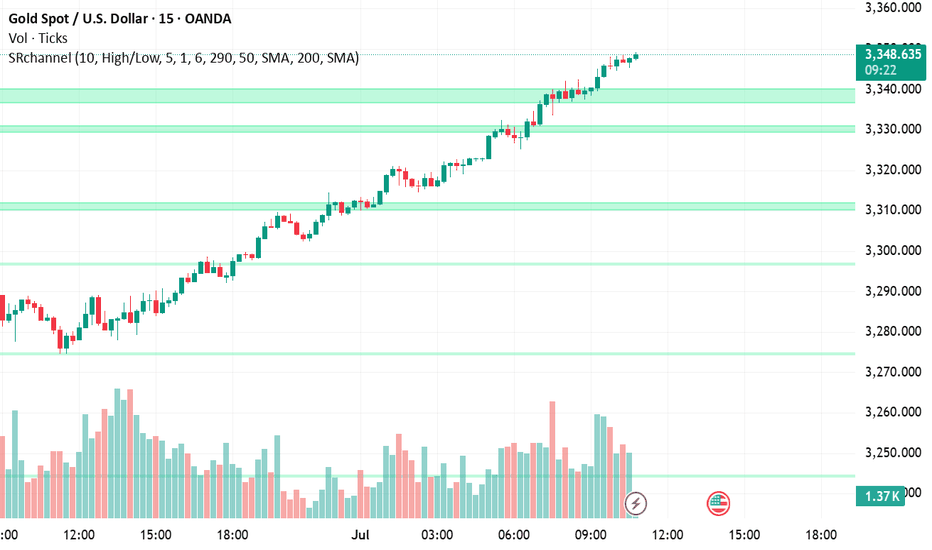

Gold continues to rise slowly

Gold weekly and monthly level: For the monthly level, many people think that the bull market is over when they see the continuous long upper shadow cross K, and they don’t think that it can’t even effectively lose the 5-day moving average, and it is still in a strong stage in the strong stage, and it is also running on the upper track of the upward channel, indicating that the bull market has yet to continue. If it directly pulls up and engulfs the high point of last month this month, a group of bearish people will be wiped out. It has always been emphasized that you should not underestimate the trend of the past two years, and don’t guess the top. This top will reach a height that everyone can’t imagine. Following the bull trend is the right choice. Holding on to the low-level bullish band bottom position in your hand is the happiest moment in the past two years and the most witnessing moment of strength; and the weekly level, as mentioned at the weekend, don’t look at the big negative last week and lose the lower track of the channel. It is also completely possible to directly come back with a big positive this week.

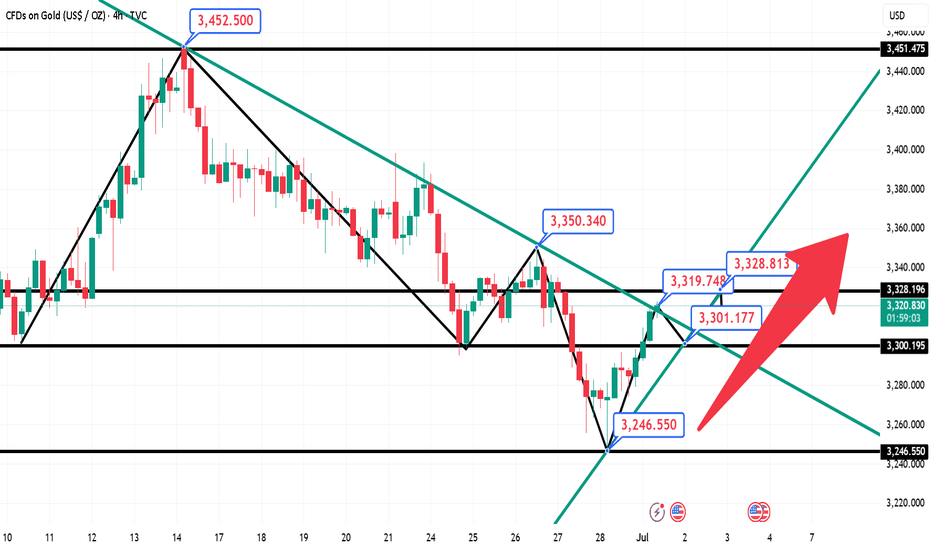

Gold daily level, there has been a continuous positive breakthrough during the day. Once the closing confirms that the breakthrough is effective, it will continue to rise tomorrow and directly approach the lower track of the previous yellow channel. 340 0 line; then going forward, we have to fight for the last key pressure point, the 3500-3452 previous high trend connection line, which roughly corresponds to 3440. Once it breaks through here directly, 3500 will inevitably be unstoppable and move towards 3700; however, there is no need to be too anxious at the moment, be down-to-earth, and overcome the resistance level step by step, but you must try to look far ahead to see more clearly

