Goldprediction

A new golden week, grasp it with the best condition

Good weekend everyone, this week's trading time is over, and next week's trading time will also enter the countdown. No matter how you grasp the market this week, whether happy or sad, Theo hopes that everyone will not bring your mood to the trading environment next week.

After all, next week is also a new beginning of the week. In the new week, everyone should be prepared for a new state. A good state should be persevered, and a bad state should be adjusted. With a good state to grasp the market trend of next week, I believe you can also be invincible and grasp the market better!

📊Technical aspects

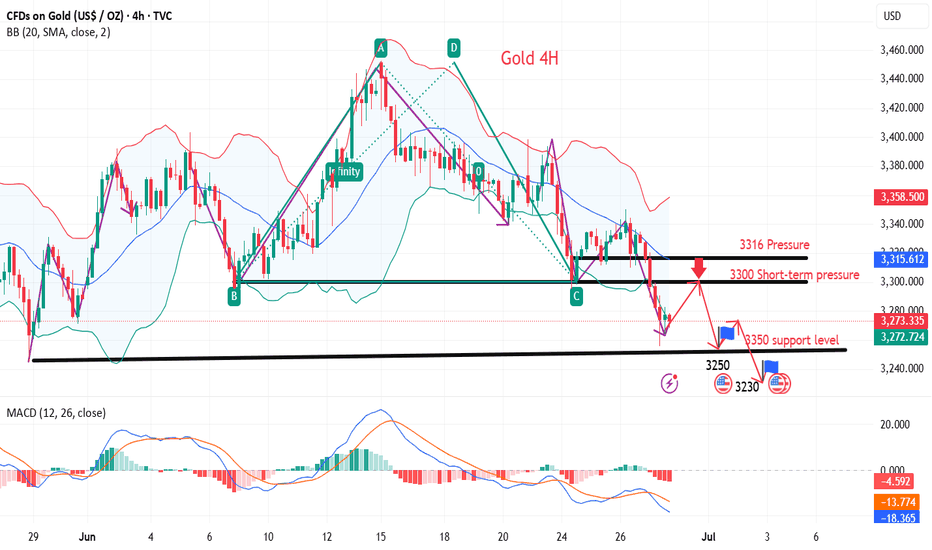

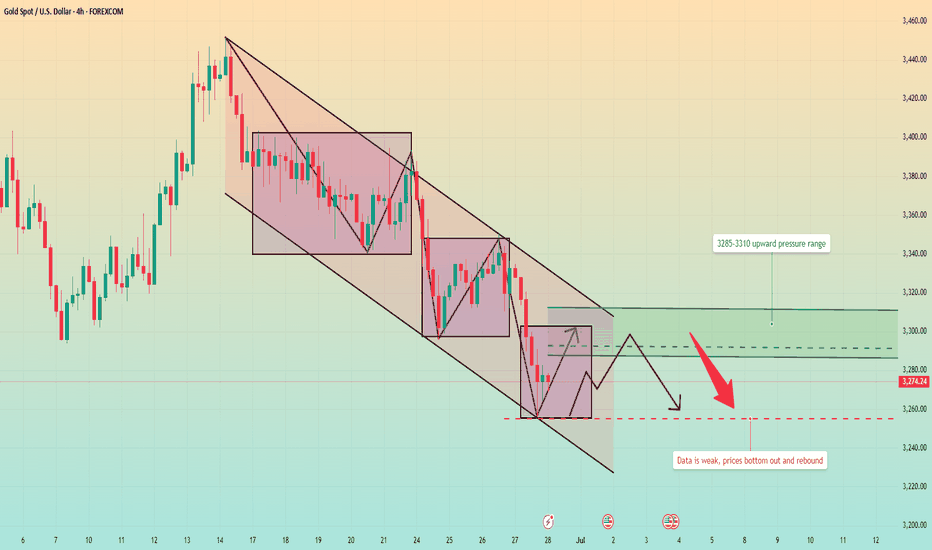

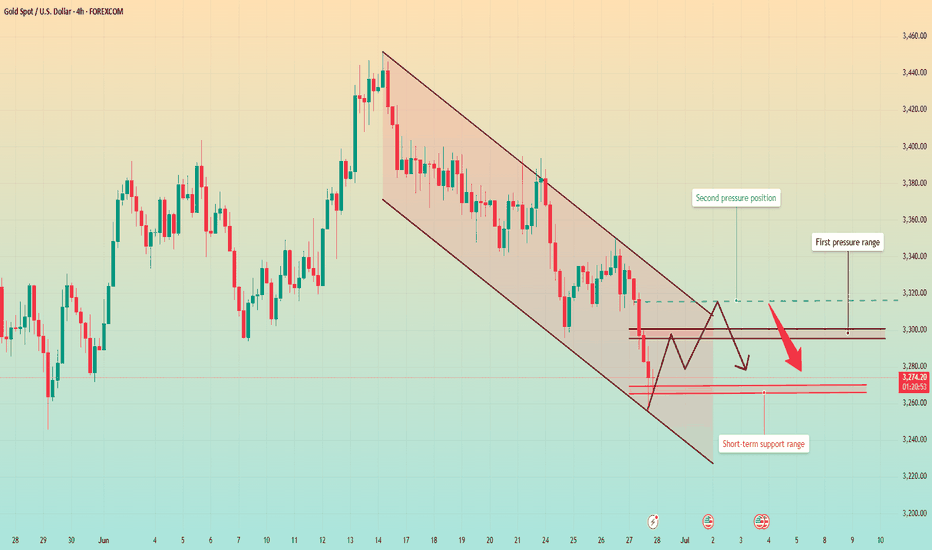

Gold did not break through the upper pressure at midnight on Friday. Gold fell directly after opening in the morning on Friday. The bears broke through the previous 3295 support line, and the lowest level in the evening was 3255, closing at around 3274.

The daily line also closed in the form of a big negative line, with an obvious downward trend, and all the previous support will also turn into pressure. The short-term moving average system crossed downward to accumulate energy for the bears. Since the closing did not break through the upper 3300 pressure level, we will continue to rebound and short next week. After all, the technical side is still short, and only by following the trend can we keep up with the rhythm of eating meat.

From the 4-hour analysis, the upper short-term resistance is around 3295-3301, with special attention paid to the suppression at 3316. In terms of operation, the rebound continues to be the main short and the trend looks down. The lower short-term support is around 3250-3255. The overall main tone of high-altitude participation remains unchanged relying on this range.

💰Strategy Package

Short Position:3290-3300,SL:3315,Target: 3240-3250

Next week's market trend analysisShort-term technical analysis of gold next week:

After gold was horizontally consolidated below 3400, it had two relatively large retracements. The short-term downward channel, the upper edge of the channel is currently around 3340, which is also the turning point of the short-term long and short cycles that we need to pay attention to later.

Has the current big rhythm entered a weak position?

Daily level analysis: After reaching 3500, gold is still in a trend of high-level consolidation, and there is a periodic switch between long and short positions, and there is no extremely strong or weak rhythm. In this consolidation process, there are two relatively large retracements: the first from 3500 to 3200 space 300 points, the second from 3435 to 3120 space 315 points. In other words, in the current daily level cycle, the maximum decline is around 300 US dollars. Not exceeding this maximum retracement value, to a certain extent, it is still in the rhythm of high-level correction. According to the range of this space retracement, the limit of the daily retracement is around 3150, with an error of about 20 points. However, the daily range is large, so it is too early to talk about this threshold.

At present, the short-term pressure points of 0.618 and the top and bottom structures are all around 3300. Another point for everyone to pay attention to: in the market with a small cycle of negative decline, once there is a sideways trend. Don't take it as support! The price is consolidating horizontally, which only means that the current bulls are weak in pulling back and the change of weakness must be a strong pullback to break through the big negative. Similarly, the slow rise market is the same.

