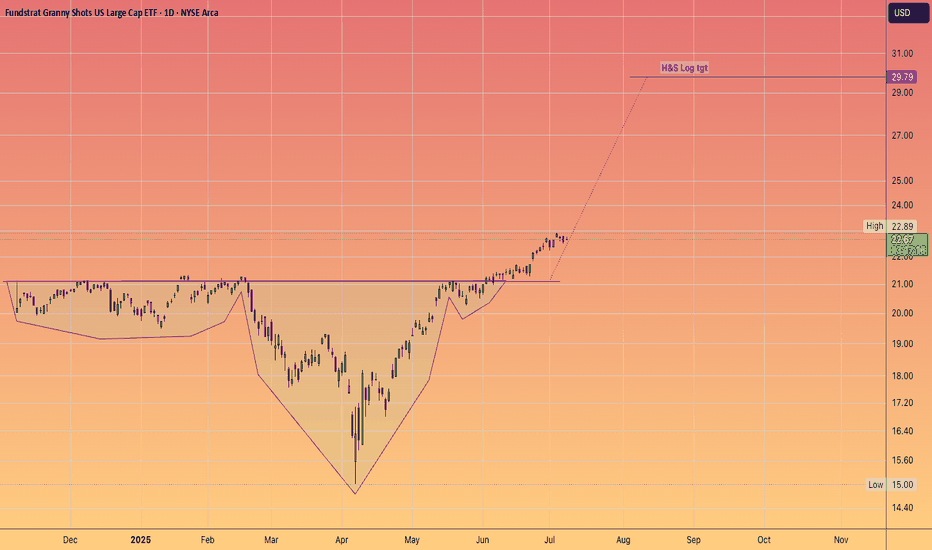

TOM LEE leading the charge in this new BULL MarketThank you for providing excellent analysis,

being on the right side of the trade

and helping retail with your public speaking on your own channel, podcasts, and of course CNBC.

I wish you continued success in you Granny shots ETF which is already over $1.5 Billion in AUM!

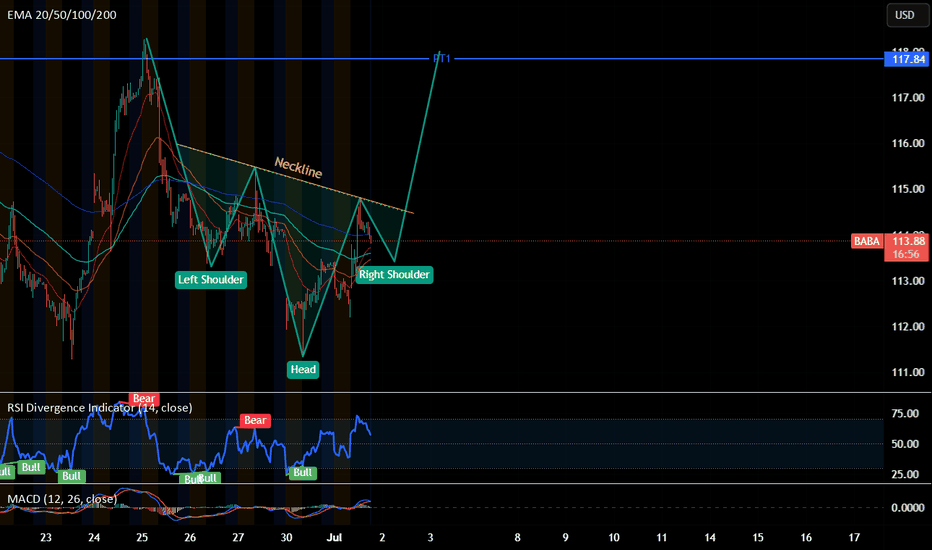

Head and Shoulders

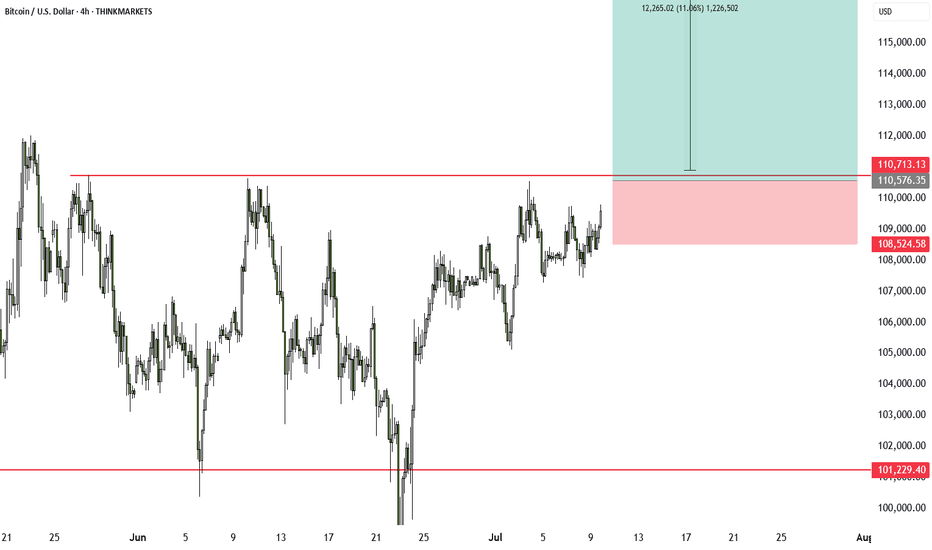

XRP breaks out: 19% rally in sightXRP has just broken out of an inverse head and shoulders pattern, a classic bullish setup that points to a potential 19% rally. The breakout comes at a time when the US is expected to deliver key crypto regulation updates by July 22. If the legal outcome is positive, it could fuel further upside not only in XRP but across the broader crypto market. This setup offers a strong risk-to-reward profile, especially if Bitcoin also breaks out of its current rectangle pattern.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

