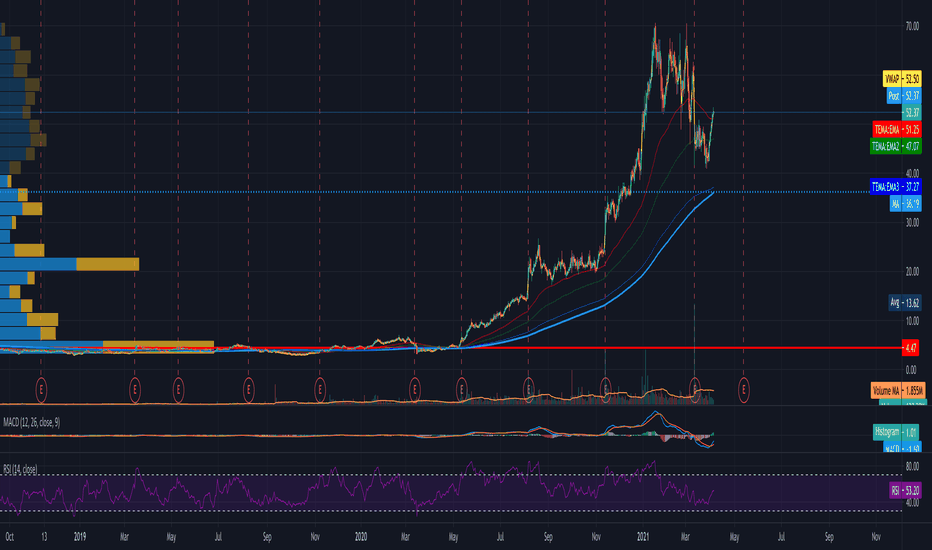

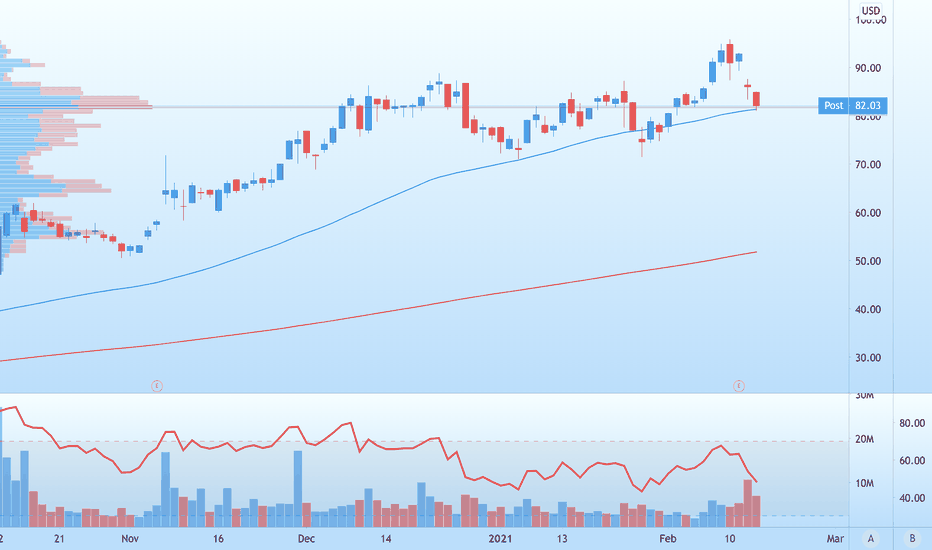

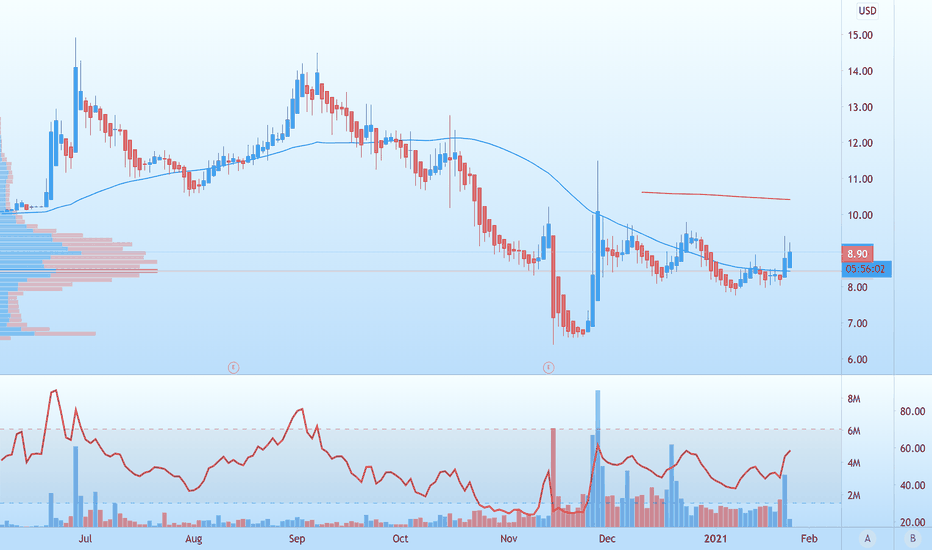

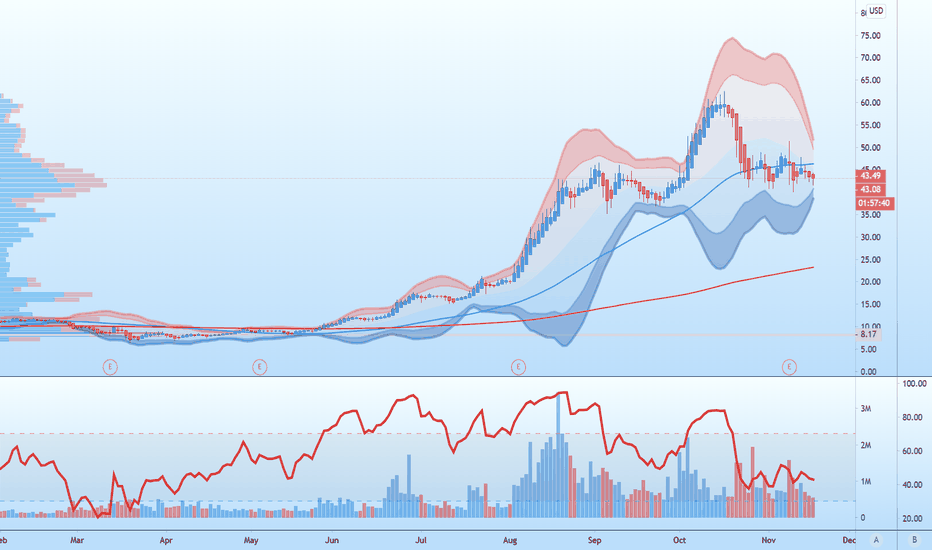

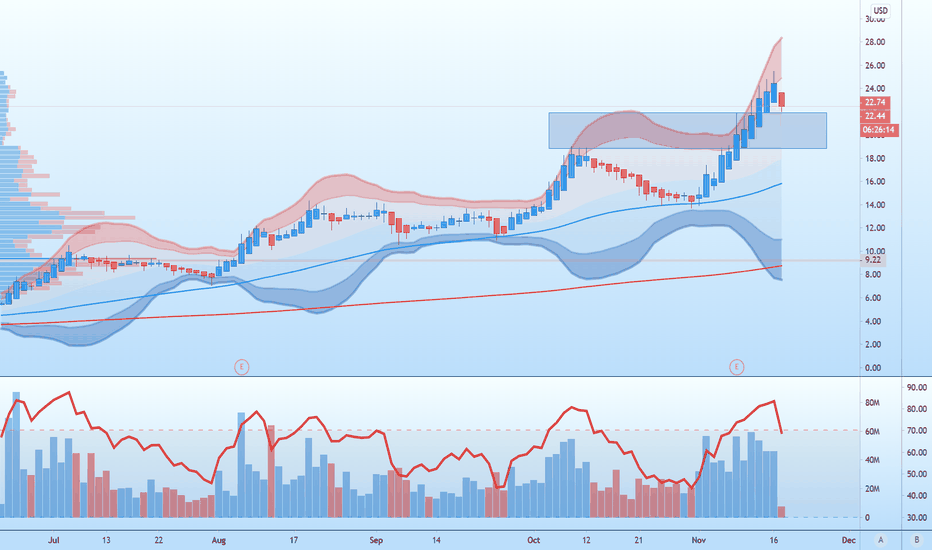

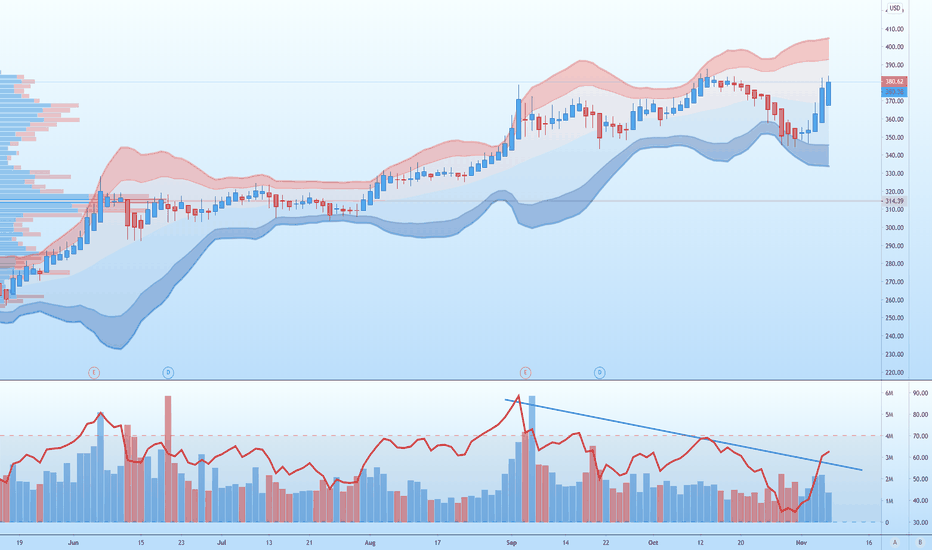

Waiting for $CELH to skyrocketI like the way $CELH is looking right now!!

After dipping on earnings report, where expectation were too high, the company is bouncing back.

IMO the selloff was due to a few factors coming together:

- Broader market selle off and repositioning,

- increase in 10 years treasury yield,

- inflation pressure

From a stock prospective, $CELH had some issue with inventory management, in the sense that they could not bring enough products on shelves or stores. This was due, not for a problem with distribution, but the way that the company sells to stores. Because they do not keep inventories, after the demand surged, there were no product available..

On the plus side, I believe that if the company can fix this temporary problem, is well position for the future. I like $CELH especially because is a mix of growth and re-opening stock.

From the technical side, MACD just turned positive and RSI is trading in the mid range. I will be waiting for volume to kick in before adding in a meaningful way.

However, for transparency, today I entered a small position of 1000 shares and look to increase in the weeks ahead on any pullback or on any positive news.

