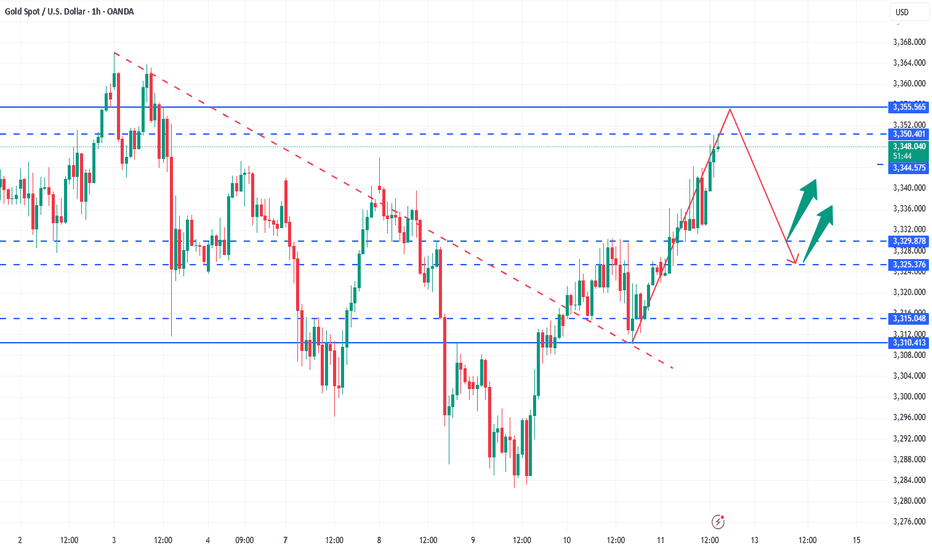

Try shorting once below 3355!The market closed at 3326 on Thursday and still failed to break through the small range of long and short positions. The overall market is in a strong bullish trend and this trend indicates the possibility of a breakout in the future. In this week's trading example, after confirming that the 3315 low support is effective, a short-term long operation was successfully carried out below the area and profited. The picture and truth can be checked in the article on Thursday. In the short term, continue to pay attention to the range shock and pay close attention to the breakthrough direction of key points. The first thing to pay attention to is the strong pressure of 3355. If it breaks through and stands firmly at this position, it will open up further upward space, and the potential target can be seen in the 3365 or even 3400 area. On the contrary, if the gold price is always under pressure below 3355, the market is likely to continue the current shock and consolidation rhythm. Therefore, breaking through the 3355 mark will be a key signal to judge whether the market can release significant upward momentum in the future. Before the effective breakthrough, continue to intervene in the low-long opportunity at the 3325-15 support level of the shock range. On the upper side, you can arrange short positions at 3345-3455.

Goldsignal

How to seize gold trading opportunitiesNews:

On Friday (July 11) in the Asian time zone, US President Trump posted a "tariff change" on social media, announcing that a 35% tariff would be imposed on all Canadian goods from August 1, a 10 percentage point increase from the current rate. This decision was like a thunderbolt, instantly igniting the market's risk aversion sentiment, and the spot gold price soared, reaching a high of $3,344 per ounce during the session. Although Trump extended the tariff agreement to August 1, which once suppressed the gold price, he subsequently stated that it would not be extended after the expiration, and launched further tariff attacks after the expiration, announcing a new 50% tariff on copper imports from the United States and a 50% tariff on goods from Brazil, which increased concerns about tariff risks and pushed the gold price to rebound from the bottom;

Gold trend analysis:

The market is fluctuating repeatedly now, and it is possible to rise or fall, but under the bullish trend, the main force is still rising. Therefore, this week's trading is to fall back and do more at a low price. Whether it is the previous 3285, 3304, or 3317, there are good profits. Although it is temporarily unable to break out of the bullish volume, at least the trend remains unchanged, and there will definitely be a large upward space in the future. Today is Friday, and we still pay attention to the possibility of bullish volume. This Monday has been emphasizing that if it rises during the week, it will look at the 3345 high point. If 3345 breaks, there are still 3365 and 3400 above. Friday will see whether this idea is realized.

From a technical point of view, all cycles are obviously bullish now. The daily line bottomed out on Tuesday, and Wednesday and Thursday were all small broken Yang rising. If it continues, we will first see whether the daily Bollinger middle rail 3345 pressure is broken. After the break, the big Yang closes high. This wave of rise may reach 3400. Therefore, the daily cycle has a lot of room for growth and should not be taken lightly. The H4 cycle needs to see whether today's rise can break 3345, because if it breaks 3345, there is a possibility of the upper rail opening. After the upper rail opens, gold will have a unilateral trend. Therefore, today's bullish target is 3345. If 3345 is not broken, there is still a possibility of a decline. If 3345 breaks, there will be 3365 and 3400 above. Here, it is clearly bullish and optimistic about the break of 3345. After determining the direction, the trading idea on Friday is also clear. It must be mainly long on the decline. The support below is 3320-3310. Don't chase more in the European session. Trade again if there is a decline.

Gold operation strategy: It is recommended to go long if it falls back to around 3315-3325, with the target at 3335-3345; it is recommended to consider shorting if it touches 3345 but does not break, with the target at 3335-3325.

