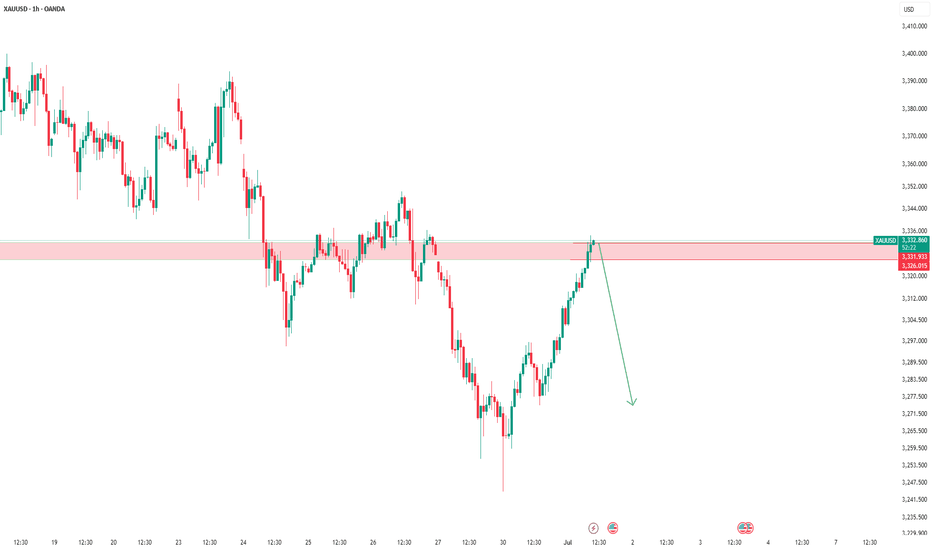

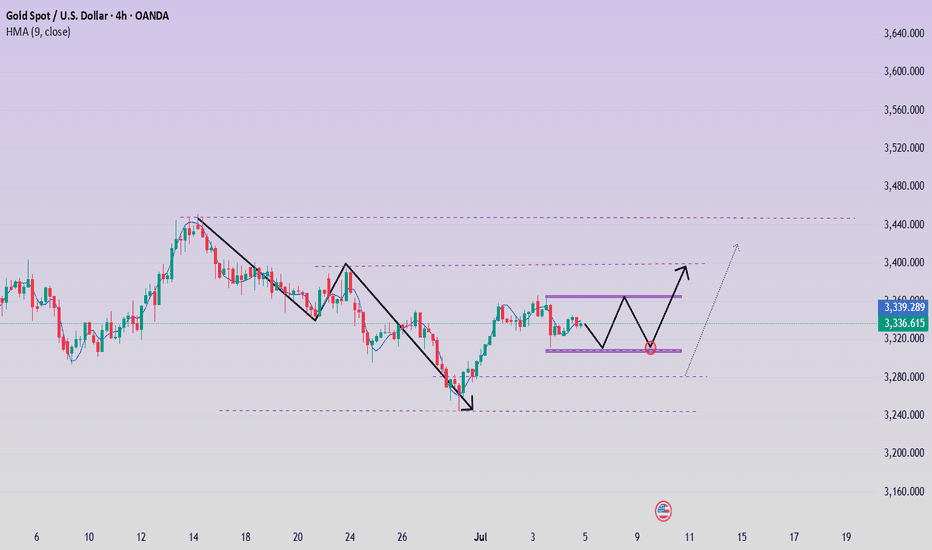

Gold shorts may continue to 3280 or even 3255Gold started to fall from around 3342 in the Asian session, and currently hit a low of around 3305. This is completely consistent with my prediction: "Before gold stabilizes at 3340, it is still in a short trend. Gold shorts may counterattack at any time and look at the target area in turn: 3315-3305." Currently, gold has reached the target area as expected.

There is no doubt that gold is still in an obvious short arrangement at present, and gold shorts may have just begun. For the next short-term trading, we still focus on shorting gold, so what we are most concerned about now is where gold can rebound and where is the most suitable short entry? ! From the current structure of gold, gold is under pressure from the short-term head and shoulders technical structure. This resistance structure compresses the rebound limit in the short term to the 3335-3340 area; and the short-term resistance area is located in the 3320-3330 area; once gold is under pressure and falls again, I think it is very likely that gold will fall to the 3295-3285 area again, and may even extend to the 3365-3355 area.

