Goldsell

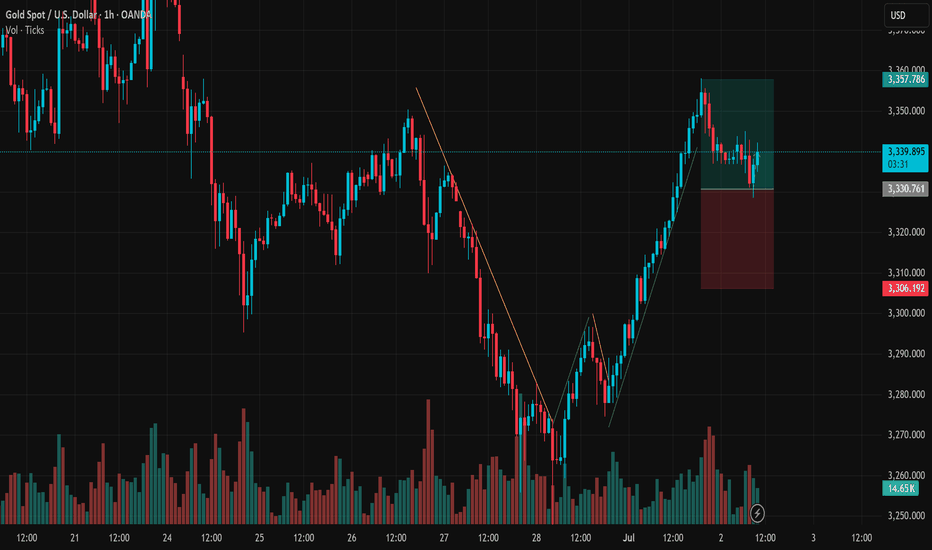

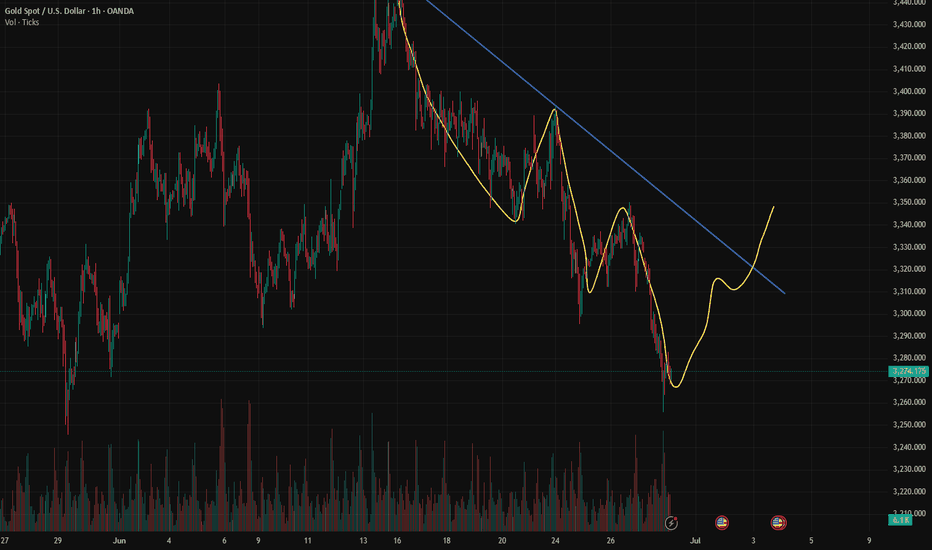

Gold breaks trend – bullish wave returnsIn the most recent trading session, gold (XAUUSD) has made a strong rebound from the key support zone around $3,263 and is now approaching a short-term resistance near $3,347 – signaling a potential continuation of the bullish momentum in the short term.

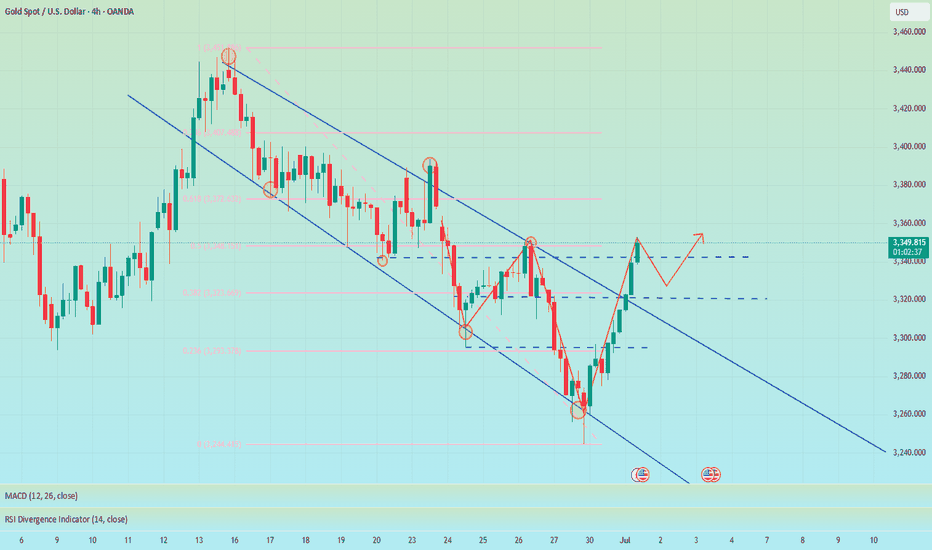

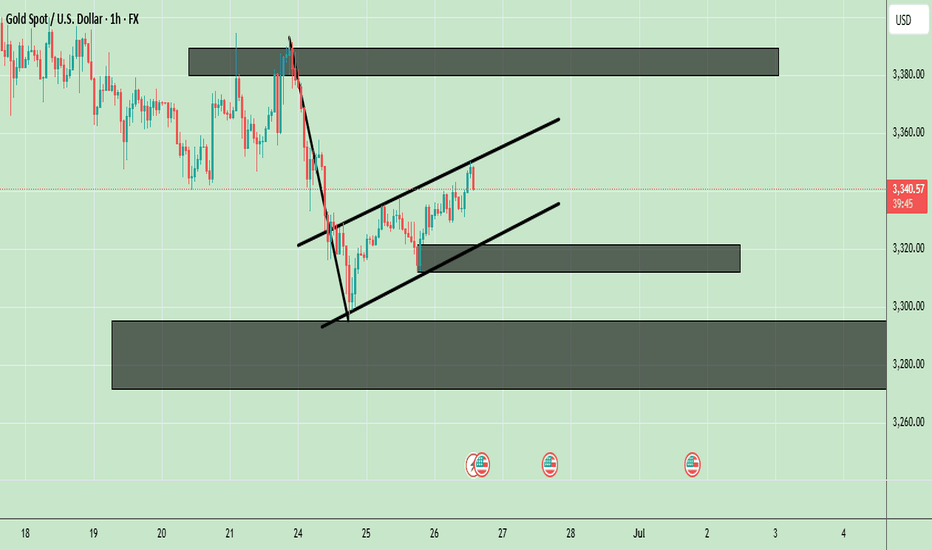

1. Price Structure & Market Behavior After reaching a local top around $3,347–$3,350, gold entered a clear downtrend.

However, the breakout of the descending trendline (yellow line) with solid bullish candles is a strong reversal signal.

The market has formed higher highs and higher lows with strong bullish candles, confirming a V-shape reversal pattern from the bottom zone.

2. Key Support & Resistance Levels Immediate resistance: $3,347–$3,350 – previous rejection zone.

Short-term support: $3,308 – newly broken resistance now acting as support.

Major support: $3,263 – previous low with strong bullish bounce, highlighting significant buyer interest.

3. Suggested Trading Strategy Given the strong breakout and bullish trend structure, traders may consider a buy-the-dip strategy around $3,308–$3,315 on potential pullbacks.