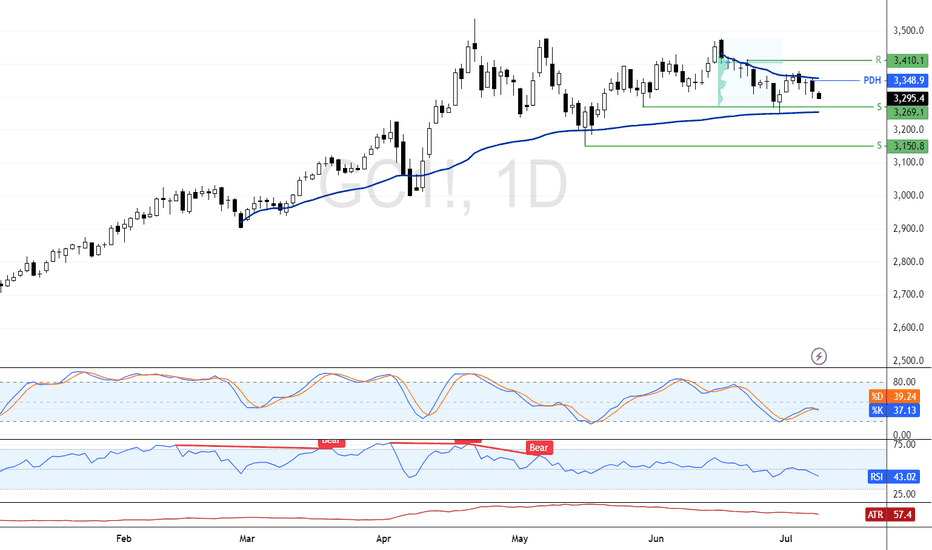

DeGRAM | GOLD held the trend line📊 Technical Analysis

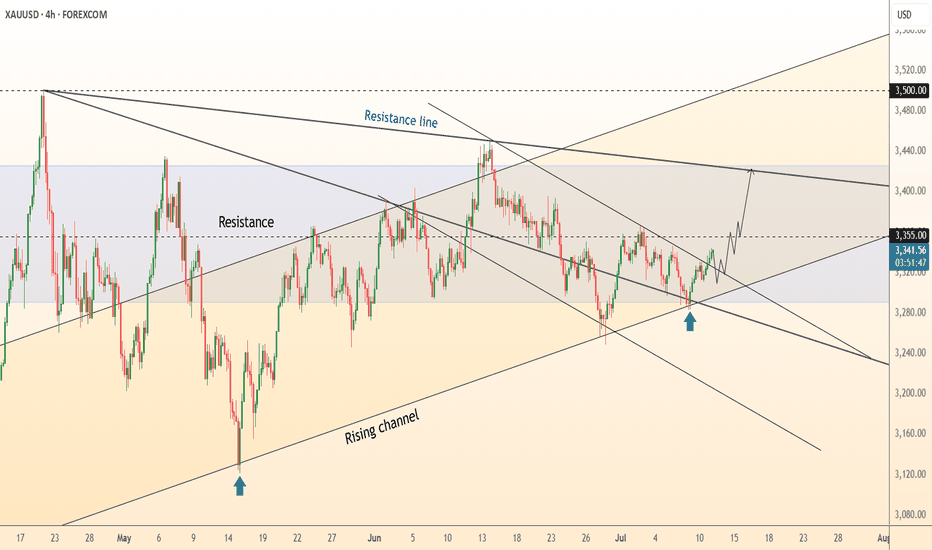

● Bulls defended the channel‐base 3 280 zone, breaking the six-week falling wedge and reclaiming 3 312; structure flips to higher-highs within the rising channel.

● A close above the wedge lip at 3 355 should unlock the grey range ceiling where the May trend-cap and 3 430 – 3 450 intersect. Pull-backs into 3 300-3 312 are expected to attract bids while the wedge retest holds.

💡 Fundamental Analysis

● US headline-CPI cooled for a second month, knocking 2-yr real yields to one-month lows and trimming Fed-cut timing, while PBoC data show June net gold purchases resuming—both reviving spot demand.

✨ Summary

Long 3 300-3 320; breakout >3 355 eyes 3 430 → 3 450. Invalidate on an H4 close below 3 280.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

