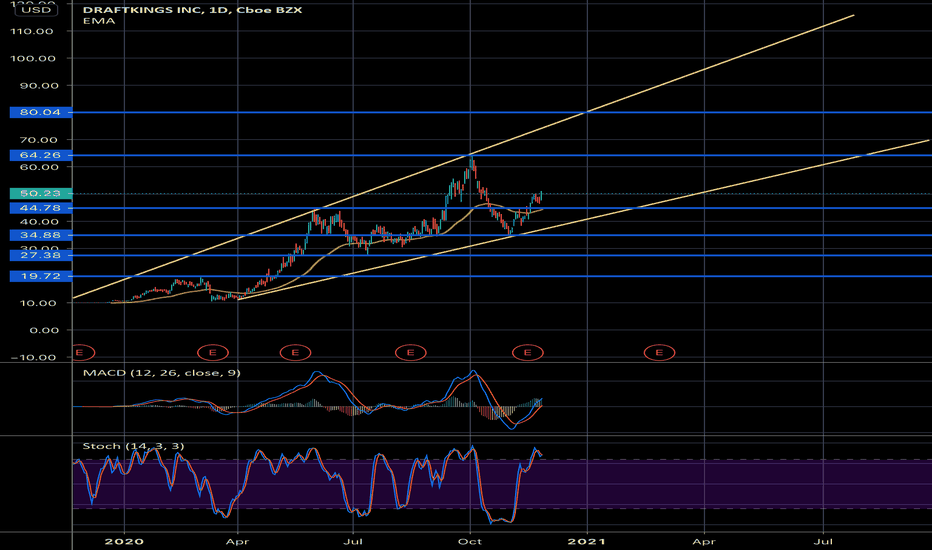

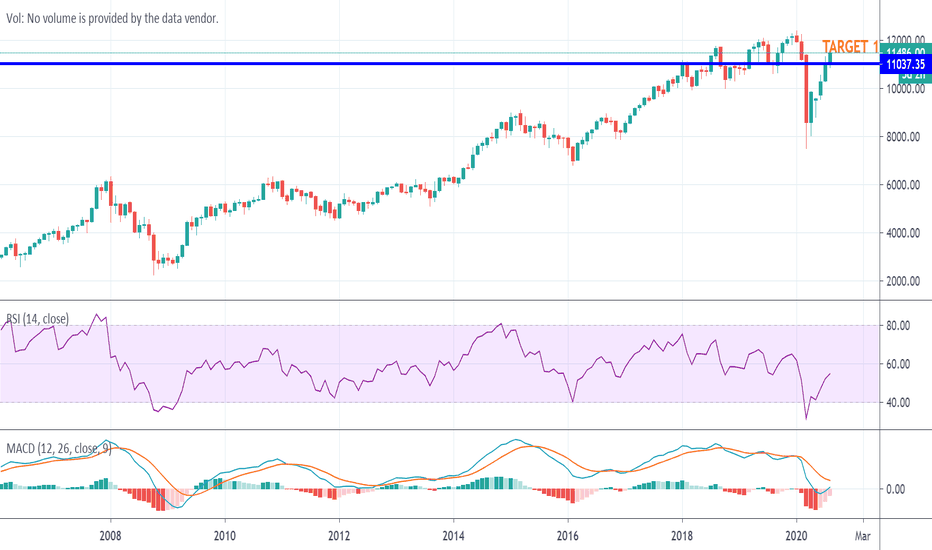

NASDAQ : DKNGHello everyone.