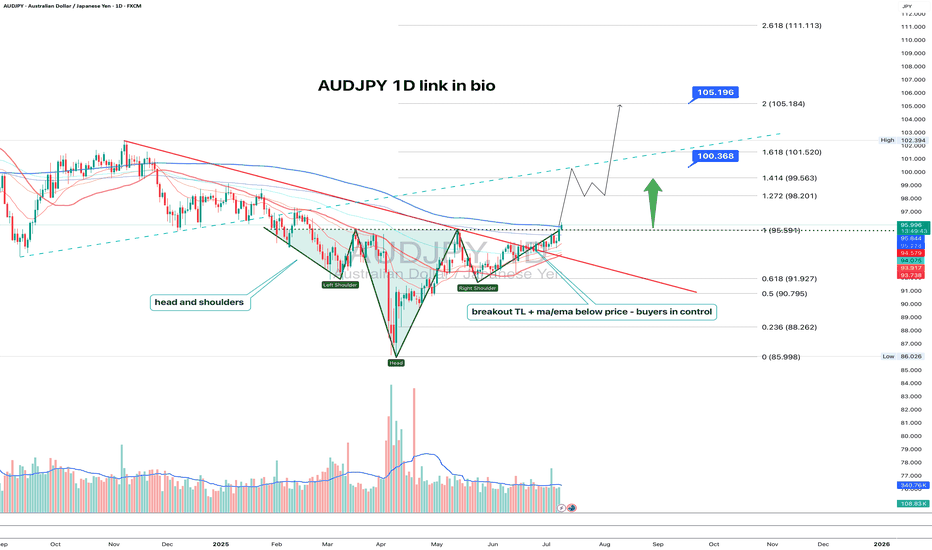

AUDJPY 1D: breakout toward 100–105AUDJPY has confirmed an inverse head and shoulders breakout on the daily chart, with a strong move above the neckline. All key moving averages, including MA50 and MA200, remain below the current price — confirming bullish momentum. Volume increased on the breakout, and price has held above the 95.6 neckline zone. As long as that level holds, the setup remains valid. Targets are set at 100.36 (1.618 Fibo) and 105.19 (2.0 Fibo).

