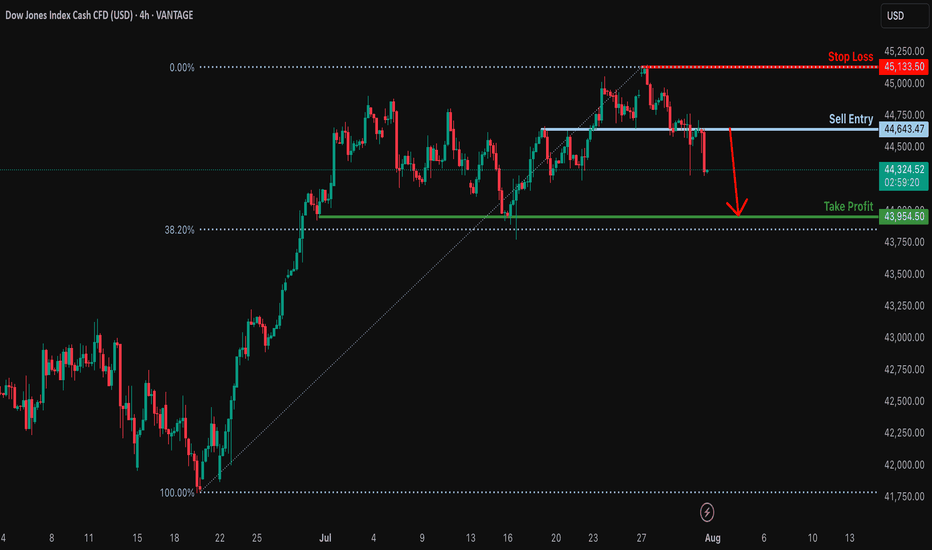

Potential bearish drop?Dow Jones (DJ30) has reacted off the resistance level which is an overlap resitance and could drop from this levle ot our takeprofit.

Entry: 44,643.47

Why we like it:

There is an overlap resistance levle.

Stop loss: 45,133.50

Why we like it:

There is a swing high resistance.

Take profit: 43,954.50

Why we like it:

There is a multi swing low support.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Harmonic Patterns

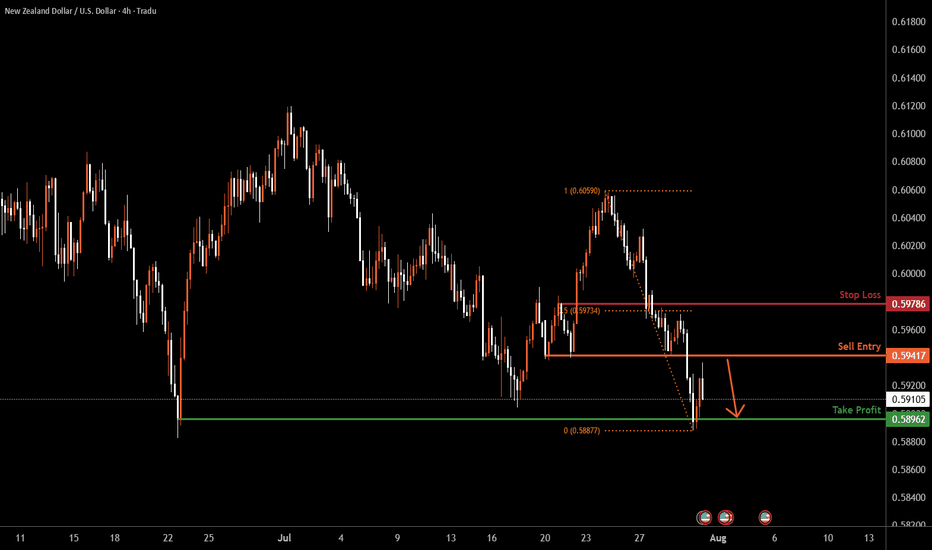

NZDUSD H4 | Bearish drop off 50% Fibonacci resistanceNZD/USD is rising towards the sell entry, which serves as a pullback resistance and could potentially reverse lower.

Sell entry is at 0.5941, which is a pullback resistance.

Stop loss is at 0.5978, which is a pullback resistance that lines up with the 50% Fibonacci retracement.

Take profit is at 0.5896, which is a swing low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

