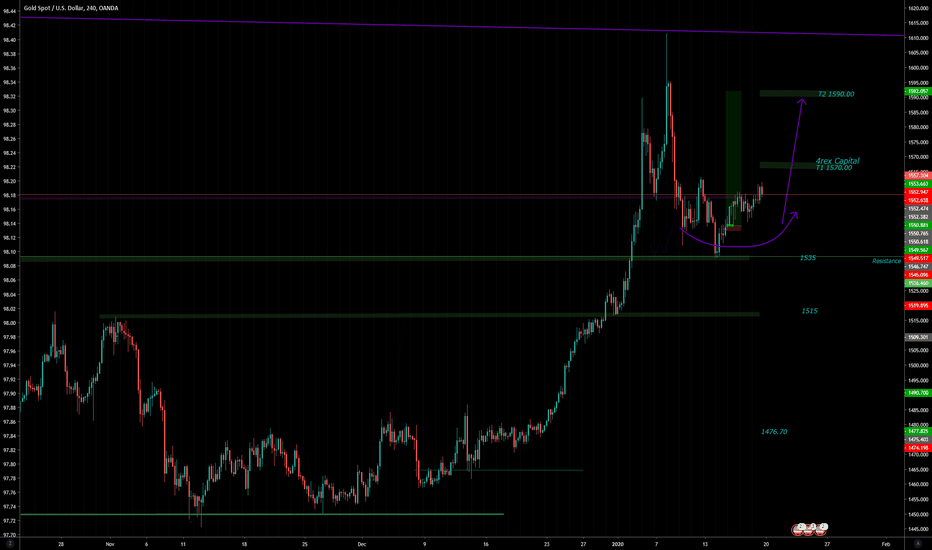

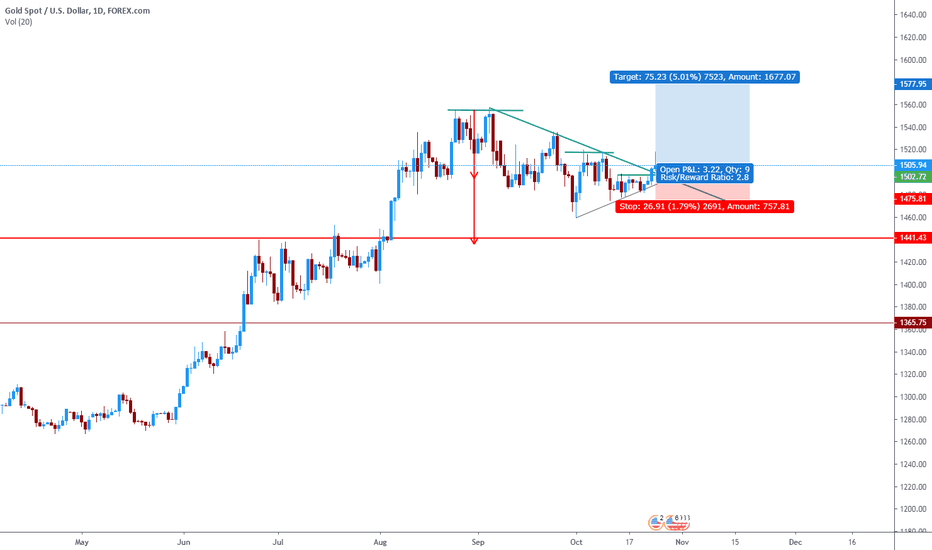

XAUUSD Weekly Forecast 20th - 25th Jan 2020XAUUSD Weekly Forecast 20th - 25th Jan 2020

- As 2020 starts all markets will potentially be more volatile while they settle into a good structure for the rest of the year so with all new trades make sure your risk management is on point!

- Gold has slowed down after fundamental tensions have calmed down.

- Still looking for bullish moves in the market as it seems a lot of stop hunts are being executed while holding weekly/daily support.

-Potential inverted head and shoulders pattern is occurring but will not be putting in any mire new trades till clear confirmation of the direction of the market.

- I have key levels set both ways but keeping a bias view on gold to go bullish to my first target set at 1570.00.

- For any new trades I would set my stop loss below 1535 due to any further pullbacks before continuation.

.

.

My Weekly forecast, highlighting the overall trend with key levels to get an idea of the best targets in the upcoming week and weeks ahead. Basic projection of the market with technical/fundamental analysis and is to be used for ideas, entry point analysis is done on a daily basis for entries with minimal drawdown.