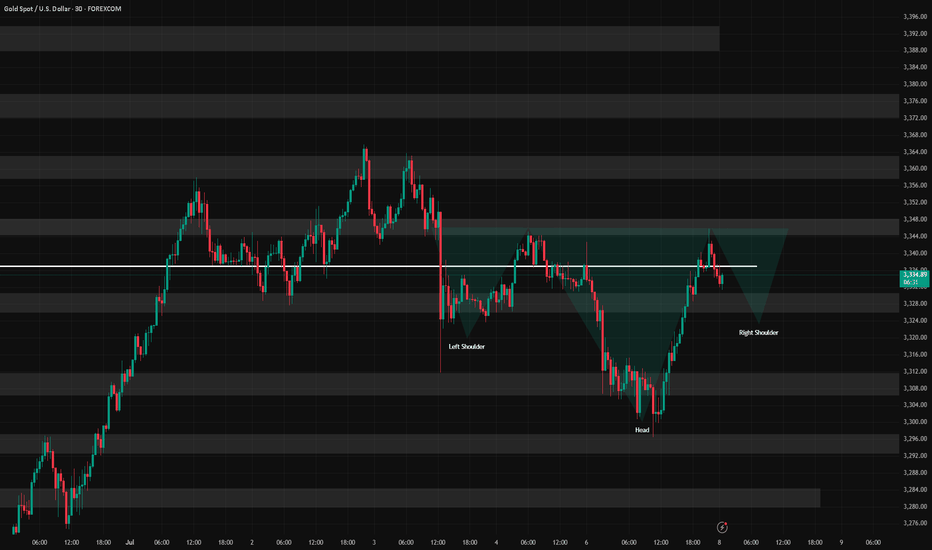

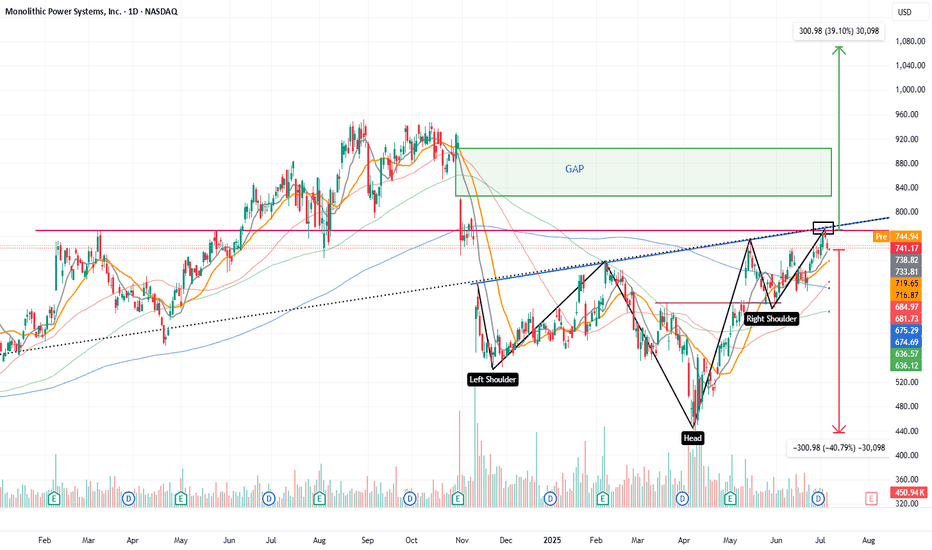

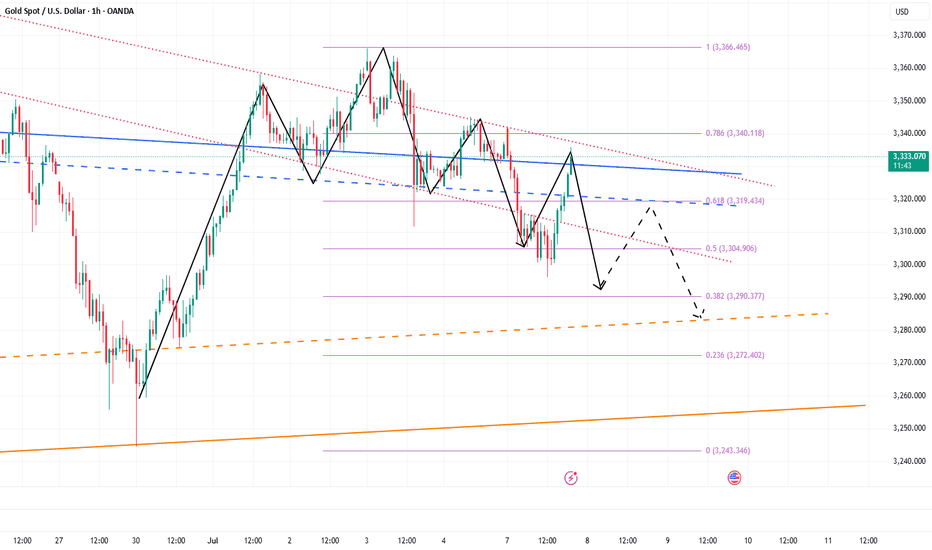

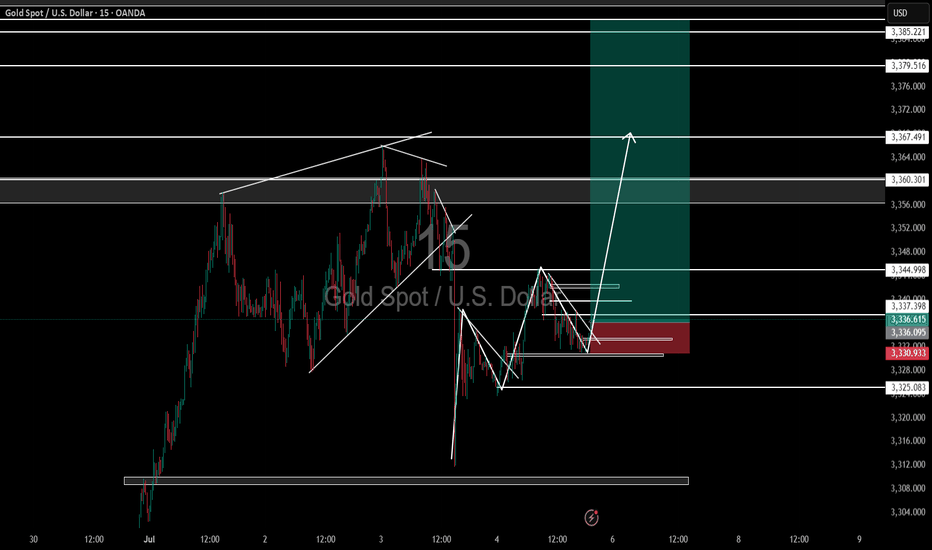

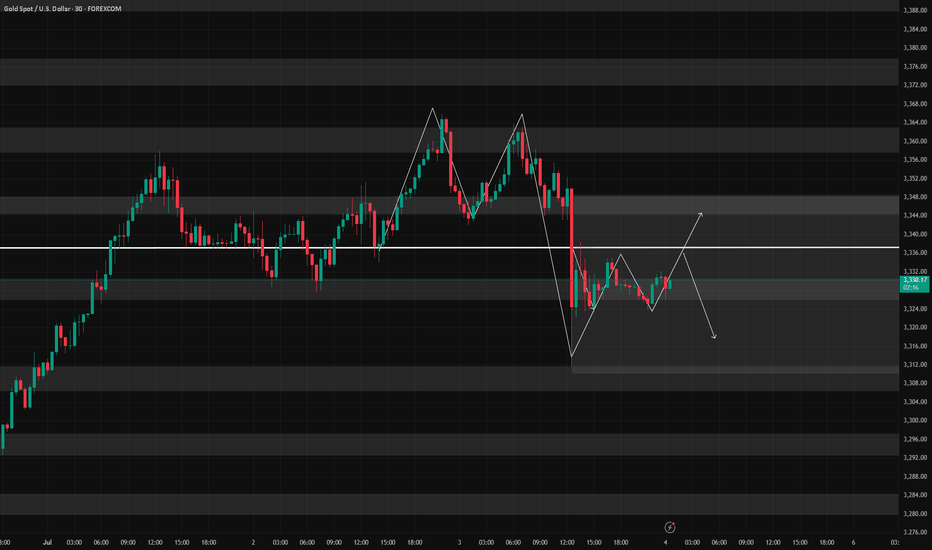

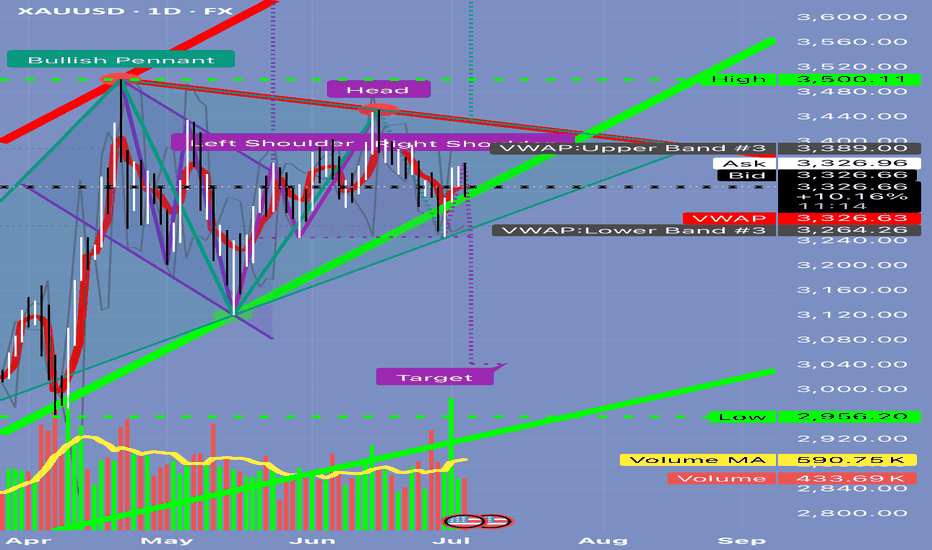

7/8: Inverse Head and Shoulders Pattern, Support at 3321–3312Good morning, everyone!

