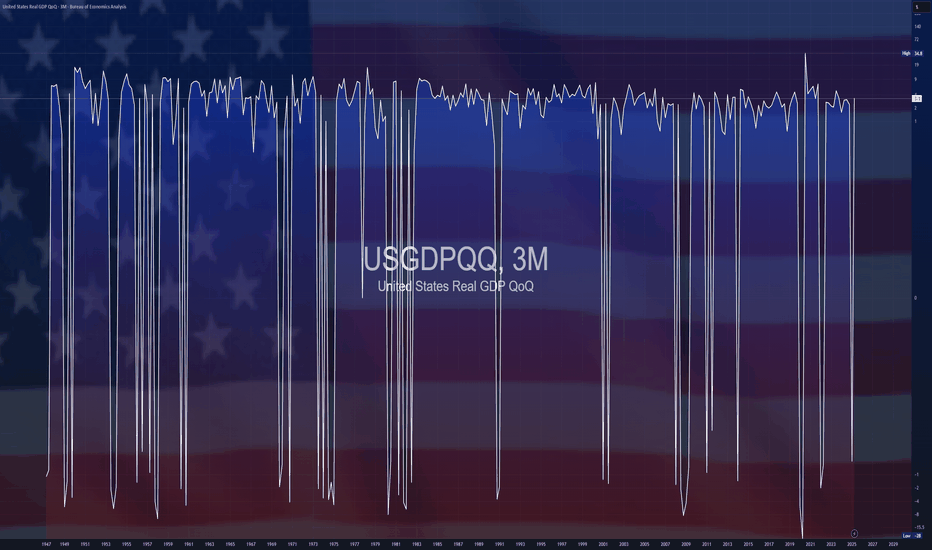

$USGDPQQ -U.S GDP Growth Revised HigherECONOMICS:USGDPQQ

Q2/2025

source: U.S. Bureau of Economic Analysis

- United States GDP grew at a 3.3% annual rate in Q2/2025,

rebounding from a 0.5% drop in Q1, according to second estimates.

The upgrade from the initial estimate of 3% reflects upward revisions to investment and consumer spending that were partly offset by a downward revision to government spending and an upward revision to imports.

Growthdomesticproducts

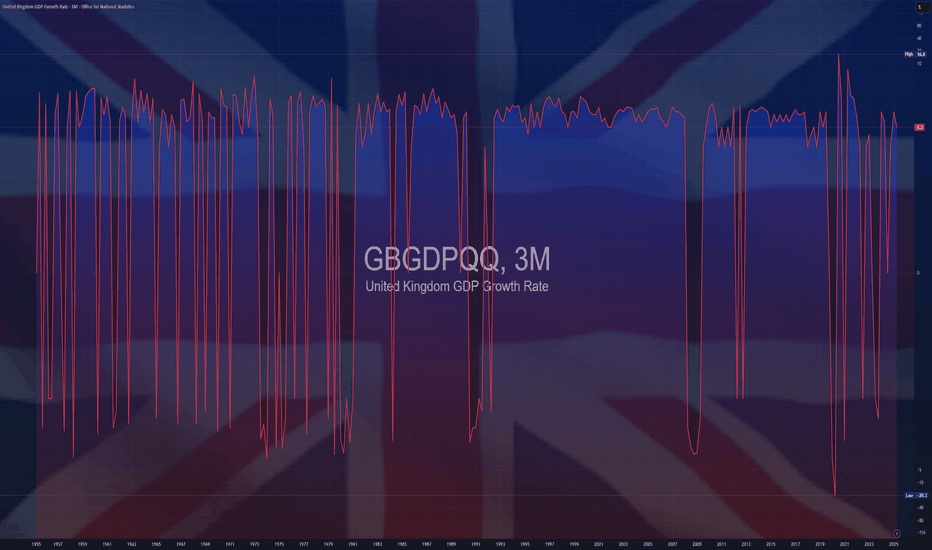

GBGDPQQ -Great Britain GDP (Q2/2025)ECONOMICS:GBGDPQQ

Q2/2025

source: Office for National Statistics

- The British economy grew 0.3% qoq in Q2 2025, slowing from a 0.7% expansion in Q1 but surpassing forecasts of just 0.1%, according to preliminary estimates.