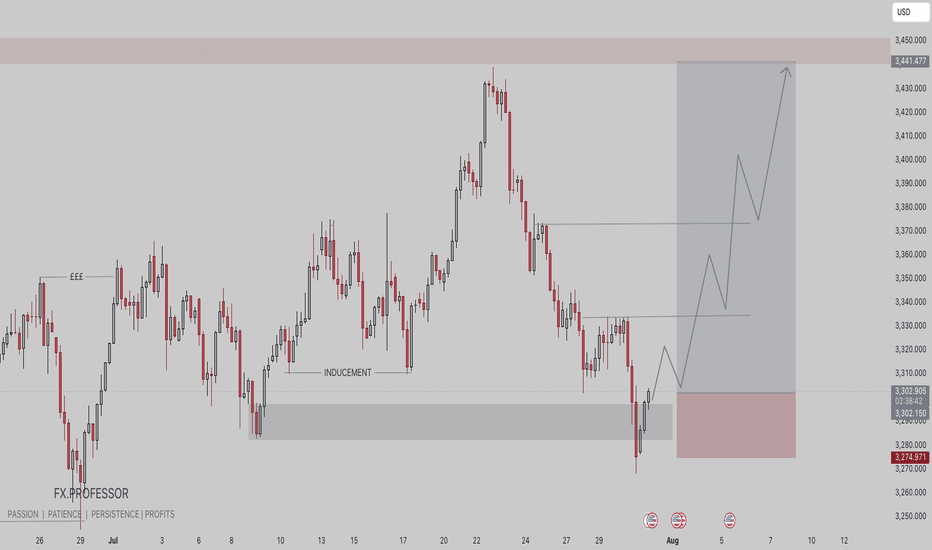

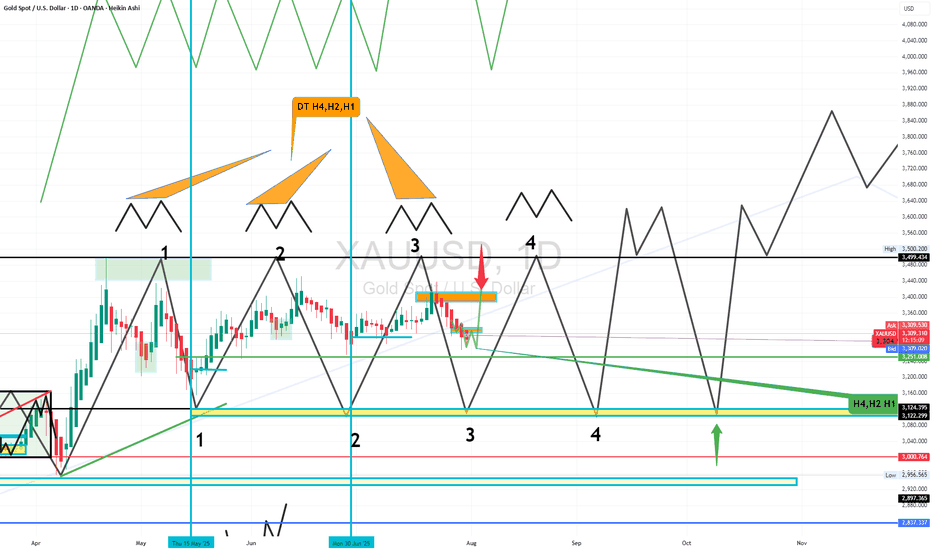

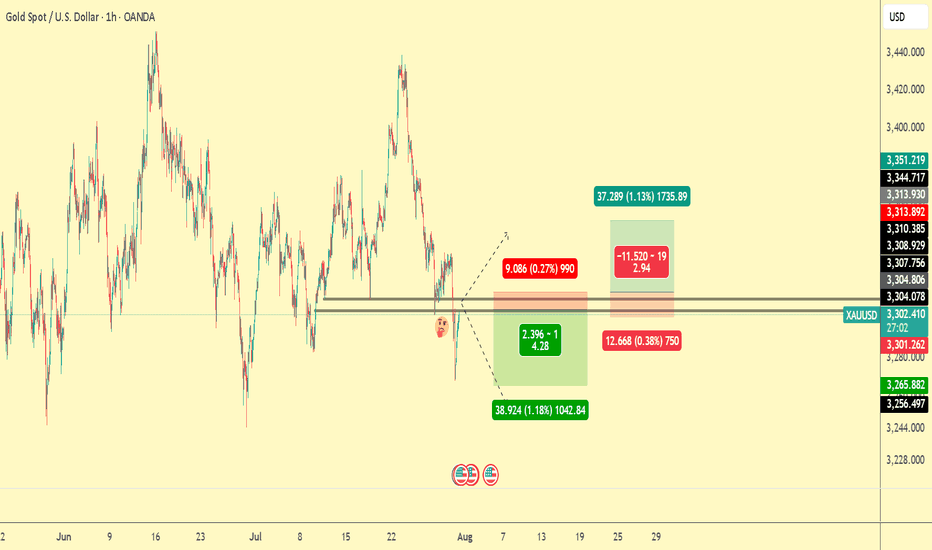

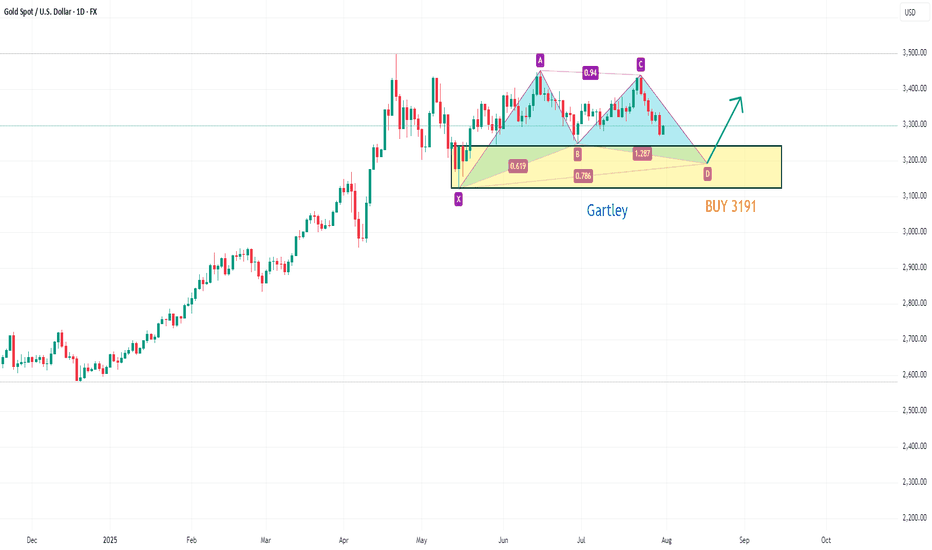

GOLD BUY TRADE IDEA🟡 XAU/USD Smart Money Setup – July 31, 2025

🔍 Key Technical Highlights:

• Demand Zone Entry:

• Price has tapped into a clear demand zone (gray box) around 3,274 – 3,290, signaling potential institutional accumulation.

• The previous inducement low has been swept, aligning with Smart Money Concepts (SMC).

• Liquidity Engineering:

• Equal highs (liquidity pool) visible from late June remain uncollected — a prime upside target.

• Price structure shows internal BOS, suggesting a shift in market sentiment.

• Expected Path:

• A potential multi-leg bullish move is mapped out, targeting the 3,440+ premium zone, completing imbalance fill and stop-run above highs.

• Risk-Reward:

• Stop loss sits just below the demand zone (~3,274), maintaining a favorable risk-to-reward ratio.