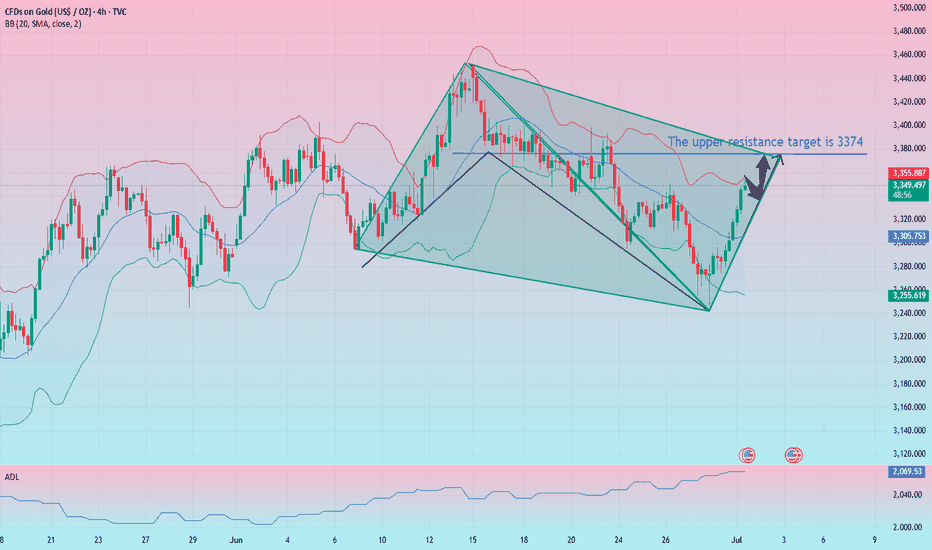

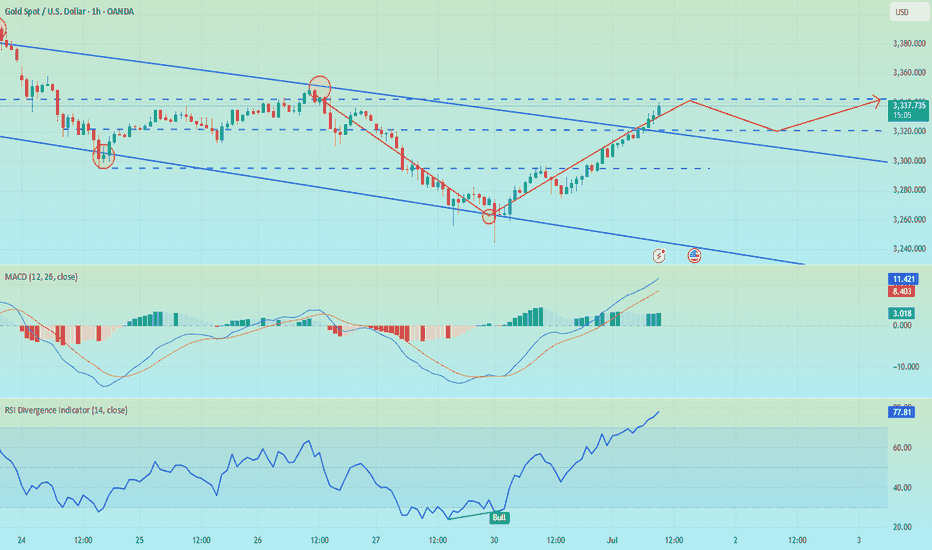

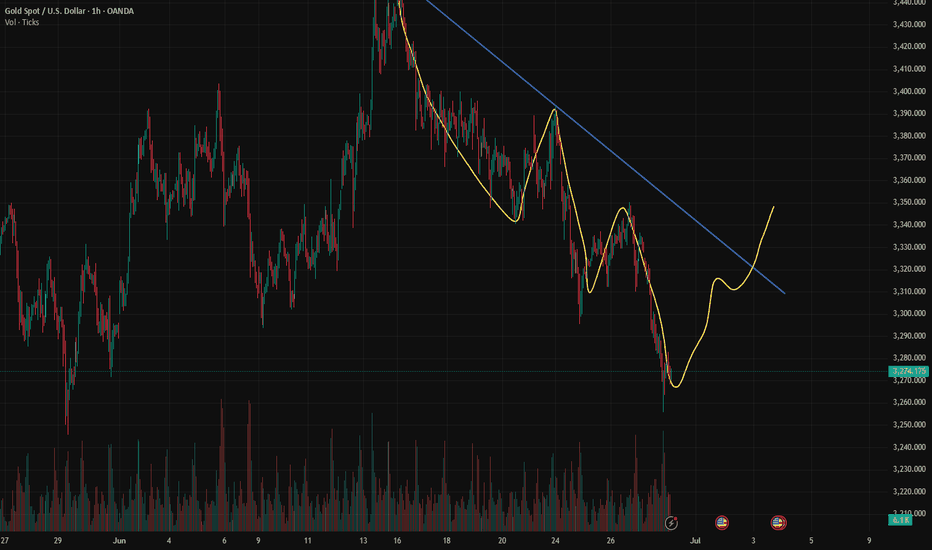

Gold hourly line level: From the opening to now, it has been rising slowly all the way, with a small negative in the middle, all positive, this kind of pull-up pattern must not be tested for shorts, and during the European session, it also broke through the upper rail resistance level of the 3335 downward channel, and there was a second pull-up in the US session; it just couldn't step back, and even the 10-day moving average didn't give a chance. If you want to step back and follow the long position, there is no chance for the time being, and going long directly seems more radical; you can wait patiently, be bullish, and don't go short; if you can confirm that it is above 3335 today, you can try to follow the bullish trend, and the upper resistance target is 3374

Goldprediction

Today, we will focus on the resistance around 3350

Gold continued to rise without any retracement. At present, the reason for the rise in gold is the market's optimistic expectation that the Federal Reserve will resume interest rate cuts later this year. The US employment report to be released on Thursday may also become a catalyst for the decline in US bond yields, which is usually favorable for gold. Although gold has recently adjusted back, if the US dollar continues to depreciate, gold still has the greatest potential for growth in the short term.

From the trend point of view, gold has risen slowly and continuously, and the new round of resistance needs to be placed around 3350. If this position breaks again, it actually looks at 3400 above, or pierces 3350 but weakens, then it will not fall sharply. At present, this slow rise market has no other good intervention opportunities except for direct long

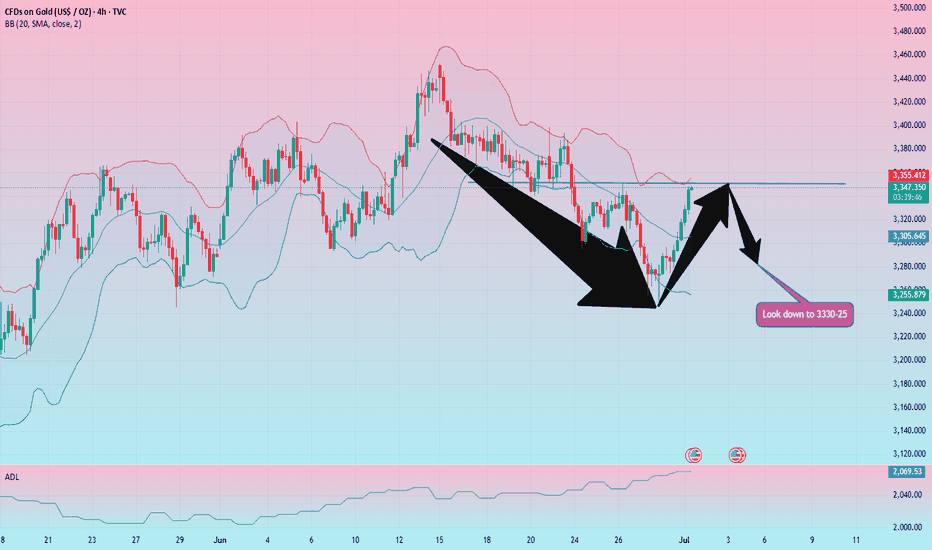

And the European session will first look at the second highest pressure of 3336. If it breaks easily, there is no need to intervene in the short position. At present, the good intervention opportunity is around 3350, with a small stop loss of 3357, and look at the 3330-25 line.

