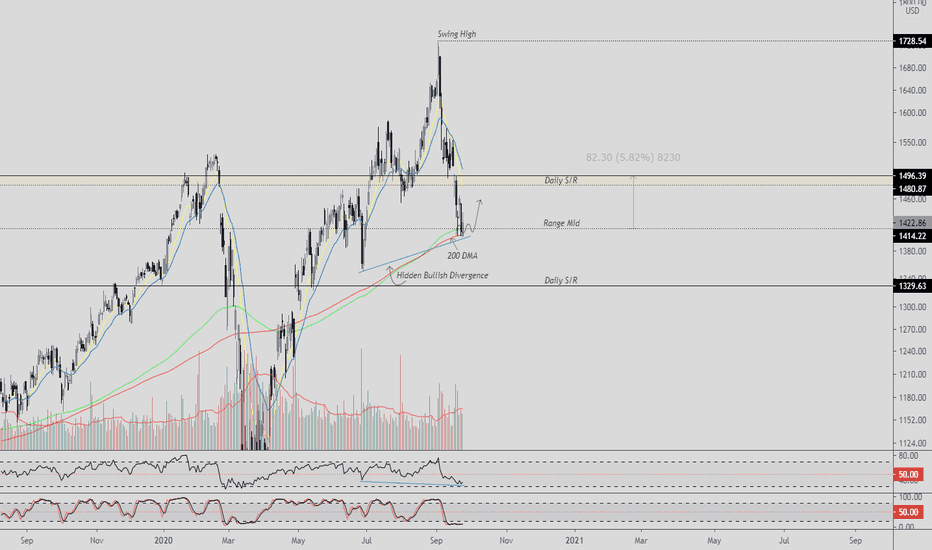

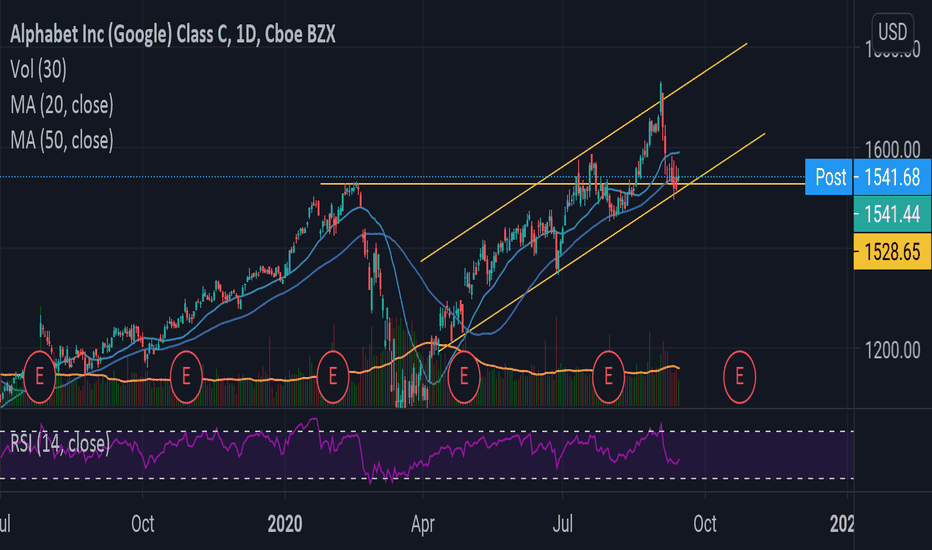

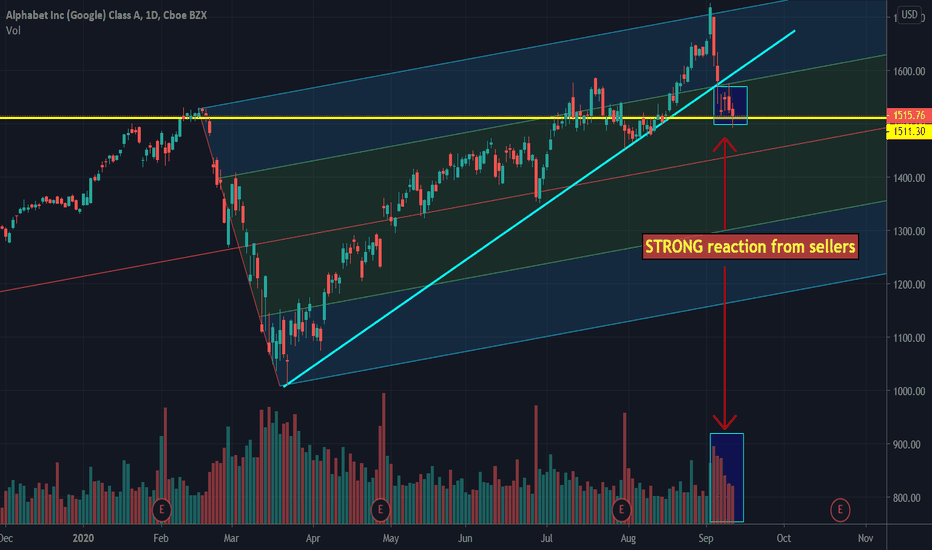

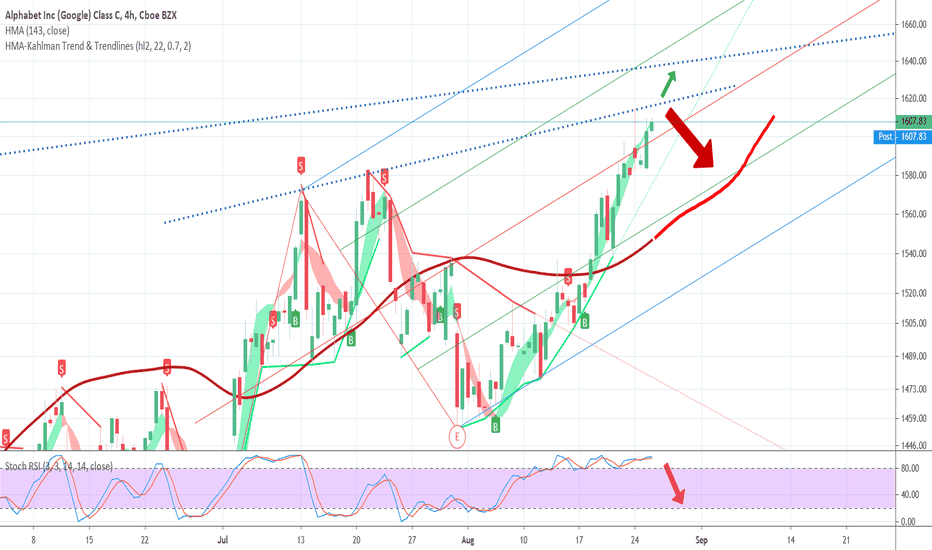

GOOGL Daily S/R|200 MA|Hidden Divergence|Swing High|Price ActionEvening Traders,

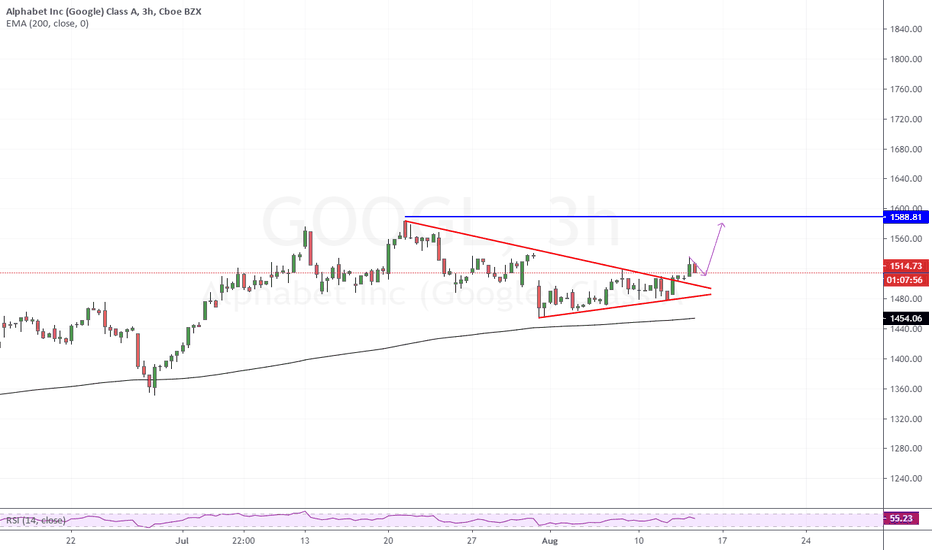

Second analysis – GOOGL – testing key 200DMA where a bounce into Daily S/R is probable,

Points to consider,

- Bearish Price Action

- 200DMA (Support)

- Daily S/R Resistance

- RSI Hidden Bullish Divergence

- Increasing Volume

GOOGL’s immediate Price Action from swing high is bearish where a back test and respect of the Daily S/R will establish a bearish retest.

The current 200DMA is supporting price, this is a technical pivot where a bounce is probable.

The RSI has a valid hidden bullish divergence, indicative of strength and a potential short term reversal.

Current volume profile nodes are increasing; this is expected as price trades at a key technical level.

Overall, in my opinion, GOOGL is a valid short-term long into Daily S/R with defined risk. Price action is to be used upon management/ discretion of trade.

Hope this analysis helps

Thank you for following my work!

And remember,

“Win, loss whatever emerges in the short-term, place and manage your next trades untouched, unattached... always keeping your eyes on the long-term picture.”