As usual, do your own DD

Happy hunting!

Growthstock

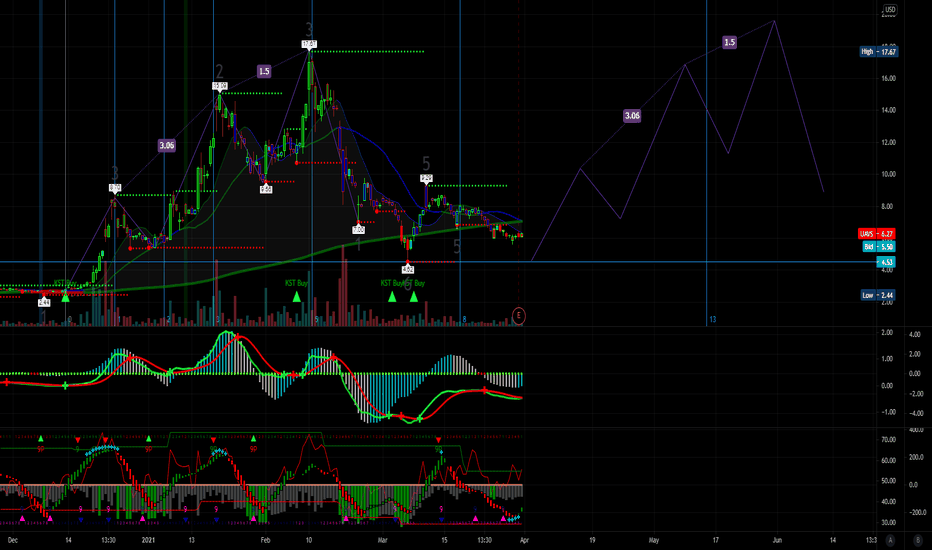

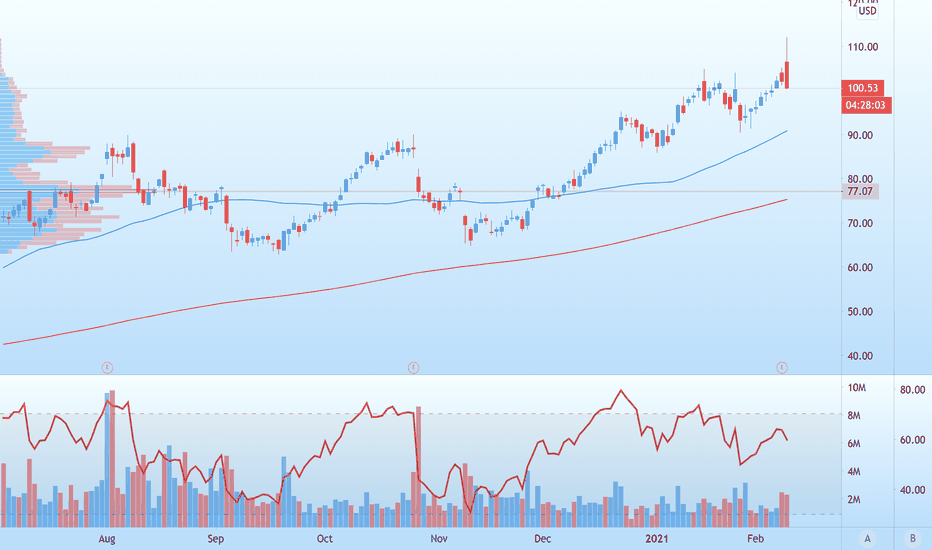

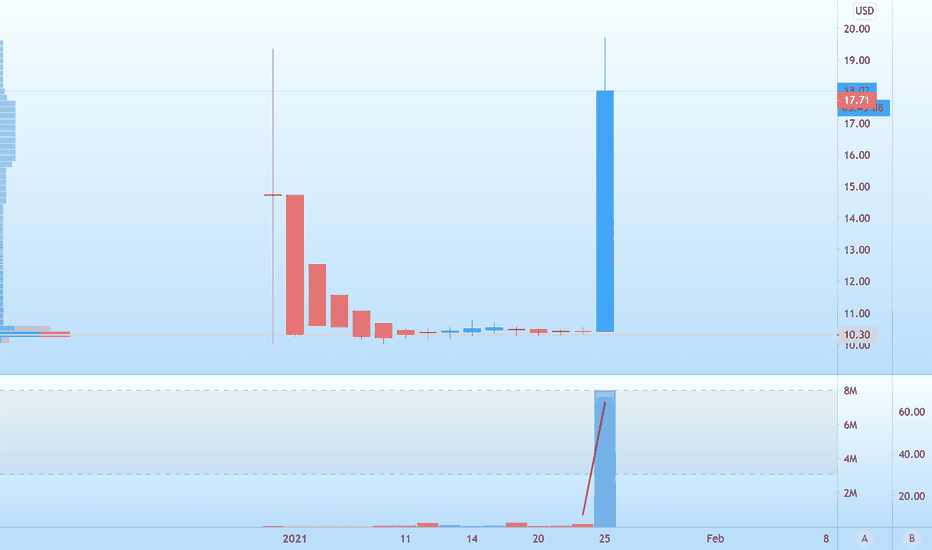

$UAVS AgEagle Aerial Systems, Inc. designs, develops, produces, distributes, and supports unmanned aerial vehicles for the precision agriculture industry in the United States and internationally. It offers FarmLens, a subscription based cloud analytics service that processes data collected with a drone for use by farmers and agronomists; HempOverview, a software-as-a-solution web- and map-based technology platform to support the operations of domestic industrial hemp programs for state and tribal nation departments of agriculture, growers, and processors; and ParkView, a proprietary aerial imagery and data analytics platform for assessing and supporting sustainability initiatives involving municipal, state, and federal public parks and recreation areas. The company was founded in 2010 and is headquartered in Wichita, Kansas.