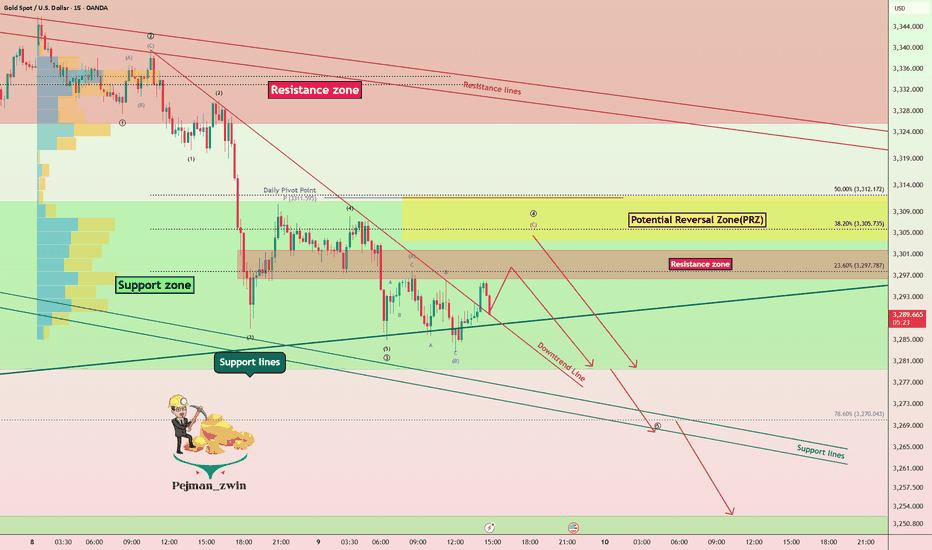

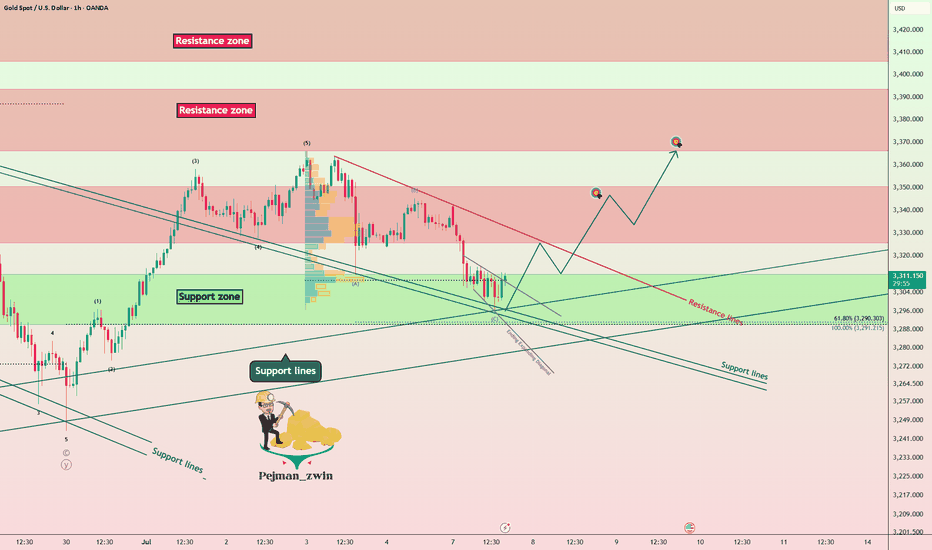

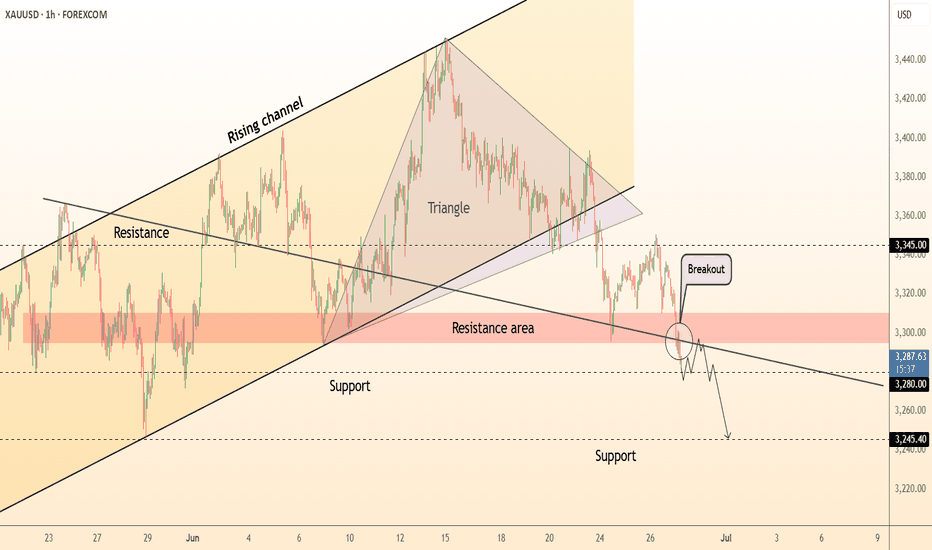

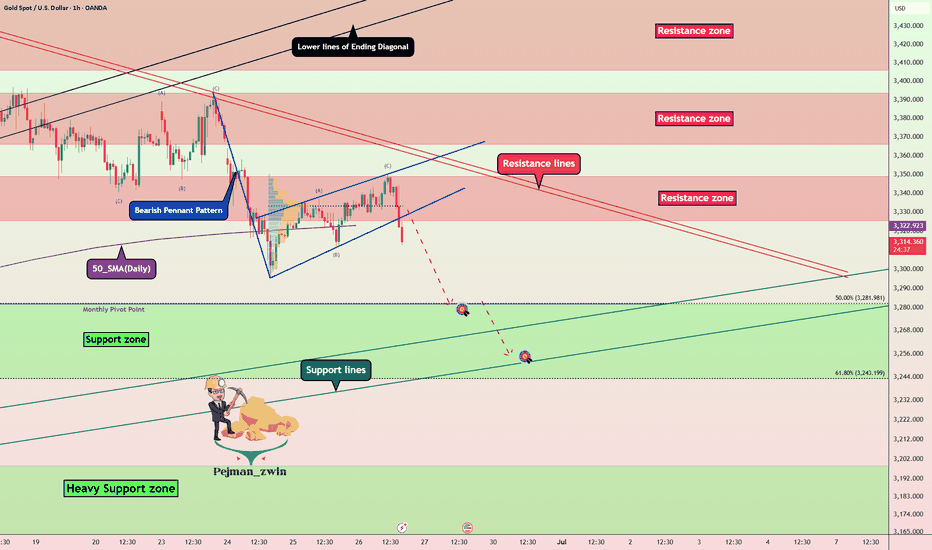

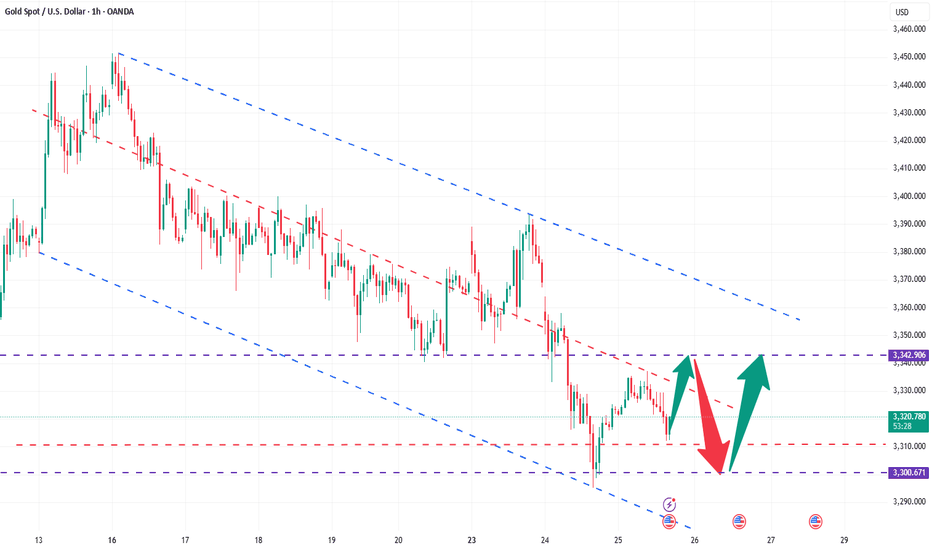

Support Under Siege – Is Gold Ready for Another Leg Down?As I expected in the previous idea , Gold ( OANDA:XAUUSD ) rose to $3,343 on the 1-hour time frame , but failed to break the Resistance zone($3,350-$3,326) and started to fall with relatively good momentum .

Do you think Gold can finally break the Support zone($3,312-$3,280) and Support lines , or will it rise again?

Gold is currently trading in the Support zone($3,312-$3,280) and near the Support line s. It has also managed to break the downtrend line .

In terms of Elliott Wave theory on the 15-minute time frame , Gold appears to be completing a main wave 4 . The main wave 4 appears to follow Double Three Correction(WXY) . Also, the main wave 3 is extended due to the high downward momentum.

I expect Gold to start falling again by entering the Potential Reversal Zone(PRZ) or Resistance zone($3,302-$3,296) and eventually breaking the Support zone($3,312-$3,280) and Support lines, Gold's falling targets are clear on the chart.

Note: Stop Loss (SL) = $3,313

Gold Analyze (XAUUSD), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

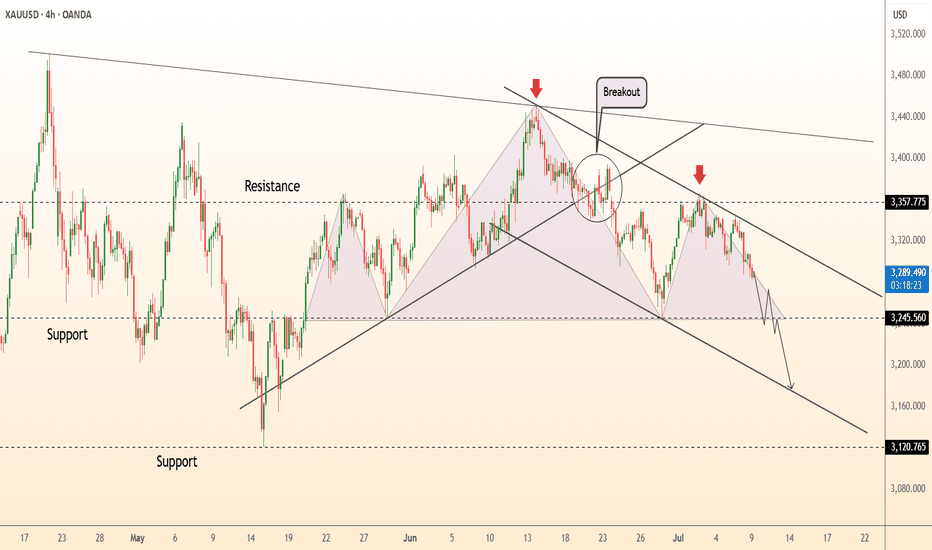

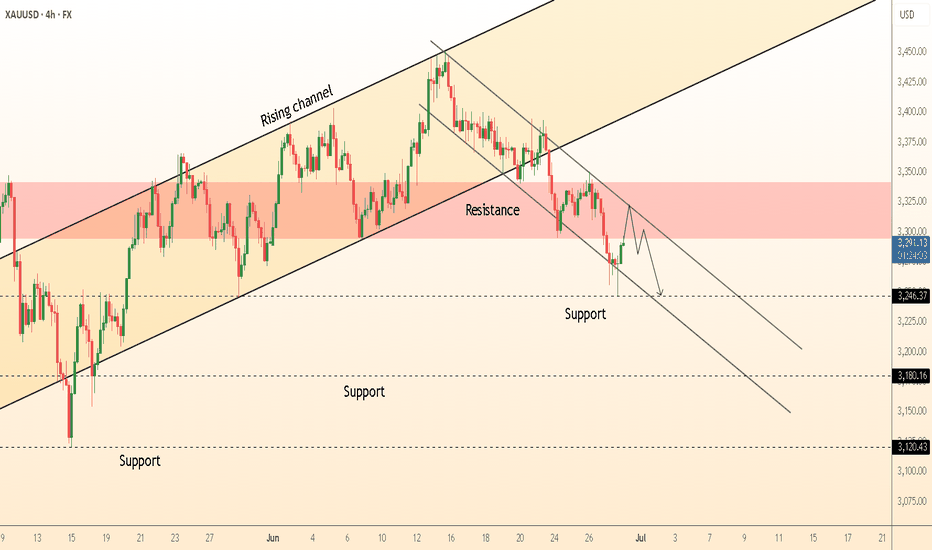

DeGRAM | GOLD forming head and shoulders📊 Technical Analysis

● A double rejection at 3 358—confluence of the May-July descending trend-line and the long-term channel roof—has carved successive lower highs; the break of the inner up-trend (circled) shifts structure bearish.