― Yvan Byeajee

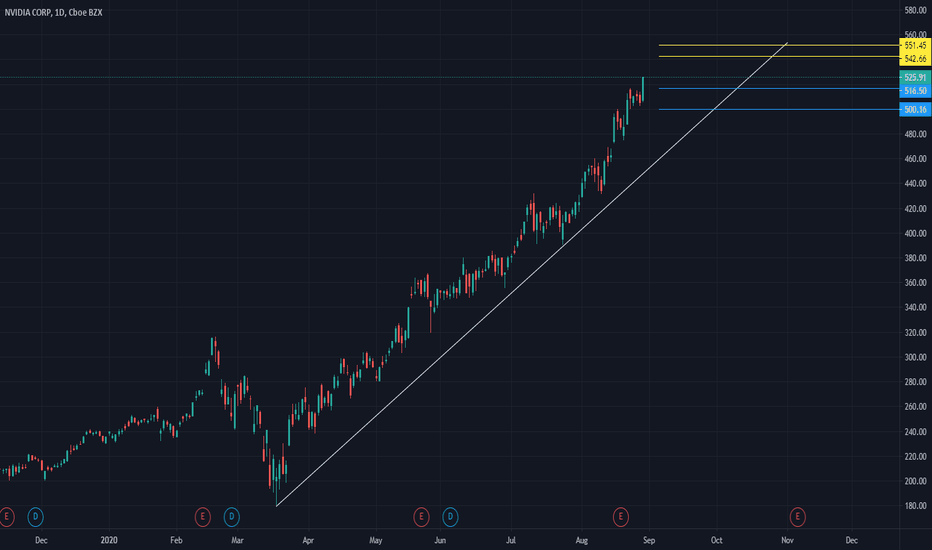

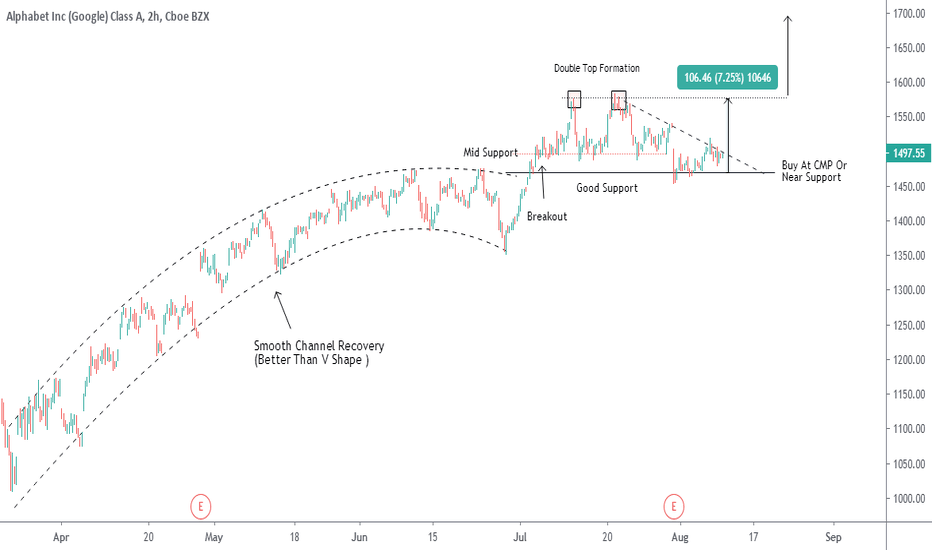

GOOGL

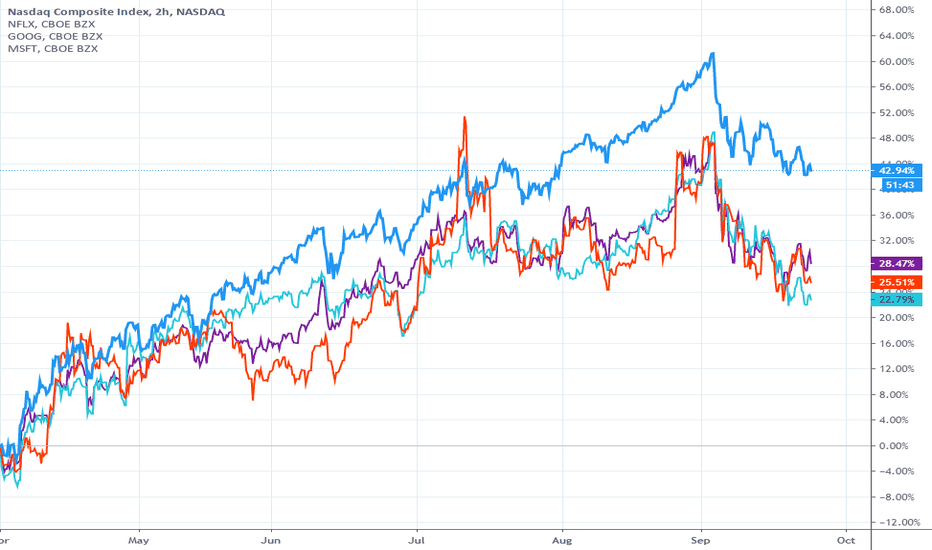

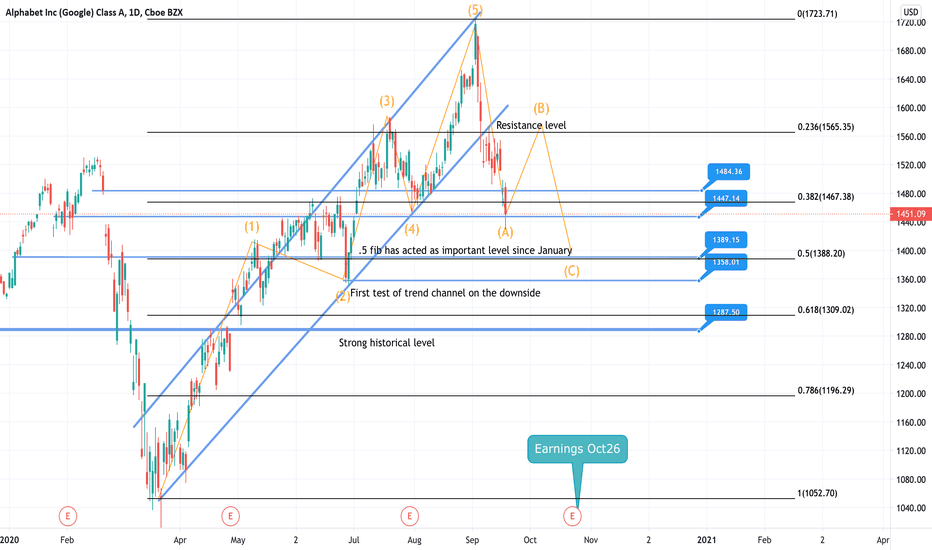

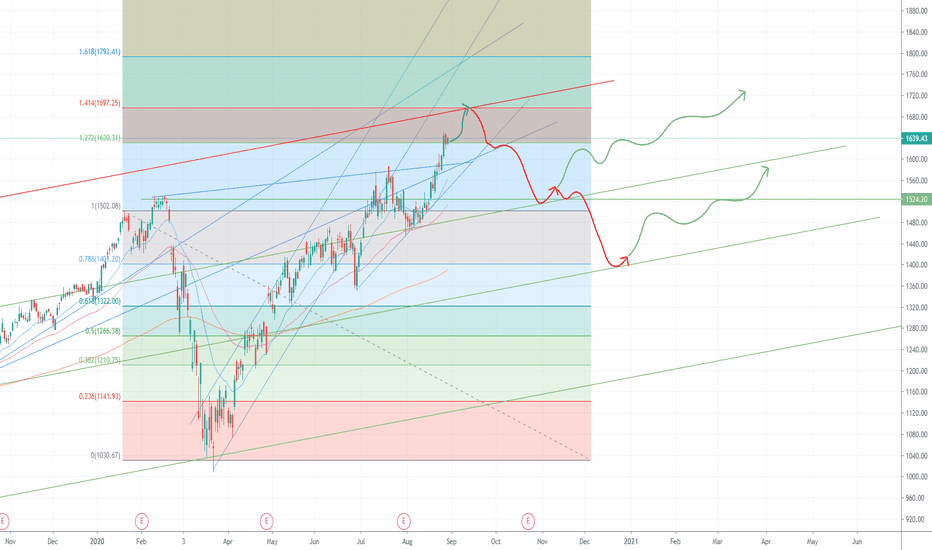

GOOGL Swing TradingNASDAQ:GOOGL has broken its trend channel and seen some major downside. Due to TikTok news and the tech slide GOOGL could