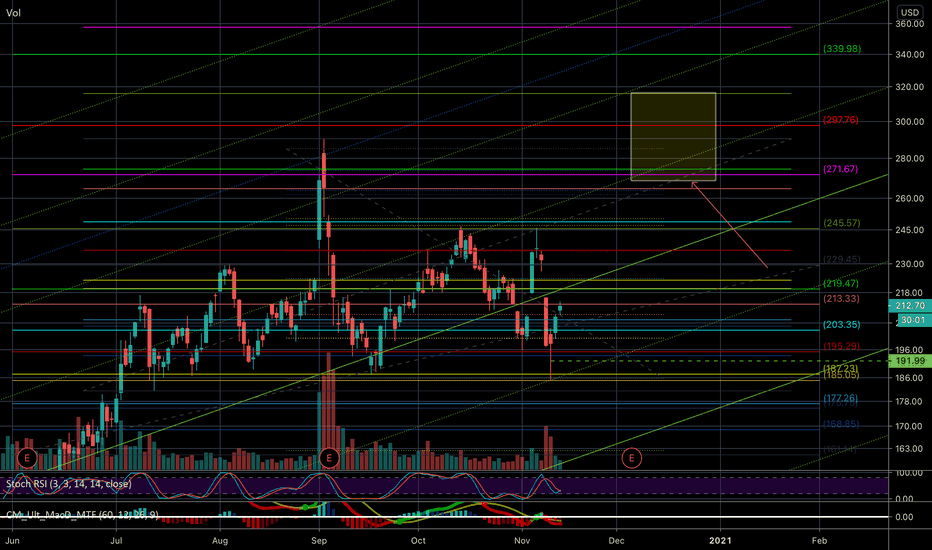

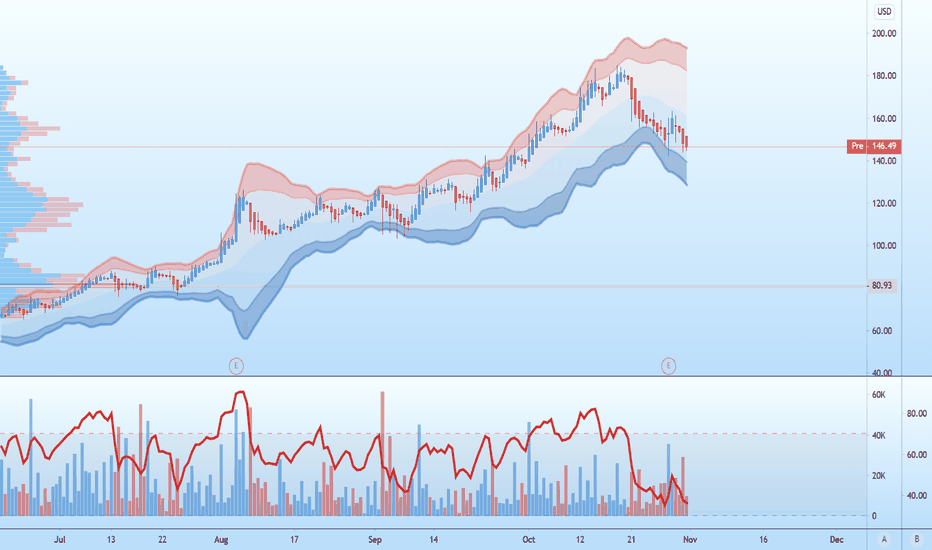

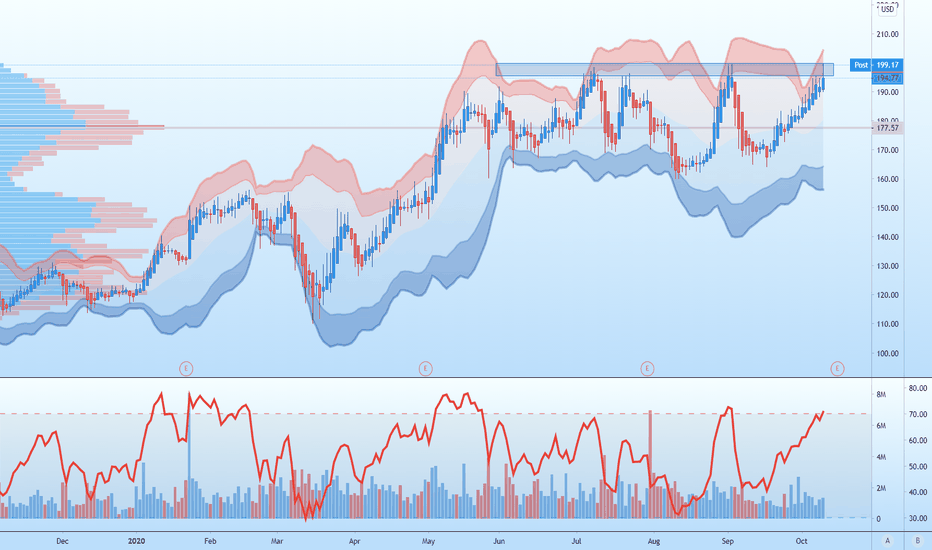

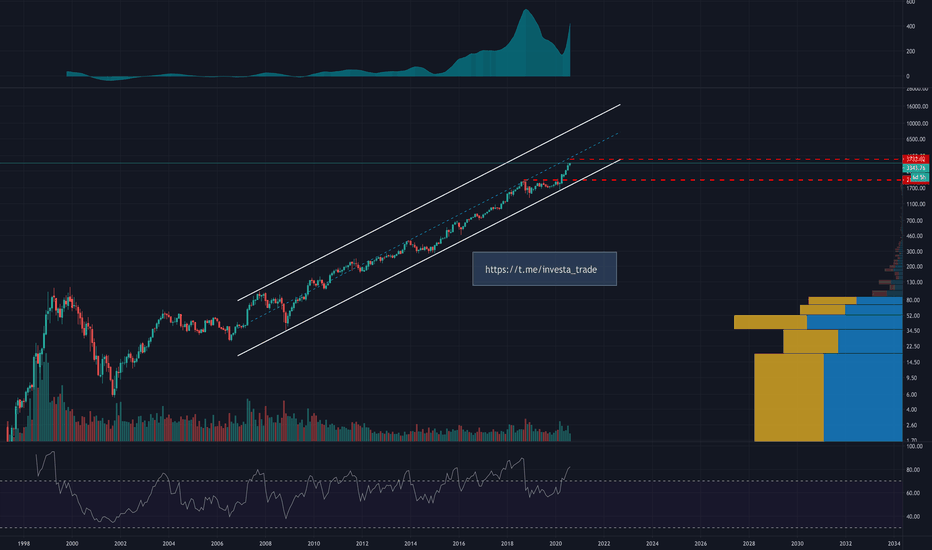

NASDAQ: DKNG daily chart support and resistance levels present. Clear uptrend given the growing interest in online gambling and bets. Sports and venues are coming back and Draftkings being an industry leader is well positioned to grow.