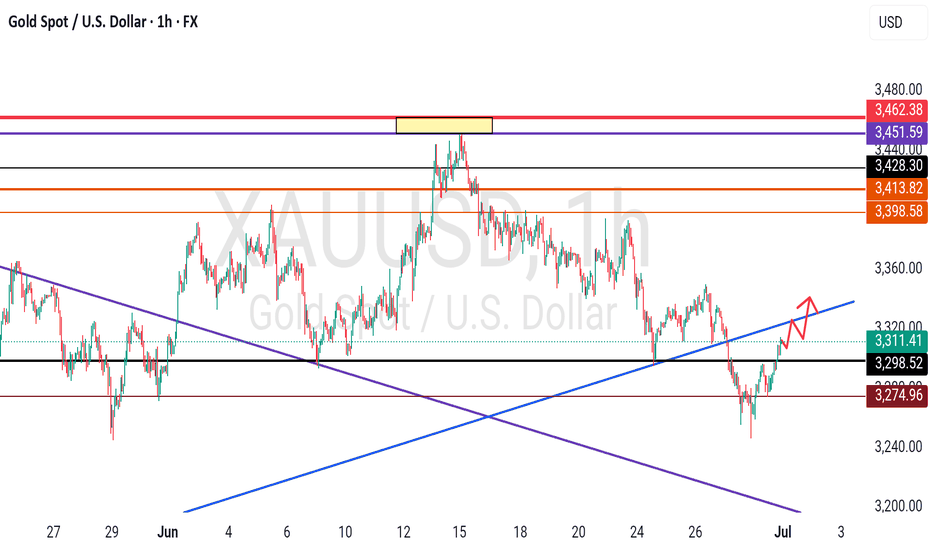

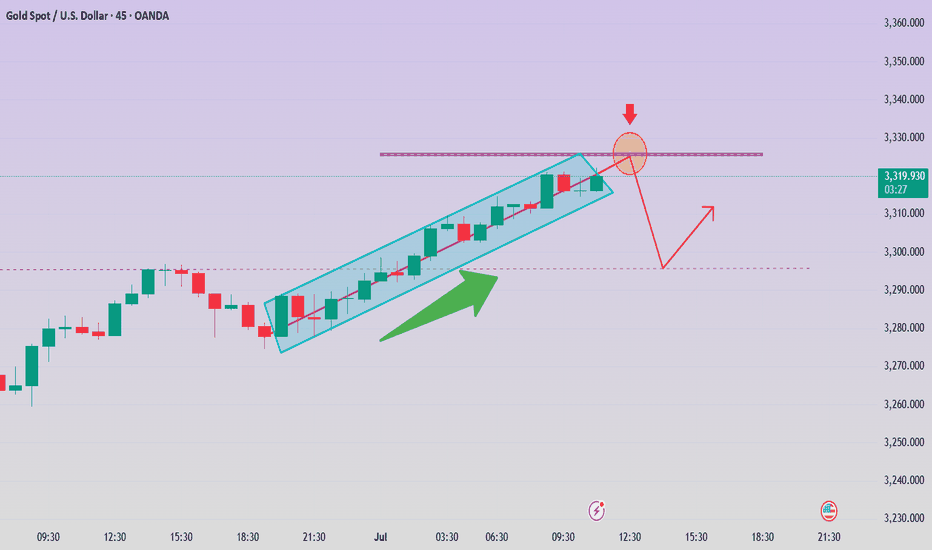

XAU/USD – Bullish Trend Faces Resistance at $3,350 XAU/USD – Bullish Trend Faces Resistance at $3,350 | Watch for Breakout or Pullback!

📅 Published on: Jul 01, 2025

✍️ By: MR_MARK0

🧠 Market Context:

Gold (XAU/USD) has been riding a strong bullish wave, pushing through multiple resistance levels. Currently, price is hovering just below the $3,350 resistance, which marks a critical level for either trend continuation or a potential pullback. Momentum remains in favor of buyers, but signs of exhaustion are beginning to surface.

🔍 Key Zones:

🔴 Resistance Zone: $3,350.0 – $3,352.5

🟢 Support Zone: $3,338.0 – $3,340.0

🟢 Demand Block: $3,310.0 – $3,315.0 (bullish base before recent breakout)

📌 Strategy in Play:

The chart reflects a Trend Continuation Strategy with key support/resistance zones identified. Price has shown strength, but we are now at a make-or-break level. Patience is crucial here.

🧭 Trade Idea:

🔁 Buy the Dip:

Entry Zone: $3,340 – $3,342

SL: Below $3,338

TP1: $3,352

TP2: $3,360

🔁 Breakout Play (Aggressive):

Entry: On breakout above $3,352 with bullish volume

SL: Below breakout candle low

TP: $3,360 and $3,372

⚠️ Risk Note:

Price is extended; a fake breakout above $3,350 may trigger a bull trap. If price fails and drops below $3,338, expect a corrective move toward $3,330 – $3,310. Watch volume divergence and candle rejection patterns.

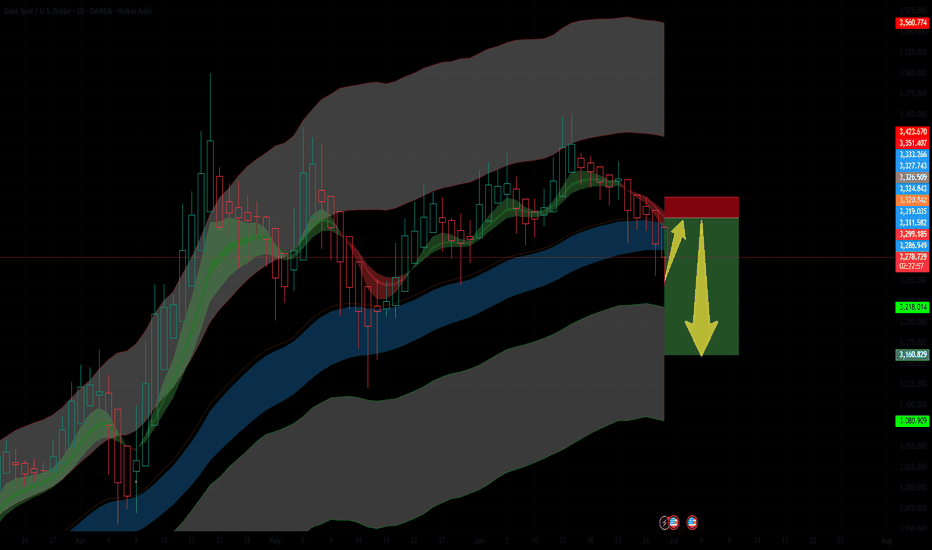

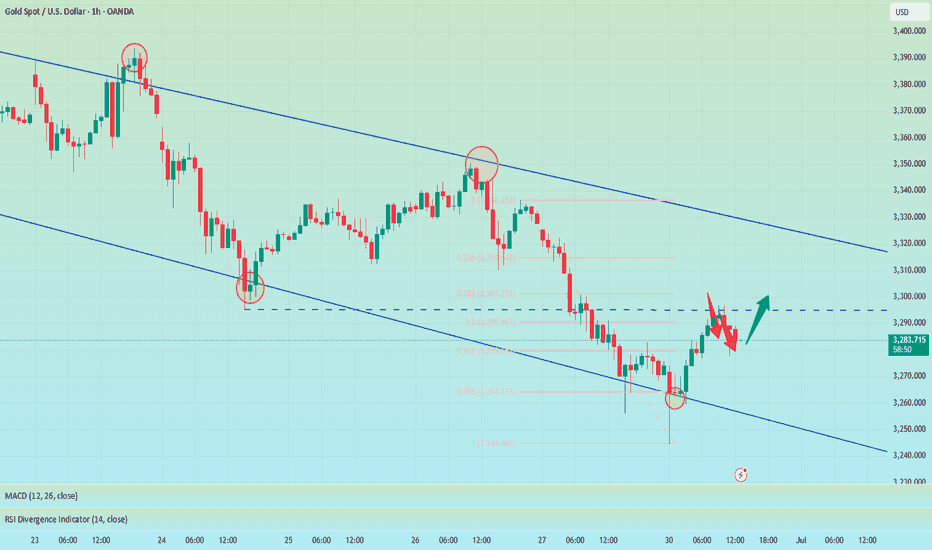

Bearish Setup for GoldGold is currently in a retracement phase after breaking below the mid Keltner channel zone. The small upward arrow marks this temporary relief rally, which I anticipate will be short-lived.

Price is testing the lower band of the inner Keltner channel after rejecting from the upper zones. The structure suggests a classic lower high formation before a potential major sell-off, targeting the deeper liquidity zones around $3,218 – $3,160 and possibly $3,080 if momentum accelerates.

📉 Bias: Bearish

📌 Invalidation: A clean break and close above the red resistance block (~$3,320+)

📌 Target Zones: $3,218 → $3,160 → $3,080

🔔 Look for volume drop and wick exhaustion confirming the next leg down.

This retracement may offer one final short entry opportunity before a deeper correction unfolds.