Therefore, I think shorting gold is still the first choice for short-term trading; you can consider shorting gold in the 3320-3340 area, looking at the target area of 3290-3280-3270

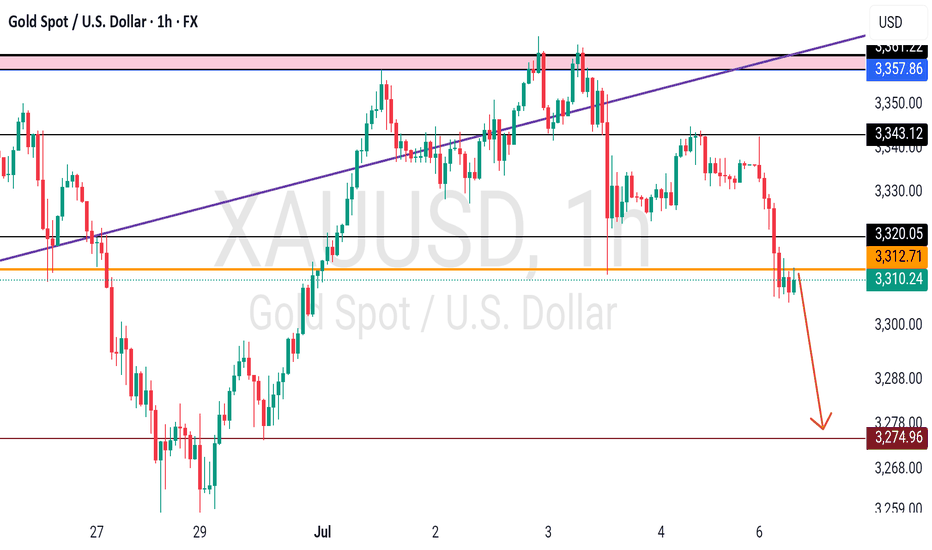

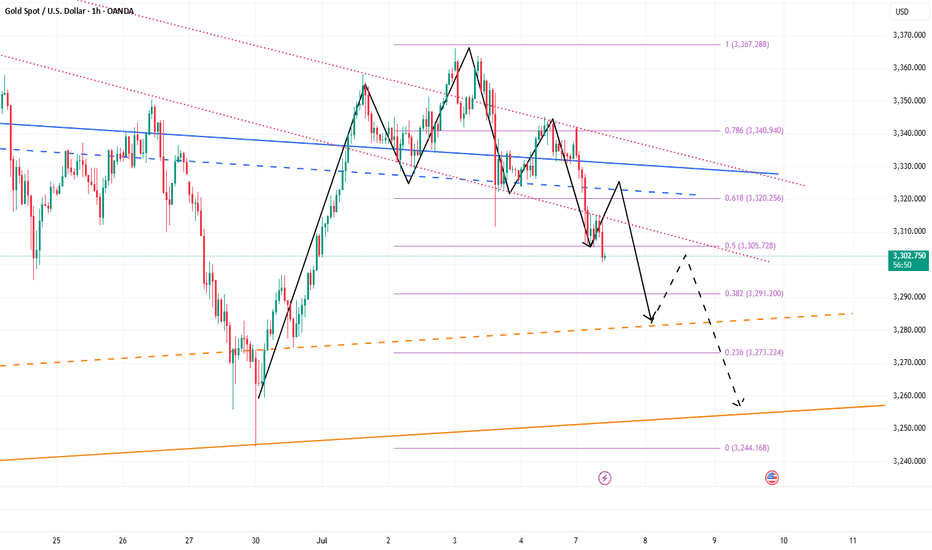

Gold Under Pressure After NFP Beat – More Downside Ahead?Moments ago, the US Non-Farm Payrolls surprised to the upside at 147K (vs 111K forecast), while the Unemployment Rate dropped to 4.1% (vs 4.3% expected) .

This stronger-than-expected labor market data reinforces the idea that the Fed has no immediate reason to cut rates. As a result, the USD( TVC:DXY ) strengthened, and gold came under renewed selling pressure.

If the dollar momentum continues, Gold ( OANDA:XAUUSD ) may face further downside in the short term.