possibly rally next week before facing more downside into the week of its earnings. Pictured are Elliots wave and its correction along, the thickest line was taken from the weekly chart and has proven as a key level over the years.

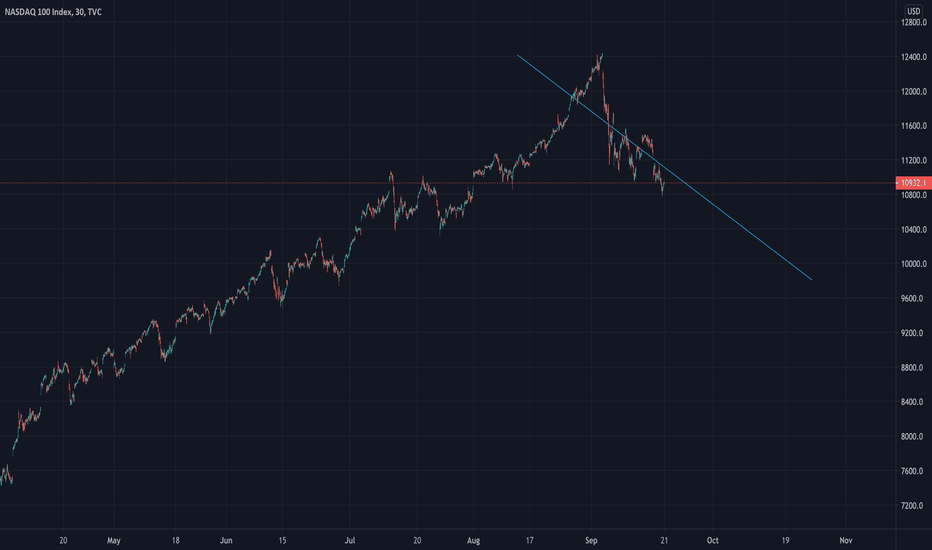

Drop it Like its Hot.GUH.

September Short.

Convergence of Nikkei, Shanghai Composite, NDX.