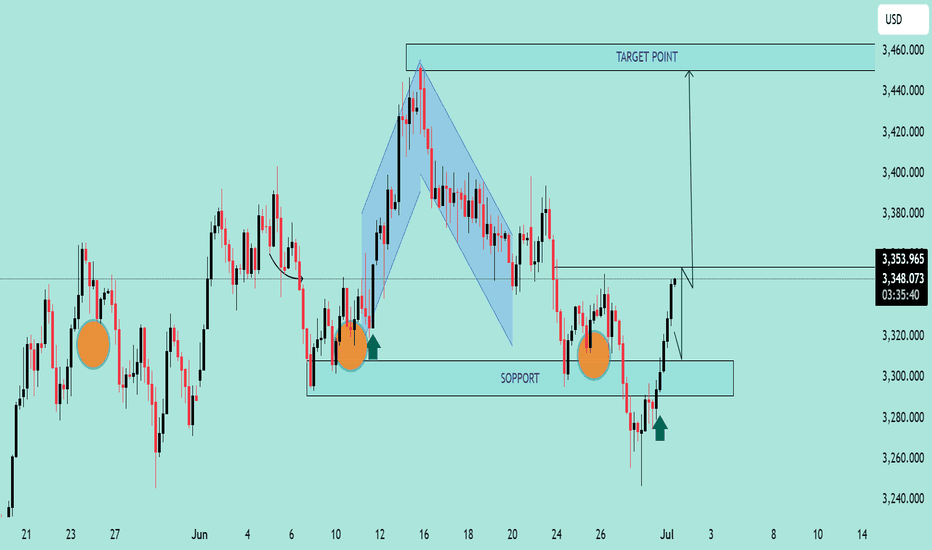

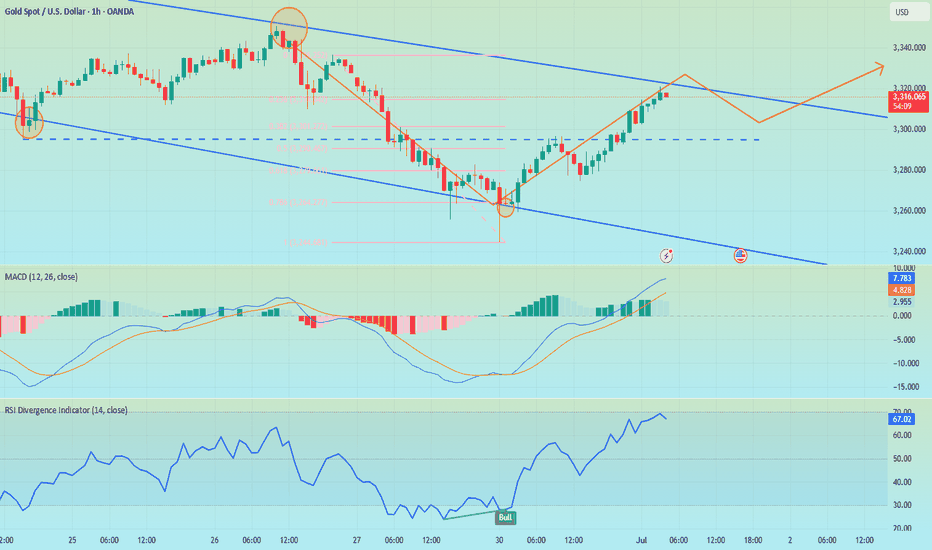

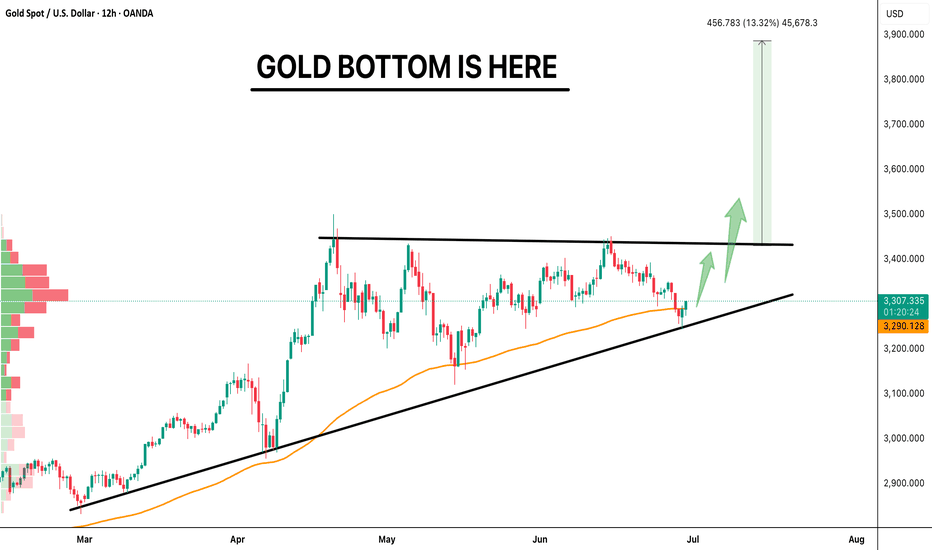

Bullish Reversal Setup on GOLD/USD Bullish Reversal Setup on GOLD/USD 💰📈

🔍 Chart Analysis:

The chart illustrates a clear bullish reversal structure forming off a strong support zone:

📌 Key Observations:

Multiple Rejections at Support 🟠

The price has reacted to the 3,300 - 3,280 USD support zone multiple times, forming a triple bottom pattern, indicating strong buyer interest.

Bullish Harmonic Pattern ✅

A bullish harmonic pattern (likely a Bat or Gartley) completed right at the support level, triggering a strong reversal with a bullish engulfing candle.

Break of Minor Structure 📊

Price broke through minor resistance near 3,340 USD, confirming bullish momentum. The breakout is supported by a retest shown with the green arrow 🟢.

Target Point Identified 🎯

The projected target is 3,460 USD, marked clearly as the next significant resistance zone. This aligns with previous price rejection areas, making it a high-probability target.

📈 Trading Outlook:

✅ Buy Confirmation: Break and retest of 3,340 USD zone.

🎯 Target: 3,460 USD.

🛡️ Support Zone: 3,300 – 3,280 USD (watch for any breakdown below this).

📌 Conclusion:

The chart signals a high-probability bullish continuation, with strong support, harmonic confluence, and structural breakout. Traders may look for buy opportunities on pullbacks with the target set at 3,460 USD. 🚀📊

The bull market is too fierce. How to solve the short position?📰 News information:

1. Geopolitical situation

2. PMI data

📈 Technical Analysis:

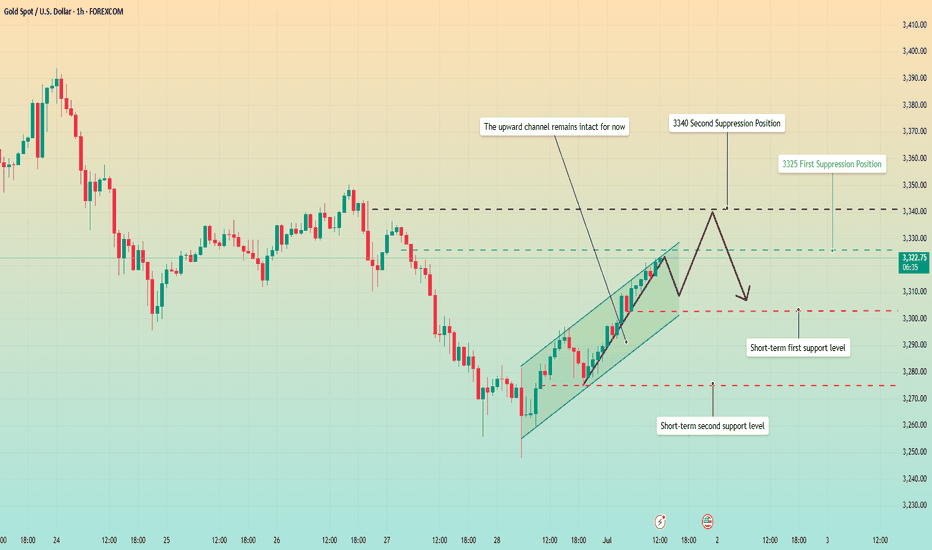

The conflict between Iran and Israel has stopped for a while, but there is a possibility of it breaking out again. There is a possibility of triggering risk aversion in the short term. From a technical perspective, the 4H MACD indicator shows a golden cross, and the moving average and other indicators are also radiating upward, with a strong bullish signal. The 1H chart Bollinger Bands open upward, and the short-term pressure position is at 3340-3345. The short-term data indicators are seriously overbought, and there may be a profit correction in the short term. Therefore, if you want to short in the short term, you can only consider the 3340-3350 range. In the short term, gold will not usher in a large retracement, and the short-term target is only suitable for looking at 3320-3310. As for the long trading point, it is expected to wait for the European and American trading hours.