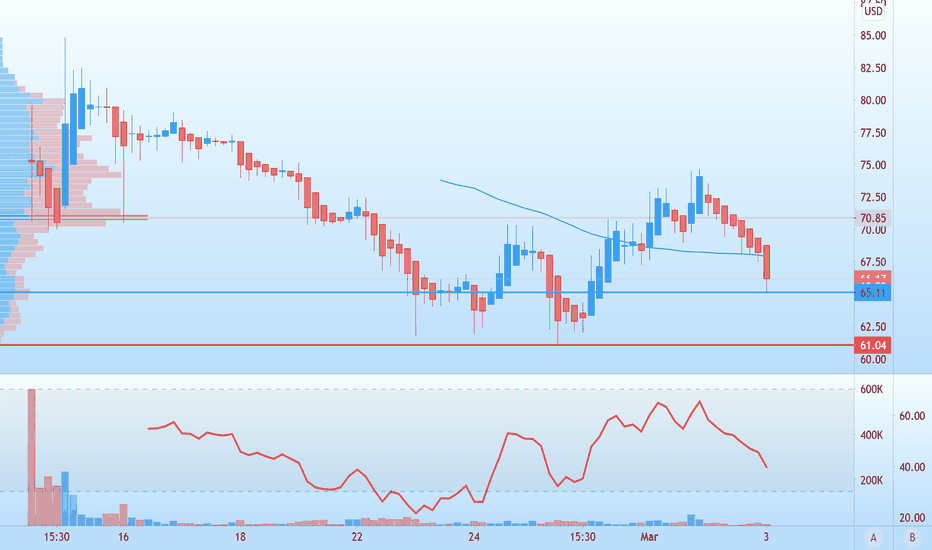

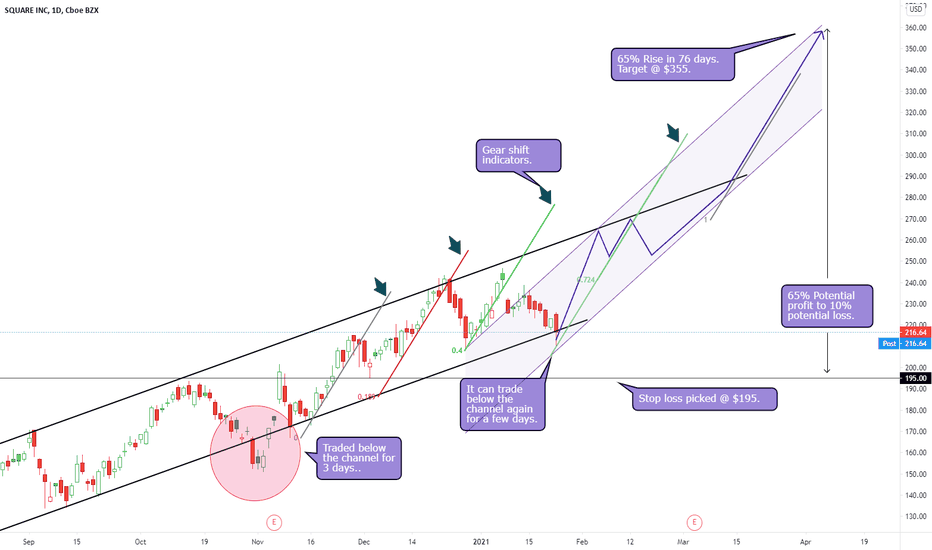

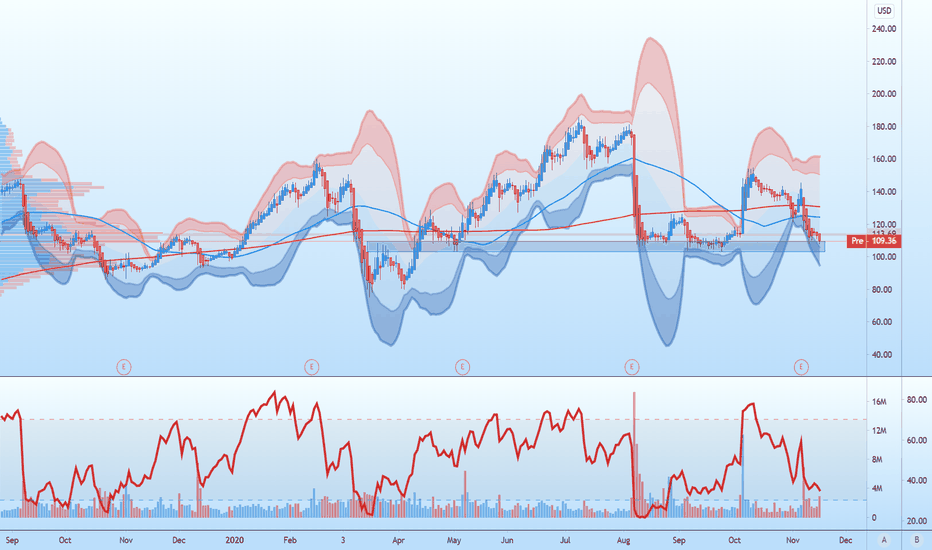

Square is shifting gears! Low risk 65% gain in < 3 months.Square ( NYSE:SQ ) is a serious growth company and is certainly a long-term investment. I'm bullish on NYSE:SQ long term, but I believe especially today, the stock has presented us with an excellent buying opportunity. As usual, I don't talk fundamentals. I'm only looking at the chart from a technical analysis perspective. Sometimes, after a stock is running inside an ascending parallel channel, there comes a point when it seems to be dropping below the channel, but the reality is it's only changing gears to enter a an even faster ascending parallel channel. It's kind of like the small moment of deceleration a racer has to suffer in order to shift to a higher gear, a phenomenon that coming generations will never know thanks to Tesla's single-speed transmission taking over the world. Anyway, back to NYSE:SQ . Let's look at the chart.