-

-

Telegram -

Goldspot

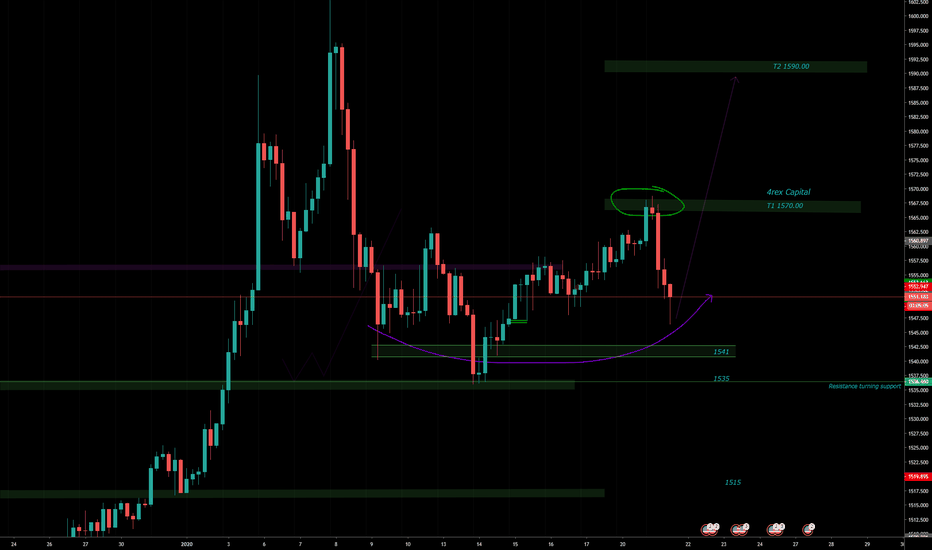

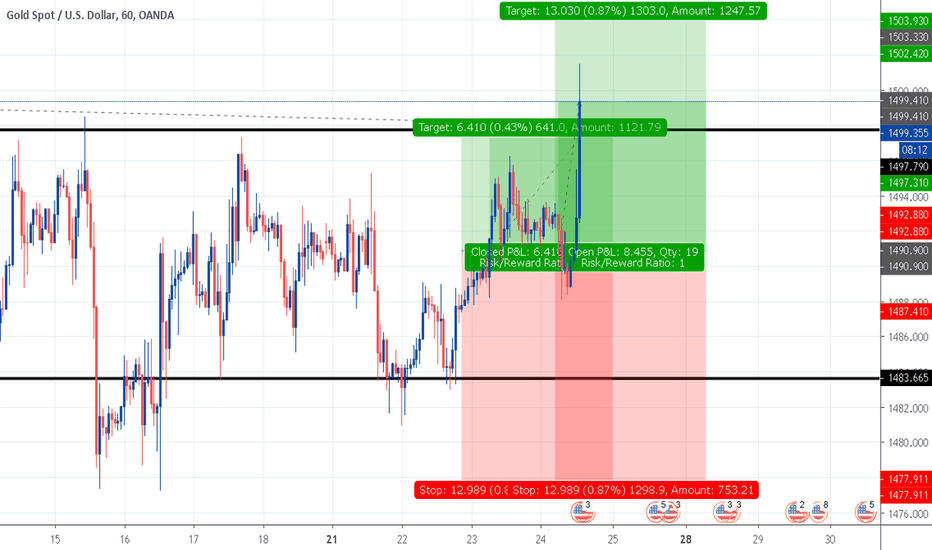

XAUUSD UPDATE for Weekly Forecast Results 20th-25th Jan 2020XAUUSD UPDATE for Weekly Forecast Results 20th-25th Jan 2020

- Target 1 Hit when market opened.

- Market doing a nice pullback towards my buy zones

- Ive added another level at the previous shoulder @1541 for potential shorter time frame hold zone ( inverted head and shoulders)

.

.