● Price is now slipping out of a contracting pennant; sustained trade beneath 3 246 (pattern base / April pivot) exposes the mid-channel magnet at 3 202, with the outer rail projecting 3 121.

💡 Fundamental Analysis

● Surprise rise in NY Fed 1-yr inflation expectations and Daly’s “no urgency to cut” remarks lifted 2-yr real yields and the DXY, while ETFs saw a fifth straight day of outflows, signalling fading bullion demand.

✨ Summary

Sell 3 300–3 320; break below 3 246 targets 3 202 → 3 121. Short view void on a 4 h close above 3 358.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

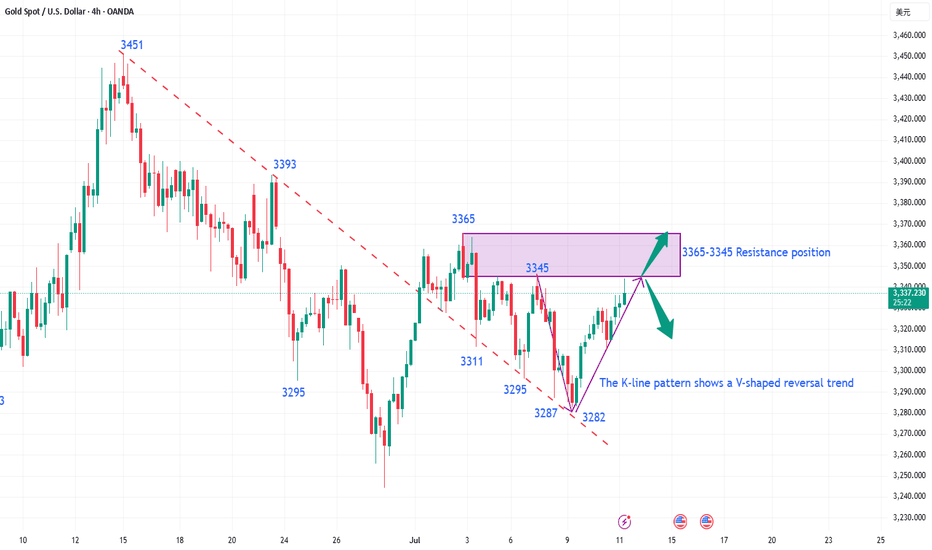

The risks of shorting at low levels have been informed!Today, I have reminded you many times not to chase short positions at low levels. Now you can see that gold has bottomed out and rebounded. We also bought gold in batches at 3285-3295, and the long positions also made perfect profits. I believe that friends who follow my articles can see that I have always emphasized not to short at low levels. It is also obvious to everyone that we bought long positions near 3295-3285. In the future, we will continue to pay attention to the suppression of the upper 3318-3325 line. If the rebound does not break, we will look for opportunities to short. I hope everyone can grasp the entry position and hold the profit. The rebound will first look at the previous break point of the 3325 line, and then short when the rebound is suppressed! If your current gold operation is not ideal, I hope I can help you avoid detours in your investment. Welcome to communicate with me!

From the current analysis of gold trend, today's upper short-term resistance focuses on the hourly top and bottom conversion position of 3318-3325. The intraday rebound relies on this position to go short once and look down. The lower short-term support focuses on 3280. The overall support relies on the 3280-3325 area to maintain the main tone of high-altitude low-multiple cycles. In the mid-line position, keep watching and do less, be cautious in chasing orders, and wait for the opportunity to enter the market after the key points are in place.

Gold operation strategy: short gold rebounds near 3318-3325, target 3305-3295.

Gold Finds Supports – Is the Rebound About to Begin?Gold ( OANDA:XAUUSD ) declined to the Support zone($3,312-$3,290) and Support lines as I expected in the previous idea .

Gold is currently trading in the Support zone($3,312-$3,290) and near a set of support lines .

In terms of Elliott Wave theory , it seems that Gold has completed the Zigzag Correction(ABC/5-3-5 ) and we should wait for the next 5 impulse waves . One of the confirmation signs of the end of these corrective waves could be the break of the resistance line .

I expect Gold to trend higher in the coming hours and rise to at least $3,343 AFTER breaking the Resistance line .

Second Target: $3,364

Note: Stop Loss (SL) = $3,287

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

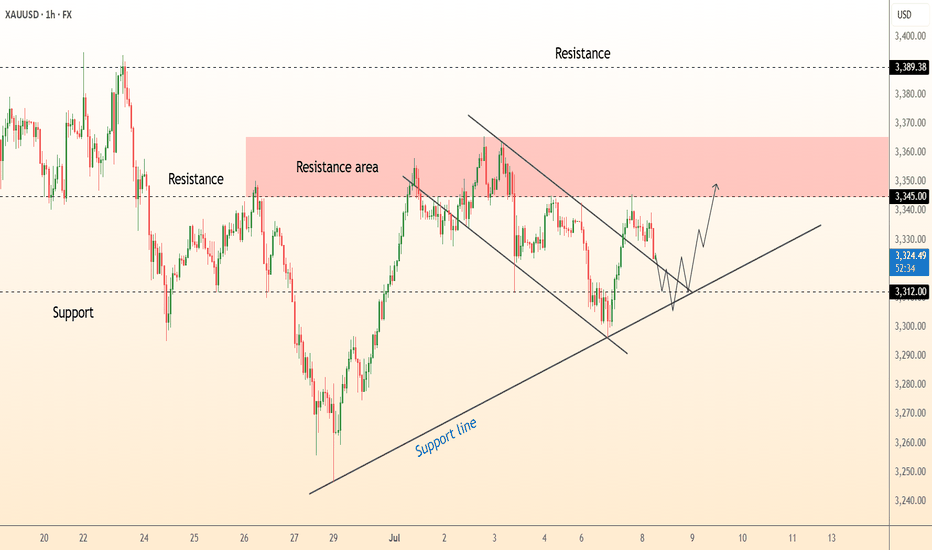

DeGRAM | GOLD rebound📊 Technical Analysis

● Price is coiling inside a contracting triangle whose base sits on the blue up-sloping support line (~3 312); successive higher reaction-lows signal buyers defending trend structure.