The first support below in the short term is around 3250. The strong support is at the integer level of 3200. Once this position is reached, it will become a repeated test position like 3400.

Gold fluctuates and rebounds, don't chase shorts at low levels

💡Message Strategy

Yesterday, Thursday, we believed that the easing of tensions in the Middle East, the cooling of market risk aversion, and the hawkish stance of the Federal Reserve, which believed that the possibility of rate cuts should not be overly expected, suppressed expectations of rapid rate cuts, dragged down the dollar, and jointly suppressed the trend of gold.

However, trade uncertainty, geopolitical situation and expectations of rate cuts still support gold prices, which temporarily supports gold's rebound from a three-week low. Therefore, in terms of operations, it is recommended that everyone pay attention to the upper pressure of $3,345, followed by $3,357, and the lower support of $3,325, followed by $3,310.

From the subsequent trend, during the Asian session, gold fell back to $3,330 and stabilized. After the opening of the European session, the gold price rebounded and rose to $3,350 and encountered resistance. After that, gold fluctuated and fell. The decline continued after the opening of the US session, falling to $3,310 and stabilizing. After the rebound of $3,336 and encountering resistance, gold fell again, and continued to fall after the opening of Friday, refreshing the June low to $3,291, and performing weakly in the short term.

Overall, gold rebounded to $3,350 on Thursday and encountered resistance, then fell back to $3,310 and stabilized. It basically operated between the support and pressure levels we gave. On Friday, the gold price tried to break downward, and the short-term downside risk increased.

📊Technical aspects

On the daily chart, gold fell from a two-month high and rebounded from a low in June this week, but as gold prices fell back on Thursday, the short-term trend of gold prices turned downward again. For gold's upper pressure, pay attention to the integer position of $3,300, followed by Thursday's low of $3,310, and the 1-hour Bollinger band middle track of $3,325;

For gold's lower support, pay attention to the current intraday low of $3,291, which is also the lower track of the daily Bollinger band. A downward break may increase the risk of short-term decline. Pay attention to the two lows of $3,270 and $3,250 when gold prices rebounded at the end of May.

The 5-day moving average and MACD indicator cross, and the KDJ and RSI indicators cross. The short-term technical aspect shows that gold prices are at risk of continuing to fall.

