Growthstocks

Chargepoint (SBE): Potential Exponential Growth AnalysisChargePoint, an electric vehicle charging network, has struck a deal to merge with a SPAC (Special Purpose Acquisition Company), Switchback Energy Acquisition Corporation (SBE), with a market valuation of $2.4 billion.

In this analysis, I'll be going over the company's business model and financials, as well as technical analysis of the very short price action history we have available.

What is Chargepoint?

- Founded in 2007, ChargePoint has built one of the world’s leading electric vehicle (EV) charging networks

- The company delivers a fully integrated EV charging solution, with a comprehensive portfolio of hardware, software and services

- It recently received an enterprise value of $2.4b.

- Essentially, while companies like Tesla (TSLA) and Nio (NIO) compete for dominance in the EV market share, Chargepoint (SBE) offers the infrastructure necessary for all EVs.

Market Outlook

- EVs are projected to consist 9.9% of all new vehicles sold in 2025 and 29.2% in 2030 in the U.S. and Europe.

- The trend is definitely green, especially with Biden essentially having been elected as president recently.

- In the market of Network L2 Charging, Chargepoint takes up 73% of the market share, 7x more than its closest competitor.

- I always emphasize the importance of choosing the number 1 stock in the industry or field, and Checkpoint qualifies.

Financials

- Chargepoint demonstrated good revenue growth until this year

- It did $66m in 2017, $92m in 2018, and $147m in 2019.

- However, due to the Corona virus pandemic (Covid-19), the expected revenue for this year is at $135m.

- Nonetheless, the company has very bold goals as it seeks to reach a $2b revenue target by 2026.

- This would indicate a 40% compound growth rate per year over the next 6 years.

- While they are still at a net loss, Chargepoint is currently sitting on $648m of cash, so their cumulative net loss of $347m can easily be covered.

- By 2026, which is when the $2b revenue target is hit, we could see the company reach net profit

- Their gross margins have been deteriorating due to massive expansion and scalability of infrastructure around the world.

- However, it's important to understand that these are one time costs, and we could expect Chargepoint's gross margin to grow from 13% in 2019, to 42% by 2026.