🎯 Trading Points:

SELL 3340-3350

TP 3320-3310

BUY 3325-3315

TP 3335-3340-3350

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

TVC:GOLD OANDA:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD FXOPEN:XAUUSD FX:XAUUSD

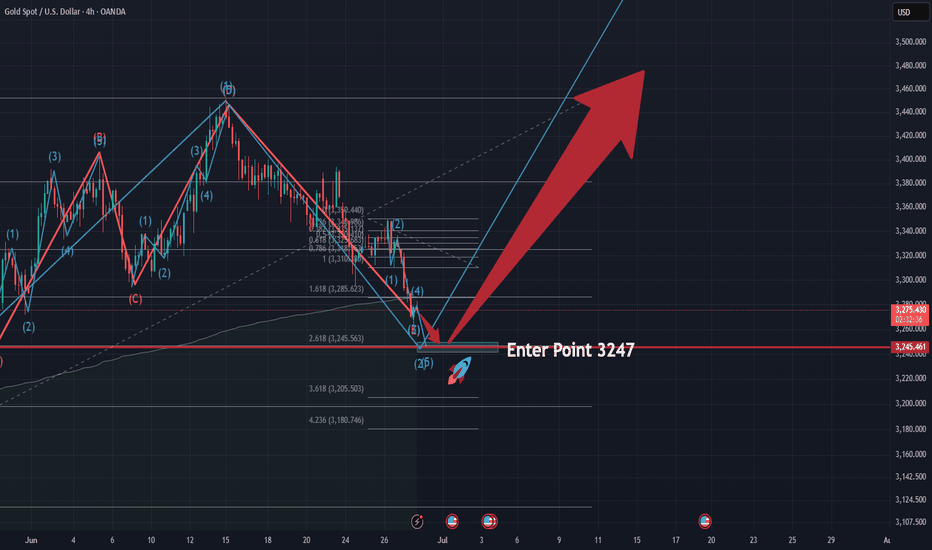

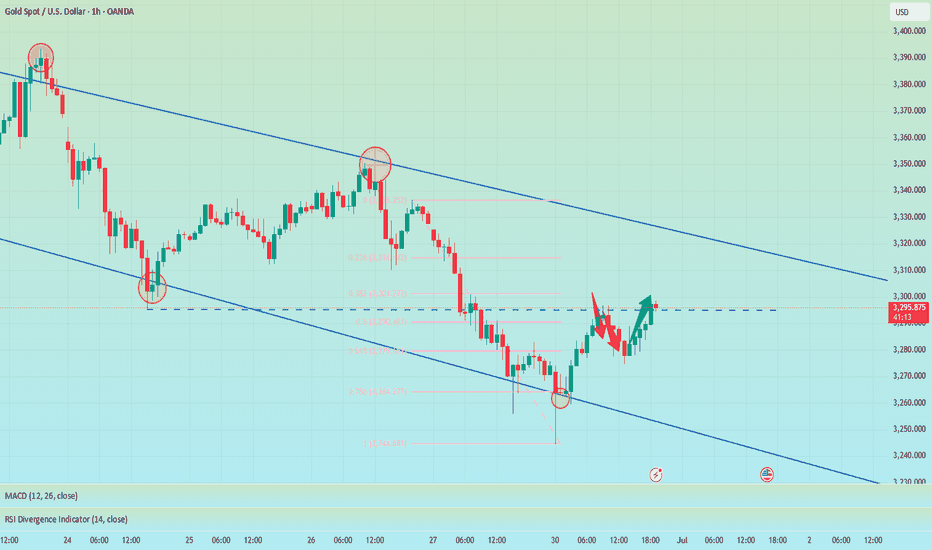

XAUUSD Long Setup – Watching 3247 Entry ZoneHi Traders,

The recent price action of XAUUSD has been a bit complex, but I hope this idea turns out to be profitable for everyone.

Feel free to share your thoughts if you see anything differently.

What I find most interesting is the entry zone around 3247–3245 . If we take the wave count starting from May 15, 2025 (3120.76) and consider wave 5 to be completed on June 15, 2025 (3451.52), then wave 2 should ideally retrace to around 3247.

On top of that, wave C of wave 2 seems to follow a clean 1–2–3–4–5 structure. If we treat the current move as a downtrend, wave 5 would likely complete right at 3247, which I find both accurate and technically compelling.

I'll be watching 3247 closely and plan to go long from there.

7.1 London gold rebounds and rises, gold market trend analysis aGold rose to 3295 in the Asian session on Monday and was blocked. It fell in the European session as we expected, but the decline was not strong. After the lowest price of 3274.57, it rose again in the US session and stood firmly at the 3300 mark. The monthly line closed with a cross Yang K. The gold price continued to rise at the opening today. After the market on Monday, the 3247 below can be used as a reference for the bottom rebound position. Now the short-term trend belongs to the bulls, so we will continue this trend today and look at the upward trend first, wait for the European session to see the strength of the decline and then formulate the idea of the US session.

From the market point of view, after the gold price stood above the 3300 mark again, it is used as a short-term support level reference for the bulls. The Asian session can rely on this position to arrange long orders to see the continuation of the upward trend; the initial pressure on the upper side focuses on the 3328 position, followed by 3345. Now that the idea is established, the idea for intraday operations is: wait for the gold price to pull back to around 3308 in the Asian session and then go long and bullish, protect the 3300 mark, and target around 3328; if there is pressure at 3328 in the European session, you can arrange short positions with a downward trend, wait for the US session, and then decide whether to go long again based on the pullback position and target around 3345.

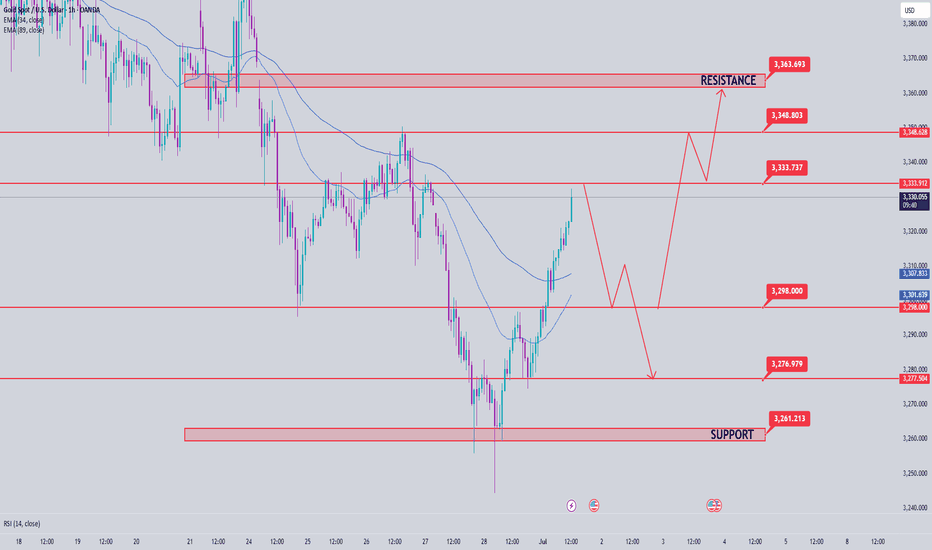

Gold price analysis July 1On the D1 chart, the price has recovered positively when the candle closed above 50% of the decrease range of last Friday's session. This shows that buying power is returning and a new uptrend is forming, with the target heading towards the GAP zone around 3363.