Yesterday, gold broke below the 3321 support during the session, dropped to around 3296, then staged a strong rebound back toward the opening price—forming a classic deep V-shaped reversal and regaining support above the MA60 on the daily chart.

The market remains in a consolidation phase between the MA20 and MA60 on the 1D chart, with no clear directional breakout yet.

On the 30-minute chart, the previous head-and-shoulders top pattern has been completed with the recent decline. The current structure can be tentatively viewed as the formation of a head-and-shoulders bottom.

If this bullish reversal pattern holds:

The 3321 level must act as valid support during any pullback; deeper confirmation may come from 3312, which corresponds to the previous left shoulder low. Although this was partially driven by a data-related spike, most candle bodies remained around 3321—so 3321 is the primary support, and 3312 is the backup.

If confirmed, the price may advance toward the 3360 target zone.

If the pattern fails, watch for the development of a double bottom formation, with MA60 on the daily chart remaining a key support level.

📌 For today, focus on trading within the 3312–3352 range, using a buy-low/sell-high approach, and stay flexible in response to evolving chart patterns.

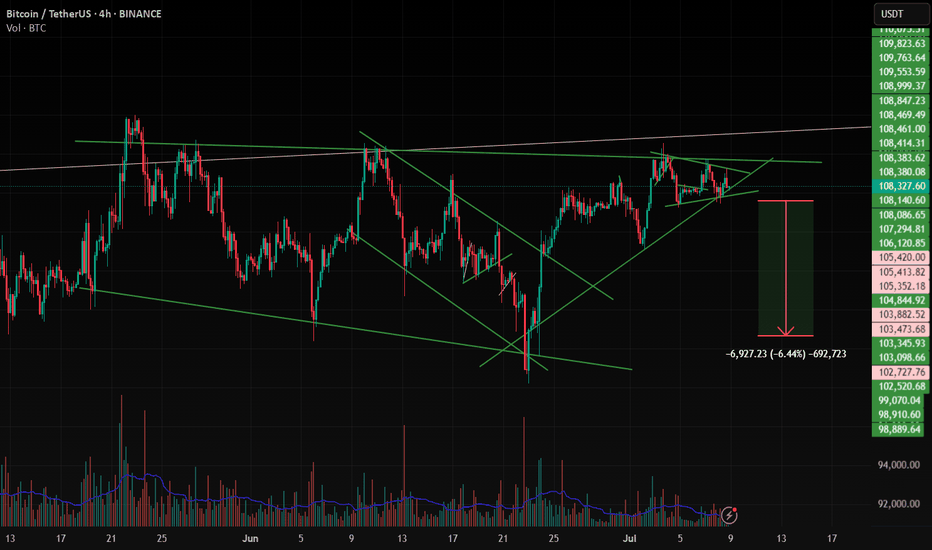

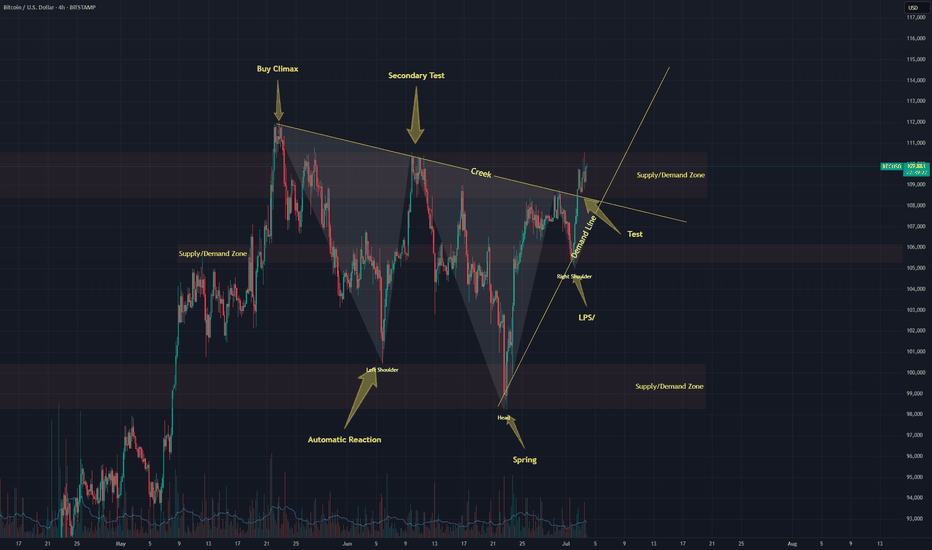

BTC , 4hr , BearishBTC is Forming a Pattern and it is at the top of the Another Pattern and It is facing rejection 3 Times from Above and now it is forming another pattern inside and Ready for Break Down of the Pattern , if it breaks the Pattern Down then it will be bearish almost 90% it will move to down side , if it has not given Breakdown and moving inside the small pattern then wait patiently and observe carefully .

Then it may also give Breakout for up side .

Follow Risk Management Properly

Follow for More Swing Ideas Like this .