● A 1 h candle through the triangle top 3 330 would confirm breakout and allow a run to the June swing cap at 3 345, with the pattern’s measured move aligning with the channel mid-band at 3 389.

💡 Fundamental Analysis

● Powell’s testimony hinting at “better balance” in the labour market trimmed 2-yr real yields, while latest IMF data show central-bank gold buying expanding for a fourth month, underpinning spot demand.

✨ Summary

Long 3 312-3 330; breakout >3 330 targets 3 345 → 3 389. Bull view void on an H1 close below 3 300.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

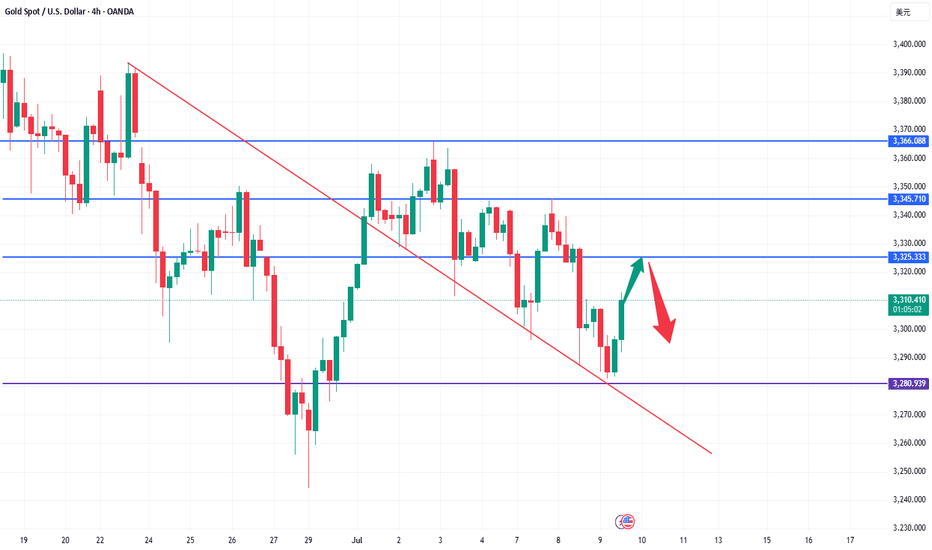

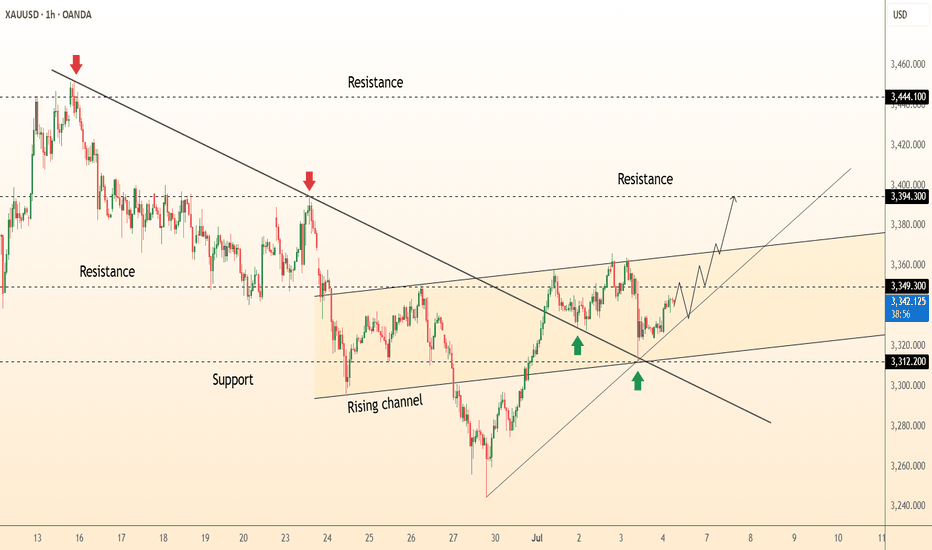

Gold Under Pressure After NFP Beat – More Downside Ahead?Moments ago, the US Non-Farm Payrolls surprised to the upside at 147K (vs 111K forecast), while the Unemployment Rate dropped to 4.1% (vs 4.3% expected) .

This stronger-than-expected labor market data reinforces the idea that the Fed has no immediate reason to cut rates. As a result, the USD( TVC:DXY ) strengthened, and gold came under renewed selling pressure.

If the dollar momentum continues, Gold ( OANDA:XAUUSD ) may face further downside in the short term.

In terms of Technical Analysis , Gold fell below the Resistance zone($3,350-$3,326) again after the announcement of US indices and is currently moving near the Support lines and 50_SMA(Daily) .

In terms of Elliott wave theory , it seems that Gold has completed 5 impulsive waves in the one-hour time frame, and we should now wait for corrective waves .

I expect Gold to fall again after the upward correction , and the Support zone($3,312-$3,290) could be the target.

Note: Stop Loss (SL) = $3,365

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

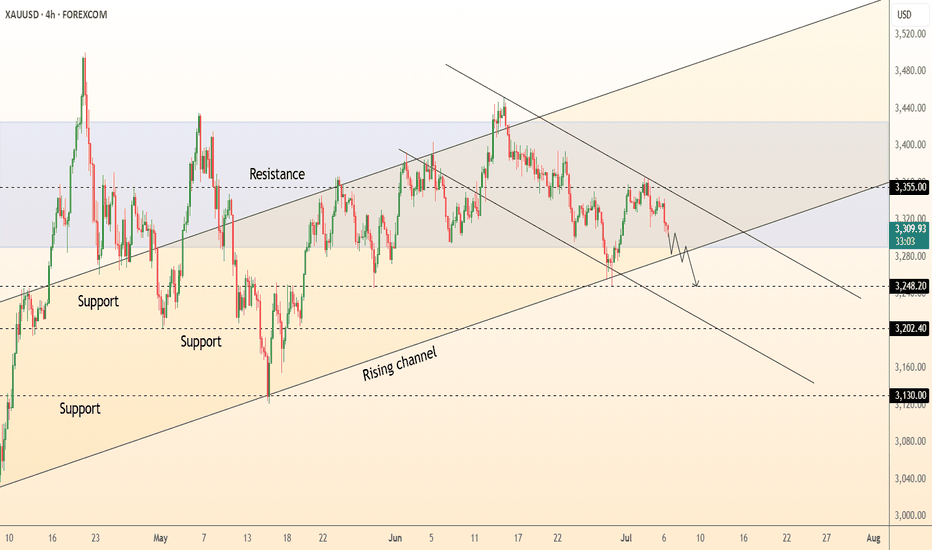

DeGRAM | GOLD formed a declining peak📊 Technical Analysis

● Price has slipped back beneath the inner rising-channel median and is now riding a fresh descending channel; repeated failures at 3 355 have carved a lower-high sequence.

● A clean hourly close under 3 308 would confirm loss of the late-June support shelf and open the next structural pivots at 3 248 (mid-May swing) and 3 202 (channel base / former demand).

💡 Fundamental Analysis

● Firmer US payroll headline and another uptick in 2-yr real yields revived the dollar, while CFTC data show a second week of long liquidation in COMEX gold—dampening bid strength.

