GoldMinds Family — Sniper Plan for June 12 👋 Good evening traders!

CPI delivered clean reactions, and now we're stepping into the next setup zone as Core PPI, PPI m/m and Unemployment Claims line up on tomorrow’s calendar. Expect the volatility machine to wake up again.

Gold remains capped inside premium supply while liquidity continues to build on both sides. My plan is simple: execute only when price moves into proper levels — clean, confirmed, and structured.

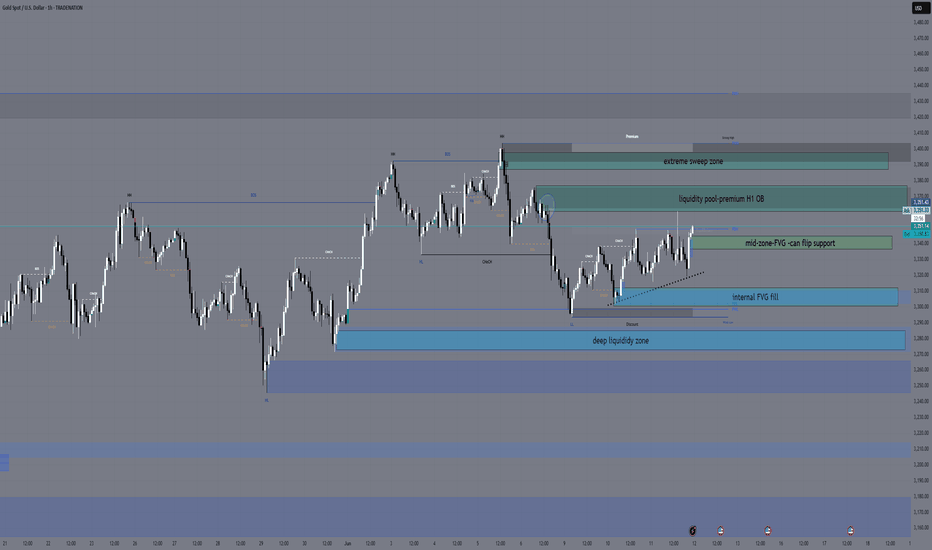

🔎 Sniper Zones

Sell Zones:

• 3359 – 3375 → H1 premium OB + weak high inducement

• 3387 – 3398 → Extreme premium sweep zone

Buy Zones:

• 3312 – 3300 → H1 demand zone + internal FVG fill

• 3285 – 3272 → Deep flush liquidity zone

Mid Zone:

• 3336 – 3344 → Only valid for quick scalps with clean M5 confirmation

🧭 Bias

Bias remains bearish under 3375, but as always: let liquidity show its hand first.

News triggers liquidity. Liquidity triggers setups. We execute the third move.

🔎 The Battle Plan for Tomorrow

If price moves higher ahead of or after the news, I’m watching my first sell zone between 3359 and 3375. This is where liquidity stacks above recent highs, sitting inside the H1 premium order block and imbalance. Any clean reaction here can offer solid short opportunities.

If volatility drives an even stronger push, I have my second sell zone between 3387 and 3398 — an extreme premium zone where late buyers could get trapped after the news spike completes a full liquidity hunt. This would be my deeper liquidity sweep area.

If sellers take control early and we see a flush down before or after the release, I’ll be focused first on the 3312–3300 zone. This sits inside clean H1 demand, where previous liquidity was already collected. If price drops even further, I’m watching 3285–3272 as the deep liquidity sweep zone — where price may fully clear weaker hands before potential reversal.

Between 3336 and 3344 sits my mid-zone.

This is the area where price may consolidate or chop ahead of news. I avoid entering here unless I see a clean M5 confirmation for a quick scalp. Otherwise, it’s simply no-man’s land.

🎯 My Tactical Approach

If price reaches the sell zones → I wait for strong rejection & structure break on M5/M15 to execute shorts.

If price flushes into the buy zones → I wait for bullish confirmation on M15 to enter long.

Mid-range is ignored unless very clean setups appear on lower timeframe flips.

⚠ News days often start with traps. The first reaction isn’t always the real direction. I stay patient, disciplined, and let liquidity build before executing.

🚀 If this sniper plan helps you stay prepared, drop a 🚀, leave a comment, and Boost the post to support clean, real structure-based trading.

Follow GoldFxMinds for daily sniper updates 🧠✨

Goldsweep

XAUUSD DAILY PLAN 11 JUNE | CPI FIRE & STRUCTURE SNIPES!Hey GoldMinds! 🔥

Welcome to the June 11 plan — perfect timing as CPI is dropping tomorrow and the market is heating up! Let’s get tactical and prep for both volatility and sniper setups.