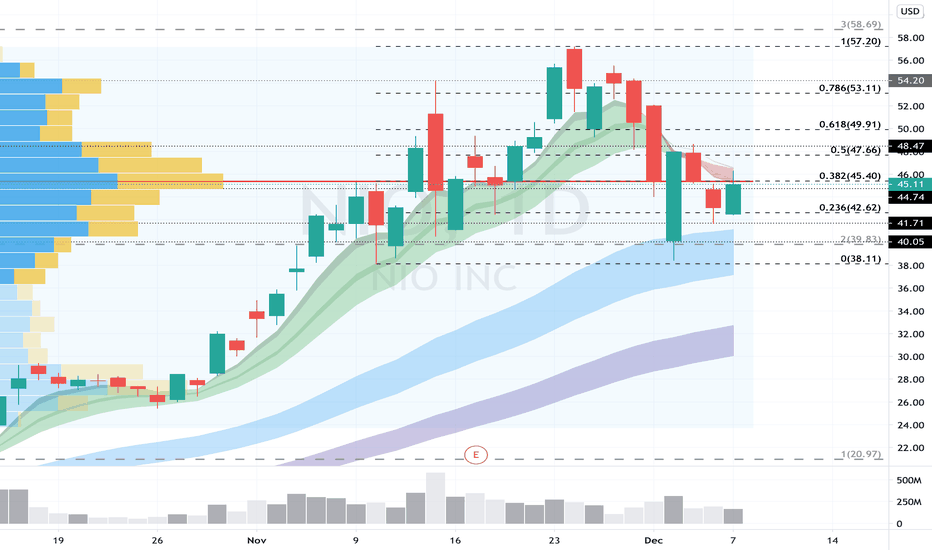

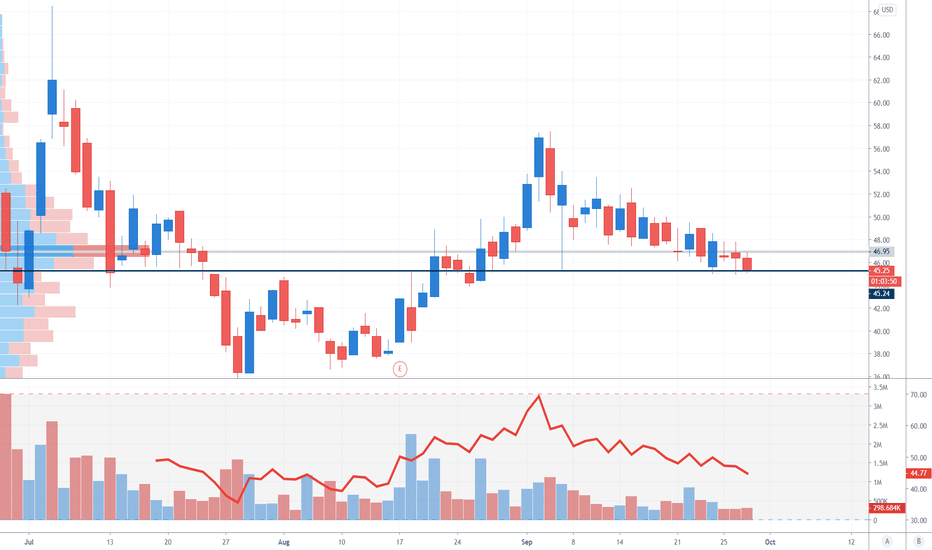

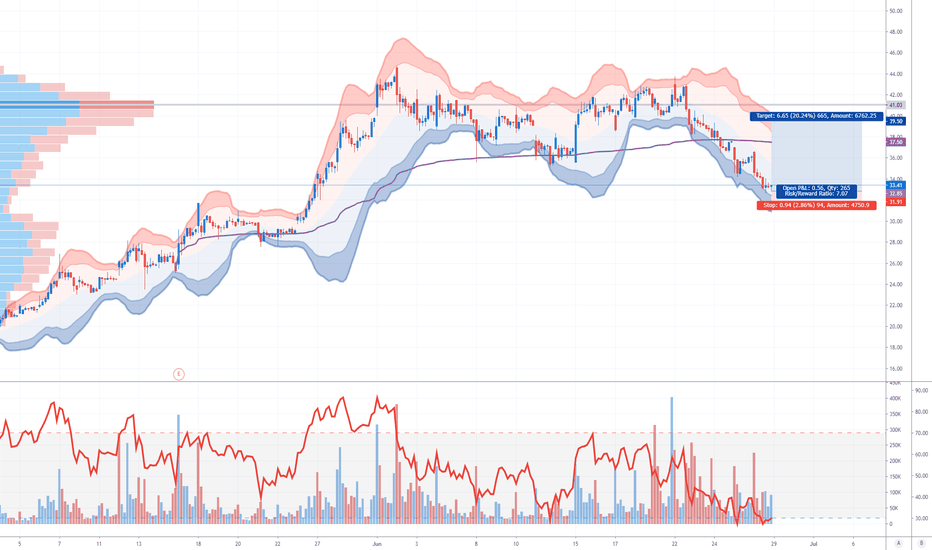

Technical Analysis

- Because Chargepoint was listed through a SPAC recently, it does not have much price action data to be analyzed.

- Based on the hourly chart, we can see that prices are ranging in a slow uptrend, forming higher lows and higher highs

- It's trading within an ascending parallel channel, in an extremely choppy range

- There are currently three key levels of support on the hourly, formed through gaps

Summary

This company's fundamentals for the long term appears extremely solid. It has high growth potential, dominant market share, and is part of a megatrend industry of EV infrastructures. We would have to see whether the company delivers, according to their IR deck, but the overall outlook remains very bullish.

If you like this analysis, please make sure to like the post, and follow for more quality content!

I would also appreciate it if you could leave a comment below with some original insight.

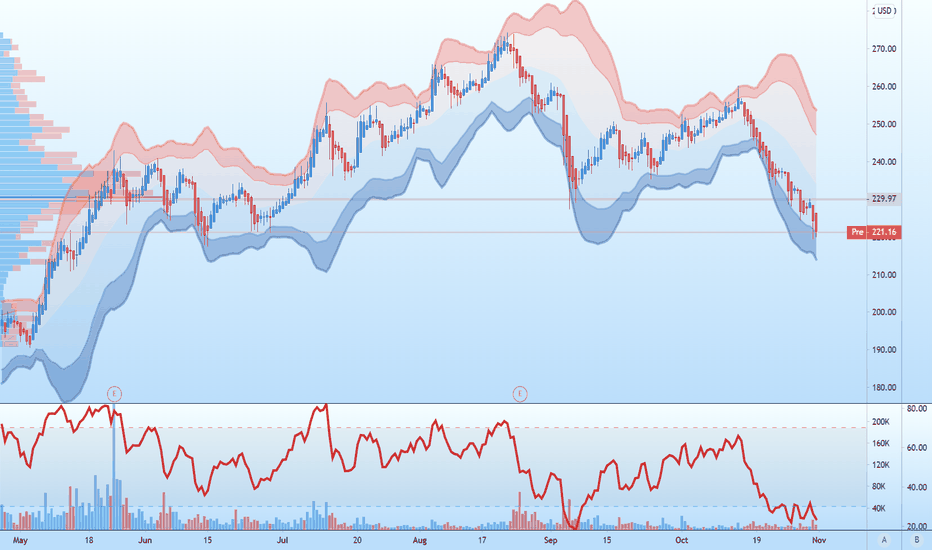

#swing #tradeidea Long over 250 Tight stopsPossible bounce area

Spotify misses by $0.03, misses on revs; guides Q4 revs in-line

Reports Q3 (Sep) loss of €0.58 per share, excluding non-recurring items, €0.03 worse than the S&P Capital IQ Consensus of (€0.55); revenues rose 14.1% year/year to €1.98 bln vs the €2 bln S&P Capital IQ Consensus.