Stop-loss should be placed below $3,263 to protect against false breakouts.

Short-term take-profit targets can be set at $3,350–$3,360. If this level breaks, extended targets could reach $3,375.

Volume & Momentum Volume is increasing along with price, confirming strong buyer participation.

Bullish candles are closing near highs, showing weak selling pressure and suggesting the uptrend may continue.

Conclusion: Gold has resumed a short-term uptrend after breaking its previous downtrend. Traders should favor bullish setups and look for pullbacks to enter at better prices. Watch the $3,347 zone closely – if gold breaks and holds above it, further upside is likely.

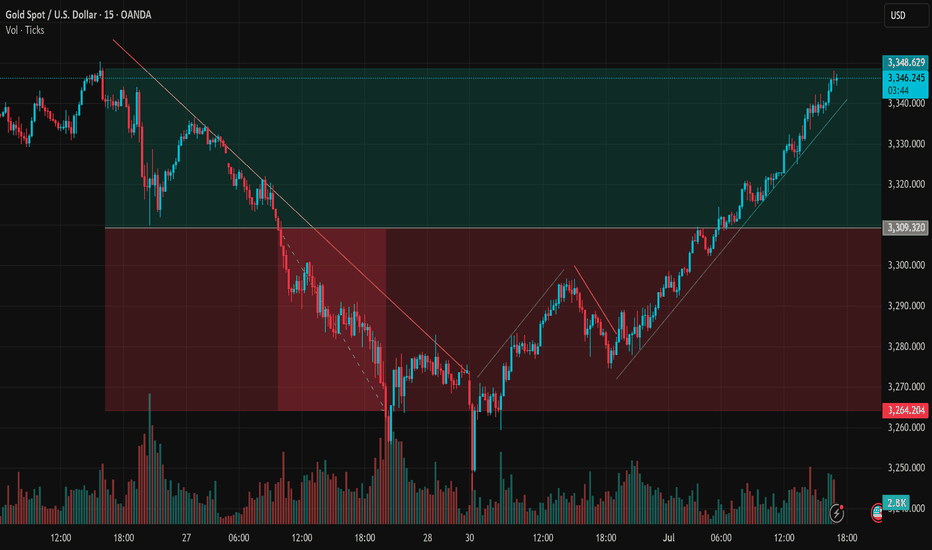

XAUUSD Consolidates Near Resistance After Strong RallyGold (XAUUSD) on the 1H timeframe has staged a solid bullish reversal from the 3,263 USD support zone, reaching a recent high of 3,357 USD. Now, the market is entering a consolidation phase just below this resistance. This price action may be setting the stage for the next directional move.

After breaking a clear descending trendline, XAUUSD formed a two-leg bullish structure with higher highs and higher lows – a classic signal of trend reversal. The rally paused around 3,357 USD, a previous swing high acting as short-term resistance. The price is currently ranging between 3,330–3,340 USD with decreasing volume, indicating a potential accumulation zone rather than distribution.

Resistance: 3,357 USD – breakout target

Support zone: 3,330–3,335 USD – short-term demand zone

Invalidation level: 3,306 USD – below this, bullish structure breaks

As long as price holds above 3,330 USD, a bullish continuation remains the primary scenario. Traders can look for pullbacks or bullish patterns within this zone for potential long entries. A break and close above 3,357 USD would confirm strength, opening the path toward 3,370 or even 3,390 USD.

Stop-loss should be placed below 3,306 USD to manage risk if the breakout fails. If price loses the 3,306 support decisively, the setup turns neutral to bearish short-term.

The breakout leg was supported by rising volume, validating real demand. Current low-volume sideways movement suggests the market is “cooling off” after the rally, often a precursor to the next breakout move. Watching for bullish engulfing candles or volume spikes near support can offer trade confirmation.

Conclusion:

Gold remains in a bullish technical structure on the 1H chart. The current range between 3,330–3,357 USD is key. If price breaks above resistance, we could see strong continuation toward higher levels. Traders should stay patient, manage risk carefully, and let price action confirm the next move.

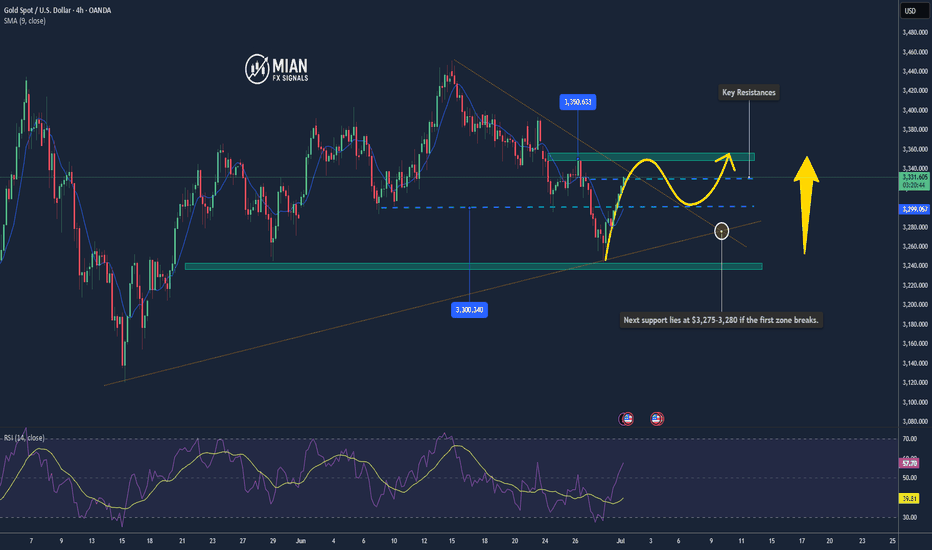

Gold Might Break Higher As It Hits $3,330 Resistance📊 Market Drivers

Gold has just climbed to $3,330/oz, supported by ongoing safe-haven demand and a slightly weaker U.S. dollar ahead of Fed Chair Powell’s speech. Investor expectations of a rate cut in September are keeping bullish momentum alive.

________________________________________

📉 Technical Analysis

• Resistance:

→ $3,330–3,335 (50-day SMA & Fibonacci level)

A breakout above $3,335 could open the door to $3,350+.

• Support:

→ $3,300–3,310 (psychological level & EMA9)

→ Next support lies at $3,275–3,280 if the first zone breaks.

• EMA09:

Price is currently above the 9-EMA, confirming a short-term bullish trend.

• Momentum Indicators:

o MACD is bullish; Stochastics is high — all signaling upside, though a short-term pullback may occur if the resistance holds.

________________________________________

📌 Outlook

Gold is likely to continue climbing in the short term if it breaks above the $3,330–$3,335 resistance zone, fueled by bullish sentiment and dovish Fed expectations.

If it fails to break higher, a minor correction toward $3,300–$3,310 could follow.

________________________________________

💡 Suggested Trade Strategy

BUY XAU/USD : $3,320–3,325

🎯 TP: 40/80/200 pips

❌ SL: $3,310

SELL XAU/USD : $3,340–3,345

🎯 TP: 40/80/200 pips

❌ SL: $3,350

Gold price rises by more than $100, will the bull run continue?📰 News information:

1. Geopolitical situation

2. PMI data

3. Global Central Bank Governors Meeting

📈 Technical Analysis:

The NY session is about to begin, and there are two things we need to pay attention to. First, the PMI data, and second, the talks between global central bank governors. If Powell again hints that the inflation outlook is weaker than expected, this will increase the Fed's easing bets and trigger a new round of decline in the US dollar. The dovish tone may help gold prices to further rebound. On the contrary, if Powell makes some hawkish or cautious remarks, this may exacerbate the recent downward trend in gold prices. The key point at present is the 3350 mark. If the 4H closing line of the NY session remains below 3350, then in the short term we are expected to continue to retreat to the 3330-3320 range. If the 4H closing line is above 3350 and stabilizes, gold may rebound to the 61.8% position, which is around 3372.