Timeframe: mid-term.

If you like the idea and find it helpful please hit that like button.

Happy trading everyone.

Growth-stocks

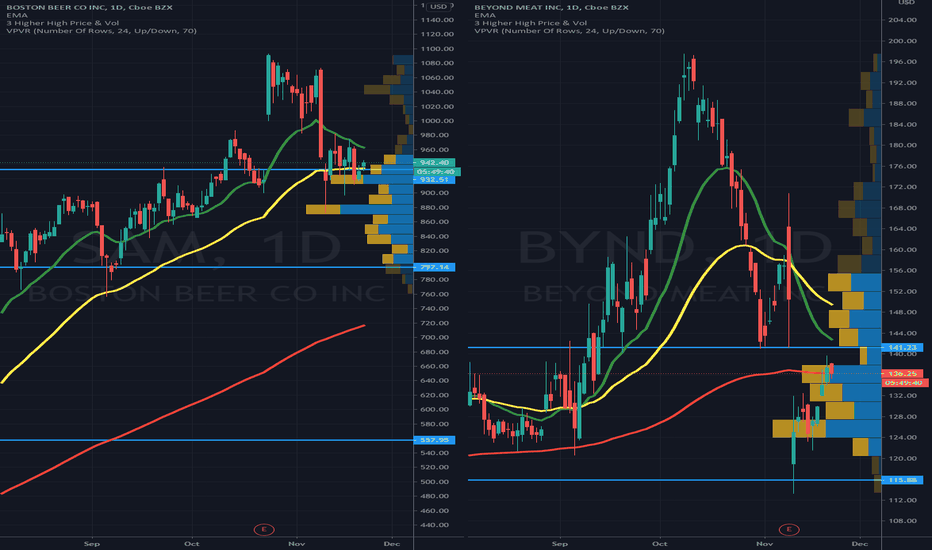

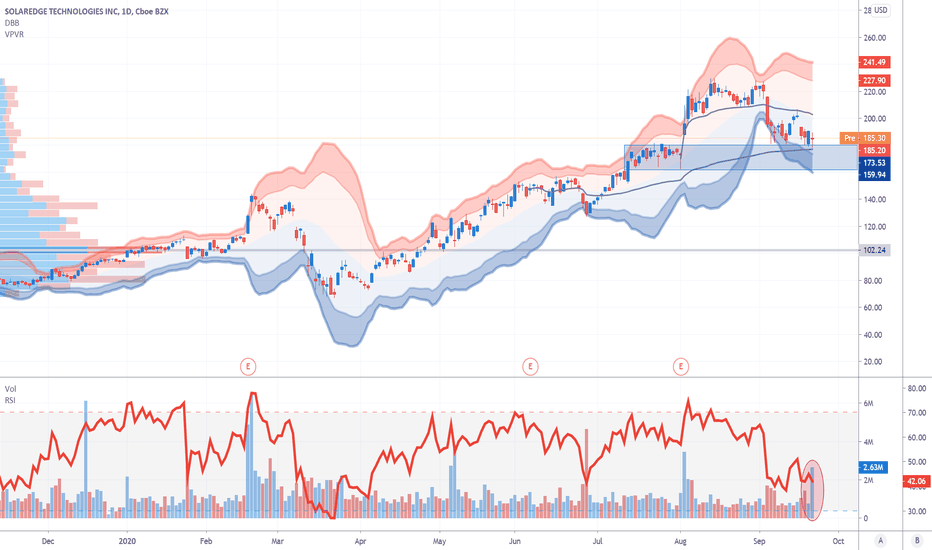

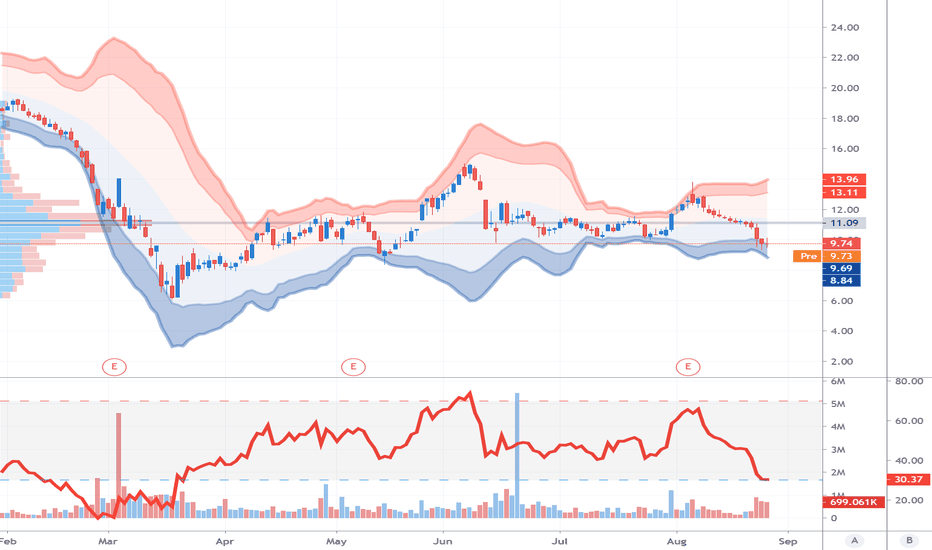

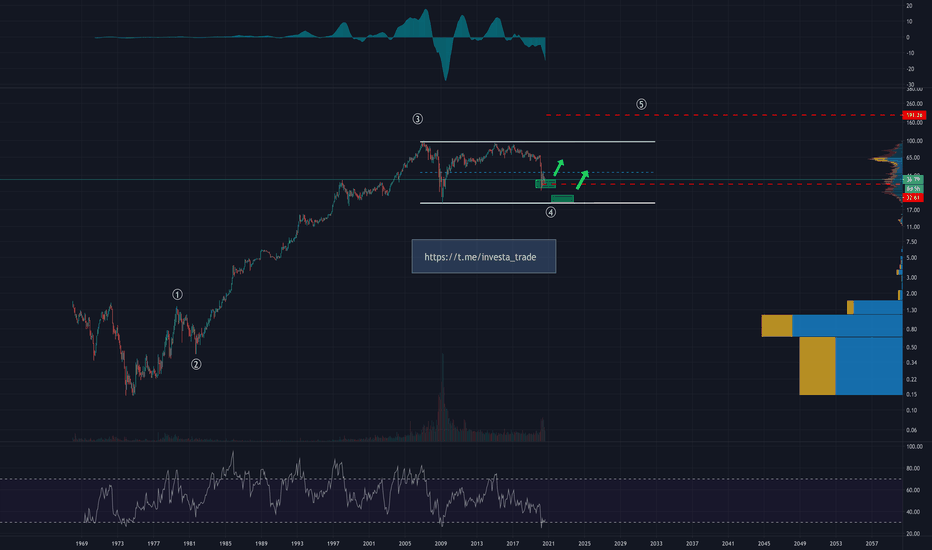

TWO NON-TECH GROWTH STOCK TO WATCH (FUNDAMENTALS) $BYND $SAM Welcome to another idea by Jose Najarro Stocks, don't forget to check the signature to learn more about me.

Make sure to follow for more content! Today I am looking at two stocks outside the tech growth market, seeing insane revenue growth or expecting strong growth shortly. This thread will be a quick read with some information on their fundamentals.