Today's trading strategy:

Prioritize buying (BUY) if the price has a correction to the support zone of 3300.

Sell strategy should only be implemented at important resistance zones, with short-term profit expectations because the main trend is leaning towards the uptrend.

Important technical levels:

Support: 3300 - 3337 - 3360

Resistance: 3334 - 3348 - 3363

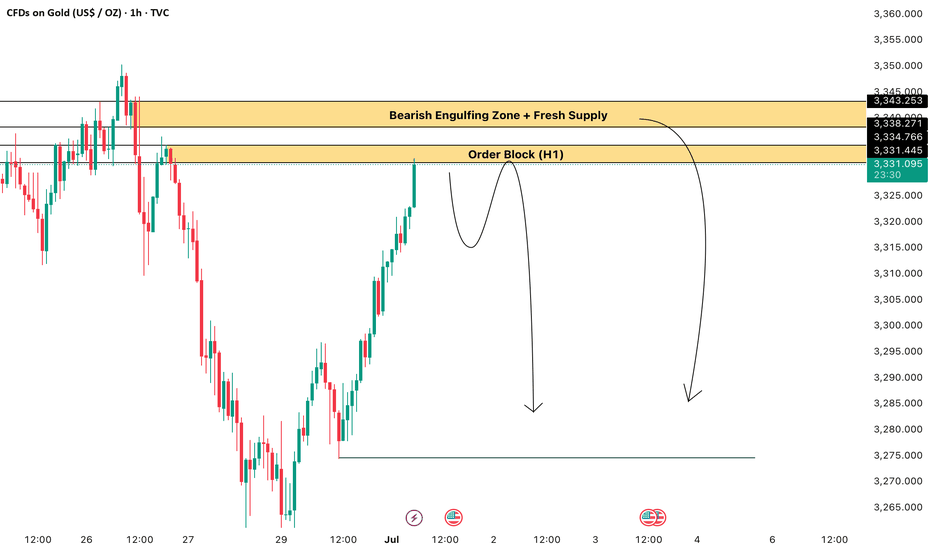

GOLD SHORT TRADE IDEA ! Gold Looking For Sell On Order Block Zone 3331/3334 Target Will Be 3300

Gold Sell Second Zone Bearish Engulfing + Fresh Supply Target Will Be 3275

Gold Sell First Zone OB H1 (3331/3335

Stoploss - 3345

Tp Levels - 3325,3320,3310,3300

Gold Sell Second Zone Bearish EG + Fresh Supply (3338/3344)

Stoploss - 3350

TP levels : 3330; 3322; 3314; 3330, 3290

Gold is rising. Second starting point?Information summary:

1. The US dollar index has experienced the longest consecutive monthly decline since 2017. The weakening of the US dollar has increased the attractiveness of gold denominated in US dollars to non-US dollar holders, becoming an important support factor for gold prices.

2. Trump's continued pressure on the Federal Reserve to cut interest rates has formed a resonance effect with the weakening of the US dollar, which has jointly pushed up the short-term attractiveness of gold.

Multiple factors are intertwined, and gold has risen slightly again.

Market analysis:

Gold bottomed out and rebounded on Monday, showing a positive closing, and above 3300. After falling sideways for 5 consecutive trading days last week, although it fell for a short time on Monday, it did not continue. In this case, whether a new high can be reached, the watershed is the 3295 line. As long as the European session breaks the high, the long position is near the starting point of 3305 in the early trading session.

At present, the main focus is on the upper resistance around 3325. It opened directly upward on Tuesday, but did not break through too much space, unless it directly broke through 3325-3330; then the next resistance is around 3340. At present, the bulls are still running at a high level. The upward trend line generated after the reversal is more obvious, and the trend line has good effectiveness.

Since the current market is in the first wave of rise, the high point has not been confirmed. Quaid believes that when the high point is clear and the price falls back to the support area, consider entering the market to go long based on the support level. Of course, aggressive trading can choose to buy around 3320 and choose a suitable high point to take profit.

Operation strategy:

Short near the rebound 3340, stop loss 3350, profit range 3310-3300

Long near the fall 3305, stop loss 3290, profit range 3320-3335

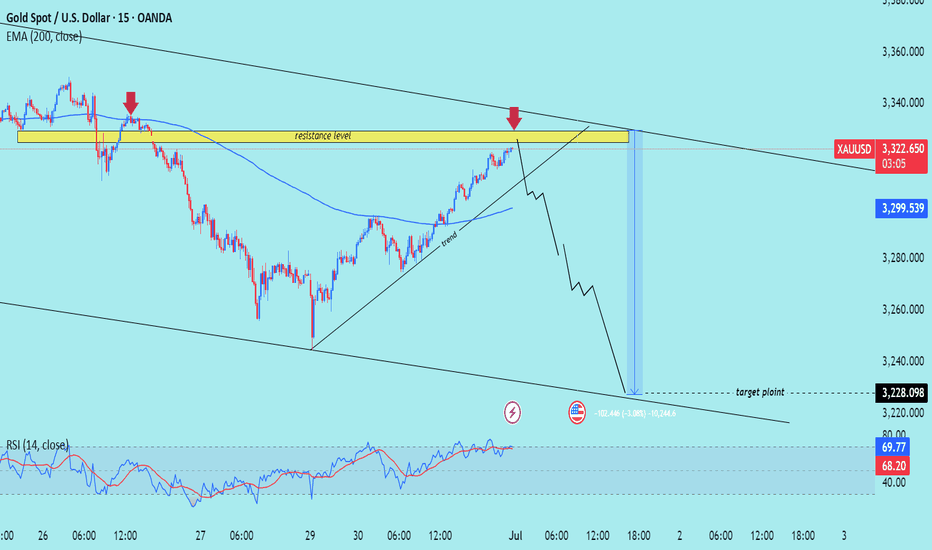

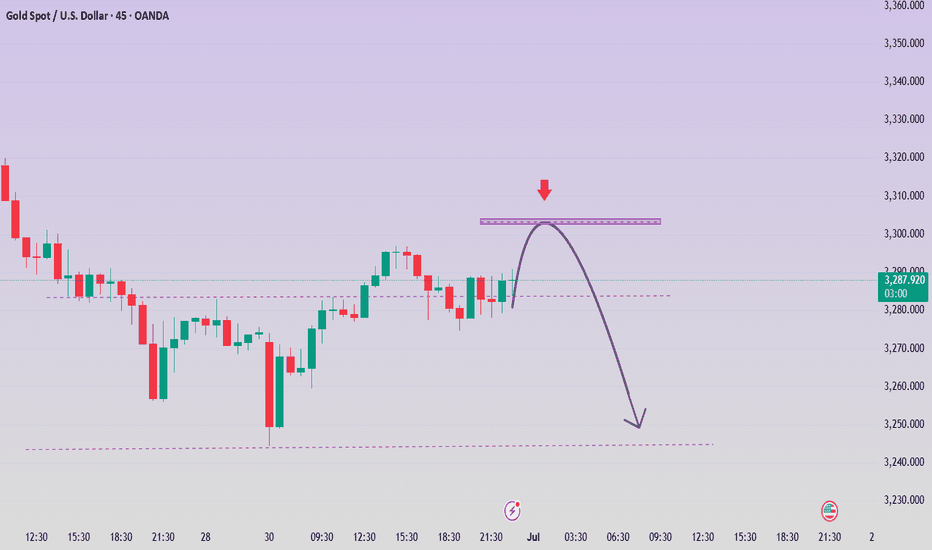

XAU/USD) bearish reversal analysis Read The captionTechnical analysis of (XAU/USD) based on price action and technical indicators on the 15-minute timeframe. Here's a

---

Key Technical Insights:

1. Resistance Level (Highlighted Yellow Zone):

Price is approaching a strong resistance zone (previous rejection marked by red arrows).