🎯 Trading Points:

SELL 3340-3350-3355

TP 3330-3325-3320

BUY 3330-3320

TP 3340-3350-3372

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

FX:XAUUSD FXOPEN:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD TVC:GOLD

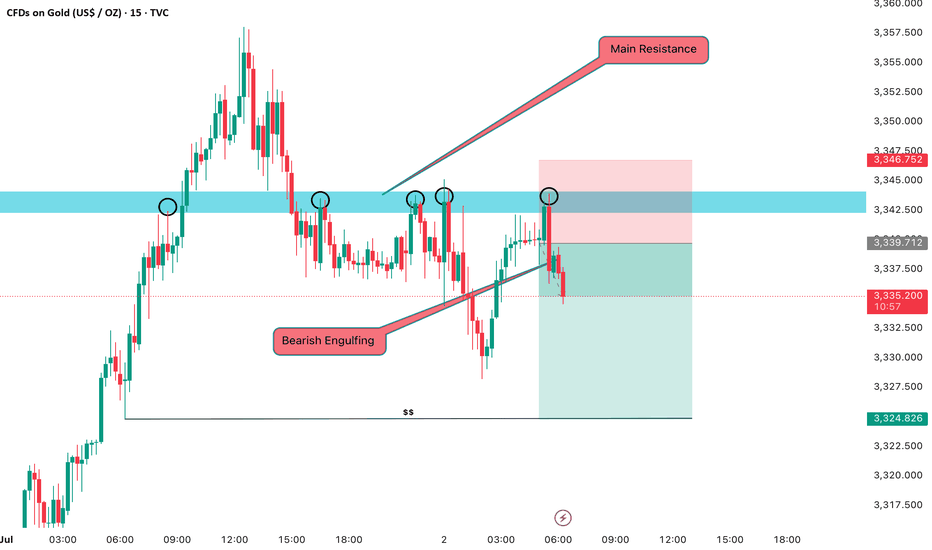

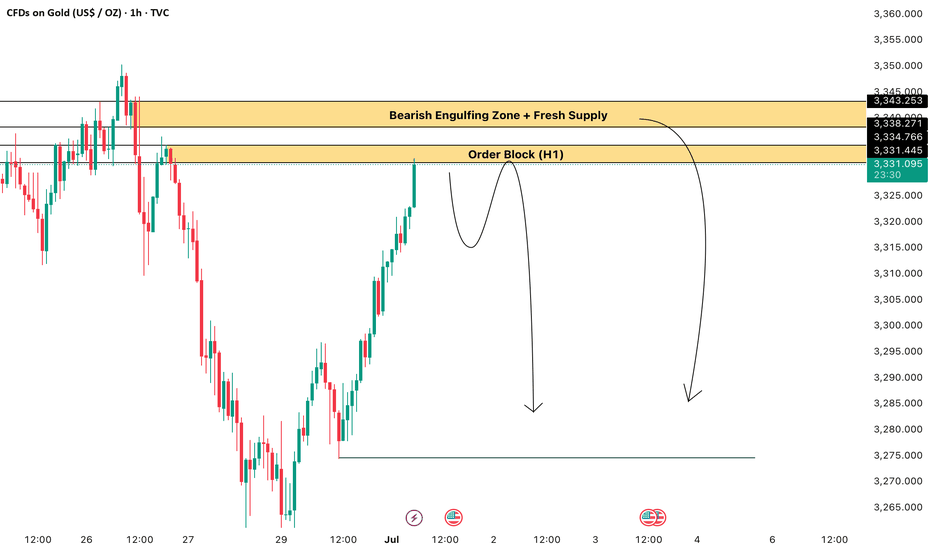

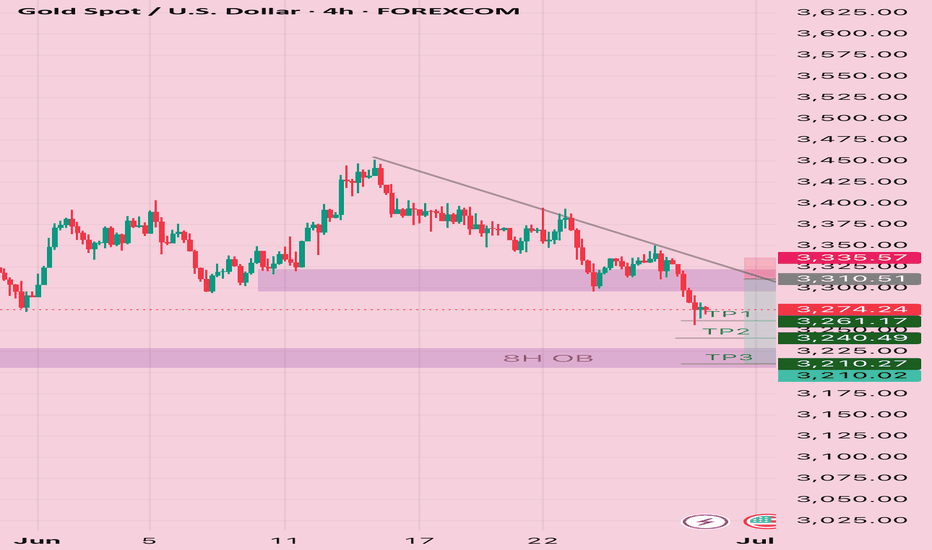

GOLD SHORT TRADE IDEA ! Gold Looking For Sell On Order Block Zone 3331/3334 Target Will Be 3300

Gold Sell Second Zone Bearish Engulfing + Fresh Supply Target Will Be 3275

Gold Sell First Zone OB H1 (3331/3335

Stoploss - 3345

Tp Levels - 3325,3320,3310,3300

Gold Sell Second Zone Bearish EG + Fresh Supply (3338/3344)