⸻

🧠 Smart Money Flow Narrative:

1. Sweep of inducement lows triggers institutional entries.

2. Demand zone holds with bullish reaction — confirmation of intent.

3. Expect higher highs and a rally toward uncollected liquidity above 3,440.

4. Low-risk buy opportunity for both swing and intraday traders.

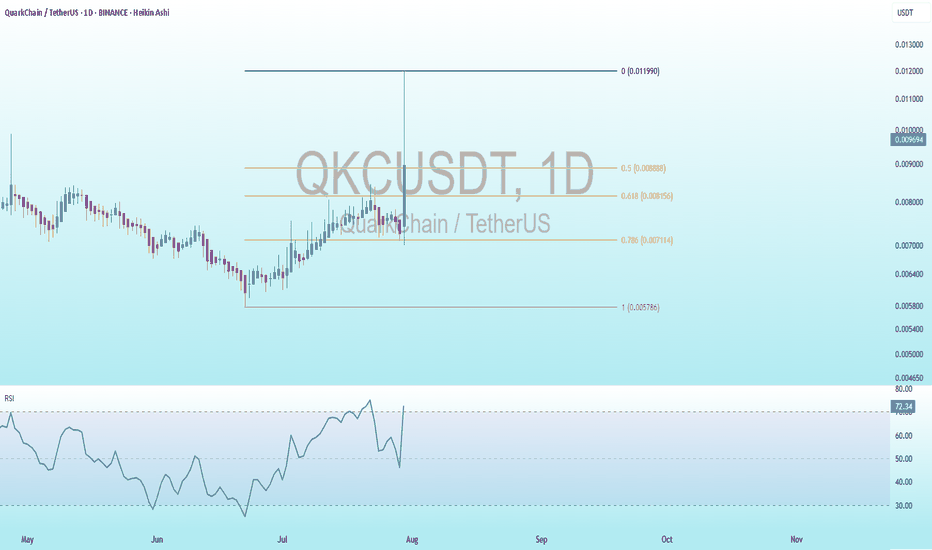

QKC Bearish DivergenceBINANCE:QKCUSDT

Trade Setup:

Target 1: 0.008888 (0.5 Fibonnaci Golden Zone).

Target 2: 0.008156 (0.618 Fibonnaci Golden Zone).

Target 3: 0.007114 (0.786 Fibonnaci Golden Zone).

Target 4: 0.005786 (1 Fibonnaci).

Stop Loss: 0.011990 (0 Fibonnaci).

RSI Analysis: The RSI is showing a bullish divergence, suggesting potential bullish momentum. The current RSI is around 72.29, approaching overbuy territory, so caution is advised.

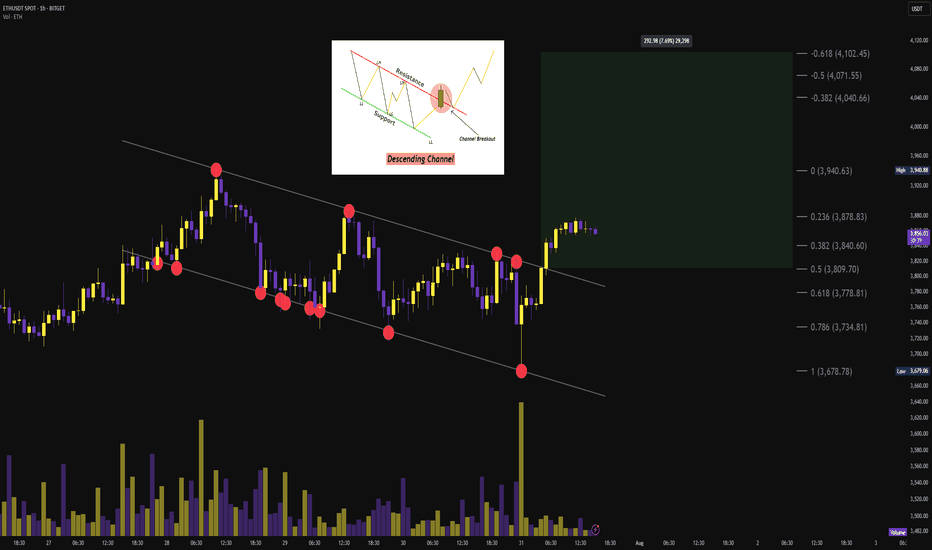

$ETH 1H Descending Channel Breakout🟩 Breakout Level: $3,770

🟩 Fib-Based Targets:

→ $3,878 (0.236)

→ $3,940 (0)

→ $4,040 (0.382)

🟥 Invalidation:

Break back inside the channel + loss of $3,678

Momentum Summary:

Perfect touchpoints across the descending channel. Final wick tagged demand with massive volume, followed by impulsive breakout and retest. Short-term structure favoring bullish continuation.

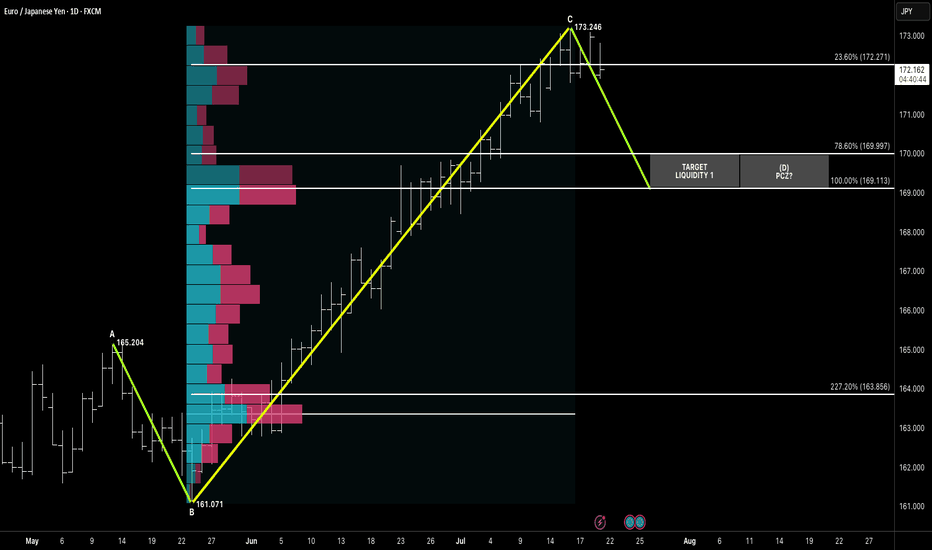

Symmetry Bearish Setup Targeting PCZ Liquidity Zone 1HELLO awesome traders, I hope y'all have had a great weekend!! What a beginning of trading week, ha? lets crack on by droping some chart here for yall.