I have two parallel channels. The current one, and the new one I expect price to be bound within in the near future. I also have a set of steeper-inclined parallel lines which delineate local bullish movements. I believe this inclination will keep supporting price much longer in the coming bullish moves. I also believe that it will be the slope of a parallel channel later this year, but I'll sit on that idea for now.

Based on that, I drew a price path prediction. My target is $355 in 76 days, by 7 April 2021. My stop loss is at $195. Picking the stop loss was rather hard and somewhat arbitrary. I picked it based on historic RSI levels, how long I expect a drop to last in case a drop occurs, and basic support and resistance levels.

Most importantly, the last close has hit the very bottom of the parallel channel. My estimation is that this is a golden buying opportunity. My only worry is that even though the parallel channel has held the price four times since September 2020, it has failed one time (30 Oct - 3 Nov) which I marked in the red circle. It wasn't a serious break though. However, we must be prepared for it to happen again. That's why I set the stop loss a little bit lower. However, I am confident it will hold the price, and even if it doesn't, it will make an even better buying opportunity. And even if it breaks lower, Square is a solid investment and is certainly a hold.

Conclusion :

If you're in it for a trade, then decide the size of your position depending on how much you are willing to lose. If you're willing to lose $100, and our stop loss is at -10%, then open a trade with $1000 and set your stop loss.

If you're in this for investment, this is a good opportunity to add to your long-term position. So, buy and hold.