All analysis was sent on sunday on all my platforms

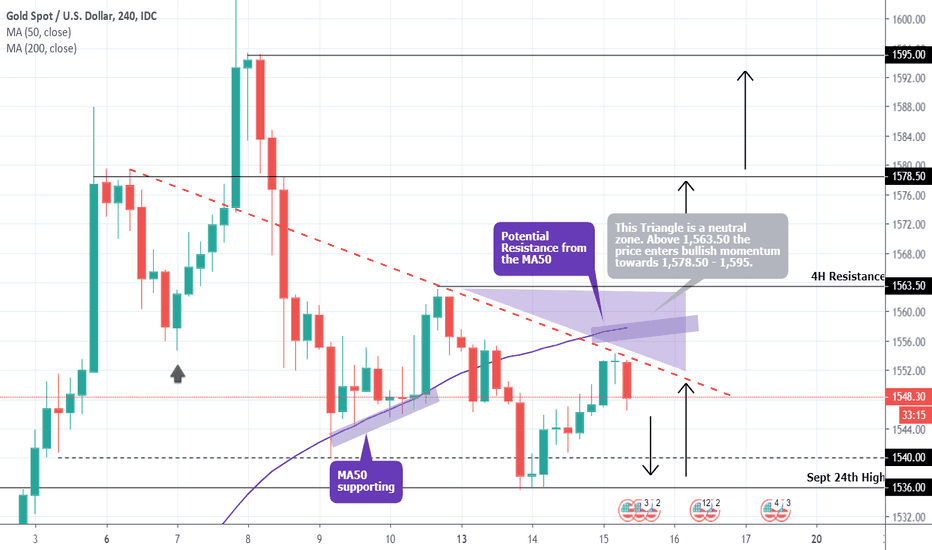

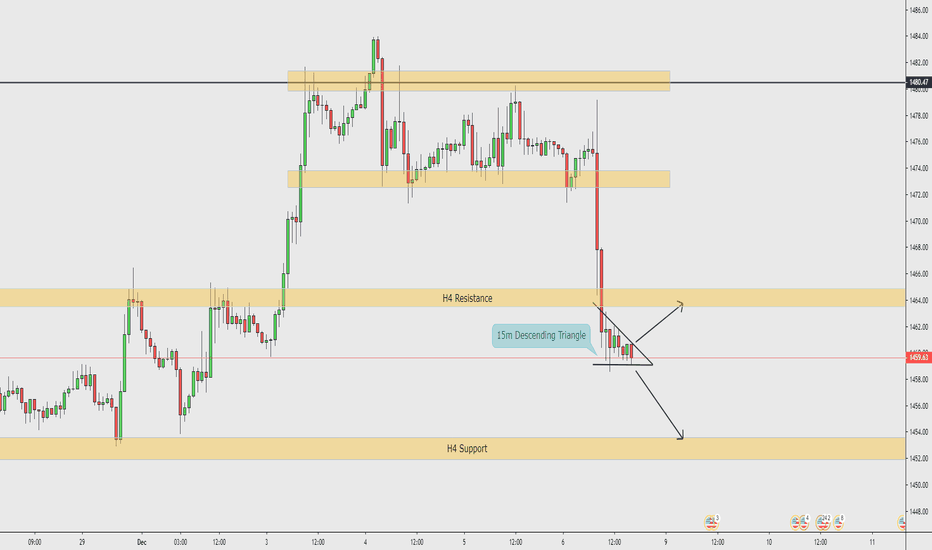

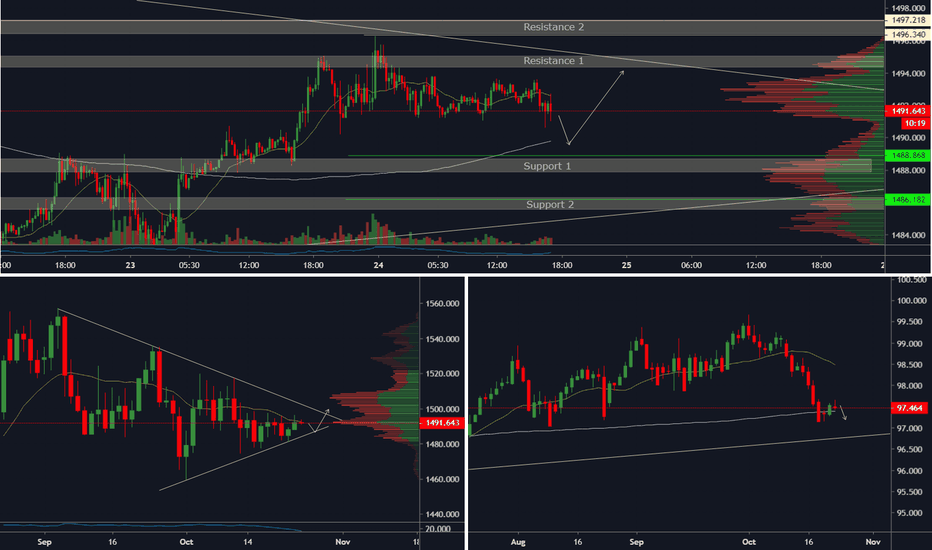

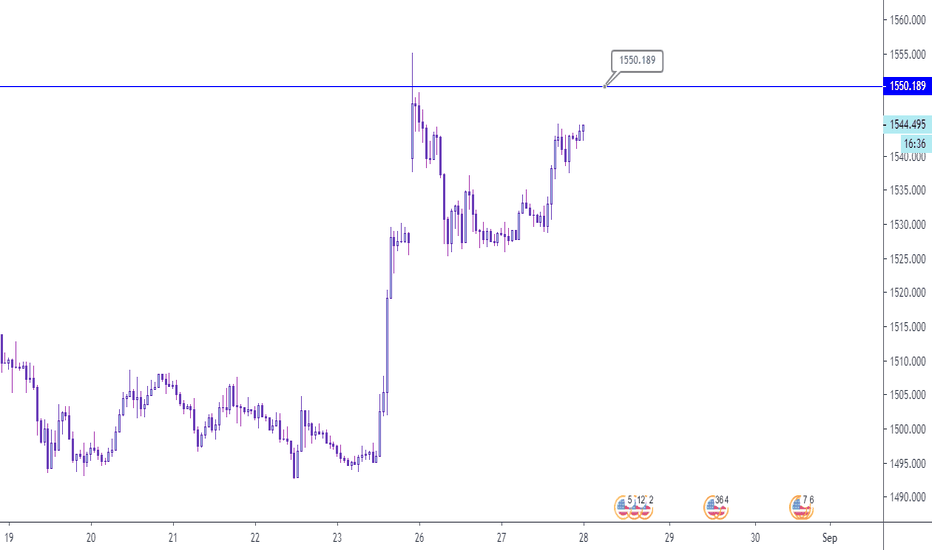

XAUUSD: Short term outlook | Descending Triangle.Gold respected the 1,536 - 1,540 4H Support Zone which was the symmetrical level from the September 24th Lower High, but the rebound stopped on the Lower High trend line (red dashed line) of the 4H Descending Triangle (RSI = 46.910, MACD = -1.340, ADX = 27.607, Highs/Lows = 0.0000). A break above that line justifies a 1,563.50 test, while a rejection another attempt to keep the 1,536 - 1,540 Support Zone intact.

If Gold breaks the 1,563.50 Resistance breaks, then more buyers should join. TP = 1,578.50 and 1,595 (medium term).

** If you like our free content follow our profile (tradingview.sweetlogin.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