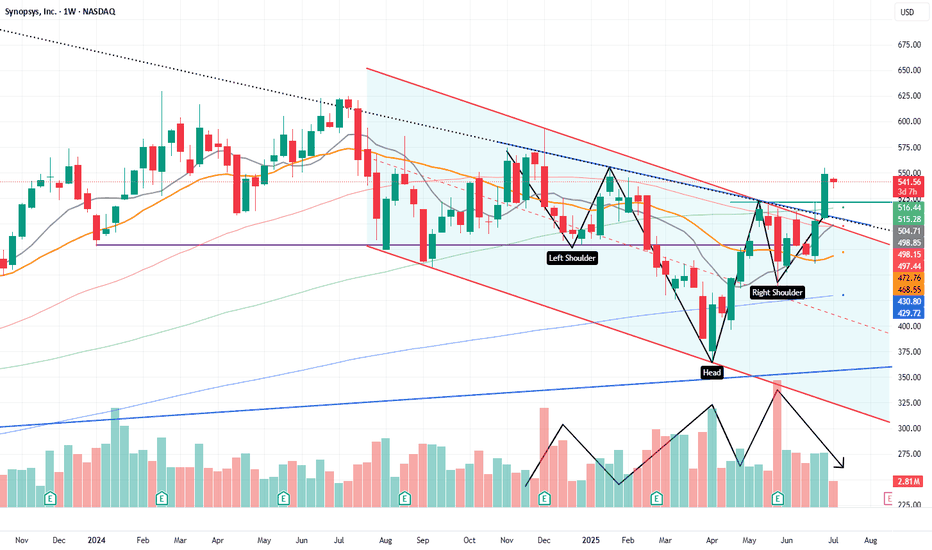

Inverse Head and Shoulders Already Completed Toward a New ATHThe price has completed the formation of an inverse head and shoulders pattern, with the final breakout occurring last week.

Volume confirms the validity of the pattern.

The distance from the head to the neckline projects a target toward a new all-time high (ATH).

As often happens after a breakout, a retest of the neckline may occur, which could present a good entry or accumulation opportunity

Inverse head and shoulders with a gap to close towards 1070$The price is completing the formation of an inverse head and shoulders pattern, with a head-to-neckline distance of approximately $300.

This suggests a potential breakout target around $1070.

Along the way, there is also a significant gap that has remained unfilled for several months.

The stock belongs to a company that manufactures power management chips used in all types of electronic devices, with steadily growing revenue

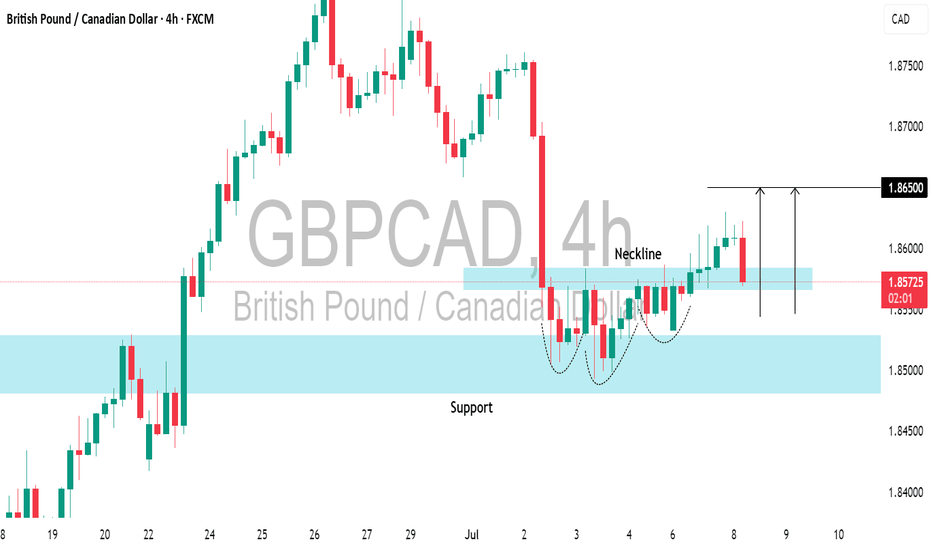

GBPCAD: Classic Pullback Trade for TodayThe GBPCAD pair formed a head and shoulders pattern at a crucial daily/intraday horizontal support level.

The recent breach of its neckline indicates a notable strength of buyers, suggesting a bullish momentum.

Given this technical setup, I anticipate that the pair could rally and potentially reach the 1.8650 level in the near term.

The short position is losing money. What should we do?Gold hit the intraday low of around 3296 and then began to rebound. We can see that the rebound of gold is not strong, but it is relatively sustained, so gold has rebounded to around 3335. To be honest, I did short gold according to my plan and still hold a short position.

Although gold has rebounded to around 3330, I don’t think my short gold trade has failed. As I said in the previous point of view, gold is facing technical suppression of the head and shoulders in the short term, which will suppress the rebound limit within the 3335-3340 area. So before gold stabilizes at 3340, I think the gold shorts still have the upper hand. So as long as gold stays below 3340, I think the gold rebound is a good opportunity to short gold.

At present, gold is facing the resistance area of 3335-3340 and begins to show signs of stagflation. After consuming a certain amount of bullish momentum, the gold shorts may counterattack strongly again and stimulate gold to fall rapidly. Therefore, before gold breaks upward through the 3335-3345 area, we can still consider shorting gold, or continue to hold a short position in gold!

I win when I don't postLets see how it goes.