This area has historically pushed price downward.

2. Trendline Support (Rising Black Line):

Price has been following a short-term ascending trendline, forming higher lows.

A break below this trendline signals potential bearish reversal.

3. EMA 200 (Blue Line):

Price is currently above the EMA 200, indicating short-term bullish momentum.

However, price is testing resistance — a rejection could flip momentum bearish.

4. Bearish Rejection & Projection:

The chart shows an anticipated rejection from resistance, followed by a break of trendline support.

Target zone is marked near 3,228.098, indicating a drop of ~94 points from the current level.

5. RSI (Relative Strength Index):

RSI is nearing overbought territory (68.79).

A bearish divergence or RSI crossing down may confirm weakening momentum.

Mr SMC Trading point

---

Conclusion / Trading Idea:

Bias: Bearish

Entry Zone: Near the resistance level (~3,322)

Confirmation: Break of trendline support

Target: 3,228

Stop-Loss: Above resistance zone (just over the upper trendline)

---

pelas support boost 🚀 this analysis)

This is the reason why gold suddenly "changed its face"!

📣 Gold News

Spot gold closed up $28.59, or 0.87%, at $3,302.71 per ounce on Monday. Gold prices fell to around $3,246 per ounce in early Asian trading, the lowest level since May 29.

At 21:30 Beijing time on Tuesday, Federal Reserve Chairman Powell, European Central Bank President Lagarde, Bank of England Governor Bailey, Bank of Japan Governor Kazuo Ueda, and Bank of Korea Governor Lee Chang-yong will hold a group meeting.

Last Tuesday and Wednesday, Federal Reserve Chairman Powell attended a congressional hearing and said that the Fed needs more time to observe whether tariffs make inflation rise higher before considering cutting interest rates.

Powell said in his congressional testimony that he and most Fed officials expect inflation to start to pick up soon, and the Fed is not in a hurry to cut interest rates before that.

Powell said: "At present, we have good conditions to wait and further understand the possible development path of the economy before considering whether to adjust the policy stance." Yesterday, gold opened at $3381.6 and quickly fell back, reaching a low of $3248.8, then rebounded, rebounded in the early trading and touched $3270 and fell again, gold fell back, reaching a low of $3259.4, then gold did not continue to fall, and rebounded. Gold continued to rebound in the European and American markets, with the highest rebound in the US market reaching $3309.4, and finally closed at $3002.9 in the late trading. The monthly line closed with a long upper shadow line and a shooting star pattern. After such a pattern ended, today's gold rebounded high, and the upper resistance focused on the $3326 line. The rebound relied on the resistance below here to short, and the lower side looked at the $3295 line.

The latest analysis and layout of gold in July made a good start📰 News information:

1. Geopolitical situation

2. PMI data

📈 Technical Analysis:

Yesterday, we gave the idea of looking at the upper resistance of 3310-3320. The 4H pressure is still at 3327. As long as this key resistance level is not effectively broken, gold will fall again. On the contrary, if it stabilizes above 3327, the trend may reverse. In the short term, pay attention to the upper resistance of 3327. If it is not broken, you can short with a light position. If it falls below 3300-3290, consider going long.

🎯 Trading Points:

SELL 3310-3320

TP 3305-3300

BUY 3300-3290

TP 3310-3320-3350

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

TVC:GOLD FXOPEN:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD OANDA:XAUUSD TVC:GOLD

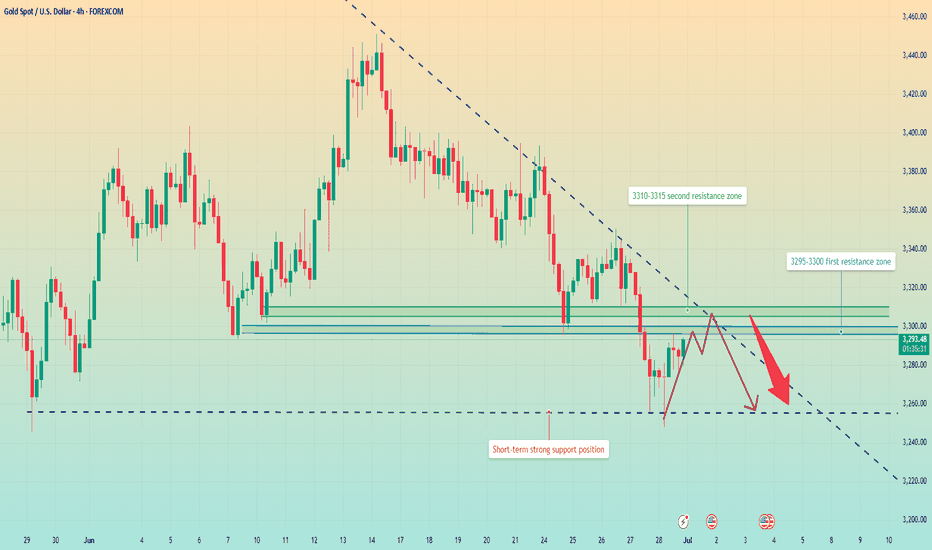

The limit is 3320. Rebound and still short📰 News information:

1. Gold market liquidity at the end of the month

2. Impact of geopolitical situation

📈 Technical Analysis:

Currently, gold has rebounded to around 3295, reaching our ideal trading area. I have given the short-selling trading idea in the previous post. At present, in the short term, we still maintain the short-selling trading idea before effectively breaking through the upper resistance. Focus on the 3325 line of resistance

🎯 Trading Points:

SELL 3295-3310-3320

TP 3285-3270

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

OANDA:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD PEPPERSTONE:XAUUSD FXOPEN:XAUUSD TVC:GOLD

XAUUSD/GOLD Geopolitical conflicts have escalated again. Next week is a week of heavy news. How will the gold price focus next week? How to trade? Look at the news preview first.

1. Geopolitics, Russia-Ukraine conflict, Palestine-Israel conflict, Iran-Israel conflict.

2. ADP data, NFP data.

3. Tariff deadline.

The above three news are enough to cause drastic fluctuations in the gold price.

On Friday, the New York market followed my expectations. After rebounding around 3282, it fell back. Finally closed around 3274.

The impact of the weekend news is huge. From the news perspective, the opening price of next Monday will be higher than the closing price on Friday. In terms of operation, you can pay attention to buying at a low price after the market opens.

GOLD Bouncing from Trendline, Breakout Ahead?GOLD BOTTOM IS HERE 🔥

Gold has taken support from the rising trendline and is now close to breaking a key resistance. The chart is showing an ascending triangle, which usually means a big move is coming.