✨ Summary

Sell rallies ≤3 330; sustained trade below 3 308 targets 3 248 → 3 202. Bias void on an H4 close above 3 355.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | GOLD around $3350📊 Technical Analysis

● Bulls defended the 3 312 pivot where the rising-channel base and July trend-support intersect; successive higher-lows are squeezing price against 3 355—last week’s swing cap and channel median.

● A break of 3 355 completes a 1 : 1 wedge measured to 3 380, and the grey inner rail projects follow-through toward the prior range ceiling at 3 425.

💡 Fundamental Analysis

● Softer US ISM-Services prices and falling 2-yr real yields curb USD demand, while IMF data show central-bank gold purchases rising for a third straight month—both underpinning bullion.

✨ Summary

Long 3 330-3 345; confirmed close above 3 355 eyes 3 380 then 3 425. Bull view void on an H1 close below 3 312.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | GOLD retest of the resistance line📊 Technical Analysis

● Price holds above the broken blue resistance line, now acting as support near 3 347, while an inner up-sloper is guiding a stair of higher lows inside the new grey channel.

● The confluence of channel mid-line and 3 355 swing high is the gate; its clearance activates an equal-width objective at 3 380, with the outer rail / former consolidation lid at 3 425 next.

💡 Fundamental Analysis

● Easing US ISM-services prices trimmed real 2-yr yields and the dollar, while latest WGC data show June net central-bank purchases rising for a third month, reviving dip-buying in gold.

✨ Summary

Long 3 345–3 355; hold above 3 355 targets 3 380 → 3 425. Invalidate on an H1 close below 3 320.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

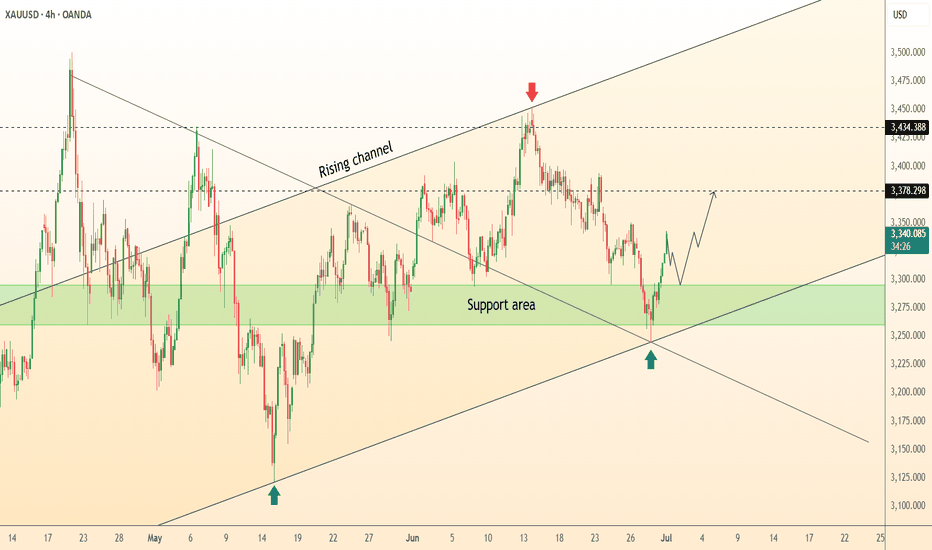

DeGRAM | GOLD held the support area📊 Technical Analysis

● Bullish rebound from the green 3 250-3 300 demand, where the rising-channel base and May’s inner trend-line intersect, prints a higher low and invalidates the prior break.

● Price is reclaiming the channel median; a push through 3 378 unlocks the June swing cap at 3 434, while risk is contained by the fresh pivot turned support at 3 300.

💡 Fundamental Analysis

● Softer US ISM-Mfg prices and a dip in 2-yr yields eased dollar pressure, while IMF data show another uptick in official gold purchases—both restoring near-term bid.

✨ Summary

Long 3 300-3 320; hold above aims 3 378 → 3 434. Invalidate below 3 250.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Gold Rebound Underway – Support Zone Holds Strong! - Short termGold( OANDA:XAUUSD ), as I anticipated in the previous idea , has attacked the Support zone($3,281-$3,243) and Support lines .

From an Elliott Wave theory perspective , it appears that Gold has completed 5 sub-waves of the main wave C .

Also, we can see the Regular Divergence(RD+) between Consecutive Valleys.

I expect Gold to rise to at least $3,307 in the coming hours.

Second Target: $3,321

Note: Stop Loss (SL) = $3,240

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

DeGRAM | GOLD under the resistance area📊 Technical Analysis

● Price broke the long-standing rising-channel floor, then formed a clean bear flag inside a fresh down-sloping channel; the flag’s ceiling coincides with the 3 300-3 310 supply band.

● Lower-high sequence and confluence of flag top with former support turned resistance favour continuation toward the mid-channel / fib pivot at 3 246, next 3 180.

💡 Fundamental Analysis

● Friday’s hotter US core-PCE and Fed governor Bowman’s “no cuts in 2025” comment lifted 2-yr yields above 4.80 %, firming the DXY and draining flows from non-yielding gold.

✨ Summary

Sell 3 290-3 305; hold below 3 310 targets 3 246 → 3 180. Short bias void on an H4 close above 3 310.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | GOLD broke the demand zone📊 Technical Analysis

● Price sliced beneath the long-term rising‐channel base and the triangle apex, turning 3 300-3 310 into fresh supply; the current pull-back is a textbook bearish retest of the break zone.

● Hourly structure now tracks a new descending trend-line; failure to reclaim 3 300 keeps momentum pointed to the next fib / horizontal shelf at 3 280, with the channel width projecting 3 245 support.

💡 Fundamental Analysis

● Rebound in US 2-yr yields after hawkish Fed speakers and a stronger-than-expected durable-goods print lifted the DXY, reducing short-term bullion appeal.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

