Goldspot

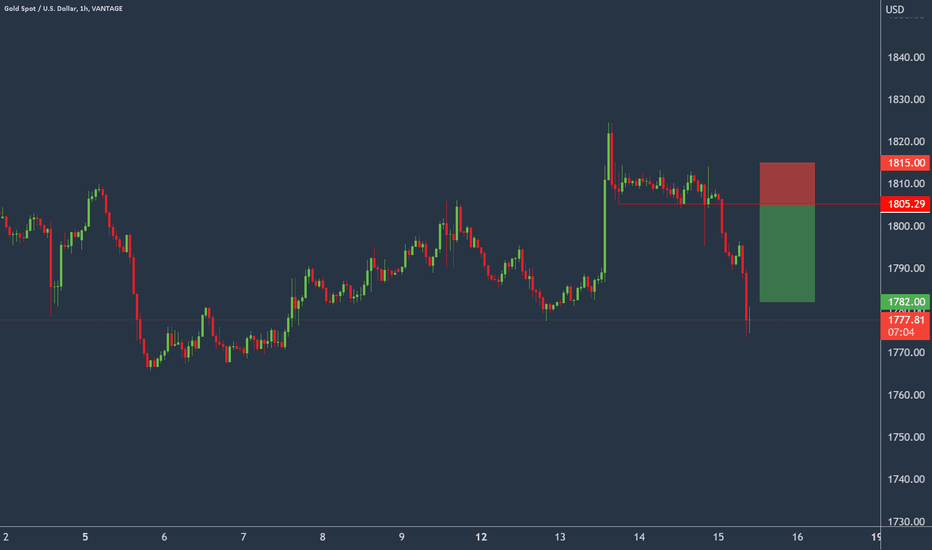

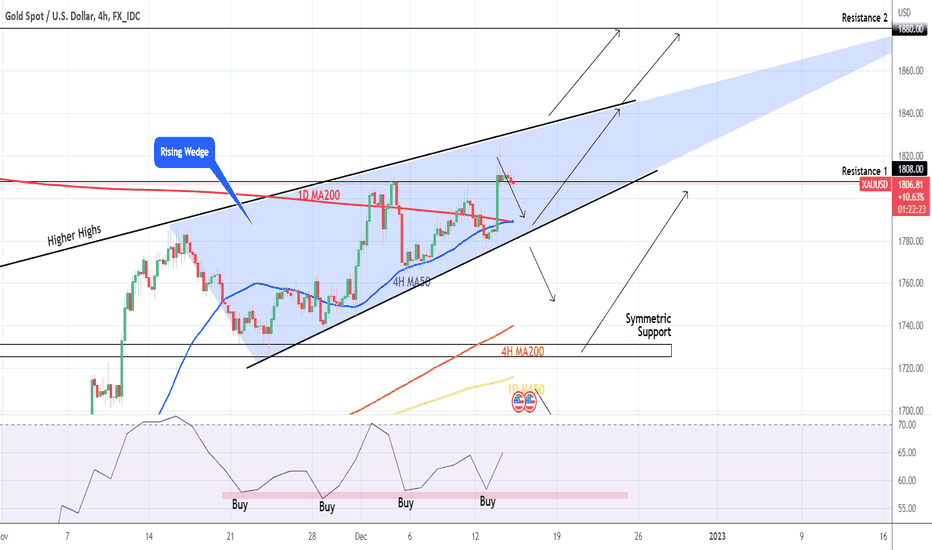

Gold - Correction incoming?Gold - Intraday - We look to Sell at 1805 (stop at 1815)

Closed the day little net changed. Selling posted in Asia. Price action has formed a bearish ending wedge formation. Trend line support is located at 1785. Bespoke support is located at 1782. Risk/Reward would be poor to call a sell from current levels. Preferred trade is to sell into rallies. The formation has a measured move target of 1727.

