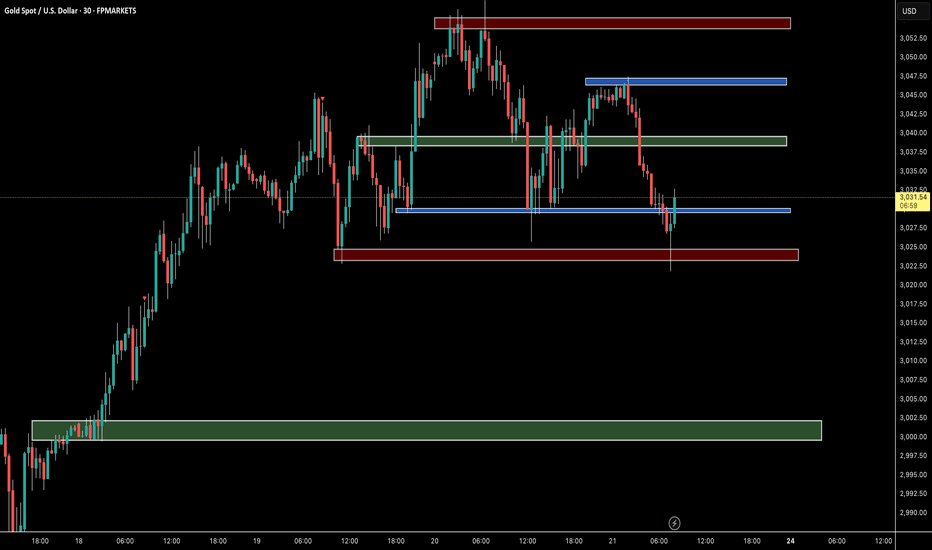

Gold (XAU/USD)– Bearish Setup Against the Main Trend (High Risk)hello guys.

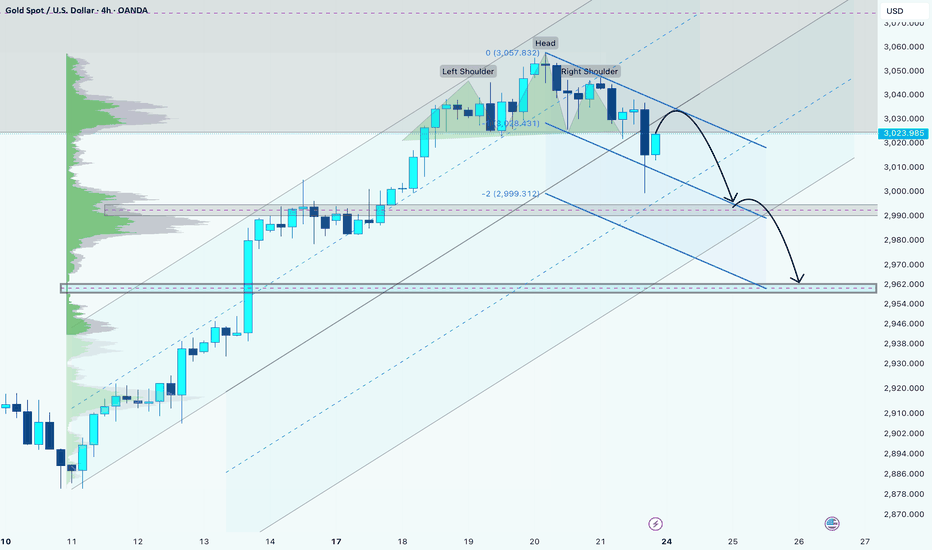

In this 4-hour chart, we can see a Head and Shoulders pattern forming, which is typically a bearish reversal signal. The price has broken below the neckline of the pattern, suggesting a potential downside move. Additionally, the price is currently trading inside a descending channel, reinforcing the bearish momentum.

Bearish Scenario

A potential pullback to the upper boundary of the descending channel (around $3,030-$3,035) could serve as a selling opportunity.

The first target for the decline is around $3,000, a psychological level and previous support.

If momentum continues downward, the price could drop further to $2,962-$2,965, which aligns with strong historical support.

in higher timeframe:

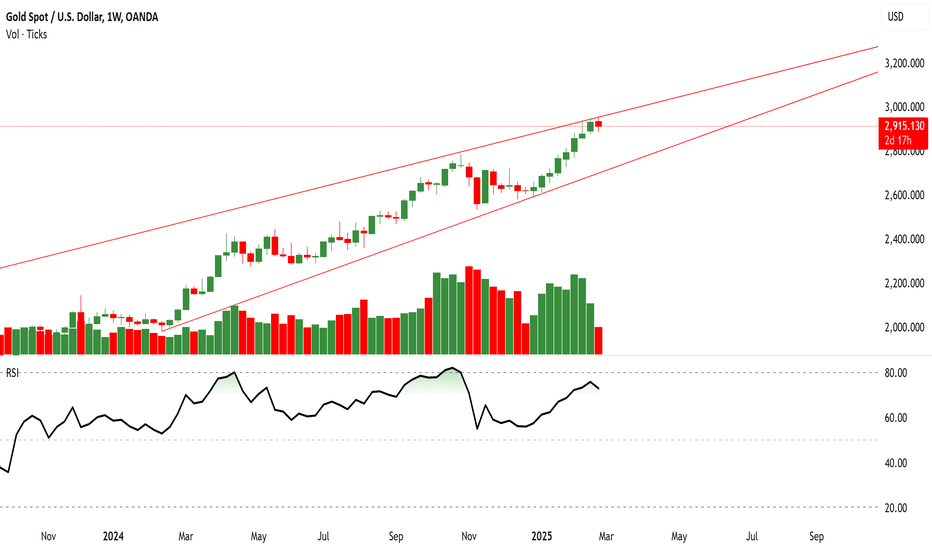

The volume has noticeably declined towards the end of this uptrend, signaling a potential loss of bullish momentum. As prices reach new highs, the decreasing volume suggests that buyers are becoming exhausted, which often precedes a correction or reversal. This divergence between price action and volume indicates that the recent upward movement may not be sustainable, increasing the likelihood of a pullback in the near term.