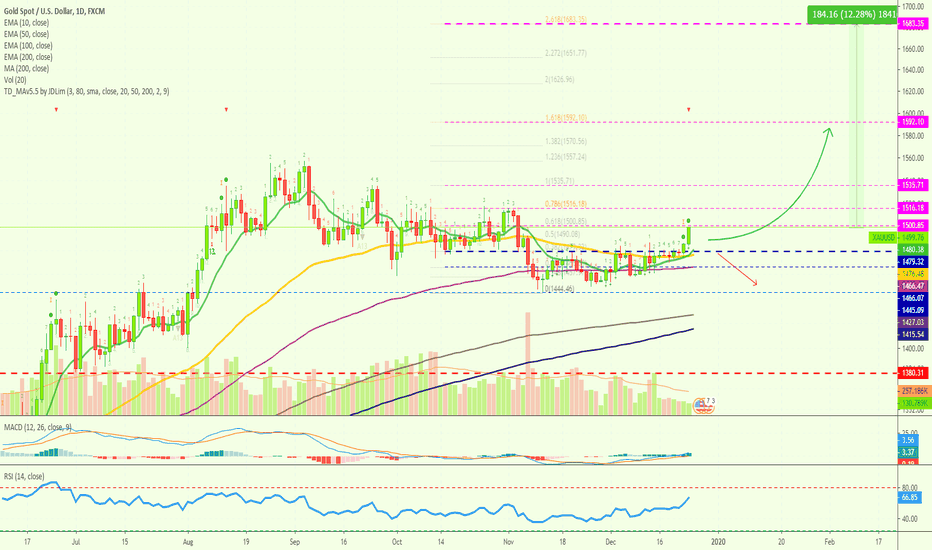

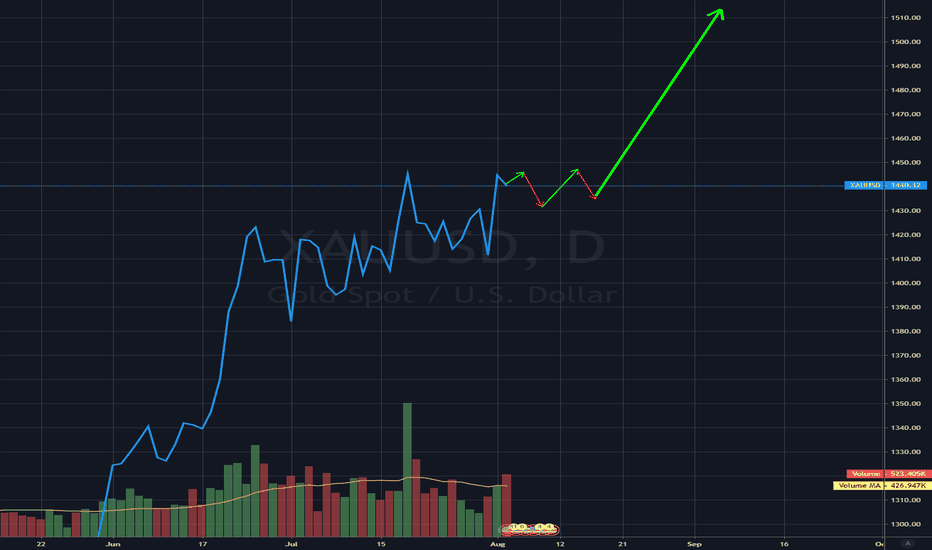

Can Gold Go To $1600 In January 2020 Or Higher? Merry Gold!The chart for Gold Spot (XAUUSD) is looking super bullish and allows for additional growth.

This move is just getting started and the way this looks now, XAUUSD can easily break $1,515 and move higher.

There will be some retraces and consolidation along the way but BULLISH/GREEN it is all day.

Gold Spot (XAUUSD) Chart Signals & Indicators

The MACD is now on the green allows for additional growth.

The RSI is very strong at 66.78 and at its highest since September 2019.

EMA10/50/100 fully conquered and now working as support.

This chart screens bullish.

Looks like Gold is going to have a very good start in 2020.

Let's hope that Bitcoin and Cryptocurrency can also do the same.

Thanks a lot for reading.

This is Alan Masters.

Namaste.