Our profit targets will be 1782 and 1727

Resistance: 1805 / 1810 / 1825

Support: 1785 / 1782 / 1727

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

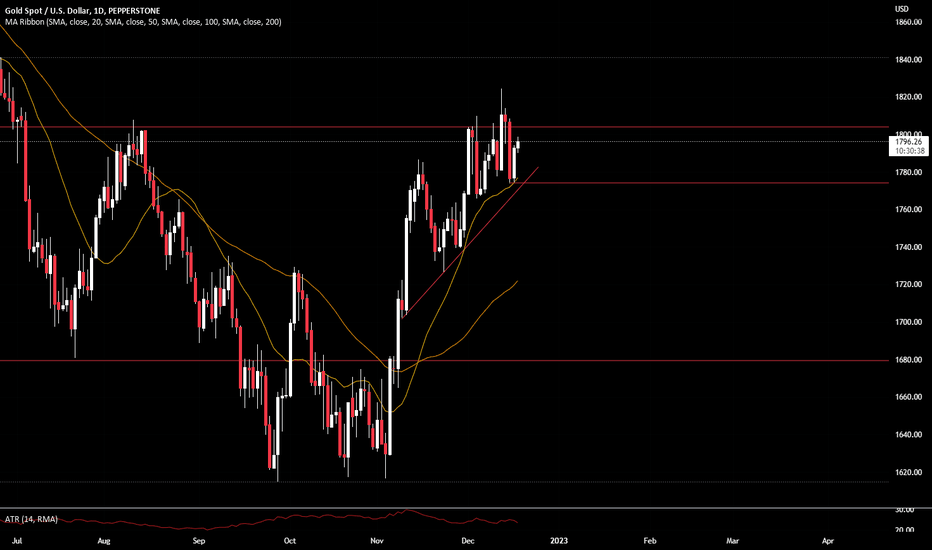

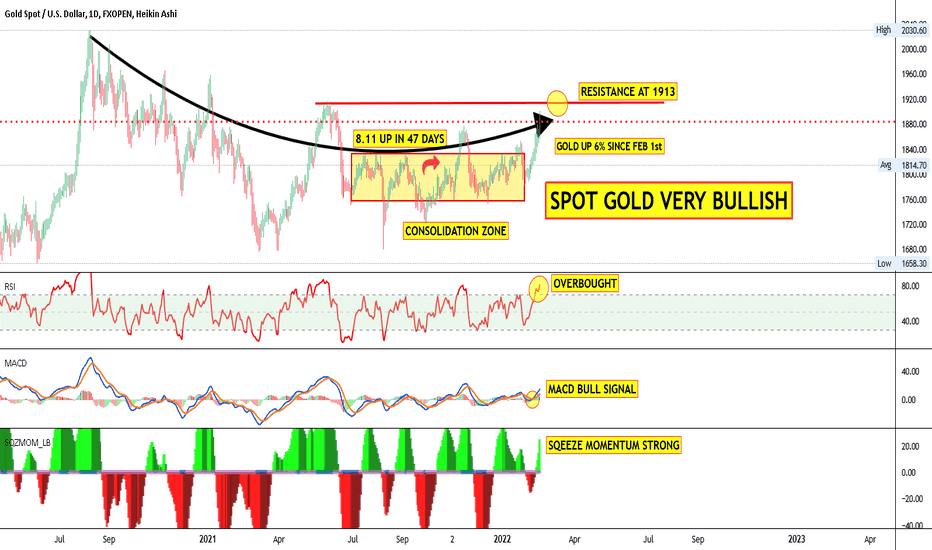

GOLD: Rising Wedge still holdingExcellent confirmation of our short-term buy trade as, following the lower than expected U.S. CPI, Gold skyrocketed above the 4H MA50 (1,788.91) broke above the 1,808 (August 10th and Dec 5th Highs) Resistance and made a Higher High on the Rising Wedge pattern (started on November 15th) at 1,824.50. With 4H but mostly 1D technicals still bullish (RSI = 63.776, MACD = 25.400, ADX = 28.407), the price is now long-term bullish targeting the 1,860 - 1,880 zone (1,880 is the June 12th High).

However, ahead of today's critical Fed Rate Decision, we have to be extra careful with our positioning. I am looking to buy again (slightly) below the 4H MA50 at 1,785 and target 1,820 intra day only. A break below 1,777 is a bearish break-out call towards the 4H MA200 (1,739.22 and rising). Beyond that, I will wait for a clear 1D MA50 test in the following days to get my long-term buy, if not and we close above 1,825 first, then I will enter a buy on the spot, which is possible if the DXY continues to sink while also the US10Y goes for a Lower Low. Those indicate a strong bullish long-term trend for Gold.

Previous Gold chart:

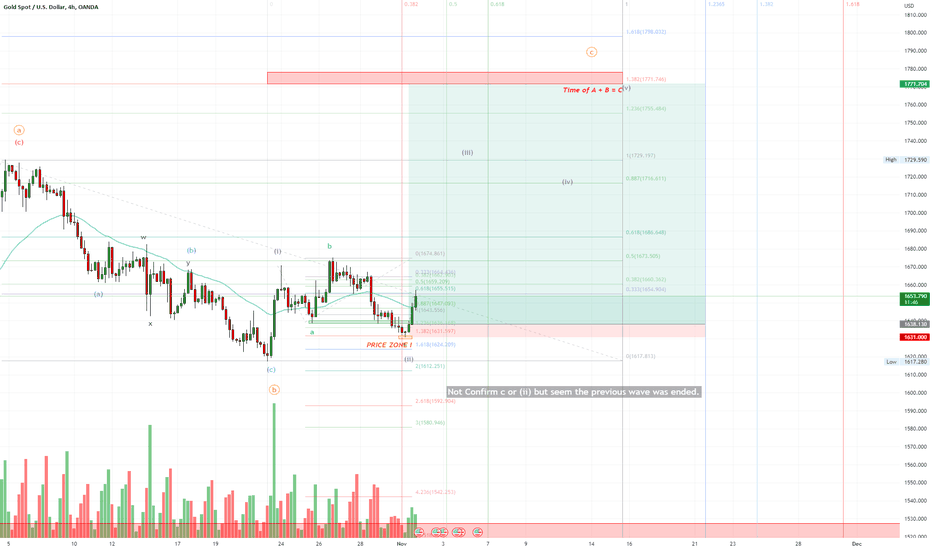

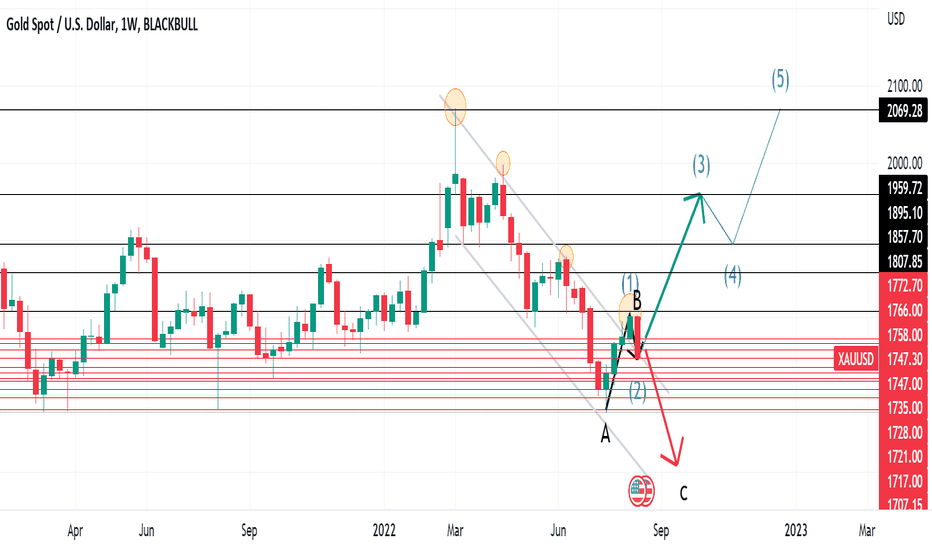

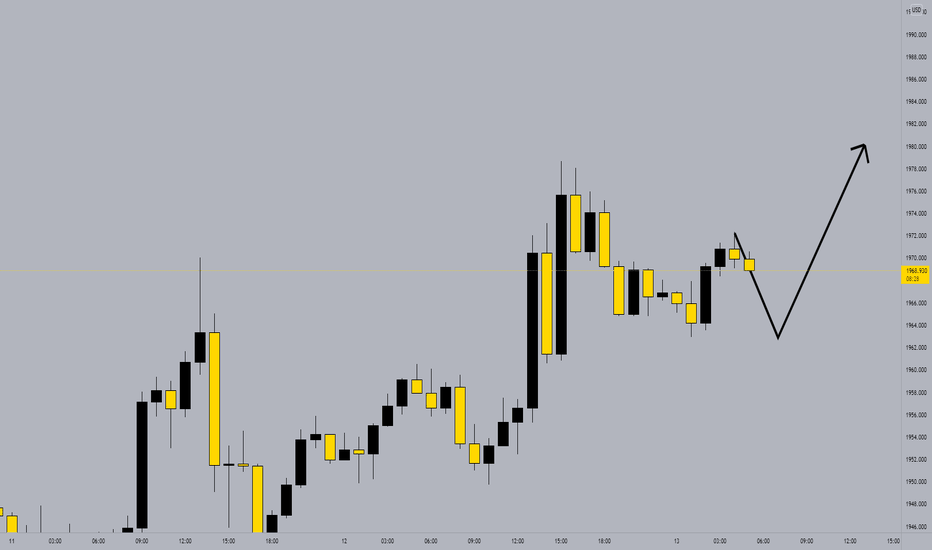

Does Gold doing wave C? part 2According to the previous idea, After the price reached 138.2% of a, The price makes a reversal pattern on TF4H (plus MACD doing bullish divergence in TF1H), So I decide to enter the 1st Buy position. (For now moving SL in front of EP, Risk = 0), To enter the 2nd position, Waiting for the price action around the end of wave b (Continue pattern, plus bullish divergence in a smaller time frame like 15m to 1H or wait for a breakout), About the bigger time frame If price going as analyzed, The target will be around 1771$ and should be reach around 15 to 22 November.

OANDA:XAUUSD

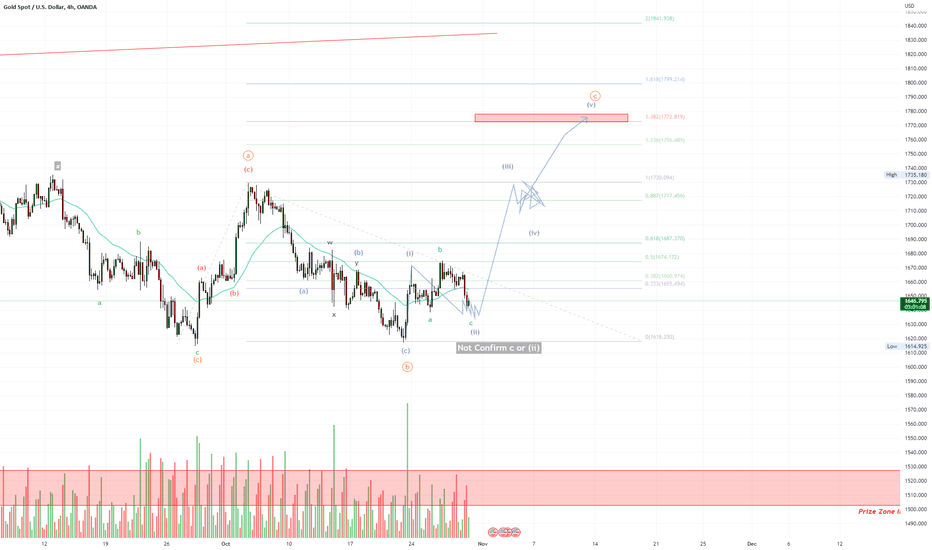

Does Gold doing wave C?After the gold price doesn't make a new low and does some correction, I think it may be making a FLAT correction and we're at the beginning of wave "C", If the price doesn't go below 1617, or the analysis will be wrong, must be something else. To enter the Long or Buy position, wait for the price breaking 1670, which will be a safety position (Price Action is the most important information)