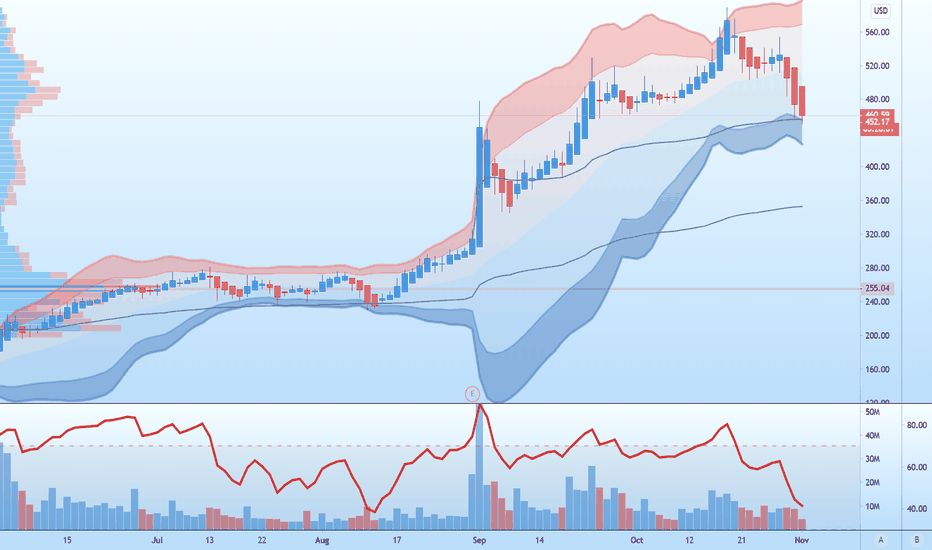

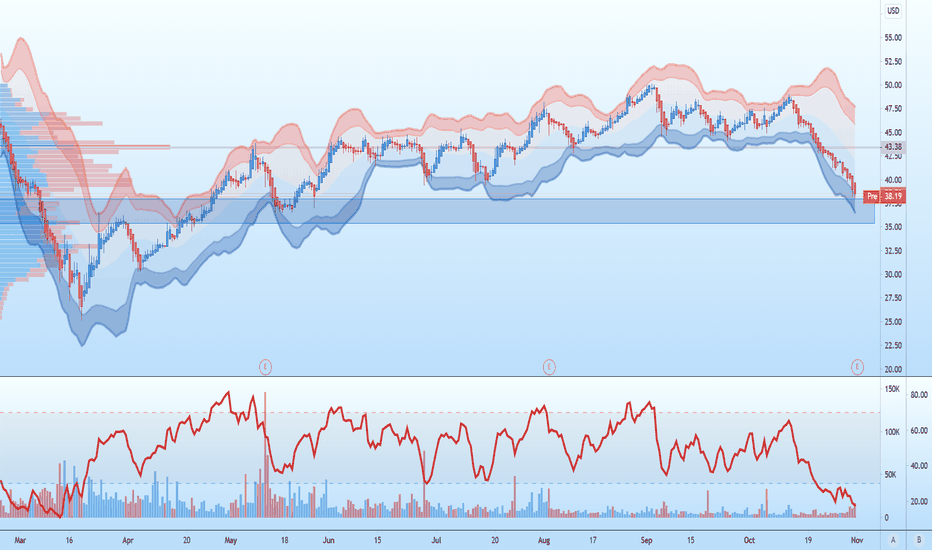

The first stock is $SAM

Market Cap ~$11.4B

YTD ~151%

Currently ~14% Down from ATH

Business: sells alcoholic beverages primarily in the United States. Samuel Adams Boston Lager. It offers various beers, hard ciders, and hard seltzers under the Samuel Adams, Twisted Tea, Truly Hard Seltzer, Angry Orchard, Dogfish Head, Angel City, Coney Island, Concrete Beach, Wild Leaf, and Tura brand names. Main costumers are wholesalers (domestic & international) who then sell to others.

Recent Earnings Q3 Non-Gaap EPS $6.10 | Gaap EPS $6.51 (Profitable)!

Revenue: 492.8M Up 30% Y/Y

Currently positive CFO and positive Earnings with analyst expectations to continue to grow as the years' progress.

Revenue growth is expected to be 28.5% annually on average for the next 3-5 years. I consider anything with an annual average growth of 15% to be high growth, so this is a hyper-growth!!

Very Strong Balance sheet, no debt, and plenty of cash!

I am more of a long-term investor, so technicals aren't much of a focus. Two things I check 1) The stock price is not over-extended from its moving averages 2) Currently at levels with strong volume with the stock price.