💰Strategy Package

Short Position:3275-3295,SL:3315,Target: 3240-3250

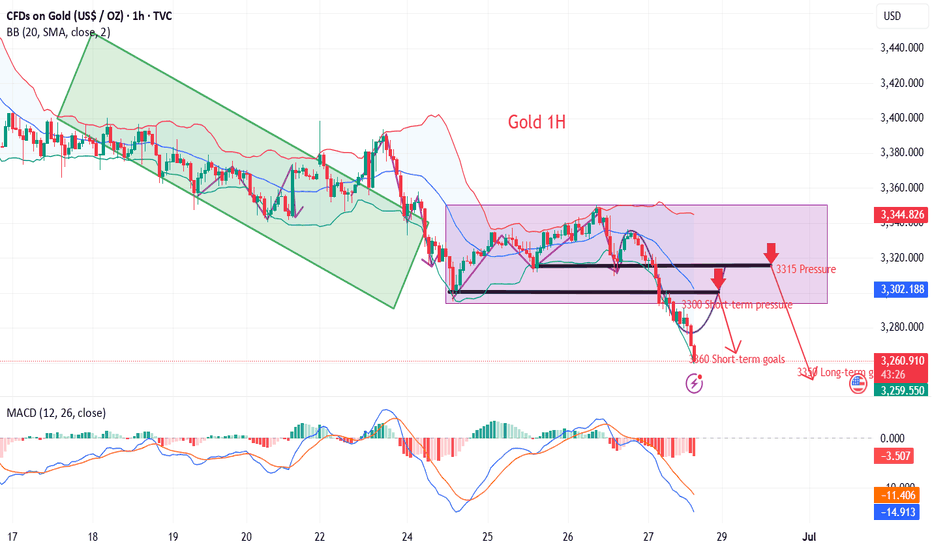

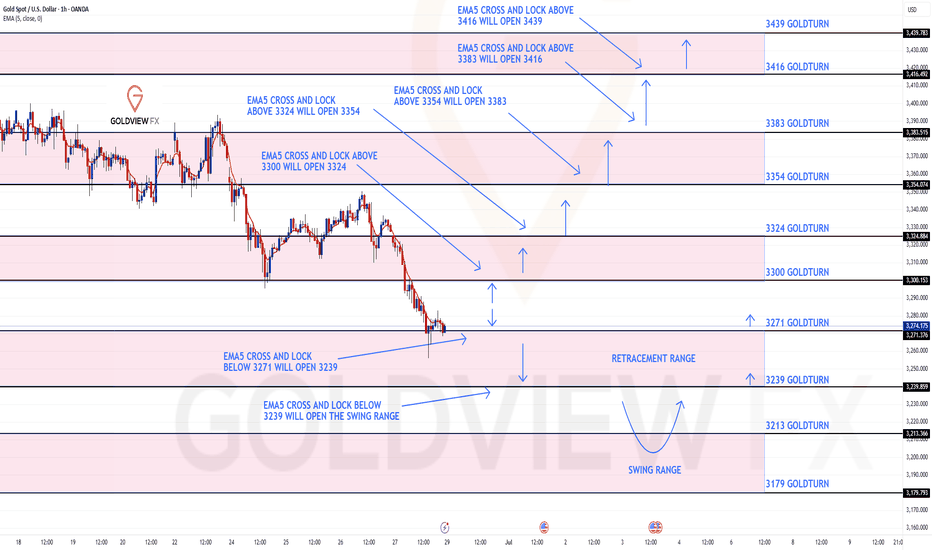

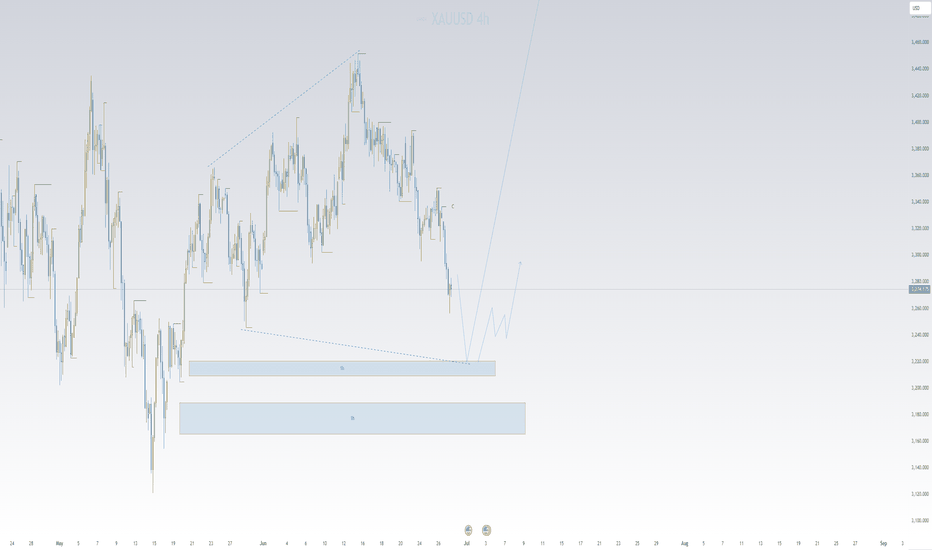

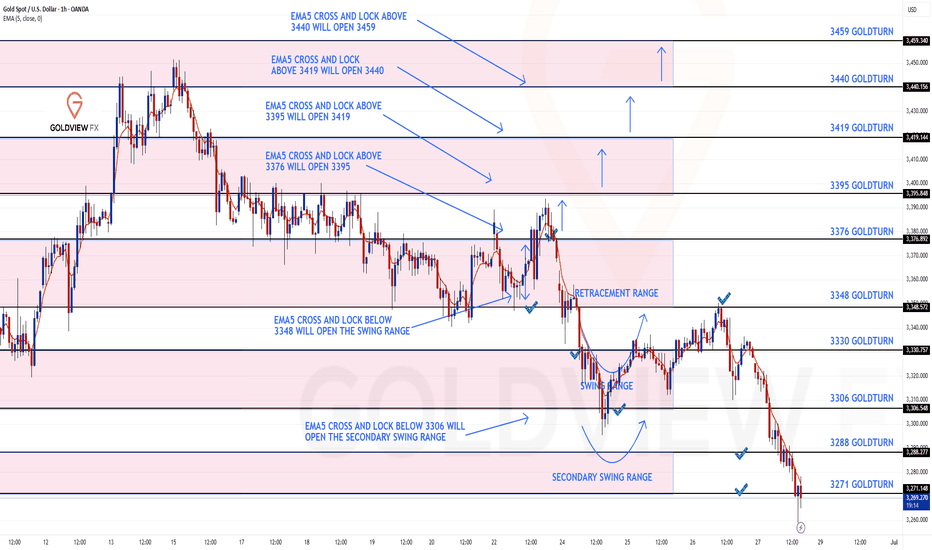

GOLD 1H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3300 and a gap below at 3271. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3300

EMA5 CROSS AND LOCK ABOVE 3300 WILL OPEN THE FOLLOWING BULLISH TARGETS

3324

EMA5 CROSS AND LOCK ABOVE 3324 WILL OPEN THE FOLLOWING BULLISH TARGET

3354

EMA5 CROSS AND LOCK ABOVE 3354 WILL OPEN THE FOLLOWING BULLISH TARGET

3383

BEARISH TARGETS

3271

EMA5 CROSS AND LOCK BELOW 3354 WILL OPEN THE FOLLOWING BEARISH TARGET

3239

EMA5 CROSS AND LOCK BELOW 3239 WILL OPEN THE SWING RANGE

3213

3179

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

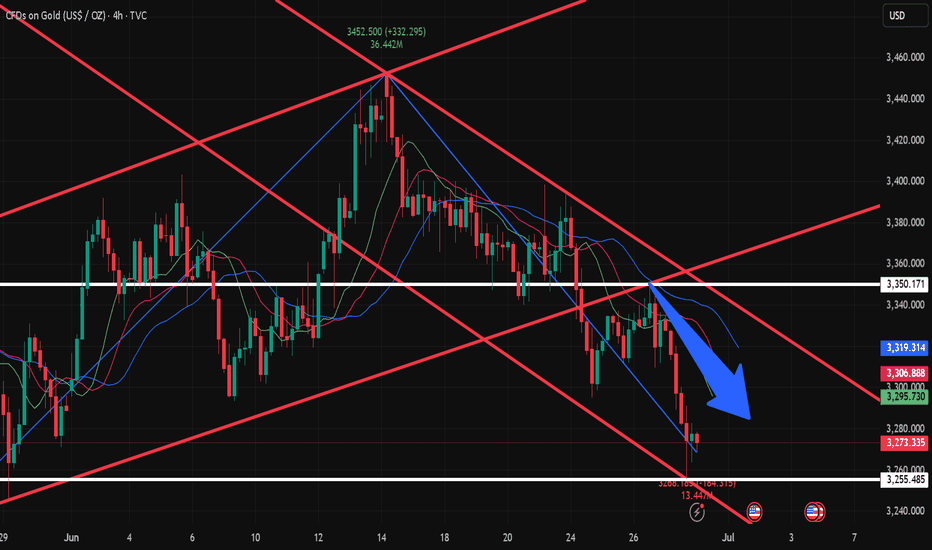

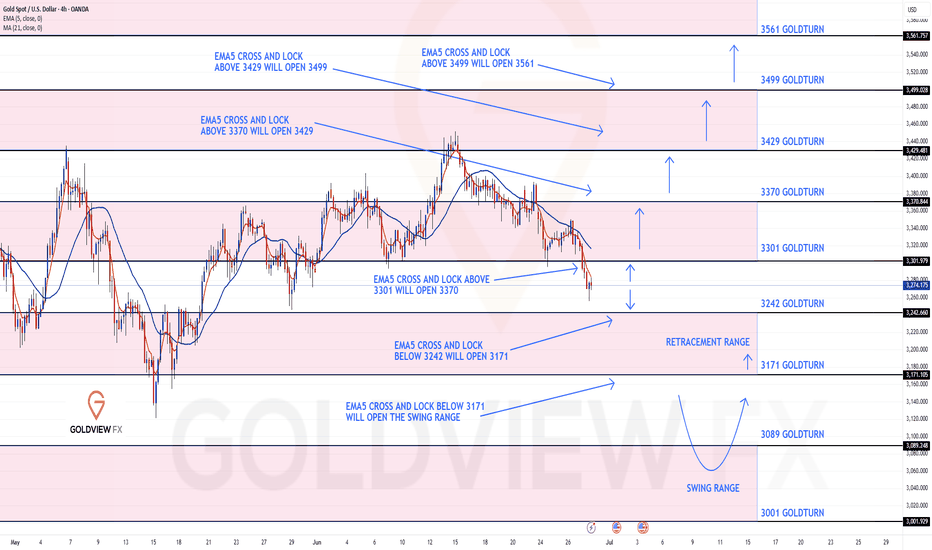

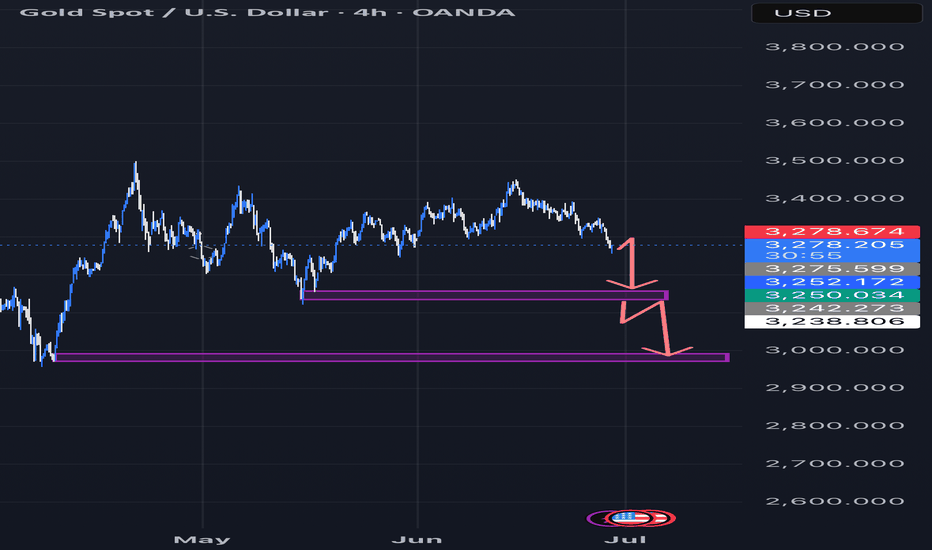

GOLD 4H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 4h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3301 and a gap below at 3242. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see levels tested side by side until one of the weighted levels break and lock to confirm direction for the next range.

We will keep the above in mind when taking buys from dips. Our updated levels and weighted levels will allow us to track the movement down and then catch bounces up.

We will continue to buy dips using our support levels taking 20 to 40 pips. As stated before each of our level structures give 20 to 40 pip bounces, which is enough for a nice entry and exit. If you back test the levels we shared every week for the past 24 months, you can see how effectively they were used to trade with or against short/mid term swings and trends.

The swing range give bigger bounces then our weighted levels that's the difference between weighted levels and swing ranges.