OANDA:XAUUSD

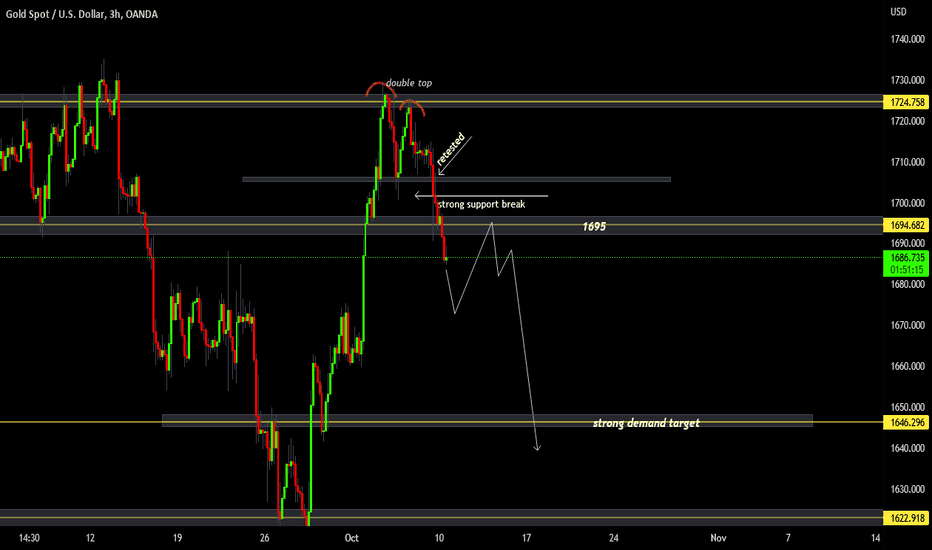

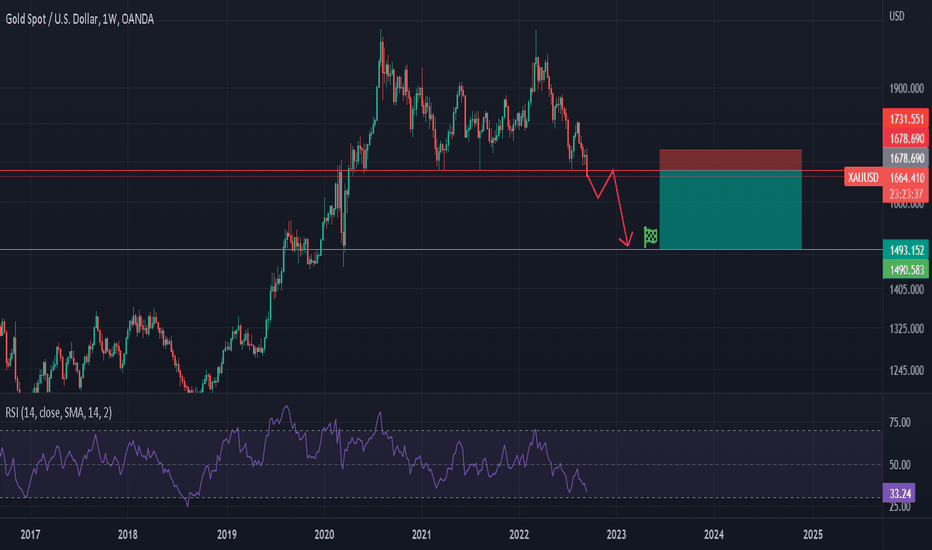

GOLD - More downside comingGold has broke the key support. There´s no buyers at these levels.

If the weekly candle closes below this key level , we expect the price to retest previous support and get rejected which would be a confirmation that this level is acting now as a strong resistance.

Target: $1500

Enter the trade only if the weekly candle closes below the key support (now resistance)

Good luck

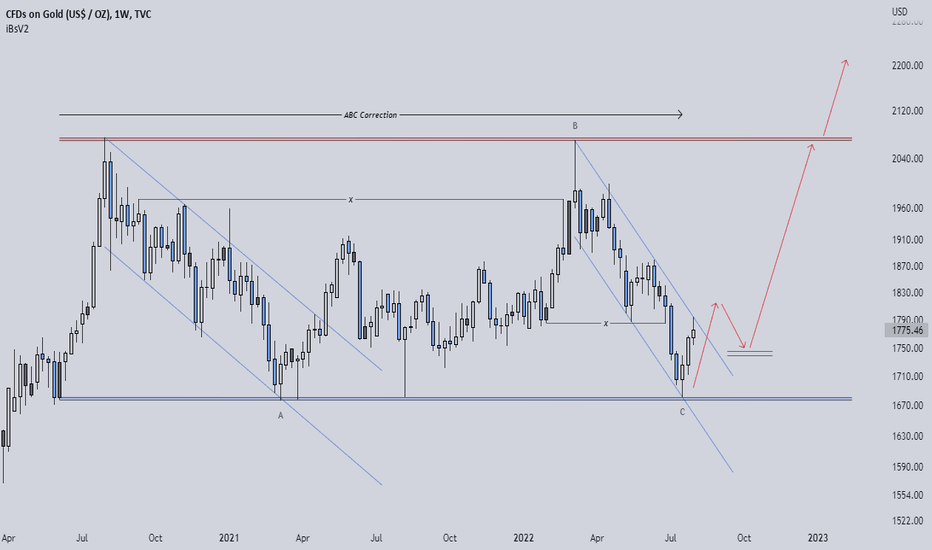

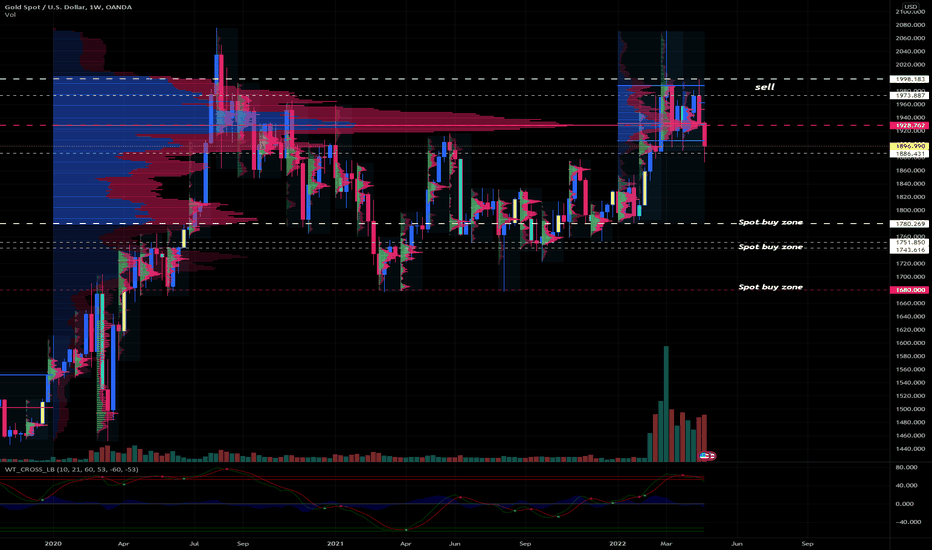

Gold Price Prediction analysis TF WeekGold chooses its direction to wave 2 or C as predicted on 11 August. At the current level of 1747, about 50% pulled back and arrived at significant support but still have more downside.