The moderation partly reflects activity being brought forward to February and March ahead of April’s stamp duty changes and the announcement of new US tariffs.

In Q2, growth was fuelled by a 0.4% rise in services, led by computer programming and consultancy (+4.1%).

Construction climbed 1.2%, while production fell 0.3% due to utilities (-6.8%) and mining (-0.3%), partly offset by a 0.3% increase in manufacturing.

On the expenditure side, growth was driven mainly by a 1.2% rise in government consumption, particularly in health (vaccinations) and public administration and defence.

Gross capital formation increased on the back of higher changes in valuables, inventories, and alignment adjustments, but business investment slumped 4%.

Household spending rose a modest 0.1% and exports increased 1.6%, outpacing the 1.4% rise in imports.

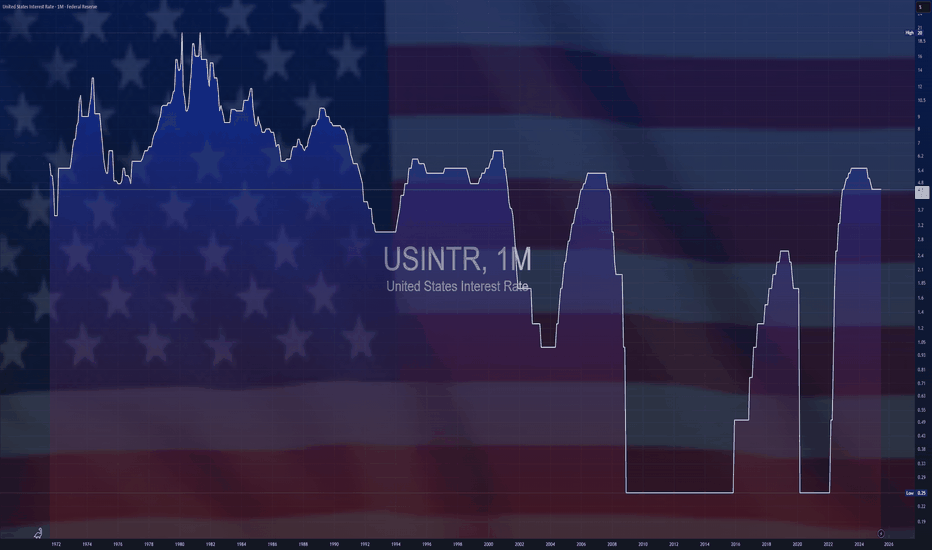

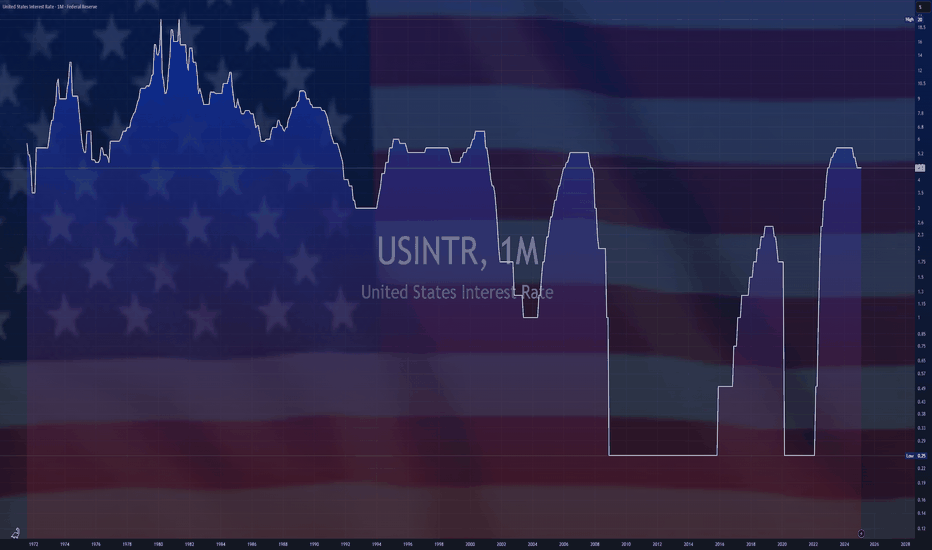

$USINTR -Feds Leaves Rates Steady (July/2025)ECONOMICS:USINTR

July/2025

source: Federal Reserve

- The Federal Reserve held rates steady at 4.25%–4.50% for a fifth straight meeting, defying President Trump’s demands for cuts even after positive GDP growth .