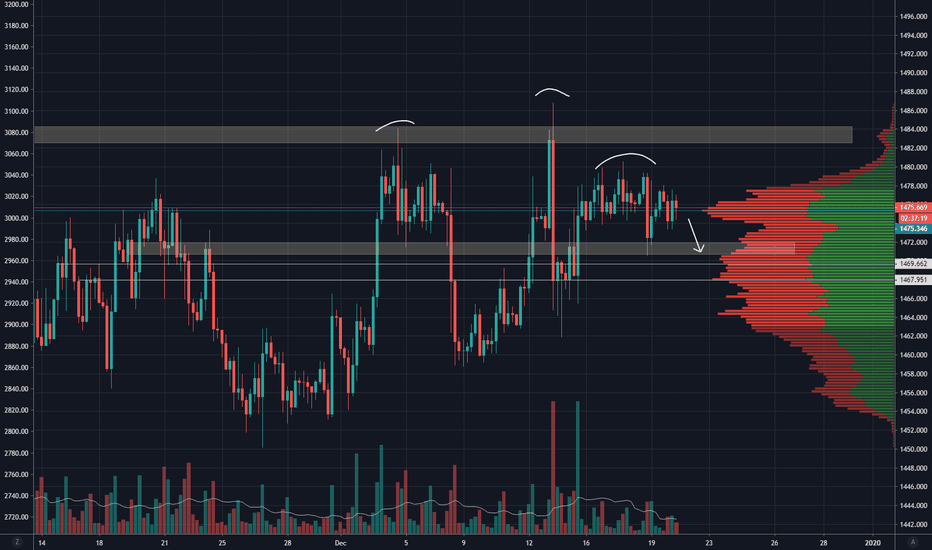

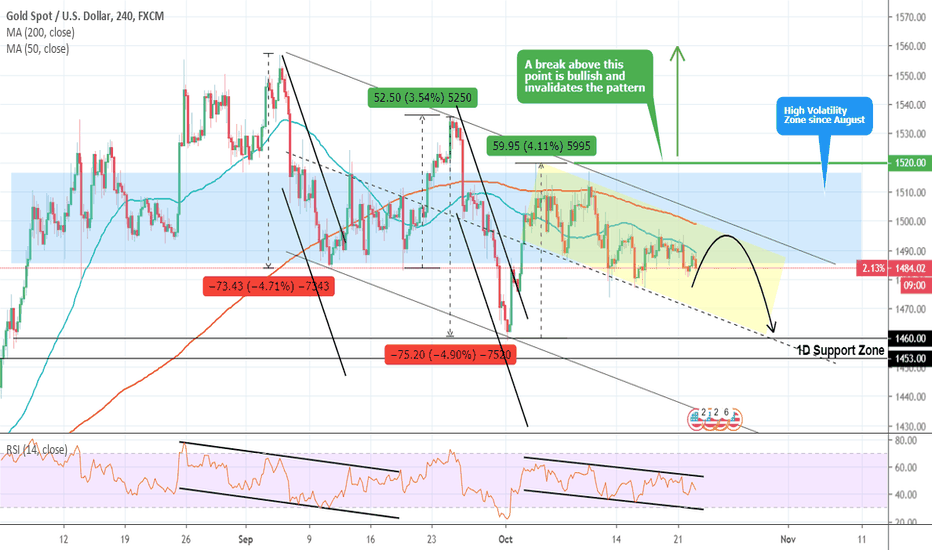

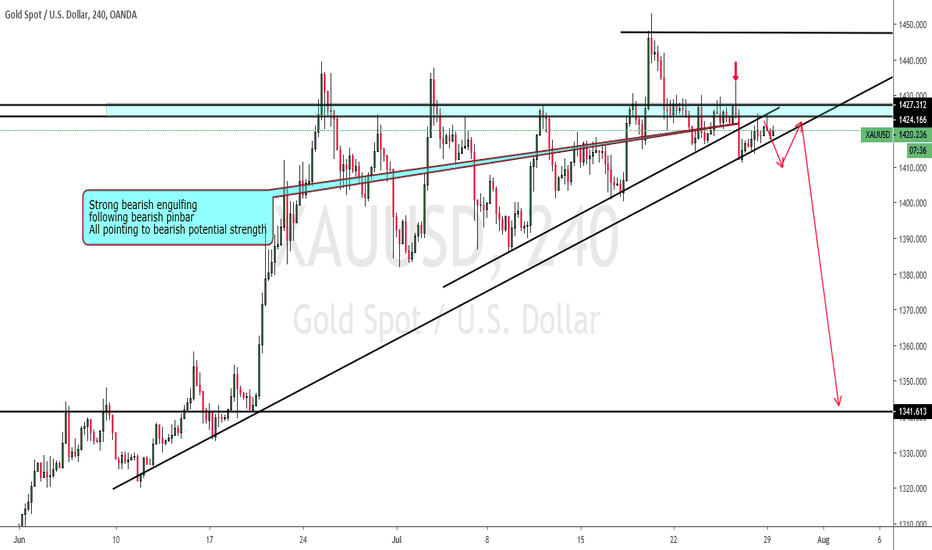

XAUUSD: Sell Opportunity with bearish channel within channel.Gold confirmed our medium term bearish view, as the 1D Channel Down (RSI = 44.533, MACD = -5.450, Highs/Lows = -2.2965) was successfully rejected on a Lower High below the 1,520 break out barrier. See that idea below:

It traded for a while within the High Volatility Zone (blue Rectangle) but again formed a shorter term Channel Down on 4H (RSI = 42.719, MACD = -2.270, Highs/Lows = -2.3479) which uses the 4H MA50 and MA200 as Lower Highs.

The 4H RSI sequence resembles the August 23 - Sept 18 cohesion which spiked before making the Lower Low at 1,460. We are expecting a similar price action and are again shorting with 1,460 as the Target.

As mentioned on the previous analysis, the final target on the 1W chart seems to be the 1,381.50 - 1,400 1W Support Zone , and if the 1D Support breaks, we are expecting an aggressive fill of this level. This is where Gold is expected to make contact with its 1W MA50 and continue its aggressive new Bull Cycle that it entered in June, in a manner similar to the 2000s Bull Cycle.

That idea was explained in September with a comparison of the two eras, which you can see below:

** If you like our free content follow our profile (tradingview.sweetlogin.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