Whilst, DXY recovered its value as the positive data of U.S. Retail Sales and initial Jobless Claims. The dollar could keep rising this coming week with limited downside. If DXY breaks the old high (109 as of 14 July), it might rapidly surge to 111.

So, this may cause negative sentiment for gold. Nonetheless, gold can rebound for a short period before going down again. Suggest picking a top to sell.

Sell 1754 - 1766

TP 1758/1754/1747/1735/1728

SL set according to your margin ( above 1772 is a crucial point for gold rally to wave 3 )

Have a good week!!

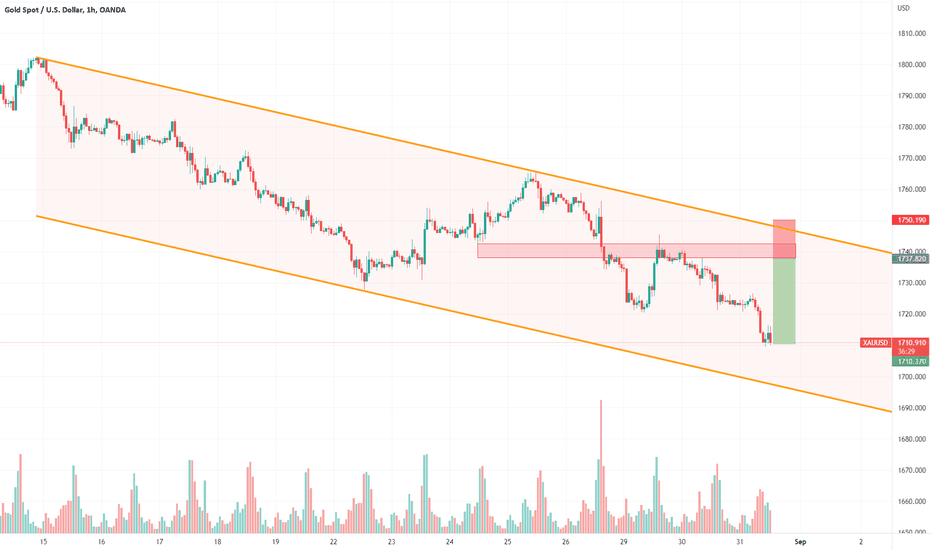

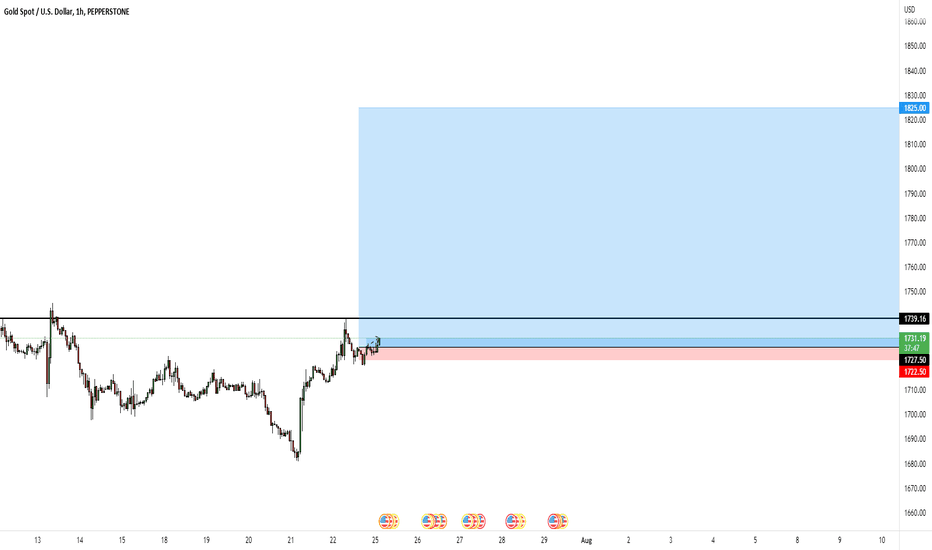

Medium term bias remains bearish on GoldXAUUSD - Intraday - We look to Sell at 1737.82 (stop at 1750.19)

The medium term bias remains bearish. A higher correction is expected. Resistance is located at 1740.00 and should cap gains to this area. Preferred trade is to sell into rallies.

Our profit targets will be 1710.37 and 1700.00

Resistance: 1740.00 / 1800.00 / 1880.00

Support: 1710.00 / 1600.00 / 1450.00

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.'

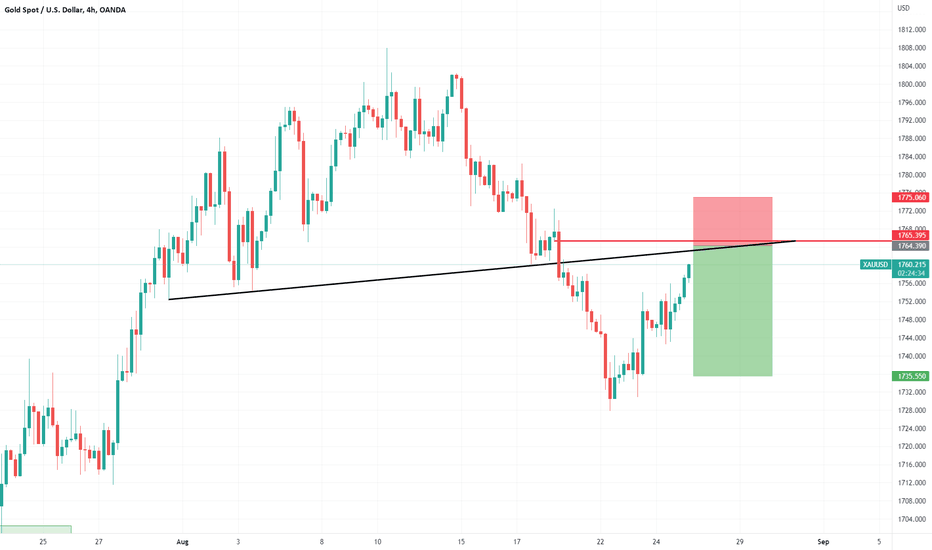

Gold approaching resistanceGold - Intraday - We look to Sell at 1764.39 (stop at 1775.06)

The medium term bias remains bearish. We are assessed to be in a corrective mode higher. Horizontal resistance is seen at 1765.00. We look to sell rallies.