Quad Witch

Rebalance

Fear

Every Rip is Sold

Big Tech AntiTrust Probes

JPMorgan, Bloomberg Trying to Crash Market.

Fed Pump of 500B of 10/14 will come too late (RIP Powell)

Potential Trade War Tensions

Corona Resurgence

Spain

Max Pain of Options is 280

Linear Regression

Election

martinshkreli.com

the only way we go up is if softbank or some big bank buys a bunch of far OTM calls for cheap to lift markets. and then stonks only go up and then we get free tendies.

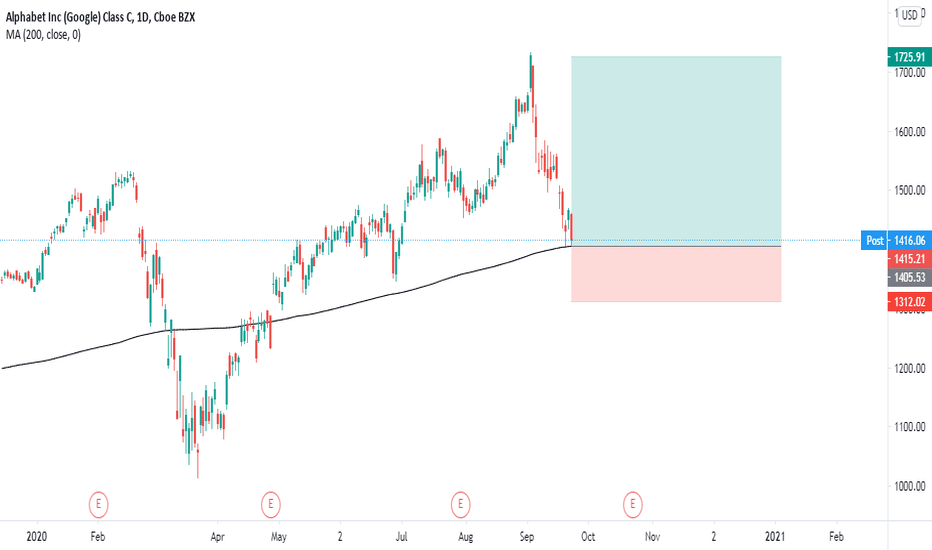

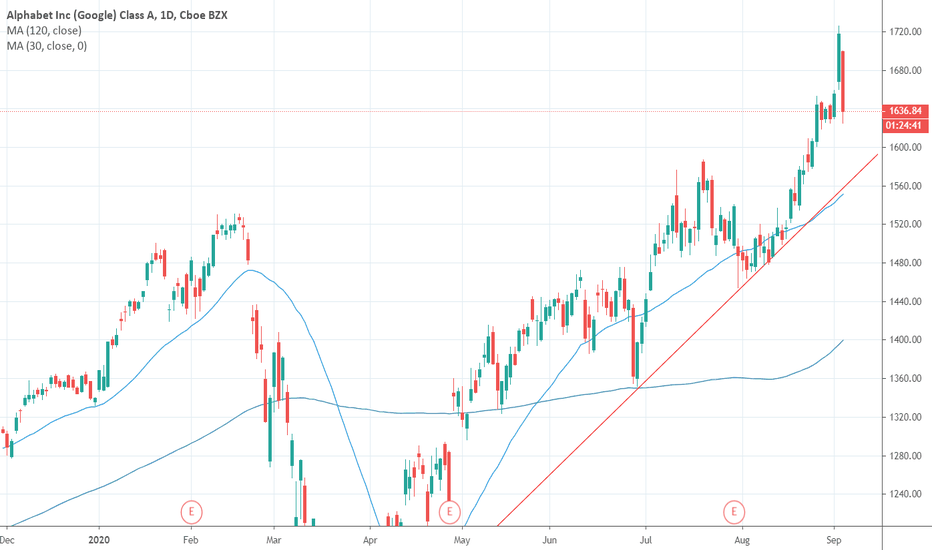

Opening Idea:GOOG facing Difficulties to go higher (explanation)For 4 times, the stock has tested the blue line which was a support and now a resistance, and delivers some bearish signals looking at the upper shadows and the strong volumes.

- For trading: you need to wait for the breaking of the highlighted rectangle, the bearish signals are encouraging to break from below and maybe reach the lower red level of PITCHFORK.

- For investing: I'm still bullish, If you analyze the stock from the beginning of the explosion of prices till now, you will see that the chart is doing an angle of 45° approximately, so it is very difficult to go down, and very risky to go against the trend.