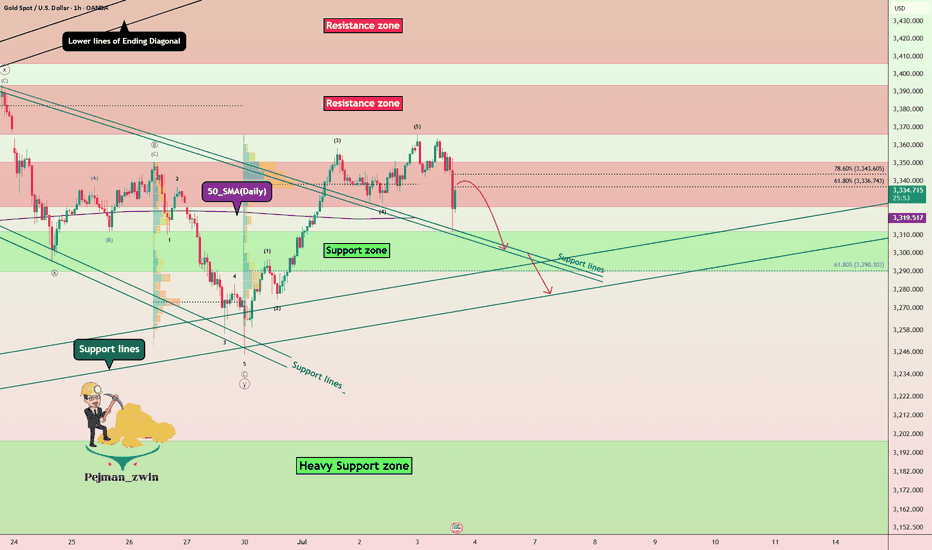

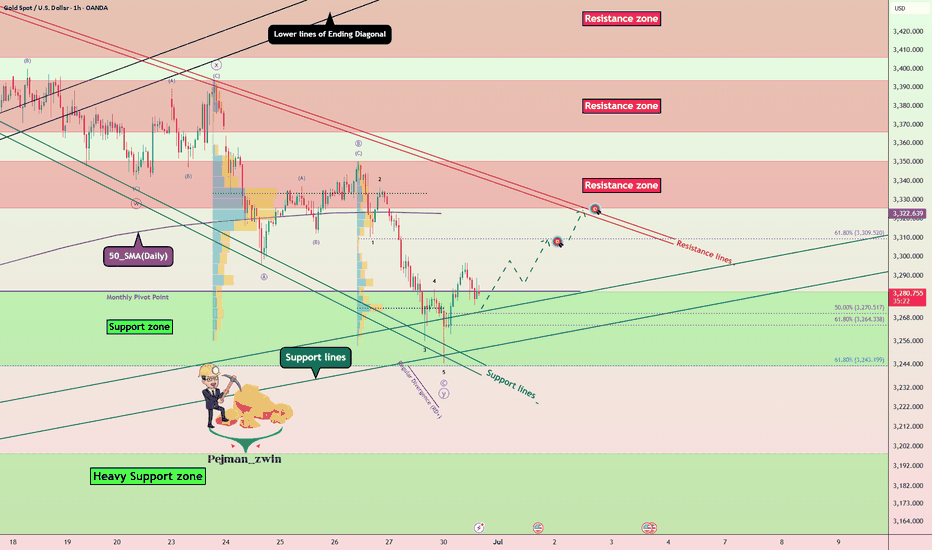

Gold Breakdown Confirmed — Bearish Pennant Targets UnfoldingGold ( OANDA:XAUUSD ) started to decline as I expected in my previous idea after the lower lines of the Ending Diagonal broke .

Gold is moving near the Resistance zone ($3,349-$3,325) . And Gold seems to be crossing the 50_SMA(Daily) .

From a Classical Technical Analysis perspective , the Bearish Pennant Pattern seems to indicate a continuation of the downtrend in Gold .

From an Elliott wave theory perspective , it seems that Gold has completed the Zigzag Correction(ABC) , and we can expect the next 5 downwaves .

I expect Gold to continue to decline at least to the Support zone($3,281-$3,243) and Monthly Pivot Point .

Note: Stop Loss (SL) = $3,360

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

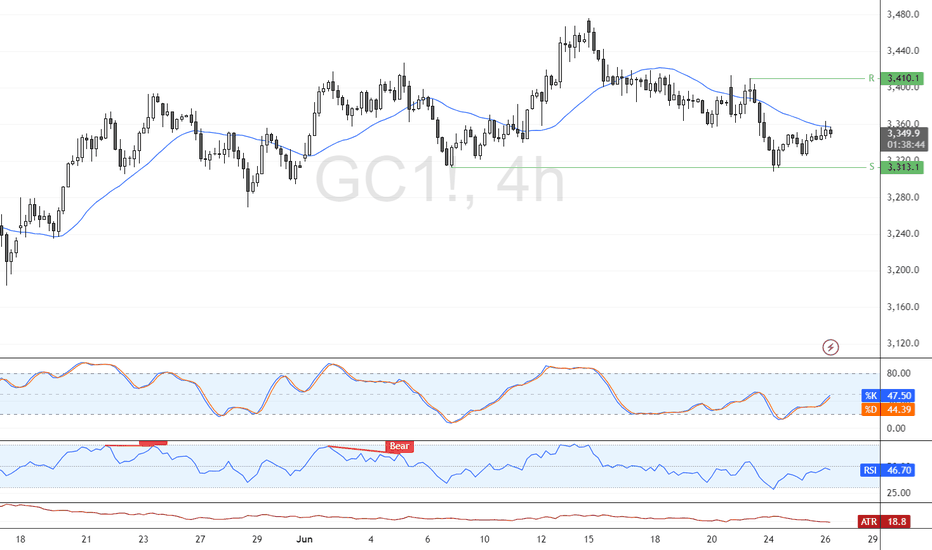

Gold Builds Bullish Momentum After $3,294.0 ReboundGold bounced from $3,294.0, forming a double bottom pattern as XAU/USD consolidates near $3,330.0. Stochastic has exited oversold territory, signaling strengthening bullish momentum.

If $3,294.0 holds as support, the uptrend may continue toward the $3,393.0 target.

DeGRAM | GOLD rebound📊 Technical Analysis

● Friday’s flush tagged the green 3 300–3 310 demand and the long-term trend-support, then left a bullish gap inside the falling channel; price is now basing above the gap midpoint and printing higher lows toward the pink supply.

● A clean break of channel resistance at 3 348 completes a 4 h inverse-H&S measured to the next confluence at 3 375 (May pivot / former range top).

💡 Fundamental Analysis

● Core PCE cooled to 0.1 % m/m, pulling real 2-yr yields to two-week lows while IMF flagged persistent central-bank bullion buying—both restoring bid tone in gold.

✨ Summary

Long 3 320-3 335; clearance of 3 348 targets 3 375. Bias void on a 4 h close below 3 300.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | GOLD held the lower boundary of the channel📊 Technical Analysis

● Price bounced from the channel floor (≈ 3 320) forming a bullish falling-wedge whose breakout target coincides with the median resistance at 3 348.

● Hidden RSI divergence and a series of higher lows inside today’s micro-range show buyers absorbing supply; reclaiming the wedge apex should accelerate toward the upper channel band near 3 375.

💡 Fundamental Analysis

● Spot-ETF inflows resumed and Fed-funds futures now price only one cut this year while real yields eased after soft US consumer-confidence data, trimming dollar bid and reviving gold demand.