After completing a clean ABC symmetry leg, EURJPY is now showing signs of exhaustion just below 173.250, with price stalling at the high-volume node. The projected Potential Completion Zone (PCZ) aligns at 169.997 (78.6%) and 169.113 (100%), backed by volume profile voids and confluence from prior structure.

This symmetrical move offers a classic liquidity sweep play, with target zones sitting below price in thin auction areas.

📌 Pattern Structure:

A: 165.204

B: 161.071

C: 173.246

D Target = 1:1 Symmetry → PCZ = 169.997–169.113

🔻 Bearish Trigger:

Break below 23.6% retracement (172.271) = early momentum shift

Liquidity likely rests between 170.00–169.00

🎯 Targets:

T1: 169.997

T2: 169.113 (let's do T1, Them will see)

🧠 Context:

JPY strength resurfaces amid macro uncertainty. Volume profile suggests fast price drop once liquidity is triggered below 171.00. Watching for confirmation candle or rejection below 172.20 zone.

“Symmetry leads the setup, but liquidity confirms the move.”

#DOGS/USDT#DOGS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have support from the lower boundary of the descending channel, at 0.0001432.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

There is a key support area in green at 0.0001402, which represents a strong basis for the upward trend.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.0001460

First target: 0.0001538

Second target: 0.0001500

Third target: 0.0001581

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

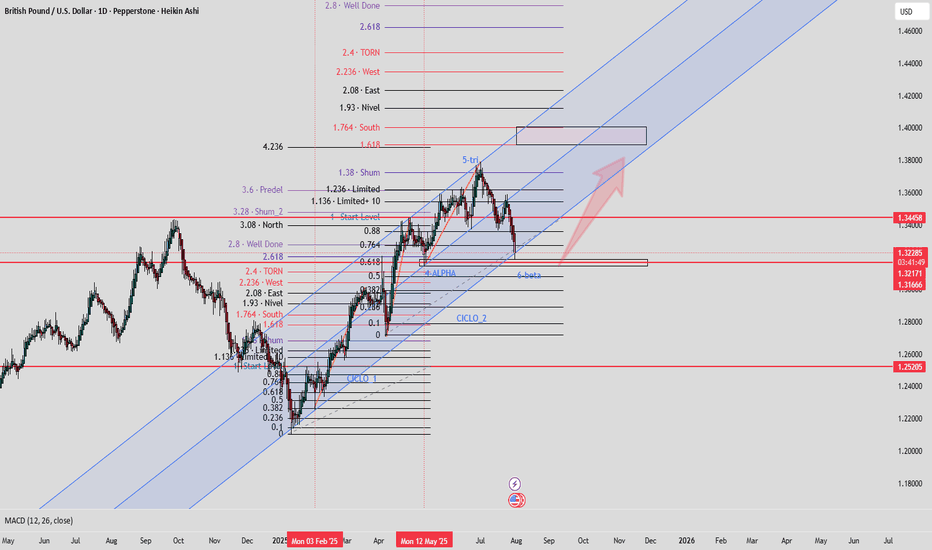

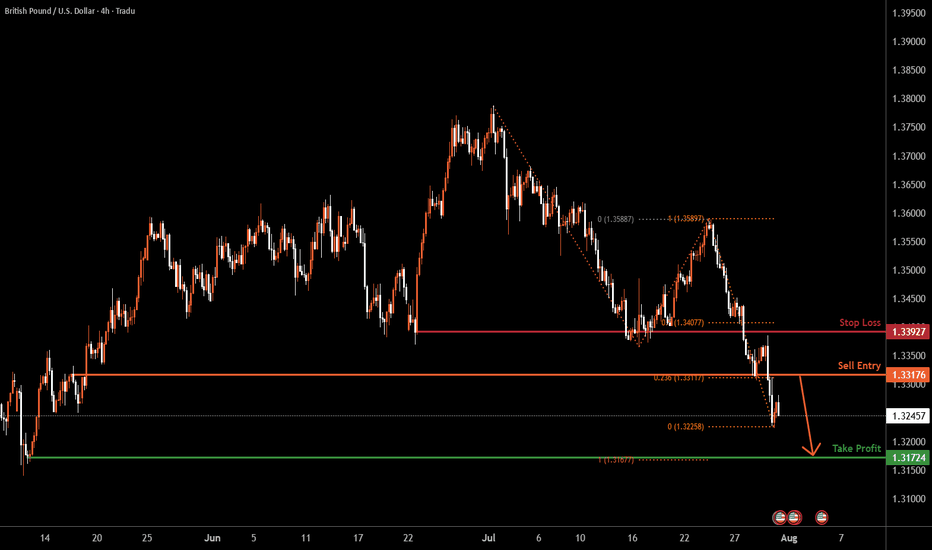

GBPUSD H4 | Bearish continuationThe Cable (GBP/USD) is rising towards the sell entry, which is a pullback resistance that aligns with the 23.6% Fibonacci retracement and could drop lower from this level.

Sell entry is at 1.3317, which is a pullback resistance that lines up with the 23.6% Fibonacci retracement.