Stoploss - 3350

TP levels : 3330; 3322; 3314; 3330, 3290

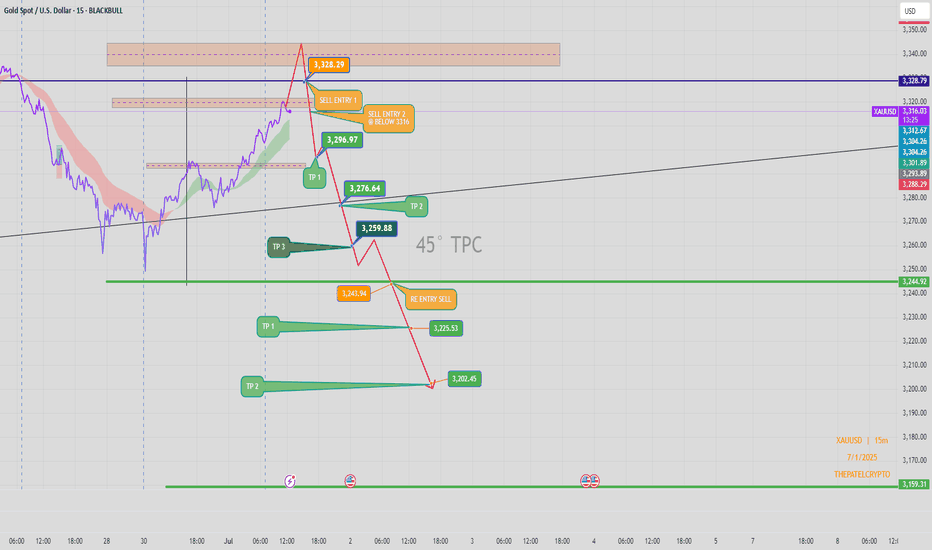

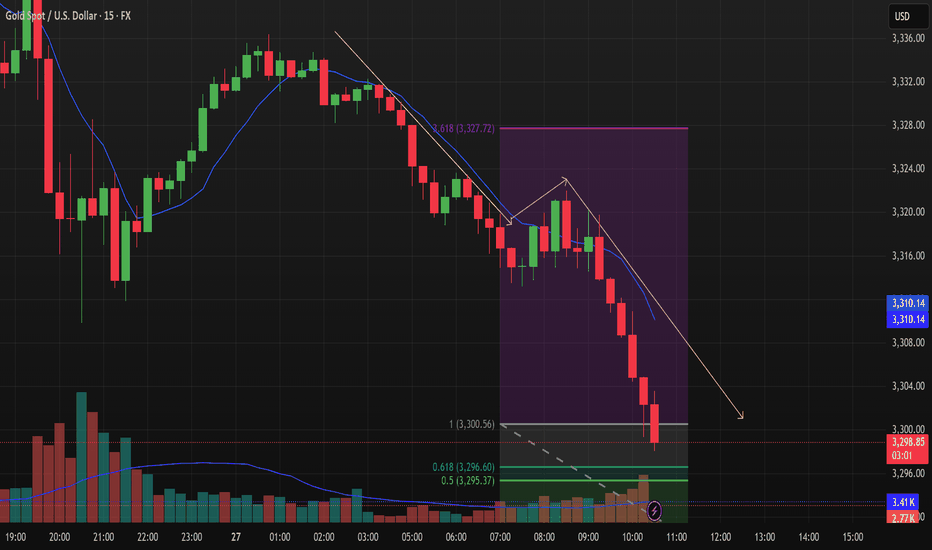

XAUUSD 15min – Bearish Setup | Short Trade Plan Below 3328Price action on Gold (XAUUSD) is showing signs of exhaustion near the 3,328 resistance zone, where we anticipate potential bearish rejection. A short opportunity may unfold once confirmation occurs below the key structural level of 3316.

Sell Trade Setup:

🔹 Primary Entry (Sell Entry 1):

📍 Zone: Around 3,328.29

📌 Reaction expected near major supply & resistance zone.

🔹 Confirmation Entry (Sell Entry 2):

📍 Below 3,316

📌 Break below structure may trigger bearish momentum.

Targets:

🎯 TP 1: 3,296.97 (Initial reaction zone)

🎯 TP 2: 3,276.64 (Mid support/EMA cross zone)

🎯 TP 3: 3,259.88 (Key structural support)

🎯 Extended TP:

3,243.94 (Re-entry confirmation level)

3,225.53 (Prior base structure)

3,202.45 (Final target if strong momentum follows)

3,159.31 (Ultimate low if sellers dominate trend)

Re-Entry Plan:

🔄 If price retraces after TP 3, watch for rejection at 3,243.94 to re-enter short toward the next levels.

Confluence Factors:

✔ 45° TPC angle supports bearish path

✔ Structure break expected below 3316

✔ EMA resistance and trendline rejection from upper zone

✔ Volatility cluster observed near 3,328 – ideal for trap setup

Bias:

Bearish below 3,316 – Expecting a downward continuation if structure confirms breakdown.

Author:

📅 1 July 2025

📊 Chart: XAUUSD – 15min

🧠 Shared by: @THEPATELCRYPTO

The limit is 3320. Rebound and still short📰 News information:

1. Gold market liquidity at the end of the month

2. Impact of geopolitical situation

📈 Technical Analysis:

Currently, gold has rebounded to around 3295, reaching our ideal trading area. I have given the short-selling trading idea in the previous post. At present, in the short term, we still maintain the short-selling trading idea before effectively breaking through the upper resistance. Focus on the 3325 line of resistance

🎯 Trading Points:

SELL 3295-3310-3320

TP 3285-3270

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

OANDA:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD PEPPERSTONE:XAUUSD FXOPEN:XAUUSD TVC:GOLD

XAUUSD/GOLD Geopolitical conflicts have escalated again. Next week is a week of heavy news. How will the gold price focus next week? How to trade? Look at the news preview first.

1. Geopolitics, Russia-Ukraine conflict, Palestine-Israel conflict, Iran-Israel conflict.

2. ADP data, NFP data.

3. Tariff deadline.

The above three news are enough to cause drastic fluctuations in the gold price.

On Friday, the New York market followed my expectations. After rebounding around 3282, it fell back. Finally closed around 3274.

The impact of the weekend news is huge. From the news perspective, the opening price of next Monday will be higher than the closing price on Friday. In terms of operation, you can pay attention to buying at a low price after the market opens.

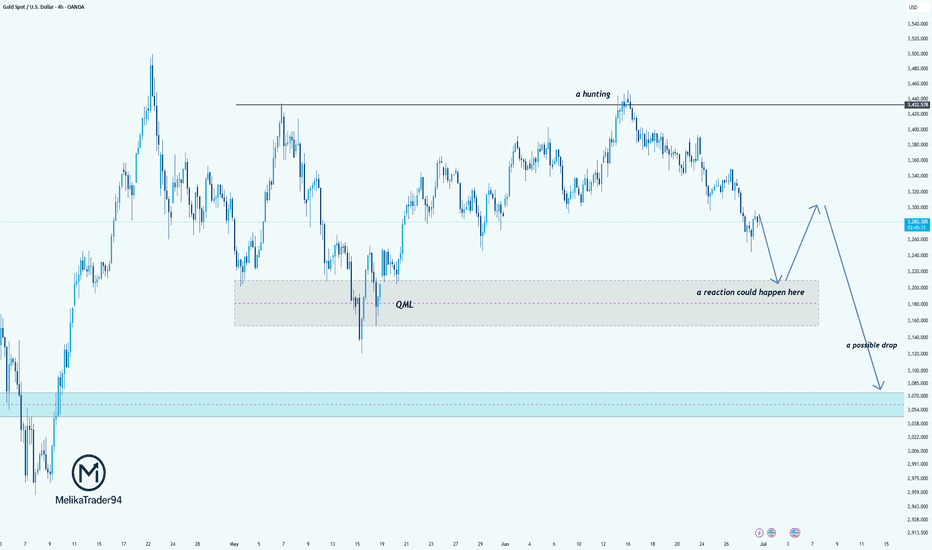

Gold: Eyes on QML Zone for Potential Reaction Before Deeper DropHello guys!

Let's go deep into the GOLD chart!

Price has completed a liquidity grab near 3440 (marked as "a hunting") and is now heading downward toward a key QML zone.

First, a reaction is expected around the QML area (3180–3220), where previous structural interest and demand may cause a temporary bounce.

After this reaction, the price is likely to retest higher, potentially forming a lower high.

Then, the dominant bearish structure is expected to continue, with a possible sharp drop toward the final demand zone around 3050–3080.

This movement represents a classic manipulation.

Gold Faces Resistance Near $3,300 Ahead of U.S. Jobs Data📊 Market Highlights:

Gold holds firm above $3,280 supported by expectations of future Fed rate cuts, but upside momentum has stalled as traders await this Friday’s U.S. jobs report. A slight rebound in the U.S. dollar and elevated bond yields are pressuring gold in the short term.

📉 Technical Analysis:

• Key Resistances:

– $3,300 (strong psychological and profit-taking level)

– $3,320 (last week’s high – potential heavy selling zone)

• Key Supports:

– $3,255 (short-term dynamic support – EMA 09)

– $3,230 (major support from previous breakout structure)

• EMA 09: Price remains above the 09 EMA → trend still bullish

• Momentum: The bullish momentum is weakening. A shooting star candle near $3,300 and RSI approaching overbought territory (>70) suggest a possible short-term correction.

