H4

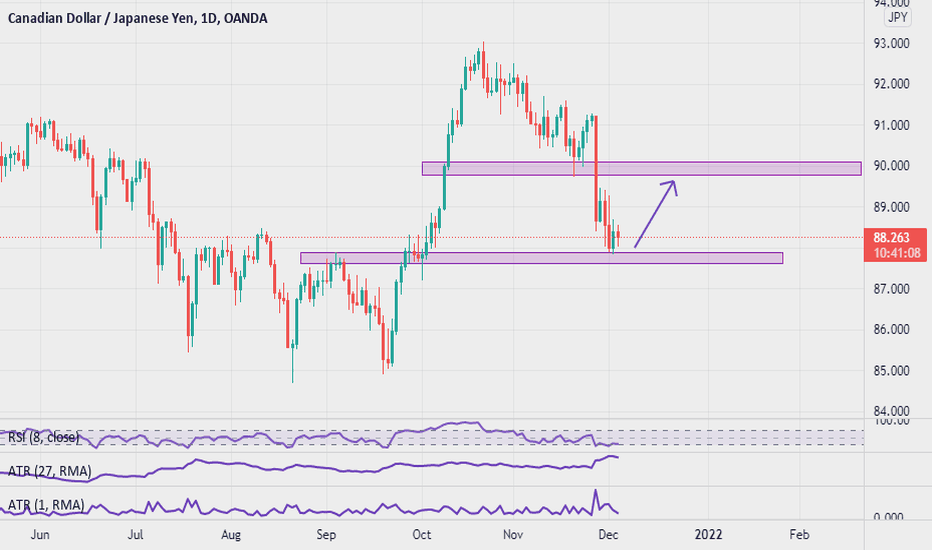

Gold prices grind between $1780 - $1815Gold prices grind between $1780 - $1815. The 4-hour chart indicates to be long above $1,815 and short below $1,780. Between these levels, traders will be at risk of whipsaw price action and sideways consolidation.

Even so, a clear downside break of the stated support line, around $1785 by the press time, won’t be enough as multiple levels around $1780 also challenge gold bears. XAUUSD is poised to test its November low at 1,758.81, while below the latter the slide may continue towards the 1,700 figure.

=> Meanwhile, sustained run-up beyond $1,815 will get a conviction on crossing November 09 swing high near $1,833. Following that, gold can quickly target the $1,850 hurdle whereas the $1,870 and the monthly peak of $1,877 could entertain the bulls afterward.

IS EUR/USD IS READY FOR NEW LOWER LOWEUR/USD also edged north yesterday touch and drove back to the downside resistance line taken from the high of September 03rd, which suggests that any further recovery may stay limited.

The experts believe that the bears may jump back into the action from near the crossroads of that line and the 1.1640 barriers, marked by the high of October 4th. This could result in a slide back near the 1.1587 zones, the break of which may open the path towards the 1.1524 area, defined by the low of October 12th.

On the other side, the bulls may gain complete control upon a break above the 1.1690 territories. This may cement the break above the downside line taken from the high of September 3rd and allow advances towards the 1.1750 level. Another break, above 1.1749, could carry extensions towards the high at 1.1837.

Looking at our oscillator indicators, we can notify that the price stopped very close to the 70 levels of RSI before the overbought zone.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carry a high-risk level. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and such sites. Furthermore, one understands that the company carries zero influence over transactions, needs, and trading signals. Therefore, it cannot be held liable nor guarantee any profits or losses.