Why This Trade is Super Risky?

Main Trend is Bullish – The overall market structure remains in an uptrend, so this short setup is against the major trend.

Liquidity & Buyer Pressure – The price could find strong buying pressure around $3,000, leading to a false breakdown.

Risk Management is Crucial – If entering a short position, risk should be minimal, with a tight stop-loss above $3,035-$3,040 to prevent excessive losses in case of invalidation.

📌 Conclusion:

This setup offers a potential short trade, but high caution is needed due to the bullish macro trend. Entering with low risk and tight stops is essential to manage exposure. If the price breaks above the descending channel, the bearish idea is invalidated.

Goldshort

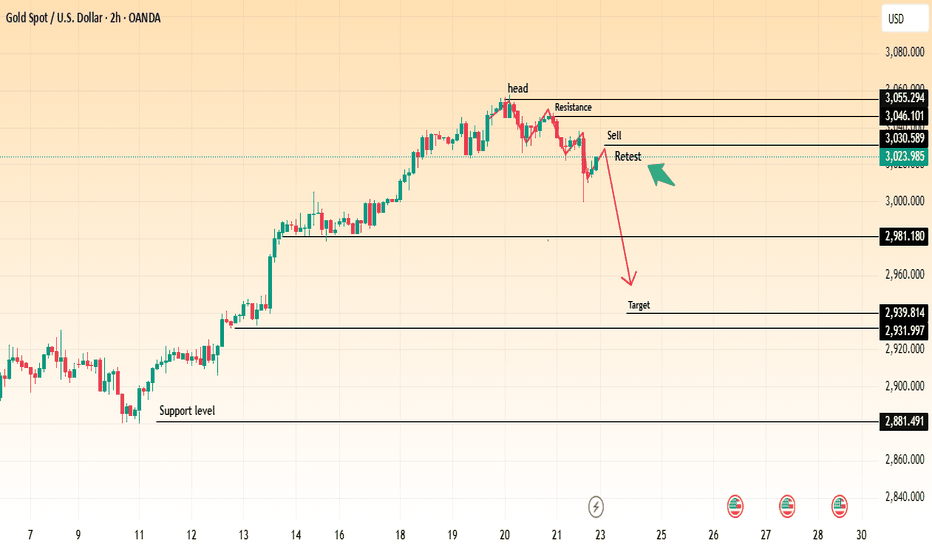

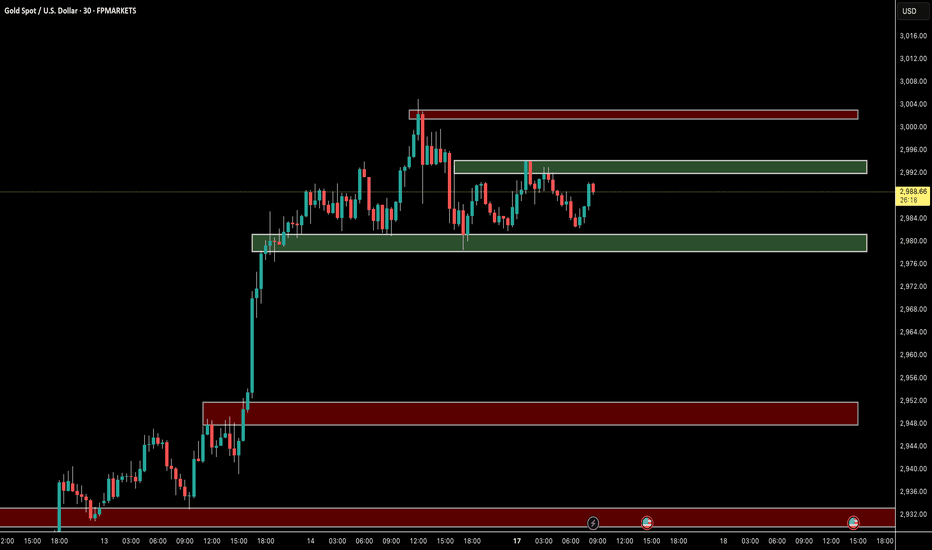

(XAU/USD) Forming a Bearish Reversal–Key Short Setup Unfolding!Chart Pattern: Head and Shoulders Formation