📌 Outlook:

Gold may retreat to $3,255 or lower if it fails to break above the $3,300–$3,320 resistance zone. However, the overall bullish trend remains intact as long as price holds above $3,230.

💡 Suggested Trade Setup:

🔻 SELL XAU/USD at: $3,295 – $3,300

🎯 TP: 40/80/200 pips

❌ SL: $3,305

🔺 BUY XAU/USD at: $3,255 – $3,260

🎯 TP: 40/80/200 pips

❌ SL: $3,245

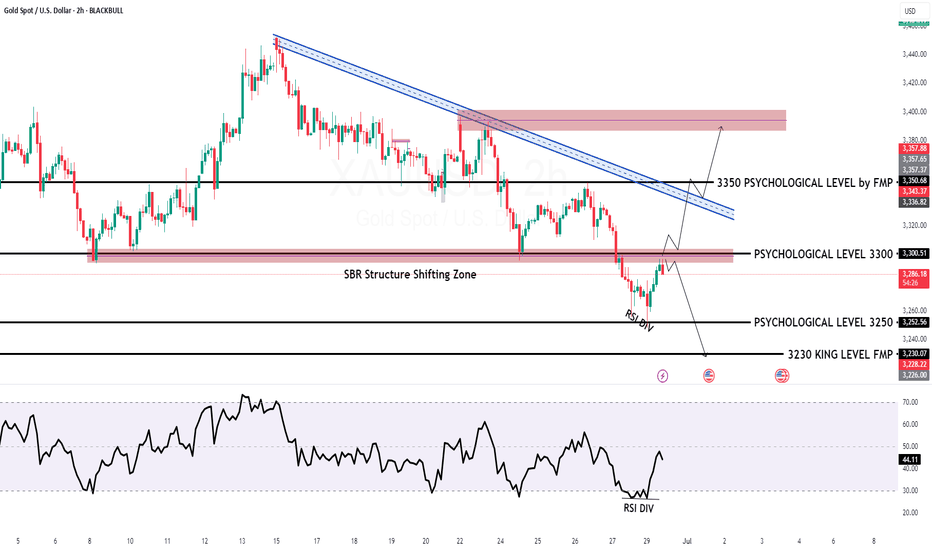

GOLD H2 Intraday Chart update for 30 June 2025Hello Traders,

As you can see that there are some solid in the market since morning, right now market is sustains below 3300 Psychological Level and move towards 3270-75 key support zone and then at 3350

Monthly candlestick closing also due today

only if market breaks 3305 successfully today then GOLD will move towards 3335

Disclaimer: Forex is Risky

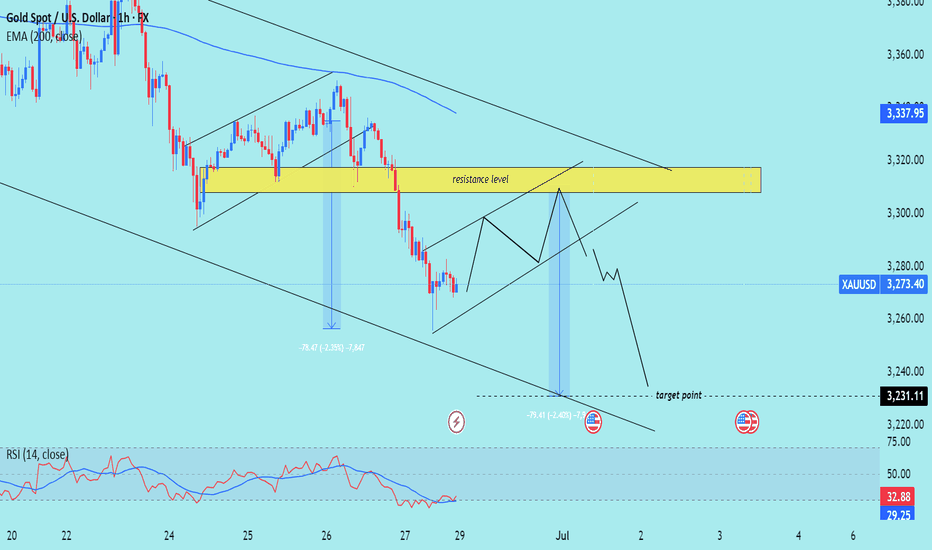

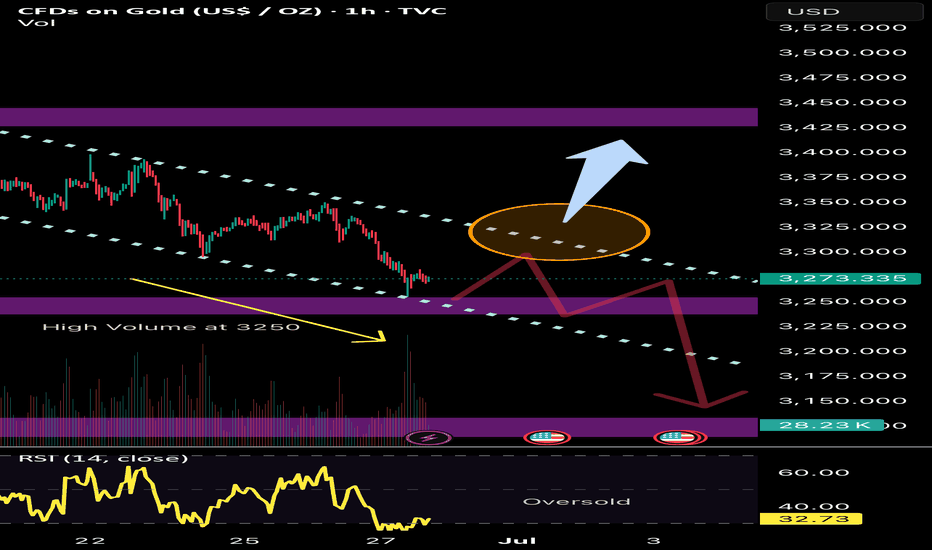

XAU/USD) bearish Trand analysis Read The captionSMC trading point update

Technical analysis of (XAU/USD) on a short-term timeframe, incorporating several key tools and concepts:

---

Overview of the Analysis

Price Level (Current): Around $3,273.40

EMA 200 (Blue Line): Around $3,337.95 (signaling broader trend)

Resistance Zone (Yellow Box): Between approximately $3,300–$3,320

Support/Target Zone: Around $3,231.11

RSI (Relative Strength Index): At 32.88, which is near oversold territory (below 30)

---

Interpretation of Chart Structure

1. Descending Channel:

Price is moving within a downward-sloping channel.

Suggests a bearish trend is in play.

2. Resistance Level (Yellow Box):

Price is expected to retest this area and face resistance.

Confluence of a supply zone and upper trendline, reinforcing its strength.

3. Projected Price Action:

Price may climb back up into the resistance zone.

A rejection is anticipated, leading to another leg down.

The target is around $3,231.11, which matches previous measured moves.

4. Measured Moves (Blue Arrows):

Highlights historical price drops of ~79 points.

Repeating this pattern suggests symmetry and continuation.

5. RSI Indicator:

Currently at 32.88: nearing oversold, but not quite.

No clear bullish divergence, so price could drop further.

---

Trade Idea Summary

Bias: Bearish

Entry Zone: Near $3,300–$3,320 (resistance)

Target: Around $3,231.11

Invalidation: If price breaks and holds above $3,337–$3,340 (EMA 200 and channel breakout)

Mr SMC Trading point

---

Caution/Considerations

Watch for false breakouts above the resistance zone.

Monitor RSI for potential bullish divergence that could invalidate the downside.