Stop loss at 1.3392, which is a pullback resistance that is slightly below the 50% Fibonacci retracement.

Take profit is at 1.3172, which is a swing low support that aligns with the 100% Fibonacci projection.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

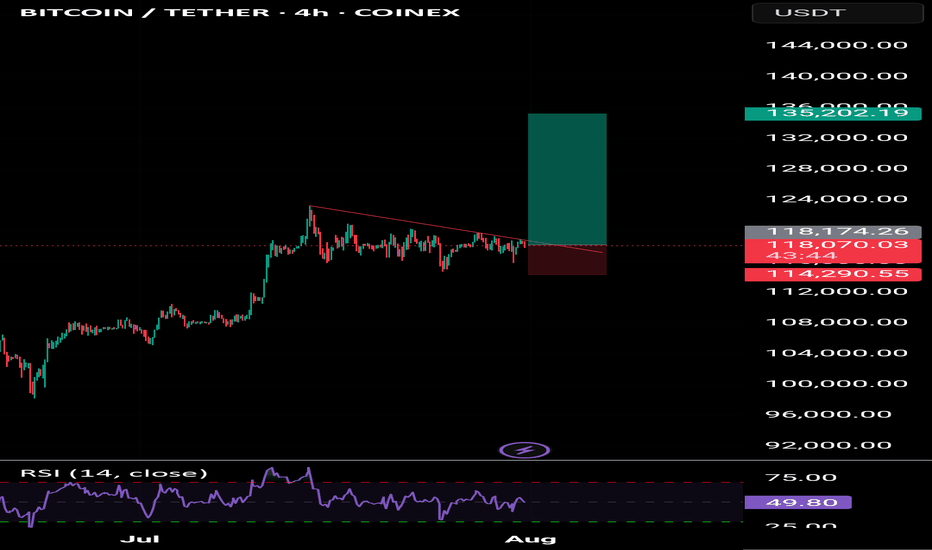

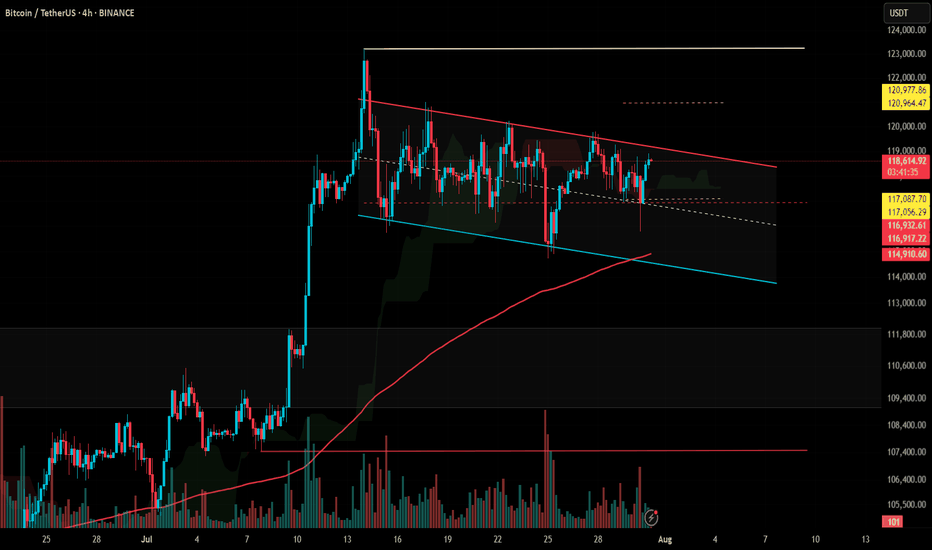

#BTC Update #12 – July 31, 2025#BTC Update #12 – July 31, 2025

Bitcoin is currently at the upper boundary of the channel it has been following. It may experience a pullback from this upper boundary. This pullback is estimated to reach the $116,800 level. If it wants to go lower, it could drop as far as the $114,500 level.

There is a significant amount of liquidity between $121,000 and $117,000. Bitcoin may also try to sweep this area. However, despite 4 or 5 attempts, it still hasn’t managed to break above the upper resistance zone. Therefore, a pullback should always be taken into account.

Overall, Bitcoin is still in a correction within a correction. That means no impulsive move has occurred yet. It’s not at a suitable point for either long or short positions. You may choose to trade within this range, but keep in mind that it's quite risky.

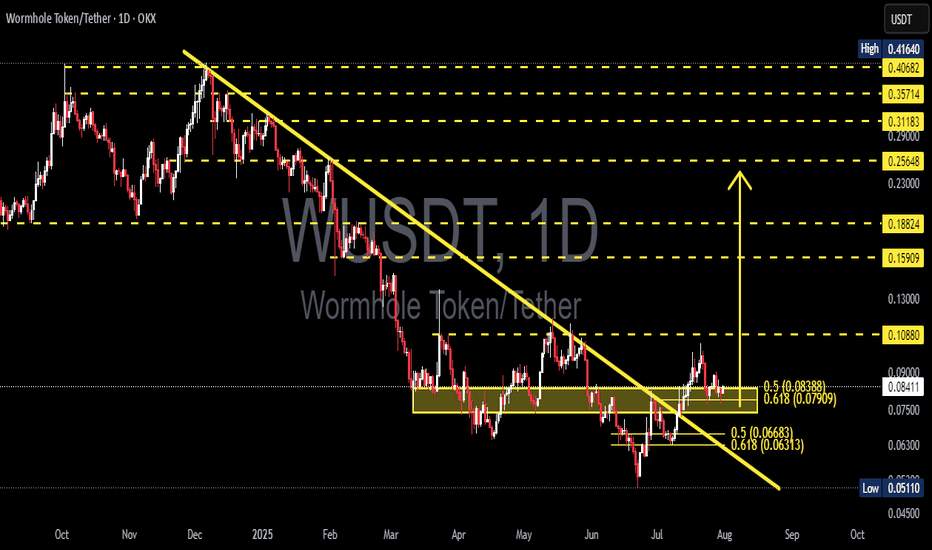

WUSDT Major Downtrend Break! Now Testing the Golden Pocket!🧩 Overview:

Wormhole Token (WUSDT) has finally broken out of a long-standing downtrend line that has been pressing the price down since February 2025. This breakout is a significant technical development and now the price is undergoing a critical retest phase — a moment that could mark the beginning of a major bullish reversal.