BULLISH TARGET

3301

EMA5 CROSS AND LOCK ABOVE 3301 WILL OPEN THE FOLLOWING BULLISH TARGETS

3370

EMA5 CROSS AND LOCK ABOVE 3370 WILL OPEN THE FOLLOWING BULLISH TARGET

3429

EMA5 CROSS AND LOCK ABOVE 3429 WILL OPEN THE FOLLOWING BULLISH TARGET

3499

BEARISH TARGETS

3242

EMA5 CROSS AND LOCK BELOW 3242 WILL OPEN THE FOLLOWING BEARISH TARGET

3171

EMA5 CROSS AND LOCK BELOW 3171 WILL OPEN THE SWING RANGE

3089

3171

EMA5 CROSS AND LOCK BELOW 3171 WILL OPEN THE SECONDARY SWING RANGE

3089

3001

As always, we will keep you all updated with regular updates throughout the week and how we manage the active ideas and setups. Thank you all for your likes, comments and follows, we really appreciate it!

Mr Gold

GoldViewFX

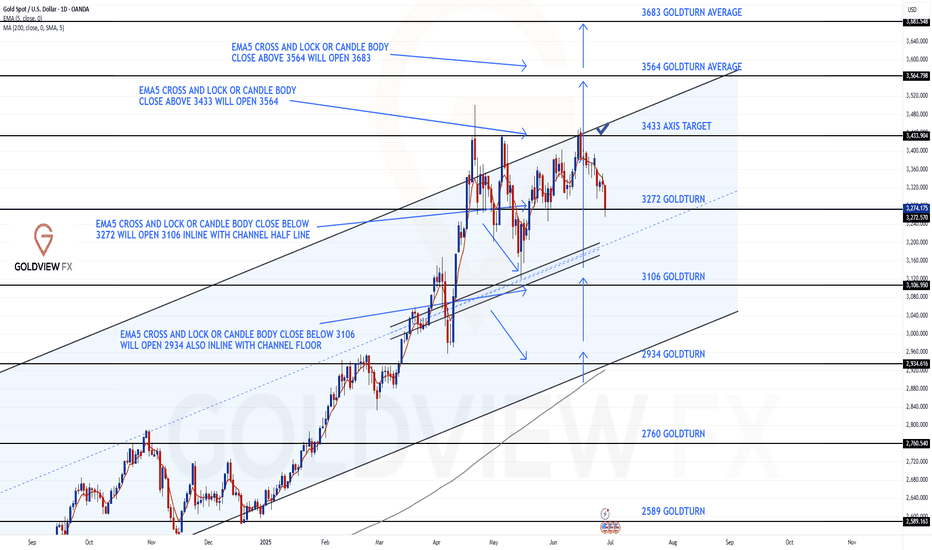

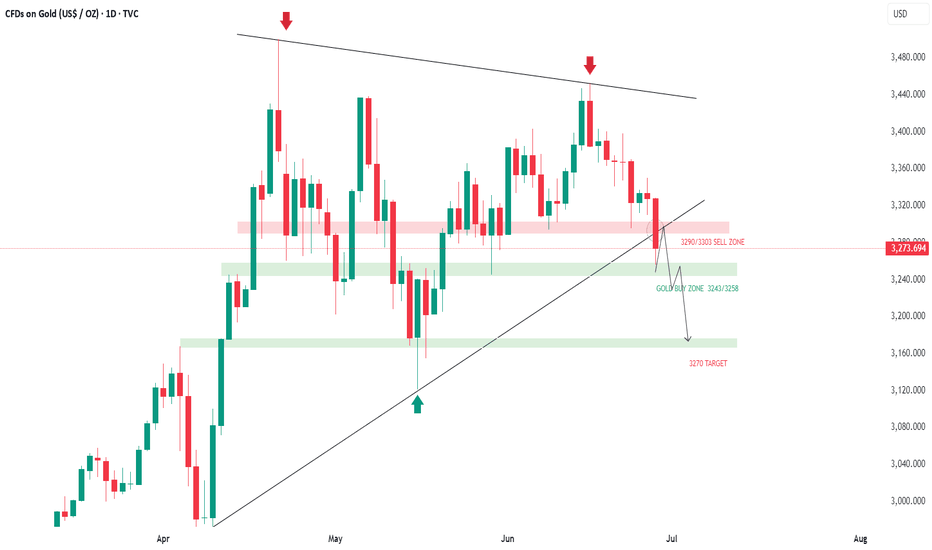

GOLD DAILY CHART ROUTE MAPHey Everyone,

Following up on our previous Goldturn channel post – the recent price action has played out exactly as anticipated. We saw a clean rejection at the channel top around 3433, with price failing to lock above and confirming that resistance is still very much in control at the range ceiling.

This rejection was perfect and it led to a decisive move back down into the 3272 Goldturn support. This level is now acting as a critical pivot. From here, we’re watching closely for one of two outcomes:

1. Bounce Scenario: If price holds and we see a supportive reaction from 3272, particularly with no EMA5 cross and lock confirmation, we will look for long opportunities to slowly ascend the channel again. Expect a grind with testing of in-between levels as structure develops.

2. Breakdown Scenario: If 3272 fails to hold, we expect the next key test to occur at the channel’s midline – a level that has acted as support. A further breakdown would likely target 3106, our next Goldturn support zone, for potential reversal setups.

This price action continues to validate the effectiveness of the Goldturn channel structure keeping us grounded and responsive rather than reactive.

We remain focused on level to level trading, guided by the channel and supported by EMA5 confirmations for directional analysis.

Key Levels to Watch:

Resistance: 3433

Support: 3272 (current test), 3106 (if breakdown continues)

Stay patient and let price confirm. The best trades continue to come from structure respecting reactions, not from chasing.