Be cautious around the U.S. economic news event icon, which might cause volatility.

plesse support boost 🚀 this analysis)

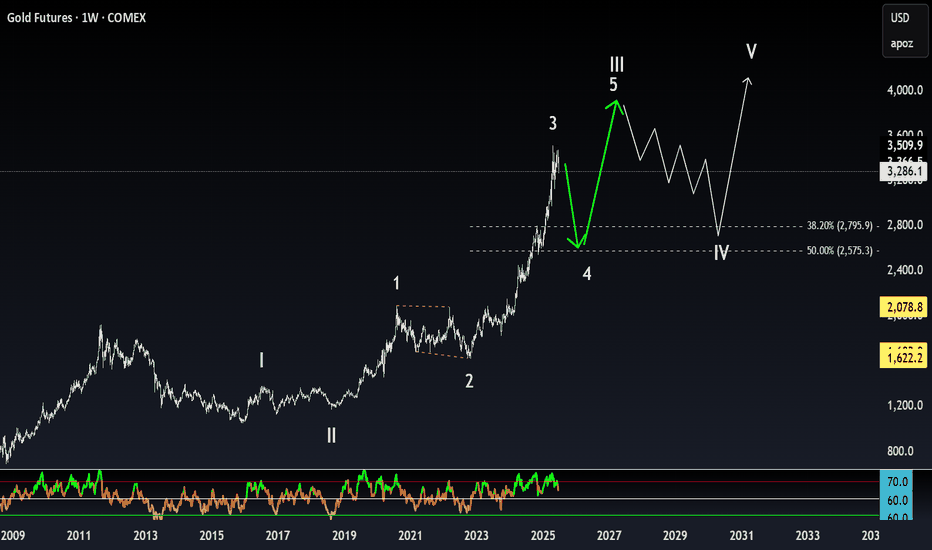

Navigating Gold Futures: Support, Resistance, and ProjectionsCOMEX:GC1!

The chart appears to depict a clear five-wave pattern: I, II, III, IV, and V.

Waves I to III show strong upward movements, indicating bullish sentiment.

Wave IV looks like it could be a corrective phase, with a potential dip before another upward movement in Wave V.

Support and Resistance Levels:

The horizontal lines around 2,800 and 2,575.3 indicate critical Fibonacci retracement levels (38.20% and 50%).

If the price approaches these levels during the correction, they could serve as support, making it a potential buying opportunity.

RSI Indicator:

From the bottom indicator (RSI), we can see fluctuations in momentum, which can aid in timing trades.

Look for interpretations of the RSI: if it trends towards the extremes (overbought/oversold), that could signal reversal points.

Future Projections:

Should the market respect the outlined support levels, Wave V could potentially push towards a new high above 4,000 as indicated by the upward projection.

Market Sentiment:

Overall, the pattern suggests a bullish outlook long-term, but caution is warranted during corrective phases as prices might retrace towards support levels.

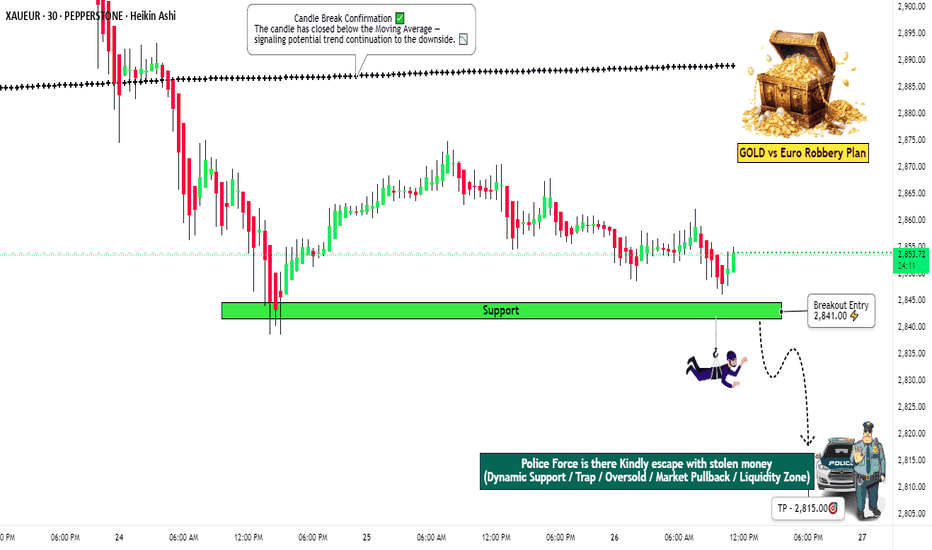

"BREAKOUT ALERT! XAU/EUR Bear Raid – Get In Before The Drop!"🤑 GOLD HEIST ALERT! 🚨 XAU/EUR Bearish Raid Plan (Thief Trading Style) 💰🔥

🌟 Greetings, Market Pirates & Profit Snatchers! 🌟

Based on the 🔥Thief Trading Strategy🔥, we’re plotting a high-stakes bearish raid on XAU/EUR ("The Gold Market"). Our mission? Short the breakout & loot the downside!

🎯 TRADE SETUP (Scalping/Day Trade)

Entry (Sell Zone) 📉: 2841.00 – Wait for Neutral Level breakout, then strike!

Pro Tip: Place sell-stop below support or sell-limit on pullback (15-30min TF).

Set an ALERT! Don’t miss the breakout moment.

Stop Loss 🛑:

"Stop right there, cowboy! 🤠 If you’re entering on a sell-stop, DO NOT set SL before breakout!

Thief SL Rule: Nearest swing high (30min TF) – Adjust based on your risk & lot size.

Rebels, be warned – stray at your own peril! 🔥

Target 🎯: 2815.00 (Lock profits & escape like a pro thief!)

💡 WHY THIS HEIST? (Bearish Triggers)

Technical Setup: Oversold bounce? Trap. Strong bearish reversal brewing.

Fundamentals: Macro risks, COT data, geopolitics – Gold’s under pressure!

News Alert 🚨: High-impact events ahead! Avoid new trades during news – trail stops to protect gains.

💥 BOOST THE HEIST! 💥

Like & Boost this idea to strengthen our robbery crew! More loot = more winning trades. Stay tuned for the next heist! 🚀💰

⚠️ Disclaimer: Trade at your own risk. This is not financial advice – just a strategic raid plan. Manage risk wisely!