"Total MAUs grew 29% Y/Y to 320 million in the quarter and above the top end of our guidance range. From a regional perspective, Y/Y growth in North America and Europe accelerated more than 400 bps and 100 bps, respectively, while Latin America and Rest of World continued to see the fastest growth, growing 30% and 51%, respectively."

Co issues in-line guidance for Q4, sees Q4 revs of EUR 2.00-2.20 bln vs. €2.19 bln S&P Capital IQ Consensus. Total MAUs: 340-345 million.

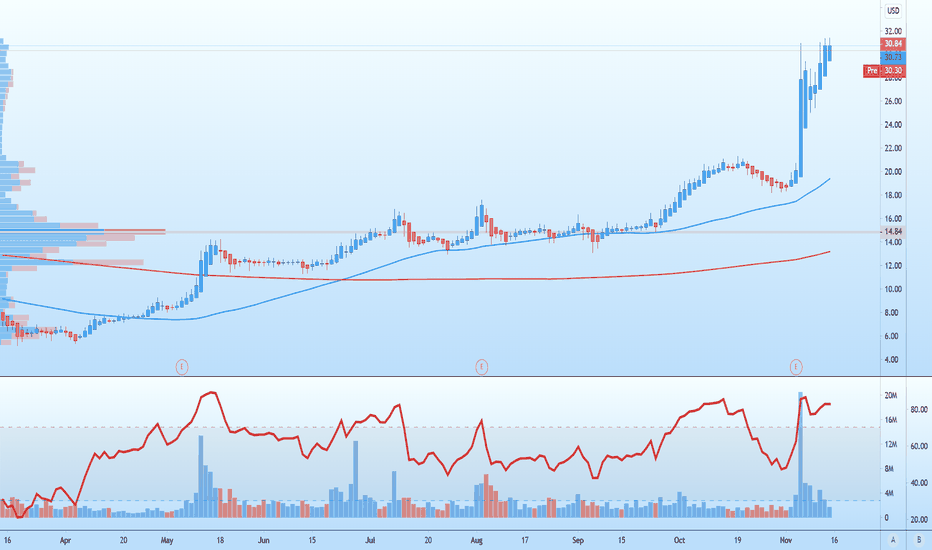

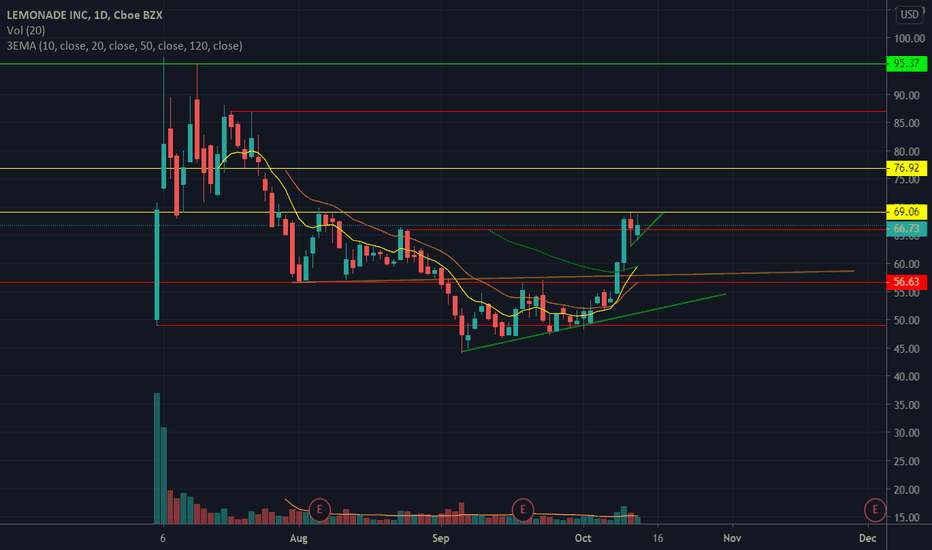

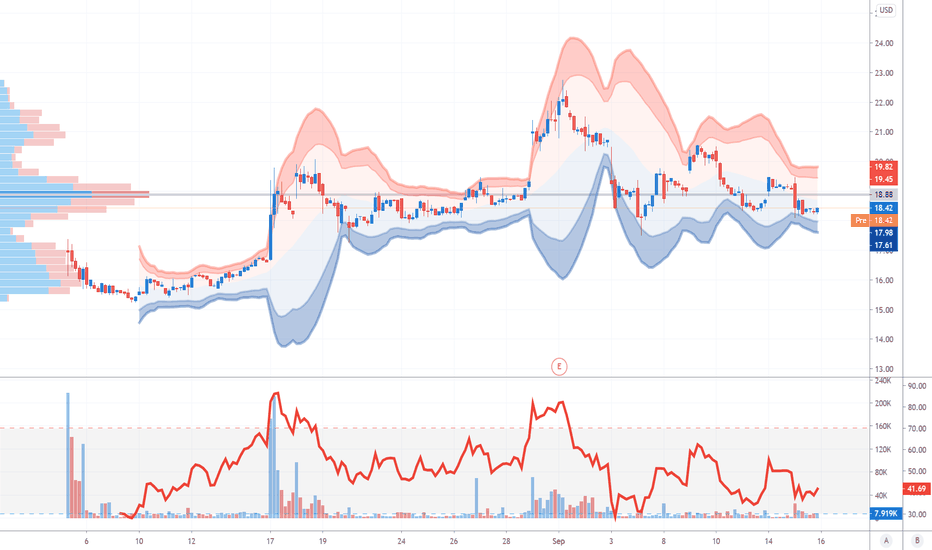

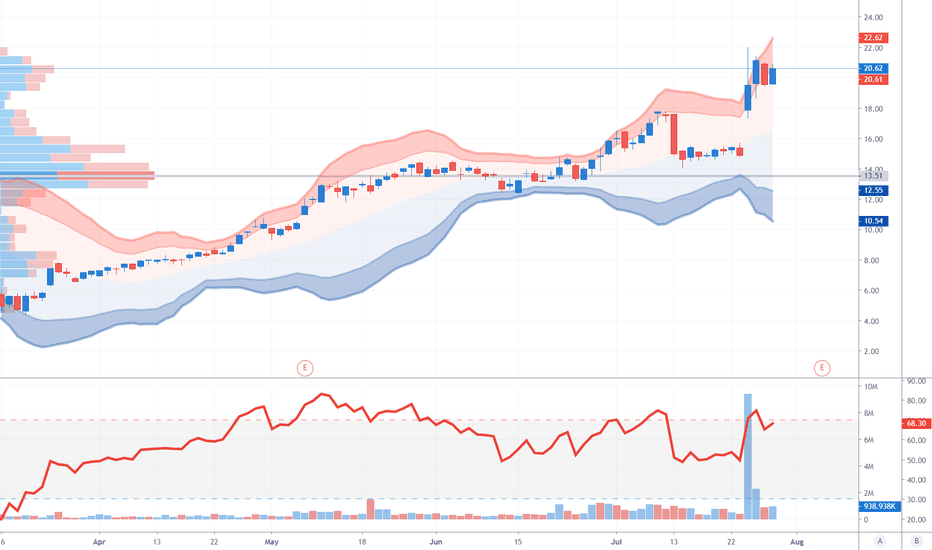

Potential IPO base $LMNDPotential IPO base

"90 seconds to get insured. 3 minutes to get paid"

If you haven't already noticed, we are living in a world of immediate gratification. Insurance is just another sector that's ripe to be disrupted by better efficiency.

TA,

- Increasing volume and consolidating at previous highs $69.

FA,

- Disrupting the archaic industry of insurance

-High NPS score of 70. Industry average is 70.

- $5 Trillion TAM. Current market cap is $3.8Bn

- Huge barrier between insurance companies and customers. Making claims is a headache. Lemonade is bridging that gap through better customer service by leveraging the powers of AI. AI JIM and AI MAYA

- +167% revenue growth 2020

- Expansion beyond US. France is next by end of 2020.

- Only 3 types available still. Renters, home and pet insurance. More potential for other types

Concerns,

- Still not fully convinced of the business model

-Continued losses(side effect of disrupting)

- Price discovery phase still so will be super volatile.