Our profit targets will be 1735.55 and 1730.00

Resistance: 1765.00 / 1820.00 / 1980.00

Support: 1735.00 / 1700.00 / 1600.00

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.'

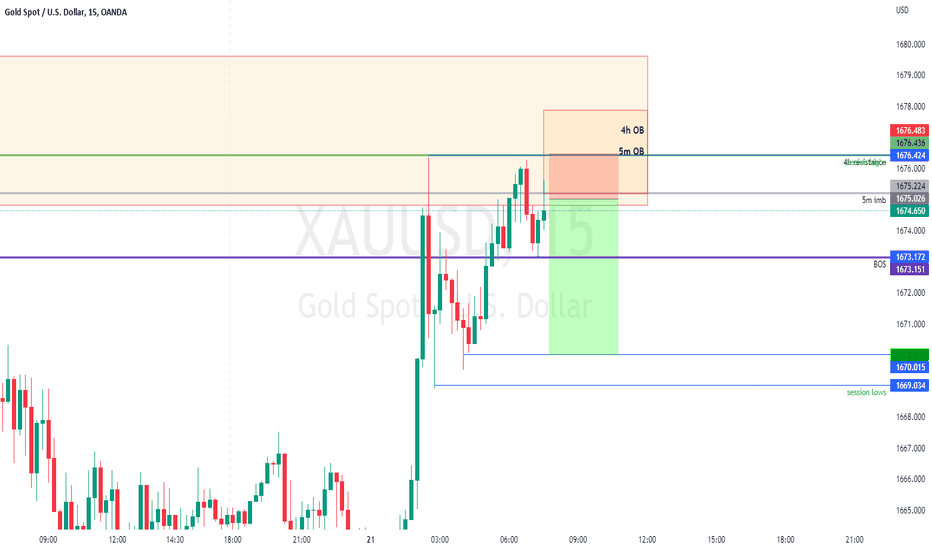

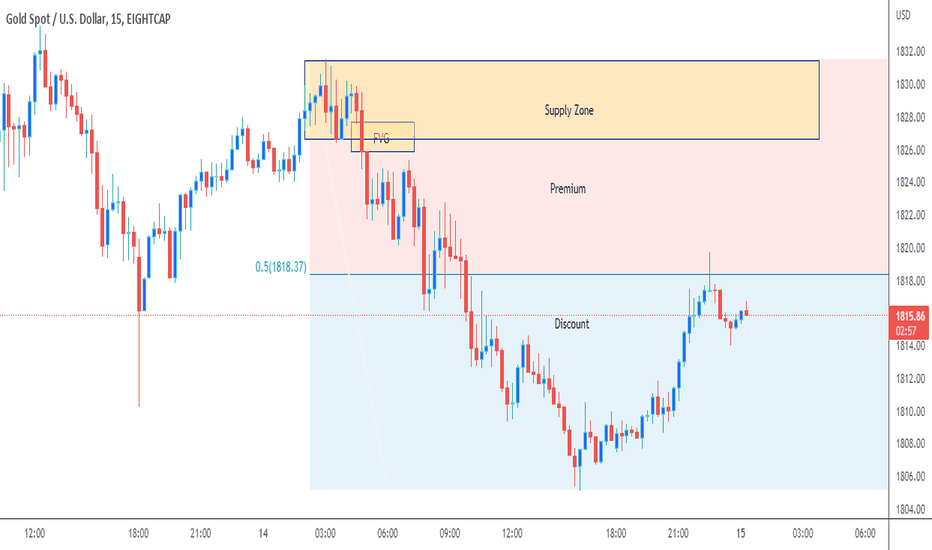

GOld Bearish BiasI am selling off gold at the premium area along those dealing range. Noted on yesterday FVG formed within the confinement of a supply zone. Hence increases the odds. Imbalance towards the sell side. Targeting the sell side liquidity at yesterday new low. NOted FOMC later might get it there quicker so need to ensure the price enters into that zone or FVG either during London Session or Prior NY or during NY session.

Happy hunting everyone.