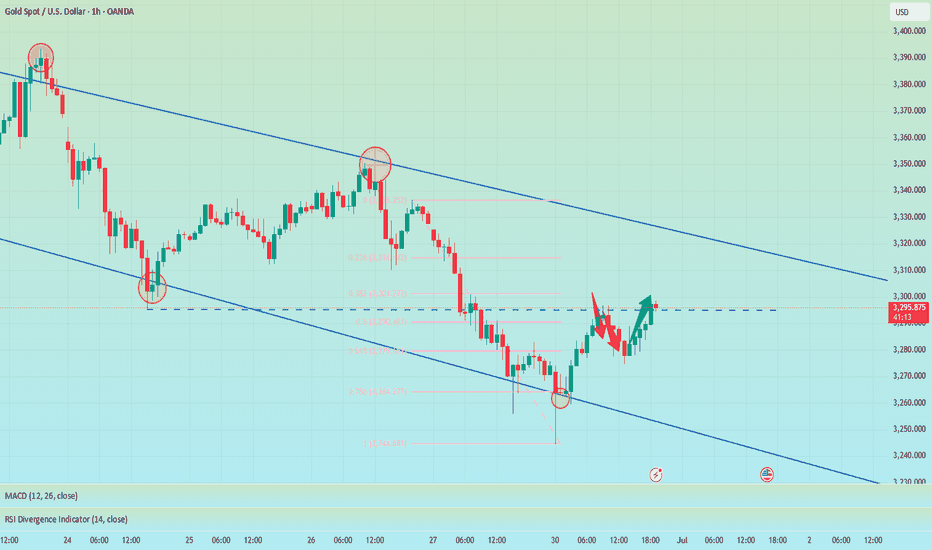

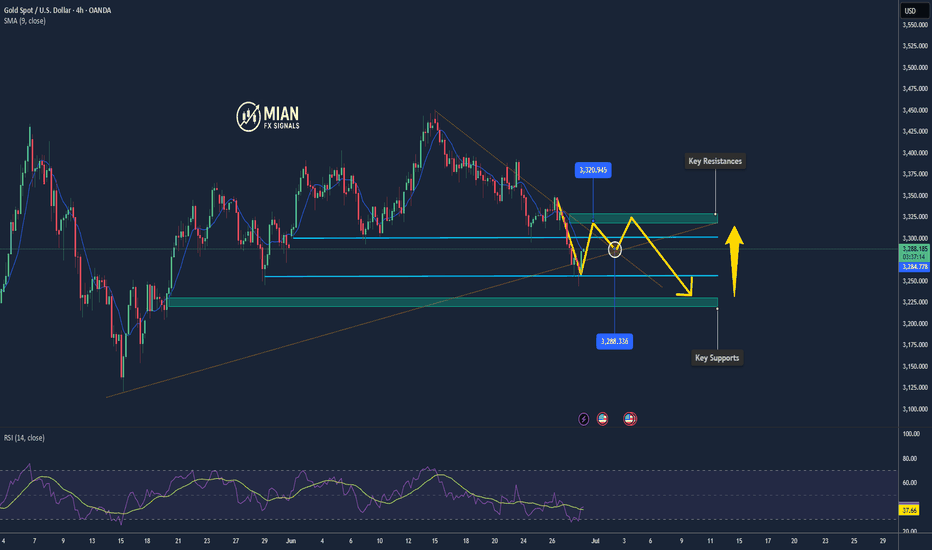

GOLD Setup- Bearish Bias!FOREXCOM:XAUUSD Price is forming a series of lower highs and lower lows on the 4‑hour timeframe, indicating a downtrend bias. Recent resistance at the 70 EMA / descending trendline is holding strong,hard to break above.

Based on recent candle pattern with long lower wicks at current price, it’s most likely A short term correctional swing might occur to zone 3295-3310.

Setup:

Entry: 3300-3310

Targets: 3260, 3240, 3210

Stop Loss: 3331

Risk: 1:2,3,5

Disclaimer: This is not financial advice.

.

Welcoming your thoughts in this setup. Let’s grow together<3

Will the FALL continues?Last trade idea was fulfilled and went into the downside. Targeted 3250. If this 3250 major support area breaks down, we can expect a bigger downside move.

However, there’s a huge buying that happened at that level. It may first have a pullback upwards before it continues its decline. RSI is also at oversold level.

Bullish reversal can be confirmed if 3350 gets broken.

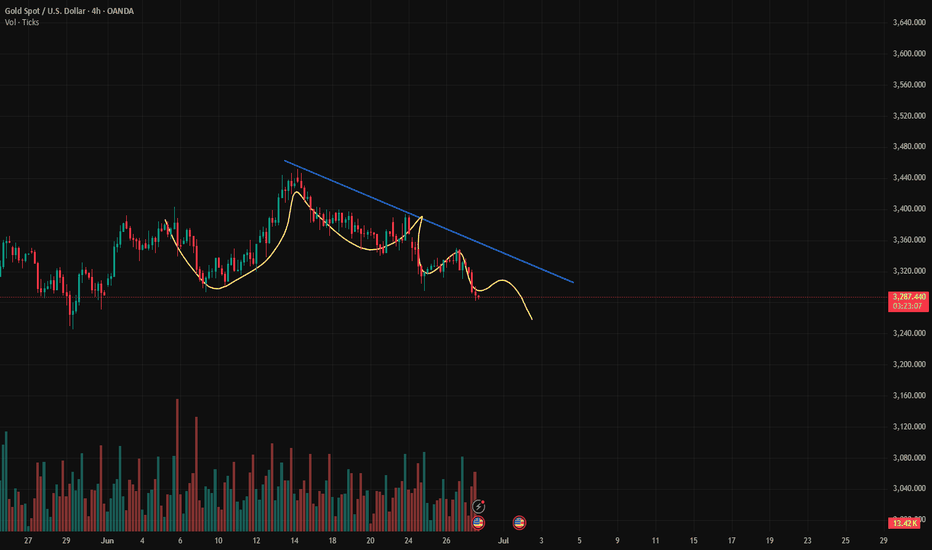

XAUUSD/GOLD/SellThe pressure from the bears is too great. In the end, the pressure from above was not broken. Instead, it broke out and fell after being under pressure. The stop loss was hit.

The current price is 3285. After gradually boosting the US dollar index. The trend of gold prices has continued to fall. More importantly, the tariff issue has been eased. At the same time, geopolitical factors are also orderly and stable. This is the news that caused the bears to attack.

History has not become the savior because of repeating itself. Of course, this is also an emergency. In some transactions, the extremely low probability of causing losses is a common problem in transactions. However, our analysis team has stabilized a high trading win rate.

Then the next trading plan is still to focus on the pressure from above. If the London market rebounds above 3300. It is still mainly selling. 3314 is an important level for short-term rebound, and we need to pay attention. Although there is no obvious sign of rebound yet, the release of short-selling pressure has been alleviated because the decline is slow. Today's main trading idea is still to sell at high levels.

The target is to focus on the position of 3264-3248. Remember the risk of buying at low levels. Do not trade independently.

XAUUSD - Gold Bearish Bias Remains StrongXAU/USD remains under bearish pressure on the 4-hour timeframe. Until price breaks and closes above $3,336 with strength, selling the rallies remains a preferred strategy. However, watch for potential bounces near support zones, especially if momentum weakens or reversal candles appear. The price is currently trading below both the 50, 100 and 200 EMA, indicating a short-term downtrend. The recent price action has respected the trendline resistance and failed to break higher, reinforcing sellers’ control.

Price structure has formed a descending channel, which often signals a bearish continuation. However, if price finds a strong reaction from support, a temporary rebound could occur before further downside. Overall sentiment is cautious due to recent geopolitical de-escalation between Iran and Israel, which reduced gold’s safe-haven demand. Dollar strength, driven by hawkish Fed tone, continues to pressure gold.

Key Support Levels :

$3,295 – A minor support where previous candles showed buying interest.

$3,289 – Critical horizontal support and psychological level.

$3,270 – Next significant support if $3,289 breaks.

$3,240 – Major support zone, last line before larger downside moves.

Key Resistance Levels:

$3,310 – Near-term resistance and EMA zone.

$3,320 – Price rejection level from earlier 4H candles.

$3,336 – Strong resistance with previous swing highs.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Analysis and layout of the latest gold trends during the day📰 Impact of news:

1. PCE and Consumer Index

📈 Market analysis:

Judging from the 4H chart, the Bollinger Bands are closing and the MACD is showing a trend of forming a death cross, indicating that the short-selling momentum is still relatively strong in the short term. However, as the overall upward structure has not been destroyed, there is still a possibility of a rebound and repair in the future. During the day, we need to pay special attention to the support strength of the MA5 and MA10 moving averages. It is recommended to adopt the idea of shorting at high levels and going long at low levels. The key support below is the 3305-3295 area, and the upper resistance is the 3340-3350 range. However, judging from the chart, in the short term, there may be a rebound near 3313. At present, it has indeed rebounded to around 3319 as expected. If it falls weakly to this week's low of 3295, you can buy if it does not break. On the whole, if it rebounds to 3335-3345, you can consider shorting, and if the support below 3305-3295 is not broken, go long. Today is Friday, and as it is near the end of the month, market liquidity is strong. Please be cautious in your operations today and be sure to set stop losses strictly.