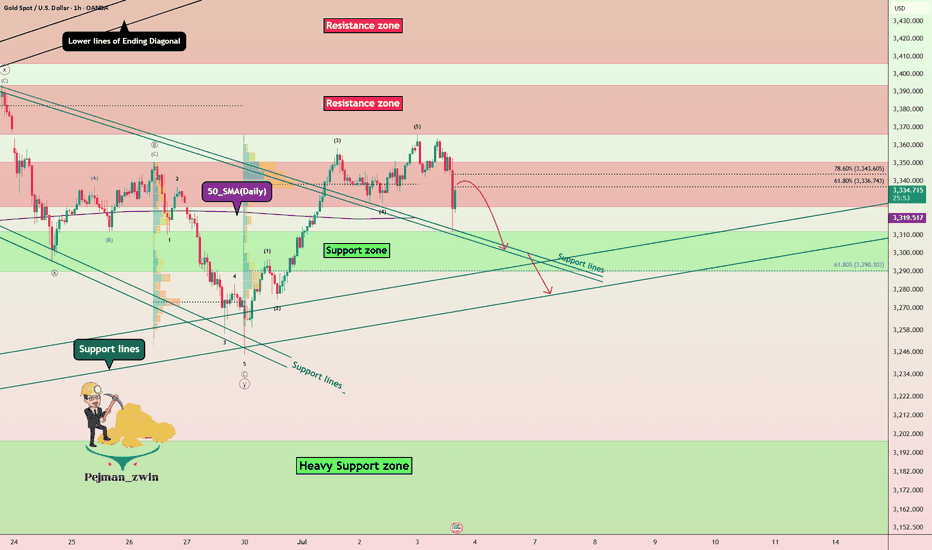

In terms of Technical Analysis , Gold fell below the Resistance zone($3,350-$3,326) again after the announcement of US indices and is currently moving near the Support lines and 50_SMA(Daily) .

In terms of Elliott wave theory , it seems that Gold has completed 5 impulsive waves in the one-hour time frame, and we should now wait for corrective waves .

I expect Gold to fall again after the upward correction , and the Support zone($3,312-$3,290) could be the target.