Entry : Break of 69.2

Stop loss: 62.2

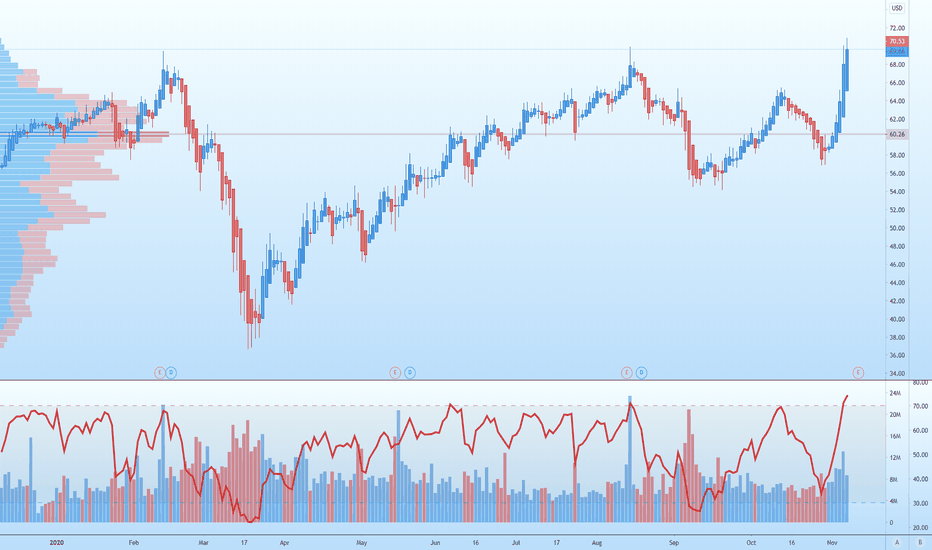

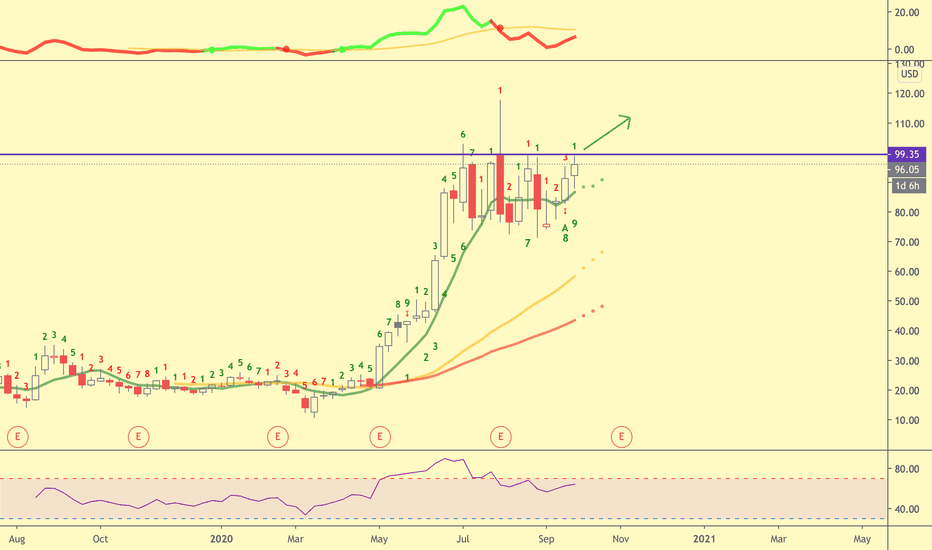

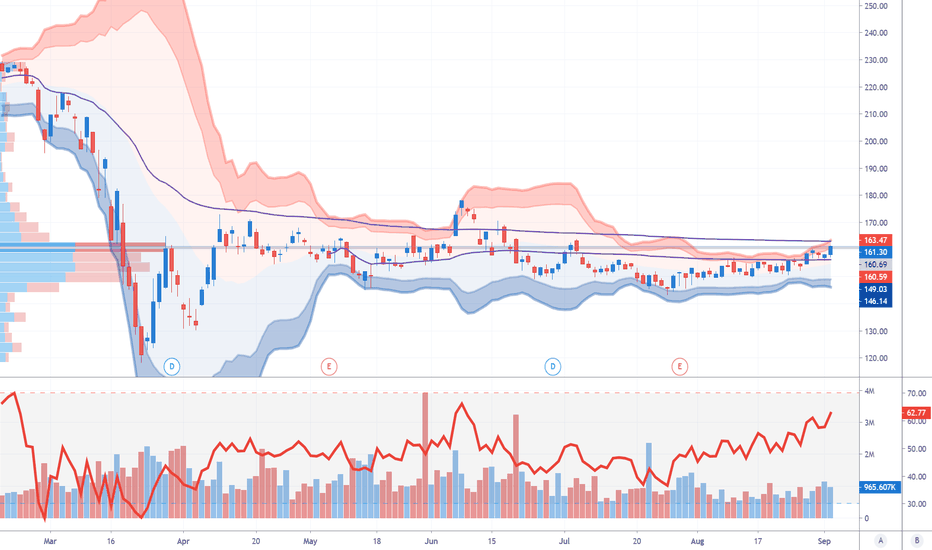

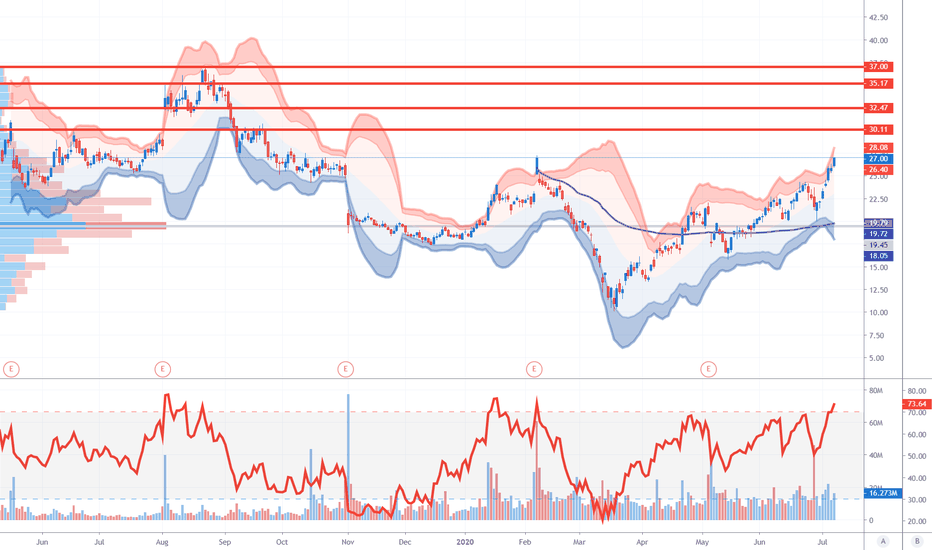

NVDA Nvidia Exciting Upward Trend! NVDA (Nvidia) is an exciting stock to be in. Given their processing tech and the ability to branch into many cloud businesses such as gaming, processing, and storage, their technology has become a necessity, and demand consistently exceeds supply.

I got into NVIDIA as a long-term growth play when it was trading at $360. The breakout above previous ATH with volume was an obvious signal to buy, along with STRONG fundamentals and macroeconomic environment making it a recipe for the next rocket.

I don't typically buy into overbought stocks, but with the environment around stocks like TSLA and AAPL making it obvious a tech bubble was forming, it looked like a stock that wasn't getting as much attention yet given the news cycles were sparse, and product launches upcoming in Q4 were going to be great fodder for future growth.

I played it right, and the stock went all the way up to $585, now in a correction pattern.

Based on the Fib extensions and Elliot wave patterns, this is a very healthy growth stock with potential to shatter its ATH in the next 6 months.

Disclaimer: I am not a professional and I draw charts for my own education and keeping track of my trades to know when to get in and when to get out. I'm always open to constructive feedback so feel free to share your thoughts in the comments. Thank you!