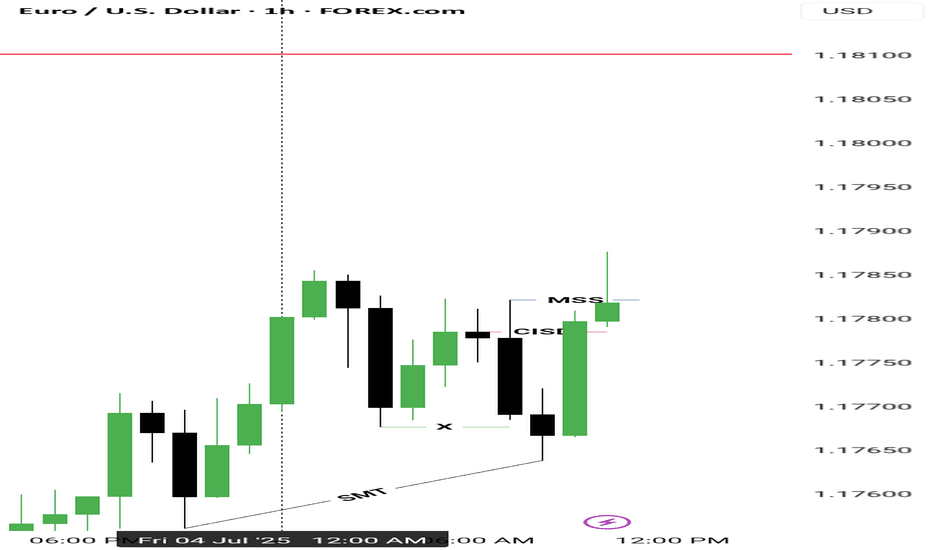

The consolidation that occurred because of the U.S holiday has led to giving buyers more power.

If not, I have a Stop Loss in place. We either win or we lose.

5th wave analysis + Market Structure support zone + Heads & shoulder(4H Timeframe) - we are currently in the right shoulder.

Risk what you can afford to lose

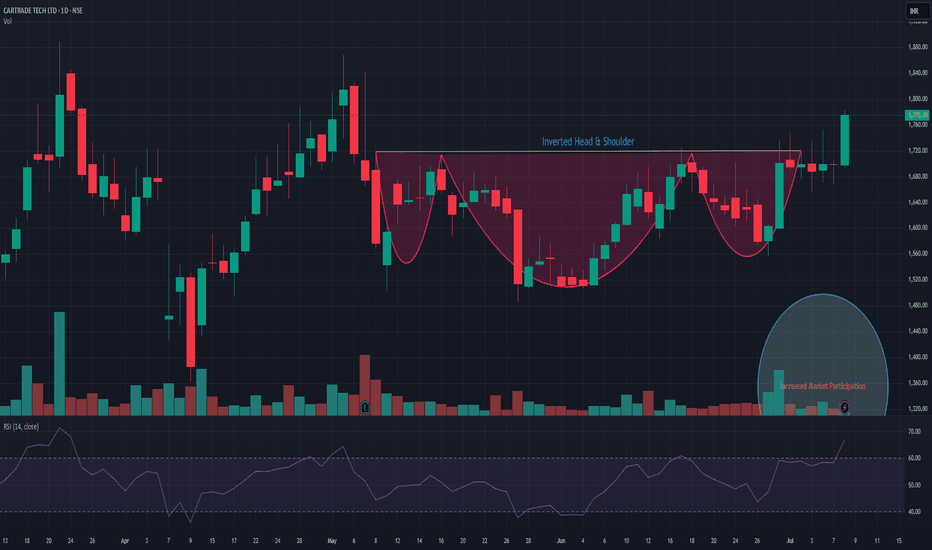

Apollo Hospitals – Inverted Head & Shoulders BreakoutChart Pattern: Inverted Head & Shoulders

Timeframe: Daily

Breakout Level: ₹7,565

Target: ₹8,980

Potential Upside: +18.7%

Stop Loss: ₹7,250

Volume: Strong breakout volume confirms institutional activity

RSI: 71 – Momentum strong, no signs of exhaustion or divergence

Technical Thesis:

Apollo Hospitals has completed a multi-month inverted head & shoulders pattern with a breakout above the ₹7,565 neckline zone. The structure developed over 8 months, showing accumulation and basing under resistance. The breakout is supported by the highest volume since Oct 2023 and a clean bullish candle. There is no visible supply zone until the ₹8,800–₹9,000 area, suggesting potential for a swift move.

Trade Plan:

Entry: On breakout above ₹7,565 or on pullback to ₹7,450–₹7,500 (if offered)

Target: ₹8,980 (based on measured move projection)

Stop Loss: ₹7,250 (below neckline and prior range low)

Risk:Reward: ~3.5:1

Disclaimer:

This chart and analysis are intended for educational and informational purposes only. This is not a recommendation to buy, sell, or hold any financial instrument. The views expressed are based on technical patterns and personal interpretation and may not reflect actual market movement. Always do your own research and consult your financial advisor before making any trading decisions. Trading in equities involves risk of capital loss.