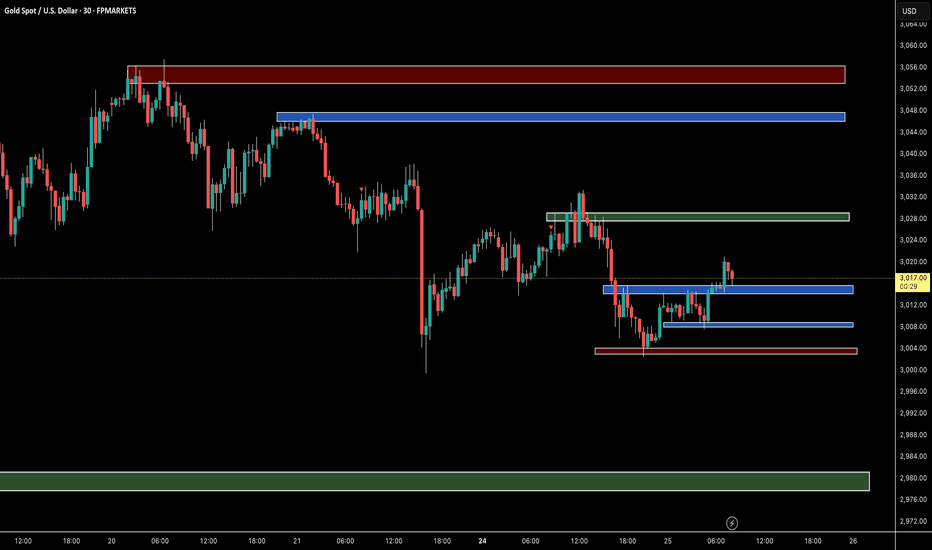

The chart shows a potential Head and Shoulders pattern, which is a bearish reversal setup. The head is the highest peak, while the two shoulders form lower highs on both sides. The price has already broken below the neckline, indicating a sell opportunity.

Key Levels:

Resistance Levels:

$3,055.29 – Major resistance

$3,046.10 – Key level near recent highs

$3,030.58 – Short-term resistance where price is currently retesting

Support Levels (Potential Targets):

$2,981.18 – First support level

$2,939.81 - $2,931.99 – Strong demand zone

$2,881.49 – Major support level

Trade Setup:

Entry:

The price has broken below the neckline and is currently retesting the breakdown zone (~$3,030.58).

If the retest holds, it confirms a sell entry opportunity.

Target:

First target near $2,981.18

Second target around $2,939.81 - $2,931.99

Final target at $2,881.49 for a deeper correction

Stop-Loss:

A stop-loss above $3,046.10 to minimize risk

Market Sentiment:

The break below the neckline and a possible rejection at the retest area suggest further downside potential.

If buyers push the price above $3,046.10, the bearish outlook would be invalidated.

This setup presents a high-probability short trade if confirmation follows through after the retest. Traders should monitor price action around the retest zone before entering a position. 🚨📉