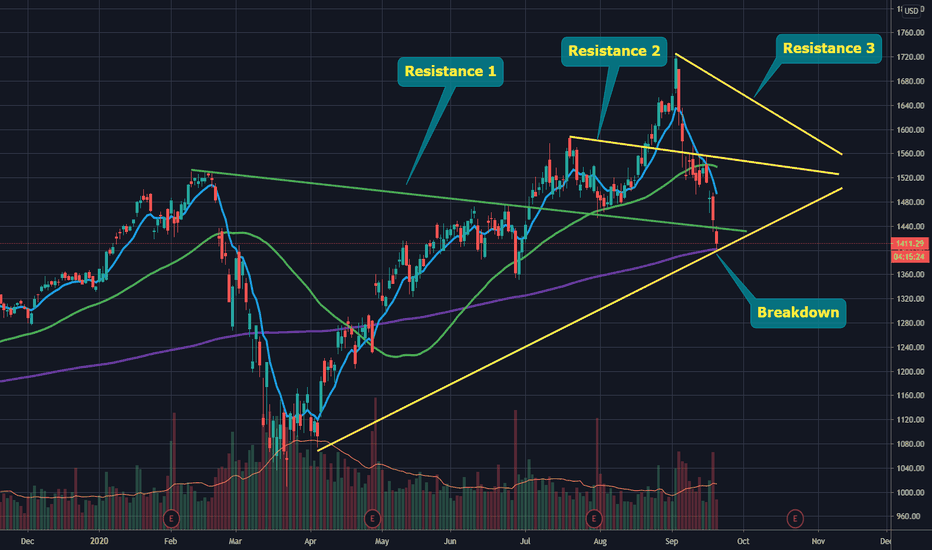

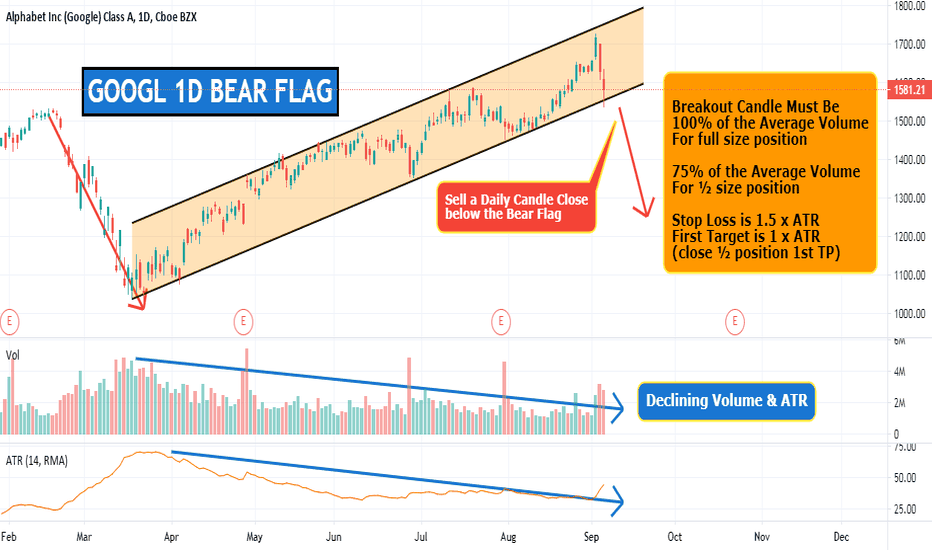

GOOGL 1D BEAR FLAGBear Flags are Ranges that are repeatable trading chart patterns.

Bear Flag chart patterns will have a directional bias depending on the previous incoming trend (short trade).

Each chart pattern will have defining trendlines of the support/resistance levels creating the pattern.

Whatever time frame you are trading this chart pattern, wait for a candle close outside of the trendline in the direction of the breakout candle. (Our time frame preference is the Daily chart).

Add volume indicator - Volume is the amount of $ that went into a particular candle or in Forex the # of trades that took place.

Add ATR indicator - Volatility is the amount of price movement that occurred. Use the ATR to measure the price movement.

When you see descending Volume bars and descending ATR line (which indicates volatility) this shows

a dis-interest in traders to invest in this pair creating consolidation which creates the chart pattern.

Trade Management after there is a breakout candle close.

1 - Position size (compare volume bar to volume ma line).

a - Breakout candle must be 100% of average volume for a full position size.

b - If 75% of average volume then ½ position size. (To find 75% of Volume

look at the charts volume settings – divide smaller # into larger # = 75%+)

2 - Enter two trades.

3 - SL for both trades will be 1.5 x ATR.

4 - 1st trade TP will be 1 x ATR.

5 - No TP on 2nd trade – letting profit run and adjusting SL to follow price.

6 - When 1st TP hit – move 2nd trade SL to breakeven.

7 - Adjust the 2nd trade SL to follow price.

*8 – After Breakout candle – if price closes back into chart pattern close trade

*9 - When breakout candle is more than 1 ATR from breakout candle open.

a - Enter 1st trade at candle close with ½ position size.

b - Enter 2nd trade with a pending limit order that is 1 ATR of breakout candle open.

c – Price should pullback to that pending limit order for 2nd trade.

d – If Price returns back into chart pattern close trade before SL is hit.