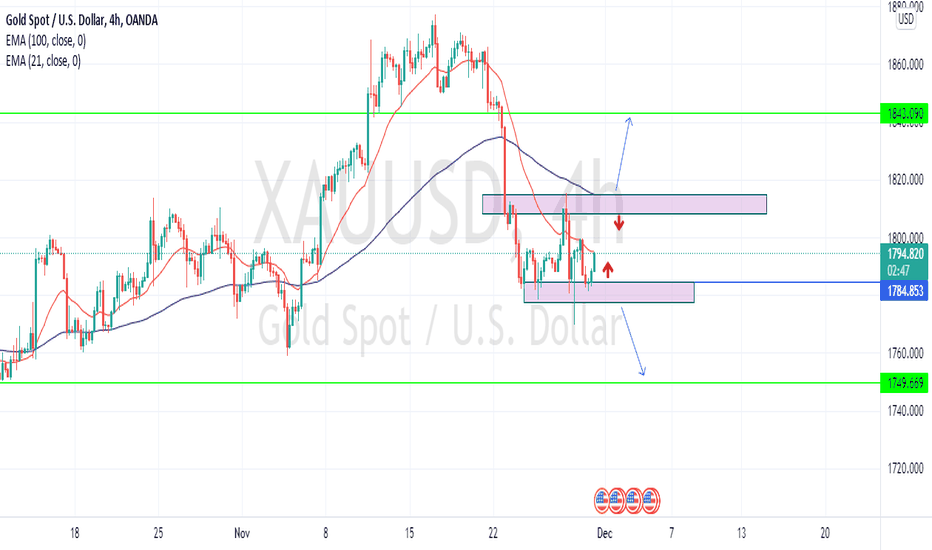

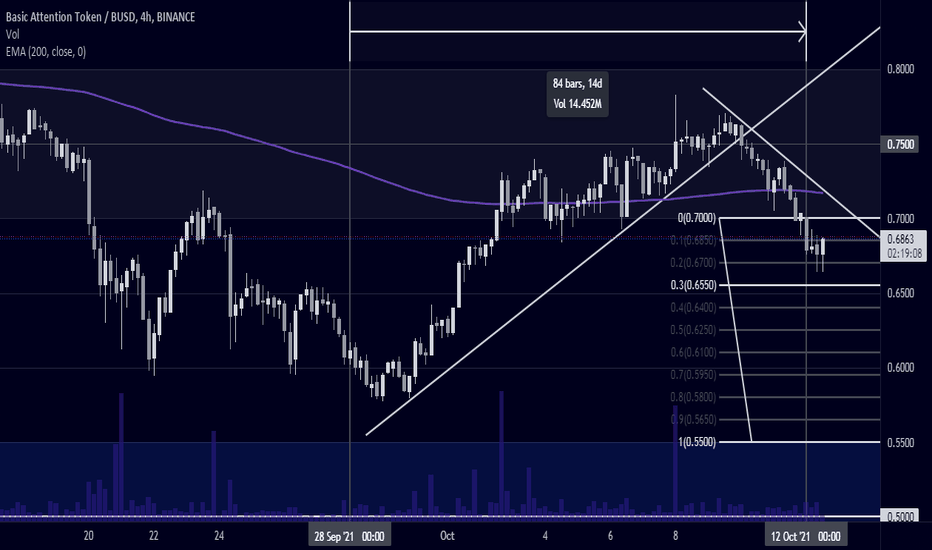

H4/BAT Long Accumulation from $0.50H4/BAT Update: Slowly marking lower, 06:00 UTC, 12/10/2021

Still a long way off from $0.50 w/ 3x $0.05 cent price levels from it

Price crossing under the 200 EMA, along a freshly-created DTL

Buy orders hanging at $0.75 & $0.50 for an accumulation

LRC > Time to bounce-back? > Support & ResistanceHello Friends,

Hope you all are having a thrill in your trading journey.

I am presenting you my analysis of LRC.

According to my technical analysis, LRC is going to reach its next Resistance Zone(Potential target). Now, we are expecting a fall to support zone and a rise!

"My analysis is valid until We don't see a breakout from support zone"

I hope my analysis is pretty clear to you guys.

Kindly do your own research and follow proper risk management.

Feel free to share your views in the comment section. Like and Follow!

Best Regards,

Shaswat Naman

TradeThrill, India🇮🇳

Disclaimer: The analysis provided is purely informative and it should not be used as financial advice. Remember that you need a plan before you start trading; so, take this knowledge and use it as a guidebook that will ultimately help you understand the market and easily predict your next move.