Note: Stop Loss (SL) = $3,365

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

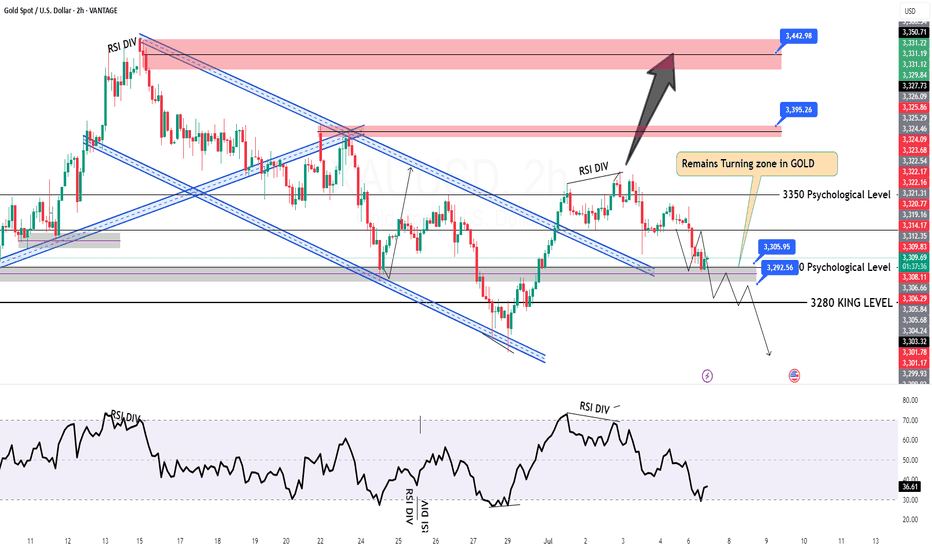

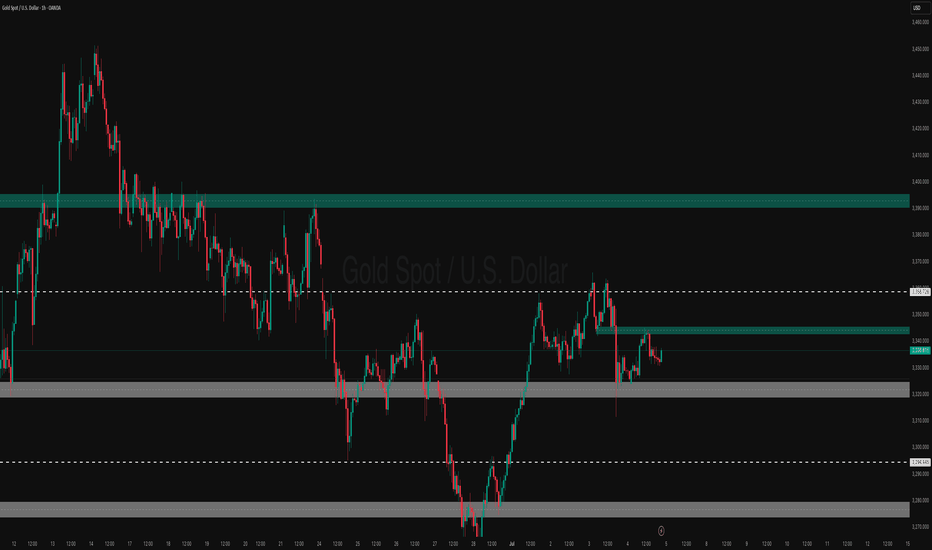

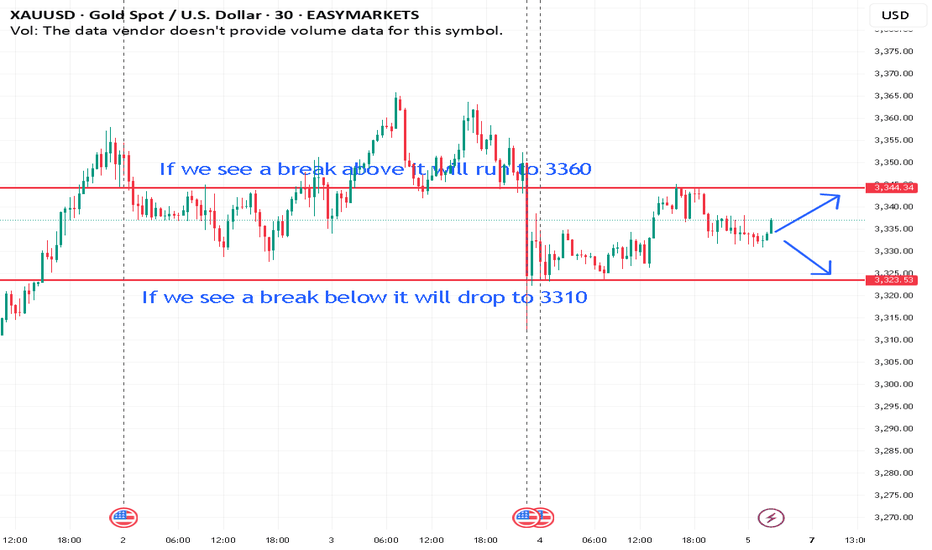

GOLD H2 Intraday Chart Update For 7 July 2025Welcome to the new week traders

as we have FOMC meeting minutes report due this week so firs market is fell down from 3350 Psychological level now is testing 3300 psychological level

all eyes on breakout of 3300 level for now if market breaks 3300 level then it will move towards 3280 then 3350