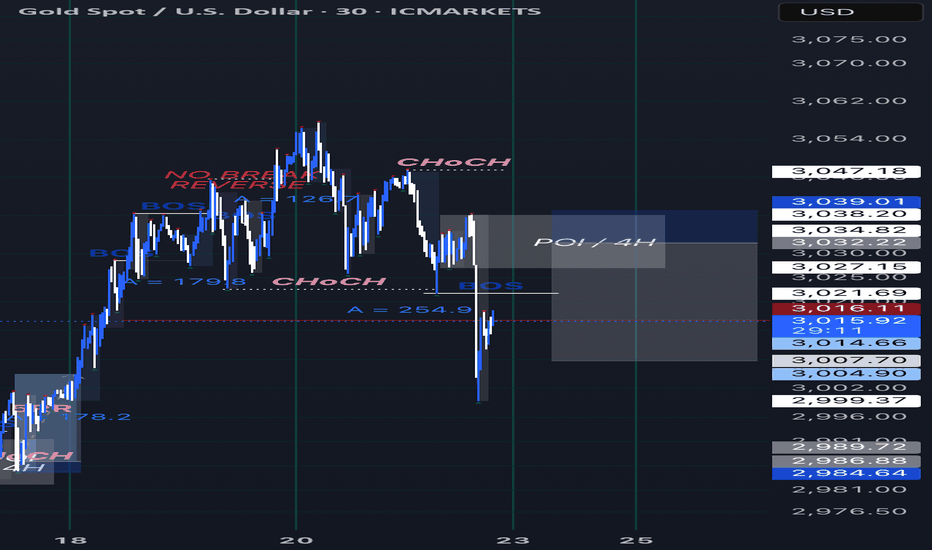

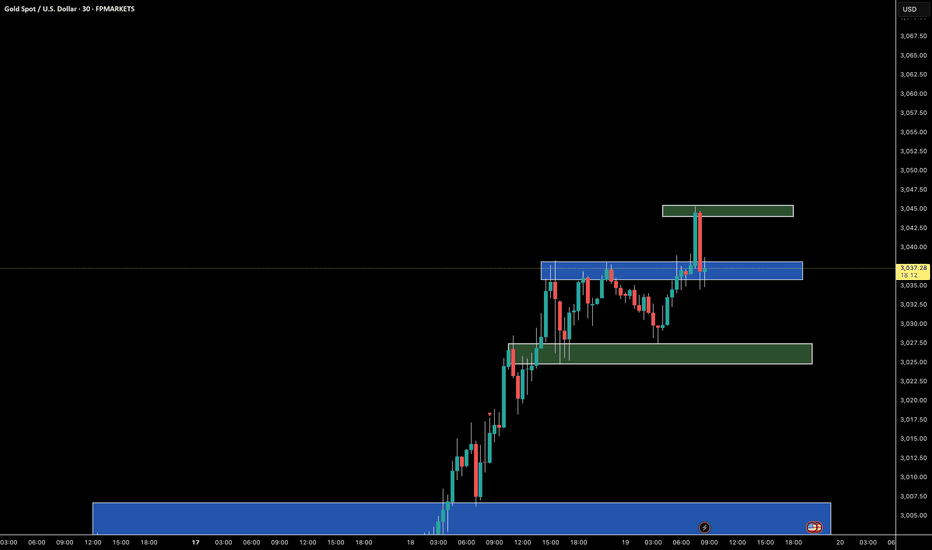

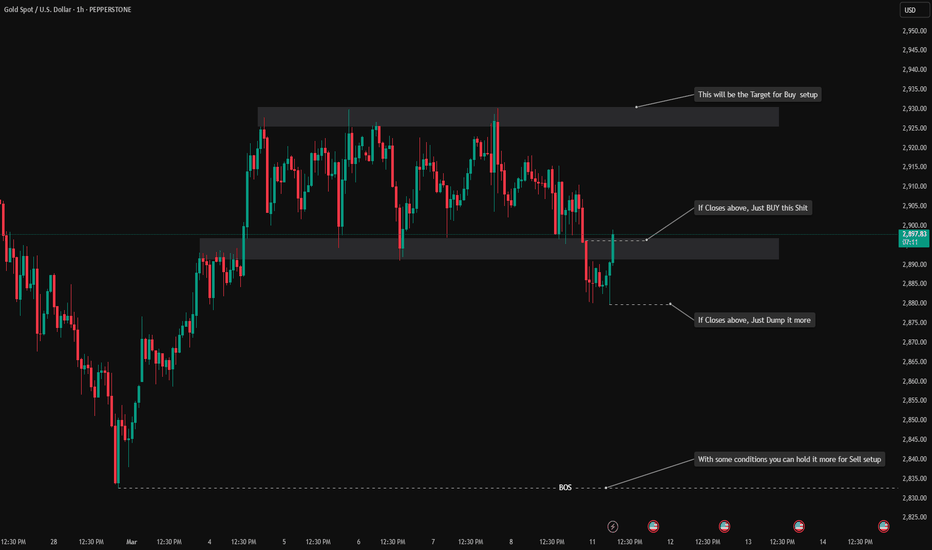

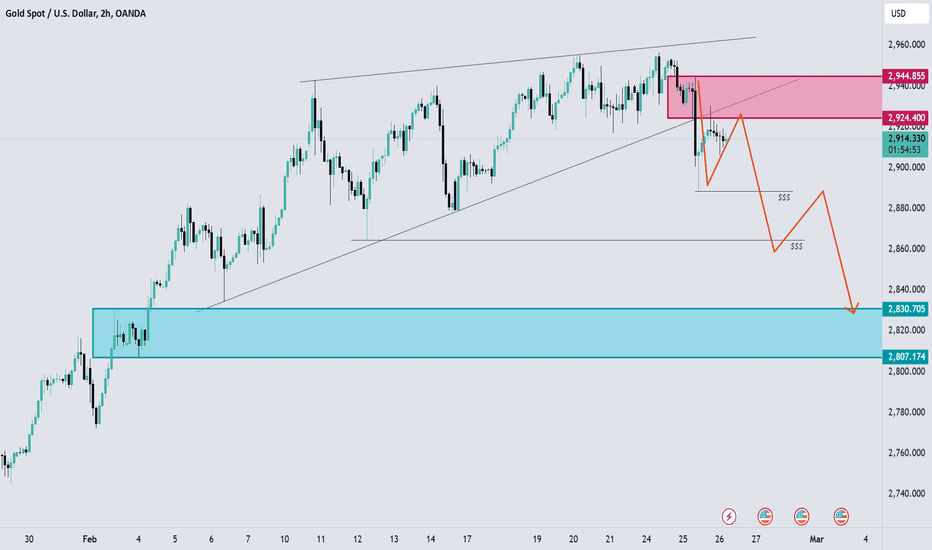

GOLD TRADE IDEA : SHORT (W.B. 24/03/2025)Gold ended on a high, seeking to return low. It changed character breaking the most recent low, signalling to me that it will seek to go low once it collects enough liquidity to expand again. What I drew up on the chart is essentially what will happen but it will be a hypothetical, I’d suggest that you refine if you are seeking to take this trade But theory still stands.

N.B.: This is not financial advice. Trade safely and with caution.