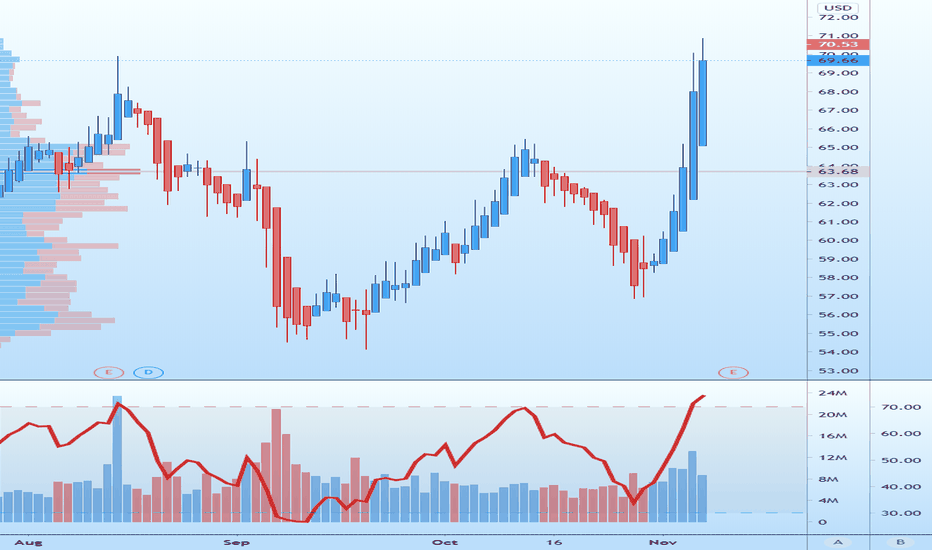

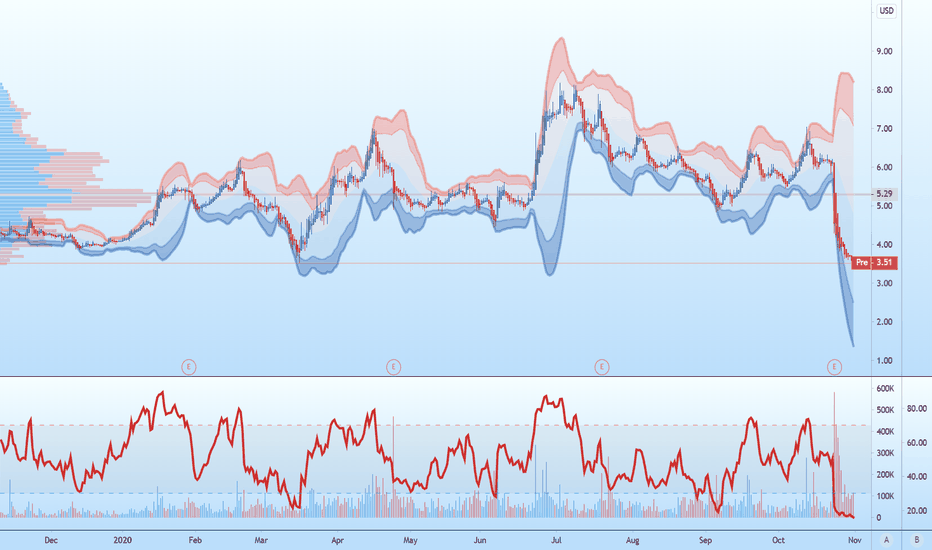

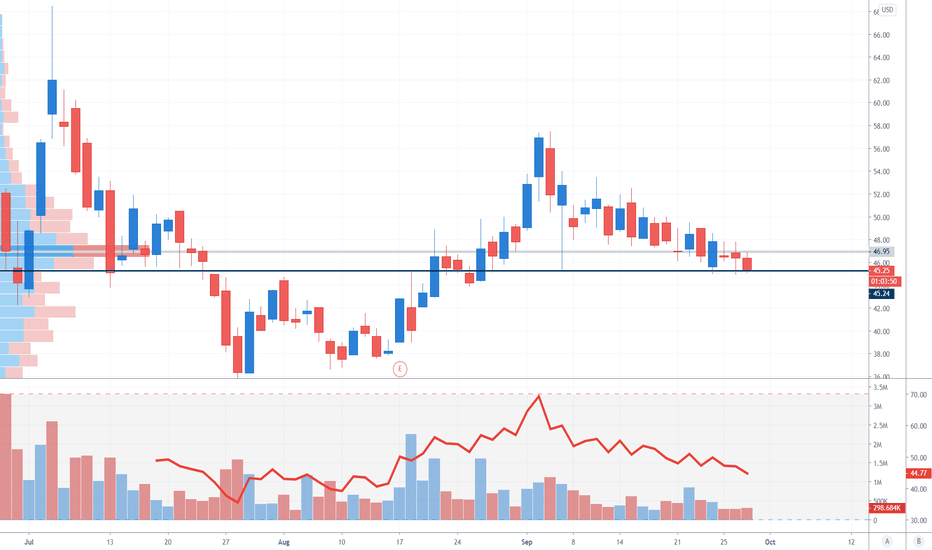

The second stock is $BYND

Market Cap ~$8.6B

YTD ~82%

Currently ~29% Down from ATH

Business: Beyond Meat, Inc., a food company, manufactures, markets, and sells plant-based meat products in the United States and internationally. Brands under the Beyond Meat, Beyond Burger, Beyond Beef, Beyond Sausage, Beyond Breakfast Sausage, Beyond Chicken, Beyond Fried Chicken, Beyond Meatball. The company sells its products through grocery, mass merchandiser, club and convenience store, natural retailer channels, direct to consumer, restaurants, food service outlets, and schools.

Recent Earnings Q3 Non-Gaap EPS $-0.28 | Gaap EPS $-0.31 (Not Profitable)

Revenue: 94.44M Up 2.7% Y/Y (Impressive that they saw growth even though pandemic has hit the restaurant business, most likely due to all new deals + expansion)

Currently negative CFO and Earnings with analyst expectations to continue and be positive by the end of 2021.

Revenue growth is expected to be 32.0% annually on average for the next 3-5 years. I consider anything with an annual average growth of 15% to be high growth, so this is a hyper-growth even bigger than $SAM!!

Very Strong Balance sheet, $50m debt, and $214m in cash, This is important since they are profitable or have +CFO, so they need to have strong cash.!

I am more of a long-term investor, so technicals aren't much of a focus. Two things I check 1) The stock price is not over-extended from its moving averages 2) Currently at levels with strong volume with the stock price after the huge pull-down.

Disclaimer: All content provided in any of my Social channels/videos/posts/podcasts and any other communications are only for entertainment/educational purposes. Talk to a financial adviser before making any decision