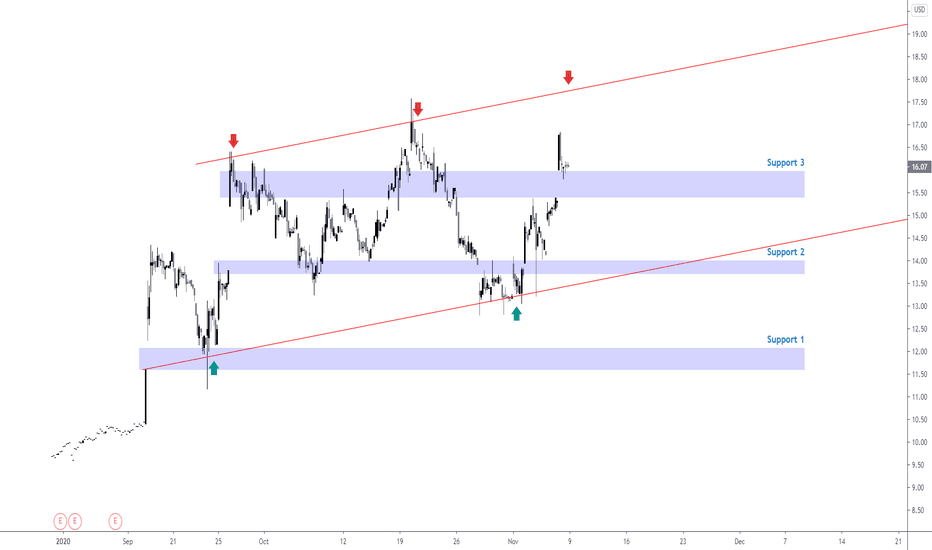

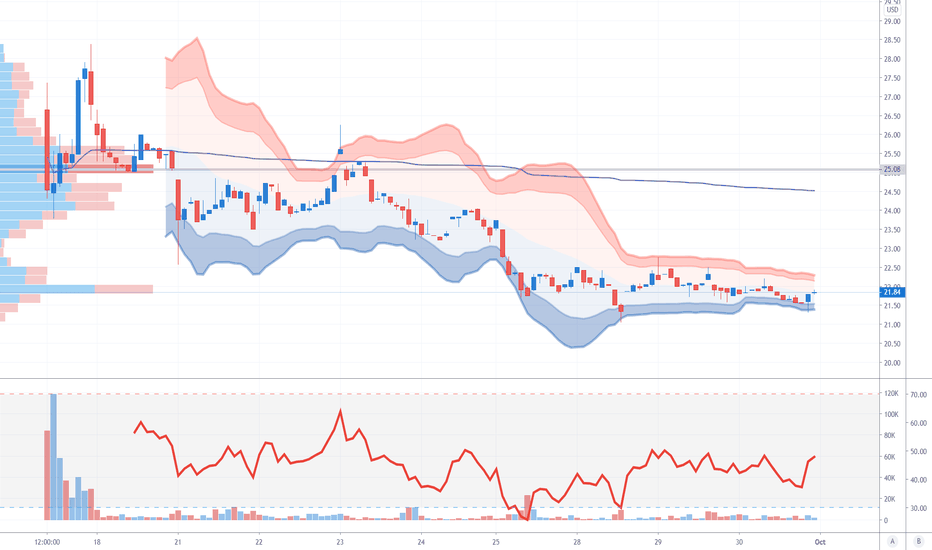

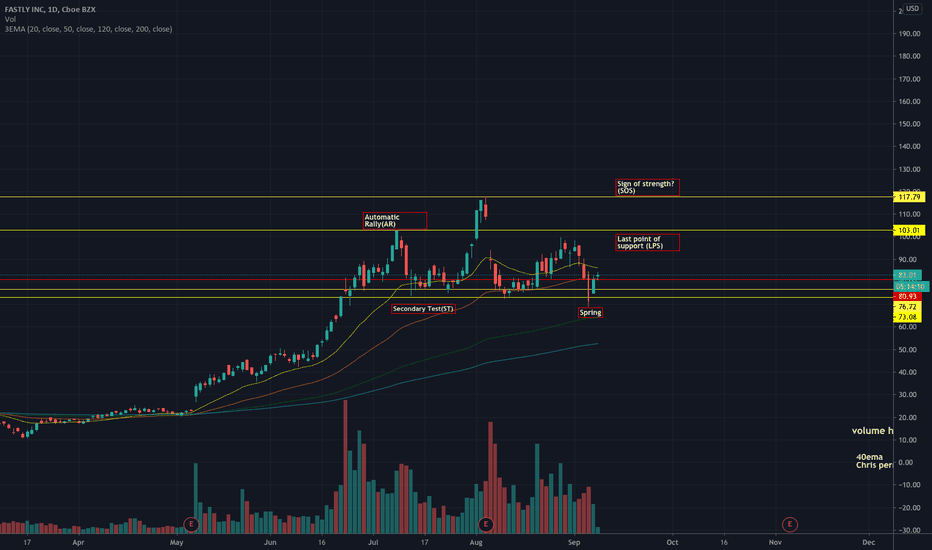

Fastly : Wyckoff Pattern springLooks like Fastly is at spring on Wyckoff Patterns.

Likely catalyst to push it over the last point of support could be any news from Tik Tok acquisition or a short squeeze

Link : school.stockcharts.com

Concerns,

- Head and shoulders

- High volume on red days compared to green

I'm long Fastly.

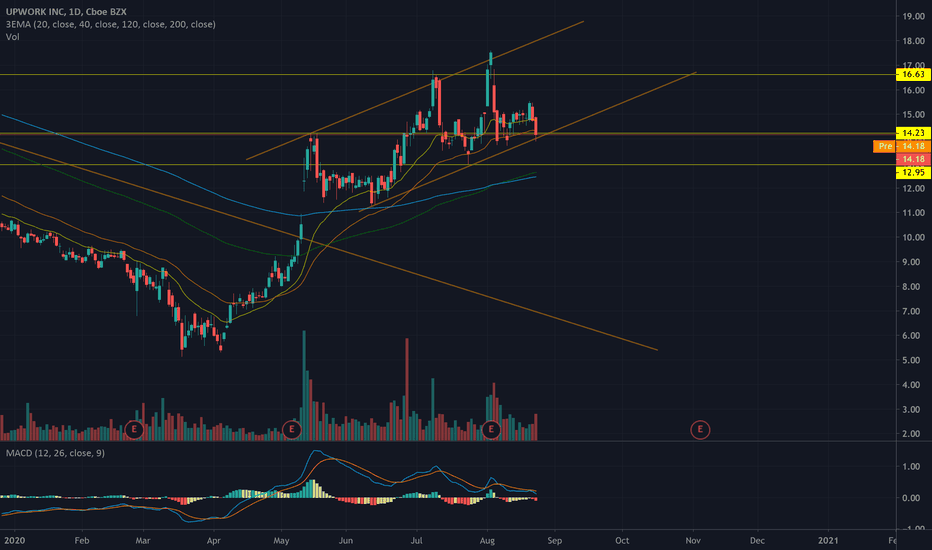

Gig economy winner. $FVRR or $UPWK?FA,

- Structural headwinds through gig economy, freelancing and 'escape the rat race' theme

- 3Y revenue growth 22%

- Improving gross margins. 70%

- Recent insider purchases

- Like shopify, but for talent. Online talent marketplace.

-Value? Market cap half of Fiverr with revenue twice as much.

TA,

- Major trend reversal. Short term moving averages crossing Long term MA

- Trendline support

- 120MA support 4H

- Higher highs and lows

Concerns,

- Less than expected revenue growth during lockdown. YOY growth 19% at $87.5M

Main competitor Fiverr reported YoY growth of 82% at 47.1m. Growth is key.

- Fiverr reporter a net loss of only -$0.1M while UPWK reported a loss of -$10M.

-Freelancers prefer Fiverr over Upwork.