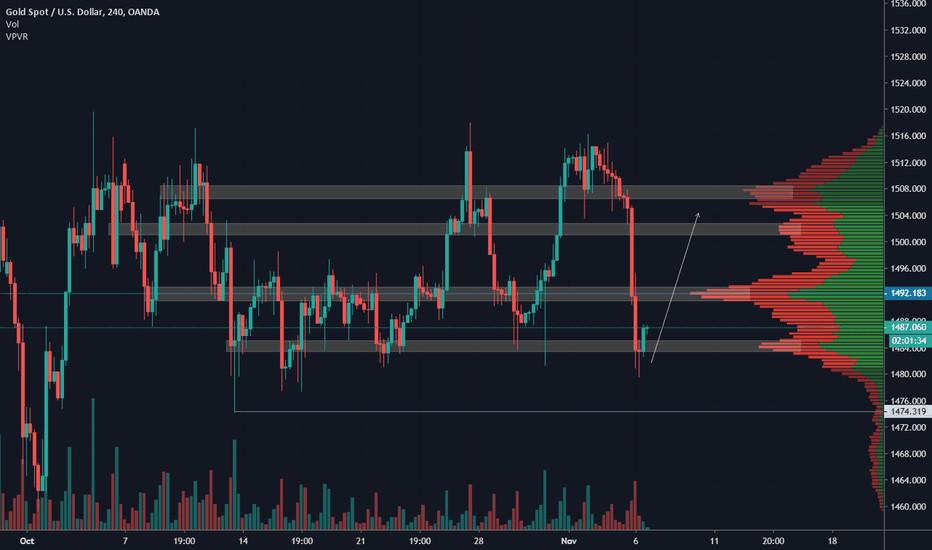

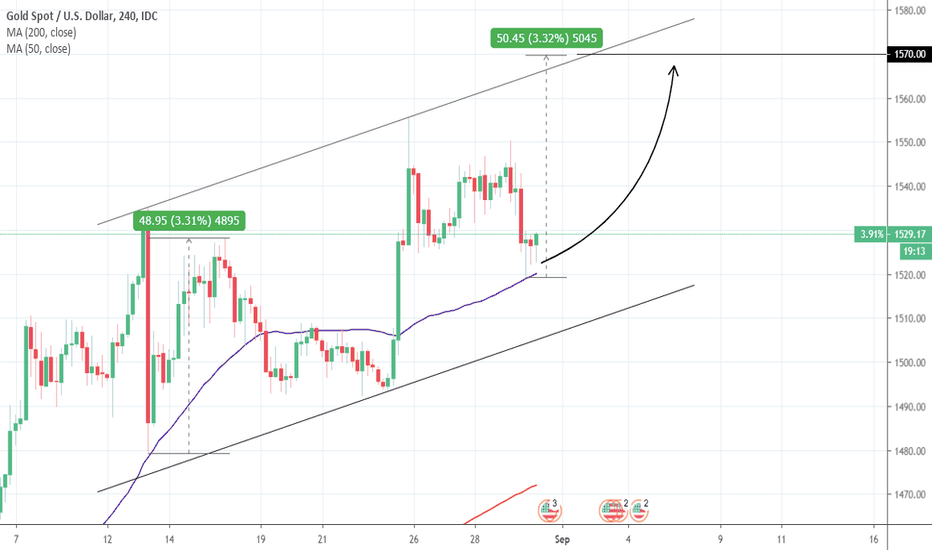

XAUUSD: Hit the 4H MA50. Long opportunity.Gold has been trading this month within a 4H Channel Up (RSI = 49.668, MACD = 3.600, Highs/Lows = -3.3550). Those indicators along with the fact that the price touched the 4H MA50 yesterday and held, make the short term outlook bullish again, even though the Higher Low zone is marginally lower. Our TP is 1,570, with the next possible Higher High projected to be around 1,580.

** If you like our free content follow our profile (tradingview.sweetlogin.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

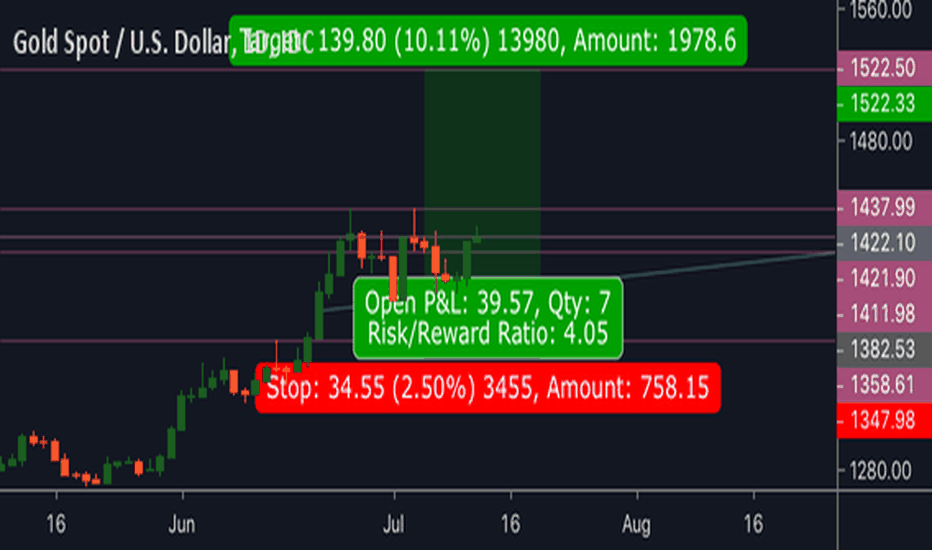

Gold: A Few Slight Retracements; 1450 Soon; 1500 Within ReachI have discussed at length in my previous posts where I think Gold will go and the specific reasons for my conclusions. As such, I will refrain from repeating.

To keep it simple, I see 1450 as the next major hurdle and once 1450 is broken we will be set to reach and exceed 1500 within 3 weeks afterwards. Until then it will take some volatility before we get to 1450 and a lot of false bear flags will be dished out.

As a rule of thumb when trading Gold and Silver: never panic sell and always wait for two consecutive trading sessions for confirmation.

I expect Gold to do the following in the near-term:

1) 1440ish (current) --> 1443-1446 (Sunday futures open)

2) 1443-1446 --> 1431-1438

3) 1431-1438 --> 1447

4) 1447 --> 1440-1442

*5) 1440-1442 --> 1450 --> 1470 --> 1490 --> 1500 and beyond

*Slight retracements after 1450 on the journey to 1500 but nothing major.

I expect we will reach 1450 by this coming week and we will top 1500 anytime in September. Longer-term I am still eyeing 1700+ by the mid-point of 2020.

If Gold happens to gap fill some lower levels into the 1416-1421 range it will be very quick and sometime Sunday overnight into pre-dawn Monday.