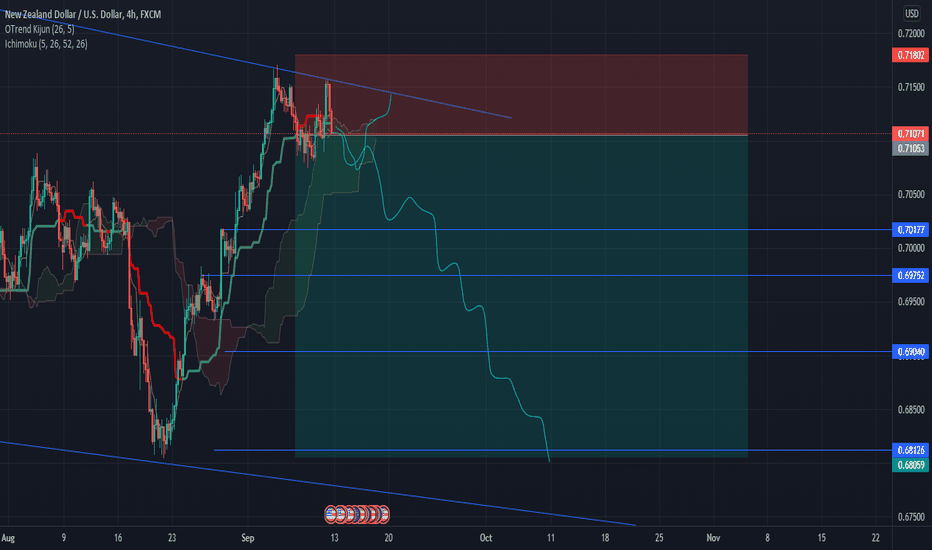

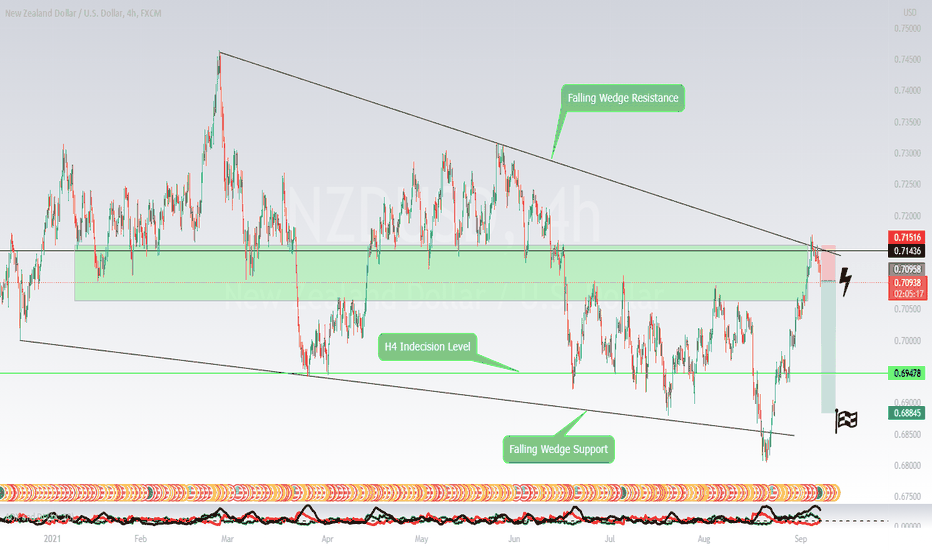

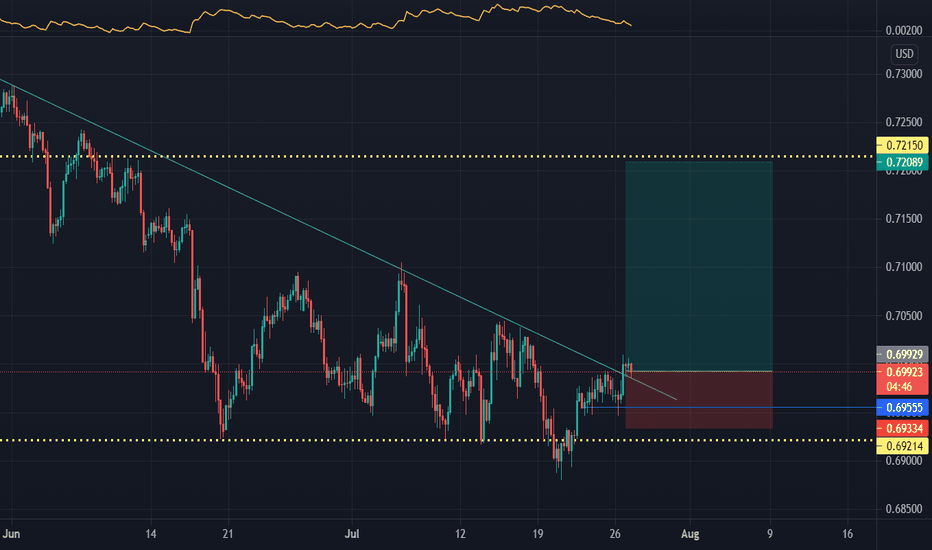

GREAT SELLWhere a D1 indecision level and the resistance of a H4 falling wedge intercept, price respected. NZDUSD is currently beginning to push off the resistance, however, expect some consolidation around the zone pictured above for the possible formation of a fibonacci retracement. A bullish DXY is another NZDUSD sell confirmation due to the fact that USD is the quote currency.