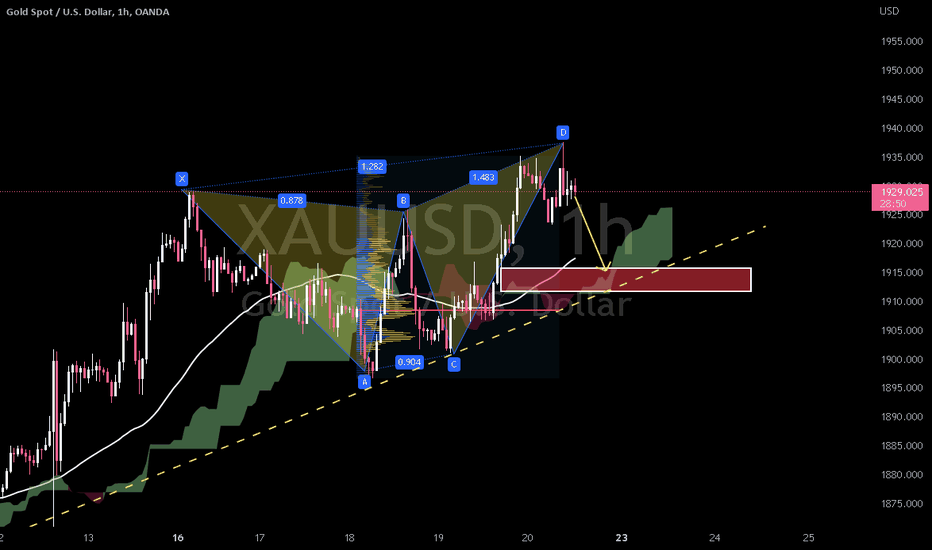

XAUUSD DAILY BIAS : B.U.L.L.I.S.H 🐃🔱 GOLD TRADE IDEA 🔱

BIAS: Bullish

FUNDAMENTAL BIAS: Bullish

The latest inflation rate reaffirms global inflation rate & amid heightened escalations between Russia & the West.

Putin stated that talks with Ukraine are at dead-end following latter deviation from agreements reached in Turkey

TECHNICAL BIAS: Bullish

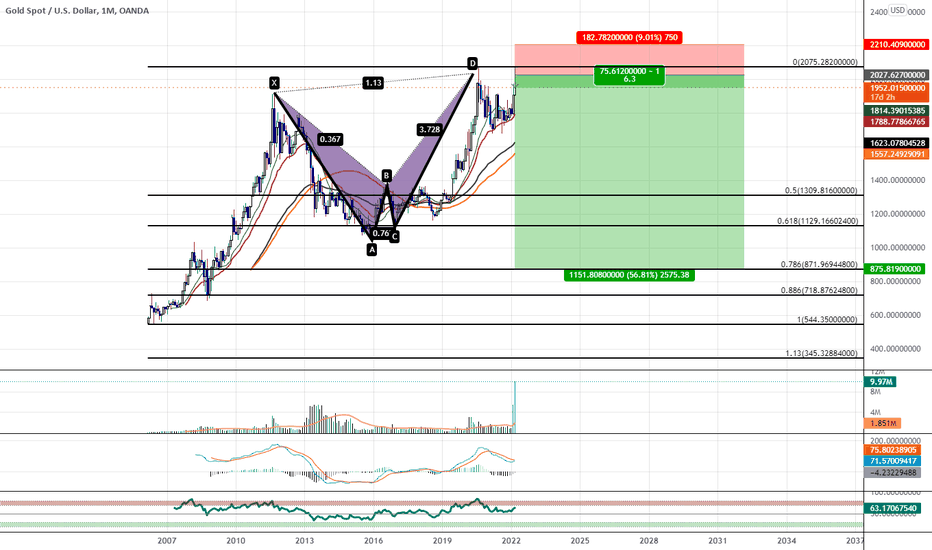

Bearish Alt Bat Visible On Gold's Monthly ChartThis is an update to the First Post I made on Gold's Bearish Alt-bat last year just to let you know that it is still in play and that it has just come back up to tap the PCZ a Second Time and this time on Greater Volume this looks like it could be the end and where Gold begins a Presumably Years Long retrace back to the zone between $1,129 and $718.80

If you want to see my original posting from last year on this Alt-Bat i have it on the related ideas section below.