- zSplit

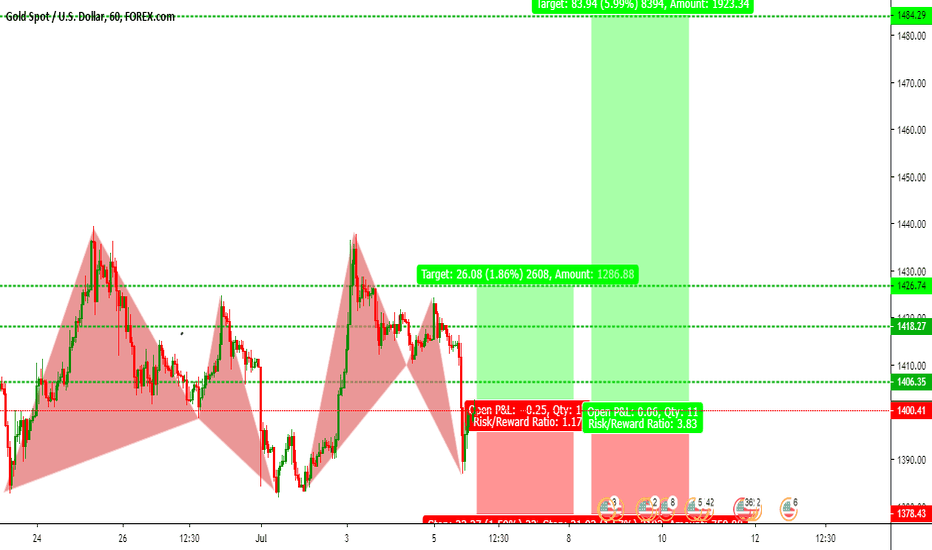

XAUUSD 1HOUR - BUY - Bullish Gartley 222+Cup and Handle+TrendXAUUSD is half of the way to the profit objective of the giant Cup and Handle pattern that I posted about a week ago.

Bullish Gartley 222 pattern formed in the market increasing the possibility of the trade.

3.83 Reward/Risk Ratio.

837 pips of trend continuation profit potential

267 pips of pattern targets profit potential

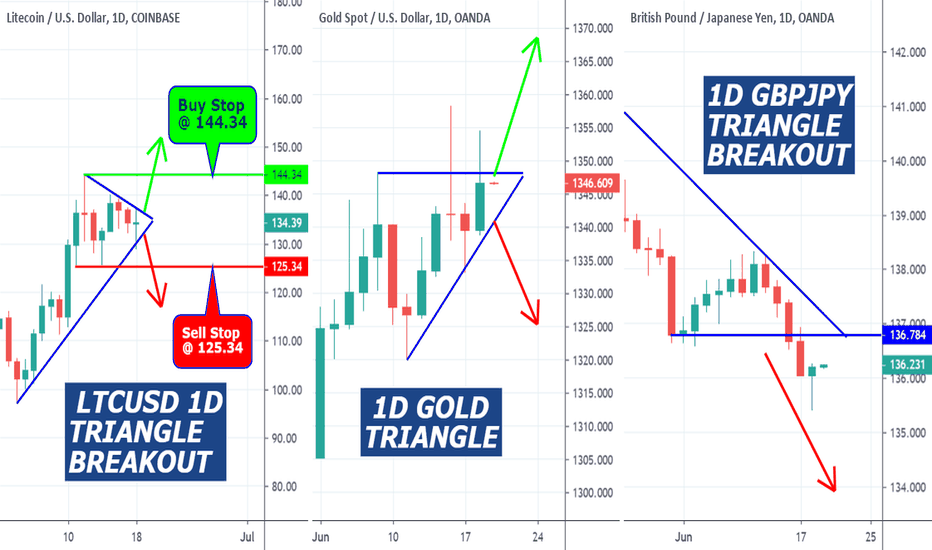

FESTIVAL'S OF TRIANGLE BREAKOUTS LTCUSD TRIANGLE BREAKOUT CHART PATTERN

GOLD SPOT ASCENDING TRIANGLE BREAKOUT

GBPJPY DESCENDING TRIANGLE BREAKOUT

We are doing a live triangle trading class on our TTT Strategy June 25th @ 2PM ET! If you are interested in learning more about it, please visit the link you see below in our signature. Thanks!