Still, two governors dissented in favor of a cut—the first such dual dissent since 1993.

Policymakers observed that, fluctuations in net exports continue to influence the data, and recent indicators point to a moderation in economic activity during the first half of the year.

The unemployment rate remains low, while Inflation somewhat elevated.

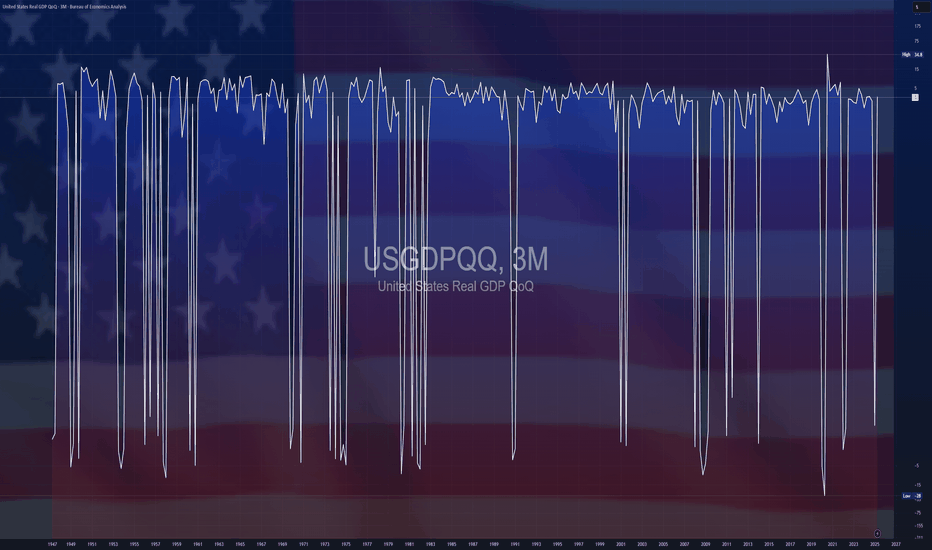

$USGDPQQ -U.S Economic Growth Outpaces Forecasts (Q2/2025)ECONOMICS:USGDPQQ 3%

Q2/2025

source: U.S. Bureau of Economic Analysis

- The US economy grew at an annualized rate of 3% in Q2 2025,

sharply rebounding from a 0.5% contraction in Q1 and exceeding market expectations of 2.4% growth, largely driven by a decline in imports and a solid increase in consumer spending.

However, the gains were partly offset by weaker investment and lower exports.