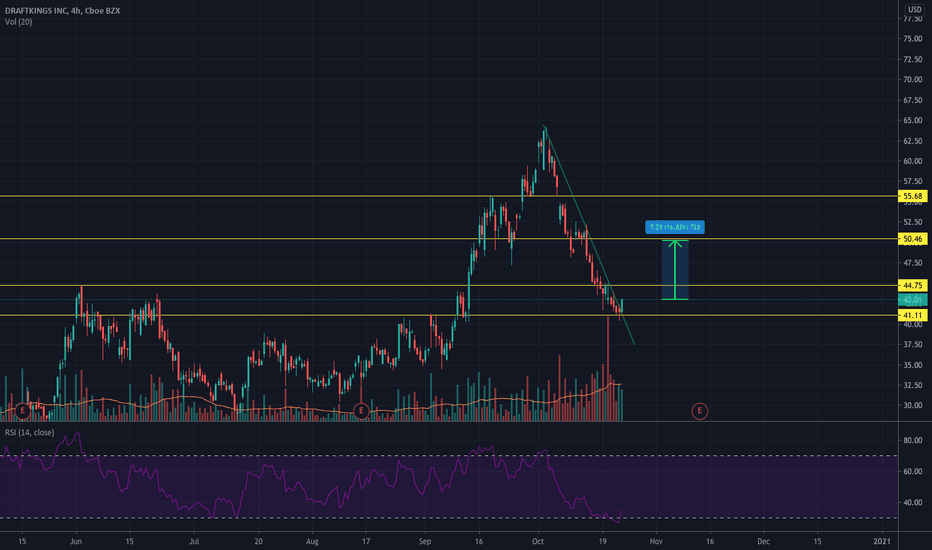

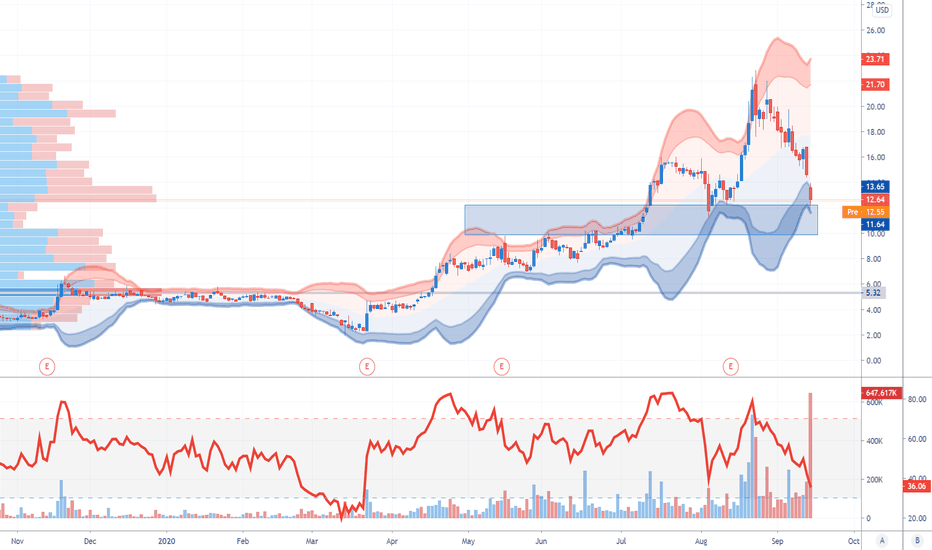

Betting on Draftkings : Oversold+signs of recovery $DKNGFA,

- Market cap : 16BN. Global TAM : 70BN

- Top rated app(4.8/5)

- Currently in 7 states(12% of US population). 19 states with mobile legislation while ,majority are still being considered

- iGaming CAGR New Jersey (2014-2018)- 25%

- Products : Daily fantasy sports, Sportsbook,iGaming.

- Building a great brand.

-Personalized experience

-History of track record = More data.

- Michael Jordan as special advisor. GOAT

- Habits picked up from Covid lockdown

TA,

- RSI oversold. 36. Rising up

- Closed above downtrend on 4H

- Short interest 23%

Entry: 43

PT1:50.5

SL: 40.2 (6.5% max loss)