🌎 Macro & News Context

All eyes on CPI (US Inflation Data) tomorrow — expect increased volatility and liquidity sweeps!

USD is showing signs of strength after a broad correction. DXY breakout could pressure gold lower, but a miss on CPI could mean instant reversal.

Market is trapped in a wide structure, so we’re trading only the best confluence zones — not mid-range noise.

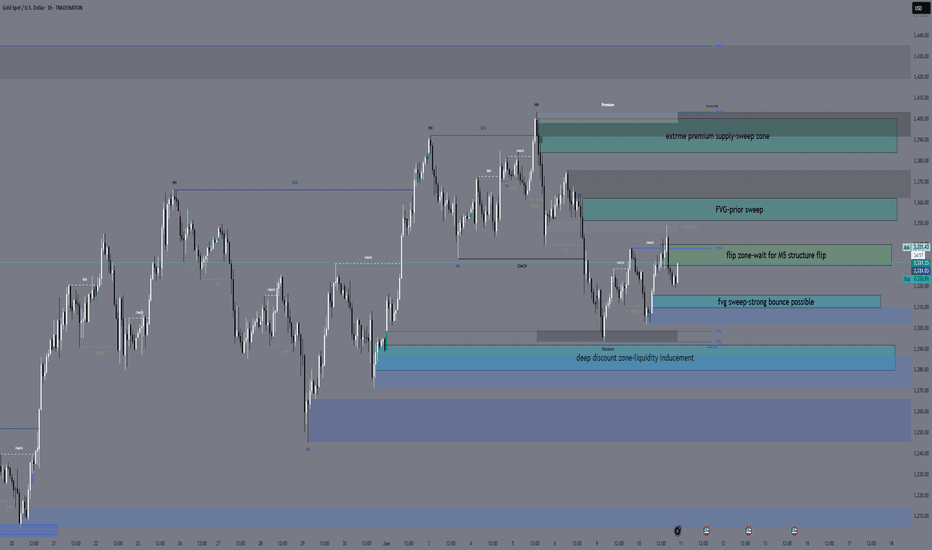

📊 Key Levels & Zones

Type Zone Logic / Target

Buy #1 3315–3310 Daily OB + H4 demand + FVG sweep, strong bounce expected if CPI spike flushes price

Buy #2 3292–3280 Deep discount zone, liquidity inducement & last-stand HL

Sell #1 3352–3362 H1/H4 premium OB + FVG + prior sweep, CPI pump trap

Sell #2 3384–3400 Extreme premium, stop hunt and sweep zone, strong rejection expected if FOMO kicks in

Mid Range 3330–3340 If NY plays range, look for quick reaction scalps here with M5 confirmation only

🧭 Bias

Neutral-to-Bearish (with event risk):

Market is currently consolidating below premium supply, showing signs of distribution and lower highs on H1/H4.

As long as price is capped below 3350–3362, sellers remain in control — especially if USD holds its strength into CPI.

However, CPI can easily flip the script! If data surprises dovish and USD drops, we could see an aggressive squeeze higher.

Best play: Let price reach extreme zones (either buy discount or sell premium) and wait for clear confirmation — don’t force trades in the middle.

Summary:

→ Bearish below 3350–3362

→ Bullish only on sharp flushes into 3310 or deeper discount, with M15 reversal

→ Flat/mixed in the mid-range (3330–3340), scalp only with confirmation

🎯 Trade Scenarios

Bullish:

If CPI comes in weak or USD retraces, expect price to spike into 3315–3310 and 3292–3280 zones. Look for strong M15 reversal for buys.

Targets: 3345 (first), then 3360.

Bearish:

Strong CPI = gold pumps into 3352–3362 or even 3384–3400, then look for M15/M5 rejection to sell.

Targets: 3330 (first), then 3310.

🧠 Tactical Notes

Only trade with confirmation — ignore random candles in mid-range!

If price is between 3330–3340, wait for clear M5 structure flip.

CPI can create fakeouts — first reaction isn’t always real direction!

Protect capital, don’t chase, and always respect your plan.

👇 Drop a 🚀 if the plan helped you or you enjoy the daily insights!

Comment your bias, follow for more sniper plans, and let’s boost the post if you found value!

Community = power. Let’s own CPI together, GoldMinds! 🧠✨

GoldFxMinds

Eyes on the Trap: Will Gold Explode or Collapse from Here👋 Hey gold warriors — Tuesday’s battlefield is fully loaded.