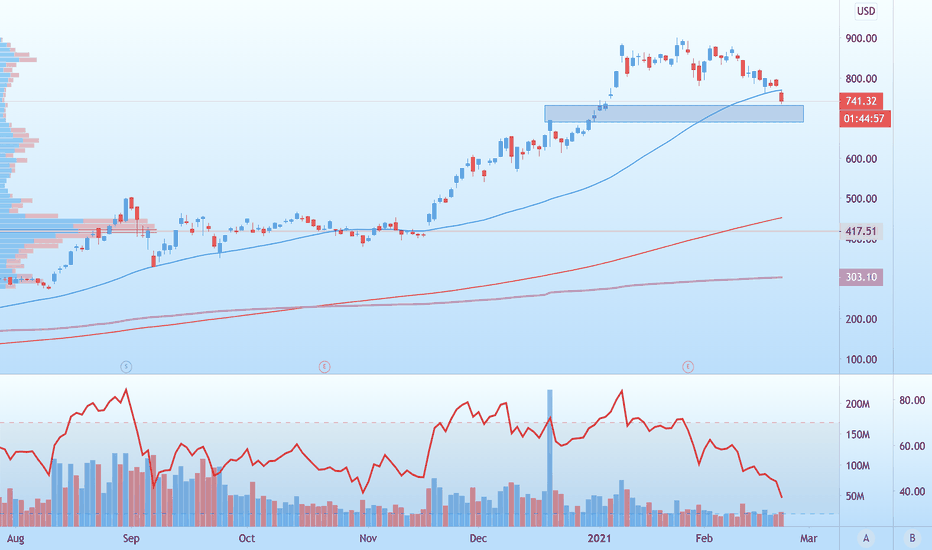

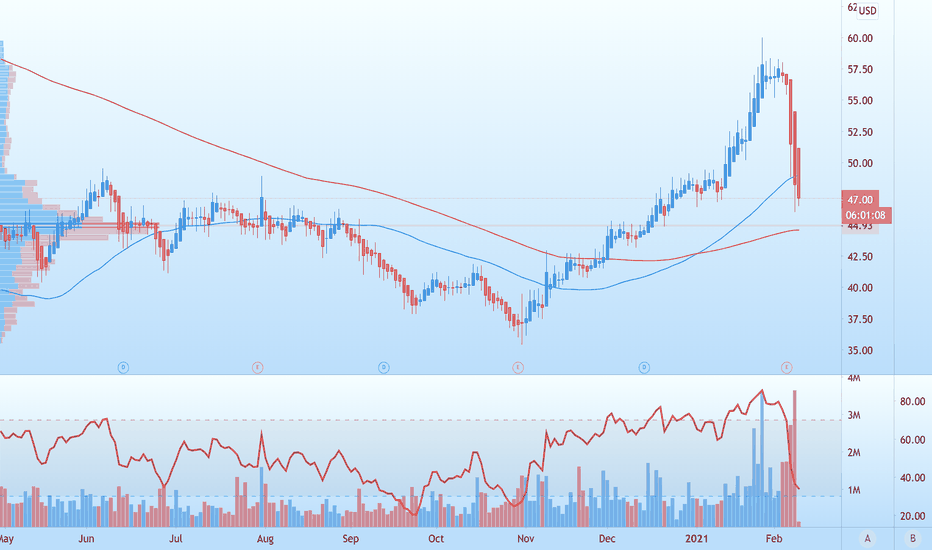

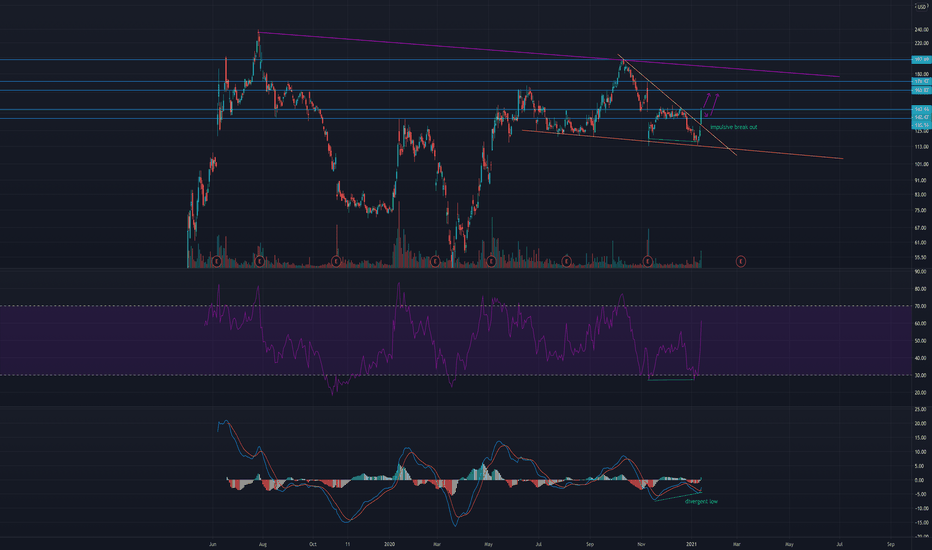

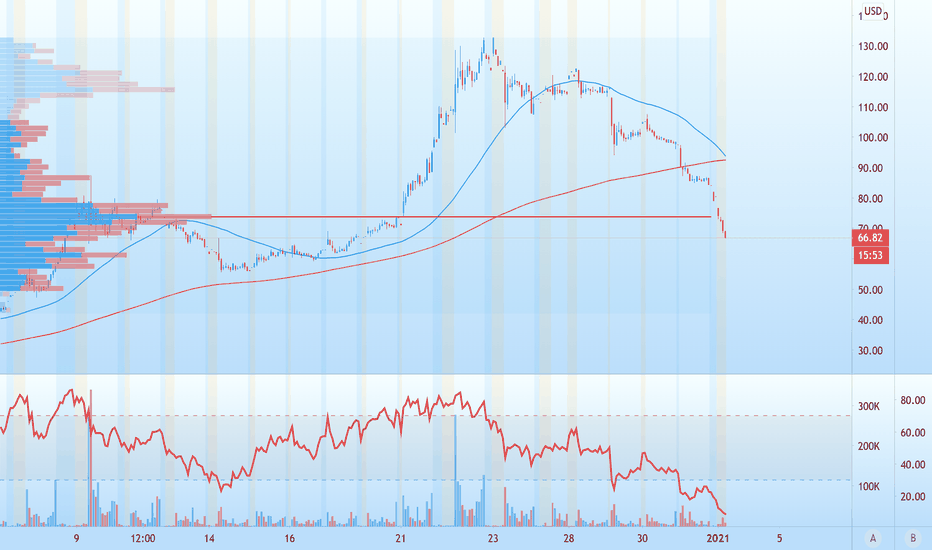

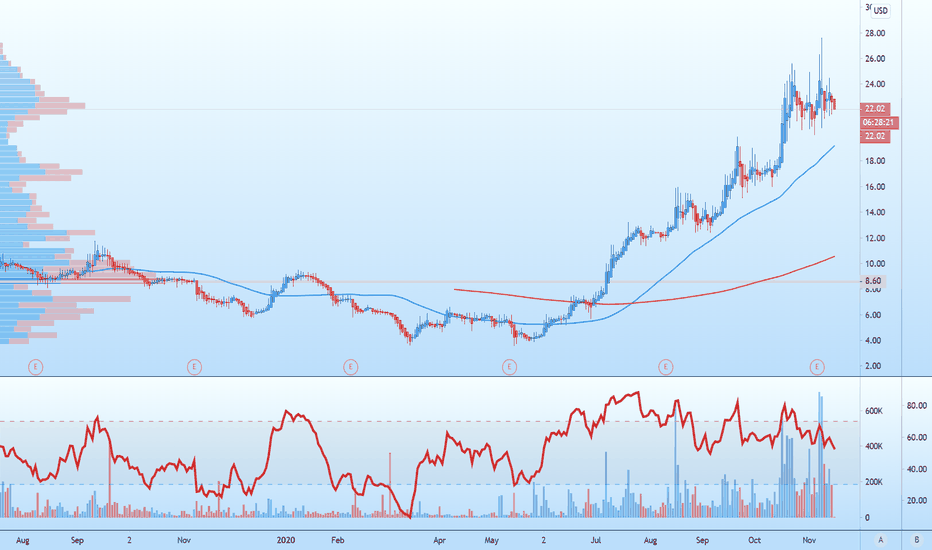

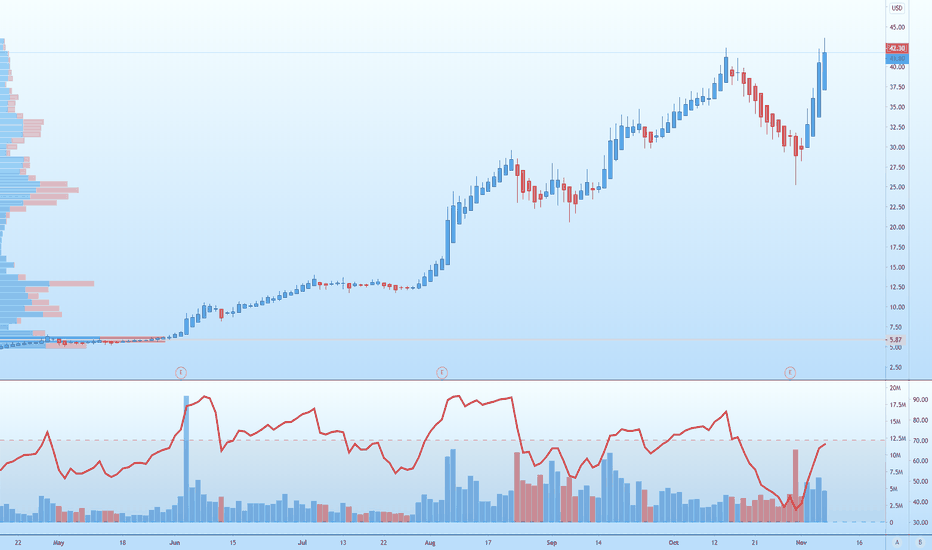

BYND breaking out of wedgeBYND is breaking out of bulling falling wedge very impulsively.

Highest volume since November, 20202

Divergent low on indicators

Low level bullish crossover on PPO

Oversold reading on RSI

Successfully bouncing on the bottom of the descending channel (yellow line)

Above presented pretty objective long entry with stop right below the bottom of the channel.

Where does it go from here....?

Higher.