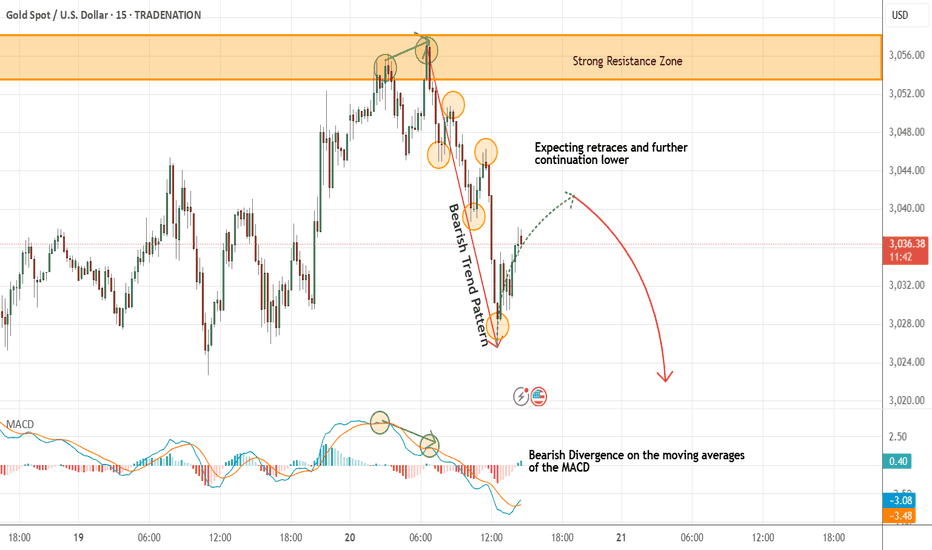

Gold - Expecting Retraces and Further Continuation LowerH1 - Bearish divergence on the moving averages of the MACD indicator.

Followed by bearish trend pattern in the form of three lower highs, lower lows structure

Strong bearish momentum

Potential drop after retraces if the strong resistance zone will not be broken.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

----------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Reached it's Apex and is ready for a dumpIn my earlier posts I said that Gold has the potential to reach the U-MLH, which has become true.

Up there, the price of Gold is stretched. Yes it can go up even more beyond the Upper-Medianline-Parallel. But the overall numbers of occurrences are small.

So, at this natural stretch, price has a high probability to revert to the mean. And this is supported by the fact, that the overall indexes are heavenly oversold and already showing the signs of a pullback to the North (see my last NQ post).

Why not just watch how it plays out, and make a decision for a trade after the FOMC, or even tomorrow. Don't rush into these unknowing situations. Be patient and wait for clear signs to take action.

Gold day trade short Gold has been exhibiting a strong bullish trend; however, I’ve noticed some divergence today, suggesting a potential high for the session. Based on this observation, I’ve entered a short position, anticipating a pullback in gold prices.

I'm targeting the 2957 level, as there is significant liquidity below Friday’s lows, which serve as a key support level. I believe these levels need to be taken out before gold can continue its upward trajectory.

I’d love to hear your thoughts—let me know what you think! If you found this analysis useful, feel free to give it a boost.

Thanks!

Gold surges, just $17 away from $3,000 Gold is sprinting to new all-time highs and approaching the $3000 level. The price has just reached $2983 at the time of writing, just $17 away from the key $3000 level.

Alex Ebkarian from Allegiance Gold forecasts “prices to trade between $3,000 and $3,200 this year,”.

Momentum is currently being driven by uncertainty around Trump tariffs and stalled ceasefire talks with Vladimir Putin, who has outlined sweeping conditions for any potential truce.

The upcoming Federal Reserve meeting next Wednesday could also be influencing prices. While the central bank is expected to keep its rate at 4.25%-4.50% until at least June, with the current economic environment, a change in guidance from the Fed might be warranted. A delay in the anticipated June rate cut wouldn't be helpful for the gold price

Short positions are in trouble, how to get out of trouble?Bros, gold accelerated to above 2980 today under the stimulation of news. If you hold a short position in gold, you must be in a trading dilemma, so how to get rid of the trading dilemma has become the current primary goal.

First remember the key node, Thursday. Under normal circumstances, Thursday and Friday are the nodes most likely to cause market changes! And from the candle chart, it is just pulled back to the high area with the stimulation of news. From the regional conversion, we can clearly see that according to the current momentum of gold, it will only reach the area around 2980-2982 (there may be a technical false breakthrough). It is difficult to rise to the vicinity of the 3000 mark in one fell swoop.

If you still have sufficient margin levels to help you get out of trouble, you might as well consider adding more positions near 2980 to continue shorting gold, effectively raising your average cost price. After gold falls back, you can choose to close all short positions and turn losses into profits. However, because gold has risen sharply, we must lower our expectations for the extent of gold's retracement. If gold retraces to the 2940-2930 area, we can consider closing our positions, so that we can turn losses into profits! And I predict that gold will enter a correction market tomorrow at the latest!

Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

GOLD/USD Short Trade Setup - Bearish Outlook📉 GOLD/USD Short Trade Setup - Bearish Outlook (Higher Inflation Risk) 📉

🔴 Short Entry: 1910

🎯 Take Profit (TP): 1875 (First Target), 1850 (Extended Target)

🛑 Stop Loss (SL): 1930

---

💡 Trade Rationale:

1️⃣ Macro Factors: Recent inflation data suggests higher-than-expected CPI, strengthening the USD and pressuring gold prices. Fed rate hike expectations could fuel further downside.

2️⃣ Technical Setup:

- Strong resistance zone at 1920-1930, rejecting multiple times.

- Support Breakdown: A break below 1910 confirms bearish momentum.

- RSI near overbought, signaling potential correction.

3️⃣ Risk Management: Tight SL to protect against unexpected volatility; TP aligns with key historical support levels.

📊 Watch for:

- Any hawkish Fed commentary reinforcing USD strength.

- A clean breakdown of 1910 with volume for confirmation.

- Potential retracements to 1925-1930 for better short entries.