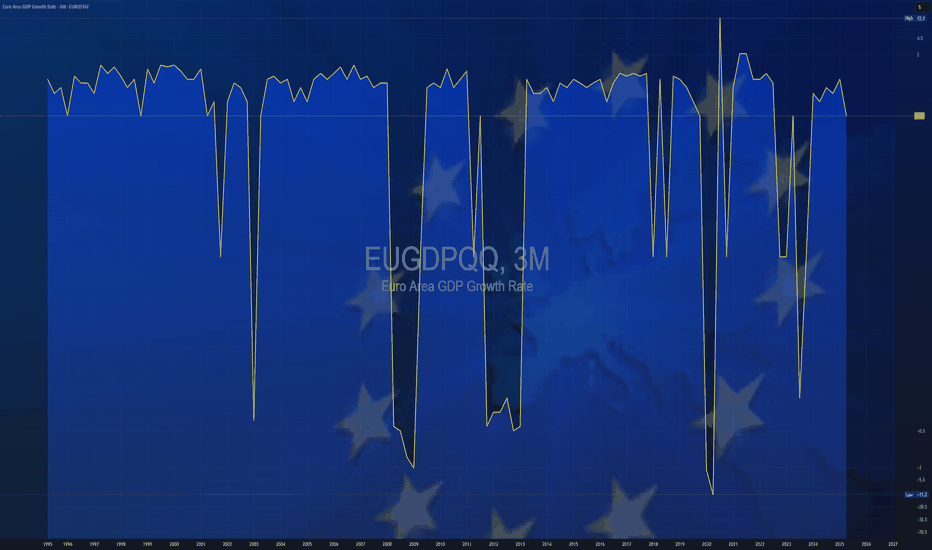

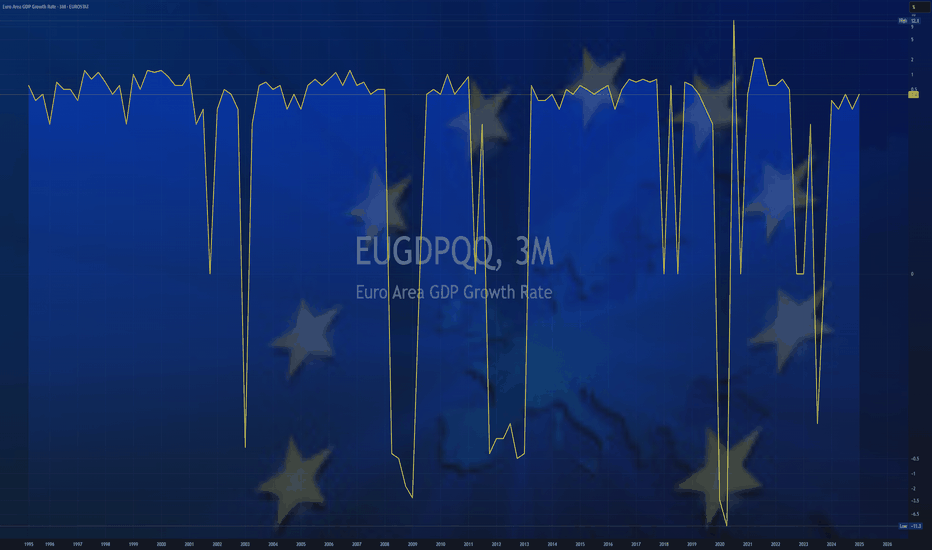

$EUGDPQQ -Europe GDP (Q2/2025)ECONOMICS:EUGDPQQ

Q2/2025

source : EUROSTAT

- The Gross Domestic Product (GDP) In the Euro-Area expanded 0.10 percent in the second quarter of 2025 over the previous quarter.

GDP Growth Rate in the Euro Area averaged 0.37 percent from 1995 until 2025, reaching an all time high of 11.60 percent in the third quarter of 2020 and a record low of -11.10 percent in the second quarter of 2020.

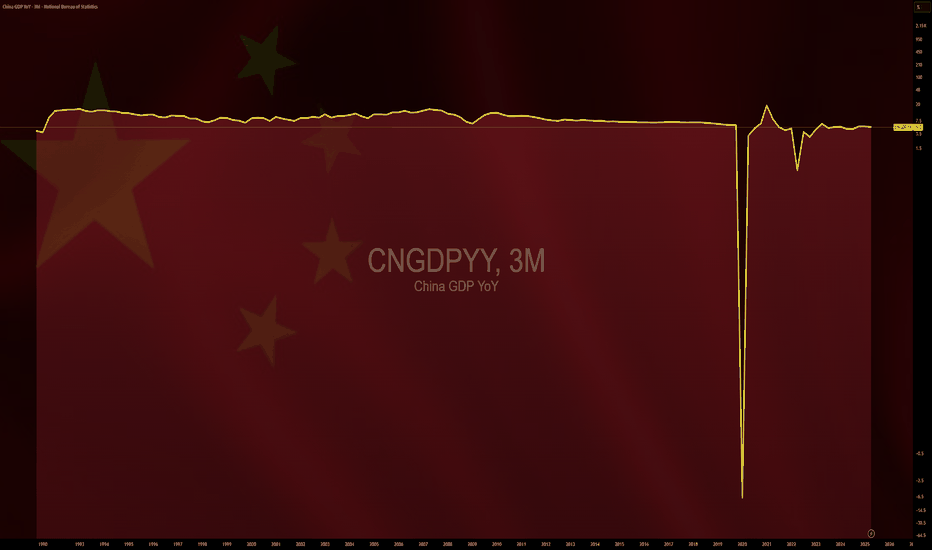

$CNGDPYY -China GDP Growth Slows Less Than Expected (Q2/2025)ECONOMICS:CNGDPYY

Q2/2025

source: National Bureau of Statistics of China

- China’s economy expanded 5.2% yoy in Q2 2025, easing from 5.4% in the prior two quarters and marking the softest pace since Q3 2024.