After a strong NY push, Gold is now deep in premium, pressing into key H1/H4 supply. Liquidity is building above, and the market is hunting late buyers. With Powell’s speech on the radar, structure will decide everything.

Will we explode through 3400... or collapse back into discount?

Let’s lock in the zones that matter 👇

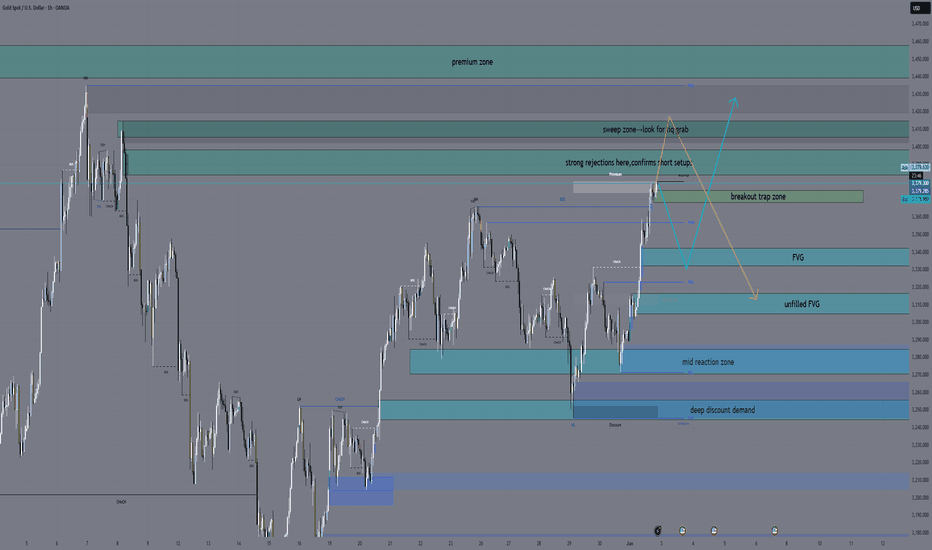

🔻 SELL ZONES – Premium Reversal Hotspots

Zone Key Levels What to Watch

🔺 Main Rejection Zone 3384–3398 Final imbalance + H1/H4 supply. Rejection here with M15/M30 CHoCH = high-probability short.

🔺 Breakout Trap Zone 3368–3375 Already broken weak high — could act as a pivot if price fails to hold above. Watch for bearish reaction.

🔺 Sweep Extension Zone 3405–3412 Only valid on impulsive break above 3398. Look for wick trap or quick rejection.

🔺 Extreme Premium Zone 3440–3458 Deep liquidity + fib extension. If reached, this is the ultimate sniper sell zone — watch for divergence and exhaustion.

🔹 BUY ZONES – Demand Reload Triggers

Zone Key Levels What to Watch

🔹 M30 Demand Rebound 3332–3342 Short-term OB + FVG. Scalps only. Must see HL confirmation on M15.

🔹 H1 Demand Cluster 3305–3315 Strong BOS origin + FVG. Clean area to build long if price pulls back.

🔹 Intermediate Reaction Zone 3270–3284 Minor FVG + past reaction. Not a major OB, but could bounce. Confirmation needed!

🔹 Deep Discount Demand 3244–3255 H4 OB + macro structure support. If market flushes here, expect powerful rejection setup.

🧠 Strategic Scenarios

📉 Sell Setup A → Spike into 3384–3398 → M15 shift → short to 3332, then 3305

📉 Sell Setup B → Breakout to 3405–3412 → trap wick → short with target back to 3342

📉 Sell Setup C → Full sweep into 3440–3458 → divergence + reversal → high-prob swing short

📈 Buy Setup A → Pullback into 3315 → HL confirmed → long toward 3375

📈 Buy Setup B → Clean bounce from 3270–3284 with CHoCH → scalp to 3332

📈 Buy Setup C → Washout into 3255 → bullish engulfing or M15 BOS → long setup toward 3305+

⚙️ EMAs & Momentum

✅ EMA 5/21/50 = bullish lock across TFs

⚠️ RSI showing divergence in premium → risk of exhaustion above 3400

🔁 Price now extended — wait for clear reaction before taking action

💬 Final Word from GoldFxMinds

We’re in the zone — literally.

This is not the time to chase green candles or short early.

🧠 Let the structure shift. Let liquidity clear.

Then enter with confidence, not emotion.

💛 If you appreciate this sniper-grade breakdown:

👍 Smash that LIKE

💬 Comment your thoughts below

📍 And follow GoldFxMinds for real-time intraday updates and battle-tested plans.

Let’s trade like tacticians, not gamblers.

— GoldFxMinds