🚨 Bearish Bias 🚨 – Short Gold on Breakdown Below 1910! Let’s see how it plays out! 💰💥

#GOLD #XAUUSD #Trading #Short #Inflation #Fed #Bearish

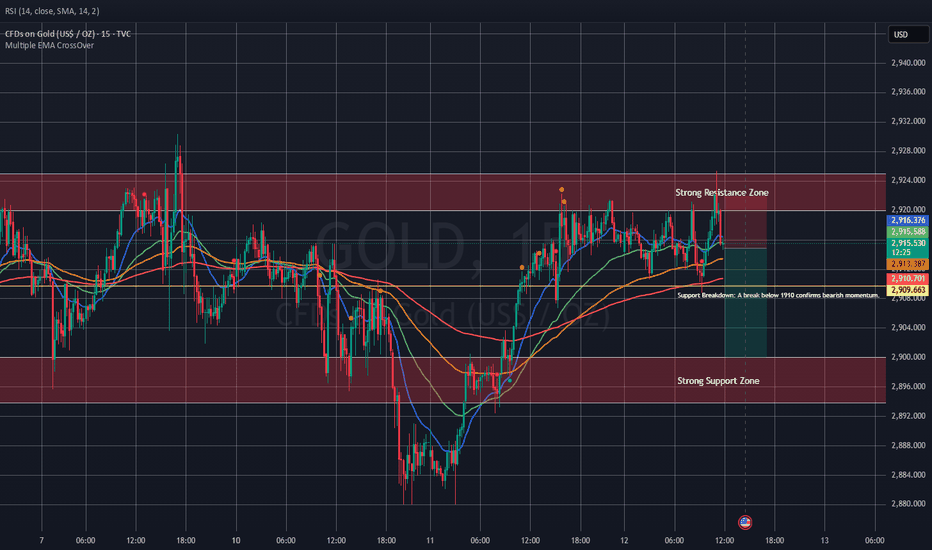

Successfully gained long profits and started shorting goldBros, I mentioned very clearly yesterday that gold would only touch the lowest area of 2880-2870 during the decline. As I expected, gold rebounded again after touching 2880. Yesterday, I insisted on absorbing as many cheap chips as possible during the gold correction. Today's gold rebound has brought us extremely rich profits. If you have been paying attention to my trading strategies, I believe you have made exponential profits in gold trading.

At present, gold continues to rebound and touches around 2915, but the overall rebound is not strong, and the upper 2920-2930 area constitutes strong resistance in the short term. According to the current rebound potential of gold, it is difficult for gold to easily break through the resistance in this area, and gold may still retest the area around 2900 after encountering resistance. So in terms of short-term trading, we can try to short gold in the 2915-2925 area.

Trading means that everything has results and everything has feedback. I have been committed to market trading and trading strategy sharing, striving to improve the winning rate of trading and maximize profits. If you want to copy trading signals to make a profit, or master independent trading skills and thinking, you can follow the channel at the bottom of the article to copy trading strategies and signals