Short term Swing

Risks,

- High volume during pullback

- Hasn't closed above downtrend on daily

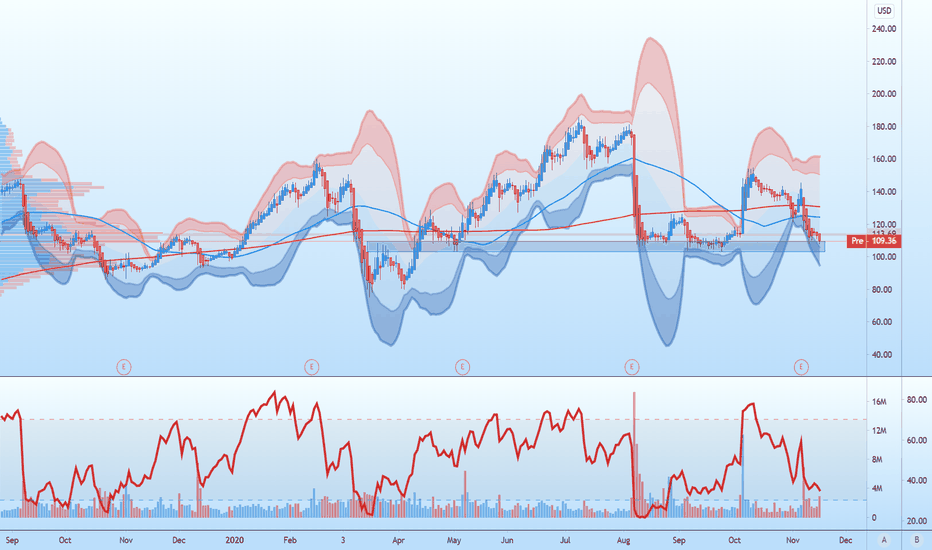

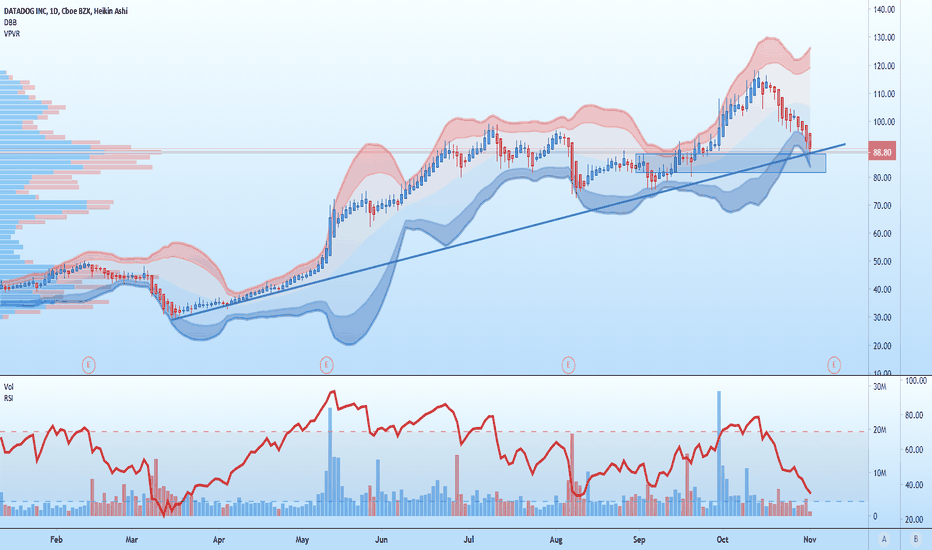

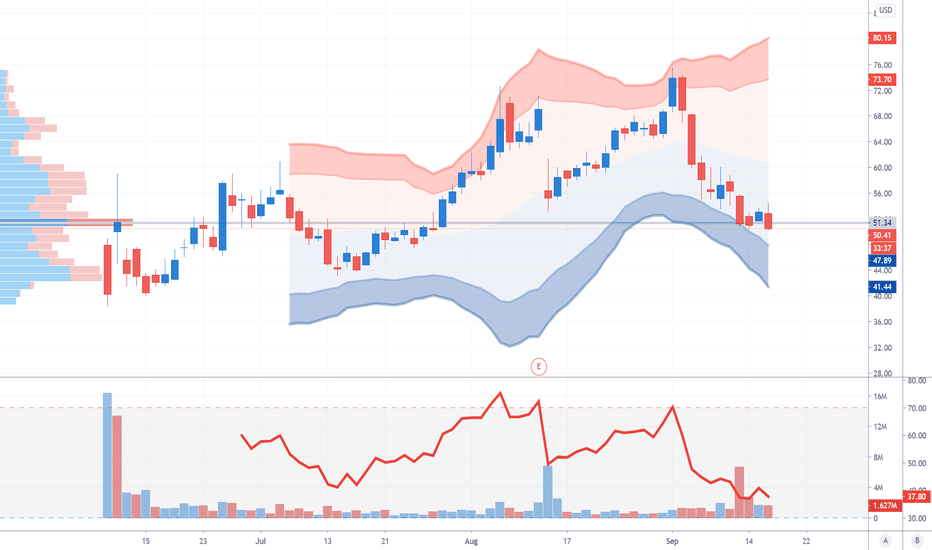

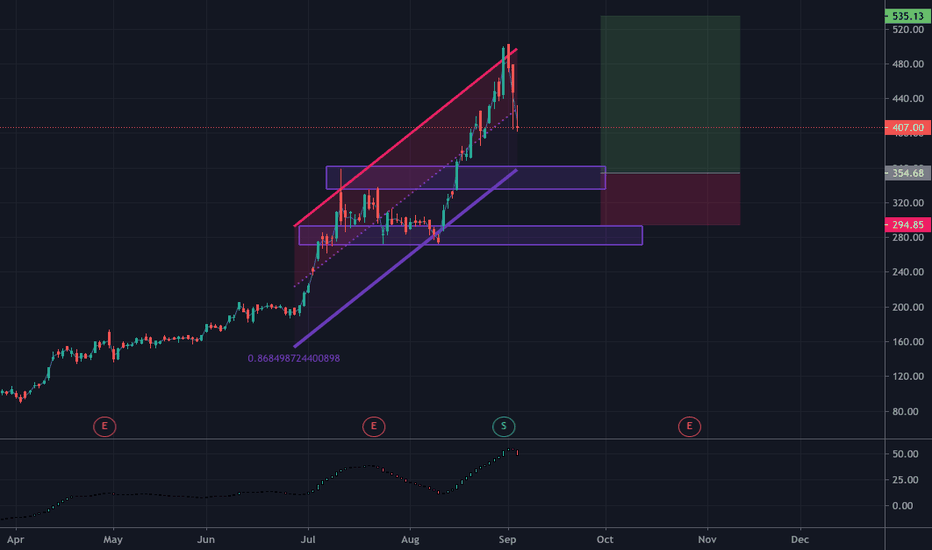

Tesla Down Whats Your Next Play?Tesla's taken a great hit today, as shares were sold off at wicked speeds. Time can only tell for the best possible entry, but I have my eye on $360-$375 based on the previous resistance from July. Any entry at this point is a little premature and I'd rather jump on the train when it slows down rather than get hit.

STOCK-PICKING-BY-SECTOR-PERFORMANCEContinuing the series of stock selection:

Last time i shared the idea to select stocks by indices :

Now, this time i am attaching the screenshot of sectorial performance on different time frames.

It gives us clear idea , where momentum is bullish right now.

If we combine these 2 results , it further narrow down the search for quality shares.

LOOK..ANALYSE..PICK..ENJOY :)

PLEASE LET ME KNOW YOUR THOUGHTS IN COMMENT SECTION.