Mr Gold

GoldViewFX

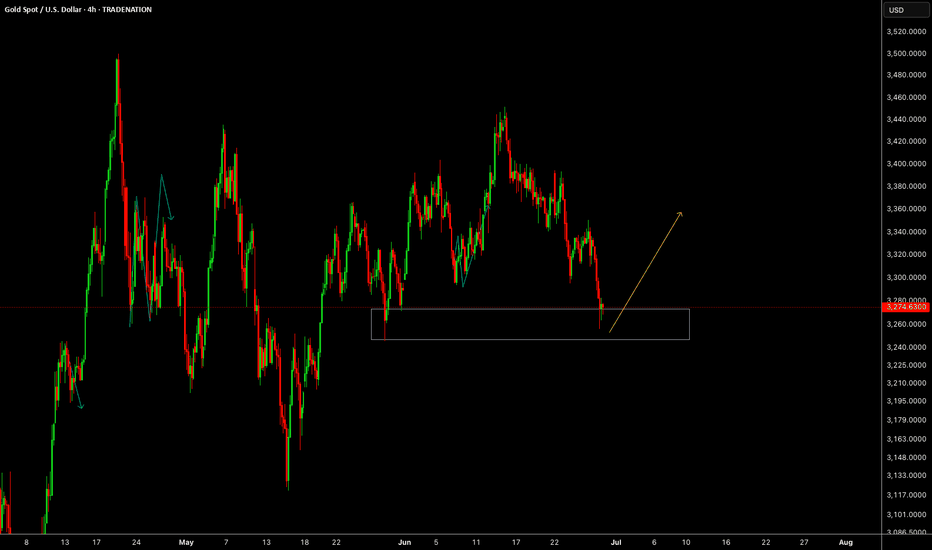

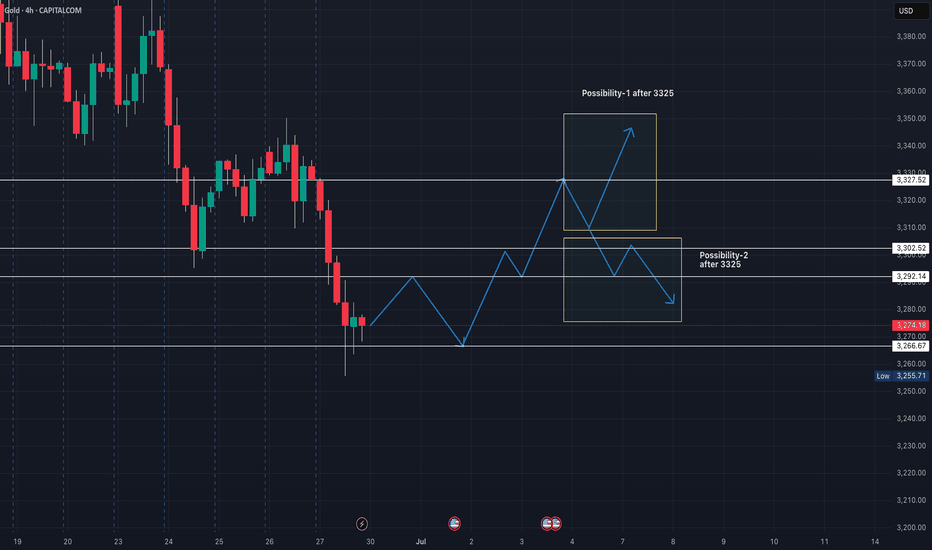

Gold for Week Starting June 30-2025Probability of gold becoming minor bullish in coming week.

After retesting the price to 3266, it should be going north to 3290. Might face small resistence and then to 3300-3302.

Price should take a pullback from that level before going further to 3325 range.

There are 2 possible scenarios after 3325. lets see how price action plays out post that.

Gold has been falling continuously. Will it continue next week?Market review:

The conflict between Israel and Iran intensified, and gold surged in the early stage, and then continued to fluctuate downward. Affected by the situation in the Middle East and weak data from the United States, it fell severely in three trading days, and most of the other time periods were in the stage of repeated washing.

The first round of decline began at the high point of 3452. Affected by the situation in the Middle East, the price rose rapidly, but the rapid rise led to insufficient upward momentum, and the departure of buyers led to continuous declines in a single trading day. The second round of decline was affected by the easing of the conflict between Iran and Israel, and the US dollar, crude oil, and gold all plunged sharply; the third round of decline was Powell's wait-and-see attitude towards the interest rate cut policy, and some US data were bearish for gold, leading to a new round of decline.

Market outlook for next week:

The breaking of the key support bands of 3303 and 3295 means that the downward adjustment has not ended, but after touching the support near 3250, there was a clear bottoming out and recovery. It means that there is strong support below, and the focus of next week's opening is the emergence of price rebound. There were rebounds to varying degrees after the previous two rounds of decline, so this round of decline still needs to be paid attention to. The strategy mainly revolves around shorting on price rebound, with a focus on the upward suppression range of 3285-3310.

If the rebound is small, then at the beginning of next week, it is likely to maintain a small fluctuation in the range of 3270-3285.

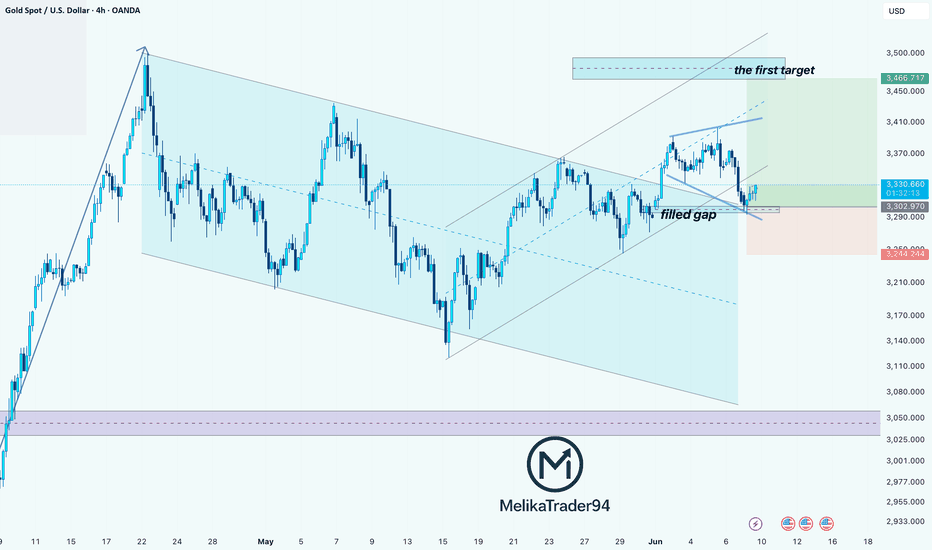

Gold Rebounds After Filling Gap >> Bullish Continuation in SightHello guys!

Gold (XAU/USD) is showing signs of strength on the 4H chart after filling a key gap around the $3,290 level and bouncing off it with bullish intent.

🔹 What I see:

– Price previously broke out of a broad descending channel, flipping the structure bullish

– After forming a rising wedge, Gold corrected lower and filled the gap

– The zone around $3,290 acted as solid support, and the current bounce suggests bulls are regaining control

📈 Outlook:

If this bounce holds and momentum builds, the next area of interest is clearly marked:

🎯 First Target: $3,466 – an area of prior structure and possible supply

📍 Current Price: $3,329

🟢 Bias: Bullish (above $3,290)

🔴 Invalidated below: $3,244

This setup offers a favorable risk-to-reward opportunity if the structure continues holding. Keep an eye on price action near the recent local highs for confirmation.

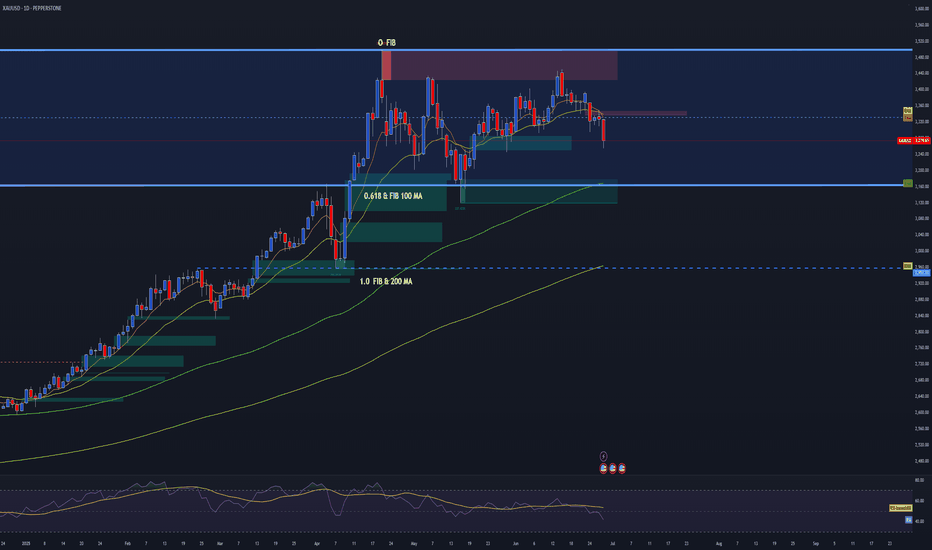

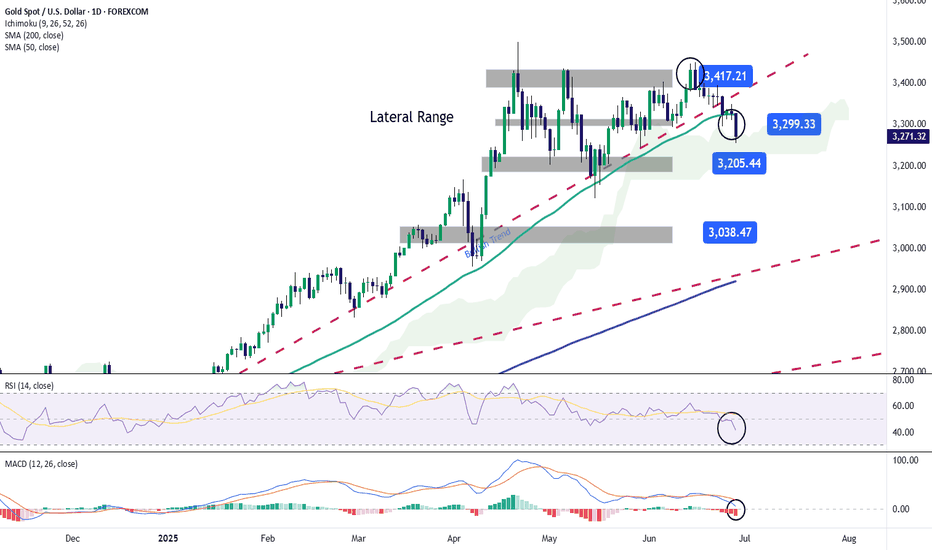

GOLD DAILY OUTLOOK | BEAR MARKET STRUCTURE CONFIRMED 📉 Trend Reversal Underway – Prepare for Lower Levels