Price is currently consolidating around the Fibonacci 0.5–0.618 retracement zone (0.079–0.084), commonly known as the "Golden Pocket Zone" — a popular area for smart money accumulation.

---

🧠 Pattern & Structure:

📉 A long-term descending trendline was decisively broken, signaling a potential shift in market sentiment.

📦 A consolidation range is forming within a yellow support box — between 0.07909 and 0.08388, a prior resistance zone that is now being retested as support.

🔁 This is a classic breakout-retest structure, often seen before major price expansions.

---

🟢 Bullish Scenario (Reversal Potential):

If the price holds above the 0.079–0.084 support range, it sets the stage for a potential bullish continuation. Key upside targets include:

🔹 0.10880 – Previous distribution zone.

🔹 0.13000 – Psychological and structural resistance.

🔹 0.15909 – March resistance.

🔹 0.18824 – Measured move target from breakout.

🔹 0.23000–0.29000 – Expansion zone if momentum sustains.

A strong bullish candle closing above 0.09000 with increasing volume would strengthen this outlook.

---

🔴 Bearish Scenario (Failed Retest):

If the Golden Pocket fails to hold:

Price may retrace to lower supports:

🔻 0.07500 – Minor support zone.

🔻 0.06300 – Key support from June.

🔻 0.05110 – Yearly low and last line of defense. A breakdown below this level would revalidate the bearish trend.

Traders should be cautious if daily closes fall below the yellow zone with high selling volume.

---

💡 Conclusion & Strategy:

WUSDT is currently at a critical technical juncture. A confirmed breakout has occurred, but the retest phase is what will validate the strength of this move.

🎯 Swing traders may look for entries within the 0.079–0.084 range with invalidation below 0.075.

📉 Short-sellers might wait for a confirmed breakdown below this support with volume confirmation.

Momentum is building — the next move could define the mid-term trend.

---

📊 Chart Highlights:

✅ Downtrend Breakout: Confirmed

✅ Retesting Key Fibonacci Zone (0.5–0.618)

✅ Former Resistance → Becoming Support

🚨 Crucial Bullish-Bearish Decision Zone

#WUSDT #WUSDTAnalysis #WormholeToken #CryptoBreakout #GoldenPocket #PriceAction #FibonacciLevels #AltcoinReversal #TechnicalAnalysis

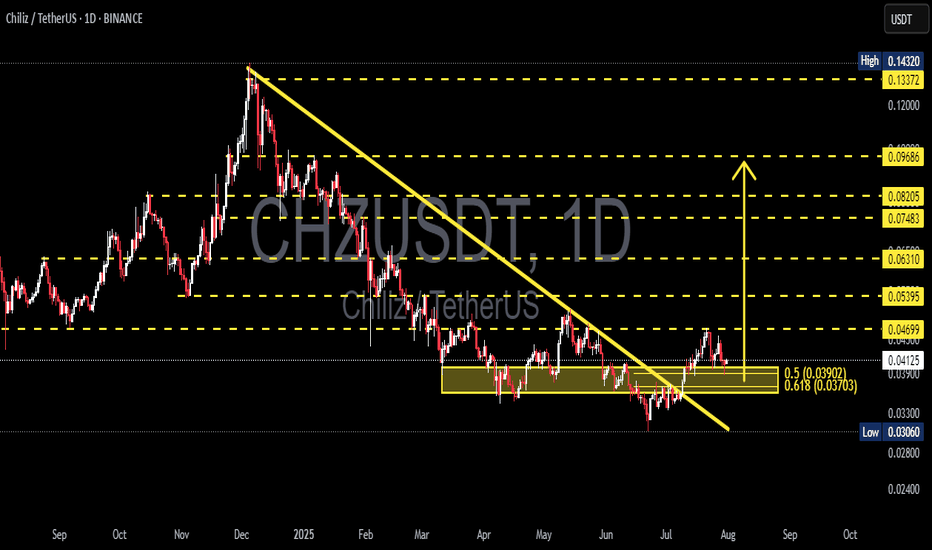

CHZUSDT Reversal Potential Breakout & Fibonacci Retest in FocusChart Analysis:

The CHZ/USDT pair on the 1D timeframe has successfully broken out of a long-term descending trendline, which had been acting as resistance since December 2024. The breakout occurred with a strong bullish candle, suggesting a potential trend reversal.

Currently, the price is performing a retest of the breakout zone, which aligns perfectly with the Fibonacci retracement levels:

0.5 at $0.03902

0.618 at $0.03703

This confluence zone is critical as it may serve as a base for a continued bullish move.

---

Pattern Identified:

Descending Triangle Breakout → Signaling the end of a distribution phase and the potential start of accumulation.

Bullish Retest Zone → Price is testing the previous resistance turned support + Fibonacci confluence.

---

Bullish Scenario:

✅ If price holds above the $0.037–$0.039 support area and forms a bullish rejection candle, potential upside targets include:

$0.04699 (minor resistance)

$0.05395

$0.06310

$0.07483

Up to psychological resistance at $0.09686

---

Bearish Scenario:

❌ If price breaks below the $0.03703 level, further downside could be seen toward:

$0.03306 (local support)

And possibly the recent low at $0.03060

However, as long as the price stays above the 0.618 Fibonacci, the bias remains bullish.

---

Conclusion:

CHZ/USDT is at a critical decision point. A successful retest of the breakout zone combined with Fibonacci support could provide a strong accumulation opportunity for buyers. Watch closely for bullish confirmation candles in the yellow zone before entering.