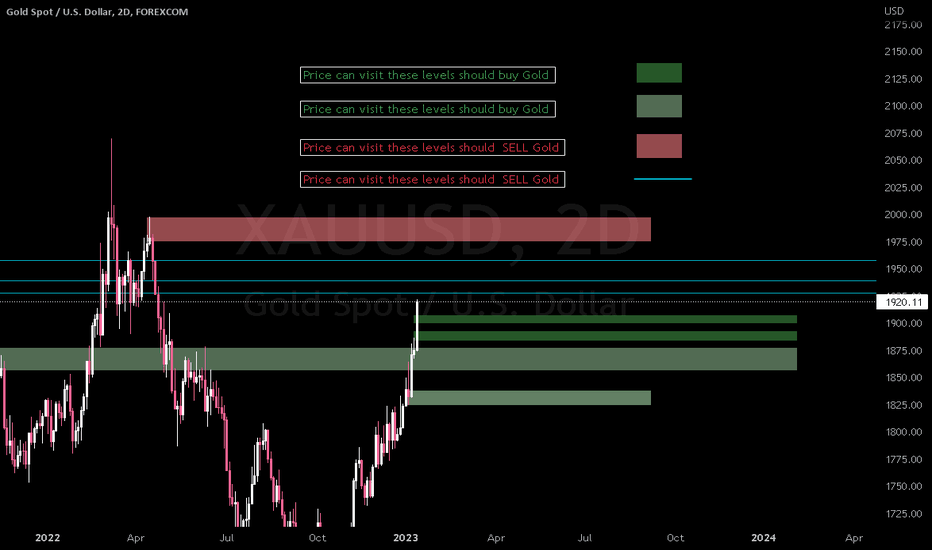

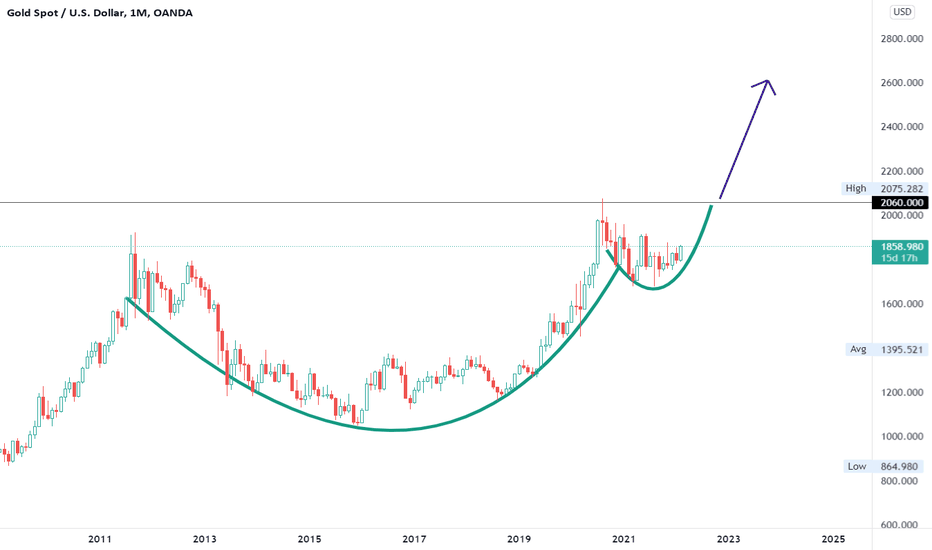

Gold Spot to $2600 by 2024Gold ( OANDA:XAUUSD ) is forming an immature cup and handle on the monthly with a price target of $2600. On the weekly, we see it has broken above this triangle as you see in the chart below. That move is not confirmed yet either, but if next week, gold trades above this week's close, then we set a price target of $2060 and set a stop loss below the recent low.

Charting Gold versus M2 Money Supply, we see gold hitting a historical low of 2007 which has supported the price many times between 2007 and today where it remains a strong support.

Let me know what you think. Leave comments and if you like, leave a like. Cheers.

XAUUSD (Gold Spot) - February 4Hello?

Traders, welcome.

If you "follow", you can always get new information quickly.

Please also click "Like".

Have a nice day.

-------------------------------------

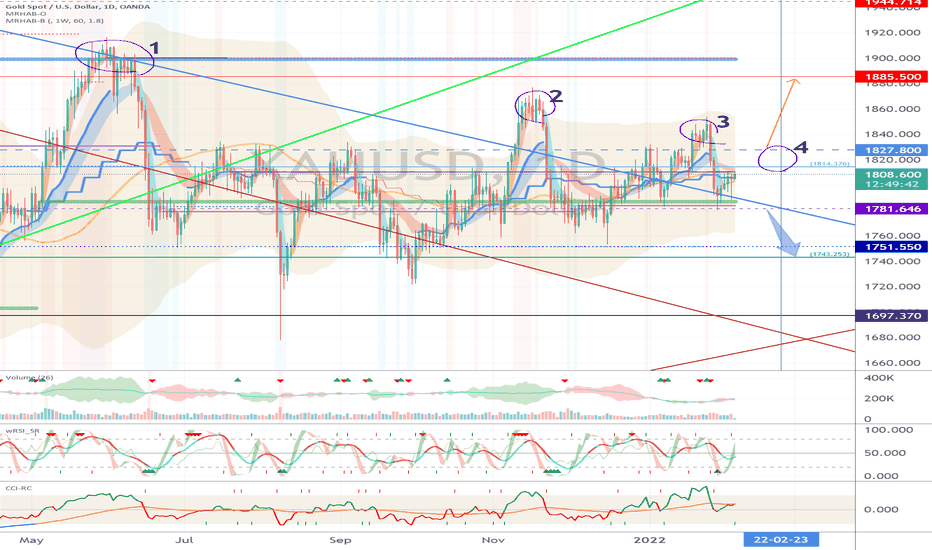

(XAUUSD 1W Chart) - Mid-Long-Term Perspective

The Bollinger Bands are converging on the 1781.646-1827.800 section.

Accordingly, if there is movement outside the 1781.646-1827.800 interval, the Bollinger Bands will expand.

In the CCI-RC indicator, the CCI line is falling below the +100 point and below the EMA line, so it is more likely to show a downtrend.

(1D chart)

(Full: )

1743.253-1814.376: An important section to determine the trend

Resistance section: 1814.376-1827.800

First support section: around 1781.646

Second support section: 1743.253-1751.550

The highs are moving downwards, so you should check the resistance zone for movement.

------------------------------------------

We recommend that you trade with your average unit price.

This is because, if the price is below your average unit price, whether the price trend is in an upward trend or a downward trend, there is a high possibility that you will not be able to get a big profit due to the psychological burden.

The center of all trading starts with the average unit price at which you start trading.

If you ignore this, you may be trading in the wrong direction.

Therefore, it is important to find a way to lower the average unit price and adjust the proportion of the investment, ultimately allowing the funds corresponding to the profits to be able to regenerate themselves.

------------------------------------------------------------ -----------------------------------------------------

** All indicators are lagging indicators.

Therefore, it is important to be aware that the indicator moves accordingly with the movement of price and volume.

However, for convenience, we are talking in reverse for the interpretation of the indicator.

** The MRHAB-O and MRHAB-B indicators used in the chart are indicators of our channel that have not been released yet.

(Since it was not disclosed, you can use this chart without any restrictions by sharing this chart and copying and pasting the indicators.)

** The wRSI_SR indicator is an indicator created by adding settings and options to the existing Stochastic RSI indicator.

Therefore, the interpretation is the same as the traditional Stochastic RSI indicator. (K, D line -> R, S line)

** The OBV indicator was re-created by applying a formula to the DepthHouse Trading indicator, an indicator disclosed by oh92. (Thanks for this.)

** Support or resistance is based on the closing price of the 1D chart.

** All descriptions are for reference only and do not guarantee a profit or loss in investment.

(Short-term Stop Loss can be said to be a point where profit and loss can be preserved or additional entry can be made through split trading. It is a short-term investment perspective.)

---------------------------------

GOLDSales area and resistance ...

Accompanied by Mr. Powell's speech ...

Although interest rates in Canada and the United States are still stable, I expect the Federal Reserve to raise interest rates in seven stages in March.

And this is not good for risky markets at all ...

I have shown close support so far ... and I will definitely update my analysis if this support is lost.