only clear breakout of 3335 will clear path for towards 3368 level

Disclaimer: Forex is Risky

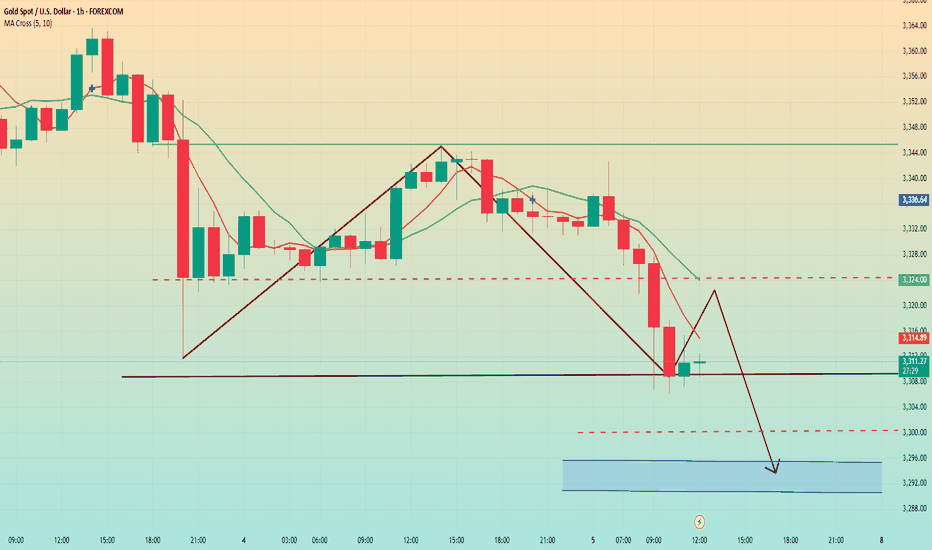

Continue to short gold, bears will exert force againAffected by the NFP market, gold fell precipitously, almost giving back 50% of the gains in the previous wave, and the short-selling performance was particularly strong; technically, gold successfully built a double-top structural resistance in the 3365-3363 area in the short term, which played a technical suppression role in the short term. As gold fell, the current short-term resistance moved down to the 3340-3350 area;

On the other hand, although gold began to rebound after falling to around 3312, it clearly showed the characteristics of weak rebound, and it did not even stand above 3340 once, and the long forces were insufficient; and technically, a single lower shadow line was not enough to support the continued rebound of gold, so gold still had the need to retrace the support below from a technical perspective; and once gold fell again, it was very likely to test the 3305-3295 area again.

So I think we can take advantage of the rebound of gold to short gold again. We can still short gold with the 3340-3350 area as resistance and look at the target area: 3315-3305-3295.

Gold new ATH soon?🟡 GOLD LONG SETUP: Buying the Fear at Key Support 📈

ICMARKETS:XAUUSD

"Be fearful when others are greedy, and greedy when others are fearful" - Warren Buffett

The oscillator we developed is showing some compelling signals on gold right now, and the market sentiment couldn't be more perfect for a contrarian play. 💎

Technical Analysis:

Our custom oscillator is painting a clear picture at the bottom - we're seeing those beautiful green zones emerging after extended red periods

Price action has found solid support around the 3,300 level, creating a strong foundation for the next leg up

The fear in the market is palpable, which historically has been an excellent buying opportunity for precious metals

Volume profile suggests accumulation is happening at these levels

Why This Setup Works: 🎯

The beauty of this oscillator lies in its ability to identify when institutional money starts flowing back into gold during periods of maximum pessimism. When retail traders are panicking and selling, smart money is quietly accumulating.

Key levels to watch:

• Support: 3,300 (current zone)

• First target: 3,350

• Extended target: 3,400+

Risk Management: ⚠️

• Stop loss below 3,275

• Position sizing: Never risk more than 2% of account

• Trail stops as momentum builds

The oscillator's fear signals have been remarkably accurate in identifying these reversal points. When fear reaches extremes, that's typically when the best opportunities present themselves.

This is not financial advice - always do your own research and manage risk appropriately.

What are your thoughts on this setup? Are you seeing similar signals on your charts? 🤔

#Gold #XAUUSD #TechnicalAnalysis #BuyTheFear #Oscillator

XAUUSD – Gold at a Key AreaGold is now in a crucial zone with short potential.

If the market provides a valid bearish signal, I’ll take the short.

But if this zone breaks and confirms with a pullback, I’ll switch bias and go long.

💡 Remember:

We don’t control the market — we just try to profit using structure, setups, and solid risk management.

📌 Always risk max 1% per trade.

If the market goes against your bias, you only lose 1% — not your whole account.

🧠 One trade won’t make you rich,

But one reckless trade can destroy everything.

No gambling.

Just discipline, structure, and smart execution.

The bill was introduced; the price did not rise but fell.Due to the implementation of the US bill, most traders in the market are bullish on gold and believe that gold will soar on Monday. As a result, it jumped up and fell sharply this morning. This is the uncertainty of the market. Although the short position given near 3340 last Friday was late, it fell to the low point of 3306 at the opening of the Asian market today.