#CHZ #CHZUSDT #CryptoBreakout #FibonacciLevels #TechnicalAnalysis #AltcoinWatch #TrendReversal #CryptoTrading #TradingViewAnalysis

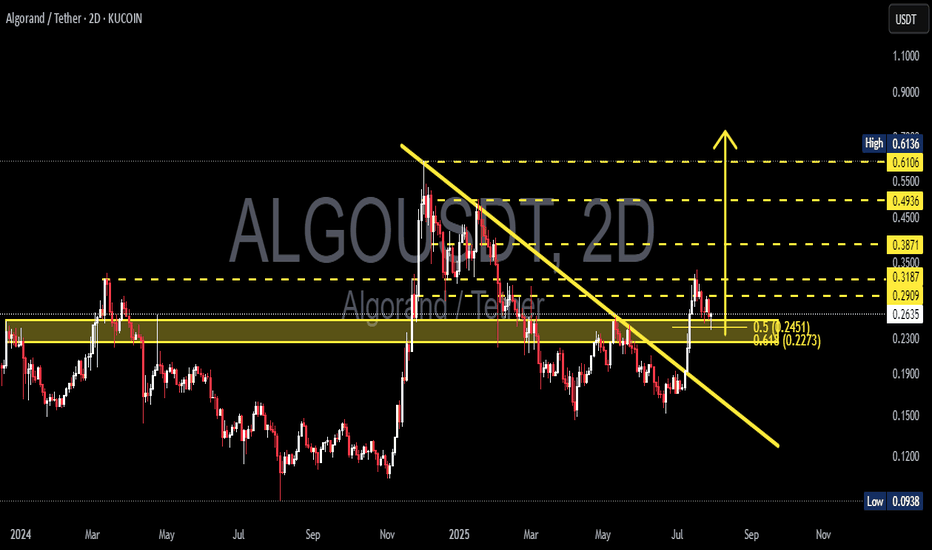

ALGOUSDT Break Downtrend – Reversal in Progress or Just a Retest📊 Technical Analysis Overview:

The Algorand (ALGO) / Tether (USDT) pair has shown a notable technical development by successfully breaking above a medium-term descending trendline that has acted as resistance since early 2025.

---

🔍 Pattern & Structure:

A clean breakout above the descending trendline (yellow sloped line) indicates a potential shift in trend from bearish to bullish.

Price is currently undergoing a retest of the breakout zone, aligning with the Fibonacci retracement levels 0.5 ($0.2451) and 0.618 ($0.2273).

The yellow horizontal zone ($0.25–$0.29) has been a significant support/resistance flip zone, showing strong historical reaction throughout 2024 and early 2025.

A higher high and higher low structure is starting to form — an early signal of a potential bullish reversal.

---

📈 Bullish Scenario:

If the price holds the support zone between $0.2451 and $0.2273, we could see a continuation of the upward move toward the following resistance levels:

$0.2909 (current minor resistance)

$0.3187

$0.3500

$0.3871

Mid-term targets: $0.4936 and $0.6106

A daily or 2D candle close above $0.3187 with strong volume would confirm a bullish continuation.

---

📉 Bearish Scenario:

On the other hand, failure to hold above the $0.2451–$0.2273 support zone could lead to a renewed bearish move with potential targets at:

$0.1900 (weekly historical support)

$0.1500

Extreme support: $0.0938 (2024 cycle low)

A break below $0.2273 would invalidate the breakout and may signal a bull trap.

---

📌 Summary:

ALGO is at a key inflection point. The current pullback could be a healthy correction after a breakout or a failed retest. Watch for price action and volume reaction near $0.2451–$0.2273 to confirm the next move.

#ALGO #Algorand #ALGOUSDT #CryptoAnalysis #TechnicalAnalysis #Breakout #BullishReversal #Fibonacci #SupportResistance #Altcoins #CryptoSetup #PriceAction

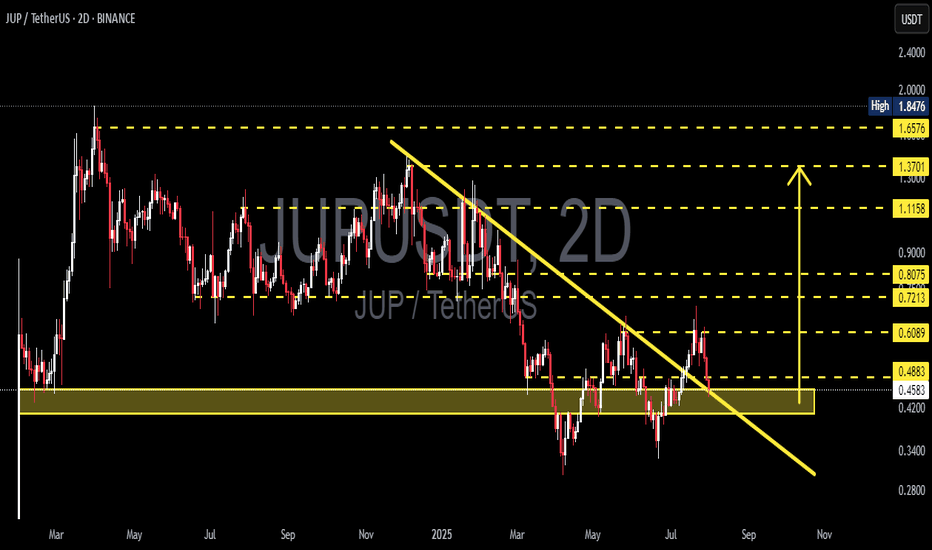

JUP/USDT Retests Key Support! Bounce Incoming or Breakdown Ahead📉 Complete Technical Analysis:

The JUP/USDT pair is currently showing a critical price action after breaking out from a medium-term descending trendline (yellow diagonal line). However, the price is now retesting a major demand zone around $0.4200–$0.4574.