✨ Summary

Long 3 320-3 330; wedge break > 3 335 eyes 3 348 then 3 375. Bull view void on a 30 min close below 3 300.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

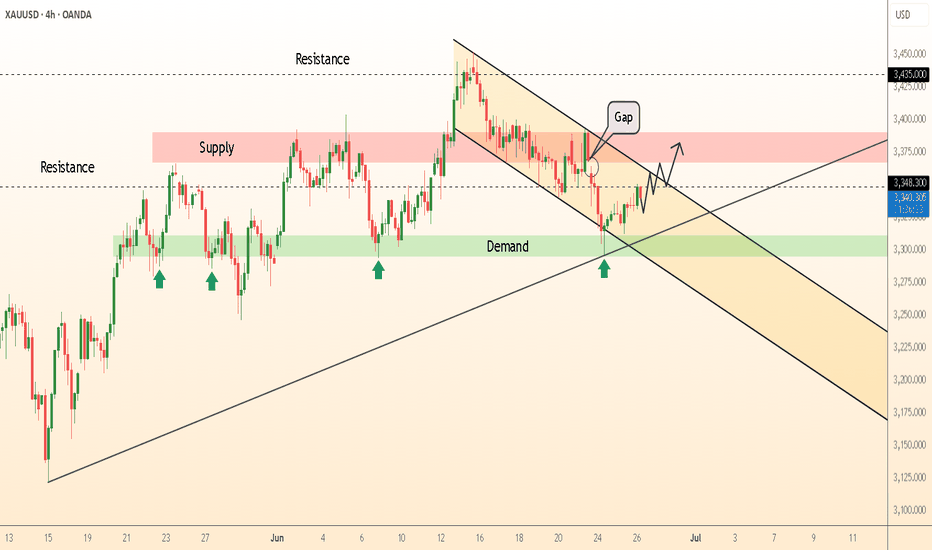

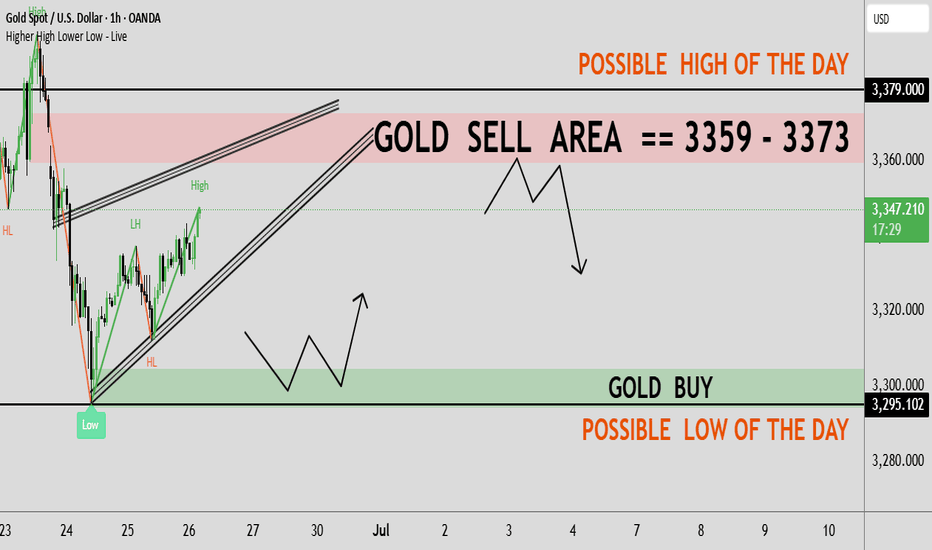

Gold (XAUUSD) – Pullback Setup Before Breakout? – JUNE 26, 2025🟡 GOLD PRICE OUTLOOK – June 26, 2025

Bias: Bullish | Looking for long entry on pullback

📊 Technical Overview :

OANDA:XAUUSD Gold continues to build a bullish market structure, forming consistent Higher Highs (HH) and Higher Lows (HL). Price is currently moving within a rising wedge, approaching a short-term resistance zone.

🔴 Sell Zone (Resistance) : 3359 – 3373

– Rising wedge top + upper trendline

– Fakeout trap possible near 3379.26

🟢 Buy Zone (Support) : 3294 – 3300

– Strong confluence zone

– Matches previous structure support + trendline

– Ideal for HL formation and long setup

🌍 Fundamentals & Macro Drivers :

💵 USD Weakness:

• DXY near 3.5-year low after Powell replacement rumors

• Boosting gold's upside momentum

☢ Geopolitical Risk:

• Iran–Israel ceasefire in place, but fragile

• Safe-haven demand still supportive

🏦 Central Bank Demand:

• 20% of global gold demand from central banks

• China 🇨🇳 & India 🇮🇳 are major buyers

📅 Upcoming Catalysts:

• US PCE Inflation & GDP due tomorrow

→ Weak data = Potential breakout above 3370+

📌 Trade Plan :

✔ Watch for rejection at 3359–3373

✔ Long setup if price retests 3294–3300

🎯 Target = 3370+

❌ Invalidation = Daily close below 3280

📈 Summary :

Gold remains structurally bullish, supported by weak USD, central bank demand, and macro risks.

Waiting for a healthy pullback into demand for long continuation setups.

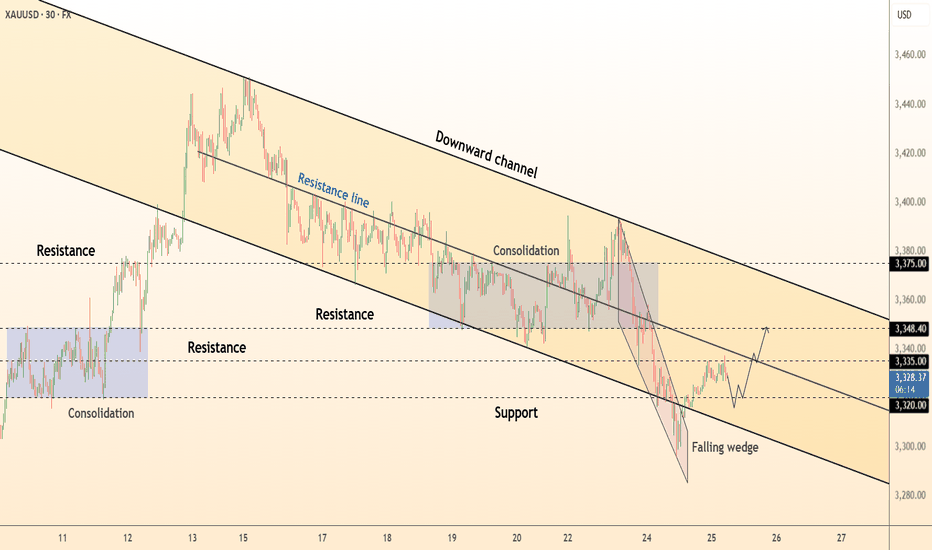

Gold is obviously suppressed, so we must go short!Yesterday, gold continued to fluctuate and fall under pressure at the 3360 mark. The US market further accelerated downward to break through the 3300 integer mark and reached a weak closing near 3295. The daily K-line closed with a suppressed fall and broke the bottom of the middle shadow. The overall gold price continued to fluctuate and fall in a weak rhythm. After reaching the lowest level of 3295, it rebounded and closed at 3323. Today, it opened at 3324. As of now, it has reached the highest level of 3337. At present, we are focusing on the suppression of 3340-3348. If the rebound is under pressure, we can still intervene in short orders. The recent market trends are basically the same - bottoming out and rebounding. In terms of operation, continue to keep shorting under pressure and long positions after bottoming out and rebounding.

From the current market trend, today's upper short-term resistance focuses on the 3338-3342 area. If it rebounds to this range and is under pressure, you can consider choosing an opportunity to arrange short orders. The lower support focuses on the 3315-3305 line. If it falls back and stabilizes, there is a possibility of a short-term rebound. The overall situation is still in a range-bound structure. It is recommended to focus on key points, buy high and sell low, follow the trend, and strictly control risks. For more specific operation points, please pay attention to the 🌐 notification at the bottom.