Still, the latest reading narrowly beat estimates of 5.1%, supported in part by Beijing’s policy measures amid a fragile trade truce.

Growth momentum in H2 is projected to weaken further, due to headwinds from trade tensions, deflation risks, and a prolonged property slump.

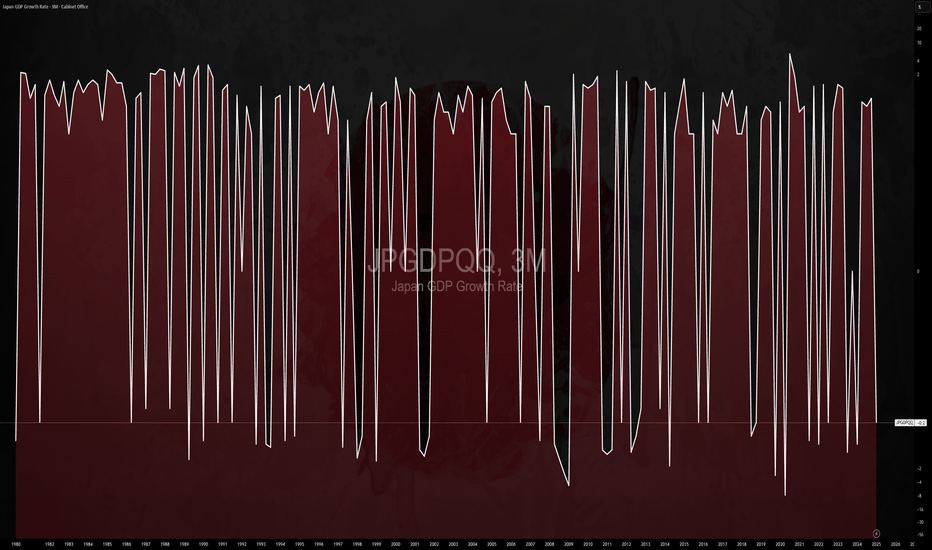

$JPGDBQQ -Japan's GDP Shrinks More than Expected (Q1/2025)$JPGDBQQ

Q1/2025

source: Cabinet Office, Japan

- Japan's GDP shrank 0.2% qoq in Q1 of 2025, compared with forecasts of a 0.1% fall and after a 0.6% growth in Q4, flash data showed.

It was the first GDP contraction in a year, amid worries over the impact of US trade policy under President Donald Trump.

On an annualized basis, the economy contracted 0.7%, worse than consensus of a 0.2% drop and a reversal from an upwardly revised 2.4% gain in Q4.

$USINTR -Fed Keeps Rates Unchanged (May/2025)ECONOMICS:USINTR

May/2025

source: Federal Reserve

- The Federal Reserve kept the funds rate at 4.25%–4.50% range for a third consecutive meeting as officials adopt a wait-and-see approach amid concerns about the effects of President Trump’s tariffs.

Policymakers noted that uncertainty about the economic outlook has increased further and that the risks of higher unemployment and higher inflation have risen.

$USGDPQQ -U.S Economy Unexpectedly Contracts in Q1/2025ECONOMICS:USGDPQQ

Q1/2025

source: U.S. Bureau of Economic Analysis

-U.S economy shrank 0.3% in Q1 2025, the first contraction since Q1 2022,

versus 2.4% growth in Q4 and expectations of 0.3% expansion, as rising trade tensions weighed on the economy.

Net exports cut nearly 5 percentage points from GDP as imports jumped over 40%. Consumer spending rose just 1.8%,

the weakest since mid-2023, while federal government outlays fell 5.1%, the most since Q1 2022.