Please like and follow for future analysis'.

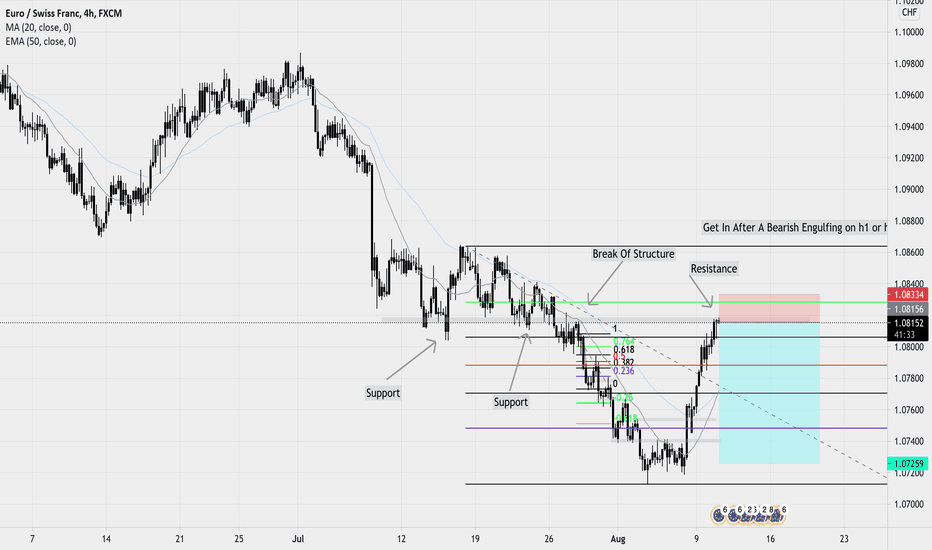

EURCHF - SELLFrom the daily and h4, I see that EC has been trending down and right now I see multiple reasons for me to sell. Price is using an area of resistance that was previously used as support in the past. It made a break and retest and now it's at the resistance, I'm now waiting for a bearish engulfing on the h1 or h4 to get in sells. (using the fib as confluence also)

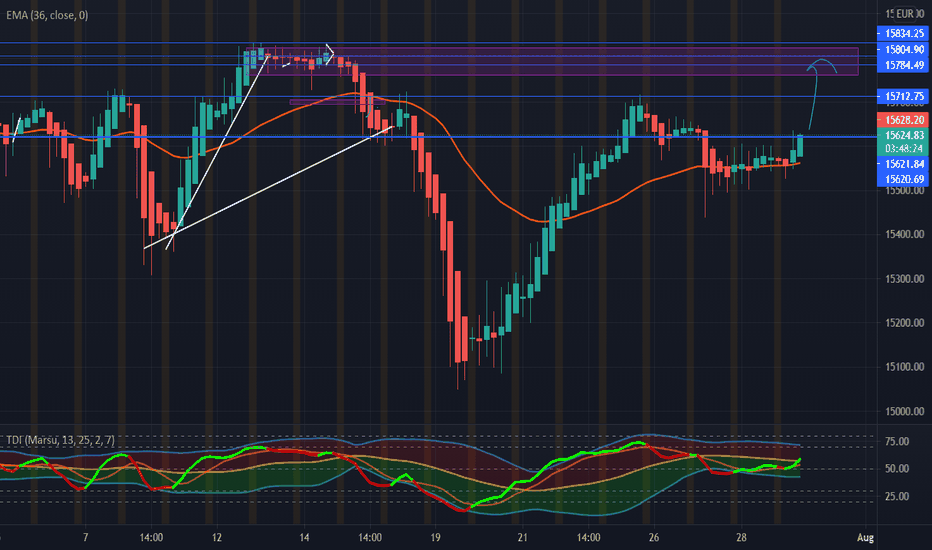

GER30 DAX LONG on H4+Daily!Strong pullback of a retest on Dax, nice long, taking an aggressive position here looking to hit the previous highs on daily chart!