🏅 Trading strategies:

SELL 3335-3345-3350

TP 3320-3315-3300

BUY 3305-3295

TP 3310-3320-3330

If you agree with this view, or have a better idea, please leave a message in the comment area. I look forward to hearing different voices.

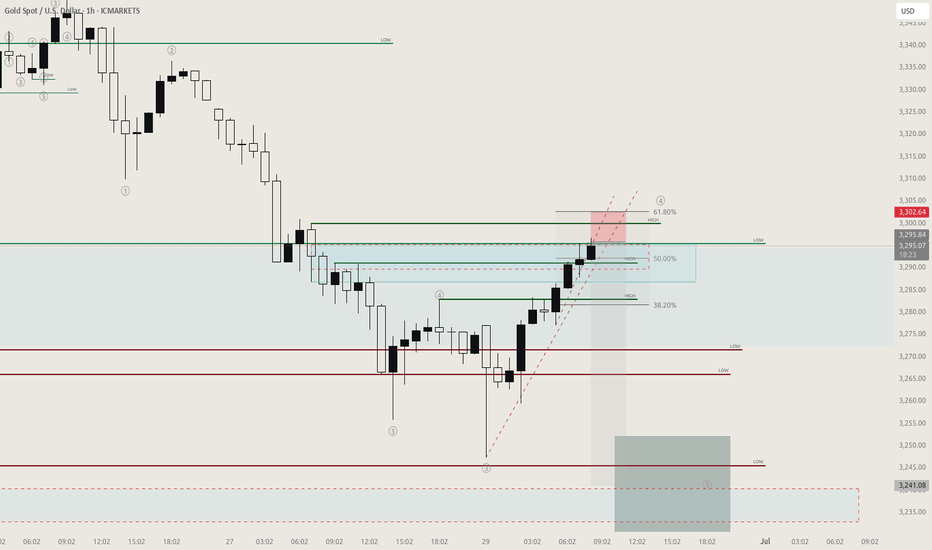

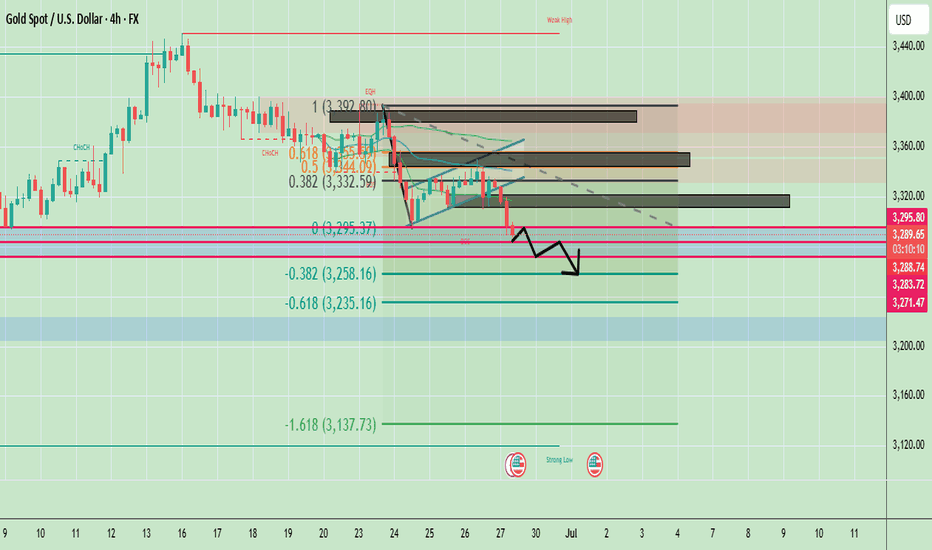

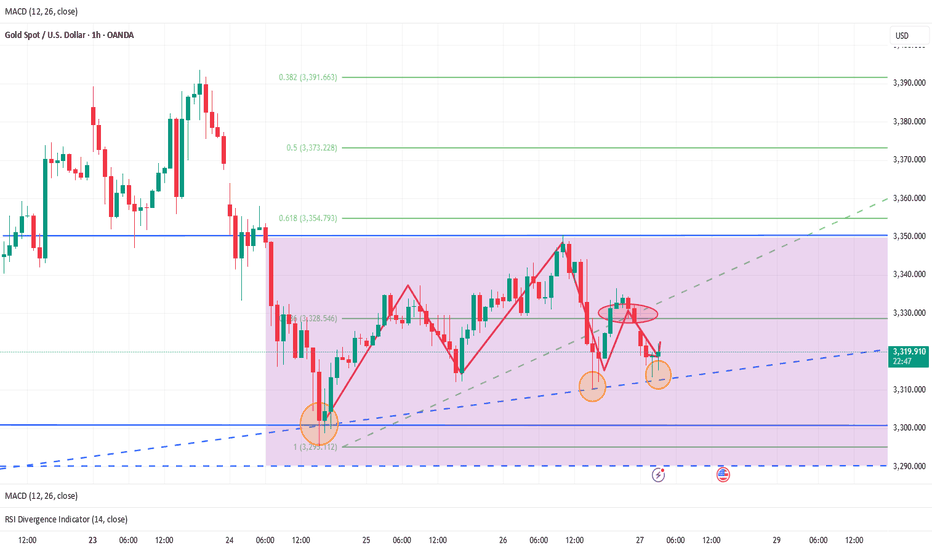

XAUUSD: Bearish Trend, Key Support at $3,295Market Overview

In today’s trading session (26/06/2025), XAUUSD shows continued downward momentum. Gold prices are currently hovering around $3,302.05, with a slight drop of 0.01%. The intraday price range has been tight, between $3,330.00 and $3,350.00, indicating a battle between the buyers and sellers around the short-term equilibrium zone.

Recent price action suggests that after a brief recovery, gold is once again encountering resistance at the $3,350.00 level. In the coming hours, a decisive breakout either above this resistance or below current support will dictate the market’s next move.

Key Technical Levels to Watch:

Support Levels: The first significant support is at the $3,295.37 level (50% Fibonacci retracement), with the next support at $3,296.60 (61.8% Fibonacci retracement), followed by a crucial level at $3,300.56.

Resistance Levels: The primary resistance area lies around $3,350.00, with the second resistance at $3,327.72, which coincides with the 3.618 extension of the previous price swing.

Price Action Analysis

As seen in the chart, XAUUSD is currently trading below both the 50-period (blue) and 200-period (yellow) moving averages, indicating a strong bearish trend. The price action is forming a series of lower lows and lower highs, reinforcing the downtrend.

Bearish Trend Continuation: A break below the support at $3,295.37 could signal further downside towards $3,290.00 or even $3,275.00. The yellow trendline indicates the overall bearish direction, and any failure to hold above $3,300.00 could trigger additional selling pressure.

Fibonacci Retracement Levels: Price is testing the 50% and 61.8% Fibonacci levels. A rejection at these levels could cause a pullback towards lower support zones, confirming the bearish outlook for the short term.

Volume Analysis

The volume chart shows relatively low volatility, with decreasing volume during the price pullbacks. This suggests that there is not enough buying interest to push the price higher, and the market may be more inclined towards bearish continuation in the near term.

Market Sentiment

Currently, the market is undecided. The recent price action suggests that traders are waiting for a confirmation of direction. The next few hours are critical in determining if the downtrend will continue or if we will see a short-term bounce at one of the key support levels.

Trading Strategy

Short Position: A break below $3,295.37 would be an excellent opportunity to short XAUUSD with a target at $3,290.00, and further down to $3,275.00.

Long Position: Only consider long positions if XAUUSD manages to break above $3,350.00 decisively, with the next target near $3,375.00.

Conclusion

XAUUSD remains under pressure, and unless there’s a strong reversal at support levels, the bearish momentum could continue in the short term. Traders should monitor the key levels mentioned above closely to adjust positions accordingly.