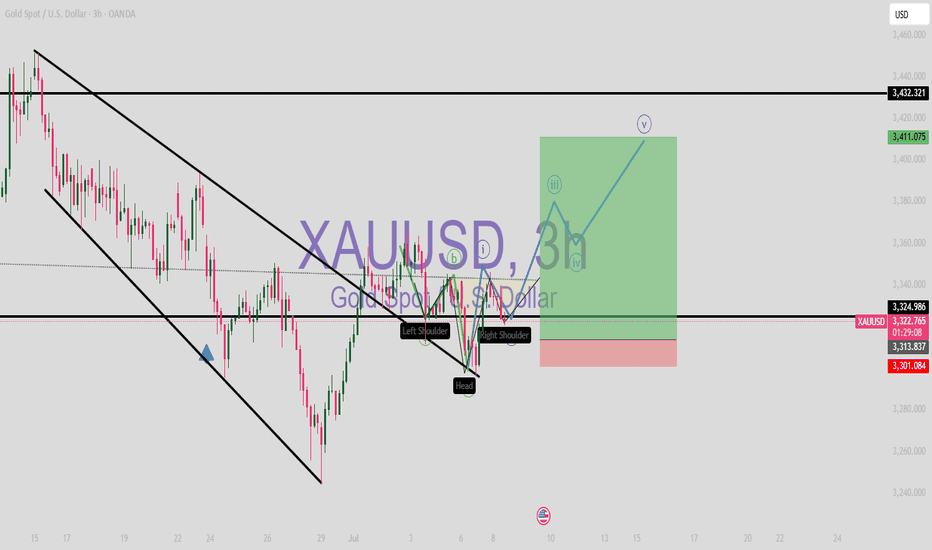

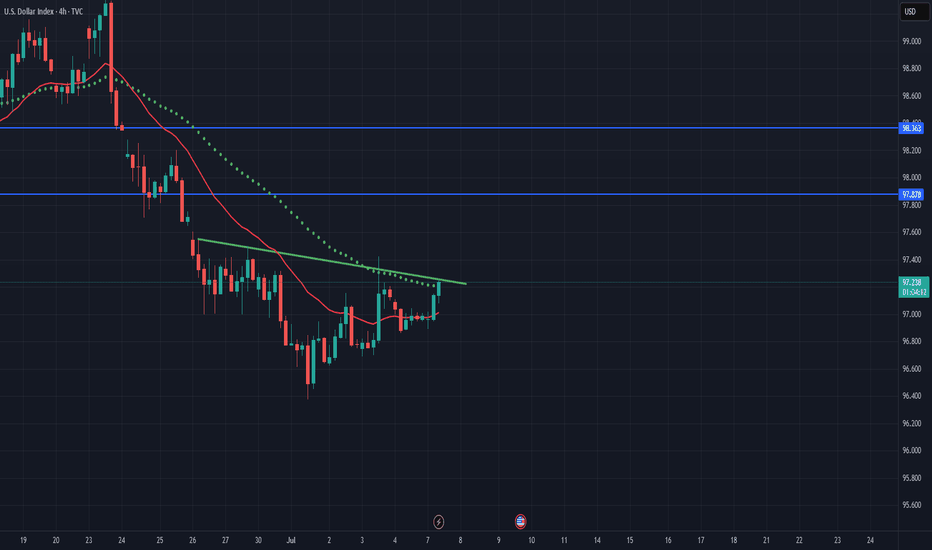

7/4: Trade Within the 3313–3346 RangeGood morning, everyone!

Yesterday’s intraday trades delivered solid profits. Since the U.S. market will be closed today, news-driven volatility is expected to be limited. Therefore, today’s trading focus will primarily revolve around technical setups.

Current structure:

Key support: 3321–3316

Immediate resistance: 3337–3342, followed by 3360

If support holds and resistance breaks, a potential inverse head-and-shoulders pattern may form on the 4H chart, with the next target near 3380

If support breaks, focus shifts to the 3303–3289 support zone

Given the likelihood of range-bound price action today, the suggested intraday range is 3313–3346, with a preference for selling near resistance and buying near support.

If an upside breakout occurs, consider using the MA20 on the 30-minute chart as a guide for pullback entries.

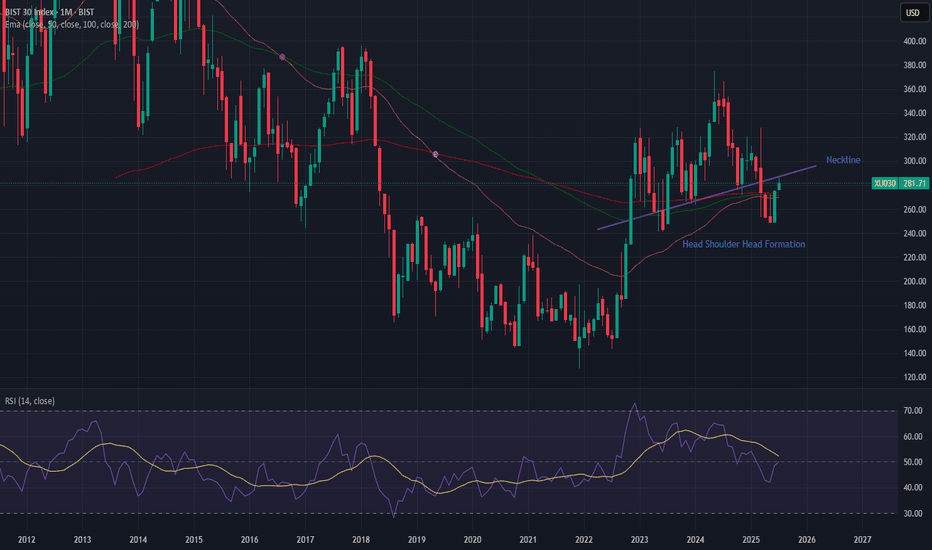

BIST30 (USD) Monthly: Head & Shoulders Confirmed? Neckline RetesType: Bearish

The Turkish Stock Market (BIST30 or XU030), when viewed in US Dollar terms on the monthly chart, presents a textbook Head and Shoulders (H&S) topping pattern.

We can observe the Left Shoulder, a higher Head, and a lower Right Shoulder, indicating waning bullish momentum at the peak of what has been a significant rally.

The fact that this pattern is forming on the monthly timeframe underscores its long-term significance, suggesting a major structural shift rather than just a short-term correction.

The Neckline Break & Retest:

Crucially, the BIST30 (USD) has recently broken below its multi-month neckline, a key support level that connected the lows between the shoulders and the head. This breakdown served as the initial confirmation of the H&S pattern.

What we are witnessing now is the classic retest of this broken neckline. Price has rallied back towards this former support, which now acts as strong overhead resistance.

This retest often provides a 'last kiss goodbye' before the larger bearish move unfolds.

The market's reaction at this retest level will be paramount. A strong rejection from the neckline, potentially accompanied by increasing bearish volume or bearish candlestick formations on lower timeframes (e.g., weekly), would further validate the H&S breakdown and strengthen the bearish outlook.