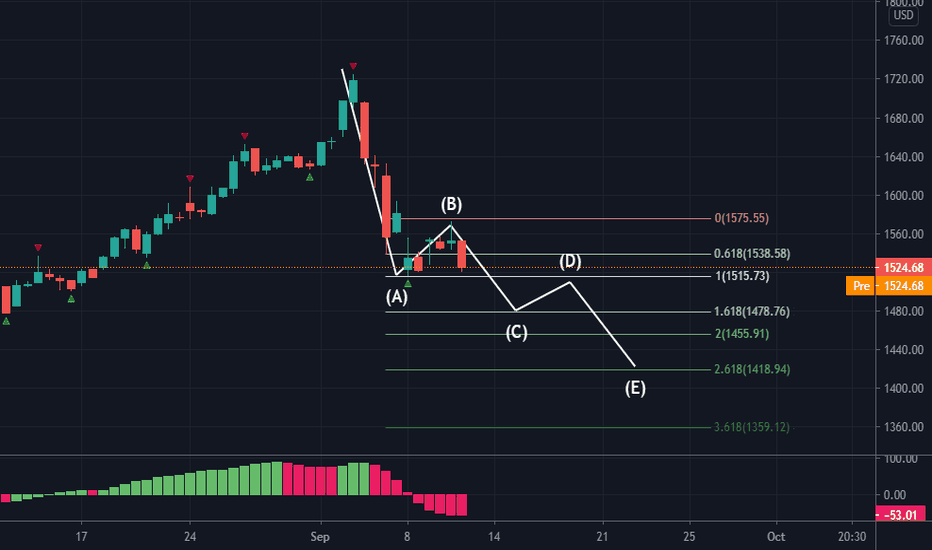

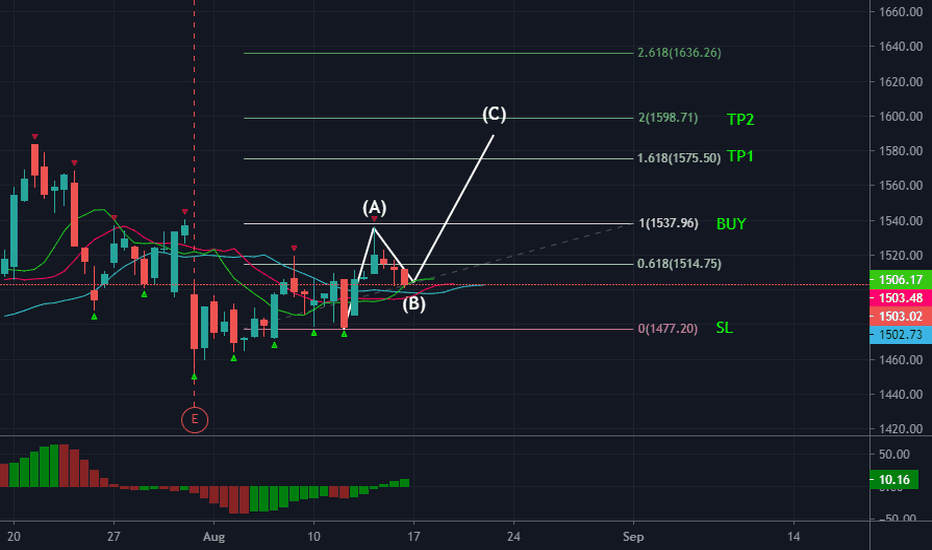

Elliott Wave View: Support Area for Alphabet (GOOGL)Alphabet (GOOGL) 45 minutes chart below shows that the stock has rallied higher from August 10 low. From that low, the stock rallied higher in wave ((iii)), which ended at 1652.79 high. The rally unfolded as a 5 waves impulsive Elliott Wave Structure. Up from wave ((ii)) low, wave (i) ended at 1536.97 high. The dip in wave (ii) ended at 1499 low. The stock then extended higher in wave (iii), which ended at 1608.78 high. Wave (iv) pullback then ended at 1575.04 low. The push higher in wave (v) ended at 1652.79 high. This completed wave ((iii)) in larger degree.

Currently, the stock is doing a pullback in wave ((iv)) to correct the cycle from August 10 low. The structure is unfolding as a double correction. Wave (w) ended at 1618.81 low. The bounce in wave (x) ended at 1647.79 high. Wave (y) lower is in progress. The 100-161.8% extension of wave (w)-(x) where (y) can potentially end is at 1592.53 – 1613.70 area, highlighted with a blue box. If reached, that area can produce 3 waves bounce at least or the stock can resume higher in wave ((v)). The 100% extension from June 29 low, where wave ((v)) could target is at 1689.