The daily structure on Gold (XAUUSD) confirms a shift from accumulation to distribution.

Here's what stands out:

🔻 Key Breakdown Factors:

Failure at O_FIB Rejection Zone

The price failed to sustain above the upper Fib extension and supply zone (marked in red). Multiple attempts at reclaiming this level have resulted in sharp rejections, signaling exhaustion of buyers.

Break of Mid-Range Structure

We've decisively closed below the range midpoint, with strong bearish daily candles. This confirms loss of control by bulls and opens the door for a move toward deeper retracement zones.

Support Zones Exposed

The 0.618 FIB & 100 MA area around ~3160 is now a primary target. This zone held previously, but repeated touches weaken structure.

The 1.0 FIB & 200 MA zone around ~2960 is the macro support target. If sentiment continues to deteriorate, this will be the magnet.

EMA Crosses Rolling Over

Price has decisively lost the 9/21 EMA zone. Until a daily close reclaims this zone (~3335+), bearish momentum remains valid.

📉 Bearish RSI Momentum

While not a primary signal, RSI confirms momentum divergence and bear control below the midline. No sign of reversal.

🎯 Bearish Bias Until Reclaim of 3335 Zone

📌 Next Target = 3160, then 2960

🛑 Invalidation = Daily close above 3340 with strong volume and reclaim structure

This is not a short-term pullback — it's the beginning of a deeper correction. Gold is no longer in the “safe-haven” trade. Be patient, position with structure, and let the trend do the work.

Focus will be on fading the traps on pullbacks into structure.

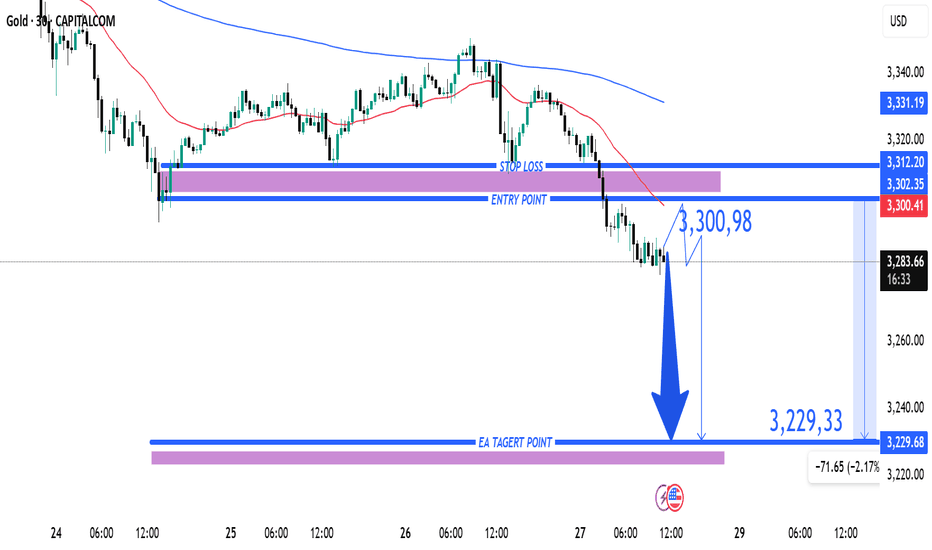

Gold (XAU/USD) Bearish Trade Setup – June 27, 2025Entry Point: Around 3,300.98 USD

Stop Loss (SL): ~3,312.20 USD

Take Profit (TP): 3,229.33 USD

Current Price: 3,286.15 USD

Risk-Reward Ratio: ~1:6.3

(Potential reward ≈ 71.65 pts; risk ≈ 11.22 pts)

Technical Breakdown:

Trend:

The price is in a short-term downtrend, supported by:

Lower highs and lower lows.

Price trading below both 50 EMA (red) and 200 EMA (blue), confirming bearish momentum.

Bearish Breakout:

Price broke below a key support-turned-resistance zone near 3,300–3,302, triggering sell pressure.

Resistance Area:

Strong rejection at 3,302–3,312 zone, which is now acting as resistance.

SL is placed just above this zone to protect against false breakouts.

Target Zone:

TP set at 3,229.33, aligning with a previous support zone — a logical area for price to react.

Strategy Notes:

Bias: Bearish

Entry confirmation: Already triggered.

Risk Management: SL placement is tight and strategic; RR ratio is highly favorable.

Next support below TP: If 3,229 breaks, further downside could follow.

Summary:

This setup shows a well-defined bearish continuation with a clean break of support, a controlled SL above resistance, and a strong RR ratio. A suitable trade for trend-following strategies, but price must not retrace above 3,312 for this idea to remain valid.

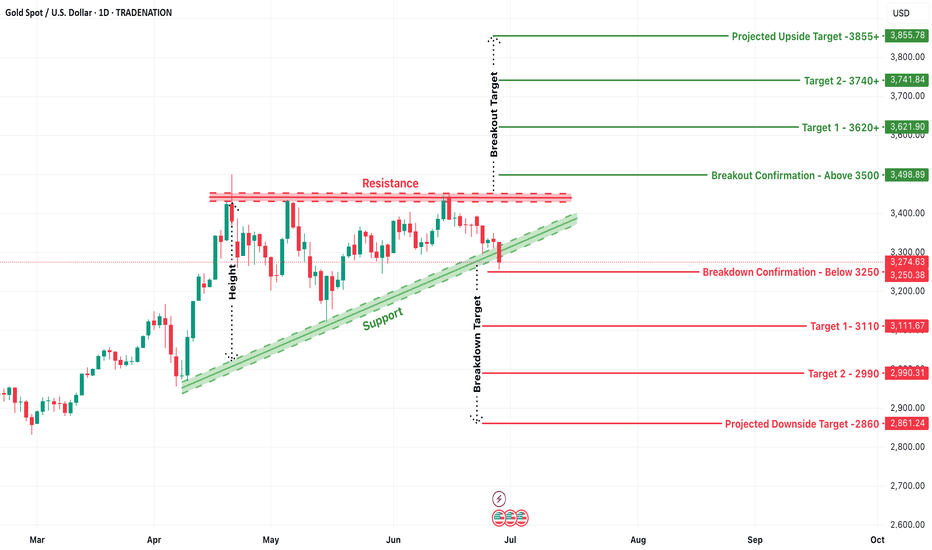

XAU/USD (Gold) Breakout or Breakdown Setup – Key Decision ZoneThe Gold Spot (XAU/USD) price action is currently at a crucial inflection point after consolidating in a rising wedge pattern between ascending support and horizontal resistance. This type of structure typically indicates a strong directional breakout is likely, and the current daily candle shows a close below the ascending support, signaling a potential bearish breakdown confirmation.