It is testing the resistance from the bottom. It may blast though it or pull back to the resistance and push up higher. If it does pull back to the support or breaking out of the resistance will present another objective places to add on to the position. Next few targets are posted. It may depend of where the market goes in general but the swing target is the top of the channel (purple line). It will depend on how it get there but if it gets there pretty quick, taking a profit or reversing to short would be a good option depending on the trading style and expectation.

Have a good trade!

T.

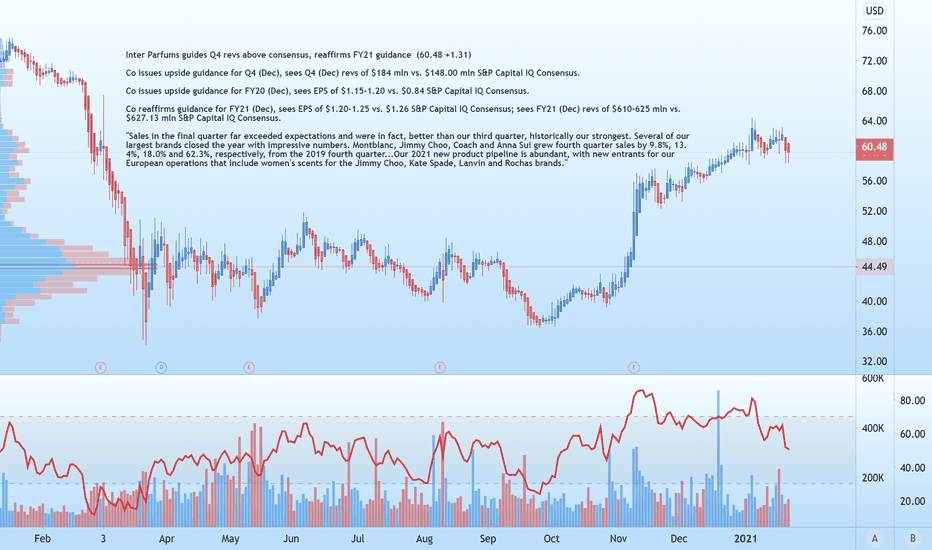

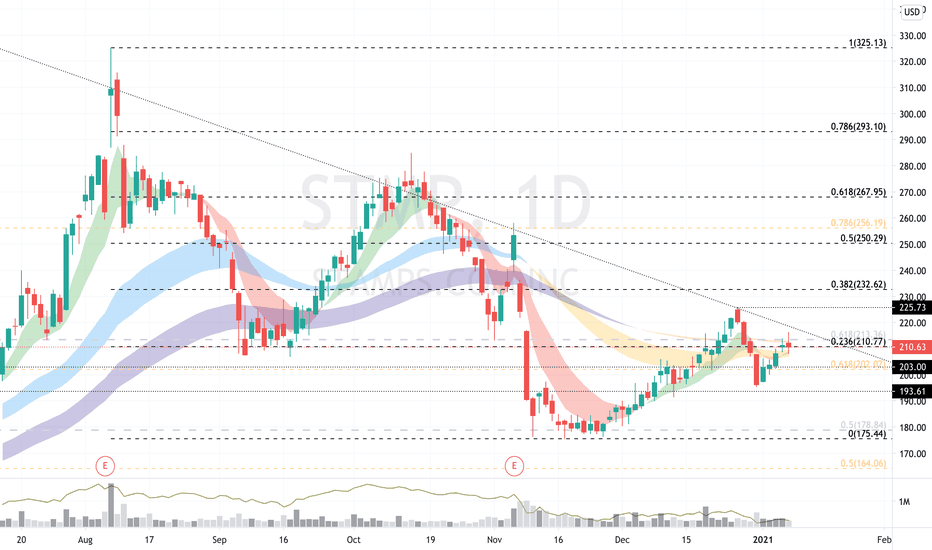

STMP over 225.73One of my favorite patterns, rounding bottoms tapping up against a descending trendline. Should yield a big move. Good for a swing, better with commons as options can be spready.