In addition, the key to this sharp drop is the high point before the rebound, that is, the starting point or the position of the top and bottom conversion. Once it is broken, you have to change your mindset. The volatile market is like this, just get used to it. The turmoil caused by Trump's bill will not appear for a while. It takes a process and cannot be unilaterally considered as bullish or bearish.

In the early Asian market, the price fell all the way from 3342 US dollars to 3306. How to judge the end of the decline? It is to stare at the high point of the rebound before the last decline of 3320 US dollars. The loss of 3300 US dollars in the early trading indicates that the gap-up opening is a lure for more.

Today, I think that 3325 above 3320 can be used as the dividing point between long and short positions. You can short with a light position near 3315, and pay attention to the 3295-3290 line below. After the upward breakthrough is confirmed, consider adjusting the position and making other arrangements. For the time being, we will look at the weak adjustment during the day.

GOLD CONFIRM TRADE🔍 Chart Analysis Summary:

Current Price: ~3,336

Key Resistance (Supply Zone): 3,340 – 3,353

Major Resistance Above: 3,388 – 3,395

Key Support (Demand Zone): 3,320 – 3,330

Major Support Below: 3,294 – 3,305

⚔️ Trade Setup Ideas:

📉 Sell Setup (High Probability Intraday Short)

Scenario: Price is near the lower supply zone (3,340–3,353), showing rejection.

Entry: 3,340 – 3,345 (on bearish candle confirmation or rejection wick)

Stop Loss: Above 3,353 (zone high or recent swing high)

Take Profit Targets:

TP1: 3,330 (first minor support)

TP2: 3,320 (demand zone)

TP3: 3,295 (major support)

📌 Confirmation Tips:

Look for bearish engulfing / rejection candles

RSI divergence or weakness

Break of 3,330 support confirms continuation

📈 Buy Setup (If Price Drops to Demand)

Scenario: Price drops back into demand zone 3,320–3,330 with bullish reaction.

Entry: 3,322 – 3,328 (bullish wick or engulfing candle)

Stop Loss: Below 3,320

Take Profit Targets:

TP1: 3,340

TP2: 3,353 (supply)

TP3: 3,388 (major resistance)

📌 Confirmation Tips:

Bullish price action near 3,322 zone

Momentum buildup from demand

Use M15/M30 for refined entry

Big changes begin. Dominant trend?Event summary:

The United States passed the Big and Beautiful Act; how to get this part of the tax after the massive tax cut? Then it can only be obtained through other means, and the tariff war initiated by Trump is one of them. At the same time, the bill will increase the federal debt by trillions of dollars, further widening the gap between the rich and the poor.

Immediately after the bill was signed and took effect, Musk announced the establishment of the "American Party". He wrote: We live in a one-party state, not a democratic country. Today, the American Party is established to return your freedom to you. At the same time, Musk posted on July 6, when and where should we hold the first congress of the "American Party"? This will be very interesting.

This event is likely to support the trend change of gold bulls in the short term.

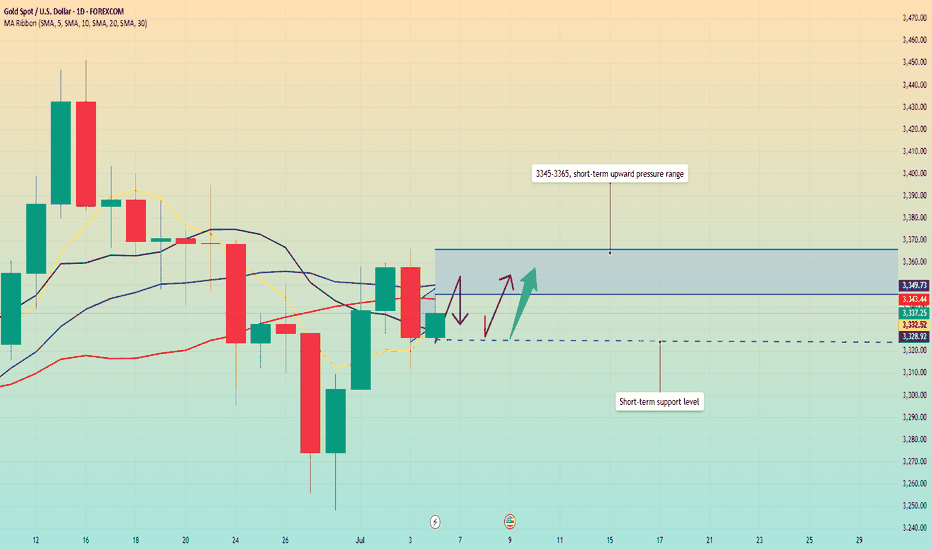

Market analysis:

From the daily chart, after bottoming out and rebounding this week, the weekly line closed higher, and there is still upward momentum next week; short-term focus on the pressure of the 3345-3365 range, which is likely to become a key area for long and short competition. Before breaking upward, focus on the high and fall. Pay attention to the support rebound of 3320-3325 area below. Once the upper pressure range is broken, the bullish space will expand, and it is not ruled out that it will hit above 3400 and then go down.

In terms of operation, the price falls back and buy on dips in the 3315-20 area, and pay attention to the profit range of 3345-3365 on the upside.

Gold continues to fluctuate, where will it go next week?Fundamental analysis:

With the Trump administration's massive tax cut and spending bill officially implemented, the U.S. Treasury may start a "supply flood" of short-term Treasury bonds to make up for the trillions of dollars in fiscal deficits in the future. The market has begun to respond to future supply pressures. Concerns about the oversupply of short-term Treasury bonds have been directly reflected in prices - the yield on 1-month short-term Treasury bonds has risen significantly since Monday this week. A closer look at non-agricultural new jobs exceeded expectations, but nearly half came from government departments, which is likely to reverse in July. Slowing wage growth, declining total working hours, stagnant wage income growth, and worrying consumer spending are all signs of support for gold.

Gold bottomed out and rose from the low of 3245 this week, and then soared all the way to 3365. Finally, the weekly line closed with a positive line with an upper shadow. From the overall trend, after the data is digested, next week will still be treated with a volatile mindset. The large range will focus on the 3280-3393 area. If it does not break, it will still be mainly a sweeping operation. On the daily line, it also closed with a positive line with a long upper shadow, and closed firmly above 3323. It repeatedly tested the pressure of 3345 and did not break and fell back. The structure still maintained an oscillation rhythm within a small range. From the 4-hour cycle, the Bollinger Bands closed significantly. If it opens normally next week, pay attention to the 3325-3315 and 3311 areas when it falls back to support, and pay attention to the 3357 and 3365 positions when it hits the high pressure. It is recommended to maintain the strategy of selling high and buying low in operation and respond to the trend.For more specific operational details and strategy updates, please pay attention to the notifications at the bottom 🌐 and follow them in time.

Trump's new tariffs are coming, will gold soar?

✏Hello everyone, let's comment on the gold price next week (July 7, 2025-July 11, 2025)

. ⭐️Gold Information:

This week, the spot gold price showed a trend of rising first and then falling. From Monday to Wednesday, driven by safe-haven demand and the weakness of the US dollar, the gold price recorded three consecutive increases, climbing rapidly from US$3,271/ounce to the intraday high of US$3,365/ounce on Wednesday afternoon, showing strong upward momentum. However, on Thursday, before the release of the June non-farm payrolls data, market sentiment turned, and the gold price plummeted to US$3,312/ounce, the largest single-day drop in the week. On Friday, affected by the light trading during the US Independence Day holiday, the gold price fluctuated between US$3,330 and US$3,355/ounce, closing at around US$3,337/ounce, up about 1.91% for the week.

U.S. President Donald Trump announced that the U.S. will begin sending formal letters to trading partners on Friday, ahead of a July 9 deadline, outlining new tariffs ranging from 10% to 70%, which will take effect on August 1. Treasury Secretary Scott Bessant added that a series of trade agreements are expected before the deadline, with an estimated 100 countries facing reciprocal tariffs of at least 10%. He also hinted that some agreements will be announced soon.