🔽 Bearish Breakdown Scenario (Confirmed Below 3250)

If price sustains below the 3250 support breakdown level, it confirms a bearish breakdown from the wedge. The height of the wedge (distance between the base of the move and the resistance) is used to project the downside target, giving us key levels to monitor:

Breakdown Confirmation: Below 3250.00

Target 1: 3111.67

Target 2: 2990.31

Projected Downside Target: 2861.24

This move suggests that gold could enter a deeper correction if buyers fail to reclaim the ascending structure quickly.

🔼 Bullish Breakout Scenario (Above 3500)

On the flip side, if bulls manage to push price back above the 3500 level, it would invalidate the current bearish momentum and confirm a bullish breakout. The projected upside targets are based on the same measured move logic:

Breakout Confirmation: Above 3500.00

Target 1: 3621.90

Target 2: 3741.84

Projected Upside Target: 3855.78

A close above 3500 with volume would set the tone for a fresh rally toward new highs.

🧭 Strategy Outlook

Short Bias (active): Entry below 3250; SL above 3300; TP at 3110 / 2990 / 2860

Long Bias (if reversal): Entry above 3500; SL below 3460; TP at 3620 / 3740 / 3850

Always wait for a strong daily candle close beyond the breakout/breakdown levels before initiating any trades

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

Gold Trade Setup - 27/Jun/2025Hi Traders,

I expect this pair to go Up after finishing the correction.

1) Need to wait for market to show changing of the direction.

2) The current move can be just a part of a correction or an impulse in itself. Going to follow the market behavior at my zones.

How to Enter : Look for engulfing with in the SL zone.

Gold Continues to Fall Below $3,300As the week comes to a close, gold is on track for a decline of more than 1.5% during the latest trading session. So far, the bearish bias remains firmly in place in the movements of the precious metal, as demand for safe-haven assets continues to fade, mainly due to the ceasefire agreement in the Middle East conflict, which has helped restore market confidence. Since gold is a classic safe-haven asset, demand has steadily weakened in recent sessions, and as long as this situation holds, selling pressure on gold may continue to intensify.

Uptrend Breaks:

Recent selling activity has played a crucial role, as it has led to a bearish breakout below the short-term trendline, which had been consistently holding on the chart. This breakdown has now opened the door for a lateral channel to form, suggesting that market sentiment has entered a more neutral zone in the short term. If bearish pressure continues, it could pave the way for a more dominant downtrend to take shape in the sessions ahead.

Indicators:

RSI: The RSI line has started oscillating steadily below the 50 level, signaling that downward momentum is beginning to dominate. If the line continues to move away from the neutral 50 level, we could expect more consistent bearish pressure on the chart.

MACD: A similar setup is emerging on the MACD. The indicator's histogram has dropped below the neutral line at zero and is showing persistent negative readings. This signals that selling momentum remains dominant, based on the average strength of the moving averages. If this continues, it would confirm a clear bearish bias.

Key Levels to Watch:

$3,300 – Current barrier: This level aligns with the midpoint of the short-term lateral channel. Price action around this area could reinforce the neutral outlook in the near term.

$3,400 – Key resistance zone: This level marks the historical highs of the gold market. A return to this level would revive the recently abandoned bullish trend and could reestablish a more optimistic outlook.

$3,200 – Critical support: This marks the lower boundary of the short-term channel. A breakdown below this level could trigger a fresh selling trend in the coming sessions.

Written by Julian Pineda, CFA – Market Analyst

XAUUSD/GOLD/SellThe pressure from the bears is too great. In the end, the pressure from above was not broken. Instead, it broke out and fell after being under pressure. The stop loss was hit.

The current price is 3285. After gradually boosting the US dollar index. The trend of gold prices has continued to fall. More importantly, the tariff issue has been eased. At the same time, geopolitical factors are also orderly and stable. This is the news that caused the bears to attack.

History has not become the savior because of repeating itself. Of course, this is also an emergency. In some transactions, the extremely low probability of causing losses is a common problem in transactions. However, our analysis team has stabilized a high trading win rate.

Then the next trading plan is still to focus on the pressure from above. If the London market rebounds above 3300. It is still mainly selling. 3314 is an important level for short-term rebound, and we need to pay attention. Although there is no obvious sign of rebound yet, the release of short-selling pressure has been alleviated because the decline is slow. Today's main trading idea is still to sell at high levels.

The target is to focus on the position of 3264-3248. Remember the risk of buying at low levels. Do not trade independently.

The data is negative. Will the price rebound from the bottom?Gold prices have continued to fall since the high near 3450. This trading day started the downward mode near 3328, and the European session continued to fall, breaking a new low. The negative PCE data also continued the downward mode. So far, it has rebounded after hitting the lowest level near 3255. However, the rebound is small, and the upper pressure is still very strong.

From the 4-hour chart, short-term resistance focuses on the vicinity of 3295-3300, followed by important pressure near 3315. The short-term support below focuses on the vicinity of 3265-3270. The overall strategy of shorting at high positions remains unchanged based on this range.

Operation strategy:

Short at the price rebound near 3295, short covering at the high point of 3315, stop loss 3325, profit range 3370-3360.

At present, the price fluctuates greatly. If you want to try scalping transactions, you can trade with a light position and float up and down 5 points to stop loss or profit in time.

This is the last trading day of this week. I hope you all will gain something and have a happy weekend with your family.

GOLD ROUTE MAP UPDATEHey Everyone,

A fantastic close to the week as our analysis once again played out level to level with precision!

As a follow-up from yesterday's post:

- The swing range completed the move into 3348, as expected.

- However, we had no further EMA5 lock above, confirming rejection back into the swing range.

- This was followed by an EMA5 cross and lock below 3306, opening the secondary swing range.

- That range played out perfectly today, hitting both 3288 and 3271 targets.

We’re now seeing a bounce off those levels giving the 20 to 40 pips, and we will now be observing to see if the full secondary swing is completed.

It's Friday, and it's been a PIPTASTIC week across the board. Well done to everyone following the plan and sticking to the levels.

QUICK RECAP

BULLISH TARGET

3376 - DONE

BEARISH TARGETS

3348 - DONE

EMA5 CROSS AND LOCK BELOW 3348 WILL OPEN THE SWING RANGE

3330 - DONE

3306 - DONE

EMA5 CROSS AND LOCK BELOW 3306 WILL OPEN THE SECONDARY SWING RANGE

3288 - DONE

3271 - DONE

We’ll be back now on Sunday with our multi-timeframe analysis and trading plans for the week ahead. Thanks again for all your likes, comments, and follows.

Wishing you all a fantastic weekend!!

Mr Gold

GoldViewFX

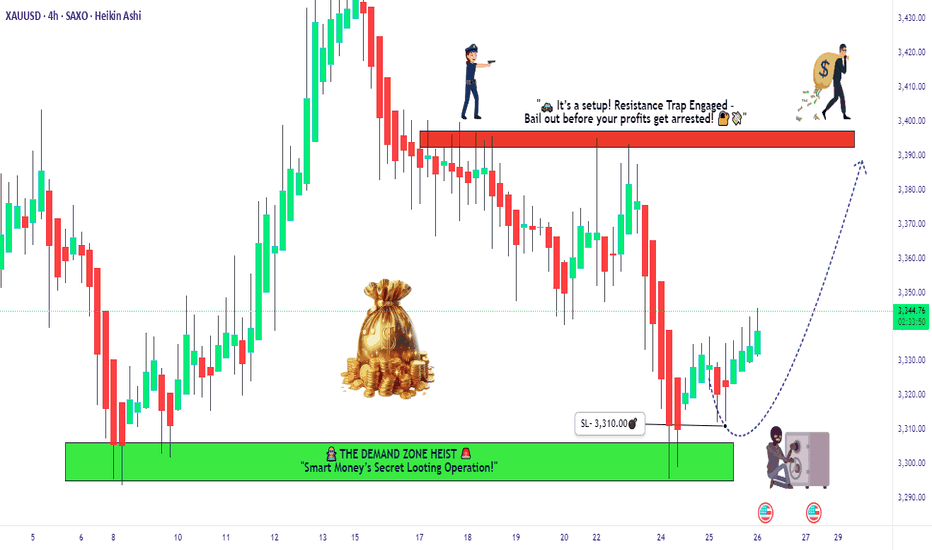

"Gold Vault Breach! XAU/USD Heist Plan in Motion"🏴☠️💰 XAU/USD Gold Heist Blueprint 💰🏴☠️

“The Vault’s Open… Time to Load Up!”