LMND. This Insurance Disruptor will DOUBLE in the Next 3 Months!NYSE:LMND is the new and promising tech company in the insurance market. It's beyond promising; it's already a product with proven scalability and disruptive features to the aging insurance business model. Lemonade follows a creative insurance model. To understand this, consider the conventional insurance business model where companies are incentivized to NOT approve claims of their customers. That's because less money given to customers means more profits for the shareholders. This places you, the customer, and them in a constant state of dispute. It is a flawed business model. Lemonade flips that around and removes the incentive completely by introducing one simple rule. Their profit margin is fixed. They will always take 25% of what you pay. The remaining 75% will be used either to cover claims, or to be donated to a charity organization of your choice. This way, they have no incentive to deny your claim. At the same time, you have no incentive to claim more than what you think is fair because you will be reducing what goes to the charity of your choice.

On top of that, Lemonade is a tech company that employs Artificial Intelligence to manage claims. You will be surprised, and perhaps you shouldn't be, how well an AI can catch a fraudster trying to falsely claim some insurance money. This already cuts the cost by a huge margin and allows for faster growth and better scalability.

Currently, Lemonade has proven that their platform works and that it can expand. They are slowly covering more areas than just pet insurance and household insurance. They are expanding to more states in the US and countries around the world. And all of that at a minimal cost of human resource. And the brilliant thing is that the more they expand, the more data they will have to train their AI, and the more accurate and efficient the process would be. That is what disruption looks like. It's new. It flips the model around. It works. It cuts cost by a big margin. It scales. It grows before you even know it. Think Apple, Amazon, Tesla.

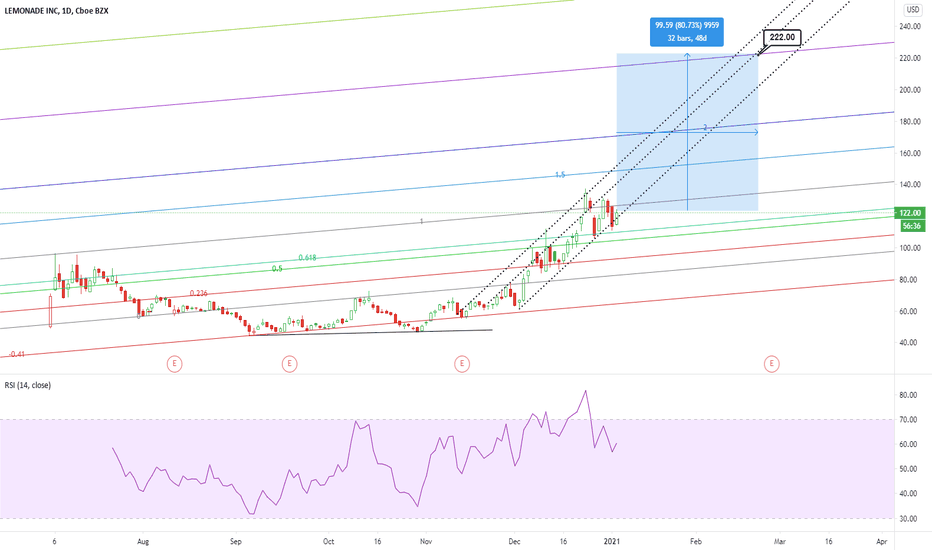

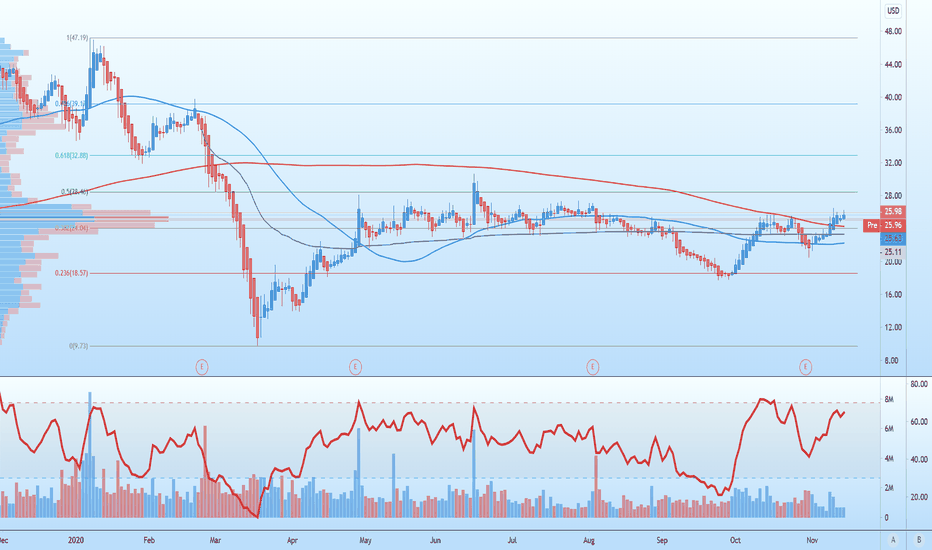

Now after this brief introduction, let's get into the chart. I've drawn this ascending channel a week ago and I am surprised that it is holding price this well. This shows strong demand added to the higher lows in RSI. I believe this momentum will accelerate in the coming few months. I've drawn targets based on Fibonacci of the most recent swing.

According to the channel and the Fib levels, this stock can reach $222 by 22 Feb. That's 80% gain in 48 days. I believe that in 90 days, this stock will have doubled, and by the end of the year it will have 5X'd. This is a stock to buy and hold, not a stock to trade. Good luck!