⭐️Labaron personal comment:

Gold prices continue to consolidate sideways, fluctuating in the 3242-3450 range

The following important key areas have been identified:

Resistance: $3362, $3393, $3446

Support: $3312, $3279, $3241

Gold opening market strategy analysis

💡Message Strategy

In the case of all negative non-agricultural data, gold did not fall below the support of 3300, which shows that gold bulls are still the main trend. The current daily pattern of gold is three positives, one negative and one positive. The trend of the opening next Monday is also very important. Once it continues to rise and rebound to break through the suppression, the bulls will open the door to regain the 3400 mark.

At present, the short-term pressure is still maintained at 3345-50, which is also the first point for the bulls to break through. Once the breakthrough is successful, the next target will be around 3365-3370.

📊Technical aspects

From the 4-hour analysis, the support at 3330 is concerned, and the support at 3320 is concerned. The short-term resistance at 3345-50 is concerned, and the suppression at 3365-70 is concerned. The overall low-multiple cycle participation is maintained. In the middle position, watch more and do less, and be cautious in chasing orders, and wait patiently for key points to participate. Pay attention to the specific operation strategy in time.

💰Strategy Package

Long Position:3320-3330,SL:3305,Target: 3370

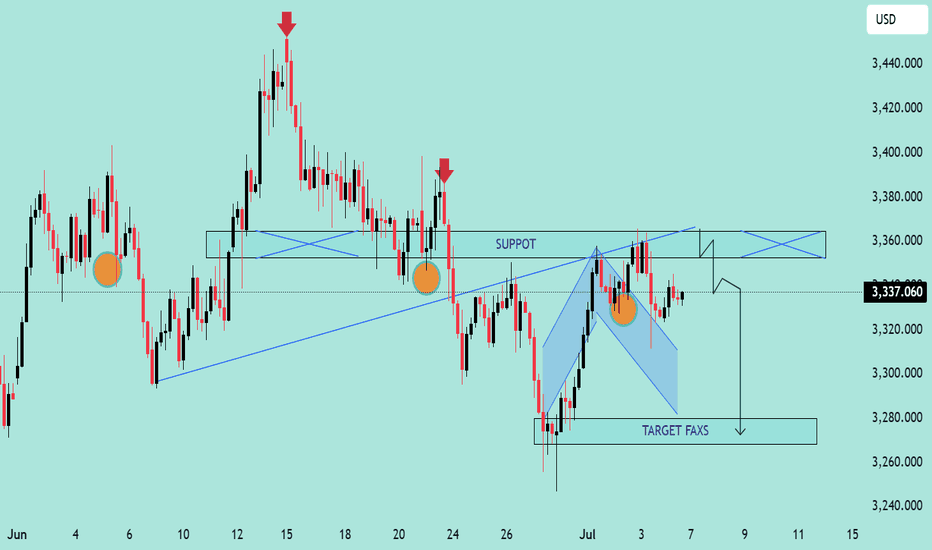

GOLD/USD Bearish Rejection From Resistance Zone – Potential DropGOLD/USD Bearish Rejection From Resistance Zone – Potential Drop Ahead! 🎯

📊 Technical Analysis Summary:

The chart illustrates a bearish setup forming after multiple rejection points near a key resistance zone around 3,360–3,380 USD.

🔍 Key Observations:

🔴 Double Rejection Pattern:

Red arrows highlight strong bearish rejections from resistance.

Indicates sellers are defending this zone aggressively.

🟠 Support Turned Resistance:

The previous support (labelled as "SUPPOT") is now acting as resistance.

Classic bearish retest behavior.

🔷 Bearish Flag Formation:

Price consolidates in a descending flag pattern.

Breakdown below the flag suggests continuation to the downside.

🎯 Target Zone:

If breakdown confirms, price may drop towards target area near 3,275–3,280 USD (marked as “TARGET FAXS”).

🟧 Important Reaction Zones:

Multiple orange circles indicate zones of high reaction – historically significant for both buyers and sellers.

📌 Conclusion:

Unless bulls reclaim the 3,360–3,380 resistance zone convincingly, the bias remains bearish, and the next leg down may target the 3,280 USD area.

🔔 Traders should watch for a clean break below 3,320 to confirm bearish continuation.

GOLDGOLD needs more upside after this correction, next reaction will be coming above 3345 and if consolidates it's a push up further towards 3380 otherwise drop from 3345 above and push up again from below 3300.

Disclosure: We are part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in our analysis.