- Fiverr better glassdoor ratings (4.3 Vs. 3.8)

- Higher volume on red days

Seems more like a technical trade considering the above points or a value play. Fiverr is still the better company fundamentally. Until Upwork can show above significant growth rates, the stock would not gain much momentum. 20% growth for a growth stock with people looking for jobs online is not enough in my opinion.

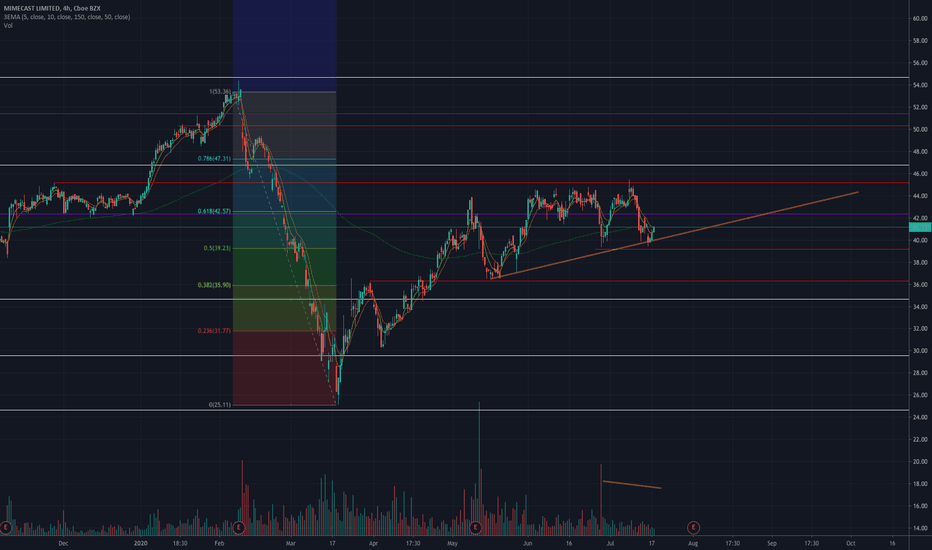

MIME entry: Fundamental and Technical analysisFundamental metrics

- Gross margin > 70%

- Just entered profitability with a net margin of 0.04%

- Revenue growth 25.4%

- Rule of 40 = 0.04+0.04 = 25.4

- Free cash flow growing slowly

- The net revenue retention rate of 111%. Existing customer base alone has added 11% of revenue for the year ended 2019. 1100 new customers which is about a 30% increase

- Financial health is a concern with a current ratio of only 1.04, interest coverage of 1.04 and a Debt/equity of 0.82

- Structural tailwinds due to growing adaption of cloud services and network hacking.

- An organization would spend more funds on ensuring cybersecurity, detecting threats and protecting data. Remember, data is the new oil.

TA,

- Lower Bollinger band accumulation

-4H/Daily RSI buy

- 5EMA trending up

- 0.5 Fib support

- Daily level support

- Ascending wedge?

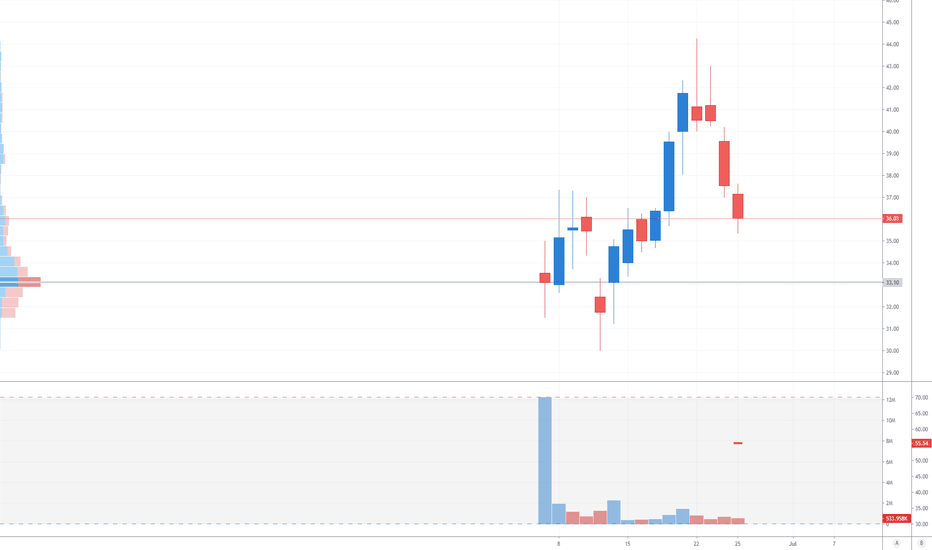

Recent IPO + hot sector! Quiet period ending Jun 30thIndependent payment processing and financial technology company

Lead:Citigroup, Credit Suisse, Goldman Sachs

Co manager: BofA Securities, Morgan Stanley, RBC Capital Markets, Evercore ISI, Raymond James, Suntrust Robinson Humphrey, Wolfe Capital, TD Securities, Telsey Advisory Group