If price breaks above the resistance, we might see a strong rally of 13% or more.

The setup looks positive as long as the support stays strong.

Looks like Gold is ready to shine again!

Retweet if you're bullish.

Like and follow for more updates!

#GOLD TVC:XAU

Go long on dips and short on rallies📰 News information:

1. Gold market liquidity at the end of the month

2. Impact of geopolitical situation

📈 Technical Analysis:

Last week we predicted that gold would rebound. Today, after gold rebounded as expected, we gave a short trading strategy. Gold fell precisely at the point we gave, 3295, and successfully hit our TP3280-3270. The result confirmed the correctness of our trading strategy. Next, we will focus on the long trading opportunities below 3270-3260.

🎯 Trading Points:

BUY 3270-3260

TP 3290-3300

SELL 3295-3300-3310

TP 3280-3270

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

TVC:GOLD FXOPEN:XAUUSD PEPPERSTONE:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD OANDA:XAUUSD

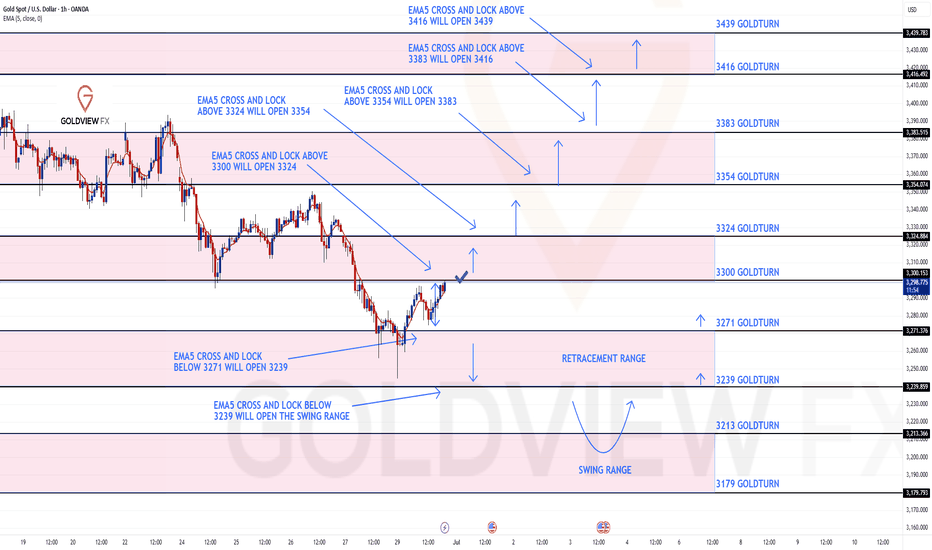

GOLD ROUTE MAP UPDATEHey Everyone,

Great start to the week with our Bullish target at 3300 hit perfectly!!!!

We will now look for ema5 cross and lock to confirm a continuation or failure to lock will follow with a rejection into the lower Goldturns for support and bounce.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3300 - DONE

EMA5 CROSS AND LOCK ABOVE 3300 WILL OPEN THE FOLLOWING BULLISH TARGETS

3324

EMA5 CROSS AND LOCK ABOVE 3324 WILL OPEN THE FOLLOWING BULLISH TARGET

3354

EMA5 CROSS AND LOCK ABOVE 3354 WILL OPEN THE FOLLOWING BULLISH TARGET

3383

BEARISH TARGETS

3271

EMA5 CROSS AND LOCK BELOW 3354 WILL OPEN THE FOLLOWING BEARISH TARGET

3239

EMA5 CROSS AND LOCK BELOW 3239 WILL OPEN THE SWING RANGE

3213

3179

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

Gold fluctuates upward. Is the decline over?On Monday, gold opened at around 3282, and then fell back quickly to around 3247 under pressure; the downward low was blocked, and then rebounded strongly to around 3297; the market currently maintains a small upward trend.

At present, we need to focus on the resistance range of the upward trend.

From the 4-hour chart, the upper short-term resistance is around 3295-3300, followed by the suppression range of 3310-3315. The main direction of short-term operations maintains the rebound short-selling strategy. The support below is around 3255; the overall short-term operation relies on 3260-3300 to maintain the main tone of high-altitude participation unchanged.

Operation strategy:

Short near 3305, stop loss 3320, profit range 3270-3260.

A new week has just begun. I wish you all gain something from the market fluctuations.

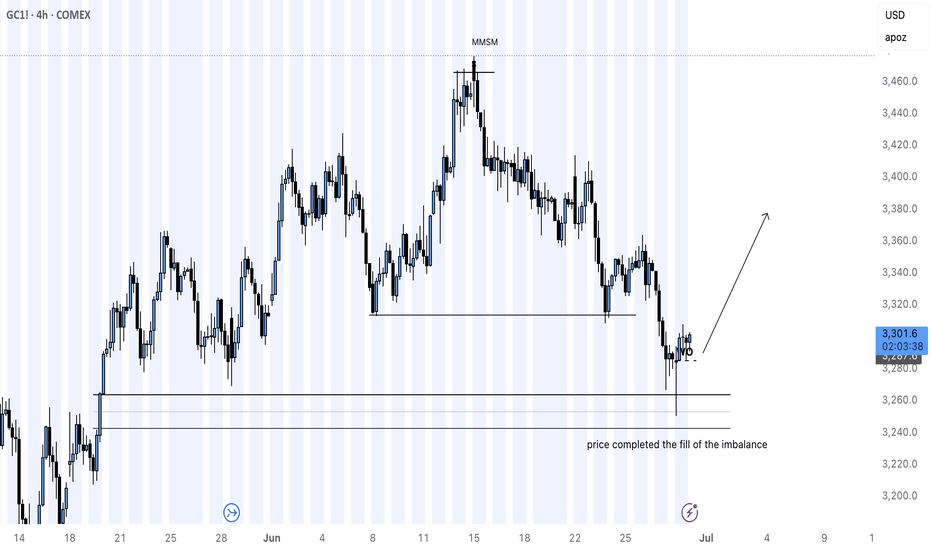

GOLD LONG IDEA MARKET STRUCTURE CHANGEgold futures were on a full sell off due to ongoing global turbulence in the month of June macro news is there to show the bigger picture but price tells the full story

imbalance was filled and the week opened with a bearish candle closing above 3,250 COMEX:GC1! price range now it is time to see It play out to the buyside for the precious metal

Gold long-short strategy US trading range operation

Gold prices (XAU/USD) recovered some of their losses during Monday's Asian trading session, driven by expectations that the Federal Reserve may cut interest rates further this year (and perhaps earlier than previously expected). This prospect weighed on the dollar, making dollar-denominated gold more attractive to overseas buyers.

However, the recent improvement in global risk sentiment (driven by the US-China trade agreement and the Israeli-Iranian ceasefire agreement) may reduce the safe-haven demand for gold. Investors will now turn their attention to upcoming comments from Federal Reserve officials, with Atlanta Fed President Rafael Bostic and Chicago Fed President Austan Goolsbee expected to speak later in the day.

Gold prices recovered, accumulating around the 3,300 price range at the beginning of the new week. Still in a major downtrend.

⭐️Set Gold Price:

🔥Sell Gold Area: 3316-3318 SL 3323

TP1: $3305

TP2: $3290

TP3: $3277

🔥Buy Gold Area: $3248-$3246 SL $3241

TP1: $3258

TP2: $3270

TP3: $3286

⭐️Technical Analysis:

Set reasonable buy orders based on technical indicators EMA 34, EMA89 and support and resistance areas.