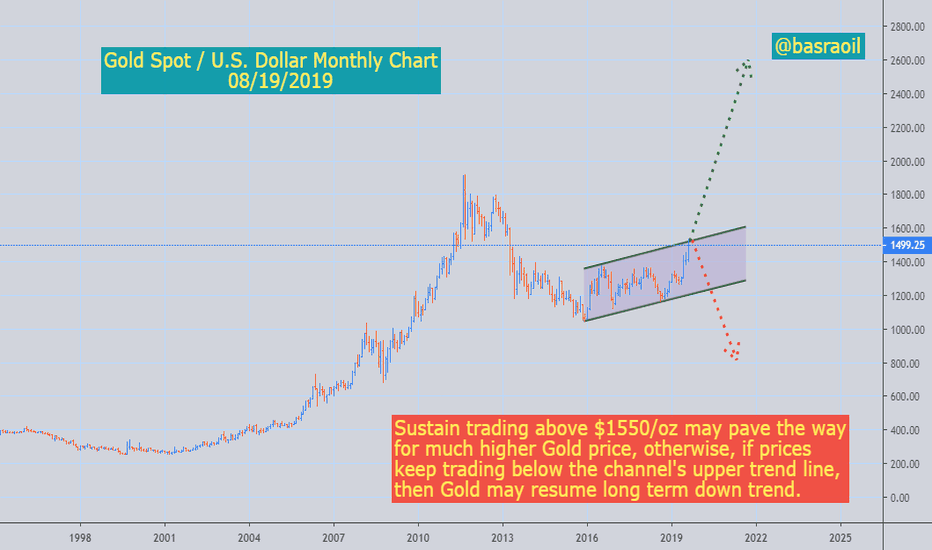

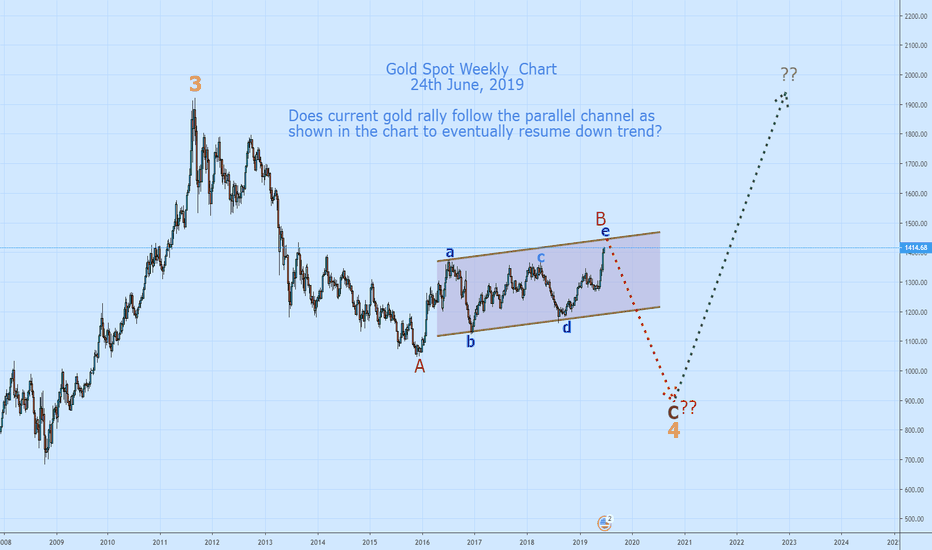

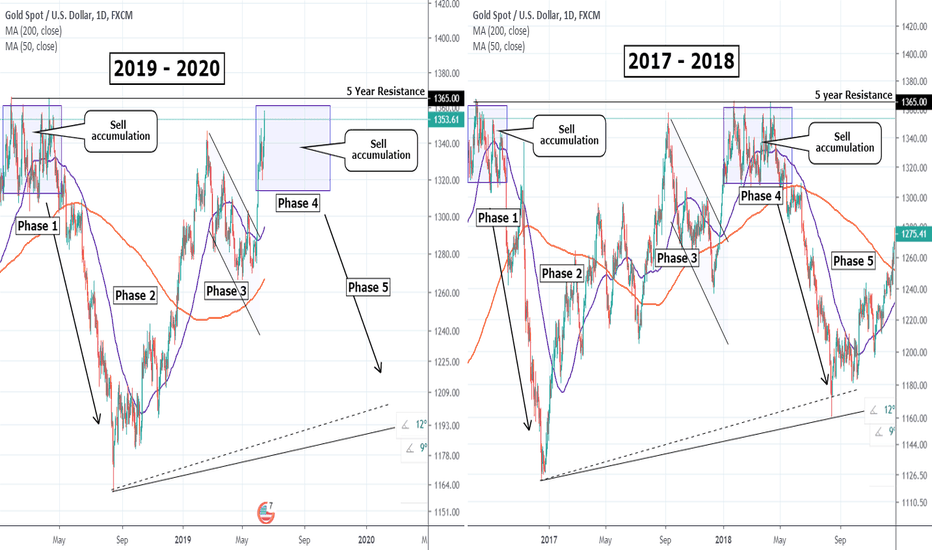

GOLD's seasonal cycle. Don't miss the strongest sell signal!Gold has entered its 5 year Resistance Zone (1350 - 1365). This alone is an immediate sell signal. What's even more interesting though (and a stronger reason to go short on Gold) is the cycle that the metal tends to seasonally follow every 1.5 years.

The chart speaks by itself. I have distinguished two time periods: 2017/18 and 2019/20. Every time the price enters the 1350 - 1365 monthly Resistance Zone, longs take their profits and a balance between buyers and sellers is observed roughly within 1300 - 1365. I call this the sell accumulation phase where the market is undecided but sellers eventually prevail under the heavy pressure of the 5 year Resistance level. Note that there is always a catalyst (normally geopolitical tensions) that drives the price towards that Resistance Zone (N. Korea, stock market crash, Oil crash, trade war and more recently the U.S. - Iran tensions) but it eventually fails.

I take this as a strong long term sell signal. The target can differ but I am counting (and targeting) at at least 1220 - 1240, with a strong probability for 1200 also.

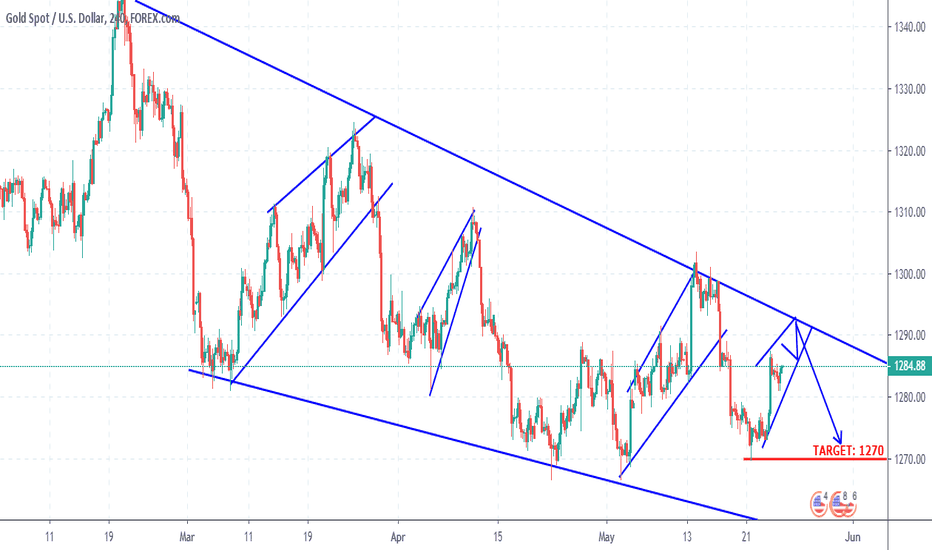

GOLD 4-HOUR TIMEFRAME SHORTGold continues in it's downtrend, as it currently completes a corrective structure towards the 1290 resistance level. I will be looking to short gold around the 1290 area if price action suggests so. Therefore, be on the lookout for bearish engulfing candles or any type of heavy selling close to the dynamic resistance (trendline). A possible target is the 1270 zone. May the bears be will you!!!