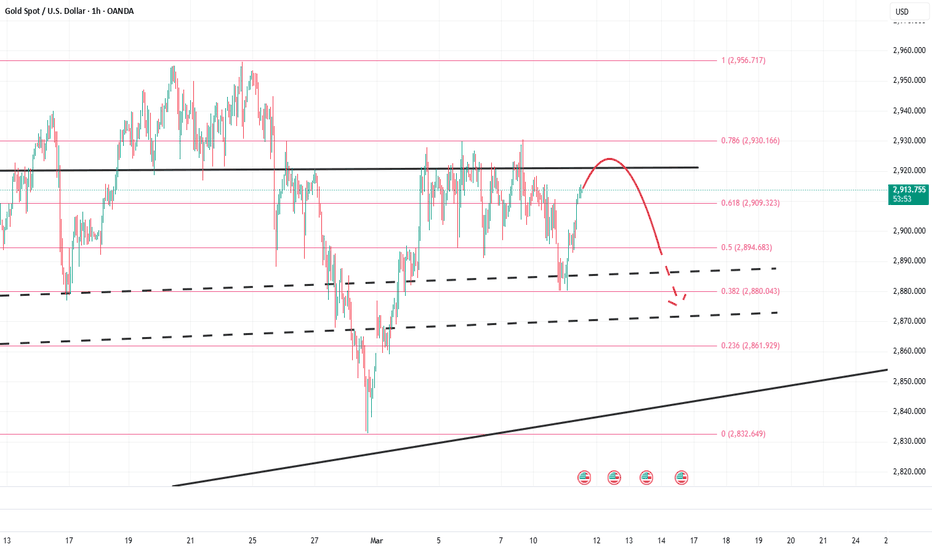

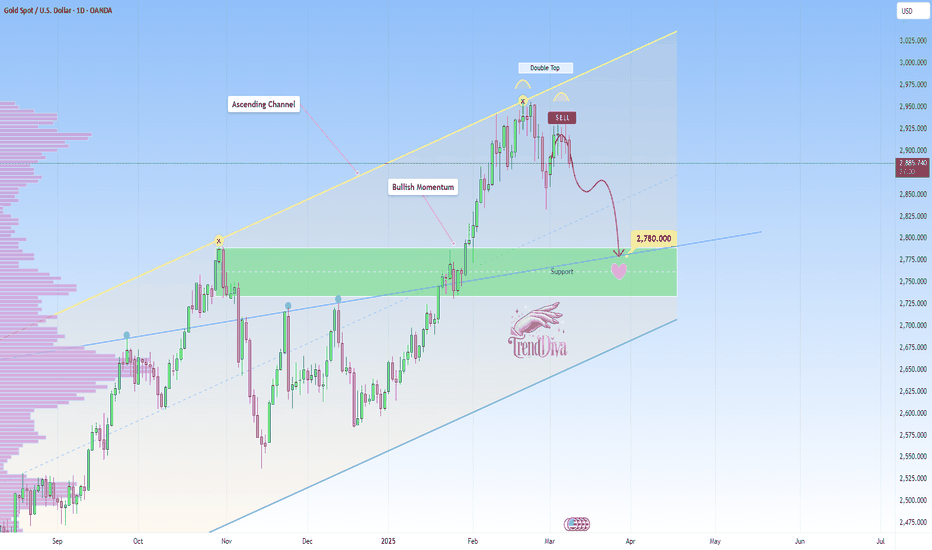

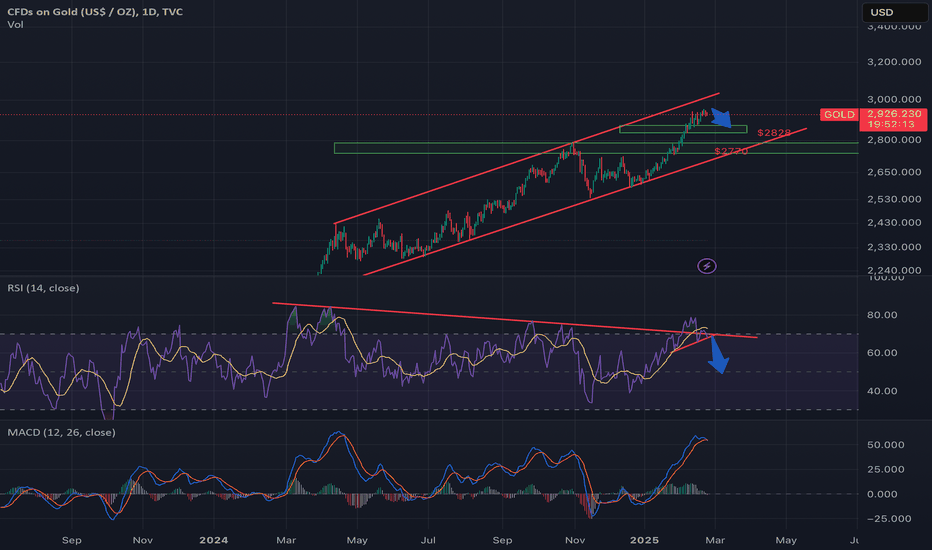

GOLD Daily Analysis: Is This the Start of a Deeper Correction?OANDA:XAUUSD is moving inside a clear ascending channel, with the upper boundary acting as long-term resistance and the lower boundary providing dynamic support. Price has been respecting this channel, with multiple touches on both the upper and lower boundaries, reinforcing its structure. Recently, the price formed a double top near the upper boundary, a classic reversal signal suggesting bullish exhaustion.

If the price continues to hold below this level, it could lead to further downside. The next major support is around 2,780 , which aligns with a previous support level and also falls within the golden pocket on the Fibonacci retracement, making it a significant area for a potential reaction.

However, if the price reclaims the double-top region and pushes above recent highs, it would invalidate the bearish outlook and suggest another attempt to break the channel’s upper boundary. For now, the structure remains bearish, with 2,780 as the main downside target.

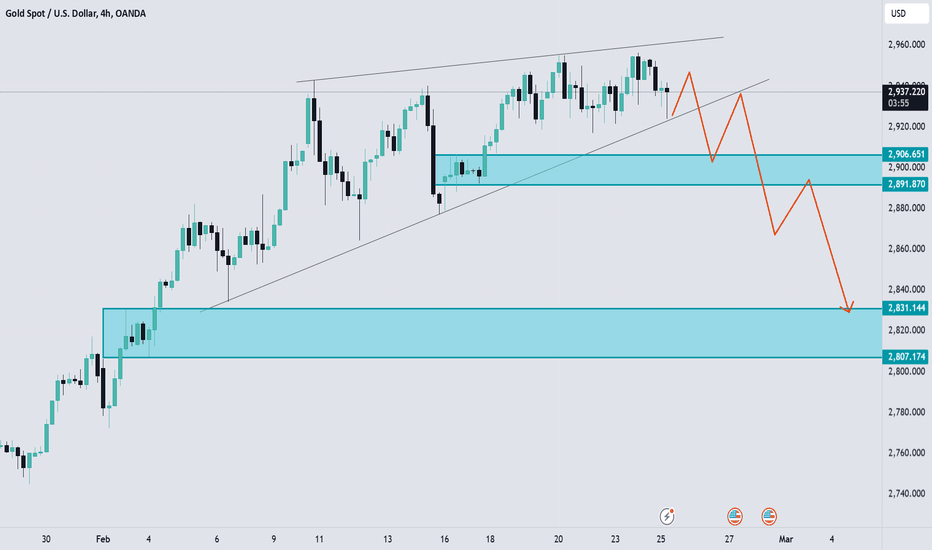

Gold Turning Bearish on H4Gold trading at 2866.xx

It failed to hold above suggested weekly levels 2953/2958 by making high that was expected weekly resistance on long term charts that achieved low of 2832 on last Friday.

Now as per H4 charts gold is changing bullish direction that started on Jan 2025 to corrective or sideways direction with expected resistance around 2907/2916 that limit the upsides upon test and correct gold further to 2839/2831 that is my initial Goal now.

Please note failing to hold 2831/2830 may open 2790/2756.