Potential Price Target:

Based on the classic H&S methodology, we can project a potential price target. By measuring the vertical distance from the peak of the 'Head' to the neckline and projecting it downwards from the breakdown point, we derive a preliminary bearish target around 220 USD for BIST30 (XU030)

From Congestion to Collapse: Understanding Distribution and H&S A Simple Lesson: How to Identify Congestion Zones in the Market — Schabacker’s Approach and the Head and Shoulders Pattern

⸻

👤 Who Was Schabacker?

🔹 Richard Schabacker was one of the pioneers who authored seminal works on technical analysis.

🔹 He lived over 90 years ago and served as Editor-in-Chief of Financial World magazine.

🔹 His most notable book is:

Technical Analysis and Stock Market Profits

🔹 Published around 1932 in the United States.

🔹 Schabacker is often considered the “grandfather” of technical analysis, and much of the methodology traders use today can be traced back to his insights.

⸻

🟢 What Did He Teach?

🔹 Schabacker introduced a critical concept:

✅ The Congestion Zone

🌟 What Does It Mean?

When the market makes a strong move—either a sharp rally or a steep decline—price often becomes trapped in a range:

• Buyers at higher levels wait for further gains.

• Sellers at lower levels expect more downside.

But in reality, retail traders aren’t moving the market. Large institutions and funds—the so-called smart money—are in control.

👈 When these big players want to exit positions, they avoid selling everything at once to prevent a sudden collapse in price and to avoid revealing their hand.

✅ Their Playbook:

• Keep price contained within a narrow band between support and resistance.

• Gradually increase volume over time.

• Attract new buyers who believe the trend is still intact.

• Quietly distribute their holdings without alarming the market.

🌟 Why Do They Do This?

If they were to dump all at once:

• Price would drop rapidly.

• Everyone would realize a large seller was active.

• Institutions would get stuck, unable to exit at favorable prices.

🔻 So They Create Congestion and Distribution:

1️⃣ Sell discreetly over time.

2️⃣ Maintain the illusion that the trend is healthy.

3️⃣ Trap latecomers who buy into the range.

⸻

🟢 How Do You Recognize This on a Chart?

🎯 A Simple Example:

• Price climbs steadily from 3,000 to 3,300.

• Suddenly, it surges to 3,450.

✅ Most traders think the rally will continue.

🌟 What happens next:

• Price stalls between 3,380 and 3,450.

• Numerous candles form in this area.

• Volume remains elevated.

🔥 Inside this range:

1️⃣ Institutions sell into every upward move.

2️⃣ Early buyers remain committed, hoping for new highs.

3️⃣ New participants enter, unaware of the distribution.

🔻 What Do You See?

• Repeated candles oscillating within the same band.

• Failed breakouts above resistance.

• Sustained high volume.

✅ This is the classic Congestion Zone.

⸻

💡 How Can You Tell If It’s Distribution, Not Accumulation?

• Persistent high volume indicates steady selling.

• Price struggles to make fresh highs.

• Long upper wicks signal selling pressure.

• A Head and Shoulders pattern may start forming.

⸻

🎯 What Happens After Congestion?

• Institutions complete their distribution.

✅ Price breaks sharply below the range.

✅ The market drops quickly.

✅ Late buyers are forced to sell at losses.

⸻

🟢 Practical Illustration:

Visualize the range like this:

| |

| The Range |

| |

3380 ————> Resistance

| Multiple Candles |

| Multiple Candles |

| Multiple Candles |

3300 ————> Support and Neckline

✅ If price breaks below 3,300 on heavy volume:

• The distribution is complete.

• Price declines rapidly.

⸻

📌 Key Takeaway:

After any strong move, expect congestion as large players exit. Once they’re done, the trend often reverses.

⸻

🎯 Quick Tips:

✅ Never rush to buy inside congestion after a big rally.

✅ Watch volume—if it’s high, it’s likely distribution.

✅ Wait for a clear breakdown before shorting.

✅ Your target should at least match the size of the preceding move.

⸻

🔥 Let’s Cover the Head and Shoulders Pattern:

✅ What Is It?

A reversal pattern appearing after a strong uptrend, signaling the end of bullish momentum.

⸻

✅ Pattern Components:

1️⃣ Left Shoulder:

• Price makes a high.

• Pulls back.

2️⃣ Head:

• Rallies to a higher high.

• Declines again.

3️⃣ Right Shoulder:

• Attempts to rise but fails to exceed the head’s high.

4️⃣ Neckline:

• Connects the lows between the shoulders and the head.

🔻 When the Neckline Breaks Down:

It’s a strong sell signal. The market often drops decisively.

⸻

💡 Example in Numbers:

• Price moves from 3,200:

1️⃣ Up to 3,350 (Left Shoulder)

2️⃣ Down to 3,300

3️⃣ Up to 3,400 (Head)

4️⃣ Down to 3,300

5️⃣ Up to 3,350 (Right Shoulder)

6️⃣ Down to 3,300

✅ If price closes below 3,300 on strong volume, the pattern is confirmed.

🎯 Target Calculation:

• Head = 3,400

• Neckline = 3,300

• Distance = 100 points

• Target = 3,200

⸻

🟢 How To Trade It:

1️⃣ Don’t preemptively sell during the right shoulder.

2️⃣ Wait for a confirmed breakdown.

3️⃣ Enter a short position targeting 3,200.

4️⃣ Set your stop loss above the right shoulder.

⸻

🟢 Final Advice:

✅ The Head and Shoulders is powerful if confirmed by volume.

✅ Always wait for the neckline break—otherwise, it could be a false signal.

✅ Keep monitoring volume for confirmation.

⸻

🔥 Be disciplined in your analysis and decisive in your execution.

🔥 As Warren Buffett said:

“The stock market is a device for transferring money from the impatient to the patient.”

⸻

If you found this valuable, let me know—I’d be glad to prepare more lessons. 🌟