📌 Pattern Identified:

Descending Trendline Breakout: Price successfully broke above a long-standing bearish trendline.

Retest of Breakout Zone: The current move is a classic retest, often seen before a trend reversal continuation.

Strong Demand Zone: The yellow zone ($0.4200–$0.4574) has historically served as a strong accumulation and bounce area.

---

📈 Bullish Scenario:

If the price holds and bounces from the $0.4200–$0.4574 zone, bullish momentum could resume with upside targets:

Short-term target: $0.6089

Next resistances: $0.7213 – $0.8075

A confirmed higher low above support would strengthen the bullish structure.

---

📉 Bearish Scenario:

If the price breaks down below $0.4200, bearish pressure could return, leading to further downside.

Potential decline toward deeper support levels around $0.35–$0.30.

Breakdown with increasing volume would confirm seller dominance.

---

🎯 Key Levels to Watch:

Support Zone: $0.4200 – $0.4574 (Critical Retest Area)

Immediate Resistance: $0.4883, $0.6089

Major Resistance Levels: $0.7213, $0.8075, $1.1158, up to $1.6576

---

🧠 Conclusion:

JUP/USDT is currently at a crucial decision point. The reaction at this support zone will define whether the breakout holds or fails. Traders should watch this level closely for confirmation of the next major move.

#JUPUSDT #CryptoAnalysis #AltcoinUpdate #TechnicalAnalysis #CryptoBreakout #SupportAndResistance #TradingView #Cryptocurrency #ChartPattern #BullishSetup #BearishCase

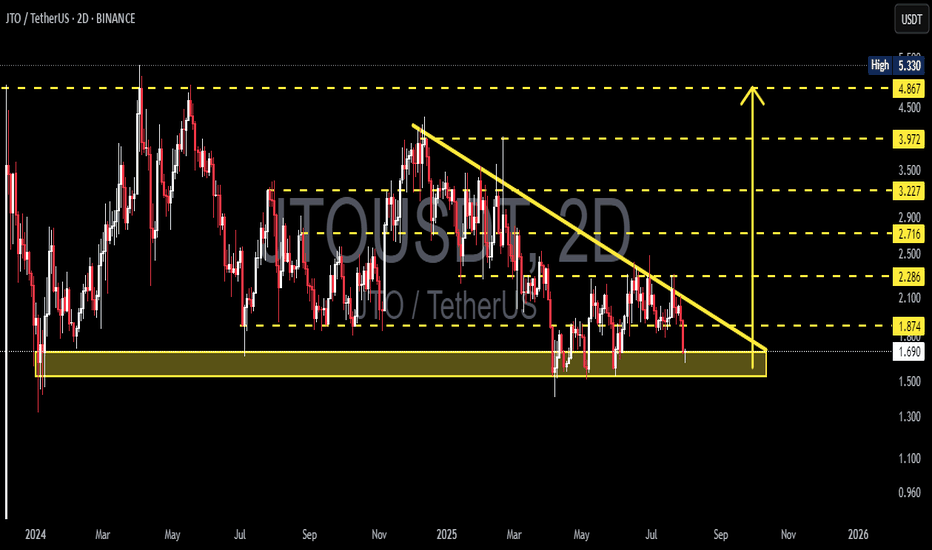

JTO/USDT at the Edge of Pressure – Breakout or Breakdown Ahead?🧠 Detailed Technical Analysis (2D Timeframe):

JTO/USDT is currently consolidating at a critical support zone within a well-defined Descending Triangle pattern that has been forming for over 6 months.

Key observations:

Price has been making lower highs, forming a downward-sloping resistance trendline.

Meanwhile, strong buying interest has held up the support zone between $1.69 and $1.87, suggesting accumulation.

This creates a classic Descending Triangle, often leading to a sharp breakout or breakdown.

---

📌 Key Levels:

Level Description

$1.69–$1.87 Major Demand Zone / Key Support

Descending Trendline Dynamic Resistance (from Lower Highs)

$2.29 First Resistance (Breakout Trigger)

$2.71 Key Mid-Term Resistance

$3.22 – $3.97 Major Upside Targets

$1.50 & $1.30 Breakdown Targets

---

📈 Bullish Scenario (Breakout):

If the price holds the support and successfully breaks the descending trendline, we could see a strong bullish reversal:

Confirmation breakout may lead to a rally toward $2.29 → $2.71 → $3.22 → up to $3.97.

Breakout strength increases if accompanied by volume surge.

Bullish Catalysts:

Positive project fundamentals.

Volume squeeze near triangle apex.

RSI/MACD divergence (if present).

---

📉 Bearish Scenario (Breakdown):

If price closes below the $1.69 zone with conviction:

Descending triangle confirms as a bearish continuation.

Target downside to $1.50 and potentially $1.30.

Could signal distribution phase by larger players.

Bearish Confirmation: Strong 2D candle close below $1.69 with high volume.

---

🧩 Pattern Breakdown – Descending Triangle:

The pattern represents price compression between lower highs and a horizontal support.

Statistically, 70% of descending triangles resolve to the downside.

However, in oversold conditions or with bullish catalysts, it may lead to a powerful short squeeze breakout.

---

🧭 Summary & Strategy Insight:

JTO/USDT is nearing a decision point. At the edge of the triangle’s apex, volatility is likely to spike — with a strong move in either direction.

💡Possible Strategy:

Conservative entry: Wait for breakout confirmation above the trendline with volume.

Aggressive entry: Speculative buy near $1.70 with tight stop loss.

Avoid heavy positions until the breakout or breakdown confirms.

---

🧲 Suggested Post Title:

> "JTO/USDT at a Crossroads – Descending Triangle Set for Explosive Move?"

A breakout is imminent. Will you be ready?

#JTOUSDT #CryptoBreakout #DescendingTriangle #AltcoinSetup #TechnicalAnalysis #CryptoStrategy #ChartPatterns