Buyers should work with cautions

GOLD | Bearish Reversal Pattern – More Downside Ahead?### **Analysis & Description:**

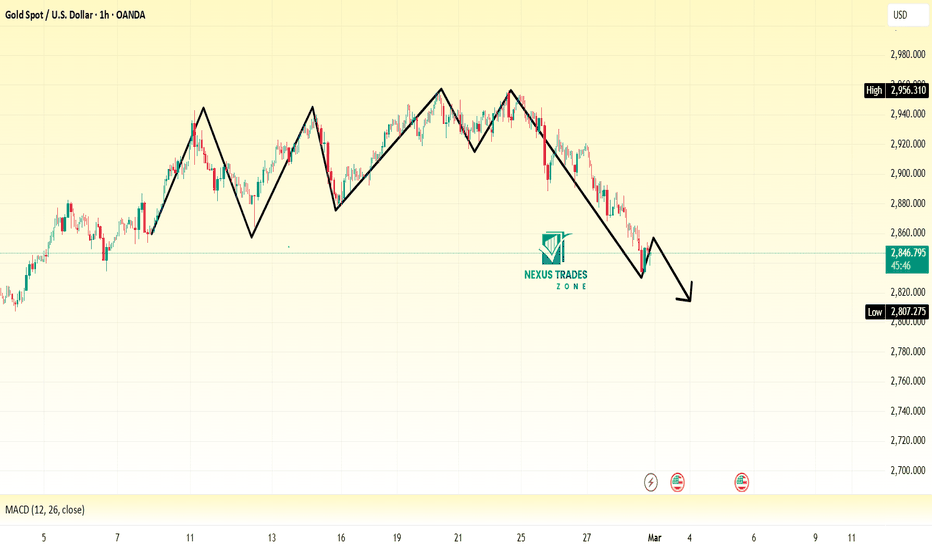

This is a **1-hour chart of XAU/USD (Gold vs. U.S. Dollar)** from TradingView, highlighting a **bearish trend reversal pattern**. The price action forms a series of **lower highs and lower lows**, indicating a clear **downtrend formation**.

#### **Key Observations:**

1. **Lower Highs & Lower Lows:**

- The chart outlines a classic **bearish market structure** with multiple rejection points.

- Each bullish rally is met with strong selling pressure, leading to a downward continuation.

2. **Momentum Weakness (MACD Indicator):**

- The MACD at the bottom indicates **bearish momentum**, with both the MACD line and Signal line in negative territory.

- This suggests that selling pressure dominates and further downside movement is likely.

3. **Price Projection:**

- The final arrow suggests **further downside movement**, possibly breaking below key support zones.

- If price breaks below the **$2,807 support**, it could accelerate selling toward **$2,780 – $2,750 zones**.

4. **Possible Trading Strategy:**

- **Bearish Confirmation:** Traders should watch for a breakdown below **$2,807** for a short-selling opportunity.

- **Bullish Reversal?:** If price forms a strong support at **$2,807**, we may see a bounce before further downside.

### **Conclusion:**

Gold is currently in a **short-term downtrend**, and traders should be cautious of potential bearish continuation. However, **fundamental news events** could also impact price action, so it's essential to monitor economic data and market sentiment.

#### **Key Levels to Watch:**

- **Support:** $2,807 – $2,780

- **Resistance:** $2,846 – $2,880

📉 **What do you think? Will gold continue to drop, or will we see a reversal soon? Drop your thoughts below!** 🚀

Gold bulls pause witnessed around suggested resistance 2953/2958Gold bulls paused its bullish movement last week exactly by testing 2953 with high 2954.xx and during current week 2956.xx

We are now considering 2966/2967 is tough weekly resistance, gold bulls need to sustain above said level to target 3000/3022 else we may see a deep correction towards 2859/2791

Don't say it's impossible, everything is possible in trading and investing world :-)

GOLD, Will the correction continue or not ??Hello Traders, Hope you are doing great.

As you can see below this post, We expected a correction in GOLD yesterday because it was forming a Rising Wedge Reversal pattern. The price corrected about 500 pips and then it began to retrace to 61.8 Fibo level. But what happens now? will the correction continue or not ?

The answer of this question is a Hesitant Yes, it will probably continue its downward correction, but PCE data that comes Friday can change everything, so Don't forget to use proper risk management. and Remember that these kind of corrections are temporary and gold price will probably see higher price this year

and finally tell me What are your thoughts about GOLD ? UP or DOWN ? comment your opinion below this post.

Gold might experience a price correction in the upcoming week!!!Hi Everyone, Gold may experience a price correction in the upcoming week. Although there are no concerning signals in the trend for the long term, the daily chart suggests that the RSI cannot fail the divergence. It appears that a retest of the 50 areas (in RSI) is likely, so we might see a correction of at least $100. First target $2838

Disclaimer: This is not financial advice.

CAPITALCOM:GOLD CAPITALCOM:GOLD TVC:GOLD FXOPEN:XAUUSD

GOLD, Is a correction on the way ???Hello Traders, Hope you are doing great.

GOLD is forming a Rising Wedge Reversal pattern these days and it seems that Bulls aren't able to raise the price at least for now. So I expect a downward correction in upcoming days.

Remember that this kind of corrections are temporary and gold price will probably see higher price this year; so Don't forget to use proper risk management .

and finally tell me What are your thoughts about GOLD ? UP or DOWN ? comment your opinion below this post.