Trading idea not investment opportunity!

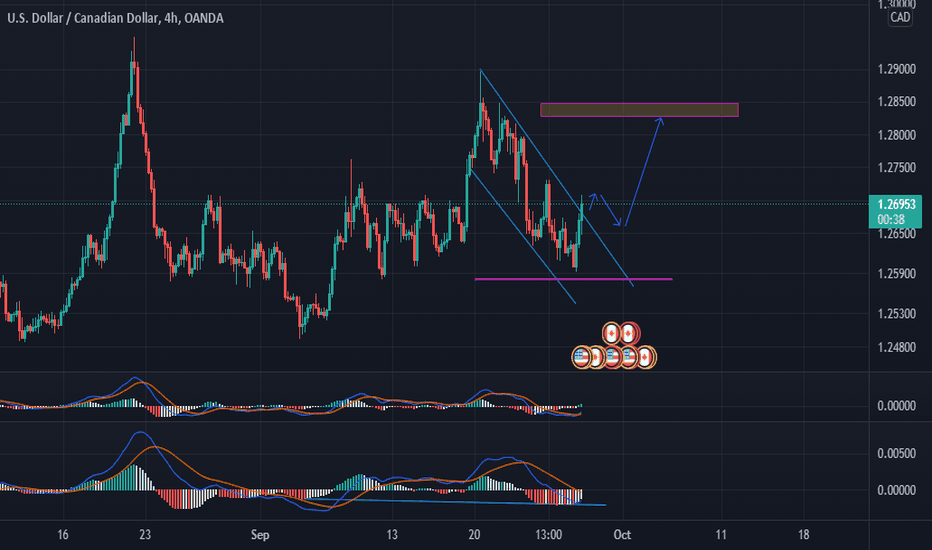

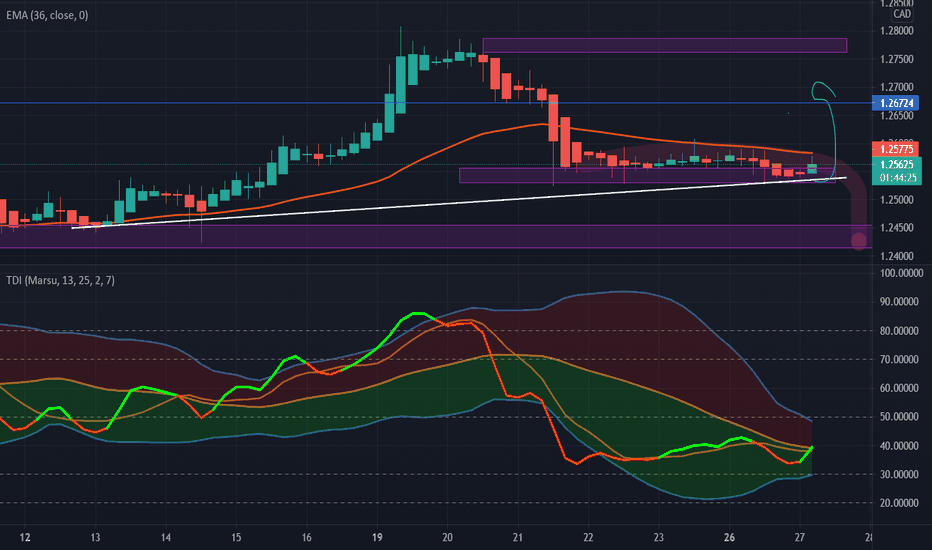

USDCAD Long (H4) PLEASE READ DESCRIPTION.PLEASE NOTE: I have reduced my exposure for USDCAD SHORT (Daily) by taking out most of my position at break even/ very small loss, and instead went for a long on H4, as I felt that USDCAD would have a strong move up bouncing off demand zone/100ema twice AND having a bollinger band volatility contraction as well (awaiting a big explosive move potentially). Could be the day for USD today. We shall see...

I am still keeping a SMALL position on USDCAD for a SHORT (on the Daily setup on my other idea) but will not be entering any more short positions on USDCAD until I see a clear pattern on lower timeframes (H4/H1) that suggests the move is bearish confirmation.

Cheers

TRADING IDEA , NOT INVESTMENT OPPORTUNITY ---- TRADE AT YOUR OWN RISK!