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Market Robbers 🤑💰💸✈️

Get ready to execute the Golden Robbery with style and precision! Based on our 🔥Thief Trading Style🔥 using both technical & fundamental weapons, we’ve decoded the latest gold vault password: XAU/USD (Gold vs USD) is showing bullish bias!

🎯 Heist Instructions:

📈 Entry Point –

“The vault is wide open!”

Enter long anytime — but for the sharp shooters, place buy limits on the most recent 15/30min swing lows or pullback zones for a stealthier entry. Let the retracement pull the guards away 😏🔐

🛑 Stop Loss –

🔒 Set your Thief SL just below recent swing lows on the 4H timeframe (around 3310.0).

🔧 Adjust based on risk tolerance, lot size, and number of open trades — every heist has its escape plan!

🏁 Target Zone –

🎯 Aim for 3395.0 — or vanish before the cops show up!

Trail the stop as you go and don’t get greedy — wealth is preserved when exits are clean! 🏃♂️💨

🧲 Scalper's Advisory:

Only steal on the Long Side! Bulls are funding this operation.

💼 Big pockets? Dive in.

💳 Small stack? Swing with the pros & follow the plan.

🎯 Use Trailing SL to keep the loot safe.

📊 Market Insight – Why We Rob Gold Now?

XAU/USD shows bullish momentum 🐂 backed by:

Macro & Fundamental Data 🧠

Geopolitical & Intermarket Trends 🌍

COT Reports & Sentimental Outlook 💼

Dollar Weakness + Safe Haven Flow 💸

📚 Always cross-check the news wires & reports to validate the path! Fundamentals are the lockpick tools behind every breakout! 🔓📈

⚠️ Stealth Warnings:

📆 News Events = Increased Surveillance!

🚫 No new entries during high-volatility news drops.

🛡 Use Trailing SL on live trades to secure the bag.

💖 Wanna Support Our Heist Style?

Smash that 🚀 BOOST BUTTON 🚀

It fuels our Thief Army and helps you & your crew loot the market with confidence and flair!

Every day’s a new caper — follow the plan, manage your risk, and stay outta jail! 🏆💪🤝🎉

🔐 See you in the next Robbery Blueprint — Stay Locked & Loaded!

🐱👤💼📈💣💸

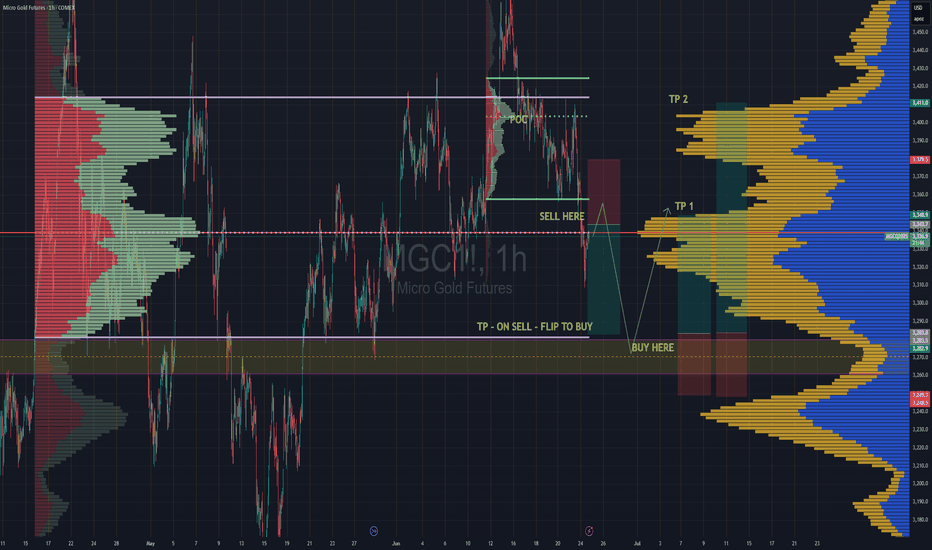

Long & Short Entry Forecast For GoldCooling war tensions seem to be cooling the Gold bullish rally as well.

But we're still in the same range since April 15th and will likely stay in the range until further notice *or the next tweet*

The Sell entry is great now cos we're near the top of the high volume node, so even if we consolidate around that POC this sell entry will still be putting us closest to the top of the node.

Hold your sell and TP at the VAL . We have a very deep low volume area there and its being a point of support since April. So we can place bets with small risk on hoping it holds cos if it doesn't, it wont be pretty. That is still the best place to buy regardless. So manage your risk accordingly

TP 1 for the Buy trade is at the POC , which also happens to be the top of the huge volume node. Totally make sense to take a decent chunk of profit of your position there, then move you stop loss into profit and grab some pop corn. Depending on the news , the best case scenario of for the uptrend is to continue all the way up to TP2 which is at the VAH

Secure the bag :)

Enjoy

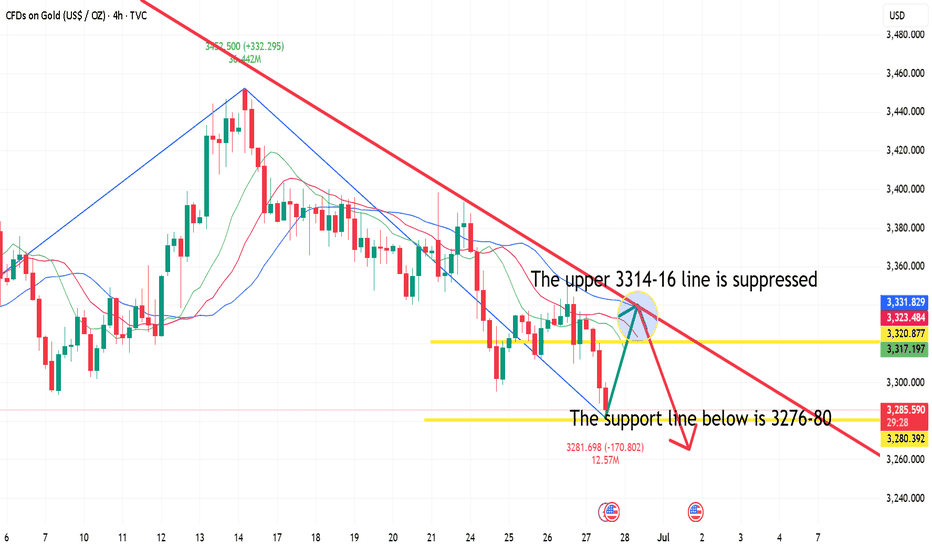

6.27 Gold rebounds and adjusts, don't chase shorts at low levelsGold fell below this week's low of 3295 today. As of now, gold has hit 3285 and is fluctuating. Don't chase the short position and short it when it rebounds. Now you can only wait patiently for the rebound before entering the short position. Be a steady hunter and wait patiently for the appearance of prey!

Gold is now focusing on the short-term suppression of the upper 3301-3306 line, focusing on the suppression of the upper 3314-16 line, and the support below is 3276-80. Short it when it rebounds.

Strategy ideas:

1. Gold rebounds to 3301-3306 line and shorts lightly, rebounds to 3314-16 line to cover short position, stop loss 3324, target 3280-85 line;