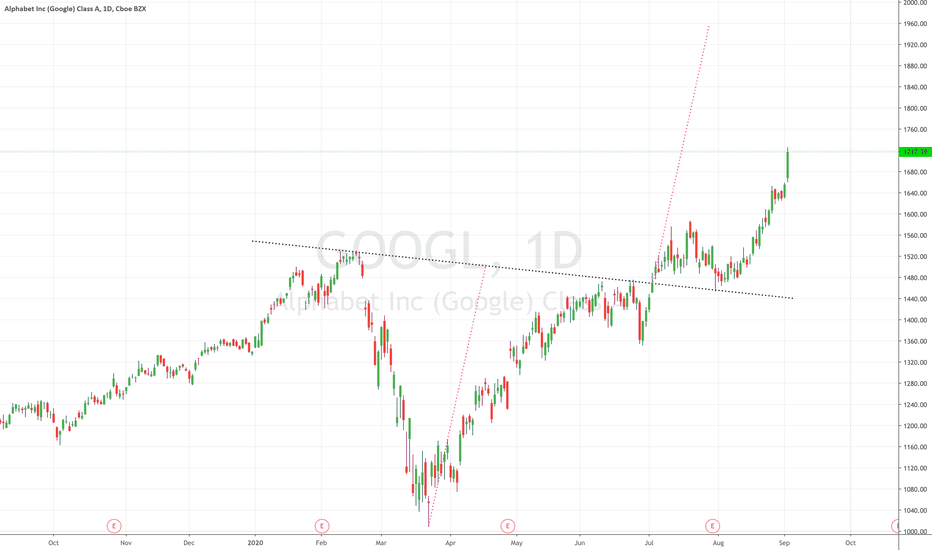

GOOGL SMACKED AT $1700GOOGL has a major yearly trend line resistance that coincidentally hits @~$1700. Following historical trends, google should fail and retest the bottom yearly support trend line. Depending on what happens with the election google could once again fail that line and head to the next support line. $1500 will be retested at some point.

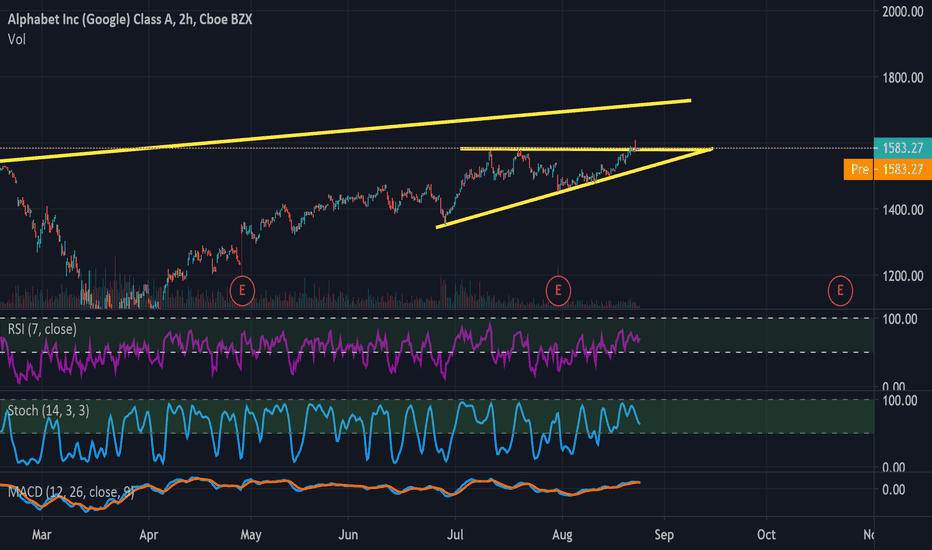

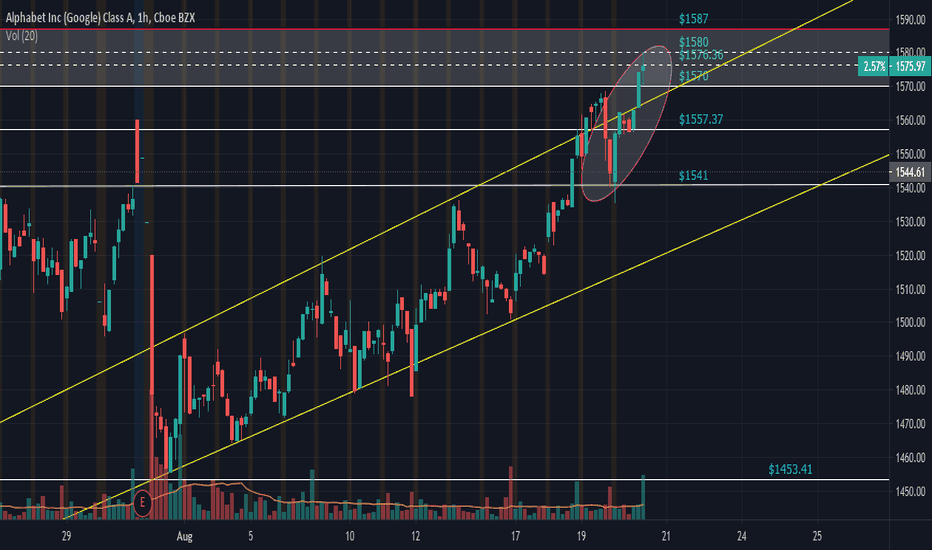

GOOGL - 7.17% Profit Potential - Ascending TriangleAscending Triangle and new support confirmed multiple times in the past 3 days.

Target price set at new historical resistance line bounce.

- Historical Uptrend

- RSI and STOCH above 50

- MACD above Signal

Suggested Entry $1592.45

Suggested Stop Loss $1560.3

Target price $1710.71

Note that I tend to adjust stop losses in order to secure profits early and preserve capital. This means that the target price is going to be achieved as long as there are no strong pullbacks that trigger my new adjusted stop loss.